Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALKALINE WATER Co INC | form8k.htm |

|

|

Notice Regarding Forward-Looking Statements and Health Claims

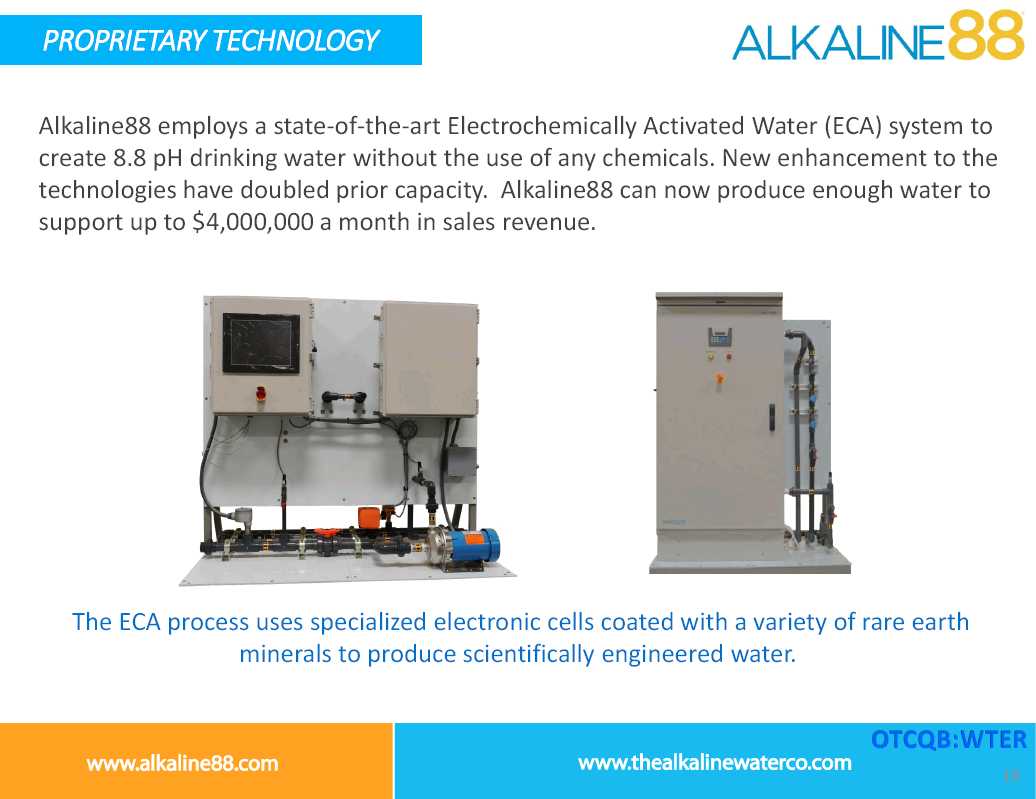

This presentation contains "forward-looking statements." Statements in this presentation that are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Such forward-looking statements include, among other things, The Alkaline Water Company Inc.’s (the “Company”) statements regarding the Company’s intention to provide the highest quality alkaline drinking water to the largest consumer audience possible; the Company’s estimated sales revenue of $7 million for fiscal year 2016, experiencing 89% year over year growth; the Company’s estimated sales revenue of $18 million for the fiscal 2017; the Company’s estimated total revenue of $2,000,000 for Q4 of fiscal 2015; the Company’s estimation that it will be cash flow neutral by fiscal Q1 ending June 30, 2016; the Company’s expectation to be in over 30,000 stores by the end of this fiscal year; the Company’s intention to continue with its nationwide public relations and advertising programs featuring Brande Roderick; the Company’s estimates for the income statement for the twelve months ended December 31, 2015; the Company’s estimates for the balance sheet as of December 31, 2015; the Company’s commitment to become the #1 best selling Alkaline water across the country by the end of 2016; the Company’s statement regarding the capacity to produce enough water to support up to $4,000,000 a month in sales revenue; and the Company’s projection of over 100% year over year sales increase.

The material assumptions supporting these forward-looking statements include, among others, that the demand for the Company's products will continue to significantly grow; that there will be continued expansion of direct store distributor sales; that there will be increased production capacity through implementation of new technology; that there will be an increase in number of products available for sale to retailers and consumers; that there will be an expansion in geographical areas by national retailers carrying the Company’s products; that there will be an expansion into new national and regional grocery retailers; and that the Company will be able to obtain additional capital to meet the Company's growing demand and satisfy the capital expenditure requirements needed to increase production and support sales activity. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, governmental regulations being implemented regarding the production and sale of alkaline water; additional competitors selling alkaline water bulk containers reducing the Company’s sales; the fact that the Company does not own or operate any of its production facilities and that co-packers may not renew current agreements and/or not satisfy increased production quotas; that fact that the Company has a limited number of suppliers of its unique bulk bottles; the potential for supply chain interruption due to factors beyond the Company’s control; the fact that there may be a recall of products due to unintended contamination; the inherent uncertainties associated with operating as an early stage company; changes in customer demand; the extent to which the Company is successful in gaining new long-term relationships with new retailers and retaining existing relationships with retailers; the Company’s ability to raise the additional funding that it will need to continue to pursue its business, planned capital expansion and sales activity; competition in the industry in which the Company operates and market conditions. These forward-looking statements are made as of the date of this presentation, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States. Although the Company believes that any beliefs, plans, expectations and intentions contained in this presentation are reasonable, there can be no assurance that any such beliefs, plans, expectations or intentions will prove to be accurate. Investors should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents we file with the SEC, available at www.sec.gov. The Company has not conducted any clinical studies regarding the health benefits of alkaline water and accordingly make no claims as to the benefits of alkaline water.

