Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - UNITED BANCORP INC /OH/ | v433714_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - UNITED BANCORP INC /OH/ | v433714_ex31-1.htm |

| 10-K - FORM 10-K - UNITED BANCORP INC /OH/ | v433714_10k.htm |

| EX-23 - EXHIBIT 23 - UNITED BANCORP INC /OH/ | v433714_ex23.htm |

| EX-32.2 - EXHIBIT 32.2 - UNITED BANCORP INC /OH/ | v433714_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - UNITED BANCORP INC /OH/ | v433714_ex32-1.htm |

Exhibit 13

DIVIDEND AND STOCK HISTORY

| Distribution Date of | ||||||||

| Cash Dividends | Special Cash Dividends | Dividends and | ||||||

| Declared(1) | and Stock Dividends | Exchanges | ||||||

| 1983 | $ | 0.05 | - | - | ||||

| 1984 | $ | 0.06 | 4 for 1 Exchange(2) | January 2, 1984 | ||||

| 1985 | $ | 0.07 | - | - | ||||

| 1986 | $ | 0.09 | - | - | ||||

| 1987 | $ | 0.09 | 50% Stock Dividend | October 2, 1987 | ||||

| 1988 | $ | 0.10 | - | - | ||||

| 1989 | $ | 0.10 | - | - | ||||

| 1990 | $ | 0.11 | - | - | ||||

| 1991 | $ | 0.12 | - | - | ||||

| 1992 | $ | 0.12 | 100% Stock Dividend | September 10, 1992 | ||||

| 1993 | $ | 0.12 | 100% Stock Dividend | November 30, 1993 | ||||

| 1994 | $ | 0.13 | 10% Stock Dividend | September 9, 1994 | ||||

| 1995 | $ | 0.19 | - | - | ||||

| 1996 | $ | 0.20 | 10% Stock Dividend | June 20, 1996 | ||||

| 1997 | $ | 0.23 | 10% Stock Dividend | September 19, 1997 | ||||

| 1998 | $ | 0.26 | 5% Stock Dividend | December 18, 1998 | ||||

| 1999 | $ | 0.30 | 5% Stock Dividend | December 20, 1999 | ||||

| 2000 | $ | 0.31 | 5% Stock Dividend | December 20, 2000 | ||||

| 2001 | $ | 0.32 | 5% Stock Dividend | December 20, 2001 | ||||

| 2002 | $ | 0.33 | 5% Stock Dividend | December 20, 2002 | ||||

| 2003 | $ | 0.35 | 10% Stock Dividend | December 19, 2003 | ||||

| 2004 | $ | 0.39 | 10% Stock Dividend | December 20, 2004 | ||||

| 2005 | $ | 0.43 | 10% Stock Dividend | December 20, 2005 | ||||

| 2006 | $ | 0.48 | 10% Stock Dividend | December 20, 2006 | ||||

| 2007 | $ | 0.52 | – | – | ||||

| 2008 | $ | 0.54 | – | – | ||||

| 2009 | $ | 0.56 | – | – | ||||

| 2010 | $ | 0.56 | – | – | ||||

| 2011 | $ | 0.56 | – | – | ||||

| 2012 | $ | 0.42 | – | – | ||||

| 2013 | $ | 0.29 | – | – | ||||

| 2014 | $ | 0.33 | – | – | ||||

| 2015 | $ | 0.37 | 5¢ Per Share Special Dividend | December 29, 2015 | ||||

2016 AnticipAted dividend Payable Dates

First Quarter

March 18, 2016

Second Quarter*

June 20, 2016

Third Quarter*

September 20, 2016

Fourth Quarter*

December 20, 2016

*Subject to action by Board of Directors

| (1) | Adjusted for stock dividends and exchanges. Does not include dividends from Southern Ohio Community Bancorporation, Inc. prior to the merger. |

| (2) | Formation of United Bancorp, Inc. (UBCP). The Citizens Savings Bank shareholders received 4 shares of UBCP stock in exchange for 1 share of The Citizens Savings Bank. |

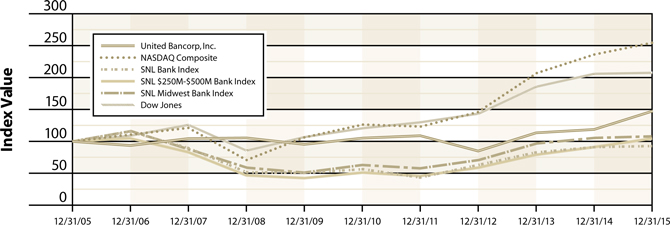

TOTAL RETURN PERFORMANCE

| Index | 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | |||||||||||||||||||||||||||||||||

| United Bancorp, Inc. | 100.00 | 94.40 | 104.27 | 105.21 | 96.09 | 104.93 | 108.69 | 84.59 | 113.06 | 118.30 | 147.53 | |||||||||||||||||||||||||||||||||

| NASDAQ Composite | 100.00 | 110.39 | 122.15 | 73.32 | 106.57 | 125.91 | 124.92 | 147.09 | 206.18 | 236.76 | 253.59 | |||||||||||||||||||||||||||||||||

| SNL Bank Index | 100.00 | 116.98 | 90.90 | 51.87 | 51.33 | 57.52 | 44.54 | 60.11 | 82.53 | 92.26 | 93.83 | |||||||||||||||||||||||||||||||||

| SNL Bank $250M-$500M | 100.00 | 104.48 | 84.92 | 48.50 | 44.89 | 50.22 | 47.18 | 58.56 | 79.52 | 90.74 | 103.82 | |||||||||||||||||||||||||||||||||

| SNL Midwest Bank | 100.00 | 115.59 | 90.09 | 59.27 | 50.23 | 62.37 | 58.91 | 70.91 | 97.08 | 105.54 | 107.14 | |||||||||||||||||||||||||||||||||

| Dow Jones | 100.00 | 119.04 | 126.71 | 86.25 | 105.81 | 120.69 | 130.81 | 144.20 | 186.95 | 205.72 | 206.20 | |||||||||||||||||||||||||||||||||

Decade of Progress

Unaudited

2005 |  2006 |  2007 |  2008 |  2009 |  2010 |  2011 |  2012 |  2013 |  2014 |  2015 | ||||||||||||||||||||||||||||||||||

| Interest and dividend income | $ | 22,181,071 | $ | 25,279,212 | $ | 26,603,043 | $ | 25,715,309 | $ | 23,354,885 | $ | 21,667,356 | $ | 20,211,170 | $ | 18,462,265 | $ | 17,025,223 | $ | 16,377,445 | $ | 16,082,746 | ||||||||||||||||||||||

| Interest expense | 9,146,249 | 12,837,256 | 14,517,591 | 10,251,384 | 8,064,768 | 6,480,008 | 4,707,077 | 3,861,046 | 3,033,178 | 2,466,512 | 2,283,468 | |||||||||||||||||||||||||||||||||

| Net interest income | 13,034,822 | 12,441,956 | 12,085,452 | 15,463,925 | 15,290,117 | 15,187,348 | 15,504,093 | 14,601,219 | 13,992,045 | 13,910,933 | 13,799,278 | |||||||||||||||||||||||||||||||||

| Provision for loan losses | 412,000 | 1,384,261 | 993,505 | 1,188,270 | 1,325,052 | 1,816,012 | 1,968,021 | 1,127,634 | 1,240,847 | 888,000 | 552,996 | |||||||||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 12,622,822 | 11,057,695 | 11,091,947 | 14,275,655 | 13,965,065 | 13,371,336 | 13,536,072 | 13,473,585 | 12,751,198 | 13,022,933 | 13,246,282 | |||||||||||||||||||||||||||||||||

| Noninterest income, including security gains/(losses) | 2,341,826 | 2,297,373 | 3,079,567 | 3,066,769 | 3,295,030 | 3,317,126 | 3,512,340 | 2,937,420 | 4,212,273 | 3,697,486 | 3,802,215 | |||||||||||||||||||||||||||||||||

| Noninterest expense | 10,763,473 | 11,046,170 | 11,252,758 | 12,627,590 | 13,838,651 | 13,921,806 | 13,103,041 | 13,466,431 | 13,994,647 | 13,146,050 | 12,490,093 | |||||||||||||||||||||||||||||||||

| Income before income taxes | 4,201,175 | 2,308,898 | 2,918,755 | 4,714,834 | 3,421,444 | 2,766,656 | 3,945,371 | 2,944,574 | 2,968,824 | 3,574,369 | 4,558,407 | |||||||||||||||||||||||||||||||||

| Income tax expense | 908,647 | 240,891 | 333,926 | 955,700 | 516,524 | 219,289 | 854,447 | 546,399 | 356,544 | 923,074 | 1,334,078 | |||||||||||||||||||||||||||||||||

