Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Fogo de Chao, Inc. | fogo-ex321_8.htm |

| EX-31.1 - EX-31.1 - Fogo de Chao, Inc. | fogo-ex311_7.htm |

| EX-31.2 - EX-31.2 - Fogo de Chao, Inc. | fogo-ex312_6.htm |

| EX-32.2 - EX-32.2 - Fogo de Chao, Inc. | fogo-ex322_69.htm |

| EX-23.1 - EX-23.1 - Fogo de Chao, Inc. | fogo-ex231_504.htm |

| EX-21.1 - EX-21.1 - Fogo de Chao, Inc. | fogo-ex211_505.htm |

| EX-10.14 - EX-10.14 - Fogo de Chao, Inc. | fogo-ex1014_224.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 3, 2016

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________to ________

Commission File Number: 001-37450

FOGO DE CHAO, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

45-5353489 |

|

( State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

|

|

|

|

14881 Quorum Drive Suite 750 Dallas, TX |

|

75254 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (972) 960-9533

Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.01 per share; Common stock traded on NASDAQ stock market.

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

o |

|

Accelerated filer |

|

o |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

þ (Do not check if a small reporting company) |

|

Small reporting company |

|

o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO þ

As of June 28, 2015, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant's outstanding common stock held by non-affiliates was approximately $120,011,000, based upon the last reported sales price on June 26, 2015. The registrant’s common stock was not traded on June 28, 2015, the last day of the registrant’s second fiscal quarter. For purposes of this calculation, shares of common stock held by each executive officer and director and by holders of more than 5% of the outstanding common stock have been excluded since those persons may under certain circumstances be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of registrant’s Common Stock outstanding as of March 24, 2016 was 28,079,383.

Portions of the registrant’s definitive proxy statement relating to the registrant’s Annual Meeting of Stockholders, scheduled to be held on May 9, 2016, are incorporated by reference into Part III of this Report.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

14 |

|

|

Item 1B. |

35 |

|

|

Item 2. |

35 |

|

|

Item 3. |

36 |

|

|

Item 4. |

37 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

38 |

|

|

Item 6. |

39 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

|

Item 7A. |

62 |

|

|

Item 8. |

64 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

64 |

|

Item 9A. |

64 |

|

|

Item 9B. |

65 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

66 |

|

|

Item 11. |

66 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

66 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

|

Item 14. |

66 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

67 |

i

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. Forward-looking statements relate to expectations, beliefs, projections, guidance, future plans, objectives and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, our prospects and strategies for future growth, the development and introduction of new products, and the implementation of our marketing and branding strategies. Forward-looking statements can also be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “seeks,” “intends,” “targets” or the negative of these terms or other comparable terminology.

Forward-looking statements are not guarantees of future performance and actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed in the section entitled "Risk Factors" in Item 1A of this Form 10-K and other factors noted in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this Form 10-K. The risk factors and other factors discussed in this Form 10-K are in addition to those contained in any other cautionary statements, written or oral, which may be made or otherwise addressed in connection with a forward-looking statement or contained in any of our subsequent filings with the SEC. Because of these factors, we caution against placing undue reliance on forward-looking statements. Forward-looking statements speak only as of the date on which they are made. Except as required by applicable securities law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

In this section and other parts of this Form 10-K, we refer to certain measures used for financial and operational decision making and as a means to evaluate period-to-period comparisons. We also may refer to a number of financial measures that are not defined under GAAP, but have corresponding GAAP-based measures. Where non-GAAP measures appear, we provide tables reconciling these non-GAAP measures to their corresponding GAAP-based measures and make reference to a discussion of their use. We believe these measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making.

The following discussion should be read in conjunction with the accompanying Consolidated Financial Statements and related notes thereto included elsewhere in this annual report. All information presented herein is based on our fiscal calendar. Unless otherwise stated, references to particular years, quarters, months or periods refer to our fiscal years and the associated quarters, months and periods of those fiscal years.

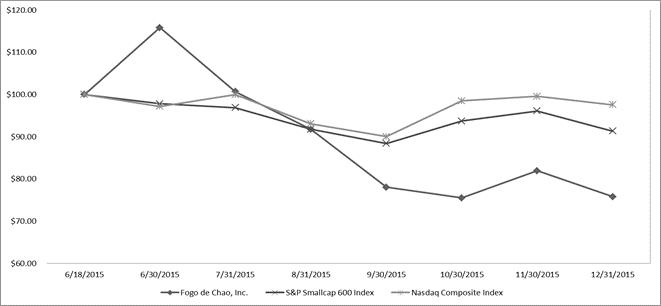

PART I

Overview

Fogo de Chão, Inc. and its subsidiaries (“Fogo,” “we” or the “Company”) began operations in 1979 in Brazil and in 1997 in the United States (“US”). We are principally engaged in the operation of Brazilian steakhouses, or churrascarias, in the US, Brazil, Puerto Rico and through a joint venture in Mexico. On June 24, 2015 we completed our initial public offering ("IPO") of 5,073,528 shares of common stock at a price to the public of $20.00 per share. Our common stock currently trades on the NASDAQ Global Select Market under the symbol “FOGO.”

We operate on a 52- or 53-week fiscal year that ends on the Sunday that is closest to December 31 of that year. Each fiscal year generally is comprised of four 13-week fiscal quarters, although in the years with 53 weeks the fourth quarter represents a 14-week period. References to Fiscal 2015 relate to our 53-week fiscal year ended January 3, 2016. References to Fiscal 2014 and Fiscal 2013 relate to our 52-week fiscal years ended December 28, 2014 and December 29, 2013, respectively.

Our Company

Fogo de Chão (fogo-dee-shoun) is a leading Brazilian steakhouse, or churrascaria, which has specialized for over 36 years in fire-roasting high-quality meats utilizing the centuries-old Southern Brazilian cooking technique of churrasco. We deliver a distinctive and authentic Brazilian dining experience through the combination of our high-quality Brazilian cuisine and our differentiated service model known as espeto corrido (Portuguese for “continuous service”) delivered by our churrasqueiros, which we refer to as our gaucho chefs. We offer our guests a tasting menu of a variety of meats including beef, lamb, pork and chicken, simply seasoned and carefully fire-roasted to expose their natural flavors.

1

Guests can begin their dining experience at the Market Table, which offers a wide variety of Brazilian-inspired side dishes, fresh-cut vegetables, seasonal salads, aged cheeses and cured meats, or they can receive immediate entrée service table-side from our gaucho chefs by turning a service medallion, found at each guest’s seat, green side up. Each gaucho chef rotates throughout the dining room, and is responsible for a specific cut of meat which they prepare, cook and serve to our guests continuously throughout their meal. Guests can pause the service at any time by turning the medallion to red and then back to green when they are ready to try additional selections and can communicate to our gauchos their preferred cut of meat, temperature and portion size. Our continuous service model allows customization and consumer engagement since our guests control the variety and quantity of their food and the pace of their dining experience. Through the combination of our authentic Brazilian cuisine, differentiated service model, prix fixe menu and engaging hospitality in an upscale restaurant atmosphere, we believe our brand delivers a differentiated dining experience relative to other specialty and fine-dining concepts and offers our guests a compelling value proposition.

