Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - OptimizeRx Corp | f8k031516_optimizerxcorp.htm |

| EX-99.2 - CONFERENCE CALL TRANSCRIPT DATED MARCH 15, 2016 - OptimizeRx Corp | f8k031516ex99ii_optimizerx.htm |

Exhibit 99.1

Corporate Presentation March 2016 OTCQB: OPRX

OTCQB: OPRX This presentation contains forward - looking statements within the definition of Section 27A of the Securities Act of 1933, as amended and such section 21E of the Securities Act of 1934, amended. These forward - looking statements should not be used to make an investment decision. The words 'estimate,' 'possible' and 'seeking' and similar expressions identify forward - looking statements, which speak only as to the date the statement was made. The company undertakes no obligation to publicly update or revise any forward - looking statements, whether because of new information, future events, or otherwise. Forward - looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward - looking statements. The risks and uncertainties to which forward - looking statements are set forth in our Annual Report on Form 10 - K as filed with the Securities and Exchange Commission and available on our website at optimizerx.com or the SEC site at sec.gov. Important Cautions Regarding Forward Looking Statements 2

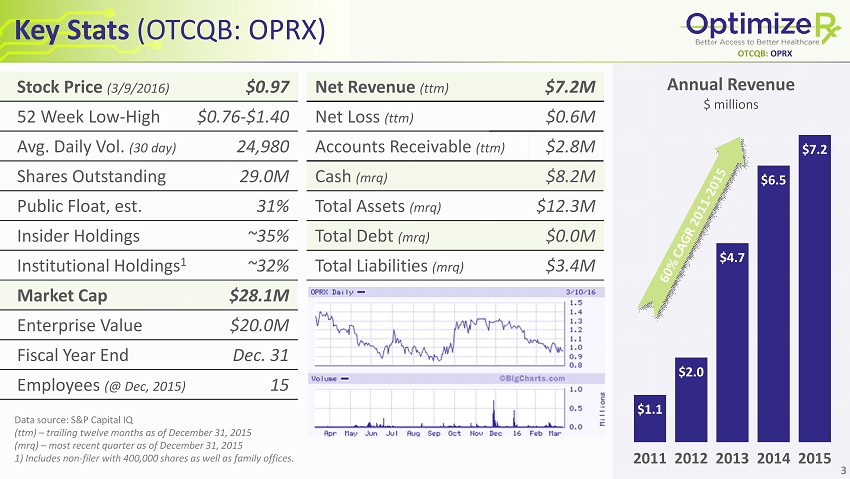

OTCQB: OPRX $1.1 $2.0 $4.7 $6.5 $7.2 2011 2012 2013 2014 2015 Annual Revenue $ millions Stock Price (3/9/2016 ) $0.97 52 Week Low - High $0.76 - $1.40 Avg. Daily Vol. (30 day) 24,980 Shares Outstanding 29.0M Public Float, est. 31% Insider Holdings ~35% Institutional Holdings 1 ~32% Market Cap $28.1M Enterprise Value $20.0M Fiscal Year End Dec. 31 Employees (@ Dec, 2015) 15 Data source: S&P Capital IQ (ttm) – trailing twelve months as of December 31, 2015 (mrq) – most recent quarter as of December 31, 2015 1) Includes non - filer with 400,000 shares as well as family offices. Net Revenue ( ttm ) $7.2M Net Loss ( ttm ) $0.6M Accounts Receivable ( ttm ) $ 2.8M Cash ( mrq ) $8.2M Total Assets ( mrq ) $12.3M Total Debt ( mrq ) $0.0M Total Liabilities ( mrq ) $ 3.4M Key Stats (OTCQB: OPRX) 3

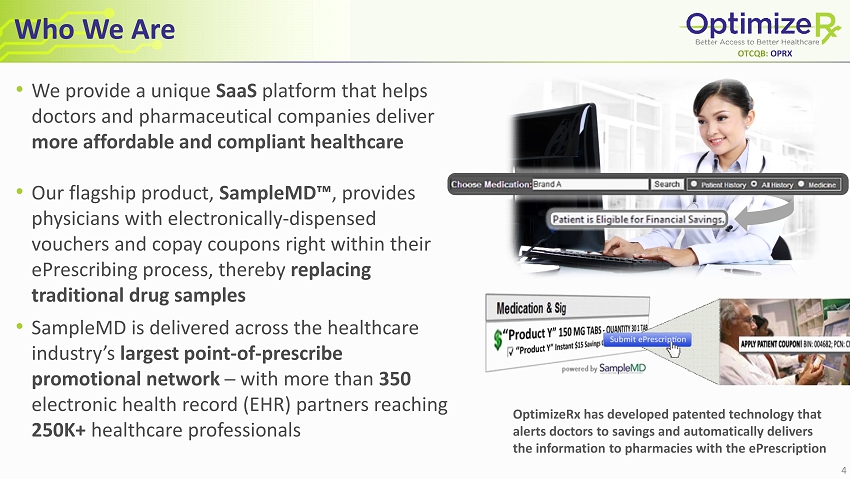

OTCQB: OPRX Who We Are • We provide a unique SaaS platform that helps doctors and pharmaceutical companies deliver more affordable and compliant healthcare • Our flagship product, SampleMD ™ , provides physicians with electronically - dispensed vouchers and copay coupons right within their ePrescribing process, thereby replacing traditional drug samples • SampleMD is delivered across the healthcare industry’s largest point - of - prescribe promotional network ─ with more than 350 electronic health record (EHR) partners reaching 250K+ healthcare professionals 4 OptimizeRx has developed patented technology that alerts doctors to savings and automatically delivers the information to pharmacies with the ePrescription

