Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - INNOVATE Corp. | a201410-kexhibit32.htm |

| EX-23.1 - EXHIBIT 23.1 - INNOVATE Corp. | a201410-kexhibit231.htm |

| EX-31.1 - EXHIBIT 31.1 - INNOVATE Corp. | a201410-kexhibit311.htm |

| EX-31.2 - EXHIBIT 31.2 - INNOVATE Corp. | a201410-kexhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________

FORM 10-K/A

Amendment No. 1

____________________________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

Commission File No. 001-35210

____________________________________________________

HC2 HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________

Delaware | 54-1708481 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

505 Huntmar Park Drive, Suite 325, Herndon, VA | 20170 | |

(Address of principal executive offices) | (Zip Code) | |

(703) 456-4100

(Registrant’s telephone number, including area code)

____________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.001 per share | NYSE MKT LLC | |

Securities registered pursuant to Section 12(g) of the Act:

N/A

____________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | x |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate fair market value of the Common Stock held by non-affiliates of the registrant as of June 30, 2014 was approximately $87,890,040, based on the closing sale price of the Common Stock on such date. All executive officers and directors of the registrant and all persons filing a Schedule 13D with the Securities and Exchange Commission in respect of the registrant’s common stock as of such date have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of February 28, 2015, 23,815,216 shares of Common Stock, par value $0.001, were outstanding.

Documents Incorporated by Reference:

Portions of the definitive Proxy Statement to be delivered to Stockholders in connection with the Annual Meeting of Stockholders are incorporated by reference into Part III.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A ("Amendment No. 1") amends the Annual Report on Form 10-K of HC2 Holdings, Inc. (the “Company”) for the fiscal year ended December 31, 2014, as originally filed with the Securities and Exchange Commission (the “SEC”) on March 16, 2015 (the “Original Filing”).

As previously disclosed in Form 8-K filed on February 22, 2016 and described in more detail in Note 1 of the Notes to Consolidated Financial Statements, on February 21, 2016, we determined that we had improperly accounted for certain items. As a result of the aggregate effect of these errors and other individually immaterial errors that had been waived in prior periods, the Audit Committee of our Board of Directors determined that our financial statements for the fiscal year ended December 31, 2014 and the fiscal quarters ended June 30, 2014, September 30, 2014, March 31, 2015, June 30, 2015 and September 30, 2015 could no longer be relied upon and should be restated. To correct the errors described above and in Note 1 of the Notes to Consolidated Financial Statements, we are amending the Original Filing to provide restated consolidated financial statements as of and for the fiscal year ended December 31, 2014 and to amend related disclosures.

As previously disclosed, we identified an error in accounting for income taxes, including the income tax provision and related tax assets and liabilities in the consolidated statement of operations for the year ended December 31, 2014. The Company subsequently recorded an out-of-period adjustment to tax benefit of $2.3 million in its quarterly period ended September 30, 2015 and is correcting that error and other known out-of-period errors that had been waived in prior periods in its restated consolidated financial statements for the fiscal year ended December 31, 2014.

Subsequently, management identified a material weakness in the Company’s internal controls over the valuation of a business acquisition and the application of U.S. GAAP to complex and/or non-routine transactions. In particular, the Company determined that it incorrectly accounted for the acquisition of American Natural Gas, completed on August 1, 2014 as required by FASB Accounting Standards Codification 805. Further, the Company determined that it incorrectly classified funds released from escrow totaling $29.2 million as cash flows from operating activities rather than cash flows from investing activities in its Consolidated Statements of Cash Flows for the fiscal year ended December 31, 2014. The funds related to the 2013 sales of the North American Telecom and BLACKIRON Data business units.

As a result of material weaknesses leading to the errors described above, management has concluded that the Company’s internal control over financial reporting and its disclosure controls and procedures were not effective as of the ends of each of the applicable restatement periods. The effects of the material weaknesses are discussed in more detail in Item 9A, Controls and Procedures.

For ease of reference, this Amendment No. 1 amends and restates the Original Filing in its entirety. Revisions to the Original Filing have been made to the following sections:

• | Part I - Item 1 - Business |

• | Part I - Item 1A - Risk Factors |

• | Part I - Item 2 - Properties |

• | Part I - Item 6 - Selected Financial Data |

• | Part II - Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations |

• | Part II - Item 8 - Financial Statements and Supplementary Data |

• | Part II - Item 9A - Controls and Procedures |

• | Part IV - Exhibits |

In addition, the Company’s principal executive officer and principal financial officer have provided new certifications in connection with this Amendment No.1 (Exhibits 31.1, 31.2, and 32), as well as various exhibits related to XBRL.

Except as described above, no other amendments have been made to the Original Filing. This Amendment continues to speak as of the date of the Original Filing, and the Company has not updated the disclosure contained herein to reflect events that have occurred since the date of the Original Filing, other than with respect to the items listed above. Accordingly, this Amendment should be read in conjunction with the Company’s other filings made with the SEC subsequent to the filing of the Original Filing, including any amendments to those filings.

TABLE OF CONTENTS

Item | Description | Page |

1 | ||

1A. | ||

1B. | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

7A. | ||

8 | ||

9 | ||

9A. | ||

9B. | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

PART I

ITEM 1. BUSINESS

Unless the context otherwise requires, in this Annual Report on Form 10-K, “HC2,” means HC2 Holdings, Inc. and the “Company,” “we” and “our” mean HC2 together with its consolidated subsidiaries.

General

We are a diversified holding company with six reportable operating segments based on management’s organization of the enterprise—Manufacturing, Marine Services, Utilities, Telecommunications, Life Sciences and Other, which includes operations that do not meet the separately reportable segment thresholds. We expect to continue to focus on acquiring and investing in businesses with attractive assets that we consider to be undervalued or fairly valued and growing our acquired businesses.

On May 29, 2014, we completed the acquisition of 2.5 million shares of common stock of Schuff International, Inc. (“Schuff”), a steel fabrication and erection company and negotiated an agreement to purchase an additional 198,411 shares, representing an approximately 65% interest in Schuff. Schuff repurchased a portion of its outstanding common stock in June 2014, which had the effect of increasing the Company’s ownership interest to 70%. During the fourth quarter, the final results of a tender offer for all outstanding shares of Schuff were announced and various open-market purchases were made, which resulted in the acquisition of 809,043 shares and an increase in our ownership interest to 91%. We intend to execute a short-form merger, which will increase our ownership of Schuff shares to 100%. Schuff and its wholly-owned subsidiaries primarily operate as integrated fabricators and erectors of structural steel and heavy steel plates with headquarters in Phoenix, Arizona and operations in Arizona, Georgia, Texas, Kansas and California. Schuff’s construction projects are primarily in the aforementioned states. In addition, Schuff has construction projects in select international markets, primarily Panama.

On August 1, 2014, the Company paid $15.5 million to acquire 15,500 shares of Series A Convertible Preferred Stock of American Natural Gas (“ANG”), representing an approximately 51% interest in ANG. ANG is a premier distributor of natural gas motor fuel headquartered in the Northeast that designs, builds, owns, acquires, operates and maintains compressed natural gas fueling stations for transportation.

