Attached files

| file | filename |

|---|---|

| EX-21.1 - FORM 10-K, EXHIBIT 21.1 - Associated Capital Group, Inc. | form10k2015ex211.htm |

| EX-32.1 - EXHIBIT 32.1 - Associated Capital Group, Inc. | form10kac2015ex321.htm |

| EX-32.2 - EXHIBIT 32.2 - Associated Capital Group, Inc. | form10kac2015ex322.htm |

| EX-31.2 - EXHIBIT 31.2 - Associated Capital Group, Inc. | form10kac2015ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Associated Capital Group, Inc. | form10kac2015ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission file number 001-37387

Associated Capital Group, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

47-3965991

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

One Corporate Center, Rye, NY

|

10580-1422

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code (203) 629-9595

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Class A Common Stock, par value $0.001 per share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes No .

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes No .

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yes No .

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

Accelerated filer

|

|

Non-accelerated filer (Do not check if a smaller reporting company)

|

Smaller reporting company

|

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2) Yes No .

The aggregate market value of the class A common stock held by non-affiliates of the registrant as of June 30, 2015 was $0 as the registrant is a newly public company. The registrant had annual revenues of less than $50 million upon becoming a public company.

As of March 1, 2016, 6,211,564 shares of class A common stock and 19,196,792 shares of class B common stock were outstanding. 18,423,741 shares of class B common stock were held by a subsidiary of GGCP, Inc.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the registrant's definitive proxy statement relating to the 2016 Annual Meeting of Shareholders are incorporated by reference in Items 10, 11, 12, 13 and 14 of Part III of this report.

2

|

GAMCO Investors, Inc.

|

||||

|

Annual Report on Form 10-K For the Fiscal Year Ended December 31, 2015

|

||||

|

Part I

|

||||

|

Item 1

|

Business

|

4

|

||

|

Business Strategy

|

7

|

|||

|

Competition

|

8

|

|||

|

Intellectual Property

|

8

|

|||

|

Regulation

|

9

|

|||

|

Employees

|

12

|

|||

|

Item 1A

|

Risk Factors

|

13

|

||

|

Item 1B

|

Unresolved Staff Comments

|

26

|

||

|

Item 2

|

Properties

|

26

|

||

|

Item 3

|

Legal Proceedings

|

26

|

||

|

Item 4

|

Mine Safety Disclosures

|

26

|

||

|

Part II

|

||||

|

Item 5

|

Market For The Registrant's Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities

|

27

|

||

|

Item 6

|

Selected Financial Data

|

28

|

||

|

Item 7

|

Management's Discussion And Analysis Of Financial Condition And Results Of Operations

|

28

|

||

|

Item 7A

|

Quantitative And Qualitative Disclosures About Market Risk

|

39

|

||

|

Item 8

|

Financial Statements And Supplementary Data

|

40

|

||

|

Item 9

|

Changes In And Disagreements With Accountants On Accounting And Financial Disclosure

|

78

|

||

|

Item 9A

|

Controls And Procedures

|

78

|

||

|

Item 9B

|

Other Information

|

78

|

||

|

Part III

|

||||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

79

|

||

|

Item 11

|

Executive Compensation

|

79

|

||

|

Item 12

|

Security Ownership Of Certain Beneficial Owners And Management And Related

|

|||

|

Stockholder Matters

|

79

|

|||

|

Item 13

|

Certain Relationships And Related Transactions, and Director Independence

|

79

|

||

|

Item 14

|

Principal Accountant Fees And Services

|

79

|

||

|

Part IV

|

||||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

80

|

||

|

Signatures

|

82

|

|||

|

Power of Attorney

|

83

|

|||

|

Subsidiaries of Associated Capital Group, Inc.

|

|

|||

|

Certifications

|

Exhibit 31.1

|

|||

|

Exhibit 31.2

|

||||

|

Exhibit 32.1

|

||||

|

Exhibit 32.2

|

||||

3

PART I

Forward-Looking Statements

Our disclosure and analysis in this report and in documents that are incorporated by reference contain some forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. You should not place undue reliance on these statements. They use words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," and other words and terms of similar meaning. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, expenses, the outcome of any legal proceedings, and financial results.

Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, there can be no assurance that our actual results will not differ materially from what we expect or believe. Some of the factors that could cause our actual results to differ from our expectations or beliefs include, without limitation: the adverse effect from a decline in the securities markets; a decline in the performance of our products; a general downturn in the economy; changes in government policy or regulation; changes in our ability to attract or retain key employees; and unforeseen costs and other effects related to legal proceedings or investigations of governmental and self-regulatory organizations. We also direct your attention to any more specific discussions of risk contained in Item 1A below and in our other public filings or in documents incorporated by reference here or in prior filings or reports.

We are providing these statements as permitted by the Private Litigation Reform Act of 1995. We do not undertake to update publicly any forward-looking statements if we subsequently learn that we are unlikely to achieve our expectations or if we receive any additional information relating to the subject matters of our forward-looking statements.

Unless we have indicated otherwise, or the context otherwise requires, references in this report to "Associated Capital Group, Inc.," "AC Group," "the Company," "AC," "we," "us" and "our" or similar terms are to Associated Capital Group, Inc., its predecessors and its subsidiaries.

Our principal executive offices are located at One Corporate Center, Rye, New York 10580. We post or provide a link on our website, www.associated-capital-group.com, to the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission ("Commission" or "SEC"): our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. All such filings on our website are available free of charge.

The Spin-off and Related Transactions

We are a newly formed Delaware corporation organized to be the parent operating company for the Spin-off of GAMCO Investors, Inc.'s ("GAMCO's") alternative investment management business, institutional research services operations and certain cash and other assets.

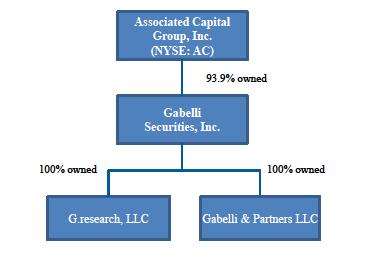

On November 30, 2015, GAMCO distributed all the outstanding shares of each class of common stock of AC Group on a pro rata one-for-one basis to the holders of each class of GAMCO's common stock. Prior to the distribution, GAMCO contributed the 93.9% interest it held in Gabelli Securities, Inc. ("GSI") and certain cash and other assets to AC Group. GSI is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended.

GSI and its wholly owned subsidiary, Gabelli & Partners, LLC ("Gabelli & Partners"), collectively serve as general partners, co-general partners or investment managers to investment funds including limited partnerships and offshore companies (collectively, "Investment Partnerships"), and separate accounts. We primarily manage assets in equity event-driven value strategies, across a range of risk and event arbitrage portfolios. The business earns fees from its advisory assets, and income (loss) from trading and investment portfolio activities. The advisory fees include management and incentive fees. Management fees are largely based on a percentage of the portfolios' levels of assets under management. Incentive fees are based on the percentage of profits derived from the investment performance delivered to clients' invested assets.

