Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RLJ ENTERTAINMENT, INC. | rlje-8k_20160314.htm |

28th Annual ROTH Conference March 15, 2016 RLJE Exhibit 99.1

SAFE HARBOR This presentation includes “forward-looking statements” that involve risks and uncertainties within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as “will,” “should,” “could,” “may,” “might,” “expect,” “plan,” “possible,” “potential,” “predict,” “anticipate,” “believe,” “estimate,” “continue,” “future,” “intend,” “project” or similar expressions are intended to identify such forward-looking statements and may include statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future results and condition. RLJ Entertainment’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Important factors that could cause or contribute to differences from expectations, estimates and projections include those discussed in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K filed on May 19, 2015. All forward-looking statements should be evaluated with the understanding of inherent uncertainty. The inclusion of such forward-looking statements should not be regarded as a representation that contemplated future events, plans or expectations will be achieved. Unless otherwise required by law, we undertake no obligation to release publicly any updates or revisions to any such forward-looking statements that may reflect events or circumstances occurring after the date of this presentation. You are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date made.

About RLJ Entertainment (Nasdaq: RLJE) We are an entertainment content distribution company. We focus on creating OTT branded channels targeting distinct, premium audiences and Urban niche audiences. Our business goals are to grow our digital streaming channels through the development, acquisition, and distribution of exclusive rights of program franchises and feature film content. Control distinct content library, plus valuable IP ownership Long-term (5-25 year) contracts for exclusive content rights providing control over exploitation Agatha Christie Ltd., of which RLJE owns 64%, manages the extensive Agatha Christie content library, including publishing and stage play rights as well as the development of new television programs and feature films based on her stories and characters. Many of RLJE programs are part of long-running franchises. We hold lead positions in three content genres : British dramas and mystery Urban / African-American Action/Horror Independent Feature Films Monetize content across all platforms: Led by Board Chairman, Robert L. Johnson, (founder of BET); Miguel Penella, former CEO of Acorn Media Group Digital (streaming, download) VOD Broadcast / Cable DVD / Bly-ray Mobile Box-Office

Unique Content Library with Focused Genres Increasing IP ownership Quality drama / mysteries Long-running franchises / proven hits Passionate fans Direct consumer relationship Leading film licensor Focused genre (action/horror) Long-term rights (5-25 years) High digital / VOD value Pre-buy films before the competition Created by Robert L. Johnson, Chairman of RLJE and founder of BET Quality urban feature films, documentaries, original series, stand-up comedy and other exclusive content for African American / urban audiences British Mysteries & Dramas Feature Films Urban