On September 22, 2014, the Company completed the acquisition of Bridgehouse Marine Limited, the parent holding company of Global Marine Systems Limited (“GMSL”). The purchase price reflects an enterprise value of approximately $260 million, including assumed indebtedness. GMSL is a leading provider of engineering and underwater services on submarine cables. In conjunction with the acquisition, approximately 3% of the Company’s interest in GMSL was purchased by a group of individuals, leaving the Company’s controlling interest as of December 31, 2014 at approximately 97%.

On September 3, 2014, the Company invested $14.2 million for a combination of common stock, warrants and convertible preferred stock of Novatel Wireless, Inc. (“Novatel”). The Company received (i) 7,363,334 shares of common stock at a stock price of $1.75 per share, (ii) 5-year warrants to purchase an additional 4,117,647 shares of common stock at an exercise price of $2.26 per share and (iii) 87,196 shares of Series C Convertible Preferred Stock at a price of $17.50 per share. In October 2014, the 87,196 shares of Series C Convertible Preferred Stock were converted into 871,960 shares of common stock. The Company’s ownership of common stock and warrants represents beneficial ownership of approximately 25% of Novatel’s common stock.

The Company has made other investments in start-up companies that operate in the life sciences, technology and interactive gaming industries.

We have also historically operated a telecommunications business including a network of direct routes and provided premium voice communication services for national telecom operators, mobile operators, wholesale

carriers, prepaid operators, Voice over Internet Protocol (“VoIP”) service operators and Internet service providers (“ISPs”). The Company has provided telecommunications services from its North America Telecom and International Carrier Services (“ICS”) business units. In the second quarter of 2013, the Company entered into a definitive purchase agreement to sell its North America Telecom business and sought shareholder approval of such transaction. On July 31, 2013, the Company completed the initial closing of the sale of substantially all of its North America Telecom business. The sale of Primus Telecommunications, Inc. (“PTI”) was also contemplated as part of this transaction, subject to regulatory approval. On July 31, 2014, having received the necessary regulatory approvals for the sale of PTI, we completed the divestiture of the remainder of our North America Telecom business.

1

During 2013, we also provided data center services in Canada through our BLACKIRON Data business unit. On April 17, 2013, we consummated the divestiture of BLACKIRON Data.

Overall Business Strategy

We are evaluating several strategic and business alternatives, which may include the following: acquiring assets or businesses unrelated to our current or historical operations, operating, growing or acquiring additional assets or businesses related to our current or historical operations, or winding down or selling our existing operations. As part of any acquisition strategy, we may raise capital in the form of debt or equity securities (including preferred stock) or a combination thereof. We have broad discretion in selecting a business strategy for the Company. If we elect to pursue an acquisition, we have broad discretion in identifying and selecting both the industries and the possible acquisition or business combination opportunities. We have not identified a specific industry to focus on and there can be no assurance that we will, or we will be able to, identify or successfully complete any such transactions. In connection with evaluating these strategic and business alternatives, we may at any time be engaged in ongoing discussions with respect to possible acquisitions, business combinations and debt or equity securities offerings of widely varying sizes. There can be no assurance that any of these discussions will result in a definitive agreement and if they do, what the terms or timing of any agreement would be. While we search for additional acquisition opportunities, we manage a portion of our available cash and acquire interests in possible acquisition targets through our wholly-owned subsidiary, HC2 Investment Securities, Inc., a Delaware corporation.

Our Operating Subsidiaries

Schuff

Schuff is a fully integrated fabricator and erector of structural steel and heavy steel plate. Schuff fabricates and erects structural steel for commercial and industrial construction projects such as high- and low-rise buildings and office complexes, hotels and casinos, convention centers, sports arenas, shopping malls, hospitals, dams, bridges, mines and power plants. Schuff also fabricates trusses and girders and specializes in the fabrication and erection of large-diameter water pipe, water storage tanks, pollution control scrubbers, tunnel liners, pressure vessels, strainers, filters, separators and a variety of customized products. Schuff’s operations make up our Manufacturing segment.

Schuff’s results of operations are affected primarily by (i) the level of commercial and industrial construction in its principal markets; (ii) its ability to win project contracts; (iii) the number and complexity of project changes requested by customers or general contractors; (iv) its success in utilizing its resources at or near full capacity; and (v) its ability to complete contracts on a timely and cost-effective basis. The level of commercial and industrial construction activity is related to several factors, including local, regional and national economic conditions, interest rates, availability of financing, and the supply of existing facilities relative to demand.

Strategy

Schuff’s objective is to achieve and maintain a leading position in the geographic regions and project segments that it serves by providing timely, high-quality services to its customers. Schuff is pursuing this objective with a strategy comprised of the following components:

• | Pursue Large, Value-Added Design-Build Projects. Schuff’s unique ability to offer design-build services, a full range of steel construction services and project management capabilities makes it a preferred partner for complex, design-build fabrication projects in the geographic regions it serves. This capability often enables Schuff to bid against fewer competitors in a less traditional, more negotiated selection process on these projects, thereby offering the potential for higher margins while providing overall cost savings and project flexibility and efficiencies to its customers; |

• | Expand and Diversify Revenue Base. Schuff is seeking to expand and diversify its revenue base by leveraging its long-term relationships with national and multi-national construction and engineering firms, national and regional accounts and other customers. Schuff also intends to continue to grow its operations by targeting smaller projects that carry higher margins and less risk of large margin fluctuations. Schuff believes that continuing to diversify its revenue base by completing smaller projects—such as low-rise office buildings, healthcare facilities and other commercial and industrial structures—could reduce the impact of periodic adverse market or economic conditions as well as potential margin slippage that may accompany larger projects; |

• | Emphasize Innovative Services. Schuff focuses its design-build, engineering, detailing, fabrication and erection expertise on larger, more complex projects, where it typically experiences less competition and more advantageous negotiated contract opportunities. Schuff has extensive experience in providing services requiring complex fabrication and erection techniques and other unusual project needs, such as specialized transportation, steel treatment or specialty coating applications. These service capabilities have enabled Schuff to address such design-sensitive projects as stadiums and uniquely designed hotels and casinos; and |

2

• | Diversify Customer and Product Base. Although Schuff seeks to garner a leading share of the geographic and product markets in which it competes, it also seeks to diversify its construction projects across a wide range of commercial, industrial, and specialty projects, including projects related to the oil & gas and alternative energy industries. |

Services and/or Products and Customers

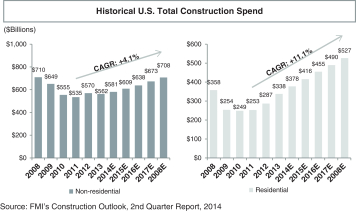

Schuff operates primarily within the over $550 billion non-residential construction industry, which serves a diverse set of end markets. As shown on the chart below, while non-residential construction has shown only a small rebound since 2011, industry experts expect that it will follow the already significant rebound in residential construction spending. Despite only a modest increase in non-residential construction spending, Schuff’s backlog has already rebounded to pre-economic crisis levels.

