Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - PSAV, Inc. | d98571dex211.htm |

| EX-23.1 - EX-23.1 - PSAV, Inc. | d98571dex231.htm |

| EX-10.32 - EX-10.32 - PSAV, Inc. | d98571dex1032.htm |

Table of Contents

As filed with the Securities and Exchange Commission on March 11, 2016

Registration No. 333-206856

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PSAV, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 7389 | 47-4766950 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

5100 N. River Road, Suite 300

Schiller Park, IL 60176

(847) 222-9800

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

J. Whitney Markowitz

Chief Legal Officer and Secretary

5100 N. River Road, Suite 300

Schiller Park, IL 60176

(847) 222-9800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 (Phone) (212) 310-8007 (Fax) |

Richard Aftanas, Esq. Kirkland & Ellis LLP 601 Lexington Avenue New York, NY 10022 (212) 446-4800 (Phone) (212) 446-4900 (Fax) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated March 11, 2016.

Shares

PSAV, Inc.

Common Stock

This is an initial public offering of shares of common stock of PSAV, Inc. PSAV, Inc. is offering shares to be sold in this offering. The selling stockholders identified in this prospectus are offering an additional shares. PSAV, Inc. will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . PSAV, Inc. has applied to list the common stock on the New York Stock Exchange under the symbol “PSAV.”

After the completion of this offering, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. See “Principal and Selling Stockholders.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 20 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to PSAV, Inc. |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | See “Underwriting (Conflicts of Interest and Other Relationships)” for a description of the compensation payable to the underwriters. |

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from the selling stockholders at the initial price to public less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2016.

| Goldman, Sachs & Co. | Morgan Stanley | |||

| Barclays | Credit Suisse | |||

| Macquarie Capital | Piper Jaffray | William Blair |

Prospectus dated , 2016.

Table of Contents

| Page | ||||

| 1 | ||||

| 20 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| Unaudited Pro Forma Condensed Consolidated Financial Statements |

47 | |||

| 53 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

57 | |||

| 91 | ||||

| 108 | ||||

| 115 | ||||

| 133 | ||||

| 136 | ||||

| 140 | ||||

| 146 | ||||

| 152 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders |

154 | |||

| Underwriting (Conflicts of Interest and Other Relationships) |

158 | |||

| 164 | ||||

| 164 | ||||

| 164 | ||||

| F-1 | ||||

Neither we (or any of our affiliates), the selling stockholders (or any of their affiliates), nor the underwriters (or any of their affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, the selling stockholders nor the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, the selling stockholders are not and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information appearing in this prospectus and any free writing prospectus is only accurate as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

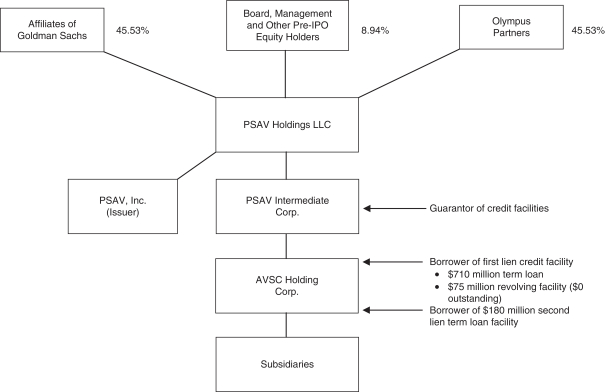

BASIS OF PRESENTATION OF FINANCIAL INFORMATION

Prior to this offering, we conducted our business through PSAV Holdings LLC, a Delaware limited liability company, and its subsidiaries. Prior to the consummation of this offering, PSAV Holdings LLC will enter into a corporate reorganization, whereby holders of equity interests of PSAV Holdings LLC will become stockholders of PSAV, Inc., a Delaware corporation and the Registrant. See “Organizational Structure.” Except as disclosed in this prospectus, the consolidated financial statements, selected historical consolidated financial data and other financial information included in this prospectus are those of PSAV Holdings LLC and its consolidated subsidiaries, or its predecessor, AVSC Holding Corp., and do not give effect to the corporate reorganization that will be effected in connection with the offering contemplated by this prospectus. Shares of common stock of PSAV, Inc. are being offered by this prospectus. Prior to the corporate reorganization and this offering, PSAV, Inc. held no material assets and did not engage in any operations. Following the corporate reorganization, the historical financial information of PSAV Holdings LLC or AVSC Holding Corp., as applicable, will be the historical financial information for PSAV, Inc.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or have the rights to use various trademarks, service marks and trade names referred to in this prospectus. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the ™, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this prospectus are the property of their respective owners.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, market position, market opportunity, market size and addressable market information used throughout this prospectus are estimated based on management’s experience and knowledge of the industry and the good faith estimates of management. Management utilized industry surveys, publications and other publicly available information prepared by a number of sources, including STR Inc. (“STR”), PKF Hospitality Research, a division of CBRE (“PKF”), PricewaterhouseCoopers LLP (“PwC”), the Content Marketing Institute, MarketingProfs and TravelClick by Passkey to estimate their market position, market opportunity, market size and addressable market information. The Boston Consulting Group also provided related consulting services to us with respect to the event technology services industry and the relevant market. STR and PKF data are as of December 31, 2015. All other such market data presented in this prospectus was compiled as of June 2015 unless otherwise indicated. All of the market data used in this prospectus involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the estimated market position, market opportunity and market size information included in this prospectus is generally reliable, such information is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” “Forward-Looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates prepared by independent parties and by us.

ii

Table of Contents

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus, including the risk factors, the consolidated financial statements and related notes thereto and the other documents to which this prospectus refers before making an investment decision. Unless otherwise stated in this prospectus, or as the context otherwise requires, references to “PSAV,” “we,” “us” or “our company” refer to (i) PSAV Holdings LLC and its subsidiaries or AVSC Holding Corp. prior to the corporate reorganization and (ii) PSAV, Inc. and its subsidiaries after giving effect to the corporate reorganization. Prior to the corporate reorganization and this offering, PSAV, Inc. held no material assets and did not engage in any operations. See “Organizational Structure.”

Overview

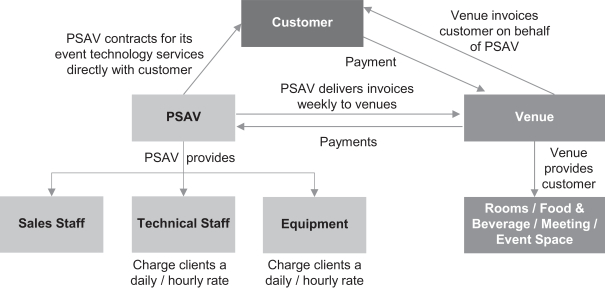

PSAV is a leading provider of audiovisual and event technology services in North America. Our highly-trained technical staff delivers innovative solutions in support of events ranging from small meetings in single conference rooms to global multi-media conference events with thousands of attendees. As our customers look to deliver more dynamic and impactful events, the event technology services we provide are a critical need and continue to grow in importance.

We are the event technology provider of choice at leading hotels, resorts and convention centers (“venues” or “venue partners”). Our business model is based on long-term partnerships with these venues, which establish us as the exclusive on-site provider of event technology services. Our customers, including corporations, event organizers, trade associations and meeting planners, hire us primarily through our on-site presence at venues to plan and execute their events. We have built a premier brand based on our comprehensive service offerings, strong track record of customer service, broad geographic footprint and on-site employee service model. Our largest market is the United States where we hold the number one position and serve more than five times the total venues of our closest competitor. In addition, we have a leading position in three of the nine countries we serve internationally.

