Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT - Grom Social Enterprises, Inc. | illumination_s1a2-ex2301.htm |

| EX-5.1 - OPINION - Grom Social Enterprises, Inc. | illumination_s1a2-ex0501.htm |

| EX-23.2 - CONSENT - Grom Social Enterprises, Inc. | illumination_s1a2-ex2302.htm |

As filed with the Securities and Exchange Commission on March 29, 2016

Registration No. 333-208968

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ILLUMINATION AMERICA, INC.

(Exact name of registrant as specified in its charter)

| Florida | 3646 | 27-1073696 |

|

(State or other jurisdiction of Incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2060 NW Boca Raton Blvd., #6

Boca Raton, FL 33431

561-997-7270

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Ismael Llera, President

ILLUMINATION AMERICA, INC.

2060 NW Boca Raton Blvd., #6

Boca Raton, FL 33431

561-997-7270

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Andrew I. Telsey, Esq.

Andrew I. Telsey, P.C.

12835 E. Arapahoe Road

Tower I Penthouse #803

Centennial, CO 80112

Tel: (303) 768-9221

As soon as practicable after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company:

| o Large accelerated filer | o Accelerated filer | |

| o Non-accelerated filer (Do not check if a smaller reporting company) | x Smaller reporting company |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share(1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

|

Common Stock, Par value $0.001 per share |

2,485,432 | $0.78 | $1,938,637 | $195.22* |

__________________

| (1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Subject to Completion, dated March __, 2016

PROSPECTUS

PRELIMINARY

PROSPECTUS

2,485,432 Shares of Common Stock

This Prospectus relates to the offer and sale of up to 2,485,432 shares of our Common Stock (“Common Stock”) held by Selling Stockholders listed beginning on page 16 of this Prospectus (the “Selling Stockholders”), (the “Offering”). See “SELLING STOCKHOLDERS.”

The Selling Stockholders may sell their shares of our Common Stock (the “Shares”) from time to time at the initial price of $0.78 per share until our Common Stock is quoted on the OTCQB and thereafter at prevailing market prices or privately negotiated prices. Each Selling Stockholder may be an underwriter within the meaning of Section 2(a)(11) of the Securities Act. See “DETERMINATION OF OFFERING PRICE,” “SELLING STOCKHOLDERS” and “PLAN OF DISTRIBUTION.”

We will pay the expenses of registering these Shares. We will not receive any proceeds from the sale of Shares of Common Stock in this Offering. All of the net proceeds from the sale of the Shares will go to the Selling Stockholders. The Selling Shareholders are expected to receive aggregate net proceeds of approximately $1,938,637 from the sale of their Shares (approximately $0.78 per share).

Our Common Stock is not currently listed for trading on any exchange. It is our intention to seek quotation on the OTCQB if we qualify for listing on the same. There can be no assurances that our Common Stock will be approved for trading on the OTCQB, or any other trading exchange.

This Prospectus is part of a registration statement that we have filed with the US Securities and Exchange Commission. Prior to filing of our registration statement, we were not a reporting company under the Securities Exchange Act of 1934, as amended. Following the effectiveness of our registration statement we will become subject to the reporting requirements under the aforesaid Act.

We are an “emerging growth company” as defined under the federal securities laws and are subject to reduced public company reporting requirements.

Investing in our Common Stock involves a high degree of risk. You should invest in our Common Stock only if you can afford to lose your entire investment.

SEE “RISK FACTORS” BEGINNING ON PAGE 4.

The information in this Prospectus is not complete and may be changed. This Prospectus is included in the registration statement that was filed by Illumination America, Inc. with the Securities and Exchange Commission. The Selling Stockholders may not sell these Shares until the registration statement becomes effective. This Prospectus is not an offer to sell these Shares and is not soliciting an offer to buy these Shares in any State where the offer or sale is not permitted.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is ____________, 201_

TABLE OF CONTENTS

| Page No. | ||

| Prospectus Summary | 1 | |

| Special Note About Forward-Looking Statements | 3 | |

| Risk Factors | 4 | |

| Use of Proceeds | 16 | |

| Determination of the Offering Price | 16 | |

| Market Price of and Dividends on the Company’s Common Equity and Related Stockholder Matters | 16 | |

| Selling Stockholders | 16 | |

| Plan of Distribution | 18 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 | |

| Description of Business | 22 | |

| Management | 33 | |

| Executive Compensation | 35 | |

| Summary Compensation Table | 34 | |

| Security Ownership of Certain Beneficial Owners & Management | 35 | |

| Certain Relationships and Related Transactions | 35 | |

| Description of Securities | 36 | |

| Shares Eligible for Future Sale | 36 | |

| Interests of Named Experts and Counsel | 37 | |

| Legal Matters | 37 | |

| Experts | 37 | |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 37 | |

| Additional Information | 38 | |

| Financial Statements | 38 | |

| i |

PROSPECTUS SUMMARY

This summary provides an overview of certain information contained elsewhere in this Prospectus and does not contain all of the information that you should consider or that may be important to you. Before making an investment decision, you should read the entire Prospectus carefully, including the “RISK FACTORS” section and the financial statements and the notes to the financial statements. In this Prospectus, the terms “the “Company,” “we,” “us” and “our” refer to Illumination America, Inc., unless otherwise specified herein.

