Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - STR HOLDINGS, INC. | a2227817zex-21.htm |

| EX-31.2 - EX-31.2 - STR HOLDINGS, INC. | a2227817zex-31_2.htm |

| EX-23.1 - EX-23.1 - STR HOLDINGS, INC. | a2227817zex-23_1.htm |

| EX-32.1 - EX-32.1 - STR HOLDINGS, INC. | a2227817zex-32_1.htm |

| EX-31.1 - EX-31.1 - STR HOLDINGS, INC. | a2227817zex-31_1.htm |

| EX-32.2 - EX-32.2 - STR HOLDINGS, INC. | a2227817zex-32_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

PART IV

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2015 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

||

Commission file number 001-34529

STR Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

27-1023344 (I.R.S. Employer Identification No.) |

|

10 Water Street, Enfield, Connecticut (Address of principal executive offices) |

06082 (Zip code) |

Registrant's telephone number, including area code: (860) 272-4235

Securities registered pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

| |

Title of each class | |

||

|---|---|---|---|---|

| Common Stock $0.01 par value per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO ý

The aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015 was $9,457,070 based on the price of the last reported sale of $1.19 per share on the New York Stock Exchange on that date.

On February 29, 2016, the registrant had 18,345,703 outstanding shares of Common Stock, $0.01 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant's Proxy Statement for the 2016 Annual Meeting of Stockholders, to be filed by the registrant on or prior to 120 days following the end of the registrant's fiscal year ended December 31, 2015, are incorporated by reference into Part III of this Annual Report on Form 10-K.

1

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For a discussion of forward-looking statements, see the section captioned "Forward-Looking Statements" in Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations.

Reverse Stock Split

On January 30, 2015, we effected a reverse stock split of our common stock at a ratio of one share-for-every three shares of the outstanding common stock. The change in the number of shares resulting from the reverse stock split has been applied retroactively to all shares and per share amounts presented in this report, including the financial statements and accompanying notes included herein.

Overview

STR Holdings, Inc. and its subsidiaries ("we", "us", "our" or the "Company") commenced operations in 1944 as a plastics and industrial materials research and development company. Based upon our expertise in polymer science, we evolved into a global provider of encapsulants to the solar industry. Encapsulant is a critical component used to protect solar cells and hold solar modules together.

We were the first to develop ethylene-vinyl acetate ("EVA") based encapsulants for use in commercial solar module manufacturing. Our initial development effort was conducted while under contract to the predecessor of the U.S. Department of Energy in the 1970s. Since that time, we have expanded our solar encapsulant business, by investing in research and development and global production capacity.

In September 2011, we sold our Quality Assurance ("QA") business, which provided consumer product development, inspection, testing and audit services that enabled our retail and manufacturing clients to determine whether products met applicable safety, regulatory, quality, performance and social standards, to Underwriters Laboratories, Inc. ("UL") for $275.0 million in cash, plus assumed cash. The historical results of operations of our former QA business have been recast and presented as discontinued operations in this Annual Report on Form 10-K. Further information about our divestiture of the QA business is included in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 4, Discontinued Operations, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Our net sales and profitability have declined significantly since 2010. We attribute these declines primarily to a rapid shift of solar module production from the United States and Europe to Asia, particularly China, the loss of our largest customer in 2013, financial distress of certain of our key customers, intensified competition and steep price declines resulting from excess capacity that previously existed throughout the solar manufacturing industry.

For several years, we have been working to increase our market share in China through investments in people, research and development and facilities, including:

- •

- increasing our Chinese sales and technical service teams to develop customer relationships at the tactical level and provide customer service in the local language, custom and time zone;

2

- •

- investing in research and development to broaden the process window of our encapsulant products for use in Chinese module production

processes, which differ from those found in the western markets we have historically supplied; and

- •

- investing in or otherwise contracting local manufacturing capacity in China to shorten the order fulfillment cycle and to comply with customer demand for domestic production.

On January 13, 2014, our indirect subsidiary, STR Solar (Hong Kong), Limited, entered into a Contract Manufacturing Agreement (the "Manufacturing Agreement") with ZheJiang FeiYu Photo-Electrical Science & Technology Co., Ltd. ("FeiYu") and Zhejiang Xiesheng Group Co., Ltd., the parent corporation of FeiYu ("Xiesheng," and together with FeiYu, the "Manufacturer"), under which FeiYu agreed to manufacture certain of our encapsulant products to our specification. FeiYu currently has approximately 1.1 gigawatts ("GW") of annual active manufacturing capacity. In addition, we have built out our own leased 57,500 square foot manufacturing facility in Shajiabang, Changshu Jiangsu Province, China. This facility became operational in the fourth quarter of 2014 and currently has 1.0 GW of production capacity.

We continue to operate at a substantial net loss. Accordingly, we believe that we must continue to increase net sales to cover our current and anticipated operating expenses, and to achieve or sustain profitability in the future. We incurred net losses from continuing operations of approximately $13.4 million and $22.7 million for the years ended December 31, 2015 and 2014, respectively.

Transaction with Zhenfa

In 2014, we entered into a purchase agreement (the "Purchase Agreement") and certain other definitive agreements with Zhenfa Energy Group Co., Ltd., a Chinese limited liability company ("Zhenfa") and its affiliate, Zhen Fa New Energy (U.S.) Co., Ltd., a Nevada corporation (the "Zhenfa U.S.").

Sale of Common Stock and Special Dividend

Pursuant to the Purchase Agreement, on December 15, 2014 (the "Closing Date"), we completed the sale of an aggregate of approximately 9.2 million shares (the "Purchased Shares") of our common stock to Zhenfa U.S. for an aggregate purchase price of approximately $21.7 million, or $2.35 per share (the "Transaction"). The Purchased Shares represented approximately 51% of our outstanding shares of common stock as of the Closing Date. In addition, pursuant to the terms of the Purchase Agreement, two members of the Board of Directors resigned, effective as of the Closing Date, and the Board of Directors was expanded from five to seven members. Four new directors, all nominated by Zhenfa U.S., were appointed to the Board of Directors effective upon the closing of the Transaction, constituting a majority of the Board of Directors. The Board of Directors also formed a Special Committee of Continuing Directors comprised of John A. Janitz and Andrew M. Leitch, both of whom were independent members of our Board of Directors prior to the sale of the Purchased Shares. The Special Committee of Continuing Directors has the power and authority to, among other things, (i) represent us in enforcing all matters under the Purchase Agreement and (ii) review and approve certain related-party transactions with Zhenfa U.S. and its affiliates.

Upon the closing of the Transaction, we entered into a registration rights agreement (the "Registration Rights Agreement") with Zhenfa U.S. that will, among other things, require us to register, at our expense, the Purchased Shares upon the request of Zhenfa U.S. or certain transferees of Zhenfa U.S.