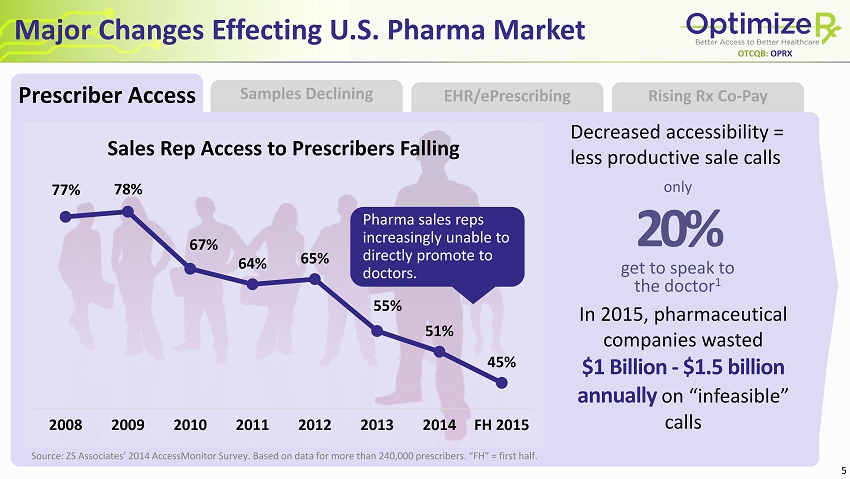

OTCQB: OPRX Samples Declining EHR/ ePrescribing Rising Rx Co - Pay Decreased accessibility = less productive sale calls In 2015, pharmaceutical companies wasted $1 Billion - $1.5 billion annually on “infeasible” calls Prescriber Access 5 Major Changes Effecting U.S. Pharma Market 77% 78% 67% 64% 65% 55% 51% 45% 2008 2009 2010 2011 2012 2013 2014 FH 2015 Sales Rep Access to Prescribers Falling Source: ZS Associates’ 2014 AccessMonitor Survey. Based on data for more than 240,000 prescribers. “FH” = first half. only 20% get to speak to the doctor 1 Pharma sales reps increasingly unable to directly promote to doctors.

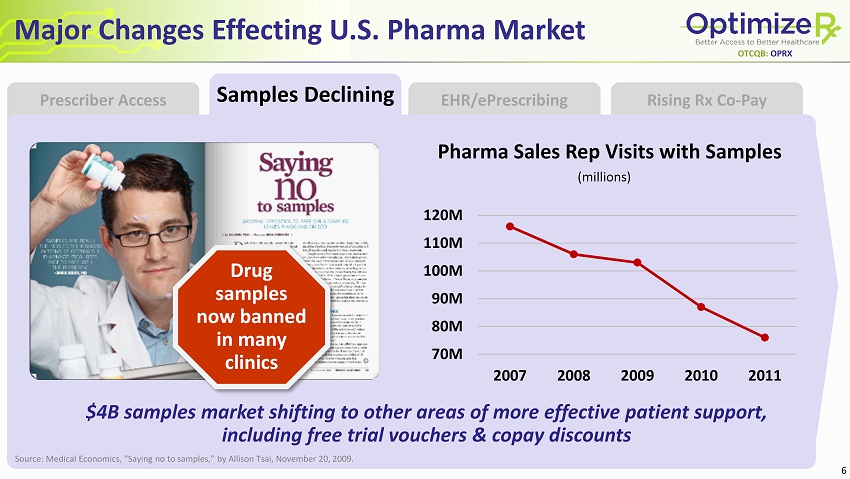

OTCQB: OPRX Prescriber Access Rising Rx Co - Pay EHR/ ePrescribing Samples Declining 6 Major Changes Effecting U.S. Pharma Market $4B samples market shifting to other areas of more effective patient support, including free trial vouchers & copay discounts Source: Medical Economics, “Saying no to samples,” by Allison Tsai, November 20, 2009. Drug samples now banned in many clinics 70M 80M 90M 100M 110M 120M 2007 2008 2009 2010 2011 (millions) Pharma Sales Rep Visits with Samples

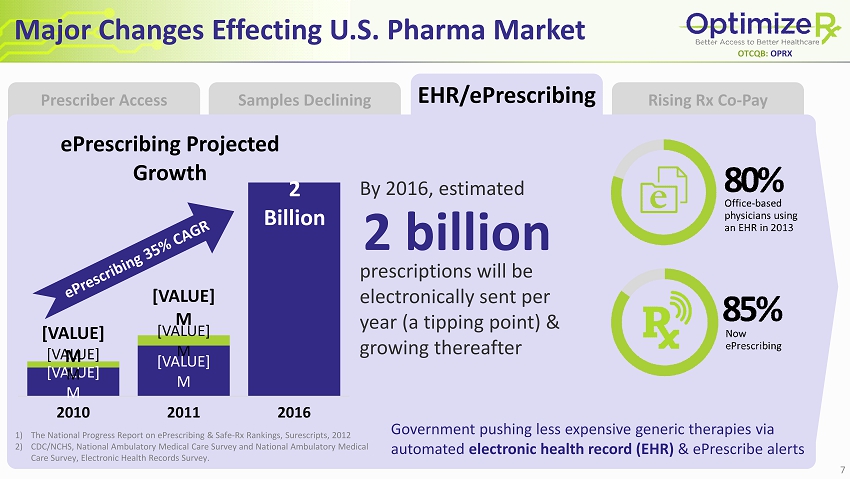

OTCQB: OPRX Samples Declining Prescriber Access Rising Rx Co - Pay EHR / ePrescribing By 2016, estimated prescriptions will be electronically sent per year (a tipping point) & growing thereafter 2 billion 7 Major Changes Effecting U.S. Pharma Market [VALUE] M [VALUE] M 2 Billion [VALUE] M [VALUE] M [VALUE] M [VALUE] M 2010 2011 2016 ePrescribing Projected Growth 1) The National Progress Report on ePrescribing & Safe - Rx Rankings, Surescripts , 2012 2) CDC/NCHS, National Ambulatory Medical Care Survey and National Ambulatory Medical Care Survey, Electronic Health Records Survey. Government pushing less expensive generic therapies via automated electronic health record (EHR) & ePrescribe alerts