Our market-leading position and scale is evidenced by the following:

| • | We support over 1.5 million meetings per year and are hired by over 1,100 meeting planners and event organizers on average each day. |

| • | We are the exclusive on-site event technology provider to over 1,300 venues globally, including venues representing 46% of the meeting and event space across all luxury and upper upscale hotel properties within the United States. |

| • | Approximately 95% of our over 7,800 employees are customer-facing, working alongside our venue partners’ sales teams and hospitality staff. |

| • | We are the market leader in 19 of the top 20 U.S. hotel markets. |

| • | We operate in nine international markets with leading positions in Canada, Mexico and the United Kingdom. |

| • | We have averaged 98% venue retention rates and organic growth of 48 new venue openings per year since 2011. |

1

Table of Contents

We offer a compelling value proposition to both our venue partners and our customers. For our venue partners, meetings and events are an important source of revenue and profit. Through our services, these venues are able to generate significant incremental revenue with limited investment on their part. For our customers, meetings and events are critical marketing and communication vehicles to reach clients, employees and other stakeholders. Our event technology services enhance the delivery of the customer’s message to its audience and increase the overall impact of the event.

Our premier brand, scale and differentiated capabilities allow us to partner with some of the most iconic, marquee venues in the world, for whom we are the exclusive on-site provider of event technology services. Our venue partners consist primarily of luxury and upper upscale hotel properties, including properties operating under all 10 of the largest hotel chains as measured by meeting space in the United States, high-profile convention centers and other meeting spaces. Our long-term contracts with venues help align our mutual interests to maximize revenue and profitability from the customer events hosted at the venues. Our on-site staff interacts with the customer directly and is entrusted with maintaining the brand equity and professional standards of that particular venue.

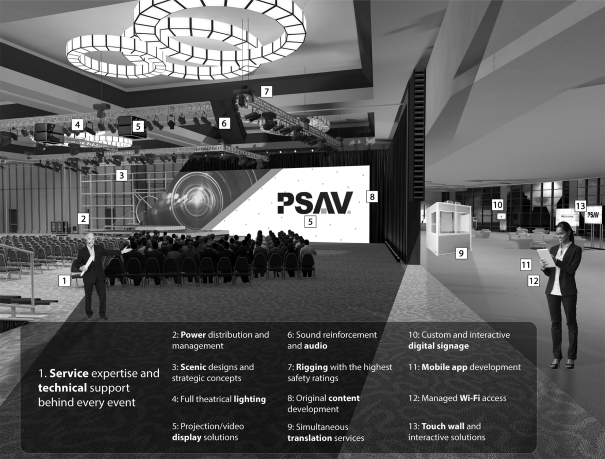

We offer our customers a comprehensive set of event technology solutions to address the entire scope of their events from planning to execution. The rising technological complexity and growing importance of meetings and events enhances the importance of the relationship between the customers holding an event and the venues and service providers executing the event. Leveraging our technical expertise, our sales and production teams work with customers directly to identify key messages and goals for an event and develop ways to convey those messages in a creative and compelling fashion. During the event, our technicians work to ensure the services are effectively, professionally and reliably delivered.

2

Table of Contents

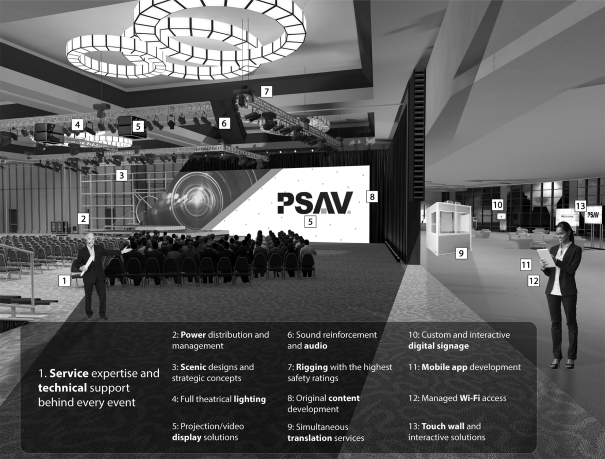

Our suite of services capitalizes on the industry’s growing demand for greater technological sophistication. We believe we have the broadest suite of services and solutions to meet the varied needs of venues and to capture the majority of their customers’ event planning spend. The following graphic illustrates some of our visible, and less visible, services:

We have experienced rapid growth as a result of our market-leading position, our contractual relationships with venues, our broad service offering and our strategic acquisitions. We have increased the number of contracted venues by approximately 60% since 2011 and averaged same venue revenue growth of 10.6% over the same period through 2015. In addition to our strong organic growth, our strategic acquisitions have enhanced our capabilities, increased our density in local markets and expanded our scale.

Internationally, our broad, established and highly scalable platform allows us to capitalize on increasing customer spending on overseas events, and the global trend towards event technology outsourcing. We are taking advantage of this opportunity by entering new markets, expanding within the international markets of our leading hotel chain partners, building relationships with new international venue partners and making strategic acquisitions. By extending our international footprint, we will further solidify our existing venue relationships. Our annual international revenue has grown 57% since 2011.

Between 2011 and 2015, our revenue increased from $645.5 million to $1,487.2 million, Adjusted EBITDA increased from $53.4 million to $174.5 million and net loss improved from $19.0 million to

3

Table of Contents

$5.8 million. For the year ended December 31, 2015, our revenue of $1,487.2 million grew 17.7% versus the prior year. In this same period, our Adjusted EBITDA of $174.5 million represented 11.7% of revenue and 11.2% growth over the prior year. The 2014 amounts reflect the combined predecessor period from January 1, 2014 through January 24, 2014 and successor period from January 25, 2014 through December 31, 2014 adjusted to give effect to the Sponsors Acquisition (as defined under “—Our Principal Stockholders”) (the “2014 Pro Forma Combined Period”). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.” Adjusted EBITDA is a non-GAAP measure. For a reconciliation of Adjusted EBITDA to net income (loss), see “Selected Historical Consolidated Financial Data.”

Our History

Through our focus on innovation and customer service, we have evolved from a small, regionally-based provider of audiovisual services to a leading global event technology services provider. Initially focused on U.S. hotel venues, we started developing relationships with venues at a time when most properties still chose to provide their own, in-house audiovisual services to their customers. By the 1990s, as events and the associated technology needs grew increasingly complex, we observed that more U.S. hotels began outsourcing event technology services, bringing third-party providers on-site to work with guests directly regarding their needs for specialized technological expertise. Over the last decade, this trend has accelerated and broadened to include other venues such as convention centers, conference centers and sports stadiums. We anticipated this outsourcing trend and began establishing relationships with leading hotel chains at the corporate level. These relationships served as an endorsement of our brand and provided us access to the venues’ customers which helped fuel our growth.

In addition to our core growth, we have continued to grow our business through strategic acquisitions and through geographic expansion. Our largest acquisition was Swank Holdings, Inc. (“Swank”) in November 2012. Swank was the second largest outsourced provider of event technology services for hotels, resorts and conference centers throughout the United States and brought to us additional talent and complementary venue relationships. Additionally, we have completed four more acquisitions since 2013 that have broadened our portfolio of services and increased our density in key markets. More recently, we have focused on building our geographic footprint internationally. We continue to leverage our strong relationships with our leading international hotel chain partners in Canada, Mexico, Europe and the Middle East.

