Attached files

| file | filename |

|---|---|

| EX-99.1 - POWERPOINT PRESENATION - Staffing Group, Ltd. | tsgl-20160322_8kex99z1.pdf |

| 8-K - CURRENT REPORT - Staffing Group, Ltd. | tsgl-20160322_8k.htm |

| Slide 1 |  |

THE STAFFING GROUP, LTD. Kim Thompson | CEO

|

| Slide 2 |  |

An Industry Ripe for Consolidation The Industrial Staffing Industry is highly fragmented. With a market projected to reach $40 billion in annual revenue by 2019 there are more 15,000 U.S. staffing companies with < $20MM in annual revenue Small operators seeking to exit face low valuations and poor deal structures. With limited resources for growth and increasing cost of capital, they are often left with few expansion opportunities beyond 2-3 geographies Conclusion A very large but highly fragmented market offers multiple acquisition opportunities at attractive valuations. Leveraging a proven platform and solid balance sheet, The Staffing Group, Ltd. will become an acquisition engine. |

| Slide 3 |  |

The opportunity Through proper capital allocation and a licensing agreement with Labor SMART, Inc., The Staffing Group will quickly build a full capacity company, utilizing Labor SMART’s corporate infrastructure as a platform for rapid growth · Unique opportunity to leverage an already established platform for maximum upside · Acquire businesses in the Industrial Staffing segment at 4x or less annual EBITDA · Economies of scale combined with sales and service synergies will drive superior value creation |

| Slide 4 |  |

Our advantages · Access to the most experienced Industry thought leaders and experts · Large network of Industry insiders to source deal flow · Capital allocation and deal structure model similar to PE firms

|

| Slide 5 |  |

The market Market opportunity A large fragmented market with no dominant competitor. 15,000 small staffing operators with few potential acquirers. We are positioned to gain significant market share through a disciplined acquisition and integration strategy. |

| Slide 6 |  |

How we will make money 2016 Complete platform acquisitions totaling over $15 million in annual revenue and $1.5 million Adj. EBITDA 2017 Expand platform brands through acquisition of $30 million in annual revenue and $3 million Adj. EBITDA. |

| Slide 7 |  |

Business model Source: Sourcing a high volume of quality small acquisition targets is key to our strategy. Execute: Capital allocation and deal structure to create positive cash flow and balance sheet enhancement with every acquisition. Integrate: By targeting small operators and leveraging an established platform, a disciplined integration strategy will prevent customer and staff attrition. Synergize: Improved cost of capital and cross selling opportunities with each acquisition. Economies of scale will be recognized quickly.

|

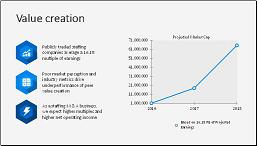

| Slide 8 |  |

Value creation · Publicly traded staffing companies average a 16.15 multiple of earnings · Poor market perception and industry metrics drive underperformance of peer value creation · As a staffing M & A business, we expect higher multiples and higher net operating income

|

| Slide 9 |  |

Contact THE STAFFING GROUP, LTD. Kim Thompson| CEO 678-881-0834 ir@staffinggroupltd.com twitter.com/thestaffgroup TheStaffingGroup |