Further, in connection with the closing of the Transaction, we declared a special dividend (the "Special Dividend") on December 11, 2014, that was subsequently paid on January 2, 2015 to all of our

3

stockholders of record (other than Zhenfa U.S.), as of December 26, 2014, in an aggregate amount of approximately $22.6 million, or $2.55 per share of common stock.

Sales Service Agreement

In connection with the execution of the Purchase Agreement, Specialized Technology Resources, Inc., one of our operating subsidiaries, entered into a sales service agreement (the "Sales Service Agreement") with Zhenfa, whereby Zhenfa agreed, among other things, to assist us in a number of endeavors, including, without limitation, marketing and selling our products in China, acquiring local raw materials, hiring and training personnel in China and complying with Chinese law. Pursuant to the Sales Service Agreement, Zhenfa has also provided us with an option to lease a manufacturing facility owned by Zhenfa rent free for a period of at least five years. The Sales Service Agreement further provides that if we lease the facility, Zhenfa will provide us with an option to extend the lease at 50% of market rent (as to be determined) for a second five year term. We do not anticipate exercising our option to lease this additional manufacturing facility unless and until we determine we are able to achieve net sales to support the operation of this additional facility. In connection therewith we are also discussing with Zhenfa the opportunity to use alternative manufacturing sites owned or used by Zhenfa or its affiliates, to those contemplated in the Sales Service Agreement. The Sales Service Agreement became effective on December 15, 2014, has an initial term of two years and is automatically extended for one-year periods unless terminated earlier by either party.

Zhenfa and its affiliates (collectively, the "Zhenfa Group") is a leading solar systems integrator, engineering, procurement, and construction company and solar power station owner-operator within China. We entered into the Transaction with Zhenfa primarily for the following strategic considerations:

- •

- China has become the world's largest solar module manufacturing market. We have historically struggled to effectively penetrate that

market in order to compete effectively. The Zhenfa Group is owned and headquartered in China and represents a significant customer of many Chinese solar module manufacturers;

- •

- to enhance our presence in China and improve our operating results to the extent that the Zhenfa Group is successful in assisting us

in marketing and selling our products to Chinese solar module manufacturers;

- •

- the Sales Service Agreement contemplates that the Zhenfa Group will provide us the opportunity to lease on favorable terms a

manufacturing facility in China, and provide other valuable assistance in doing business in China; and

- •

- given our complementary businesses and geographic locations, additional opportunities may be available to expand our mutual cooperation throughout the solar value chain.

Our transactions with Zhenfa, in addition to providing a substantial cash dividend for our stockholders, provided us with a strategic alliance in China to assist us in the highly competitive Chinese solar encapsulant manufacturing market.

2015 Execution with Zhenfa and Assessment of Strategic Alternatives

Although our consolidated net sales have decreased, our net sales in China have increased by 63% in 2015 compared to 2014. We attribute this increase to our ongoing efforts to increase our share of the Chinese market, as well as the assistance provided to us by Zhenfa. Notwithstanding these increases, we have not yet been able to achieve the necessary sales volume to reach break-even EBITDA, as market penetration in China continues to be a difficult process and intense competition, including pricing pressure, persists.

4

Encapsulant Business Restructuring

During 2015, our Spanish facility generated incremental Adjusted EBITDA. We intend to continue to seek incremental improvement to our Chinese operations, with the understanding that the business environment in China continues to be challenging, even with Zhenfa's assistance.

In July 2015, following a recent decision by our largest customer to exit its OEM module production in Malaysia, we decided to cease production at our Malaysian facility effective August 2, 2015. We continued to fulfill orders to this customer from our Spain and China facilities. Other factors contributing to the decision to close the facility included underutilization, increasing costs in Malaysia resulting from the recent introduction of a Goods & Services Tax, and the investigation by the European Commission that may result in anti-dumping and countervailing duties on solar cells and modules consigned from China and assembled in Malaysia and Taiwan. We have been seeking to sell the Malaysia facility and have sold certain of its production and ancillary equipment. Earlier in 2015, the Malaysia real estate had been appraised at approximately $8.0 million. In connection with the shut-down and sale of the Malaysia facility, we incurred approximately $1.3 million of associated non-recurring costs during the second half of 2015. We cannot assure that we will be able to sell our Malaysian real estate on a timely basis or on favorable terms, if at all, that the costs of closure of that facility will not be higher than anticipated, or that we will be able to achieve the expected savings. Should market conditions warrant, and provided we have not yet sold the associated PP&E, we may consider restarting the facility, among other options, to provide us with additional capacity. Returning the facility to operational condition would entail replacing some ancillary equipment sold at auction and rebuilding the manufacturing team, the costs for which have been neither calculated nor analyzed.

Assessment of Entry into Downstream Solar

Over the past several years, we believe that profits in the solar supply chain have shifted from upstream manufacturers to downstream service providers and solar project owners. With Zhenfa's assistance under our Sales Service Agreement, we have assessed multiple downstream projects, but have no current actionable investment opportunities. We expect to continue to evaluate potential opportunities to participate in the downstream market as they arise, which may include construction financing of solar projects, acquisition and ownership of operating solar projects and developing solar projects.

Change in Securities Market for Common Stock

On September 29, 2015, we were notified by the New York Stock Exchange (the "NYSE") that we were not in compliance with the continued listing standards set forth in Section 802.01B of the NYSE Listed Company Manual due to our failure to maintain an average global market capitalization over a consecutive 30 trading-day period of at least $15.0 million. Our common stock began trading on the OTC Pink Marketplace beginning on September 30, 2015 under the ticker symbol "STRI." Following our upgrade application to the OTC Marketplace, our common stock began trading on the OTCQX Marketplace under the symbol "STRI", effective October 5, 2015.

Solar Energy Market Overview

Solar energy has emerged as one of the most rapidly growing sources of renewable energy. A number of different technologies have been developed to harness solar energy. The most prevalent technology comprises interconnected photovoltaic ("PV") cells to generate electricity directly from sunlight. Solar energy has many advantages over other renewable and non-renewable electricity sources relative to environmental impact, delivery risk, distributed generation, matching of peak generation with demand, and low maintenance and installation cost at competitive prices in many global markets.

5

PV systems have been used to produce electricity for several decades. However, technological advances and production efficiencies combined with the rising costs of conventional/carbon-based electricity and the availability of government subsidies and incentives, have led to solar becoming one of the fastest growing renewable energy technologies.