Recent Development

On February 16, 2016, we closed the previously announced acquisition of KFP Holding GmbH (“KFP”), a leading provider of creative and event technology services based in Frankfurt, Germany. KFP provides a broad suite of conference and event technology services, along with creative event management and content production solutions in approximately 100 venues in Germany, Austria, Switzerland and Hungary. For over 20 years, KFP has been working with some of the world’s most recognized hotels, corporations and event agencies.

The acquisition strengthens our leadership position and scale in Europe while adding a talented team with strong customer and venue partnerships. The transaction is consistent with our strategy to expand our international presence and execute value enhancing acquisitions.

The transaction was funded with borrowings on our revolving credit facility and available cash. We expect to repay a substantial portion of the borrowings in the first quarter of 2016.

Unless otherwise indicated, our market position and operational data in this prospectus do not give effect to our acquisition of KFP.

4

Table of Contents

Industry Background

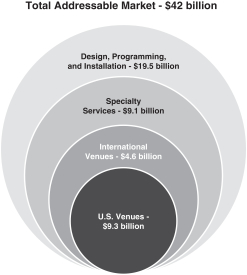

Our Addressable Market

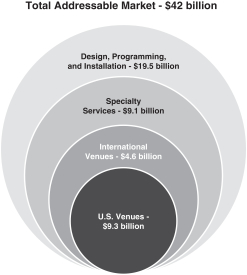

We believe we have an approximately $42 billion total addressable market. Our primary addressable market is an estimated $23 billion global audiovisual and event technology services industry. In addition, we selectively participate in the just under $20 billion estimated market for the design and construction of permanent audiovisual installations.

The market for core event technology services focuses on equipment, staging and production, which we estimate to be $9.3 billion across U.S. hotels, conference and convention centers and non-traditional venues (e.g., museums, sports stadiums and wedding halls). Today, we provide event technology services primarily in hotels, with the substantial majority in the luxury and upper upscale segments. Our Domestic segment revenue for the year ended December 31, 2015 was $1,350.0 million.

We estimate the market for core event technology services at luxury and upper upscale hotels internationally is $4.6 billion. There is a significant installed base of our targeted luxury and upper upscale hotel venues that presents an attractive opportunity to generate growth, including approximately 1,750 of such hotels in Asia Pacific,1 1,670 in Europe, Middle East and Africa (collectively, “EMEA”1), 370 in Mexico and Canada, and 220 in South America.1 In these regions, our largest hotel chain partners, Starwood, Hilton, Marriott and Hyatt, have approximately 1,000 locations that may facilitate our expansion. Outside the United States, the geographies with the largest event technology spending include China, Western Europe, Southeast Asia, Japan and Canada. We expect demand for event technology services to grow faster in many regions internationally than in the United States, driven by higher economic growth rates, the trend toward more complex U.S.-style event production and the transition to outsourced event technology services. We currently operate in nine countries outside the United States, including the United Kingdom, France and Germany, and generated International segment revenue of $137.2 million for the year ended December 31, 2015.

| (1) | Asia Pacific: Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Singapore and Thailand; EMEA: Egypt, Belgium, France, Germany, Greece, Ireland, Israel, Italy, Jordan, Russia, Spain, Switzerland, Turkey, United Arab Emirates and United Kingdom; South America: Argentina, Brazil, Chile, Colombia, Ecuador, Peru and Uruguay. |

5

Table of Contents

We also participate in what we estimate to be the $9.1 billion global market for specialty services in venues, including high-speed internet, power distribution and rigging. We believe rigging constitutes nearly half of that market and has been an area of growth for us since 2011. We believe the need for these services will continue to grow in importance for events. The proportion of our venue revenue generated by specialty services has increased from 10.6% in 2011 to 13.9% in 2015. Our ability to provide these complementary services enhances our value proposition to our customers and allows us to capture a greater portion of the spend on each event.

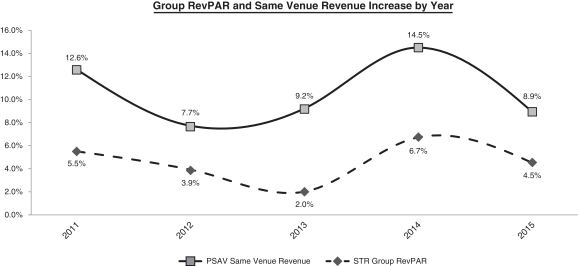

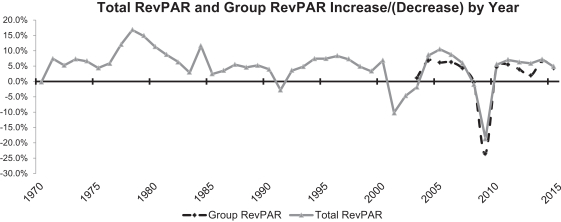

Meeting and Event Activity Historically Correlated with RevPAR

In the United States, meeting and event activity historically has been highly correlated with the hospitality industry metric Revenue per Available Room (“RevPAR”) and Group Revenue per Available Room (“Group RevPAR”), which are calculated by STR and PKF. STR is an independent, third-party service that collects and compiles the data used to calculate RevPAR and Group RevPAR, and PKF is an independent, third-party service that collects and compiles historical data used to calculate RevPAR. Whereas RevPAR is a total industry metric, Group RevPAR measures total guest hotel room revenue generated by group bookings (blocks of guest hotel rooms sold simultaneously in a group of 10 or more rooms), divided by total number of available guest hotel rooms. Because meetings and events generally require lodging for their participants, event activity typically correlates with Group RevPAR at nearby hotels, regardless of whether the events themselves are held on-site at hotels or at other nearby venues. As we provide event technology services primarily in hotels in the luxury and upper upscale segments, we refer to Group RevPAR for hotels in these segments as they more closely align with our business.

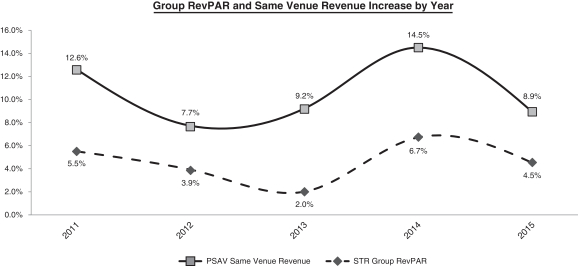

Within the United States, RevPAR has grown on average by 5.1% annually since 1970 according to PKF. Group RevPAR is a newer industry metric and represents a segment of the RevPAR performance, but tracks closely to overall RevPAR. Since 1970, RevPAR has only decreased in times of significant downturns in travel such as after September 11, 2001 and during the global financial crisis that began in 2008. More recently, both RevPAR and Group RevPAR have demonstrated strong growth in the rebound from the financial crisis, with overall RevPAR growing at a compound annual growth rate of 9.3% since 2010. Looking ahead, RevPAR for luxury and upper upscale hotels is predicted to grow at 5.0% in 2016, according to STR data. Our revenue historically has been correlated with Group RevPAR and our same venue revenue growth has exceeded Group RevPAR growth for each of the past six years as we have increased average revenue per event and expanded the services we offer through our venues.

Industry Trends

Continued Importance of Meetings and Events. In-person meetings and events continue to be rated as the single most effective marketing and communication vehicle. Companies recognize that face-to-face interactions are highly impactful and continue to support in-person events, despite the ubiquity of technology-based solutions such as video conferencing, social media, company websites, articles and webinars. In most cases, these technologies are used to supplement rather than replace in-person meetings. Meetings and events were estimated to contribute $280 billion of total spending in the United States in 2012, according to PwC, as companies and other organizations continued to deploy marketing budgets towards in-person meetings.

