Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Orion Group Holdings Inc | a4q2015earningsrelease8k.htm |

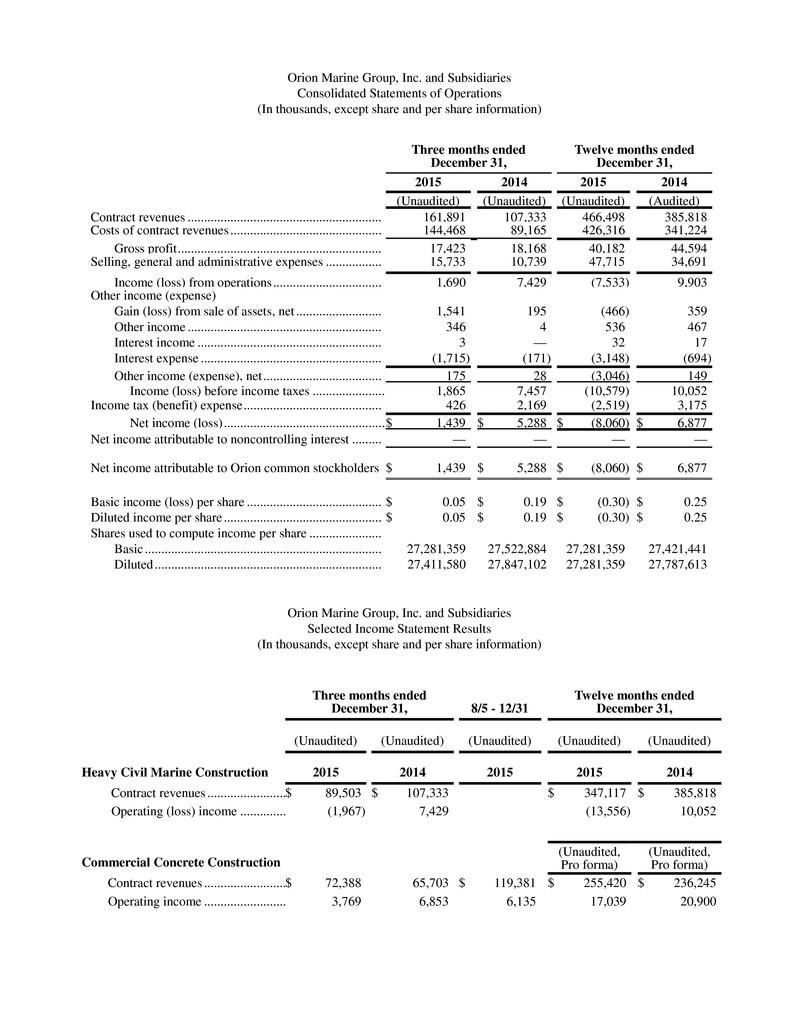

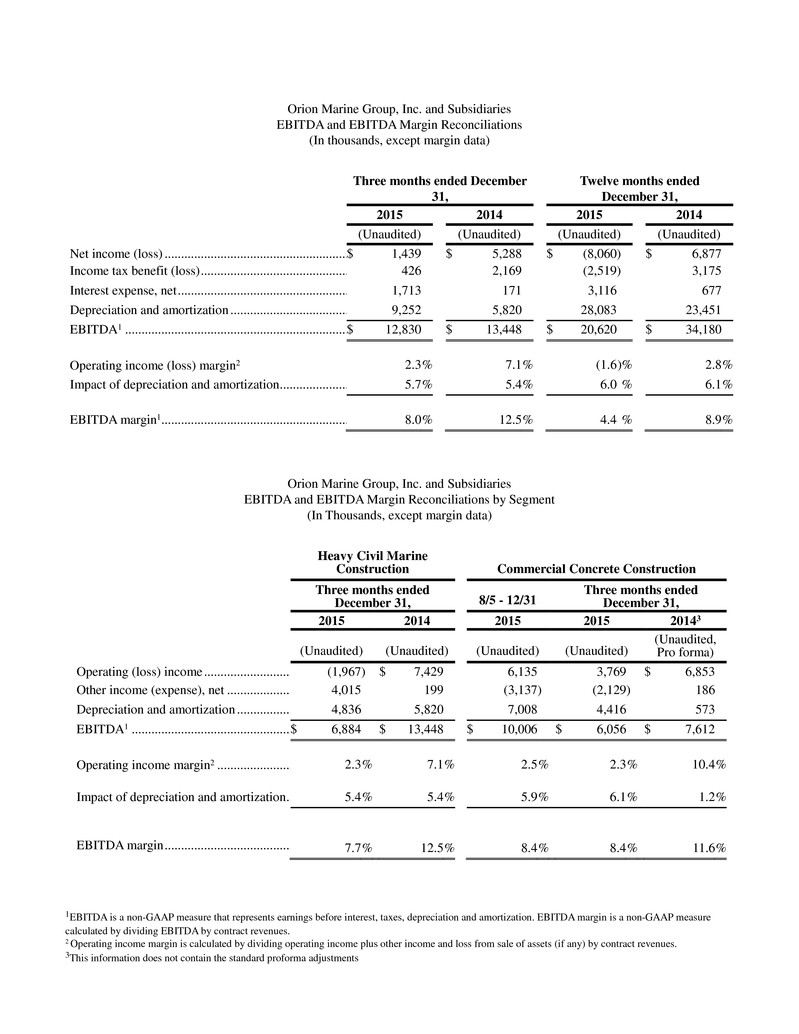

Orion Marine Group, Inc. Reports Fourth Quarter and Full Year 2015 Results Houston, Texas, March 10, 2016 -- Orion Marine Group, Inc. (NYSE: ORN) (the “Company”), a leading specialty construction company, today reported net income for the three months ended December 31, 2015, of $1.4 million ($0.05 diluted earnings per share). These results compare to net income of $5.3 million ($0.19 diluted earnings per share) for the same period a year ago. For the full year 2015, Orion Marine Group reported a net loss of $8.1 million ($0.30 diluted loss per share), which compares to the prior full year 2014 net income of $6.9 million ($0.25 diluted earnings per share). "2015 was a year filled with accomplishments, as well as challenges," said Mark Stauffer, Orion Marine Group's President and Chief Executive Officer. "I am very pleased with the acquisition of TAS and the growth opportunities it provides our Company. In our heavy civil marine construction segment, weather and project delays, along with the project execution issues during 2015 were disappointing developments in a year I initially had such high hopes for. However, the markets in both our segments remain strong and I have taken steps to correct the operational issues impacting our heavy civil marine construction segment. I remain excited about 2016 and the opportunities ahead for the Company." Financial highlights of the Company's fourth quarter and full year 2015 include: Fourth Quarter 2015 Consolidated Results • Fourth quarter 2015 contract revenue was $161.9 million, an increase of 50.9%, as compared with fourth quarter 2014 revenue of $107.3 million, primarily as a result of the addition of TAS. • Gross profit for the quarter was $17.4 million, a decrease of approximately $745 thousand as compared with the fourth quarter of 2014. Gross profit margin for the fourth quarter of 2015 was 10.8%, which was lower than the prior year period of 16.9%. • Selling, General, and Administrative expense for the fourth quarter 2015 was $15.7 million as compared to $10.7 million in the prior year period. The increase is primarily attributable to the addition of TAS. • The Company's fourth quarter 2015 EBITDA was $12.8 million, representing a 7.9% EBITDA margin, which compares to fourth quarter 2014 EBITDA of $13.4 million, or a 12.5% EBITDA margin. Heavy Civil Marine Construction Segment • Fourth quarter 2015 contract revenue was $89.5 million, a decrease of approximately 16.6%. The decrease is primarily related to the timing and mix of projects compared to the prior year period. • Fourth quarter 2015 operating loss was $2.0 million, a decrease of approximately $9.4 million. The decrease is primarily attributable to five previously discussed projects managed out of the Tampa office earning no margin during the quarter, as well as the timing and mix of projects. • Fourth quarter 2015 EBITDA was $6.9 million, representing a 7.7% EBITDA margin, a decrease of approximately $6.6 million from the prior year period. Commercial Concrete Construction Segment • Fourth quarter 2015 contract revenue was $72.4 million, an increase of approximately 10.2% over the same period last year, on a pro forma basis. The increase is attributable to a larger volume of work being executed in both the Houston and Dallas markets.