Schuff consists of three business units spread across diverse steel markets: Schuff Steel Company (steel fabrication and erection), Schuff Steel Management Company (management of smaller projects, leveraging subcontractors) and Aitken, Inc. (manufacturing of equipment for the oil & gas industry). For the fiscal year ended December 28, 2014, Schuff Steel’s revenues of $485 million account for 92% of Schuff’s total revenue. Schuff Steel Management Company’s revenues of $29 million account for 5% of Schuff’s total revenue. Aitken, Inc.’s revenues of $5 million account for 1% of Schuff’s total revenue. Schuff also provides fabricated steel to Canada and other select countries, including Panama, where Schuff owns 49% of Panama-based Schuff Hopsa Engineering, Inc., an engineering design, steel fabrication and erection company, Empresas Hopsa, S.A. Schuff Hopsa Engineering, Inc.’s revenues of $13 million account for 3% of Schuff’s total revenue. During 2014, Schuff had revenues from a customer that totaled approximately 12% of its revenues. The revenue amounts above include activity prior to HC2’s acquisition. Please refer to the “Results of Operations” discussion within Item 7. for further discussion surrounding pro forma revenue.

Schuff’s size gives it production capacity to complete large-scale, demanding projects, with typical utilization per facility ranging from 50%-88% and a sales pipeline that includes over $800 million in potential revenue generation. Schuff has benefitted from being one of the largest players in a market that is highly fragmented across many small firms. Schuff outperformed many of its competitors in the recent downturn. Due to its strong financial position and continued access to bonding facilities, whereas many competitors were forced to close their doors.

Schuff ensures a highly efficient and cost-effective construction process by focusing on partnering with all project participants and utilizing its extensive design-build and design-assist capabilities with its clients. Additionally, Schuff enjoys in-house fabrication and erection combined with access to a network of subcontractors for smaller projects in order to provide high quality solutions for its customers. Schuff offers a range of services across a broad geography through its 10 fabrication shops and 10 sales and management facilities located in the United States and Panama.

Schuff operates with minimal bonding requirements, with the current balance less than 13% of backlog, and bonding is reduced as projects are billed, rather than upon completion. Schuff has limited raw material cost exposure by securing fixed prices from mills at contract bid, and utilizing its purchasing power as the largest domestic buyer of wide flange beam in the United States.

3

Products

Schuff Steel offers a variety of services to its customers which it believes enhances our ability to obtain and successfully complete projects. These services fall into six distinct groups: design-assist/design-build, preconstruction design & budgeting, steel management, fabrication, erection, and Building Information Modeling (“BIM”). Schuff primarily operates in the southwestern and southeastern United States geographic markets.

• | Design-Assist/Design-Build: Using the latest technology and BIM, Schuff works to provide clients with cost-effective steel designs. The end result is turnkey structural steel solutions for its diverse client base. |

• | Preconstruction Design & Budgeting: Clients who contact Schuff in the early stages of planning can receive a Schuff-performed analysis of the structure and cost breakdown. Both of these tools allow clients to accurately plan and budget for any upcoming project. |

• | Steel Management: Using Schuff’s proprietary Schuff Steel Integrated Management System (“SSIMS”), Schuff can track any piece of steel and instantly know its location. Additionally, Schuff can help clients manage steel subcontracts, providing clients with savings on raw steel purchases and giving them access to variety of Schuff-approved subcontractors. |

• | Fabrication: Through its nine fabrication shops in California, Arizona, Texas, Kansas and Georgia, Schuff has one of the highest fabrication capacities in America. Schuff has over 1.3 million square feet of steel under roof and a maximum annual fabrication capacity of approximately 300,000 tons. |

• | Erection: Named the nation’s top steel erector in 2007, 2008, 2011, 2013 and 2014 by Engineering News-Record, Schuff knows how to add value to its project through safe and efficient erection of steel structures. |

• | BIM: Schuff is experienced in using BIM on every project to manage its role efficiently. Additionally Schuff’s use of SSIMS in conjunction with BIM allows for real-time reporting of a project’s progress and information-rich model review. |

Schuff Steel Management Company provides turn-key steel fabrication and erection services with an expertise in project management. Using these skills, Schuff Steel Management Company uses its relationships with reliable subcontractors and erectors, along with state-of-the-art management systems, to deliver excellence to clients.

Schuff’s third product line, Aitken, is a manufacturer of equipment used in the oil, gas, petrochemical and pipeline industries. Aitken supplies the following products both nationwide and internationally.

• | Strainers: Temporary Cone and Basket Strainers, Tee Type Srainers, Vertical and Horizontal Permanent Line Strainers, Fabricated Duplex Strainers |

• | Measurement Equipment: Orifice Meter Tubes, Orifice Plates, Orifice Flanges, Seal Pots, Flow Nozzles, Venturi Tubes, Low Loss Tubes, Straightening Vanes |

• | Major Products: Spectacle Blinds, Paddle Blinds, Drip Rings, Bleed Rings, and Test Inserts, ASME Vessels, Launchers, Pipe Spools |

Customers

Schuff offers its integrated steel construction services primarily to general contractors and engineering firms that specialize in a wide variety of projects, including the following: hotels and casinos, office complexes, hospitals, manufacturing plants, shopping malls and centers, sports stadiums, power plants, restaurants, convention facilities, entertainment complexes, airports, schools, churches and warehouses. During 2014, Schuff had revenues from a customer that totaled approximately 12% of its revenues. During 2013, Schuff did not have revenues from any one customer in excess of 10% of its revenues.

Suppliers

Schuff currently purchases a majority of its steel from various foreign and domestic steel producers but is not dependent on any one producer.

Sales and Distributions

Schuff offers its services primarily to general contractors and engineering firms that focus on a wide array of projects such as airports, malls, power plants, stadiums, shopping malls and centers. Schuff obtains these contracts through competitive bidding or negotiation, which generally are fixed-price, cost-plus, or unit cost arrangements. Bidding and negotiations require Schuff to estimate the costs of the project up front with most projects typically lasting from one to 12 months.

4

Marketing

Sales managers lead Schuff’s domestic sales and marketing efforts. Each sales manager is responsible primarily for estimating, sales, and marketing efforts in defined geographic areas. In addition, Schuff employs full-time project estimators and chief estimators. Schuff’s sales representatives maintain relationships with general contractors, architects, engineers, and other potential sources of business to determine potential new projects under consideration. Schuff generates future project reports to track the weekly progress of new opportunities. Schuff’s sales efforts are further supported by most of its executive officers and engineering personnel, who have substantial experience in the design, fabrication, and erection of structural steel and heavy steel plate.

Schuff competes for new project opportunities through its relationships and interaction with its active and prospective customer base, which provides valuable current market information and sales opportunities. In addition, Schuff is contacted by governmental agencies in connection with public construction projects, and by large private-sector project owners, general contractors and engineering firms in connection with new building projects such as plants, warehouse and distribution centers, and other industrial and commercial facilities.

Upon selection of projects to bid or price, Schuff’s estimating division reviews and prepares projected costs of shop, field, detail drawing preparation and crane hours, steel and other raw materials, and other costs. On bid projects, a formal bid is prepared detailing the specific services and materials Schuff plans to provide, payment terms and project completion timelines. Upon acceptance, Schuff’s bid proposal is finalized in a definitive contract.

