Attached files

| file | filename |

|---|---|

| EX-31.1 - Firsthand Technology Value Fund, Inc. | fp0018563_ex311.htm |

| EX-32.1 - Firsthand Technology Value Fund, Inc. | fp0018563_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 814-00830

Firsthand Technology Value Fund, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland

|

27-3008946

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

150 Almaden Boulevard, Suite 1250

San Jose, California 95113

(Address and zip code of principal executive offices)

(408) 886-7096

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $0.001 par value

|

The NASDAQ Global Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the issuer has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (check one):

|

Large accelerated filer [ ]

|

Accelerated filer [X]

|

Non-accelerated filer [ ]

(Do not check if a smaller

reporting company) |

Smaller reporting company [ ]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the Common Stock held by non-affiliates of the registrant as of December 31, 2015 was approximately $57 million (computed using the closing price of $8.17 per share of Common Stock on December 31, 2015, as reported by the NASDAQ Global Market).

As of March 15, 2016, Firsthand Technology Value Fund had 7,702,705 shares of common stock, par value $0.001 per share, outstanding.

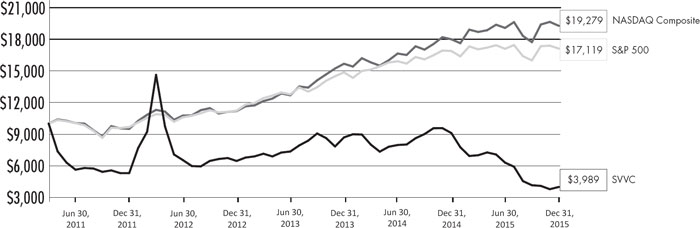

DEAR FELLOW SHAREHOLDERS

A year ago in this space I discussed the profitable exits from Facebook and Twitter that SVVC achieved in 2014. By comparison, 2015 was relatively quiet. I’m disappointed to report that the Fund’s net asset value declined by 6.94% during the year, accompanied by a steep (56.19%) decline in our market price. See pages 40-50 of the Annual Report for the Fund’s detailed financial information.

While two of our companies, Sunrun and Pure Storage, completed IPOs during the year, our pre-IPO shares were subject to a lock-up throughout 2015. For SVVC, 2015 is perhaps best described as a re-loading year, as we re-deployed the capital that came back into the Fund as a result of the liquidation of our Facebook and Twitter investments.

A SPARK FROM LATE-STAGE COMPANIES

As a result of our Facebook and Twitter exits in late 2014, the portfolio had less exposure to late-stage private companies in early 2015 than we were comfortable with. Generally, we strive to maintain a diversified portfolio of early-, middle-, and late-stage companies in order to achieve exits on a consistent basis. In order to increase our exposure to late-stage companies, we made new investments in Cloudera, Nutanix, Pure Storage, and Roku during 2015. In addition to the Sunrun and Pure Storage IPOs already mentioned, Nutanix has filed its Form S-1 in preparation to go public.

Roku’s video streaming devices continue to lead the market in the United States. Research firm Park Associates reported during the year that Roku was not only the best-selling video streaming device in the U.S., but the most-used device in the category as well. More recently, Roku announced that more than one million Roku-powered smart TVs have been sold in the U.S. since entering the market in 2014. The company recently completed another round of private funding, which we hope will set the stage for an IPO in the not-too-distant future.

Mattson Technologies announced late in the year that it has entered into a definitive agreement to merge with Beijing E-town Dragon Semiconductor Industry Investment Center (“E-town Dragon”). Under the agreement, E-town Dragon will acquire all of the outstanding shares of Mattson for $3.80 per share in cash. The transaction is subject to approval by Mattson’s stockholders, and is expected to close in the first quarter of 2016.

Some of our late-stage companies struggled during the year as well. Since going public in August 2015, Sunrun has experienced dramatic volatility in its stock, trading in a range from $6.36 to $14.95 per share in its first 6 months as a public company. Although the company’s installations and revenues continue to grow at a healthy pace, uncertainty surrounding both energy costs and the regulatory environment continue to haunt the stock.

Pure Storage has also had a rough ride in the stock market since going public in October 2015. After a lackluster IPO, in which the stock closed below its IPO price on its first day of trading, the company’s stock recovered after Dell’s acquisition of EMC was announced. Later, it suffered following an earnings miss by competitor Nimble Storage, before bouncing back with Pure Storage’s earnings beat.

Finally, it has been reported that Jawbone (a.k.a., Aliphcom) laid off 15% of its workforce in Q4 2015. In an increasingly crowded wearables market, Jawbone appears to be struggling to keep pace with competitors including Fitbit, Garmin, and Apple.

MILESTONES FOR MIDDLE-STAGE COMPANIES

A number of our middle-stage companies achieved public recognition in 2015. Pivotal Systems and Phunware were both named to Red Herring’s list of the Top 100 private companies in North America in June. Pivotal was later named one of Inc. Magazine’s Top 500 fastest-growing private companies, posting three-year revenue growth of 1,522%.

Advertising technology company Tapad continued to report significant growth. Annual revenue increased 70% in 2015 and the company announced during the year that revenues for its cross-device video business had grown 300% year-over-year, and now make up 20% of Tapad’s total revenues. In the fourth quarter alone, the company’s video revenues grew 91% on a quarter-over-quarter basis. We are pleased to report that in February 2016, Tapad announced that it is being acquired by Norwegian telecom company Telenor for $360 million in cash. As I write this, we anticipate a healthy realized gain if this proposed transaction closes on the announced terms.

After a management change and aggressive cost-cutting efforts in 2014, Hightail has reported that it is now profitable. New CEO (and co-founder) Ranjith Kumaran led the company away from the commodity file-sharing market inhabited by Box, Dropbox, Amazon, and Google. Instead, Kumaran has re-focused the company on the creative professional market segment, and its latest service offering, Hightail Spaces, reflects that focus. The goal of Hightail Spaces is to replace e-mail as the collaboration app of choice for visual files.

CONTINUED ON INSIDE BACK COVER

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement prepared in connection with the Annual Meeting of Stockholders to be held in 2016 are incorporated by reference in Part III of this Form 10-K.

2

TABLE OF CONTENTS

|

PART I.

|

|||

|

Item 1.

|

Business

|

4

|

|

|

Item 1A.

|

Risk Factors

|

17

|

|

|

Item 2.

|

Properties

|

24

|

|

|

Item 3.

|

Legal Proceedings

|

25

|

|

|

Item 4

|

Mine Safety Disclosures

|

25

|

|

|

PART II.