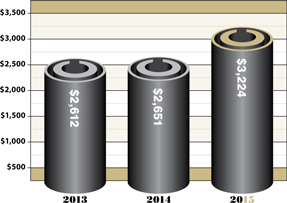

| Net income | $ | 3,292,528 | $ | 2,068,007 | $ | 2,584,829 | $ | 3,759,134 | $ | 2,904,920 | $ | 2,547,367 | $ | 3,090,924 | $ | 2,398,175 | $ | 2,612,280 | $ | 2,651,295 | $ | 3,224,329 | ||||||||||||||||||||||

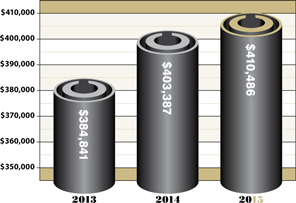

| Total assets | $ | 411,932,779 | $ | 421,653,341 | $ | 451,370,187 | $ | 441,804,491 | $ | 445,970,296 | $ | 423,434,966 | $ | 415,566,563 | $ | 438,353,660 | $ | 389,041,557 | $ | 401,811,582 | $ | 405,124,408 | ||||||||||||||||||||||

| Deposits | 306,914,758 | 330,005,480 | 330,488,711 | 347,044,549 | 344,542,900 | 325,445,596 | 328,540,953 | 350,416,519 | 310,640,827 | 322,681,733 | 323,622,229 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 32,479,697 | 32,580,485 | 33,885,779 | 33,904,759 | 35,211,133 | 35,580,582 | 36,181,269 | 36,625,833 | 38,870,794 | 40,389,103 | 41,496,430 | |||||||||||||||||||||||||||||||||

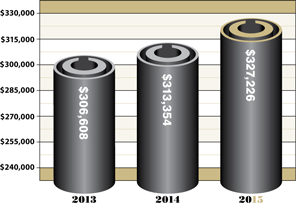

| Loans receivable, net | 229,106,682 | 229,171,793 | 232,196,753 | 235,448,307 | 255,335,658 | 276,036,674 | 281,526,111 | 293,774,257 | 306,608,265 | 313,354,040 | 327,225,277 | |||||||||||||||||||||||||||||||||

| Allowance for loan losses | 2,904,447 | 2,345,419 | 2,447,254 | 2,770,360 | 2,390,015 | 2,739,736 | 2,921,067 | 2,708,045 | 2,894,944 | 2,400,427 | 2,437,757 | |||||||||||||||||||||||||||||||||

| Net charge-offs | 502,833 | 1,936,046 | 891,648 | 865,000 | 1,705,000 | 1,466,000 | 1,785,689 | 1,340,656 | 1,053,947 | 1,382,517 | 516,146 | |||||||||||||||||||||||||||||||||

| Full time employees (average equivalents) | 132 | 132 | 123 | 142 | 136 | 146 | 133 | 134 | 133 | 132 | 122 | |||||||||||||||||||||||||||||||||

| Banking locations | Seventeen | Seventeen | Seventeen | Twenty | Twenty | Twenty | Twenty | Twenty | Twenty | Nineteen | Eighteen | |||||||||||||||||||||||||||||||||

| Earnings per common share - Basic | $ | 0.71 | $ | 0.45 | $ | 0.57 | $ | 0.82 | $ | 0.62 | $ | 0.52 | $ | 0.63 | $ | 0.49 | $ | 0.53 | $ | 0.54 | $ | 0.65 | ||||||||||||||||||||||

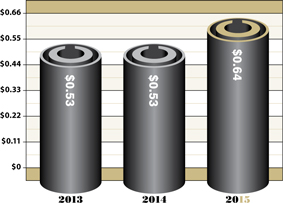

| Earnings per common share - Diluted | 0.71 | 0.45 | 0.57 | 0.82 | 0.62 | 0.52 | 0.62 | 0.48 | 0.53 | 0.53 | 0.64 | |||||||||||||||||||||||||||||||||

| Dividends per share | 0.43 | 0.48 | 0.52 | 0.54 | 0.56 | 0.56 | 0.56 | 0.42 | 0.29 | 0.33 | 0.37 | |||||||||||||||||||||||||||||||||

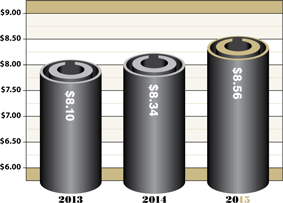

| Book value per share | 7.00 | 7.73 | 7.41 | 7.35 | 7.53 | 7.52 | 7.57 | 7.61 | 8.03 | 8.34 | 8.56 | |||||||||||||||||||||||||||||||||

| Market value range per share | 9.10-12.69 | 9.36-11.36 | 9.78-11.39 | 7.41-10.85 | 7.00-9.49 | 7.70-9.90 | 7.56-9.03 | 5.89-10.25 | 6.10-8.60 | 7.45-8.85 | 7.81-10.90 | |||||||||||||||||||||||||||||||||

| Cash dividends paid | $ | 2,114,723 | $ | 2,415,741 | $ | 2,435,317 | $ | 2,707,438 | $ | 2,871,801 | $ | 2,959,658 | $ | 2,988,155 | $ | 2,253,410 | $ | 1,555,912 | $ | 1,773,699 | $ | 1,989,431 | ||||||||||||||||||||||

| Special Cash Dividends Paid | 269,215 | |||||||||||||||||||||||||||||||||||||||||||

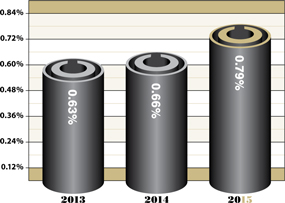

| Return on average assets (ROA) | 0.82 | % | 0.50 | % | 0.60 | % | 0.86 | % | 0.63 | % | 0.57 | % | 0.73 | % | 0.55 | % | 0.63 | % | 0.66 | % | 0.79 | % | ||||||||||||||||||||||

| Return on average equity (ROE) | 10.01 | % | 6.49 | % | 8.12 | % | 11.33 | % | 7.56 | % | 7.05 | % | 8.53 | % | 6.74 | % | 7.02 | % | 6.67 | % | 7.79 | % | ||||||||||||||||||||||

Mission Statement

United Bancorp, Inc.

our mission

United Bancorp, Inc. is a nationally traded Bank holding company whose mission is to continue earning the respect....

| .... | Of its shareholders, through continued growth in shareholder value by sustaining profitability and acquiring well managed and capitalized businesses in the financial services industry; |

| .... | Of its customers, through reaching out with the technology they want and offering the financial products and services they need; |

| .... | Of its communities, through support of civic activities that make our communities better places to live and work; |

| .... | Of its team members, through training development and career growth opportunities in a comfortable environment with modern equipment; |

Although it is recognized there is more competition from non-banking businesses for market share, the general mission of United Bancorp, Inc. is to remain independent. We will accomplish this through an aggressive acquisition program, the management of technological change that will allow us to gain efficiencies and expand our boundaries outside of the typical brick and mortar framework and the placement of new office construction or acquisition when deemed economically feasible.

Adopted by The United Bancorp, Inc., Board of Directors April 15, 2015

A Letter from the President and CEO

To the shareholders of United Bancorp, Inc….

I am extremely happy to report that our company had a very solid performance this past year! In 2015, we produced net income of $3.224 million, which was $573,000, or 22% higher than the previous year. This translated into diluted earnings per share of $0.64 in 2015, which is an improvement of $0.11, or 21%, over 2014. As highlighted in our company’s quarterly earnings reports throughout 2015, the vast majority of our growth in earnings this past year was generated on a core basis. This is of utmost importance since core earnings are recurring in nature and will continue to contribute to the earnings of our company in future periods. With the present earnings momentum that we have, it is projected that our company will continue to produce higher levels of quality earnings. This should lead to continued growth in the cash dividend that our company pays and the market value appreciation of our company’s stock. During 2015, our shareholders were handsomely rewarded by receiving a total regular cash dividend payment of $0.37, which was a $0.04, or 12%, increase over the previous year. At year-end, our dividend yield was 4.17% on a forward basis, which is nearly twice that of the average bank in our country. In addition, our company paid a special dividend of $0.05 to all shareholders on December 29, 2015 in appreciation of their steadfast support of our company. Our loyal shareholders were also rewarded this past year when the market value of our stock increased to $9.59 per share at year-end, an annualized increase of over 19%. With the anticipated continuation of core earnings growth for our company, it is strongly believed that these positive trends will continue!