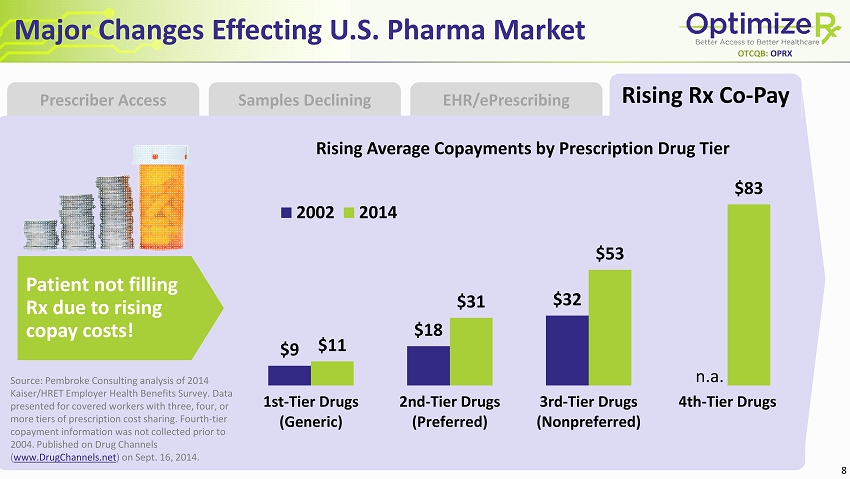

OTCQB: OPRX Prescriber Access Samples Declining EHR/ ePrescribing Rising Rx Co - Pay 8 Major Changes Effecting U.S. Pharma Market Patient not filling Rx due to rising copay costs! $9 $18 $32 $11 $31 $53 $83 1st-Tier Drugs (Generic) 2nd-Tier Drugs (Preferred) 3rd-Tier Drugs (Nonpreferred) 4th-Tier Drugs Rising Average Copayments by Prescription Drug Tier 2002 2014 Source: Pembroke Consulting analysis of 2014 Kaiser/HRET Employer Health Benefits Survey. Data presented for covered workers with three, four, or more tiers of prescription cost sharing. Fourth - tier copayment information was not collected prior to 2004. Published on Drug Channels ( www.DrugChannels.net ) on Sept. 16, 2014. n.a .

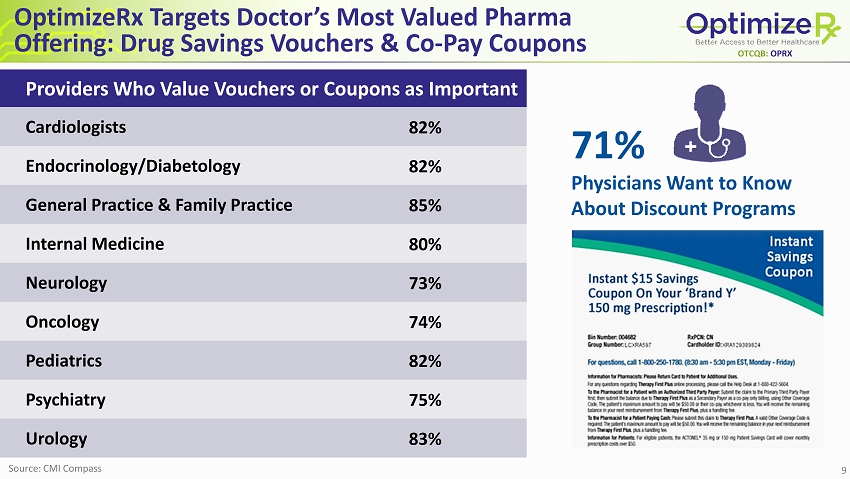

OTCQB: OPRX OptimizeRx Targets Doctor’s Most Valued Pharma Offering: Drug Savings Vouchers & Co - Pay Coupons 9 Providers Who Value Vouchers or Coupons as Important Cardiologists 82% Endocrinology/ Diabetology 82% General Practice & Family Practice 85% Internal Medicine 80% Neurology 73% Oncology 74% Pediatrics 82% Psychiatry 75% Urology 83% Source: CMI Compass 71% Physicians Want to Know About Discount Programs

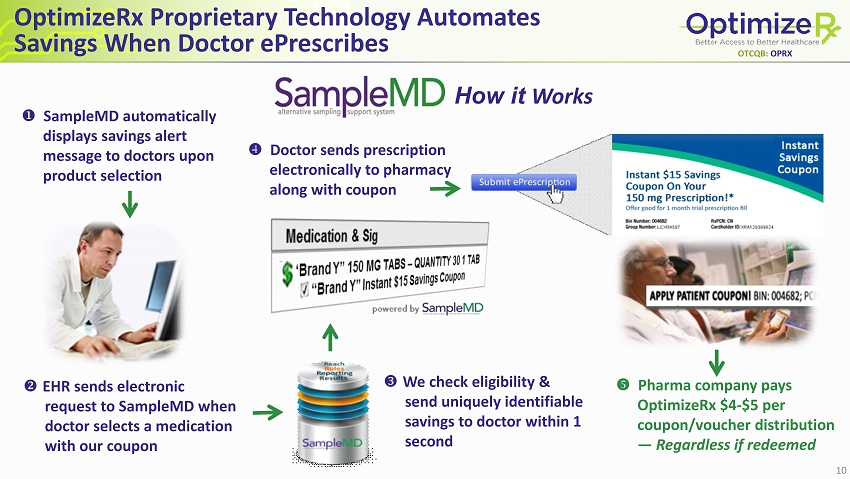

OTCQB: OPRX SampleMD automatically displays savings alert message to doctors upon product selection □ EHR sends electronic request to SampleMD when doctor selects a medication with our coupon We check eligibility & send uniquely identifiable savings to doctor within 1 second OptimizeRx Proprietary Technology Automates Savings When Doctor ePrescribes 10 Doctor sends prescription electronically to pharmacy along with coupon Pharma company pays OptimizeRx $4 - $5 per coupon/voucher distribution — Regardless if redeemed How it Works

