Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INVESTOR RELATIONS PRESENTATION - MAR. 2016 - MGP INGREDIENTS INC | mgp-form8xkinvestorpresent.htm |

Certain of the comments made in this presentation and in the question and answer session that follows may contain forward-looking statements in relation to operations, financial condition and operating results of MGP Ingredients, Inc. and such statements involve a number of risks and uncertainties. Forward-looking statements are usually identified by or associated with such words as “intend,” ”plan,” ”believe,” ”estimate,” “expect,” “anticipate,” “hopeful,” “should,” “may,” “will,” “could,” “encouraged,” “opportunities,” “potential,” and/or the negatives or variations of these terms or similar terminology. These statements reflect management’s views as of today and we do not undertake any obligation to update them. We wish to caution you that these statements are only estimates and that actual results may differ materially from those projected in the forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, among others: (i) disruptions in operations at our Atchison facility, Indiana facility, or at the Illinois Corn Processing, LLC ("ICP") facility, (ii) the availability and cost of grain, flour, and barrels, and fluctuations in energy costs, (iii) the effectiveness of our corn purchasing program to mitigate our exposure to commodity price fluctuations, (iv) the effectiveness or execution of our five-year strategic plan, (v) potential adverse effects to operations and our system of internal controls related to the loss of key management personnel, (vi) the competitive environment and related market conditions, (vii) the ability to effectively pass raw material price increases on to customers, (viii) the positive or adverse impact to our earnings as a result of the ownership of our equity method investment in ICP and the volatility of its operating results, (ix) ICP's access to capital, (x) our limited influence over the ICP joint venture operating decisions, strategies, financial or other decisions (including investments, capital spending and distributions), (xi) our ability to source product from the ICP joint venture or unaffiliated third parties, (xii) our ability to maintain compliance with all applicable loan agreement covenants, (xiii) our ability to realize operating efficiencies, (xiv) actions of governments, (xv) consumer tastes and preferences, and (xvi) the volatility in our earnings resulting from the timing differences between a business interruption and a potential insurance recovery. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in Item 1A Risk Factors of our Annual Report on Form 10-K for the period ending December 31, 2015.

• Founded in 1941 by Cloud L. Cray, Sr. • Headquartered in Atchison, Kansas • 300 employees • Leading supplier of premium bourbon, whiskey, distilled gin, and vodka • Largest U.S. supplier of rye whiskey • Largest U.S. supplier of distilled gin • Largest U.S. supplier of specialty wheat proteins and starches • 2015 (3/21/2015) total shareholder return = 49%

LAWRENCEBURG, IN DISTILLERY • Distilling & Aging • Wide Range of Whiskeys • Standard & Custom Mash Bills • Gins • Grain Neutral Spirits/Vodka • R&D Lab ATCHISON PROTEIN & STARCH • Specialty Wheat Proteins & Starches • Textured Proteins ATCHISON, KS DISTILLERY • High Quality, Efficient Production • Grain Neutral Spirits/Vodka • Gins • Industrial RESEARCH & DEVELOPMENT • Extensive R&D Resources

WHISKEY (U.S.) • Category: • 18.5MM Cases • 5% 5 Year CAGR • MGP Estimated Share = 8% CRAFT • Category: • +700 Distilleries • 2014 Volume +58% GIN (U.S.) • Category: • 6.3MM Cases • (3)% 5 Year CAGR • MGP Estimated Share = 65% RYE WHISKEY (U.S.) • Category: • 500K Cases • 45% 5 Year CAGR • MGP Estimated Share = 70% Note: 2014 data based on internal company estimates of U.S. production

HIGH PROTEIN • Category (N. Amer.) = $16B • 9% projected 5 year CAGR HIGH FIBER • Category (N. Amer.) = $1.3B • 13% projected 5 year CAGR PLANT BASED PROTIENS • Category (N. Amer.) = $0.6B • 4% projected 5 year CAGR NON-GMO • Category (N. Amer.) = $0.8B • 5% projected 5 year CAGR 37% of Americans are interested in G.M.O.-free products. Source: Mintel “MGP Ingredients offers specialty proteins and starches derived from non-bioengineered wheat.” Note: 2014 data based on internal company estimates

Secure our future by consistently delivering superior financial results by more fully participating in all levels of the alcohol and food ingredients segments for the betterment of our shareholders, employees, partners, consumers, and communities.