We operate our institutional research services operations through G.research, LLC ("G.research"), a wholly owned subsidiary of GSI. G.research is a broker-dealer registered under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Through G.research, we provide institutional research services as well as act as an underwriter. G.research is regulated by the Financial Industry Regulatory Authority ("FINRA"). G.research's revenues are derived primarily from institutional research services.

4

In addition, the following transactions were also undertaken in connection with the Spin-off:

GAMCO issued a promissory note (the "GAMCO Note") to AC Group in the original principal amount of $250.0 million used to partially capitalize the Company in connection with the Spin-off. The GAMCO Note bears interest at 4.0% per annum and has a maturity date of November 30, 2020 with respect to the original principal amount of the GAMCO Note. Interest on the GAMCO Note will accrue from the most recent date for which interest has been paid, or if no interest has been paid, from the effective date of the GAMCO Note; provided, however, that at the election of GAMCO, payment of interest on the GAMCO Note may, in lieu of being paid in cash, be paid, in whole or in part, in kind on the then-outstanding principal amount (a "PIK Amount"). GAMCO will repay the original principal amount of the GAMCO Note to AC Group, in cash, in five equal annual installments of $50 million on each interest payment date up to and including the maturity date and will repay all PIK Amounts added to the outstanding principal amount of the GAMCO Note, in cash, on the fifth anniversary of the date on which each such PIK Amount was added to the outstanding principal amount of the GAMCO Note. In no event may any interest be paid in kind subsequent to November 30, 2019. GAMCO may prepay the GAMCO Note prior to maturity without penalty.

In addition, AC Group, through its majority-owned GSI subsidiary, owns 4,393,055 shares of GAMCO Class A common stock. The sale was made from GAMCO to GSI in advance of the Spin-off. GSI paid the purchase price by issuing a note to GAMCO in the principal amount of $150 million (the "GSI Note"). In connection with the Spin-off, AC Group received the GSI Note from GAMCO and GSI became a majority-owned subsidiary of AC Group. The GSI Note is thus now an intercompany note within the AC Group.

Alternative Investment Management

We primarily manage assets in equity event-driven value strategies, across a range of risk and event arbitrage portfolios. The business earns fees from its advisory assets, and income (loss) from trading and investment portfolio activities. The advisory fees include management and incentive fees. Management fees are largely based on a percentage of the portfolios' levels of assets under management ("AUM"). Incentive fees are based on the percentage of profits derived from the investment performance. As of December 31, 2015, we managed a total of $1.08 billion in assets.

In our event-driven value funds we seek investments trading at prices that differ from those determined using our proprietary "Private Market Value (PMV) with a Catalyst" methodology where we have identified a near-term catalyst to narrow the market difference to PMV. Catalysts can include a spin-off, stock buyback, asset sale, management change, regulatory change or accounting change.

Event merger arbitrage is a subset of event-driven value investing where the catalyst, for example, an acquisition of the company, has been announced. In event merger arbitrage, the goal is to capture the difference between the market value of a security and what the acquirer is paying in the acquisition. Returns in merger arbitrage are primarily driven by the successful completion of the announced transactions in the portfolio. Other factors that can affect returns include short-term interest rates and the availability of investable deals. While merger arbitrage returns have historically been non-market correlated and deal-specific, event-driven value returns are more correlated to broader equity markets.

We generally manage assets on a discretionary basis and invest in a variety of U.S. and foreign securities utilizing a bottom up value investment style. Our managed funds primarily employ absolute return strategies such that we strive to generate positive returns regardless of market cycles or performance.

We introduced our first alternative fund, a merger arbitrage partnership, Gabelli Arbitrage (renamed Gabelli Associates), in February 1985. We then launched the Gabelli Rosenthal partnership in July 1985 to focus on leveraged buyout opportunities. An offshore version of the event merger arbitrage strategy was added in 1989. Building on our strengths in global event-driven value investing, several new Investment Partnerships have been added to balance investors' geographic, strategy and sector needs. Today, we offer Investment Partnerships in multiple categories, including event merger arbitrage, event-driven value and others across a broad range of absolute return products. Within our event merger arbitrage strategy, as of December 31, 2015, we managed approximately $869 million of assets for investors who seek positive returns not correlated to fluctuations of the general market. These funds seek to drive returns by investing mostly in announced merger and acquisition transactions that are primarily dependent on deal closure and less on the overall market environment. In event-driven value, as of December 31, 2015, we managed approximately $145 million of assets focused on the U.S. and non-U.S. Markets. We also manage $66 million of assets in a variety of other series of Investment Partnerships designed to offer investors a mechanism to diversify their portfolios by global economic and sectoral opportunities. These include sector, high yield, capital structure and venture capital or merchant banking portfolios. Since our inception, we have been closely identified with, and have enhanced, the "value" style of investing consistent with our fundamental objective of providing an absolute return for our clients. Our investment objective is to earn a superior risk-adjusted return over the long-term through our proprietary fundamental research. We serve a wide variety of investors including private wealth management accounts, corporations, corporate pension and profit-sharing plans, foundations and endowments, as well as serving as sub-advisor to certain third-party investment funds.

5

The following table sets forth AC's total AUM for the dates shown.

|

Assets Under Management (a)

|

||||||||||||||||||||

|

(in millions)

|

||||||||||||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

|

||||||||||||||||

|

Event-Driven Arb

|

$ |

|

869

|

$ |

|

796

|

$ |

|

691

|

$ |

|

721

|

$ |

|

513

|

|||||

|

Event-Driven Value (b)

|

145

|

167

|

140

|

124

|

132

|

|||||||||||||||

|

Other (c)

|

66

|

77

|

76

|

75

|

65

|

|||||||||||||||

|

Total AUM

|

$ |

|

1,080

|

$ |

|

1,040

|

$ |

|

907

|

$ |

|

920

|

$ |

|

710

|

|||||

| (a) | Asset levels include managed accounts, partnerships and offshore companies. |

| (b) | Excluding event merger arbitrage. |

| (c) | Includes investment vehicles focused on private equity, merchant banking, non-investment-grade credit and capital structure arbitrage. |

Through G.research, we provide institutional research services and act as an underwriter. G.research is regulated by FINRA. G.research's revenues are derived primarily from institutional research services, underwriting fees and selling concessions. As noted below, a significant portion of our institutional research services and underwriting revenues are from GAMCO and its affiliates. While the Spin-off is not expected to have any impact on our provision of these services to GAMCO and its affiliates, we can provide no assurance that GAMCO and its affiliates will continue use our institutional research and underwriting services to the same extent after the Spin-off. G.research provides institutional investors with investment ideas in numerous industries and special situations. Our research analysts are industry-focused, following sectors based on our core competencies. They research companies of all market capitalizations on a global basis, with a particular emphasis on small-cap and mid-cap companies. The primary function of the research team is to gather data, array the data, and then project and interpret data from which investment decisions can be made. Analysts publish their insights in the form of research reports and daily notes. In addition, G.research hosts selected conferences each year which bring together industry leaders and institutional investors. The objective of institutional research services is to provide superior investment ideas to investment decision makers.

