Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF ROSENBERG, RICH BAKER AND BERMAN COMPANY - SEEDO CORP. | grcr_ex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GRCR Partners, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

7359

(Primary Standard Industrial Classification Code Number)

47-2847446

(I.R.S. Employer Identification Number)

1771 Post Rd East #178, Westport CT 06880,

Telephone 203.456.8088

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sean Conrad, CEO, 1771 Post Rd East #178, Westport CT 06880

Telephone 203.456.8088

(Name, address, including zip code, and telephone number, including area code, of agent of service)

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [ X ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ] .

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ] .

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

1

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check One):

|

Large accelerated filer

|

.

|

Accelerated filer

|

.

|

|

|

Non-accelerated filer

|

. (Do not check if a smaller reporting company)

|

Smaller reporting company

|

X .

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of

Securities To Be Registered

|

Amount To Be

Registered

|

Proposed Maximum

Offering Price Per Share 1

|

Proposed Maximum

Aggregate Offering Price 1

|

Amount of Registration Fee

|

|

Common stock, $0.001

par value per share

|

2,500,000 shares |

$0.10

|

$ 250,000

|

$ 32.20

|

2

1 Estimated solely for purposed of calculating the registration fee under Rule 457(a) and (o) of the Securities Act. This registration statement shall also cover any additional shares of common stock which become issuable by reason of any stock split, stock dividend, anti-dilution provisions or similar transaction effected without the receipt of consideration which results in an increase in the number of the outstanding shares of common stock of the registrant.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING, PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED __, 2016

3

2,500,000 SHARES

COMMON STOCK

GRCR PARTNERS, INC.

GRCR PARTNERS, Inc. (“GRCR,” “Company,” “we,” or “us.”) is offering for sale a maximum of 2,500,000 shares of its common stock at a fixed price of $0.10 per share. This is the initial offering of public stock for the Company.

There is no minimum number of shares that must be sold by us for the offering to close, and we will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self- underwritten, best efforts basis, which means our president and chief executive officer Mr. Sean Conrad, will attempt to sell the shares. This prospectus will permit our president and chief executive officer to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. Mr. Conrad will sell the shares and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The intended methods of communication include, without limitations, telephone and personal contact. For more information, see the section of this prospectus entitled "Plan of Distribution".

The proceeds from the sale of the shares in this offering will be payable to the Company. All subscribed funds will be held in a noninterest-bearing account pending the completion of the offering of which there is no minimum number of shares that must be sold. The offering will be completed 180 days from the effective date of this prospectus, unless extended by our board of directors for an additional 180 days. All subscription agreements and checks for payment of shares are irrevocable (except as to any states that require a statutory cooling-off period or rescission right). For more information, see the section of this prospectus entitled "Plan of Distribution".

Since inception on January 16, 2015, the Company had a net loss of $11,736 and has a working capital surplus of $4,644 at December 31, 2015 . Our future growth in dependent upon achieving sales growth, management of operating expenses and ability of the Company to obtain the necessary financing to fund future obligations, and upon profitable operations.

Because this offering is self-underwritten and there is no minimum amount of shares that must be sold, the Company may lose money from this offering if the proposed proceeds of this offering are substantially less than the estimated costs of this offering. There is currently no public or established market for our shares. Consequently, our shareholders will not be able to sell their shares in any organized market place and may be limited to selling their shares privately. Accordingly, an investment in our Company is an illiquid investment.

We are not a blank check company and our business plan does not include engaging in a merger or acquisition with an unidentified company, companies, entity, or person.

Since there is no minimum amount of shares that must be sold by the company, you may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

|

-

|

Has not received enough proceeds from the offering to fully commence operations; and

|

|

-

|

Has no market for its shares

|

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

4

|

THIS INVESTMENT INVOLVES A HIGH DEGREE

|

Number of Shares | Offering Price | Underwriting Discounts & Commissions | Proceeds to the Company | ||||||||||||

|

OF RISK. YOU SHOULD PURCHASE ONLY IF YOU

|

||||||||||||||||

|

CAN AFFORD A COMPLETE LOSS OF YOUR

|

||||||||||||||||

|

INVESTMENT. SEE "RISK FACTORS" BEGINNING ON PAGE 9

|

||||||||||||||||

|

Per Share

|

1 | $ | 0.10 | $ | 0.00 | $ | 0.10 | |||||||||

|

10% of shares are sold

|

250,000 | 25,000 | $ | 0.00 | 25,000 | |||||||||||

|

50% of shares are sold

|

1,250,000 | 125,000 | $ | 0.00 | 125,000 | |||||||||||

|

75% of shares are sold

|

1,875,000 | 187,500 | $ | 0.00 | 187,500 | |||||||||||

|

Maximum Offering

|

2,500,000 | $ | 250,000 | $ | 0.00 | $ | 250,000 | |||||||||

This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE OUR SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE "RISK FACTORS" BEGINNING AT PAGE 10.

We are selling the shares without an underwriter and may not be able to sell all or any of the shares offered herein.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The date of this prospectus is ___________, 2016.

5

TABLE OF CONTENTS

| Page | |

|

PROSPECTUS SUMMARY

|

7

|

|

SUMMARY FINANCIAL DATA

|

8 |

|

RISK FACTORS

|

10 |

|

USE OF PROCEEDS

|

15 |

|

THE OFFERING

|

16 |

|

DETERMINATION OF OFFERING PRICE

|

17 |

|

DILUTION

|

17 |

|

DIVIDEND POLICY

|

18 |

|

MARKET FOR SECURITIES

|

18 |

|

NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

20 |

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

21 |

|

BUSINESS DESCRIPTION

|

23 |

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

36 |

|

PRINCIPAL SHAREHOLDERS

|

40 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

40 |

|

DESCRIPTION OF CAPITAL STOCK

|

41 |

|

PLAN OF DISTRIBUTION

|

43 |

|

LEGAL MATTERS

|

47 |

|

EXPERTS

|

47 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

48 |

6

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors” beginning on page 10, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision.

