Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Braemar Hotels & Resorts Inc. | as20160323-8k.htm |

| EX-99.1 - PRESS RELEASE, DATED MARCH 23, 2016 - Braemar Hotels & Resorts Inc. | as20160323-ex99_1.htm |

Exhibit 99.2

Company Presentation – March 2016

* In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC.This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Prime, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.Important InformationAshford Hospitality Prime, Inc. ("Ashford Prime") plans to file with the SEC and furnish to its stockholders a Proxy Statement in connection with its 2016 Annual Meeting, and advises its stockholders to read the Proxy Statement relating to the 2016 Annual Meeting when it becomes available, because it will contain important information. Stockholders may obtain a free copy of the Proxy Statement and other documents (when available) that Ashford Prime files with the SEC at the SEC's website at www.sec.gov. The Proxy Statement and these other documents may also be obtained for free from Ashford Prime by directing a request to Ashford Hospitality Prime, Inc., Attn: Investor Relations, 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254 or by calling (972) 490-9600.Certain Information Concerning ParticipantsAshford Prime, its directors and named executive officers may be deemed to be participants in the solicitation of Ashford Prime's stockholders in connection with its 2016 Annual Meeting. Stockholders may obtain information regarding the names, affiliations and interests of such individuals in Ashford Prime's proxy statement dated April 17, 2015, which is filed with the SEC. To the extent holdings of Ashford Prime's securities have changed since the amounts printed in the proxy statement, dated April 17, 2015, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Certain Disclosures

Ashford Prime – Update Ashford Prime is under attack from what the Company believes is an irresponsible and inexperienced shareholderAshford Prime’s operations have performed exceptionally well with 2015 RevPAR growth #1 amongst its peersThe Ashford Prime Board is reviewing all possible strategic alternatives to maximize value for shareholders – including a sale, and initiated that process before Sessa's initial 13D filingThe Company believes that Sessa has bungled every step of its engagement with the Company – including, for example, a failure to understand our contractual obligations or properly research our annual meeting date and bylawsThe Company believes that now is not the time to hand over the keys to what the Company believes is an inexperienced shareholder and a slate of Directors with no relevant lodging experienceThe Company believes Sessa’s only actionable strategy is to subject shareholders to costly litigationIf Sessa's purported slate is elected it could trigger a termination fee under the advisory agreement in the hundreds of millions of dollars *

Maximizing Value is Our #1 Objective * Accretively Grow Hotel Portfolio Acquired the Ritz-Carlton St. Thomas, Bardessono Hotel & Spa, Sofitel Chicago, & Pier House ResortIncreased portfolio RevPAR since spin-off by over 40% to $199 as of 12/31/15Increased asset base by 50% since spin-off ConservativeCapital Structure $164mm of cash & equivalents on handTarget leverage of 5.0x net debt/EBITDANo 2016 debt maturitiesAll debt is non-recourse Highly Aligned Management Team Highest insider ownership amongst peersIncentive fee based on AHP total return outperformance vs. its peers Strong Operating Performance 7.3% RevPAR growth in 2015 - highest amongst peersIncreased dividend by 100% since spin Disciplined Capital Strategies Bought back ~$30mm of stock at discount to NAVSince strategic alternatives announcement AHP has been restricted from buybacks$65 million convertible preferred equity raise at $18.90 conversion price Advisory Agreement Lower cost than if internally managedBenefits from scale through affiliation with AHTAdvisor is publicly tradedAnnounced key money conceptFees not based on gross assets

Strategic Alternatives Update After implementing several steps to improve value, in August of 2015, the Company announced a plan to explore a full range of strategic alternatives, including a possible sale of the CompanyIndependent directors engaged Deutsche Bank as financial advisorBoard is discussing all possible strategic alternatives to maximize value for shareholdersThe Company believes that shareholders would be best served by allowing the Board to finish the strategic review that it began before Sessa's initial 13D filingThe current Board will decide upon the best route to maximize value for shareholders, and the Company believes Sessa will not have a better alternative based on its inability to articulate an actionable strategy to date * Note: Diagram includes non-exhaustive list.