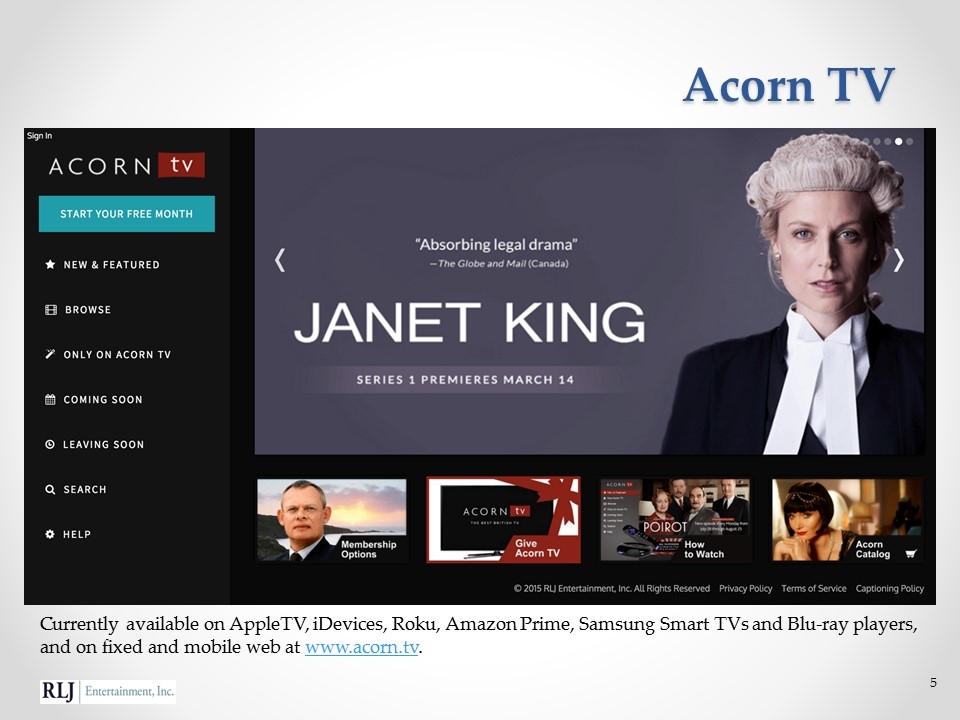

Currently available on AppleTV, iDevices, Roku, Amazon Prime, Samsung Smart TVs and Blu-ray players, and on fixed and mobile web at www.acorn.tv. Acorn TV

Acorn TV offers high quality, carefully curated British television content to discerning viewers with a focus on classic and new scripted drama, mystery, comedy, and documentary programs. Highlights include: Midsomer Murders: an iconic British series set in England’s most murderous county. Doc Martin: he’s surly, self-centered and rude, but he’s the only doctor in town A Place To Call Home: a Down under Downton set during the tumultuous 1950s. Agatha Christie’s Poirot: Agatha Christie’s brilliant Belgian detective solves mysteries in Art Deco Europe. Foyle’s War: history meets mystery in this acclaimed series set during WWII. Vera: two time Oscar nominee Brenda Blethyn stars in this long-running mystery set in the bleakly beautiful north of England. The Brokenwood Mysteries: unlikely partners investigate unusual crimes in this quirky Kiwi series. Acorn TV Content

Acorn TV – British TV British TV Demo: 35+, affluent viewers British TV Audience: North America 8-10M* RLJE Digital Offering: Acorn TV (www.acorn.tv) Launched July 2011 SVOD on Amazon, Roku, Samsung, iOS and AppleTV 1,500+ available hours with new and exclusive shows added weekly 240K+ Paying Subscribers Pricing: 30 day free trial then $4.99/monthly or $49.99/year Key Marketing: Search/PPC, Press, Device Partners (ex. Amazon, Roku), Social Media, Banner Ads, and social media Exclusive streaming windows on long-running franchises including Agatha Christie’s Poirot, Foyle’s War, Doc Martin, Murdoch Mysteries, Midsomer Murders, and many more *Based on TV ratings

Currently available on Roku, Amazon Prime, FireTV, and on fixed and mobile web at www.UrbanMovieChannel.com. Urban Movie Channel

UMC - Urban Movie Channel is devoted to the development, production, and acquisition of feature films, original series, stand-up comedy, stage plays, documentaries, and music content targeting the urban market. Highlights include: The Colony starring Laurence Fishburne Kevin Hart: I’m a Grown Little Man Winnie Mandela starring Terrence Howard & Jennifer Hudson Top Boy starring Ashley Waters The Things We Do for Love directed by and starring Alphonso Ribeiro Black Coffee starring Darrin Dewitt Henson David E. Talbert’s Mr. Right Now The Color of Freedom starring Dennis Haysbert Master Harold & The Boys starring Ving Rhames & Freddie Highmore Blood Done Sign My Name starring Nate Parker UMC Content

UMC – Urban Movie Channel Urban Demo: African American 25-54 with growing appeal to Hispanic, and other minorities Urban Audience: U.S.: 22M connected households; 2.1M SVOD consumers* RLJE Digital Offering: UMC (www.UrbanMovieChannel.com) Launched February, 2015 Pricing: 14 day free trial then SRP $4.99/month or $49.99/year Key Marketing: Search/PPC, Social Media, Press with key support from Robert L. Johnson (founder of BET), and Banner Ads – additional marketing will be in place as key content is premiered Featured cast include Kevin Hart, Jamie Foxx, Laurence Fishburne, Bernie Mac, Jennifer Hudson, Terrence Howard, and many more Goal to provide over 1,000 hours and high quality titles. Future content will include new acquisitions and original productions * Based on National Association Broadcasters July 2013 report

