Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Trinseo S.A. | a16-6413_1ex31d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2015

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36473

Trinseo S.A.

(Exact name of registrant as specified in its charter)

|

Luxembourg |

|

N/A |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

1000 Chesterbrook Boulevard, Suite 300

Berwyn, PA 19312

(Address of Principal Executive Offices)

(610) 240-3200

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Ordinary Shares, par value $0.01 per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

o |

|

Accelerated filer |

|

x |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

o (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

o |

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of March 9, 2016, there were 48,777,934 shares of the registrant’s ordinary shares outstanding.

The aggregate market value of the voting and non-voting shares of the registrant held by non-affiliates of Trinseo S.A. computed by reference to the closing price of the registrant’s common stock on the New York Stock Exchange as of June 30, 2015 was approximately $307,559,560.

Documents Incorporated by Reference

None.

EXPLANATORY NOTE

On March 11, 2016, Trinseo S.A. (the “Company”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2015. This Amendment No. 1 amends Part III, Items 10 through 14 of our original Annual Report on Form 10-K to include information previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K.

Part III

Item 10. Directors, Executive Officers and Corporate Governance

Directors

Jeffrey J. Cote, 49 - Director since May 2014. Mr. Cote has served as Chief Operating Officer of Sensata Technologies Holding N.V. (NYSE: ST) since July 2012 and as Executive Vice President of its Global Sensing Solutions business since November 2015. He joined Sensata as Senior Vice President and Chief Financial Officer in January 2007, and was appointed Executive Vice President in July 2007. From March 2005 to December 2006, Mr. Cote was Chief Operating Officer of the law firm Ropes & Gray. From January 2000 to March 2005, Mr. Cote was Chief Operating, Financial and Administrative Officer of Digitas. Previously he worked for Ernst & Young LLP from 1989 until 1997. Mr. Cote is a certified public accountant and received a B.A. degree in Business Administration and a Master of Accounting from Florida Atlantic University. Mr. Cote brings significant management, capital markets and accounting experience to the board of directors.

Felix Hauser, 39 — Director since February 2016. Mr. Hauser is a Managing Director in Bain Capital’s Munich Office and joined Bain Capital in 2005. Prior to joining Bain Capital, Mr. Hauser was a consultant at McKinsey & Company, where he worked in corporate finance and the consumer products and financial services industries. He currently serves on the board of directors of FTE Automotive. Mr. Hauser received an MBA with distinction from INSEAD and an MSc from the University of Passau. Mr. Hauser brings significant capital markets experience and knowledge of European markets.

Pierre-Marie De Leener, 58 - Director since May 2014. Mr. De Leener has served as CEO of Braas Monier Building Group SA since January 2016, Chairman of the Board of Directors of the Monier Holdings GP S.A. since November 2013 and as Chairman of the Advisory Board of the Flint Group since October 2014. Prior to that, he served as Executive Vice President for PPG Industries, Inc. from July 2010 until December 2012. From June 2008 until August 2011, Mr. De Leener also served as President of PPG Europe S.A. Mr. De Leener previously served as Chief Executive Officer of SigmaKalon Group from 1998 until January 2008. In addition, Mr. De Leener served as a member of the Total Fina operating committee from 1998 until 2001. Mr. De Leener also served as the Chief Executive Officer of Fina Italiana SpA and of Fina Research from 1989 until 1995 and from 1995 until 1998, respectively. Mr. De Leener received a B.A. degree in Economics and Philosophy and a Master of Chemical Engineering degree from Catholic University of Louvain, Belgium. Mr. De Leener brings valuable management and chemical industry experience to our Board.

Donald T. Misheff, 59 - Director since February 2015. Mr. Misheff served as managing partner from 2003 until his retirement in 2011 of the Northeast Ohio offices of Ernst & Young LLP, a public accounting firm. As the managing partner of the Northeast Ohio offices of Ernst & Young LLP, Mr. Misheff advised many of the region’s largest companies on financial and corporate governance issues. He began his career with Ernst & Young LLP in 1978 as part of the audit staff and later joined the tax practice, specializing in accounting/financial reporting for income taxes, purchase accounting, and mergers and acquisitions. He has more than 30 years of experience performing, reviewing, and overseeing the audits of financial statements of a wide range of public companies. He currently serves as a director of three other public companies of Aleris Corporation (NYSE: ALRS), TimkenSteel Corporation (NYSE: TMST) and First Energy Corp. (NYSE: FE) Mr. Misheff graduated from the University of Akron with a B.S. degree in Accounting and is a certified public accountant. Mr. Misheff brings extensive financial and corporate governance experience to our Board.

Christopher D. Pappas, 60 - Director since October 2010. Mr. Pappas joined the Company as President and Chief Executive Officer in June 2010. Mr. Pappas has also been serving as our interim chief financial officer since November 2015. Prior to joining the Company, Mr. Pappas held a number of executive positions at NOVA Chemicals of increasing responsibility from July 2000 to November 2009, most recently as President and Chief Executive Officer from May 2009 to November 2009, President & Chief Operations Officer from October 2006 to April 2009 and Vice President and President of Styrenics from July 2000 to September 2006. Before joining NOVA Chemicals, Mr. Pappas was Commercial Vice President of DuPont Dow Elastomers where he joined as Vice President of ethylene elastomers in 1995. He currently serves on the board of directors of FTE Automotive. Mr. Pappas began his chemicals career in 1978 with Dow where he held various sales

and managerial positions until 1995. Mr. Pappas is currently a member of the Board of Directors of FirstEnergy Corp. (NYSE: FE) and Univar, Inc. (NYSE: UNVR), and he is a former member of the board of directors of Allegheny Energy, NOVA Chemicals, and Methanex Corporation. Mr. Pappas holds a B.S. degree in Civil Engineering from the Georgia Institute of Technology and an MBA from the Wharton School of Business at The University of Pennsylvania. Mr. Pappas is highly qualified to serve on the board of directors by his more than 30 years of management experience with major companies in the chemical industry, by his previous service as a director of the corporations noted above, and by his leadership of the Company since its formation. In these roles he has also acquired and demonstrated substantial financial expertise which is valuable to the Company’s Board.

Michel G. Plantevin, 59 - Director since June 2010. Mr. Plantevin is a Managing Director of Bain Capital Europe, LLP. Prior to joining Bain Capital in 2003, Mr. Plantevin was a Managing Director of Goldman Sachs International in London, initially in the Investment Banking division, then in the Merchant Banking division (PIA). Prior to Goldman Sachs International, he was a consultant with Bain & Company in London and later headed the Bain & Company Paris Office as a Managing Director. He also serves as a director of IMCD N.V., Ibstock PLC, and Maisons du Monde. Mr. Plantevin also formerly served as a director of Bravida AB, FCI SA and NXP Semiconductors N.V. Mr. Plantevin received an MBA from Harvard Business School and an undergraduate and master’s degree in Engineering from the Ecole Supérieure d’ Electricité (Supélec) in France. Mr. Plantevin brings to the board of directors an expertise in business strategy and operational improvement gained from his extensive experience as a strategy consultant in the Paris and London offices of Bain & Company and then as a private equity professional. Mr. Plantevin has also had significant involvement with our Company since the Acquisition, and has served as a director of numerous public and private companies during his career in private equity, investment banking and consulting. Mr. Plantevin’s background in consulting and his significant involvement with the Company position him to provide valuable contributions to our Board.