Focusing on the performance of United Bancorp, Inc. in 2015, the aforementioned growth in core earnings can be attributed primarily to the following factors:

Stabilizing Net Interest Income: We were able to stabilize the level of net interest income realized during this past year; especially, during the second half of 2015. Although net interest income was marginally down by 0.80% year-over-year, most of this decline occurred during the first half of the year. This was prior to our newfound focus on growing our gross loans at a more acceptable level. At mid-year, management implemented a strategy that focused on driving the revenue-line of the company. This strategy entailed adding quality origination personnel to both the commercial and mortgage lending units of our operation. Over the course of the final two quarters of 2015, this strategy produced very positive results for our company. At the mid-point of 2015, our net interest income was down 3.56% from the previous year. This was primarily due to gross loans declining by $3.8 million, or 1.3%, to a level of $311.9 million. With the implementation of our new strategy and a keener focus on growing gross loans, this negative trend was reversed. By the end of 2015, our company was able to rebound and finish with gross loans of $329.7 million. This higher level of gross loans helped our company produce net interest income in the fourth quarter that was 3.4% higher than the previous year's fourth quarter. In addition, higher loan origination volumes directly led to an increase in loan fees of over 5.6% for the year. Management firmly believes that these positive trends will continue in the coming year.

On the interest expense side of the margin, our company continued to see a positive return on its strategy of attracting additional customers into lower-cost funding accounts, while allowing higher cost funding to run off. Year-over-year, low-cost funding, consisting of demand and savings deposits, increased by $11.1 million, while higher-cost time deposit balances decreased by $10.2 million. This shift in the mix of our depository balances helped our company reduce interest expense levels by 7.4% this past year. It is strongly anticipated that our company will be able to control retail interest expense levels in the coming year, while significantly lowering wholesale interest expense levels. As previously mentioned, the company’s $4.1 million subordinated debenture repriced on January 1, 2016 from a fixed rate of 6.25% to a variable rate of 0.62%, based on three-month LIBOR, plus a margin of 1.35%. At this level, the company will save approximately $177,000 annually beginning in the current year. In addition, over the course of the next 24 months, it is projected that our company’s interest expense will be positively impacted by the repricing of $26 million in fixed-rate advances with the Federal Home Loan Bank (FHLB). In May 2016, a $6.0 million FHLB advance matures at a rate of 3.28%. If this advance is replaced with a short-term borrowing at 50 basis points, the company will save approximately $167,000 annually in interest expense.

| 1 |

A Letter from the President and CEO - Continued

With the trends of increasing interest income and decreasing interest expense, it is strongly anticipated that the company will continue to see expansion in the level of its net interest income, which began during the last two quarters of 2015. This should have a positive impact on the earnings that the company realizes in the coming year.

Continuing to Enhance Noninterest Income: Once again this past year, we were able to produce higher levels of noninterest or fee Income. For the year, total noninterest income was $3.8 million, which is a 2.81% increase over the previous year. A majority of this income was produced from an increase in service charges on deposit accounts. As previously reported, our company has a marketing strategy that is geared towards attracting active transaction accounts. This strategy has led to positive results for several years and this past year was no exception. In 2015, the company realized service charges on deposit accounts of $2.9 million. Year-over-year, this is an increase of $126,000 or 4.6%. Even though is it anticipated that further implementation of certain government regulations may have an impact on the level of revenue realized per account, the company’s strategy of attracting a higher level of transaction accounts should mitigate any potential loss of fee-based revenue realized in this area.

Diminishing Noninterest Expense: During 2015, our company saw the continuation of a trend seen over the course of the past couple of years, which is the continuing decline of its noninterest expense levels. This continuing trend is a result of having a keen internal focus on driving efficiencies through process improvement. One process improvement initiative undertaken in 2015, which led to greater operational efficiency and cost savings, was the consolidation of the Glouster, Ohio stand-alone auto bank. In the first quarter of last year, we were able to complete a renovation project on our downtown office that added two drive-thru lanes and an ATM lane onto this office. By allowing our company to eliminate 2.5 full-time equivalent job positions, the consolidation of this stand-alone auto bank facility was immediately accretive to the earnings of our company. Being employee centric, we were able to relocate these job positions without a reduction in force for our company. Through natural attrition, we were able to utilize our associates working at the stand-alone auto bank to fill other available positions within the Athens County marketplace.

Another major initiative undertaken in 2015, to control the noninterest expense levels of our company, was the global implementation of Profit Center Accounting. The successful implementation of this new methodology changed how we evaluate the operational efficiency of each of our branches or “profit centers.” Under this approach, our branch leaders have been fully educated on how to more profitably operate their own individual profit centers. Our profit center leaders can be rewarded by enhancing the profitability of the business unit(s) over which they have control. This process has created more of an “ownership” attitude and has driven our leaders to have a closer focus on the profitability, or “contribution margin,” of each of our individual profit centers. Accordingly, we have experienced an increase in the level of profitability of many of our profit centers. Some of this enhanced profitability has been realized through cost savings achieved by our profit centers. Most of this cost savings relates to the elimination of approximately 7.5 full time job positions. This was accomplished through more proactive management throughout our company, which was a result of this newly initiated Profit Center Accounting concept. Even with these increased efficiencies, we were able to maintain the quality service levels that we demand and our customers expect.

Continuing the containment of noninterest expense levels may be difficult in future periods as we begin to focus on increasing the revenue-line by growing our company. In order to grow our revenue, we will need to assume additional operational overhead, by hiring more support staff and enhancing our facilities, to support the increased level of personnel that is needed to sell our quality products and services. One initiative to set the stage for this planned growth was approved last year and is presently well under way. What this initiative entails is completely renovating our main office located in Martins Ferry, Ohio. This office is our corporate headquarters and is where all of the support functions, that ensure the smooth operation of our profit centers, are located. In order to support the growth of our company envisioned within our strategic plan, we are focused on building the support infrastructure necessary to support a larger sales platform. It is anticipated that this renovation of our main office will be completed by June of this year. This much needed renovation will create the capacity to add both mortgage and commercial loan processors, along with additional loan administration staff, that can support a much larger sales force. Management anticipates that the higher level of noninterest expense created by this undertaking will be more than off-set by the enhanced revenue generated in future periods as we grow our company.

| 2 |

Lowering the Loan Loss Provision: Our company’s credit quality improved over the course of this past year. By having improving credit quality metrics (and considering the concept of proportionality), we were able to reduce our provision for loan losses. This budgeted lowering of the provision for loan losses contributed to our improved earnings. Nonaccrual loans remained relatively stable year-over-year at a level of $1.0 million, or 0.32% of total loans. Net loans charged off (exclusive of overdraft charge offs) came in at $380,000, or 0.12% of total loans, in 2015. This was a vast improvement over the $1.2 million (exclusive of overdraft charge offs), or 0.40% of total loans, charged off in 2014. Our company also saw dramatic improvement in other real estate and repossessions (“OREO”) in 2015, as balances decreased by $783,000, or 68.6%, to the relatively low level of $357,000. Lastly, total allowance for loan losses to total loans was 0.74%, resulting in a total allowance for loan losses to nonperforming loans of 233.5% at year-end. With very solid credit quality and robust coverage, our company should once again be able to lower its loan loss provision in 2016.

Each of these aforementioned factors was critical in allowing our company to grow core earnings in 2015. By keeping a focus in the current year on these same key functional areas, we firmly believe that we will continue to show core earnings improvement, and further improve the overall profitability of our company.

Many of the earnings improvements that we have seen over the course of the past year have come from the process changes and product enhancements that were implemented in recent years. These changes and enhancements have led to operational efficiencies, which have lowered our noninterest expense levels and increased the noninterest income that our company generates. Going forward, we will continue to focus on building our internal infrastructure— as we are presently doing with our loan origination and support platforms— and improve upon the products and services that we offer, such as adding new technology platforms that our customers will demand. In the area of technology, this past year we enhanced our Mobile Banking platform by introducing Remote Deposit Capture. In addition, we focused on electronic payments by setting the ground work to offer Apple Pay™, which was recently rolled out to our customer base. Although initiatives such as these will potentially increase the level of noninterest expense for our company, they will also help us achieve our new primary goal— driving our company’s revenue-line higher! Ultimately, our future success will be determined by the levels of increasing revenue that we realize. Generating higher levels of revenue, on a continual basis, should allow our company to improve our level of performance relative to peer. Our goal is to be one of the most relevant, and highest performing, community banking companies in the entire country. We realize that we need to make further progress in order to achieve this lofty level of performance; but, we firmly believe that we are presently on the proper course to get there!

Our recent internal focus on the operations of our company, to ensure its future growth, reminds me of a story that I heard a couple of years ago about the Chinese Bamboo Tree. This story is an amazing one and is as follows:

“When the seed of the Chinese Bamboo Tree is planted, watered and nurtured, for years it does not outwardly grow as much as an inch. Nothing happens for the first year. There is no sign of growth. Not even a hint. The same thing happens - or does not happen - the second year. And then the third year. The tree is carefully watered and fertilized each year, but nothing shows. No growth. No anything. So it goes as the sun rises and sets for four solid years. The farmer and his wife have nothing tangible to show for this labor or effort. Then, along comes year five. After five years of fertilizing and watering have passed, with nothing to show for it- the bamboo tree suddenly sprouts and grows eighty feet in just six weeks! Did the little tree lie dormant for four years only to grow exponentially in the fifth? Or, was the little tree growing underground, developing a root system strong enough to support its potential for outward growth in the fifth year and beyond? The answer is, of course, obvious. Had the tree not developed a strong unseen foundation, it could not have sustained its life as it grew.”

