Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Vectrus, Inc. | vec-12312015x8xk991.htm |

| 8-K - 8-K - Vectrus, Inc. | vec-12312015x8xk.htm |

VECTRUS FOURTH QUARTER AND FULL YEAR 2015 RESULTS AND 2016 GUIDANCE KEN HUNZEKER CHIEF EXECUTIVE OFFICER AND PRESIDENT MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER MARCH 16, 2016

SAFE HARBOR STATEMENT Page 2 SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 (THE “ACT”): CERTAIN MATERIAL PRESENTED HEREIN INCLUDES FORWARD-LOOKING STATEMENTS INTENDED TO QUALIFY FOR THE SAFE HARBOR FROM LIABILITY ESTABLISHED BY THE ACT. THESE FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS ABOUT OUR SPIN-OFF FROM FORMER PARENT (THE “SEPARATION” OR THE “SPIN-OFF”), THE TERMS AND THE EFFECT OF THE SEPARATION AND RELATED MATTERS, FUTURE STRATEGIC PLANS AND OTHER STATEMENTS THAT DESCRIBE OUR BUSINESS STRATEGY, OUTLOOK, OBJECTIVES, PLANS, INTENTIONS OR GOALS, AND ANY DISCUSSION OF GUIDANCE OR FUTURE OPERATING OR FINANCIAL PERFORMANCE. WHENEVER USED, WORDS SUCH AS “MAY,” “WILL,” “LIKELY,” "ANTICIPATE,“ "ESTIMATE,“ "EXPECT,“ "PROJECT,“ "INTEND,“ "PLAN,“ "BELIEVE,“ "TARGET,“ “COULD,” “POTENTIAL,” “CONTINUE,” OR SIMILAR TERMINOLOGY ARE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT OF THE COMPANY BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE RESULTS CONTEMPLATED BY THE FORWARD-LOOKING STATEMENTS, OUR HISTORICAL EXPERIENCE AND OUR PRESENT EXPECTATIONS OR PROJECTIONS. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO: RISKS AND UNCERTAINTIES RELATING TO THE SPIN-OFF, INCLUDING WHETHER THE SPIN-OFF AND THE RELATED TRANSACTIONS WILL RESULT IN ANY TAX LIABILITY, THE OPERATIONAL AND FINANCIAL PROFILE OR ANY OF OUR BUSINESSES AFTER GIVING EFFECT TO THE SPIN-OFF, AND OUR ABILITY TO OPERATE AS AN INDEPENDENT ENTITY; ECONOMIC, POLITICAL AND SOCIAL CONDITIONS IN THE COUNTRIES IN WHICH WE CONDUCT OUR BUSINESSES; CHANGES IN U.S. OR INTERNATIONAL GOVERNMENT DEFENSE BUDGETS; GOVERNMENT REGULATIONS AND COMPLIANCE THEREWITH, INCLUDING CHANGES TO THE DEPARTMENT OF DEFENSE PROCUREMENT PROCESS; PROTESTS OF NEW AWARDS; OUR ABILITY TO SUBMIT PROPOSALS FOR AND/OR WIN ALL POTENTIAL OPPORTUNITIES IN OUR PIPELINE, CHANGES IN TECHNOLOGY; INTELLECTUAL PROPERTY MATTERS; GOVERNMENTAL INVESTIGATIONS, REVIEWS, AUDITS AND COST ADJUSTMENTS; CONTINGENCIES RELATED TO ACTUAL OR ALLEGED ENVIRONMENTAL CONTAMINATION, CLAIMS AND CONCERNS; DELAYS IN COMPLETION OF THE U.S. GOVERNMENT’S BUDGET; OUR SUCCESS IN EXPANDING OUR GEOGRAPHIC FOOTPRINT OR BROADENING OUR CUSTOMER BASE, MARKETS AND CAPABILITIES; OUR ABILITY TO REALIZE THE FULL AMOUNTS REFLECTED IN OUR BACKLOG AND TO RETAIN AND RENEW OUR EXISTING CONTRACTS; IMPAIRMENT OF GOODWILL; MISCONDUCT OF OUR EMPLOYEES, SUBCONTRACTORS, AGENTS AND BUSINESS PARTNERS; OUR ABILITY TO CONTROL COSTS; OUR LEVEL OF INDEBTEDNESS; SUBCONTRACTOR PERFORMANCE; ECONOMIC AND CAPITAL MARKETS CONDITIONS; ABILITY TO RETAIN AND RECRUIT QUALIFIED PERSONNEL; SECURITY BREACHES AND OTHER DISRUPTIONS TO OUR INFORMATION TECHNOLOGY AND OPERATIONS; CHANGES IN OUR TAX PROVISIONS OR EXPOSURE TO ADDITIONAL INCOME TAX LIABILITIES; CHANGES IN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES; AND OTHER FACTORS SET FORTH IN PART I, ITEM 1A, “RISK FACTORS,” AND ELSEWHERE IN OUR 2015 ANNUAL REPORT ON FORM 10-K AND DESCRIBED FROM TIME TO TIME IN OUR FUTURE REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW.

