Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Pangaea Logistics Solutions Ltd. | a8-kearningspressreleasean.htm |

| EX-99.1 - EXHIBIT 99.1 - Pangaea Logistics Solutions Ltd. | pressrelease.htm |

Fourth Quarter and Full Year 2015 Results March 2016

2 Safe Harbor This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

3 Full Year 2015 Highlights • Net income attributable to Pangaea Logistics Solutions Ltd. was $11.3 million in 2015, compared to a net loss of $12.1 million in 2014 • Pro forma adjusted earnings per common share1 of $0.48 for 2015, compared to a pro forma adjusted earnings per common share of $0.03 in 2014 • Adjusted EBITDA2 increased to $38.6 million for 2015, compared to $20.7 million in 2014 • Cash flow from operations was $26.0 million for 2015, compared to $19.7 million for 2014 • At year-end, Pangaea had $37.5 million in cash and cash equivalents • During 2015, the Company: - Acquired the non-controlling interest in Nordic Bulk Carriers AS (“NBC”), making NBC a wholly-owned subsidiary - Took delivery of two Panamax Ice-Class 1A newbuildings 1 Earnings per share represents total earnings allocated to common stock divided by the weighted average number of common shares outstanding. Pro Forma adjusted earnings per share represents adjusted total earnings allocated to common stock divided by the weighted average number of shares giving effect to the mergers as if they had been consummated as of January 1, 2014. See Reconciliation of Adjusted EBITDA and Pro Forma Adjusted Earnings Per Share. 2 Adjusted EBITDA is a non-GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, and other non-operating income and/or expense, if any.

4 Fourth Quarter 2015 Highlights • Net loss attributable to Pangaea Logistics Solutions Ltd. was $4.8 million for the fourth quarter of 2015, compared to a net loss of $17.0 million for the fourth quarter of 2014 • Pro forma adjusted earnings per common share1 of $0.02 for the fourth quarter of 2015, compared to a pro forma adjusted loss of $0.11 per common share, for the fourth quarter of 2014 • Adjusted EBITDA2 increased to $7.4 million for the fourth quarter of 2015, compared with $0.8 million for the fourth quarter of 2014 1 Earnings per share represents total earnings allocated to common stock divided by the weighted average number of common shares outstanding. Pro Forma adjusted earnings per share represents adjusted total earnings allocated to common stock divided by the weighted average number of shares giving effect to the mergers as if they had been consummated as of January 1, 2014. See Reconciliation of Adjusted EBITDA and Pro Forma Adjusted Earnings Per Share. 2 Adjusted EBITDA is a non-GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, and other non-operating income and/or expense, if any.