Backlog

Schuff’s backlog was $357.0 million ($305.3 million under contracts or purchase orders and $51.7 million under letters of intent) at December 31, 2014. Schuff’s backlog increases as contract commitments, letters of intent, notices to proceed and purchase orders are obtained, decreases as revenues are recognized and increases or decreases to reflect modifications in the work to be performed under the contracts, notices to proceed, letters of intent or purchase orders. Schuff’s backlog can be significantly affected by the receipt, or loss, of individual contracts. Approximately $203.1 million, representing 56.9% of Schuff’s backlog at December 31, 2014, was attributable to five contracts, letters of intent, notices to proceed or purchase orders. If one or more of these large contracts or other commitments are terminated or their scope reduced, Schuff’s backlog could decrease substantially. At December 29, 2013, its backlog was $426.9 million ($370.1 million under contracts or purchase orders and $56.8 million under letters of intent). Backlog at December 30, 2012 was $186.2 million ($167.3 million under contracts or purchase orders and $18.9 million under letters of intent).

Competition

The principal geographic and product markets Schuff serves are highly competitive, and this intense competition is expected to continue. Schuff competes with other contractors for commercial, industrial and specialty projects on a local, regional, or national basis. Continued service within these markets requires substantial resources and capital investment in equipment, technology and skilled personnel, and certain of Schuff’s competitors have financial and operating resources greater than Schuff. Competition also places downward pressure on Schuff’s contract prices and margins. Among the principal competitive factors within the industry are price, timeliness of completion of projects, quality, reputation, and the desire of customers to utilize specific contractors with whom they have favorable relationships and prior experience. While Schuff believes that it maintains a competitive advantage with respect to these factors, failure to continue to do so or to meet other competitive challenges could have a material adverse effect on Schuff’s results of operations, cash flows or financial condition.

Employees

As of December 28, 2014, Schuff employed approximately 1,470 people across the country. The number of persons Schuff employs on an hourly basis fluctuates directly in relation to the amount of business Schuff performs. Certain of the fabrication and erection personnel Schuff employs are represented by the United Steelworkers of America, the International Association of Bridge, Structural, Ornamental and Reinforcing Iron Workers Union, the International Union of Operating Engineers, and the International Brotherhood of Boilermakers, Iron Shipbuilders, Blacksmiths, Forgers and Helpers Union. Schuff is a party to several separate collective bargaining agreements with these unions in certain of its current operating regions, which expire (if not renewed) at various times in the future. Approximately 25% of Schuff’s employees are covered under various collective bargaining agreements. Most of Schuff’s collective bargaining agreements are subject to automatic annual or other renewal unless either party elects to terminate the agreement on the scheduled expiration date. Approximately 11% of Schuff’s employees are covered under a collective bargaining agreement that expires within the next year. Schuff considers its relationship with its employees to be good and, other than sporadic and unauthorized work stoppages of an

5

immaterial nature, none of which have been related to its own labor relations, Schuff has not experienced a work stoppage or other labor disturbance.

Schuff strategically utilizes third-party fabrication and erection subcontractors on many of its projects and also subcontracts detailing services from time to time when economically beneficial and/or Schuff requires additional capacity for such services. Schuff’s inability to engage fabrication, erection and detailing subcontractors on terms favorable to it could limit its ability to complete projects in a timely manner or compete for new projects and could have a material adverse effect on its operations.

Legal, Environmental and Insurance

In December 2012, British Petroleum (“BP”) brought suit against Carboline Company (“Carboline”), Trinity Steel Fabricators, Inc. (“Trinity”), the Schuff’s subsidiary, Schuff Steel Company (“SSC”), Tecon Services, Inc. (“Tecon”) and Alfred Miller Contracting Company (“AMC”) in regards to fabrication work on a BP refinery in Indiana. BP alleged that the Schuff subsidiary and others defectively fireproofed certain pieces of steel used in a modernization project at the refinery. AMC and Tecon filed a Petition for Damages and Declaratory Judgment against Caroline, BP Corporation North America Inc., BP Products North America, Trinity, SSC, Schuff Steel-Gulf Coast, Inc., and others. In April 2014, the lawsuits were successfully mediated and a confidential settlement agreement was executed on June 16, 2014. Both cases were dismissed in July 2014.

Schuff is subject to other claims and legal proceedings that arise in the ordinary course of business. Such matters are inherently uncertain, and there can be no guarantee that the outcome of any such matter will be decided favorably to Schuff or that the resolution of any such matter will not have a material adverse effect upon Schuff or the Company’s business, consolidated financial position, results of operations or cash flows. Neither Schuff nor the Company believes that any of such pending claims and legal proceedings will have a material adverse effect on its business, consolidated financial position, results of operations or cash flows.

Schuff’s operations and properties are affected by numerous federal, state and local environmental protection laws and regulations, such as those governing discharges to air and water and the handling and disposal of solid and hazardous wastes. Compliance with these laws and regulations has become increasingly stringent, complex and costly. There can be no assurance that such laws and regulations or their interpretation will not change in a manner that could materially and adversely affect Schuff’s operations. Certain environmental laws, such as the CERCLA and its state law counterparts, provide for strict and joint and several liability for investigation and remediation of spills and other releases of toxic and hazardous substances. These laws may apply to conditions at properties currently or formerly owned or operated by an entity or its predecessors, as well as to conditions at properties at which wastes or other contamination attributable to an entity or its predecessors come to be located. Although Schuff has not incurred any material environmental related liability in the past and believes that it is in material compliance with environmental laws, there can be no assurance that Schuff, or entities for which it may be responsible, will not incur such liability in connection with the investigation and remediation of facilities it currently operates (or formerly owned or operated) or other locations in a manner that could materially and adversely affect its operations.

Schuff maintains commercial general liability insurance in the amount of $1.0 million per occurrence and $2.0 million in the aggregate. In addition, Schuff maintains umbrella coverage limits of $25.0 million. Schuff also maintains insurance against property damage caused by fire, flood, explosion and similar catastrophic events that may result in physical damage or destruction of its facilities and property. All policies are subject to various deductibles and coverage limitations. Although Schuff’s management believes that its insurance is adequate for its present needs, there can be no assurance that it will be able to maintain adequate insurance at premium rates that management considers commercially reasonable, nor can there be any assurance that such coverage will be adequate to cover all claims that may arise.

GMSL

GMSL is a global offshore engineering company focused on specialist subsea services across three market sectors, namely telecommunications, oil & gas and offshore power. GMSL’s operations make up our Marine Services segment.

Strategy Overview

GMSL is a leading independent operator in the subsea cable installation and maintenance markets. GMSL aims to maintain its leading market position in the telecommunications maintenance segment and will look for opportunities to grow the installation activities in the three main segments of the market and installation in the telecommunications sector while capitalizing on high market growth in the oil & gas sector through expansion of its installation and maintenance services in that sector. In order to accomplish these goals GMSL has crafted a comprehensive strategy which includes:

6

• | Re-entering the offshore power market in November 2015 after expiration of the Prysmian non-compete; |

• | Diversify the business by pursuing growth within GMSL’s three market segments (telecommunications, oil & gas, and offshore power) which will strengthen GMSL’s quality of earnings and reduce exposure to one particular market segment; |

• | Retain and build its leading position in telecommunications maintenance and installation; |

• | Exploit high market growth in oil & gas, first in installation, then in maintenance; |

• | Work to develop convergence of GMSL’s maintenance services across all three market segments; and |

• | Encourage overall consolidation in the wider subsea cables market by pursuing targeted mergers & acquisitions, joint ventures or partnerships, allowing a larger operating platform and benefitting from increased operating efficiencies. |

GMSL has a highly experienced management team with a proven track record and has demonstrated the ability to enter new markets and generate returns for investors. The senior management team has a combined 70 years of experience within the telecommunications, oil & gas, and offshore power segments.