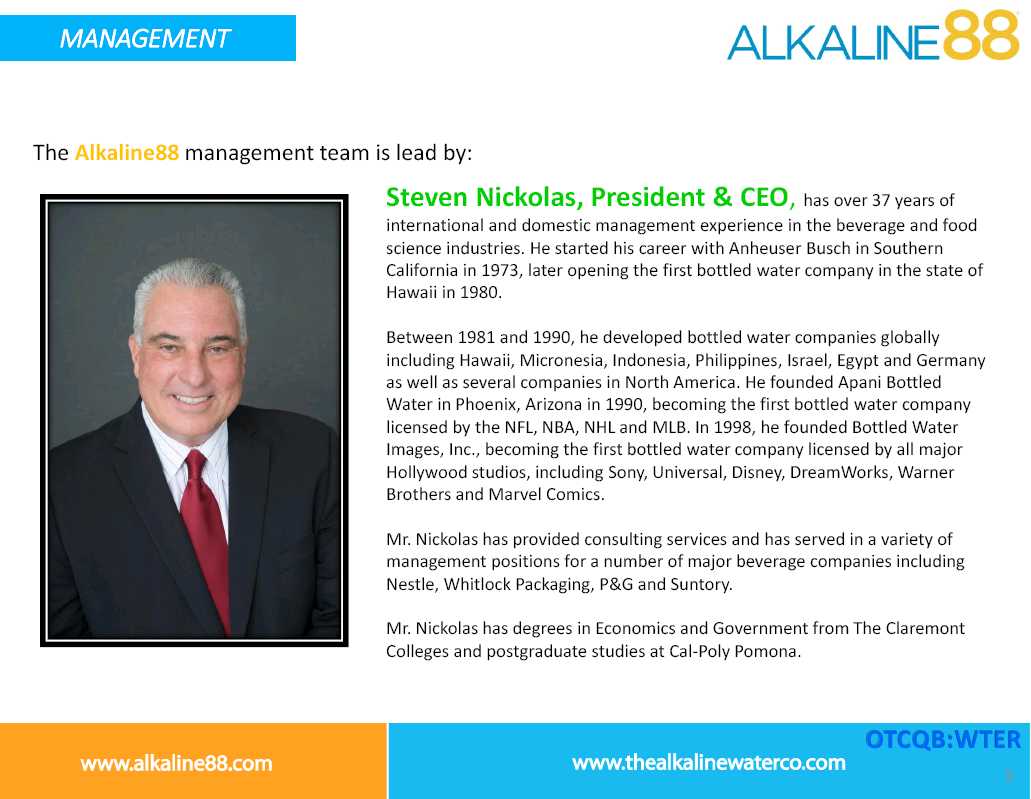

Ricky Wright, Vice President & CFO, is a former regional director of tax and financial planning with one of the big 4 financial accounting firms. He brings over 37 years of experience as a CFO, CPA , senior executive and entrepreneur.

Mr. Wright has extensive working knowledge of most areas of finance, with a strong emphasis on closely held companies, mergers and acquisitions, transaction planning and international operations.

Throughout his career, Mr. Wright has consulted on or taken part in over 100 mergers or acquisitions and has consulted with over 500 companies on sophisticated tax and financial planning matters.

Frank Chessman, National Sales Manager, is a graduate of the University of Southern California’s Marshall School of Business, and spent 25 years with Ralph’s Grocery, Kroger’s largest division. At Ralph’s, Frank was Vice President of Advertising & Marketing and went on to spend 14 years at Simon Marketing as Executive Vice President. He has over 10 years of beverage manufacturing experience.

| INCOME STATEMENT |

| Fiscal Year Ended March 30 | Nine Months Ended Dec 31 | Twelve Months Ended Dec 31 | |||||||||||||

| 2014 | 2015 | 2014 | 2015* | 2015* | |||||||||||

| Revenues | $ | 552,699 | $ | 3,700,476 | $ | 2,452,707 | $ | 5,010,547 | $ | 6,258,316 | |||||

| % growth | 569.5% | 164.6% | |||||||||||||

| Cost of goods sold | $ | 411,851 | $ | 2,532,436 | $ | 1,643,511 | $ | 3,234,840 | $ | 4,123,765 | |||||

| Gross profit | $ | 140,848 | $ | 1,168,040 | $ | 809,196 | $ | 1,775,707 | $ | 2,134,551 | |||||