Throughout our history, we have been recognized for our leading consumer appeal by both national and local media in the markets where we operate, including winning multiple “best of” restaurant awards from one of Brazil’s most prominent lifestyle publications, Veja Magazine, and numerous accolades in the US, including awards from Nation’s Restaurant News, Zagat and Wine Spectator Magazine.

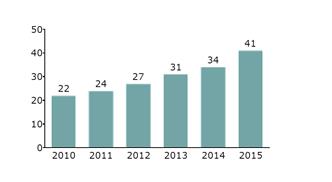

We opened our first restaurant in 1979 in Porto Alegre, Brazil. In 1986, we expanded to São Paulo, Brazil, a city in which we now operate five restaurants. Encouraged by our growth in Brazil, we opened our first restaurant in the US in 1997 in Addison, Texas, a suburb of Dallas, and have since expanded our footprint nationwide. We currently operate 31 restaurants in the US, including our newest restaurant that we opened in Naperville, Illinois in January 2016, 10 restaurants in Brazil and one restaurant in Mexico, our first joint venture restaurant. From the 2010 to 2015 fiscal years, we grew our restaurant count by a compound annual growth rate (“CAGR”) of 13.3%.

|

Restaurant Count |

Revenue |

We believe our dedication to serving high-quality Brazilian cuisine and our differentiated service model, combined with our disciplined focus on restaurant operations, have resulted in strong financial results illustrated by the following:

|

|

· |

In Fiscal 2015, we generated average unit volumes (“AUVs”) of approximately $8.5 million in the US and approximately R$15.0 million (Brazilian Real) in Brazil, and a consolidated restaurant contribution margin of 31.4%; |

|

|

· |

In Fiscal 2015, we opened seven restaurants, increasing our restaurant base 20.6% from 34 restaurants at the end of Fiscal 2014 to 41 at the end of Fiscal 2015. In Fiscal 2015, we opened restaurants in San Juan (Puerto Rico), Rio de Janeiro (Brazil), our first joint venture restaurant in Mexico City (Mexico), Summerlin (Nevada), The Woodlands (Texas), San Francisco (California) and New Orleans (Louisiana). We opened our 42nd location in Naperville, Illinois in January 2016; and |

|

|

· |

From Fiscal 2014 to Fiscal 2015, revenue grew 3.6% to $271.6 million and our net income increased from a net income of $17.3 million in Fiscal 2014 to net income of $28.0 million in Fiscal 2015. |

AUVs and restaurant contribution margin are key metrics we use in evaluating the performance of our restaurants. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for explanations of how these metrics are calculated and how we use these metrics in evaluating the performance of our restaurants.

2

We believe the following strengths differentiate us from our competitors and serve as the foundation for our continued growth:

Authentic Cuisine – A Culinary Journey to Brazil

We provide our guests with an experience that is distinctly Brazilian, and our food is at the heart of that experience. Our traditional Brazilian cuisine has been passed down from generation to generation in Brazil and lives on in the way our gaucho chefs prepare, season and continuously fire-roast our meats utilizing the traditional cooking method of churrasco – fire-roasted on skewers over an open flame to expose the natural flavors. Our entrée selection features a variety of carefully cooked and seasoned meats including Brazilian style cuts of beef such as the fraldinha and the picanha, our signature cut of steak, as well as other premium beef cuts such as filet mignon and rib eye, and lamb, chicken, pork and seafood items. Each cut is carved table-side by our gaucho chefs in a manner designed to both enhance the tenderness of each slice and meet our guests’ desired portion size and temperature. At Fogo de Chão, every table is a chef’s table. To complement our meat selection, a variety of sharable side dishes, including warm cheese bread, fried bananas and crispy polenta, are brought to each table and replenished throughout the meal. For guests preferring lighter fare, we also offer Brazilian-inspired à la carte seafood options, a “Market Table” only option and a selection of small plates. Our Market Table, which features a variety of gourmet side dishes, seasonal salads, Brazilian hearts of palm, fresh-cut vegetables, aged cheeses and cured meats is immediately available once our guests are seated. We believe it pays homage to the kitchen tables of Southern Brazil where families share fresh produce and seasonal salads grown locally. Our menu is enhanced by an award-winning wine list and a full bar complete with a selection of signature Brazilian drinks such as the caipirinha.

Interactive, Approachable Fine-Dining Experience Delivered By Our Gaucho Chefs

We believe that we offer our guests an upscale, approachable and friendly atmosphere in elegant dining rooms that is complemented by the personalized, interactive experience with our gaucho chefs and team members. Skilled artisans trained in the centuries-old Southern Brazilian cooking tradition of churrasco and the culture and heritage of Southern Brazil, the home of churrasco, our gaucho chefs are central to our ability to maintain consistency and authenticity throughout our restaurants in Brazil and the US. Due to our significant operations in Brazil, we are able to place many of our native Brazilian gaucho chefs in restaurants in the US, which we believe preserves the distinctly Brazilian attributes of our brand. Our team members focus on anticipating guests’ needs and helping guests navigate our unique dining experience for a memorable visit.

Our gaucho chefs butcher, prepare, cook and serve our premium meats to each guest, as well as engage and interact with them. We utilize a continuous style of service, where each of our gaucho chefs approaches guests at their table with various selections of meat, providing our guests with the cut, temperature and quantity they desire. During these interactions, our gaucho chefs learn each guest’s specific preferences and are able to tailor their dining experience accordingly. In addition to providing an entertaining and engaging experience, our continuous service allows our guests to control the entrée variety, portions and pace of their meal, which we believe maximizes the customization of their experience and the satisfaction they receive from dining at our restaurants.

Award-Winning Concept with a Compelling Value Proposition and Broad Appeal

We believe that the combination of our high-quality Brazilian cuisine, differentiated dining experience and the competitive price point of our prix fixe menu leads our restaurants to appeal to a wide range of demographic, including both men and women, and socioeconomic groups. We believe our restaurants provide a preferred venue for various dining occasions, including intimate gatherings, family get-togethers, business functions, convention banquets and other celebrations. Many of our guests dine at our restaurants multiple times per year.

Our restaurants have received numerous awards and accolades from critics and reviewers in the US and Brazil. For example, we have been nationally recognized by Nation’s Restaurant News, Zagat and Wine Spectator Magazine, and we have received awards from local media in the markets we operate, including Atlanta Magazine, Chicago Tribune, Dallas Observer and Houston Business Journal. Additionally, our restaurants are consistently included among the top upscale dining options by reputable online reviewers such as Yelp and Urban Spoon. We believe that the authenticity of our brand is demonstrated by the fact that we have received multiple “best of” restaurant awards from Veja Magazine.