GMSL’s three sectors of focus for providing subsea cable services are telecommunications installation and maintenance, oil & gas installation and offshore power installation.

Telecommunications: GMSL provides maintenance and installation to its global telecommunications customers. GMSL has a long, well-established reputation in the telecommunications sector and is considered a leading provider of subsea services in the industry. It operates in a mature market and is the largest independent provider in the maintenance segment. GMSL provides vessels on standby to repair fiber optic telecommunications cables in defined geographic zones, and its maintenance business is provided through contracts with consortia of up to 60 global telecommunications providers. Typically, GMSL enters into five to seven year contracts to provide maintenance to cable systems that are located in specific geographical areas. These contracts provide highly stable, predictable and recurring revenue and earnings. Additionally, GMSL provides installation of cable systems including route planning, mapping, route engineering, cable-laying, trenching and burial. GMSL’s installation business is project-based with contracts typically lasting one to five months.

Oil & Gas: GMSL provides installation, maintenance and repair of fiber optic communication and power infrastructure to offshore platforms, through which it realizes higher margins due to implementation complexity. Its primary activities include providing power from shore, enabling fiber-based communication between platforms and shore-based systems and installing permanent reservoir monitoring systems which allow customers to monitor subsea seismic data. The majority of GMSL’s oil & gas business is contracted on a project-by-project basis with major energy producers or Tier I engineering, procurement and construction (EPC) contractors.

Offshore Power: GMSL’s former subsidiary Global Marine Energy (“GME”) was established in 2011 as the vehicle for GMSL’s significant offshore power activities, which include installing inter-array power cables for use in offshore wind farms and in the offshore wind market. GME was sold to Prysmian UK Group Limited (“Prysmian”) in November 2012 in anticipation of a temporary downturn in the offshore power market and the onerous contracting regime present at the time. As part of this sale, GMSL entered into a non-compete agreement regarding offshore power operations with Prysmian lasting until November 2015 but retained certain key personnel and assets to ensure that GMSL maintained its core capabilities and experience in the offshore power sector. Following entry into this non-compete agreement, GMSL continued to install offshore power cables on behalf of Prysmian with chartered vessels through June 2014. GMSL expects to re-enter the high growth, high margin offshore power market upon the expiration of the non-compete agreement. Given that renewable energy production is predicted to grow over the next decade, with a substantial proportion of that energy to be harvested offshore, GMSL is well positioned to capitalize on this anticipated growth of the offshore alternative energy market, with a strong presence in Northern Europe and Asia, especially China.

Services and/or Products and Customers

GMSL is a pioneer in the subsea cable industry having laid the first subsea cable in the 1850s and installed the first transatlantic fiber optic cable (TAT-8) in 1988. Over the last 30 years, GMSL estimates that it has installed approximately 300,000 kilometers of cable, which management believes represents almost a quarter of all the fiber optic cable on the global seabed today. GMSL is positioned as a global independent market leader in subsea cable installation and maintenance services and derives approximately 50% of its total revenue from long term, recurring maintenance contracts. GMSL has a strong financial position with a modest level of debt (consisting only of vessel financing), has delivered substantial growth during recent years, generates a substantial amount of cash and serves a diverse mix of global, blue-chip clients with excellent credit profiles. It has started a new phase of growth through applying its capabilities to the rapidly expanding oil & gas and offshore

7

power sectors (the latter of which GMSL anticipates re-entering in November 2015, as discussed below) while retaining a leading position in the telecommunications sector. As a result of this growth, GMSL has major offices in the United Kingdom and Singapore, and has additional presence in Bermuda, Canada, China, Indonesia and the Philippines. See Item IA—“Risk Factors—Risks Related to GMSL—GMSL derives a significant amount of its revenues from sales to customers in non-U.S. countries, which pose additional risks including economic, political and other uncertainties” for a description of risks attendant to such foreign operations. GMSL operates one of the largest specialist cable laying fleets in the world, consisting of seven vessels (five owned and two operated through long-term leases).

Growth Opportunities

Today, GMSL is positioned as a leading global independent market leader in subsea cable installation and maintenance services. GMSL has a strong financial position, has delivered substantial profit growth during recent years, and generates a substantial amount of cash. It has started a new phase of growth through transferring its capabilities to the rapidly expanding demand in the oil & gas and offshore power sectors (the latter of which GMSL anticipates re-entering in November 2015, as discussed above) while retaining its leading position in the telecommunications sector. GMSL believes it has installed more offshore wind inter-array cables than any other provider and, following the sale of GME in November 2012, remains well positioned as one of the leading installers of cables in the offshore power sector.

Following the sale of GME, GMSL has remained one of the leading installers of cables in relation to supporting the growth in the offshore power market and GMSL’s track record in these types of projects includes the following:

• | Experimental UK farm, Blythe, for Shell |

• | London Array Ltd: inter-array cables for London Array project |

• | RWE: 4 export cables for Gwynt y Mor project |

• | C-Power: inter-array cables for Thornton Bank project (Belgium) |

• | Dong Energy: Inter-array cables for Horns Rev project, Denmark (three phases) |

• | Vattenfall: 3 export cables for Kentish Flats project |

• | EON/Shell: power and fiber optic cables for Blythe project |

• | GT1: largest German wind farm to date |

Fleet Overview

GMSL operates one of the largest, specialist cable laying fleets consisting of 7 vessels (5 owned, 2 operated through long-term leases). The average age of GMSL’s owned and operated fleet is 22 years, which is less than the industry average. Each vessel is equipped with specialist inspection, burial, and survey equipment. By providing oil & gas, offshore power, and telecommunications installation as well as telecommunications maintenance, GMSL can retain vessels throughout their asset lives by cascading them through different uses as they age. This provides a significant competitive advantage as GMSL can retain vessels for longer and reduce the frequency of capital expenditure requirements with a longer amortization period. GMSL’s fleet has an estimated fair value of approximately $140 million (with approximately $75.7 million of associated vessel financing as of December 31, 2014) and are all manned by GMSL employees or long-term contractors.