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Matters, and Issuer Purchases of Equity Securities

|

25

|

|

|

Item 6.

|

Selected Financial Data

|

26

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29

|

|

|

Item 8.

|

Financial Statements and Supplemental Data

|

40

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

71

|

|

|

Item 9A.

|

Controls and Procedures

|

71

|

|

|

Item 9B.

|

Other Information

|

72

|

|

|

PART III.

|

|||

|

Item 10.

|

Directors, Executive Officers, and Corporate Governance

|

72

|

|

|

Item 11.

|

Executive Compensation

|

73

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

73

|

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

73

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

73

|

|

|

PART IV.

|

|||

|

Item 15.

|

Exhibits and Financial Statements Schedules

|

73

|

|

3

PART I

Item 1. Business

FORWARD LOOKING STATEMENTS

This report, and other statements that we may make, may contain forward-looking statements, which relate to future events or our future performance or financial condition. We use words such as “anticipates,” “believes,” “expects,” “plans,” “will,” “may,” “continues,” “believes,” “seeks,” “likely,” “intends,” and similar expressions to identify forward-looking statements. The forward-looking statements contained in this Annual Report on Form 10-K involve risks and uncertainties, including forward-looking statements as to:

|

•

|

our future operating results,

|

|

•

|

our business prospects and the prospects of our prospective portfolio companies,

|

|

•

|

the impact of investments that we expect to make,

|

|

•

|

our contractual arrangements and relationships with third parties,

|

|

•

|

the dependence of our future success on the general economy and its impact on the industries in which we invest,

|

|

•

|

the ability of our prospective portfolio companies to achieve their objectives,

|

|

•

|

our expected financings and investments,

|

|

•

|

the adequacy of our cash resources and working capital, and

|

|

•

|

the timing of cash flows, if any, from the operations of our prospective portfolio companies.

|

Our actual results could differ materially from those projected in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in this Annual Report on Form 10-K. In addition, several factors that could materially affect our actual results are the ability of the portfolio companies in which we invest to achieve their objectives; our ability to source favorable private investments; changes in the securities markets, especially the markets for technology companies including those that may be early stage or micro-cap companies; the dependence of our future success of the general economy and its impact on the industries in which we invest and other factors discussed in our periodic filings with the Securities and Exchange Commission (the “SEC”).

Unpredictable or unknown factors could also have material adverse effects on us. Since our actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements, we cannot give any assurance that any of the events anticipated by the forward-looking statements will occur, or, if any of them do, what impact they will have on our results of operations and financial condition. All forward-looking statements included in this Annual Report on Form 10-K are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We do not undertake any obligation to update, amend or clarify these forward-looking statements or the risk factors contained in this Annual Report on Form 10-K, whether as a result of new information, future events or otherwise, except as may be required under the federal securities laws. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC.

GENERAL

Firsthand Technology Value Fund, Inc. (“we,” “us,” “our,” the “Company” or “SVVC”) is an externally managed, closed-end, non-diversified management investment company organized as a Maryland corporation that has elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940 (the “1940 Act”). As such, we are required to comply with certain regulatory requirements. For instance, we generally have to invest at least 70 percent of our total assets in “qualifying assets,” including securities of private or micro-cap public U.S. companies, cash, cash equivalents, U.S. government securities and high-quality debt investments that mature in one year or less. In addition, for tax purposes we have elected to be treated as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue Code of 1986, as amended, which we refer to as the “Code.” Firsthand Capital Management, Inc. (the “Investment Adviser”, the “Adviser”, or “FCM”) serves as our investment adviser and manages the investment process on a daily basis.

4

We were incorporated under the Maryland General Corporation Law in April 2010 and acquired our initial portfolio of securities through the reorganization (the “Reorganization”) into us of Firsthand Technology Value Fund (“TVF”), an open-end mutual fund and a series of Firsthand Funds, which is a Delaware statutory trust. The reorganization was completed on April 15, 2011 and we commenced operations on April 18, 2011.

Our investment objective is to seek long-term growth of capital, principally by seeking capital gains on our equity and equityrelated investments. There can be no assurance that we will achieve our investment objective. Under normal circumstances, we invest at least 80 percent of our total assets for investment purposes in technology companies. We consider technology companies to be those companies that derive at least 50 percent of their revenues from products and/or services within the information technology sector and in the “cleantech” sector. Information technology companies include, but are not limited to, those focused on computer hardware, software, telecommunications, networking, Internet, and consumer electronics. While there is no standard definition of cleantech, it is generally regarded as including goods and services designed to harness renewable energy and materials, eliminate emissions and waste, and reduce the use of natural resources. In addition, under normal circumstances we invest at least 70 percent of our assets in privately held companies and public companies with market capitalizations less than $250 million. Our portfolio is primarily composed of equity and equity derivative securities of technology and cleantech companies (as defined above). These investments generally range between $1 million and $10 million each, although the investment size will vary proportionately with the size of our capital base. We acquire our investments through direct investments in private companies, negotiations with selling shareholders, and in organized secondary marketplaces for private securities.

While our primary focus is to invest in illiquid private technology and cleantech companies, we may also invest in micro-cap publicly traded companies. In addition, we may invest up to 30% of the portfolio in opportunistic investments that do not constitute the private companies and micro-cap public companies described above. These other investments may include investments in securities of public companies that are actively traded. These other investments may also include investments in high-yield bonds, distressed debt, or securities of public companies that are actively traded; and securities of companies located outside of the United States. Our investment activities are managed by FCM.

Neither our investments nor an investment in us are intended to constitute a balanced investment program. We expect to be risk-seeking rather than risk-averse in our investment approach. There is no assurance that our investment objective will be achieved.

We invest a substantial portion of our assets in securities that we consider to be private venture capital equity investments. These private venture capital equity investments usually do not pay interest or dividends and usually are subject to legal or contractual restrictions on resale that may adversely affect the liquidity and marketability of such securities. We expect to make speculative venture capital investments with limited marketability and a greater risk of investment loss than less-speculative investments. Subject to the diversification requirements applicable to a regulated investment company (“RIC”), we may commit all of our assets to only a few investments.

Subject to continuing to meet the compliance tests applicable to BDCs, there are no limitations on the types of securities or other assets in which we may invest. Investments may include the following:

| • | Venture capital investments, whether in corporate, partnership, or other form, including development-stage or start-up entities; |

| • | Equity, equity-related securities (including options and warrants), and debt with equity features from either private or public issuers; |

| • | Debt obligations of all types having varying terms with respect to security or credit support, subordination, purchase price, interest payments, and maturity; |

|

•

|

Foreign securities;

|

|

•

|

Intellectual property or patents or research and development in technology or product development that may lead to patents or other marketable technology; and

|

|

•

|

Miscellaneous investments.

|

5

The table below provides a summary of our investments as of December 31, 2015.

|

INVESTMENT

|

BUSINESS DESCRIPTION

|

FAIR VALUE1

|

|||

|

AliphCom, Inc.

|

Consumer Electronics

|

$

|

4,090,238

|

||

|

Cloudera, Inc.

|

Software

|

557,216

|

|||

|

Gilt Groupe Holdings, Inc.

|

Internet

|

333,317

|

|||

|

Hera Systems, Inc.