Q4 AND FULL YEAR 2015 HIGHLIGHTS Page 3 • Strong fourth quarter results o Revenue of $311.2 million o Core business revenue(1) increased 16% year-over-year o Operating margin of 3.6% and diluted earnings per share (EPS) of $0.55 • 2015 results consistent with or exceeding mid-point of guidance o Revenue of $1,180.7 million o Core business revenue(1) increased 12% year-over-year o Adjusted operating margin(1) of 3.7% and adjusted diluted earnings per share(1) (EPS) of $2.23 • Paid down $23 million of debt, $12 million of which was voluntary • Won positions on seven IDIQs(2) • Successfully phased-in contracts valued at approximately $1 billion • Enhanced our IT and network communication service line in order to capture future growth opportunities (1) See Appendix for definitions and reconciliation. (2) Indefinite Delivery Indefinite Quantity (IDIQ) contracts carry no value in the pipeline of potential proposals to be submitted until a specific task order is identified.

CEO OVERVIEW Page 4 • DoD budgetary environment o President’s GFY 2017 budget request supports readiness and increases funding for Operations and Maintenance (O&M) o The Army’s number one priority is readiness and in GFY 2017 the Army is requesting a 5% funding increase for total O&M • Global threats persist o Tensions remain elevated in the Middle East and Eastern Europe and we stand ready to support our government customers o Within Europe, the DoD is working to reassure allies of the U.S. commitment to their security and territorial integrity and has requested $3.4 billion in GFY 2017 to support the European Reassurance Initiative • Procurement environment o Award delays are a natural part of our business and still continue to weigh on our industry

VECTRUS UPDATE Page 5 • Re-competes remain a priority in 2016 • Robust new business pipeline for 2016 and beyond o Over $1 billion of proposals submitted and pending potential award; anticipate revenue contribution in Q3 and Q4 • Investment in IT and Network Communication service line is underway o Expanding the IT and Network Communication footprint supporting the Vectrus long- term strategy of enhancing the foundation, balancing the portfolio, and providing more value to customers and shareholders o Potential for strong returns driving investment in our IT & Network Communication service offering over the next two to three years • Thule Base Maintenance Contract appeal results pending • Operational Excellence contributing to improvements in operating income • 2016 mandatory debt payments of $14 million; plus anticipated voluntary payments of $5-$10 million

Q4 2015 FINANCIAL RESULTS Page 6 (1) See Appendix for definitions and reconciliation. (In millions, except Operating Margin and Diluted Earnings Per Share) Q4 2015 Q4 2014 vs. 2014 Funded Orders 131.6$ 177.7$ (46.1)$ Revenue 311.2$ 285.8$ 25.4$ Operating Income 11.3$ 8.1$ 3.2$ Operating Margin 3.6% 2.9% 0.7% Diluted Earnings Per Share 0.55$ 0.31$ 0.24$ Fourth Quarter 2015 (In millions, except Operating Margin and Diluted Earnings Per Share) Q4 20 5 Q4 2014 vs. 2014 Funded Orders 131.6$ 177.7$ (46.1)$ Rev nue 311.2 285.8 25. Operating Income 11.3$ 8.6$ 2.7$ Operating Margin 3.6% 3.0% 0.6% Diluted Earnings Per Share 0.55$ 0.33$ 0.22$ Adjusted Fourth Quarter 2015 (1)

