Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nuo Therapeutics, Inc. | v435004_8k.htm |

Exhibit 99.1

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Form No. MOR-1 x MOR-1a x x MOR-1b x x x MOR-2 x x MOR-3 x MOR-4 x x x x MOR-4 x MOR-4 x MOR-5 x MOR-5 x March 21, 2016 Signature of authorized individual Date David E. Jorden Acting CEO and Acting CFO Printed name of authorized individual Title of authorized individual Schedule of Professional Fees Paid Copies of bank statements Statement of Operations Listing of aged accounts payable Accounts Receivable Reconciliation and Aging Balance Sheet Status of Postpetition Taxes Copies of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Postpetition Debts I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. * The information contained herein is provided as required by the Office of the United States Trustee. This Monthly Operating Report has been prepared based on information available to the Debtor as of the ending date in the reporting period shown above, and such information may be incomplete in certain respects. All information contained herein is unaudited and subject to future adjustments, which could be material. Nothing contained in this Monthly Operating Report shall constitute a waiver of any of the Debtor's rights or an admission with respect to its Chapter 11 proceedings. The Debtor reserves all rights to amend, modify or supplement this Monthly Operating Report. UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE Schedule of Cash Receipts and Disbursements Bank Reconciliation (or copies of debtor's bank reconciliations) MONTHLY OPERATING REPORT * Affidavit or Supplement Attached Document Attached Explanation Attached

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 CURRENT PERIOD Business checking (Capital One) Business money market (Capital One) Certificate of deposit (Capital One) Investment (Wilmington Trust) Cash reserves (Fidelity) ACTUAL PROJECTED 2 ACTUAL PROJECTED 2 Account number ending in 0542 9462 4101 6389 2370 Beginning cash balance 37,448 283 53,427 - 0 91,158 17,163 40,570 17,163 RECEIPTS Revenue collections 135,983 - - - - 135,983 853,492 135,983 853,492 Loans and advances 1,500,000 - - - - 1,500,000 2,000,000 1,500,000 2,000,000 Sweeps from / (to) other accounts - - - - - - - - - Transfers from other accounts - - - - - - - - - Proceeds from sale of assets - - - - - - - - - Other collections - 79 - - - 79 - 79 - TOTAL RECEIPTS 1,635,983 79 - - - 1,636,061 2,853,492 1,636,061 2,853,492 DISBURSEMENTS Payroll and payroll taxes 341,687 - - - - 341,687 368,971 341,687 368,971 Sales commissions 13,730 - - - - 13,730 75,000 13,730 75,000 Employee benefits 32,453 - - - - 32,453 60,574 32,453 60,574 Employee travel and entertainment 26,350 - - - - 26,350 50,445 26,350 50,445 Research and development services - - - - - - 11,700 - 11,700 Inventory purchases 8,585 - - - - 8,585 9,844 8,585 9,844 Outside services 10,530 - - - - 10,530 2,823 10,530 2,823 Marketing expense - - - - - - 13,315 - 13,315 Reimbursement expense 1 - - - - - - 6,611 - 6,611 Investor relations - - - - - - 3,613 - 3,613 Insurances 47,187 - - - - 47,187 362,309 47,187 362,309 Information technology - - - - - - 1,152 - 1,152 Supplies - - - - - - 3,812 - 3,812 Utilities 160 - - - - 160 - 160 - Licensing fees - - - - - - 471 - 471 Professional fees, ordinary course - - - - - - - - - Board of Directors fees - - - - - - 2,823 - 2,823 Excise taxes 5,692 - - - - 5,692 14,016 5,692 14,016 All other operating disbursements 27,321 - - - - 27,321 57,699 27,321 57,699 Bank fees 585 - - - - 585 5,000 585 5,000 Income and business taxes 8,892 - - - - 8,892 93,100 8,892 93,100 Interest, DIP loan new money - - - - - - 2,308 - 2,308 Interest, DIP loan pre-petition roll-up - - - - - - - - - Fees, DIP loan 67,500 - - - - 67,500 67,500 67,500 67,500 Professional fees, restructuring 170,001 - - - - 170,001 397,708 170,001 397,708 U.S. Trustee fees - - - - - - - - - Transaction fees - - - - - - - - - Vendor deposits 30,000 - - - - 30,000 150,000 30,000 150,000 Critical-vendor payments 226,491 - - - - 226,491 650,000 226,491 650,000 Priority claims - - - - - - - - - KEIP/KERP - - - - - - - - - All other (sources) / uses - - - - - - - - - Transfers to other accounts - - - - - - - - - TOTAL DISBURSEMENTS 1,017,165 - - - - 1,017,165 2,410,792 1,017,165 2,410,792 NET CASH FLOW 618,818 79 - - - 618,896 442,700 618,896 442,700 Ending cash balance 656,266$ 361$ 53,427$ -$ 0$ 710,054$ 459,863$ 659,467$ 459,863$ DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES 1,017,165 0 0 1,017,165 2. The figures in the Projected column reflect the DIP Budget exhibited in the Interim Order Under Sections 105, 361, 362, 363(c), 363(e), 364(c)(1), 364(c)(2), 364(c)(3), 364(d)(1), 364(e), and 507 of the Bankruptcy Code and Bankruptcy Rules 2002, 4001 and 9014 (I) Authorizing Debtor to Obtain Postpetition Financing; (II) Authorizing Debtor to Use Cash Collateral; (III) Granting Adequate Protection to Prepetition Secured Parties; (IV) Scheduling a Final Hearing and (V) Granting Related Relief, entered on January 28, 2016. MOR-1 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS 1 FILING TO DATE TOTAL DISBURSEMENTS (January 27, 2016 through February 29, 2016) SUBTRACT: TRANSFERS TO DEBTOR IN POSSESSION ACCOUNTS ADD: ESTATE DISBURSEMENTS MADE BY OUTSIDE SOURCES (i.e. from escrow accounts) TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES 1. The accounting systems are not primarily designed to produce reports that are consistent with the requirements of the Office of the United States Trustee. The numbers presented in the cash flow are subject to change as additional information is made available. The information contained herein is provided to fulfill the requirements of the Office of the United States Trustee. All information contained herein is unaudited and subject to future adjustments. BANK ACCOUNTS Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 2 of 13