• Fourth quarter 2015 operating income was $3.8 million, a decrease of $3.1 million over the same period last year, on a pro forma basis. The decrease is primarily driven by the amortization of intangible assets related to the acquisition and the corporate allocation of SG&A cost to the Commercial Concrete Construction segment. • Fourth quarter 2015 EBITDA was $6.1 million, representing an 8.4% EBITDA margin Full Year 2015 Consolidated Results • Full year 2015 contract revenue was $466.5 million, an increase of 21% as compared with full year 2014 revenues of $385.8 million. The increase is attributable to the addition of TAS. • Gross profit for the year was $40.2 million, which represents a decrease of $4.4 million as compared with the full year 2014. Gross profit margin for the full year 2015 was 8.6%, as compared to 11.6% for the full year 2014. • Selling, General, and Administrative expense for the full year 2015 was $47.7 million as compared with $34.7 million in the prior year period. The increase is primarily attributable to the addition of TAS. • The Company’s full year 2015 EBITDA was $20.6 million, representing a 4.4% EBITDA margin, which compares to full year 2014 EBITDA of $34.2 million, or an 8.9% EBITDA margin. Heavy Civil Marine Segment • Full year 2015 contract revenue was $347.1 million, a decrease of 10.0% as compared with full year 2014 revenues of $385.8 million. The decrease is primarily attributable to weather and project delays in the first half of 2015, as well as the timing and mix of projects. • Full year 2015 operating loss was $13.6 million, a decrease of $23.6 million. The decrease is primarily related to the project execution issues experienced on five projects managed out of the Tampa office. • Full year 2015 EBITDA was $10.7 million, representing a 3.1% EBITDA margin, which compares to full year 2014 EBITDA of $34.2 million, or an 8.9% EBITDA margin. Commercial Concrete Segment • The acquisition of TAS Commercial Concrete was completed on August 5, 2015. The annual results for this segment represent results from August 5, 2015 to December 31, 2015. • Revenue attributable to Orion Marine Group, Inc. during 2015 was $119.4 million. On a pro-forma basis, assuming that the acquisition of TAS Commercial Concrete had been completed as of January 1, 2015, total 2015 revenue would have been $255.4 million which represents an increase of 8.1% over 2014, on a pro forma basis. The increase is attributable to a larger volume of work being executed in both the Houston and Dallas markets. • Operating income attributable to Orion Marine Group, Inc. during 2015 was $6.1 million. On a pro-forma basis, assuming that the acquisition of TAS Commercial Concrete had been completed as of January 1, 2015, total 2015 operating income would have been $17.0 million which represents a decrease of 18.5% over 2014, on a pro forma basis. The decrease is primarily related to the amortization of intangible assets related to the acquisition and the corporate allocation of SG&A cost to the Commercial Concrete Construction segment. • EBITDA attributable to Orion Marine Group, Inc. during 2015 was $10.0 million. On a pro-forma basis, assuming that the acquisition of TAS Commercial Concrete had been completed as of January 1, 2015, total 2015 EBITDA would have been $27.2 million, an increase of 11.7% over 2014, on a pro forma basis.