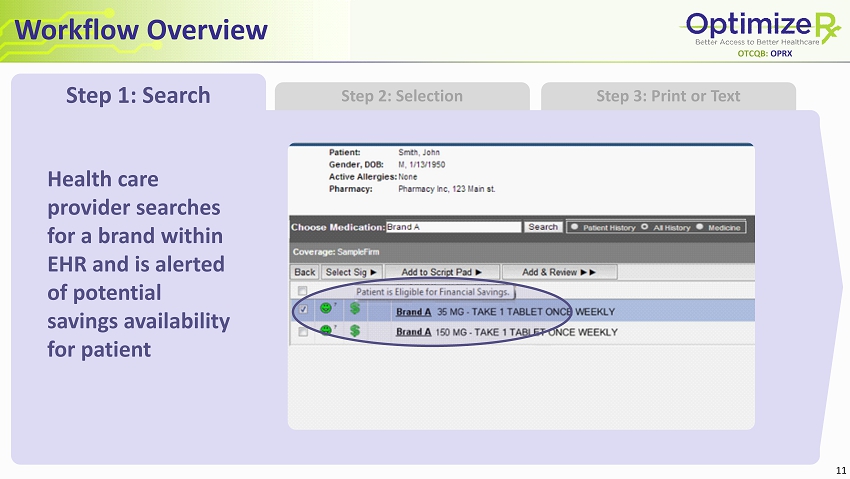

OTCQB: OPRX Step 2: Selection Step 3: Print or Text Step 1: Search 11 Workflow Overview Health care provider searches for a brand within EHR and is alerted of potential savings availability for patient

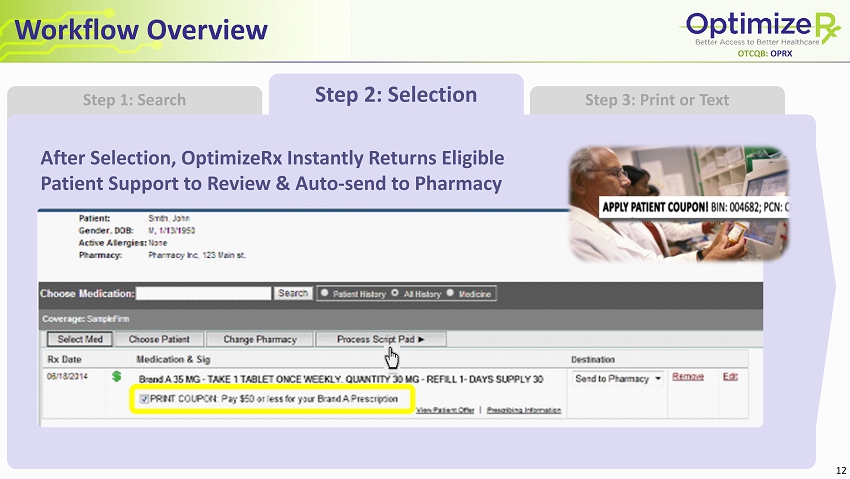

OTCQB: OPRX Step 2: Selection Step 1: Search Step 3: Print or Text 12 Workflow Overview After Selection, OptimizeRx Instantly Returns Eligible Patient Support to Review & Auto - send to Pharmacy

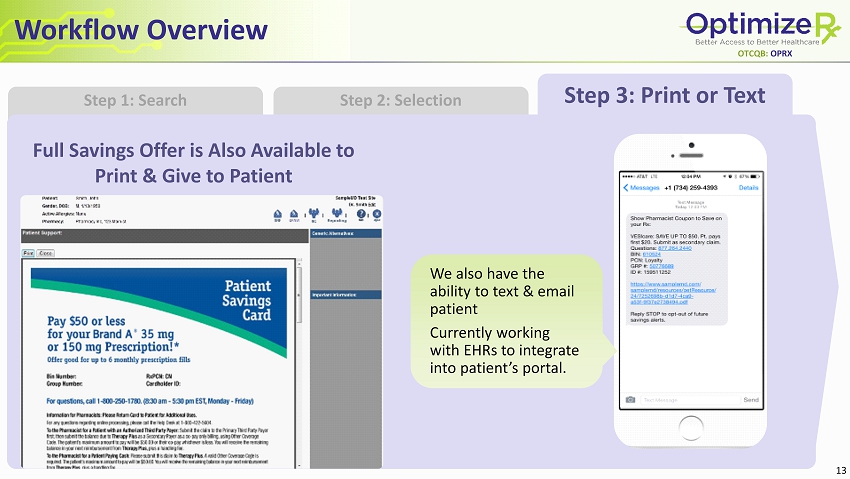

OTCQB: OPRX Step 3: Print or Text Step 1: Search Step 2: Selection 13 Workflow Overview We also have the ability to text & email patient Currently working with EHRs to integrate into patient’s portal. Full Savings Offer is Also Available to Print & Give to Patient