3

Unique Operating Model Drives Attractive Restaurant-Level Profitability

Through the consistent execution of our unique business model, we are able to produce what we believe is attractive restaurant-level profitability by optimizing labor and food costs. For Fiscal 2015, the sum of our food and beverage costs and compensation and benefits costs (or “prime costs”) as a percentage of revenue were 51.6%. Our favorable performance on the largest components of a restaurant’s cost structure, which drives our restaurant contribution margins, is due to the following unique structural characteristics of our operational model:

|

|

· |

The dual role our gaucho chefs play as both chef and server significantly reduces back-of-the-house labor costs; |

|

|

· |

Simple cooking technique and streamlined food offering, combined with table-side service and plating, allow for efficient kitchen and server operations, reducing labor costs; |

|

|

· |

Our gaucho chefs work as a team with cross-functional roles and responsibilities, increasing productivity, speed of service and guest satisfaction, while reducing labor costs; |

|

|

· |

Simple, space-efficient cooking technique and streamlined menu reduces our kitchen’s footprint and maximizes space devoted to front-of-the-house tables, which allows our restaurants to achieve higher sales per square foot and enables us to leverage our fixed costs such as occupancy; |

|

|

· |

Our self-service Market Table requires minimal staffing and kitchen preparation, thereby reducing labor costs, and provides us flexibility in the range of items we offer, which helps us manage food costs through seasons and market cycles; |

|

|

· |

In-house butchering by our highly skilled gaucho chefs maximizes the yield on our meat cuts, thereby reducing food costs; and |

|

|

· |

Our wide variety of proteins offered provides us flexibility in sourcing our meat selection, which help us optimize food costs. |

Attractive Cash-on-Cash Returns Create New Restaurant Growth Opportunity

Our business model produces attractive unit volumes and restaurant contribution margins that drive attractive cash-on-cash returns in excess of 50%. For Fiscal 2015, we generated AUVs of approximately $8.5 million in the US and approximately R$15.0 million (Brazilian Real) in Brazil, and a consolidated restaurant contribution margin of 31.4%. Since 2007, our new restaurants that have been open at least three years as of January 3, 2016, have generated an average year three cash-on-cash return of greater than 50%. We calculate our year three cash-on-cash return by dividing our restaurant contribution in the third year of operation by our initial investment costs (net of pre-opening costs and tenant allowances). Our restaurants perform well across a diverse range of geographic regions, population densities and real estate settings, which we believe demonstrates the portability of our concept to new markets. We believe the combination of our attractive cash-on-cash returns, proven concept portability, and current footprint, supports further use of cash flow to grow our restaurant base and creates an attractive new restaurant growth opportunity.

Highly Attractive Concept for Domestic and International Real Estate Developers Supports Growth

Due to the broad appeal of our brand, the diversity of our guest base and the relatively high number of weekly visits to our restaurants, our concept is a preferred tenant for real estate developers. Landlords and developers, both in the US and internationally, seek out our restaurants to be anchors for their developments as they are highly complementary to national retailers. Our ability to achieve AUVs that are comparable to those of other high-end steakhouses despite our lower average check demonstrates our capacity to attract more guests than many of our competitors. Our AUVs, brand recognition and relatively high guest traffic position us well to negotiate the prime location within a development and favorable lease terms, which enhance our return on invested capital.

We believe our concept has international appeal and makes us an attractive tenant for international real estate developers, and we believe we will be able to leverage our brand strength to negotiate attractive terms in desirable locations as we grow outside the US and Brazil. We have entered into joint ventures to expand our operations in Mexico, where there is currently one joint venture restaurant located in Mexico City, and in certain locations in the United Arab Emirates, Qatar, Kuwait, Oman, Bahrain, the Kingdom of Saudi Arabia and Lebanon.

Our Growth Strategies

We plan to continue to expand our restaurant footprint and drive revenue growth, improve margins and enhance our competitive positioning by executing on the following strategies:

4

We believe we are in the early stages of our growth with 42 current restaurants, 31 in the US, 10 in Brazil and one in Mexico, our first joint venture restaurant. Based on internal analysis and a study prepared by an independent third party, we believe there exists long-term total restaurant potential for approximately 100 new domestic sites and additional new restaurants internationally, due to the broad appeal of our differentiated concept, attractive cash-on-cash returns, flexible real estate strategy and successful history of opening new restaurants. We have a long track record of successful new restaurant development, evidenced by having grown our restaurant count by a multiple of 10 since 2000 and at a 13.3% CAGR since 2010. Since 2007, our new restaurants that have been open at least three years have generated an average year three cash-on-cash return of greater than 50%. We calculate our year three cash-on-cash return by dividing our restaurant contribution in the third year of operation by our initial investment costs (net of pre-opening costs and tenant allowances). We believe our concept has proven portability, with attractive AUVs and cash-on-cash returns across a diverse range of geographic regions, population densities and real estate settings.

We will continue to pursue a disciplined new restaurant growth strategy primarily in the US in both new and existing markets where we believe we are capable of achieving sales volumes and restaurant contribution margins that generate attractive cash-on-cash returns. We opened seven restaurants during Fiscal 2015, which included our first joint venture restaurant in Mexico City, which opened in May 2015. Over the next three to five years, we plan to increase our company-owned restaurant count by at least 10% annually, with North America being our primary market for new restaurant development. In addition, we plan to grow in other international markets.

|

|

· |

Open New Restaurants in the United States. We believe the US can support a considerable number of additional Fogo de Chão restaurants and will continue to be our primary market for new restaurant development. Based on internal analysis and a study prepared by an independent third party, we estimate that there exists long-term potential for approximately 100 new domestic sites across large- and mid-sized markets as well as urban and suburban locations that can support Fogo de Chão restaurants. |

|

|

· |

Open New Restaurants in Brazil. Based on analysis performed by our development team, we believe there is an opportunity to open additional restaurants in Brazil, the birthplace of Fogo de Chão. Over the next five years, we plan to open three to five new restaurants throughout the country as attractive real estate locations become available. In addition to providing attractive returns on invested capital, our operations in Brazil allow us to maintain our authentic and distinctive churrasco heritage and support the global growth of our brand. |

|

|

· |

Open New Restaurants in Other International Markets. We will selectively consider other international markets, as we believe attractive opportunities for opening new restaurants exist in large cities and business centers in certain international markets including Asia, Australia, Canada, Europe, the Middle East and South America. We will pursue growth in these markets through a combination of company-owned restaurant development and joint ventures, which we believe allow us to expand our brand with limited capital investment by us. In May 2015, we opened our first joint venture restaurant in Mexico City. |

Our current restaurant investment model targets an average cash investment of $4.5 million per restaurant, net of tenant allowances and pre-opening costs, assuming an average restaurant size of approximately 8,500 square feet, an AUV of $7.0 million and a cash-on-cash return in excess of 40% by the end of the third full year of operation. On average, our new company-owned restaurants opened since the beginning of 2007 have exceeded these AUV and cash-on-cash return targets within the third year of operation.

