Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Realty Capital Healthcare Trust III, Inc. | v434587_8k.htm |

Exhibit 99.1

Fourth Quarter Investor Presentation American Realty Capital Healthcare Trust III, Inc. Publicly Registered Non - Traded Real Estate Investment Trust*

2 Risk Factors Risk Factors Investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors ” in our most recent Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with our Company . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the fund’s Annual Report on Form 10 - K for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details.

3 American Realty Capital Healthcare Trust III, Inc. (including, as required by context, American Realty Capital Healthcare III Operating Partnership, L.P. and its subsidiaries, the “Company”) is a real estate investment trust focusing primarily on owning and operating healthcare - related assets including medical office buildings, seniors housing and other healthcare - related facilities. ARC Healthcare Trust III, Inc.

4 Portfolio Snapshot Data as of December 31, 2015 MOB Occupancy MOB Avg . Lease Term Affiliated MOBs On - Campus MOBs 97.1% 6.9 Years 11 of 17 1 of 17 ASSETS Medical Office Buildings 17 Seniors Housing – Operating 1 Seniors Housing - NNN 1 19 Assets $129.8 Million Invested 467,932 Square Feet

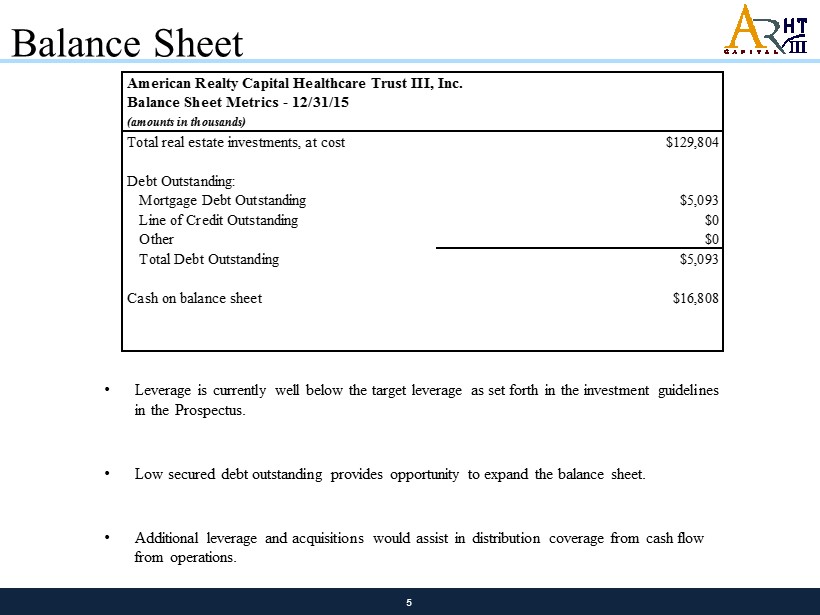

5 Balance Sheet American Realty Capital Healthcare Trust III, Inc. Balance Sheet Metrics - 12/31/15 (amounts in thousands) Total real estate investments, at cost $129,804 Debt Outstanding: Mortgage Debt Outstanding $5,093 Line of Credit Outstanding $0 Other $0 Total Debt Outstanding $5,093 Cash on balance sheet $16,808 • Leverage is currently well below the target leverage as set forth in the investment guidelines in the Prospectus. • Low secured debt outstanding provides opportunity to expand the balance sheet. • Additional leverage and acquisitions would assist in distribution coverage from cash flow from operations.