We were originally formed in the State of Florida on October 6, 2009 as a limited liability company. On April 24, 2014 we reorganized as a Florida corporation. Since inception we have been engaged in the design, development, marketing and sales of energy-efficient lighting systems and solutions. Our business currently involves direct sales of Light Emitting Diode (“LED”) products, including customized resolution of client lighting issues, which is where we have been generating our revenues to date. We intend to expand our current business to include proprietary products currently under development, which we intend to enhance over the next 12 to 24 months.

Our current business and intended expansion include the following:

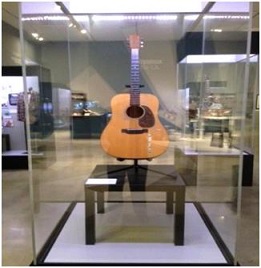

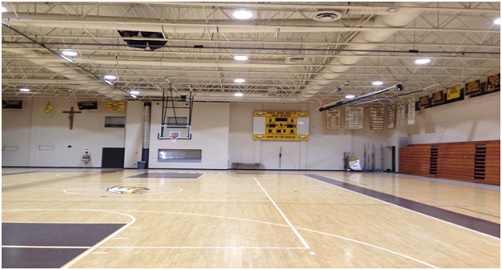

| · | Direct Sales of Original Equipment Manufacturer (“OEM”) Products. To date, all of our revenues have been derived from direct sales earned on products sold by us. These products have been marketed and sold to multi-family housing (REITS), museums, churches and private schools, among others; and |

| · | Solutions. During the third quarter of 2015, we began to align our resources with developing our proprietary LED products. We have or are in the process of developing three products, each of which is expected to provide, high-quality, energy-efficient lighting application alternatives, primarily to the customers and markets requiring specific applications and solutions. This includes development of proprietary fixtures that unlike conventional fluorescent tube fixtures hold the LED tube in a more advantageous way, directing the LED light to achieve a broader and more even beam spread from fixture to fixture. The product is intended for continuous lighting such as hallways, where fixtures are mounted perpendicular to the direction of the hallway. We are in the process of filing our application for a patent for this initial product. See “Trademarks/Trade Names/Intellectual Property” below. | |

| We are in development of a proprietary portable light source with several applications. This product is of our design and is currently being sourced for production. Our research and development team is headed by William Andrews who has over 40 years of architectural lighting design experience. He, along with outside consultants, is dedicated to developing and designing leading-edge LED lighting products. We work with contracted manufacturers from design to completion insuring the desired results. | ||

| In another example, we are currently working with four manufactures to develop and produce higher end, decorative, vapor proof units that house LED tubes. One manufacturer will provide the base fixture, another is producing a luminous lens of our own design, the third will supply the LED tube, and the fourth will provide the assembly. |

We work with contracted manufacturers from design to completion insuring the desired results. By partnering with manufacturers we take advantage of their ability to bring our designs quickly to market thereby relieving ourselves of the heavy investment in machinery and their labor force already in place.

We pursue three avenues for sales: (i) sales through the manufactures pipeline, (ii) direct sales to high volume retailers and our “found” end users that has had the need for the product, and (iii) direct Internet sales at retail pricing.

| 1 |

We are also looking to work with and/or acquire other lighting companies that target specific end-users in need of cost saving LED solutions, which is one of the principal reasons why we have elected to become a trading, reporting company. Because of our lack of financial resources we believe we will be able to utilize our securities as compensation in acquiring these other entities. See “RISK FACTORS.” However, as of the date of this Prospectus we do not have any definitive agreement with any third party to acquire any company and there are no assurances that any such agreement will be consummated in the future. See “BUSINESS – Growth by Acquisition.”

Based upon our current business plan, our ability to begin to generate profits from operations is dependent upon our obtaining additional financing and there can be no assurances that we will ever establish profitable operations. As we pursue our business plan we are incurring significant expenses without corresponding revenues. In the event that we remain unable to generate significant revenues to pay our operating expenses we will not be able to achieve profitability or continue operations. See “RISK FACTORS.”

In December 2015, we undertook a forward split of our issued and outstanding Common Stock whereby each share of Common Stock was exchanged for 1.2847603145 shares, with fractional shares rounded to the nearest round number. All references in the Prospectus to our outstanding Common Shares is presented on a post-forward split basis, unless indicated otherwise.

During the years ended December 31, 2012, 2013 and 2014, as well as in 2015, we undertook private offerings of our Common Stock wherein we sold an aggregate of 1,569,800 shares of our Common Stock (1,991,254 shares, post-forward split) for gross proceeds of $1,569,800 ($1.00 per share, $0.78 per share post-split) to 39 “accredited” investors, as that term is defined under the Securities Act of 1933, as amended. All of the shares sold in these private offerings are being registered herein.

During our fiscal years ended December 31, 2014 and 2015, we generated revenues of $131,502 and $206,733, respectively, and incurred net losses of $193,076 in 2014 and $1,199,896 in 2015. Total stockholders’ equity at December 31, 2015 was $72,650. As of December 31, 2015, we had $107,673 in cash. See “RISK FACTORS” and “FINANCIAL STATEMENTS.”

Our principal offices are located at 2060 NW Boca Raton Blvd., #6, Boca Raton, FL 33431, telephone (561) 997-7270. Our website is www.illuminationamerica.com.