Venues are Focused on Increasing Group Revenue. Revenues generated by group bookings (“Group Revenue”) were estimated to contribute approximately $40 billion in hotel revenue in the United States and approximately $100 billion globally as of 2013 according to research consolidated by Travel Click by Passkey. Group Revenue often constitutes a hotel’s most profitable segment because of the increased associated spend on meeting space, banquet catering and event technology services. Luxury hotels in particular have focused on expanding Group Revenue by

6

Table of Contents

growing aggregate meeting space which has grown at a 10% compounded annual growth rate (“CAGR”) from 2009 through 2015. As hotels and other venues focus on this large and profitable segment of their business, they seek expanded service offerings to support meetings and events, including event technology services.

Rising Complexity in Event Technology. The rise in consumer technology has led to an increased demand for technological sophistication at meetings and events. These heightened expectations drive meeting and event planners to deliver a more interactive and engaging audience experience than they have in the past. For example, our customers are frequently requesting Wi-Fi access in all meeting spaces and seeking to use video, sound and staging to create branding and special effects for audience impact. The demands of tech-savvy audiences require more complex event technology solutions and trusted providers who can implement those solutions. This development has led to an increase in our average revenue per event across our domestic venues from $2,359 in 2011 to $3,407 in 2015.

Venues are Increasingly Outsourcing Event Technology Services. Given the rising complexity in event technology services and associated capital expenditure requirements, venues are increasingly looking to partner with outsourced providers such as us. Venues and customers benefit from high-quality customer service, broad service offerings and deep domain knowledge. At the corporate level, hotel chains benefit from a consistent standard of service across their venues. In addition, outsourced providers are often able to increase venues’ event technology revenue beyond what venues could achieve on their own because of event technology providers’ expanded offerings and specific focus on meetings and events. Since 2011, we have contracted to provide event technology services at 42 venues that were previously in-sourcing these services. During the same period, approximately 25% of our new domestic venues were conversions from self-operated sites.

Internationally, Event Technology Opportunity Continues to Grow. We forecast that spending on event technology services at international luxury and upper upscale hotels will grow from an estimated $4.6 billion in 2015 to $5.4 billion in 2020, with many individual markets growing more quickly. We believe this growth is driven primarily by outsized economic growth in developing economies, increased globalization driving more meetings and events and U.S. hotel chains seeking to expand their international footprints. We expect international venues to increasingly adopt outsourcing of event technology services to realize the benefits of the on-site model that has proven successful in the United States.

Competitive Strengths

We believe our competitive strengths are as follows:

Highly Skilled Workforce with a Focus on Customer Service. We believe our ability to deliver high-quality, comprehensive event technology solutions is a direct result of our ability to hire, train and retain the best event technology services staff in the industry. Approximately 95% of our over 7,800 employees are in customer-facing roles. We provide numerous education and training programs to develop our personnel, focusing on hospitality and customer service as well as technical expertise. Our venue managers have an average tenure of nearly nine years and our regional vice presidents have an average tenure of approximately 15 years. Our employees’ technical expertise and familiarity with the specific venues in which they are based enable them to deliver seamless event execution to our customers.

Long-Term Relationships with High-Profile Venues and Hotel Chains. We have a long track record of delivering high-quality, comprehensive event technology solutions at the venues with whom we partner, including luxury and upper upscale hotel chains who have high expectations for customer service and execution. In addition, hotel chains value our ability to provide a consistent level

7

Table of Contents

of service across their venues. We have long-term master service agreements (“MSAs”) signed with four of the five largest domestic hotel chains naming us as a preferred provider of event technology services at their hotels. Individual venues in the chain may then choose to contract with us as the exclusive on-site provider pursuant to the terms established in the MSA. The MSAs typically provide us with a powerful endorsement as the only chain-endorsed event technology services provider and position us well to establish new contracts with additional hotels in the chain. For the individual venues where we provide on-site service, our integration with their operations and knowledge of their customers’ event technology needs provides them with strong incentives to renew their contracts with us, resulting in our average 98% annual venue retention rate since 2011.

U.S. Market Leader with Broad Reach, Expansive Scale and Breadth of Service Offerings. We are the audiovisual and event technology services market leader in the United States with significantly greater market share than any of our competitors. We have venue contracts representing 46% of the meeting and event space in all of the luxury and upper upscale hotel properties in the United States. Our deep and broad platform includes over 7,800 employees, over 1,300 worldwide on-site event technology venues and 44 global branch warehouse locations. Our scale and reach offers several advantages. First, it enables us to offer the broadest range of event technology services and solutions, from core audiovisual services to specialty services such as rigging and power. Second, our network density enables us to leverage our people and our specialized equipment efficiently, driving higher margins and allowing us to provide our services at a wider range of venues cost effectively. Finally, our scale provides a barrier to entry to smaller, regional providers who we believe are unable to provide comparable expertise and capabilities.

Strong Historical Same Venue Revenue Growth. In the United States, our historical same venue revenue growth has exceeded Group RevPAR by an average of 610 basis points since 2011 as shown in the table below. We have been able to achieve this revenue growth due to our track record of outstanding customer service, increasing suite of services and sales team effectiveness. Our comprehensive solution set has enabled us to benefit from the industry-wide increase in technology spend per event as our customers migrate to more advanced technologies and purchase more of our services to support their events. For example, the proportion of our venue revenue generated by specialty services has increased from 10.6% in 2011 to 13.9% in 2015. As these underlying trends continue, we expect our differentiated capabilities will allow for continued growth in same venue revenue.

8

Table of Contents

Strong and Growing International Presence. We have a leading market position in Canada, Mexico and the United Kingdom with a presence in France, Monaco, Germany, United Arab Emirates, Dominican Republic and Singapore. We have strong relationships internationally with both venues and customers, and we provide a broad range of services at nearly 300 on-site properties outside the United States. Our contractual relationships with leading hotel chains and strong market position provide us with a competitive advantage over small, local providers who lack our scale and technological expertise.

Compelling Financial Model with Multiple Levers to Drive Profitability and Manage Free Cash Flow. Our strong free cash flow allows us to continue to invest in our business, our people and our equipment. Furthermore, we have a flexible cost structure that allows resiliency in varied market conditions. Our overall cost of revenue is approximately 75% variable, driven by the variable nature of venue commissions, which is our primary expense. Our part-time labor force and strategic network of branch locations allow us to manage peak demand and sustain margins. Furthermore, most of our capital investment is success-based, with most significant capital investments tied to new or renewed venue contracts which are evaluated against our return requirements. The resulting flexibility in our cost structure and capital requirements allows us to deliver high-quality service to our customers while maintaining profitability and strong free cash flow.

Proven Management Team with Deep Industry Expertise. Our management team combines deep industry expertise with specific functional experience. They have presided over significant growth in the past several years and have led our transformation into a global event technology service provider. At the same time, they have instilled a collaborative company culture focusing on innovation and customer service, which has resulted in significant growth, high levels of satisfaction across customers and venue partners and a best-in-class team. Our senior operational team has an average of 18 years of industry experience and has operated across a variety of economic conditions and geographies.

