Attached files

| file | filename |

|---|---|

| EX-31.1 - GULF RESOURCES, INC. | e614775_ex31-1.htm |

| EX-32.1 - GULF RESOURCES, INC. | e614775_ex32-1.htm |

| EX-31.2 - GULF RESOURCES, INC. | e614775_ex31-2.htm |

| EX-23.1 - GULF RESOURCES, INC. | e614775_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

Or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number 001-34499

Gulf Resources, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

13-3637458

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Level 11,Vegetable Building, Industrial Park of the East Shouguang City, Shandong, China

|

262700

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

+86 (536) 567-0008

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $0.0005 par value

|

NASDAQ Global Select Market

|

Securities registered pursuant to section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of June 30, 2015, the aggregate market value of the common stock of the registrant held by non-affiliates (excluding shares held by directors, officers and others holding more than 5% of the outstanding shares of the class) was $51,733,034 based upon a closing sale price of $ $2.07.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15 of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o No o

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

As of March 11, 2016, the registrant had outstanding 46,007,120 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement relating to the Registrant’s 2016 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

|

PART I

|

||||

|

Item 1.

|

|

|

1

|

|

|

Item 1A.

|

|

|

13

|

|

|

Item 1B

|

27

|

|||

|

Item 2.

|

|

|

27

|

|

|

Item 3.

|

|

|

37

|

|

|

Item 4.

|

|

|

37

|

|

|

PART II

|

||||

|

Item 5.

|

|

|

38

|

|

|

Item 6.

|

|

|

39

|

|

|

Item 7.

|

|

|

40

|

|

|

Item 7A.

|

|

|

55

|

|

|

Item 8.

|

|

|

55

|

|

|

Item 9.

|

|

|

56

|

|

|

Item 9A.

|

|

|

57

|

|

|

Item 9B.

|

|

|

59

|

|

|

PART III

|

||||

|

Item 10.

|

|

|

59

|

|

|

Item 11.

|

|

|

59

|

|

|

Item 12.

|

|

|

59

|

|

|

Item 13.

|

|

|

59

|

|

|

Item 14.

|

|

|

59

|

|

|

PART IV

|

||||

|

Item 15.

|

|

|

60

|

|

|

|

63

|

|||

This report contains forward-looking statements that reflect management's current views and expectations with respect to our business, strategies, future results and events, and financial performance. All statements made in this report other than statements of historical fact, including statements that address operating performance, events or developments that management expects or anticipates will or may occur in the future, including statements related to future reserves, cash flows, revenues, profitability, adequacy of funds from operations, statements expressing general optimism about future operating results and non-historical information, are forward-looking statements. In particular, the words "believe", "expect", "intend", "anticipate", "estimate", "plan", "may", "will", variations of such words and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements and their absence does not mean that the statement is not forward-looking. Readers should not place undue reliance on forward-looking statements which are based on management's current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include those discussed in this report, particularly under the caption "Risk Factors". Except as required under the federal securities laws, we do not undertake any obligation to update the forward-looking statements in this report.

PART I

Item 1. Business.

Introduction

We manufacture and trade bromine and crude salt, manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals, and manufacture and sell materials for human and animal antibiotics. To date, our products have been sold only within the People’s Republic of China. As used in this report, the terms "we," "our," "Company" and "Gulf Resources" refers to Gulf Resources, Inc. and its wholly-owned subsidiaries, and the terms “ton” and “tons” refers to metric tons, in each case, unless otherwise stated or the context requires otherwise. All information in this report gives retroactive effect to a 4-for-1 reverse stock split of our common stock effected on October 12, 2009.

The functional currency of the Company’s operating foreign subsidiaries is the Renminbi (“RMB”), which had an average exchange rate of $0.16281 and $0.16066 during fiscal year 2014 and 2015, respectively. The functional and reporting currency of the Company is the United States dollar (“USD” or $”).

Our Corporate History

We are incorporated in Nevada. From November 1993 through August 2006, we were engaged in the business of owning, leasing and operating coin and debit card pay-per copy photocopy machines, fax machines, microfilm reader-printers and accessory equipment under the name “Diversifax, Inc.”. Due to the increased use of internet services, demand for our services declined sharply, and in August 2006, our Board of Directors decided to discontinue our operations.

Upper Class Group Limited, incorporated in the British Virgin Islands in July 2006, acquired all the outstanding stock of Shouguang City Haoyuan Chemical Company Limited ("SCHC"), a company incorporated in Shouguang City, Shandong Province, the People's Republic of China (the “PRC”), in May 2005. At the time of the acquisition, members of the family of Mr. Ming Yang, our president and former chief executive officer, owned approximately 63.20% of the outstanding shares of Upper Class Group Limited. Since the ownership of Upper Class Group Limited and SCHC was then substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Upper Class Group Limited recognized the assets and liabilities transferred at their carrying amounts.

On December 12, 2006, our Company, then known as Diversifax, Inc., a public "shell" company, acquired Upper Class Group Limited and SCHC. Under the terms of the agreement, the stockholders of Upper Class Group Limited received 13,250,000 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of voting common stock of Gulf Resources, Inc. in exchange for all outstanding shares of Upper Class Group Limited. Members of the Yang family received approximately 62% of our common stock as a result of the acquisition. Under accounting principles generally accepted in the United States, the share exchange is considered to be a capital transaction rather than a business combination. That is, the share exchange is equivalent to the issuance of stock by Upper Class Group Limited for the net assets of Gulf Resources, Inc., accompanied by a recapitalization, and is accounted for as a change in capital structure. Accordingly, the accounting for the share exchange is identical to that resulting from a reverse acquisition, except no goodwill is recorded. Under reverse takeover accounting, the post reverse acquisition comparative historical financial statements of the legal acquirer, Gulf Resources, Inc., are those of the legal acquiree, Upper Class Group Limited. Share and per share amounts stated have been retroactively adjusted to reflect the share exchange. On February 20, 2007, we changed our corporate name to Gulf Resources, Inc.

On February 5, 2007, we acquired Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"), a company incorporated in the People's Republic of China, in October 2000. Under the terms of the acquisition agreement, the stockholders of SYCI received a total of 8,094,059 (restated for the 2-for-1 stock split in 2007 and the 1-for-4 stock split in 2009) shares of common stock of Gulf Resources, Inc. in exchange for all outstanding shares of SYCI's common stock. Simultaneously with the completion of the acquisition, a dividend of $2,550,000 was paid to the former stockholders of SYCI. At the time of the acquisition, approximately 49.1% of the outstanding shares of SYCI were owned by Ms. Yu, Mr. Yang’s wife, and the remaining 50.9% of the outstanding shares of SYCI were owned by SCHC, all of whose outstanding shares were owned by Mr. Yang and his wife. Since the ownership of Gulf Resources, Inc. and SYCI are substantially the same, the acquisition was accounted for as a transaction between entities under common control, whereby Gulf Resources, Inc. recognized the assets and liabilities of SYCI at their carrying amounts. Share and per share amounts have been retroactively adjusted to reflect the acquisition.