About The Offering

| Common Stock to be Offered by Selling Shareholders | 2,485,432 shares. This number represents approximately 24.9% of the total number of shares outstanding following this Offering. | |

| Number of shares outstanding before and after the Offering | 10,000,000 (1) | |

| Use of Proceeds | We will not receive any proceeds from the sale of the Common Stock. | |

| Risk Factors | See the discussion under the caption “RISK FACTORS” and other information in this Prospectus for a discussion of factors you should carefully consider before deciding to invest in our Common Stock. |

_________________________

| (1) | Because we are not selling any of our Common Stock as part of this Offering, the number of issued and outstanding shares of our Common Stock will remain the same following this Offering. |

| 2 |

Selected Financial Data

The following selected financial data should be read in conjunction with our financial statements and the related notes to those statements included in “FINANCIAL STATEMENTS” and with “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” appearing elsewhere in this Prospectus. The selected financial data has been derived from our audited and unaudited financial statements.

Our financial statements for year ended December 31, 2014, as previously filed as part of our initial registration statement filed with the SEC on January 13, 2016, have been restated. The previously filed financial statements did not reflect the proper matching of revenues and cost during the appropriate period. The net effect of this restatement on the year ended December 31, 2014 was to reduce our net loss from $209,882 to $193,076; and to increase our revenue from $114,696 to $131,502. There was no impact on earnings per share. See Note 7 to Financial Statements herein.

Statement of Operations:

| Year Ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| (restated) | ||||||||

| Revenues | $ | 206,733 | $ | 131,502 | ||||

| Total operating expenses | $ | 1,254,293 | $ | 260,464 | ||||

| Income (Loss) from operations | $ | (1,225,216 | ) | $ | (217,076 | ) | ||

| Related Party - Other income (expense) | $ | 25,320 | $ | 24,000 | ||||

| Provision for income tax | $ | – | $ | – | ||||

| Net income (loss) | $ | (1,199,896 | ) | $ | (193,076 | ) | ||

| Net income (loss) per share – (basic and fully diluted) | $ | (0.14 | ) | $ | (0.02 | ) | ||

| Weighted common shares outstanding | 8,698,310 | 8,207,164 | ||||||

Balance Sheet:

| Year Ended December 31, | ||||||||

| 2015 | 2014 | |||||||

| (restated) | ||||||||

| Cash | $ | 107,673 | $ | 1,176 | ||||

| Current assets | $ | 163,854 | $ | 79,353 | ||||

| Total assets | $ | 163,854 | $ | 79,353 | ||||

| Current liabilities | $ | 91,204 | $ | 135,560 | ||||

| Total liabilities | $ | 91,204 | $ | 135,560 | ||||

| Total stockholders’ equity | $ | 72,650 | $ | (56,207 | ) | |||

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have made some statements in this Prospectus, including some under “RISK FACTORS,” “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” “DESCRIPTION OF BUSINESS” and elsewhere, which constitute forward-looking statements. These statements may discuss our future expectations or contain projections of our results of operations or financial condition or expected benefits to us resulting from acquisitions or transactions and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statements. These factors include, among other things, those listed under “RISK FACTORS” and elsewhere in this Prospectus. In some cases, forward-looking statements can be identified by terminology such as “may,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

| 3 |

RISK FACTORS

An investment in our Common Stock is a risky investment. In addition to the other information contained in this Prospectus, prospective investors should carefully consider the following risk factors before purchasing shares of our Common Stock offered hereby. We believe that we have included all material risks.

Risks Related to Our Business

Our independent accountants have expressed a "going concern" opinion.

Our financial statements accompanying this Prospectus have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The financial statements do not include any adjustment that might result from the outcome of this uncertainty. We have a minimal operating history and minimal revenues or earnings from operations. We have no significant assets or financial resources. We will, in all likelihood, sustain operating expenses without corresponding revenues for the immediate future. See “DESCRIPTION OF BUSINESS” and “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Liquidity and Capital Resources.” There are no assurances that we will generate profits from operations.

We have not generated profits from our operations.

We incurred net losses of $193,076 in 2014, and $1,199,896 in 2015. Based upon our current business plan, our ability to begin to generate profits from operations is dependent upon our obtaining additional financing and there can be no assurances that we will ever establish profitable operations. As we pursue our business plan, we are incurring significant expenses without corresponding revenues. In the event that we remain unable to generate significant revenues to pay our operating expenses, we will not be able to achieve profitability or continue operations.

Our ability to continue as a going concern is dependent on raising additional capital, which we may not be able to do on favorable terms, or at all.

We need to raise additional capital to support our current operations and fund our sales and marketing programs. We estimate that we will need approximately $1,000,000 in additional capital in order to generate profits from operations. We can provide no assurance that additional funding will be available on a timely basis, on terms acceptable to us, or at all. If we are unsuccessful in raising additional funding, our business may not continue as a going concern. Even if we do find additional funding sources, we may be required to issue securities with greater rights than those currently possessed by holders of our Common Stock. We may also be required to take other actions that may lessen the value of our Common Stock or dilute our common stockholders, including borrowing money on terms that are not favorable to us or issuing additional equity securities. If we experience difficulties raising money in the future, our business and liquidity will be materially adversely affected. See “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Liquidity and Capital Resources,” below.

We do not currently have an external line of credit facility with any financial institution.

As indicated above, we have estimated that we need approximately $1,000,000 in additional capital to generate profits from operations. We have attempted to establish credit facilities with financial institutions but have experienced little or no success in these attempts due primarily to the current economic climate, specifically the reluctance of most financial institutions to provide such lines of credit to relatively new business ventures. We also have limited assets available to secure such a line of credit. We intend to continue to attempt to establish an external line of credit in the future, but there can be no assurances we will be able to do so. The failure to obtain an external line of credit could have a negative impact on our ability to generate profits.

Our financial results may fluctuate from period to period as a result of several factors which could adversely affect our stock price.