• Supplying all tiers of the beverage alcohol market • Large multinationals • Bottlers and rectifiers • Craft • Supporting changing consumer tastes • Share shift from beer to spirits • Share shift from white goods to whiskey • Growth of rye • Premiumization • Mix optimization: customer and product

“The growth in this [meat substitutes] market is propelled by continuous growth in the vegetarian food industry and the increasing health concerns of consumers.” SOURCE LINK “Whatever the science says, many consumers have made up their minds: no genetic tinkering with their food,”* SOURCE LINK • Focus on MGP proprietary protein and starch products • Focusing on large branded players • Leveraging macro trends • High fiber • High protein • Non GMO • Plant based proteins • Mix optimization: customer and product

• Metze’s Select - first MGP brand • Showcasing MGP’s range of expertise and strengthening our reputation with trade and consumers • Received an “Outstanding!” rating by Whisky Advocate • Valuable opportunity to learn It’s a more delicate bourbon, light and sweet with notes of citrus and caramel. It’s a great, sippable spirit, and the best of what Indiana may have to offer. – G. Clay Whittaker, Men’s Journal Old school spicy nose, almost archetypal scents of sweet teaberry, cinnamon, and spearmint hard candy, with a firm, warm alcohol backing...I’d marry it. - Lew Bryson, Whisky Advocate “ “

• Expanding barrel warehouse capacity - $20MM investment • Building our barreled whiskey inventory - Investment up $17MM vs. 2014 to $28MM - Potential uses: - Support own brands - Strategic partnerships - Sell on open market – potential value 3X • Attracting and developing talent

• Mix shift to higher value products will reduce overall impact of commodity prices • Disciplined approach to managing commodity costs - Formula-driven pricing - Locking in margins - Passing through significant swings in cost • Strengthened supplier partnerships

• Named Distiller of the Year by Whiskey Advocate • Joined The Distilled Spirits Council • Added to the Russell 2000 and the Russell 3000 index funds • Received “Circle of Champions” award for the diversity represented on our Board of Directors • Honored as Large Business of the Year in Lawrenceburg, Indiana, and Business of the Year in Atchison, Kansas

