Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

|

Commission File Number |

|

Exact Name of Registrant as Specified in its Charter, State or Other Jurisdiction of Incorporation, Address of Principal Executive Offices, Zip Code and Telephone Number (Including Area Code) |

|

I.R.S. Identification |

|

|

|

|

||

|

333-147019 333-179941-01 333-204880 |

|

PROSPER MARKETPLACE, INC. a Delaware corporation 221 Main Street, 3rd Floor San Francisco, CA 94105 Telephone: (415)593-5400 |

|

73-1733867 |

|

|

|

|

||

|

333-179941 333-204880-01 |

|

PROSPER FUNDING LLC a Delaware limited liability company 221 Main Street, 3rd Floor San Francisco, CA 94105 Telephone: (415)593-5479 |

|

45-4526070 |

Securities registered pursuant to Section 12(b) of the Act:

|

Registrant |

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Prosper Marketplace, Inc. |

|

None |

|

None |

|

Prosper Funding LLC |

|

None |

|

None |

Securities registered pursuant to Section 12(g) of the Act:

|

Registrant |

|

Title of Each Class |

|

|

|

Prosper Marketplace, Inc. |

|

None |

|

|

|

Prosper Funding LLC |

|

None |

|

|

Indicate by check mark if each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Yes ¨ No x

Indicate by check mark if each registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Yes ¨ No x

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Yes x No ¨

Indicate by check mark whether each registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K (applicable to Prosper Marketplace, Inc. only). ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large Accelerated Filer |

|

Accelerated |

|

Non- |

|

Smaller |

|

|

|

|

|

|

||||

|

Prosper Marketplace, Inc. |

|

¨ |

|

¨ |

|

¨ |

|

x |

|

Prosper Funding LLC |

|

¨ |

|

¨ |

|

¨ |

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Yes ¨ No x

Prosper Funding LLC meets the conditions set forth in General Instruction I(1)(a), (b) and (d) of Form 10-K and is therefore filing this Annual Report on Form 10-K with the reduced disclosure format specified in General Instruction I(2) of Form 10-K.

|

Registrant |

|

Aggregate Market Value of Voting and Non-Voting Common Equity Held by Non-Affiliates of the Registrant at June 30, 2015 |

|

Number of Shares of |

|

Prosper Marketplace, Inc. |

|

(a) |

|

69,509,045 |

|

Prosper Funding LLC |

|

(a)(b) |

|

None |

|

(a) |

Not applicable. |

|

(b) |

All voting and non-voting common equity is owned by Prosper Marketplace, Inc. |

THIS COMBINED FORM 10-K IS SEPARATELY FILED BY PROSPER MARKETPLACE, INC. AND PROSPER FUNDING LLC. INFORMATION CONTAINED HEREIN RELATING TO ANY INDIVIDUAL REGISTRANT IS FILED BY SUCH REGISTRANT ON ITS OWN BEHALF. EACH REGISTRANT MAKES NO REPRESENTATION AS TO INFORMATION RELATING TO THE OTHER REGISTRANT.

2

|

ITEM |

|

|

|

Page |

|

PART I |

|

|

|

|

|

ITEM 1 |

|

|

6 |

|

|

ITEM 1A |

|

|

16 |

|

|

ITEM 1B |

|

|

34 |

|

|

ITEM 2 |

|

|

34 |

|

|

ITEM 3 |

|

|

34 |

|

|

ITEM 4 |

|

|

35 |

|

|

PART II |

|

|

|

|

|

ITEM 5 |

|

|

36 |

|

|

ITEM 6 |

|

|

36 |

|

|

ITEM 7 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

36 |

|

ITEM 7A |

|

|

48 |

|

|

ITEM 8 |

|

|

48 |

|

|

ITEM 9 |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

48 |

|

ITEM 9A |

|

|

48 |

|

|

ITEM 9B |

|

|

50 |

|

|

PART III |

|

|

|

|

|

ITEM 10 |

|

|

51 |

|

|

ITEM 11 |

|

|

56 |

|

|

ITEM 12 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

60 |

|

ITEM 13 |

|

Certain Relationships and Related Transactions, and Director Independence |

|

63 |

|

ITEM 14 |

|

|

65 |

|

|

PART IV |

|

|

|

|

|

ITEM 15 |

|

|

67 |

|

|

|

|

|

|

S-55 |

|

|

|

|

|

|

|

Exhibit 31.1 |

|

|

|

|

|

Exhibit 31.2 |

|

|

|

|

|

Exhibit 32.1 |

|

|

|

|

|

XBRL Content |

|

|

|

|

3

Except as the context requires otherwise, as used herein, “Registrants” refers to Prosper Marketplace, Inc. (“PMI”), a Delaware corporation, and its wholly owned subsidiary, Prosper Funding LLC (“PFL”), a Delaware limited liability company; “we,” “us,” “our,” “Prosper,” and the “Company” refer to PMI and its wholly owned subsidiaries, PFL, BillGuard, Inc. (“BillGuard”), a Delaware corporation, and Prosper Healthcare Lending LLC (“PHL”), a Delaware limited liability company, on a consolidated basis; and “Prosper Funding” refers to PFL and its wholly owned subsidiary, Prosper Asset Holdings LLC (“PAH”), a Delaware limited liability company, on a consolidated basis. In addition, the unsecured, consumer loans originated through our marketplace are referred to as “Borrower Loans,” and the borrower payment dependent notes issued through our marketplace, whether issued by PMI or PFL, are referred to as “Notes.” Finally, although historically we have referred to investors as “lender members,” we call them “investors” herein to avoid confusion since WebBank is the lender for Borrower Loans originated through our marketplace. All share and per share numbers presented in this Annual Report on Form 10-K have been adjusted to reflect a 5-for-1 forward stock split effected by PMI on February 16, 2016.

The following filings are available for download free of charge at www.prosper.com as soon as reasonably practicable after such filings are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”): Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports. Further, a copy of this Annual Report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. Our SEC filings are also available to the public at the SEC’s Internet site at http://www.sec.gov. The information posted on our website is not incorporated herein by reference and is not a part of this Annual Report on Form 10-K.

Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements include all statements that do not relate solely to historical or current facts, and can generally be identified by the use of words such as “may,” “believe,” “expect,” “project,” “estimate,” “intend,” “anticipate,” “plan,” “continue” or similar expressions. These statements may appear throughout this Annual Report on Form 10-K, including the sections titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements inherently involve many risks and uncertainties that could cause actual results to differ materially from those projected in these statements. Where, in any forward-looking statement, PMI or PFL expresses an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of our respective managements, is expressed in good faith, and is believed to have a reasonable basis. Nevertheless, we can give no assurances that any of the events anticipated by these forward-looking statements will occur or, if any of them does, what impact they will have on Prosper or Prosper Funding’s results of operations and financial condition.