Backlog of work under contract as of December 31, 2015 was $357.6 million, which compares with backlog under contract at December 31, 2014 of $215.3 million. Of the 2015 ending backlog, $194.3 million was attributable to the heavy civil marine construction segment, while $163.3 million was attributable to the commercial concrete segment. Additionally, the Company is currently the apparent low bidder on approximately $61 million of work. The Company reminds investors that backlog can fluctuate from period to period due to the timing and execution of contracts. Given the typical duration of the Company's projects, which generally range from three to nine months, the Company's backlog at any point in time usually represents only a portion of the revenue it expects to realize during a twelve-month period. Backlog consists of projects under contract that have either (a) not been started, or (b) are in progress and not yet complete, and the Company cannot guarantee that the revenue projected in its backlog will be realized, or, if realized, will result in earnings. Outlook "We continue to see solid demand for our services that should support improved results in 2016," said Mr. Stauffer. "With the remaining three Tampa projects that experienced issues in the third quarter nearing completion, we are excited to capitalize on improving markets in the Heavy Civil Marine Construction segment. Additionally, the market in our Commercial Concrete Construction segment remains solid, with ample opportunities for growth in 2016. "With an improved federal and state funding outlook, along with continued private sector demand, we remain optimistic for improved results in the Heavy Civil Marine Construction segment in 2016. The passage of the OMNIBUS funding bill last year is an encouraging development. Additionally, under the recently approved two year budget deal, appropriations for the fiscal year beginning October 1, 2016 should occur under regular order, which should allow the U. S. Army Corps of Engineers to let maintenance dredging projects at a more consistent and predictable pace. We were also pleased to see the passage of a 5 year, $305 billion transportation bill, called the FAST Act, in December. Among other transportation items, the FAST Act will fund bridge construction projects through various state departments of transportation. This long term bill will not only provide an increase in bid opportunities for bridge construction projects, but may also lead to improved bid pricing given the visibility provided to the market. We also continue to monitor developments in the private sector related to our midstream and downstream energy clients. As I have said over the past several quarters, despite the prolonged downturn in energy prices, we continue to see bid opportunities in this sector, driven by expansion of liquid terminals and petrochemical facilities. "In the Commercial Concrete Construction segment, demand for services also remains solid. While we are seeing somewhat of a softening in the Houston market for multifamily and office construction, this type of work does not make up a large portion of our targeted work and is being offset by increasing demand for distribution, retail and warehouse space. Vacancy rates in retail spaces in Houston remain at historically low levels along with low vacancy rates for distribution and warehouse facilities near the Port of Houston. The Dallas market continues to be a source of growth. Vacancy rates in Dallas are also trending lower, which should continue to drive demand for our services in the area. In fact, the Commercial Concrete Construction segment ended the year with its highest level of backlog for Dallas projects in its history." “We were pleased with our bid activity and success rate in 2015 across both our segments," said Chris DeAlmeida, Orion Marine Group's Vice President and Chief Financial Officer. "In the Heavy Civil Marine segment, we bid on approximately $1.4 billion in 2015 and were successful on $324 million. This resulted in a 0.94 times book to bill for the year and an annual win rate of 23%. The Commercial Concrete Construction segment also had a healthy bid levels for the year, bidding on approximately $1.2 billion in work while being awarded approximately $264 million. This resulted in a 1.07 times book to bill for the year, on a pro forma basis, and an annual win rate of 22%. Overall, we have over $568 million worth of bids outstanding, including approximately $82 million on which we are apparent low bidder or have been awarded subsequent to the end of the quarter. Given our improving end markets across both our segments and robust bidding activity, we believe results for 2016 should be within the previously stated range.”