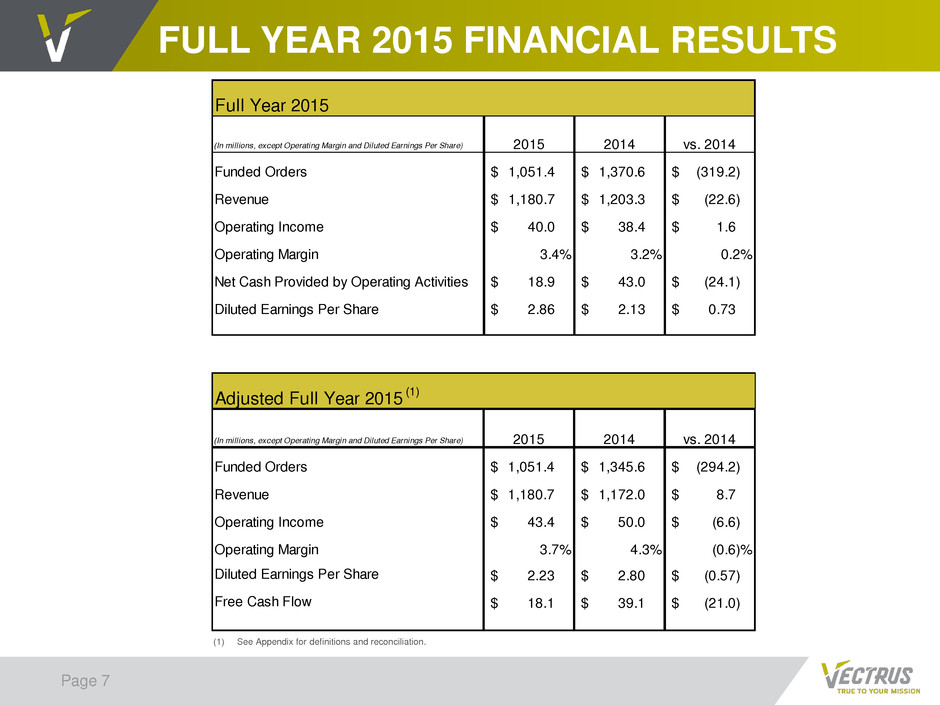

FULL YEAR 2015 FINANCIAL RESULTS Page 7 (1) See Appendix for definitions and reconciliation. (In millions, except Operating Margin and Diluted Earnings Per Share) 2015 2014 vs. 2014 Funded Orders 1,051.4$ 1,370.6$ (319.2)$ Revenue 1,180.7$ 1,203.3$ (22.6)$ Operating Income 40.0$ 38.4$ 1.6$ Operating Margin 3.4% 3.2% 0.2% Net Cash Provided by Operating Activities 18.9$ 43.0$ (24.1)$ Diluted Earnings Per Share 2.86$ 2.13$ 0.73$ Full Year 2015 (In millions, except Operating Margin and Diluted Earnings Per Share) 2015 2014 vs. 2014 Funded Orders 1,051.4$ 1,345.6$ (294.2)$ R venue 1,180.7 1,172. 8.7 Operating I come 43.4 50.0 (6.6) Operating Margin 3.7% 4.3% (0.6)% Diluted Earnings Per Share 2.23$ 2.80$ (0.57)$ Free Cash Flow 18.1$ 39.1$ (21.0)$ Adjusted Full Year 2015 (1)

BACKLOG (1) Page 8 (2) (1) Total backlog represents firm orders and potential options on multi-year contracts, excluding potential orders under IDIQ contracts. • Total backlog $2.4 billion as of December 31, 2015 o Funded backlog $0.7 billion o Unfunded backlog $1.7 billion $0.7 $0.7 $0.9 $0.7 $1.9 $1.8 $1.5 $1.7 $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Funded Unfunded $2.6 $2.5 $2.4 $2.4 ($B)

2016 ASSUMPTIONS Page 9 • 2016 anticipated revenue composition o 84% Existing Contracts o 7% Afghanistan Contracts o 6% Re-competes o 3% New Business • Depreciation / Amortization $4.1 million • Equity-based Founder’s Grants drive non-cash expense totaling $0.8 million • Operating Margin slightly improved; 3.75% at the mid-point • 2016 mandatory debt payments $14 million; plus voluntary $5-$10 million • Interest expense approximately $5.8 million • Estimated 36.4% tax rate and 11.2 million weighted average diluted shares outstanding at the end of 2016

$600 $800 $1,000 $1,200 $1,400 $1,600 2013 2014 2015 2016E Re ve nu e REVENUE MIX ($M) Page 10 ($M) Afghanistan Contracts Revenue Mix (1) See Appendix for definitions and reconciliation. Afghanistan Core Business1 +12% -38% -52% +6% -47% -6% $480 $625 $513 $270 $168 $80 10% 12% 18% 9% 6% 4% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% $0 $100 $200 $300 $400 $500 $600 $700 2011 2012 2013 2014 2015 2016E Op era ting Ma rgi n Re venu e