I assimilate cultivating the “seed” of the Chinese Bamboo Tree to the most recent history of our company. Our keen focus on strengthening the operational foundation upon which our company is built, is akin to the farmer diligently watering his seeds with little result for quite some time. Our “Chinese Bamboo Tree,” which is United Bancorp, Inc., is starting to sprout. But, we still have a long way to go to reach our full potential. In order to ensure that we reach our full potential, we have developed a vision within our company. This forward-thinking focus arose out of our most recent strategic planning and is known as "Mission 2020." Under Mission 2020, our goal is to grow the asset size of United Bancorp, Inc. to a level of $1.0 billion, or greater, by the end of 2020! To achieve this level of growth, we must not only do so organically; but, also, by acquiring other community banks within a strategic footprint. It is envisioned that this footprint will include the Tri-State area of Ohio, West Virginia and Pennsylvania. We have undertaken many initiatives in recent years, which have watered, fertilized and nurtured the “seeds” of our company. In addition to these foundational improvements which have set the stage for growth opportunity, management has also been diligently learning the intricacies of merger and acquisition. In learning the “art of the deal” and developing relationships with the investment entities that will help us achieve the level of growth that we envision, I have great confidence that we have the ability to meet the goals imagined in Mission 2020. As the rising tide lifts all boats, each of us, as United Bancorp, Inc. Shareholders, stands to tremendously benefit with the rising market capitalization of a growing and prosperous company!

| 3 |

A Letter from the President and CEO - Continued

There are many great things happening for our company, and I believe that our future is extremely promising. Our primary market, the Wheeling Metropolitan Statistical Area (MSA), is one of the fastest growing in our entire nation due to the oil and gas boom that is presently taking place. Even though the price of oil has dropped considerably over the course of the past year, which has caused economic slowdown in other regions of the country dependent on oil production, our local region has remained vibrant. We have confidence that our local region will maintain its present vibrancy, since much of the present focus is developing the infrastructure, such as pipelines and drilling pads, necessary for future production. It is hoped that the price of oil recovers to more sustainable levels in the short to intermediate term, which should be supportive of additional growth in the regions that we primarily serve. There is strong belief within the leadership of our local government, that within the next couple of years, an ethane cracker will be built in Southern Belmont County, Ohio. If this project is developed, it is projected that it will create thousands of local construction jobs lasting several years and hundreds of permanent full-time jobs once completed. But, of utmost significance, this project will spur further economic growth, since many manufacturing entities typically locate within close proximity to such ventures. This could be a real game changer for our region, and our company as we seek to grow!

We would not be experiencing our current success without the strong leadership and support of our corporate directors, who have diligently served United Bancorp, Inc. for many years. I would like to recognize two directors who finished their service with our board of directors this past year, Sam Jones and Matt Thomas. Sam retired on December 30, 2015, after achieving the mandatory retirement age of seventy-five, while Matt resigned his position from the board effective January 4, 2016, after having a change in life status. This event occurred when Matt sold his very successful insurance agency at the beginning of this year. I would like to personally thank both of these great men for providing expert guidance and astute leadership during their tenure on our board of directors. After the separation of each of these individuals from our corporate board, it was the wisdom of the present board of directors to not replace either of their open board positions. By not replacing these open positions, the United Bancorp, Inc. Board of Directors has been downsized to the minimum allowed under our corporate code of regulations, which are five. Having the minimum level of directors serving our company at the present time should be advantageous. At this level, we will have adequate capacity to support our ambitious growth goals. With such capacity, we can effect several acquisitions without growing the number of active directors to a level that could be considered excessive.

Overall, this past year was a very good one for our company as we accomplished many of the objectives established under our strategic plan and produced double-digit earnings growth. Our forward challenge is to grow the assets of our company in a fashion that will continue to produce solid and consistent earnings. Having a young and experienced management team should allow our company to grow for many years to come. There are many exciting initiatives, either presently under way or identified as part of our strategic plan, that should continue to drive the growth of our company. I can assure you that our board of directors and management team are committed to executing at a high level and making these initiatives a reality!

As always, we are extremely blessed to have a positive relationship with our shareholders, directors, officers and employees. In this sense, our company is fortunate, and we are thankful that everyone is supportive. Collectively, we will all greatly benefit from this UNITY!

| Scott A. Everson | |

| President and Chief Executive Officer | |

| ceo@unitedbancorp.com | |

| February 19, 2016 |

| Certain statements contained herein are not based on historical facts and are "forward-looking statements" within the meaning of Section 21A of the Securities Exchange Act of 1934. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company's control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of these terms. Actual results could differ materially from those set forth in forward-looking statements, due to a variety of factors, including, but not limited to, those related to the economic environment, particularly in the market areas in which the company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset/liability management, changes in the financial and securities markets, including changes with respect to the market value of our financial assets, and the availability of and costs associated with sources of liquidity. The Company undertakes no obligation to update or clarify forward-looking statements, whether as a result of new information, future events or otherwise. |  |

| 4 |

Directors

| 1 = United Bancorp, Inc. | 2 = The Citizens Savings Bank | |

| 3 = Chairman - United Bancorp Inc. | 4 = Chairman - The Citizens Savings Bank |

| 5 |

Directors and Officers

DIRECTORS OF UNITED BANCORP, INC.

| Scott A. Everson1 | President & Chief Executive Officer, United Bancorp, Inc. |

| Chairman, President & Chief Executive Officer, The Citizens Savings Bank, Martins Ferry, Ohio | |

| Gary W. Glessner2 | Certified Public Accountant, Managing Member of Glessner & Associates, PLLC; Managing Member of G & W Insurance Group, LLC; Managing Member of Wheeling Coin, LLC; Vice President of Windmill Truckers Center, Inc.; Vice President of Glessner Enterprises, Inc.; Member of Red Stripe & Associates, LLC; Managing Member of GW Rentals, LLC |

| John M. Hoopingarner1,2,3,4 | Executive Director, Muskingum Watershed Conservancy District, New Philadelphia, Ohio |

| Terry A. McGhee1,3 | Past President & Chief Executive Officer, Westerman Inc., Bremen, Ohio |

| Richard L. Riesbeck1,2,3,4 | Chairman, United Bancorp, Inc., President, Riesbeck Food Markets, Inc., St. Clairsville, Ohio |

| James W. Everson | Chairman Emeritus 1969 - 2014 |

OFFICERS OF UNITED BANCORP, INC.

| Scott A. Everson | President & Chief Executive Officer |

| Matthew F. Branstetter | Senior Vice President - Chief Operating Officer |

| Randall M. Greenwood | Senior Vice President, Chief Financial Officer & Treasurer |

| Elmer K. Leeper | Vice President - Chief Retail Banking Officer |

| Michael A. Lloyd | Vice President - Chief Information Officer |

| Chad S. Smith | Vice President - Chief Human Resource Officer |

| Lisa A. Basinger | Corporate Secretary |

DIRECTORS OF THE CITIZENS SAVINGS BANK, MARTINS FERRY, OHIO

| Jonathan C. Clark, Esq | Attorney at Law, Lancaster, Ohio |

| Scott A. Everson1 | President & Chief Executive Officer, United Bancorp, Inc. Chairman, President & Chief Executive Officer, The Citizens Savings Bank, Martins Ferry, Ohio |

| Gary W. Glessner1,2 | Certified Public Accountant, Managing Member of Glessner & Associates, PLLC; Managing Member of G & W Insurance Group, LLC; Managing Member of Wheeling Coin, LLC; Vice President of Windmill Truckers Center, Inc.; Vice President of Glessner Enterprises, Inc.; Member of Red Stripe & Associates, LLC; Managing Member of GW Rentals, LLC |

| John R. Herzig | President, Toland-Herzig Funeral Homes & Crematory, Strasburg, Ohio |

| John M. Hoopingarner1,2 | Executive Director, Muskingum Watershed Conservancy District, New Philadelphia, Ohio |

| Richard L. Riesbeck1,2, ª | Chairman, United Bancorp, Inc., President, Riesbeck Food Markets, Inc., St. Clairsville, Ohio |

| James W. Everson | Chairman Emeritus 1969 - 2014 |

1 = Executive Committee 2 = Audit Committee 3 = Compensation Committee

4 = Nominating and Governance Committee ª = Lead Director

| 6 |

Shareholder Information

United Bancorp, Inc.’s (the Company) common stock trades on The Nasdaq Capital Market tier of The Nasdaq Stock Market under the symbol UBCP, CUSIP #909911109. At year-end 2015, there were 5,385,304 shares issued, held among approximately 2,000 shareholders of record and in street name. The following table sets forth the quarterly high and low closing prices of the Company’s common stock from January 1, 2015 to December 31, 2015 compared to the same periods in 2014 as reported by the NASDAQ.