|

Aerospace

|

2,000,000

|

|||

|

Hightail, Inc.

|

Cloud Computing

|

9,999,998

|

|||

|

Hiku Labs, Inc.

|

Consumer Electronics

|

2,280,060

|

|||

|

Intevac, Inc.2

|

Other Electronics

|

1,148,688

|

|||

|

IntraOp Medical Corp.

|

Medical Devices

|

26,655,879

|

|||

|

InvenSense, Inc. 2

|

Semiconductors

|

4,092,000

|

|||

|

Mattson Technology, Inc.2

|

Semiconductor Equipment

|

11,578,400

|

|||

|

Nutanix, Inc.

|

Networking

|

4,772,712

|

|||

|

Phunware, Inc.

|

Mobile Computing

|

7,110,747

|

|||

|

Pivotal Systems Corp.

|

Semiconductor Equipment

|

23,370,825

|

|||

|

Pure Storage, Inc.

|

Computer Storage

|

185,283

|

|||

|

QMAT, Inc.

|

Advanced Materials

|

14,642,840

|

|||

|

Roku, Inc.

|

Consumer Electronics

|

2,059,350

|

|||

|

Silicon Genesis Corp.

|

Intellectual Property

|

3,630,383

|

|||

|

Sunrun, Inc.

|

Renewable Energy

|

7,148,368

|

|||

|

Tapad, Inc.

|

Advertising Technology

|

10,411,039

|

|||

|

Telepathy Investors, Inc.

|

Consumer Electronics

|

5,658,644

|

|||

|

Turn Inc.

|

Advertising Technology

|

14,297,669

|

|||

|

UCT Coatings, Inc.

|

Advanced Materials

|

203,901

|

|||

|

Vufine, Inc.

|

Consumer Electronics

|

1,522,275

|

|||

|

Wrightspeed, Inc.

|

Automotive

|

12,928,943

|

|||

|

1

|

Fair value for our private company holdings was determined in good faith by our board of directors on December 31, 2015. For public companies, the figure represents the market value of our securities on December 31, 2015, less any discount due to resale restriction on the security.

|

|

2

|

Public company.

|

INVESTMENTS AND STRATEGIES

The following is a summary description of the types of assets in which we may invest, the investment strategies we may use, and the attendant risks associated with our investments and strategies.

VENTURE CAPITAL INVESTMENTS

We define venture capital as the money and resources made available to privately held start-up firms and privately held and publicly traded small businesses with exceptional growth potential. These businesses can range in stage from pre-revenue to generating positive cash flow. Most of our long-term venture capital investments are in thinly capitalized, unproven, small companies focused on commercializing risky technologies. These businesses also tend to lack management depth, have limited or no history of operations, and have not attained profitability. Because of the speculative nature of these investments, these securities have a significantly greater risk of loss than traditional investment securities. Some of our venture capital investments will never realize their potential, and some will be unprofitable or result in the complete loss of our investment.

6

We acquire our investments through direct investments in private companies, negotiations with selling shareholders, and in organized secondary marketplaces for private securities. Our current focus is on investing in late-stage private companies, particularly those with potential for near-term realizations by way of IPO or acquisition.

In connection with our venture capital investments, we may participate in providing a variety of services to our portfolio companies, including the following:

| • |

Recruiting management,

|

|

•

|

Formulating operating strategies,

|

|

•

|

Formulating intellectual property strategies,

|

| • |

Assisting in financial planning,

|

|

•

|

Providing management in the initial start-up stages, and

|

|

•

|

Establishing corporate goals.

|

We may assist in raising additional capital for these companies from other potential investors and may subordinate our own investment to that of other investors. We typically find it necessary or appropriate to provide additional capital of our own. We may introduce these companies to potential joint venture partners, suppliers, and customers. In addition, we may assist in establishing relationships with investment bankers and other professionals. We may also assist with mergers and acquisitions (“M&As”). We do not currently derive income from these companies for the performance of any of the above services.

We may control, be represented on, or have observer rights on the Board of Directors of a portfolio company through one or more of our officers or directors, who may also serve as officers of the portfolio company. We indemnify our officers and directors for serving on the Boards of Directors or as officers of portfolio companies, which exposes us to additional risks. Particularly during the early stages of an investment, we may, in rare instances, in effect be conducting the operations of the portfolio company. Our goal is to assist each company in establishing its own independent capitalization, management, and Board of Directors. As a venture capital-backed company emerges from the developmental stage with greater management depth and experience, we expect that our role in the portfolio company’s operations will diminish.

EQUITY, EQUITY-RELATED SECURITIES AND DEBT WITH EQUITY FEATURES

We may invest in equity, equity-related securities, and debt with equity features. These securities include common stock, preferred stock, debt instruments convertible into common or preferred stock, limited partnership interests, other beneficial ownership interests and warrants, options, or other rights to acquire any of the foregoing.

We may make investments in companies with operating histories that are unprofitable or marginally profitable, that have negative net worth, or that are involved in bankruptcy or reorganization proceedings. These investments would involve businesses that management believes have potential through the infusion of additional capital and management assistance. In addition, we may make investments in connection with the acquisition or divestiture of companies or divisions of companies. There is a significantly greater risk of loss with these types of securities than is the case with traditional investment securities.

Warrants, options, and convertible or exchangeable securities generally give the investor the right to acquire specified equity securities of an issuer at a specified price during a specified period or on a specified date. Warrants and options fluctuate in value in relation to the value of the underlying security and the remaining life of the warrant or option, while convertible or exchangeable securities fluctuate in value both in relation to the intrinsic value of the security without the conversion or exchange feature and in relation to the value of the conversion or exchange feature, which is like a warrant or an option. When we invest in these securities, we incur the risk that the option feature will expire worthless, thereby either eliminating or diminishing the value of our investment.

Most of our current portfolio company investments are in the equity securities of private companies. Investments in equity securities of private companies often involve securities that are restricted as to sale and cannot be sold in the open market without registration under the Securities Act of 1933 or pursuant to a specific exemption from these registrations. Opportunities for sale are more limited than in the case of marketable securities, although these investments may be purchased at more advantageous prices and may offer attractive investment opportunities. Even if one of our portfolio companies completes an IPO, we are typically subject to a lock-up agreement for 180 days, and the stock price may decline substantially before we are free to sell.

7

We may also invest in publicly traded securities of whatever nature, including relatively small, emerging growth companies that management believes have long-term growth potential. These investments may be through open-market transactions or through private placements in publicly traded companies (“PIPEs”). Securities purchased in PIPE transactions are typically subject to a lock-up agreement for 180 days, or are issued as unregistered securities that are not freely available for six months.