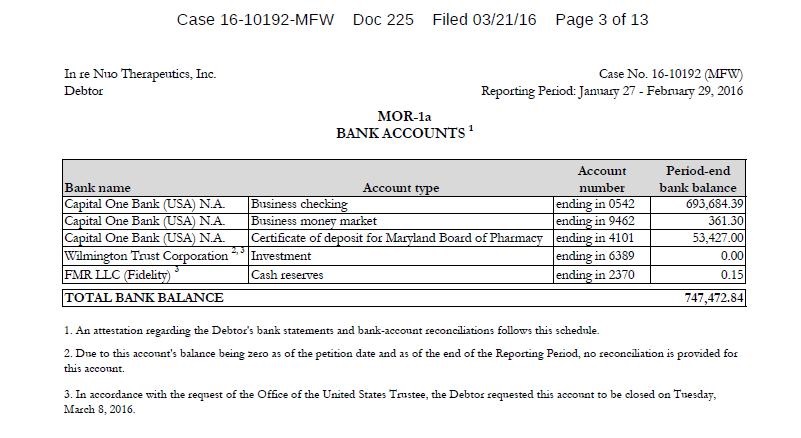

Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 3 of 13 In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 BANK ACCOUNTS 1 Bank name Account number Period-end bank balance Capital One Bank (USA) N.A. ending in 0542 693,684.39 Capital One Bank (USA) N.A. ending in 9462 361.30 Capital One Bank (USA) N.A. ending in 4101 53,427.00 Wilmington Trust Corporation 2, 3 ending in 6389 0.00 FMR LLC (Fidelity) 3 ending in 2370 0.15 TOTAL BANK BALANCE 747,472.84 3. In accordance with the request of the Office of the United States Trustee, the Debtor requested this account to be closed on Tuesday, March 8, 2016. 2. Due to this account's balance being zero as of the petition date and as of the end of the Reporting Period, no reconciliation is provided for this account. Investment 1. An attestation regarding the Debtor's bank statements and bank-account reconciliations follows this schedule. MOR-1a Account type Business checking Cash reserves Business money market Certificate of deposit for Maryland Board of Pharmacy

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 March 21, 2016 Signature of authorized individual Date David E. Jorden Acting CEO and Acting CFO Printed name of authorized individual Title of authorized individual MOR-1a ATTESTATION REGARDING BANK ACCOUNTS The above-captioned Debtor hereby submits this attestation regarding disbursement journals and bank-account reconciliations in lieu of providing copies of bank statements and account reconciliations. I attest that each of the bank accounts listed in the preceding schedule is reconciled to monthly bank statements. The Debtor's standard practice is to ensure that each bank account is reconciled to monthly bank statements for each calendar month within 20 days after month end. Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 4 of 13