There are a number of important factors that could cause actual results or events to differ materially from those indicated in the forward-looking statements, including, among other things:

|

|

× |

the performance of the Notes, which, in addition to being speculative investments, are special, limited obligations that are not guaranteed or insured; |

|

|

× |

PFL’s ability to make payments on the Notes, including in the event that borrowers fail to make payments on the corresponding Borrower Loans; |

|

|

× |

our ability to attract potential borrowers and investors to our marketplace; |

|

|

× |

the reliability of the information about borrowers that is supplied by borrowers including actions by some borrowers to defraud investors; |

|

|

× |

our ability to service the Borrower Loans, and our ability or the ability of a third party debt collector to pursue collection against any borrower, including in the event of fraud or identity theft; |

|

|

× |

credit risks posed by the credit worthiness of borrowers and the effectiveness of our credit rating systems; |

|

|

× |

potential efforts by state regulators or litigants to impose liability that could affect PFL’s (or any subsequent assignee’s) ability to continue to charge to borrowers the interest rates that they agreed to pay at origination of their loans; |

4

|

|

× |

the impact of future economic conditions on the performance of the Notes and the loss rates for the Notes; |

|

|

× |

our compliance with applicable local, state and federal law, including the Investment Advisers Act of 1940, the Investment Company Act of 1940 and other laws; |

|

|

× |

potential efforts by state regulators or litigants to characterize PFL or PMI, rather than WebBank, as the lender of the loans originated through our marketplace; |

|

|

× |

the application of federal and state bankruptcy and insolvency laws to borrowers and to PFL and PMI; |

|

|

× |

the impact of borrower delinquencies, defaults and prepayments on the returns on the Notes; |

|

|

× |

the lack of a public trading market for the Notes and any inability to resell the Notes on the Note Trader platform; |

|

|

× |

the federal income tax treatment of an investment in the Notes and the PMI Management Rights; |

|

|

× |

our ability to prevent security breaches, disruptions in service, and comparable events that could compromise the personal and confidential information held on our data systems, reduce the attractiveness of the platform or adversely impact our ability to service Borrower Loans; and |

|

|

× |

the other risks discussed under the “Risk Factors” section of this Annual Report on Form 10-K. |

There may also be other factors that could cause our actual results to differ materially from the forward-looking statements in this Annual Report on Form 10-K. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. You should carefully read the factors described in the “Risk Factors” section of this Annual Report on Form 10-K for a description of certain risks that could, among other things, cause PMI or PFL’s actual results to differ from these forward-looking statements.

All forward-looking statements included in this report speak only as of the date hereof and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 10-K. PMI and PFL undertake no obligation to update or revise such forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

5

Overview

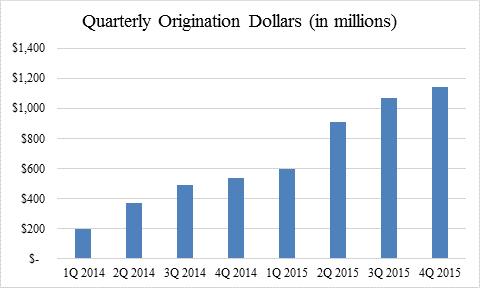

Prosper is a pioneer of online marketplace lending. Our goal is to enable borrowers to access credit at affordable rates and provide investors with attractive risk-adjusted rates of return. Our marketplace facilitated $3.7 billion in Borrower Loan originations during 2015 and $6.1 billion in Borrower Loan originations since it first launched in 2006.

We believe our online marketplace model has key advantages relative to traditional bank lending, including (i) an innovative marketplace model that efficiently connects qualified supply and demand of capital, (ii) online operations that substantially reduce the need for physical infrastructure and improve convenience, and (iii) data and technology driven automation that increases efficiency, and improves the borrower and investor experience. We do not operate physical branches or incur expenses related to that infrastructure; instead, we use data and technology to drive automation and efficiency in our operation. As part of operating our marketplace, we verify the identity of borrowers and assess borrowers’ credit risk profile using a combination of public and proprietary data. Our proprietary technology automates several loan origination and servicing functions, including the borrower application process, data gathering, underwriting, credit scoring, loan funding, investing and servicing, regulatory compliance and fraud detection.

We believe that we offer many consumers access to better pricing, on average, than the pricing than they would pay on outstanding credit card balances or unsecured installment loans from a traditional bank. We also believe that we offer faster decisions and loan originations, and greater transparency, resulting in a better customer experience than that provided by traditional consumer finance institutions.

To individual and institutional investors, we offer an asset class that we believe has attractive risk adjusted returns, transparency, and lower duration risk.

Our marketplace offers fixed rate, fully amortizing, unsecured consumer loans ranging from $2,000 to $35,000 with no prepayment penalty. Loan terms of three and five years are available, depending upon the rating assigned to the borrower at issuance and loan amount being sought. All Borrower Loans are originated and funded by WebBank, an FDIC-insured, state chartered industrial bank organized under the laws of Utah. After origination, WebBank sells the Borrower Loans to PFL, which either holds them or sells them to accredited and institutional investors.

Investors invest in Borrower Loans through two channels – (i) the “Note Channel,” which allows investors to purchase Notes from PFL, the payments of which are dependent on PFL’s receipt of payments made on the corresponding Borrower Loan; and (ii) the “Whole Loan Channel,” which allows accredited and institutional investors to purchase a Borrower Loan in its entirety directly from PFL. PFL continues to own the Borrower Loans originated through the Note Channel. Prosper services all of the Borrower Loans made through the marketplace.

Company Background and History

PMI was incorporated in the state of Delaware on March 22, 2005. PFL was formed as a limited liability company in the state of Delaware on February 17, 2012, and is a wholly-owned subsidiary of PMI.

PMI developed our marketplace and, until February 1, 2013, owned the proprietary technology that makes operation of our marketplace possible. On February 1, 2013, PMI transferred the marketplace to PFL. PFL has been organized and is operated in a manner that is intended (i) to minimize the likelihood that it will become subject to a voluntary or involuntary bankruptcy or similar proceeding, and (ii) to minimize the likelihood that, in the event of PMI’s bankruptcy, PFL would be substantively consolidated with PMI and thus have its assets subjected to claims of PMI’s creditors. We believe we have achieved this by imposing through PFL’s organizational documents and covenants in the Amended and Restated Indenture (as defined below in “Item 13. Certain Relationships and related Transactions, and Director Independence”) certain restrictions on PFL’s activities and certain formalities designed to reinforce PFL’s status as a distinct entity from PMI. In addition, under the Administration Agreement, dated February 1, 2013, between PMI and PFL (the “Administration Agreement”), PMI has agreed, in its dealings with PFL and with third parties, to observe certain “separateness covenants” related to its corporate formalities. PMI has also adopted resolutions limiting its own activities and interactions with PFL in order to further reduce the likelihood that PFL would be substantively consolidated with PMI in the event of PMI’s bankruptcy.

6

PFL has retained PMI, pursuant to the Administration Agreement, to provide certain administrative services relating to our marketplace. Specifically, the Administration Agreement contains a license granted by PFL to PMI that entitles PMI to use the marketplace for and in relation to: (i) PMI’s performance of its duties and obligations under the Administration Agreement relating to corporate administration, loan platform services, loan and note servicing, and marketing, and (ii) PMI’s performance of its duties and obligations to WebBank in relation to loan origination and funding. The license is terminable in whole or in part upon the failure by PMI to pay PFL the licensing fee, or upon PMI’s termination as the provider of some or all of the aforementioned services. See “Item 13. Certain Relationships and Related Transactions, and Director Independence—Prosper Marketplace, Inc.—Agreements with PFL” for more information.