The Company

GRCR Partners Inc. (the “Company”, “Our” or “We”) was formed on January 16, 2015 under the laws of the State of Delaware. We are a provider of corporate governance, risk management, compliance and regulatory reporting (“GRCR”) solutions for businesses (“GRCR Solutions”). Our offices are located at 1771 Post Rd East #178, Westport CT 06880. Our telephone number is 203.456.8088 and our website is www.grcrpartners.com

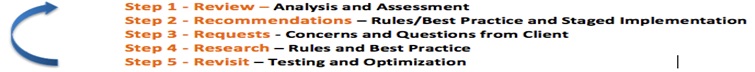

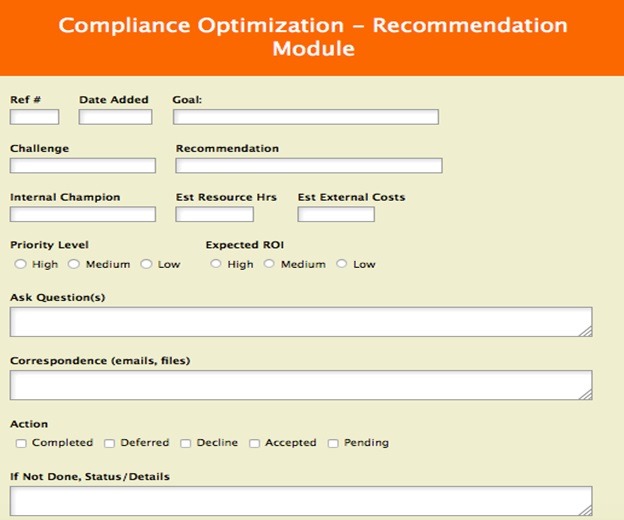

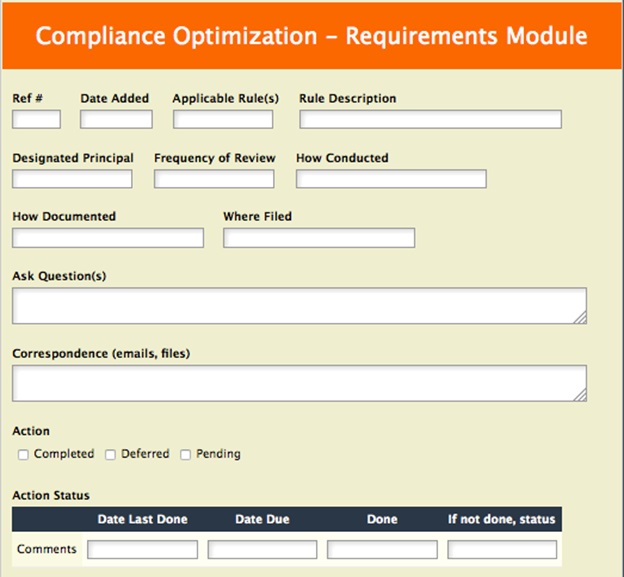

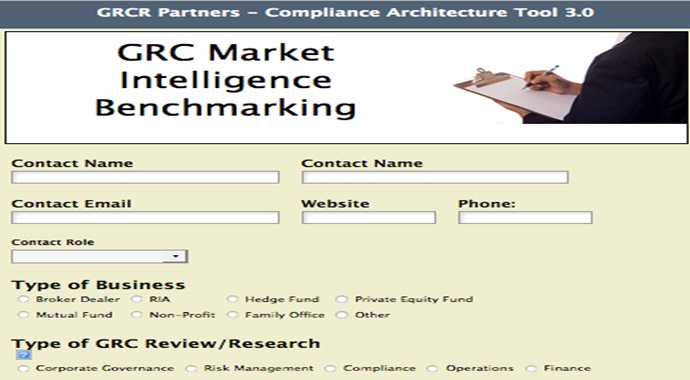

Currently, we provide GRCR Solutions through professional consulting services on a project-based fee arrangement. We deliver our services following our proprietary compliance architecture methodology. The skilled application of the fundamental principles governing compliance and risk management is what we call compliance architecture. We are building-out our Compliance Architecture Platform (“CAP”) to be an automated GRCR management tool that streamlines the process of GRCR for businesses. We believe that by combining expert consulting and GRCR software tools, we will help clients cost effectively build and maintain GRCR programs that reduce day-to-day and long term risks in their work environment.

The Company plans to become a public company. The reason for becoming a public company is to attract capital to fund further expansion and the development of our CAP tool. Many investors prefer to invest in public companies because they deem their investment to have more liquidity in their investment. Another reason for becoming public is to increase public awareness of the Company. The negatives for being public are the cost of compliance with regulatory requirements, audits, and investor relations can be high. We believe the additional costs associated with being public will range up to $50,000 per year. This estimate could range dramatically depending on the level of our success. The Company, the Company’s officers and directors do not intend for the Company, once it is reporting, to be used as a vehicle for a private company to become a reporting company.

We are a development stage company. Since inception on January 16, 2015, the Company had a retained deficit of $11,736 and a working capital surplus of $4,644 at December 31, 2015. Our monthly expenditures (burn rate) is approximately $1,000 consisting of generally of office overhead. In addition, we project the costs of being a public company to be approximately $4,000 per month. If we are unable to continue to grow our revenue and without any funding from the Offering, we estimate that we will exhaust our available capital within eight to twelve months from the date of the financial statements (December 31, 2015). For these and other reasons, our independent auditors have raised substantial doubt about our ability to continue as a going concern. Accordingly, we will require additional financing, including the equity funding sought in this prospectus.

The Offering

GRCR is offering for sale a maximum of 2,500,000 shares of common stock at a fixed price of $0.10 per share. There is no minimum number of shares that must be sold by us for the offering to close, and we will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self-underwritten, best efforts basis, which means our president and chief executive officer, Mr. Conrad, will attempt to sell the shares himself. This prospectus will permit our president and chief executive officer to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. Mr. Conrad will sell the shares himself and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934 (the "Exchange Act"). The intended methods of communication include, without limitation, telephone and personal contacts.

Since there is no minimum amount of shares that must be sold by the company, you may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

|

-

|

Has not received enough proceeds from the offering to fully commence operations; and

|

|

-

|

Has no market for its shares.

|

The proceeds from the sale of the shares in this offering will be payable to the Company. All subscription agreements and checks are irrevocable and should be delivered to the Company at the address provided in the Subscription Agreement (see Exhibit 99.1).

All subscription funds will be held in a noninterest-bearing account subject to the completion of the offering. The offering will be completed 180 days from the effective date of this prospectus, unless extended by our board of directors for an additional 180 days. There is no minimum number of shares that must be sold. All subscription agreements and checks for payment of shares are irrevocable (except as to any states that require a statutory cooling-off period or rescission right).

7

We will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers approximately 30 days after the close of the offering or as soon thereafter as practicable.

The offering price of the common stock has been determined arbitrarily and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings, if any, or net worth.

|

Shares of common stock offered by us

|

A maximum of 2,500,000 shares. There is no minimum number of shares that must be

sold by us for the offering to close.

|

|

Use of proceeds

|

GRCR will receive all of the funds from the Offering. If 2,500,000 share of common stock are sold in the Offering, we will receive total gross proceeds of $250,000. We will use the proceeds from the offering to pay offering costs and other general expenses, as well as fund the development of the Company’s operations. The total estimated costs of the offering ($55,000) may exceed the amount of offering proceeds. The first proceeds of the offering will be used to pay any unpaid legal fees in connection with this Registration Statement estimated to be $15,000.

|

|

Termination of the offering

|

The offering will conclude when all 2,500,000 shares of common stock have been sold or 180 days after this registration statement becomes effective with the Securities and Exchange Commission, whichever is the first to occur. However, we may at our discretion extend the offering for an additional 180 days.

|

|

Risk

|

The purchase of our common stock involves a high degree of risk. Please refer to the sections entitled “Risk Factors” and “Dilution” before making an investment in this stock.

|

|

Trading

|

None. While we plan to find a market maker to file a Rule 211 application with the Financial Industry Regulatory Authority market (“FINRA”) in order to apply for the inclusion of our common stock in OTCQB or Pink Sheet tiers of OTC Markets (“OTCQB”), such efforts may not be successful and our shares may never be quoted and owners of our common stock may not have a market in which to sell the shares. Also, no estimate may be given as to the time that this application process will require. Even if GRCR's common stock is quoted or granted a listing, a market for the common shares may not develop.

|

SUMMARY FINANCIAL DATA

The following summary financial data should be read in conjunction with the financial statements and the notes thereto included elsewhere in this prospectus.