Conference Call Details Orion Marine Group will conduct a telephone briefing to discuss its results for the fourth quarter and full year 2015 at 10:00 a.m. Eastern Time/9:00 a.m. Central Time on Thursday, March 10, 2016. To listen to a live broadcast of this briefing, or access a replay of the call, visit the Calendar or Events page of the Investor Relations section of the website at http://www.orionmarinegroup.com/Calendar.html. To participate in the call, please call the Orion Marine Group Fourth Quarter and Full Year 2015 Earnings Conference Call at 855-478-9690; Participant code: 56114926. About Orion Marine Group Orion Marine Group, Inc., a leading construction company, provides services both on and off the water in the continental United States, Alaska, Canada and the Caribbean Basin through its heavy civil marine construction segment and its commercial concrete segment. The Company’s heavy civil marine construction segment services includes marine transportation facility construction, marine pipeline construction, marine environmental structures, dredging of waterways, channels and ports, environmental dredging, design, and specialty services. Its commercial concrete segment provides turnkey concrete construction services including pour and finish, dirt work, layout, forming, rebar, and mesh across the light commercial, structural and other associated business areas. The Company is headquartered in Houston, Texas with offices throughout its operating areas. EBITDA and EBITDA Margin This press release includes the financial measures “EBITDA” and “EBITDA margin”. These measurements may be deemed “non- GAAP financial measures” under rules of the Securities and Exchange Commission, including Regulation G. The non-GAAP financial information may be determined or calculated differently by other companies. By reporting such non-GAAP financial information, the Company does not intend to give such information greater prominence than comparable and other GAAP financial information, which information is of equal or greater importance. Orion Marine Group defines EBITDA as net income before net interest expense, income taxes, depreciation and amortization. EBITDA margin is calculated by dividing EBITDA for the period by contract revenues for the period. The GAAP financial measure that is most directly comparable to EBITDA margin is operating margin, which represents operating income divided by contract revenues. EBITDA and EBITDA margin are used internally to evaluate current operating expense, operating efficiency, and operating profitability on a variable cost basis, by excluding the depreciation and amortization expenses, primarily related to capital expenditures and acquisitions, and net interest and tax expenses. Additionally, EBITDA and EBITDA margin provide useful information regarding the Company's ability to meet future debt repayment requirements and working capital requirements while providing an overall evaluation of the Company's financial condition. In addition, EBITDA is used internally for incentive compensation purposes. The Company includes EBITDA and EBITDA margin to provide transparency to investors as they are commonly used by investors and others in assessing performance. EBITDA and EBITDA margin have certain limitations as analytical tools and should not be used as a substitute for operating margin, net income, cash flows, or other data prepared in accordance with generally accepted accounting principles in the United States, or as a measure of the Company's profitability or liquidity. A reconciliation of the Company's future EBITDA margin to the corresponding GAAP measure is not available as these are estimated goals for the performance of the overall operations over the planning period. These estimated goals are based on assumptions that may be affected by actual outcomes, including but not limited to the factors noted in the “forward looking statements” herein, in other releases, and in filings with the Securities and Exchange Commission. Forward-Looking Statements The matters discussed in this press release may constitute or include projections or other forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, the provisions of which the Company is availing itself. Certain forward-looking statements can be identified by the use of forward-looking terminology, such as 'believes', 'expects', 'may', 'will', 'could', 'should', 'seeks', 'approximately', 'intends', 'plans', 'estimates', or 'anticipates', or the negative thereof or other comparable terminology, or by discussions of strategy, plans, objectives, intentions, estimates, forecasts, assumptions, or goals. In particular, statements regarding future operations or results, including those set forth in this press release (including those under “Outlook” above), and any other statement, express or implied, concerning future operating results or the future generation of or ability to generate revenues, income, net income, profit, EBITDA, EBITDA margin, or cash flow, including to service debt, and including any estimates, forecasts or assumptions regarding future revenues or revenue growth, are forward-looking statements. Forward looking

statements also include estimated project start date, anticipated revenues, and contract options which may or may not be awarded in the future. Forward looking statements involve risks, including those associated with the Company's fixed price contracts that impacts profits, unforeseen productivity delays that may alter the final profitability of the contract, cancellation of the contract by the customer for unforeseen reasons, delays or decreases in funding by the customer, levels and predictability of government funding or other governmental budgetary constraints and any potential contract options which may or may not be awarded in the future, and are the sole discretion of award by the customer. Past performance is not necessarily an indicator of future results. In light of these and other uncertainties, the inclusion of forward-looking statements in this press release should not be regarded as a representation by the Company that the Company's plans, estimates, forecasts, goals, intentions, or objectives will be achieved or realized. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company assumes no obligation to update information contained in this press release whether as a result of new developments or otherwise. Please refer to the Company's Annual Report on Form 10-K, filed on February 27, 2015, which is available on its website at www.orionmarinegroup.com or at the SEC's website at www.sec.gov, for additional and more detailed discussion of risk factors that could cause actual results to differ materially from our current expectations, estimates or forecasts. The remainder of the page intentionally left blank