Analysts are generally assigned to research platforms, coordinated by a senior analyst, in order to ensure a consistent process, enhance idea cross-fertilization and knowledge-sharing. Our research platforms include Digital, which includes cable, telecommunications, broadcasting, publishing, advertising, entertainment and technology; utilities and renewable energy; Consumer, Health and Wellness, Autos, Aerospace and Capital Goods; Natural Resources; and Financial Services.

G.research generates institutional research services revenues via hard dollar payments or through securities transactions executed on an agency basis on behalf of clients. Clients include institutional investors, such as hedge funds and asset managers, as well as affiliated mutual funds and client accounts. Institutional research services revenues totaled $8.4 million and $9.2 million for the years ended December 31, 2015 and 2014, respectively. G.research earned $4.9 million and $4.7 million, or approximately 59% and 54%, of its commission revenue from transactions executed on behalf of funds advised by Gabelli Funds, LLC, and clients advised by GAMCO Asset Management Inc. for the years ended December 31, 2015 and 2014, respectively. Additionally, for the years ended December 31, 2015 and 2014, Gabelli Funds, LLC and GAMCO Asset Management Inc. paid $0.8 million and $0.7 million, respectively, to G.research pursuant to research services agreements. Gabelli Funds, LLC and GAMCO Asset Management Inc. are both wholly owned subsidiaries of GAMCO. G.research continues to pursue expansion of third party and affiliated activities.

6

Certain employees of the Company or its affiliates own 1.9% of GSI, and the remaining 4.2% of GSI is owned by investors unrelated to the Company. Stockholders of GSI who are employees of the Company or its affiliates must sell their GSI shares to GSI at the book value per share of the previous fiscal year end when they leave the firm. The book value per share of GSI was $88.64 and $102.18 at December 31, 2015 and 2014, respectively.

Proprietary Trading

We received a substantial portfolio of cash and investments held by GAMCO prior to the Spin-off. We expect to use this proprietary investment portfolio to provide seed capital in introducing new products, expand our geographic presence, develop new markets and pursue strategic acquisitions, alliances and lift-outs, as well as for shareholder compensation in the form of share repurchases and dividends. Our proprietary portfolios are largely invested in products we manage or that are managed by GAMCO.

Our business strategy targets global growth of the business through continued leveraging of our proven asset management strengths including the long-term performance record of our alternative investment funds, diverse product offerings and experienced investment, research and client relationship professionals. In order to achieve performance and growth in AUM and profitability, we are pursuing a strategy which includes the following key elements:

Continuing an Active Fundamental Investment Approach

We have been managing hedge fund assets since 1985, when we launched our first merger arbitrage fund which still exists today, with an unparalleled thirty year track record. Our results through a multitude of market cycles clearly demonstrates our core competence in event driven investing. Our legacy of Gabelli "Private Market Value (PMV) with a Catalyst™" investing remains the principal management philosophy guiding our business operations. This method is based on investing principles articulated by Graham & Dodd, and has been further augmented by our founder Mario J. Gabelli. This approach, however, will not necessarily be utilized in connection with all products.

Growing our Investment Partnerships Advisory Business

We intend to grow our Investment Partnerships advisory business by gaining share in existing products and introducing new products within our core competencies, such as event and merger arbitrage. In addition, we intend to grow internationally.

Capitalizing on Acquisitions, Alliances and Lift-outs

We intend to leverage our research and investment capabilities to selectively and opportunistically pursue acquisitions, alliances and lift-outs that will broaden our product offerings and add new sources of distribution.

Pursuing Partnerships and Joint Ventures

We plan to pursue partnerships and joint ventures with partners that we believe have a strong fit with AC with respect to product quality and that might provide Asian/European distribution capabilities that would complement our U.S. equity product expertise. We expect to pursue investments in operating businesses based on our principal management philosophy, targeting opportunities with non-market correlated returns.

We intend to grow our Institutional Research Services business by increasing the breadth of our client base and by increasing our touch points and interactions with existing clientele in an effort to increase trading activity and payment flow.

Continuing Our Sponsorship of Industry Conferences

G.research, our institutional research services business, sponsors industry conferences and management events throughout the year. At these conferences and events, senior management from leading companies share their thoughts on the industry, competition, regulation and the challenges and opportunities in their businesses with portfolio managers and securities analysts. These meetings are an important component of the research services provided to institutional clients. In 2015, G.research hosted 7 such meetings:

7

|

●

|

39th Annual Automotive Aftermarket Symposium

|

|

●

|

25th Annual Pump, Valve & Water Systems Conference

|

|

●

|

21st Annual Aircraft Supplier Conference

|

|

●

|

7th Annual Movie & Entertainment Conference

|

|

●

|

6th Annual Specialty Chemicals Conference

|

|

●

|

3rd Television Broadcast Symposium

|

|

●

|

Inaugural Waste & Environmental Services Conference

|

We also have a tradition of sponsoring institutional investor symposiums that bring together prominent portfolio managers, members of academia and other leading business professionals to present, discuss and debate current issues and topics in the investment industry. These symposiums have included:

|

2015:

|

"Capital Allocation – The Tug of War"

|

|

2013:

|

"Value Investing 20 Years Later: A Celebration of the Roger Murray Lecture Series"

|

|

2006:

|

"Closed-End Funds: Premiums vs. Discounts, Dividends and Distributions"

|

|

2003:

|

"Dividends, Taxable versus Non-Taxable Issues"

|

|

2001:

1998:

|

"Virtues of Value Investing"

"The Role of Hedge Funds as a Way of Generating Absolute Returns"

|

|

1997:

|

"Active vs. Passive Stock Selection"

|

Attracting and Retaining Experienced Professionals

We offer significant variable compensation that provides opportunities to our staff. We expect to increase the scope of our investment management capabilities by adding portfolio managers and other investment personnel in order to expand our product offerings. Our ability to attract and retain highly experienced investment and other professionals with a long-term commitment to us and our clients has been, and will continue to be, a significant factor in our long-term growth.

Competition

The alternative asset management industry is intensively competitive and is expected to remain so. We face competition in all aspects of our business and in each of our investment strategies from other managers in the United States and globally. We compete with other alternative investment management firms, insurance companies, banks, brokerage firms and other financial institutions that offer products that have similar features and investment objectives. Many of these investment management firms are subsidiaries of large diversified financial companies and may have access to greater resources, including liquidity sources, not available to us. Many others are much larger in terms of AUM and revenues and, accordingly, have much larger sales organizations and marketing budgets. Historically, we have competed primarily on the basis of the long-term investment performance of many of our investment products. However, we have recently taken steps to increase our distribution channels, brand name awareness and marketing efforts.