Balance Sheet Data:

|

As of December 31, 2015

|

As of September 30, 2015 (Audited)

|

|||||||

|

Current assets

|

$ | 31,970 | $ | 33,483 | ||||

|

Current liabilities

|

$ | 27,326 | $ | 4,599 | ||||

|

Stockholders’ equity

|

$ | 6,739 | $ | 31,398 | ||||

8

Operating Statement Data:

|

For the three months ended December 31, 2015

(Unaudited)

|

For the Period January 16, 2015 (inception) to

December 31, 2015

(Unaudited)

|

|||||||

|

Revenues

|

$ | 41,409 | $ | 151,285 | ||||

|

Cost of revenues

|

$ | 26,000 | $ | 78,557 | ||||

|

Cost of revenues from a related party

|

$ | 1,500 | $ | 6,150 | ||||

|

Operating expenses

|

$ | 44,842 | $ | 63,814 | ||||

|

Net (loss) Income

|

$ | (27,954 | ) | $ | 2,264 | |||

|

Net (loss) income per common share basic and diluted

|

$ | (0.00 | ) | $ | 0.00 | |||

|

Weighted average number of shares outstanding – basic and diluted

|

17,030,549 | 17,000,000 | ||||||

9

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Please note that throughout this prospectus, the words “we”, “our”, “us”, or “GRCR Partners” refer to the Company and its subsidiaries and not to the selling stockholders.

Risks Related to Our Business

WE HAVE A LIMITED OPERATING HISTORY THAT YOU CAN USE TO EVALUATE US, AND THE LIKELIHOOD OF OUR SUCCESS MUST BE CONSIDERED IN LIGHT OF THE PROBLEMS, EXPENSES, DIFFICULTIES, COMPLICATIONS AND DELAYS FREQUENTLY ENCOUNTERED BY A SMALL DEVELOPING COMPANY.

We were incorporated in Delaware on January 16, 2015. We have no significant financial resources and have recently started generating revenues. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will operate. Since we have a limited operating history, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to meet our expenses and support our anticipated activities.

WE DEPEND ON OUR SOLE OFFICER AND THE LOSS OF THEIR SERVICES WOULD FORCE US TO EXPEND TIME AND RESOURCES IN PURSUIT OF REPLACEMENTS WHICH COULD ADVERSELY AFFECT OUR BUSINESS.

We consider our sole officer to be essential to the success of the business. Currently, he is not subject to a written employment agreement and we do not maintain key life insurance on him. Although he has not indicated any intention of leaving the Company, his loss could have a negative impact on our ability to fulfill our business plan.

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to approximate at least $50,000 per year, consisting of $25,000 in legal, $20,000 in audit and $5,000 for financial printing and transfer agent fees. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We may not be able to cover these costs from our operations and may need to raise or borrow additional funds. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

OUR SOLE OFFICER AND DIRECTOR BENEFICIALLY OWNS A SIGNIFICANT AMOUNT OF THE OUTSTANDING COMMON STOCK AS OF THE DATE OF THIS FILING AND COULD TAKE ACTIONS DETRIMENTAL TO YOUR INVESTMENT FOR WHICH YOU WOULD HAVE NO REMEDY.

Our sole officer and director beneficially owns approximately 98% of the outstanding common stock as of the date of this filing. He will continue to have the ability to substantially influence the management, policies, and business operations. In addition, the rights of the holders of our common stock will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. Because of the shareholdings of the sole officer and director and well as his management control, such officer and director may cause the company to engage in business combinations without seeking shareholder approval.

OUR SOLE OFFICER AND DIRECTOR INTENDS TO DEVOTE ONLY PART TIME EFFORTS TO OUR BUSINESS, MAY HAVE CONFLICTS OF INTERESTS IN ALLOCATING HIS TIME BETWEEN OUR COMPANY AND THOSE OF OTHER BUSINESSES AND DETERMINING TO WHICH ENTITY A PARTICULAR BUSINESS OPPORTUNITY SHOULD BE PRESENTED WHICH MAY NOT BE SUFFICIENT TO SUCCESSFULLY DEVELOP OUR BUSINESS.

Our sole officer and director has business interests apart from the Company. In this regard, Mr. Conrad has been a licensed insurance broker for over ten years. While we do not face direct competition with respect to his current insurance business, we do face competition in the amount of time that he intends to devote to our business. Currently, he devotes approximately 25% of his working time to our business. While we expect him to increase the percentage of the working time devoted to our company if our operations increase, the amount of time which he may devote to our business may not be sufficient to fully develop our business.

10

Additionally, our sole officer and director may encounter a conflict of interest in allocating his time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owes a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. Such conflicts of interests, should they arise, may be detrimental to our business.

BECAUSE OUR MANAGEMENT DOES NOT HAVE PRIOR EXPERIENCE RUNNING A PUBLIC COMPANY, WE MAY HAVE TO HIRE INDIVIDUALS OR SUSPEND OR CEASE OPERATIONS. ALSO, WE MAY HAVE INSUFFICIENT CONTROLS DUE TO LACK OF FORMAL TRAINING OF MANAGEMENT.

Because our management does not have prior experience in running a public company, including the preparation of reports under the Securities Act of 1934, we may have to hire additional experienced personnel to assist us with the preparation thereof. If we need the additional experienced personnel and we do not hire them, we could fail in our plan of operations and have to suspend operations or cease operations entirely

In addition, our sole officer and director has limited formal training or experience in financial accounting and management, however, he is responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. Our sole officer, who will act as principal financial officer, has limited formal training in financial accounting matters and no previous experience with U.S. companies or U.S. Generally Accepted Accounting Principals, he has been preparing the financial statements that have been audited and reviewed by our auditors and included in this prospectus. When the disclosure and accounting controls referred to above are implemented, he will be responsible for the administration of them. Should he not have sufficient experience, he may be incapable of creating and implementing the controls. Lack of proper controls could cause our financial statements to be inaccurate which will give us an incorrect view of our financial condition and mislead us into believing our operations are being conducted correctly. As a result, investors will be misled about our financial condition and the quality of our operations. This inaccurate reporting could cause us to be subject to sanctions and fines by the SEC which ultimately could cause you to lose your investment, however, because of the small size of our expected operations, we believe that he will be able to monitor the controls he will have created and will be accurate in assembling and providing information to investors.