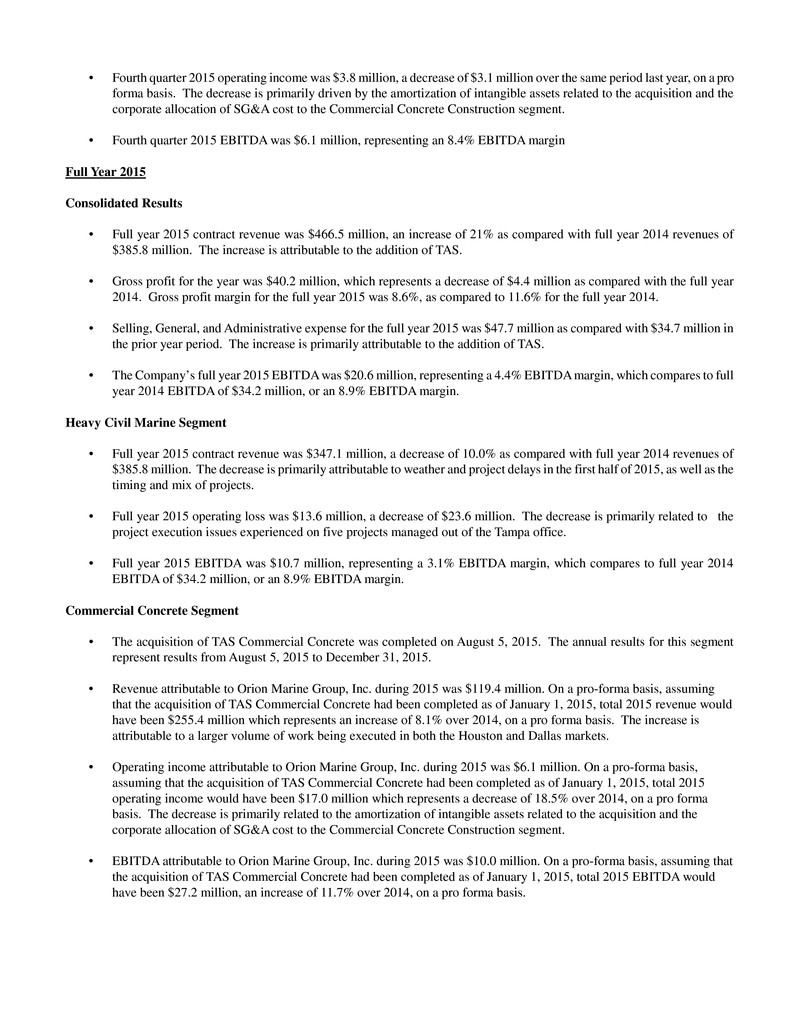

Orion Marine Group, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except share and per share information) Three months ended December 31, Twelve months ended December 31, 2015 2014 2015 2014 (Unaudited) (Unaudited) (Unaudited) (Audited) Contract revenues ........................................................... 161,891 107,333 466,498 385,818 Costs of contract revenues .............................................. 144,468 89,165 426,316 341,224 Gross profit .............................................................. 17,423 18,168 40,182 44,594 Selling, general and administrative expenses ................. 15,733 10,739 47,715 34,691 Income (loss) from operations ................................. 1,690 7,429 (7,533 ) 9,903 Other income (expense) Gain (loss) from sale of assets, net .......................... 1,541 195 (466 ) 359 Other income ........................................................... 346 4 536 467 Interest income ........................................................ 3 — 32 17 Interest expense ....................................................... (1,715 ) (171 ) (3,148 ) (694 ) Other income (expense), net .................................... 175 28 (3,046 ) 149 Income (loss) before income taxes ....................... 1,865 7,457 (10,579 ) 10,052 Income tax (benefit) expense .......................................... 426 2,169 (2,519 ) 3,175 Net income (loss) .................................................. $ 1,439 $ 5,288 $ (8,060 ) $ 6,877 Net income attributable to noncontrolling interest ......... — — — — Net income attributable to Orion common stockholders $ 1,439 $ 5,288 $ (8,060 ) $ 6,877 Basic income (loss) per share ......................................... $ 0.05 $ 0.19 $ (0.30 ) $ 0.25 Diluted income per share ................................................ $ 0.05 $ 0.19 $ (0.30 ) $ 0.25 Shares used to compute income per share ...................... Basic ........................................................................ 27,281,359 27,522,884 27,281,359 27,421,441 Diluted ..................................................................... 27,411,580 27,847,102 27,281,359 27,787,613 Orion Marine Group, Inc. and Subsidiaries Selected Income Statement Results (In thousands, except share and per share information) Three months ended December 31, 8/5 - 12/31 Twelve months ended December 31, (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) Heavy Civil Marine Construction 2015 2014 2015 2015 2014 Contract revenues ........................ $ 89,503 $ 107,333 $ 347,117 $ 385,818 Operating (loss) income .............. (1,967 ) 7,429 (13,556 ) 10,052 Commercial Concrete Construction (Unaudited, Pro forma) (Unaudited, Pro forma) Contract revenues ......................... $ 72,388 65,703 $ 119,381 $ 255,420 $ 236,245 Operating income ......................... 3,769 6,853 6,135 17,039 20,900

Orion Marine Group, Inc. and Subsidiaries EBITDA and EBITDA Margin Reconciliations (In thousands, except margin data) Three months ended December 31, Twelve months ended December 31, 2015 2014 2015 2014 (Unaudited) (Unaudited) (Unaudited) (Unaudited) Net income (loss) ........................................................ $ 1,439 $ 5,288 $ (8,060 ) $ 6,877 Income tax benefit (loss) ............................................. 426 2,169 (2,519 ) 3,175 Interest expense, net .................................................... 1,713 171 3,116 677 Depreciation and amortization .................................... 9,252 5,820 28,083 23,451 EBITDA1 .................................................................... $ 12,830 $ 13,448 $ 20,620 $ 34,180 Operating income (loss) margin2 2.3 % 7.1 % (1.6 )% 2.8 % Impact of depreciation and amortization ..................... 5.7 % 5.4 % 6.0 % 6.1 % EBITDA margin1......................................................... 8.0 % 12.5 % 4.4 % 8.9 % Orion Marine Group, Inc. and Subsidiaries EBITDA and EBITDA Margin Reconciliations by Segment (In Thousands, except margin data) Heavy Civil Marine Construction Commercial Concrete Construction Three months ended December 31, 8/5 - 12/31 Three months ended December 31, 2015 2014 2015 2015 20143 (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited, Pro forma) Operating (loss) income ........................... (1,967 ) $ 7,429 6,135 3,769 $ 6,853 Other income (expense), net .................... 4,015 199 (3,137 ) (2,129 ) 186 Depreciation and amortization ................. 4,836 5,820 7,008 4,416 573 EBITDA1 ................................................. $ 6,884 $ 13,448 $ 10,006 $ 6,056 $ 7,612 Operating income margin2 ....................... 2.3 % 7.1 % 2.5 % 2.3 % 10.4 % Impact of depreciation and amortization .. 5.4 % 5.4 % 5.9 % 6.1 % 1.2 % EBITDA margin ....................................... 7.7 % 12.5 % 8.4 % 8.4 % 11.6 % 1EBITDA is a non-GAAP measure that represents earnings before interest, taxes, depreciation and amortization. EBITDA margin is a non-GAAP measure calculated by dividing EBITDA by contract revenues. 2 Operating income margin is calculated by dividing operating income plus other income and loss from sale of assets (if any) by contract revenues. 3This information does not contain the standard proforma adjustments