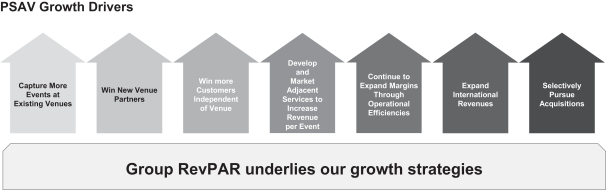

Growth Strategies

We intend to pursue the following growth strategies in order to enhance our market leading position:

Capture More Events at Existing Venues. We believe significant opportunity exists to capture incremental events at our venues. We estimate that we currently service approximately 70% of the event technology spend in our existing venues with the remaining 30% spent by customers on other event service providers without an on-site venue presence.

Win New Venue Partners. We intend to expand our revenue by pursuing new venue partners. We estimate we have contracts with approximately 40% of the luxury and upper upscale U.S. hotel venues, and we believe that the remaining 60% provides a significant target market in which to win new venues. In addition, with less than 10% of our revenues generated from events at non-hotel venues, we believe we have a significant opportunity in the $6.2 billion non-hotel venue market including convention centers, sports stadiums, theaters, museums and other cultural centers, as we have on-site contracts at select non-hotel venues and additionally provide services to existing customers at non-hotel venues where we are not currently the preferred on-site provider of event technology services.

Win More Customers Independent of Venue. We manage approximately 250 customers as national accounts because their event technology needs require highly customized solutions or because they seek a consistent solution across a range of venues or geographies. This market

9

Table of Contents

represents a significant revenue opportunity as a large portion of the domestic marketplace continues to be serviced by event technology providers who are not on-site at a particular venue. We plan to leverage our broad branch network and specialized sales teams to continue to capture incremental share in this market.

Develop and Market Adjacent Services to Increase Revenue per Event. The trend towards increased technology spend per event is creating substantial opportunities to increase our event technology revenue across our suite of services. In the near term, we believe this trend will allow us to further penetrate the $9.1 billion specialty services market. Our event technology services that are considered part of the specialty services market include rigging, power, Wi-Fi services and creative services and contributed $52.6 million of revenue in 2011, which has grown to $171.2 million of revenue in 2015. We will continue to focus on expanding our suite of services to grow our event technology revenue.

Continue to Expand Margins Through Operational Efficiencies. We have proven our ability to leverage operational efficiencies in driving profitability as our Adjusted EBITDA margin has expanded by approximately 350 basis points between 2011 and 2015. We have several initiatives in process to continue to increase margins, focused primarily on labor and equipment utilization. For example, we are improving our labor utilization by standardizing our planning and forecasting of our hourly workforce to optimize staffing levels and introducing new initiatives on equipment sharing between venues and our branch network.

Expand International Revenue. The $4.6 billion international event technology services market represents a compelling growth opportunity. The four largest U.S.-based hotel chains with whom we have strong domestic relationships represent approximately 25% of total hotels in key addressable international markets. We are already working with these partners to add new venues across our existing international footprint. In addition, we intend to enter new markets as we have recently done in Singapore.

Selectively Pursue Acquisitions. We intend to pursue acquisitions to enter new markets and accelerate growth in existing markets. Over the past few years we have acquired and integrated four event technology service providers and have demonstrated a track record of achieving forecasted synergies. We maintain a pipeline of acquisitions which we evaluate based on established investment criteria including alignment with our culture and customer focus.

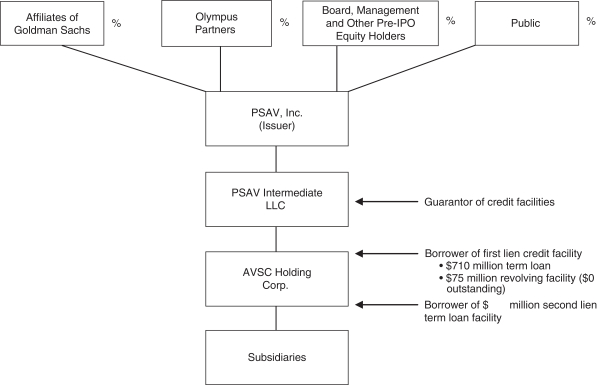

Our Principal Stockholders

On January 24, 2014, affiliates of The Goldman Sachs Group, Inc. (“Goldman Sachs”) and Olympus Partners (together with Goldman Sachs, the “Sponsors”), together with certain management investors and other investors formed PSAV Holdings LLC, which in turn acquired 100% of the voting equity interests in AVSC Holding Corp., which became an indirect wholly-owned subsidiary of PSAV Holdings LLC. We refer to the foregoing acquisition as the “Sponsors Acquisition.” Olympus Partners and Goldman Sachs currently each own approximately 45.53% of our equity.

In connection with the Sponsors Acquisition, one of our subsidiaries entered into a management advisory services agreement with Goldman, Sachs & Co., and Olympus Advisors LLC, affiliates of our Sponsors, to provide business and organizational strategy, financial and advisory services to us. We pay an annual advisory fee of $1.5 million apportioned equally between the Sponsors on January 24th of each year. We also paid a one-time fee of $6.0 million to Olympus Advisors LLC and $8.0 million to Goldman, Sachs & Co. under the agreement at the time of the Sponsors Acquisition. The management advisory services agreement will terminate in connection with this offering, and we believe the

10

Table of Contents

Sponsors currently intend to waive any amounts due to them pursuant to such termination. We expect the total amount of fees paid under the agreement to be $10.3 million to Goldman, Sachs & Co. and $8.3 million to Olympus Advisors LLC. For further information regarding the management advisory services agreement, see “Certain Relationships and Related Person Transactions—The Sponsors Acquisition—Management Advisory Services Agreement. In addition, in May 2015 and December 2015, we paid distributions totaling $174.1 million in the aggregate to the members of PSAV Holdings LLC, of which $79.3 million was paid to each of the Sponsors.

Following this offering, our Sponsors will continue to control our board of directors and corporate decisions. Our Sponsors may acquire or hold interests that compete directly with us, or may pursue acquisition opportunities that are complementary to our business, making such an acquisition unavailable to us. Our amended and restated certificate of incorporation will contain provisions renouncing any interest or expectancy held by our directors affiliated with our Sponsors in certain corporate opportunities. For further information, see “Management—Composition of Our Board of Directors” and “Risk Factors—Risks Related to This Offering and Ownership of Our Common Stock—Our Sponsors can significantly influence our business and affairs and may have conflicts of interest with us in the future.”

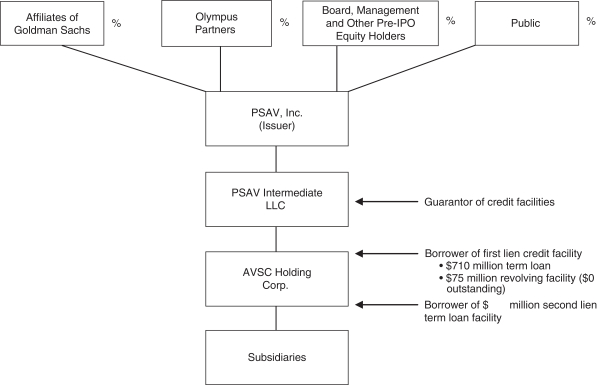

Controlled Company

Following the consummation of this offering, approximately % of our outstanding common stock will be beneficially owned by affiliates of Goldman Sachs and Olympus Partners. In particular, affiliates of Goldman Sachs collectively will beneficially own approximately % of our common stock (or approximately % if the underwriters exercise their option to purchase additional shares in full) and Olympus Partners will beneficially own approximately % of our common stock (or approximately % if the underwriters exercise their option to purchase additional shares in full). As a result, we will be a “controlled company” within the meaning of the New York Stock Exchange’s corporate governance rules. For a discussion of the applicable limitations and risks that may result from our status as a controlled company, see “Risk Factors—Risks Related to This Offering and Ownership of Our Common Stock—We are a ‘controlled company’ within the meaning of the New York Stock Exchange rules and, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements.”