Sessa Has Proposed No Plan To Maximize Value * Sessa’s Proposals Negative Impacts Replace Board through proxy contest Could trigger termination fee in the hundreds of millions of dollarsThe Company believes the election of Sessa's nominees could result in hostile relationship with advisor that would likely destroy value given Sessa's litigation strategyRemoves highly qualified Board with long history of hospitality experienceSessa's proposed slate has no relevant lodging experience and includes nominees with a history of aligning with activists No actionable plan Sessa has articulated no actionable plan other than litigation Sessa has not articulated any plan to maximize valueBased on its prior comments about a sale of the Company, Sessa may be seeking to make a quick profit on its estimated $13.43 cost basisSessa has no experience with investments in lodging or hotel market cycles

* Sessa’s Proposals Negative Impacts Litigation Sessa has pursued litigation against the Company, the Board of Directors, and Ashford Inc.Costly for shareholders Distracting to Management and BoardWe believe the existing Board is in a better position to negotiate with Ashford Inc. than a hostile slate from SessaThe advisory agreement between Ashford Prime and Ashford Inc. is a contractual obligation Sessa Has Proposed No Plan To Maximize Value (cont'd)

Sessa's Criticisms Are Misleading: Here are the Facts * Sessa’s Criticism AHP Response Conflicts of interest Highest insider ownership of any hotel REITBase fee based on enterprise value (not book value)Fewer conflicts than internally managed peersIncentive fee based on total return outperformance vs. peersInterested in accretive and strategic growth, not growth just for the sake of growingIndependent, non-overlapping Board of Directors Termination fee AHT shareholders at the time of the spin-off were on both sides of the transactionTermination fee calculation methodology clearly spelled out in the advisory agreementCalculation of the change of control termination fee has not changed since the spin-offContractual obligation between two independent public entitiesThe Company believes that the Ashford Inc. Board is more likely to negotiate the termination fee with the current Board as opposed to Sessa's purported slate given litigation Sessa has pursued against Ashford Inc.

Sessa's Criticisms Are Misleading: Here are the Facts (cont'd) * Sessa’s Criticism AHP Response Weak corporate governance Sessa is not asking for governance changes but rather contractual changes with Ashford Inc. that the Company believes Ashford Inc. will not agree toHighly qualified, majority independent Board in place7 member Board with 5 independent directorsLead independent directorOpted out of MUTANon-staggered BoardWithout prompting, initiated strategic review processManagement team has been together since inception and has generated superior long-term returns for shareholders Stalled strategic review Special committee has retained a financial advisorInbound and outbound calls have been ongoingActive process affected by changing market conditions and impact on valuations and capital marketsAll alternatives being consideredStrategic alternatives process can take a year or longer, this one has currently taken less than 7 months Strategic reviews are not governed by time, but rather thorough, quality decision making