How our Marketplace Works

Our marketplace is an online marketplace that matches individuals who wish to obtain unsecured consumer loans with individuals and institutions who are willing to commit funds to those loans. A borrower who wishes to obtain a loan through our marketplace must apply and, if accepted, post a loan listing to our marketplace. Each time we post a group of listings on our marketplace, we determine the relative proportions of such listings that will be allocated to the Note Channel and the Whole Loan Channel, respectively, based on our estimate of the relative overall demand in each channel. We then use a random allocation methodology to allocate individual listings between the two channels based on those proportions. If a listing receives enough investor commitments, WebBank will originate the Borrower Loan requested and then sell it to PFL.

Borrowers

Any natural person at least 18 years of age who is a U.S. resident in a state where loans through our marketplace are available with a U.S. bank account and a social security number may apply to become a borrower. All potential borrowers are subject to anti-fraud, anti-terrorism and identity verification processes and a potential borrower cannot obtain a loan without passing those processes.

When a borrower requests a loan, we first evaluate whether the borrower meets the underwriting criteria required by WebBank. The underwriting criteria apply to all loans originated through our marketplace and may not be changed without WebBank's consent. All borrowers who request a loan are subject to the following minimum eligibility criteria: (1) have at least a 640 credit score, (2) have fewer than seven credit bureau inquiries within the last 6 months, (3) have an annual income greater than $0, (4) have a debt-to-income ratio below 50%, (5) have at least three open trades reported on their credit report, and (6) have not filed for bankruptcy within the last 12 months. Borrowers may have up to two loans through Prosper outstanding at one time, provided that (1) the first loan is current, (2) the aggregate outstanding principal balance of both loans does not exceed the then-current maximum allowable loan amount for loans (currently $35,000), and (3) the borrower complies with the prior-borrower constraints above. From time to time, we have, with WebBank’s consent, tested new products that include features which are outside the standard eligibility criteria discussed above. These products are available on a limited basis, exclusively through our Whole Loan Channel and did not have a material impact on our business or our financial statements during the fiscal year ended December 31, 2015.

Investors

Investors are individuals and institutions that have the opportunity to buy Notes or Borrower Loans. An individual investor must be a natural person at least 18 years of age and a U.S. resident, must provide his or her social security number, and may be required to provide his or her state driver’s license or state identification card number. An institutional investor must provide its taxpayer identification number and entity formation documentation. All potential investors are subject to anti-fraud, anti-terrorism and identity verification processes and a potential investor cannot invest in Notes or Borrower Loans without passing those processes.

At the time an individual investor registers to participate in the Note Channel, such investor must satisfy any minimum financial suitability standards established for the Note Channel by the state in which the investor resides. Investors who participate in the Note Channel must enter into an investor registration agreement, which agreement governs all sales of Notes to such investors.

Only investors that are approved by us are eligible to participate in the Whole Loan Channel. At a minimum, to participate in the Whole Loan Channel, an investor must meet the definition of an “accredited investor” set forth in Regulation D under the Securities Act of 1933. Investors who participate in the Whole Loan Channel must enter into loan purchase and loan servicing agreements with us.

Relationship with WebBank

WebBank is an FDIC-insured, Utah-chartered industrial bank that originates all Borrower Loans made through our marketplace. WebBank and PMI are parties to an agreement under which PMI manages the operations of our marketplace that relate

7

to the submission of loan applications by borrowers and the making of related Borrower Loans by WebBank in exchange for a fee. WebBank makes each Borrower Loan with its own funds. A joint WebBank-Prosper Credit Policy, which can be changed only with WebBank’s approval, constitutes the policy Prosper must follow in reviewing, approving and administering Borrower Loans made by WebBank through the marketplace. WebBank, PMI and PFL are parties to a Loan Sale Agreement, under which WebBank sells and assigns the promissory notes evidencing the Borrower Loans to PFL. As consideration for WebBank's agreement to sell and assign the promissory notes, PFL pays WebBank a monthly fee in addition to the purchase price of the promissory notes. PMI receives payments from WebBank as compensation for the activities it undertakes on WebBank's behalf.

Risk Management

Each loan listing is assigned a Prosper Rating, which is a letter grade that indicates the expected level of risk associated with the listing. Each letter grade corresponds to an estimated average gross annualized loss rate range. The Prosper Rating associated with a loan listing reflects the loss expectations for that listing as of the time the rating is given. This means that otherwise similar borrowers may have different Prosper Ratings at different points in time as the Prosper Rating is updated to incorporate more recent information.

The estimated loss rate for each loan listing is based primarily on the historical performance of Borrower Loans with similar characteristics and is primarily determined by two scores: (i) a custom Prosper Score, and (ii) a credit score obtained from a credit reporting agency. The custom Prosper Score is updated periodically to include new information that is predictive of borrower risk as such information becomes available or as the evidence supporting a particular datum becomes strong enough to merit its inclusion in the custom Prosper Score.

The Prosper Score predicts the probability of a Borrower Loan going “bad,” where “bad” is defined as going more than 60 days past due within twelve months of the application date. To create the Prosper Score, we have developed and refined a custom risk model using our historical data as well as a data archive from a consumer credit bureau. We built the model on our borrower population, and included as variables information provided directly by the borrowers as well as included in their credit reports, so that the model would incorporate behavior that is unique to that population. In addition to the Prosper Score, another major element used to determine the Prosper Rating for a loan listing is a credit score from a consumer reporting agency. We currently use Experian’s FICO08 score. We obtain a borrower’s credit score at the time the loan listing is created, unless we already have a credit score on file that is not more than thirty days old.

Sale of Notes and Borrower Loans

If an investor successfully bids on a loan listing, the principal amount of the loan will be set aside in the investor’s account and may not be used for other bids. In the event a listing does not result in a loan being originated, the funds are made available for bidding by the investor.

For loan listings allocated to the Note Channel, a bid on a listing is an investor’s commitment to purchase a Note from PFL. PFL generally issues and sells a series of Notes for each Borrower Loan that is funded through the Note Channel. The Notes are sold to the investors who successfully bid on the corresponding loan listing in the principal amounts of their respective bids. Each series of Notes is dependent for payment on PFL’s receipt of payments on the corresponding Borrower Loan. PFL uses the proceeds of each series of Notes to purchase the corresponding Borrower Loan from WebBank on the business day after WebBank has originated the Borrower Loan.

For listings allocated to the Whole Loan Channel, a bid on a listing is an investor’s commitment to purchase the Borrower Loan from PFL after origination by WebBank and sale to PFL. On the business day after WebBank has originated the Borrower Loan, PFL purchases the Borrower Loan from WebBank and re-sells the Borrower Loan that same day to the corresponding investor. PFL records the investor as the owner of the Borrower Loan.

Loan Servicing and Collection

We are responsible for servicing the Borrower Loans made through our marketplace. We will pay each Note holder principal and interest on the Note in an amount equal to each such Note’s pro-rata portion of the principal and interest payments, if any, which we receive on the corresponding Borrower Loan, net of our servicing fee. We will also pay Note holders their pro rata portion of any other amounts we receive on the corresponding Borrower Loans, including late fees and prepayments, subject to our servicing fee; provided, that we will not pay Note holders any non-sufficient funds fees we receive for failed borrower payments. In addition, the funds available for payment on the Notes will be reduced by the amount of any attorneys’ fees or collection fees we, a third-party servicer or a collection agency imposes in connection with collection efforts related to the corresponding Borrower Loan. No

8

payments will be made on any Note after its final maturity date.