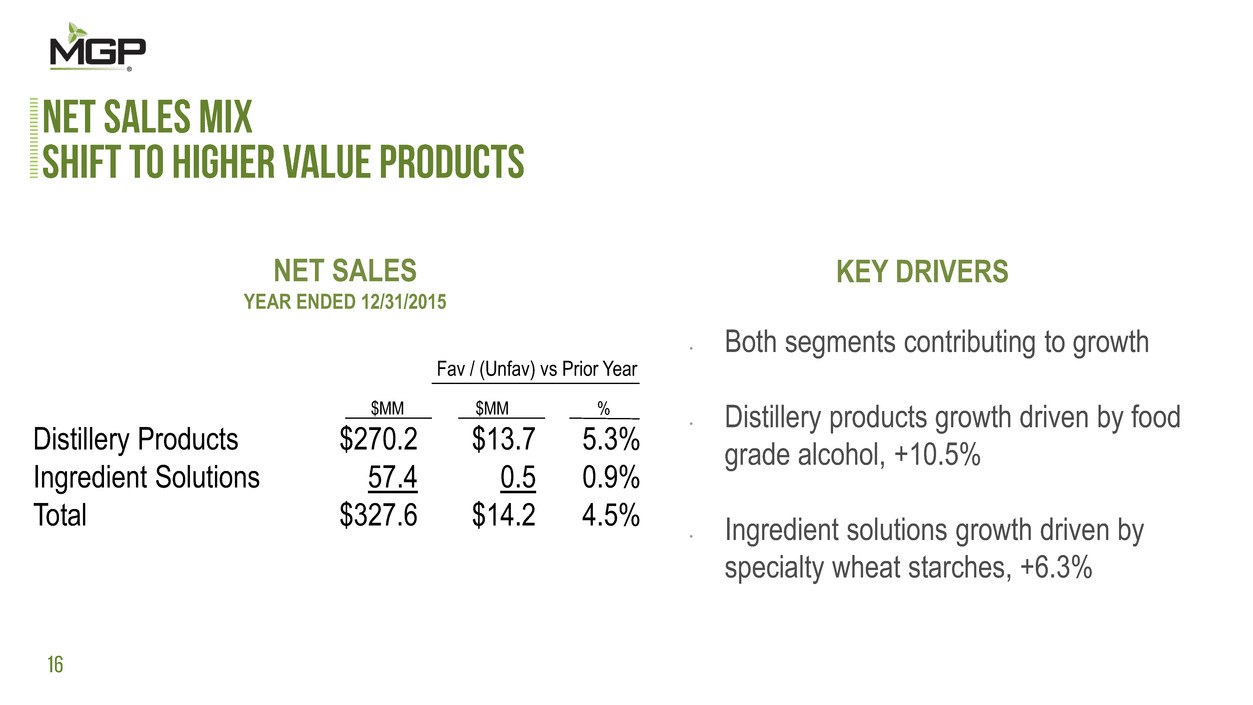

Fav / (Unfav) vs Prior Year $MM $MM % Distillery Products $270.2 $13.7 5.3% Ingredient Solutions 57.4 0.5 0.9% Total $327.6 $14.2 4.5% NET SALES YEAR ENDED 12/31/2015 • Both segments contributing to growth • Distillery products growth driven by food grade alcohol, +10.5% • Ingredient solutions growth driven by specialty wheat starches, +6.3% KEY DRIVERS

GROSS PROFIT MARGINS ANNUAL PERCENT OF NET SALES • Net Sales shift to more profitable products • Effective price management during commodity declines • Improved plant efficiencies KEY DRIVERS 6.6% 9.1% 17.9% 2013 2014 2015