Government incentive programs, which make solar energy more price competitive with other energy sources, are among the key demand drivers for PV. Historically, the largest growth in the demand for PV was in the European Union, driven by its goal of generating 20% of its electricity from renewable sources by 2020. However, Europe's share of global demand has recently declined and is expected to continue to decline as many European Union countries, such as Germany and Italy, continue to reduce their subsidy programs in light of financing constraints, overall fiscal policy, and saturation due to cumulative installed capacity. The reduction in subsidies and increased competition in the solar industry have driven a reduction in selling prices throughout the supply chain that is expected to yield future unit volume growth in new end markets as grid- parity is achieved and a price-elastic model continues to develop. We anticipate continued growth in installations of PV modules in the United States, China, India, South America, Africa and the Middle East.

Despite our expectations for favorable conditions for the adoption of solar electricity generation, solar energy continues to represent only a small fraction of the world's electricity supply.

Solar Energy Systems

Solar electricity is primarily generated by PV systems comprised of solar modules, mounting structures and electrical components. PV systems are either grid-connected or off-grid. Grid-connected systems are tied to the transmission and distribution grid and feed electricity into the end-user's electrical system and/or the grid. Such systems are commonly mounted on the rooftops of buildings, integrated into building facades or installed on the ground using support structures, and range in size from a small number of kilowatts to hundreds of megawatts. Off-grid PV systems are typically much smaller and are frequently used in remote areas where they may be the only source of electricity for the end-user.

Solar Modules

PV cells are semiconductor devices that convert sunlight directly to electricity by a process known as the photovoltaic effect. A solar module is an assembly of PV cells that are electrically interconnected, laminated and framed in a durable and weatherproof package.

There are two primary commercialized categories of solar cells: crystalline silicon and thin-film. PV devices can be manufactured using different semiconductor materials, including mono-and poly-crystalline silicon for silicon cells, and amorphous silicon, gallium arsenide, copper indium gallium selenide and cadmium telluride, among others, for thin-film cells. Crystalline silicon cells typically operate at higher conversion efficiency. Historically, crystalline silicon cells have been higher in cost due to a more complex production process and the need for more expensive raw materials. In recent years, the price of polysilicon has declined rapidly, eroding the cost advantage of thin-film cells, while the gap in conversion efficiency narrows due to more rapid improvements in the thin-film sector.

During the last five years, the production of solar modules has migrated rapidly from the U.S. and Europe to Asia, primarily China.

Encapsulants

Regardless of the technology used to create solar energy from a PV system, the core component of the solar cell is the semiconductor circuit. To protect and preserve that circuit, solar module manufacturers typically use an encapsulant. Encapsulants are critical to the proper functioning of solar

6

modules, as they protect cells from the elements, bond the multiple layers of a module together and provide electrical isolation. Encapsulants must incorporate high optical transparency, stability at high temperatures and high levels of ultraviolet radiation, good adhesion to different module materials, adequate mechanical compliance to accommodate stresses induced by differences in thermal expansion and contraction between glass and cells, good dielectric properties (electrical isolation) and resistance to potential induced degradation. Even slight deterioration of any of these properties over time could significantly impair the electrical output of the solar module, which is of critical importance in the solar industry, where solar module manufacturers typically provide 20 to 25-year warranties for their products.

Over the years, various encapsulant materials have been used in solar modules, including EVA, polyvinyl butyral ("PVB"), polyolefin elastomer ("POE") and poly dimethyl siloxane or silicone. We currently use EVA to make substantially all of our encapsulant products, although we are currently commercializing a range of POE encapsulants. Our encapsulants are modified with additives to increase stability for long-term outdoor applications, such as solar modules. We have also begun selling EVA interlayer to the laminated glass market to further expand our product offering.

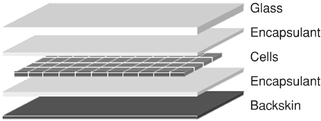

During solar module assembly, encapsulation is typically accomplished by vacuum lamination, wherein a "pre-lam" stack (as depicted in the following diagram) is fashioned into a singular part comprising multiple layers. Thin sheets of EVA are positioned on either side of the PV cells, top and bottom. Heating the "sandwich" then causes the EVA to melt and then to cure, or crosslink, bonding the module into one piece. This step occurs towards the end of the manufacturing process and is critical to the entire solar module, as there is only one opportunity to laminate correctly.

Solar Module Component Stack—Crystalline Silicon

Excessive shrinkage or inadequate adhesion (associated with improperly formulated encapsulants) can occur during lamination and may result in voids or holes in the encapsulant, which are considered defects and cause for rejection of the entire panel. Upon direct exposure to the elements, encapsulants are susceptible to several performance failures, which may jeopardize the integrity and performance of the entire solar module and lead to significant warranty costs for solar module manufacturers. The most significant failures include:

- •

- Loss of clarity—the propensity of an encapsulant to "brown" after long-term exposure to ultraviolet ("UV") light, leading

to a permanent loss of transparency. If an encapsulant positioned above the cells loses its transparency, the power output of the module will be reduced.

- •

- Module delamination—the loss of adhesion between the encapsulant and other module layers. Delamination in the field could occur in cases where the encapsulant was improperly cured or where incompatibilities between the encapsulant and other module components exist. Most delamination observed in the field has occurred at the interface between the encapsulant and the front surface of the solar cells. Delamination is more frequent and more severe in hot and humid climates, sometimes occurring after less than five years of exposure. Delamination first causes a performance loss due to optical de-coupling of the encapsulant from the cells. Of greater concern from a module lifetime perspective is the likelihood that the void resulting from

7

- •

- Potential Induced Degradation ("PID")—the loss of electrical output caused by sodium ion migration from the cover glass, through the encapsulant to the cell, is a factor that could adversely impact the energy yield of crystalline silicon solar modules. PID can occur in some solar module installations where a transformerless inverter is used in combination with a high negative voltage bias applied to the solar cells. The magnitude of the power loss depends upon many factors, including the applied voltage bias and the type of surface coatings on the solar cells. Specific encapsulant chemistry, such as in our recent product introductions, has been demonstrated to help inhibit power loss due to PID.

the delamination will provide a preferential location for moisture accumulation, greatly increasing the possibility of corrosion failures in metallic contacts and resulting in module failure.

Despite the critical nature of encapsulant to solar cell applications, the encapsulant represents a small percentage of the total manufacturing cost of the solar module.

We typically sell our encapsulants in square meters. However, because the solar industry's standard measurement for production volume and capacity is watts, megawatts ("MW"), or gigawatts ("GW"), we convert our capacity and production volume from square meters to approximate MW depending on the applicable conversion efficiencies specific to our customers. The conversion rate is approximately 13,000 square meters of encapsulant per MW. This rate is based on our calculations using publicly available information, our industry experience and assumptions that our management believes to be appropriate and reasonable. Certain production capacity and market metrics included in this Annual Report on Form 10-K are based on these calculations. Our calculations may not be accurate, and we may change the methodology of our calculations in the future as new information becomes available. In that case, period-to-period comparisons of such metrics may not be perfectly comparable.