We will pay each investor that has purchased a Borrower Loan through the Whole Loan Channel principal and interest on the Borrower Loan purchased in an amount equal to the principal and interest payments, if any, that we receive, net of our servicing fee. We will also pay these investors any other amounts we receive on the Borrower Loans, including late fees and prepayments, subject to our servicing fee, provided that we will not pay these investors any non-sufficient funds fees we receive for failed borrower payments. In addition, the funds available for payment on the Borrower Loans will be reduced by the amount of any attorneys' fees or collection fees we, a third-party servicer or a collection agency imposes in connection with collection efforts related to the Borrower Loan.

If a Borrower Loan becomes past due, we may collect on it directly or refer it to a third-party collection agency. Our in-house collections department and third-party collection agencies are compensated by keeping a portion of the payments they collect based on a predetermined schedule.

Recent Acquisitions

On January 23, 2015, PMI acquired all of the outstanding limited liability company interests of American HealthCare Lending, LLC (“American HealthCare Lending”), a company that operates a patient financing platform, and merged American HealthCare Lending with and into PHL, with PHL surviving the merger.

On October 9, 2015, PMI acquired all of the outstanding shares of BillGuard, a privately held personal finance analytics company that develops consumer apps that help consumers manage their identity, finances and credit, pursuant to an Agreement and Plan of Merger, dated as of September 23, 2015, by and among PMI, BillGuard, Beach Merger Sub, Inc., a wholly owned subsidiary of PMI, and Shareholder Representative Services LLC, solely in its capacity as the Stockholders’ Representative.

Industry Background and Trends

According to the Board of Governors of the Federal Reserve System, as of December 2015, the balance of outstanding consumer credit in the United States totaled $3.5 trillion. This amount included $936 billion of revolving consumer credit, which many consumers seek to refinance for a lower interest rate.

The market for consumer lending is competitive and rapidly evolving, and there is an opportunity for the online marketplace model to transform the traditional lending process. We believe our marketplace offers a superior solution for both borrowers and investors.

For borrowers, we believe our marketplace offers the following principal competitive factors: better pricing versus other alternatives; a simple, easy and intuitive customer experience; a fast and efficient process; and trust and transparency.

For investors, we believe our marketplace offers the following principal competitive factors: attractive risk adjusted returns; lower duration risk; diversification from other asset classes; a simple, easy and intuitive customer experience; and trust and transparency.

Competition

For borrowers, we compete with banking institutions, credit unions, credit card issuers and other consumer finance companies. We also face competition from other online consumer lending companies. For investors, we compete with other investment vehicles and asset classes such as equities, bonds and commodities. We may also face potential competition from new market entrants, or business expansion from established companies. These companies may have significantly greater financial, technical, marketing and other resources and may be able to devote greater resources to the development, promotion, sale and support of their offerings.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and provide us with sustainable competitive advantages:

9

|

|

strengthens. This allows us to attract top talent, speed up product innovation, attract marketplace participants and drive down our cost structure, all of which further benefit borrowers and investors. |

|

|

× |

Robust Network Effect: The attractiveness of our marketplace increases as the number of participants on our marketplace increases, yielding a classic network effect. Our marketplace offers consumer borrowers access to affordable credit, and allows individual and institutional investors to invest in an asset class with attractive risk-adjusted returns. The diversity of investors brings scale and breadth of funding to our marketplace and makes credit more affordable. As both sides of the equation grow, the advantages (reduced risk, lower cost) scale accordingly, attracting even more borrowers and investors. The increased participant pool generates more data which we use to improve the effectiveness of our credit decisioning and scoring models. This enhances our aggregate loan performance and builds increased trust in our marketplace, which in turn attracts more borrowers and investors. |

|

|

× |

Technology Platform: Our technology platform automates key aspects of our operations, including the borrower application process, data gathering, underwriting, credit scoring, loan funding, investing and servicing, regulatory compliance and fraud detection. This provides a significant time and cost advantage over traditional consumer lending business models and, we believe, enables us to provide a superior user experience to our borrowers and investors. Using our accumulated performance data, we continually invest in incremental improvements in our algorithms thus extending our technological advantage. |

|

|

× |

Proprietary Risk Management Capabilities: We have developed a proprietary risk model based on consumer loan performance data, which we believe allows us to accurately assess the credit risk profile of borrowers and which we believe also allows investors to earn attractive risk adjusted returns. We leverage the results from our growing data stream to continually refine this risk model and more accurately predict loan performance. |

|

|

× |

Unique Corporate Structure: Our corporate structure was designed to offer our investors extra protection. The organization and operation of PFL and PMI as separate and distinct entities should serve to protect our Note investors in the event of a bankruptcy filing by or against PMI. This organizational structure, along with the federal and state registration process, is expensive and time consuming to undertake, and is not easily duplicated by competitors. |

|

|

× |

Efficient and Attractive Financial Model: We have multiple revenue streams and an efficient cost model. We generate revenue from transaction fees from our marketplace’s role in matching borrowers with investors to enable loan originations, as well as from servicing fees related to Borrower Loans for which we retain the servicing rights. Our technology platform significantly reduces the need for physical infrastructure and therefore allows our business to grow with a lower cost operating model, providing us with significant operating leverage. |

Sources of Revenues

We have two primary sources of revenues: transaction fees and servicing fees. Prosper earns transaction fees from WebBank by facilitating the origination of Borrower Loans through the marketplace. Prosper earns servicing fees from investors for processing principal and interest payments made by borrowers and passing such payments on to investors.

Sales and Marketing

Our sales and marketing efforts are designed to attract individuals and institutions to our marketplace, encourage their enrollment and participation as users, and facilitate and enhance their understanding and utilization of the services for borrowing or investing. We employ a wide range of marketing channels to reach potential customers and build our brand and value proposition. These channels include word-of-mouth referrals, online marketing, direct mail, radio campaigns, partner and affiliate introductions, emails, and public media. We are constantly seeking new methods to reach more potential members, while testing and optimizing the end to end customer experience.

Origination and Servicing

We have highly efficient and scalable systems for credit risk assessment, loan underwriting, and servicing. Our risk model takes borrowers’ supplied information and combines that information with public and proprietary data to make real time decisions. Our verification agents use automated tools to confirm credit eligibility. Our loan servicing platform calculates a loan’s amortization and processes payments received from borrowers and passes such payments on to investors. In addition, we have a back-up servicing agreement with First Associates Loan Servicing, LLC (“First Associates”), a loan servicing company that is willing and able to

10

assume servicing responsibilities in the event that we are no longer able to service the Borrower Loans and Notes. First Associates is a financial services company that has entered into numerous successor loan servicing agreements.

Technology

We have made substantial investment in our customer acquisition capability, customer experience, and credit underwriting, loan servicing and payment systems. Our marketplace utilizes proprietary accounting software to process electronic cash movements, record book entries and calculate cash balances in users’ funding accounts. Electronic deposits and payments are mostly done via Automated Clearing House (“ACH”) transactions. The technology platform allows us to economically acquire and service Borrower Loans and Notes, and allows WebBank to efficiently originate and fund Borrower Loans. We believe the growth of our marketplace will give us the economies of scale to lower unit costs.