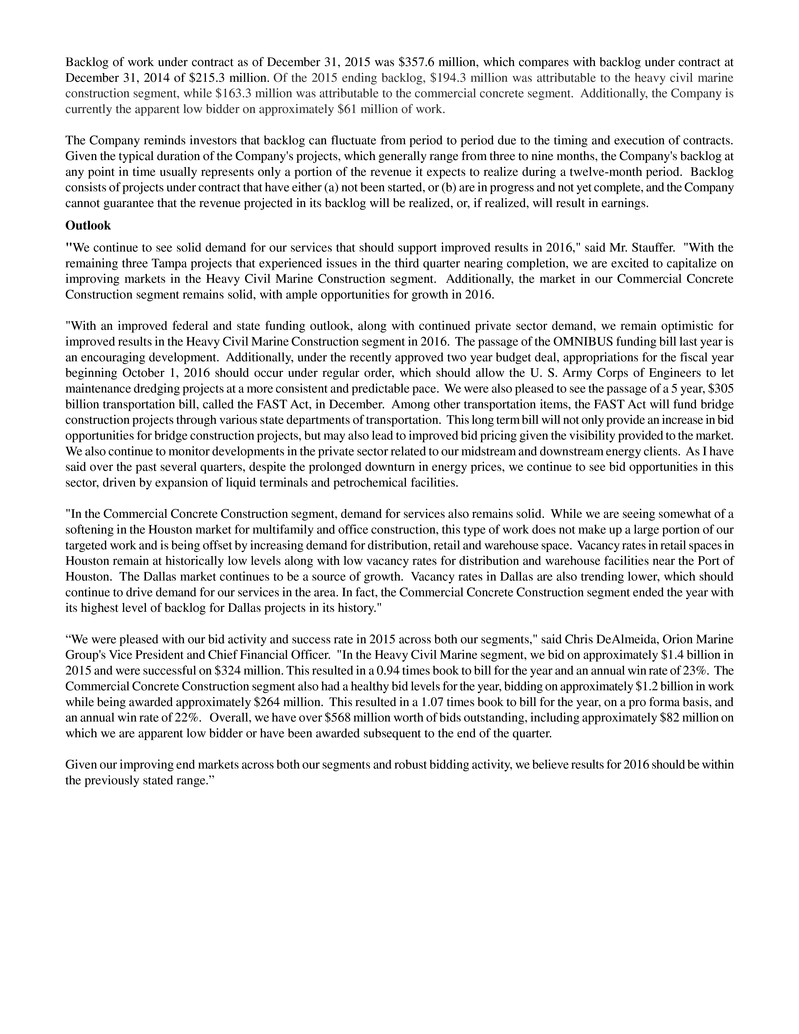

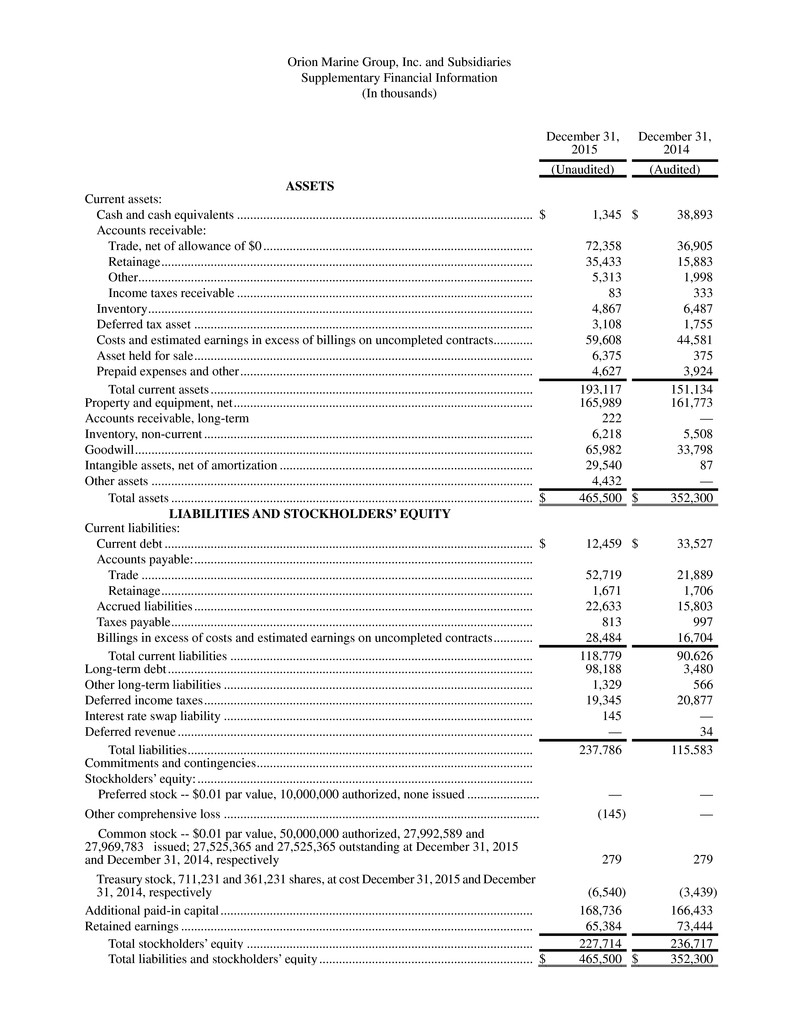

Orion Marine Group, Inc. and Subsidiaries Supplementary Financial Information (In thousands) December 31, 2015 December 31, 2014 (Unaudited) (Audited) ASSETS Current assets: Cash and cash equivalents .......................................................................................... $ 1,345 $ 38,893 Accounts receivable: Trade, net of allowance of $0 .................................................................................. 72,358 36,905 Retainage ................................................................................................................. 35,433 15,883 Other........................................................................................................................ 5,313 1,998 Income taxes receivable .......................................................................................... 83 333 Inventory ..................................................................................................................... 4,867 6,487 Deferred tax asset ....................................................................................................... 3,108 1,755 Costs and estimated earnings in excess of billings on uncompleted contracts ............ 59,608 44,581 Asset held for sale ....................................................................................................... 6,375 375 Prepaid expenses and other ......................................................................................... 4,627 3,924 Total current assets .................................................................................................. 193,117 151,134 Property and equipment, net ........................................................................................... 165,989 161,773 Accounts receivable, long-term 222 — Inventory, non-current .................................................................................................... 6,218 5,508 Goodwill ......................................................................................................................... 65,982 33,798 Intangible assets, net of amortization ............................................................................. 29,540 87 Other assets .................................................................................................................... 4,432 — Total assets .............................................................................................................. $ 465,500 $ 352,300 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Current debt ................................................................................................................ $ 12,459 $ 33,527 Accounts payable: ....................................................................................................... Trade ....................................................................................................................... 