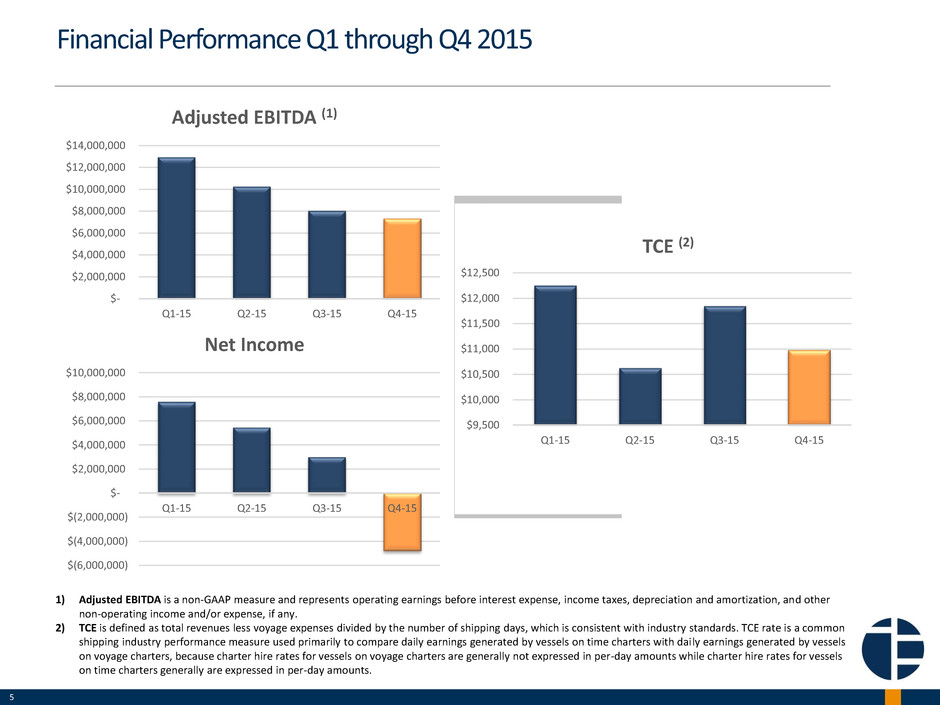

5 Financial Performance Q1 through Q4 2015 1) Adjusted EBITDA is a non-GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, and other non-operating income and/or expense, if any. 2) TCE is defined as total revenues less voyage expenses divided by the number of shipping days, which is consistent with industry standards. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per-day amounts while charter hire rates for vessels on time charters generally are expressed in per-day amounts. $- $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 $14,000,000 Q1-15 Q2-15 Q3-15 Q4-15 Adjusted EBITDA (1) $(6,000,000) $(4,000,000) $(2,000,000) $- $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 Q1-15 Q2-15 Q3-15 Q4-15 Net Income $9,500 $10,000 $10,500 $11,000 $11,500 $12,000 $12,500 Q1-15 Q2-15 Q3-15 Q4-15 TCE (2)

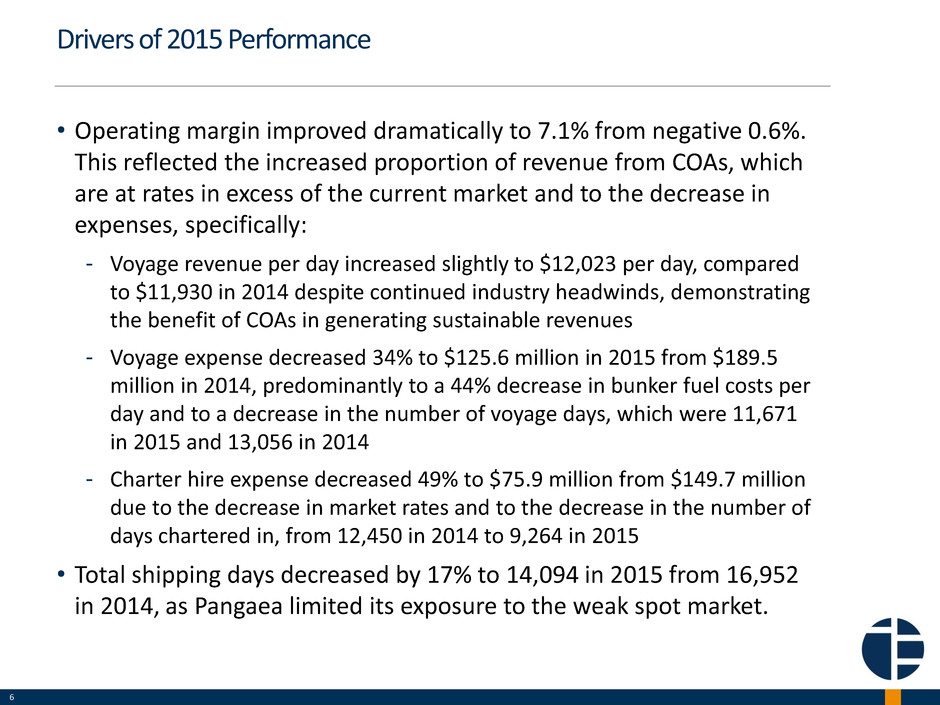

6 • Operating margin improved dramatically to 7.1% from negative 0.6%. This reflected the increased proportion of revenue from COAs, which are at rates in excess of the current market and to the decrease in expenses, specifically: - Voyage revenue per day increased slightly to $12,023 per day, compared to $11,930 in 2014 despite continued industry headwinds, demonstrating the benefit of COAs in generating sustainable revenues - Voyage expense decreased 34% to $125.6 million in 2015 from $189.5 million in 2014, predominantly to a 44% decrease in bunker fuel costs per day and to a decrease in the number of voyage days, which were 11,671 in 2015 and 13,056 in 2014 - Charter hire expense decreased 49% to $75.9 million from $149.7 million due to the decrease in market rates and to the decrease in the number of days chartered in, from 12,450 in 2014 to 9,264 in 2015 • Total shipping days decreased by 17% to 14,094 in 2015 from 16,952 in 2014, as Pangaea limited its exposure to the weak spot market. Drivers of 2015 Performance