11

Table of Contents

Corporate Reorganization

Prior to this offering, PSAV Holdings LLC and its subsidiaries conducted our business. Prior to the completion of this offering, a series of transactions will occur pursuant to which holders of equity interests in PSAV Holdings LLC will become holders of common stock in PSAV, Inc., the issuer of shares in this offering. For a more detailed description, see “Organizational Structure.”

The diagram below reflects our organizational structure following the corporate reorganization, this offering and the use of the net proceeds therefrom as if each occurred on December 31, 2015:

Risk Factors

An investment in our common stock involves a high degree of risk. Our ability to execute on our strategy also is subject to certain risks. Some of the more significant challenges and risks include the following:

| • | Unfavorable economic conditions have adversely affected, and in the future could adversely affect, our business, financial condition and results of operations. |

| • | Our failure to retain current venue partners and hotel chains or renew existing venue partner contracts and hotel chain MSAs would have a material adverse effect on our business, financial condition and results of operations. |

| • | Our failure to increase the number of quality of properties covered by our venue partner contracts, increase the number of hotel chains for which we are the preferred provider could have a material adverse effect on our business. |

12

Table of Contents

| • | The widespread adoption of more effective teleconference and virtual meeting technologies could reduce the number of events held at our venue partners, the size and scope of such events, including reduced demand for our services at events, or the attendance at such events, which could adversely affect our business results of operations or financial condition. |

| • | Potential venue partners may be reluctant to switch to a new preferred provider of event technology services, which may adversely affect our growth. |

| • | If venues reduce their outsourcing or use of preferred providers, it could have a material adverse effect on our business, financial condition and results of operations. |

| • | We have substantial indebtedness and we may incur additional indebtedness in the future, which may require us to use a substantial portion of our cash flow to service debt and limit our financial and operating flexibility. |

| • | We are a “controlled company” within the meaning of the New York Stock Exchange rules and, as a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. Accordingly, stockholders will not have the same protections as stockholders of companies that are subject to such requirements. |

The above list is not exhaustive. Before you invest in our common stock, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors” immediately following this summary.

Corporate Information

PSAV, Inc. was incorporated in Delaware on August 11, 2015. Our principal executive offices are located at 5100 N. River Road, Suite 300, Schiller Park, Illinois 60176, and our telephone number is (847) 222-9800. Our website is www.psav.com. Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

13

Table of Contents

The Offering

| Issuer |

PSAV, Inc. |

| Common Stock Offered by Us |

shares of common stock. |

| Common Stock Offered by the Selling Stockholders |

shares of common stock. |

| Common Stock to be Outstanding After This Offering |

shares of common stock. |

| Option to Purchase Additional Shares of Common Stock |

The underwriters have an option to purchase a maximum of additional shares of common stock from the selling stockholders named in this prospectus. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of Proceeds |

We estimate that the net proceeds from the sale of our common stock in this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $ million based on an assumed initial public offering price of $ per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus). We intend to use the net proceeds from this offering to repay borrowings under our second lien credit facility. See “Use of Proceeds.” We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders. |

| Conflicts of Interest |

Because Goldman, Sachs & Co. is an underwriter and its affiliates own in excess of 10% of our issued and outstanding common stock, Goldman, Sachs & Co. is deemed to have a “conflict of interest” under FINRA Rule 5121. Accordingly, this offering will be made in compliance with the applicable provisions of Rule 5121. Rule 5121 requires that a “qualified independent underwriter” meeting certain standards participate in the preparation of the registration statement and prospectus and exercise the usual standards of due diligence in respect thereto, subject to certain exceptions which are not applicable here. Morgan Stanley & Co. LLC will serve as a qualified independent |

14

Table of Contents

| underwriter within the meaning of Rule 5121 in connection with this offering. For more information, see “Underwriting (Conflicts of Interest and Other Relationships)—Conflicts of Interest and Other Relationships.” |

| Dividend Policy |

We do not intend to pay dividends on our common stock. However, we may change this policy in the future. See “Dividend Policy.” |

| Listing |

We have applied to have our common stock listed on the New York Stock Exchange under the symbol “PSAV.” |

| Risk Factors |

Investing in our common stock involves a high degree of risk. See the “Risk Factors” section of this prospectus for a discussion of factors you should carefully consider before deciding to purchase shares of our common stock. |

Except as otherwise indicated, all information in this prospectus:

| • | excludes shares of restricted common stock to be granted to a director under our 2016 PSAV, Inc. Equity Incentive Plan, or the 2016 Equity Plan, in connection with this offering; |

| • | excludes an aggregate of additional shares of common stock that will be available for future awards pursuant to the 2016 Equity Plan; |

| • | gives effect to our amended and restated certificate of incorporation, which will be in effect prior to the consummation of this offering; and |

| • | assumes an initial public offering price of $ per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus). |

15

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth our summary historical consolidated financial and other data for the periods and as of the dates indicated. The periods prior to and including January 24, 2014, the date of the Sponsors Acquisition, are referred to in the following table as “Predecessor,” and all periods after such date are referred to in the following table as “Successor.” The consolidated financial statements for all Successor periods are not comparable to those of the Predecessor periods.

We derived the summary consolidated statement of operations and other data for the year ended December 31, 2013, the period from January 1, 2014 through January 24, 2014, the period from January 25, 2014 through December 31, 2014 and the year ended December 31, 2015 from our audited consolidated financial statements contained elsewhere in this prospectus.

Our historical results are not necessarily indicative of future operating results. You should read the information set forth below in conjunction with “Selected Historical Consolidated Financial Data,” “Unaudited Pro Forma Condensed Consolidated Financial Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto contained elsewhere in this prospectus.