Stephen F. Thomas, 41 - Director since September 2015. Mr. Thomas is a Managing Director at Bain Capital, where he has worked since 2007. Prior to joining Bain Capital, he was a Manager at Bain & Company, where he consulted for the media, telecom, consumer, financial services, and private equity industries. Mr. Thomas received an MBA from Harvard Business School and graduated cum laude with an A.B. degree in Economics from Princeton University. He also currently serves as a director of TI Automotive and Big Tex Trailers, Inc. Mr. Thomas was previously on our board of directors from May 2014 through February 2015. Mr. Thomas brings to the board of directors significant knowledge and expertise in strategy and operations gained from his experiences as a strategy consultant and as a Managing Director of Bain Capital.

Aurélien Vasseur, 39 - Director since May 2014. Mr. Vasseur joined Bain Capital Luxembourg S.à r.l. in 2011 and is a corporate manager of the firm. Before joining Bain Capital, Mr. Vasseur was a finance auditor at Ernst and Young, Luxembourg. Mr. Vasseur currently serves as a member of the board of directors for Atento Floatco S.A., Magnolia (BC) S.A., and Atento Luxco 1 S.A. Mr. Vasseur received a master’s degree in management from the Ecole des Hautes Etudes Commerciales (Edhec Business School). Mr. Vasseur brings to the board of directors an expertise in finance and governance experience serving as a director of other Luxembourg-based companies.

Stephen M. Zide, 55 - Director and Chairman since June 2010. Mr. Zide is a senior advisor to Bain Capital in the private equity business, having joined the firm in 1997. From 2001 through 2015, Mr. Zide was a Managing Director of Bain Capital. Prior to joining Bain Capital, Mr. Zide was a partner of the law firm of Kirkland & Ellis LLP, where he was a founding member of the New York office and specialized in representing private equity and venture capital firms. Mr. Zide received an MBA from Harvard Business School, a Juris Doctorate from Boston University School of Law, and a B.A. degree from the University of Rochester. He also serves as a director of Sensata Technologies B.V., Consolidated Container Corporation, and TI Automotive. Mr. Zide was a director of HD Supply Holdings, Inc. (NASDAQ: HDS) from 2007 through 2014 and Innophos Holdings, Inc. (NASDAQ: IPHS) from 2004 through 2013. Mr. Zide’s significant experience serving on public and private company boards puts him in a position to provide important contributions to our board of directors and leadership as Chairman of the Board of Directors.

Executive Officers

Martin Pugh, Executive Vice President and Chief Operating Officer. Mr. Pugh, 62, became the Company’s Chief Operating Officer in November 2015. Mr. Pugh joined the Company as Senior Vice President and Business President, Plastics, in March 2013 and was named Senior Vice President and Business President, Performance Materials in October 2014, where was responsible for the global leadership of the Company’s Performance Materials business with overall accountability for the Rubber, Latex and Performance Plastics businesses. Prior to joining the Company, Mr. Pugh held the position of President for Europe, Middle East and Africa (EMEA) and board member for Styrolution Group Gmbh, the global styrenics joint venture between BASF Group and INEOS from October 2011 until February 2013. Mr. Pugh began his career in 1975 with Mobil Oil Company as a technical representative. He

joined The Dow Chemical Company in 1978 and served in a variety of sales and marketing roles from 1978 until 1998, working in the UK, Dubai, Sweden and Switzerland. His final role at Dow was global business director for Specialty Polyethylenes. In 1998, Pugh

joined Elementis plc as Managing Director for the specialty rubber division called Linatex. In 2002, he returned to Switzerland and joined Nova Chemicals as Managing Director for Europe. Following the formation of Nova Innovene in 2005, he was appointed Managing Director of the company and continued in the role of Managing Director—Europe as the company was broadened to include the Americas region and renamed INEOS Nova. He remained in this position within INEOS Nova and INEOS Styrenics until the formation of Styrolution Group GmbH in October 2011. Mr. Pugh has a Bachelor of Science degree in Industrial Chemistry and Management Studies from Loughborough University in the United Kingdom.

Angelo N. Chaclas, Senior Vice President, Chief Legal Officer, and Corporate Secretary. Mr. Chaclas, 52, has been the Company’s Chief Legal Officer, Senior Vice President, and Corporate Secretary since January 2015. In his role, he provides legal support for all capital markets, transactional, compliance, commercial, regulatory, governance, intellectual property and other operational activities of the Company worldwide. Mr. Chaclas joined the Company in 2010 as Associate General Counsel and Chief Intellectual Property Counsel, where he managed the Company’s global intellectual property portfolio and supported the legal activities of several of the Company’s commercial businesses. Prior to joining the Company in 2010, Mr. Chaclas was Deputy General Counsel and Chief Counsel for the software division of Pitney Bowes where he led its Intellectual Property, Technology Law and Procurement legal functions. Mr. Chaclas holds a bachelor’s degree in Mechanical Engineering from Tufts University and a Juris Doctorate from Pace University.

E. Jeffery Denton, Senior Vice President—Corporate Development and Business Services. Mr. Denton, 50, joined the Company as Vice President—Shared Services and Feedstocks in June 2010 and was named Vice President—Corporate Development and Business Services in October 2014, and subsequently Senior Vice President in October 2015. Mr. Denton is responsible for the Company’s Feedstocks, Procurement, Supply Chain, Customer Service, Information Technology and Corporate Development activities. He previously served in a similar role at the Company (when it was a division of Dow) from September 2009 until June 2010 and as the Director of Joint Venture Implementation at Dow, implementing Americas Styrenics & K-Dow from February 2006 until September 2009. Prior to that, he served as Product Director of Dow Polystyrene and Commercial Manager of Dow Polystyrene and Engineering Plastics from 1998 to January 2007. Mr. Denton received a bachelor’s degree in Business Administration from Alma College.

Marilyn N. Horner, Senior Vice President—Human Resources. Ms. Horner, 58, joined the Company as Senior Vice President of Human Resources in January 2011. Prior to joining the Company, Ms. Horner held a number of executive positions at NOVA Chemicals where she started her career in 1988. She served as the Senior Vice President and Chief Human Resources Officer for NOVA Chemicals from 2008 to December 2010. Ms. Horner also held the positions of Vice President Finance and Controller, Olefins / Polyolefins Division; Vice President Human Resources and Organizational Effectiveness; and Vice President to the Chief Executive Officer. Ms. Horner served on the board of trustees for Point Park University and the University of Alberta. Ms. Horner holds a Bachelor of Commerce degree and an MBA from the University of Windsor in Ontario, Canada.

Tim Stedman, Senior Vice President and Business President, Basic Plastics & Feedstocks. Mr. Stedman, age 46, joined the Company as Senior Vice President and Business President, Basic Plastics & Feedstocks, in November 2015. In this role, he is responsible for business leadership for polystyrene, co-polymers, polycarbonate, and styrene monomer. As part of his role, he serves as a member of the operating committee of the Plastics Division of the American Chemistry Council. Prior to joining the Company, Mr. Stedman spent more than 20 years with ExxonMobil Chemical working in the U.K., the U.S., and Belgium. Most recently, Mr. Stedman was the Europe Business Director for ExxonMobil Chemical’s Basic Chemicals business, and prior to that was the Site Manager for the Fife Ethylene Plant (steam cracker) in Scotland. Stedman also led Global Sales and Marketing organizations for several ExxonMobil Chemical’s Polymers and Intermediates businesses, including the Santoprene business that was formally part of the Advanced Elastomers Systems joint venture with Monsanto. Mr. Stedman served on the boards of Petrochemicals Europe and the European Petrochemical Association until September 2015 and was also a member of the Energy and Climate Change Leadership Group of the International Council of Chemical Associations (ICCA). Mr. Stedman holds a degree in Chemical Engineering from the University of Manchester Institute of Science and Technology, U.K., and the Ecole Nationale Supérieure des Industries Chimiques, Nancy, France. He is also a Chartered Engineer and a Fellow of the Institute of Chemical Engineers (U.K.).