The market for providing investment management services to institutional and private wealth management clients is also highly competitive. Selection of investment advisors by U.S. institutional investors is often subject to a screening process and to favorable recommendations by investment industry consultants. Many of these investors require their investment advisors to have a successful and sustained performance record, often five years or longer, with focus also on one-year and three-year performance records. We have significantly increased our AUM on behalf of U.S. institutional investors since our entry into the institutional asset management business. At the current time, we believe that our investment performance record would be attractive to potential new institutional and private wealth management clients. However, no assurance can be given that our efforts to obtain new business will be successful.

Intellectual Property

Service marks and brand name recognition are important to our business. We have rights to the service marks under which our products are offered. We have rights to use the "Gabelli" name, and the "GAMCO" name, pursuant to a Service Mark and Name License Agreement, a non-exclusive, royalty-free perpetual license agreement we have entered into with GAMCO (the "Service Mark and Name License Agreement"). GAMCO has licensed to us its rights to the "Gabelli" name and the "GAMCO" name for use with respect to our funds, collective investment vehicles, investment partnerships and other investment products pursuant to the Service Mark and Name License Agreement. The Service Mark and Name License Agreement has a perpetual term, subject to termination only in the event we are not in compliance with the quality control provisions in the Service Mark and Name License Agreement. Pursuant to an assignment agreement signed in 1999, Mario J. Gabelli had assigned to GAMCO all of his rights, title and interests in and to the "Gabelli" name for use in connection with investment management services and institutional research services. In addition, the funds managed by Mario J. Gabelli outside GAMCO and AC have entered into a license agreement with GAMCO permitting them to continue limited use of the "Gabelli" name under specified circumstances.

8

Regulation

Virtually all aspects of our businesses are subject to various federal, state and foreign laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and investors, the markets and customers of broker-dealers. Under such laws and regulations, agencies that regulate investment advisors and broker-dealers have broad powers, including the power to limit, restrict or prohibit such an advisor or broker-dealer from carrying on its business in the event that it fails to comply with such laws and regulations. In such an event, the possible sanctions that may be imposed include civil and criminal liability, the suspension of individual employees, injunctions, limitations on engaging in certain lines of business for specified periods of time, revocation of the investment advisor and other registrations, censures and fines.

Global Regulatory Reform

We are subject to numerous regulatory reform initiatives in each country in which we do business. Any such initiative, or any new laws or regulations or changes in enforcement of existing laws or regulations, could materially and adversely impact the scope or profitability of AC's business activities, lead to business disruptions, require AC to change certain business practices and expose AC to additional costs (including compliance and legal costs), as well as reputational harm. AC's profitability also could be materially and adversely affected by modification of the rules and regulations that impact the business and financial communities in general, including changes to the laws governing taxation, antitrust regulation and electronic commerce.

Dodd-Frank Wall Street Reform and Consumer Protection Act. In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "DFA") was signed into law in the United States. The DFA is expansive in scope and requires the adoption of extensive regulations and numerous regulatory decisions, many of which have been adopted. As the impact of these rules will become evident over time, it is not yet possible to predict the ultimate effects that the DFA, or subsequent implementing regulations and decisions, will have upon AC's business, financial condition and results of operations.

Securities and Exchange Commission Review of Asset Managers. Our business may also be impacted by the SEC regulatory initiatives. For example, on December 11, 2014 the Chair of the SEC announced that she is recommending that the SEC enhance its oversight of asset managers by (i) expanding and updating data requirements with which asset managers must comply, (ii) improving fund level controls, including those related to liquidity levels and the nature of specific instruments and (iii) ensuring that asset management firms have appropriate transition plans in place to deal with market stress events or situations where an investment adviser is no longer able to serve its clients. Although these recommendations have not yet resulted in any proposed rules, any additional SEC oversight or the introduction of any new reporting, disclosure or control requirements could expose us to additional compliance costs and may require us to change how we operate our business.

Taxation. Our global business may be impacted by the Foreign Account Tax Compliance Act ("FATCA"), which was enacted in 2010 and introduced expansive new investor onboarding, withholding and reporting rules aimed at ensuring U.S. persons with financial assets outside of the United States pay appropriate taxes. In many instances, however, the precise nature of what needs to be implemented will be governed by bilateral Intergovernmental Agreements ("IGAs") between the United States and the countries in which we do business or have accounts. While many of these IGAs have been put into place, others have yet to be concluded. The FATCA rules will impact both U.S. and non-U.S. Funds and subject us to extensive additional administrative burdens. The Organization for Economic Co-operation and Development has also recently launched the business erosion and profit shifting ("BEPS") proposal that aims to rationalize tax treatment across jurisdictions. If the BEPS proposal becomes the subject of legislative action in the format proposed, it could have unintended taxation consequences for collective investment vehicles and our tax position, which could adversely affect our financial condition.

In addition, certain individual EU Member States, such as France and Italy, have enacted national financial transaction taxes ("FTTs"). There has also been renewed momentum by several other Member States to introduce FTTs, which would impose taxation on a broad range of financial instrument and derivatives transactions. In general, any tax on securities and derivatives transactions would impact investors and would likely have a negative impact on the liquidity of the securities and derivatives markets, could diminish the attractiveness of certain types of products that we manage in those countries and could cause clients to shift assets away from such products. An FTT could significantly increase the operational costs of our entering into, on behalf of our clients, securities and derivatives transactions that would be subjected to an FTT, which could adversely impact our financial results and clients' performance results.

9

Our business could also be impacted to the extent there are other changes to tax laws. For example, the administration recently announced its proposed U.S. federal budget, which called for new industry fees for financial firms. To the extent such fees are adopted and found to apply to us; such fees could adversely affect our financial results.

Alternative Investment Fund Managers Directive. Our European business is impacted by the EU Alternative Investment Fund Managers Directive ("AIFMD"), which became effective on July 21, 2011. The AIFMD regulates managers of, and service providers to, a broad range of alternative investment funds ("AIFs") domiciled within and (depending on the precise circumstances) outside the EU. The AIFMD also regulates the marketing of all AIFs inside the European Economic Area ("EEA"). The AIFMD is being implemented in stages, which run through 2018. Compliance with the AIFMD's requirements restrict alternative investment fund marketing and impose additional compliance and disclosure obligations regarding remuneration, capital requirements, leverage, valuation, stakes in EU companies, depositaries, the domicile of custodians and liquidity management on AC. These new compliance and disclosure obligations and the associated risk management and reporting requirements will subject us to additional expenses.