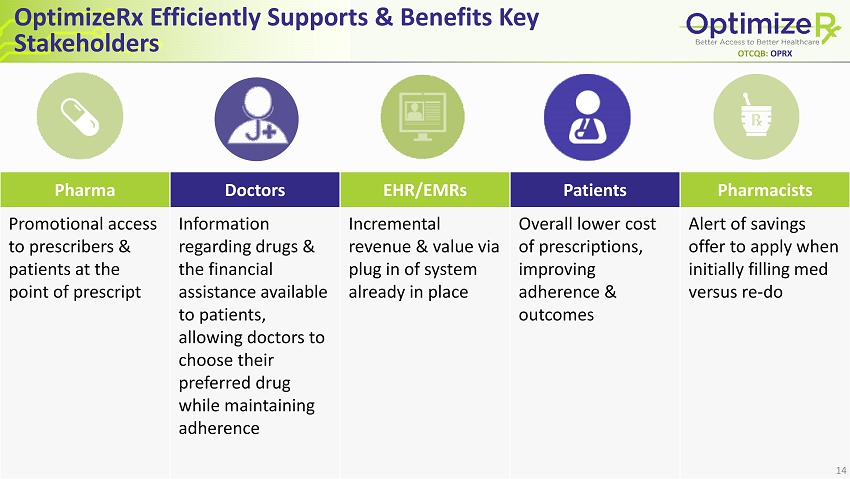

OTCQB: OPRX Pharma Doctors EHR/EMRs Patients Pharmacists Promotional access to prescribers & patients at the point of prescript Information regarding drugs & the financial assistance available to patients, allowing doctors to choose their preferred drug while maintaining adherence Incremental revenue & value via plug in of system already in place Overall lower cost of prescriptions, improving adherence & outcomes Alert of savings offer to apply when initially filling med versus re - do OptimizeRx Efficiently Supports & Benefits Key Stakeholders 14

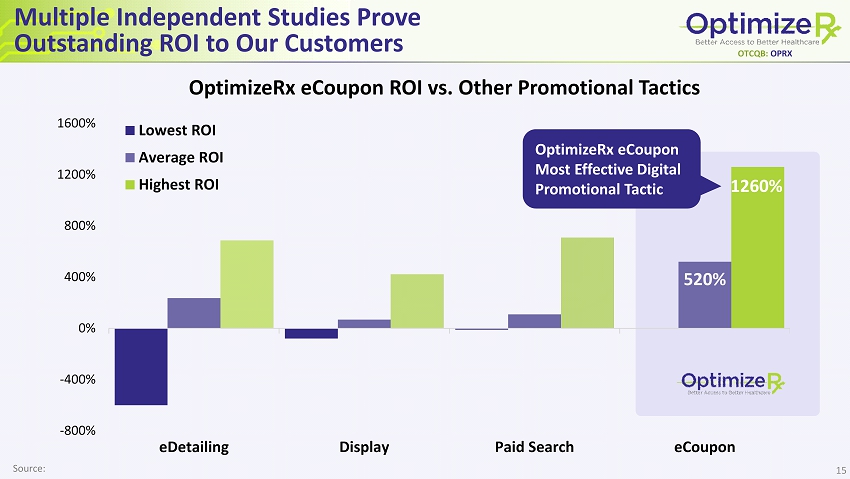

OTCQB: OPRX 520% 1260% -800% -400% 0% 400% 800% 1200% 1600% eDetailing Display Paid Search eCoupon OptimizeRx eCoupon ROI vs. Other Promotional Tactics Lowest ROI Average ROI Highest ROI 15 Multiple Independent Studies Prove Outstanding ROI to Our Customers OptimizeRx eCoupon Most Effective Digital Promotional Tactic Source:

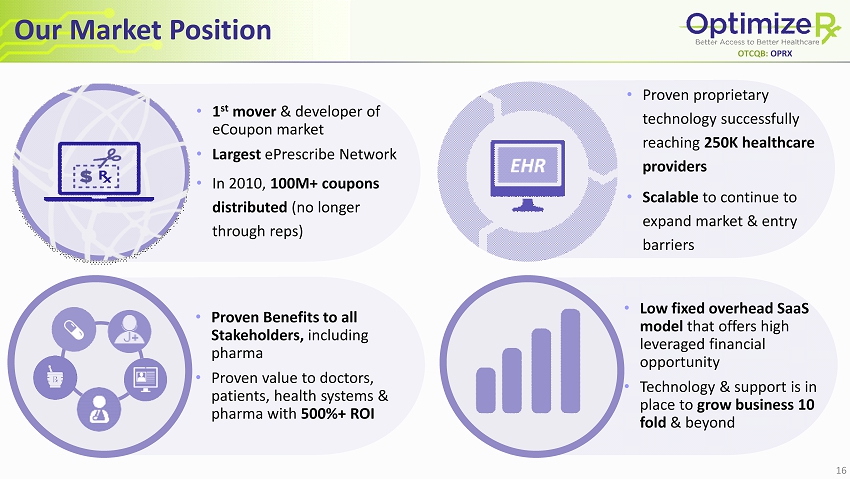

OTCQB: OPRX • Low fixed overhead SaaS model that offers high leveraged financial opportunity • Technology & support is in place to grow business 10 fold & beyond • Proven Benefits to all Stakeholders, including pharma • Proven value to doctors, patients, health systems & pharma with 500%+ ROI • Proven proprietary technology successfully reaching 250K healthcare providers • Scalable to continue to expand market & entry barriers • 1 st mover & developer of eCoupon market • Largest ePrescribe Network • In 2010, 100M+ coupons distributed (no longer through reps) Our Market Position 16

OTCQB: OPRX Our Technology is Integrated in 350+ Electronic Health Record (EHR) Providers & Growing Largest point of prescribe promotional network: 350+ EHRs , with 200+ EHRs exclusive to OptimizeRx , including Allscripts = high barriers to entry 17 August 2015: OptimizeRx & Allscripts expanded its exclusive partnership to automate voucher and copay savings support within its Touchworks ® EHR platform. Some of the largest health systems in the country use Touchworks EHR — enabling OptimizeRx to reach 45,000+ new prescribers in 2H - 2016 .

OTCQB: OPRX Our Clients Are the Leading Pharmaceutical Companies in the World 18 Over 670 Rx brands that have copay coupons!