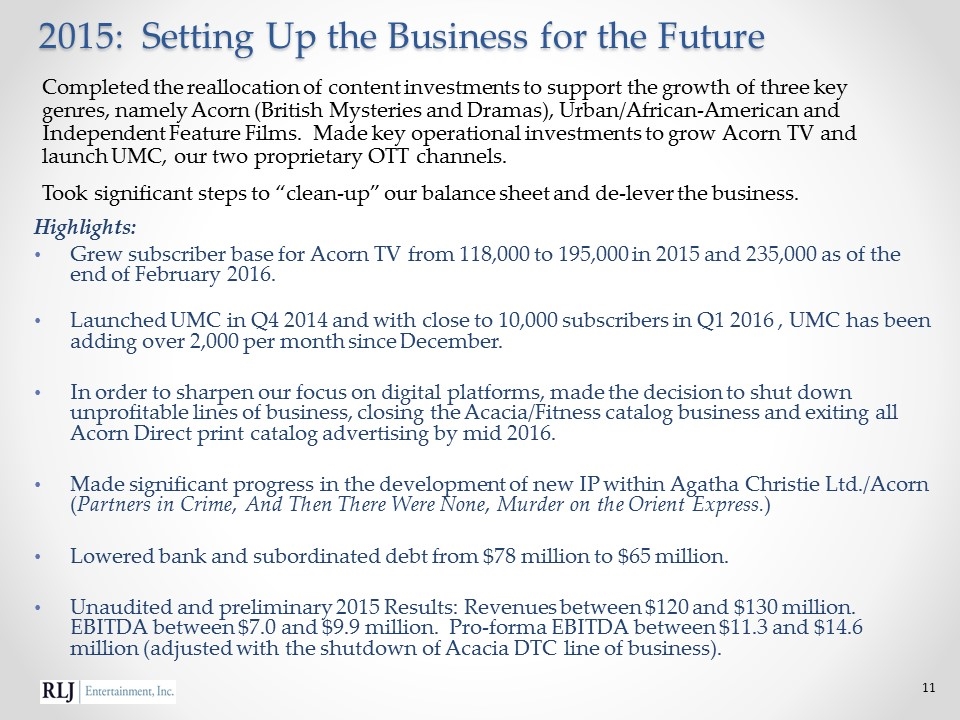

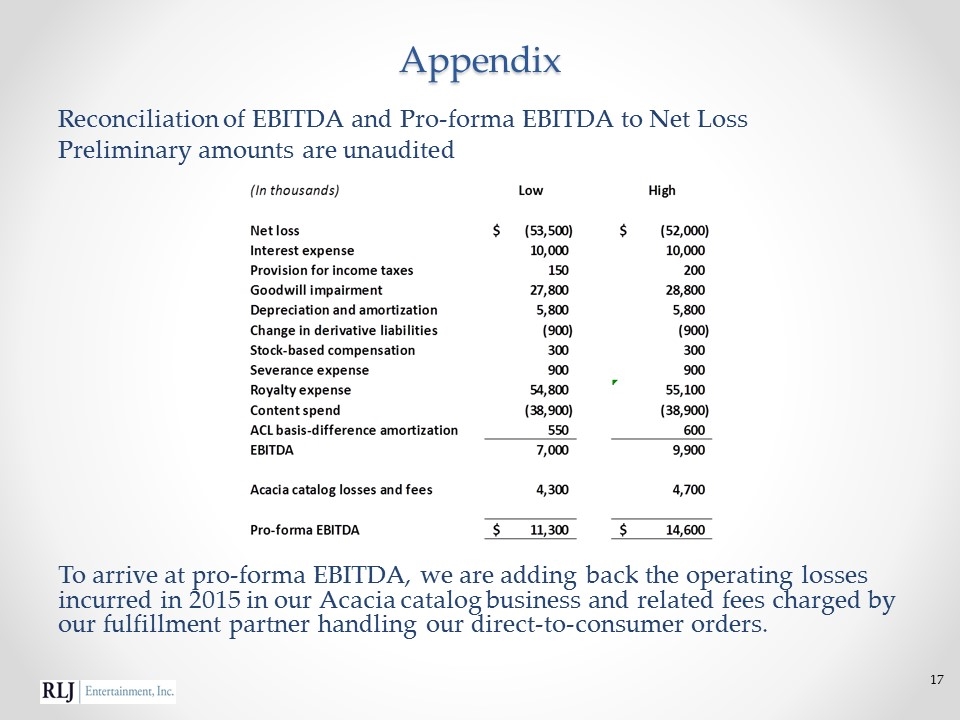

2015: Setting Up the Business for the Future Highlights: Grew subscriber base for Acorn TV from 118,000 to 195,000 in 2015 and 235,000 as of the end of February 2016. Launched UMC in Q4 2014 and with close to 10,000 subscribers in Q1 2016 , UMC has been adding over 2,000 per month since December. In order to sharpen our focus on digital platforms, made the decision to shut down unprofitable lines of business, closing the Acacia/Fitness catalog business and exiting all Acorn Direct print catalog advertising by mid 2016. Made significant progress in the development of new IP within Agatha Christie Ltd./Acorn (Partners in Crime, And Then There Were None, Murder on the Orient Express.) Lowered bank and subordinated debt from $78 million to $65 million. Unaudited and preliminary 2015 