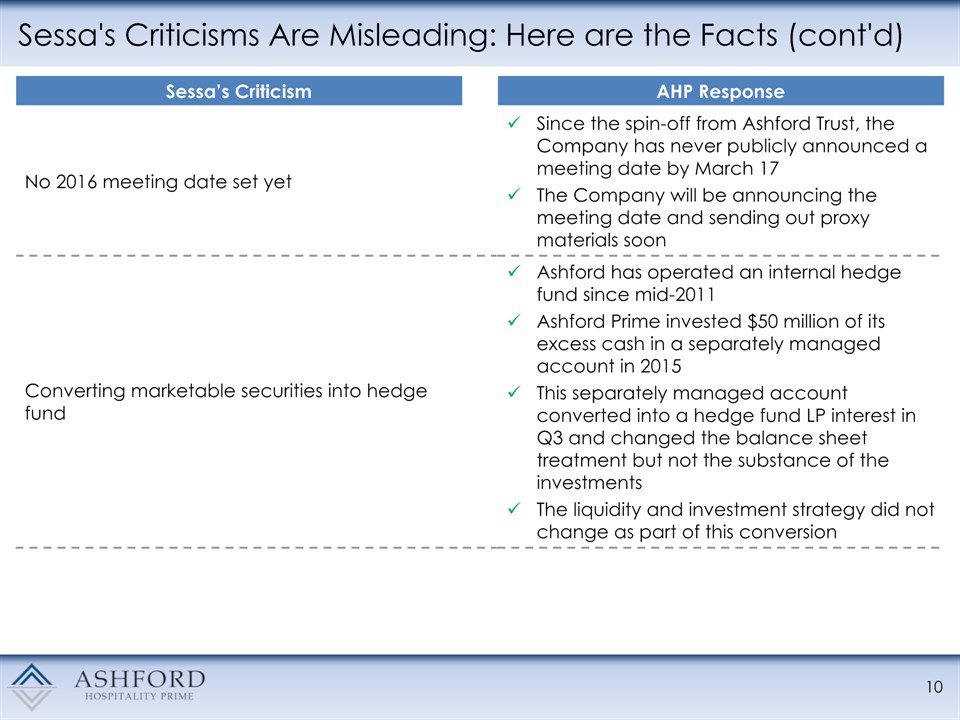

Sessa's Criticisms Are Misleading: Here are the Facts (cont'd) * Sessa’s Criticism AHP Response No 2016 meeting date set yet Since the spin-off from Ashford Trust, the Company has never publicly announced a meeting date by March 17The Company will be announcing the meeting date and sending out proxy materials soon Converting marketable securities into hedge fund Ashford has operated an internal hedge fund since mid-2011Ashford Prime invested $50 million of its excess cash in a separately managed account in 2015This separately managed account converted into a hedge fund LP interest in Q3 and changed the balance sheet treatment but not the substance of the investmentsThe liquidity and investment strategy did not change as part of this conversion

Sessa's Criticisms Are Misleading: Here are the Facts (cont'd) * Sessa’s Criticism AHP Response Purchase of AINC stock Investment allows AHP shareholders to participate in the economics of AINC and we believe it will be an attractive investment for AHPWe viewed this as an attractive opportunity to acquire a large stake in our advisor without driving the price up ($95 price equated to 90-Day VWAP at the time)Stock prices of all asset managers have dropped substantially since this past summer Poor stock price performance We have taken several steps to improve valueBought back ~5% of our outstanding sharesDoubled common dividendRefinanced debt at lower interest rates to improve cash flowStrong operational performance since spinStock dropped 18% the week Sessa nominated directorsBoard has announced exploration of strategic alternatives and engaged financial advisor (prior to Sessa's initial 13D filing)

Poorly Informed / Incapable of Research The company believes that Sessa:Failed to research their own slateFailed to research or understand our contractual obligations in our advisory agreementFailed to file lawsuit in the proper jurisdictionFailed to follow simple Company bylawsFailed to properly research our annual meeting dates Unable to grasp that the Advisory Agreement cannot be unilaterally changed and is a contractual obligation between two public companies Concealing Damaging and Potentially Illegal Information Concealed nominee Livingston’s purchase of approximately $40,000 of stock while possibly in possession of material non-public informationFailed to disclose the formation of a “group” by Sessa and Livingston Making False and Materially Misleading Statements Impugning the character, integrity and reputation of AHP’s directors and managementFailed to disclose that their refusal to comply with the Advance Notice Requirements rendered the purported notice of nomination invalidNominee Livingston engaged in blatant resume-padding by falsely claiming to be a CPAFalsely stated that the Termination Fee was increased by the Third Amended Advisory AgreementFailed to disclose the significant economic risks to the Company and its stockholders if Sessa is successful in its proxy campaignFalsely claiming that Ashford Prime sold voting stock to holders of the limited partnership solely for $43,750 * Sessa's Inexperience Is Evident At Every Step

Sessa is Not the Right Steward for Shareholders * WeakTrack Record No hospitality experience No hotel real estate asset management experienceUnproven hotel market cycle knowledgeOnly 3 years in business with no activist experience Inadequate Slate Lack of significant public board experienceApparent misrepresentation of board qualificationsSlate includes nominees with a history of aligning with activistsNo relevant hospitality experience Short-Sighted Investment Horizon History of short hold positions, rather than longer term views on share price maximization Average hold period of realized positions: ~2 quartersAverage hold period of current positions: ~4 quarters