| 2015 | 2014 | |||||||||||||||||||||||||||||||

| 31-Mar | 30-Jun | 30-Sep | 31-Dec | 31-Mar | 30-Jun | 30-Sep | 31-Dec | |||||||||||||||||||||||||

| Market Price Range | ||||||||||||||||||||||||||||||||

| High ($) | $ | 8.23 | 9.01 | 10.90 | 9.59 | $ | 8.85 | 8.22 | 8.25 | 8.20 | ||||||||||||||||||||||

| Low ($) | $ | 7.99 | 7.81 | 7.87 | 8.15 | $ | 8.12 | 7.45 | 7.91 | 7.79 | ||||||||||||||||||||||

| Cash Dividends | ||||||||||||||||||||||||||||||||

| Quarter ($) | $ | 0.09 | 0.09 | 0.09 | 0.10 | $ | 0.08 | 0.08 | 0.08 | 0.09 | ||||||||||||||||||||||

| Cumulative ($) | $ | 0.09 | 0.18 | 0.27 | 0.37 | $ | 0.08 | 0.16 | 0.24 | 0.33 | ||||||||||||||||||||||

| Special Cash Dividends | $ | - | - | - | 0.05 | |||||||||||||||||||||||||||

Investor Relations:

A copy of the Company’s Annual Report on form 10-K as filed with the SEC, will be furnished free of charge upon written or E-mail request to:

Randall M. Greenwood, CFO

United Bancorp, Inc.

201 South 4th Street

PO Box 10

Martins Ferry, OH 43935

or

cfo@unitedbancorp.com

Dividend Reinvestment and Stock Purchase Plan:

Shareholders may elect to reinvest their dividends in additional shares of United Bancorp, Inc.’s common stock through the Company’s Dividend Reinvestment Plan. Shareholders may also invest optional cash payments of up to $5,000 per month in our common stock at market price. To arrange automatic purchase of shares with quarterly dividend proceeds, please contact:

American Stock Transfer

and Trust Company

Attn: Dividend Reinvestment

6201 15th Avenue, 3rd Floor

Brooklyn, NY 11219

1-800-278-4353

Annual Meeting:

The Annual Meeting of Shareholders will be held at 2:00 p.m., April 20, 2016 at the Corporate Offices in Martins Ferry, Ohio.

Internet:

Please look us up at

http//:www.unitedbancorp.com

Independent Auditors:

BKD LLP

312 Walnut Street, Suite 3000

Cincinnati, Ohio 45202

(513) 621-8300

Corporate Offices:

The Citizens Savings Bank Building

201 South 4th Street

Martins Ferry, Ohio 43935

Lisa A. Basinger

Corporate Secretary

(888) 275-5566 (EXT 6113)

(740) 633-0445 (EXT 6113)

(740) 633-1448 (FAX)

Transfer Agent and Registrar:

For transfers and general correspondence, please contact:

American Stock Transfer

and Trust Company

6201 15th Avenue, 3rd Floor

Brooklyn, NY 11219

1-800-937-5449

Stock Trading:

Raymond James

222 South Riverside Plaza

7th Floor

Chicago, Illinois 60606

Lou Coines

800-800-4693

Stifel, Nicolaus & Company Inc.

655 Metro Place South

Dublin, Ohio 43017

Steven Jefferis

877-875-9352

| 7 |

The Citizens Bank Profile

A Division of The Citizens Savings Bank

OVER A CENTURY OF SERVICE AT THE CITIZENS SAVINGS BANK

In the year 1902, a group of home-town businessmen in Martins Ferry felt there was room for another bank in the community in addition to the two already established and proceeded to organize. On the 27th of January, 1902, a charter was granted to The German Savings Bank of Martins Ferry, Ohio with authorized capital of $50,000. Martins Ferry is nestled among the scenic foothills along the Upper Ohio Valley across the river from the greater metropolitan area of Wheeling, West Virginia, 60 miles southwest of Pittsburgh, Pennsylvania and 125 miles east of Columbus, Ohio. The area has a strong network of transportation including easy access to major interstate highway systems, nearby river and railway transportation and within 45 minutes of the Pittsburgh International Airport.

Organization was completed by electing the original Board of Directors: Attorney Edward E. McCombs, John E. Reynolds, Henry H. Rothermund, William M. Lupton, Dr. Joseph W. Darrah, Chris A. Heil, Fred K. Dixon, Thomas J. Ball and Dr. R.H. Wilson. The first officers were Edward E. McCombs, President; John E. Reynolds, Vice President; William C. Bergundthal, Cashier; and William H. Wood, Assistant Cashier. A room in the old Henderson Building located at the alley on Hanover Street between Fourth and Fifth Streets, currently occupied by a local realtor, was rented. A vault and counters were installed and the new Bank opened for business on Saturday, April 26, 1902. This was the beginning of The Citizens Savings Bank.

Upon Mr. Bergundthal’s death in 1918, Harold H. Riethmiller, who began his banking career at the bank in 1911, was rehired by the Bank as Cashier. He had previously worked for the Bank and had been working for 6 months at the Citizens-Peoples Trust Company in Wheeling. Mr. Riethmiller brought with him an assistant, David W. Thompson, who upon his death in 1966 was Vice President and Cashier.

In 1936 the Bank suffered a loss with the sudden death of Edward E. McCombs, who had served as President and Attorney for the Bank during the 34 years since its beginning. John E. Reynolds was then elected President with Attorney David H. James as Vice President. Mr. Reynolds served as the bank’s second President until his death in 1940, at which time Harold H. Riethmiller was elected President. Upon Harold H. Riethmiller’s retirement in January of 1973, James W. Everson, who began his banking career as a student intern with the Bank in 1959, was elected as the Bank’s fourth President and Chief Executive Officer.

In May 1999, The Citizens Savings Bank and its affiliate, The Citizens-State Bank then of Strasburg, Ohio were merged into one Bank under the leadership of James W. Everson continuing as Chairman and Harold W. Price as the Bank’s fifth President and Chief Executive Officer since its founding in 1902. Harold W. Price served as President and CEO for five months, suffering a fatal heart attack on September 12th, 1999, after which James W. Everson was reappointed Chairman, President and CEO.

Continuing growth and increased business at The German Savings Bank brought the need for larger quarters, and in 1917, the Bank relocated into a new banking building on the corner of Fourth and Walnut streets where they were located until February 21, 1984 when they moved to their current banking center located one block south at the corner of Fourth and Hickory Street in Martins Ferry. The First World War brought the name ‘German’ into bad repute, making a change in name necessary. On May 1, 1918, the old German Savings Bank became The Citizens Savings Bank of Martins Ferry, Ohio.

In 1957, a total remodeling of the first level was completed at the Fourth and Walnut location enlarging the banking lobby by taking the adjoining room formerly occupied by the Mear Drug Store. In 1963, the Bank opened a Consumer Loan Office at the Fourth and Walnut Street location by expanding into the space occupied by the former Packer Insurance Agency.

| 8 |

Upon James W. Everson becoming President in January 1973, the Bank began an expanded growth program. The Bank’s first branch office was opened on November 18, 1974. A banking center was opened in Colerain, Ohio offering full service banking to that area, including safe deposit boxes and a modern new home for the Colerain, Ohio Post Office. On June 12, 1978, the Bank opened its second full service branch at the Corner of Howard and DeKalb Streets in Bridgeport, Ohio.

Recognizing the continued growth of the Bank, the Board of Directors authorized the purchase in July 1979 of an .8 acre site formerly occupied by the vacated Central School, one block south on the Corner of Fourth and Hickory Streets, for the purpose of future expansion. A Phase I building program was completed on May 12, 1980 with the opening of a limited-service four-station auto teller with a two-station lobby and large off-street parking facility.

In October of 1982, approval was granted by the State Banking Department and the Federal Deposit Insurance Corporation to relocate the Bank’s Main Office to the corner of Fourth and Hickory streets in Martins Ferry and ground was immediately broken for a new banking center. As a result of 5 years of strategic planning, The Citizens Savings Bank introduced a new era of banking to the Ohio Valley on February 21, 1984 with the opening of their new 21,500 square foot headquarters office located at the corner of Fourth and Hickory streets. This new banking center offered state-of-the-art security with high-tech scanning and alarm equipment, and the latest in electronic data processing programs for banking. The new Bank building was designed by the architectural firm of Jack H. Tribbie and Associates of Martins Ferry and was constructed by the Byrum Construction Company of Martins Ferry. The new building was of colonial design in keeping with the Bank’s Colerain and Bridgeport offices, with the interior of the Bank tastefully decorated in the Williamsburg period.