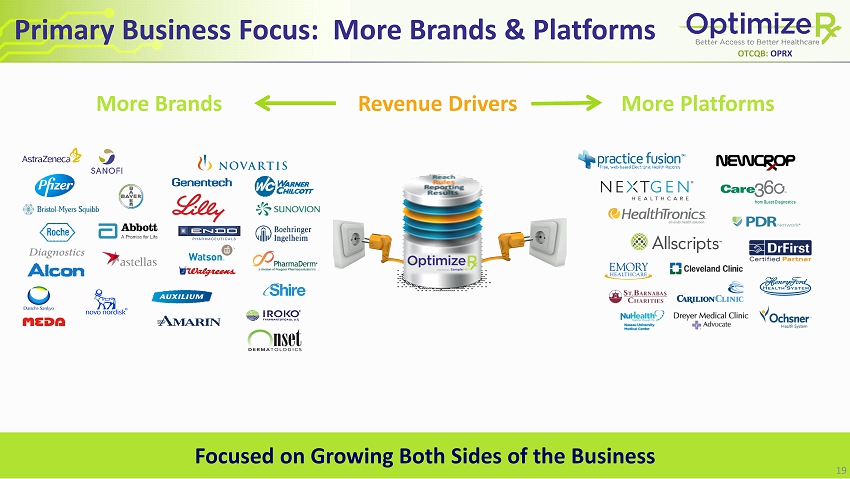

OTCQB: OPRX Focused on Growing Both Sides of the Business Revenue Drivers More Brands More Platforms Primary Business Focus: More Brands & Platforms 19

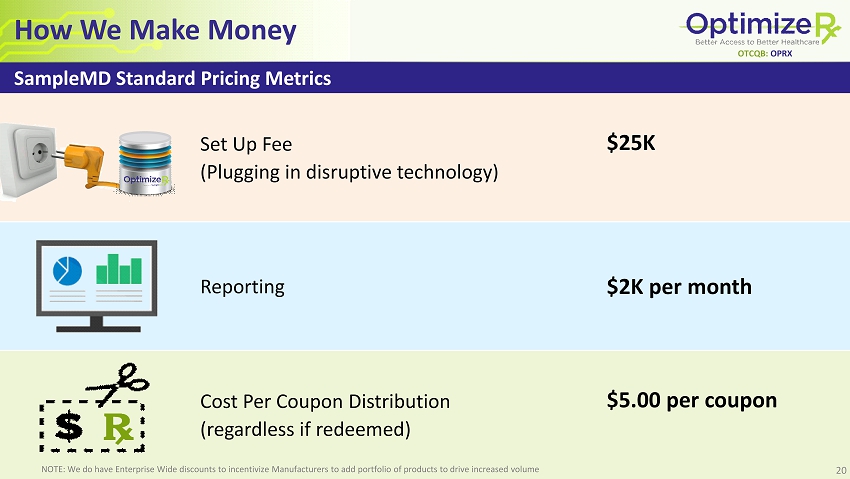

OTCQB: OPRX SampleMD Standard Pricing Metrics Set Up Fee (Plugging in disruptive technology) $25K Reporting $2K per month Cost Per Coupon Distribution (regardless if redeemed) $5.00 per coupon How We Make Money 20 NOTE: We do have Enterprise Wide discounts to incentivize Manufacturers to add portfolio of products to drive increased volum e

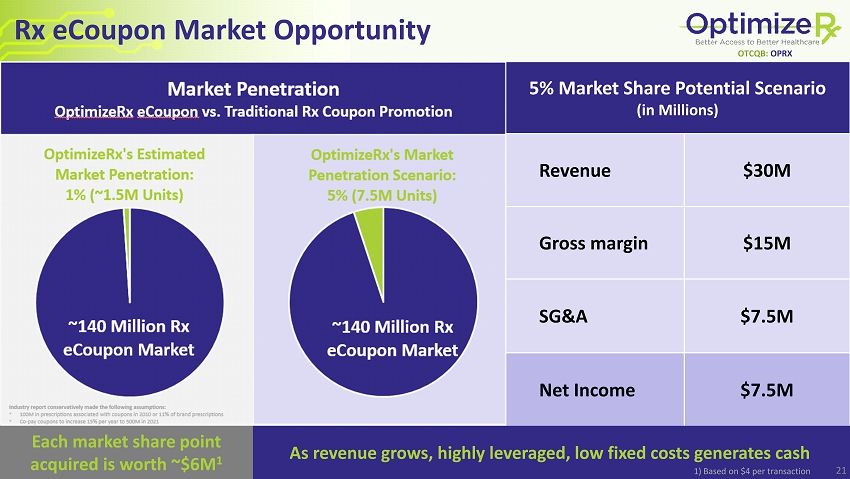

OTCQB: OPRX Market Penetration OptimizeRx eCoupon vs. Traditional Rx Coupon Promotion 5% Market Share Potential Scenario (in Millions) Revenue $30M Gross margin $15M SG&A $7.5M Net Income $7.5M As revenue grows, highly leveraged, low fixed costs generates cash 21 ~140 Million [CATEGOR Y NAME] [CATEGORY NAME] [PERCENTAG E] (7.5M Units) Rx eCoupon Market Opportunity ~140 Million [CATEGOR Y NAME] [CATEGORY NAME] [PERCENTAG E] (~1.5M Units) 1) Based on $4 per transaction Industry report conservatively made the following assumptions: • 100M in prescriptions associated with coupons in 2010 or 11% of brand prescriptions • Co - pay coupons to increase 15% per year to 500M in 2021 Each market share point acquired is worth ~$6M 1