WE EXPECT OUR QUARTERLY RESULTS TO FLUCTUATE WHICH MAY ADVERSELY AFFECT OUR STOCK PRICE.

We expect that our quarterly results will fluctuate significantly. We believe that period-to-period comparisons of our operating results are not meaningful. Additionally, if our operating results in one or more quarters do not meet securities analysts' or your expectations, the price of our common stock could decrease.

IF OUR COSTS AND EXPENSES ARE GREATER THAN ANTICIPATED AND WE ARE UNABLE TO RAISE ADDITIONAL WORKING CAPITAL, WE MAY BE UNABLE TO FULLY FUND OUR OPERATIONS AND TO OTHERWISE EXECUTE OUR BUSINESS PLAN.

Our currently available working capital will not be sufficient to continue our business for at least the next 12 months. Should our costs and expenses prove to be greater than we currently anticipate, or should we change our current business plan in a manner that will increase or accelerate our anticipated costs and expenses, the depletion of our working capital would be accelerated. To the extent it becomes necessary to raise additional cash in the future as our current cash and working capital resources are depleted, we will seek to raise it through the public or private sale of debt or equity securities, funding from joint-venture or strategic partners, debt financing or short-term loans, or a combination of the foregoing. We may also seek to satisfy indebtedness without any cash outlay through the private issuance of debt or equity securities. We currently do not have any binding commitments for, or readily available sources of, additional financing. We cannot give you any assurance that we will be able to secure the additional cash or working capital we may require to continue our operations.

IF WE REQUIRE ADDITIONAL CAPITAL AND EVEN IF WE ARE ABLE TO RAISE ADDITIONAL FINANCING, WE MIGHT NOT BE ABLE TO OBTAIN IT ON TERMS THAT ARE NOT UNDULY EXPENSIVE OR BURDENSOME TO THE COMPANY OR DISADVANTAGEOUS TO OUR EXISTING SHAREHOLDERS.

If we require additional capital and even if we are able to raise additional cash or working capital through the public or private sale of debt or equity securities, funding from joint-venture or strategic partners, debt financing or short-term loans, or the satisfaction of indebtedness without any cash outlay through the private issuance of debt or equity securities, the terms of such transactions may be unduly expensive or burdensome to the Company or disadvantageous to our existing shareholders. For example, we may be forced to sell or issue our securities at significant discounts to market, or pursuant to onerous terms and conditions, including the issuance of preferred stock with disadvantageous dividend, voting or veto, board membership, conversion, redemption or liquidation provisions; the issuance of convertible debt with disadvantageous interest rates and conversion features; the issuance of warrants with cashless exercise features; the issuance of securities with anti-dilution provisions; and the grant of registration rights with significant penalties for the failure to quickly register. If we raise debt financing, we may be required to secure the financing with all of our business assets, which could be sold or retained by the creditor should we default in our payment obligations.

11

OUR SUCCESS IS DEPENDENT ON OUR ABILITY TO RETAIN AND ATTRACT KEY PERSONNEL.

Many of our management personnel have worked for us for less than one year. Our efficiency may be limited while these employees and future employees are being integrated into our operations. In addition, we may be unable to find and hire additional qualified management and professional personnel to help lead us.

Our expenses will increase as we build an infrastructure to implement our business model. For example, we expect to hire additional employees, expand information technology systems and lease more space for our corporate offices to the extent we have capital available. Due to our current limited capital, we initially intend to offer independent contractor arrangements. If any of these and other expenses are not accompanied by increased revenue, our operating losses will be greater than we anticipate.

WE FACE INTENSE COMPETITION AND OPERATE IN AN INDUSTRY WITH LIMITED BARRIERS TO ENTRY, AND MOST OF OUR COMPETITORS ARE BETTER POSITIONED THAN WE ARE.

Competition in the professional consulting services markets in which we operate is highly fragmented, consisting of several large global firms including; McKinsey & Co, The Boston Consulting Group, Deloitte Consulting LLP, PricewaterhouseCoopers LLP, and several thousand smaller firms. We may compete with both the large firms and the smaller firms in all areas of our consulting service offerings. The markets for the Company’s services and products are highly competitive. There are few barriers to entry, so new entrants occur frequently, resulting in considerable market fragmentation. Companies in this industry compete on a number of parameters including degree and quality of Consultants, position knowledge, industry expertise, service quality, and efficiency in completing assignments. Typically, companies with greater strength in these parameters garner higher margins. Competition in the GRC Platform provider market in which we operate is highly fragmented, consisting of several large global firms including; Oracle, Provitti, SAI Global, SAP, SAS Institute, and many smaller software firms that have designed software applications for specific tasks. As such, we may compete with both the large firms and the smaller firms in all areas of our GRC platform offering.

A SIGNIFICANT OR PROLONGED ECONOMIC DOWNTURN WOULD HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS.

Our results of operations are affected by the level of business activity of our clients, which in turn is affected by general economic conditions and the level of economic activity in the industries and markets that they serve. On an aggregate basis, our clients may be less likely to hire third party professional service providers or purchase software solutions during economic downturns and periods of economic uncertainty. To the extent our clients delay or reduce hiring professional service providers, our results of operations will be adversely affected. A continued economic downturn or period of economic uncertainty and a decline in the level of business activity of our clients would have a material adverse effect on our business, financial condition and results of operations.

OUR PROFITABILITY WILL BE ADVERSELY IMPACTED IF WE ARE UNABLE TO MAINTAIN OUR PRICING AND UTILIZATION RATES AS WELL AS CONTROL OUR COSTS.

Our profitability derives from and is impacted by three primary factors: (i) the prices for our services; (ii) our professionals’ utilization or billable time; and (iii) our costs. To achieve our desired level of profitability, our utilization must remain at an appropriate rate, and we must contain our costs. Should we reduce our prices in the future as a result of pricing pressures, or should we be unable to achieve our target utilization rates and costs, our profitability could be adversely impacted.

CLIENT CONCENTRATION & OUR CLIENTS COULD UNEXPECTEDLY TERMINATE THEIR CONTRACTS FOR OUR SERVICES.

As of the date of this Prospectus, we have two clients that make up 85.6% of our revenue (each 42.8%). Should one of both clients terminate their contracts our results of operations would be significantly impacted. Generally, our contracts look for extended commitments from clients. However, other contracts can be canceled by the client with limited advance notice and without significant penalty. A client’s termination of a contract for our services could result in a loss of expected revenues and additional expenses for staff that were allocated to that client’s assignment. We could be required to maintain underutilized employees who were assigned to the terminated contract. The unexpected cancellation or significant reduction in the scope of any of our large assignments, or client termination of one or more recurring revenue contracts could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Our Common Stock

YOU MAY NOT BE ABLE TO LIQUIDATE YOUR INVESTMENT SINCE THERE IS NO ASSURANCE THAT A PUBLIC MARKET WILL DEVELOP FOR OUR COMMON STOCK OR THAT OUR COMMON STOCK WILL EVER BE APPROVED FOR TRADING ON A RECOGNIZED EXCHANGE

There is no established public trading market for our securities. Although we intend to be quoted on the OTCQB tier or Pink Sheet tier of OTC Markets in the future, our shares are not and have not been quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the FINRA, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment, which will result in the loss of your investment.