The investment targets for our new restaurants do not consider any allocations of corporate support expense, non-cash items such as depreciation, amortization and equity-related compensation expense, or income taxes, and do not represent a targeted return on an investment in our common stock. Additionally, the actual performance of any new restaurant may differ from the originally targeted performance due to a variety of factors, many of which are outside of our control, and such differences may be material. There can be no assurance that any new restaurant opened will have similar operating results to those of established restaurants. See “Risk Factors—Risks Related to Our Business and Industry—Our historical revenue and AUVs may not be indicative of our future financial performance.”

Grow Our Comparable Restaurant Sales

We believe the following strategies will allow us to grow our comparable restaurant sales:

|

|

· |

Food and Beverage Innovation. We seek to introduce innovative items that we believe align with evolving consumer preferences and broaden our appeal, and we will continue to explore ways to increase the number of occasions for guests to visit our restaurants. In order to drive guest frequency and broaden the appeal of our menu, we have added seafood items and on-trend seasonal food and beverage offerings. Additionally, we believe there are significant day-part opportunities with our Bar Fogo concept, a “small plates” menu served at the bar, happy hour and special occasion menus. |

5

|

|

· |

Further Grow Our Large Group Dining Sales. We believe our differentiated dining experience, open restaurant layout, speed of service and compelling value proposition make us a preferred destination for group dining occasions of all types. For Fiscal 2015, large group sales represented 12.6% of US revenue, and we believe there is a significant opportunity to grow that aspect of our business. We currently have group sales managers at all of our US restaurants who introduce large group reception and meeting packages, which have generated significant momentum in group sales growth. In Fiscal 2015, we generated large group sales growth of 11.6% for our comparable restaurants over the prior year period, and we believe the investments we have made in our group sales business will continue to yield positive results. |

|

|

· |

Continue to Improve Our Marketing to Drive Traffic. We will continue to invest in marketing and advertising to drive guest trial and frequency. We continue to introduce new marketing initiatives through various channels, including social, online, print, digital advertising, TV and radio media, with the intent to promote brand awareness. We will continue to harness word of mouth and grow our social media and e-mail marketing fan base through thoughtful planning, unique promotions and rich content that reward loyalty and increase guest engagement with our brand. We intend to drive repeat traffic by becoming our guests’ preferred upscale restaurant destination and believe targeted marketing investments that heighten awareness, reinforce the premium image of our brand and highlight the authenticity of our dining experience will continue to generate guest loyalty and promote brand advocacy. |

|

|

· |

Opportunistically Remodel Select Restaurants. Beginning in Fiscal 2015, we launched an opportunistic remodel program, which we expect to continue through 2016. We believe our new design will enhance the guest experience, highlight our brand attributes and encourage guest trial and frequency. We also believe there are opportunities to optimize restaurant capacity and enhance merchandising to maximize sales per square foot. |

Improve Margins by Leveraging Our Infrastructure and Investments in Human Capital

To support our future growth and improve our operations and management team, over the last three years we have made significant investment in personnel costs by adding 25 positions to our corporate team in executive positions and key functional areas and added local sales manager positions and assistant manager positions at the restaurant level. These hires have bolstered key functional areas and supported future growth initiatives including senior leadership, new restaurant site selection and analysis, new restaurant design, group dining, product innovation and in-restaurant employee training. In addition, we have implemented initiatives in our restaurants to improve labor productivity, which we believe will further enhance restaurant profitability and the guest experience. These investments and initiatives have yielded positive results and we believe we will continue to benefit from these investments as we grow our business in the long-term. Furthermore, we expect our general and administrative expenses to decrease as a percentage of total revenue over time as we are able to leverage these investments by growing revenue faster than our fixed cost base. In addition, we have made substantial investments in our IT systems, and we expect to utilize our IT infrastructure for continued improvements in operational efficiency and margins through the use of labor productivity and training tools.

Our Dining Experience

Our restaurants offer a differentiated prix fixe menu as well as select à la carte options. For the full churrasco experience, the prix fixe menu includes two courses. Guests can begin at the Market Table, which features a variety of gourmet side dishes, seasonal salads, Brazilian hearts of palm, fresh-cut vegetables, aged cheeses, smoked salmon and cured meats, and is available immediately after the guests are seated.

The second course of the menu is the rodizio (meat) service. We offer a variety of cuts of beef, lamb, pork and chicken fire-roasted over open flames in the traditional Brazilian style. Gaucho chefs rotate through the dining room, with each server responsible for a single cut of meat that is carved table-side to guests’ specifications. Some of our most popular Brazilian style cuts include the picanha, our signature cut (a part of the sirloin), alcatra (cut from the top sirloin), new beef ancho (the prime part of the rib eye), fraldinha (bottom sirloin), linguica (robust pork sausages) and costela (beef ribs).

6

Each guest has beside them a two-sided medallion with one side red and one side green. When a guest is ready to begin enjoying the various selections of meat they simply turn the medallion to green. This signals our gaucho chefs to visit that table and offer whatever cut of meat they are serving. Guests can pause the service at any time by turning the medallion to red and then back to green when they are ready to try additional selections, and can communicate to our gauchos any specific cut of meat they prefer. The medallion allows customization so the guest can control the pace and choice of meats. Each cut is carved by our gaucho chefs in a manner designed to both enhance the tenderness of each slice as well as meet our guests’ desired portion size and temperature.

To complement the meats, a variety of sharable side dishes, including warm cheese bread, fried bananas and crispy polenta, are brought to each table and replenished throughout the meal. Our restaurants also offer a selection of traditional desserts, including papaya cream and tres leches.

For guests preferring lighter fare, we also offer Brazilian-inspired à la carte seafood options across our restaurant base to increase guest frequency and broaden the appeal of our menu. We also offer the option to have only food from the Market Table. Our menu options are enhanced by an award-winning wine list and a full bar complete with a selection of signature Brazilian drinks such as the caipirinha. We also offer Bar Fogo, a “small-plates” menu offered at the bar designed to enhance our bar experience, increase alcohol sales and drive higher spend per guest. We believe there is substantial opportunity to increase guest frequency and spend per guest through continued menu innovation and further day-part expansion.

Site Selection and Development

New Restaurant Development

We will continue to pursue a disciplined restaurant growth strategy in markets where we believe we are capable of achieving sales volumes and restaurant contribution margins that achieve attractive cash-on-cash returns. Over the next three to five years, we plan to increase our company-owned restaurant count by at least 10% annually.

We believe we are in the early stages of our growth and view the US as our primary market for new restaurant development. Our restaurants perform well across a diverse range of geographic regions, population densities and real estate settings. Based on internal analysis and studies by an independent third party, we believe there is long-term potential for approximately 100 new sites in the US to support Fogo de Chão restaurants. In Brazil, we plan to open three to five new restaurants throughout the country over the next five years as attractive real estate locations become available. We will continue to selectively consider other international markets, as we believe attractive opportunities for opening new restaurants exist in international markets, including Asia, Australia, Canada, Europe, Mexico, the Middle East and South America.

