Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Healthcare Trust, Inc. | v434585_8k.htm |

Exhibit 99.1

Healthcare Trust, Inc. Fourth Quarter Investor Presentation Publicly Registered Non - Traded Real Estate Investment Trust*

Risk Factors 2 Risk Factors Investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with our Company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s Annual Report on Form 10 - K for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details.

Healthcare Trust, Inc. 3 Healthcare Trust, Inc. (including, as required by context, Healthcare Trust Operating Partnership, LP and its subsidiaries, the "Company ") invests in healthcare real estate, such as seniors housing and medical office buildings, in the United States for investment purposes.

Portfolio Snapshot 4 ASSETS Medical Office Buildings 81 Seniors Housing 58 Post - Acute Care 20 Hospitals 4 Land 2 Development 1 MOB Occupancy MOB Avg . Lease Term Affiliated MOBs On - Campus MOBs 91.4% 6.0 Years 66 of 81 20 of 81 166 Assets $2.3 Billion Invested 8.5 Million Square Feet

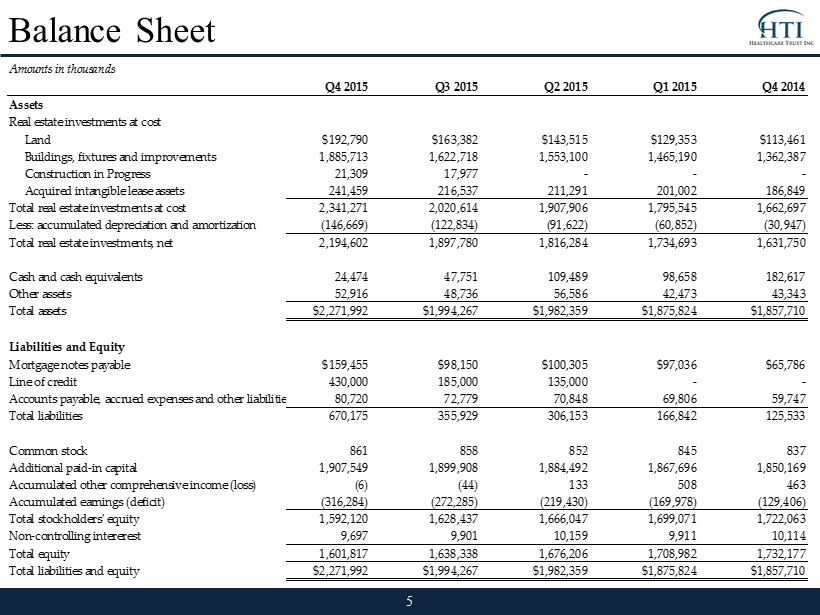

Balance Sheet 5 Amounts in thousands Q4 2015 Q3 2015 Q2 2015 Q1 2015 Q4 2014 Assets Real estate investments at cost Land $192,790 $163,382 $143,515 $129,353 $113,461 Buildings, fixtures and improvements 1,885,713 1,622,718 1,553,100 1,465,190 1,362,387 Construction in Progress 21,309 17,977 - - - Acquired intangible lease assets 241,459 216,537 211,291 201,002 186,849 Total real estate investments at cost 2,341,271 2,020,614 1,907,906 1,795,545 1,662,697 Less: accumulated depreciation and amortization (146,669) (122,834) (91,622) (60,852) (30,947) Total real estate investments, net 2,194,602 1,897,780 1,816,284 1,734,693 1,631,750 Cash and cash equivalents 24,474 47,751 109,489 98,658 182,617 Other assets 52,916 48,736 56,586 42,473 43,343 Total assets $2,271,992 $1,994,267 $1,982,359 $1,875,824 $1,857,710 Liabilities and Equity Mortgage notes payable $159,455 $98,150 $100,305 $97,036 $65,786 Line of credit 430,000 185,000 135,000 - - Accounts payable, accrued expenses and other liabilities 80,720 72,779 70,848 69,806 59,747 Total liabilities 670,175 355,929 306,153 166,842 125,533 Common stock 861 858 852 845 837 Additional paid-in capital 1,907,549 1,899,908 1,884,492 1,867,696 1,850,169 Accumulated other comprehensive income (loss) (6) (44) 133 508 463 Accumulated earnings (deficit) (316,284) (272,285) (219,430) (169,978) (129,406) Total stockholders' equity 1,592,120 1,628,437 1,666,047 1,699,071 1,722,063 Non-controlling intererest 9,697 9,901 10,159 9,911 10,114 Total equity 1,601,817 1,638,338 1,676,206 1,708,982 1,732,177 Total liabilities and equity $2,271,992 $1,994,267 $1,982,359 $1,875,824 $1,857,710