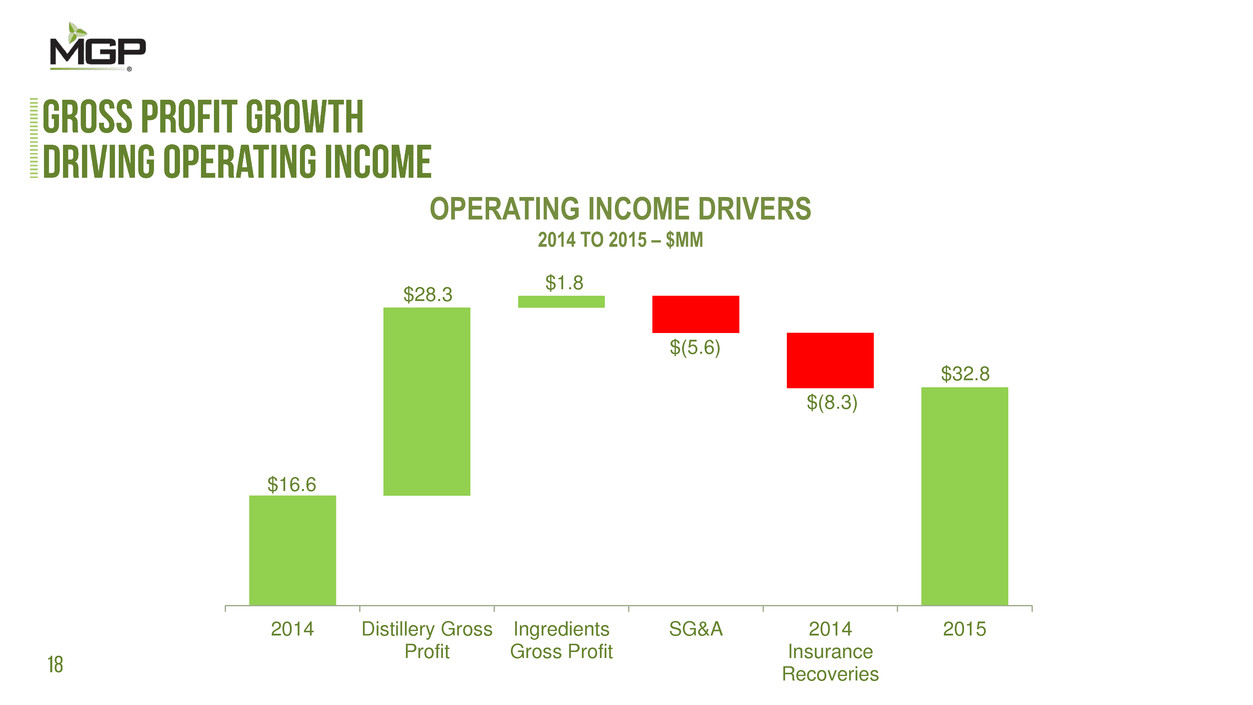

2014 Distillery Gross Profit Ingredients Gross Profit SG&A 2014 Insurance Recoveries 2015 OPERATING INCOME DRIVERS 2014 TO 2015 – $MM $16.6 $28.3 $1.8 $(5.6) $(8.3) $32.8

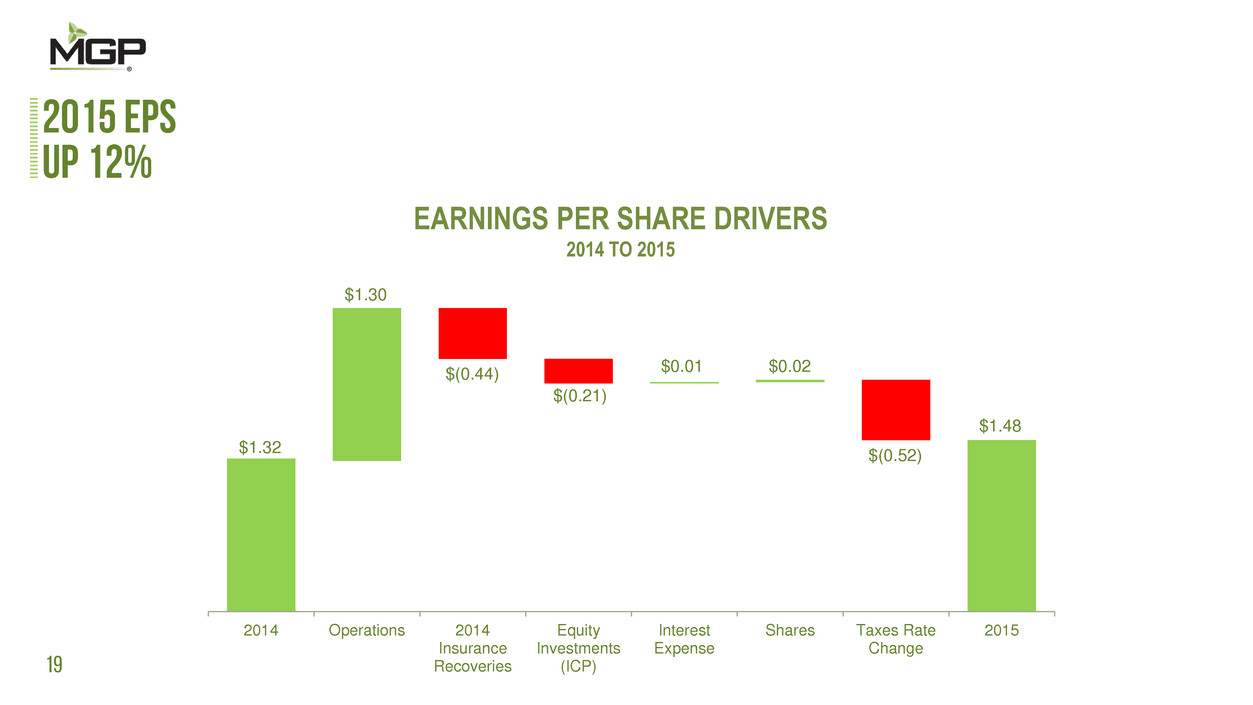

2014 Operations 2014 Insurance Recoveries Equity Investments (ICP) Interest Expense Shares Taxes Rate Change 2015 EARNINGS PER SHARE DRIVERS 2014 TO 2015 $1.32 $1.30 $(0.44) $(0.21) $0.01 $0.02 $(0.52) $1.48