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 #/EFT Date paid Fees Expenses Fees Expenses Winter Harbor LLC 1/27/16 - 1/31/16 29,173.39 Nuo Therapeutics, Inc. EFT 2/24/2016 26,788.50 2,384.89 Winter Harbor LLC 2/1/16 - 2/7/16 47,953.15 Nuo Therapeutics, Inc. EFT 2/26/2016 45,960.00 1,993.15 Winter Harbor LLC 2/8/16 - 2/14/16 39,556.35 Nuo Therapeutics, Inc. EFT 2/26/2016 37,656.00 1,900.35 Winter Harbor LLC 2/15/16 - 2/21/16 53,317.90 Nuo Therapeutics, Inc. EFT 2/24/2016 51,414.00 1,903.90 170,000.79 161,818.50 8,182.29 161,818.50 8,182.29 Dentons US LLP None - Nuo Therapeutics, Inc. None None - - - - Ashby & Geddes, P.A. None - Nuo Therapeutics, Inc. None None - - - - Epiq Bankruptcy Solutions, LLC None - Nuo Therapeutics, Inc. None None - - - - Pepper Hamilton LLP None - Nuo Therapeutics, Inc. None None - - - - Robbins, Salomon & Patt, Ltd. None - Nuo Therapeutics, Inc. None None - - - - 170,000.79 161,818.50 8,182.29 161,818.50 8,182.29 Professional Role Notes Winter Harbor LLC Debtor's Chief Restructuring Officer and additional personnel Dentons US LLP Debtor's counsel, lead Ashby & Geddes, P.A. Debtor's counsel, local Epiq Bankruptcy Solutions, LLC Debtor's noticing, claims and balloting agent Pepper Hamilton LLP Counsel to the Official Committee of Unsecured Creditors Robbins, Salomon & Patt, Ltd. Counsel to the Ad Hoc Equity Committee MOR-1b SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID This schedule is to include all retained professional payments from case inception to current month. Amount approved Period covered Payor Payee Check Period amount paid Case-to-date amount paid Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 5 of 13

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Line item Current period Filing to date Revenue Sales, Aurix 123,240 123,240 Sales, Angel 67,791 67,791 Royalties 196,164 196,164 License fees 38,940 38,940 Other sales - - Total revenue 426,135 426,135 Cost of sales Cost of goods sold, Aurix 58,873 58,873 Cost of goods sold, Angel 49,888 49,888 Cost of royalties 15,194 15,194 Cost of license fees - - Other cost of sales 7,597 7,597 Total cost of sales 131,551 131,551 Gross profit 294,584 294,584 Operating expenes Employee compensation and benefits 348,307 348,307 Insurance 29,509 29,509 Rent 24,172 24,172 Travel and entertainment 20,517 20,517 Depreciation and amortization 45,110 45,110 Selling and marketing expense 56,792 56,792 Research and development expense 45,305 45,305 Professional fees 46,324 46,324 Board of Directors fees 17,903 17,903 Other operating expenses 2 68,652 68,652 Total operating expenses 702,590 702,590 Operating profit (408,006) (408,006) Non-operating expenses Interest expense / (income) 243,762 243,762 Reorganization expense / (income) 2 983,258 983,258 Loss / (gain) on asset disposal 2,040 2,040 Other non-operating expense / (income) - - Income-tax expense - - Total non-operating expenses 1,229,060 1,229,060 NET INCOME (1,637,066) (1,637,066) MOR-2 STATEMENT OF OPERATIONS (UNAUDITED) 1 1. The accounting systems are not primarily designed to produce reports that are consistent with the requirements of the Office of the United States Trustee. The information contained herein is provided to fulfill the requirements of the Office of the United States Trustee. All information contained herein is unaudited and subject to future adjustments. 2. See the continuation sheet following Schedule MOR-2 for additional detail regarding these line items. Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 6 of 13

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Line item Current period Filing to date Other operating expenses Other services 426 426 Investor services 3,786 3,786 Information technology 15,131 15,131 Temporary labor - - Repairs and maintenance - - Supplies 121 121 Office expense 25,336 25,336 State and local taxes 7,149 7,149 Business-development expense (91) (91) Bad-debt expense - - Dues, subscriptions and fees 16,602 16,602 Miscellaneous expense 192 192 Total other operating expenses 68,652 68,652 Reorganization expense / (income) Professional fees, Debtor's Chief Restructuring Officer 224,791 224,791 Professional fees, Debtor's counsel, lead 327,777 327,777 Professional fees, Debtor's counsel, local 94,000 94,000 Professional fees, Debtor's investment banker and related services 61,708 61,708 Professional fees, Debtor's claims and noticing agent 19,400 19,400 Professional fees, DIP lender's counsel, lead and local 120,081 120,081 Professional fees, Unsecured Creditors' Committee counsel 129,000 129,000 Professional fees, Ad Hoc Equity Committee counsel - - U.S. Trustee fees 6,500 6,500 Total reorganization expense 983,258 983,258 MOR-2 CONTINUATION SHEET STATEMENT OF OPERATIONS (UNAUDITED) * * The accounting systems are not primarily designed to produce reports that are consistent with the requirements of the Office of the United States Trustee. The numbers presented in this schedule are subject to change as additional information is made available. The information contained herein is provided to fulfill the requirements of the Office of the United States Trustee. All information contained herein is unaudited and subject to future adjustments. Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 7 of 13