2016 GUIDANCE SUMMARY Page 11 (1) See Appendix for reconciliation. (2) 2016 diluted EPS is calculated using the estimated weighted average diluted common shares outstanding for the year ending December 31, 2016 of 11.2 million. (3) 2016 Free cash flow is calculated as GAAP net cash (used in) and provided by operating activities less estimated capital expenditures of $2.1 million. $ millions, except for operating margin and per share amounts Adjusted 20151 2016 Mid Var %Var Revenue 1,110$ to 1,190$ 1,181$ 1,150$ (31)$ (2.6)% Operating Margin 3.60 % to 3.90 % 3.68 % 3.75 % 7 BPS Diluted EPS2 1.94$ to 2.31$ 2.23$ 2.12$ (0.11)$ (4.9)% Free Cash Flow3 20$ to 30$ 18$ 25$ 7$ 38.9 % 2016 Guidance

KEN HUNZEKER CHIEF EXECUTIVE OFFICER AND PRESIDENT MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER VECTRUS FOURTH QUARTER AND FULL YEAR 2015 RESULTS AND 2016 GUIDANCE

APPENDIX

RECONCILIATION OF NON-GAAP MEASURES Page 14 The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. In addition, we consider adjusted revenue, adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, free cash flow, adjusted funded orders and core business revenue to be useful to management and investors in evaluating our operat ing performance for the periods presented, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. Adjusted revenue, adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, free cash flow, adjusted funded orders and core business revenue, however, are not measures of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for revenue, operating income, net income, diluted earnings per share or net cash provided by operating activities as determined in accordance with GAAP. Reconciliations of these items are provided below. “Adjusted revenue” is defined as revenue adjusted to exclude historical revenue from the Tethered Aerostat Radar System (TARS) program which was retained by our former parent in connection with the Spin-off. “Adjusted operating income” is defined as net income, adjusted to exclude income tax expense (benefit), interest income (expense), TARS program operating income (loss), pretax impact of separation costs incurred to become a public company, and tax indemnifications. “Adjusted operating margin” is defined as net income, adjusted to exclude income tax expense (benefit), interest income (expense), TARS program operating income (loss), pretax impact of separation costs incurred to become a public company, and tax indemnifications divided by adjusted revenue. “Adjusted net income” is defined as net income, adjusted to exclude TARS program operating income (loss), separation costs incurred to become a public company, and net settlement of uncertain tax positions, net of taxes. “Adjusted diluted earnings per share” is defined as net income, adjusted to exclude TARS program operating income (loss), separation costs incurred to become a public company, and net settlement of uncertain tax positions, net of taxes, divided by the weighted average diluted common shares outstanding. “Free cash flow” is defined as GAAP net cash provided by operating activities less capital expenditures. “Adjusted funded orders” is defined as funded orders adjusted to exclude the TARS program orders. “Core business revenue” is defined as adjusted revenue less revenue from Afghanistan programs. (In thousands) Adjusted Revenue (Non-GAAP Measure) 2015 2014 2015 2014 R v nue 311,194$ 285,765$ 1,180,684$ 1,203,269$ TARS revenue ¹ — — — (31,315) Adjusted revenue 311,194$ 285,765$ 1,180,684$ 1,171,954$ Three Months Ended December 31, Year Ended December 31, ¹ TARS program historical revenue, which has been retained by Exelis

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Page 15 (In thousands) Adjusted Operating Income (Non-GAAP Measure) 2015 2014 2015 2014 Net income 5,960$ 3,331$ 30,973$ 22,812$ Income tax expense 3,416 3,264 2,458 14,079 Interest (expense) income (1,915) (1,554) (6,531) (1,526) Operating income 11,291$ 8,149$ 39,962$ 38,417$ Operating margin 3.6 % 2.9 % 3.4 % 3.2 % TARS operating income (loss) ¹ (pretax) — (116) — (1,623) Separation costs ² (pretax) — 566 177 13,237 Tax indemnifications 3 — — 3,300 — Adjusted operating income 11,291$ 8,599$ 43,439$ 50,031$ Adjusted operating margin 3.6 % 3.0 % 3.7 % 4.3 % (In thousands, except for share and per share data) Adjusted Net Income and Adjusted Diluted Earnings Per Share (Non-GAAP Measure) 2015 2014 2015 2014 Net income 5,960$ 3,331$ 30,973$ 22,812$ TARS operating income ¹ (pretax) — (116) — (1,623) Separation costs ² (pretax) — 566 177 13,237 Tax impact of adjustments (20) (223) (13) (4,437) Net settlement of uncertain tax positions 3 — — (6,949) — Adjusted net income 5,940$ 3,558$ 24,188$ 29,989$ GAAP EPS - diluted $0.55 $0.31 $2.86 $2.13 Adjusted EPS - diluted $0.55 $0.33 $2.23 $2.80 Weighted average common shares outstanding - diluted 10,869 10,696 10,825 10,692 Three Months Ended December 31, Year Ended December 31, ¹ TARS program historical operating income (loss), which has been retained by our former parent. ² Costs incurred to become a stand-alone public company. 3 Net settlement of uncertain tax positions due to resolution of examinations of tax returns of our former parent ("Uncertain Tax Positions" in Note 3 to the financial statements in our 2015 Annual Report on Form 10-K). ¹ TARS program historical operating income (loss), which has been retained by our former parent. ² Costs incurred to become a stand-alone public company. 3 Tax indemnifications in connection with the spin-off (see "Tax Indemnifications" in Note 3 to the financial statements in our 2015 Annual Report on Form 10-K). Three Months Ended December 31, Year Ended December 31,