On July 3, 1983, the Bank’s Board of Directors positioned itself for continued growth by forming United Bancorp, Inc. of Martins Ferry, Ohio, the Citizens Savings Bank holding company. At formation, the shareholders of The Citizens Savings Bank exchanged their stock on a one-for-four basis for shares in United Bancorp, Inc. On December 29, 1986, United Bancorp, Inc. became one of Ohio’s then 21 multi-bank holding companies by acquiring the outstanding shares of stock of the $12.5 million asset based Citizens-State Bank of Strasburg, Ohio. Under the leadership of James W. Everson as Chairman and Charles E. Allensworth as President and CEO, The Citizens-State Bank then grew from its one office in Strasburg by opening a new banking center at 2909 N. Wooster Avenue in Dover, Ohio in February 1990; the purchase of it’s offices in New Philadelphia and Sherrodsville in April 1992; and the purchase of it’s Dellroy Office in June 1994. Harold W. Price was appointed President and CEO of The Citizens-State Bank of Strasburg in April 1993. The Citizens Savings Bank of Martins Ferry further expanded into St. Clairsville with an in store location at Riesbeck’s Food Market in July l997 and purchased a full service banking center in Jewett, Ohio in January 1999. United Bancorp entered Northern Athens County in July 1998 when the $47.8 million asset based Community Bank of Glouster was purchased, expanding United Bancorp, Inc. to a three bank holding company. Today, The Community Bank is headquartered in Lancaster, Ohio with three locations in Lancaster in addition to its two offices in Glouster and offices in Amesville and Nelsonville, Ohio.

As space in the new headquarters became occupied, property across from the new Main Office on the other corner of Fourth and Hickory Streets was acquired in 1993 to support the continued growth. It was renovated into a modern Operations Center now housing the Data and Item Processing Equipment for the affiliate banks of United Bancorp, Inc. and the offices for United Bancorp, Inc.’s Accounting Group. With the introduction of 24 x 7 x 365 Automated Call Center and Internet Banking in 2001, the Accounting and Operations Center was further expanded through the purchase and renovation of the adjoining property formerly known as the Fullerton Bakery Building. Today, the Accounting and Operations Center Building supports the back room operations for the seventeen banking offices of The Citizens Bank and The Community Bank of Lancaster.

On April 21, 1999 the $74.1 million asset based Citizens-State Bank of Strasburg was merged into The Citizens Savings Bank. This expanded customer service under the charter of The Citizens Savings Bank to 10 locations in Belmont, Carroll, Harrison and Tuscarawas counties. Harold W. Price, who had served as President and CEO of The Citizens-State Bank of Strasburg was appointed The Citizens Savings Bank’s fifth President and CEO with James W. Everson continuing as Chairman, in addition to serving as Chairman of The Community Bank and Chairman, President and CEO of United Bancorp. Everson was reappointed Chairman, President and CEO of The Citizens Savings Bank five months later upon Harold W. Price’s sudden death.

In November 2004, the Citizens Bank Board of Directors completed its senior management reorganization plans for the beginning of its second century of service. James W. Everson, will continue as the Bank’s Chairman. Furthermore, the Citizens Bank Board of Directors announced the appointment of Scott A. Everson as Director, President and Chief Executive Officer, which became effective on November 1, 2004.

On September 19, 2008, Citizens acquired from the Federal Deposit Insurance Corporation ("FDIC") the deposits of three banking offices of a failed institution in St. Clairsville, Dillonvale and Tiltonsville, Ohio.

In June 2012, the Company's subsidiary The Citizens Savings Bank purchased a full service banking facility from another financial institution on the West side of St. Clairsville in the same development where the Company has been leasing space for its In Store Banking Facility since 1997.

| 9 |

The purchase agreement contained a one year "black out" period where the location could not be used as a financial institution. In January 2013, the Company began extensive renovations on the building and the plans called for a complete renovation of the lobby and customer service areas of the bank. In addition, the Company constructed a state of the art Training Center for staff that also offers educational seminars for current and future customers of the bank. At the time of opening in June of 2013, the Company closed its In Store Banking Facility and now has two full service banking centers including drive thru service and safe boxes in St. Clairsville, one on West side and one on East side of City.

The growth and success of The Citizens Savings Bank and the United Bancorp, Inc. have been attributed to the association of many dedicated men and women. Having served on the Board of Directors are Edward E. McCombs, 1902-1936; John E. Reynolds, 1902-1940; Dr. J.W. Darrah, 1902-1937; J.A. Crossley, 1902-1903; William M. Lupton, 1902-1902; F.K. Dixon, 1902-1909; Dr. R.H. Wilson, 1902-1905; C.A. Heil, 1903-1909; David Coss, 1904-1938; L.L. Scheele, 1905-1917; A.T. Selby, 1906-1954; H.H. Rothermund, 1907-1912; Dr. J.G. Parr, 1912-1930; T.E. Pugh, 1920-1953; J.J. Weiskircher, 1925-1942; David H. James, 1925-1963; Dr. C.B. Messerly, 1931-1957; H.H. Riethmiller, 1936-1980; E.M. Nickles, 1938-1968; L.A. Darrah, 1939-1962; R.L. Heslop, 1941-1983; Joseph E. Weiskircher, 1943-1975; Edward M. Selby, 1953-1976; David W. Thompson, 1954-1966; Dr. Charles D. Messerly, 1957-1987; James M. Blackford, 1962-1968; John H. Morgan, 1967-1976; Emil F. Snyder, 1968-1975; James H. Cook, 1976-1986; Paul Ochsenbein, 1978-1991; David W. Totterdale, 1981-1995; Albert W. Lash, 1975-1996; Premo R. Funari, 1976-1997; Donald A. Davison, 1963-1997; Harold W. Price, 1999-1999; John H. Clark, Jr., 1976-2001; Dwain R. Hicks, 1999-2002; and Michael A. Ley, 1999-2002, Michael J. Arciello 1992 - 2009, Leon F. Favede, O.D., 1981-2012, Herman E. Borkoski, 1987-2012, James W. Everson, 1969-2014, Robin L. Rhodes, 2007-2015, Andrew C. Phillips 2007-2015, Errol C. Sambuco 1996-2015, Samuel J. Jones 2007-2015 and Matthew C. Thomas 1988-2016. On April 16, 2014, James W. Everson retired from his position as Chairman of the Board with 55 years of service to the Bank and Scott A. Everson was appointed Chairman, President and CEO of The Citizens Savings Bank.

Today, The Citizens Savings Bank is Martins Ferry’s only locally owned financial institution. The general objective of The Citizens Savings Bank as outlined in its Mission Statement which was adopted by its Board of Directors on June 8, 1982 and renewed annually is to remain an independent state-chartered commercial bank and expand its asset base and market share through acquisitions and new branch construction where financially feasible.

The Community Bank Profile

A Division of The Citizens Savings Bank

COMMUNITY was established in August 1945 with corporate offices in downtown Glouster, Ohio, in Athens County. Its founder was L.E. Richardson, a local entrepreneur. At that time, Athens County was booming with the industries of gas, oil and coal mining. COMMUNITY was then known as The Glouster Community Bank. The Bank played a vital role in the region as it developed, earning a reputation for friendliness, quality customer service and responsiveness to the individual financial needs of its customers, as well as the community. More than 25 years later, Richardson turned over the day-to-day management of the bank to his son, L.E. Richardson, Jr., in 1971.

With that foundation, COMMUNITY acquired the First National Bank of Amesville, Ohio in 1976. The Bank’s prosperity continued, and, in 1978, a three-lane Auto Bank drive-up facility was constructed on the west side of Glouster.

| 10 |

In 1984, the Bank created a holding company, Southern Ohio Community Bancorp, Inc., in anticipation of future growth and diversification of products and services.

In 1987, the service area was expanded once again. A modular office in Nelsonville served the village and the surrounding communities. A few years later, on December 6, 1993 a ribbon cutting ceremony was held for a newly constructed Nelsonville office. The brick building, which replaced the mobile bank unit, features four drive-up lanes and a drive-up ATM. Night deposit and safe deposit box services were also introduced to the Nelsonville area.

In 1996, COMMUNITY completed an extensive renovation of its downtown Glouster office, including the addition of a 24-hour access ATM in the vestibule.

In 1998, COMMUNITY became affili-ated with United Bancorp, Inc. of Martins Ferry, Ohio, when United Bancorp purchased The Glouster Community Bank and its holding company, Southern Ohio Community Bancorp, Inc.

That acquisition led to COMMUNITY establishing a Loan Production Office (LPO) in 1998 in Lancaster, Ohio. This LPO provided the opportunity for COMMUNITY to build its franchise along the U.S. Route 33 corridor from Athens County through Fairfield County.

Lancaster, the county seat of Fairfield County, is approximately 30 miles southeast of Columbus, Ohio and is considered a bedroom community to Columbus. According to the city’s Economic Development Office, Fairfield County is the fourth fastest growing county in Ohio and is ranked among the top six counties for growth potential.

COMMUNITY opened its first Fairfield County banking office in December 1999. The East Main Street Banking Office in Lancaster offers full service banking with extended evening and Saturday hours. The office features a three-lane drive-up, a drive-up ATM and night depository.