Even if we have registration rights to make our investments in privately held and publicly traded companies more marketable, a considerable amount of time may elapse between a decision to sell or register the securities for sale and the time when we are able to sell the securities. The prices obtainable upon sale may be adversely affected by market conditions or negative conditions affecting the issuer during the intervening time. We may elect to hold formerly restricted securities after they have become freely marketable, either because they remain relatively illiquid or because we believe that they may appreciate in value, during which holding period they may decline in value and be especially volatile as unseasoned securities. If we need funds for investment or working capital purposes, we might need to sell marketable securities at disadvantageous times or prices.

DEBT OBLIGATIONS

We may hold debt securities, including in privately held and thinly traded public companies, for income and as a reserve pending more speculative investments. Debt obligations may include U.S. government and agency securities, commercial paper, bankers’ acceptances, receivables or other asset-based financing, notes, bonds, debentures, or other debt obligations of any nature and repurchase agreements related to these securities. These obligations may have varying terms with respect to security or credit support; subordination; purchase price; interest payments; and maturity from private, public, or governmental issuers of any type located anywhere in the world. We may invest in debt obligations of companies with operating histories that are unprofitable or marginally profitable, that have negative net worth or are involved in bankruptcy or reorganization proceedings, or that are start-up or development-stage entities. In addition, we may participate in the acquisition or divestiture of companies or divisions of companies through issuance or receipt of debt obligations. As of December 31, 2015, the debt obligations held in our portfolio consisted of convertible bridge notes and term notes. The convertible bridge notes generally do not generate cash payments to us, nor are they held for that purpose. Our convertible bridge notes and the interest accrued thereon are held for the purpose of potential conversion into equity at a future date. The term notes we hold are income generating.

Our investments in debt obligations may be of varying quality, including non-rated, unsecured, highly speculative debt investments with limited marketability. Investments in lower-rated and non-rated securities, commonly referred to as “junk bonds,” including our venture debt investments, are subject to special risks, including a greater risk of loss of principal and non-payment of interest. Generally, lower-rated securities offer a higher return potential than higher-rated securities, but involve greater volatility of price and greater risk of loss of income and principal, including the possibility of default or bankruptcy of the issuers of these securities. Lower-rated securities and comparable non-rated securities will likely have large uncertainties or major risk exposure to adverse conditions and are predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal in accordance with the terms of the obligation. The occurrence of adverse conditions and uncertainties to issuers of lower-rated securities would likely reduce the value of lower-rated securities held by us, with a commensurate effect on the value of our shares.

The markets in which lower-rated securities or comparable non-rated securities are traded generally are more limited than those in which higher-rated securities are traded. The existence of limited markets for these securities may restrict our ability to obtain accurate market quotations for the purposes of valuing lower-rated or non-rated securities and calculating net asset value or to sell securities at their fair value. Any economic downturn could adversely affect the ability of issuers’ lower-rated securities to repay principal and pay interest thereon. The market values of lower-rated and non-rated securities also tend to be more sensitive to individual corporate developments and changes in economic conditions than higher-rated securities. In addition, lower-rated securities and comparable non-rated securities generally present a higher degree of credit risk. Issuers of lower-rated securities and comparable non-rated securities are often highly leveraged and may not have more traditional methods of financing available to them, so that their ability to service their debt obligations during an economic downturn or during sustained periods of rising interest rates may be impaired. The risk of loss owing to default by these issuers is significantly greater because lower-rated securities and comparable non-rated securities generally are unsecured and frequently are subordinated to the prior payment of senior indebtedness. We may incur additional expenses to the extent that we are required to seek recovery upon a default in the payment of principal or interest on our portfolio holdings.

The market value of investments in debt securities that carry no equity participation usually reflects yields generally available on securities of similar quality and type at the time purchased. When interest rates decline, the market value of a debt portfolio already invested at higher yields can be expected to rise if the securities are protected against early call. Similarly, when interest rates increase, the market value of a debt portfolio already invested at lower yields can be expected to decline. Deterioration in credit quality also generally causes a decline in market value of the security, while an improvement in credit quality generally leads to increased value.

8

FOREIGN SECURITIES

We may make investments in securities of issuers whose principal operations are conducted outside the United States, and whose earnings and securities are stated in foreign currency. In order to maintain our status as a BDC, our investments in non-qualifying assets, including the securities of companies organized outside the U.S., would be limited to 30 percent of our assets, because we must invest at least 70 percent of our assets in “qualifying assets,” and securities of foreign companies are not “qualifying assets.”

Compared to otherwise comparable investments in securities of U.S. issuers, currency exchange risk of securities of foreign issuers is a significant variable. The value of these investments to us will vary with the relation of the currency in which they are denominated to the U.S. dollar, as well as with intrinsic elements of value such as credit risk, interest rates, and performance of the issuer. Investments in foreign securities also involve risks relating to economic and political developments, including nationalization, expropriation of assets, currency exchange freezes, and local recession. Securities of many foreign issuers are less liquid and more volatile than those of comparable U.S. issuers. Interest and dividend income and capital gains on our foreign securities may be subject to withholding and other taxes that may not be recoverable by us. We may seek to hedge all or part of the currency risk of our investments in foreign securities through the use of futures, options, and forward currency purchases or sales.

INTELLECTUAL PROPERTY

We believe there is a role for organizations that can assist in technology transfer. Scientists and institutions that develop and patent intellectual property perceive the need for and rewards of entrepreneurial commercialization of their inventions. Our form of investment may be:

|

•

|

Funding research and development in the development of a technology,

|

|

•

|

Obtaining licensing rights to intellectual property or patents,

|

|

•

|

Acquiring intellectual property or patents, or

|

|

•

|

Forming and funding companies or joint ventures to commercialize further intellectual property.

|

Income from our investments in intellectual property or its development may take the form of participation in licensing or royalty income, fee income, or some other form of remuneration. In order to satisfy RIC requirements, these investments will normally be held in an entity taxable as a corporation. Investment in developmental intellectual property rights involves a high degree of risk that can result in the loss of our entire investment as well as additional risks, including uncertainties as to the valuation of an investment and potential difficulty in liquidating an investment. Further, investments in intellectual property generally require investor patience, as investment return may be realized only after or over a long period. At some point during the commercialization of a technology, our investment may be transformed into ownership of securities of a development-stage or start-up company, as discussed under “Venture Capital Investments” above.

REPURCHASE OF SHARES

Our shareholders do not have the right to compel us to redeem our shares. We may, however, purchase outstanding shares of our common stock from time to time, subject to approval of our Board of Directors and in compliance with applicable corporate and securities laws. The Board of Directors may authorize public open-market purchases or privately negotiated transactions from time to time when deemed to be in the best interest of our shareholders. Public purchases would be conducted only after notification to shareholders through a press release or other means. The Board of Directors may or may not decide to undertake any purchases of our common stock.