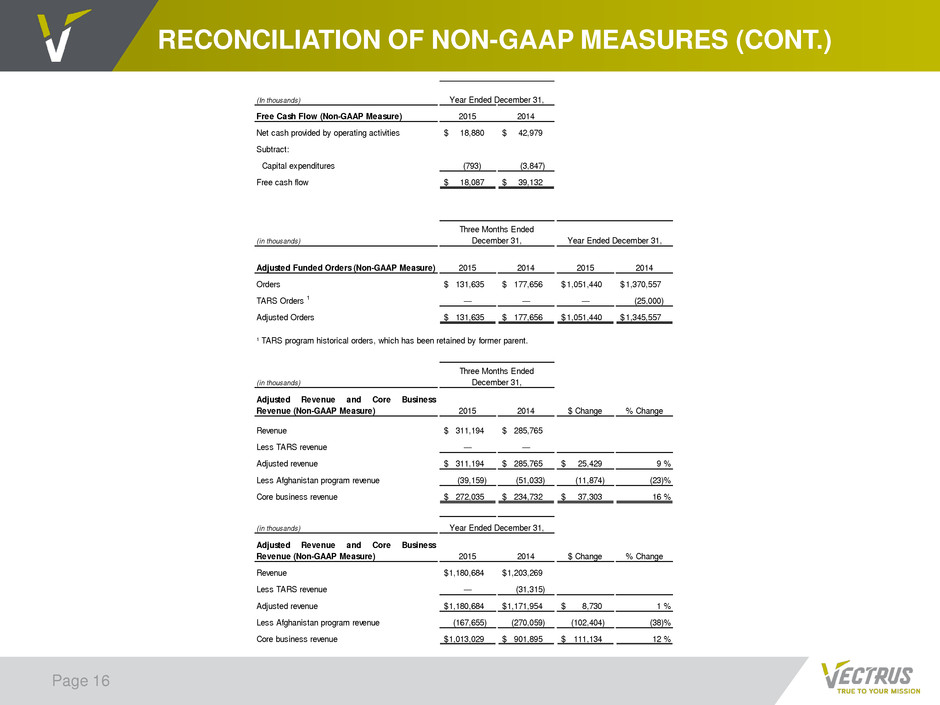

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Page 16 (In thousands) Free Cash Flow (Non-GAAP Measure) 2015 2014 Net cash provided by operating activities 18,880$ 42,979$ Subtract: Capital expenditures (793) (3,847) Free cash flow 18,087$ 39,132$ (in thousands) Adjusted Funded Orders (Non-GAAP Measure) 2015 2014 2015 2014 Orders 131,635$ 177,656$ 1,051,440$ 1,370,557$ TARS Orders 1 — — — (25,000) Adjusted Orders 131,635$ 177,656$ 1,051,440$ 1,345,557$ (in thousands) Adjusted Revenue and Core Business Revenue (Non-GAAP Measure) 2015 2014 $ Change % Change Revenue 311,194$ 285,765$ Less TARS revenue — — Adjusted revenue 311,194$ 285,765$ 25,429$ 9 % Less Afghanistan program revenue (39,159) (51,033) (11,874) (23)% Core business revenue 272,035$ 234,732$ 37,303$ 16 % (in thousands) Adjusted Revenue and Core Business Revenue (Non-GAAP Measure) 2015 2014 $ Change % Change Revenue 1,180,684$ 1,203,269$ Less TARS revenue — (31,315) Adjusted revenue 1,180,684$ 1,171,954$ 8,730$ 1 % Less Afghanistan program revenue (167,655) (270,059) (102,404) (38)% Core business revenue 1,013,029$ 901,895$ 111,134$ 12 % Three Months Ended December 31, Year Ended December 31, Year Ended December 31, Three Months Ended December 31, Year Ended December 31, ¹ TARS program historical orders, which has been retained by former parent.