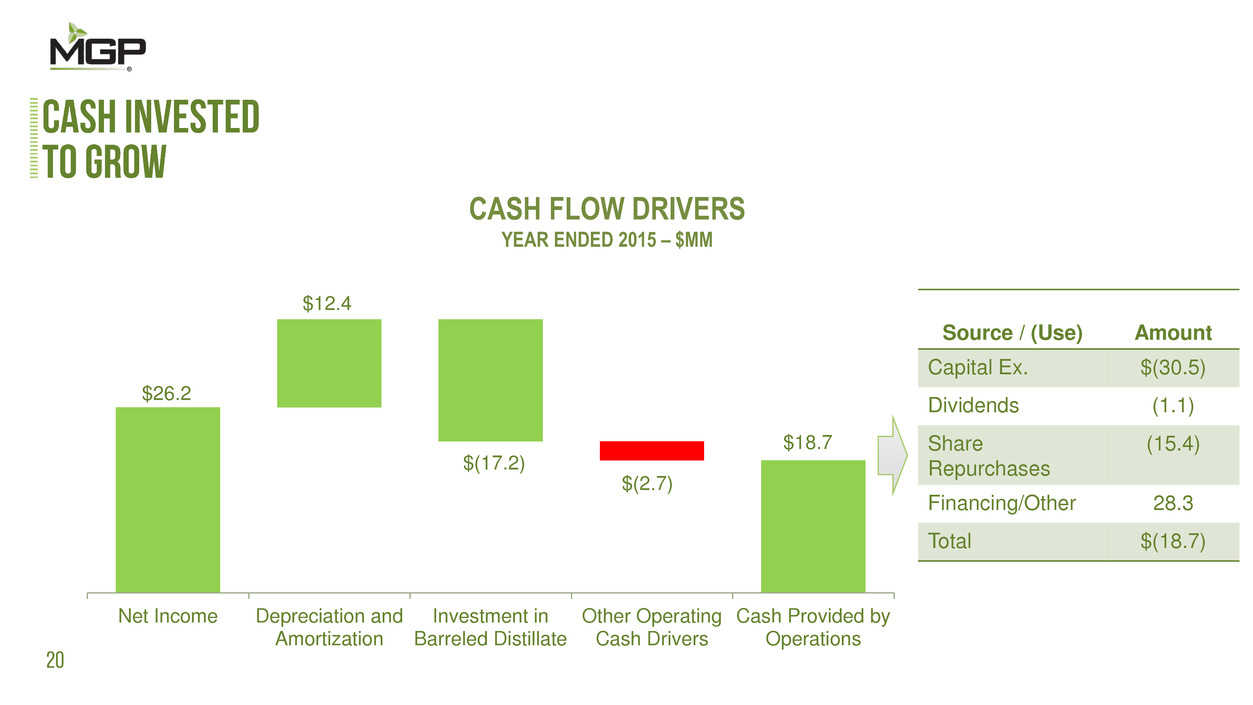

Net Income Depreciation and Amortization Investment in Barreled Distillate Other Operating Cash Drivers Cash Provided by Operations CASH FLOW DRIVERS YEAR ENDED 2015 – $MM Source / (Use) Amount Capital Ex. $(30.5) Dividends (1.1) Share Repurchases (15.4) Financing/Other 28.3 Total $(18.7) $26.2 $12.4 $(17.2) $(2.7) $18.7

2014 2015 DEBT TO EBITDA – $MM Debt EBITDA • 2015 YE Debt to EBITDA Ratio of .65 • $33MM Available on Credit Facility at 12/31/15 $9.9 $33.5 $39.1 $51.3 See Appendix for GAAP to Non GAAP Reconciliation

2016 and Long Term Guidance : • Operating income is expected to increase by a compound annual growth rate in the ten to fifteen percent range over the next three years. • 2016 net sales percentage growth is expected to accelerate into the high single digits. • 2016 gross margin gains are expected to be moderate following strong 2015 improvement. • 2016 effective tax rate is forecast to be 35% and shares outstanding are expected to be approximately 16.7 million, reflecting the benefit of the 2015 share repurchase. • Due to challenging and volatile conditions in the fuel ethanol market, ICP's 2015 level of profitability may not be sustainable in 2016.

