Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Finance Trust, Inc | v435157_8k.htm |

Exhibit 99.1

A Public Non - Traded Real Estate Investment Trust* Fourth Quarter Investor Presentation

2 Risk Factors Investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with American Finance Trust, Inc . (“AFIN” or the “Company”) Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the Company’s most recent Annual Report on Form 10 - K for a more complete list of risk factors, as well as a discussion of forward - looking statements and other details. American Finance Trust, Inc. RISK FACTORS 2

American Finance Trust, Inc. 3 INVESTMENT THESIS AFIN is a leading manager of net lease commercial real estate properties. AFIN has and may continue to additionally invest in commercial real estate mortgage loans and other commercial real estate - related debt investments. 3 Primary Objectives*: □ Preserve and protect investors’ capital; □ Pay monthly distributions; and □ Increase the value of assets in order to generate capital appreciation. * There is no guarantee these objectives will be met.

Retail Banking 19.1% Healthcare 15.4% Financial Services 12.4% Distribution 11.1% Refrigerated Warehousing 7.8% Supermarket 6.8% Restaurant 6.8% Home Maintenance 6.6% Pharmacy 3.9% Discount Retail 2.7% Other 7.4% Industry Diversification American Finance Trust, Inc. Property Purchase Price (1) : $2.2 Billion Annualized GAAP (2) Straight - Line Rental Income : $162.5 Million Number of Properties: 463 Total Rentable Square Feet: 13.1 Million Percentage Leased : 100% Weighted Avg . Remaining Lease Term: 8.6 years Number of Industries: 18 Number of States: 37 states (including D.C.) 4 (1) Aggregated contract purchase price of properties acquired, excluding acquisition related costs and mortgage premiums resultin g f rom the debt assumed in connection with our property acquisitions. (2) Accounting principles generally accepted in the United States of America PORTFOLIO SUMMARY Geographic Diversification

American Finance Trust, Inc. 5 PORTFOLIO UPDATE ▪ Strong Portfolio: 463 net lease assets with investment grade and creditworthy tenants and 3 senior commercial mortgage loans as of December 31, 2015 ▪ Leverage: 47.3% total debt to total assets with weighted average effective interest rate of 4.77% ▪ Flexible C ash P osition: Cash balance of $130.5 million provides operational flexibility ▪ Selective Acquisitions: Management will continue to evaluate real e state & real estate debt investments ▪ Net A sset V alue: On March 17, 2016, the Company’s independent directors unanimously reaffirmed an estimated per - share net asset value (“Estimated Per - Share NAV) equal to $24.17 as of December 31, 2015, consistent with the Estimated Per - Share NAV approved as of March 31, 2015 ▪ Distribution R ate : AFIN continues to pay an annualized distribution per share of $1.65, or 6.83% based on the most recent Estimated Per - Share NAV

American Finance Trust, Inc. 6 NET LEASE MARKET OVERVIEW • Over the course of 2015, cap rates for U.S retail and office properties declined by 15 and 35 bps, respectively, to 6.25% and 7.0% at year - end. • The decline in cap rates can be attributed to the limited supply of retail & office net lease properties with heightened investor demand. • During the 4 th quarter of 2015 the overall supply of net lease assets declined by more than 11 %. • The net lease market is expected to remain active in 2016 as investor demand for high quality, net lease assets remains high. Source: The Net Lease Market Report, 4th Quarter 2015. The Boulder Group

American Finance Trust, Inc. 7 WHY NET LEASE? Resilient Cash Flow: • Net leases are similar to a long term bonds due to nature of contractual, long lease terms. • Percentage leased tends to stay high with long term leases and high tenant retention. • Limited operating expenses and capital expenditures provides predictability of cash flow. Institutional Demand: • The net lease REIT industry has experienced a surge in transactions during the last three years. (1) • There are 13 public net lease REITs that comprise approximately 6% of the NAREIT Equity Index as of December 31, 2015. (2) • The net lease sector now roughly the same size as the industrial, lodging, and self - storage sectors. (2) • Public net lease REITs have highly geographically diverse portfolios. • The net lease sector has been an outperformer relative the benchmark and other REIT sectors over time. (1) Dealogic Analytics (2) Weightings per NAREIT REITWatch – January 2016. Net Lease Sector per Green Street includes O, NNN, SRC, STOR, SRG, ADC, GTY, VER, STAG, GPT, EPR, GNL, WPC (3) Per FactSet . Net Lease sector includes NNN, O, SRC, STOR, VER. Data as of 3/17/2016 (4) Per Green Street for Jan 2008 to March 2009,. Per FactSet for 1/1/2008 to 3/17/2016. Total return for the net l ease s ector has generally outpaced the REIT benchmark over time (3) The net lease s ector has been an outperformer since January 2008 (4) 12% 28% 132% 291% 4% 34% 79% 81% 0% 50% 100% 150% 200% 250% 300% LTM 3-Year 5-Year 10-Year Net Lease Sector Average RMZ (44%) (44%) (66%) (69%) (80%) (85%) 237% 138% 41% 81% 91% 59% (100%) 0% 100% 200% 300% Net Lease Healthcare Office Strip Center Mall Industrial Jan 08 - Mar 09 1/1/2008 - 3/17/2016