7 Defensible Pillars of Profitability • Execution specialization: - Material cost savings & enhanced profit through granular operating knowledge & risk sensitive approach - Secured & defended by 200+ years of expertise & embedded relationships; key managers average 20 years in the industry • Backhaul specialization: - Generating profit from a cost center - Secured & defended by reputation, long-term contracts & repeat customers - Minimal ballast time • Ice-class specialization: - Capturing profit from limited supply of tonnage & lower costs - Secured & defended by expertise & ownership of specialized fleet - Own & operate a significant portion of the world’s 1A ice-class dry tonnage • Broader logistics solutions: - Design & implement loading & discharge efficiencies in critical ports - Expand markets & improve business terms for customers

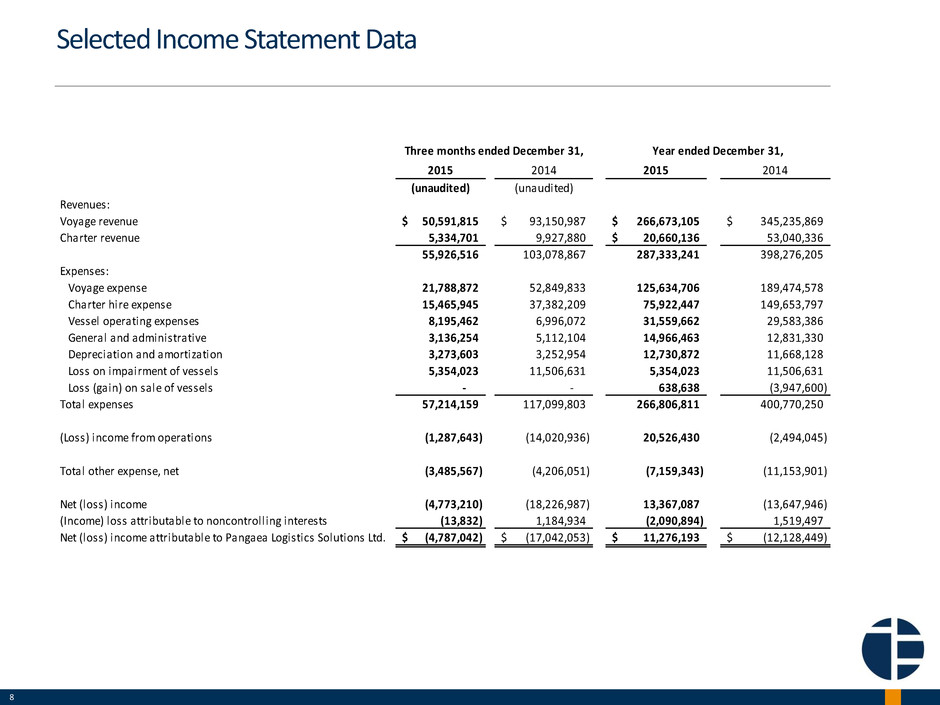

8 Selected Income Statement Data 2015 2014 2015 2014 (unaudited) (unaudited) Revenues: Voyage revenue 50,591,815$ 93,150,987$ 266,673,105$ 345,235,869$ Charter revenue 5,334,701 9,927,880 20,660,136$ 53,040,336 55,926,516 103,078,867 287,333,241 398,276,205 Expenses: Voyage expense 21,788,872 52,849,833 125,634,706 189,474,578 Charter hire expense 15,465,945 37,382,209 75,922,447 149,653,797 Vessel operating expenses 8,195,462 6,996,072 31,559,662 29,583,386 General and administrative 3,136,254 5,112,104 14,966,463 12,831,330 Depreciation and amortization 3,273,603 3,252,954 12,730,872 11,668,128 Loss on impairment of vessels 5,354,023 11,506,631 5,354,023 11,506,631 Loss (gain) on sale of vessels - - 638,638 (3,947,600) Total expenses 57,214,159 117,099,803 266,806,811 400,770,250 (Loss) income from operations (1,287,643) (14,020,936) 20,526,430 (2,494,045) Total other expense, net (3,485,567) (4,206,051) (7,159,343) (11,153,901) Net (loss) income (4,773,210) (18,226,987) 13,367,087 (13,647,946) (Income) loss attributable to noncontrolling interests (13,832) 1,184,934 (2,090,894) 1,519,497 Net (loss) income attributable to Pangaea Logistics Solutions Ltd. (4,787,042)$ (17,042,053)$ 11,276,193$ (12,128,449)$ Three months ended December 31, Year ended December 31,