• Long-term strategy in place • Turnaround well underway • Mix and investment driving long-term growth • Well positioned against macro trends

• GAAP to Non GAAP Reconciliations • Cash flow details

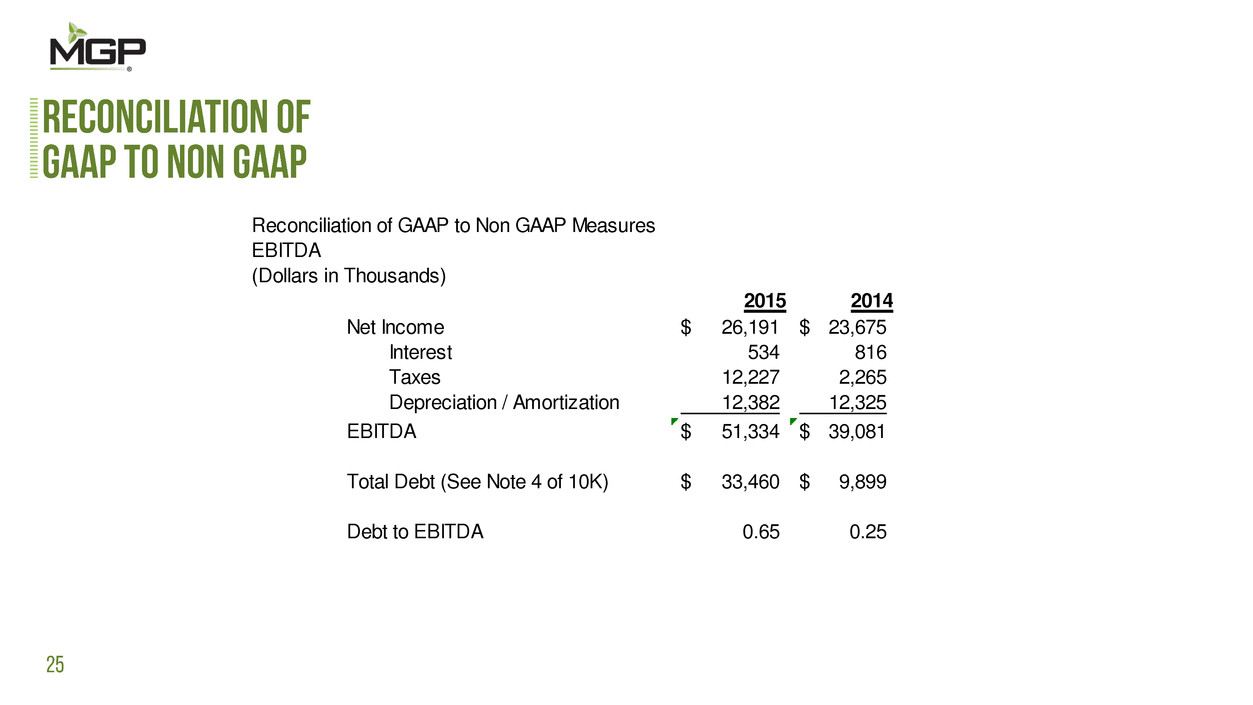

Reconciliation of GAAP to Non GAAP Measures EBITDA (Dollars in Thousands) 2015 2014 Net Income 26,191$ 23,675$ Interest 534 816 Taxes 12,227 2,265 Depreciation / Amortization 12,382 12,325 EBITDA 51,334$ 39,081$ Total Debt (See Note 4 of 10K) 33,460$ 9,899$ Debt to EBITDA 0.65 0.25