Results: Revenues between $120 and $130 million. EBITDA between $7.0 and $9.9 million. Pro-forma EBITDA between $11.3 and $14.6 million (adjusted with the shutdown of Acacia DTC line of business). Completed the reallocation of content investments to support the growth of three key genres, namely Acorn (British Mysteries and Dramas), Urban/African-American and Independent Feature Films. Made key operational investments to grow Acorn TV and launch UMC, our two proprietary OTT channels. Took significant steps to “clean‐up” our balance sheet and de-lever the business.

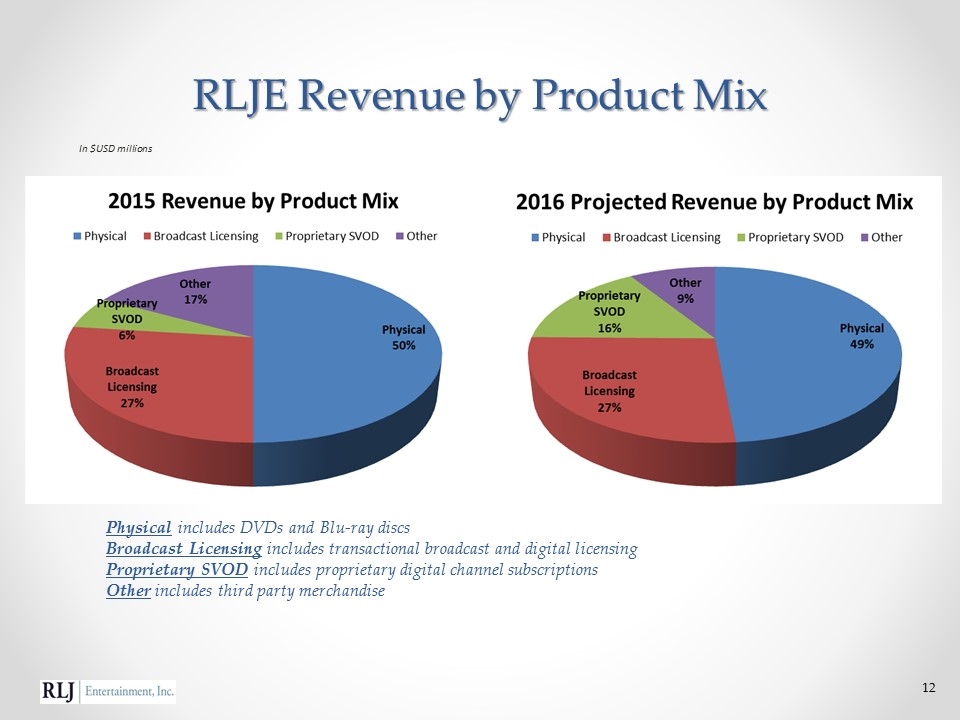

In $USD millions Physical includes DVDs and Blu-ray discs Broadcast Licensing includes transactional broadcast and digital licensing Proprietary SVOD includes proprietary digital channel subscriptions Other includes third party merchandise RLJE Revenue by Product Mix