Undertakings for Collective Investment in Transferable Securities. The EU has also adopted directives on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities ("UCITS") as regards depositary functions, remuneration policies and sanctions. The latest initiative in this area, UCITS V, which became effective in September 2014, seeks to align the depositary regime, remuneration rules and sanctioning powers of regulators under the UCITS Directive with the requirements of the AIFMD. UCITS V is required to be adopted in the national law of each EU member state during the second quarter of 2016. Similarly, in August 2014 ESMA revised the guidelines it initially published in 2012 on exchange-traded funds and other UCITS funds. The guidelines introduced new collateral management requirements for UCITS funds concerning collateral received in the context of derivatives using Efficient Portfolio Management ("EPM") techniques (including securities lending) and over-the-counter derivative transactions. These rules, which are now in effect, required us to make a series of changes to its collateral management arrangements applicable to the EPM of its UCITS fund ranges. Compliance with the UCITS directives will cause us to incur additional expenses associated with new risk management and reporting requirements.

Existing U.S. Regulation Overview

AC and certain of its U.S. subsidiaries are currently subject to extensive regulation, primarily at the federal level, by the SEC, the Department of Labor, FINRA and other government agencies and regulatory bodies. Certain of our U.S. subsidiaries are also subject to various anti-terrorist financing, privacy, anti-money laundering regulations and economic sanctions laws and regulations established by various agencies.

The Investment Advisers Act of 1940

GSI is registered with the SEC under the Advisers Act and is regulated by and subject to examination by the SEC. The Advisers Act imposes numerous obligations on registered investment advisors including fiduciary duties, disclosure obligations and record keeping, operational and marketing requirements. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from censure to termination of an investment advisor's registration. The failure of GSI to comply with the requirements of the SEC could have a material adverse effect on us.

We derive a substantial majority of our revenues from investment advisory services through our various investment management agreements. Under the Advisers Act, our investment management agreements may not be assigned without the client's consent.

Broker-Dealer and Trading and Investment Regulation

G.research is registered as broker-dealer with the SEC and is subject to regulation by FINRA and various states. In its capacity as a broker-dealer, G.research is required to maintain certain minimum net capital amounts. These requirements also provide that equity capital may not be withdrawn, advances to affiliates may not be made or cash dividends paid if certain minimum net capital requirements are not met. G.research's net capital, as defined, met or exceeded all minimum requirements as of December 31, 2015. As a registered broker-dealer, G.research is also subject to periodic examination by FINRA, the SEC and the state regulatory authorities.

Our trading and investment activities for client accounts are regulated under the Exchange Act, as well as the rules of various U.S. and non-U.S. securities exchanges and self-regulatory organizations, including laws governing trading on inside information, market manipulation and a broad number of technical requirements (e.g., short sale limits, volume limitations and reporting obligations) and market regulation policies in the United States and globally. Violation of any of these laws and regulations could result in restrictions on our activities and damage our reputation.

10

Potential Legislation Relating to Private Pools of Capital

We manage a variety of private pools of capital, including hedge funds. Congress, regulators, tax authorities and others continue to explore, on their own and in response to demands from the investment community and the public, increased regulation related to private pools of capital, including changes with respect to investor eligibility, certain limitations on trading activities, record-keeping and reporting, the scope of anti- fraud protections, safekeeping of client assets and a variety of other matters. AC may be materially and adversely affected by new legislation, rule-making or changes in the interpretation or enforcement of existing rules and regulations imposed by various regulators.

Employee Retirement Income Security Act of 1974 ("ERISA")

Subsidiaries of AC are subject to ERISA and to regulations promulgated thereunder, insofar as they are "fiduciaries" under ERISA with respect to certain of their clients ERISA and applicable provisions of the Code, impose certain duties on persons who are fiduciaries under ERISA and prohibit certain transactions involving ERISA plan clients. Our failure to comply with these requirements could have a material adverse effect on us.

The Patriot Act

The USA Patriot Act of 2001 contains anti-money laundering and financial transparency laws and mandates the implementation of various new regulations applicable to broker-dealers and other financial services companies, including standards for verifying client identification at account opening, and obligations to monitor client transactions and report suspicious activities. Anti-money laundering laws outside of the United States contain some similar provisions. Our failure to comply with these requirements could have a material adverse effect on us.

Laws and Other Issues Relating to Taking Significant Equity Stakes in Companies

Investments by AC and on behalf of our advisory clients and Investment Partnerships often represent a significant equity ownership position in an issuer's class of stock. As of December 31, 2015, we had five percent or more beneficial ownership with respect to 116 equity securities (this is partially due to the fact that we may be deemed to be a member of "group" with GAMCO and therefore may be deemed to beneficially own the securities owned by that group). This activity raises frequent regulatory, legal and disclosure issues regarding our aggregate beneficial ownership level with respect to portfolio securities, including issues relating to issuers' stockholder rights plans or "poison pills," and various federal and state regulatory limitations, including state gaming laws and regulations, federal communications laws and regulations and federal and state public utility laws and regulations, as well as federal proxy rules governing stockholder communications and federal laws and regulations regarding the reporting of beneficial ownership positions. Our failure to comply with these requirements could have a material adverse effect on us.

Existing International Regulation Overview

Our international operations are subject to the laws and regulations of a number of international jurisdictions, as well as oversight by numerous regulatory agencies and bodies in those jurisdictions. In some instances, they are also affected by U.S. laws and regulations that have extra-territorial application.

Below is a summary of certain international regulatory standards to which AC is subject. It is not meant to be comprehensive as there are parallel legal and regulatory arrangements in force in many jurisdictions where AC's subsidiaries conduct business.

Of note among the various other international regulations to which AC is subject, are the extensive and increasingly stringent regulatory reporting requirements that necessitate the monitoring and reporting of issuer exposure levels (thresholds) across the holdings of managed funds and accounts and those of AC.

European Regulation

The Financial Conduct Authority ("FCA") currently regulates AC in the United Kingdom. It also regulates those U.K. subsidiaries' branches established in other European countries and the U.K. branches of certain of AC's U.S. subsidiaries. Authorization by the FCA is required to conduct certain financial services related business in the United Kingdom under the Financial Services and Markets Act 2000. The FCA's rules adopted under that Act govern the majority of a firm's capital resources requirements, senior management arrangements, and conduct of business, interaction with clients and systems and controls. The FCA supervises AC through a combination of proactive engagement, event-driven and reactive supervision and thematic based reviews in order to monitor our compliance with regulatory requirements. Breaches of the FCA's rules may result in a wide range of disciplinary actions against our U.K.-regulated subsidiaries and/or its employees.