Our repurchases of our common shares would decrease our total assets and would therefore likely have the effect of increasing our expense ratio. Subject to our investment restrictions, we may borrow money to finance the repurchase of our common stock in the open market pursuant to any tender offer. Interest on any borrowings to finance share repurchase transactions would reduce our net assets. If, because of market fluctuations or other reasons, the value of our assets falls below the required 1940 Act coverage requirements, we may have to reduce our borrowed debt to the extent necessary to comply with the requirement. To achieve a reduction, it is possible that we may be required to sell portfolio securities at inopportune times when it may be disadvantageous to do so.

9

PORTFOLIO COMPANY TURNOVER

Changes with respect to portfolio companies will be made as our management considers necessary in seeking to achieve our investment objective. The rate of portfolio turnover will not be treated as a limiting or relevant factor when circumstances exist that are considered by management to make portfolio changes advisable.

Although we expect that many of our investments will be relatively long term in nature, we may make changes in particular portfolio holdings whenever it is considered that an investment no longer has substantial growth potential or has reached its anticipated level of performance, or (especially when cash is not otherwise available) that another investment appears to have a relatively greater opportunity for capital appreciation. We may also make general portfolio changes to increase our cash to position us in a defensive posture. We may make portfolio changes without regard to the length of time we have held an investment, or whether a sale results in profit or loss, or whether a purchase results in the reacquisition of an investment that we may have only recently sold. Our investments in privately held companies are illiquid, which limits portfolio turnover. The portfolio turnover rate may vary greatly during a year as well as from year to year and may also be affected by cash requirements.

COMPETITION

We compete for investments with a number of business development companies and other investment funds (including private equity funds and venture capital funds), reverse merger and special purpose acquisition company (“SPACs”) sponsors, investment bankers that underwrite initial public offerings, hedge funds that invest in private investments in public equities (PIPEs), traditional financial services companies such as commercial banks, and other sources of financing. Many of these entities have greater financial and managerial resources than we do. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act will impose on us as a business development company. We believe we compete with these entities primarily on the basis of our willingness to make smaller, non-controlling investments, the experience and contacts of our investment professionals within our targeted industries, our responsive and efficient investment analysis and decision-making processes, and the investment terms that we offer. We do not seek to compete primarily on the deal terms we offer to potential portfolio companies. We use the industry information available to FCM to assess investment risks and determine appropriate pricing for our investments in portfolio companies. In addition, we believe that the relationships of Kevin Landis (FCM’s President and Chief Investment Officer), and the other senior investment professionals FCM retains, enable us to learn about, and compete effectively for, financing opportunities with attractive companies in the industries in which we seek to invest. For additional information concerning the competitive risks we face, see “Risk Factors—Risks relating to our business and structure—We operate in a highly competitive market for investment opportunities.”

REGULATION

The Small Business Investment Incentive Act of 1980 added the provisions of the 1940 Act applicable only to BDCs. BDCs are a special type of investment company. After a company files its election to be treated as a BDC, it may not withdraw its election without first obtaining the approval of holders of a majority of its outstanding voting securities. The following is a brief description of the 1940 Act provisions applicable to BDCs, qualified in its entirety by reference to the full text of the 1940 Act and the rules issued thereunder by the Securities and Exchange Commission (“SEC”).

Generally, to be eligible to elect BDC status, a company must primarily engage in the business of furnishing capital and making significant managerial assistance available to companies that do not have ready access to capital through conventional financial channels. Such companies that satisfy certain additional criteria described below are termed “eligible portfolio companies.” In general, in order to qualify as a BDC, a company must: (i) be a domestic company; (ii) have registered a class of its securities pursuant to Section 12 of the Securities Exchange Act of 1934 (the “Exchange Act”); (iii) operate for the purpose of investing in the securities of certain types of portfolio companies, including early-stage or emerging companies and businesses suffering or just recovering from financial distress (see following paragraph); (iv) make available significant managerial assistance to such portfolio companies; and (v) file a proper notice of election with the SEC.

An eligible portfolio company generally is a domestic company that is not an investment company or a company excluded from investment company status pursuant to exclusions for certain types of financial companies (such as brokerage firms,

10

banks, insurance companies, and investment banking firms) and that: (i) has a fully diluted market capitalization of less than $250 million and has a class of equity securities listed on a national securities exchange, (ii) does not have a class of securities listed on a national securities exchange, or (iii) is controlled by the BDC by itself or together with others (control under the 1940 Act is presumed to exist where a person owns at least 25 percent of the outstanding voting securities of the portfolio company) and the BDC has a representative on the Board of Directors of such company.

We may be examined periodically by the SEC for compliance with the 1940 Act.

As with other companies regulated by the 1940 Act, a BDC must adhere to certain substantive regulatory requirements. A majority of our directors must be persons who are not interested persons, as that term is defined in the 1940 Act. Additionally, we are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect the BDC. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to us or our shareholders arising from willful malfeasance, bad faith, gross negligence, or reckless disregard of the duties involved in the conduct of such person’s office.

The 1940 Act provides that we may not make an investment in non-qualifying assets unless at the time at least 70 percent of the value of our total assets (measured as of the date of our most recently filed financial statements) consists of qualifying assets. Qualifying assets include: (i) securities of eligible portfolio companies; (ii) securities of certain companies that were eligible portfolio companies at the time we initially acquired their securities and in which we retain a substantial interest; (iii) securities of certain controlled companies; (iv) securities of certain bankrupt, insolvent, or distressed companies; (v) securities received in exchange for or distributed in or with respect to any of the foregoing; and (vi) cash items, U.S. government securities, and high quality short-term debt. The SEC has adopted a rule permitting a BDC to invest its cash in certain money market funds. The 1940 Act also places restrictions on the nature of the transactions in which, and the persons from whom, securities can be purchased in some instances in order for the securities to be considered qualifying assets.

We are permitted by the 1940 Act, under specified conditions, to issue multiple classes of debt and a single class of preferred stock if our asset coverage, as defined in the 1940 Act, is at least 200 percent after the issuance of the debt or the preferred stock (i.e., such senior securities may not be in excess of our net assets). Under specific conditions, we are also permitted by the 1940 Act to issue warrants.

Except under certain conditions, we may sell our securities at a price that is below the prevailing net asset value per share only during the 12-month period after (i) a majority of our directors and our disinterested directors have determined that such sale would be in the best interest of us and our stockholders, and (ii) the holders of a majority of our outstanding voting securities and the holders of a majority of our voting securities held by persons who are not affiliated persons of ours approve our ability to make such issuances. A majority of the disinterested directors must determine in good faith that the price of the securities being sold is not less than a price that closely approximates the market value of the securities, less any distribution discount or commission.

Certain transactions involving certain closely related persons of the Company, including its directors, officers, and employees, may require the prior approval of the SEC. However, the 1940 Act ordinarily does not restrict transactions between us and our portfolio companies.