| % margin | 25.5% | 31.6% | 29.0% | 35.5% | 33.2% | ||||||||||

| Operating expenses: | |||||||||||||||

| Sales and marketing expenses | $ | 464,081 | $ | 1,386,671 | $ | 1,063,749 | $ | 2,098,678 | $ | 2,421,600 | |||||

| General and administrative | $ | 3,852,773 | $ | 6,520,451 | $ | 4,984,996 | $ | 2,628,152 | $ | 4,163,607 | |||||

| General and administrative - related party | $ | 62,092 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||

| Depreciation expense | $ | 42,407 | $ | 175,036 | $ | 107,801 | $ | 214,333 | $ | 308,568 | |||||

| Total operating expenses | $ | 4,421,353 | $ | 8,082,158 | $ | 6,156,546 | $ | 4,941,163 | $ | 6,893,775 | |||||

| Operating income | ($4,280,505 | ) | ($6,914,118 | ) | ($5,347,350 | ) | $ | 3,165,456 | ($4,759,224 | ) | |||||

| Other income (expense) | $ | 50,992 | ($225,331 | ) | ($133,229 | ) | ($478,572 | ) | ($570,674 | ) | |||||

| Net loss | ($4,229,513 | ) | ($7,139,449 | ) | ($5,480,579 | ) | $ | 3,644,028 | ($5,329,898 | ) | |||||

| Net (loss) income per share: | |||||||||||||||

| Basic | ($2.50 | ) | ($3.00 | ) | ($2.56 | ) | ($1.29 | ) | |||||||

| Weighted average shares outstanding: | |||||||||||||||

| Basic | $ | 1,604,414 | $ | 2,234,096 | $ | 2,140,899 | $ | 2,831,761 | |||||||

Source: Company filings

*Estimated to December 31,2015. See

Disclaimer on page 2.

| BALANCE SHEET |

| Fiscal Year Ended March 30 | As of | ||||||||

| 2014 | 2015 | 12/31/2015* | |||||||

| Assets | |||||||||

| Current assets | |||||||||

| Cash | $ | 2,665 | $ | 90,113 | $ | 109,781 | |||

| Accounts receivable, net | $ | 166,404 | $ | 416,373 | $ | 699,208 | |||

| Inventory | $ | 7,965 | $ | 193,355 | $ | 201,319 | |||

| Prepaid expenses and other current assets | $ | 0 | $ | 17,500 | $ | 2,500 | |||

| Deferred financing cost | $ | 54,288 | $ | 0 | $ | 0 | |||

| Total current assets | $ | 281,322 | $ | 717,341 | $ | 1,012,808 | |||

| Fixed assets, net | $ | 286,986 | $ | 1,199,900 | $ | 1,005,028 | |||

| Equipment deposits - related party | $ | 0 | $ | 0 | $ | 194,997 | |||

| Total assets | $ | 568,308 | $ | 1,917,241 | $ | 2,212,833 | |||

| Liabilities & Stockholders' Equity | |||||||||

| Current liabilities | |||||||||

| Accounts payable | $ | 320,154 | $ | 562,499 | $ | 678,917 | |||

| Accounts payable - related party | $ | 18,403 | $ | 43,036 | $ | 0 | |||

| Accrued expenses | $ | 56,601 | $ | 160,437 | $ | 211,069 | |||

| Accrued interest | $ | 19,829 | $ | 0 | $ | 0 | |||

| Revolving financing | $ | 83,348 | $ | 242,875 | $ | 383,936 | |||

| Current portion of capital leases | $ | 0 | $ | 209,544 | $ | 234,224 | |||

| Note payable, net of debt discount | $ | 0 | $ | 0 | $ | 1,100,607 | |||

| Convertible notes payable, net of debt discount | $ | 0 | $ | 146,250 | |||||

| Derivative liability | $ | 337,988 | $ | 194,940 | $ | 7,747 | |||

| Total current liabilities | $ | 836,323 | $ | 1,413,331 | $ | 2,762,750 | |||

| Long-term liabilities | |||||||||

| Capitalize leases | $ | 0 | $ | 233,770 | $ | 133,997 | |||

| Total long-term liabilities | $ | 0 | $ | 233,770 | $ | 133,997 | |||

| Total liabilities | $ | 836,323 | $ | 1,647,101 | $ | 2,896,747 | |||

| Redeemable convertible preferred stock | $ | 83,820 | $ | 0 | |||||

| Stockholders' equity (deficit): | |||||||||

| Preferred stock | $ | 20,000 | $ | 20,000 | $ | 20,000 | |||

| Common stock | $ | 81,602 | $ | 124,496 | $ | 3,292 | |||

| Additional paid in capital | $ | 4,059,464 | $ | 11,777,994 | $ | 14,589,172 | |||

| Deficit accumulated | ($4,512,901 | ) | ($11,652,350 | ) | ($15,296,378 | ) | |||

| Total stockholders' equity (deficit) | ($351,835 | ) | $ | 270,140 | ($683,914 | ) | |||

| Total liabilities and stockholders' equity (deficit) | $ | 568,308 | $ | 1,917,241 | $ | 2,212,833 | |||

Source: Company filings

*Estimated to December 31,2015. See

Disclaimer on page 2.

Appendix