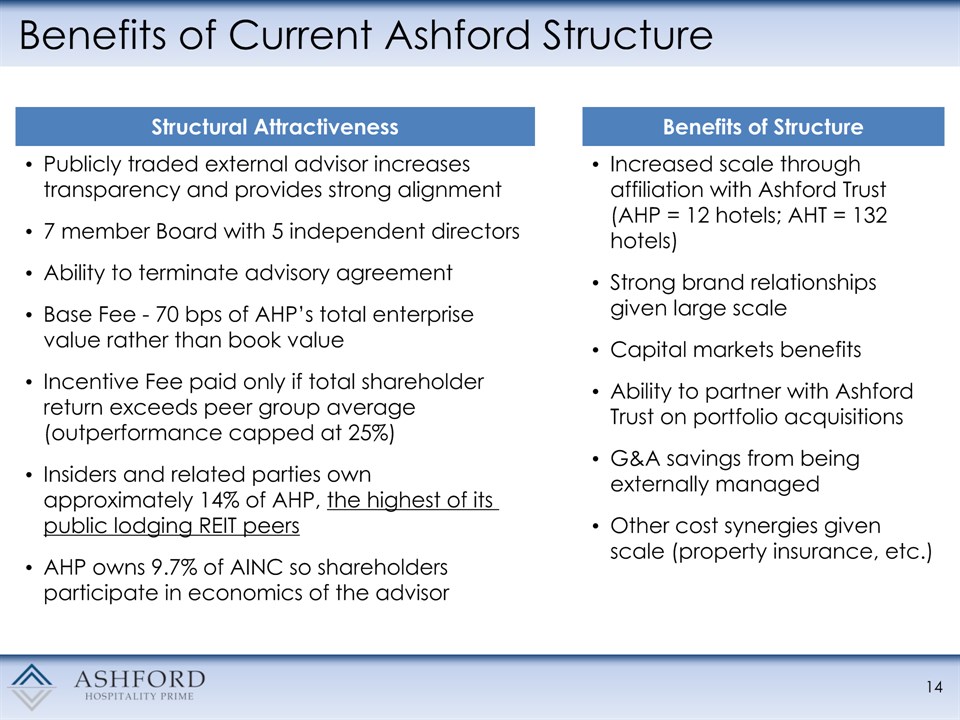

Benefits of Current Ashford Structure * Structural Attractiveness Publicly traded external advisor increases transparency and provides strong alignment7 member Board with 5 independent directorsAbility to terminate advisory agreementBase Fee - 70 bps of AHP’s total enterprise value rather than book valueIncentive Fee paid only if total shareholder return exceeds peer group average (outperformance capped at 25%)Insiders and related parties own approximately 14% of AHP, the highest of its public lodging REIT peersAHP owns 9.7% of AINC so shareholders participate in economics of the advisor Benefits of Structure Increased scale through affiliation with Ashford Trust (AHP = 12 hotels; AHT = 132 hotels)Strong brand relationships given large scaleCapital markets benefitsAbility to partner with Ashford Trust on portfolio acquisitionsG&A savings from being externally managedOther cost synergies given scale (property insurance, etc.)

Highest Insider Ownership in the Industry * Public Lodging REITs include: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHOSource: Company filings.* Insider ownership for Ashford Prime includes direct & indirect interests & interests of related parties Insider Ownership High insider ownership encourages management to think and act like ownersMeaningful net worth of management is held in AHP

Management Team with Deep Experience * Aggregate 139 Years of Relevant Industry Experience 27 years of hospitality experience13 years with Ashford (14 years with Ashford predecessor)Cornell School of Hotel Administration BSCornell S.C. Johnson MBA Montgomery J. BennettChief Executive Officer & Chairman of the Board 20 years of hospitality experience13 years with AshfordStanford BA, MBA10 years with Goldman Sachs Douglas A. KesslerPresident 24 years of hospitality experience13 years with Ashford (11 years with Ashford predecessor)University of North Texas BS, University of Houston JD David A. BrooksChief Operating Officer, General Counsel 16 years of hospitality experience13 years with AshfordSouthern Methodist University BBA3 years with ClubCorpCFA charterholder Deric S. Eubanks, CFAChief Financial Officer 10 years of hospitality experience5 years with Ashford (5 years with Ashford predecessor)Oklahoma State University BS5 years with Stephens Investment Bank Jeremy J. WelterEVP of Asset Management 31 years of hospitality experience13 years with Ashford (18 years with Ashford predecessor)Pepperdine University BS, University of Houston MS, CPA Mark L. NunneleyChief Accounting Officer 11 years of hospitality experience11 years with AshfordPrinceton University AB3 years of M&A experience at Dresser Inc. & Merrill Lynch J. Robison HaysChief Strategy Officer