Hayati Yarkadas, Senior Vice President and Business President, Performance Materials. Mr. Yarkadas, age 47, joined the Company in November 2015 to lead the Rubber, Latex, and Performance Plastics businesses. Mr. Yarkadas has more than 20 years of experience in materials businesses and an established track record of business management and leadership skills. Prior to joining Trinseo, Mr. Yarkadas led the food ingredient business of Tate & Lyle in Europe as Senior Vice President and General Manager, based in London. Prior to that, Mr. Yarkadas spent over 17 years with DuPont in many of its worldwide locations. Most recently Mr. Yarkadas served as General Manager of the DuPont Teijin Films joint venture, where he was responsible for the financial results and transformation of the business. Previously, he was Global Business Director for DuPont Advanced Glass Interlayers and held a series of roles in sales, sales management, Six Sigma, marketing, product management and business management in plastics and chemicals. Throughout his career, Mr. Yarkadas gained significant operating and global leadership skills with various roles in Turkey, the U.K.,

Switzerland, the U.S., and Luxembourg. He started his career in manufacturing and R&D at Borusan Mannessmann, where he gained operation experience early in his career. Mr. Yarkadas has a master’s degree in Mechanical Engineering from Istanbul Technical University and an MBA from Imperial College London.

Catherine C. Maxey, Vice President—Public Affairs, Sustainability and Environment, Health and Safety. Ms. Maxey, 50, joined the Company as Vice President—Public Affairs and Business Intelligence in June 2010. Previously she held positions of increasing responsibility at The Dow Chemical Company, which she joined in 1988, most recently as Public Affairs director for Mergers & Acquisitions, Joint Ventures, Dow Portfolio Optimization/Divestitures and Manufacturing and Engineering from March 2009 until June 2010. Prior to that, she served as vice president of Public Affairs and Communications for K-Dow Petrochemicals, a planned JV that was later cancelled from June 2008 until March 2009 and Business Public Affairs Director for Performance Chemicals from 2003 to June 2008. Ms. Maxey received a bachelor’s degree in Journalism/Science Writing from Lehigh University.

David Stasse, Vice President—Treasury and Corporate Finance. Mr. Stasse, 45, joined the Company in July 2013 as Vice President and Treasurer with responsibility for all treasury and investor relations matters, including cash management, risk management, relationships with rating agencies and commercial banks, and financing matters. Mr. Stasse joined the Company from Freescale Semiconductor, Inc., a global semiconductor manufacturer that serves the automotive, networking, consumer and industrial markets, where he served as Vice President and Treasurer since July 2008, and Assistant Treasurer from August 2006 to July 2008. Prior to that, Mr. Stasse served as First Vice President, Debt Capital Markets of MBNA Corporation and as Treasury Manager of SPX Corporation. Mr. Stasse also held numerous financial positions from 1998 to 2004 at Honeywell International, last serving as Director, Corporate Finance. Mr. Stasse holds a MBA in Finance from the University of Maryland and a Bachelor of Science degree in Business Logistics from Penn State University.

Corporate Governance

Audit Committee

The purpose of the audit committee is set forth in the audit committee charter. The audit committee’s primary duties and responsibilities are to:

· Appoint or replace, compensate and oversee the outside auditors for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us and will report directly to the audit committee.

· Pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our outside auditors, which are approved by the audit committee prior to the completion of the audit.

· Review and discuss with management and the outside auditors the annual audited and quarterly unaudited financial statements, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and the selection, application and disclosure of critical accounting policies and practices used in such financial statements.

· Review and approve all related party transactions as defined under Item 404(a) of Regulation S-K.

· Discuss with management and the outside auditors significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles, any major issues as to the adequacy of our internal controls and any special steps adopted in light of material control deficiencies.

A copy of the charter, which satisfies the applicable standards of the Securities and Exchange Commission (the “SEC”) and the NYSE is available on our website. The audit committee consists of Donald T. Misheff, Jeffrey J. Cote and Pierre-Marie De Leener. Our Board of Directors has determined that Messrs. Misheff, Cote and De Leener are independent directors pursuant Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 303A.02 of the New York Stock Exchange Listed Company Manual. Each of Messrs. Misheff and Cote is also an “audit committee financial expert” within the meaning of Item 407(d)(5) of Regulation S-K. Mr. Cote serves as chair of the audit committee.

Code of Ethics

We have adopted a written Code of Business Conduct applicable to all directors, officers and employees and a written Code of Ethics for Senior Financial Employees, applicable to our Chief Executive Officer, Chief Financial Officer, Treasurer, Principal Accounting Officer, Controller, and all employees performing similar functions. These policies are designed to maintain the integrity

of our business and financial reporting. These codes cover, among other things, professional conduct, conflicts of interest, accurate recordkeeping and reporting, public communications and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. Copies of these codes can be found by under the “Corporate Governance” link on the “Ethics and Compliance” tab of the Investor Relations section of our website, www.investor.trinseo.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, among others, to file with the SEC an initial report of ownership of our stock on a Form 3 and reports of changes in ownership on a Form 4 or a Form 5. Persons subject to Section 16 are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file. Under SEC rules, certain forms of indirect ownership and ownership of company stock by certain family members are covered by these reporting requirements. When requested, we assist our executive officers and directors in preparing initial ownership reports and reporting ownership changes and will file these reports on their behalf. Based solely on a review of the copies of such forms in our possession, and on written representations from our current directors and executive officers, we believe all of our executive officers and directors filed the required reports on a timely basis under Section 16(a) during 2015.

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis (CD&A) section is intended to provide information about our 2015 compensation objectives and programs for our named executive officers. For 2015, our named executive officers, or NEOs, were:

|

Name |

|

Position |

|

|

|

|

|

Christopher D. Pappas |

|

President and Chief Executive Officer |

|

|

|

|

|

John A. Feenan* |

|

Executive Vice President and Chief Financial Officer |

|

|

|

|

|

Martin Pugh** |

|

Executive Vice President and Chief Operating Officer |

|

|

|

|

|

Marilyn N. Horner |

|

Senior Vice President, Human Resources |

|

|

|

|

|

Angelo N. Chaclas |

|

Senior Vice President, Chief Legal Officer & Corporate Secretary |

* Mr. Feenan resigned from his officer position on November 18, 2015 and was employed in an advisory capacity with the Company through the end of 2015. Mr. Pappas is acting as the Interim Chief Financial Officer until Mr. Feenan’s replacement has been identified.

** Effective November 1, 2015, Martin Pugh was promoted from Senior Vice President and Business President for Performance Materials to Executive Vice President and Chief Operating Officer.