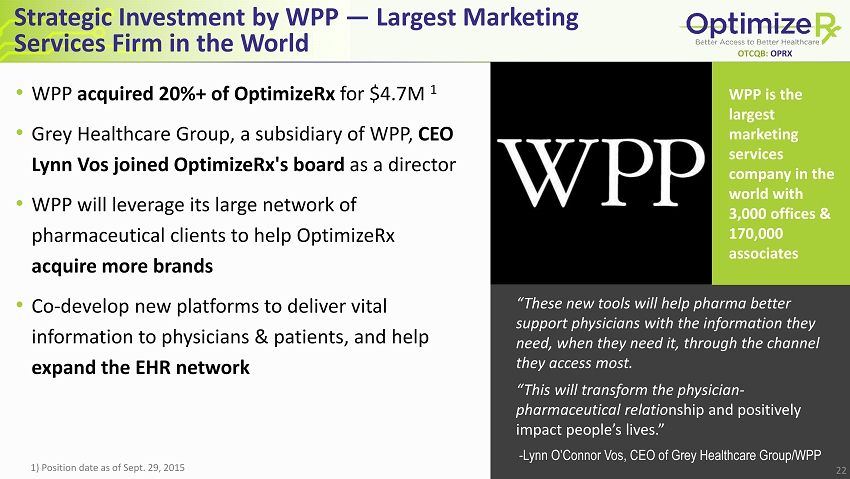

OTCQB: OPRX “These new tools will help pharma better support physicians with the information they need, when they need it, through the channel they access most. “This will transform the physician - pharmaceutical relatio nship and positively impact people’s lives.” - Lynn O’Connor Vos, CEO of Grey Healthcare Group/WPP Strategic Investment by WPP — Largest Marketing Services Firm in the World • WPP acquired 20%+ of OptimizeRx for $4.7M 1 • Grey Healthcare Group, a subsidiary of WPP, CEO Lynn Vos joined OptimizeRx's board as a director • WPP will leverage its large network of pharmaceutical clients to help OptimizeRx acquire more brands • Co - develop new platforms to deliver vital information to physicians & patients, and help expand the EHR network WPP is the largest marketing services company in the world with 3,000 offices & 170,000 associates 1) Position date as of Sept. 29, 2015 22

OTCQB: OPRX $1.1 $2.0 $4.7 $6.5 $7.2 2011 2012 2013 2014 2015 Annual Revenue Growth ($ in millions) Q4 2015 and Full Year 2015 Financial Highlights • Net revenue was a record $ 2.02M in Q4, driving record full year revenue of $ 7.2M • Generated operating income , excluding non - cash expenses, of $350,000 in 2015 • Cash & cash equivalents totaled $8.2M as of Dec. 31, 2015 and the company continues to operate debt - free 23

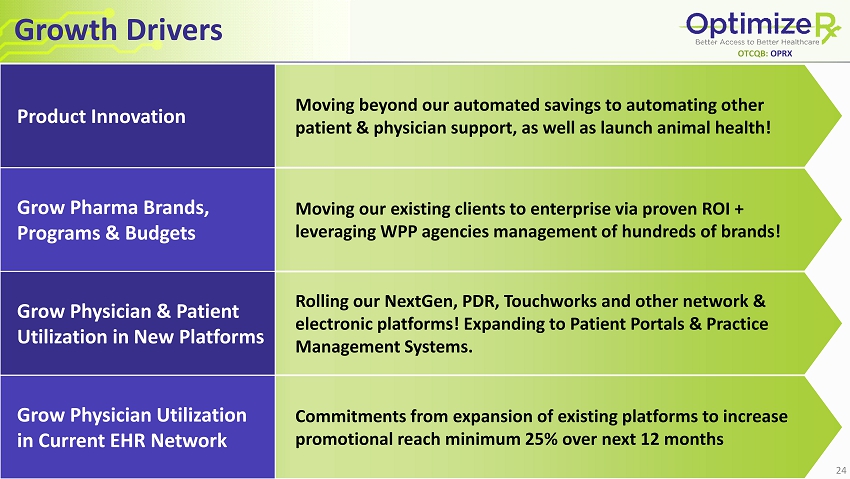

OTCQB: OPRX Moving our existing clients to enterprise via proven ROI + leveraging WPP agencies management of hundreds of brands! Rolling our NextGen , PDR, Touchworks and other network & electronic platforms! Expanding to Patient Portals & Practice Management Systems. Commitments from expansion of existing platforms to increase promotional reach minimum 25% over next 12 months Moving beyond our automated savings to automating other patient & physician support, as well as launch animal health! Growth Drivers There are 670+ Rx brands that have copay coupons 24 Product Innovation Grow Pharma Brands, Programs & Budgets Grow Physician & Patient Utilization in New Platforms Grow Physician Utilization in Current EHR Network

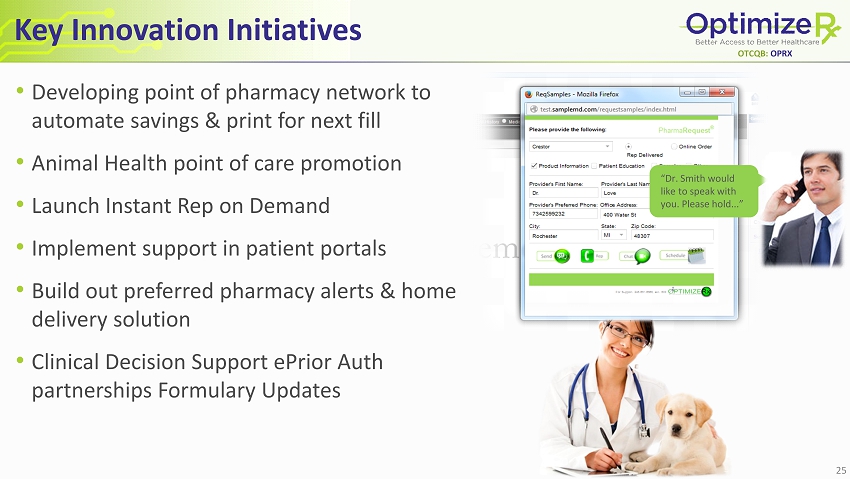

OTCQB: OPRX “Dr. Smith would like to speak with you. Please hold...” Key Innovation Initiatives • Developing point of pharmacy network to automate savings & print for next fill • Animal Health point of care promotion • Launch Instant Rep on Demand • Implement support in patient portals • Build out preferred pharmacy alerts & home delivery solution • Clinical Decision Support ePrior Auth partnerships Formulary Updates 25