SUBCHAPTER M STATUS

We elected to be treated as a RIC, taxable under Subchapter M of the Internal Revenue Code of 1986 (the “Code”), for federal income tax purposes. In general, a RIC is not taxable on its income or gains to the extent it distributes such income or gains to its shareholders. In order to qualify as a RIC, we must, in general, (1) annually derive at least 90 percent of our gross income from dividends, interest, and gains from the sale of securities and similar sources (the “Income Source Rule”); (2) quarterly meet certain investment asset diversification requirements; and (3) annually distribute at least 90 percent of our investment company taxable income as a dividend (the “Income Distribution Rule”). Any taxable investment company income not distributed will be subject to corporate level tax. Any taxable investment company income distributed generally will be taxable to shareholders as dividend income.

11

Although we may retain income and gains subject to the limitations described above (including paying corporate level tax on such amounts), we could be subject to an additional four percent excise tax if we fail to distribute 98 percent of our aggregate annual taxable income.

As noted above, in order to qualify as a RIC, we must meet certain investment asset diversification requirements each quarter. Because of the specialized nature of our investment portfolio, in some years we have been able to satisfy the diversification requirements under Subchapter M of the Code primarily as a result of receiving certifications from the SEC under the Code with respect to each taxable year beginning after 1998 that we were “principally engaged in the furnishing of capital to other corporations which are principally engaged in the development or exploitation of inventions, technological improvements, new processes, or products not previously generally available” for such year.

Although we generally intend to qualify as a RIC for each taxable year, under certain circumstances we may choose to take action with respect to one or more taxable years to ensure that we would be taxed under Subchapter C of the Code (rather than Subchapter M) for such year or years. We will choose to take such action only if we determine that the result of the action will benefit us and our shareholders.

INVESTMENT OPPORTUNITY

SVVC invests primarily in equity securities of private technology companies in the United States. We believe that the growth potential exhibited by private technology companies, including cleantech companies, creates an attractive investment environment for SVVC.

The last 15 years has been marked by dramatic changes in the initial public offering (“IPO”) market. Since the dot-com bubble burst in 2000, emerging technology companies have often chosen to stay private longer. The combination of volatile equity markets, increased regulatory requirements (such as the Sarbanes-Oxley Act of 2002), and a lack of investment research coverage has made it less attractive for companies to access the public markets through an IPO. We believe the result is an environment with more opportunities to invest in relatively mature private companies, either directly via primary investments or by purchasing shares in the growing secondary market.

At the same time we believe there are a number of powerful trends creating opportunities for innovative companies and investors alike. The dramatic growth of social networking, cloud computing, and powerful, connected mobile computing devices has enabled new ways of communicating, doing business, and accessing information anytime, anywhere. The Company was established to benefit from convergence of exciting technologies and the growth of private investment opportunities.

COMPETITIVE ADVANTAGES

We believe that we have the following competitive advantages over other capital providers in technology and cleantech companies:

MANAGEMENT EXPERTISE

Kevin Landis, our Chief Executive Officer and Chief Financial Officer, has principal management responsibility for Firsthand Capital Management, Inc. as its owner, President and Chief Investment Officer. Mr. Landis has more than 20 years of experience in technology sector investing, and he intends to dedicate a substantial portion of his time to managing the Company. Mr. Landis controls FCM and is a trustee of Firsthand Funds and a director of the Company.

DISCIPLINED INVESTMENT APPROACH

The Investment Adviser employs a disciplined approach in selecting investments. The Investment Adviser’s investment philosophy focuses on ensuring that our investments have an appropriate return profile relative to risk. When market conditions make it difficult for us to invest according to our criteria, the Investment Adviser intends to be highly selective in deploying our capital. We believe this approach enables us to build an attractive investment portfolio that meets our return and value criteria over the long term.

12

We believe it is critical to conduct extensive due diligence on investment targets. In evaluating new investments we, through the Investment Adviser, conduct a rigorous due diligence process that draws from the Investment Adviser’s investment experience, industry expertise, and network of contacts.

FOCUSING ON INVESTMENTS THAT CAN GENERATE POSITIVE RISK-ADJUSTED RETURNS

The Investment Adviser seeks to maximize the potential for capital appreciation. In making investment decisions the Investment Adviser seeks to pursue and invest in companies that meet several of the following criteria:

|

•

|

outstanding technology,

|

|

•

|

barriers to entry (i.e., patents and other intellectual property rights),

|

|

•

|

experienced management team,

|

|

•

|

established financial sponsors that have a history of creating value with portfolio companies,

|

|

•

|

strong and competitive industry position, and

|

|

•

|

viable exit strategy.

|

Assuming a potential investment meets most or all of our investment criteria, the Investment Adviser intends to be flexible in adopting transaction structures that address the needs of prospective portfolio companies and their owners. Our investment philosophy is focused on internal rates of return over the life of an investment. Given our investment criteria and due diligence process, we structure our investments so they correlate closely with the success of our portfolio companies.

ABILITY TO SOURCE AND EVALUATE TRANSACTIONS THROUGH THE INVESTMENT ADVISER’S RESEARCH CAPABILITY AND ESTABLISHED NETWORK

FCM’s investment management team has overseen investments in dozens of private companies across various industries while employed by FCM and its affiliates since 1994. We believe the expertise of the Investment Adviser’s management team enables FCM to identify, assess, and structure investments successfully across all levels of a company’s capital structure and to manage potential risk and return at all stages of the economic cycle.

We seek to identify potential investments both through active origination and through dialogue with numerous management teams, members of the financial community, and corporate partners with whom Mr. Landis has long-standing relationships. We believe that the team’s broad network of contacts within the investment, commercial banking, private equity and investment management communities in combination with their strong reputation in investment management, enables us to attract well-positioned prospective portfolio companies.

LONGER INVESTMENT HORIZON WITH ATTRACTIVE PUBLICLY TRADED MODEL

Unlike private equity and venture capital funds, we are not subject to standard periodic capital return requirements. Such requirements typically stipulate that funds raised by a private equity or venture capital fund, together with any capital gains on such invested funds, must be returned to investors after a pre-agreed time period. These provisions often force private equity and venture capital funds to seek returns on their investments through mergers, public equity offerings, or other liquidity events more quickly than they otherwise might, potentially resulting in both a lower overall return to investors and an adverse impact on their portfolio companies. While we are required to distribute substantially all realized gains, we believe that with our dividend reinvestment plan and our flexibility to make investments with a long-term view and without the capital return requirements of traditional private investment vehicles provide us with the opportunity to generate returns on invested capital and at the same time enable us to be a better long-term partner for our portfolio companies.

INVESTMENTS

FCM seeks to create a diversified portfolio of equity securities by investing approximately $1 million to $10 million of capital, on average, in the securities of micro-cap public and private companies.

Our portfolio consists primarily of equity securities of private companies and cash and we expect that our portfolio will continue to consist primarily of, equity positions in private companies and cash. These investments include holdings in several private technology and cleantech companies. Moreover, we may acquire investments in the secondary market and, in analyzing such

13

investments, we will employ the same analytical process as we use for our primary investments. For description of our current investments, see “Portfolio Investments.”

