Attached files

| file | filename |

|---|---|

| 8-K - 8-K - J.G. Wentworth Co | jgw8-kmar102016.htm |

Adjusted Cash Flow – A Non-GAAP Financial Measure March 15, 2016

SAFE HARBOR 2 Certain statements in this press release constitute “forward-looking statements.” All statements, other than statements of historical fact, are forward- looking statements. You can identify such statements because they contain words such as ‘‘plans,’’ ‘‘expects’’ or ‘‘does expect,’’ ‘‘budget,’’ ‘‘forecasts,’’ ‘‘anticipates’’ or ‘‘does not anticipate,’’ ‘‘believes,’’ ‘‘intends,’’ and similar expressions or statements that certain actions, events or results ‘‘may,’’ ‘‘could,’’ ‘‘would,’’ ‘‘might,’’ or ‘‘will,’’ be taken, occur or be achieved. Any statements that refer to expectations or other characterizations of future events, circumstances or results are forward-looking statements. A number of factors could cause actual results, performance or achievements to differ materially from the results expressed or implied in the forward- looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Forward- looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause our actual results, performance and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. Consideration should also be given to the areas of risk set forth under the heading “Risk Factors” in our filings with the Securities and Exchange Commission, and as set forth more fully under “Part 1, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, these risks and uncertainties include, among other things: our ability to execute on our business strategy; our ability to successfully compete in the industries in which we operate; our dependence on the effectiveness of direct response marketing; our ability to retain and attract qualified senior management; any improper use of or failure to protect the personally identifiable information of past, current and prospective customers to which we have access; our ability to upgrade and integrate our operational and financial information systems, maintain uninterrupted access to such systems and adapt to technological changes in the industries in which we operate; our dependence on third parties, including our ability to maintain relationships with such third parties and our potential exposure to liability for the actions of such third parties; damage to our reputation and increased regulation of our industries which could result from unfavorable press reports about our business model; the accuracy of the estimates and assumptions of our financial models; infringement of our trademarks or service marks; our ability to maintain our state licenses or obtain new licenses in new markets; changes in, and our ability to comply with, federal, state and local laws and regulations governing us; our business model being susceptible to litigation; our ability to continue to purchase structured settlement payments and other financial assets; the public disclosure of the identities of structured settlement holders maintained in our proprietary database; our dependence on the opinions of certain credit rating agencies of the credit quality of our securitizations; our ability to complete future securitizations or other financings on favorable terms; the insolvency of a material number of structured settlement issuers; adverse changes in the residential mortgage lending and real estate markets, including any increases in defaults or delinquencies, especially in geographic areas where our loans are concentrated; our ability to grow our loan origination volume, acquire MSRs and recapture loans that are refinanced; changes in the guidelines of government-sponsored entities, or GSEs, or any discontinuation of, or significant reduction in, the operation of GSEs; potential misrepresentations by borrowers, counterparties and other third-parties; changes in prevailing interest rates and our ability to mitigate interest rate risk through hedging strategies; our ability to obtain sufficient working capital at attractive rates; and our ability to remain in compliance with the terms of our substantial indebtedness. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to publicly revise any forward-looking statements, to report events or to report the occurrence of unanticipated events unless we are required to do so by law.

Non-GAAP Disclosure Disclaimer We use Adjusted Cash Flow, a Non-GAAP financial measure, as a measure of our cash flows from operations. We define Adjusted Cash Flow as it is presented on the accompanying table. The Company believes Adjusted Cash Flow is useful to investors and management as a measure of cash generated by business operations that can be used to repay debt, invest in future growth or repurchase stock. This metric can also be used to evaluate the Company’s ability to generate cash flow from business operations and the impact that this cash flow has on the Company’s liquidity. You should not consider Adjusted Cash Flow in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because not all companies use identical calculations, our presentation of Adjusted Cash Flow may not be comparable to other similarly titled measures of other companies. 3

Objective 4 U.S. Generally Accepted Accounting Principles (U.S. GAAP) prescribes the specific requirements for statements of cash flows. Due to the nature of the Company’s business, investors have expressed difficulty in understanding the Company’s cash flows and in particular, cash flows provided by its operations. In response, we are presenting the non-GAAP financial measure of Adjusted Cash Flow as a measure of unrestricted cash provided by (or used in) operations available to repay debt, invest in future growth or repurchase stock. Adjusted Cash Flow is calculated based on information directly from the Company’s quarterly and annual financial statements (i.e., Statements of Operations and Cash Flows). Should not be used in isolation or as a substitute for analysis of results as reported under U.S. GAAP. Refer to the slide titled “Glossary of Terms” for a general description of the line items comprising Adjusted Cash Flow, their contributing segments and the specific sources of the information.