11

In addition, our U.K.-regulated subsidiaries and other European subsidiaries and branches must comply with the pan-European regulatory regime established by the Markets in Financial Instruments Directive ("MiFID"), which became effective on November 1, 2007 and regulates the provision of investment services and activities throughout the wider EEA. MiFID, the scope of which is being enhanced through MiFID 2 which is described more particularly under "—Global Regulatory Reform" above, sets out detailed requirements governing the organization and conduct of business of investment firms and regulated markets. It also includes pre- and post-trade transparency requirements for equity markets and extensive transaction reporting requirements. In addition, relevant entities must comply with revised obligations on capital resources for banks and certain investment firms (the Capital Requirements Directive), which became effective in January 2014. These include requirements not only on capital, but address matters of governance and remuneration as well. The obligations introduced through these directives will have a direct effect on some of our European operations.

Our EU-regulated subsidiaries are additionally subject to an EU regulation on OTC derivatives, central counterparties and trade repositories, which was adopted in August 2012 and which requires (i) the central clearing of standardized OTC derivatives, (ii) the application of risk-mitigation techniques to non-centrally cleared OTC derivatives and (iii) the reporting of all derivative contracts from February 2014.

Regulatory Matters

The investment management industry is likely to continue facing a high level of regulatory scrutiny and become subject to additional rules designed to increase disclosure, tighten controls and reduce potential conflicts of interest. In addition, the Commission has substantially increased its use of focused inquiries which request information from investment advisors and a number of fund complexes regarding particular practices or provisions of the securities laws. We participate in some of these inquiries in the normal course of our business. Changes in laws, regulations and administrative practices by regulatory authorities, and the associated compliance costs, have increased our cost structure and could in the future have a material adverse impact. Although we have installed procedures and utilize the services of experienced administrators, accountants and lawyers to assist us in adhering to regulatory guidelines and satisfying these requirements, and maintain insurance to protect ourselves in the case of client losses, there can be no assurance that the precautions and procedures that we have instituted and installed, or the insurance that we maintain to protect ourselves in case of client losses, will protect us from all potential liabilities.

Employees

On February 29, 2016, we had a full-time staff of 72 teammates, of whom 45 served in the portfolio management, research and trading areas, 19 served in the marketing and shareholder servicing areas and 8 served in the administrative area. We also avail ourselves of services provided by GAMCO employees in accordance with the Transitional Services Agreement that were entered into with GAMCO as part of the Spin-off.

Status as an Emerging Growth Company and a Smaller Reporting Company

We are an "emerging growth company," as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies." These exemptions include not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We may take advantage of some or all of the reduced regulatory and reporting requirements that will be available to us as long as we qualify as an emerging growth company, except that we have irrevocably elected not to take advantage of the extension of time to comply with new or revised financial accounting standards available under Section 107(b) of the JOBS Act.

We will, in general, remain as an emerging growth company for up to five full fiscal years following the Spin-off. We would cease to be an emerging growth company and, therefore, become ineligible to rely on the above exemptions, if we:

|

●

|

have more than $1 billion in annual revenue in a fiscal year;

|

|

●

|

issue more than $1 billion of non-convertible debt during the preceding three-year period; or

|

12

|

●

|

become a "large accelerated filer" as defined in Exchange Act Rule 12b-2, which would occur after: (i) we have filed at least one annual report pursuant to the Exchange Act; (ii) we have been an SEC-reporting company for at least 12 months; and (iii) the market value of AC common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter.

|

In addition, we qualify as a "smaller reporting company" under the Exchange Act. As a smaller reporting company, we enjoy many of the same exemptions as emerging growth companies, in addition to scaled disclosures. We will likely cease to be a smaller reporting company beginning in the year after our public float at the end of the second quarter of our fiscal year (June 30) exceeds $75 million. We expect this to occur on June 30, 2016, and as such we would be required to transition out of the scaled disclosure system for "smaller reporting companies" by the time we filed our quarterly report on Form 10-Q covering the first fiscal quarter of the fiscal year 2017, which would be due in May 2017. However, we would still be able to avail ourselves of the "emerging growth company" exemptions.

We caution the reader that the following risks and those risks described elsewhere in this report and in our other SEC filings could have a material adverse effect on our business, prospects, financial condition, results of operations or cash flow or could cause a decline in the Company's stock price.

Risks Related to the Spin-off

We may not achieve the benefits expected from our Spin-off from GAMCO and may be more susceptible to adverse events.

We expect that, as a company independent from GAMCO, we will be able to grow organically and through acquisitions. Nonetheless, we may not be able to achieve either of these goals. Furthermore, by separating from GAMCO, there is a risk that we may be more susceptible to adverse events than we would have otherwise experienced as a subsidiary of GAMCO. As a subsidiary of GAMCO, we enjoyed certain benefits, including economies of scope and scale in costs, employees and business relationships. These benefits may not be as readily achievable as a smaller, stand-alone company.

Certain of our directors and officers may have actual or potential conflicts of interest because of their positions or relationships with GAMCO.

Mario J. Gabelli serves as our Chairman and Chief Executive Officer and also continues to serve as Chairman and Chief Executive Officer of GAMCO. Our President, Marc Gabelli, is a son of Mario J. Gabelli and also serves on the GAMCO Board. Marc Gabelli continues to have responsibilities relating to GAMCO, including continuing to serve on the GAMCO Board and participating on GAMCO's portfolio management team. Kevin Handwerker, Associated Capital's Executive Vice President, General Counsel and Secretary also serves in the same capacities for GAMCO. In addition, some of our portfolio managers and employees will initially be provided pursuant to the Transitional Services Agreement with GAMCO and will be officers or employees of GAMCO. Such dual assignments could create, or appear to create, potential conflicts of interest when our and GAMCO's officers and directors face decisions that could have different implications for the two companies.

Associated Capital has renounced its rights to certain business opportunities, and our certificate of incorporation will provide that no director or officer of Associated Capital will breach their fiduciary duty and therefore be liable to Associated Capital or its stockholders by reason of the fact that any such individual directs a corporate opportunity to another person or entity (including GAMCO) instead of Associated Capital, or does not refer or communicate information regarding such corporate opportunity to Associated Capital, unless (x) such opportunity was expressly offered to such person solely in his or her capacity as a director or officer of Associated Capital or as a director or officer of any of our subsidiaries, and (y) such opportunity relates to a line of business in which Associated Capital or any of its subsidiaries is then directly engaged; provided, however, if the conditions specified in the immediately preceding clauses (x) and (y) are satisfied, any officer or director of Associated Capital may pursue such corporate opportunity (or direct it to another person or entity) if either (i) Associated Capital renounces its interest in the potential business opportunity in writing or (ii) Associated Capital does not within a reasonable period of time, begin to pursue, or thereafter continue to pursue, such corporate opportunity diligently and in good faith. Our certificate of incorporation specifically provides that any person purchasing, receiving or otherwise becoming an owner of any shares of our capital stock, or any interest therein, will be deemed to have notice of and to have consented to the corporate opportunity policy contained in our certificate of incorporation.