Key Initiatives 6 • Execute closings on current committed pipeline of $ 49 million • Access additional secured debt sources • Deploy additional capital into new investments • Actively manage assets to maximize cash flow • Continue to evaluate liquidity options for HTI • Establish NAV in compliance with FINRA 15 - 02 As of 12/31/15

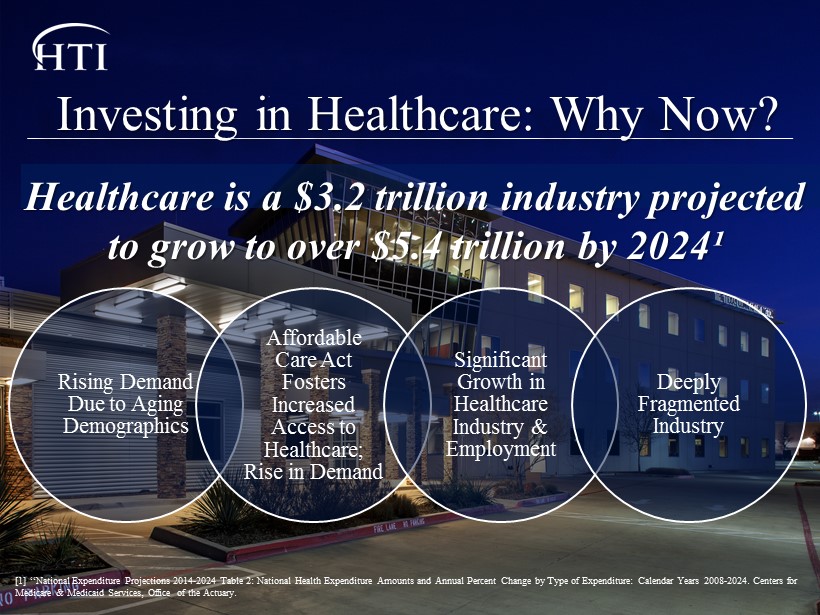

Investing in Healthcare: Why Now? Rising Demand Due to Aging Demographics Affordable Care Act Fosters Increased Access to Healthcare; Rise in Demand Significant Growth in Healthcare Industry & Employment Deeply Fragmented Industry [1] “National Expenditure Projections 2014 - 2024 Table 2: National Health Expenditure Amounts and Annual Percent Change by Type of Expenditure: Calendar Years 2008 - 2024. Centers for Medicare & Medicaid Services, Office of the Actuary . Healthcare is a $3.2 trillion industry projected to grow to over $ 5.4 trillion by 2024¹

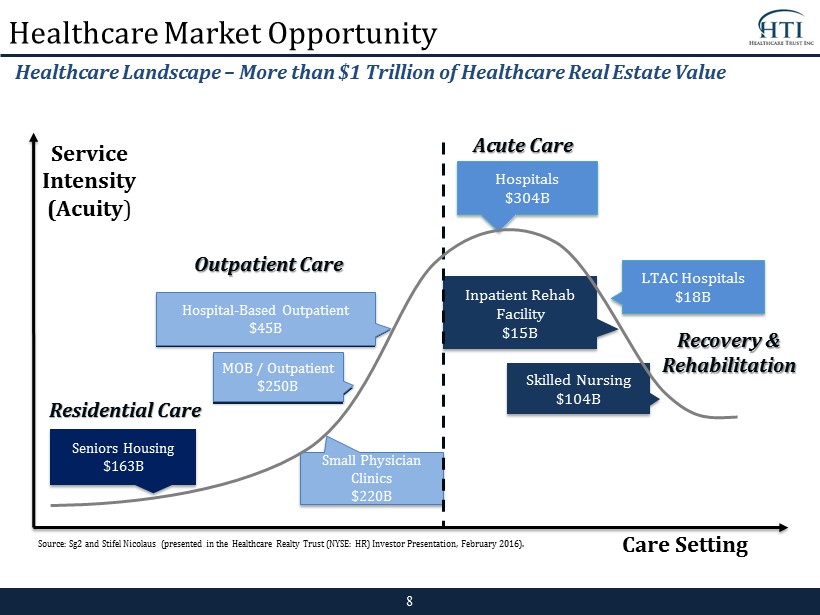

Healthcare Market Opportunity 8 Healthcare Landscape – More than $1 Trillion of Healthcare Real Estate Value Hospital - Based Outpatient $42B Medical Office $250B Seniors Housing $163B Inpatient Rehab Facility $15B Skilled Nursing $ 104B LTAC Hospitals $18B Hospitals $304B Hospital - Based Outpatient $ 45B Small Physician Clinics $ 220B MOB / Outpatient $250B Residential Care Outpatient Care Recovery & Rehabilitation Acute Care Service Intensity (Acuity ) Source: Sg2 and Stifel Nicolaus (presented in the Healthcare Realty Trust (NYSE: HR) Investor Presentation, February 2016). Care Setting