12

THE OFFERING PRICE OF THE SHARES WAS SOLELY DETERMINED BY THE SOLE DIRECTOR, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SECURITIES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO THE ACTUAL VALUE OF THE COMPANY, AND MAY MAKE OUR SHARES DIFFICULT TO SELL.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.10 for the shares of common stock was determined by our director and in consideration of the fact the shares will be liquid and registered. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

SHOULD OUR STOCK BECOME QUOTED ON THE OTC BULLETIN BOARD, IF WE FAIL TO REMAIN CURRENT ON OUR REPORTING REQUIREMENTS, WE COULD BE REMOVED FROM THE OTC BULLETIN BOARD WHICH WOULD LIMIT THE ABILITY OF BROKER-DEALERS TO SELL OUR SECURITIES AND THE ABILITY OF STOCKHOLDERS TO SELL THEIR SECURITIES IN THE SECONDARY MARKET.

Companies quoted on the OTCQB tier of OTC Markets, such as we are seeking to become, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTCQB. If we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In addition, we may be unable to get re-quoted on the OTC Bulletin Board, which may have an adverse material effect on our Company.

ONCE PUBLICLY TRADING, THE APPLICATION OF THE “PENNY STOCK” RULES COULD ADVERSELY AFFECT THE MARKET PRICE OF OUR COMMON SHARES AND INCREASE YOUR TRANSACTION COSTS TO SELL THOSE SHARES.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

•

|

that a broker or dealer approve a person's account for transactions in penny stocks; and

|

|

•

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

•

|

obtain financial information and investment experience objectives of the person; and

|

|

•

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

|

•

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

•

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

13

WE DO NOT EXPECT TO PAY DIVIDENDS IN THE FUTURE; ANY RETURN ON INVESTMENT MAY BE LIMITED TO THE VALUE OF OUR COMMON STOCK.

We do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our Common Stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our Board of Directors. If we do not pay dividends, our Common Stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

OUR COMMON STOCK PRICE IS LIKELY TO BE HIGHLY VOLATILE WHICH MAY SUBJECT US TO SECURITIES LITIGATION THEREBY DIVERTING OUR RESOURCES WHICH MAY AFFECT OUR PROFITABILITY AND RESULTS OF OPERATION.

The market price for our common stock is likely to be highly volatile as the stock market in general and the market for Internet-related stocks.

The following factors will add to our common stock price's volatility:

|

·

|

actual or anticipated variations in our quarterly operating results;

|

|

·

|

announcements by us of acquisitions;

|

|

·

|

additions or departures of our key personnel; and.

|

|

·

|

sales of our common stock

|

Many of these factors are beyond our control. These factors may decrease the market price of our common stock, regardless of our operating performance. In the past, plaintiffs have initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES MAY MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS. We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

|

o

|

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

o

|

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit

firm rotation or a supplement to the

auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

o

|

submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and

|

|

|

o

|

disclose certain executive compensation related items such as the correlation between executive compensation and performance

and comparisons of the CEO's compensation to median employee compensation.

|

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We will remain an emerging growth company for up to five full fiscal years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any January 31 before that time, we would cease to be an emerging growth company as of the following December 31, or if our annual revenues exceed $1 billion, we would cease to be an emerging growth company the following fiscal year, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an emerging growth company immediately.

Notwithstanding the above, we are also currently a "smaller reporting company," meaning that we are not an investment company, an asset-backed issuer, nor a majority-owned subsidiary of a parent company that is not a smaller reporting company, and has a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. If we are still considered a "smaller reporting company" at such time as we cease to be an "emerging growth company," we will be subject to increased disclosure requirements. However, the disclosure requirements will still be less than they would be if we were not considered either an "emerging growth company" or a "smaller reporting company." Specifically, similar to "emerging growth companies", "smaller reporting companies" are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2015; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in its SEC filings due to its status as an "emerging growth company" or "smaller reporting company" may make us less attractive to investors given that it will be harder for investors to analyze the Company's results of operations and financial prospects and, as a result, it may be difficult for us to raise additional capital as and when we need it.

14

USE OF PROCEEDS

GRCR will apply the proceeds from the offering to pay for accounting fees, legal and professional fees associated with the offering. The total estimated costs of the offering ($50,000) do not exceed the maximum amount of offering proceeds ($250,000). The estimated costs of the offering, which principally relate to professional costs, are estimated to consist of:

|

SEC Registration fee

|

$ | 32 | ||

|

FINRA filing fee

|

100 | |||

|

Accounting expenses

|

25,000 | |||

|

Legal fees and expenses

|

15,000 | |||

|

Transfer agent fees

|

2,500 | |||

|

Blue Sky fees and expenses

|

5,000 | |||

|

Miscellaneous expenses

|

2,368 | |||

| Total | $ | 50,000 |

Our offering is being made on a best efforts basis: no minimum number of shares must be sold in order for the offering to proceed. GRCR will pay all costs related to this offering. If the amount of offering costs exceed the amount raised, this amount in excess of the offering proceeds will be paid when necessary or otherwise accrued on the books and records of GRCR until we are able to pay the full amounts due either from revenues or loans from our president and chief executive officer, related or unrelated parties that we may approach. A significant portion of the estimated costs of the offering ($50,000) are professional fees and expenses ($40,000). Absent sufficient revenues to pay these amounts, we will seek financial assistance either from our president and chief executive officer, or shareholders or possibly third party business associates of our president and chief executive officer who may agree to loan us the funds necessary to cover the balance of outstanding professional and related fees related to our prospectus to the extent that such liabilities cannot be extended or satisfied in other ways and the professional service providers insist upon payment. Absent the above, Mr. Conrad will attempt to seek sufficient funding personally for the amounts due and, if successful in obtaining these funds, to lend it to the Company on an interest-free basis. No formal written arrangement exists, with respect to Mr. Conrad or anyone’s commitment outside of the Company, to loan funds for this purpose.