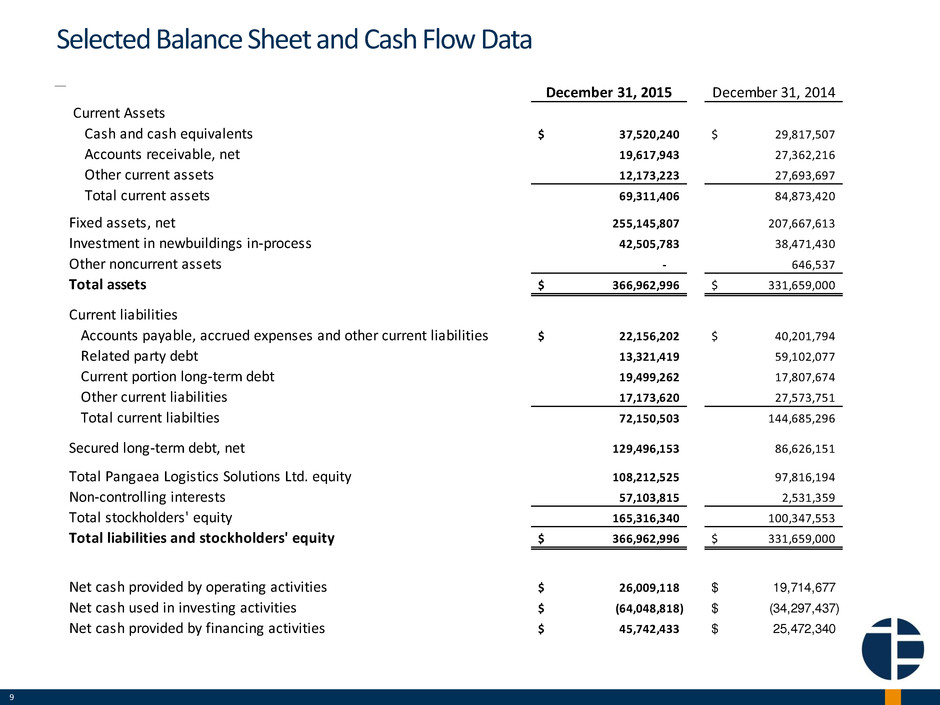

9 Selected Balance Sheet and Cash Flow Data December 31, 2015 December 31, 2014 Current Assets Cash and cash equivalents 37,520,240$ 29,817,507$ Accounts receivable, net 19,617,943 27,362,216 Other current assets 12,173,223 27,693,697 Total current assets 69,311,406 84,873,420 Fixed assets, net 255,145,807 207,667,613 Investment in newbuildings in-process 42,505,783 38,471,430 Other noncurrent assets - 646,537 Total assets 366,962,996$ 331,659,000$ Current liabilities Accounts payable, accrued expenses and other current liabilities 22,156,202$ 40,201,794$ Related party debt 13,321,419 59,102,077 Current portion long-term debt 19,499,262 17,807,674 Other current liabilities 17,173,620 27,573,751 Total current liabilties 72,150,503 144,685,296 Secured long-term debt, net 129,496,153 86,626,151 Total Pangaea Logistics Solutions Ltd. equity 108,212,525 97,816,194 Non-controlling interests 57,103,815 2,531,359 Total stockholders' equity 165,316,340 100,347,553 Total liabilities and stockholders' equity 366,962,996$ 331,659,000$ Net cash provided by operating activities 26,009,118$ 19,714,677$ Net cash used in investing activities (64,048,818)$ (34,297,437)$ Net cash provided by financing activities 45,742,433$ 25,472,340$