Our operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are outside our control. Factors that will affect our financial results include:

| ● | acceptance of our products and market penetration; |

| ● | the amount and timing of capital expenditures and other costs relating to the implementation of our business plan; |

| ● | the introduction of new products by our competitors; |

| ● | general economic conditions and economic conditions specific to our industry. |

| 4 |

As a strategic response to changes in the competitive environment, we may from time to time make certain pricing, service, or marketing decisions or acquisitions that could have a material adverse effect on our business, prospects, financial condition, and results of operations.

We are dependent upon third party suppliers of our products.

We are dependent on our foreign and domestic partners for our supplies of LED products. While we believe that there are numerous potential sources of LED products available, if these manufacturers were to cease production or otherwise fail to supply us with quality product in sufficient quantities on a timely basis and we were unable to contract on acceptable terms for these products with alternative manufacturers it would have a material adverse effect on our business.

If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could suffer.

Our future success and ability to implement our business strategy depends, in part, on our ability to attract and retain key personnel, and on the continued contributions of members of our senior management team and key technical personnel, each of whom would be difficult to replace. All of our employees, including our senior management, are free to terminate their employment relationships with us at any time. Competition for highly skilled technical people is extremely intense, and we face challenges identifying, hiring and retaining qualified personnel in many areas of our business. If we fail to retain our senior management and other key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our strategic objectives and our business could suffer.

Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

Generally accepted accounting principles and related pronouncements, implementation guidelines and interpretations with regard to a wide variety of matters that are relevant to our business, such as, but not limited to, revenue recognition, stock-based compensation, trade promotions, and income taxes are highly complex and involve many subjective assumptions, estimates and judgments by our management. Changes to these rules or their interpretation or changes in underlying assumptions, estimates or judgments by our management could significantly change our reported results.

If we are unable to build and sustain proper information technology infrastructure, our business could suffer.

We depend on information technology as an enabler to improve the effectiveness of our operations and to interface with our customers, as well as to maintain financial accuracy and efficiency. If we do not allocate and effectively manage the resources necessary to build and sustain the proper technology infrastructure, we could be subject to transaction errors, processing inefficiencies, the loss of customers, business disruptions, or the loss of or damage to intellectual property through security breach. Our information systems could also be penetrated by outside parties’ intent on extracting information, corrupting information or disrupting business processes. Such unauthorized access could disrupt our business and could result in the loss of assets.

| 5 |

Our new products may not achieve broad market acceptance, which would prevent us from increasing our revenue and market share.

If we fail to achieve broad market acceptance of our existing and new products, there could be an adverse impact on our ability to increase our revenue, gain market share, and achieve and sustain profitability. Our ability to achieve broad market acceptance for existing and additional products will be impacted by a number of factors, including:

| · | our ability to timely introduce and complete new designs and timely qualify and certify our products; |

| · | whether the owners of large industrial or commercial facilities will continue to be willing to purchase our products given our current size of operations; |

| · | our ability to produce LED lighting systems that compete favorably against other solutions on the basis of price, quality, design, reliability and performance; |

| · | our ability to choose appropriate products from our suppliers that we will be able to modify to comply with local standards and regulatory requirements, as well as potential in-country manufacturing requirements; and |

| · | our ability to continue to develop and maintain successful relationships with our customers and suppliers. |

In addition, our ability to achieve increased market share will depend on our ability to increase sales to commercial, residential and industrial facilities. These potential customers often have in certain cases made substantial investments in other types of lighting systems, which may create challenges for us to achieve their adoption of our LED solutions.

The LED lighting industry is highly competitive and we expect to face increased competition as new and existing competitors introduce competing products, which could negatively impact our results of operations and market share.

Marketing and selling our LED solutions against traditional lighting solutions is highly competitive, and we expect competition to intensify as new and existing competitors enter the LED lighting market. We believe that there are possibly a number of companies developing LED and other products that will compete directly with our LED systems.

Some of our competitors have announced plans to introduce LED products that could compete with our systems. Several of our existing and potential competitors are significantly larger, have greater financial, marketing, distribution, customer support and other resources, are more established than we are, and have significantly better brand recognition. Some of our competitors have more resources to develop or acquire, and more experience in developing or acquiring, new products and technologies and in creating market awareness for these products and technologies. Further, certain competitors may be able to develop new products more quickly than we can and may be able to develop products that are more reliable or which provide more functionality than ours. In addition, some of our competitors have the financial resources to offer competitive products at aggressive or below-market pricing levels, which could cause us to lose sales or market share or require us to lower prices for our LED systems in order to compete effectively. If we have to reduce our prices by more than we anticipated, or if we are unable to offset any future reductions in our average selling prices by increasing our sales volume, reducing our costs and expenses or introducing new products, our gross profit would suffer.

A drop in the price of electricity derived from the utility grid or from alternative energy sources may harm our business, financial condition and results of operations.

We believe that a decision to purchase an LED system is strongly influenced by the cost of electricity. Decreases in the prices of electricity would make it more difficult for all LED systems to compete. In particular, growth in unconventional natural gas production and an increase in global liquefied natural gas capacity are expected to keep natural gas prices relatively low for the foreseeable future. Persistent low natural gas prices, lower prices of electricity produced from other energy sources, such as nuclear power, or improvements to the utility infrastructure could reduce the retail price of electricity from the utility grid, making the purchase of an LED less economically attractive and lowering sales of our LED lighting systems. In addition, energy conservation technologies and public initiatives to reduce demand for electricity also could cause a fall in the retail price of electricity from the utility grid which could negatively impact our sales.