We will pursue international expansion beyond Brazil in large cities through a combination of company-owned restaurant development and joint ventures. We have developed a joint venture strategy to grow our restaurant base in new international jurisdictions by leveraging the capital and local market expertise of restaurant operating partners to enable us to enter these new markets efficiently. We opened our first joint venture restaurant in Mexico City in May 2015. We will pursue growth in Mexico through this joint venture, which we believe will allow us to expand our brand with limited capital investment by us. In addition, we entered into a second joint venture in 2015, pursuant to which we currently expect to open joint venture restaurants in the Middle East.

There is no guarantee that we will be able to increase the number of our restaurants. We may be unsuccessful in expanding within our existing or into new markets for a variety of reasons described herein under “Risk Factors,” including competition for guests, sites, employees, licenses and financing.

Market and Site Selection Process

We consider market and site selection to be critical to our long-term success because the location of a restaurant is a critical variable in its long-term success, and we accordingly devote considerable resources to market analysis, real estate planning and site selection.

We use a combination of our internal development committee as well as a national real estate broker interfacing with local networks in our target markets to identify and assess potential sites for new restaurant development. Our in-house real estate team has experience with a wide range of national restaurant brands. We utilize sophisticated analytical tools designed to uncover characteristics that we believe drive successful restaurant openings. In the US, we utilize two complementary site selection tools for market planning: (i) an independent third party that utilizes transaction data based on actual guest zip codes to identify the most valuable psychographic guest segments and maps those segments to uncover trade areas that contain the highest concentration of our core guests in Designated Market Areas (“DMAs”) to help us prioritize market and site selection and (ii) a second independent third party, which also uses psychographic criteria as well as site-specific features, location of competitors and customer surveys to further refine the search within potential DMAs.

7

Criteria for evaluating market expansion opportunities include total population and population density, guest demographics, total DMA restaurant sales, gross domestic product per capita, labor force and unemployment rates, availability of premier site locations, competition penetration and projected unit economics, among other things. We seek out locations with high average household income and commercial density as well as traffic drivers such as high daytime population and proximity to luxury hotels, meeting spaces and airports and sites with a strong mix of retail co-tenancy.

Our real estate process is led by our internal development committee, which is comprised of senior management and members of our real estate team. The development committee meets periodically to review new site opportunities and recommends new locations to our board of directors for approval. Once a location has been approved by the board of directors, we begin a design process to align the characteristics of the site to our brand attributes.

Restaurant Design

We place significant emphasis on the unique design and atmosphere of our restaurants. Each of our restaurants has a unique layout to optimize available space, and we have a flexible restaurant design. This flexibility enhances our growth opportunity, since our concept performs well in a diverse range of property types, building sizes and locations from high-density urban to less dense suburban markets with either in-line or free-standing building types.

Restaurant design is handled by our in-house architectural team utilizing in-house resources as well as local third-party architects in the markets where we develop restaurants. In designing our restaurants, our goal is to provide guests with an open, interactive layout that complements the continuous style of service provided by our gaucho chefs. We believe our restaurant design highlights our Southern Brazilian roots in a modern, contemporary way. This is accomplished through our choice of color palette, imagery and décor, which we believe creates an atmosphere that enhances our guests’ dining experience. Depending on the location and size of the restaurant, guests will find unique elements incorporated in the restaurant design. For example, many restaurants include a glass-enclosed pit roaster prominently displayed with large cuts of meat cooking over an open flame. While all of our restaurants share similar design elements, each restaurant is customized to accommodate the specifics of the location and the available floor space. Our restaurant floor plans have ample space, allowing for a fluid and dynamic setup and provide flexibility to accommodate large groups. Because of the simplicity of our back-of-house operations, we are able to dedicate more floor space for the seating area than some of our competitors, thereby optimizing our restaurant locations and increasing revenue per square foot.

Construction

Restaurant construction is overseen by our construction team, which includes our Vice President of Development, in-house architects and our in-house construction managers. Construction of a new restaurant in the US typically takes approximately four to six months. We generally construct restaurants in in-line leased retail space or free-standing buildings on leased properties. Our restaurant investment model targets a cash build-out cost of $3.0 to $6.0 million per restaurant, net of tenant allowances and pre-opening costs.

Restaurant Management and Operations

Restaurant Organizational Structure

Each restaurant typically employs approximately 60 to 85 people. There are approximately 10 to 12 gaucho chefs per restaurant. Supporting the gaucho chefs are approximately 10 to 30 servers and approximately 10 to 30 bussers and kitchen staff as well as other operating personnel. Our gaucho chefs butcher, prepare, fire-roast and serve all our meats. Each restaurant has a general manager and an assistant general manager, and most of our restaurants in the US employ a second assistant manager. To promote authenticity, continuity of the churrasco culture and improved operations, most of our employees holding management-level positions and our general managers are former gaucho chefs.

We emphasize a culture of collaboration within the management of our restaurants to facilitate the continuous development of “best practices” regarding guest service, cost control and growth opportunities. In both our US and Brazilian operations, our general managers meet each week to discuss performance and opportunities for improvement.

Our Gaucho Chefs

Our highly-trained and skilled gaucho chefs perform a combination of “back-of-the-house” and “front-of-the-house” duties. The skill set required to perform as one of our gaucho chefs illustrates the importance of the position in the organization. The responsibilities and skills fall into three general categories – culinary, service, and authenticity:

8

|

|

· |

Assess meat quality; |

|

|

· |

Butcher, season and marinate meats; |

|

|

· |

Forecast nightly business flow and adjust the types and quantities of meats to be cooked to ensure quality and utilize procedures to minimize meat waste; and |

|

|

· |

Cooking temperature management (each meat requires different temperature management techniques). |

Service

|

|

· |

Ability to serve in high energy “espeto corrido” style in a safe manner; |

|

|

· |

Delivery and presentation of skewered meats to each table; |

|

|

· |

Customized carving of meats to satisfy the preferences of the guest; |

|

|

· |

Monitor the tables and coordinate with each other, ensuring that each guest is presented with all available cuts of meat; and |

|

|

· |

Ensure that the pace and style of the presentation of each meal is consistent with authentic gaucho traditions. |

Authenticity

|

|

· |

Knowledgeable regarding culture, history, and lifestyle of Southern Brazil and its gauchos; |

|

|

· |

Knowledgeable regarding traditional gaucho cuisine, including the different cuts of meat and the style of cooking; |

|

|

· |

Ability to answer guests’ questions regarding gaucho tradition, culture and cuisine; and |

|

|

· |

Train employees in the US in authentic service, monitor service delivery at each meal and make any corrections needed to preserve the authentic nature of presentation. |

We maintain very high standards for the gaucho chef position. Once selected, the employee must successfully complete an apprenticeship program of 18 to 24 months, which primarily consists of on-the-job training before being certified for the position. The training is not completed after this initial program, as we have implemented a program of continuous training and mentoring. We credit our stringent hiring and intense training practices for our ability to deliver a consistent and authentic product to our guests, which we believe differentiates us from our competition. These practices have also resulted in strong retention rates in our restaurants, with our gaucho chefs having been employed with us for an average of over three years and our restaurant general managers having been employed with us for an average of 12 years.