Also, some of our directors, executive officers, portfolio managers and teammates own shares of GAMCO common stock and GAMCO restricted stock awards ("RSAs") or other GAMCO equity awards. At the time of the Spin-off, these equity awards were supplemented by the awarding of Associated Capital RSAs. Specifically, outstanding RSAs relating to GAMCO remain unchanged, with each RSA holder also receiving an equal number of RSAs relating to Associated Capital. The terms of the new Associated Capital RSAs are the same as the terms of the pre-Spin-off GAMCO RSAs. The purpose of the issuance was to ensure that any employee who had GAMCO RSAs was granted an equal number of AC RSAs so that the total value of the RSAs post-spin-off was equivalent to the total value pre-spin-off. The ownership of these RSAs may create, or may create the appearance of, conflicts of interest.

13

In addition, potential conflicts of interest could arise in connection with the resolution of any dispute that may arise between GAMCO and Associated Capital regarding the terms of the agreements governing the separation and the relationship thereafter between the companies. The executive officers and other personnel of GAMCO who serve as directors or executive management of Associated Capital may interpret these agreements in their capacity as GAMCO employees in a manner that would adversely affect the business of Associated Capital.

Also, certain subsidiaries of GAMCO and GSI are investment advisers. The executive officers and other personnel of GAMCO who also serve as directors or executive management of Associated Capital may be confronted with the possibility of making decisions in their GAMCO capacity that would adversely affect the business of Associated Capital.

Associated Capital and GAMCO expect to be vigilant in attempting to identify and resolve any potential conflicts of interest, including but not limited to the types described above, at the earliest possible time. However, there can be no guarantee that the interests of Associated Capital may not be adversely affected at some point by such a conflict.

The separation from GAMCO may adversely affect the level of our assets under management ("AUM").

Our revenues are dependent on the amount of our AUM as well as the performance of our products. Many investors may have invested assets in alternative investment products (the "Alternative Investments") in part because GSI was a subsidiary of GAMCO. There can be no assurance that we will be able to attract investors to the Alternative Investments at the same rate as in prior years. In addition, we can make no assurance that current investors will not redeem their investments from the Alternative Investments as a result of our changed relationship with GAMCO. The occurrence of either of these events could adversely affect our business, results of operations and financial condition.

Concerns about our prospects as a stand-alone company could affect our ability to attract and retain employees or individuals whom we are attempting to recruit as employees.

Our employees or individuals whom we are attempting to recruit as employees may have concerns about our prospects as a stand-alone company, including our ability to maintain our independence and our inability to continue our current reliance on GAMCO's resources. If we are not successful in assuring our employees or individuals whom we are attempting to recruit as employees of our prospects as an independent company, our employees or recruits may seek or accept other employment, which could adversely affect our business and our results of operations.

We may have been able to receive better terms from unaffiliated third parties than the terms provided in our agreements with GAMCO.

The agreements related to our separation from GAMCO, including, but not limited to, the Separation Agreement, the Transitional Services Agreement and the Service Mark and Name License Agreement, were negotiated in the context of our separation from GAMCO while Associated Capital was still majority-owned by GAMCO. Accordingly, they may not reflect terms that would have been reached between unaffiliated parties. The terms of the agreements we negotiated in the context of our separation related to, among other things, indemnities and other obligations between GAMCO and us. Had these agreements been negotiated with unaffiliated third parties, they might have been more favorable to us.

In connection with the Spin-off, GAMCO has indemnified us for certain liabilities. There can be no assurance that the indemnity will be sufficient to insure us against the full amount of such liabilities, or that GAMCO's ability to satisfy its indemnification obligations will not be impaired in the future.

Pursuant to the Separation Agreement, GAMCO will agree to indemnify us from certain liabilities. Third parties could seek to hold us responsible for any of the liabilities that GAMCO has agreed to retain, and there can be no assurance that the indemnity from GAMCO will be sufficient to protect us against the full amount of such liabilities or that GAMCO will be able to fully satisfy its indemnification obligations. Moreover, even if we ultimately succeed in recovering from GAMCO any amounts for which we are held liable, we may be temporarily required to bear those losses until such recovery. Each of these risks could adversely affect our business, results of operations and financial condition.

14

Risks Related to Our Industry

Changes in laws or regulations or in governmental policies and compliance with existing laws or regulations could limit the sources and amounts of our revenues, increase our costs of doing business, decrease our profitability and materially and adversely affect our business.

Our business is subject to extensive regulation in the United States, primarily at the federal level, including regulation by the SEC under the Advisers Act as well as other securities laws, by the Department of Labor under ERISA, and regulation by FINRA and state regulators. The Advisers Act imposes numerous obligations on investment advisors, including record-keeping, advertising and operating requirements, fiduciary and disclosure obligations, custodial requirements and prohibitions on fraudulent activities. In addition, our businesses are also subject to regulation by the FCA in the United Kingdom, and we are also subject to the laws of other non-U.S. jurisdictions and non-U.S. regulatory agencies or bodies.

Our failure to comply with applicable laws or regulations could result in fines, censure, suspensions of personnel or other sanctions, including revocation of our subsidiaries' registrations as an investment advisor or broker-dealer. Industry regulations are designed to protect our clients and investors in our funds and other third parties who deal with us and to ensure the integrity of the financial markets. Our industry is frequently altered by new laws or regulations and by revisions to, and evolving interpretations of, existing laws and regulations, both in the United States and in other nations. Changes in laws or regulations or in governmental policies could limit the sources and amounts of our revenues, increase our costs of doing business, decrease our profitability and materially and adversely affect our business.

We are subject to extensive and pervasive regulation around the world.

Our business is subject to extensive regulation around the world. These regulations subject our business activities to a pervasive array of increasingly detailed operational requirements, compliance with which is costly, time-consuming and complex. We may be adversely affected by our failure to comply with current laws and regulations or by changes in the interpretation or enforcement of existing laws and regulations. Challenges associated with interpreting regulations issued in numerous countries in a globally consistent manner may add to such risks if regulators in different jurisdictions have inconsistent views or provide only limited regulatory guidance. In particular, violation of applicable laws or regulations could result in fines, temporary or permanent prohibition of certain activities, reputational harm and related client terminations, suspensions of employees or revocation of their licenses, suspension or termination of investment adviser, broker-dealer or other registrations or other sanctions, which could have a material adverse effect on our reputation or business and may cause our AUM, revenue and earnings to decline.

New tax legislation or changes in U.S. and foreign tax laws and regulations or challenges to Associated Capital's historical taxation practices may adversely affect Associated Capital's effective tax rate, business and overall financial condition.