This Management Team Has A Long-Term Track Record of Value Creation * Since AHT IPO on August 26, 2003Peer average includes: CHSP, CLDT, DRH, FCH, HT, INN, LHO, RLJ, SHOReturns as of 3/18/16Source: SNL Total Shareholder Return Significant long-term outperformance proves management's ability to create value for shareholders over time (1)

Strong Asset Performance * Source: Company filings FY2015 RevPAR Growth 2015 RevPAR growth was the highest amongst our peers

Asset Management Expertise – Bardessono * Bardessono – Yountville, CA Acquired in July 20152015 RevPAR of $56462 keys, 1,350 sq. ft. of meeting spaceLocated in Yountville, CA the “Culinary Capital of Napa Valley”High barrier to entry marketEasily accessible to the major markets in Northern CaliforniaOne of only three LEED Platinum certified hotels in the U.S., only hotel in California Hotel Overview: Opportunity to add 2 to 3 luxury villas to attract ultra-luxury guestsCost control opportunitiesImplementation of Remington revenue initiativesRevPAR up 5.9%, EBITDA Margin up 460 bps, & EBITDA flow-through of 83% in the 4th quarter (1st full quarter of ownership) Opportunities: Bardessono – Yountville, CA

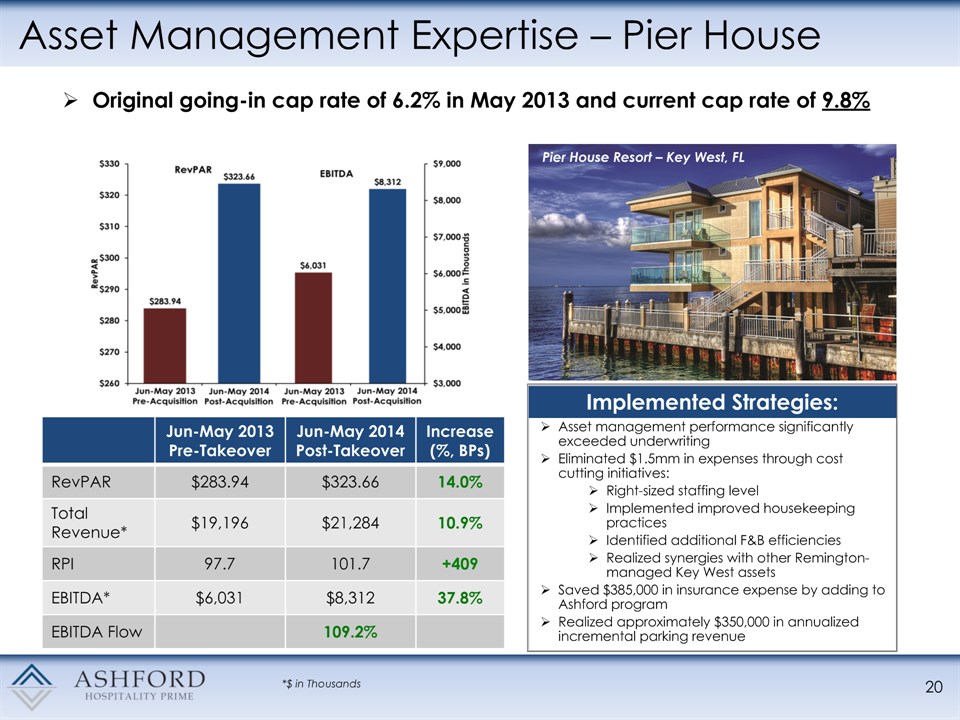

Asset Management Expertise – Pier House * Asset management performance significantly exceeded underwritingEliminated $1.5mm in expenses through cost cutting initiatives: Right-sized staffing levelImplemented improved housekeeping practicesIdentified additional F&B efficienciesRealized synergies with other Remington-managed Key West assetsSaved $385,000 in insurance expense by adding to Ashford programRealized approximately $350,000 in annualized incremental parking revenue Implemented Strategies: Pier House Resort – Key West, FL Jun-May 2013 Pre-Takeover Jun-May 2014Post-Takeover Increase (%, BPs) RevPAR $283.94 $323.66 14.0% Total Revenue* $19,196 $21,284 10.9% RPI 97.7 101.7 +409 EBITDA* $6,031 $8,312 37.8% EBITDA Flow 109.2% *$ in Thousands Original going-in cap rate of 6.2% in May 2013 and current cap rate of 9.8%