| Twelve Months Ended December 31, 2014 |

||||||||||||||||||

| Predecessor | Predecessor | Successor | Successor | |||||||||||||||

| Year Ended December 31, 2013 |

January 1, through January 24, 2014 |

January 25, through December 31, 2014 |

Year Ended December 31, 2015 |

|||||||||||||||

| (dollars in thousands) | ||||||||||||||||||

| Consolidated Statement of Operations Data: |

||||||||||||||||||

| Revenue |

$ | 1,096,374 | $ | 75,622 | $ | 1,188,283 | $ | 1,487,170 | ||||||||||

| Income (loss) from operations |

53,998 | (33,960 | ) | 33,755 | 52,815 | |||||||||||||

| Income (loss) before income taxes |

14,576 | (36,424 | ) | (10,673 | ) | (2,838 | ) | |||||||||||

| Net income (loss) |

17,596 | (25,921 | ) | (10,566 | ) | (5,801 | ) | |||||||||||

| Consolidated Statement of Cash Flows Data: |

||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||

| Operating activities |

$ | 51,330 | $ | (2,018 | ) | $ | 46,271 | $ | 62,699 | |||||||||

| Investing activities |

(77,219 | ) | (4,268 | ) | (911,732 | ) | (105,762 | ) | ||||||||||

| Financing activities |

35,750 | — | 935,071 | 17,200 | ||||||||||||||

| Other Financial Data: |

||||||||||||||||||

| Capital expenditures |

$ | 36,506 | $ | 4,268 | $ | 34,130 | $ | 61,869 | ||||||||||

| Venue incentive payments |

6,361 | 99 | 15,542 | 22,777 | ||||||||||||||

| Adjusted EBITDA(1) |

130,381 | 7,892 | 149,047 | 174,511 | ||||||||||||||

| Adjusted EBITDA margin(1) |

11.9 | % | 10.4 | % | 12.5 | % | 11.7 | % | ||||||||||

| Operating Data: |

||||||||||||||||||

| Domestic: |

||||||||||||||||||

| Revenue |

$ | 991,682 | $ | 70,240 | $ | 1,087,737 | $ | 1,350,008 | ||||||||||

| Adjusted EBITDA(1) |

118,618 | 7,280 | 138,594 | 159,750 | ||||||||||||||

| International: |

||||||||||||||||||

| Revenue |

104,692 | 5,382 | 100,546 | 137,162 | ||||||||||||||

| Adjusted EBITDA(1) |

11,763 | 612 | 10,453 | 14,761 | ||||||||||||||

16

Table of Contents

| As of December 31, 2015 |

||||

| (in thousands) | ||||

| Consolidated Balance Sheet Data: |

||||

| Cash and cash equivalents |

$ | 40,895 | ||

| Total assets |

1,235,168 | |||

| Long-term debt (including current portion) |

863,489 | |||

| Total liabilities |

1,158,031 | |||

| Total members’ equity |

77,137 | |||

| (1) | Adjusted EBITDA represents net income before interest expense, income taxes, depreciation, amortization of intangibles, transaction-related expenses, long-term incentive plan payments, gain or loss on disposal of assets, gains or losses on foreign currency transactions, changes in the fair value of our interest rate caps, amortization of venue incentives including the expense impact of certain venue incentive payments for which deferred expense recognition was not applicable under U.S. GAAP, management fees paid to our Sponsors, equity-based compensation expense, executive severance and certain consulting and professional fee costs. Certain of the arrangements with venue operators to secure the right to be the exclusive on-site provider of event technology services contain up-front incentive payments which are not deferred over the contract term as they do not contain a contractual requirement to repay a ratable portion of the incentive. Management excludes these incentive payments from the calculation of Adjusted EBITDA as they are expensed at the beginning of the contract period and are therefore not indicative of the ongoing operations. We define Adjusted EBITDA margin as Adjusted EBITDA as a percentage of revenue. Management believes Adjusted EBITDA and Adjusted EBITDA margin are useful because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods, capital structure, investments in securing and renewing venue relationships or other items that we believe are not indicative of our ongoing operating performance. In addition, the determination of Adjusted EBITDA is consistent with the definition of a similar measure in our credit agreements other than pro forma adjustments for acquisitions and certain forward-looking adjustments permitted by the credit agreements but not considered by management in evaluating our performance using Adjusted EBITDA. |

Adjusted EBITDA is a “non-GAAP financial measure” as defined under the rules of the SEC. Our presentation of Adjusted EBITDA is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, U.S. GAAP. Adjusted EBITDA should not be considered as an alternative to income (loss) from operations, net income (loss), earnings per share or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected by these items. Adjusted EBITDA is included in this prospectus because it is a key metric used by management to assess our operating performance.

Management believes the inclusion of Adjusted EBITDA is meaningful to our investors to enhance their understanding of our financial performance. Although Adjusted EBITDA is not necessarily a measure of liquidity or our ability to fund our operations, we understand that it is frequently used by securities analysts, investors and other interested parties as a supplemental measure of financial performance.

17

Table of Contents

Adjusted EBITDA has important limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of these limitations are:

Adjusted EBITDA:

| • | does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| • | does not reflect our cash expenditures for venue incentives or the amortization of those venue incentive payments; |

| • | although depreciation and amortization of intangibles are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

| • | does not reflect the costs of acquisitions of businesses or other capital market transactions; |

| • | does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments on our debt; |

| • | does not reflect our income tax expense or the cash requirements to pay our income taxes; |

| • | does not reflect changes in, or cash requirements for, our working capital needs; |

| • | does not reflect the cash requirements for other excluded items; |

| • | does not reflect the impact of equity-based compensation upon our operations; and |

| • | may not be consistent with how other companies in our industry calculate Adjusted EBITDA. |

In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation.

The following table reconciles net income (loss) to Adjusted EBITDA for the periods presented:

| Twelve Months Ended December 31, 2014 |

||||||||||||||||||

| Predecessor | Predecessor | Successor | Successor | |||||||||||||||

| Year Ended December 31, 2013 |

January 1, through January 24, 2014 |

January 25, through December 31, 2014 |

Year Ended December 31, 2015 |

|||||||||||||||

| (in thousands) | ||||||||||||||||||

| Net income (loss) |

$ | 17,596 | $ | (25,921 | ) | $ | (10,566 | ) | $ | (5,801 | ) | |||||||

| Income tax (benefit) expense |

(3,020 | ) | (10,503 | ) | (107 | ) | 2,963 | |||||||||||

| Interest expense, net |

40,700 | 2,830 | 40,536 | 51,024 | ||||||||||||||

| Depreciation and amortization of intangibles |

47,502 | 3,222 | 71,950 | 84,541 | ||||||||||||||

| Transaction-related expenses(a) |

12,004 | 14,243 | 20,410 | 3,590 | ||||||||||||||

| Long-term incentive plan payments(b) |

— | 18,021 | 42 | — | ||||||||||||||

| Loss on disposal of assets |

2,052 | 127 | 2,918 | 3,164 | ||||||||||||||

| Foreign currency transactions (gain)/loss(c) |

(1,278 | ) | (366 | ) | 2,075 | 2,659 | ||||||||||||

| Changes in fair value of interest rate caps(d) |

— | — | 1,817 | 1,350 | ||||||||||||||

| Amortization of venue incentives(e) |

9,318 | 705 | 8,306 | 8,420 | ||||||||||||||

| Management fee(f) |

— | — | 1,405 | 1,500 | ||||||||||||||

| Equity-based compensation expense(g) |

— | 5,365 | 299 | 326 | ||||||||||||||

| Severance expense(h) |

2,334 | 163 | 798 | 2,331 | ||||||||||||||

| Consulting fees and other(i) |

3,173 | 6 | 9,164 | 18,444 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 130,381 | $ | 7,892 | $ | 149,047 | $ | 174,511 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

18

Table of Contents

| (a) | Expenses incurred in connection with acquisitions, including the Sponsors Acquisition, such as pre-acquisition professional fees and costs to integrate these businesses. |

| (b) | Expenses associated with our long-term incentive plans for certain members of management paid in connection with the Sponsors Acquisition in 2014. |

| (c) | Gains and losses on transactions settled in foreign currencies. |

| (d) | Refer to Note 11 and Note 12 to our audited consolidated financial statements included elsewhere in this prospectus for further information on our interest rate caps. |

| (e) | Amortization of signing incentive payments made to venues over the term of related agreements, including the expense impact of $4.1 million for the twelve months ended December 31, 2014 and $2.7 million for the year ended December 31, 2015 in venue incentive payments for which deferred expense recognition was not applicable under U.S. GAAP. |

| (f) | Annual management fee paid to our Sponsors. |

| (g) | For the period from January 1, 2014 through January 24, 2014, relates to distributions received on equity-based awards in connection with the Sponsors Acquisition. |

| (h) | Severance expense related to employees terminated subsequent to acquisitions. |

| (i) | Consulting fees and other related to interim management and strategic initiatives. For 2013 and 2014, includes costs related to an insurance policy purchased by the Predecessor. |

19

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our common stock. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline and you may lose some or all of your investment.