Financial Information About Our Segment and Geographic Areas

Financial information about our segment and geographical areas of operation is included in Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 19-Reportable Segment and Geographical Information, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Our Products

Drawing upon our considerable experience, we develop our formulations internally and work in conjunction with our customers to meet their varying requirements. Our encapsulant formulations offer a range of properties and processing attributes, including various curing times and temperatures that align with the requirements of our customers' individual lamination processes and module constructions. Our formulations can be used in both crystalline silicon and thin-film modules.

Our Markets and Customers

Our customers are solar module manufacturers located primarily in North America, Europe and Asia. We typically sell our encapsulants on a purchase order basis that specifies prices and delivery parameters, but can be cancelled or postponed prior to production. We also provide technical support and assist our customers when they are qualifying solar modules that utilize our products, which can take from two months to more than two years. Historically, our sales strategy has focused on developing long-term relationships with solar module manufacturers and working collaboratively during their product development efforts. We use independent sales agents as a part of our growth strategy, primarily in China and India.

8

Over the past several years, many of our western customers continued to lose market share to lower-cost Chinese module manufacturers, with many being forced into bankruptcy or exiting the solar business as module production migrated rapidly to Asia, primarily China. We have been actively trying to enhance our presence and improve our competitiveness in China.

ReneSola Ltd., and its subsidiaries ("ReneSola"), and Global Wedge, Inc., each accounted for at least 10% of our net sales, and in the aggregate accounted for approximately 28% of our net sales for the year ended December 31, 2015. In 2014, ReneSola accounted for approximately 37% of our net sales for the year ended December 31, 2014, while no other customer accounted for more than 10% of net sales. Our top five customers accounted for approximately 49% and 64% of our net sales in 2015 and 2014, respectively.

Our Operations

Facilities and Equipment

We currently operate production facilities in Llanera, Asturias, Spain and Shajiabang, Changshu, Jiangsu Province, China. These production facilities are augmented by our research, development and testing laboratory in Enfield, Connecticut, which is co-located with our corporate headquarters and our pilot production facility.

We also own a dormant production facility in Johor, Malaysia, which we have had on the market for sale since the third quarter of 2015. Should we fail to receive an acceptable offer for this property and if market conditions warrant we may consider restarting production in this facility among other options.

In March 2013, we ceased manufacturing operations at our East Windsor, Connecticut location and sold this facility in October 2014. We currently have total annual production capacity of approximately 5.1 GW, with 3.0 GW at our Spain location and 1.0 GW at our China facility. In addition, our Manufacturing Agreement with FeiYu provides us with approximately 1.1 GW of additional annual manufacturing capacity in China.

We are also contemplating returning one of our pilot production lines based in Connecticut to full production status in order to help launch our new POE encapsulants in North America. This production line is capable of manufacturing approximately 450MW of POE on an annual basis. The decision to produce POE in Connecticut on a production scale will be based on demand resulting from our current efforts to launch this new product line in North America and globally.

Our production lines incorporate our proprietary technology and processes. We rely on third-party equipment manufacturers to produce our manufacturing lines to our specifications, which we then further customize in-house. Most of our production lines are functionally equivalent, having the ability to manufacture all of our formulations and providing us with flexibility in meeting shifting trends in global demand.

Encapsulant Production Process

Our production process typically begins by mixing EVA pellets with several additives to give the encapsulant its desired properties. The mixture is then melted, homogenized, pressurized and forced through a die to create an "EVA curtain", forming a continuous encapsulant sheet. The sheet then progresses downstream in a proprietary process and ultimately wound into rolls, slit to the desired width, and packaged for shipment to customers.

9

Our manufacturing quality program is ISO 9001 certified. We have a high level of automation at each of our facilities that includes real-time computerized monitoring of the manufacturing process. Such automation provides consistency across our facilities so we can satisfy customer orders at all of our manufacturing locations. In addition, our enterprise resource planning system allows us to efficiently plan our production by location with global, real-time visibility.

We test our products in real-time and at a high frequency after production. The Quality Department at all of our manufacturing facilities follows our global quality assurance program and has a mandate to disposition products that do not meet required standards.

Raw Materials

Resin is the primary raw material used in our process, accounting for more than half of our manufacturing costs. A number of additives as well as packaging materials represent the remainder of our raw material costs.

We have multiple vendors for resin. Our objective has been to carry at least a five-week supply of resin to provide protection against supply interruptions resulting from inclement weather, natural disasters and strikes. The stock is distributed among our production facilities and warehouses so that a disruptive event at one location would not affect our ability to continue production. We have qualified resin suppliers local to each of our manufacturing facilities and continue to pursue qualification of additional resin suppliers.

Seasonal Trends

Our business could be adversely affected by seasonal trends, holiday seasons and weather patterns. See Item 1A-Risk Factors for more information.

Our Competition

We face intense competition in the solar encapsulant market and have experienced a significant decline in our global market share from approximately 30% in 2010 to approximately 3% in 2015. We compete with a number of encapsulant manufacturers, including Bridgestone Corporation, Hangzhou First PV Material Co., Ltd., Mitsui Chemicals Group, Inc. and SK Chemical Ltd. We also face competition from suppliers of non-EVA encapsulants including 3M Company, Dow Chemical Corporation, Dow Corning Corporation, Dai Nippon Printing Co., Ltd., and E.I. DuPont De Nemours and Company ("DuPont"). Over the years, various alternative encapsulant materials have been used in solar modules, including POE, PVB and silicone. Many of our competitors are large, global companies with substantially more financial, manufacturing and logistical resources. Also, low-cost solar module manufacturers have emerged in Asia, primarily in China, who compete with our legacy customers in Western markets. As the China solar market matures, additional encapsulant providers from China and the greater Asian markets may compete with us. We compete on the basis of various factors, including:

- •

- price;

- •

- product performance, including quality and technology;

- •

- product innovations;

- •

- customer service and technical support; and

- •

- delivery timing and logistics.

We expect competition in the encapsulant space to continue to be intense.

10

Qualification and Certification

Design certification programs for solar modules measure performance under simulated or advanced environmental conditions. In certifying their solar modules, our customers must qualify the encapsulant utilized within their product. The certification and qualification tests related to solar modules are defined in the following standards: IEC 61215 (crystalline silicon), IEC 61646 (thin-film) and UL 1703.

A successful qualification test program typically means that the tested models/types of solar modules have been subjected to and have passed the minimum requirements of the relevant standards. In addition, many PV module manufacturers often use internal validation tests that are beyond the scope and requirements of IEC and UL. These tests require suppliers to spend more time and investment to become approved suppliers for the module manufacturer's bill of materials. Qualification or certification does not guarantee any performance, but is designed to provide reasonable assurance that the solar modules of the tested model or type will perform reliably under field conditions.