Asset Management Expertise – Ritz St. Thomas * The Ritz-Carlton St. Thomas Acquired in December 2015180 keys, 10,000 sq. ft. of meeting spaceAcquisition completed at favorable metrics of 7.2x TTM EBITDA and 10% TTM NOI cap rateLocated in St. Thomas in the stunning U.S. Virgin Islands with high barriers to entry30 oceanfront acres along Great BayRecognized in the 2015 U.S. News & World Report's Best Hotel Rankings Hotel Overview: Significant upside after recently completed extensive $22 million renovation of guest rooms and public spaceAdditional growth opportunities include ability to expand the resort further through additional keys and villas Opportunities: Great Bay ViewThe Ritz-Carlton St. Thomas

Current AHP Board of Directors is Experienced and Highly Qualified * Aggregate 44 Years of Public Board Experience Hospitality ExperienceREIT ExperienceReal Estate ExperiencePublic Company Board ExperienceLegal ExperienceCapital Markets Experience Montgomery J. BennettChairman 13 years of public board experienceFounder, Chairman, & CEO of AHP Curtis B. McWilliamsLead Director 10 years of public board experiencePreviously CEO of CNL Real Estate Advisors and previously CEO of Trustreet Properties Douglas A. KesslerPresident 2 years of public board experiencePresident of AHP Stefani D. CarterIndependent Director 2 years of public board experiencePartner at the law firm of Stefani Carter & Associates, LLC Matthew D. RinaldiIndependent Director 2 years of public board experienceCounsel at the law firm of Dykema Cox Smith W. Michael MurphyIndependent Director 13 years of public board experienceHead of Lodging and Leisure Capital Markets of the First Fidelity Mortgage Corporation Andrew L. StrongIndependent Director 2 years of public board experiencePartner at the law firm of Pillsbury Winthrop Shaw Pittman, LLP Denotes independent director