Walgreens (NASDAQ: WBA) Dollar General (NYSE (3) : DG) AutoZone (NYSE (3) : AZO) S&P Rating BBB BBB BBB Corporate Bond Yield (1) 3.80% 4.15% 3.25% AFIN Distribution Yield (2) 6.83% 6.83% 6.83% Spread (AFIN – Bond) 3.03% 2.68% 3.58% American Finance Trust, Inc. 8 LOW YIELD ENVIRONMENT Non - traded portfolios can offer exposure to the same investment grade companies and offer higher yields without the volatility of the public markets (1) At issuance (2) Based on most recent Estimated Per - Share NAV calculation (3) New York Stock Exchange

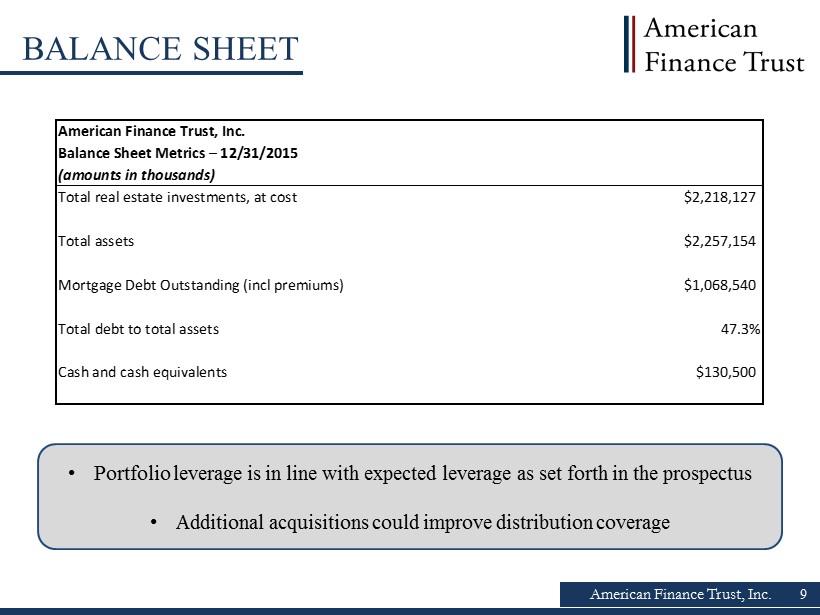

American Finance Trust, Inc. 9 BALANCE SHEET • Portfolio leverage is in line with expected leverage as set forth in the prospectus • Additional acquisitions could improve distribution coverage American Finance Trust, Inc. Balance Sheet Metrics – 12/31/2015 (amounts in thousands) Total real estate investments, at cost $2,218,127 Total assets $2,257,154 Mortgage Debt Outstanding (incl premiums) $1,068,540 Total debt to total assets 47.3% Cash and cash equivalents $130,500