52,719 21,889 Retainage ................................................................................................................. 1,671 1,706 Accrued liabilities ....................................................................................................... 22,633 15,803 Taxes payable .............................................................................................................. 813 997 Billings in excess of costs and estimated earnings on uncompleted contracts ............ 28,484 16,704 Total current liabilities ............................................................................................ 118,779 90,626 Long-term debt ............................................................................................................... 98,188 3,480 Other long-term liabilities .............................................................................................. 1,329 566 Deferred income taxes .................................................................................................... 19,345 20,877 Interest rate swap liability .............................................................................................. 145 — Deferred revenue ............................................................................................................ — 34 Total liabilities ......................................................................................................... 237,786 115,583 Commitments and contingencies .................................................................................... Stockholders’ equity: ...................................................................................................... Preferred stock -- $0.01 par value, 10,000,000 authorized, none issued ...................... — — Other comprehensive loss ................................................................................................ (145 ) — Common stock -- $0.01 par value, 50,000,000 authorized, 27,992,589 and 27,969,783 issued; 27,525,365 and 27,525,365 outstanding at December 31, 2015 and December 31, 2014, respectively 279 279 Treasury stock, 711,231 and 361,231 shares, at cost December 31, 2015 and December 31, 2014, respectively (6,540 ) (3,439 ) Additional paid-in capital ............................................................................................... 168,736 166,433 Retained earnings ........................................................................................................... 65,384 73,444 Total stockholders’ equity ....................................................................................... 227,714 236,717 Total liabilities and stockholders’ equity ................................................................. $ 465,500 $ 352,300