Fleet Details

8

Vessels | Ownership | Lease Expiry | Joined Fleet | Age | Flag | Base Port | Market Value ($m) | |||||||||

Maintenance - GMSL | ||||||||||||||||

Wave Venture | GMSL | N/A | Purchased -1999 | 31 | UK | Victoria, Canada | $ | 5 | ||||||||

Pacific Guardian | GMSL | N/A | New Build -1984 | 30 | UK | Curacao | 9 | |||||||||

Wave Sentinel | GMSL | N/A | Purchased - 1999 | 18 | UK | Portland, UK | 16 | |||||||||

Cable Retriever | ICPL | Jan-23 | New Build - 1997 | 15 | Singapore | Batangas, Philippines | N/A | |||||||||

Installation – GMSL | ||||||||||||||||

Sovereign | GMSL | N/A | New Build - 1991 | 22 | UK | Portland, UK | 32 | |||||||||

Innovator (2) | DYVI Cableship AS | Mar-18 | New Build - 1995 | 18 | UK | Portland, UK | N/A | |||||||||

Networker | GMSL | N/A | New Build - 1999 | 14 | Panama | Batam, Indonesia | 7 | |||||||||

Total Value | $ | 69 | ||||||||||||||

SBSS Joint Venture Vessels (49% share) | ||||||||||||||||

Installation | ||||||||||||||||

CS Fu Hai | SBSS | N/A | Purchased - 2003 | 14 | Panama | Shanghai, China | $ | 38 | ||||||||

Bold Maverick | SBSS | N/A | Purchased - 2012 | 13 | Panama | Shanghai, China | 38 | |||||||||

CS Fu An | SBSS | N/A | Purchased - 2000 | 32 | Panama | Shanghai, China | 9 | |||||||||

Total Value | $ | 85 | ||||||||||||||

Owned Vessel Market Value | ||||||||||||||||

GMSL Vessels | $ | 69 | ||||||||||||||

SBSS Joint Venture Vessels | 42 | |||||||||||||||

Total Value | $ | 111 | ||||||||||||||

Product Research & Development

Drawing on its long experience in the subsea cable market, over the years GMSL has provided many important innovations to the subsea cable market. One such innovation was GEOCABLE, GMSL’s proprietary Geographical Information System (GIS), which GMSL believes to be the largest cable database in the market and was developed specifically to meet the needs of the cable industry. GEOCABLE is an important tool to any vendor planning subsea cable installation and GMSL sells data from GEOCABLE to third-party customers.

In addition to GEOCABLE, GMSL also developed and owns intellectual property associated with the Universal Joint in a consortium with other industry participants, a product which easily and effectively links together cables from different manufacturers. The Universal Joint has gained such prevalence in the industry that new fiber optic cables may be certified to the Universal Joint, which is a service provided by GMSL among others, so that the subsea cable manufacturer can ensure compatibility of their subsea cable with other existing subsea cables and the standardized equipment on board cable repair vessels. GMSL benefits from its sales of the Universal Joint, and proceeds from GMSL sponsored training of jointing skills, but GMSL also enjoys the industry leadership and brand enhancement that come with creation of an industry leading product.

Intellectual Property

GMSL is looking to protect its interests in intellectual property and closely monitors industry changes, including GEOCABLE and Universal Joint.

9

Customers

GMSL’s customer base is made up primarily of blue-chip companies. Within the two kinds of services provided by GMSL, maintenance and repair and installation, contract length varies. Maintenance and repair contracts tend to be long-term upon inception (5-7 years), with a relatively high level of expected renewal rates and the customer is typically a consortium of different cable owners such as national, regional and international telecommunication companies and others who have an owner in the subsea cables covered by the maintenance contract. GMSL charges a standing fee for cost of vessels in port plus margin, paid in advance proportionally by each member, and an additional daily call out fee for repairs paid by the specific cable owner(s). All four maintenance vessels are engaged on GMSL’s three current long term telecommunications maintenance contracts with ACMA, SEAIOCMA, and NAZ. Installation contracts tend to be much shorter term (30-150 days) and the counter party tends to be a single client. Contracts are typically bid for on a fixed-sum basis with an initial upfront payment plus subsequent installments providing working capital support. Due to the added complexity of cable installation as opposed to maintenance, GMSL generally realizes higher margins on its installation contracts, especially in the oil & gas and offshore power sectors.

Sales and Distributions

In the telecommunications cable market, cable maintenance is most often accomplished by zone maintenance contracts in which a consortium of telecommunications operators or cable owners contract with a maintenance provider like GMSL, over a long-term period of around five to six years. GMSL has three cable maintenance agreements and these are a steady, high-quality source of income for GMSL. These maintenance contracts are usually re-awarded to incumbent providers unless there are significant performance issues which ultimately may mean that GMSL likely need not expend extra capital on retaining these contracts. GMSL constantly has a focused sales plan to build relationships with current and potential customers at regional and corporate offices and readily leverages Huawei Technologies’ large sales organization.

Marketing

In the oil & gas sector, GMSL has a focused sales and marketing plan to create relationships with major players in the oil & gas industries. In particular and depending on the prevailing market conditions, GMSL hopes to use its expertise in installing PRM systems to forge new contacts with both the end users of PRM services, such as oil majors, and the PRM suppliers themselves. Additionally GMSL hopes to pursue a strategy of specialization in installing the small power and fiber optic cables that its competitors in the oil & gas and offshore power sectors find unprofitable and lack installation experience in.

In order to aid these plans for expansion, GMSL plans on increasing its fleet of maintenance and installation vessels anywhere from two to four vessels over the next several years. In particular, GMSL intends to acquire an installation vessel in 2015, to replace one of its older maintenance vessels in 2016, and purchase both a new remotely operated vehicle (“ROV”) in 2017 as well as a new build vessel in 2018, as funded 75/25 through vessel-financing.

Competition

GMSL is one of the few companies that provide subsea cable installation and maintenance services on a worldwide basis. GMSL competes for contracts with companies that have worldwide operations, as well as numerous others operating locally in various areas. There are a number of players, mainly Asian based, who focus primarily on their countries of origin. Competition for GMSL’s services historically has been based on vessel availability, location of or ability to deploy these vessels and associated subsea equipment, quality of service and price. The relative importance of these factors can vary depending on the customer or specific project and also over time based on the prevailing market conditions. The ability to develop, train and retain skilled engineering personnel is also an important competitive factor in GMSL’s markets.

GMSL believes that its ability to provide a wide range of subsea cable installation and maintenance services in the telecommunications, oil & gas and offshore power sectors on a worldwide basis enables it to compete effectively in the industry in which it operates. However, in some cases involving projects that require less sophisticated vessel and subsea equipment, smaller companies may be able to bid for contracts at prices uneconomical to GMSL. In addition, GMSL’s competitors generally have the capability to move their vessels to where GMSL operates from other locations with relative ease, which may impact competition in the markets it serves.

Management and Employees

As of December 31, 2014, GMSL employed 365 people. GMSL’s employees are not formally represented by any labor union or other trade organization although the majority of the seafarers are members of an established trade union. GMSL

10

considers relations with its employees to be satisfactory and it has never experienced a work stoppage or strike. GMSL regularly uses independent consultants and contractors to perform various professional services in different areas of the business, including in its installation and fleet operations and in certain administrative functions. Dick Fagerstal is a 3% interest holder, chairman and chief executive officer of Global Marine Holdings LLC, the parent holding company of Bridgehouse Marine Limited, and he is executive chairman of Global Marine Systems Limited. Mr. Fagerstal has served in an executive capacity for companies operating in various industries including energy, marine services, and their related infrastructure.

Legal, Environmental and Insurance

GMSL is from time to time subject to claims and legal proceedings that arise in the ordinary course of business. Such matters are inherently uncertain, and there can be no guarantee that the outcome of any such matter will be decided favorably to GMSL or that the resolution of any such matter will not have a material adverse effect upon GMSL’s business, consolidated financial position, results of operations or cash flows. GMSL does not believe that any of such pending claims and legal proceedings will have a material adverse effect on its business, consolidated financial position, results of operations or cash flows.