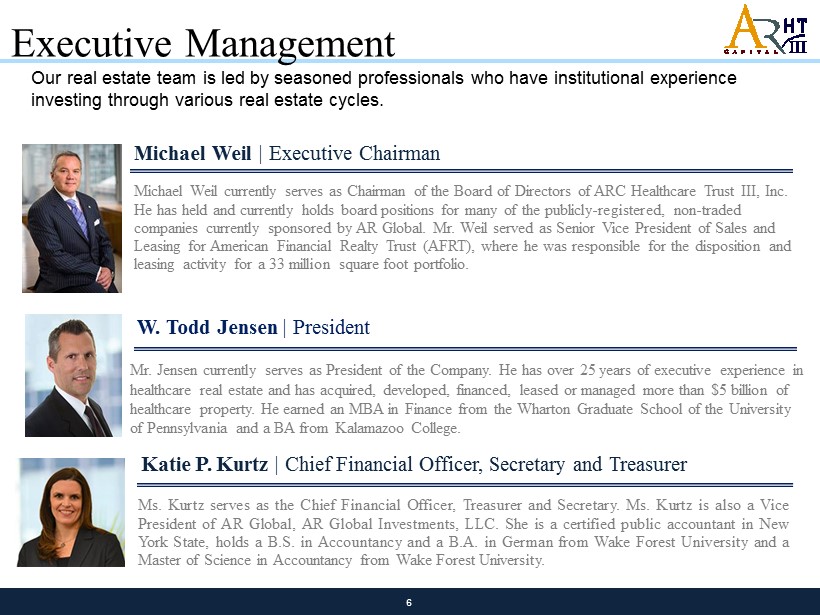

6 Executive Management Our real estate team is led by seasoned professionals who have institutional experience investing through various real estate cycles. Michael Weil | Executive Chairman Michael Weil currently serves as Chairman of the Board of Directors of ARC Healthcare Trust III, Inc. He has held and currently holds board positions for many of the publicly - registered, non - traded companies currently sponsored by AR Global. Mr. Weil served as Senior Vice President of Sales and Leasing for American Financial Realty Trust (AFRT), where he was responsible for the disposition and leasing activity for a 33 million square foot portfolio. Mr. Jensen currently serves as President of the Company. He has over 25 years of executive experience in healthcare real estate and has acquired, developed, financed, leased or managed more than $5 billion of healthcare property. He earned an MBA in Finance from the Wharton Graduate School of the University of Pennsylvania and a BA from Kalamazoo College. Ms . Kurtz serves as the Chief Financial Officer, Treasurer and Secretary . Ms . Kurtz is also a Vice President of AR Global, AR Global Investments, LLC . She is a certified public accountant in New York State, holds a B . S . in Accountancy and a B . A . in German from Wake Forest University and a Master of Science in Accountancy from Wake Forest University . Katie P. Kurtz | Chief Financial Officer, Secretary and Treasurer W. Todd Jensen | President

7 Risk Factors Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Rep ort on Form 10 - K for the year ended December 31, 2015. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: • We have a limited operating history and no established financing sources, which makes our future performance difficult to pre dic t. • All of our executive officers and directors are also officers, managers or holders of a direct or indirect controlling intere st in American Realty Capital Healthcare III Advisors, LLC (the "Advisor") and other entities affiliated with AR Global Investments , LLC (the successor business to AR Capital, LLC, "AR Global"), the parent of our sponsor, American Realty Capital VII, LLC. As a result, our executive officers and directors, our Advisor and its affiliates face conflicts of interest, including signific ant conflicts created by our Advisor's compensation arrangements with us and other investment programs advised by affiliates of AR Global and conflicts in allocating time among these investment programs and us. These conflicts could result in unanticipated action s. • Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affil iat es of AR Global, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other inve stm ents and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could redu ce the investment return to our stockholders. • No public market currently exists, or may ever exist, for shares of our common stock which are, and may continue to be, illiq uid . • Our initial public offering of common stock (the "IPO"), which commenced on August 20, 2014, is a blind pool offering. We suspended our IPO on November 15, 2015, effective as of December 31, 2015, and it is not likely that we will resume the IPO. • We focus on acquiring a diversified portfolio of healthcare - related assets located in the United States and are subject to risks inherent in concentrating investments in the healthcare industry. We have only $16.8 million in cash on hand. While we may us e a portion of cash on hand to consummate additional acquisitions, we generally expect to use cash on hand to fund distributions or for working capital needs. • We suspended our IPO, which was our primary source of capital to implement our investment strategy, reduce our borrowings, complete acquisitions, make capital expenditures and pay distributions, and we may not be able to obtain additional capital f rom other sources. As a result of the suspension of the IPO, we will be unable to achieve certain of our investment objectives, s uch as the anticipated size and diversification of our portfolio. • The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of l ice nsure or failure to obtain licensure could result in the inability of tenants to make lease payments to us. • We are depending on our Advisor to conduct our operations. Adverse changes in the financial condition of our Advisor or our relationship with our Advisor could adversely affect us.

8 Risk Factors (Continued) • We may be unable to pay or maintain cash distributions or increase distributions over time. • We are permitted to pay distributions from unlimited amounts of any source. We have used, and may continue to use, net proceeds from our IPO, which has been suspended and is not likely to resume, and may use borrowings to fund distributions unt il we have sufficient cash flows from operations. There are no established limits on the amount of net proceeds and borrowings t hat we may use to fund distribution payments, except for those imposed by our organizational documents or Maryland law. • We may not generate cash flows in the future sufficient to pay our distributions to stockholders and, as such, to continue to pa y distributions, we may be required to fund distributions from our remaining proceeds from our IPO, which has been suspended, and from borrowings, which may be at unfavorable rates and could restrict the amount we can borrow for investments and other purposes, or depend on our Advisor to waive reimbursement of certain expenses and fees to fund our operations. • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates. • We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of ou r tenants. • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions to our stockholders. • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit marke ts of the United States from time to time. • We suspended our IPO, which was our primary source of capital to implement our investment strategy, reduce our borrowings, complete acquisitions, make capital expenditures and pay distributions, and we may not be able to obtain additional capital f rom other sources. • We may fail to qualify, or continue to qualify, to be treated as a real estate investment trust for U.S. federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and the cash available for distributions. • We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Act"), and thus subject to regulation under the Investment Company Act. • Commencing on the net asset value ("NAV") pricing date, the offering price and repurchase price for our shares, including sha res sold pursuant to our DRIP, will be based on NAV, which may not accurately reflect the value of our assets and may not represent what stockholders may receive on a liquidation of our assets.

9 ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com