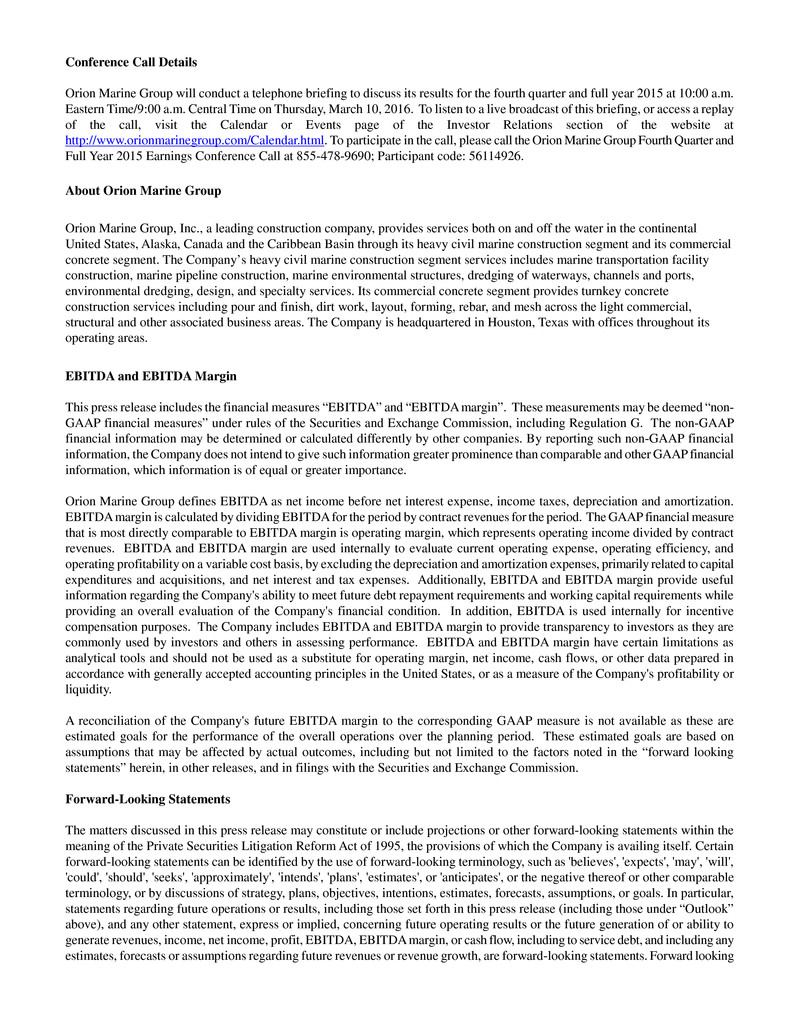

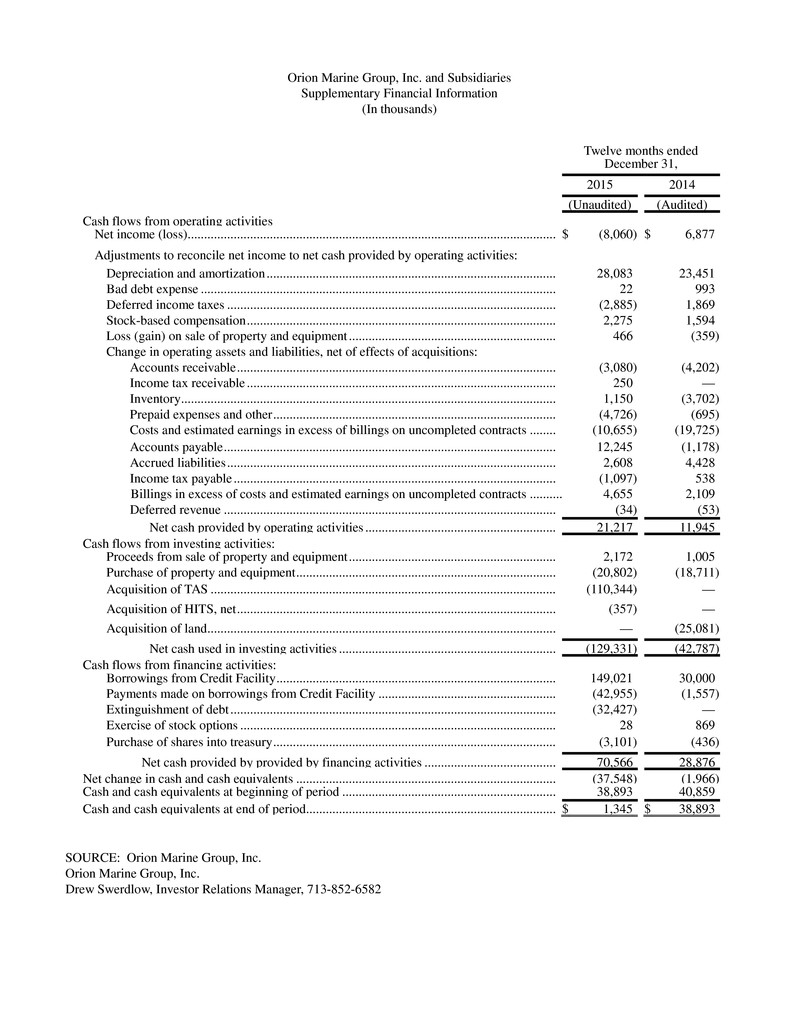

Orion Marine Group, Inc. and Subsidiaries Supplementary Financial Information (In thousands) Twelve months ended December 31, 2015 2014 (Unaudited) (Audited) Cash flows from operating activities Net income (loss) ................................................................................................................ $ (8,060 ) $ 6,877 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ........................................................................................ 28,083 23,451 Bad debt expense ............................................................................................................ 22 993 Deferred income taxes .................................................................................................... (2,885 ) 1,869 Stock-based compensation .............................................................................................. 2,275 1,594 Loss (gain) on sale of property and equipment ............................................................... 466 (359 ) Change in operating assets and liabilities, net of effects of acquisitions: Accounts receivable ................................................................................................. (3,080 ) (4,202 ) Income tax receivable .............................................................................................. 250 — Inventory .................................................................................................................. 1,150 (3,702 ) Prepaid expenses and other ...................................................................................... (4,726 ) (695 ) Costs and estimated earnings in excess of billings on uncompleted contracts ........ (10,655 ) (19,725 ) Accounts payable ..................................................................................................... 12,245 (1,178 ) Accrued liabilities .................................................................................................... 2,608 4,428 Income tax payable .................................................................................................. (1,097 ) 538 Billings in excess of costs and estimated earnings on uncompleted contracts .......... 4,655 2,109 Deferred revenue ..................................................................................................... (34 ) (53 ) Net cash provided by operating activities .......................................................... 21,217 11,945 Cash flows from investing activities: Proceeds from sale of property and equipment ............................................................... 2,172 1,005 Purchase of property and equipment ............................................................................... (20,802 ) (18,711 ) Acquisition of TAS ......................................................................................................... (110,344 ) — Acquisition of HITS, net ................................................................................................. (357 ) — Acquisition of land .......................................................................................................... — (25,081 ) Net cash used in investing activities .................................................................. (129,331 ) (42,787 ) Cash flows from financing activities: Borrowings from Credit Facility ..................................................................................... 149,021 30,000 Payments made on borrowings from Credit Facility ...................................................... (42,955 ) (1,557 ) Extinguishment of debt ................................................................................................... (32,427 ) — Exercise of stock options ................................................................................................ 28 869 Purchase of shares into treasury ...................................................................................... (3,101 ) (436 ) Net cash provided by provided by financing activities ........................................ 70,566 28,876 Net change in cash and cash equivalents ............................................................................... (37,548 ) (1,966 ) Cash and cash equivalents at beginning of period ................................................................. 38,893 40,859 Cash and cash equivalents at end of period ............................................................................ $ 1,345 $ 38,893 SOURCE: Orion Marine Group, Inc. Orion Marine Group, Inc. Drew Swerdlow, Investor Relations Manager, 713-852-6582