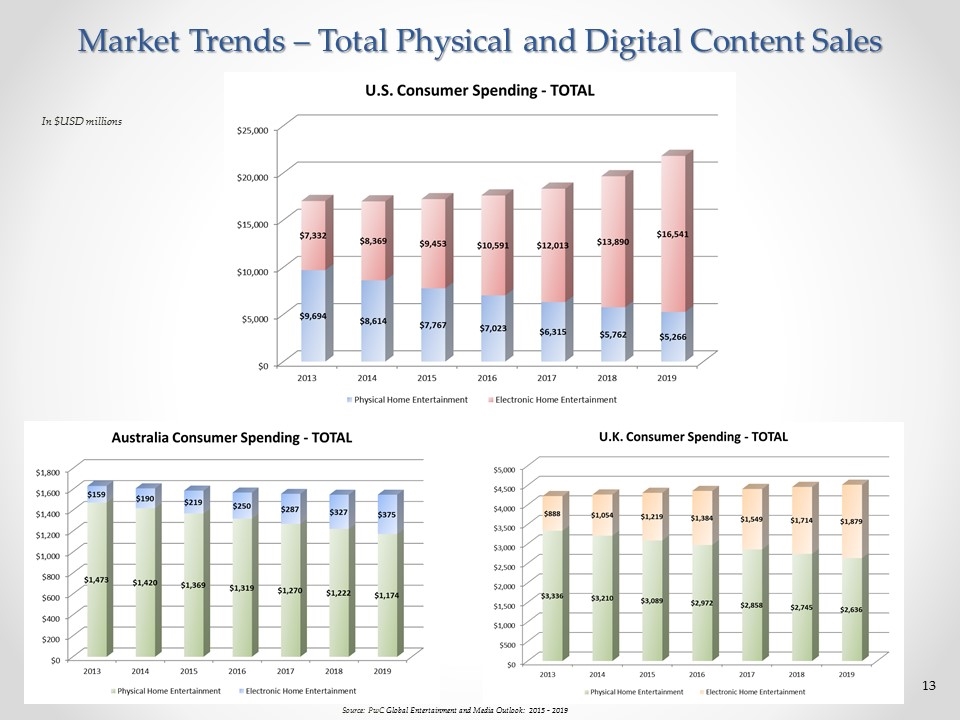

Market Trends – Total Physical and Digital Content Sales In $USD millions Source: PwC Global Entertainment and Media Outlook: 2015 - 2019