GMSL has various kinds of insurance coverage including protection and indemnity, hull and machinery, war risk, and property insurances, directors and officers liability insurance, contract warranty insurance for the maintenance contracts, and all other necessary corporate insurances. GMSL’s liability is capped and insured under each of its installation contracts.

Other Businesses and Investments

Outside of Schuff and GMSL, which collectively represented $383.6 million, or 70.1% of our net revenue for 2014, we currently have controlling equity positions in several other businesses.

• | In our Telecommunications segment, International Carrier Services, Inc. (“ICS”) is our 100% owned telecommunications business, through which we operate direct routes and provide premium voice communication services for national telecom operators, mobile operators, wholesale carriers, prepaid operators, VoIP service operators and Internet service providers. |

• | In our Life Sciences segment, we operate Pansend, LLC, which has an 80% interest in Genovel Orthopedics, Inc., which seeks to develop products to treat early osteoarthritis of the knee, and a 61% interest in GemDerm Aesthetics, Inc., which develops skin lightening technology. |

• | In our Utilities segment, we invested $15.5 million for a 51% stake in American Natural Gas (“ANG”), a compressed natural gas fueling company. |

In the interactive gaming sector, we acquired a 100% ownership interest in DMi, Inc., which owns licenses to create and distribute NASCAR® video games, for $6.0 million. We also have made several recent noncontrolling investments, including $14.2 million for an approximate 25% ownership interest in Novatel, a publicly listed company that designs and develops wireless communications technologies, and $5.6 million for a 40% interest in NerVve Technologies, Inc. (“NerVve Technologies”), an information technology company.

See Note 17—“Operating Segment and Related Information,” for additional detail regarding our operating segments.

Recent Divestitures

Historically, we operated a network of direct routes and provided premium voice communication services for national telecommunications, operators, mobile operators, wholesale carriers, prepaid operators, Voice over Internet Protocol (“VoIP”) service operators and Internet service providers (“ISPs”). We classified these services into two categories: Traditional Services and International Carrier Services (“ICS”). We provided these services from our two business units: North America Telecom (“NAT”) and ICS.

In the second quarter of 2013, we entered into a definitive purchase agreement to sell our NAT business for approximately $129 million. On July 31, 2013, we completed the initial closing of the sale of substantially all of our NAT business. The closing of the sale of the remainder of our NAT business, consisting of our subsidiary Primus Telecommunications, Inc. (“PTI”), was deferred pending the receipt of regulatory approvals. On July 31, 2014, having received the necessary regulatory approvals for PTI, we completed the divestiture of the remainder of our NAT business. We recorded a $13.8 million gain from the sale of the NAT business for the year ended December 31, 2013.

11

During 2013, we also provided certain growth services through our BLACKIRON Data business unit, which operated our pure data center operations in Canada. On April 17, 2013, we completed the sale of our BLACKIRON Data business for approximately $195.6 million (CAD$200.0 million). We recorded a $135.0 million gain from the sale of BLACKIRON Data during the second quarter of 2013.

Employees

As of December 31, 2014, we had approximately 1,886 employees, 1,870 of which were full-time employees. We consider our relations with our employees to be satisfactory.

Environmental Regulation

Our operations and properties, including those of Schuff and GMSL, are subject to a wide variety of increasingly complex and stringent foreign, federal, state and local environmental laws and regulations, including those concerning emissions into the air, discharge into waterways, generation, storage, handling, treatment and disposal of waste materials and health and safety of employees. Sanctions for noncompliance may include revocation of permits, corrective action orders, administrative or civil penalties and criminal prosecution. Some environmental laws provide for strict, joint and several liability for remediation of spills and other releases of hazardous substances, as well as damage to natural resources. In addition, companies may be subject to claims alleging personal injury or property damage as a result of alleged exposure to hazardous substances. These laws and regulations may also expose us to liability for the conduct of or conditions caused by others, or for our acts that were in compliance with all applicable laws at the time such acts were performed.

Compliance with federal, state and local provisions regulating the discharge of materials into the environment or relating to the protection of the environment has not had a material impact on our capital expenditures, earnings or competitive position. Based on our experience to date, we do not currently anticipate any material adverse effect on our business or consolidated financial position, results of operations or cash flows as a result of future compliance with existing environmental laws and regulations. However, future events, such as changes in existing laws and regulations or their interpretation, more vigorous enforcement policies of regulatory agencies, or stricter or different interpretations of existing laws and regulations, may require additional expenditures by us, which may be material. Accordingly, there can be no assurance that we will not incur significant environmental compliance costs in the future.

Corporate Information

The Company’s executive offices are located at 460 Herndon Parkway, Suite 150, Herndon, VA 20170. The Company’s telephone number is (703) 456-4100. Our Internet address is www.hc2.com. We make available free of charge through our Internet website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the United States Securities and Exchange Commission (the “SEC”). The information on our website is not a part of this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

A wide range of factors could materially affect our overall performance, the performance of particular businesses and our results of operations, and therefore, an investment in us is subject to risks and uncertainties. In addition to factors affecting specific business operations and the financial results of those operations identified elsewhere in this Annual Report on Form 10-K, the following factors, among others, could adversely affect our operations. While each risk is described separately below, some of these risks are interrelated and it is possible that certain risks could trigger the applicability of other risks described below. Also, the risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties not presently known to us, or that are currently deemed immaterial, could also potentially impair our overall performance, the performance of particular businesses and our results of operations.

Risks Related to Our Businesses

We have experienced significant historical, and may experience significant future, operating losses and net losses, which may hinder our ability to meet working capital requirements or service our indebtedness, and we cannot assure you that we will generate sufficient cash flow from operations to meet such requirements or service our indebtedness.

We cannot assure you that we will recognize net income in future periods. If we cannot generate net income or sufficient operating profitability, we may not be able to meet our working capital requirements or service our indebtedness. Our ability to

12

generate sufficient cash for our operations will depend upon, among other things, our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, many of which are beyond our control. We recognized a net loss of $14.4 million in 2014, net income of $111.6 million in 2013 (after taking into account $148.8 million of gain from the sale of discontinued operations, net of tax) and net income of $27.9 million in 2012 (after taking into account $94.3 million of gain from the sale of discontinued operations, net of tax), and have incurred net losses in prior periods.

We cannot assure you that our business will generate cash flow from operations in an amount sufficient to fund our liquidity needs. If our cash flows and capital resources are insufficient, we may be forced to reduce or delay capital expenditures, sell assets and/or seek additional capital or financings. Our ability to obtain financings will depend on the condition of the capital markets and our financial condition at such time. Any financings could be at high interest rates and may require us to comply with covenants, which could further restrict our business operations. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our obligations. We may not be able to consummate those dispositions for fair market value or at all. Furthermore, any proceeds that we could realize from any such disposition may not be adequate to meet our obligations. We recognized cash flows from operating activities of $32.8 million in 2014, $(20.3) million in 2013 and $23.6 million in 2012.

We may not be able to fully utilize our net operating loss and other tax carryforwards.

Our ability to utilize our net operating loss (“NOL”) and other tax carryforward amounts to reduce taxable income in future years may be limited for various reasons, including if future taxable income is insufficient to recognize the full benefit of such NOL carryforward amounts prior to their expiration. Additionally, our ability to fully utilize these U.S. tax assets can also be adversely affected by “ownership changes” within the meaning of Sections 382 and 383 of the Internal Revenue Code of 1986, as amended (the “Code”). An ownership change is generally defined as a greater than 50% increase in equity ownership by “5% shareholders” (as that term is defined for purposes of Sections 382 and 383 of the Code) in any three year period.