The system hardware for our marketplace is located in hosting facilities in Scottsdale, Arizona; Las Vegas, Nevada; and San Francisco, California. We own all of the hardware deployed in support of our marketplace. We continuously monitor the performance and availability of our marketplace. The infrastructure is scalable and utilizes standard techniques such as load-balancing and redundancies.

Key aspects of our technology include:

Scalability: Our marketplace is designed and built as a highly scalable, multi-tier, redundant system. It incorporates technologies designed to prevent any single point of failure within the data center from taking the entire system offline. This is achieved by utilizing load-balancing technologies at the front end and business layer tiers and clustering technologies in the back-end tiers to allow scaling both horizontally and vertically depending on marketplace utilization.

Data integrity and security: We are committed to protecting our user’s information and we take the integrity and security of the data provided by them very seriously. To that end, we have established data protection policies which are implemented and enforced using the latest technologies. All sensitive information is transmitted on secure channels using SSL technology, with SSL certificates issued by VeriSign (Symantec). We employ principles of least privilege and layered security to protect stored sensitive information. Information at rest is encrypted using the industry level encryption technologies with appropriate controls to access the data. We protect the network perimeter using the latest technologies including but not limited to firewall and anti-virus threat management techniques. We use strong multi-factor authentication to protect and monitor remote access. We back up all data securely and would expect to recover operations in a short period of time in the event of a disaster. Extensive logging and monitoring of the systems and security controls enables us to ensure that the controls are functional and that alerts are triggered on policy violations.

Fraud detection: We employ a combination of proprietary technologies and commercially available licensed technologies and solutions to prevent and detect fraud. These include knowledge-based authentication, out-of-band authentication and notification, behavioral analytics and digital fingerprinting to prevent identity fraud. We use services from third-party vendors for user identification, credit checks and for checking customer names against the list of Specially Designated Nationals maintained by the Office of Foreign Assets Control (“OFAC”). In addition, we use specialized third-party software to augment the identity fraud detection systems. We also have a dedicated team which conducts additional investigations of cases flagged for high fraud risk. Finally, we enable investors to report suspicious activity, which we may then evaluate further.

Intellectual Property

We rely on a combination of copyright, trade secret, trademark, and other rights, as well as confidentiality procedures and contractual provisions, to protect our proprietary technology, processes and other intellectual property. We enter into confidentiality and other written agreements with our employees, consultants and service providers, and through these and other written agreements, attempt to control access to and distribution of the software, documentation and other proprietary technology and information. Despite these efforts to protect our proprietary rights, third parties may, in an authorized or unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute our intellectual property rights or technology or otherwise develop a product with the same functionality. Policing all unauthorized use of intellectual property rights is nearly impossible. Therefore, we cannot be certain that the steps we have taken or will take in the future will prevent misappropriations of our technology or intellectual property rights.

11

We have registered trademarks in the United States for “Prosper,” “Prosper Healthcare Funding,” “Prosper.com,” the Prosper and Prosper Healthcare Funding logos, and other trademarks.

Employees and Contractors

As of December 31, 2015, we employed 619 full-time employees. The following table shows a breakdown by function:

|

|

|

Employees |

|

|

|

Origination and Servicing |

|

|

221 |

|

|

Sales and Marketing |

|

|

115 |

|

|

General and Administrative - Research and Development |

|

|

133 |

|

|

General and Administrative – Other |

|

|

150 |

|

|

Total Headcount |

|

|

619 |

|

None of our employees are represented by labor unions. We have not experienced any work stoppages, and we believe that our relations with our employees are good.

Government Regulation

Overview

The lending and securities industries are highly regulated. The marketplace, Notes and Borrower Loans are all subject to extensive and complex rules and regulations. We also are subject to licensing and examination by various federal, state and local government authorities. These authorities impose obligations and restrictions on our activities and WebBank’s activities and the Borrower Loans acquired and Notes issued through our marketplace. In particular, these rules may limit the fees that may be assessed on the Borrower Loans, require extensive disclosure to, and consents from, borrowers, prohibit discrimination and impose multiple qualification and licensing obligations on marketplace activities. Failure to comply with these requirements may result in, among other things, revocation of required licenses or registrations, loss of approved status, voiding of loan contracts, indemnification liabilities to contract counterparties, class action lawsuits, administrative enforcement actions and civil and criminal liabilities. While compliance with such requirements is at times complicated by our novel business model, we believe we are in substantial compliance with these rules and regulations. These rules and regulations are subject to continuous change, however, and a material change could have an adverse effect on our compliance efforts and ability to operate.

State and Federal Laws and Regulations

State Licensing Requirements. In most states we believe that WebBank, as originator of all Borrower Loans originated through our marketplace, satisfies any relevant licensing requirements with respect to the origination of such Borrower Loans. In addition, as needed, we seek licenses and/or authorizations of various types so that we may conduct activities such as servicing and marketing in all states and the District of Columbia, with the exceptions of Iowa, Maine, North Dakota and Pennsylvania. We are subject to supervision and examination by the state regulatory authorities that administer these state lending laws. The licensing statutes vary from state to state and prescribe or impose different requirements on us, including: restrictions on loan origination and servicing practices, including limits on finance charges and the type, amount and manner of charging fees; disclosure requirements; requirements that licensees submit to periodic examination; surety bond and minimum specified net worth requirements; periodic financial reporting requirements; notification requirements for changes in principal officers, stock ownership or corporate control; restrictions on advertising; and requirements that loan forms be submitted for review.

State Usury Laws. Section 521 of the Depository Institution Deregulation and Monetary Control Act of 1980 (12 U.S.C. § 1831d) (“DIDA”) and Section 85 of the National Bank Act (“NBA”) (12 U.S.C. § 85), federal case law interpreting the NBA such as Tiffany v. National Bank of Missouri and Marquette National Bank of Minneapolis v. First Omaha Service Corporation and FDIC advisory opinion 92-47 permit FDIC-insured depository institutions, such as WebBank, to “export” the interest rate permitted under the laws of the state where the bank is located, regardless of the usury limitations imposed by the state law of the borrower’s state of residence unless the state has chosen to opt out of the exportation regime. WebBank is located in Utah, and Title 70C of the Utah Code does not limit the amount of fees or interest that may be charged by WebBank on loans of the type offered through our marketplace. Only Iowa and Puerto Rico have opted out of the exportation regime under Section 525 of DIDA and we do not operate in either jurisdiction. However, we believe that if a state in which we did operate opted out of rate exportation, judicial interpretations support the view that such opt outs only apply to loans “made” in those states.

In May 2015, the U.S. Court of Appeals for the Second Circuit issued a decision in Madden v. Midland Funding, LLC that interpreted the scope of federal preemption under the NBA and held that a nonbank assignee of a loan originated by a national bank

12

was not entitled to the benefits of federal preemption of claims of usury. The Second Circuit’s decision is binding on federal courts located in Connecticut, New York, and Vermont, but the decision could also be adopted by other courts. The defendant’s petition to the U.S. Supreme Court to review the decision is currently pending. We are unable to predict whether the U.S. Supreme Court will review the decision and, if it does, what the outcome will be. If applied to any of the Borrower Loans originated through our marketplace, the Second Circuit’s decision could adversely impact our business.