Observations 5 Adjusted Cash Flow varies significantly based on the timing and structure of securitizations and sales of the Structured Settlements & Annuity Purchasing (SSAP) segment’s finance receivables. Until the 2015-3 securitization, securitization transactions had historically been structured with an "initial close" in which the Company issued a principal amount of securitized debt and received: (i) cash in exchange for assets delivered and (ii) restricted cash in exchange for assets to be delivered 60 to 90 days in the future (referred to as the "pre-funding" date). On the pre-funding date, additional assets would be delivered to the lenders in return for the lifting of restrictions on the restricted cash. As a result, restricted cash balances have fluctuated significantly depending on the timing of the transactions' initial close and their associated pre-funding dates. Adjusted Cash Flow for the year ended December 31, 2014 included the impact of an ~$89M increase in restricted cash primarily related to the net effect of: Both 2013-3 securitization's initial-close and pre-funding occurring in the fourth quarter of 2013, and The 2014-3 securitization's initial-close occurring in the fourth quarter of 2014 but the associated pre-funding occurring in the first quarter of 2015. As a result of the timing of the 2013-3 and 2014-3 pre-fundings, restricted cash increased ~$72M in 2014.

Observations (continued) 6 Adjusted Cash Flow for the year ended December 31, 2015 included the impact of an ~$66M decrease in restricted cash primarily related to the net effect of: The timing of 2014-3 securitization's pre-funding. The 2015-3 securitization being structured with only an initial-close and not having an associated pre-funding. As a result of the timing & structure of 2014-3 and 2015-3 securitizations, restricted cash decreased $72M in 2015. Adjusted Cash Flow also varies based on the timing of the financing of our residual interests in SSAP’s finance receivables via the residual term facility.