This CD&A is divided into the following sections:

· Executive Summary

· Compensation Philosophy and Design

· How We Make Compensation Decisions

· 2015 Compensation Structure & Performance

· Other Compensation and Tax Matters

Executive Summary

Business Achievements

We had an exceptional year with respect to the Company’s business achievements, which include:

· Delivering record net income of $133.6 million and Adjusted EBITDA of $410.0 million, excluding inventory revaluation and joint venture earnings, including continued strong results from our Performance Materials division as well as record results from our Basic Plastics & Feedstocks division;

· Successfully rebranding our operating name and legal entities from “Styron” to “Trinseo”;

· Adding greater depth to our business leadership team with the hiring of Tim Stedman as Senior Vice President and Business President, Basic Plastics & Feedstocks and Hayati Yarkadas, Senior Vice President and Business President, Performance Materials; and

· Refinancing our debt under a new capital structure that is expected to reduce our annual interest expense by approximately $37.0 million.

Consideration of 2015 Advisory Vote on Executive Compensation

The compensation committee regularly reviews the philosophy, objectives and elements of our executive compensation programs in relation to our short- and long-term business objectives. As part of this review, the compensation committee considers the views of shareholders as reflected in their annual advisory vote on our executive compensation proposal. At our 2015 annual general meeting of shareholders, our executive compensation proposal received overwhelming approval (approximately 96%). Based on the compensation committee’s review and the support our executive compensation programs received from shareholders, the compensation committee did not make significant changes to its compensation programs.

Compensation Philosophy and Design

Overview

Our executive compensation policies and programs are designed to attract, retain and motivate key executives through competitive and cost effective programs that reinforce executive accountability and reward the achievement of business and individual results. Executive compensation consists of four main elements: (1) base salary, (2) annual cash incentive awards, (3) long-term incentive compensation, and (4) retirement savings and benefit programs. The relative weighting of each element is aligned with our philosophy of linking pay to performance. A substantial percentage of our executives’ compensation is provided in the form of performance-based variable compensation with a greater emphasis on variable components for our senior executives. Annual cash awards are directly linked to corporate results and short-term performance measures, including financial and non-financial goals. Our equity incentive awards align our executives’ interest with those of our shareholders and our long-term business objectives. Executive retirement and benefits programs are generally consistent with broader employee programs offered in the country where an executive primarily provides services to the Company. We provide limited perquisites to our executives and senior management, and such perquisites are only provided to the extent that they reflect particular business needs and objectives.

Our annual cash incentive plan is designed to create a pay-for-performance culture by aligning the compensation program to the achievement of our strategic and business objectives and with shareholder interests. Our business objectives are to: (1) deliver strong recurring profits relative to our industry; (2) effectively manage our working capital; (3) demonstrate effective cost management; (4) provide EBITDA growth that is stronger than the industry; and (5) provide a safe working environment.

We strive to provide our NEOs with a compensation package that is market competitive within our industry and recognizes and rewards superior individual and company performance.

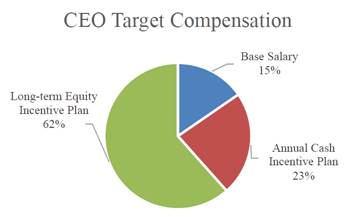

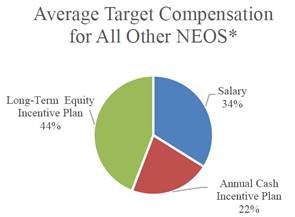

Compensation Mix

The chart below shows the 2015 target mix of compensation between salary and short- and long-term incentive compensation for Mr. Pappas and our other NEOs as a group.

|

|

|

*This target excludes additional cash incentives payable to Mr. Chaclas and described below in” —Additional Incentives to Mr. Chaclas”.

Maintaining Best Practices Regarding Executive Compensation

Our compensation committee intends to compensate our NEOs effectively and consistently with the objectives and design principles outlined above. We have adopted the following compensation practices, which are intended to promote strong governance and alignment with shareholder interests:

Compensation Committee Practices

|

Independent Compensation Consultant |

|

The compensation committee retains and annually reviews the independence of its compensation consultant. |

|

Risk Assessment |

|

The compensation committee regularly assesses whether our incentive compensation arrangements encourage excessive risk-taking to ensure that our plans and awards are designed and working in a way to not encourage excessive risk taking.

|

|

Compensation at Risk |

|

We grant a high percentage of at-risk compensation. We believe this is essential to creating a culture of pay-for-performance.

|

|

Mitigate Undue Risk |

|

We mitigate undue risk in our compensation program by instituting governance policies such as capping potential payments, utilizing multiple performance metrics, striking a balance between short- and long-term incentives and adopting share ownership requirements.

|

|

Share Ownership Guidelines |

|

The compensation committee has adopted share ownership guidelines (i) equal to six times base salary for the CEO, and (ii) equal to two times base salary for our other NEOs.

|

|

Clawback Requirements |

|

We have the right to seek recoupment of all or part of any 2015 annual incentive compensation if there is a breach by the executive of his or her award agreement or any non-competition, non-solicitation, confidentiality or similar covenant or agreement with us or an overpayment of incentive compensation due to inaccurate financial data. Our compensation committee also may recover any award or payments under any award in accordance with any applicable company clawback or recoupment policy, or as otherwise required by applicable law or applicable stock exchange listing standards.

|

|

Anti-Hedging and Pledging Policy |

|

We prohibit our executive officers from hedging or pledging the Company’s securities.

|

How We Make Compensation Decisions

Our compensation committee is responsible for, among other matters: (1) reviewing key executive compensation goals, policies, plans and programs; (2) reviewing the compensation of our executive officers; (3) reviewing and approving employment agreements and other similar arrangements between the Company and our executive officers; and (4) administering our equity-based plans and other incentive compensation plans.

Our Chief Executive Officer reviews annually with the compensation committee each NEO’s performance (other than his own) and recommends to the compensation committee appropriate base salary, annual cash incentive awards and long-term equity incentive awards (to the extent applicable with respect to a particular year) for these NEOs. Based upon the recommendations of our Chief Executive Officer and in consideration of certain objectives and philosophies described above, the compensation committee makes the final recommendation to the Board for annual compensation packages of our executive officers. With respect to our Chief Executive Officer, the compensation committee and/or the Board reviews annually his performance and the compensation committee recommends to the Board his base salary, annual cash incentive awards and grants of long-term equity incentive awards based on the compensation committee’s assessment of his performance, as approved by the Board.

In making decisions with respect to any element of an NEO’s compensation, the compensation committee considered the total compensation that may be awarded to the executive, including salary, annual cash incentive awards and long-term incentive compensation. In addition, in reviewing and approving employment agreements for our NEOs, the compensation committee considered the other benefits to which the officer is entitled by the agreement, including compensation payable upon termination of the executive’s employment under a variety of circumstances. Our goal is to award compensation that is competitive to attract and retain highly qualified leaders and that motivates them to drive strong business performance. We believe that our compensation programs align executive and shareholder interests, while allowing compensation to vary based on each executive’s individual contributions to the Company and to the Company’s overall performance.

Use of Benchmarking Comparison Data

In 2014, the compensation committee selected a peer group of companies, with assistance from Willis Towers Watson, for use in making 2015 compensation decisions, with respect to the total mix and amount of compensation. This peer group consists of companies in the chemical and chemical-related industries, as well as companies in the construction, container and packaging and paper and forest product industries. The compensation committee reviewed various market-based metrics of the peer group that it deemed appropriate, which included enterprise value, revenue, market capitalization, and EBITA margins.