To satisfy certain ministerial requirements necessary to confirm certain government approvals required in connection with the acquisition of SCHC by Upper Class Group Limited, all of the equity interest of SCHC were transferred to a newly formed Hong Kong corporation named Hong Kong Jiaxing Industrial Limited (“Hong Kong Jiaxing”) all of the outstanding shares of which are owned by Upper Class Group Limited. The transfer of all of the equity interest of SCHC to Hong Kong Jiaxing received approval from the local State Administration of Industry and Commerce on December 10, 2007.

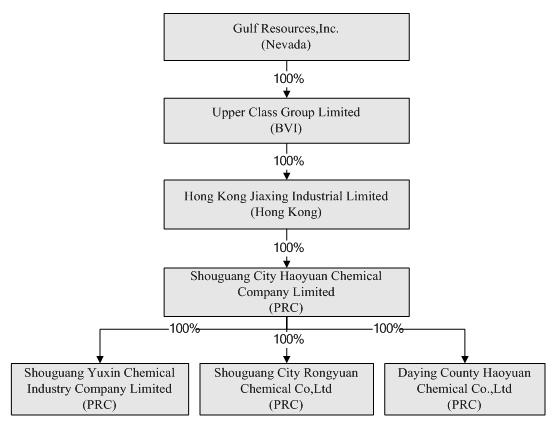

As a result of the transactions described above, our corporate structure is linear. That is Gulf Resources owns 100% of the outstanding shares of Upper Class Group Limited, which owns 100% of the outstanding shares of Hong Kong Jiaxing, which owns 100% of the outstanding shares of SCHC, which owns 100% of the outstanding shares of SYCI. Further, as a result of our acquisitions of SCHC and SYCI, our historical financial statements, as contained in our Condensed Consolidated Financial Statements and Management's Discussion and Analysis, appearing elsewhere in the report, reflect the accounts of SCHC and SYCI.

On October 12, 2009, we completed a 1-for-4 reverse stock split of our common stock, such that for each four shares outstanding prior to the stock split there was one share outstanding after the reverse stock split. All shares of common stock referenced in this report have been adjusted to reflect the stock split figures. On October 27, 2009, our shares began trading on the NASDAQ Global Select Market under the ticker symbol “GFRE” and on June 30, 2011 we changed our ticker symbol to “GURE” to better reflect our corporate name.

On January 12, 2015, the Company and SCHC entered into an Equity Interest Transfer Agreement with Shouguang City Rongyuan Chemical Co., Ltd ("SCRC") pursuant to which SCHC agreed to acquire SCRC and all rights, title and interest in and to all assets owned by SCRC, a leading manufacturer of materials for human and animal antibiotics in China and other parts of Asia.

On February 4, 2015 the Company closed the transactions contemplated by the agreement between the Company, SCHC and SCRC.

On the Closing Date, the Company issued 7,268,011shares of its common stock, par value $0.0005 per share (the “Shares”), at the closing market price of $1.84 per Share on the closing date to the four former equity owners of SCRC .The issuance of the Shares was exempt from registration pursuant to Regulation S of the Securities Act of 1933, as amended. On the Closing Date, the Company entered into a lock-up agreement with the four former equity owners of SCRC. In accordance with the terms of the lock-up agreement, the shareholders have agreed not to sell or transfer the Shares for five years from the date the stock certificates evidencing the Shares are issued.

The sellers of SCRC agreed as part of the purchase price to accept the Shares, based on a valuation of $2.00, which was a 73% premium to the price on the day the agreement was reached. For accounting purposes, the Shares are now being valued at $1.84, which was the closing price of our stock on the closing date of the agreement. The price difference between the original $2.00 and the current $1.84 is solely for accounting purposes. There has been no change in the number of shares issued.

On November 24, 2015, Gulf Resources, Inc., a Delaware corporation consummated a merger with and into its wholly-owned subsidiary, Gulf Resources, Inc., a Nevada corporation. As a result of the reincorporation, the Company is now a Nevada corporation.

On December 15, 2015, the Company registered a new subsidiary in the Sichuan Province of the PRC named Daying County Haoyuan Chemical Company Limited (“DCHC”) with registered Capital of RMB50,000,000, and there is no capital contributed yet until now. DCHC was established to further explore and develop natural gas and brine resources (including bromine and crude salt) in China. And the business has not commenced yet.

Our current corporate structure chart is set forth in the following diagram:

Our executive offices are located in China at Level 11,Vegetable Building, Industrial Park of the East in Shouguang City, Shandong Province, P.R.C. Our telephone number is +86 (536) 5670008. Our website address is www.gulfresourcesinc.com. The information contained on or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this Form 10-K.

Business Acquisitions

On January 12, 2015, the Company’s wholly owned subsidiary, SCHC signed an equity interest transfer agreement with the four individual shareholders of SCRC. Consideration for this transaction consists of $66.2 million in cash and the issuance of shares of approximately 7.27 million shares of common stock at a price of $2.00 per share, which represents a 73% premium over our 10 day stock price prior to closing, bringing the total consideration for the purchase of SCRC to $80.8 million. The shareholders of SCRC have guaranteed that SCRC’s audited 2014 net income will not be less than approximately $11.4 million, otherwise the purchase price shall be proportionally adjusted.

Leased Facility

On November 5, 2010, SCHC entered into a lease (the “Lease Contract”) with State-Operated Shouguang Qingshuibo Farm (the “Lessor”). Pursuant to the Lease Contract, SCHC shall lease certain property with an area of 3,192 square meters and buildings adjacent to the Company’s Factory No. 1. There are currently non-operating bromine production facilities on the property which have not been in production for more than 12 months. The annual lease payment for the property is RMB5 million, approximately US$755,000, per year and shall be paid by SCHC no later than June 30th of each year. The term of the Lease Contract is for twenty years commencing from January 1, 2011. The Lease Contract may be renewed by SCHC for an additional twenty-year period on the same terms. The Lessor has agreed to permit SCHC to reconstruct and renovate the existing bromine production facilities on the property.

Our Business Segments

Our business operations are conducted in three segments, bromine, crude salt, and chemical products. We manufacture and trade bromine and crude salt, and manufacture and sell chemical products used in oil and gas field exploration, oil and gas distribution, oil field drilling, papermaking chemical agents, inorganic chemicals and human and animal antibiotics. We conduct all of our operations in China.

Bromine and Crude Salt

We manufacture and distribute bromine through our wholly-owned subsidiary, Shouguang City Haoyuan Chemical Company Limited, or SCHC. Bromine (Br2) is a halogen element and it is a red volatile liquid at standard room temperature which has reactivity between chlorine and iodine. Elemental bromine is used to manufacture a wide variety of bromine compounds used in industry and agriculture. Bromine is also used to form intermediates in organic synthesis, in which it is somewhat preferable over iodine due to its lower cost. Our bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines and disinfectants.

The extraction of bromine in the Shandong Province is limited by the Provincial Government to licensed operations. We hold one such license. As part of our business strategy, it is our plan to continue acquiring smaller scaled and unlicensed producers and to use our bromine to expand our downstream chemical operations.