The following table sets forth the uses of proceeds assuming the sale of 100%, 75%, 50% and 10% respectively, of the securities offered for sale by the Company. The first offering proceeds will be allocated to pay any outstanding legal expenses related to this filing (Total agreed upon costs are $15,000). There is no assurance that we will raise the full $250,000 as anticipated. The following scenarios are for illustrative purposes only and the actual amounts of proceeds, if any, may differ.

|

% of Total Offering ($250,000)

|

100 | % | 75 | % | 50 | % | 10 | % | ||||||||

|

Offering Costs

|

50,000 | 50,000 | 50,000 | 50,000 | ||||||||||||

|

Net Proceeds

|

200,000 | 137,500 | 75,000 |

(25,000

|

) | |||||||||||

|

Market Collateral & Website Development

|

55,000 | 35,000 | 20,000 | - | ||||||||||||

|

Compliance Architecture System Development

|

50,000 | 50,000 | 25,000 | - | ||||||||||||

|

Accounting & Operations Support

|

15,000 | 7,000 | 4,000 | - | ||||||||||||

|

Advertising & Search Engine Optimization

|

25,000 | 15,000 | 7,500 | - | ||||||||||||

|

Rent and Office Equipment

|

15,000 | 7,500 | 5,000 | - | ||||||||||||

|

Consultants for Service Delivery

|

40,000 | 23,000 | 13,500 | - | ||||||||||||

|

Total

|

200,000 | 137,500 | 75,000 | - |

15

THE OFFERING

The Company will have substantial costs relating to this offering. We will also incur ongoing continuous costs to meet the reporting requirements of a public company. These costs may very well exceed our current or anticipated revenues, significantly. However, the Company believes that the risks are worth taking because management believes, based on its own observations which are not based on any formal studies, that potential future vendors, consultants and manufacturers will have a higher regard in providing services for a public company than a small, privately-held startup company. Management’s belief is based solely on the advice and informal consultation with various business and legal professionals who are known to us and have public company experience. These discussions have led us to believe that being a public company may afford the business (management and its shareholders) with a higher degree of recognition than would be typically attained as a small private (or non-public) company and may increase its ability and/or options to obtain financing for its growth. In addition, by being a public company we believe increases the visibility of our future opportunities to raise funds or to pay vendors by issuing restricted common stock rather than cash. We cannot predict the likelihood that our observations and conclusions about the benefits of being a public company will prove accurate or beneficial to us.

We are offering for sale a maximum of 2,500,000 shares of common stock at a fixed price of $0.10 per share. There is no minimum number of shares that must be sold by us for the offering to close, and we will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self-underwritten, best efforts basis, which means our president, and chief executive officer, Mr. Conrad, will attempt to sell the shares. This prospectus will permit our president and chief executive officer to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares that he may sell. Mr. Conrad will sell the shares and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, Mr. Conrad will rely primarily on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The intended methods of communication include, without limitation, telephone and personal contacts.

As discussed above in connection with GRCR’s selling efforts in the offering, Mr. Conrad will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, as amended, but rather will rely upon the “safe harbor” provisions of Rule 3a4-1, promulgated under the Exchange Act, as amended. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Mr. Conrad is not subject to any statutory disqualification, as that term is defined in Section 3(a) (39) of the Exchange Act. Mr. Conrad will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Conrad is not, nor has he been within the past 12 months, a broker or dealer, and he is not, nor has he been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Conrad will continue to primarily perform duties for the Company or on its behalf otherwise than in connection with transactions in securities. Mr. Conrad will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

The proceeds from the sale of the shares in this offering will be made payable directly to the Company. All subscription agreements and checks are irrevocable and should be delivered to the Company at the address provided on the Subscription Agreement.

We will receive all proceeds from the sale of up to 2,500,000 shares being offered. No proceeds will be received by any other entity other than the Company. The price per share is fixed at $0.10 for the duration of this offering.

All subscribed funds will be held in a noninterest-bearing account. Any subscribed funds may be immediately utilized by the Company prior to the completion of the offering. The offering will be completed 180 days from the effective date of this prospectus (or such earlier date when all 2,500,000 shares are sold), unless extended by our board of directors for an additional 180 days. There is no minimum number of shares that must be sold in this offering. All subscription agreements and checks for payment of shares are irrevocable (except as to any states that require a statutory cooling-off period or rescission right).

The Company will deliver stock certificates attributable to shares of common stock purchased directly by the purchasers within 30 days of the close of this offering or as soon thereafter as practicable.

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

16

The offering may terminate on the earlier of:

|

i.

|

the date when the sale of all 2,500,000 shares is completed, or

|

|

ii.

|

180 days from the effective date of this document or any extension thereto.

|

The offering price of the common stock has been determined arbitrarily and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings or net worth.

The purchase of the common stock in this offering involves a high degree of risk. The common stock offered in this prospectus is for investment purposes only, and currently no market for our common stock exists. While we plan to find a market maker to file a Rule 211 application with FINRA in order to apply for the inclusion of our common stock in the OTCQB, such efforts may not be successful, and our shares may never be quoted and owners of our common stock may not have a market in which to sell their shares. Also, no estimate may be given as to the time that this application process may require.

Since there is no minimum amount of shares that must be sold by the company, you may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

|

-

|

Has not received enough proceeds from the offering to fully launch its operations; and

|

|

-

|

Has no market for its shares.

|

Please refer to the sections of this prospectus entitled "Risk Factors" and "Dilution" before making an investment in the common stock of the Company.

DETERMINATION OF OFFERING PRICE

The offering price of the common stock has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, any historical earnings or net worth. In determining the offering price, management considered such factors as the prospects, if any, for similar companies, anticipated results of operations, present financial resources and the likelihood of acceptance of this offering. No valuation or appraisal has been prepared for our business. We cannot assure you that a public market for our securities will develop or continue or that the securities will ever trade at a price higher than the offering price.

DILUTION

“Dilution” represents the difference between the offering price of the shares of common stock hereby being offered and the net book value per share of common stock immediately after completion of this offering. "Net book value" is the amount that results from subtracting total liabilities from total assets. In this offering, the level of dilution is increased as a result of the relatively low net book value of our issued and outstanding common stock and because the proceeds of the offering are substantially less than our estimated costs. Assuming all of the shares of common stock offered herein are sold, the purchasers in this offering may lose the entire value of their shares purchased in that each purchased share may have a negative net book value if raise less proceeds than the cost of during the offering. Net book value of existing shareholders’ shares will also decrease if the costs exceed the proceeds received from this offering.

17

The following table illustrates the dilution to the purchasers of the common stock in this offering (as of the date of this Prospectus):

|

If 50% of Shares Sold

|

If 100% of Shares Sold

|

|||||||

|

Shares Sold

|

1,250,000 | 2,500,000 | ||||||

|

Offering price per share

|

$ | 0.10 | $ | 0.10 | ||||

|

Book value per share before offering

|

$ | 0.002 | $ | 0.002 | ||||

|

Book value per share after offering

|

$ | 0.009 | $ | 0.014 | ||||

|

Net increase to original shareholders

|

$ | 0.007 | $ | 0.013 | ||||

|

Decrease in investment to new shareholders

|

$ | (0.091 | ) | $ | (0.086 | ) | ||

|

Dilution percentage to new Shareholders

|

(91.4 | %) | (85.6 | %) | ||||

The following table summarizes the number and percentage of shares purchased the amount and percentage of consideration paid and the average price per share paid by our existing stockholders and by new investors in this offering:

|

2,500,000 shares sold

Existing shareholders

|

Price Per Share

$0.001

|

Number of Shares Held

17,347,500

|

Percentage of Ownership

87.4%

|

Consideration

$ 32,375

|

||||||||||||

|

Investors in this offering

|

$ | 0.10 | 2,500,000 | 12.6 | % | $ | 250,000 | |||||||||

|

1,250,000 shares sold

Existing shareholders

|

$ | 0.001 | 17,347,500 | 93.3 | % | $ | 32,375 | |||||||||

|

Investors in this offering

|

$ | 0.10 | 1,250,000 | 6.7 | % | $ | 125,000 | |||||||||

DIVIDEND POLICY

We have never paid cash or any other form of dividend on our common stock, and we do not anticipate paying cash dividends in the foreseeable future. Moreover, any future credit facilities might contain restrictions on our ability to declare and pay dividends on our common stock. We plan to retain all earnings, if any, for the foreseeable future for use in the operation of our business and to fund the pursuit of future growth. Future dividends, if any, will depend on, among other things, our results of operations, capital requirements and on such other factors as our board of directors, in its discretion, may consider relevant.