The compensation committee may annually review the companies included in our peer group and may add or eliminate companies as it determines to be appropriate. The peer group selected for making fiscal 2015 compensation decisions consisted of the following 24 companies:

|

|

|

|

|

|

|

A. Schulman, Inc. |

|

Eastman Chemical Company |

|

PolyOne Corporation |

|

Axiall Corporation |

|

Ferro Corporation |

|

Resolute Forest Products Inc. |

|

Berry Plastics Group, Inc. |

|

Graphic Packaging Holding Company |

|

Rockwood Holdings, Inc.(1) |

|

Boise Cascade Company |

|

Greif, Inc. |

|

RPM International Inc. |

|

Cabot Corporation |

|

HB Fuller Company |

|

Silgan Holdings Inc. |

|

Celanese Corporation |

|

Kraton Performance Polymers, Inc. |

|

Stepan Company |

|

Chemtura Corporation |

|

Olin Corporation |

|

Taminco Corporation(2) |

|

Domtar Corporation |

|

OMNOVA Solutions Inc. |

|

Tronox Limited |

|

|

(1) |

Acquired by Albemarle Corporation in January 2015. |

|

|

(2) |

Acquired by Eastman Chemical Company in December 2014. |

The compensation committee has retained Willis Towers Watson as its independent compensation consultant. Willis Towers Watson, a globally recognized as a leader in compensation and benefits advisory services, provides the compensation committee with advice on a broad range of executive compensation matters. The scope of their services includes, but is not limited to, the following:

|

|

· |

Apprising the compensation committee of compensation-related trends and developments in the marketplace; |

|

|

|

|

|

|

· |

Informing the compensation committee of regulatory developments relating to executive compensation practices; |

|

|

|

|

|

|

· |

Providing the compensation committee with an assessment of the market competitiveness of the Company’s executive compensation; |

|

|

|

|

|

|

· |

Assessing the composition of the peer companies used for comparative purposes; |

|

|

|

|

|

|

· |

Assessing the executive compensation structure to confirm that no design elements encourage excessive risk taking; |

|

|

|

|

|

|

· |

Assessing the relationship between executive compensation and corporate performance; and |

|

|

|

|

|

|

· |

Identifying potential changes to the executive compensation program to maintain competitiveness and ensure consistency with |

|

|

business strategies, good governance practices and alignment with shareholder interests. |

During fiscal 2015, Willis Towers Watson attended all regularly scheduled meetings of the compensation committee.

In addition to providing the compensation committee with these executive compensation consulting services in 2015, for which it received aggregate fees of $152,183, Willis Towers Watson also provided the Company with the following additional services for which it received fees totaling $328,471: international actuarial support for the Company’s pension and postretirement benefit plans; actuarial support for one of the Company’s domestic welfare benefit plans; and compensation support to management. Before Willis Towers Watson undertook any compensation support work for the Company’s management, the compensation committee was consulted and approved the scope of work.

The compensation committee actively considered the range of the additional services that Willis Towers Watson was already providing to the Company when it made the decision to retain Willis Towers Watson as its independent compensation consultant in 2015. The compensation committee assessed the independence of Willis Towers Watson pursuant to SEC rules and concluded that no conflict of interest exists that would prevent Willis Towers Watson from independently representing the compensation committee.

2015 Compensation Structure & Performance

The principal components of our executive compensation program include both short-term and long-term compensation. Short-term compensation consists of an executive’s annual base salary and annual cash incentive award. Long-term compensation may include grants of share-based incentives as determined by the compensation committee and approved by the Board. Certain elements of compensation of our NEOs were determined through direct negotiation with the executives at the time of their hiring.

Base Salary

Setting appropriate levels of base pay allows us to attract and retain an executive leadership team that will continue to meet our commitments to customers, sustain profitable growth and create value for our shareholders. The base salaries for our NEOs were determined based on the scope of their responsibilities, competitive benchmarking, and our compensation committee members’ collective knowledge of competitive compensation levels. Base salaries are reviewed annually by the compensation committee and adjusted from time to time to reflect individual responsibilities, performance and experience, as well as market compensation levels. In 2015, Mr. Pappas received an incremental increase of 5% effective January 1, 2015. In connection with his promotion to Senior Vice President, Chief Legal Officer, and Corporate Secretary, Mr. Chaclas’ base salary was raised to $365,000 effective January 1, 2015. In connection with his promotion to Executive Vice President and Chief Operating Officer, Mr. Pugh’s base salary was raised to 600,000 Swiss Francs (CHF) effective November 1, 2015.

Annual Cash Incentive Plan

We have an annual cash incentive plan that is designed to serve as an incentive to drive annual financial and non-financial performance. Annual cash incentive awards are based on a combination of the achievement of Company performance goals as well as individual performance. The performance goals and metrics are recommended by the compensation committee to the Board at the beginning of the year. At the end of the year, the amount paid to each NEO is based on the achievement of the Company performance goals and an assessment of the executive’s overall performance.

For 2015, the annual cash incentive plan was designed to align our executives’ compensation with the Company’s business plan and priorities for the year, and reward performance based on the following three components:

· Responsible Care® : Injuries, Spills and Process Safety Incidents (PSIs);

· EBITDA: Adjusted as described below; and

· Individual Goals: Performance against defined business/functional and individual goals.

We believe best-in-class environmental, health and safety metrics, as well as individual performance, are important measures for establishing performance objectives and measuring the performance of our NEOs. We are a Responsible Care® company and our environment, health and safety policy states that protecting people and the environment is part of everything we do and every decision we make. Each employee has a responsibility to ensure that our products and operations meet applicable government and Company standards.

The 2015 annual cash incentive plan includes three key environment, health and safety metrics that we track for our Company—Recordable Injuries as defined by OSHA, Process Safety Incidents as defined by the American Chemistry Council, and Loss of Primary Containment defined as any physical device used to contain a chemical or plastic resin as part of our manufacturing processes. Incentive payouts with respect to these metrics are determined based on our achievement rating for Responsible Care® performance and in accordance with the threshold, target and maximum levels set forth in the preceding table.

In 2015, Company financial performance metrics were based on an Adjusted EBITDA target of $283.0 million and threshold EBITDA of $253.0 million (in each case, excluding earnings from joint venture companies of $140.2 million and including an adjustment of $58.3 million to reflect current cost of raw materials). We believe that Adjusted EBITDA is a key measure of our financial performance, removing the impacts of our capital structure (such as interest expense), asset base (such as depreciation and amortization) and tax structure as well as other non-recurring items. Therefore, for purposes of the annual cash incentive plan, we define Adjusted EBITDA, which is considered a non-GAAP measure, as net income (loss) from continuing operations before interest expense, net; income tax provision; depreciation and amortization expense; asset impairment charges; loss on extinguishment of long-term debt, net gain (loss) on the disposition of businesses and assets, restructuring and other non-recurring items. Our Adjusted EBITDA performance target metric for the 2015 annual cash incentive awards is set consistent to our 2015 business plan that was approved by the Board, but is also adjusted to exclude earnings from joint venture companies and to exclude the effects of inventory revaluation.

We exclude inventory revaluation in order to facilitate the comparability of results from period to period, by adjusting cost of sales to reflect the cost of raw materials during the period, which is often referred to as the replacement cost method of inventory valuation. We believe this measure minimizes the impact of raw material purchase price volatility in evaluating our performance. See “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Important Performance Measures” of our Annual Report on Form 10-K for more information on our approach to calculating inventory revaluation.