Under guidelines developed by the IEC/TC82/WG2 committee in 2000, modifications to the encapsulation system for solar modules can require retesting of the solar module. Such guidelines call for various retesting if there is any change in the chemistry of the encapsulant used in the solar module.

Employees

As of December 31, 2015, we employed approximately 165 people on a full or part-time basis. We maintain a non-unionized workforce, with the exception of some employees in our manufacturing facility in Spain, where unions are statutory. We have not experienced any significant work stoppages during the past five years.

Executive Officers

The following table sets forth the names and ages, as of March 1, 2016, of our executive officers. The descriptions below include each such person's service as a board member or an executive officer of STR Holdings, Inc. and our predecessor.

Name

|

Age | Position | |||

|---|---|---|---|---|---|

Robert S. Yorgensen |

52 | Chairman, President and Chief Executive Officer | |||

Thomas D. Vitro |

55 | Vice President, Chief Financial Officer and Chief Accounting Officer | |||

Robert S. Yorgensen. Mr. Yorgensen has been our Chairman since December 2014 and our President and Chief Executive Officer and a director of our board since January 2012. Prior to becoming our CEO, Mr. Yorgensen was Vice President of STR Holdings, Inc., and President of our Solar Division since 2007, and has been employed with us for over 30 years. Mr. Yorgensen has held a variety of positions with us, including Extruded Products Manager and Senior Technical Specialist of Materials RD&E and Specialty Manufacturing, Technical Specialist of Materials RD&E and Specialty Manufacturing and Project Leader of Development Engineering and Specialty Manufacturing. He holds a Bachelor of Technology, Mechanical Engineering degree from the University of Connecticut and an A.S. from Hartford State Technical College.

Thomas D. Vitro. Mr. Vitro has been our Vice President and Chief Financial Officer since December 2015 and is responsible for all finance and accounting functions of the Company. Previously, Mr. Vitro served in various positions with us between 1982 and 2013, most recently as Vice President, Finance from 2009 to 2013. Prior to that, he was the Corporate Controller from 1988 to 2009. Mr. Vitro has a Bachelor of Science in Accountancy from Bentley University and is a Certified Management Accountant.

11

Each executive officer holds office for a term of one year and until his successor is duly elected and qualified, in accordance with our bylaws.

Intellectual Property

Our intellectual property consists of multiple encapsulant formulations, as well as several processes and sub-processes, and our trademarks "STR®", "PhotoCap®" and "STR Protected®." As appropriate, we require employees, suppliers and customers to execute confidentiality agreements.

We own a number of trademarks, trade secrets and other intellectual property rights that relate to our products. We typically rely on trade secrets rather than patents to protect our proprietary manufacturing processes, proprietary encapsulant formulations, methods, documentation and other technology, as well as certain other business information. Patent protection requires a costly and uncertain federal registration process that would place our confidential information in the public domain. While we enter into confidentiality agreements with our employees and third parties to protect our intellectual property rights, such confidentiality provisions related to our trade secrets could be breached and may not provide meaningful protection for our trade secrets. Also, others may independently develop technologies or products that are similar or identical to ours. In such case, our trade secrets would not prevent third parties from competing with us. See Item 1A—Risk Factors and Item 3—Legal Proceedings.

Environmental Regulation

We are subject to a variety of environmental, health and safety and pollution-control laws and regulations in the jurisdictions in which we operate. The cost of compliance with these laws and regulations is not material and we do not believe the cost of compliance with these laws and regulations will be material. We use, generate and discharge hazardous substances, chemicals and wastes at some of our facilities in connection with our product development and manufacturing activities. Any failure by us to restrict adequately the discharge of such substances, chemicals or wastes could subject us to potentially significant liabilities, clean-up costs, monetary damages, fines or suspensions in our business operations. In addition, some of our facilities are located on properties with a history of use involving hazardous substances, chemicals and wastes and may be contaminated. For example, we are in the process of monitoring recently performed environmental remediation at our 10 Water Street, Enfield, Connecticut location under a state remediation program. During our investigation, the site was found to contain a presence of volatile organic compounds, and we have removed contaminated soil to remediate these conditions. The estimated remaining cost we expect to pay to monitor the property is approximately $0.1 million. If we elect to sell, transfer or change the use of the facility, additional environmental testing would be required. We cannot assure that we will not discover further environmental contamination or that we would not be required to incur significant expenditures for environmental remediation in the future.

Available Information

Information regarding us, including corporate governance policies, ethics policies and charters for the committees of the Board of Directors can be found on our internet website at http://www.strsolar.com and copies of these documents are available to stockholders, without charge, upon request to Investor Relations, STR Holdings, Inc., 10 Water Street, Enfield, Connecticut 06082. The information contained in our website is not intended to be incorporated into this Form 10-K. In addition, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are made available free of charge on our internet website on the same day that we electronically file such material with, or furnish it to, the SEC. Information filed with the SEC may be read or copied at the SEC's Public Reference Room at 100 F Street, N.E.,

12

Washington, D.C. 20549. Information on operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. These filings are also available to the public from commercial document retrieval services and at the internet website maintained by the SEC at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

An investment in our common stock involves a very high degree of risk. You should carefully consider the following risks, as well as the other information in this Annual Report on Form 10-K, before making an investment in us. If any of these risks, or other events that we do not currently anticipate or that we currently deem immaterial, actually occur, our business, results of operations or financial condition may be materially adversely affected. In such an event, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Business

We have recently incurred substantial losses and we may not be able to achieve or sustain profitability in the future.

We incurred net losses from continuing operations of $13.4 million and $22.7 million for the years ended December 31, 2015 and 2014, respectively. Although we are pursuing plans to improve our financial results, such plans contemplate significant increases in net sales volume compared to 2015 volume. Failure to achieve such net sales may result in continued substantial net losses and will have a material adverse effect on our business, prospects and financial condition.

We have a limited amount of cash, a limited factoring arrangement and may not be able to obtain credit.

As of the date of this report, we had no credit facilities other than a limited factoring arrangement in Spain. In recent years, the credit markets have experienced unprecedented levels of volatility and disruption. In many cases, the markets still have limited credit capacity for certain issuers, and lenders have requested more restrictive terms. The market for new debt financing is extremely limited and in some cases not available at all to meet our liquidity needs or to fund growth in our business. As a result, until we return to profitability, it is not likely that we will be able to obtain debt or other financing on reasonable terms, or at all. Furthermore, tight credit in the solar manufacturing industry may delay or prevent our customers from securing funding adequate to operate their businesses and purchase our products and could lead to an increase in our bad debt levels.