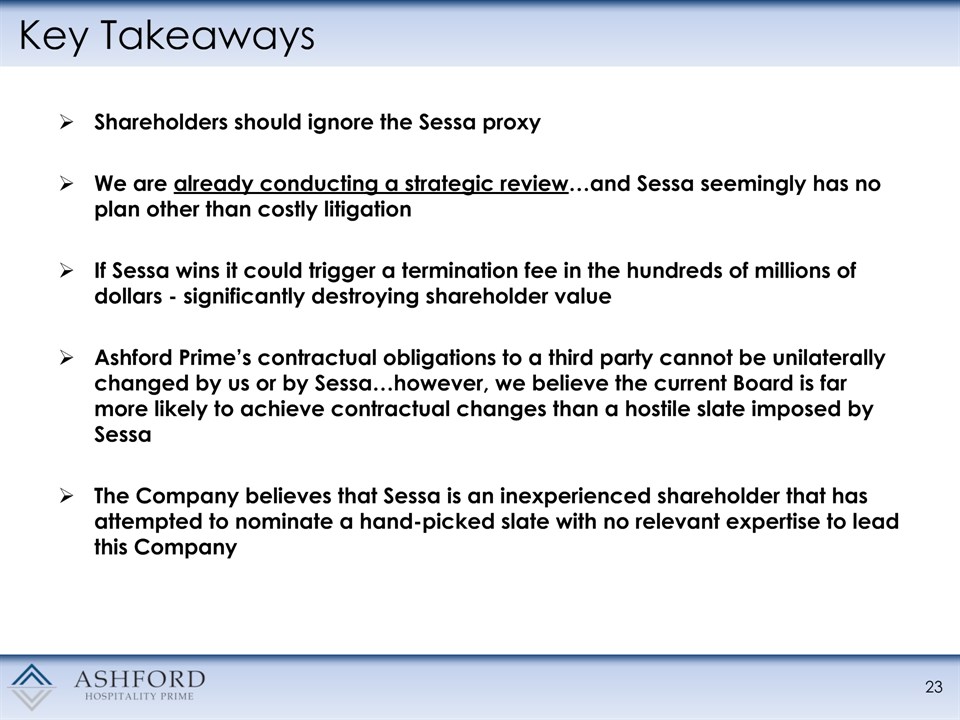

Key Takeaways Shareholders should ignore the Sessa proxyWe are already conducting a strategic review…and Sessa seemingly has no plan other than costly litigationIf Sessa wins it could trigger a termination fee in the hundreds of millions of dollars - significantly destroying shareholder valueAshford Prime’s contractual obligations to a third party cannot be unilaterally changed by us or by Sessa…however, we believe the current Board is far more likely to achieve contractual changes than a hostile slate imposed by SessaThe Company believes that Sessa is an inexperienced shareholder that has attempted to nominate a hand-picked slate with no relevant expertise to lead this Company *

Key Takeways Shareholders should ignore the Sessa proxyWe are already conducting a strategic review…and Sessa seemingly has no plan other than costly litigationIf Sessa wins it could trigger a termination fee in the hundreds of millions of dollars - significantly destroying shareholder valueAshford Prime’s contractual obligations to a third party cannot be unilaterally changed by us or by Sessa…however, we believe the current Board is far more likely to achieve contractual changes than a hostile slate imposed by SessaThe Company believes that Sessa is an inexperienced shareholder that has attempted to nominate a hand-picked slate with no relevant expertise to lead this Company *

* Appendix

Ashford Hospitality Prime Vision Well defined strategy investing in luxury hotels in gateway and resort markets * Bardessono Hotel & SpaYountville, CA Pier House ResortKey West, FL Chicago Sofitel WaterTowerChicago, IL Grow platform through accretive acquisitions of high quality assets Highly-aligned management team and organizational structure Simple and straightforward investment profile Grow organically through strong revenue initiatives Maintain conservative capital structure with target Net Debt / EBITDA of 5.0x or less Continue to take steps to improve shareholder value and increase total shareholder return

High Quality Portfolio * Ashford Prime Hotels Courtyard Seattle DowntownSeattle, WA Marriott SeattleSeattle, WA Hilton Torrey PinesLa Jolla, CA Bardessono Hotel & SpaYountville, CA Pier House ResortKey West, FL Renaissance TampaTampa, FL Chicago Sofitel WaterTowerChicago, IL Courtyard PhiladelphiaPhiladelphia, PA Capital HiltonWashington D.C. Courtyard San FranciscoSan Francisco, CAz Renaissance TampaTampa, FL Courtyard PhiladelphiaPhiladelphia, PA Capital HiltonWashington D.C. Marriott Plano LegacyPlano, TX The Ritz-Carlton St. ThomasSt. Thomas, BVI

Portfolio Overview * As of December 31, 2015Wells Fargo Securities Research; Lodging: TripAdvisor Rankings (September 4, 2015) Note: Hotel EBITDA in thousands High quality portfolio with total ADR and RevPAR of $243 and $199, respectively for the TTM periodGeographically diversified portfolio located in strong marketsHighest TripAdvisor ranking among publicly-traded Hotel REITs(2)

Debt Maturities and Leverage Target leverage: Net Debt / EBITDA < 5.0xMaintain mix of fixed and floating rate debtLadder maturitiesExclusive use of property-level, non-recourse debt * As of December 31, 2015Assumes extension options are exercisedNote: All debt yield statistics are based on EBITDA to principal. Debt Maturity Schedule (mm)(1) Debt Yield: 15.9% Debt Yield: N/A Debt Yield: 10.5% Debt Yield: 15.0% Debt Yield: 14.2%