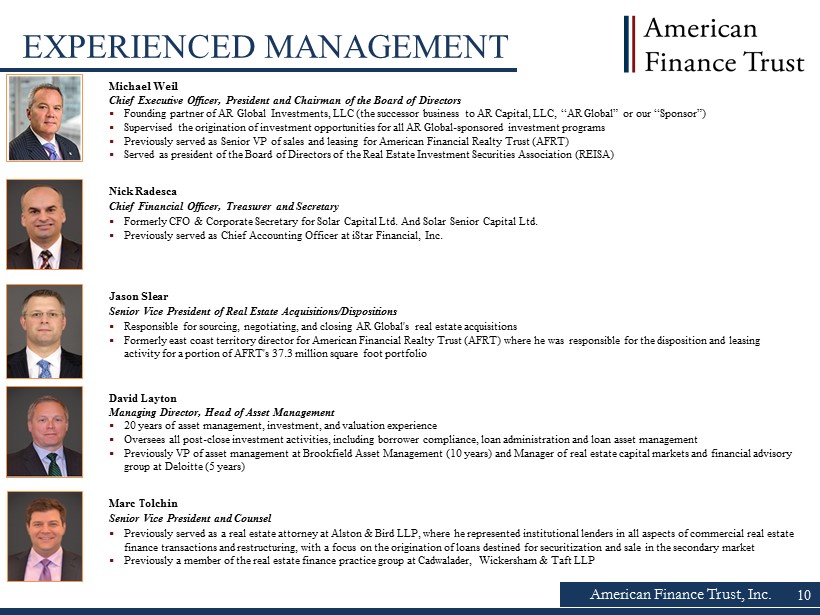

10 American Finance Trust, Inc. 10 EXPERIENCED MANAGEMENT David Layton Managing Director, Head of Asset Management ▪ 20 years of asset management, investment, and valuation experience ▪ Oversees all post - close investment activities, including borrower compliance, loan administration and loan asset management ▪ Previously VP of asset management at Brookfield Asset Management (10 years) and Manager of real estate capital markets and fi nan cial advisory group at Deloitte (5 years) Marc Tolchin Senior Vice President and Counsel ▪ Previously served as a real estate attorney at Alston & Bird LLP, where he represented institutional lenders in all aspects o f c ommercial real estate finance transactions and restructuring, with a focus on the origination of loans destined for securitization and sale in the sec ondary market ▪ Previously a member of the real estate finance practice group at Cadwalader, Wickersham & Taft LLP Jason Slear Senior Vice President of Real Estate Acquisitions/Dispositions ▪ Responsible for sourcing, negotiating, and closing AR Global's real estate acquisitions ▪ Formerly east coast territory director for American Financial Realty Trust (AFRT) where he was responsible for the dispositio n a nd leasing activity for a portion of AFRT's 37.3 million square foot portfolio Nick Radesca Chief Financial Officer, Treasurer and Secretary ▪ Formerly CFO & Corporate Secretary for Solar Capital Ltd. And Solar Senior Capital Ltd. ▪ Previously served as Chief Accounting Officer at iStar Financial, Inc. Michael Weil Chief Executive Officer, President and Chairman of the Board of Directors ▪ Founding partner of AR Global Investments, LLC (the successor business to AR Capital, LLC, “AR Global” or our “ Sponsor”) ▪ Supervised the origination of investment opportunities for all AR Global - sponsored investment programs ▪ Previously served as Senior VP of sales and leasing for American Financial Realty Trust (AFRT) ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association (REISA)

11 American Finance Trust, Inc. RISK FACTORS 11 Our potential risks and uncertainties are presented in the section titled “Item 1 A . Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31 , 2015 . The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements : ▪ All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Finance Advisors, LLC (our "Advisor") or other entities under common control with AR Global . As a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by affiliates of our Sponsor and conflicts in allocating time among these entities and us, which could negatively impact our operating results . ▪ Although we intend to list our shares of common stock on the New York Stock Exchange, there can be no assurance that our shares of common stock will be listed . No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . ▪ We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic viability of our tenants . ▪ Our tenants may not achieve our rental rate incentives and our expenses could be greater, which may impact our results of operations .

12 American Finance Trust, Inc. RISK FACTORS 12 ▪ We have not generated, and in the future may not generate, operating cash flows sufficient to cover 100 % of our distributions, and, as such, we may be forced to source distributions from borrowings, which may be at unfavorable rates, or depend on our Advisor to waive reimbursement of certain expenses or fees . There is no assurance that our Advisor will waive reimbursement of expenses or fees . ▪ We may be unable to pay or maintain cash distributions or increase distributions over time . ▪ We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates . ▪ We are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in the credit markets of the United States of America . ▪ We may fail to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and our cash available for distributions . ▪ We may be deemed by regulators to be an investment company under the Investment Company Act of 1940 , as amended (the "Investment Company Act"), and thus subject to regulation under the Investment Company Act .

ARCT - 5.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com