MARKET FOR SECURITIES

There is no established public market for our common stock, and a public market may never develop. No market maker has agreed to file an application with FINRA. There can be no assurance as to whether such a market maker will agree to file an application or the market maker’s application will be accepted by FINRA nor can we estimate the time period that will be required for the application process. Even if our common stock were quoted in a market, there may never be substantial activity in such market. If there is substantial activity, such activity may not be maintained, and no prediction can be made as to what prices may prevail in such market.

If we become able to have our shares of common stock quoted on the OTCQB, we will then try, through a broker-dealer and its’ clearing firm, to become eligible with the DTC to permit our shares to be traded electronically. If an issuer is not “DTC-eligible,” its shares cannot be electronically transferred between brokerage accounts, which, based on the realities of the marketplace as it exists today (especially the OTCQB), means that shares of a issuer will not be able to be traded (technically the shares can be traded manually between accounts, but this may take days and is not a realistic option for issuers relying on broker-dealers for stock transactions - like all the companies on the OTCQB). What this means is that while DTC-eligibility is not a requirement to trade on the OTCBB, it is however a necessity to efficiently process trades on the OTCQB if a company’s stock is going to trade with any volume. There are no assurances that our shares will ever become DTC- eligible or, if they do, how long it may take.

18

We do not have common stock or equity subject to outstanding options or warrants to purchase or securities convertible into our common stock or equity. Also, 98% of our outstanding common stock (17,000,000 shares) is held by Mr. Conrad, our president, and chief executive officer. In general, under Rule 144, a holder of restricted common shares who is an affiliate at the time of the sale or any time during the three months preceding the sale can resell shares, subject to the restrictions described below.

If we become a public reporting company under the Exchange Act for at least 90 days immediately before the sale, then at least six months must have elapsed since those shares were acquired from us or an affiliate, and we must remain current in our filings for an additional period of six months; in all other cases, at least one year must have elapsed since the shares were acquired from us or an affiliate.

The number of shares sold by such person within any three-month period cannot exceed the greater of:

|

-

|

1% of the total number of our common shares then outstanding; or

|

|

-

|

The average weekly trading volume of our common shares during the four calendar weeks preceding the date on which notice on Form 144 with respect to the sale is filed with the SEC (or, if Form 144 is not required to be filed, then four calendar weeks preceding the date the selling broker receives the sell order) (This condition is not currently available to the Company because its securities do not trade on a recognized exchange).

|

Conditions relating to the manner of sale, notice requirements (filing of Form 144 with the Securities and Exchange Commission) and the availability of public information about us must also be satisfied.

All of the presently outstanding shares of our common stock are "restricted securities" as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available. Pursuant to the Rule 144, one year must elapse from the time a “shell company,” as defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act, ceases to be a “shell company” and files a Form 8-K addressing Item 5.06 with such information as may be required in a Form 10 Registration Statement with the SEC, before a restricted shareholder can resell their holdings in reliance on Rule 144. The Form 10 information or disclosure is equivalent to the information that a company would be required to file if it were registering a class of securities on Form 10 under the Exchange Act. Under amended Rule 144, restricted or unrestricted securities that were initially issued by a reporting or non-reporting shell company or a company that was at any time previously a reporting or non- reporting shell company, can only be resold in reliance on Rule 144 if the following conditions are met:

1) the issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company;

2) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

3) the issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the Issuer was required to file such reports and materials), other than Form 8-K reports; and

4) at least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

We are not classified as a “shell company” under Rule 405 of the Securities Act Rule 12b-2 of the Exchange Act.

Current Public Information

In general, for sales by affiliates and non-affiliates, the satisfaction of the current public information requirement depends on whether we are a public reporting company under the Exchange Act:

|

-

|

If we have been a public reporting company for at least 90 days immediately before the sale, then the current public information requirement is satisfied if we have filed all periodic reports (other than Form 8-K) required to be filed under the Exchange Act during the 12 months immediately before the sale (or such shorter period as we have been required to file those reports).

|

|

-

|

If we have not been a public reporting company for at least 90 days immediately before the sale, then the requirement is satisfied if specified types of basic information about us (including our business, management and our financial condition and results of operations) are publicly available.

|

19

However, no assurance can be given as to:

|

-

|

the likelihood of a market for our common shares developing,

|

|

-

|

the liquidity of any such market,

|

|

-

|

the ability of the shareholders to sell the shares, or

|

|

-

|

the prices that shareholders may obtain for any of the shares.

|

No prediction can be made as to the effect, if any, that future sales of shares or the availability of shares for future sale will have on the market price prevailing from time to time. Sales of substantial amounts of our common shares, or the perception that such sales could occur, may adversely affect prevailing market prices of the common shares.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained in this prospectus which is a part of our registration statement involve risks and uncertainties, including statements as to:

|

-

|

our future operating results;

|

|

-

|

our business prospects;

|

|

-

|

any contractual arrangements and relationships with third parties;

|

|

-

|

the dependence of our future success on the general economy;

|

|

-

|

any possible financings; and

|

|

-

|

the adequacy of our cash resources and working capital.

|

These forward-looking statements can generally be identified as such because the context of the statement will include words such as we “believe," “anticipate,” “expect,” “estimate” or words of similar meaning. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which are described in close proximity to such statements and which could cause actual results to differ materially from those anticipated as of the date of this prospectus. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this prospectus, and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

20

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act. We will continue to be an emerging growth company until: (i) the last day of our fiscal year during which we had total annual gross revenues of $1,000,000,000 or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which we are deemed to be a large accelerated filer, as defined in Section 12b-2 of the Exchange Act.

As an emerging growth company, we are exempt from:

· Sections 14A(a) and (b) of the Exchange Act, which require companies to hold stockholder advisory votes on executive compensation and golden parachute compensation;

· The requirement to provide, in any registration statement, periodic report or other report to be filed with the Securities and Exchange Commission (the “Commission” or “SEC”), certain modified executive compensation disclosure under Item 402 of Regulation S-K or selected financial data under Item 301 of Regulation S-K for any period before the earliest audited period presented in our initial registration statement;

· Compliance with new or revised accounting standards until those standards are applicable to private companies;

· The requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002 to provide auditor attestation of our internal controls and procedures; and

· Any Public Company Accounting Oversight Board (“PCAOB”) rules regarding mandatory audit firm rotation or an expanded auditor report, and any other PCAOB rules subsequently adopted unless the Commission determines the new rules are necessary for protecting the public.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the Jumpstart Our Business Startups Act.