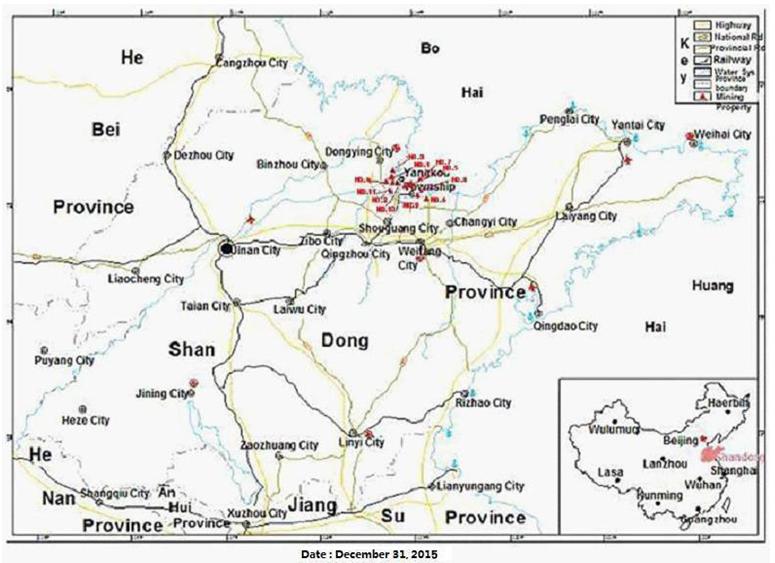

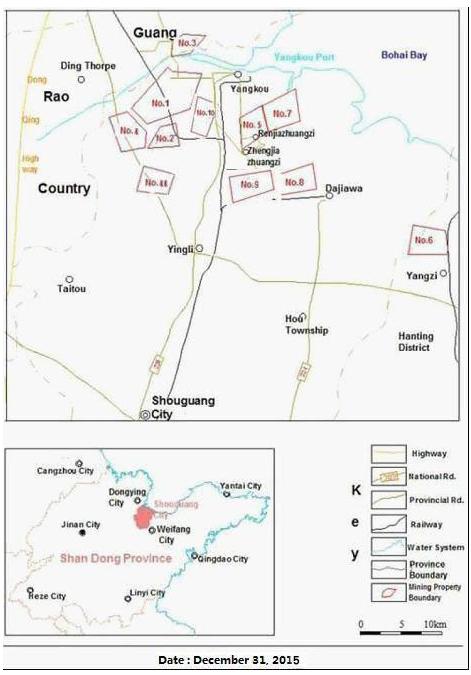

Location of Production Sites

Our production sites are located in the Shandong Province in northeastern China. The productive formation (otherwise referred to as the “working region”), extends from latitude N 36°56’ to N 37°20’ and from longitude E 118°38’ to E 119°14’, in the north region of Shouguang city, from the Xiaoqing River of Shouguang city to the west of the Dan River, bordering on Hanting District in the east, from the main channel of “Leading the Yellow River to Supply Qingdao City Project” in the south to the coastline in the north. The territory is classified as coastal alluvial – marine plain with an average height two to seven meters above the sea level. The terrain is relatively flat.

Geological background of this region

The Shandong Province working region is located to the east of Lubei Plain and on the south bank of Bohai Laizhou Bay. The geotectonic location bestrides on the North China Platte (I) and north three-level structure units, from west to east including individually the North China Depression, Luxi Plate, and Jiaobei Plate. Meanwhile, 4 V-level structure units including the Dongying Sag of Dongying Depression (IV) of North China Depression, the Buried Lifting Area of Guangrao, Niutou sag and Buried Lifting Area of Shuanghe and are all on two V-level structure units including Xiaying Buried Lifting Area of Weifang Depression (IV) of Luxi Plate and Chuangyi Sag, as well as on a V-level structure units of Jiaobei Buried Lifting Area of Jiaobei Plate.

Processing of Bromine

Natural brine is a complicated salt-water system, containing many ionic compositions in which different ions have close interdependent relationships and which can be reunited to form many dissolved soluble salts such as sodium chloride, potassium chloride, calcium sulfate, potassium sulfate and other similar soluble salts. The goal of natural brine processing is to separate and precipitate the soluble salts or ions away from the water. Due to the differences in the physical and chemical characteristics of brine samples, the processing methods are varied, and can result in inconsistency of processing and varied technical performance for the different useful components from the natural brine.

Bromine is the first component extracted during the processing of natural brine. In natural brine, the bromine exists in the form of bromine sodium and bromine magnesium and other soluble salts.

The bromine production process is as follows:

|

1.

|

natural brine is pumped from underground through extraction wells by subaqueous pumps;

|

|

2.

|

the natural brine then passes through transmission pipelines to storage reservoirs;

|

|

3.

|

the natural brine is sent to the bromine refining plant where bromine is extracted from the natural brine. In neutral or acidic water, the bromine ion is easily oxidized by adding the oxidative of chlorine, which generates the single bromine away from the brine. Thereafter the extracted single bromine is blown out by forced air, then absorbed by sulfur dioxide or soda by adding acid, chlorine and sulfur. Extracted bromine is stored in containers of different sizes; and

|

|

4.

|

the wastewater from this refining process is then transported by pipeline to brine pans.

|

Our production feeds include (i) natural brine; (ii) vitriol; (iii) chlorine; (iv) sulfur; and (v) coal.

Crude Salt

We also produce crude salt, which is produced from the evaporation of the wastewater after our bromine production process. Once the brine is returned to the surface and the bromine is removed, the remaining brine is pumped to on-site containing pools and then exposed to natural sunshine. This causes the water to evaporate from the brine, resulting in salt being left over afterwards. Crude salt is the principal material in alkali production as well as chlorine alkali production and is widely used in the chemical, food and beverage, and other industries.

Chemical Products

We produce chemical products through our wholly-owned subsidiary, Shouguang Yuxin Chemical Industry Company Limited, or SYCI and Shouguang City Rongyuan Chemical Co, Ltd (PRC), or SCRC. The products we produce and the markets in which they are sold include, among others:

|

Product name

|

Application sector

|

|

Hydroxyl guar gum

|

Oil Exploration & Production

|

|

Demulsified agent

|

Oil Exploration & Production

|

|

Corrosion inhibitor for acidizing

|

Oil Exploration & Production

|

|

Bactericide

|

Oil Exploration / Agricultural

|

|

Chelant

|

Paper Making

|

|

Iron ion stabilizer

|

Oil Exploration & Production

|

|

Clay stabilizing agent

|

Oil Exploration & Production

|

|

Flocculants agent

|

Paper Making

|

|

Remaining agent

|

Paper Making

|

|

Expanding agent with enhanced gentleness

|

Paper Making

|

|

Bromopropane

|

Agricultural

|

|

Environmental friendly additive products

|

Oil Exploration & Production

|

|

Solid lubricant

|

Oil Exploration & Production

|

|

Polyether lubricant

|

Oil Exploration & Production

|

|

Benzaldehyde dibromide

|

Agricultural

|

|

Chlorantraniliprole

|

Agricultural

|

|

Semi-finished Product of Tetramethylbenzidine

|

Pharmaceutical intermediates

|

|

Semi-finished Product of Trimethylolpropane

|

Pharmaceutical intermediates

|

|

Material of Lactic acid Trimethylolpropane

|

Pharmaceutical intermediates

|

SYCI concentrates its efforts on the production and sale of chemical products that are used in oil and gas field explorations, oil and gas distribution, oil field drilling, wastewater processing, papermaking chemical agents, and inorganic chemicals. SYCI also engages in research and development of commonly used chemical products as well as medicine intermediates. Currently, SYCI's annual production of oil and gas field exploration products and related chemicals is over 26,000 tons, and its production of papermaking-related chemical products is over 5,000 tons. These products are mainly distributed to large domestic papermaking manufacturers and major oilfields such as Shengli Oilfield and Talimu Oilfields.