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Line item Current period As of petition date ASSETS Current assets Cash and cash equivalents 713,454 94,558 Accounts receivable 1,427,261 1,237,057 Intercompany receivable 14,533,197 14,593,348 Other receivables 706,457 474,489 Inventory 175,888 254,764 Deposits 370,371 478,564 Prepaid expenses 719,942 727,665 Deferred costs, current portion 1,136,387 1,091,387 Total current assets 19,782,956 18,951,831 Property, plant and equipment 2 Angel machines 225,493 225,493 Aurix centrifuges 924,970 924,970 Computer and office equipment 113,842 113,842 Furniture and fixtures 40,849 40,849 Production equipment 307,851 307,851 Leasehold improvements 32,131 32,131 Software 523,571 523,571 Less: Accumulated depreciation (1,169,946) (1,119,749) Net property, plant and equipment 998,762 1,048,959 Other assets Deferred costs, long-term portion 2,273,721 2,379,339 Investment, Aldagen 2 31,753,381 31,753,381 Intangible assets, net of accumulated amortization 2 1,804,236 1,830,059 Other long-term assets 18,361 11,986 Total other assets 35,849,699 35,974,765 TOTAL ASSETS 56,631,417 55,975,555 LIABILITIES AND OWNERS' EQUITY Liabilities not subject to compromise Accounts payable 172,379 - Accrued compensation and benefits 49,227 - Accrued expenses 856,671 - Accrued taxes 31,568 - Accrued interest 12,803 - Customer deposits 329,145 - Debtor-in-possession financing 1,500,000 - Convertible debt, net of original issue discount - - Deferred revenue 1,033,163 - Derivative liabilities - - Other long-term liabilities 205,679 - Total liabilities not subject to compromise 4,190,636 - Liabilities subject to compromise 3 Accounts payable 2,043,235 2,293,463 Accrued compensation and benefits 878,157 950,283 Accrued expenses 693,292 735,733 Accrued taxes 20,206 50,352 Accrued interest 4,529,645 4,529,645 Customer deposits - 329,145 Debtor-in-possession financing - - Convertible debt, net of original issue discount 1,084,088 981,554 Deferred revenue - 1,072,103 Derivative liabilities 2,597,930 2,597,930 Other long-term liabilities - 207,892 Total liabilities subject to compromise 11,846,553 13,748,099 Shareholders' equity Mezzanine equity 500,000 500,000 Common stock 405,427 405,427 Additional paid-in capital 125,982,896 125,979,057 Retained earnings / (losses), pre-petition 3 (84,657,028) (84,657,028) Retained earnings / (losses), post-petition (1,637,066) - Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 8 of 13 Total shareholders' equity 40,594,229 42,227,456 TOTAL LIABILITIES AND OWNERS' EQUITY 56,631,417 55,975,555 MOR-3 BALANCE SHEET (UNAUDITED) 1 3. Pre-petition liabilities and retained earnings continue to be adjusted monthly based on actual pre-petition invoices received and reconciled post-petition. 1. The accounting systems are not principally designed to produce reports that are consistent with the requirements of the Office of the United States Trustee. The numbers presented in this schedule are subject to change as additional information is made available. The information contained herein is provided to fulfill the requirements of the Office of the United States Trustee. All information contained herein is unaudited and subject to future adjustments. 2. With respect to the book value of property, plant and equipment, the subsections of Accounting Standards Codification 360-10 “Property, Plant, and Equipment—Overall” published by the Financial Accounting Standards Board related to impairment or disposal of long-lived assets mandate that long-lived assets, such as property, plant and equipment, and purchased intangible assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Although an impairment test has not yet been performed for the fiscal year ended December 31, 2015, the Debtor expects an asset impairment could be required in one or more asset categories.