We depend upon a few manufacturers. Our operations could be disrupted if we encounter problems with these manufacturers.

We rely primarily upon the products of third party manufacturers with whom we have entered into agreements to allow us to offer their products on an exclusive basis. Our reliance on those manufacturers makes us vulnerable to possible capacity constraints and reduced control over component availability, delivery schedules, manufacturing yields and costs.

| 6 |

The revenues that our manufacturers generate from our orders may represent a relatively small percentage of their overall revenues. As a result, fulfilling our orders may not be considered a priority in the event of constrained ability to fulfill all of their customer obligations in a timely manner. In addition, some of the facilities in which our products are manufactured are located outside of the United States. We believe that the location of these facilities outside of the United States increases supply risk, including the risk of supply interruptions or reductions in manufacturing quality or controls.

If our manufacturers were unable or unwilling to manufacture our products in required volumes and at high quality levels or renew existing terms under supply agreements, we would have to identify, qualify and select acceptable alternative manufacturers. An alternative contract manufacturer may not be available to us when needed or may not be in a position to satisfy our quality or production requirements on commercially reasonable terms, including price. Further, in most instances the products we purchase from any particular manufacturer are proprietary to that manufacturer and it would not be possible to source the same product from another manufacturer. Any significant interruption in manufacturing would require us to reduce our supply of products to our customers, which in turn would reduce our revenues, harm our relationships with our customers, and damage our relationships with our distributors and end customers and cause us to forego potential revenue opportunities.

If we are unable to effectively develop, manage and expand our distribution channels for our products, our operating results may suffer.

If we are unable to effectively penetrate additional business channels or develop alternate channels to ensure our products are reaching the appropriate customer base, our financial results may be adversely impacted. In addition, if we successfully penetrate or develop these channels, we cannot guarantee that customers will accept our products or that we will be able to deliver them in the timeline established by our customers.

We will rely on our lighting sales agents to develop and expand their customer base as well as anticipate demand from their customers. If they are not successful, our growth and profitability may be adversely impacted.

We will operate in an industry that is subject to significant fluctuation in supply and demand that affects our LED revenue and profitability.

The LED lighting industry is in the early stages of adoption and is characterized by constant and rapid technological change, rapid product obsolescence and price erosion, evolving standards, short product life-cycles, and fluctuations in product supply and demand. The industry has experienced significant fluctuations, often in connection with, or in anticipation of product cycles and declines in general economic conditions. These fluctuations have been characterized by lower product demand, production overcapacity, higher inventory levels, and increased pricing pressure.

The adoption of or changes in government and/or industry policies, standards or regulations relating to the efficiency, performance or other aspects of LED lighting or changes in government and/or industry policies, standards or regulations that discourage the use of certain traditional lighting technologies, could impact the demand for our LED products.

The adoption of or changes in government and/or industry policies, standards or regulations relating to the efficiency, performance or other aspects of LED lighting may impact the demand for our LED products. Demand for our LED products may also be impacted by changes in government and/or industry policies, standards or regulations that discourage the use of certain traditional lighting technologies. For example, the Energy Independence and Security Act of 2007 in the United States imposed constraints on the sale of incandescent lights which began in 2012. These constraints may be eliminated or delayed by legislative action, which could have a negative impact on demand for our products.

Depressed general economic conditions, including the strength of the construction market, may adversely affect our operating results and financial condition.

Our business is sensitive to changes in general economic conditions, both inside and outside the United States. An economic downturn may adversely impact our business. Sales of our lighting products depend significantly upon the level of new building and renovation construction, which is affected by commercial and housing market trends, interest rates and the weather. In addition, due to the seasonality of construction and the sales of lighting products, our revenue and income have tended to be significantly lower in the first quarter of each year. We may experience substantial fluctuations in our operating results from period to period as a consequence of these factors. Slow growth in the economy or an economic downturn could adversely affect our ability to meet our working capital requirements and growth objectives, or could otherwise adversely affect our business, financial condition and results of operations. As a result, any general or market-specific economic downturns, particularly those affecting new building construction and renovation, or that cause end-users to reduce or delay their purchases of lighting products, services, or retrofit activities, would have a material adverse effect on our business, cash flows, financial condition and results of operations.

| 7 |

Our operating results may fluctuate due to factors that are difficult to forecast and not within our control.

Our past operating results may not be accurate indicators of future performance, and you should not rely on such results to predict our future performance. Our operating results have fluctuated significantly in the past, and could fluctuate in the future. Factors that may contribute to fluctuations include:

| · | changes in aggregate capital spending, cyclicality and other economic conditions, or domestic and international demand in the industries we serve; |

| · | our ability to effectively manage our working capital; |

| · | our ability to satisfy consumer demands in a timely and cost-effective manner; |

| · | pricing and availability of labor and materials; |

| · | our inability to adjust certain fixed costs and expenses for changes in demand; |

| · | seasonal fluctuations in demand and our revenue; and |

| · | disruption in component supply from foreign and or domestic vendors. |

If LED lighting technology fails to gain widespread market acceptance or we are unable to respond effectively as new lighting technologies and market trends emerge, our competitive position and our ability to generate revenue and profits may be harmed.