SYCI’s factories are located in Shouguang City at 2nd Living District, Qinghe Oil Factory, Shouguang City, Shandong Province, China. The company has been certified as ISO9001-2000 compliant and received the Quality Products and Services Guarantee Certificate from China Association for Quality. SYCI has been accredited by Shandong as a Provincial Credit Enterprises and is a Class One supplier for both China Petroleum & Chemical Corporation (“SINOPEC”) and Petro China Company Limited.

SCRC, a leading manufacturer of materials for human and animal antibiotics in China and other parts of Asia, located in Yangkou Township, Shouguang City, Shandong Province, China. Its major products including Semi-finished Product of Tetramethylbenzidine , Semi-finished Product of Trimethylolpropane , Material of Lactic acid Trimethylolpropane and so on.

Segment disclosure

We have three reportable segments: bromine, crude salt and chemical products.

The amounts set forth below are based upon on an average RMB to USD exchange rates of $0.16281 and $0.16066 during fiscal years 2014 and 2015, respectively.

|

Net Revenue by Segment

|

||||||||||||||||

|

Year Ended December 31, 2015

|

Year Ended December 31, 2014

|

|||||||||||||||

|

Segment:

|

% of total

|

% of total

|

||||||||||||||

|

Bromine

|

$

|

52,385,491

|

32

|

%

|

$

|

57,949,824

|

51

|

%

|

||||||||

|

Crude Salt

|

$

|

10,494,939

|

7

|

%

|

$

|

10,752,226

|

9

|

%

|

||||||||

|

Chemical Products

|

$

|

99,436,690

|

61

|

%

|

$

|

44,958,281

|

40

|

%

|

||||||||

|

Total sales

|

$

|

162,317,120

|

100

|

%

|

$

|

113,660,331

|

100

|

%

|

||||||||

|

Segment:

|

Percentage Increase/Decrease in Net Revenue

from fiscal year 2014 to 2015

|

|||

|

Bromine

|

(10 | %) | ||

|

Crude Salt

|

(2 | %) | ||

|

Chemical Products

|

121 | % | ||

|

SCHC’s products sold in metric tons

|

Year ended

December 31, 2015

|

Year ended

December 31, 2014

|

Percentage Change

|

|||||||||

|

Bromine

|

16,569 | 20,077 | (17 | %) | ||||||||

|

Crude Salt

|

330,373 | 342,127 | (3 | %) | ||||||||

|

Chemical products segment

sold in metric tons

|

Year ended

December 31, 2015

|

Year ended

December 31, 2014

|

Percentage Change

|

|||||||||

|

Oil and gas exploration additives

|

14,332 | 13,685 | 5 | % | ||||||||

|

Paper manufacturing additives

|

4,134 | 3,936 | 5 | % | ||||||||

|

Pesticides manufacturing additives

|

3,127 | 3,110 | 0.5 | % | ||||||||

|

Pharmaceutical intermediates

|

1,682 | - | - | |||||||||

|

By products

|

12,273 | - | - | |||||||||

| 35,548 | 20,731 | 71 | % | |||||||||

|

Income from Operations by Segment

|

||||||||||||||||

|

Year ended December 31, 2015

|

Year ended December 31, 2014

|

|||||||||||||||

|

Segment:

|

% of total

|

% of total

|

||||||||||||||

|

Bromine

|

$

|

10,854,711

|

24

|

%

|

$

|

9,500,428

|

38

|

%

|

||||||||

|

Crude Salt

|

$

|

1,183,755

|

3

|

%

|

719,226

|

3

|

%

|

|||||||||

|

Chemical Products

|

$

|

32,997,870

|

73

|

%

|

$

|

14,432,851

|

59

|

%

|

||||||||

|

Income from operations before corporate costs

|

$

|

45,036,336

|

100

|

%

|

$

|

24,652,505

|

100

|

%

|

||||||||

|

Corporate costs

|

$

|

(1,447,023

|

)

|

$

|

(926,696

|

)

|

||||||||||

|

Unrealized translation difference

|

$

|

1,575,397

|

$

|

92,412

|

||||||||||||

|

Income from operations

|

$

|

45,164,710

|

$

|

23,818,221

|

||||||||||||

|

Year Ended

December 31, 2015

|

Bromine *

|

Crude

Salt *

|

Chemical

Products

|

Segment

Total

|

Corporate

|

Total

|

||||||||||||||||||

|

Net revenue

(external customers)

|

$

|

52,385,491

|

$

|

10,494,939

|

$

|

99,436,690

|

$

|

162,317,120

|

$

|

-

|

$

|

162,317,120

|

||||||||||||

|

Net revenue (intersegment)

|

8,039,156

|

-

|

-

|

8,039,156

|

-

|

8,039,156

|

||||||||||||||||||

|

Income from operations before taxes

|

10,854,711

|

1,183,755

|

32,997,870

|

45,036,336

|

128,374

|

45,164,710

|

||||||||||||||||||

|

Income taxes

|

2,508,902

|

500,451

|

8,362,555

|

11,371,908

|

-

|

11,371,908

|

||||||||||||||||||

|

Income from operations after taxes

|

8,345,809

|

683,304

|

24,635,315

|

33,664,428

|

128,374

|

33,792,802

|

||||||||||||||||||

|

Total assets

|

136,701,878

|

40,306,628

|

179,733,958

|

356,742,464

|

762

|

356,743,226

|

||||||||||||||||||

|

Depreciation and amortization

|

17,498,441

|

6,136,889

|

5,460,318

|

29,095,648

|

-

|

29,095,648

|

||||||||||||||||||

|

Capital expenditures

|

20,665,890

|

2,120,622

|

72,113

|

22,858,625

|

-

|

22,858,625

|

||||||||||||||||||

|

Goodwill

|

-

|

-

|

29,559,174

|

29,559,174

|

-

|

29,559,174

|

||||||||||||||||||

|

Year Ended

December 31, 2014

|

Bromine *

|

Crude

Salt *

|

Chemical

Products

|

Segment

Total

|

Corporate

|

Total

|

||||||||||||||||||

|

Net revenue

(external customers)

|

$

|

57,949,824

|

$

|

10,752,226

|

$

|

44,958,281

|

$

|

113,660,331

|

$

|

-

|

$

|

113,660,331

|

||||||||||||

|

Net revenue (intersegment)

|

3,013,295

|

-

|

-

|

3,013,295

|

-

|

3,013,295

|

||||||||||||||||||

|

Income (loss) from operations before taxes

|

9,500,428

|

719,226

|

14,432,851

|

24,652,505

|

(834,284

|

)