In January 2000, COMMUNITY relocated its Main Office from Glouster to downtown Lancaster. This substantial investment significantly strengthened COMMUNITY’S presence in Fairfield County. Formerly a furniture store, the historic 1919 building was restored to as near the original appearance as possible. The building was further enhanced with a Verdin Company clock. The 435-pound timepiece is attached to the southeast corner of the building. The interior of the building was converted from a furniture store to a modern full service banking office. Of special note is the historical mural of Fairfield County landmarks, painted by local stencil artist Cheryl Fey, which graces the main stairway. The renovation added greatly to the city’s business district, as the Main Office complements the downtown revitalization that also was completed in 2000.

COMMUNITY’S Auto Bank, located across the street from the Main Office, also was opened in January 2000. The structure is unique to the market, because of its walk-in lobby. It also features a four-lane drive-thru, night depository and automatic teller machine.

In July 2000, COMMUNITY opened its Community Room, also unique to the area. The Community Room has grown quickly into a convenient and frequently used location for meeting of area civic organizations. It is also a popular gallery for local artists to display their talents.

From the rolling hills of Athens County to the bustling commerce of Fairfield County, COMMUNITY continues to play a vital role in the lives of its customers and the region it serves. The Bank not only has built upon its customer base through the years, but upon its reputation for friendliness, quality customer service and responsiveness to the individual financial needs of its customers and the communities it proudly serves.

On July 1, 2007, the Company received regulatory approval for the merger of its wholly owned subsidiaries, The Glouster Community Bank ("Community"), Lancaster, Ohio, and The Citizens Savings Bank ("Citizens"), Martins Ferry, Ohio, under the charter of the latter. The Boards of both Citizens and Community endorsed this consolidation. The Company continues to capitalize on the established branding in the market places of each institution. Community operates under the trade name "The Community Bank, a Division of The Citizens Savings Bank" and Citizens operates under the trade name "The Citizens Bank, a Division of The Citizens Savings Bank". A key focus of the consolidation involved the centralization of executive authority under Citizens’ proven management structure that has been perennially ranked in the upper quartile of all banks in the United States.

Including the Community Board members on the Board of the combined institution was essential for the Company to realize the full potential of the combination. Management was pleased to report on the merger date of July lst that Samuel J. Jones, Business Owner, Glouster, Ohio; Terry A. McGhee, President and CEO, Westerman, Inc., Bremen, Ohio; Andrew F. Phillips, President and General Manager, Miller Brands of South East Ohio, Glouster, Ohio; Robin L. Rhodes, M.D., Physician, Pediatric Associates of Lancaster, Inc., Lancaster, Ohio; and L.E. "Dick" Richardson, Jr., Retired President, Southern Ohio Community Bancorporation, Inc., Glouster, Ohio accepted the Company’s invitation to become members of The Citizens Savings Bank Board of Directors.

On October 31, 2007, the Company completed the ‘‘physical consolidation" of its two charters under the management group of The Citizens Savings Bank, resulting in a 22% reduction in staffing at The Community Bank division. Merging all of the Company’s bank charters into a single charter and common operating system now allows each banking office to focus on growing the Company’s banking franchises by providing the highest level of customer service from a common market basket of products.

In the first quarter of 2015, the Company completed a renovation project on our downtown Glouster, Ohio office that added two drive-thru lanes and an ATM lane onto this office. Being able to close the stand-alone auto bank facility was immediately accretive to earnings by allowing our Compnay to eliminate 2.5 full-time equivalent job positions.

| 11 |

Management’s Discussion and Analysis

In the following pages, management presents an analysis of United Bancorp, Inc.’s financial condition and results of operations as of and for the year ended December 31, 2015 as compared to prior years. This discussion is designed to provide shareholders with a more comprehensive review of the operating results and financial position than could be obtained from an examination of the financial statements alone. This analysis should be read in conjunction with the Consolidated Financial Statements and related footnotes and the selected financial data included elsewhere in this report.

When used in this discussion or future filings by the Company with the Securities and Exchange Commission, or other public or shareholder communications, or in oral statements made with approval of an authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “believe,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made, and to advise readers that various factors, including regional and national economic conditions, changes in levels of market interest rates, credit risks of lending activities and competitive and regulatory factors, could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from those anticipated or projected.

The Company is not aware of any trends, events or uncertainties that will have or are reasonably likely to have a material effect on its liquidity, capital resources or operations except as discussed herein. The Company is not aware of any current recommendations by regulatory authorities that would have such effect if implemented.

The Company does not undertake, and specifically disclaims, any obligation to publicly release any revisions that may be made to any forward-looking statements to reflect occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

Financial Condition

Overview

The Company’s net income realized in 2015 generated diluted earnings per share of $0.64 for the year ended December 31, 2015 compared to $0.53 for the year ended December 31, 2014, an increase of 21%. This growth in earnings can be attributed to several factors which are explained below in detail. The Company’s diluted earnings per share for the three months ended December 31, 2015 increased 13% to $0.17 from $0.15 for the three months ended December 31, 2014.

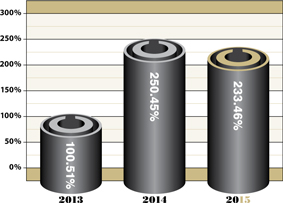

Total Assets (In Thousands)

We are very happy to report on the earnings improvement of our Company, both quarterly and for the year ended December 31, 2015. The increase in the Company’s earnings is reflective of the growth in loan-related earning assets for the Company, especially over the second half of 2015. The Company’s net interest margin decreased slightly for 2015 to a level of 3.64% compared to 3.75% for 2014. This decrease in the net interest margin is attributed to the Company having a higher level of investment securities for 2015 as compared to 2014. Even though the yield on these short-duration securities had somewhat of a dilutive impact on the net interest margin, the increased position in these securities helped keep the Company’s level of investment income relatively stable year-over-year. In addition, the net interest margin was impacted by the downward repricing of the loan portfolio in the low rate environment that continued during the course of this past year. While the Federal Open Market Committee did increase the target for the federal funds rate by 25 basis points in December 2015, this did not impact the Company’s revenue stream given that the adjustment was made so late in the year. Period-over-period, the Company’s average loans increased $4.6 million while gross loans increased by $13.9 million or 4.40%. As previously mentioned, the Company generated strong loan growth during the final two quarters of 2015 which led to an increase in the level of net interest income that the Company realized in each of these final two quarters. It is strongly anticipated that this positive trend will continue in 2016. The Company maintained its funds management policy by keeping the majority of its surplus funding in very liquid, lower-yielding excess reserves at the Federal Reserve, which totaled $30.4 million on an average basis for 2015, and resisting the temptation of extending the duration of its investment portfolio to achieve higher investment yields; although, investment in shorter-duration securities accelerated for the year. As a result, the securities and other restricted stock balance increased by $14.8 million to a level of $38.8 million at year end. On a year-over-year basis, the Company’s credit quality has not changed significantly as nonaccrual loans marginally increased by $86,000 to a level of $1.0 million, or 0.32%, of total loans. Net loans charged off (exclusive of overdraft charge offs) for 2015 were $380,000, or 0.12% of average loans, as compared to $1.2 million (exclusive of overdraft charge offs), or 0.40%, for 2014. In addition, the Company continued to see a decrease in its other real estate and repossessions (“OREO”) as balances decreased by $783,000, or 68.6%, during the course of this past year to a level of $357,000. Lastly, the overall total allowance for loan losses to total loans was 0.74% resulting in a total allowance for loan losses to nonperforming loans of 233.46% at December 31, 2015 compared to 0.76% and 250.45% respectively at December 31, 2014. With this continued trend of improving credit quality and strong coverage, the Company projects a further reduction of its provision for loan losses which should have a positive impact on future earnings.

| 12 |

On the liability-side of the balance sheet, the Company continued to see a positive return on its strategy of attracting additional customers into lower-cost funding accounts while allowing higher-cost funding to run off. Year-over-year, low-cost funding, consisting of demand and savings deposits, increased by $11.1 million while higher-cost time deposit balances decreased by over $10.2 million, helping to reduce the overall interest expense of the Company. The Company continued to see the positive impact of attracting a higher number of active transaction accounts which resulted in service charges on deposit accounts increasing by $127,000, or 4.60%, on a year-over-year basis as of December 31, 2015. It is projected that this trend will continue even with the Government mandated regulations relating to the Dodd-Frank Act being more fully implemented. The heightened implementation of this legislation may potentially have a limiting effect on the level of revenue realized per account which should be offset by the Company’s focus on attracting a higher number of transaction accounts that can generate fee-based income. Lastly, noninterest expense decreased on a year-over-year basis by $656,000 or 5.0%. As previously announced, the Company’s office consolidation in its Glouster, Ohio marketplace was completed late in the first quarter of 2015 and has lead to additional cost savings which should help to further contain noninterest expense in future periods. Our goal is to control our level of noninterest expense while continuing to build and strengthen our operational foundation which should lead to future growth, higher levels of operating income and, ultimately, a higher level of performance. Over the next 24 months, it is projected that the Company’s interest expense will be positively impacted by the repricing of $26 million in fixed-rate advances with the Federal Home Loan Bank (”FHLB”) that are set to mature. The average cost of these advances is 3.66% and, given the current interest rate environment, should lead to continued savings in interest expense. In May 2016, a $6.0 million FHLB advance matures at a rate of 3.28%. If this advance is replaced with a short term borrowing at a current rate of 50 basis points, the Company will save approximately $167,000 annually in interest expense beginning in May 2016. In addition, the Company’s $4.1 million subordinated debenture repriced on January 1, 2016 from a fixed rate of 6.25% to a variable rate of 0.62% based on the three-month LIBOR plus a margin of 1.35%. At this level, the Company will save approximately $177,000 in interest expense annually beginning this year. With our continued focus of shifting lower-yielding liquid assets into higher-yielding quality loans, growing service charge income on deposit accounts, controlling of our noninterest expense, reducing our interest expense in 2016 and the budgeted lowering of our loan loss provision even further, we are projecting continued improvement in our earnings for 2016.