Talent Acquisition, Training and Leadership Development

Our talent management begins with attracting, selecting and training talent that aligns with our values. We believe this approach has been a cornerstone of our success and we continue to focus on our training efforts to ensure our brand standards are maintained globally. Our talent strategy is focused on three core tenets, underpinned by a technology-based platform and web-based tools, including:

|

|

· |

Selection, On-Boarding and Cultural Immersion. We take a balanced approach on selection by attracting and developing like-minded, guest- and hospitality-focused leaders for future management needs. All leaders at all levels of our organization are immersed in the culture and heritage of Fogo de Chão. |

|

|

· |

Competency-Based Learning. After passing an interview and selection process, managers must be certified through an eight- to 12-week in-restaurant management development program. During the onboarding process, newly promoted or hired leaders learn all of the functional positions in the restaurant and develop strong guest-oriented management routines. Training takes place in one of our six training restaurants. All Fogo employees, irrespective of level in the organization, are coached and developed in the competency their role requires and are certified through a validation process. |

|

|

· |

Next Level Leadership. We continue to identify future leaders through our rigorous succession-management process and develop tailored, competency-based development action plans in partnership with direct supervisors at every level of our organization. Our learning and development platforms continue to track development action plans to ensure our Fogo employees are prepared to meet current and future needs. |

9

Our learning and development platforms are web-based and are delivered with interactive content that engage users and test for retained knowledge. This video-based approach allows us to deliver our learning and development platforms in multiple languages and maintain version control, keeping learning consistent internationally as we continue to develop new content.

Brazilian Gaucho Chef Development and Mentor Process

To help to create an exceptional dining experience and authenticity, we utilize our Brazilian operations as a training ground and recruitment base for our restaurants in the US, selecting talented gaucho chefs to transfer to the US. We pay for English lessons, travel expenses, and immigration expenses for our gaucho chefs.

Since opening our first location in the US in 1997, we have brought gaucho chefs to the US from Brazil utilizing the L-1B “specialized knowledge” visa which generally permits an employee to remain in the US for up to five years. We also utilize the L-1A “intracompany manager” visa for our employees who qualify. The L-1A visa generally permits an employee to remain in the US for up to seven years. We have applied for and received permanent resident alien (“green card”) immigration status for a number of these transferees.

Since 2013, we have also brought Brazilian gaucho chefs to the US on one-year corporate training programs through use of the J-1 “cultural exchange” visa. The primary focus of this program is training and cultural exchange, including classroom instruction.

Marketing and Advertising

Our marketing goals are to:

|

|

· |

Increase comparable restaurant sales by attracting new guests; |

|

|

· |

Increase frequency (return visits) of existing guests; |

|

|

· |

Support new restaurant openings to achieve sales and profit goals; and |

|

|

· |

Communicate and promote brand positioning as a leading Brazilian Steakhouse through our focus on high-quality ingredients, a high level of service and commitment to the traditional gaucho method of cooking. |

All advertising is coordinated by our corporate office. We utilize various advertising channels to create awareness and drive trial of the brand. These channels may include digital, social media, print, out-of-home, radio and television advertising as well as local restaurant marketing. Other areas of marketing include travel publications and advertising to support the growing social media platforms.

Social media

Social media is an increasingly important and growing marketing channel. We maintain a strong presence on several social platforms including Facebook, Twitter, YouTube and Instagram, allowing us to maintain a high level of guest engagement and brand awareness. We periodically conduct promotions and provide content on various social platforms to further drive a unique level of guest engagement. We believe our social presence allows us to meaningfully connect with our guests and harness positive word of mouth.

Local restaurant marketing

A key strategy utilized by our management teams at the local level is to maintain strong relationships with concierge desks at key area hotels. At various restaurants, managers will also host networking events with chambers and associations to create awareness and goodwill among community organizations.

New restaurant openings

New restaurants are supported first by bringing on a local public relations firm to assist in introducing the brand to the market and promoting the brand through media relations. Advertising spend is optimized depending on the market and includes a combination of digital and social advertising, print, out-of-home, radio and television.

10

We believe our restaurants are preferred group dining venues because of the quality and variety of our menu offering, the efficiency of our service model in handling large groups and our attractive private dining areas. Group sales managers prospect for new business with local businesses and organizations and work with existing guests on larger event planning. We define large groups as reservations with more than 15 guests. Over the last two years, we invested in hiring group sales managers to support all of our locations. We implemented group sales coverage at each of our US locations during Fiscal 2015. We believe this investment has yielded strong results, as we generated large group sales growth of 11.6% for Fiscal 2015 over Fiscal 2014 for our comparable restaurants in the US. We believe continued increases in our group sales business represents a large growth opportunity.

Purchasing, Innovation and Quality Control

Our purchasing strategy is to offer our guests high-quality ingredients while leveraging the flexibility of our operating model to optimize costs. Since our menu does not require exact menu specifications, we innovate utilizing high-quality seasonal items to continually introduce new products while achieving the best available price for a range of proteins, including beef, chicken, lamb and pork, as well as Market Table ingredients. This advantage allows us to shift the mix of our ingredients to offset inflationary pressure and optimize the cost of the basket of products we deliver without compromising the guest experience. Our belief is that all innovation begins with focused, seasonal procurement that keeps our menu on-trend and maintains our affordable price positioning.

In addition, we have flexibility in the type and weights of proteins we purchase and serve, which helps us to manage our food costs. We have national supplier arrangements in the US ranging from three months to one year depending on the product and season. We monitor contracts monthly, and shift the mix of our products served to respond to changes in pricing, thus optimizing the cost of the ingredients we offer in our restaurants. Finally, management of food waste through proper training and procedures at the restaurant level represents another lever through which we control our food costs given our prix fixe menu. From Fiscal 2014 to Fiscal 2015, pounds of meat consumed per guest decreased from 2.00 to 1.99 for all restaurants in the US due to improved training protocols regarding food waste management.

As evidence of our ability to manage our food costs without compromising our guest experience given our unique operating and service model, our food and beverage costs as a percentage of revenue decreased from 29.9% in Fiscal 2014 to 29.5% in Fiscal 2015 despite a 3.2% increase in beef prices over the same period. Additionally, over this period, we have maintained strong guest satisfaction scores from New Brand Analytics, highlighting our ability to reduce our costs while providing an excellent guest experience.

We maintain strict quality standards at our restaurants. Each employee is expected to adhere to these standards, and it is the responsibility of the general managers and the gaucho chefs to ensure that these standards are upheld. We are committed to providing guests with high quality, fresh products and superior service. Through the use of our training programs, extensive experience requirements for our gaucho chefs and our commitment to hiring and developing staff, we are able to maintain high standards and guidelines for all menu items across our restaurants. Similarly, we rely on a quality assurance team to conduct regular, comprehensive audits of our suppliers to ensure we are offering our guests high-quality products.