|

23,818,221

|

|||||||||||||||||

|

Income taxes

|

2,214,988

|

370,974

|

3,640,053

|

6,226,015

|

-

|

6,226,015

|

||||||||||||||||||

|

Income (loss) from operations after taxes

|

7,285,440

|

348,252

|

10,792,798

|

18,426,490

|

(834,284

|

)

|

17,592,206

|

|||||||||||||||||

|

Total assets

|

195,539,637

|

51,632,485

|

75,748,241

|

322,920,363

|

61,789

|

322,982,152

|

||||||||||||||||||

|

Depreciation and amortization

|

18,011,790

|

6,076,042

|

3,554,390

|

27,642,222

|

-

|

27,642,222

|

||||||||||||||||||

|

Capital expenditures

|

5,414,738

|

1,123,873

|

-

|

6,538,611

|

-

|

6,538,611

|

||||||||||||||||||

Sales and Marketing

We have an in-house sales staff of 19 persons. Our customers send their orders to us first. Our in-house sales staff then attempts to satisfy these orders based on our actual production schedules and inventories on hand. Many of our customers have a long term relationship with us. We expect this to continue due to stable demand for mineral products, however, these relationship can not be guaranteed in the future.

Principal Customers

We sell a substantial portion of our products to a limited number of PRC customers. Our principal customers during 2015 were Shandong Morui Chemical Company Limited, Shandong Brother Technology Limited, Kuerle Xingdong Trading Limited, Shouguang Weidong Chemical Company Limited and qinghe production plant of Sinopec Shengli oilfield branch. We have ongoing policies in place to ensure that sales are made to customers who are credit-worthy. We are not aware of any allowances for doubtful debts required for each of the years ended December 31, 2015 and 2014.

During each of the years ended December 31, 2015 and 2014, sales to our three largest bromine customers, based on net revenue from such customers, aggregated $19,540,851 and $19,919,942, respectively, or approximately 37% and 34.4% of total net revenue from sale of bromine; and sales to our largest customer represented approximately 15% and 14.7%, respectively, of total net revenue from the sale of bromine.

During each of the years ended December 31, 2015 and 2014, sales to our three largest crude salt customers, based on net revenue from such customers, aggregated $9,080,707 and $9,171,621, respectively, or approximately 87% and 85.3% of total net revenue from sale of crude salt; and sales to our largest customer represented approximately 37% and 37.8%, respectively, of total net revenue from the sale of crude salt.

During each of the years ended December 31, 2015 and 2014, sales to our three largest chemical products customers, based on net revenue from such customers, aggregated $22,613,400 and $20,649,995, respectively, or approximately 23% and 45.9% of total net revenue from sale of chemical products; and sales to our largest customer represented approximately 10% and 20.7%, respectively, of total net revenue from the sale of chemical products.

This concentration of customers for all three segments makes us vulnerable to an adverse near-term impact, should one or more of these relationships be terminated.

Principal Suppliers

Our principal external suppliers are Shandong Xinlong Biological Technology Company limited, Shouguang City Rongguang Trading Company Limited and Shandong Xinlong Group Company limited, Shouguang Hongye Trading Company Limited and Shandong Tianling Fine Chemical co., LTD.

During each of the years ended December 31, 2015 and 2014, we purchased 58.2% and 62.1%, respectively, of raw materials for our bromine and crude production from three suppliers.

During each of the years ended December 31, 2015 and 2014, we purchased 71% and 92%, respectively, of raw materials for our chemical products production from three suppliers. We purchased a portion of the bromine produced by the Company internally as well, at cost totaling $8,039,156 and $3,013,295, for the years ended December 31, 2015 and 2014 respectively, for the production of chemical products.

This supplier concentration makes us vulnerable to a near-term adverse impact, should the relationships be terminated.

Business Strategy

Expansion of Production Capacity to Meet Demand

▼ Bromine and Crude Salt

|

In view of keen competition and the trend of less bromine contraction of brine water being extracted in Shouguang City, Shandong Province, the Company had announced its intent to access more bromine and crude salt resources by finding new underground brine water resources in the Sichuan Province. The Company completed the drilling of its first exploratory well in December 2011 and announced in mid-January 2012 that the Company discovered underground brine water resources in Daying County. It has provided preliminary concentration results after testing by a third-party independent expert. According to the third-party independent report, the bromine concentration in the underground brine water resources is 1.53 grams per liter, which is approximately six to seven times higher than the average bromine concentration from its brine water resources at our bromine factories in Shouguang City. In September 2014, the Company started deeper drilling exploration under its existing well and did an exploration analysis on the resources from different levels. We incurred a total of $488,880 in exploration costs during 2014. On January 30, 2015 we announced that we had found natural gas resources under our bromine well in the Sichuan area. Then the Company subsequently hired a third party (a subsidiary of Sinopec) to conduct of survey of this well. Based on the assessment report, the Company estimates this well should produce annual revenue of approximately US$4.7 million and annual net income approximately US$2.3 million per year. On November 23, 2015 the company’s wholly owned subsidiary SCHC entered into an agreement with the People’s Government of Daying County in Sichuan Province for the exploration and development of natural gas and brine resources (including bromine and crude salt).

In order to improve the bromine and crude salt production capacity, the Company will continue to enhance its existing bromine and crude salt production facilities. In the third quarter of 2015, the Company incurred enhancement works in Factories No. 10 and 11 at costs of approximately $10,396,597 to the protective shells to transmission channels and ducts. In the fourth quarter of 2015, the Company incurred enhancement projects to our existing bromine extraction in Factory No. 10 and 11 at costs of approximately $12,088,375. The Company expects to carry out enhancement projects for the transmission channels and ducts and our existing bromine extraction in 2016, which will cost approximately $15 million. The company will also expect to invest approximately $10.0 million in Sichuan Province for the natural gas resource project in 2016. The Company expects such enhancement expenditures will be funded by the Company’s cash on hand. The Company also estimated that the amount of ordinary repair and maintenance expense will be approximately $1.0 million in 2016.

|

▼ Chemical Products

|

To expand its chemical production capacity, on January 12, 2015, the Company entered into an Equity Interest Transfer Agreement with SCRC and its shareholders with total consideration of approximately $80.8 million. On February 4, 2015, the transactions contemplated by the agreement dated January 12, 2015 closed. Pursuant to the agreement, SCHC acquired all rights, title and interest in and to all assets owned by SCRC, a leading manufacturer of materials for human and animal antibiotics in China and other parts of Asia.

|

Competition

To date, our sales have been limited to customers within the PRC and we expect that our sales will remain primarily domestic for the immediate future. Our marketing strategy involves developing long term ongoing working relationships with customers based on large multi-year agreements which foster mutually advantageous relationships.

We compete with PRC domestic private companies and state-owned companies. Certain state-owned and state backed competitors are more established and have more control of certain resources in terms of pricing than we do. We compete in our business based on price, our reputation for quality and on-time delivery, our relationship with suppliers and our geographical proximity to natural brine deposits in the PRC for bromine, crude salt and chemical productions. Management believes that our stable quality, manufacturing processes and plant capacity for the production of bromine, crude salt and chemical products are key considerations in awarding contracts in the PRC.