As of December 31, 2015, our principal source of liquidity was $7.7 million of cash, $2.1 million due from Zhenfa and approximately $8.3 million of income tax receivables. Our principal needs for liquidity have been and for the foreseeable future will continue to be, for capital investments and working capital. Payment terms are currently longer in China than in many other markets, resulting in delayed cash receipts from certain of our customers. Although we believe that our available cash will be sufficient to meet our liquidity needs, including for capital investments, through at least the next 12 months, if we are unable to collect our receivables or obtain bank acceptance notes (which customers in China frequently provide to settle their payables to the Company), or fail to receive payment of receivables in a timely fashion, our financial condition and results of operations will be negatively affected.

We currently rely on a single product line for nearly all of our net sales.

In 2015 and 2014, we derived substantially all of our net sales from solar encapsulant products. For our business to succeed, we will have to achieve broader market acceptance of our products. As a result, factors adversely affecting the demand for our solar encapsulants, such as competition, pricing or

13

technological change, could materially adversely affect our business, financial condition and results of operations.

Our business's growth is dependent upon securing net sales to new customers, growing net sales to existing key customers and increasing our market share, particularly in China.

We estimate that our global market share has declined significantly from approximately 30% in 2010 to approximately 3% in 2015. The future success of our business depends on our ability to secure net sales to new customers, to grow net sales to existing key customers and to increase our global market share. Over the last few years, we believe our European and North American customers have lost market share to Asian module manufacturers, primarily from China, who continue to penetrate the global solar market. In order to be successful, we believe that we will need to significantly increase our net sales, including to Chinese module manufacturers. Our failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Our business is dependent on a limited number of customers, which may cause significant fluctuations or result in declines in our net sales.

The solar module industry is relatively concentrated, and we expect this concentration to increase as the industry continues to consolidate. As a result, we sell substantially all of our encapsulants to a limited number of solar module manufacturers. We expect that our results of operations will, for the foreseeable future, continue to depend on the sale of encapsulants to a relatively small number of customers. ReneSola Ltd and its subsidiaries ("ReneSola") and Global Wedge, Inc., each accounted for at least 10% of our net sales, and in the aggregate accounted for approximately 28% of our net sales for the year ended December 31, 2015. ReneSola accounted for approximately 37% of our net sales for the year ended December 31, 2014, while no other customer accounted for more than 10% of net sales. Our top five customers accounted for approximately 49% and 64% of our net sales in 2015 and 2014, respectively. Furthermore, participants in the solar industry, including our customers, are experiencing pressure to reduce their costs. Since we are part of the overall supply chain to our customers, any cost pressures experienced by them may affect our business and results of operations. Our customers may not continue to generate significant net sales for us. Conversely, we may be unable to meet the production demands of our customers or maintain these customer relationships. Any one of the following events may cause material fluctuations or declines in our net sales and have a material adverse effect on our business, financial condition and results of operations:

- •

- reduction in the price that one or more of our significant customers is willing to pay for our encapsulants;

- •

- reduction, postponement or cancellation of orders from one or more of our significant customers;

- •

- selection by one or more of our customers of products competitive with our encapsulants;

- •

- loss of one or more of our significant customers and failure to obtain additional or replacement customers; and

- •

- failure of any of our significant customers to make timely payment for our products, if at all.

We currently outsource and rely on a third-party for the manufacture of a portion of our encapsulants, and our future success will be dependent on the timeliness and effectiveness of the efforts of this third party.

We have engaged a third-party manufacturer, FeiYu, to supply certain of our proprietary products to us in China. If problems develop in our relationship with FeiYu, or if FeiYu fails to perform as expected, it could lead to product defects, manufacturing and shipping delays, significant cost increases,

14

changes in our strategies, and even failure of our initiatives, each of which may have a material adverse effect on our business, financial condition, and results of operations.

Technological changes in the solar energy industry or our failure to develop and introduce or integrate new technologies could render our encapsulants uncompetitive or obsolete, which would adversely affect our business.

The solar energy market is very competitive, rapidly evolving and characterized by continuous improvements in solar modules to increase efficiency and power output and improve aesthetics. This requires us and our customers to invest significant financial resources to develop new products and solar module technology to enhance existing modules to keep pace with evolving industry standards and changing customer requirements and to compete effectively in the future. During 2013, we engaged in significant cost-reduction actions, including substantial reductions to our research and development and engineering personnel. The reduction of these resources may limit our ability to introduce new products or manufacturing improvements and may put us at a competitive disadvantage, which could negatively impact our ability to increase or maintain our market share and generate net sales, and negatively impact our financial condition, prospects and results of operations. Consequently, our competitors may develop encapsulant products and technologies that perform better or are more cost-effective than our products. This could cause our encapsulants to become uncompetitive or obsolete, which would adversely affect our business, financial condition and results of operations. Product development activities are inherently uncertain, and we could encounter difficulties and increased costs in commercializing new technologies. As a result, our product development expenditures may not produce corresponding benefits.

Moreover, we produce a component utilized in the manufacture of solar modules. New or existing solar technologies that do not require encapsulants as we produce them, or at all, may emerge and/or gain market share. Recently, competitors have introduced new encapsulant products to the market based upon POE. We believe that certain of our former customers are now using POE encapsulant for their modules. Although we have been pursuing the development of POE products, such products are not yet in regular commercial production and it is uncertain as to when or if we will manufacture and sell such products on a regular basis. In the event that solar module manufacturers switch to POE encapsulant products from EVA encapsulants and we do not offer a competitive POE product, such switch could materially and adversely affect our business, financial condition and results of operations.

Also, manufacturing methods may emerge that could be more advanced or efficient than our current manufacturing capability. Such manufacturing methods could result in competitive products that are more effective and/or are less expensive to produce, resulting in decreased demand for our encapsulants or render them obsolete, which would adversely affect our business, financial condition and results of operations.

We face competition in our business from other companies producing encapsulants for solar modules.

The market for encapsulants is highly competitive and continually evolving. We compete with a number of encapsulant manufacturers, many of which are large, global companies with substantially more financial, manufacturing and logistical resources and strong customer relationships. If we fail to attract and retain customers for our current and future products, we will be unable to increase our net sales and market share. Our primary encapsulant competitors include Bridgestone Corporation, Hangzhou First PV Material Co., Ltd., Mitsui Chemicals Group, Inc. and SK Chemical Ltd. We also face competition from suppliers of non-EVA encapsulants including 3M Company, Dow Chemical Corporation, Dow Corning Corporation, Dai Nippon Printing Co., Ltd., and DuPont. We also expect to compete with new entrants to the encapsulant market, including those that may offer more advanced technological solutions or complementary products such as backsheet that possess advanced or more efficient manufacturing capabilities or that have greater financial resources than we do. Some solar

15

module manufacturers have encapsulant production capabilities of their own and this trend may broaden with market consolidation. Further, as the China solar market matures, we expect additional encapsulant providers from China and the greater Asian markets to compete with us. Our competitors may develop and produce or may be currently producing encapsulants that offer advantages over our products. A widespread adoption of any of these technologies could result in a rapid decline in our position in the encapsulant market and adversely affect our net sales and margins.