Management Information Systems

All of our restaurants use computerized point-of-sale and back-office systems that we believe are scalable to support our continued growth. The systems provide a touch screen interface and integrated, high-speed credit card and gift card processing. The point-of-sale computers are designed specifically for the restaurant industry and the system is used to collect daily transaction data which generates information about daily sales, product mix and average check totals that we actively analyze. Applications inside the restaurant capture guest and reservation information, aiding in the management of the restaurant’s tables during service and optimizing our guests’ experience.

Our corporate systems provide our management with operating reports that show restaurant performance comparisons with budget and prior year results. These systems allow us to monitor restaurant sales, food and beverage costs, operating expenses and other restaurant trends on a regular basis and enable regular communication and collaboration between restaurants and the corporate office.

In early 2014, we developed a multi-year information technology strategy to further transform information technology into a growth-enabling function by focusing on building infrastructure, increasing technical staff, creating a technology platform to support sales growth and enabling productivity improvements. During 2013 and 2014, we invested in an enterprise-level Human Resources Information System, reservation and seating management tools and high-speed guest internet in our restaurants. In 2015, we enhanced our corporate office and restaurant information system infrastructure for continued improvements to our operational efficiency by pursuing technologies for mobile ordering, mobile payments, Customer Relationship Management tools and comprehensive training platforms.

11

The restaurant industry is highly competitive. The number, size and strength of our competitors vary widely by region. There are many different segments within the restaurant industry, which are distinguished based on the type of food, food quality, service, location, associated price-to-value relationship and overall dining experience. Our restaurants compete with a number of restaurants within their markets, both locally owned restaurants and other restaurants that are members of regional or national chains based on the quality and variety of our menu offering, our service model and our authentic Brazilian cuisine. Our competition continues to intensify as competitors increase the breadth and depth of their product offerings and open new restaurants. We compete in the full-service dining category with other Brazilian-style steakhouses and local and national upscale steakhouses such as Ruth’s Chris, Del Frisco’s and the Capital Grille.

Our Employees

As of January 3, 2016, we had 2,848 employees, of which 2,197 were employed in the US and 651 were employed in Brazil. Of the 2,197 employees employed in the US, 2,129 were employed in our restaurants and 68 performed selling, general and administration functions. Of the 651 employees employed in Brazil, 618 were employed in our restaurants and 33 performed selling, general and administration functions. None of our employees in the US are currently covered by a collective bargaining agreement though many of our employees in Brazil participate in industry-wide trade union programs. We have had no labor-related work stoppages, and we believe our relations with our employees are generally good.

Government Regulation

Our restaurants are subject to licensing and regulation by state and local health, safety, fire and other authorities, including licensing and regulation requirements for the sale of alcoholic beverages and food. Failure to obtain or retain food or other licenses would adversely affect the operations of restaurants. We believe we maintain the necessary restaurant, alcoholic beverage and retail licenses, permits and approvals. The development and construction of additional restaurants are also subject to compliance with applicable zoning, land use and environmental regulations. We are subject to federal, state and local laws and regulations concerning waste disposal, pollution, protection of the environment, and the presence, discharge, storage, handling, release and disposal of, and exposure to, hazardous or toxic substances. Federal and state labor laws govern our relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime, unemployment tax rates, workers’ compensation rates, citizenship requirements and sales taxes. We are also subject to the Fair Labor Standards Act, the Occupational Safety and Health Act, the Immigration Reform and Control Act of 1986, the Americans with Disabilities Act, and various federal and state laws governing such matters as minimum wages, overtime, tips, tip credits and other working conditions.

Our restaurants are subject in each state in which we operate to “dram shop” laws, which allow, in general, a person to sue us if that person was injured by an intoxicated person who was wrongfully served alcoholic beverages at one of our restaurants. Please see “Risk Factors—Risks Related to Our Business and Industry—Our business is subject to extensive regulation and we may incur additional costs or liabilities as a result of government regulation of our restaurants.”

Environmental Matters

Our operations are also subject to national, provincial, state and local laws and regulations in the US, Brazil and Mexico relating to environmental protection, including regulation of discharges into the air and water, storage and disposal of waste and clean-up of contaminated soil and groundwater. Under various national, provincial, state and local laws, an owner or operator of real estate may be liable for the costs of removal or remediation of hazardous or toxic substances on, in or emanating from such property. Such liability may be imposed without regard to whether the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances.

Intellectual Property

Our principal trademarks include FOGO, FOGO DE CHÃO, BAR FOGO, and our campfire design, which we have registered with the United States Patent and Trademark Office. We have also registered or applied for registration of the FOGO EXPRESS, FOGO GRILL, BAR FOGO, FOGO TO GO, THE GAUCHO WAY OF PREPARING MEAT, and various designs as trademarks in the US. In addition, we have registered or applied for FOGO DE CHÃO, FOGO’S, various FOGO and FOGO DE CHÃO-formative terms, our campfire design, and other terms as trademarks in Brazil. Several of our principal marks are also registered or applied-for in numerous foreign countries.

12

We believe that our trademarks, service marks and other intellectual property rights have significant value and are important to the marketing and reputation of our brand. An important part of our intellectual property strategy is the monitoring and enforcement of our rights in markets in which our restaurants currently exist or markets which we intend to enter in the future. We monitor international trademark registers to discover and oppose third-party trademark applications for confusingly similar trademarks to preserve and enhance the scope of protection for our brands.

We enforce our rights through a number of methods, including sending cease-and-desist letters or making infringement claims in federal court. We are aware of third-party restaurants with names similar to our trademarks in certain limited geographical areas in the US, Brazil and elsewhere and are pursuing enforcement of our rights. However, we cannot predict whether steps taken to protect such rights will be adequate. See “Risk Factors—Risks Related to Our Business and Industry—Any failure to protect and maintain our intellectual property rights could adversely affect the value of our brand.”

The Company

Fogo de Chão, Inc. was incorporated under the name Brasa (Parent) Inc. on May 24, 2012 in connection with the acquisition (the “Acquisition”) on July 21, 2012 of Fogo de Chão Churrascaria (Holdings) LLC, a Delaware limited liability company, and its parent company, FC Holdings Inc., a Cayman Islands exempt company, by a collaborative group consisting of funds affiliated with Thomas H. Lee Partners, L.P. (“THL” and along with such funds and their affiliates, the “THL Funds”) and other minority investors. The Acquisition was financed by loans to Brasa Holdings and equity contributions by the THL Funds and certain members of management. On December 17, 2014, we changed our corporate name from Brasa (Parent) Inc. to Fogo de Chão, Inc.

Fogo de Chão, Inc. is a holding company with no assets or operations of its own. The Company owns 100% of Brasa (Purchaser) Inc., which owns Brasa (Holdings) Inc. (“Brasa Holdings”). Brasa Holdings owns Fogo de Chão (Holdings) Inc., which owns the Company’s domestic and foreign operating subsidiaries.