If a Borrower Loan made through our marketplace was deemed to be subject to the usury laws of a state that has opted-out of the exportation regime or becomes bound by the Second Circuit’s or a similar judicial decision, we could become subject to fines, penalties, and possible forfeiture of amounts charged to borrowers, and we may decide not to originate Borrower Loans through our marketplace in that applicable jurisdiction, which may adversely impact our growth. For more information, see “Item 1 A. Risk Factors—If our marketplace were found to violate a state’s usury laws, we might have to alter our business model and our business could be harmed.”

State Securities Laws. We are subject to the securities laws of each state in which the registration or qualification to offer and sell the Notes and PMI Management Rights has been approved. Certain of these state laws require us to renew the registration or qualification of Notes and PMI Management Rights on an annual basis.

The Dodd-Frank Wall Street Reform and Consumer Protection Act. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) created many new restrictions and an expanded framework of regulatory oversight for the financial services industry. Among other things, the Dodd-Frank Act centralized responsibility for consumer financial protections by creating the Consumer Financial Protection Bureau (the “CFPB”), which has broad authority to write regulations under federal consumer financial protection laws, such as the Truth-in Lending Act, the Equal Credit Opportunity Act, the Fair Credit Reporting Act, and the Fair Debt Collection Practices Act, and to enforce those laws against and examine large financial institutions, such as our issuing bank, for compliance. The CFPB is authorized to prevent “unfair, deceptive or abusive acts or practices” through its regulatory, supervisory and enforcement authority. We are subject to the CFPB’s jurisdiction, including its enforcement authority and may become subject to their supervisory authority, as a servicer and acquirer of consumer credit. The CFPB may request reports concerning our organization, business conduct, markets and activities, and also conduct on-site examinations of our business on a periodic basis.

Truth-in-Lending Act. The federal Truth-in-Lending Act (“TILA”), and Regulation Z, which implements TILA, require creditors to provide consumers with uniform, understandable information concerning certain terms and conditions of their loan and credit transactions. These rules apply to WebBank as the creditor for Borrower Loans facilitated through our marketplace, but because the transactions are carried out on our hosted website, we facilitate compliance at WebBank’s direction. For closed-end credit transactions of the type provided through our marketplace, these disclosures include providing the annual percentage rate, the finance charge, the amount financed, the number of payments and the amount of the monthly payment. The creditor must provide the disclosures before the Borrower Loan is closed. TILA also regulates the advertising of credit and gives borrowers, among other things, certain rights regarding updated disclosures and the treatment of credit balances. Our marketplace provides borrowers with a TILA disclosure prior to the time a Borrower Loan is originated. We also seek to comply with TILA’s disclosure requirements related to credit advertising.

Equal Credit Opportunity Act. The federal Equal Credit Opportunity Act (“ECOA”) prohibits creditors from discriminating against credit applicants on the basis of race, color, sex, age, religion, national origin, marital status, or the fact that all or part of the applicant’s income derives from any public assistance program or the fact that the applicant has in good faith exercised any right under the federal Consumer Credit Protection Act or any applicable state law. Regulation B, which implements ECOA, restricts creditors from requesting certain types of information from applicants and from making statements that would discourage on a prohibited basis a reasonable person from making or pursuing an application. These requirements apply both to a lender such as WebBank as well as to a party such as Prosper that regularly implements and communicates a credit decision. Investors may also be subject to the ECOA in their capacity as purchasers of Notes, if they are deemed to regularly participate in credit decisions. In the underwriting of Borrower Loans on our marketplace, both WebBank and we seek to comply with ECOA’s provisions prohibiting discouragement and discrimination. ECOA also requires creditors to provide consumers with timely notices of adverse action taken on credit applications. WebBank and we provide prospective borrowers who apply for a Borrower Loan through our marketplace but are denied credit with an adverse action notice in compliance with applicable requirements (see also below regarding “Fair Credit Reporting Act”).

Fair Credit Reporting Act. The federal Fair Credit Reporting Act (“FCRA”), administered by the CFPB, promotes the accuracy, fairness and privacy of information in the files of consumer reporting agencies. FCRA requires a permissible purpose to obtain a consumer credit report, and requires persons to report loan payment information to credit bureaus accurately. FCRA also imposes disclosure requirements on creditors who take adverse action on credit applications based on information contained in a credit report. WebBank and we have a permissible purpose for obtaining credit reports on potential borrowers and WebBank and we also

13

obtain explicit consent from borrowers to obtain such reports. As the servicer for the Borrower Loan, we have systems in place to report Borrower Loan payment and delinquency information to appropriate reporting agencies. We provide an adverse action notice to a rejected borrower on WebBank’s behalf at the time the borrower is rejected that includes all the required disclosures. We have implemented an identity theft prevention program.

Fair Debt Collection Practices Act. The federal Fair Debt Collection Practices Act (“FDCPA”) provides guidelines and limitations on the conduct of third-party debt collectors in connection with the collection of consumer debts. The FDCPA limits certain communications with third parties, imposes notice and debt validation requirements, and prohibits threatening, harassing or abusive conduct in the course of debt collection. While the FDCPA applies to third-party debt collectors, debt collection laws of certain states impose similar requirements on creditors who collect their own debts. Our agreement with our investors prohibits investors from attempting to collect directly on the Borrower Loan. We use our internal collection team and professional external debt collection agents to collect delinquent accounts. They are required to comply with all other applicable laws in collecting delinquent accounts of our borrowers.

Servicemembers Civil Relief Act. The federal Servicemembers Civil Relief Act (“SCRA”) allows military members to suspend or postpone certain civil obligations so that the military member can devote his or her full attention to military duties. The SCRA requires us to adjust the interest rate of borrowers who qualify for and request relief. If a borrower with an outstanding Borrower Loan qualifies for SCRA protection, we will reduce the interest rate on the Borrower Loan to 6% for the duration of the borrower’s active duty. During this period, the investors who have invested in such Borrower Loan will not receive the difference between 6% and the Borrower Loan’s original interest rate. For a borrower to obtain an interest rate reduction on a Borrower Loan due to military service, we require the borrower to send us a written request and a copy of the borrower’s mobilization orders. We do not take military service into account in assigning Prosper Ratings to borrower loan requests and we do not disclose the military status of borrowers to investors.

Other Lending Regulations. We are subject to and seek to comply with other state and federal laws and regulations applicable to consumer lending, including additional requirements relating to loan disclosure, credit discrimination, credit reporting, debt collection and unfair, deceptive or abusive business practices. These laws and regulations may be enforced by state consumer credit regulatory agencies, state attorneys general, the CFPB and private litigants, among others. Given our novel business model and the subjective nature of some of these laws and regulations, particularly laws regulating unfair, deceptive or abusive business practices, we may become subject to regulatory scrutiny or legal challenge with respect to our compliance with these requirements.

Electronic Funds Transfer Act. The federal Electronic Fund Transfer Act (“EFTA”), and Regulation E, which implements it, provide guidelines and restrictions on the electronic transfer of funds from consumers’ bank accounts. In addition, transfers performed by ACH electronic transfers are subject to detailed timing and notification rules and guidelines administered by the National Automated Clearinghouse Association (“NACHA”). Most transfers of funds in connection with the origination and repayment of the Borrower Loans are performed by ACH. We obtain necessary electronic authorization from borrowers and investors for such transfers in compliance with such rules. Transfers of funds through our marketplace are executed by Wells Fargo and conform to the EFTA, its regulations and NACHA guidelines.