To be successful, we depend on continued market acceptance of existing LED technology. Although adoption of LED lighting continues to grow, the use of LED lighting products for general illumination is in its early stages, is still limited and faces significant challenges. Potential customers may be reluctant to adopt LED lighting products as an alternative to traditional lighting technology because of its higher initial cost or perceived risks relating to its novelty, reliability, usefulness, light quality, and cost-effectiveness when compared to other established lighting sources available in the market. Changes in economic and market conditions may also affect the marketability of some traditional lighting technologies such as declining energy prices in certain regions or countries may favor existing lighting technologies that are less energy efficient, reducing the rate of adoption for LED lighting products in those areas. Even if LED lighting products continue to achieve performance improvements and cost reductions, limited customer awareness of the benefits of LED lighting products, lack of widely accepted standards governing LED lighting products, and customer unwillingness to adopt LED lighting products in favor of entrenched solutions could significantly limit the demand for LED lighting products and adversely impact our results of operations. In addition, we will need to keep pace with rapid changes in LED technology, changing customer requirements, new product introductions by competitors, and evolving industry standards, any of which could render our existing products obsolete if we fail to respond in a timely manner. Development of new products incorporating advanced technology is a complex process subject to numerous uncertainties. We have previously experienced, and could in the future experience, delays in the introduction of new products. If effective new sources of light other than LEDs are discovered, our current products and technologies could become less competitive or obsolete. If others develop innovative proprietary lighting technology that is superior to ours, or if we fail to accurately anticipate technology and market trends, respond on a timely basis with our own development of new products and enhancements to existing products, and achieve broad market acceptance of these products and enhancements, our competitive position may be harmed and we may not achieve sufficient growth in our net sales to attain or sustain profitability.

If we are unable to manage any future growth effectively, our profitability and liquidity could be adversely affected.

Our ability to achieve our desired growth depends on our execution in functional areas such as management, sales and marketing, and general administration and operations. To manage any future growth, we must continue to improve our distribution, operational and financial processes and systems and expand, train and manage our employee base. If we are unable to manage our growth effectively, our business and results of operations could be adversely affected.

| 8 |

If we are not able to compete effectively against companies with greater resources, our prospects for future success will be jeopardized.

The lighting industry is highly competitive. In the high performance lighting markets in which we sell our advanced lighting systems, our products compete with lighting products utilizing traditional lighting technology provided by many vendors. Additionally, in the advanced lighting markets in which we have primarily competed to date, competition has largely been fragmented among a number of small manufacturers. However, some of our competitors, particularly those that offer traditional lighting products, are larger, established companies with greater resources to devote to research and development, manufacturing and marketing, as well as greater brand recognition.

Moreover, we expect to encounter competition from an even greater number of companies in the general lighting market. Our competitors are expected to include the large, established companies in the general lighting industry, such as GE, Inc., Osram Sylvania, CREE, Inc. and Royal Philips Electronics. Each of these competitors has undertaken initiatives to develop LED technology. These companies have global marketing capabilities and substantially greater resources to devote to research and development and other aspects of the development, manufacture and marketing of LED lighting products than we possess. The relatively low barriers to entry into the lighting industry and the limited proprietary nature of many lighting products also permit new competitors to enter the industry easily.

In each of our markets, we also anticipate the possibility that LED manufacturers, including those that currently supply us with LEDs, may seek to compete with us. Our competitors’ lighting technologies and products may be more readily accepted by customers than our products. Moreover, if one or more of our competitors or suppliers were to merge with one another, the change in competitive landscape could adversely affect our competitive position. Additionally, to the extent that competition in our markets intensifies, we may be required to reduce our prices in order to remain competitive. If we do not compete effectively, or if we reduce our prices without making commensurate reductions in our costs, our net sales and profitability and our future prospects for success may be harmed.

We depend on independent sales representatives for a substantial portion of our net sales, and the failure to manage our relationships with these third parties, or the termination of these relationships, could cause our net sales to decline and harm our business.

We rely significantly on indirect sales channels to market and sell our products. Most of our products are sold through third-party independent sales representatives. In addition, these parties provide technical sales support to end-users. Our current agreements within these sales channels are generally non-exclusive, meaning they can sell products of our competitors. We anticipate that any such agreements we enter into in the future will be on similar terms. Furthermore, our agreements are generally short-term, and can be cancelled by these sales channels without significant financial consequence. We cannot control how these sales representatives perform and cannot be certain that we or end-users will be satisfied by their performance. If these sales representatives significantly change their focus away from us, or change their historical pattern of selling products from us, there could be a significant impact on our net sales and profits.

Our products could contain defects or they may be installed or operated incorrectly, which could reduce sales of those products or result in claims against us.

Despite product testing, defects may be found in our existing or future products. This could result in, among other things, a delay in the recognition or loss of net sales, loss of market share, or failure to achieve market acceptance. These defects could cause us to incur significant warranty, support and repair costs, divert the attention of our engineering personnel from our product development efforts, and harm our relationship with our customers. The occurrence of these problems could result in the delay or loss of market acceptance of our lighting products and would likely harm our business. Some of our products use line voltages (such as 120 or 277 AC), which involve enhanced risk of electrical shock, injury or death in the event of a short circuit or other malfunction. Defects, integration issues or other performance problems in our lighting products could result in personal injury or financial or other damages to end-users or could damage market acceptance of our products. Our customers and end-users could also seek damages from us for their losses. A product liability claim brought against us, even if unsuccessful, would likely be time consuming and costly to defend.

The cost of compliance with environmental, health and safety laws and regulations could adversely affect our results of operations or financial condition.