In 2014, substantial acquisitions of our common stock were reported by new beneficial owners on Schedule 13D filings made with the SEC and we issued shares of our Preferred Stock, which are convertible into a substantial number of shares of our common stock. During the second quarter of 2014, we completed a Section 382 review. The conclusions of this review indicated that an ownership change had occurred as of May 29, 2014. Our annual Section 382 base limit following the ownership change is estimated to be $2.3 million per year. As of December 31, 2014, we had an estimated U.S. NOL carryforward in the amount of $62.7 million.

We are dependent on certain key personnel, the loss of which may adversely affect our financial condition or results of operations.

HC2 and its operating subsidiaries depend, and will continue to depend in the foreseeable future, on the services of HC2’s and each such subsidiary’s executive management team and other key personnel, which may consist of a relatively small number of individuals that possess sales, marketing, engineering, financial and other

skills that are critical to the operation of our businesses. The ability to retain officers and key senior employees is important to our success and future growth. Competition for these professionals can be intense, and we may not be able to retain and motivate our existing management and key personnel, and continue to compensate such individuals competitively. The unexpected loss of the services of one or more of these individuals could have a detrimental effect on the financial condition or results of operations of our businesses, and could hinder the ability of such businesses to effectively compete in the various industries in which we operate.

We may not be able to attract additional skilled personnel.

We may not be able to attract new personnel, including management and technical and sales personnel, necessary for future growth or to replace lost personnel. Competition for the best personnel in our businesses can be intense. Our financial condition and results of operations could be materially adversely affected if we are unable to attract qualified personnel.

Because we face significant competition for acquisition and business opportunities, including from numerous companies with a business plan similar to ours, it may be difficult for us to fully execute our business strategy. Additionally, our subsidiaries also operate in highly competitive industries, limiting their ability to gain or maintain their positions in their respective industries.

We expect to encounter intense competition for acquisition and business opportunities from both strategic investors and other entities having a business objective similar to ours, such as private investors (which may be individuals or investment

13

partnerships), blank check companies, and other entities, domestic and international, competing for the type of businesses that we may intend to acquire. Many of these competitors possess greater technical, human and other resources, or more local industry knowledge, or greater access to capital, than we do and our financial resources will be relatively limited when contrasted with those of many of these competitors. These factors may place us at a competitive disadvantage in successfully completing future acquisitions and investments.

In addition, while we believe that there are numerous target businesses that we could potentially acquire or invest in, our ability to compete with respect to the acquisition of certain target businesses that are sizable will be limited by our available financial resources. We may need to obtain additional financing in order to consummate future acquisitions and investment opportunities and cannot assure you that any additional financing will be available to us on acceptable terms, or at all. This inherent competitive limitation gives others an advantage in pursuing acquisition and investment opportunities.

Furthermore, our subsidiaries also face competition from both traditional and new market entrants that may adversely affect them as well, as discussed below in the risk factors related to Schuff, GMSL and our ICS operations.

Future acquisitions or business opportunities could involve unknown risks that could harm our business and adversely affect our financial condition and results of operations.

We are a diversified holding company that owns interests in a number of different businesses. We have in the past, and may in the future, acquire businesses or make investments, directly or indirectly through our subsidiaries, that involve unknown risks, some of which will be particular to the industry in which the investment or acquisition targets operate, including risks in industries with which we are not familiar or experienced. Although we intend to conduct appropriate business, financial and legal due diligence in connection with the evaluation of future investment or acquisition opportunities, there can be no assurance our due diligence investigations will identify every matter that could have a material adverse effect on us. We may be unable to adequately address the financial, legal and operational risks raised by such investments or acquisitions, especially if we are unfamiliar with the relevant industry. The realization of any unknown risks could expose us to unanticipated costs and liabilities and prevent or limit us from realizing the projected benefits of the investments or acquisitions, which could adversely affect our financial condition and liquidity. In addition, our financial condition, results of operations and the ability to service our debt may be adversely impacted depending on the specific risks applicable to any business we invest in or acquire and our ability to address those risks.

We will increase our size in the future, and may experience difficulties in managing growth.

We have adopted a business strategy that contemplates that we will expand our operations, including in connection with or in anticipation of any future acquisitions or other business opportunities, and as a result we are required to increase our level of corporate functions, which may include hiring additional personnel to perform such functions and enhancing our information technology systems. Any future growth may increase our corporate operating costs and expenses and impose significant added responsibilities on members of our management, including the need to identify, recruit, maintain and integrate additional employees and implement enhanced informational technology systems. Our future financial performance and our ability to compete effectively will depend, in part, on our ability to manage any future growth effectively.

Our officers, directors, stockholders and their respective affiliates may have a pecuniary interest in certain transactions in which we are involved, and may also compete with us.

While we have adopted a code of ethics applicable to our officers and directors reasonably designed to promote the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, we have not adopted a policy that expressly prohibits our directors, officers, stockholders or affiliates from having a direct or indirect pecuniary interest in any transaction to which we are a party or have an interest. Nor do we have a policy that expressly prohibits any such persons from engaging for their own account in business activities of the types conducted by us. We have in the past engaged in transactions in which such persons have an interest and, subject to the terms of any applicable covenants in financing arrangements or other agreements we may enter into from time to time, may in the future enter into additional transactions in which such persons have an interest. In addition, such parties may have an interest in certain transactions such as strategic partnerships or joint ventures in which we are involved, and may also compete with us.

In the course of their other business activities, certain of our current and future directors and officers may become aware of business and acquisition opportunities that may be appropriate for presentation to our Company as well as the other entities with which they are affiliated. Such directors and officers may therefore not present otherwise attractive business or acquisition opportunities to us.

14

Certain of our current and future directors and officers may become aware of business and acquisition opportunities which may be appropriate for presentation to us as well as the other entities with which they are or may be affiliated. Due to those directors’ and officers’ affiliations with other entities, they may have obligations to present potential business and acquisition opportunities to those entities, which could cause conflicts of interest. Moreover, in accordance with Delaware law, our certificate of incorporation contains a provision that renounces our expectation to certain corporate opportunities that are presented to our current and future directors that serve in capacities with other entities. Accordingly, our directors and officers may not present otherwise attractive business or acquisition opportunities to us.

We may suffer adverse consequences if we are deemed an investment company and we may incur significant costs to avoid investment company status.

We have not held, and do not hold, ourselves out as an investment company and do not believe we are an investment company under the Investment Company Act of 1940. If the SEC or a court were to disagree with us, we could be required to register as an investment company. This would subject us to disclosure and accounting rules geared toward investment, rather than operating, companies; limiting our ability to borrow money, issue options, issue multiple classes of stock and debt, and engage in transactions with affiliates; and requiring us to undertake significant costs and expenses to meet the disclosure and regulatory requirements to which we would be subject as a registered investment company.

From time to time we may be subject to litigation for which we may be unable to accurately assess our level of exposure and which, if adversely determined, may have a material adverse effect on our financial condition and results of operations.