Our principal competitors in the bromine business are Shandong Yuyuan Group Company Limited, Shandong Haihua Group Company Limited, Shandong Dadi Salt Chemical Group Company Limited and Shandong Haiwang Chemical Company Limited, all of which produce bromine principally for use in their chemicals businesses and sell part of the bromine produced to customers. These companies may switch to selling bromine to the market if they no longer use bromine in their chemical businesses.

Our principal competitors in the crude salt business are Shandong Haiwang Chemical Company Limited, Shandong Haihua Group Company Limited, Shandong Weifang Longwei Industrial Company Limited, Shandong Yuyuan Group Company Limited and Shandong Caiyangzi Saltworks.

Our principal competitors in the chemical business are Beijing Tianqing Chemical Company Limited, Shandong Weifang Shuangxing Pesticides Company Limited, Shandong Dacheng Pesticides Company Limited, Binhua Group Company Limited, Dongying City Dongchen (Group) Chemical Industry Company Limited, Beijing Peikangjiaye Technologies Limited, Shouguang Fukang Pharmaceutical Co., Ltd. Shandong Xinhua Pharmaceutical Limited by Share Ltd, Hunan Erkang Pharmaceutical Limited by Share Ltd and Xinan Synthetic Pharmaceutical Limited by Share Ltd.

Government Regulation

The following is a summary of the principal governmental laws and regulations that are or may be applicable to our operations in the PRC. The scope and enforcement of many of the laws and regulations described below are uncertain. We cannot predict the effect of further developments in the Chinese legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement of laws.

In the natural resources sector, the PRC and the various provinces have enacted a series of laws and regulations over the past 20 years, including laws and regulations designed to improve safety and decrease environmental degradation. The "China Mineral Resources Law" declares state ownership of all mineral resources in the PRC. However, mineral exploration rights can be purchased, sold and transferred to foreign owned companies. Mineral resource rights are granted by the Central Government permitting recipients to conduct mineral resource activities in a specific area during the license period. These rights entitle the licensee to undertake mineral resource activities and infrastructure and ancillary work, in compliance with applicable laws and regulations, within the specific area covered by the license during the license period. The licensee is required to submit a proposal and feasibility studies to the relevant authority and to pay the Central Government a natural resources fee in an amount equal to a percent of annual sales. Shandong Province has determined that bromine is to be extracted only by licensed entities and we hold one of such licenses. Despite the province desire to limit extraction to licensed entities hundreds of smaller operations continue to extract bromine without licenses.

The Ministry of Land and Resources (“MLR”) is the principal regulator of mineral rights in China. The Ministry has authority to grant licenses for land-use and exploration rights, issue permits for mineral rights and leases, oversee the fees charged for them and their transfer, and review reserve evaluations. We are required to hold a bromine and salt production license in order to operate our bromine and salt production business in the PRC. Our bromine and salt production license is subject to a yearly audit. If we do not successfully pass the yearly approval by relevant government authorities, our bromine and salt production operations may be suspended until we are able to comply with the license requirements which could have a material adverse effect on our business, financial condition and results of operations.

Employees

As of December 31, 2015, we employed approximately 738 full-time employees, of whom approximately 63% are with SCHC, 16% are with SYCI and 20% are with SCRC. Approximately 6% of our employees are management personnel and 4% are sales and procurement staff. None of our employees are represented by a union.

Our employees in China participate in a state pension arrangement organized by Chinese municipal and provincial governments. We are required to contribute to the arrangement at the rate of 17% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with other types of social insurance. Our total contribution amounts to 27% of the average monthly salary. We have purchased social insurance for almost all of our employees. Expense related to social insurance was approximately $980,359 for fiscal year 2015.

Available Information

We make available free of charge on or through our internet website, www.gulfresourcesinc.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, if any, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission. The information contained on our website is not intended to be incorporated into this Annual Report on Form 10-K.

Item 1A. Risk Factors.

You should consider carefully each of the following business and investment risk factors and all of the other information in this report. If any of the following risks and uncertainties develops into actual events, the business, financial condition or results of our operations could be materially adversely affected. If that happens, the trading price of our shares of common stock could decline significantly. The risk factors below contain forward-looking statements regarding our business. Actual results could differ materially from those set forth in the forward-looking statements. See "Special Note Regarding Forward-Looking Information".

Risks Relating to Our Business

The unsuccessful integration of a business or business segment we acquire could have a material adverse effect on our results.

As part of our business strategy, we expect to acquire assets and businesses relating to or complementary to our operations. These acquisitions will involve risks commonly encountered in acquisitions. These risks include exposure to unknown liabilities of the acquired assets, right, additional acquisition costs and unanticipated expenses. Our quarterly and annual operating results could fluctuate due to the costs and expenses of acquiring and integrating new assets and businesses. We may also experience difficulties in assimilating the operations of acquired businesses. Our ongoing business may be disrupted and our management's time and attention diverted from existing operations. Our acquisition strategy will likely require additional equity or debt financing, resulting in additional leverage or dilution of ownership. We cannot assure you that any future acquisition will be consummated, or that if consummated, that we will be able to integrate such acquisition successfully.

We depend on revenues from a few significant relationships, and any loss, cancellation, reduction, or interruption in these relationships could harm our business.

In general, we have derived a material portion of our revenue from a limited number of customers. If sales to such customers were terminated or significantly reduced, our revenues and net income could significantly decline. Our success will depend on our continued ability to develop and manage relationships with significant customers and suppliers. Any adverse change in our relationship with our customers and suppliers may have a material adverse effect on our business. Although we are attempting to expand our customer base, we expect that our customer concentration will not change significantly in the near future. We cannot be sure that we will be able to retain our largest customers and suppliers or that we will be able to attract additional customers and suppliers, or that our customers and suppliers will continue to buy our products in the same amounts as in prior years. The loss of one or more of our largest customers or suppliers, any reduction or interruption in sales to these customers or suppliers, our inability to successfully develop relationships with additional customers or suppliers or future price concessions that we may have to make could significantly harm our business.

Attracting and retaining key personnel is an essential element of our future success.

Our future success depends to a significant extent upon the continued service of our executive officers and other key management and technical personnel and on our ability to continue to attract, retain and motivate executive and other key employees, including those in managerial, technical, marketing and information technology support positions. Experienced management and technical, marketing and support personnel are in demand and competition for their talents is intense. The loss of the services of one or more of our key employees or our failure to attract, retain and motivate qualified personnel could have a material adverse effect on our business, financial condition and results of operations.

If we lose the services of our chairman and chief executive officer, our business may suffer.

We are dependent on Mr. Ming Yang, our chairman and Mr. Liu Xiaobin, our chief executive officer. The loss of their services could materially harm our business because of the cost and time necessary to retain and train a replacement. Such a loss would also divert management attention away from operational issues.

If we do not pass the review and approval for renewing our bromine and salt production license, our bromine business may suffer.

We are required to hold a bromine and salt production license in order to operate our bromine and salt production business in the PRC. Our bromine and salt production license is subject to a yearly audit. If we do not successfully pass the yearly approval by relevant government authorities, our bromine and salt production operations may be suspended until we are able to comply with the license requirements which could have a material adverse effect on our business, financial condition and results of operations.