Excess capacity currently exists throughout the solar supply chain leading to substantial solar module price declines, which has caused cost to become the predominant factor in the encapsulant procurement process.

Although recently improving, excess capacity currently exists and may exist again in the future throughout the solar supply chain resulting in decreased selling prices of solar modules. Due to many module manufacturers not producing at full capacity as well as being impacted by pricing pressure, our encapsulants' value proposition has been reduced in the current excess capacity environment. Our customers and potential customers have been increasingly focused on the purchase price of encapsulants. In light of recent declines in our global market share, it is a priority to increase our market share through net sales to existing customers and to new customers. In order to remain competitive, we expect to be subject to continuing pricing pressures that will negatively impact our net sales and net earnings. In addition, our competitors may reduce the price of their products, which may force us to further reduce the price of our encapsulant products to retain net sales.

If demand for solar energy in general and solar modules in particular does not continue to develop or takes longer to develop than we anticipate, net sales in our business may continue to stagnate or decline, which would negatively affect our financial condition and results of operations.

Our encapsulants are used in the production of solar modules; therefore our financial condition and results of operations and future growth are tied to a significant extent to the overall demand for solar energy and solar modules. The solar energy market is at a relatively early stage of development and the extent to which solar modules will be widely adopted is uncertain. Many factors may affect the viability and widespread adoption of solar energy technology and demand for solar modules, and in turn, our encapsulants, including:

- •

- cost-effectiveness of solar modules compared to conventional and non-solar renewable energy sources and products;

- •

- performance and reliability of solar modules compared to conventional and non-solar renewable energy sources and products;

- •

- availability and amount of government subsidies and incentives to support the development and deployment of solar energy technology;

- •

- rate of adoption of solar energy and other renewable energy generation technologies, such as wind, geothermal and biomass;

- •

- seasonal fluctuations related to economic incentives and weather patterns;

- •

- impact of fiscal issues experienced by governments, primarily in Europe;

- •

- fluctuations in economic and market conditions that affect the viability of conventional and non-solar renewable energy sources, such

as increases or decreases in the prices of fossil fuels and corn or other biomass materials;

- •

- changes in global economic conditions including increases in interest rates and the availability of financing and investment capital that is required to fund solar projects.

16

- •

- fluctuations in capital expenditures by end users of solar modules, which tend to decrease when the overall economy slows down;

- •

- the extent to which the electric power and broader energy industries are deregulated to permit broader adoption of solar electricity

generation;

- •

- the cost and availability of polysilicon and other key raw materials for the production of solar modules;

- •

- construction of transmission facilities in certain areas to transport new solar energy loads;

- •

- saturation in certain markets such as Europe; and

- •

- rate of adoption of solar energy in growing solar markets such as the United States, China, India, the Middle East and Africa.

For example, we experienced a decline in our business during 2012 and 2011 partially due to overcapacity in the solar supply chain that created excess module inventory, primarily of low-cost Chinese modules, due to weaker-than-expected demand driven by the European financial crisis, global economic uncertainty, falling module prices that did not stabilize and further potential solar subsidy cuts. The result of these dynamics was primarily the loss of the market share of our Western customer base to their Chinese competition, which in turn drove reductions in our net sales and our market share. In 2009, we also experienced a decline in our business mainly due to decreased global demand for solar energy as a result of legislative changes, such as the cap in feed-in tariffs in Spain implemented in 2008, the global recession and the worldwide credit crisis.

If demand for solar energy and solar modules fails to develop sufficiently along our expectations, demand for our customers' products as well as demand for our encapsulants will decrease, and we may not be able to grow our business or net sales and our financial condition and results of operations will be negatively impacted.

Our operations and assets in China are subject to significant political and economic uncertainties.

We manufacture our products in China within our own leased manufacturing plant, and also engage a third-party located in China to toll for us. If the manufacture of our products in China is disrupted, our overall capacity could be significantly reduced and net sales and/or profitability could be negatively impacted. Furthermore, changes in Chinese laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under its current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

We may have limited legal recourse under the laws of China if disputes arise under our agreements with third parties.

The Chinese government has enacted certain laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our tolling arrangement or other future arrangements, are unsuccessful or other adverse circumstances arise from these arrangements, we face the risk that our third-party manufacturer may dishonor our purchase orders or unwritten arrangements. Similarly, if our product sale arrangements with customers are

17

unsuccessful or other adverse circumstances arise from these arrangements we face the risk that our customers may dishonor their obligation to pay us for purchased products. Further, if disputes arise under our agreements with any other parties doing business in China, including Zhenfa, we face the risk that such party may breach any such agreement or otherwise engage in conduct relating to their relationship with us that could otherwise give rise to liability under U.S. law. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under Chinese law, in either of these cases, may be limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Our potential inability to adequately protect our intellectual property during the outsource manufacturing of our products in China could negatively impact our performance.

In connection with our tolling manufacturing arrangement, we rely on a third-party manufacturer to implement customary manufacturer safeguards onsite, such as the use of confidentiality agreements with employees, to protect our proprietary information and technologies during the manufacturing process. However, these safeguards may not effectively prevent unauthorized use of such information and technical knowhow, or prevent the manufacturer from retaining them. Although the courts in China are increasing and broadening their protection of intellectual property rights, the legal regime governing intellectual property rights in China is relatively immature and it is often difficult to create and enforce intellectual property rights or protect trade secrets there. We face risks that our proprietary information may not be afforded the same protection in China as it is in countries with well-developed intellectual property laws, and local laws may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights in China, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position. In the event that the third-party tolling manufacturer of our proprietary products misappropriates our intellectual property, our business, prospects and financial condition could be materially and adversely affected.

A significant reduction or elimination of government subsidies and economic incentives or a change in government policies that promote the use of solar energy could have a material adverse effect on our business and prospects.

Demand for our encapsulants depends on the continued adoption of solar energy and the resultant demand for solar modules. Demand for our products depends, in large part, on government incentives aimed to promote greater use of solar energy. In many countries in which solar modules are sold, solar energy would not be commercially viable without government incentives. This is because the cost of generating electricity from solar energy may exceed the cost of generating electricity from conventional energy sources in some regions of the world and because the capital investment associated with deploying solar modules may have a long payback period or be difficult to finance, making conventional sources available on the grid without capital investment a more widely accessible option.