We are subject to a broad range of environmental, health, and safety laws and regulations. These laws and regulations impose increasingly stringent environmental, health, and safety protection standards and permitting requirements regarding, among other things, air emissions, wastewater storage, treatment, and discharges, the use and handling of hazardous or toxic materials, waste disposal practices, the remediation of environmental contamination, and working conditions for our employees. Some environmental laws, such as Superfund, the Clean Water Act, and comparable laws in U.S. states and other jurisdictions world-wide, impose joint and several liability for the cost of environmental remediation, natural resource damages, third party claims, and other expenses, without regard to the fault or the legality of the original conduct, on those persons who contributed to the release of a hazardous substance into the environment. We may also be affected by future laws or regulations, including those imposed in response to energy, climate change, geopolitical, or similar concerns. These laws may impact the sourcing of raw materials and the manufacture and distribution of our products and place restrictions and other requirements on the products that we can sell in certain geographical locations.

| 9 |

We believe that certification and compliance issues are critical to adoption of our lighting systems, and failure to obtain such certification or compliance would harm our business.

We are required to comply with certain legal requirements governing the materials in our products. Although we are not aware of any efforts to amend any existing legal requirements or implement new legal requirements in a manner with which we cannot comply, our net sales might be adversely affected if such an amendment or implementation were to occur.

Moreover, although not legally required to do so, we strive to obtain certification for substantially all our products. In the United States, we seek certification on substantially all of our products from Underwriters Laboratories (UL®) or Intertek Testing Services (ETL®). Although we believe that our broad knowledge and experience with electrical codes and safety standards have facilitated certification approvals, we cannot ensure that we will be able to obtain any such certifications for our new products or that, if certification standards are amended, that we will be able to maintain such certifications for our existing products. Moreover, although we are not aware of any effort to amend any existing certification standard or implement a new certification standard in a manner that would render us unable to maintain certification for our existing products or obtain ratification for new products, our net sales might be adversely affected if such an amendment or implementation were to occur.

Failure to effectively estimate employer-sponsored health insurance premiums and incremental costs due to the Affordable Healthcare Act could materially and adversely affect our results of operations, financial position, and cash flows.

In March 2010, the United States federal government enacted comprehensive health care reform legislation, which, among other things, includes guaranteed coverage requirements, eliminates pre-existing condition exclusions and annual and lifetime maximum limits, restricts the extent to which policies can be rescinded, and imposes new taxes on health insurers, self-insured companies, and health care benefits. The legislation imposes implementation effective dates that began in 2010 and extend through 2020 with many of the changes requiring additional guidance from federal agencies and regulations. Possible adverse effects could include increased costs, exposure to expanded liability, and requirements for us to revise the ways in which healthcare and other benefits are provided to employees. We continue to monitor the potential impacts the health care reform legislation will have on our financial results.

We may be subject to legal claims against us or claims by us which could have a significant impact on our resulting financial performance.

At any given time, we may be subject to litigation, the disposition of which may have an adverse effect upon our business, financial condition, or results of operation. Such claims include but are not limited to and may arise from product liability and related claims in the event that any of the products that we sell is faulty or contains defects in materials or design. We may be subject to patent infringement claims from our products. In addition, we may be subject to claims by our lenders, claims for rent, and claims from our vendors on our accounts payable; and although we have been able to obtain understandings with the foregoing and have informal forbearance agreements from those parties, one or more of them may elect to commence collection proceedings which could result in judgments against us and have a significant negative impact on our operations.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act, and other applicable securities rules and regulations. Compliance with these rules and regulations increases our legal and financial compliance costs, make some activities more difficult, time-consuming or costly, and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company,” as defined in the Jumpstart our Business Startups Act, or the JOBS Act. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and operating results. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet this standard, significant resources and management oversight may be required. As a result, management’s attention may be diverted from other business concerns which could adversely affect our business and operating results. We may need to hire more employees in the future or engage outside consultants who will increase our costs and expenses.

| 10 |

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate legal proceedings against us and our business may be adversely affected.

However, for as long as we remain an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

We would cease to be an “emerging growth company” upon the earliest of: (i) the first fiscal year following the fifth anniversary of our becoming a reporting company, (ii) the first fiscal year after our annual gross revenues are $1.0 billion or more, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities, or (iv) as of the end of any fiscal year in which the market value of our Common Stock held by non-affiliates exceeded $75 million as of the end of the second quarter of that fiscal year.

We also expect that being a public company and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

As a result of disclosure of information in this Prospectus and in future filings required of a public company, our business and financial condition will become more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be adversely affected, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business and operating results.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

| 11 |

Our management and principal shareholders have the ability to significantly influence or control matters requiring a shareholder vote and other shareholders may not have the ability to influence corporate transactions.

Currently, our principal shareholders own in excess of a majority of our outstanding Common Stock. As a result, they have the ability to determine the outcome on all matters requiring approval of our shareholders, including the election of directors and approval of significant corporate transactions.

Risks Relating to our Common Stock

There is no trading market for our securities and there can be no assurance that such a market will develop in the future.

We intend to cause an application to be filed on our behalf to trade our Common Stock on the OTCQB in the near future. There is no assurance that our application will be approved, or once approved that a market will develop in the future or, if developed, that it will continue. In the absence of a public trading market, an investor may be unable to liquidate his investment in our Company.

There are no automated systems for negotiating trades on the OTCQB and it is possible for the price of a stock to go up or down significantly during a lapse of time between placing a market order and its execution, which may affect your trades in our securities.

Because there are no automated systems for negotiating trades on the OTCQB, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders, an order to buy or sell a specific number of shares at the current market price, it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and its execution.

If our application to trade our Common Stock is approved, our stock will be considered a “penny stock” so long as it trades below $5.00 per share. This can adversely affect its liquidity.