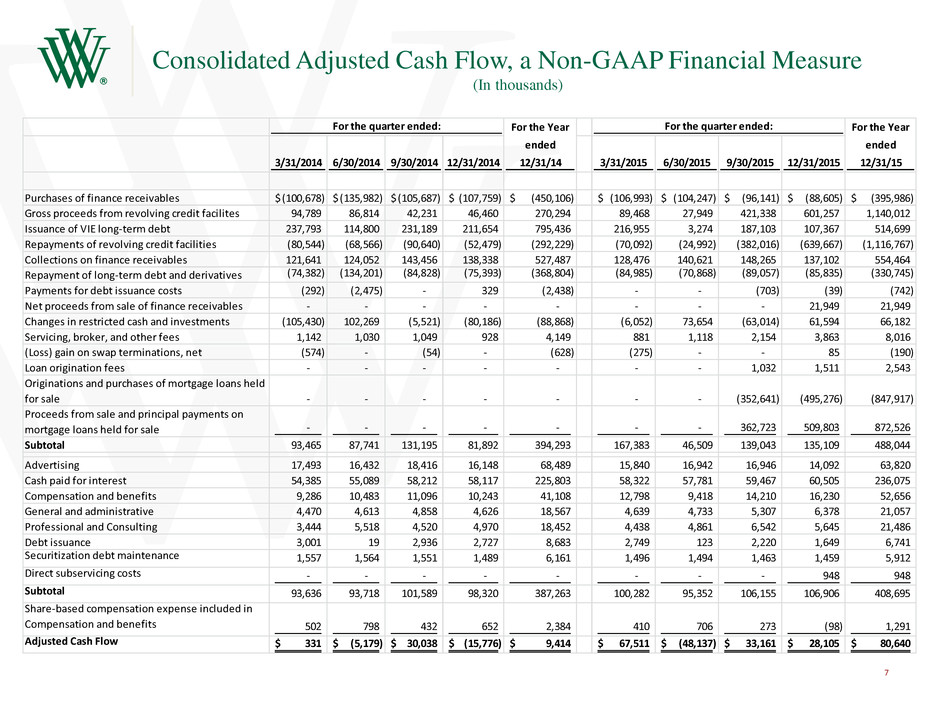

Consolidated Adjusted Cash Flow, a Non-GAAP Financial Measure (In thousands) 7 3/31/2014 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 12/31/2015 Purchases of finance receivables (100,678)$ (135,982)$ (105,687)$ (107,759)$ (450,106)$ (106,993)$ (104,247)$ (96,141)$ (88,605)$ (395,986)$ Gross proceeds from revolving credit facilites 94,789 86,814 42,231 46,460 270,294 89,468 27,949 421,338 601,257 1,140,012 Issuance of VIE long-term debt 237,793 114,800 231,189 211,654 795,436 216,955 3,274 187,103 107,367 514,699 Repayments of revolving credit facilities (80,544) (68,566) (90,640) (52,479) (292,229) (70,092) (24,992) (382,016) (639,667) (1,116,767) Collections on finance receivables 121,641 124,052 143,456 138,338 527,487 128,476 140,621 148,265 137,102 554,464 Repayment of long-term debt and derivatives (74,382) (134,201) (84,828) (75,393) (368,804) (84,985) (70,868) (89,057) (85,835) (330,745) Payments for debt issuance costs (292) (2,475) - 329 (2,438) - - (703) (39) (742) Net proceeds from sale of finance receivables - - - - - - - - 21,949 21,949 Changes in restricted cash and investments (105,430) 102,269 (5,521) (80,186) (88,868) (6,052) 73,654 (63,014) 61,594 66,182 Servicing, broker, and other fees 1,142 1,030 1,049 928 4,149 881 1,118 2,154 3,863 8,016 (Loss) gain on swap terminations, net (574) - (54) - (628) (275) - - 85 (190) Loan origination fees - - - - - - - 1,032 1,511 2,543 Originations and purchases of mortgage loans held for sale - - - - - - - (352,641) (495,276) (847,917) Proceeds from sale and principal payments on mortgage loans held for sale - - - - - - - 362,723 509,803 872,526 Subtotal 93,465 87,741 131,195 81,892 394,293 167,383 46,509 139,043 135,109 488,044 Advertising 17,493 16,432 18,416 16,148 68,489 15,840 16,942 16,946 14,092 63,820 Cash paid for interest 54,385 55,089 58,212 58,117 225,803 58,322 57,781 59,467 60,505 236,075 Compensation and benefits 9,286 10,483 11,096 10,243 41,108 12,798 9,418 14,210 16,230 52,656 General and administrative 4,470 4,613 4,858 4,626 18,567 4,639 4,733 5,307 6,378 21,057 Professional and Consulting 3,444 5,518 4,520 4,970 18,452 4,438 4,861 6,542 5,645 21,486 Debt issuance 3,001 19 2,936 2,727 8,683 2,749 123 2,220 1,649 6,741 Securitization debt maintenance 1,557 1,564 1,551 1,489 6,161 1,496 1,494 1,463 1,459 5,912 Direct subservicing costs - - - - - - - - 948 948 Subtotal 93,636 93,718 101,589 98,320 387,263 100,282 95,352 106,155 106,906 408,695 Share-based compensation expense included in Compensation and benefits 502 798 432 652 2,384 410 706 273 (98) 1,291 Adjusted Cash Flow 331$ (5,179)$ 30,038$ (15,776)$ 9,414$ 67,511$ (48,137)$ 33,161$ 28,105$ 80,640$ For the quarter ended: For the quarter ended:For the Year ended 12/31/14 For the Year ended 12/31/15