Our businesses may be affected by new tax legislation or regulations, or the modification of existing tax laws and regulations, by U.S. or non-U.S. authorities. In particular, the Foreign Account Tax Compliance Act ("FATCA") has introduced expansive new investor onboarding, withholding and reporting rules aimed at ensuring U.S. persons with financial assets outside of the United States pay appropriate taxes. The FATCA rules will impact both U.S. and non-U.S. funds and subject Associated Capital to extensive additional administrative burdens. Certain of our FATCA compliance are done by third parties, and we cannot be certain that they will always comply with applicable FATCA rules. Similarly, there has been renewed momentum by several European Union ("EU") Member States to introduce national FTTs, which would impose taxation on a broad range of financial instrument and derivatives transactions. If introduced as proposed, FTTs could have an adverse effect on Associated Capital's financial results and on clients' performance results. In addition, the Organization for Economic Co-operation and Development recently launched a BEPS proposal that aims to rationalize tax treatment across jurisdictions. If the BEPS proposal becomes the subject of legislative action in the format proposed, it could have unintended taxation consequences for collective investment vehicles and our tax position, which could adversely affect our financial condition.

We also manage significant assets in products and accounts that have specific tax and after-tax related objectives, which could be adversely impacted by changes in tax policy. Additionally, any new legislation, modification or interpretation of tax laws could impact Associated Capital's corporate tax position. The application of complex tax regulations involves numerous uncertainties and in the normal course of business, U.S. and non-U.S. tax authorities may review and challenge Associated Capital's historical tax positions. These challenges may result in adjustments to Associated Capital's tax position, or impact the timing or amount of, taxable income, deductions or other tax allocations, which may adversely affect Associated Capital's effective tax rate and overall financial condition.

15

To the extent we are forced to compete on the basis of price, we may not be able to maintain our current fee structure.

The investment management business is highly competitive and has relatively low barriers to entry. To the extent we are forced to compete on the basis of price, we may not be able to maintain our current fee structure. Although our investment management fees vary from product to product, historically we have competed primarily on the performance of our products and not on the level of our investment management fees relative to those of our competitors. In recent years, however, there has been a trend toward lower fees in the investment management industry. In order to maintain our fee structure in a competitive environment, we must be able to continue to provide clients with investment returns and service that make investors willing to pay our fees. We cannot be assured that we will succeed in providing investment returns and service that will allow us to maintain our current fee structure. Fee reductions on existing or new business could have an adverse effect on our profit margins and results of operations.

Catastrophic and unpredictable events could have a material adverse effect on our business.

A terrorist attack, political unrest, war (whether or not directly involving the United States), power failure, cyber-attack, technology failure, natural disaster or many other possible catastrophic or unpredictable events could adversely affect our future revenues, expenses and earnings by, among other things: causing disruptions in United States, regional or global economic conditions; interrupting our normal business operations; inflicting employee casualties, including loss of our key executives; requiring substantial expenditures and expenses to repair, replace and restore normal business operations; and reducing investor confidence.

Pursuant to the Transitional Services Agreement with GAMCO, we have a disaster recovery plan to address certain contingencies, but we cannot assure you that this plan will be effective or sufficient in responding to, eliminating or ameliorating the effects of all disaster scenarios. If our employees or vendors we rely upon for support in a catastrophic event are unable to respond adequately or in a timely manner, we may lose clients resulting in a decrease in AUM which may have a material adverse effect on revenues and net income.

The soundness of other financial institutions could adversely affect our business.

Financial services institutions are interrelated as a result of trading, clearing, counterparty or other relationships. We and the investments we manage may have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial services industry, including: brokers and dealers, commercial banks, investment banks, clearing organizations, mutual and hedge funds and other institutions. Many of these transactions expose us and the accounts we manage to credit risk in the event of the counterparty's default. There is no assurance that any such losses would not materially and adversely impact Associated Capital's revenues and earnings.

Risks Related to Our Business

Control by Mario J. Gabelli of a majority of the combined voting power of Associated Capital common stock may give rise to conflicts of interests.

Mario J. Gabelli, through his control and majority ownership of GGCP and his individual ownership of Associated Capital common stock, will beneficially own a majority of our outstanding Associated Capital Class B Stock, representing approximately 94.7% voting control. As long as Mario J. Gabelli indirectly beneficially owns a majority of the combined voting power of Associated Capital common stock, he will have the ability to elect all of the members of our Board and thereby control our management and affairs, including determinations with respect to acquisitions, dispositions, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on the Associated Capital common stock. In addition, Mario J. Gabelli will be able to determine the outcome of all matters submitted to a vote of our stockholders for approval and will be able to cause or prevent a change in control of Associated Capital. As a result of Mario J. Gabelli's control, none of our agreements with Mario J. Gabelli and other companies controlled by him can be assumed to have been arrived at through "arm's-length" negotiations, although the parties endeavor to implement market-based terms. There can be no assurance that we would not have received more favorable terms, or offered less favorable terms to, an unaffiliated party.

In addition, Mario J. Gabelli, through his control and majority ownership of GGCP, controls GAMCO, and he could take actions that favor GAMCO over Associated Capital.

We may compete with GAMCO for clients and investment opportunities.

Although our business is expected to focus primarily on alternative investment management and institutional services, while GAMCO is expected to focus primarily on its mutual fund and institutional and private wealth management businesses, situations may arise where we find ourselves directly competing with GAMCO for investment clients and opportunities. For example, it is possible that a potential investor might consider investing in Associated Capital and GAMCO investment products and that such potential investor will have to choose between our investment products and those offered by GAMCO. In addition, Associated Capital and GAMCO could pursue the same investment opportunities in the future.

16

Investors in our products have the right to redeem their investments in our products on a regular basis and could redeem a significant amount of AUM during any given quarterly period, which would result in significantly decreased revenues.

Subject to any specific redemption provisions applicable to a product, investors may generally redeem their investments in our products on an annual or quarterly basis following the expiration of a specified period of time. In a declining market, the pace of redemptions and consequent reduction in our AUM potentially could accelerate. Furthermore, investors in our products may also invest in products managed by other alternative asset managers that have restricted or suspended redemptions or may in the future do so. Such investors may redeem capital from our products, even if our performance is superior to such other alternative asset managers' performance, if they are restricted or prevented from redeeming capital from those other managers.

The decrease in revenues that would result from significant redemptions in our products could have a material adverse effect on our results of operations, cash flows and business. In 2009, due to factors related to the financial crisis, investors redeemed approximately $62 million invested in Associated Capital's products which represented approximately 20% of Associated Capital's AUM at that time. If economic and market conditions remain uncertain or worsen, we may once again experience significant redemptions.

Our business and financial condition may be materially adversely impacted by the highly variable nature of our revenues, results of operations and cash flows. In a typical year, a substantial portion of our incentive allocation income is determined and recorded in the fourth quarter of each year, which means that our interim results are not expected to be indicative of our results for a full year.