Because we do not have any proven or probable reserves of brine water, we may not be able to continue to produce bromine and crude salt at existing levels in the future which could harm our business, results or operations and financial condition

The SEC’s Industry Guide 7, which relates to businesses with mining operations such as ours defines “reserves” as: “that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.” In addition, Industry Guide 7 provides the following definitions with respect to the classification of reserves for mining companies:

|

l

|

“Proven (Measured) Reserves” - Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

|

|

|

l

|

“Probable (Indicated) Reserves” - Reserves for which quantity and grade and/or quality are computed form information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

|

We do not have any proven or probable reserves of brine water on our mining properties. Therefore, we cannot provide investors with any assurance that there will be adequate volume or concentration of brine water on our mining properties to continue our bromine and crude salt operations at existing levels or to expand our production capacity of bromine and crude salt. If we experience decreases in the volume and/or concentration of brine water we are able to extract from our mining properties, our business, results of operations and financial condition may be adversely affected.

We do not have mining permits for some of our bromine factories which we have acquired. Our operations depend on our existing permits and approvals already obtained from government authorities.

We hold government permits or operations permits and for each of our bromine factories except bromine Factory No.10 and 11. However, we do not currently hold valid mining permits issued by the State Land and Resources Bureau for our Factories No. 5, 6, 8, 9, 10 and 11. We have already filed applications for these mining permits, however we are not able to confirm when such mining permits will be issued, if at all.

We received a letter from the Shouguang Municipal State Land and Resources Bureau on March 10, 2011, stating that our Factories No. 5, 6, 7, 8, and 9 “are permitted to continue mining and can operate in a standard manner and carry out mining activities in a reasonable way pursuant to the requirements of the relevant mineral resources authorities, and are free of any illegal acts of exceeding layer or boundary limits and any violations of relevant laws and regulations of the State.”

All of our bromine and crude salt production facilities have been authorized by the local land and resources departments, of which Factories No. 1 to No. 4 are included under a single permit, which was originally issued in January 2005. And this permit was updated on July 2013, which Factories No. 1 to No. 4, and Factory 7 are included under a single permit issued on July 2013.

A decision made by relevant government agency(ies) to reject or delay the issuance of a new permit or to repeal or modify an existing permits or approval could prevent or limit our ability to continue operations at the affected facilities and harm our business, financial condition and operating results. Expansion of our existing operations would also require securing the necessary permits and approvals which we may not be able to obtain in a timely manner, if at all.

We do not have a certificate of land use rights for the land relating to certain bromine assets and crude salt production. We will not be able to obtain the property certificates for the relevant buildings attached to the land.

We do not have certificates of land use rights for land leased by SCHC. As a result, we have not been able to obtain the relevant property certificates for buildings on such leased land which are normally required as security in obtaining financing from financial institutions. Although we believe that this is a common occurrence with respect to property leases in the PRC, the property certificates confirm legal ownership of the buildings. Because we do not have certificate of land use rights for the leased land, we might be required by the government to demolish our buildings and/or restore the land back to its original state. If such event occurs, it will have major impact on our operations, financial status and performance results.

Because we have not been able to obtain property certificates to certain of our properties we may not be able to borrow money from banks in the PRC and as a result, could face liquidity problems.

As discussed above, we have not been able to obtain property certificates for certain of our properties. In the PRC banks normally require a company’s property certificates to be pledged as security before they will provide a loan to a company. In the past several years we have financed our operations with loans from third-party companies, cash from operations and equity financing. However, if these sources of funds are not available in the future and we need to find an alternate source of financing to maintain our operations, we may not be able to borrow money from a bank to meet our cash needs. This could materially harm our business and have a major impact on our operations, financial status and performance results.

Our inability to successfully manage the growth of our business may have a material adverse effect on our business, results or operations and financial condition.

We expect to experience growth in the number of employees and the scope of our operations as a result of internal growth and acquisitions. Such activities could result in increased responsibilities for management. Our future success will be highly dependent upon our ability to manage successfully the expansion of operations. Our ability to manage and support our growth effectively will be substantially dependent on our ability to implement adequate improvements to financial, inventory, management controls, reporting, order entry systems and other procedures, and hire sufficient numbers of financial, accounting, administrative, and management personnel.

Our future success depends on our ability to address potential market opportunities and to manage expenses to match our ability to finance operations. The need to control our expenses will place a significant strain on our management and operational resources. If we are unable to control our expenses effectively, our business, results of operations and financial condition may be adversely affected.

Our management is comprised almost entirely of individuals residing in the PRC with very limited English skills.

Our management is comprised almost entirely of individuals born and raised in the PRC. As a result of differences in culture, educational background and business experiences, our management may analyze, evaluate and present business opportunities and results of operations differently from the way they are analyzed, evaluated and presented by management teams of public companies in Europe and the United States. In addition, our management has very limited skills in English. Consequently, it is possible that our management team will emphasize or fail to emphasize aspects of our business that might customarily be emphasized in a different manner by comparable public companies from different geographical and political areas.

We will face many of the difficulties that companies in the early stage may face.

We have a limited operating history as a bromine produce and chemical processing company, which may make it difficult for you to assess our ability to identify merger or acquisition candidates and our growth and earnings potential. Therefore, we may face many of the difficulties that companies in the early stages of their development in new and evolving markets often face. We may continue to face these difficulties in the future, some of which may be beyond our control. If we are unable to successfully address these problems, our future growth and earnings will be negatively affected.

We cannot accurately forecast our future revenues and operating results, which may fluctuate.

Our short operating history and the rapidly changing nature of the markets in which we compete make it difficult to accurately forecast our revenues and operating results. Furthermore, our revenues and operating results may fluctuate in the future due to a number of factors, including the following:

|

l

|

the success of identifying and completing mergers and acquisitions;

|

|

|

l

|

the introduction of competitive products by different or new competitors;

|

|

|

l

|

reduced demand for any given product;

|

|

|

l

|

difficulty in keeping current with changing technologies;

|

|

|

l

|

increased or uneven expenses, whether related to sales and marketing, product development or administration;

|

|

|

l

|

deferral of recognition of our revenue in accordance with applicable accounting principles due to the time required to complete projects; and

|

|

|

l

|

costs related to possible acquisitions of technology or businesses.

|

|

|

l

|

new environmental compliance policies enacted by the Chinese government

|

Due to these factors, forecasts may not be achieved, either because expected revenues do not occur or because they occur at lower prices or on terms that are less favorable to us. In addition, these factors increase the chances that our results could be lower than the expectations of investors and analysts. If so, the market price of our stock would likely decline.

Mr. Ming Yang, our Chairman and a substantial shareholder, has potential conflicts of interest with us, which may adversely affect our business.