Electronic Signatures in Global and National Commerce Act/Uniform Electronic Transactions Act. The federal Electronic Signatures in Global and National Commerce Act (“ESIGN”) and similar state laws, particularly the Uniform Electronic Transactions Act (“UETA”), authorize the creation of legally binding and enforceable agreements utilizing electronic records and signatures. ESIGN and UETA require businesses that want to use electronic records or signatures in consumer transactions to obtain the consumer’s consent to receive information electronically. When a borrower or individual investor registers with our marketplace, we obtain his or her consent to transact business electronically and maintain electronic records in compliance with ESIGN and UETA requirements.

Privacy and Data Security Laws. The federal Gramm-Leach-Bliley Act (“GLBA”) limits the disclosure of nonpublic personal information about a consumer to nonaffiliated third parties and requires financial institutions to disclose certain privacy policies and practices with respect to information sharing with affiliated and nonaffiliated entities as well as to safeguard personal customer information. Additional state and federal privacy and data security laws require safeguards to protect the privacy and security of consumers’ personally identifiable information, require notification to affected customers in the event of a breach, and restrict certain sharing of nonpublic personal information about a consumer with affiliated entities. We have a detailed privacy policy, which complies with GLBA and is accessible from our website. We maintain participants’ personal information securely, and we do not sell, rent or share such information with nonaffiliated third parties for marketing purposes unless previously agreed to by the participant. In addition, we take a number of measures to safeguard the personal information of our borrowers and investors and to protect it against unauthorized access.

14

Bank Secrecy Act. In cooperation with WebBank, we have implemented an anti-money laundering policy and various anti-money laundering procedures to comply with applicable federal law. With respect to new borrowers and investors, we apply the customer identification and verification program rules and screen names against the list of Specially Designated Nationals maintained by the U.S. Department of the Treasury Office of Foreign Asset Control’s (“OFAC”) pursuant to the USA PATRIOT Act amendments to the Bank Secrecy Act (“BSA”) and its implementing regulation.

New Laws and Regulations. From time to time, various types of federal and state legislation are proposed and new regulations are introduced that could result in additional regulation of, and restrictions on, the business of consumer lending. We cannot predict whether any such legislation or regulations will be adopted or how this would affect our business or our important relationships with third parties. In addition, the interpretation of existing legislation may change or may prove different than anticipated when applied to our novel business model. Compliance with such requirements could involve additional costs, which could have a material adverse effect on our business. As a consequence of the extensive regulation of commercial lending in the United States, our business is particularly susceptible to being affected by federal and state legislation and regulations that may increase the cost of doing business.

Foreign Laws and Regulations

We do not permit non-U.S. based individuals to register as borrowers on our marketplace and the marketplace does not operate outside the United States. Therefore, we do not believe that our marketplace is subject to foreign laws or regulations.

15

You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, when evaluating our business. Any of the following risks, either alone or taken together, could materially and adversely affect our business, financial condition, operating results and prospects. While we believe the risks and uncertainties described below include all material risks currently known by us, it is possible that these may not be the only ones we face.

RISKS RELATED TO BORROWER DEFAULT

The Notes are risky and speculative investments for suitable investors only.

Investors should be aware that the Notes offered through our marketplace are risky and speculative investments. The Notes are special, limited obligations of PFL and depend entirely for payment on PFL’s receipt of payments under the corresponding Borrower Loans. Notes are suitable only for investors of adequate financial means. If an investor cannot afford to lose the entire amount of such investor’s investment in the Notes, the investor should not invest in the Notes.

Payments on the Notes depend entirely on payments PFL receives on corresponding Borrower Loans. If a borrower fails to make any payments on the corresponding Borrower Loan related to a Note, payments on such Note will be correspondingly reduced.

PFL will only make payments pro rata on a series of Notes after it receives a borrower’s payment on the corresponding Borrower Loan, net of servicing fees. PFL also will retain from the funds received from the relevant borrower and otherwise available for payment on the Notes any non-sufficient funds fees and the amounts of any attorneys’ fees or collection fees imposed in connection with collection efforts. Under the terms of the Notes, if PFL does not receive any or all payments on the corresponding Borrower Loan, payments on the Note will be correspondingly reduced in whole or in part. If the relevant borrower does not make a payment on a specific monthly loan payment date, no payment will be made on the Note on the corresponding succeeding Note payment date.

Information provided by borrowers may be incomplete, inaccurate or intentionally false, and should generally not be relied upon.

Information in loan listings regarding the purpose of the loan and an applicant’s income, occupation and employment status is supplied directly by the applicant. Not all of this self-reported information is verified by us, and it may be incomplete, inaccurate or intentionally false. Moreover, loan listings do not disclose the identity of applicants, and investors have no ability to obtain or verify applicant information either before or after they purchase a Note. Investors are therefore cautioned not to rely on self-reported information such as income, occupation and employment status when making investment decisions. If an applicant supplies false, misleading or inaccurate information, an investor may lose part or all of the purchase price paid for a Note.

Investors should be aware that all listings are posted to our marketplace without our verifying self-reported information such as the purpose of the loan, income, occupation and employment status. Neither we nor WebBank verifies any statements by applicants as to how loan proceeds are to be used nor do we or WebBank confirm after loan funding how loan proceeds were used. In the cases in which we select applicants for income and employment verification, the verification is generally completed after the loan listing has been created but prior to the time the Borrower Loan is funded. For the period from July 14, 2009 to December 31, 2015, we verified employment and/or income on approximately 58% of the Borrower Loans originated through our marketplace on a unit basis (275,607 out of 473,986) and approximately 72% of originations on a dollar basis ($4,319,303 out of $5,979,755). We selected these listings based on a combination of factors, including amount of loan requested, Prosper Rating, debt-to-income ratio and stated income. The number or percentage of applicants whose income and employment information is verified in relation to future listings may differ from the historical information supplied above. No assurance is made that such information will be verified with respect to any particular applicant or borrower. Further, Note holders will not have any contractual or other relationship with any borrowers that would enable them to make any claim against such borrowers for fraud or breach of any representation or warranty in relation to any false, incomplete or misleading information supplied by such borrowers in relation to the relevant Borrower Loan or Note.

16

The Borrower Loans are not secured by any collateral or guaranteed or insured by any third party, and investors must rely on us or a third-party collection agency to pursue collection against any borrower.

Borrower Loans are unsecured obligations of borrowers. They are not secured by any collateral, and they are not guaranteed or insured by PFL, PMI or any third party, or backed by any governmental authority in any way. We and our third-party collection agencies will, therefore, be limited in our ability to collect on Borrower Loans. Moreover, Borrower Loans are obligations of borrowers to PFL as successor to WebBank, not obligations to the holders of Notes. Although payments on the Notes are dependent on the borrowers’ payments on the corresponding Borrower Loans, Note holders will have no recourse to the borrowers and no ability to pursue borrowers to collect payments under Borrower Loans. Holders of the Notes may look only to PFL for payment of the Notes.

The credit information of an applicant may be inaccurate or may not accurately reflect the applicant’s creditworthiness, which may cause an investor to lose all or part of the price paid for a Note.