If our application to trade our Common Stock on the OTCQB is approved, of which there can be no assurance, it is anticipated that our Common Stock will be considered a “penny stock” and will continue to be considered a penny stock so long as it trades below $5.00 per share and as such, trading in our Common Stock will be subject to the requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker/dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction.

SEC regulations also require additional disclosure in connection with any trades involving a “penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from recommending transactions in our securities, which could severely limit the liquidity of our securities and consequently adversely affect the market price for our securities. In addition, few broker or dealers are likely to undertake these compliance activities. Other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

| 12 |

Any adverse effect on the market price of our Common Stock could make it difficult for us to raise additional capital through sales of equity securities at a time and at a price that we deem appropriate.

Sales of substantial amounts of our Common Stock, or in anticipation that such sales could occur, may materially and adversely affect prevailing market prices for our Common Stock, if and when such market develops in the future.

The market price of our Common Stock may fluctuate significantly in the future.

If our application to trade our Common Stock on the OTCQB is approved, we expect that the market price of our Common Stock may fluctuate in response to one or more of the following factors, many of which are beyond our control:

| · | competitive pricing pressures; | |

| · | our ability to market our services on a cost-effective and timely basis; | |

| · | our inability to obtain working capital financing, if needed; | |

| · | changing conditions in the market; | |

| · | changes in market valuations of similar companies; | |

| · | stock market price and volume fluctuations generally; | |

| · | regulatory developments; | |

| · | fluctuations in our quarterly or annual operating results; | |

| · | additions or departures of key personnel; and | |

| · | future sales of our Common Stock or other securities. |

The price at which you purchase shares of our Common Stock may not be indicative of the price that will prevail in the trading market. You may be unable to sell your shares of Common Stock at or above your purchase price, which may result in substantial losses to you and which may include the complete loss of your investment. In the past, securities class action litigation has often been brought against a company following periods of stock price volatility. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and our resources away from our business. Any of the risks described above could adversely affect our sales and profitability and also the price of our Common Stock.

Provisions of our Articles of Incorporation and Bylaws may delay or prevent a take-over that may not be in the best interests of our stockholders.

Provisions of our Articles of Incorporation and Bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called, and may delay, defer or prevent a takeover attempt.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members.

As a public company, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, the Sarbanes-Oxley Act, the Dodd-Frank Act, and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company,” as defined in the Jumpstart our Business Startups Act, or the JOBS Act. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and operating results. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet this standard, significant resources and management oversight may be required. As a result, management’s attention may be diverted from other business concerns, which could adversely affect our business and operating results. We may need to hire more employees in the future or engage outside consultants, which will increase our costs and expenses.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate legal proceedings against us and our business may be adversely affected.

| 13 |

However, for as long as we remain an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

We would cease to be an “emerging growth company” upon the earliest of: (i) the first fiscal year following the fifth anniversary of this offering, (ii) the first fiscal year after our annual gross revenues are $1.0 billion or more, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities, or (iv) as of the end of any fiscal year in which the market value of our Common Stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

We also expect that being a public company and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage once we put such coverages in place, which we intend to implement in the near future. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

As a result of disclosure of information in this Prospectus and in filings required of a public company, our business and financial condition will become more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be adversely affected, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business and operating results.

The market price for our Common Stock will be particularly volatile given our status as a relatively unknown company, with a limited operating history and lack of profits which could lead to wide fluctuations in our share price. You may be unable to sell your Common Stock at or above your purchase price, which may result in substantial losses to you.

While there is no market for our Common Stock, our price volatility in the future will be particularly volatile when compared to the shares of larger, more established companies that trade on a national securities exchange and have large public floats. The volatility in our share price will be attributable to a number of factors. First, our Common Stock will be, compared to the shares of such larger, more established companies, sporadically and thinly traded. As a consequence of this limited liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the price of those shares in either direction. The price for our shares could decline precipitously in the event that a large number of our Common Stock are sold on the market without commensurate demand. Secondly, we are a speculative or “risky” investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the stock of a larger, more established company that trades on a national securities exchange and has a large public float. Many of these factors are beyond our control and may decrease the market price of our Common Stock, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our Common Stock will be at any time.

Our future results may vary significantly which may adversely affect the price of our Common Stock.

It is possible that our quarterly revenues and operating results may vary significantly in the future and that period-to-period comparisons of our revenues and operating results are not necessarily meaningful indicators of the future. You should not rely on the results of one quarter as an indication of our future performance. It is also possible that in some future quarters, our revenues and operating results will fall below our expectations or the expectations of market analysts and investors. If we do not meet these expectations, the price of our Common Stock may decline significantly.

| 14 |

We are classified as an “emerging growth company” as well as a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our Common Stock less attractive to investors.

As a reporting company under the Exchange Act, we expect to be classified as an "emerging growth company," as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933 (the “Securities Act” or “33 Act”) for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Notwithstanding the above, we expect that we would be a “smaller reporting company.” In the event that we are still considered a “smaller reporting company,” at such time are we cease being an “emerging growth company,” the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects. Should we cease to be an “emerging growth company” but remain a “smaller reporting company”, we would be required to: (1) comply with new or revised US GAAP accounting standards applicable to public companies, (2) comply with new Public Company Accounting Oversight Board requirements applicable to the audits of public companies, and (3) to make additional disclosures with respect to related party transactions, namely Item 404(d).

Risks Relating To This Offering

There is no public market for the securities and even if a market is created, the market price of our Common Stock will be subject to volatility.