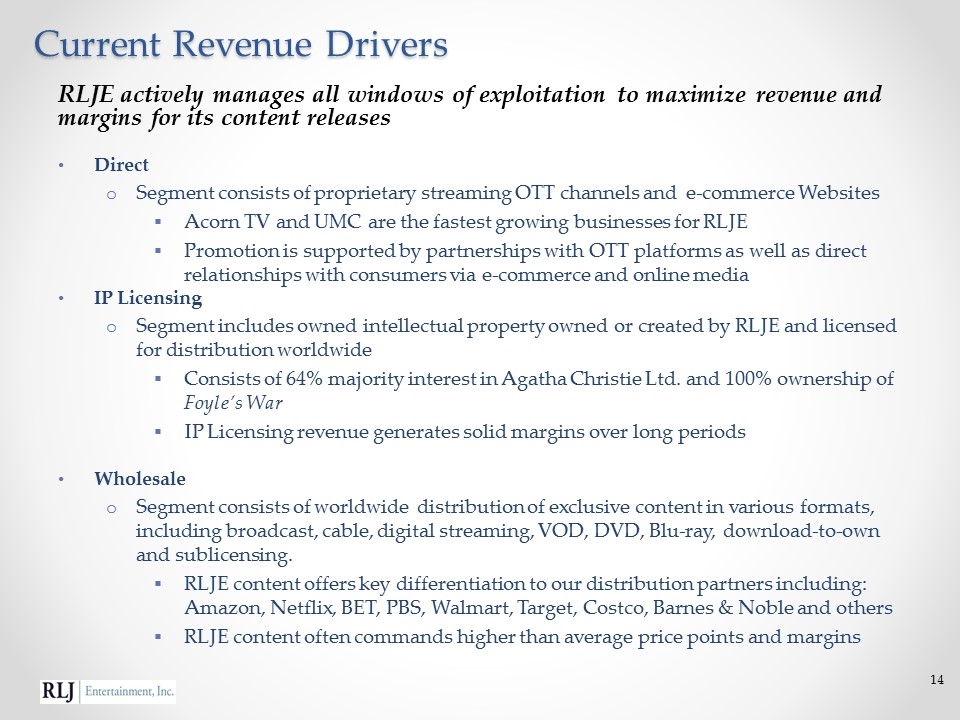

Current Revenue Drivers RLJE actively manages all windows of exploitation to maximize revenue and margins for its content releases Direct Segment consists of proprietary streaming OTT channels and e-commerce Websites Acorn TV and UMC are the fastest growing businesses for RLJE Promotion is supported by partnerships with OTT platforms as well as direct relationships with consumers via e-commerce and online media IP Licensing Segment includes owned intellectual property owned or created by RLJE and licensed for distribution worldwide Consists of 64% majority interest in Agatha Christie Ltd. and 100% ownership of Foyle’s War IP Licensing revenue generates solid margins over long periods Wholesale Segment consists of worldwide distribution of exclusive content in various formats, including broadcast, cable, digital streaming, VOD, DVD, Blu-ray, download-to-own and sublicensing. RLJE content offers key differentiation to our distribution partners including: Amazon, Netflix, BET, PBS, Walmart, Target, Costco, Barnes & Noble and others RLJE content often commands higher than average price points and margins