We are also a smaller reporting company as defined in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are not required to provide selected financial data pursuant to Item 301 of Regulation S-K, nor are we required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. We are also permitted to provide certain modified executive compensation disclosure under Item 402 of Regulation S-K.

Summary of Business

GRCR Partners Inc. (the “Company”, “Our” or “We”), formed on January 16, 2015, is a provider of corporate governance, risk management, compliance and regulatory reporting (“GRCR”) solutions for businesses (“GRCR Solutions”). Currently, we provide GRCR Solutions through professional consulting services on a project-based fee arrangement. We deliver our services following our proprietary compliance architecture methodology. The skilled application of the fundamental principles governing compliance and risk management is what we call compliance architecture. We are building-out our Compliance Architecture Platform (“CAP”) to be an automated GRCR management tool that streamlines the process of GRCR for businesses. We believe that by combining expert consulting and GRCR software tools, we will help clients cost effectively build and maintain GRCR programs that reduce day-to-day and long term risks in their work environment.

Our Opportunity

We believe corporate governance, risk management, compliance and regulatory reporting has become a growing operational and financial burden, limiting a company’s ability to keep pace with business growth goals and objectives. We believe that to close that gap clients need to utilize the efficiencies driven through technology automation and the use of third-party subject-matter-experts and GRCR service providers. We believe that by combining these solutions in one ease to use platform allows us an opportunity to step in to meet a significant need for the cost-effective development and maintenance of a business’s GRCR program.

Our Operations and Strategy

As of the date of this Prospectus, we have taken the following steps to implement our business plan:

|

- We have developed our business plan;

- We have engaged 5 consulting services clients, and, for the period from inception (January 16, 2015) to September 30, 2015 had a positive gross margin and net profit;

- We have developed and launched our website, www.GRCRpartners.com;

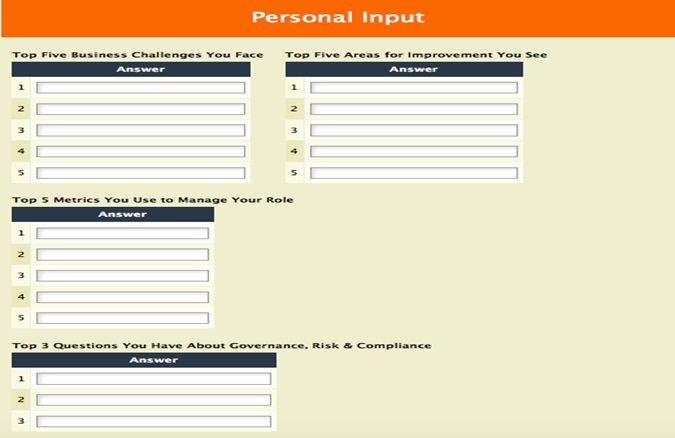

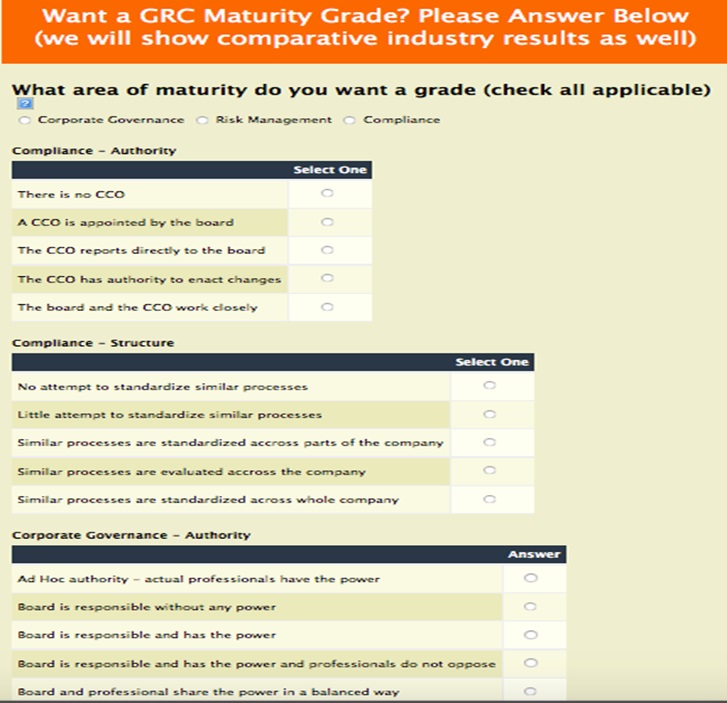

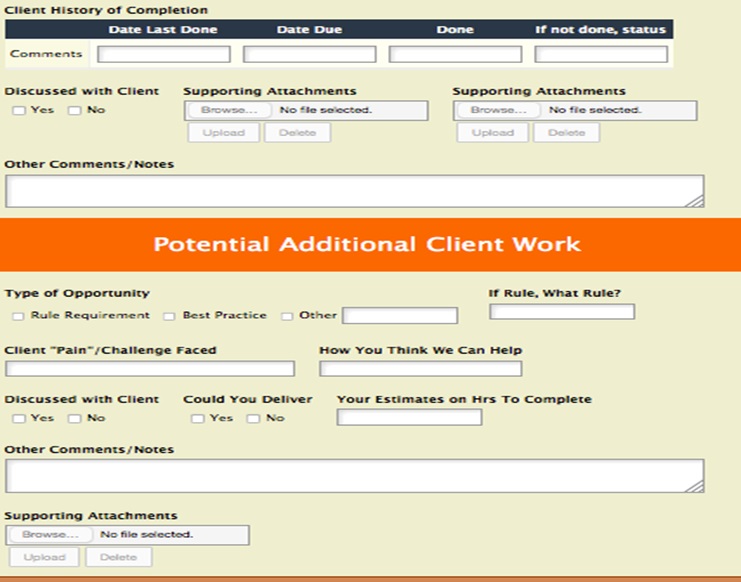

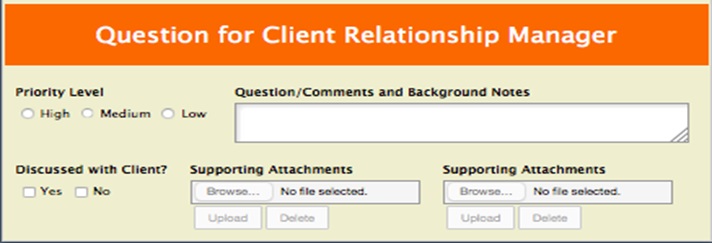

- We have developed various online tools associated with our CAP platform

As part of our CAP, we have researched and developed a database of over 100 third-party GRCR software tools and 25 GRCR service providers.

|

21

Over the next twelve months we plan to;