The table below shows the weight and targets of the component metrics, along with the payout opportunity for the annual cash incentive plan.

|

|

|

Weight |

|

Threshold |

|

Level of Performance |

|

Exceeds |

| |||

|

Performance Goal |

|

|

|

|

|

|

|

|

| |||

|

1. Responsible Care® |

|

|

|

|

|

|

|

|

| |||

|

Recordable Injuries* |

|

5 |

% |

8 |

|

6 |

|

4 |

| |||

|

Loss of Primary Containment* |

|

5 |

% |

10 |

|

7 |

|

4 |

| |||

|

Process Safety Incidents* |

|

5 |

% |

2 |

|

1 |

|

0 |

| |||

|

Sub-total |

|

15 |

% |

|

|

|

|

|

| |||

|

2. Financial Performance |

|

|

|

|

|

|

|

|

| |||

|

2015 EBITDA Target (Per 2015 Business Plan) |

|

60 |

% |

$ |

253M |

|

$ |

283M |

|

$ |

333 M |

|

|

3. Individual Goals |

|

25 |

% |

|

|

|

|

|

| |||

|

Total Opportunity at Target |

|

100 |

% |

|

|

|

|

|

| |||

|

Maximum Opportunity |

|

200 |

% |

|

|

|

|

|

| |||

|

* |

Metrics represent incident count. |

In 2015, our achievement rating for Responsible Care® performance qualified each NEO for a 15% annual cash incentive award payout. In addition, based on our 2015 audited financial results, our compensation committee determined that our financial performance resulted in 200% of the Adjusted EBITDA portion of the bonus becoming payable. Actual results for Responsible Care® and Adjusted EBITDA financial performance are set forth below:

|

|

|

|

|

|

|

Level of Performance |

| ||||||||

|

|

|

Actual |

|

Actual |

|

Threshold |

|

Target |

|

Exceeds |

| ||||

|

Responsible Care® |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Recordable Injuries* |

|

0 |

% |

9 |

|

8 |

|

6 |

|

4 |

| ||||

|

Loss of Primary Containment* |

|

5 |

% |

7 |

|

10 |

|

7 |

|

4 |

| ||||

|

Process Safety Incidents* |

|

10 |

% |

0 |

|

2 |

|

1 |

|

0 |

| ||||

|

Total |

|

15.0 |

% |

|

|

|

|

|

|

|

| ||||

|

Financial Performance (Adjusted EBITDA) |

|

120.0 |

% |

$ |

410 M |

|

$ |

253 M |

|

$ |

283 M |

|

$ |

333 M |

|

|

* |

Metrics represent incident count. |

In addition, each NEO had personal performance goals that included, depending on the individual: corporate or business EBITDA; asset, product optimization and customer profitability; organizational effectiveness; talent management and cost management. The results achieved against each of these goals were assessed by the compensation committee and ratings assigned.

During 2015, the target bonus under this plan for each NEO was based on a percentage of base salary ranging from 150%, in the case of Mr. Pappas, to 75%, in the case of Messrs. Feenan and Pugh, 60% in the case of Ms. Horner and 55% in the case of Mr. Chaclas. The table below shows the 2015 target annual incentive award for each NEO and the actual award payable, based on our performance and the individual’s performance.

|

Name |

|

Target Percentage |

|

Target Amount |

|

Actual |

| ||

|

Christopher D. Pappas |

|

150 |

% |

$ |

1,575,000 |

|

$ |

2,693,250 |

|

|

John A. Feenan |

|

75 |

% |

$ |

450,000 |

|

$ |

720,000 |

|

|

Martin Pugh(1) |

|

65%-75 |

% |

$ |

386,717 |

|

$ |

662,249 |

|

|

Marilyn N. Horner |

|

60 |

% |

$ |

252,000 |

|

$ |

431,550 |

|

|

Angelo N. Chaclas |

|

55 |

% |

$ |

200,750 |

|

$ |

340,271 |

|

|

(1) |

Mr. Pugh’s compensation is payable in CHF and was converted using the foreign exchange rate of US$1.037 to CHF1.00. This rate was determined by averaging the exchange rates in effect during 2015. In addition, his 2015 target annual cash incentive award takes in to consideration the salary increase he received effective as of November 1, 2015 and is a blend of the pro-rated amounts for the time period at each compensation level throughout the year, with a target of 65% utilized for the first ten months of 2015, and a target of 75% utilized for the remainder of 2015. |

Based on our achievement rating for Responsible Care® performance, our financial results for 2015 with respect to Adjusted EBITDA, and the compensation committee’s determination of achievement of individual performance goals, each as described below, the table below show the 2015 target annual cash incentive award for each NEO and the actual award payable, based on our performance.

The following table shows the contribution of each performance metric under our annual cash incentive plan to the actual bonus award earned by our NEOs.

|

Name |

|

Responsible Care® |

|

EBITDA |

|

Individual Goals |

|

Actual Award |

|

|

Christopher D. Pappas |

|

100 |

% |

200 |

% |

144 |

% |

171.0 |

% |

|

John A. Feenan |

|

100 |

% |

200 |

% |

100 |

% |

160.0 |

% |

|

Martin Pugh |

|

100 |

% |

200 |

% |

145 |

% |

171.3 |

% |

|

Marilyn N. Horner |

|

100 |

% |

200 |

% |

145 |

% |

171.3 |

% |

|

Angelo N. Chaclas |

|

100 |

% |

200 |

% |

138 |

% |

169.5 |

% |

Long-Term Equity Incentive Compensation

Our Board adopted the 2014 Omnibus Incentive Plan and, following our initial public offering (IPO), all equity-based awards were granted under this plan. The 2014 Omnibus Plan provides for awards of stock options, SARs, restricted stock, unrestricted stock, stock units, performance awards, other awards convertible into or otherwise based on our ordinary shares and cash awards. Eligibility for stock options intended to be incentive stock options, or ISOs, is limited to our employees.

|

|

· |

Stock options and stock appreciation rights (SARs). The exercise price of a stock option, and the base price against which a SAR is to be measured, may not be less than the fair market value (or, in the case of an ISO granted to a ten percent shareholder, 110% of the fair market value) of our ordinary shares on the date of grant. |

|

| ||

|

|

· |

Restricted and unrestricted stock. A restricted stock award is an award of our ordinary shares subject to forfeiture |

restrictions, while an unrestricted stock award is not subject to such restrictions.

· Stock units. A stock unit award is an award denominated in our ordinary shares that entitles the participant to receive ordinary shares or cash measured by the value of our ordinary shares in the future. The delivery of our ordinary shares or cash under a stock unit may be subject to the satisfaction of performance conditions or other vesting conditions.

· Performance awards. A performance award is an award the vesting, settlement or exercisability of which is subject to specified performance criteria.

· Cash awards. A cash award is an award denominated in cash.

· Other awards. Other awards are awards that are convertible into or otherwise based on our ordinary shares.