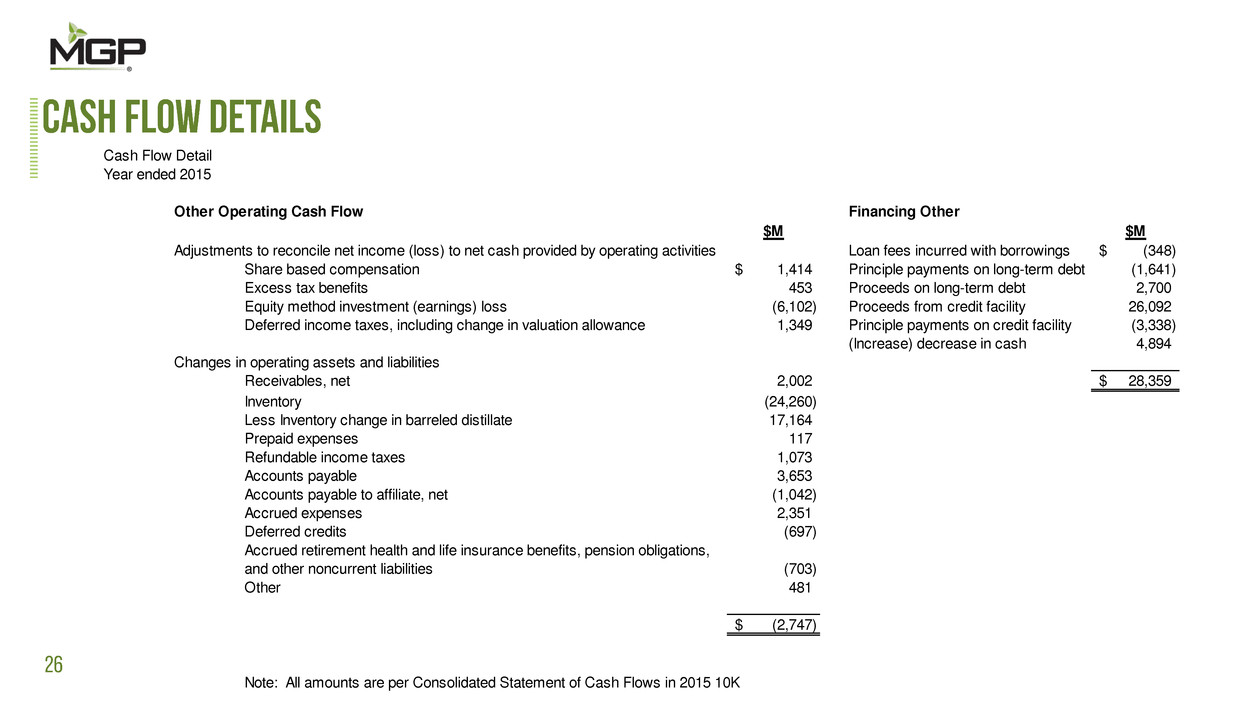

Cash Flow Detail Year ended 2015 Other Operating Cash Flow Financing Other $M $M Adjustments to reconcile net income (loss) to net cash provided by operating activities Loan fees incurred with borrowings (348)$ Share based compensation 1,414$ Principle payments on long-term debt (1,641) Excess tax benefits 453 Proceeds on long-term debt 2,700 Equity method investment (earnings) loss (6,102) Proceeds from credit facility 26,092 Deferred income taxes, including change in valuation allowance 1,349 Principle payments on credit facility (3,338) (Increase) decrease in cash 4,894 Changes in operating assets and liabilities Receivables, net 2,002 28,359$ Inventory (24,260) Less Inventory change in barreled distillate 17,164 Prepaid expenses 117 Refundable income taxes 1,073 Accounts payable 3,653 Accounts payable to affiliate, net (1,042) Accrued expenses 2,351 Deferred credits (697) Accrued retirement health and life insurance benefits, pension obligations, and other noncurrent liabilities (703) Other 481 (2,747)$ Note: All amounts are per Consolidated Statement of Cash Flows in 2015 10K

MGP Ingredients, Inc.® Cray Business Plaza 100 Commercial Street P.O. Box 130 Atchison, Kansas 66002 800.255.0302 mgpingredients.com