The scope of government incentives for solar energy depends, to a large extent, on political and policy developments relating to environmental and energy concerns in a given country that are subject to change, which could lead to a significant reduction in, or a discontinuation of, the support for renewable energy in such country. Federal, state and local governmental bodies in many of our customers' target markets, including Germany, Italy, Spain, the United States, China, France, Japan and South Korea, have provided subsidies and economic incentives in the form of feed-in tariffs,

18

rebates, tax credits and other incentives to end users, distributors, system integrators and manufacturers of solar energy products to promote the use of solar energy and to reduce dependency on other forms of energy. In many cases, the costs of these government subsidy programs are passed on to electricity consumers in the applicable regions. These government economic incentives could be reduced or eliminated earlier than anticipated. For example, in Germany, which was a large solar PV installation market, the government enacted legislation that reduced feed-in tariffs beginning June 30, 2010. In early 2011, the German government enacted further legislation that accelerated the annual year-end feed-in tariff reduction to July 1, 2011 for roof-top systems and September 1, 2011 for ground-mount projects. In 2012, the German government enacted additional legislation that reduced feed-in tariffs by between 20% and 30% depending on the size of the solar energy system. Additional negative changes to solar incentives in 2013 continued to affect the solar markets throughout the European Union. Similarly, in September 2008, the Spanish Parliament decreased the feed-in tariff for solar energy by approximately 27% and capped its subsidized PV installations at 500 MW for 2009. This event drove an over-supply of solar module inventory in the supply chain during the first half of 2009 and was one of the main drivers behind our sales volume decline in 2009 compared to 2008. In addition, numerous other countries have recently reduced solar incentives. A change in government incentives similar to these may result in the pull-in of demand from solar module manufacturers due to increased end-user demand being driven by the incentive to purchase a solar system prior to the enactment of the decreased feed-in tariff incentives.

It is our belief that most if not all government solar incentive programs are designed to increase the use of solar energy and are subject to periodic adjustment in light of the rate of installations resulting from the incentive and the economics of solar energy resulting from the price of the installed systems combined with the incentives. As has often happened over the past several years, the rate of incentivized installations has outpaced estimates and the price of solar panels and systems has fallen faster than anticipated. When combined, these dynamics result in a situation where the incentive is more generous than is necessary to drive more installations, and the incentive is subsequently reduced in light of these economics. Adjustments in these incentive programs, which may range from a minor adjustment to a complete shutdown, or in some cases even retroactive action, have resulted in the formation of boom-and-bust cycles within the solar industry.

Some European governments have recently experienced sovereign debt issues and a risk exists that some of these governments will continue to reduce current subsidies provided for PV installations in conjunction with generally tighter fiscal policies.

Policies relative to solar in China, while generally very supportive, have shifted focus and scope with some regularity over the past few years and may change with little notice again in the future. China is currently the world's largest consumption market for solar panel installations as well as production. The strength or weakness of China's economy may cause their domestic solar policy to shift in a positive or negative manner.

In the United States, recent solar installation growth has been driven by Renewable Portfolio Standards, regulatory mandates to increase production of energy from renewable sources such as wind, solar, biomass and other alternatives to fossil and nuclear electricity generation, and a 30% federal energy Investment Tax Credit (the "ITC") for both residential and commercial solar installation through December 31, 2019. The ITC ratchets down to 26% for 2020, 22% for 2021 and 10% for 2022 and later. The ITC, which was extended as part of the tax extenders package in December 2015, had been set to expire as the end of 2016. In addition to being extended, the ITC now includes a "commence construction" clause that allows system owners to claim the associated tax credit provided construction began within the period and is finished before 2024.

19

Electric utility companies, or generators of electricity from fossil fuels or other energy sources, could also lobby for changes to the relevant legislation in their markets to protect their revenue streams. Reduced growth in or the reduction, elimination or expiration of government subsidies and economic incentives for solar energy, especially those in our customers' target markets, could cause our net sales to decline and negatively impact our business.

Our gross margins and profitability may be adversely affected by rising commodity costs.

We are dependent upon certain raw materials, particularly resin, for the manufacture of our encapsulants. EVA resin comprises approximately 50% of our cost of sales. We do not believe that EVA resin can be effectively hedged with derivatives in the commodity markets. Although the prices for resin declined in 2015 and 2014, they have been volatile over the past several years. If raw material prices increase, our gross margins and results of operations may be materially and adversely affected.

Deterioration of our customers' financial profile may cause additional credit risk on our accounts receivable.

A significant portion of our outstanding accounts receivable is derived from sales to a limited number of customers. The accounts receivable from our top five customers represented 39% and 79% of our accounts receivable balance as of December 31, 2015 and December 31, 2014, respectively. The accounts receivable due from our largest customer was 6% of our accounts receivable balance as of December 31, 2015. During the past several years, many solar module manufacturers became insolvent and the number of days outstanding on accounts receivable has increased significantly industry-wide. For example, in 2013, we recorded bad debt expense of $0.3 million and $1.4 million for Suntech Power Holdings Company Limited and Conergy AG, respectively. Moreover, many solar manufacturing companies continue to face significant liquidity and capital expenditure requirements, and as a result, our customers may have trouble making payments owed to us. In addition, payment terms are currently longer in China than in many other locations. In order to mitigate this risk, we are attempting to obtain bank acceptance notes from financial institutions with respect to the accounts receivable from certain of our customers. If we are unable to collect our accounts receivable or obtain bank acceptance notes, or fail to receive payment of accounts receivable in a timely fashion, our financial condition and results of operations will be negatively affected.

If we are unable to attract, train and retain key personnel, our business may be materially and adversely affected.

Our future success depends, to a significant extent, on our ability to attract, train and retain management, operations and technical personnel. This may be particularly difficult in light of our financial performance and our delisting from the New York Stock Exchange. In addition, we have substantially reduced our headcount during the past few years, which limits the resources available to successfully manage and grow our business. The loss of the services of any member of our senior management team or the inability to hire or retain experienced management personnel could adversely affect our ability to execute our business plan and harm our operating results.

In periods of cost reduction, there is a risk that employees may voluntarily leave us to pursue other career opportunities. There is substantial competition for qualified technical personnel for our business, and as a result, we may be unable to continue to attract or retain qualified technical personnel necessary for the development of our business or recruit suitable replacement personnel. If we are unable to attract and retain qualified employees, our business may be materially and adversely affected.

20

Our dependence on a limited number of suppliers for raw materials for our encapsulants and other significant materials used in our process could prevent us from timely delivery of encapsulants to our customers in the required quantities, which could result in order cancellations and decreased net sales.