In February 2015, our Board approved equity award grants to certain key employees, including our NEOs. Each of our NEOs received a grant of restricted share units and options to purchase our ordinary shares based on a target percentage of their base salary and shown in the table below. These awards are subject to time-based vesting conditions, with restricted share unit awards vesting in full on the third anniversary of the date of grant and options vesting in three equal annual installments beginning on the first anniversary of the date of grant, in each case generally subject to an NEO’s continuous employment with us on the applicable vesting date. Our Board approved grants of long-term incentives in the form of stock options and restricted stock units to align the interests of our executives with those of our shareholders and to provide a retention tool.

|

Name |

|

Target Percentage |

|

Target Amount |

| |

|

Christopher D. Pappas |

|

400 |

% |

$ |

4,200,000 |

|

|

John A. Feenan |

|

125 |

% |

$ |

750,000 |

|

|

Martin Pugh |

|

150 |

% |

$ |

935,120 |

|

|

Marilyn N. Horner |

|

130 |

% |

$ |

546,000 |

|

|

Angelo N. Chaclas |

|

100 |

% |

$ |

365,000 |

|

Additional Incentives to Mr. Chaclas

Mr. Chaclas became our Senior Vice President, Chief Legal Officer, and Corporate Secretary in January 2015. Therefore, prior to becoming part of our executive leadership team, he was eligible to participate in incentive programs not available to our other NEOs in 2015. Mr. Chaclas participated in the Company’s 2012 Long-Term Incentive Plan. The 2012 Long-Term Incentive Plan was designed to provide long-term incentives to our employees who did not receive long-term incentive compensation in the form of equity awards in our Parent. See “Executive Compensation—— Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table” for more information regarding our NEOs Executive Subscription Agreements with our Parent. The 2012 Long-Term Incentive Plan sets three-performance year EBITDA targets (excluding inventory revaluation) with each year having equal weighting. The payout factor is determined by averaging the actual payout percentage approved by the compensation committee for each performance year. The cash incentive was paid out in March 2015 at the average payout factor of 69% and resulted in a cash award to Mr. Chaclas of $66,413.

|

|

|

|

|

|

|

Level of Performance |

| ||||||||

|

|

|

Actual |

|

Actual |

|

Not |

|

Target |

|

Exceeds |

| ||||

|

Annual EBITDA Goal |

|

|

|

|

|

|

|

|

|

|

| ||||

|

2012 |

|

50 |

% |

$ |

231M |

* |

$ |

238M |

|

$ |

318M |

|

$ |

438M |

|

|

2013 |

|

82 |

% |

$ |

325M |

|

$ |

270M |

|

$ |

356M |

|

$ |

436M |

|

|

2014 |

|

74 |

% |

$ |

303M |

|

$ |

279M |

|

$ |

329M |

|

$ |

379M |

|

|

Payout Range |

|

69 |

% |

|

|

50 |

% |

100 |

% |

250 |

% | ||||

*Because EBIDTDA was just under the threshold for 2012 the compensation committee approved a threshold payout level in recognition of the overall performance and contributions by all employees.

When appropriate, we offer cash retention awards for certain key employees. The purpose of these awards is to maintain the stability of our Company’s leadership and other staff by providing an additional incentive for these individuals to remain with the Company during the period over which the award vested. In July 2013, the Company agreed to pay Mr. Chaclas a special cash

retention award payable in three installments. The right to receive any amount was contingent on strong sustained leadership, overall performance and continuous full-time employment with the Company through December 31, 2015. The final payment in the amount of $65,000 was made in December 2015.

Other Compensation and Tax Matters

Retirement Benefits

Our qualified U.S. savings plan (the “401(k) plan”) provides for (1) annual discretionary Company contributions and (2) employer matching contributions to be credited to participants’ accounts. The U.S.-based NEOs participate in this plan on the same basis as our other employees. We also maintain a non-qualified savings and deferral plan in which each of our NEOs (other than Mr. Pugh) participates. This plan allows participants to defer a portion of their compensation on a pre-tax basis, with matching contributions from the Company that are payable at a future date based on the terms of the plan. Additionally, the plan provides for discretionary Company contributions in connection with earnings that are in excess of the limitations set forth in the 401(k) Plan.

Our NEOs do not participate or have account balances in any qualified or nonqualified defined benefit pension plans sponsored by the Company, with the exception of Mr. Pugh, who participates in our Switzerland-based defined contribution retirement plan. Mr. Pugh is also entitled to a retirement benefit payable at age 65 in the amount of CHF 250,000, which will be prorated if his retirement from the Company occurs prior to age 65.

Pursuant to the terms of Mr. Pappas’s employment agreement, he is entitled to a retirement benefit payable in the form of a cash lump sum upon his retirement or other termination of employment in an amount determined in accordance with a formula contained in his employment agreement as described in more detail under “Executive Compensation—Pension and Other Postretirement Benefits—Supplemental Employee Retirement Benefit” below.

Severance Benefits

Our NEOs are eligible for severance benefits under their employment agreements upon certain terminations of employment. The agreements provide the NEOs, except Mr. Pappas, with severance benefits in an amount equal to 1.5 times the sum of the executive’s annual base salary and target bonus. Mr. Pappas is eligible for severance benefits in an amount equal to 2.0 times the sum of his annual base salary and target bonus.

Change-in-Control Severance Benefits

We provide change-in-control severance benefits to certain executives, including our current NEOs. These change-in-control severance benefits are intended to minimize the distraction and uncertainty that could affect key management in the event we become involved in a transaction that could result in a change in control of the Company and to enable the executives to impartially evaluate such a transaction. Under the terms of these agreements, each NEO is entitled to a lump sum payment equal to the severance benefits set forth above (rather than payment of severance benefits in installments) if the NEO experiences a termination of employment other than for cause or in the event the NEO resigns for good reason, as defined in the agreements, within two years following a change-in-control of the Company. Mr. Pappas is also entitled to a so-called 280G gross-up with respect to certain payments that may be made to him in connection with a change in control, a benefit that was negotiated at the time Mr. Pappas was hired by us.

Other Compensation

Each NEO is eligible to participate in our generally-applicable benefit plans, such as savings, medical, dental, group life, disability and accidental death and dismemberment insurance, in accordance with country practices.

Tax and Accounting Considerations

Section 162(m) of the Code imposes a limit of $1,000,000 on the amount that a publicly-traded company may deduct for federal income tax purposes in any taxable year for compensation paid to our CEO and the three other highest-paid NEOs, other than our CFO, who are employed as of the end of the year. To the extent that compensation is “performance-based” within the meaning of Section 162(m) or to the extent that compensation meeting certain requirements is paid during a limited period of time following our IPO, the Section’s limitations will not apply. To qualify as performance based, compensation must, among other things, be paid pursuant to a shareholder approved plan upon the attainment of objective performance criteria.

Our compensation committee believes that the tax deductibility of compensation is an important factor, but not the sole factor, in setting executive compensation policies and in rewarding superior executive performance. However, the compensation committee reserves the right to approve the payment of compensation to our executive officers that does not qualify as “performance-based”

within the meaning of Section 162(m) and therefore, may not be deductible for federal income tax purposes.

In determining variable compensation program designs, our compensation committee also considers other tax and accounting implications of particular forms of compensation, such as the implications of Section 409A of the Code governing deferred compensation arrangements and favorable accounting treatment afforded certain equity based plans that are settled in shares.

Timing of Awards

We intend to regularly award annual equity grants in February and June of each year. The equity grant date is not selected or changed to increase the value of equity awards for executives, but is the date when the Board’s resolution is effective.

Compensation Committee Report

The compensation committee has reviewed and discussed the Compensation Discussion and Analysis section (the “CD&A”) required by Item 402(b) of Regulation S-K with management. Based on such review and discussions, the compensation committee recommended to the Board that the CD&A be included in this amended Annual Report on Form 10-K for the year ended December 31, 2015.