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Employee-related taxes Federal tax 5,007 99,443 (104,378) Various ACH 71 State tax 993 15,273 (16,252) Various ACH 14 City tax 8 161 (169) Various ACH 0 School-district tax 8 152 (160) Various ACH 0 Subtotal, employee-related taxes 6,016 115,030 (120,960) 86 Income and business taxes Sales tax 24,216 579 - None None 24,794 Franchise tax 20,120 6,774 - None None 26,894 Income tax - - - None None - All other taxes - - - None None - Subtotal, income and business taxes 44,336 7,353 - 51,688 Taxes included in accounts payable 16,499 25 (14,423) Various ACH 2,101 TOTAL TAXES 66,851 122,407 (135,383) 53,875 Less: Taxes included in accounts payable (16,499) (25) Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 9 of 13 14,423 (2,101) TOTAL ACCRUED TAXES 50,352 122,382 (120,960) 51,774 Ending liability MOR-4 STATUS OF POST-PETITION TAXES Line item Beginning liability Amount withheld, accrued, or expensed Amount paid Date paid Check #/EFT

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 March 21, 2016 Signature of authorized individual Date David E. Jorden Acting CEO and Acting CFO Printed name of authorized individual Title of authorized individual I hereby certify, to the best of my knowledge, that: (1) all federal, state and local post-petition taxes and estimates due and owing for the period indicated above for the Debtor have been paid or that any remaining balance dues are de minimis; and (2) to the extent that tax returns have not been submitted, an extension has been either obtained or requested from the appropriate state or federal agency, or the Debtor is in the process of obtaining or requesting such extension from the appropriate state or federal agency. The above-captioned Debtor hereby submits this attestation regarding the status of post-petition taxes in lieu of providing tax returns and detailed records of paid or unpaid taxes by type and entity. MOR-4 ATTESTATION REGARDING STATUS OF POST-PETITION TAXES Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 10 of 13

Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 11 of 13 In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Current 1-30 31-60 61-90 91-120 Over 120 Totals Accounts payable 2 65,039 89,511 17,771 57 - - 172,379 Accrued compensation and benefits 49,227 - - - - - 49,227 Accrued expenses 856,671 - - - - - 856,671 Accrued taxes 31,568 - - - - - 31,568 Accrued interest 12,803 - - - - - 12,803 Customer deposits 329,145 - - - - - 329,145 Debtor-in-possession financing 1,500,000 - - - - - 1,500,000 Convertible debt, net of original issue discount - - - - - - - Deferred revenue 1,033,163 - - - - - 1,033,163 Derivative liabilities - - - - - - - Other long-term liabilities 205,679 - - - - - 205,679 Totals 4,083,295 89,511 17,771 57 - - 4,190,636 MOR-4 Line item 2. Amounts in this line item represent open and outstanding trade vendor invoices, aged based on invoice due date, that have been entered into the Debtor's accounts payable system. These amounts do not include any payables based on accruals for goods provided and/or services performed but for which invoices have not been received. The Debtor expects to pay all amounts not listed as "Current" as soon as practicable. This note is provided in place of a list of aged accounts payable. Days Outstanding STATUS OF UNPAID POST-PETITION DEBTS 1 1. All information contained herein is unaudited and subject to future adjustments. Certain debts payable pursuant to orders of the Bankruptcy Court are reflected as current for the purposes of this schedule. All post-petition debts other than aged accounts payable are assumed to be current.

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 Current 1-30 31-60 61-90 Over 90 Totals Accounts receivable 3,260 186,360 538,558 154,279 630,525 1,512,982 Less: Allowance for doubtful accounts - - - - (85,721) (85,721) Totals 3,260 186,360 538,558 154,279 544,804 1,427,261 0.2% 13.1% 37.7% 10.8% 38.2% 100.0% Reconciliation of accounts receivable, trade Accounts receivable, net at the beginning of the reporting period 1,237,057 Add: Amounts billed during the period 257,898 Subtract: Amounts collected during the period (67,705) Subtract: Change in allowance for doubtful accounts - Other adjustments 10 Accounts receivable at the end of the reporting period 1,427,261 MOR-5 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING * Line item Days Outstanding * All information contained herein is unaudited and subject to future adjustments. Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 12 of 13

In re Nuo Therapeutics, Inc. Case No. 16-10192 (MFW) Debtor Reporting Period: January 27 - February 29, 2016 # Line item Yes No 1 Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. x 2 Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. x 3 Have all post-petition tax returns been timely filed? If no, provide an explanation below. x 4 Are workers' compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. x 5 Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). x Explanations 1 2 3 4 5 None required None required MOR-5a DEBTOR QUESTIONNAIRE None required None required None required Case 16-10192-MFW Doc 225 Filed 03/21/16 Page 13 of 13