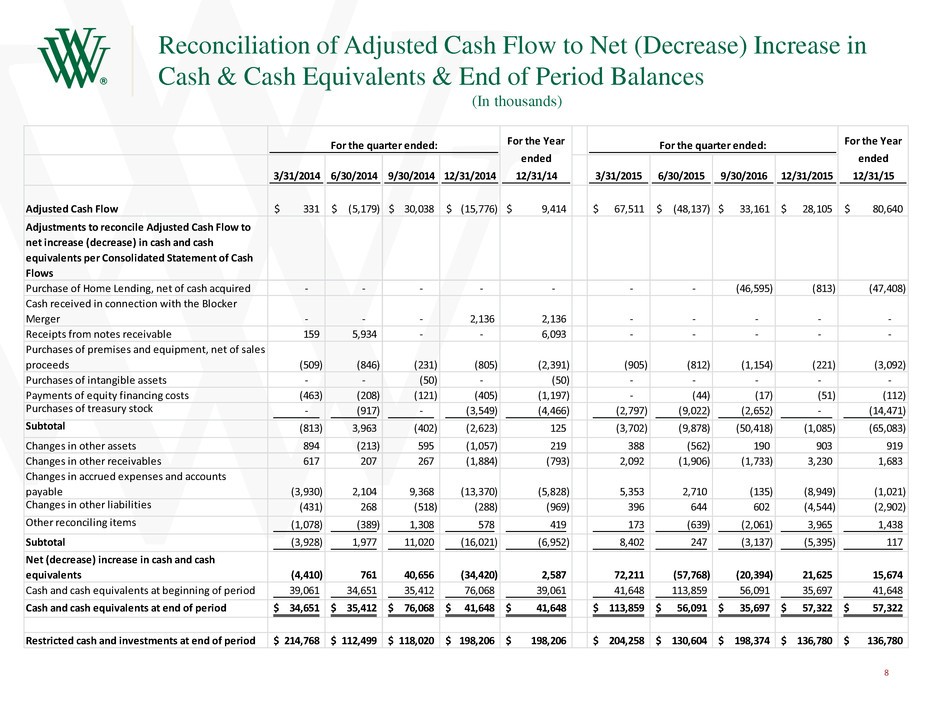

Reconciliation of Adjusted Cash Flow to Net (Decrease) Increase in Cash & Cash Equivalents & End of Period Balances (In thousands) 8 3/31/2014 6/30/2014 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2016 12/31/2015 Adjusted Cash Flow 331$ (5,179)$ 30,038$ (15,776)$ 9,414$ 67,511$ (48,137)$ 33,161$ 28,105$ 80,640$ Adjustments to reconcile Adjusted Cash Flow to net increase (decrease) in cash and cash equivalents per Consolidated Statement of Cash Flows Purchase of Home Lending, net of cash acquired - - - - - - - (46,595) (813) (47,408) Cash received in connection with the Blocker Merger - - - 2,136 2,136 - - - - - Receipts from notes receivable 159 5,934 - - 6,093 - - - - - Purchases of premises and equipment, net of sales proceeds (509) (846) (231) (805) (2,391) (905) (812) (1,154) (221) (3,092) Purchases of intangible assets - - (50) - (50) - - - - - Payments of equity financing costs (463) (208) (121) (405) (1,197) - (44) (17) (51) (112) Purchases of treasury stock - (917) - (3,549) (4,466) (2,797) (9,022) (2,652) - (14,471) Subtotal (813) 3,963 (402) (2,623) 125 (3,702) (9,878) (50,418) (1,085) (65,083) Changes in other assets 894 (213) 595 (1,057) 219 388 (562) 190 903 919 Changes in other receivables 617 207 267 (1,884) (793) 2,092 (1,906) (1,733) 3,230 1,683 Changes in accrued expenses and accounts payable (3,930) 2,104 9,368 (13,370) (5,828) 5,353 2,710 (135) (8,949) (1,021) Changes in other liabilities (431) 268 (518) (288) (969) 396 644 602 (4,544) (2,902) Other reconciling items (1,078) (389) 1,308 578 419 173 (639) (2,061) 3,965 1,438 Subtotal (3,928) 1,977 11,020 (16,021) (6,952) 8,402 247 (3,137) (5,395) 117 Net (d crease) increase in cash and cash equivalents (4,410) 761 40,656 (34,420) 2,587 72,211 (57,768) (20,394) 21,625 15,674 Cash and cash equivalents at beginning of period 39,061 34,651 35,412 76,068 39,061 41,648 113,859 56,091 35,697 41,648 Cash and cash equivalents at end of period 34,651$ 35,412$ 76,068$ 41,648$ 41,648$ 113,859$ 56,091$ 35,697$ 57,322$ 57,322$ Restricted cash and investments at end of period 214,768$ 112,499$ 118,020$ 198,206$ 198,206$ 204,258$ 130,604$ 198,374$ 136,780$ 136,780$ For the quarter ended: For the Year ended 12/31/14 For the quarter ended: For the Year ended 12/31/15

Glossary of Terms 9 Primary Sources of Cash Segment General Description Data Source Gross proceeds from revolving credit facilites Home Lending, SSAP Cash received from borrowing on credit facilities to purchase receivables and originate mortgage loans Cash Flow Statement Issuance of VIE long-term debt SSAP Cash received from securitizing finance receivables and our residual interests in finance receivables Cash Flow Statement Collections on finance receivables SSAP Cash received as payment on finance receivables Cash Flow Statement Net proceeds from sale of finance receivables SSAP Cash received from direct-asset sales of finance receivables Cash Flow Statement Changes in restricted cash and investments Home Lending, SSAP Cash inflows/outflows based on changes in restricted cash primarily due to the timing and structure of securitizations and sales of finance receivables Cash Flow Statement Servicing, broker, and other fees Home Lending, SSAP Cash received in exchange for mortgage servicing and servicing securitizations as well as from other revenue generating activities Income Statement (Loss) gain on swap terminations, net SSAP Cash received/paid in connection with terminating derivatives associated with credit facilities Income Statement Loan origination fees Home Lending Cash received for services performed in connection with origination of mortgage loans Income Statement Proceeds from sale and principal payments on mortgage loans held for sale Home Lending Cash received from selling mortgage loans and principal payments received prior to sale Cash Flow Statement Primary Uses of Cash Segment General Description Data Source Purchases of finance receivables SSAP Cash paid to acquire finance receivables Cash Flow Statement Gross proceeds from revolving credit facilites Home Lending, SSAP Cash outflow to pay down borrowings on credit facilities Cash Flow Statement Repayment of long-term debt and derivatives Home Lending, SSAP Cash outflow to pay down VIE and securitized debt and associated derivatives Cash Flow Statement Payments for debt issuance costs SSAP Cash outflow for debt issuance costs not directly expensed in the P&L Cash Flow Statement Originations and purchases of mortgage loans held for sale Home Lending Cash outflows to originate mortgage loans held for sale Cash Flow Statement Cash paid for interest Home Lending, SSAP Cash outflows to pay interest on all forms of debt (including term loan) Cash Flow Statement- Supplemental Information