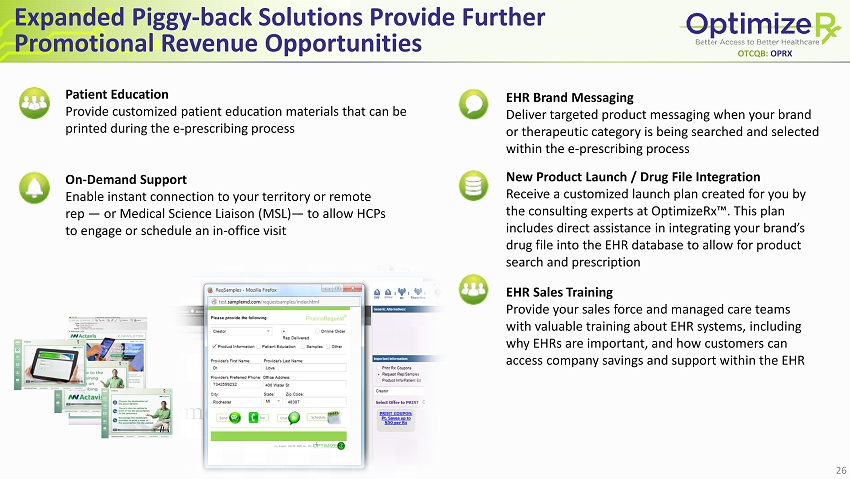

OTCQB: OPRX Expanded Piggy - back Solutions Provide Further Promotional Revenue Opportunities 26 Patient Education Provide customized patient education materials that can be printed during the e - prescribing process On - Demand Support Enable instant connection to your territory or remote rep — or Medical Science Liaison (MSL) — to allow HCPs to engage or schedule an in - office visit EHR Brand Messaging Deliver targeted product messaging when your brand or therapeutic category is being searched and selected within the e - prescribing process EHR Sales Training Provide your sales force and managed care teams with valuable training about EHR systems, including why EHRs are important, and how customers can access company savings and support within the EHR New Product Launch / Drug File Integration Receive a customized launch plan created for you by the consulting experts at OptimizeRx ™. This plan includes direct assistance in integrating your brand’s drug file into the EHR database to allow for product search and prescription

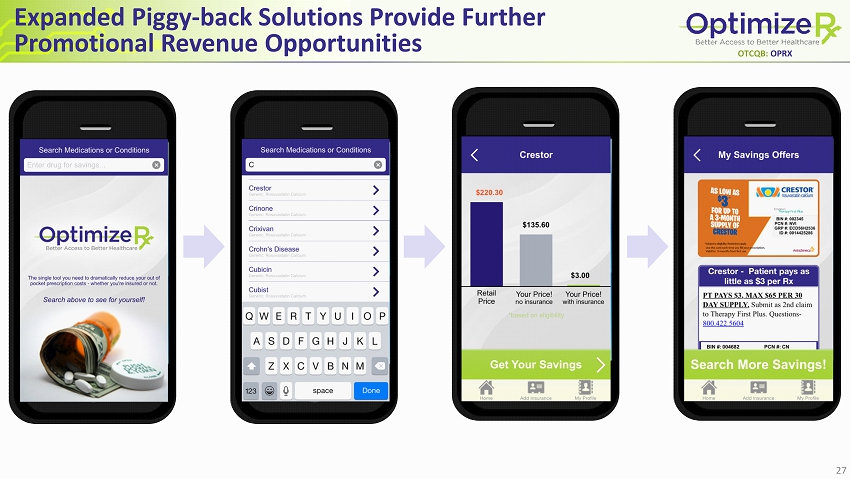

OTCQB: OPRX Expanded Piggy - back Solutions Provide Further Promotional Revenue Opportunities 27

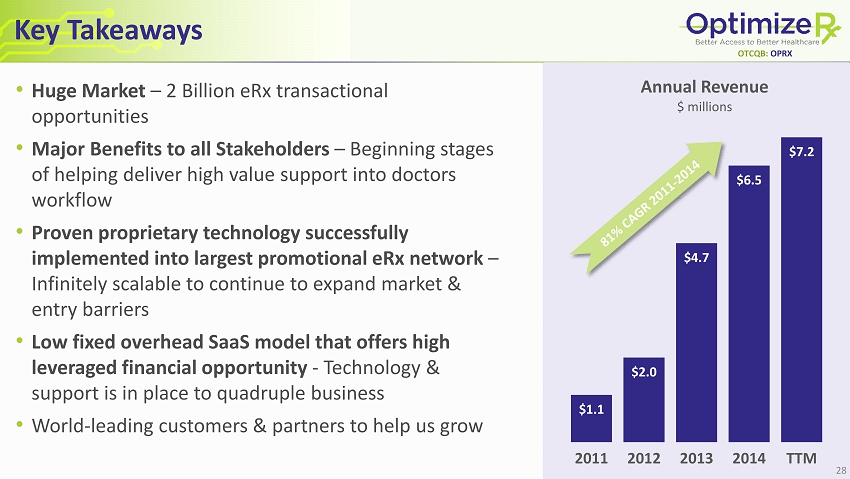

OTCQB: OPRX Key Takeaways • Huge Market – 2 Billion eRx transactional opportunities • Major Benefits to all Stakeholders – Beginning stages of helping deliver high value support into doctors workflow • Proven proprietary technology successfully implemented into largest promotional eRx network – Infinitely scalable to continue to expand market & entry barriers • Low fixed overhead SaaS model that offers high leveraged financial opportunity - Technology & support is in place to quadruple business • World - leading customers & partners to help us grow 28 $1.1 $2.0 $4.7 $6.5 $7.2 2011 2012 2013 2014 TTM Annual Revenue $ millions

OTCQB: OPRX Contact Us Company Contacts: William Febbo, CEO wfebbo@optimizerx.com 248 - 651 - 6568 Doug Baker, CFO dbaker@samplemd.com 248 - 651 - 6568 x807 Investor Relations Contact: Liolios Group Ron Both, Senior Managing Director oprx@liolios.com 949 - 574 - 3860 29 Headquarters: 400 Water Street STE 200 Rochester, MI 48307