We obtain applicant credit information from consumer reporting agencies, and assign Prosper Ratings to loan listings based in part on the applicant’s credit score. A credit score that forms a part of the Prosper Rating assigned to a listing may not reflect the applicant’s actual creditworthiness because the credit score may be based on outdated, incomplete or inaccurate consumer reporting data. Similarly, the credit data taken from the applicant’s credit report and displayed in listings may also be based on outdated, incomplete or inaccurate consumer reporting data. We do not verify the information obtained from the applicant’s credit report. Moreover, investors do not, and will not, have access to financial statements of applicants or to other detailed financial information about applicants.

The Prosper Rating may not accurately set forth the risks of investing in the Notes, no assurances can be provided that actual loss rates for the Notes will come within the estimated loss rates indicated by the Prosper Rating, and investors have limited rights to cause Prosper to repurchase the Notes.

The Prosper Rating assigned to a loan listing may not accurately reflect the risks of investing in the Notes, and is not a recommendation by us to buy, sell or hold a Note. For example, the Prosper Rating for a listing could be inaccurate because the applicant’s credit report contained incorrect information. Similarly, although most of the information provided by applicants that is relevant to the Prosper Rating is verified by us before calculating the Prosper Rating, we do not verify all such information. For example, we do not verify the income information on all applications. Further, the Prosper Rating does not reflect PFL’s credit risk as a debtor (such credit risk exists even though, as the debtor on the Notes, PFL’s only obligation is to pay to the Note holders their pro rata shares of collections received on the related Borrower Loans net of applicable fees). In addition, no assurances can be provided that actual loss rates for the Notes will fall within the expected loss rates indicated by the Prosper Rating. The interest rates on the Notes might not adequately compensate Note investors for these additional risks.

If we include in a listing a Prosper Rating that is different from the Prosper Rating calculated by us or calculate the Prosper Rating for a listing incorrectly, and such error materially and adversely affects a holder’s interest in the related Note, PFL will indemnify the holder or repurchase the Note. PFL will not, however, have any indemnity or repurchase obligation under the Amended and Restated Indenture, the Notes, the investor registration agreement or any other agreement associated with the Note Channel as a result of any other inaccuracy with respect to a listing’s Prosper Score or Prosper Rating. PFL’s contractual repurchase obligations do not affect a Note holder’s rights under federal or state securities laws.

Investors who use the Quick Invest tool may face additional risk of funding Borrower Loans that have been erroneously selected by Quick Invest.

Quick Invest is a loan search tool that allows investors to identify loan listings in the Note Channel that meet their criteria. Investors who use the Quick Invest tool may face additional risk of funding Borrower Loans that have been erroneously selected by Quick Invest. Since its first implementation in July 2011 through December 31, 2015, the Quick Invest tool has experienced programming errors that affected 8,630 Notes out of the 6,182,159 Notes purchased.

In the event that any errors in Quick Invest cause an investor to purchase a Note from PFL that such investor would not otherwise have purchased or that differs materially from the Note such investor would have purchased had there been no error, PFL will either repurchase the Note, indemnify the investor against losses suffered on that Note or cure such error. See “Item 1A. Risk Factors—Risks Related to PFL and PMI, our Marketplace and Our Ability to Service the Notes” for more information.

17

Some borrowers may use our marketplace to defraud investors, which could adversely affect investors’ ability to recoup their investment.

We perform identity and fraud checks with external databases to authenticate each borrower’s identity. There is a risk, however, that these checks could fail and fraud may occur. In addition, applicants may misrepresent their intentions regarding loan purpose or other information contained in listings, and we do not verify the majority of this information. Except in certain limited circumstances (including, e.g., a material payment default on the Borrower Loan resulting from verifiable identity theft), we are not obligated to indemnify or repurchase a Note or Borrower Loan from an investor if the investment is not realized in whole or in part due to fraud in connection with a loan listing, or due to false or inaccurate statements or omissions of fact in a listing, whether in credit data, a borrower’s representations, similar indicia of borrower intent and ability to repay the Borrower Loan. If PFL does repurchase a Note or Borrower Loan, the repurchase price will be equal to the Note’s or Borrower Loan’s outstanding principal balance and will not include accrued interest. Further, at the time of such repurchase of a Note, PMI will also concurrently repurchase the related PMI Management Rights for zero consideration.

The fact that we have the exclusive right and ability to investigate claims of identity theft in the origination of Borrower Loans creates a significant conflict of interest between us and our investors.

We have the exclusive right to investigate claims of identity theft and determine, in our sole discretion, whether verifiable identity theft has occurred. Such a determination of verifiable identity theft may trigger an obligation by PFL to either repurchase the related Notes or Borrower Loans or indemnify the applicable Note holders. The denial of a claim under PFL’s identity theft guarantee would save PFL from its indemnification or repurchase obligation. Because investors rely solely on us to investigate incidents that might require PFL to indemnify the applicable Note holders or repurchase the related Notes or Borrower Loans, a conflict of interest exists between us and such investors.

PFL does not have significant historical performance data about performance on the Borrower Loans. Loss rates on the Borrower Loans may increase and prior to investing you should consider the risk of non-payment and default.

The estimated loss rates displayed on loan listings and used to determine Prosper Ratings have been developed from the loss histories of all Borrower Loans originated through our marketplace. However, future Borrower Loans originated through our marketplace may default more often than similar Borrower Loans have defaulted in the past, which increases the risk of investing in the Notes.

If payments on the Borrower Loan corresponding to an investor’s Note become more than 30 days overdue, such investor will be unlikely to receive the full principal and interest payments that were expected on the Note, and such investor may not recover the original purchase price on the Note.

We may refer Borrower Loans that become past due to a third party collection agency for collection or we may collect on such Borrower Loans directly. If a borrower fails to make a required payment on a Borrower Loan within 30 days of the due date, we will pursue reasonable collection efforts in respect of the Borrower Loan, including referring the delinquent Borrower Loan to a collection agency within five business days after it becomes 30 days past due. If payment amounts on a delinquent Borrower Loan are received from a borrower after the loan has been referred to our in-house collections department or an outside collection agency, we or that collection agency may retain a percentage of that payment as a fee before any principal or interest becomes payable to an investor. Collection fees may be up to 40% of recovered amounts, in addition to any legal fees and transaction fees associated with accepting payments incurred in the collection effort.

For some non-performing Borrower Loans, we may not be able to recover any of the unpaid loan balance and, as a result, an investor who has purchased a corresponding Note may receive little, if any, of the unpaid principal and interest payable under the Note. In all cases, investors must rely on our collection efforts or the applicable collection agency to which such Borrower Loans are referred, and are not permitted to collect or attempt collection of payments on the Borrower Loans in any manner.

Loss rates on the Borrower Loans may increase as a result of economic conditions beyond our control and beyond the control of the borrower.

Borrower Loan loss rates may be significantly affected by economic downturns or general economic conditions beyond our control and beyond the control of individual borrowers. In particular, loss rates on Borrower Loans may increase due to factors such as prevailing interest rates, the rate of unemployment, the level of consumer confidence, residential real estate values, the value of the U.S. dollar, energy prices, changes in consumer spending, the number of personal bankruptcies, disruptions in the credit markets and other factors.

18

The Borrower Loans do not restrict borrowers from incurring additional unsecured or secured debt, nor do they impose any financial restrictions on borrowers during the term of the Borrower Loan, which may reduce the likelihood that an investor will receive the full principal and interest payments that such investor expects to receive on a Note.