Mr. Ming Yang, our chairman, was a substantial owner of SCHC and SCYI before their acquisition by us, and remains, with the shares held by him, both individually and through Shandong Haoyuan Industry Group Ltd., and by his wife and son, Wenxiang Yu and Zhi Yang, a substantial owner of our securities. There may have been conflicts of interest between Mr. Yang and our Company as a result of such ownership interests. The terms on which we acquired SCHC and SCYI may have been different from those that would have been obtained if SCHC and SCYI were owned by unrelated parties. In addition, conflicts of interest between Mr. Yang’s dual roles as our shareholder and our director may arise. We cannot assure you that, when conflicts of interest arise, Mr. Yang will act in the best interests of the Company or that conflicts of interest will be resolved in our favor.

Currently, we do not have existing arrangements to address potential conflicts of interest between Mr. Yang and us. We rely on that Mr. Yang to abide by the laws of the State of Delaware, which provide that directors owe a fiduciary duty to the Company, and which require them to act in good faith and in the best interests of the Company, and not use their positions for personal gain. If we cannot resolve any conflicts of interest or disputes between us and Mr. Yang, we would have to rely on legal proceedings, which could result in disruption of our business and substantial uncertainty as to the outcome of any such legal proceedings.

We cannot assure that there will be a return on our investment on certain related exploration costs in the Sichuan Province.

We have been conducting exploration projects in Daying County since 2011. We discovered that the bromine concentration in the underground brine water resources was 6-7 times higher than those in Shandong Province. Then, in beginning of 2015, we discovered natural gas at its original brine well. We subsequently hired a third party (a subsidiary of Sinopec) to conduct a survey of this well. The survey and geographic studies indicated rich natural gas resources under the well. On November 23, 2015, our wholly owned subsidiary, SCHC, entered into a Project Investment Agreement with the People’s Government of Daying County in Sichuan Province for the exploration and development of natural gas and brine resources (including bromine and crude salt). We estimate that the well should produce annual revenue of approximately US$4.7 million and annual net income approximately US$2.3 million per year. However, we cannot assure that there will be a return on investment of our exploration costs.

Risks Related to Doing Business in the People's Republic of China.

Our business operations take place primarily in the People's Republic of China. Because Chinese laws, regulations and policies are changing, our Chinese operations will face several risks summarized below.

|

-

|

Limitations on Chinese economic market reforms may discourage foreign investment in Chinese businesses.

|

The value of investments in Chinese businesses could be adversely affected by political, economic and social uncertainties in China. The economic reforms in China in recent years are regarded by China’s central government as a way to introduce economic market forces into China. Given the overriding desire of the central government leadership to maintain stability in China amid rapid social and economic changes in the country, the economic market reforms of recent years could be slowed, or even reversed.

Any change in policy by the Chinese government could adversely affect investments in Chinese businesses.

Changes in policy could result in imposition of restrictions on currency conversion, imports or the source of supplies, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in China. Although China has been pursuing economic reforms, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries, could significantly affect the government's ability to continue with its reform.

|

-

|

We face economic risks in doing business in China.

|

As a developing nation, China’s economy is more volatile than that of developed Western industrial economies. It differs significantly from that of the U.S. or a Western European country in such respects as structure, level of development, capital reinvestment, legal recourse, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of China was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will emphasize greater utilization of market forces. For example, in 1999 the Government announced plans to amend the Chinese Constitution to recognize private property, although private business will officially remain subordinate to state-owned companies, which are the mainstay of the Chinese economy. However, we cannot assure you that, under some circumstances, the government's pursuit of economic reforms will not be restrained or curtailed. Actions by the central government of China could have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects for our Chinese operations.

|

-

|

We are subject to comprehensive regulation by the PRC legal system, which is uncertain. As a result, it may limit the legal protections available to you and us and we may not now be, or remain in the future, in compliance with PRC laws and regulations.

|

SCHC, SYCI and SCRC, our PRC operating companies, are incorporated under and are governed by the laws of the PRC; all of our operations are conducted in the PRC; and our suppliers and customers are all located in the PRC. The PRC government exercises substantial control over virtually every sector of the PRC economy, including the production, distribution and sale of bromine, brominated chemical products and crude salt. In particular, we are subject to regulation by local and national branches of the Ministry of Land and Resources, as well as the State Administration of Foreign Exchange, and other regulatory bodies. In order to operate under PRC law, we require valid licenses, certificates and permits, which must be renewed from time to time. If we were to fail to obtain the necessary renewals for any reason, including sudden or unexplained changes in local regulatory practice, we could be required to shut down all or part of our operations temporarily or permanently.

SCHC, SYCI and SCRC are subject to PRC accounting laws, which require that an annual audit be performed in accordance with PRC accounting standards. The PRC foreign-invested enterprise laws require that our subsidiary, SCHC, SYCI and SCRC submit periodic fiscal reports and statements to financial and tax authorities and maintain its books of account in accordance with Chinese accounting laws. If PRC authorities were to determine that we were in violation of these requirements, we could lose our business license and be unable to continue operations temporarily or permanently.

The legal and judicial systems in the PRC are still rudimentary. The laws governing our business operations are sometimes vague and uncertain and enforcement of existing laws is inconsistent. Thus, we can offer no assurance that we are, or will remain, in compliance with PRC laws and regulations.

|

-

|

The Chinese legal and judicial system may negatively impact foreign investors.

|

In 1982, the National People’s Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in China. However, China's system of laws is not yet comprehensive. The legal and judicial systems in China are still under development, and enforcement of existing laws is inconsistent. Many judges in China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. China's legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may shift to reflect domestic political changes.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. We cannot assure you that a change in leadership, social or political disruption, or unforeseen circumstances affecting China's political, economic or social life, will not affect the Chinese government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on our business and prospects.

The practical effect of the People’s Republic of China’s legal system on our business operations in China can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate articles and contracts to Foreign Invested Enterprise participants. These laws, however, do impose standards concerning corporate formation and governance, which are not qualitatively different from the general corporation laws of the several states. Similarly, the accounting laws and regulations of the People’s Republic of China mandate accounting practices which are not consistent with U.S. Generally Accepted Accounting Principles. China's accounting laws require that an annual "statutory audit" be performed in accordance with People’s Republic of China’s accounting standards and that the books of account of Foreign Invested Enterprises are maintained in accordance with Chinese accounting laws. Article 14 of the People’s Republic of China Wholly Foreign-Owned Enterprise Law requires a Wholly Foreign-Owned Enterprise to submit certain periodic fiscal reports and statements to designated financial and tax authorities, at the risk of business license revocation. Second, while the enforcement of substantive rights may appear less clear than United States procedures, Foreign Invested Enterprises and Wholly Foreign-Owned Enterprises are Chinese registered companies, which enjoy the same status as other Chinese registered companies in business-to-business dispute resolution. Generally, the Articles of Association provide that all business disputes pertaining to Foreign Invested Enterprises are to be resolved by the Arbitration Institute of the Stockholm Chamber of Commerce in Stockholm, Sweden, applying Chinese substantive law. Any award rendered by this arbitration tribunal is, by the express terms of the respective Articles of Association, enforceable in accordance with the "United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958)". Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different in operation from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises.

Because our principal assets are located outside of the United States and some of our directors and all of our executive officers reside outside of the United States, it may be difficult for you to enforce your rights based on the United States Federal securities laws against us and our officers and directors in the United States or to enforce judgments of United States courts against us or them in the People's Republic of China.