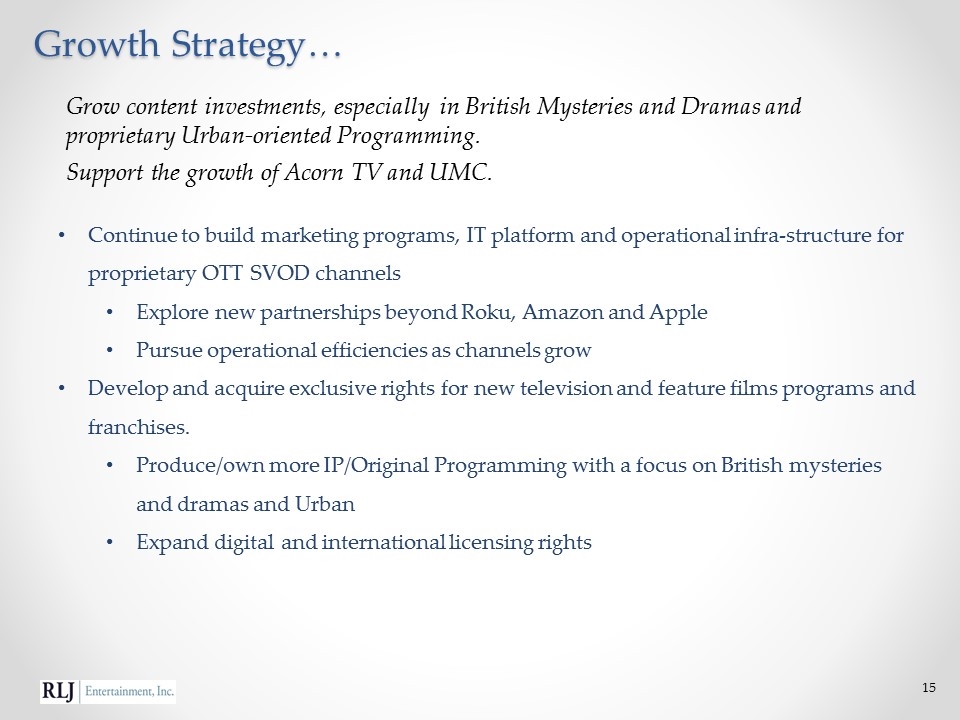

Growth Strategy… Continue to build marketing programs, IT platform and operational infra-structure for proprietary OTT SVOD channels Explore new partnerships beyond Roku, Amazon and Apple Pursue operational efficiencies as channels grow Develop and acquire exclusive rights for new television and feature films programs and franchises. Produce/own more IP/Original Programming with a focus on British mysteries and dramas and Urban Expand digital and international licensing rights Grow content investments, especially in British Mysteries and Dramas and proprietary Urban-oriented Programming. Support the growth of Acorn TV and UMC.

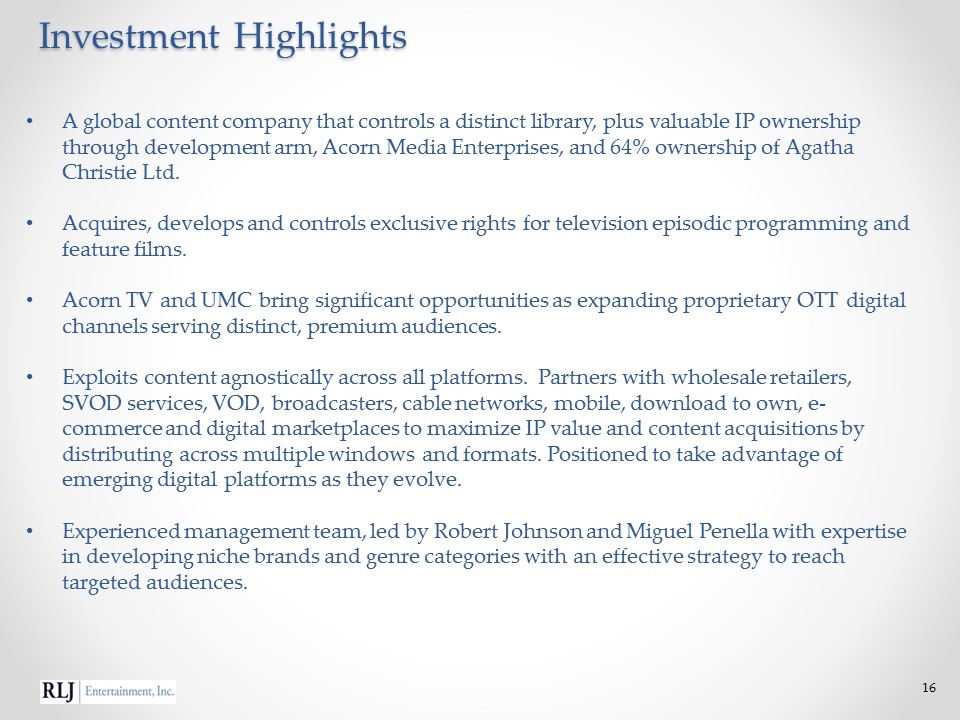

Investment Highlights A global content company that controls a distinct library, plus valuable IP ownership through development arm, Acorn Media Enterprises, and 64% ownership of Agatha Christie Ltd. Acquires, develops and controls exclusive rights for television episodic programming and feature films. Acorn TV and UMC bring significant opportunities as expanding proprietary OTT digital channels serving distinct, premium audiences. Exploits content agnostically across all platforms. Partners with wholesale retailers, SVOD services, VOD, broadcasters, cable networks, mobile, download to own, e-commerce and digital marketplaces to maximize IP value and content acquisitions by distributing across multiple windows and formats. Positioned to take advantage of emerging digital platforms as they evolve. Experienced management team, led by Robert Johnson and Miguel Penella with expertise in developing niche brands and genre categories with an effective strategy to reach targeted audiences.

Appendix Reconciliation of EBITDA and Pro-forma EBITDA to Net Loss Preliminary amounts are unaudited To arrive at pro-forma EBITDA, we are adding back the operating losses incurred in 2015 in our Acacia catalog business and related fees charged by our fulfillment partner handling our direct-to-consumer orders.