Risks Related to Our Business and Industry

Unfavorable economic conditions have adversely affected, and in the future could adversely affect, our business, financial condition and results of operations.

A national or international economic downturn has reduced, and in the future could reduce, demand for our services, which may result in the loss of business or increased pressure to negotiate new contracts or renewals on less favorable terms than our generally preferred terms. Economic hardship among our venue partners and customers can also adversely affect our business. For example, we provide services in hotels and convention centers that are sensitive to an economic downturn, as expenditures to hold or attend conventions or other events requiring our event technology services are funded to a partial or total extent by discretionary income. The last economic downturn negatively affected the number of events held at our venue partners and the amount of spending on such events. Further, because our exposure to customers of our event technology services is limited in large part by our dependence on our venue partners to attract those customers to hold their events at their properties, our ability to respond to such a reduction in events, and therefore our revenue, is limited. There are many other factors that could reduce the numbers of events at a venue or attendance at any such events, including acts of terrorism, particularly acts that impact hotels or the travel industry, and the national and global military, diplomatic and financial response to such acts or other threats or natural disasters, including hurricanes and earthquakes, and global calamities, such as an Ebola outbreak or a flu pandemic, which could adversely affect our business, financial condition and results of operations.

Our failure to retain our current venue partners and hotel chains or renew our existing venue partner contracts and hotel chain MSAs would have a material adverse effect on our business, financial condition and results of operations.

Our business depends on our ability to retain our current venue partners and hotel chains and renew our existing venue partner contracts and hotel chain MSAs. We may not be able to renew existing venue partner contracts and hotel chain MSAs on the same or more favorable terms. Our current venue partners may work with our competitors, cease operations, elect to provide event technology services in-house, diversify their preferred providers, reduce their cooperation with our sales representatives or terminate contracts with us. Also, consolidation within the hotel industry may result in our current venue partners being owned by hotel chains that we do not have an MSA with, that work with our competitors or that provide their event technology services in-house. While our MSAs and individual service agreements generally do not provide for termination upon a change of control, we may not be able to enter into an MSA with the hotel chain or renew our venue partner contracts with the individual hotel properties when they expire.

In addition, while we enter into MSAs with major hotel chains, individual hotel properties typically make separate decisions as to their event technology services providers. Therefore, our inability to renew hotel chain MSAs will not automatically terminate our relationships with the individual hotel properties. However, the corporate offices of major hotel chains may influence the decisions of their individual properties. For example, if the hotel chain discontinues its relationship with us in favor of another service provider or an in-house solution, our relationship with the properties under that brand

20

Table of Contents

may suffer even though, in nearly all cases, we negotiate with each property individually. This may lead to significant lost revenue or result in additional costs to complete sales of our event technology services, any of which would adversely affect our results of operations.

The failure to renew a significant number of our existing contracts or MSAs would have a material adverse effect on our business, financial condition and results of operations.

Our failure to increase the number or quality of properties covered by our venue partner contracts, increase the number of hotel chains for which we are the preferred provider could have a material adverse effect on our business, financial condition and results of operations.

Our business and revenue growth depends on our ability to increase the services for which we are the preferred provider at our venue partners and obtain new venue partners. While our contracts with our venue partners and hotel chain MSAs generally allow us to be the exclusive on-site provider of services, customers can bring in their own technologies or use other parties that are not located on-site at these locations. In addition, such contracts do not generally provide any minimum revenue or event commitments. Accordingly, our ability to generate or increase revenue at these venues depends on a variety of factors, including:

| • | our ability to obtain and retain attractive venues for which we serve as preferred provider; |

| • | our ability to obtain leads for events from our venue partners; |

| • | the quality, price and appeal of our event technology services; |

| • | our ability to integrate new technologies into our event technology services to avoid obsolescence and provide scalability and meet evolving customer preferences; and |

| • | our ability to market our services effectively and differentiate ourselves from our competitors or the venue’s in-house solutions. |

This risk is heightened by the concentrated nature of the hospitality industry, which is dominated by a relatively small number of major hotel chains that are focused on hosting large business-oriented events. If we are unable to maintain and grow our network of hotel chains and venues, we may be unable to satisfy our customers’ needs, lose market share or incur additional costs to support our customers, all of which could have a material adverse effect on our business, results of operations or financial condition.

The widespread adoption of more effective teleconference and virtual meeting technologies could reduce the number of events held at our venue partners, the size and scope of such events, including reduced demand for our services at events, or the attendance at such events, which could adversely affect our business, financial condition and results of operations.

Our business and growth strategies rely in part upon our customers’ continued need for in-person meetings and conferences. Should more effective teleconference and virtual meeting technologies be developed, customers could choose to substitute these technologies for part or all of their in-person meetings and conferences. The emergence of more effective teleconference or virtual meeting technologies, the widespread adoption of teleconference and virtual meeting technologies or changes in preferences of our customers could adversely affect our business, financial condition and results of operations.

In addition, existing or potential venue partners and customers may elect to use self-operated solutions, eliminating business opportunities for us. As technology advances, demand for our services at events at venue partners could be reduced as customers become more able to substitute readily available products for our services. If it becomes easier and more cost-effective for customers to host

21

Table of Contents

events without the type of services we provide, our business, financial condition and results of operations could be adversely affected.

Potential venue partners may be reluctant to switch to a new preferred provider of event technology services, which may adversely affect our growth.

Many large hotel chains, convention centers and other venues have existing relationships with event technology services providers and may be reluctant to switch to a new preferred provider due to a variety of factors, including service disruptions associated with a change of providers and potential impact on revenue during the transition period. If we are unable to overcome these concerns, we may not be able to attract new venue partners, which could have a material adverse effect on our growth.

If venues reduce their outsourcing or use of preferred providers, it could have a material adverse effect on our business, financial condition and results of operations.

Our business and growth strategies depend in part on the continuation of a current trend toward outsourcing services in general and event technology services in particular. Venues will outsource if they perceive that outsourcing allows them to provide quality services at a lower cost, generates incremental revenue for them and permits them to focus on their core business activities. Potential venue partners may seek to provide event technology services in-house in order to maintain control over the quality of the event technology services provided at their venues, enhance their customer relationships and increase their revenue. If the trend to outsource does not continue or our venue partners elect to perform these event technology services in-house (due to consolidation in the hotel industry or otherwise), it could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, some of our large hotel chain partners have retained a limited number of preferred partners to provide all or a large part of their required services across their portfolio of hotels. If we are not selected and retained as a preferred partner to provide event technology services or if hotel chains that have agreements with other providers acquire our existing venue partners, it could limit our ability to pursue and enter into venue contracts and have a material adverse effect on our business, financial condition and results of operations.

Our success depends on our ability to maintain the value and reputation of our brand.

Our success depends on the value and reputation of the PSAV brand. Brand and name recognition is an important differentiator in the event technology services business as prospective venue partners may only outsource to well-known and established event technology service providers. The PSAV name is integral to our business as well as to the implementation of our strategies for expanding our business. Maintaining, promoting and positioning our brand will depend largely on the success of venue partner and customer relationships and our ability to provide consistent, high quality and innovative services. Our brand could be adversely affected if we fail to achieve these objectives or if our public image or reputation were to be tarnished by negative publicity, which could have a material adverse effect on our business, financial condition and results of operations.

Competition in our industry could adversely affect our results of operations.