We generally seek to invest in companies from the broad variety of industries in which the Investment Adviser has expertise. The following is a representative list of the industries in which we may elect to invest.

|

•

|

Advanced Materials

|

|

•

|

Advertising Technology

|

|

•

|

Automotive

|

|

•

|

Biofuels

|

|

•

|

Cloud Computing

|

|

•

|

Computer Hardware

|

|

•

|

Computer Peripherals

|

|

•

|

Computer Software

|

|

•

|

Electronic Components

|

|

•

|

Energy Efficiency

|

|

•

|

Fuel Cells

|

|

•

|

Medical Devices

|

|

•

|

Mobile Computing

|

|

•

|

Semiconductors

|

|

•

|

Social Networking

|

|

•

|

Solar Photovoltaics

|

|

•

|

Solid-state Lighting

|

|

•

|

Telecommunications

|

|

•

|

Water Purification

|

|

•

|

Wearable Technology

|

|

•

|

Wind-Generated Electricity

|

We may invest in other industries if we are presented with attractive opportunities.

We may on a limited basis purchase or sell options on indexes or securities. We may engage in these transactions to manage risks or otherwise protect the value of the portfolio, and to use these strategies to a limited extent on an opportunistic basis.

INVESTMENT SELECTION

The Investment Adviser seeks to maximize the potential for capital appreciation.

PROSPECTIVE PORTFOLIO COMPANY CHARACTERISTICS

We have identified several criteria that we believe are important in identifying and investing in prospective portfolio companies. These criteria provide general guidelines for our investment decisions; however, we caution you that no single portfolio company (or prospective portfolio company) will meet all of these criteria. Generally, we use our experience and access to market information generated to identify investment candidates and to structure investments quickly and effectively.

Outstanding Technology

Our investment philosophy places a premium on identifying companies that have developed disruptive technologies, that is, technologies with the potential to dramatically alter the economics or performance of a particular type of product or service.

Barriers to Entry

We believe having defensible barriers to entry, in the form of patents or other intellectual property rights, is critically important in technology industries, in which change happens very rapidly. We seek out companies that have secured protection of key technologies through patents, trademarks, or other means.

14

Experienced management and established financial sponsor relationship

We generally require that our portfolio companies have an experienced management team. We also require the portfolio companies to have in place proper incentives to induce management to succeed and to act in concert with our interests as investors, including having significant equity interests. In addition, we focus our investments in companies backed by strong financial sponsors that have a history of creating value and with whom members of our investment adviser have an established relationship.

Strong and defensible competitive market position in industry

We seek to invest in target companies that have developed leading market positions within their respective markets and are well positioned to capitalize on growth opportunities. We seek companies that demonstrate significant competitive advantages versus their competitors, which should help to protect their market position and profitability.

Viable exit strategy

We seek to invest in companies that we believe will provide a steady stream of cash flow to reinvest in their respective businesses. In addition, we also seek to invest in companies whose business models and expected future cash flows offer attractive exit possibilities. These companies include candidates for strategic acquisition by other industry participants and companies that may repay our investments through an initial public offering of common stock or another capital market transaction. In today’s market environment, we believe that a strategic sale is more likely than an IPO for many of our portfolio companies, although IPOs cannot be ruled out. We believe that an acquisition by a strategic buyer is possible at any time for any of our companies.

DUE DILIGENCE

We believe it is critical to conduct extensive due diligence on investment targets. In evaluating new investments, we, through the Investment Adviser, conduct a rigorous due diligence process that draws from the Investment Adviser’s investment experience, industry expertise, and network of contacts. The Investment Adviser conducts extensive due diligence investigations in their investment activities. In conducting due diligence, the Investment Adviser uses publicly available information as well as information from its relationships with former and current management teams, consultants, competitors, and investment bankers.

Our due diligence typically includes:

|

•

|

review of historical and prospective financial information;

|

|

•

|

review of technology, product, and business plan;

|

|

•

|

on-site visits;

|

|

•

|

interviews with management, employees, customers, and vendors of the potential portfolio company;

|

|

•

|

background checks; and

|

|

•

|

research relating to the company’s management, industry, markets, products and services, and competitors.

|

Upon the completion of due diligence, the Investment Adviser’s investment committee determines whether to pursue the potential investment. Additional due diligence with respect to any investment may be conducted on our behalf by attorneys and accountants prior to the closing of the investment, as well as other outside consultants, experts, and/or advisers, as appropriate. To the extent unaffiliated, third-party consultants, experts, and/or advisers are used, we will be responsible for those expenses.

INVESTMENT STRUCTURE

Once we have determined that a prospective portfolio company is suitable for investment, we work with the management of that company and its other capital providers to structure an investment. We negotiate among these parties to agree on how our investment is expected to perform relative to the other capital in the portfolio company’s capital structure.

MANAGERIAL ASSISTANCE

As a business development company, we offer, and must provide upon request, managerial assistance to certain of our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies, and providing other organizational and financial guidance. We may receive fees for these services. FCM will provide such managerial assistance on our behalf to portfolio companies that request this assistance. For a description of relationships between us and our portfolio companies, please see “Portfolio Companies.”

15

ONGOING RELATIONSHIPS WITH PORTFOLIO COMPANIES

Monitoring

FCM monitors our portfolio companies on an ongoing basis. Specifically, FCM monitors the financial trends of each portfolio company to determine if they are meeting their respective business plans and to assess the appropriate course of action for each company.

FCM has several methods of evaluating and monitoring the performance and fair value of our investments, which may include the following:

| • | Assessment of success in adhering to portfolio company’s technology development, business plan and compliance with covenants; |

| • | Periodic and regular contact with portfolio company management and, if appropriate, the financial or strategic sponsor, to discuss financial position, requirements, and accomplishments; |

|

•

|

Comparisons to other portfolio companies in the industry, if any;

|

|

•

|

Attendance at and participation in board meetings; and

|

|

•

|

Review of monthly and quarterly financial statements and financial projections for portfolio companies.

|

Valuation Process

The following is a description of the steps we take each quarter to determine the value of our portfolio. Investments for which market quotations are readily available are recorded in our financial statements at such market quotations. With respect to investments for which market quotations are not readily available, our board of directors undertakes a multi-step valuation process each quarter, as described below under “Determination of Net Asset Value.”

We expect that all of our portfolio investments will be recorded at fair value as determined under the valuation process discussed above. As a result, there will be uncertainty with respect to the value of our portfolio investments.