Loans-Net (In Thousands)

| 13 |

The results that we are seeing today are reflective of the somewhat conservative posturing that we undertook in recent years in the aftermath of the Great Recession to protect both our capital base and earnings stream. Most of the earnings improvements that we have seen over the course of the past eighteen months have come from process changes and product enhancements implemented in recent years that have led to operational efficiencies which have lowered our non-interest expense levels while driving higher levels of fee-based revenue for our Company. We are currently pleased with the results that we are now seeing and will continue looking for additional opportunities that will help our organization become more operationally efficient, generate higher levels of revenue and produce higher levels of quality earnings. Being a very well capitalized Bank in today’s environment will allow us to enhance our focus in the coming quarters on further implementing the growth strategy that was initiated late in the second quarter of 2015 which exclusively focuses on driving the loan volumes of our company. This strategy, which entails adding additional origination personnel to our commercial and residential lending platforms and enhancing the lending programs that our Company offers, should generate higher levels of interest and fee-based revenue in the coming quarters. Although it is anticipated that such initiatives will lead to higher non interest expense levels for our Company, the projected revenue generated and earnings produced should be far greater. We have begun to see the results of this initiative with our gross loans increasing by $13.9 million year-over-year. Most of this growth occurred during the last two quarters of this past year. With this recent momentum, we strongly anticipate that this newly initiated revenue enhancement strategy, along with the aforementioned downward pricing of a large portion of our borrowed funds base, should help enhance the overall operating income that our Company generates over the course of the next twenty-four months and drive earnings growth at levels similar to what we have seen in recent quarters. Our Company is beginning to be rewarded by the markets for this level of performance as we have seen the market value of our stock increase from $8.07 at year-end 2014 to $9.59 at year-end 2015, an increase of 19%. With our Company’s present price-to-earnings multiple and projected direction of earnings, we believe that our stock can continue to trade at higher market valuations in the near term. Our number one focus continues to be protecting and growing our shareholders’ investment in our Company through sound and profitable operations and strategic growth. In addition to driving the market value appreciation of our shareholders’ ownership, we will continue striving to reward our owners by paying a solid cash dividend. Our Company’s dividend payout increased 12.1% year-over-year and is presently yielding 4.17% on a forward basis (not including the recently paid special cash dividend.) At this level, our Company’s cash dividend is yielding nearly twice that of the average bank in our country. In addition, on December 29, 2015, the Company paid a special dividend of $0.05 which provides for a total cash dividend payout of $0.42 per common share by our Company in 2015. Overall, we are very pleased with the present operating performance of our Company and the direction that we are going. We look forward to carrying the earnings momentum seen this past year into 2016!

Total Average Earning Assets (In Thousands)

Earning Assets – Loans

Gross loans totaled $315.8 million at December 31, 2014, representing a 4.4% increase to $329.7 million at December 31, 2015. Average loans totaled $313.7 million for 2014, representing a 1.4% increase compared to average loans of $318.3 million for 2015.

The increase in gross loans from December 31, 2014 to December 31, 2015 was primarily an increase in commercial and commercial real estate loans by $20.1 million which was offset by a decrease of $3.8 million in installment loans and a decrease of $2.4 million in residential real estate.

The Company's commercial and commercial real estate loan portfolio represents 70.0% of the total portfolio at December 31, 2015, compared to 66.7% at December 31, 2014. During this past year, we found many new customers within our lending areas and our focus continues on our small business customers that operate in our defined market area. We utilize all the SBA, Ohio Department of Development and State of Ohio loan programs as well as local revolving loan funds to best fit the needs of our customers.

The Company’s installment lending portfolio represented 5.3% of the total portfolio at December 31, 2015, compared to 6.7% at December 31, 2014. The targeted installment lending areas encompass the four geographic areas serviced by the Bank, which are diverse, thereby reducing the risk to changes in economic conditions. Competition for installment loans principally comes from the captive finance companies offering low to zero percent financing for extended terms.

The Company's residential real estate portfolio represents 24.7% of the total portfolio at December 31, 2015, compared to 26.6% at December 31, 2014. Residential real estate loans are comprised of 1, 3, and 5 year adjustable-rate mortgages and 15 fixed rated loans used to finance 1-4 family units. The Company also offers fixed-rate real estate loans through our Secondary Market Real Estate Mortgage Program. Once these fixed rate loans are originated and immediately sold without recourse in what is referred to as the secondary market, the Company does not assume credit risk or interest rate risk in this portfolio. This arrangement is quite common in banks and saves our customers from looking elsewhere for their home financing needs.

| 14 |

In 2015, the interest rate environment continued to be favorable to the secondary market fixed-rate mortgage loan product. However, the secondary market origination volume was impacted by an issue that has developed in the overall industry related to higher risk sub-prime loans. While the Company did not participate in sub-prime lending, the additional regulations and unstable appraisal market have made it more difficult to obtain a loan that is saleable in the secondary market. With these conditions, the Company did recognize a gain on the sale of secondary market loans of $42,000 in 2015 and a gain of $30,000 in 2014.

The allowance for loan losses represents the amount which management and the Board of Directors estimates is adequate to provide for probable incurred losses in the loan portfolio. Accounting for the allowance and the related provision for loan losses is viewed by management as a critical accounting policy. The allowance balance and the annual provision charged to expense are reviewed by management and the Board of Directors on a monthly basis. The allowance calculation is determined by utilizing a risk grading model that considers borrowers’ past due experience, coverage ratio to industry averages, economic conditions and various other circumstances that are subject to change over time. In general, the loan loss policy for installment loans requires a charge-off if the loan reaches 120-day delinquent status or if notice of bankruptcy liquidation is received. The Company follows lending policies, with established criteria for determining the repayment capacity of borrowers, requirements for down payments and current market appraisals or other valuations of collateral when loans are originated. Installment lending also utilizes credit scoring to help in the determination of credit quality and pricing.

The Company generally recognizes interest income on the accrual basis, except for certain loans which are placed on non-accrual status, when in the opinion of management; doubt exists as to collection on the loan. The Company’s policy is to generally place loans greater than 90 days past due on non-accrual status unless the loan is both well secured and in the process of collection. When a loan is placed on non-accrual status, interest income may be recognized on a cash basis as payment is received if the loan is well secured. If the loan is not deemed well secured, payments are credited to principal.

Net Income (In Thousands)

Management and the Board of Directors believe the current balance of the allowance for loan losses is sufficient to cover probable incurred losses. Refer to the Provision for Loan Losses section for further discussion on the Company’s credit quality.

Earning Assets – Securities and Federal Funds Sold

The securities portfolio is comprised of U.S. Government and agency obligations, tax-exempt obligations of states and political subdivisions and certain other investments. The Company does not hold any derivative securities. The quality rating of the majority of the Bank’s securities issued by political subdivisions is generally no less than A. Board policy permits the purchase of certain non-rated or lesser rated bonds of local schools, townships and municipalities, based on known levels of credit risk.

Securities available for sale at December 31, 2015 increased $15.3 million, or 79.0%, from 2014, while the last securities in the held to maturity portfolio were either called or matured in 2015. The Company does not anticipate using the held to maturity designation over the near term. The Company’s U.S. Government agency portfolio is subject to increased levels of redemptions due to the call features in this type of investment security. Given the extent of the decrease in overall interest rates, the Company did experience a significant amount of called government agency investment securities during 2015 and to extent in 2014. While the Company has plans to reinvest a portion of these funds in other available-for-sale securities, there is lag between the time when bonds are called and the right investment opportunity is available to the Company. In addition, given the historical low interest rate environment, there is concern on the duration of future purchases in the investment portfolio.