Experienced Management 9 Randy Read | Non - Executive Chairman W. Todd Jensen | Interim CEO and President Katie P. Kurtz | Chief Financial Officer, Secretary and Treasurer Ms. Kurtz currently serves as the Chief Financial Officer, Treasurer and Secretary of the Company. Ms. Kurtz is also a Vice President of AR Global Investments, LLC. She is a certified public accountant in New York State, holds a B.S. in Accountancy and a B.A. in German from Wake Forest University and a Master of Science in Accountancy from Wake Forest University. Mr. Jensen currently serves as Interim CEO and President of the Company. He is also Chief Investment Officer of the Advisor. He has over 25 years of executive experience in healthcare real estate and has acquired, developed, financed, leased or managed more than $5 billion of healthcare property. He earned an MBA in Finance from the Wharton Graduate School of the University of Pennsylvania and a BA from Kalamazoo College. Mr. Read has been President and CEO of Nevada Strategic Credit Investments LLC since 2009. From 2007 - 2009 he served with Greenspun Corporation as Executive Director and President. Mr. Read has previously served on a number of public and private company boards. He has an MBA in Finance from the Wharton Graduate School of the University of Pennsylvania and a BS from Tulane University.

Risk Factors 10 Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2015. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward looking statements: • Certain of our executive officers and directors are also officers, managers or holders of a direct or indirect controlling interest in our advisor, Healthcare Trust Advisors, LLC (the "Advisor"), formerly known as American Realty Capital Healthcare II Advisors, LLC, and other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital, LLC, "AR Global"), the parent of our sponsor, American Realty Capital VII, LLC. As a result, certain of our executive officers and directors, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by ou r Advisor's compensation arrangements with us and other investment programs advised by affiliates of AR Global and conflicts in allocating time among these investment programs and us. These conflicts could result in unanticipated actions. • Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affiliates of AR Global, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and ot her investments and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, whic h could reduce the investment return to our stockholders. • Although we intend to list our shares of common stock on a national stock exchange when we believe market conditions are favorable to do so, there is no assurance that our shares of common stock will be listed. No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid. • We focus on acquiring a diversified portfolio of healthcare - related assets located in the United States and are subject to risks inherent in concentrating investments in the healthcare industry. • If our Advisor loses or is unable to obtain qualified personnel, our ability to implement our investment strategies could be delayed or hindered. • The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of licensure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. • We are depending on our Advisor to select investments and conduct our operations. Adverse changes in the financial condition of our Advisor or our relationship with our Advisor could adversely affect us. • We may be unable to pay distributions with cash flows from operations, or maintain cash distributions or increase distributions over time.

Risk Factors (cont’d) 11 • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates. • We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of our tenants. • We may not be able to achieve our rental rate objectives on new and renewal leases and our expenses could be greater, which may impact our results of operations. • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions. • We are permitted to pay distributions of unlimited amounts from any source. There are no established limits on the amount of borrowings that we may use to fund distribution payments, except for those imposed by Maryland law. • Any distributions, especially those not covered by our cash flows from operations, may reduce the amount of capital we ultimately invest in properties and other permitted investments and negatively impact the value of our stockholders' investment. • We have not and may not in the future generate cash flows sufficient to pay our distributions to stockholders and, as such, we may be required to fund distributions from borrowings, which may be at unfavorable rates and could restrict the amount we can borrow for investments and other purposes, or depend on our Advisor or our property manager, Healthcare Trust Properties, LLC, formerly known as American Realty Capital Healthcare II Properties, LLC, to waive fees or reimbursement of certain expenses and fees to fund our operations. There is no assurance these entities will waive such amounts or that we will be able to borrow funds at all. • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit markets of the United States from time to time. • We are subject to risks associated with changes in general economic, business and political conditions including the possibility of intensified international hostilities, acts of terrorism, and changes in conditions of United States or international lending, capital and financing markets. • We may fail to continue to qualify to be treated as a REIT, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and the cash available for distributions. • We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Act"), and thus subject to regulation under the Investment Company Act. • Commencing with the day we publish a net asset value ("NAV"), anticipated on or prior to April 11, 2016, the offering price and repurchase price for our shares, including shares sold pursuant to our DRIP will be based on NAV, which may not accurately reflect the value of our assets and may not represent what stockholders may receive upon a liquidation of our assets.

▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com