INVESTMENT MANAGEMENT AGREEMENT

MANAGEMENT SERVICES

FCM has entered into an Investment Management Agreement (the “Investment Management Agreement”) with us whereby FCM provides investment management services. Subject to the overall supervision of our board of directors, the Investment Adviser manages the day-to-day operations of, provides investment management services to, and serves as portfolio manager for us. Mr. Landis, FCM’s President and Chief Investment Officer, has been primarily responsible for our portfolio management since our inception. Under the terms of the Investment Management Agreement, FCM will:

| • | determine the composition of our portfolio, the nature and timing of the changes to our portfolio, and the manner of implementing such changes; |

| • | identify, evaluate and negotiate the structure of the investments we make (including performing due diligence on our prospective portfolio companies); and |

|

•

|

close and monitor the investments we make.

|

FCM’s services under the Investment Management Agreement are not exclusive, and it is free to furnish similar services to other entities so long as its services to us are not impaired. FCM currently serves as investment manager to Firsthand Funds, a family of open-end mutual funds.

INVESTMENT MANAGEMENT FEE

Pursuant to the Investment Management Agreement, we pay FCM a fee for investment management services consisting of two components—a base management fee and an incentive fee.

The base management fee will be calculated at an annual rate of 2.00% of our gross assets. For services rendered under the Investment Management Agreement, the base management fee will be payable quarterly in arrears. The base management fee will be calculated based on the average of (1) the value of our gross assets at the end of the current calendar quarter and (2) the value of our gross assets at the end of the preceding calendar quarter; and appropriately adjusted for any share issuances or

16

repurchases during the current calendar quarter. Base management fees for any partial month or quarter will be pro-rated. The incentive fee is determined and payable in arrears as of the end of each calendar year (or upon termination of the Investment Management Agreement, as of the termination date), and equals 20% of our realized capital gains, if any, on a cumulative basis from inception through the end of each calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid incentive fees.

Mathematically, the formula for computing the annual incentive fee can be written as:

|

Incentive fee

|

=

|

20%

|

x

|

(

|

Cumulative

realized gains |

-

|

Cumulative

realized losses |

-

|

Unrealized

depreciation |

)

|

-

|

Previously paid

incentive fees |

For the purposes of calculating realized capital gains, the cost basis of each security acquired in the Reorganization shall be equal to the greater of the original purchase price of that security by Firsthand Funds or the fair market value of the security at the time of the Reorganization.

EXAMPLE INCENTIVE FEE CALCULATION

EXAMPLE: INCENTIVE FEE ON CAPITAL GAINS:

Assumptions

Year 1 = no net realized capital gains or losses

Year 2 = $50,000 realized capital gains and $20,000 realized capital losses and unrealized capital depreciation. Capital gain incentive fee = 20% x (realized capital gains for year computed net of all realized capital losses and unrealized capital depreciation at year end)

Calculation of Incentive Fee

|

Year 1 incentive fee

|

= 20% x (0)

|

|

= 0

|

|

|

= no incentive fee

|

|

|

Year 2 incentive fee

|

= 20% x ($50,000 - $20,000)

|

|

= 20% x $30,000

|

|

|

= $6,000

|

AVAILABLE INFORMATION

Additional information about us, including quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are available free of charge on our website at www.firsthandtvf.com. Information on our website is not part of this Annual Report on Form 10-K.

EMPLOYEES

We do not currently have any direct employees. Mr. Landis, our chief executive officer and chief financial officer, is the majority owner and chief investment officer of the Investment Adviser. The Investment Adviser currently employs a staff of 12, including investment, legal, and administrative professionals.

Item 1A. Risk Factors

Investing in Firsthand Technology Value Fund involves a number of significant risks relating to our business and investment objective. As a result, there can be no assurance that we will achieve our investment objective.

17

RISKS RELATING TO OUR BUSINESS AND STRUCTURE

WE HAVE A LIMITED OPERATING HISTORY.

We were incorporated in April 2010 and commenced operations on April 15, 2011. We are subject to all of the business risks and uncertainties associated with any business, including the risk that we will not achieve our investment objective and that the value of your investment could decline substantially. The net assets of SVVC, as of December 31, 2015 were approximately $176 million.

WE ARE DEPENDENT UPON FCM’S KEY PERSONNEL FOR OUR FUTURE SUCCESS.

If the Investment Adviser is unable to hire and retain qualified personnel, or if it loses any key member of its management team, our ability to achieve our investment objective could be significantly impaired.

We depend on the diligence, skill, and access to the network of business contacts of the management of FCM, including Mr. Landis, the owner, president and chief executive officer of FCM. We also depend, to a significant extent, on FCM’s access to the investment information and deal flow generated by Mr. Landis and any other investment professionals of FCM. Mr. Landis and other management personnel of FCM evaluate, negotiate, structure, close, and monitor our investments. Our future success depends on the continued service of Mr. Landis and other management personnel of FCM. The resignation of FCM, or the departure of Mr. Landis or any other key managers hired by FCM could have a material adverse effect on our ability to achieve our investment objective. In addition, we can offer no assurance that FCM will remain the Investment Adviser.

THE INVESTMENT ADVISER AND ITS MANAGEMENT HAS LIMITED EXPERIENCE MANAGING A BUSINESS DEVELOPMENT COMPANY.

The 1940 Act imposes numerous constraints on the operations of business development companies. For example, business development companies are required to invest at least 70% of their total assets primarily in securities of private or micro-cap U.S. public companies, cash, cash equivalents, U.S. government securities, and other high quality debt investments that mature in one year or less. These constraints may hinder the Investment Adviser’s ability to take advantage of attractive investment opportunities and to achieve our investment objective. Under the 1940 Act, our ability to own publicly-traded securities with market capitalizations in excess of $250 million is limited. While Mr. Landis has more than 20 years of experience managing technology stock mutual funds investments and more than 15 years of experience managing private equity investments, Mr. Landis and FCM have only managed a business development company since April 2011, when they began managing SVVC. The investment philosophy and techniques used by Mr. Landis and FCM may differ from those of other funds. Accordingly, we can offer no assurance that SVVC will replicate the historical performance of other investment companies with which Mr. Landis has been affiliated, and we caution you that our investment returns could be substantially lower than the returns achieved by such other companies.

THE INVESTMENT ADVISER AND ITS MANAGEMENT MANAGE OTHER FUNDS.

In addition to managing SVVC, FCM is also the investment adviser to two open-end mutual funds in the Firsthand Funds family: Firsthand Technology Opportunities Fund and Firsthand Alternative Energy Fund. Mr. Landis, who has primary responsibility for SVVC, also serves as portfolio manager of Firsthand Alternative Energy Fund and Firsthand Technology Opportunities Fund. This may reduce the time FCM and its investment management team have to devote to the affairs of SVVC. The other funds managed by FCM have stated investment objectives which differ from our own. Accordingly, there may be times when the interests of FCM’s management team differ from our interests.

THE INVESTMENT ADVISER MAY NOT BE ABLE TO ACHIEVE THE SAME OR SIMILAR RETURNS TO THOSE ACHIEVED BY ITS INVESTMENT PROFESSIONALS WHILE THEY WERE EMPLOYED AT PRIOR JOBS.