THE COMPENSATION COMMITTEE

Michel G. Plantevin

Stephen M. Zide

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information regarding the compensation paid to or earned by our NEOs for the years ended December 31, 2015, 2014, and 2013. For additional information, please read the footnotes and narrative disclosures that follow the table.

|

Name and |

|

Year |

|

Salary |

|

Bonus |

|

Stock |

|

Option |

|

Non-Equity |

|

Changes in |

|

All Other |

|

Total |

| ||||||||

|

Christopher D. Pappas |

|

2015 |

|

$ |

1,050,000 |

|

$ |

— |

|

$ |

2,100,000 |

|

$ |

2,100,000 |

|

$ |

2,693,250 |

|

$ |

2,048,653 |

|

$ |

164,000 |

|

$ |

10,155,903 |

|

|

President and Chief |

|

2014 |

|

$ |

1,000,001 |

|

$ |

500,000 |

|

$ |

— |

|

$ |

— |

|

$ |

1,218,725 |

|

$ |

2,865,711 |

|

$ |

165,104 |

|

$ |

5,749,541 |

|

|

Executive Officer |

|

2013 |

|

$ |

1,000,000 |

|

$ |

— |

|

$ |

11,284,837 |

|

$ |

— |

|

$ |

1,600,000 |

|

$ |

2,007,918 |

|

$ |

165,302 |

|

$ |

16,058,057 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

John A. Feenan(9) |

|

2015 |

|

$ |

600,000 |

|

$ |

— |

|

$ |

375,000 |

|

$ |

375,000 |

|

$ |

720,000 |

|

$ |

— |

|

$ |

62,502 |

|

$ |

2,132,502 |

|

|

EVP & Chief |

|

2014 |

|

$ |

600,000 |

|

$ |

1,000,000 |

|

$ |

— |

|

$ |

— |

|

$ |

375,180 |

|

$ |

— |

|

$ |

61,948 |

|

$ |

2,037,128 |

|

|

Financial Officer |

|

2013 |

|

$ |

600,000 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

465,000 |

|

$ |

— |

|

$ |

176,493 |

|

$ |

1,241,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Martin Pugh(10) |

|

2015 |

|

$ |

622,200 |

|

$ |

— |

|

$ |

467,560 |

|

$ |

467,560 |

|

$ |

662,249 |

|

$ |

184,440 |

|

$ |

— |

|

$ |

2,404,009 |

|

|

EVP & Chief |

|

2014 |

|

$ |

603,900 |

|

$ |

549,000 |

|

$ |

— |

|

$ |

— |

|

$ |

271,030 |

|

$ |

424,591 |

|

$ |

— |

|

$ |

1,848,521 |

|

|

Operating Officer |

|

2013 |

|

$ |

495,017 |

|

$ |

918,026 |

|

$ |

2,090,261 |

|

$ |

— |

|

$ |

283,510 |

|

$ |

1,311,635 |

|

$ |

2,569 |

|

$ |

5,101,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Marilyn N. Horner |

|

2015 |

|

$ |

420,000 |

|

$ |

— |

|

$ |

273,000 |

|

$ |

273,000 |

|

$ |

431,550 |

|

$ |

— |

|

$ |

49,879 |

|

$ |

1,447,429 |

|

|

SVP, Human Resources |

|

2014 |

|

$ |

420,000 |

|

$ |

210,000 |

|

$ |

— |

|

$ |

— |

|

$ |

198,367 |

|

$ |

— |

|

$ |

49,591 |

|

$ |

877,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

Angelo N. Chaclas |

|

2015 |

|

$ |

365,000 |

|

$ |

65,000 |

|

$ |

182,500 |

|

$ |

182,500 |

|

$ |

406,684 |

|

$ |

— |

|

$ |

40,189 |

|

$ |

1,241,873 |

|

|

SVP, Chief Legal Officer, & Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

(1) Amounts in this column for 2014 for Mr. Pappas and Ms. Horner reflect their special retention awards paid in 2014. Amounts in this column for Mr. Chaclas reflect a special retention award paid in 2015, which is described above under “Compensation Discussion and Analysis—Compensation Elements—Additional Incentives to Mr. Chaclas”.

(2) Mr. Feenan was entitled to a $5.0 million retention award pursuant to his employment agreement dated December 22, 2011. These amounts vested and were paid over a four-year period. Mr. Feenan received $1.0 million in 2014 pursuant to his employment agreement. In 2013 no retention awards were paid to Mr. Feenan and pursuant to his November 16, 2015 separation letter agreement remaining retention award amounts were forfeited. Mr. Pugh received a retention bonus of CHF 750,000 as part of his employment agreement, which was paid in two installments of CHF 250,000 and CHF 500,000 in 2013 and 2014, respectively. In addition, Mr. Pugh received a signing bonus of CHF 600,000 in connection with his employment in March 2013.

(3) The amount in this column reflects the fair value of restricted share and restricted stock units awards granted in the periods presented (there were no share awards granted in 2014), calculated in accordance with ASC 718, excluding the effects of estimated forfeitures. The assumptions used for determining fair value are described in Note 17 to our consolidated financial statements filed with our Annual Report on Form 10-K. In 2013, the amount attributable to the performance-based portion of the awards assumes that all performance-based vesting criteria were satisfied in full. The performance-based awards were modified in connection with our IPO as described below in “—Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table.”

(4) The amount in this column reflects the fair value of option awards granted in 2015, computed using the Black-Scholes pricing model, whose inputs and assumptions are as of the grant date and described in Note 17 to our consolidated financial statements filed with our Annual Report on Form 10-K. There were no grants of option awards under the 2014 Omnibus Incentive Plan prior to 2015.

(5) This amount includes each NEO’s earned cash incentive payout as discussed in “Compensation Discussion and Analysis—Compensation Elements—Annual Cash Incentive Plan” above. Additionally, for Mr. Chaclas in 2015 this amount includes incentive payouts under the Company’s 2012 Long-Term Incentive Plan described under “Compensation Discussion and Analysis—Compensation Elements—Additional Incentives to Mr. Chaclas”.

(6) Changes in Pension and Other Postretirement Benefits for Messrs. Pappas and Pugh for the year December 31, 2015 amounted to $2,048,653 and $184,440, respectively. Changes in Pension and Other Postretirement Benefits for Messrs. Pappas and Pugh for the year ended December 31, 2014 amounted to $2,865,711 and $424,591, respectively. Changes in Pension and Other Postretirement Benefits for Messrs. Pappas and Pugh for the year ended December 31, 2013 amounted to $2,007,918 and $1,311,635, respectively. Mr. Chaclas and Ms. Horner do not participate in pension and other postretirement benefit arrangements and Mr. Feenan did not participate in pension and other postretirement benefit arrangements prior to his termination from the Company. Please see “—Pension and Other Postretirement Benefits” for a description of these arrangements.

(7) No amount is reported with respect to earnings on non-qualified deferred compensation plans because above market rates are not provided under such plans. See “—U.S. Non-Qualified Deferred Compensation Table” below for information with respect to the NEOs’ deferred compensation amounts for 2015.

(8) Included in “All Other Compensation” for fiscal year 2015 were the following items:

|

Name |

|

401(k) plan(i) |

|

Non-qualified |

|

Other(iii) |

|

Total |

| ||||

|

Christopher D. Pappas |

|

$ |

21,266 |

|

$ |

141,150 |

|

$ |

1,584 |

|

$ |

164,000 |

|

|

John A. Feenan |

|

$ |

22,700 |

|

$ |

39,250 |

|

$ |

552 |

|

$ |

62,502 |

|

|

Marilyn N. Horner |

|

$ |

22,297 |

|

$ |

26,550 |

|

$ |

1,032 |

|

$ |

49,879 |

|

|

Angelo N. Chaclas |

|

$ |

24,599 |

|

$ |

15,038 |

|

$ |

552 |

|

$ |

40,189 |

|

(i) Represents Company matching and discretionary contributions to the 401(k) Plan for all NEOs except Mr. Pugh.