Available Information

We are subject to the information and periodic and current reporting requirements of the United States Securities Exchange Act of 1934 (“Exchange Act”), and, in accordance therewith, we file periodic and current reports, proxy statements and other information with the United States Securities and Exchange Commission (“SEC”). Such periodic and current reports, proxy statements and other information are available to the public on the SEC's website at www.sec.gov and free of charge through our website at www.fogodechao.com. To receive copies of public records not posted to the SEC's website at prescribed rates, you may complete an online form at www.sec.gov, send a fax to (202) 772-9337 or submit a written request to the SEC, Office of FOIA/PA Operations, 100 F Street, N.E., Washington, D.C. 20549-2736. You may call the SEC at 1-800-SEC-0330 for further information. Our website address is provided as an inactive textual reference only. The information contained on, or accessible through, our website is not part of this Annual Report on Form 10-K and is not incorporated by reference herein.

13

RISK FACTORS

This section and other parts of this Annual Report on Form 10-K contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. Forward-looking statements relate to expectations, beliefs, projections, guidance, future plans, objectives and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, our prospects and strategies for future growth, the development and introduction of new products, and the implementation of our marketing and branding strategies. Forward-looking statements can also be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “seeks,” “intends,” “targets” or the negative of these terms or other comparable terminology. Forward-looking statements are not guarantees of future performance and actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, the risk factors discussed below. The risk factors and other factors discussed in this Form 10-K are in addition to those contained in any other cautionary statements, written or oral, which may be made or otherwise addressed in connection with a forward-looking statement or contained in any of our subsequent filings with the SEC. Because of these factors, we caution against placing undue reliance on forward-looking statements. Forward-looking statements speak only as of the date on which they are made. Except as required by applicable securities law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Risks Related to Our Business and Industry

The restaurant industry in general, and the specialty and fine-dining segment in particular, are affected by changes in economic conditions, including continuing effects from the recent recession, which could negatively affect our guest traffic, business, financial condition and results of operations.

Dining at restaurants is a discretionary activity for consumers, and, therefore, we are subject to the effects of any economic conditions. Our restaurants cater to both business and social guests. Accordingly, our business is susceptible to economic factors that may result in reduced discretionary spending by our clientele. We also believe that consumers generally tend to make fewer discretionary expenditures, including for high-end restaurant meals, during periods of actual or perceived negative economic conditions. The recession from late 2007 to mid-2009 reduced consumer confidence to historic lows, impacting the public’s ability and desire to spend discretionary dollars as a result of job losses, home foreclosures, significantly reduced home values, investment losses, bankruptcies and reduced access to credit, resulting in lower levels of customer traffic and lower average check sizes in our restaurants. Changes in spending habits as a result of another economic slowdown, inflation or lower consumer confidence are likely to decrease the number of restaurant guests and average revenue per guest and put pressure on pricing, which would adversely affect our business and financial performance.

The US, Brazil or the specific markets in which we operate may suffer from depressed economic activity, recessionary economic cycles, higher fuel or energy costs, low consumer confidence, high levels of unemployment, reduced home values, increases in home foreclosures, investment losses, personal bankruptcies, reduced access to credit or other economic factors that may affect consumer discretionary spending. During the recent economic crisis and recession, our business was materially adversely affected by a significant decrease in revenues from our restaurants in the US and Brazil due to adverse economic conditions in those areas. If negative economic conditions persist for a long period of time or become more pervasive, consumers might make long-lasting changes to their discretionary spending behavior, including dining out less frequently on a permanent basis and generating lower average check sizes at our restaurants. If restaurant revenue decreases, our profitability could decline as we spread fixed costs across a lower level of revenue. Reductions in staff levels, asset impairment charges and potential restaurant closures could result from prolonged negative restaurant sales. There can be no assurance that the macroeconomic environment or the regional economics in which we operate will improve significantly or that government stimulus efforts will improve consumer confidence, liquidity, credit markets, home values or unemployment, among other things.

The future performance of the US and Brazilian economies is uncertain and may be affected by economic, political and other factors that are beyond our control. These factors, which also affect consumer spending on restaurant meals, include, among others, national, regional and local economic conditions, levels of disposable consumer income, consumer confidence and the effects of geopolitical incidents. We believe that any negative developments relating to these factors, whether actual or perceived, could adversely impact our business and financial performance.

14

We face significant competition from other restaurant companies, which could adversely affect our business and financial performance and make it difficult to expand in new and existing markets.

We must compete successfully with other restaurant companies in existing or new markets in order to maintain and enhance our overall financial performance. The restaurant industry in the US, Brazil and internationally is highly competitive in terms of price, quality of service, restaurant location, atmosphere, and type and quality of food. We compete with restaurant chains and independently owned restaurants (including, among others, churrascaria operators) for guests, restaurant locations and experienced management and staff. Some of our competitors have greater financial and other resources, have been in business for a longer period of time, have greater name recognition and are more established in the markets where we currently operate and where we plan to open new restaurants. Any inability to compete successfully with other restaurant companies may harm our ability to maintain or increase our revenue, force us to close one or more of our restaurants or limit our ability to expand our restaurant base. Restaurant closings would reduce our revenue and could subject us to significant costs, including severance payments to employees, write-downs of leasehold improvements, equipment, furniture and fixtures, and legal expenses. In addition, we could remain liable for remaining future lease obligations for any terminated restaurant locations.

Churrascaria operators and other competitors in the steakhouse sector of our industry have continued to open restaurants in recent years. If we overestimate demand for our restaurants or underestimate the popularity of competing restaurants, we may be unable to realize anticipated revenue from existing or new restaurants. Similarly, if any of our competitors opens additional restaurants in existing or targeted markets, we may realize lower than expected revenue from our restaurants. Any decrease in the number of restaurant guests for any of our existing or new restaurants due to competition could reduce our revenue and adversely affect our business and financial performance, which could cause the market price of our common stock to decline.

Our Brazilian operations, and any other future international operations, expose us to economic, regulatory and other risks associated with such countries.

We have long-standing operations in Brazil, where we now have 10 restaurants. Our Brazilian restaurants accounted for 23.7% of our revenues in Fiscal 2014 and 16.4% in Fiscal 2015. While we do not currently operate any restaurants outside of the US, Brazil and our joint venture restaurant in Mexico, we intend to expand into other international markets in the future. Our lack of experience in operating restaurants outside of the US and Brazil increases the risk that any international expansion efforts that we may undertake may not be successful. In addition, international operations, including our operations in Brazil and Mexico, subject us to a number of risks, including:

|

|

· |

fluctuations in currency exchange rates; |

|

|

· |

foreign and legal regulatory requirements; |

|

|

· |

difficulties in managing and staffing international operations; |

|

|

· |

potentially adverse tax consequences, including complexities of international tax systems and restrictions on the repatriation of earnings; |

|

|

· |

expropriation or governmental regulation restricting foreign ownership or requiring divestiture; |

|

|

· |

increases in the cost of labor (as a result of unionization or otherwise); |

|

|

· |

the burdens of complying with different legal standards; and |

|

|

· |

political, social and economic conditions. |