Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - A. M. Castle & Co. | cas-ex991x123115.htm |

| 8-K - FORM 8-K COVER - A. M. Castle & Co. | cas-8xkx123115.htm |

A.M. Castle & Co. ® A. M. Castle & Co. NYSE: CAS March 14, 2016 A. M. Castle & Co. Supplement: Q4 and Year End 2015 Earnings Conference Call EX-10- EXHIBIT 99.2 1

A. M. Castle & Co. ® Forward-Looking Statements Information provided and statements contained in this release that are not purely historical are forward- looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this release and the Company assumes no obligation to update the information included in this release. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy, and the cost savings and other benefits that we expect to achieve from our facility closures and organizational changes. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “predict,” “plan,” "should," or similar expressions. These statements are not guarantees of performance or results, and they involve risks, uncertainties, and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements, including our ability to effectively manage our operational initiatives, the impact of volatility of metals and plastics prices, the cyclical and seasonal aspects of our business, our ability to effectively manage inventory levels and the impact of our substantial level of indebtedness, as well as including those risk factors identified in Item 1A “Risk Factors” of our Annual Report on Form 10- K for the fiscal year ended December 31, 2014 and our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, to be filed shortly. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Except as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future, to reflect the occurrence of unanticipated events or for any other reason. EX-11- 2

A. M. Castle & Co. ® This presentation includes non-GAAP financial measures to assist the reader in understanding our business. The non-GAAP financial information should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with U.S. GAAP (“GAAP”). However, we believe that non-GAAP reporting, giving effect to the adjustments shown in the reconciliation contained in the appendix to this presentation, provides meaningful information and therefore we use it to supplement our GAAP guidance. Management often uses this information to assess and measure the performance of our business. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analysis of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations and to assist with period-over-period comparisons of such operations. The exclusion of the charges indicated herein from the non-GAAP financial measures presented does not indicate an expectation by the Company that similar charges will not be incurred in subsequent periods. In addition, the Company believes that the use and presentation of EBITDA, which is defined by the Company as income before provision/benefit for income taxes plus depreciation and amortization, and interest expense, less interest income, is widely used by the investment community for evaluation purposes and provides the investors, analysts and other interested parties with additional information in analyzing the Company’s operating results. EBITDA should not be considered as an alternative to net income or any other item calculated in accordance with U.S. GAAP, or as an indicator of operating performance. Our definition of EBITDA used here may differ from that used by other companies. Adjusted non-GAAP net income and adjusted EBITDA, which are defined as reported net income and EBITDA adjusted for non-cash items and items which are not considered by management to be indicative of the underlying results, are presented as the Company believes the information is important to provide investors, analysts and other interested parties additional information about the Company’s financial performance. Management uses EBITDA, adjusted non-GAAP net income and adjusted EBITDA to evaluate the performance of the business. The financial information herein contains information generated from audited financial statements and unaudited information and has been prepared by management in good faith and based on data currently available to the Company. Regulation G & Other Cautionary Notes EX-12- 3

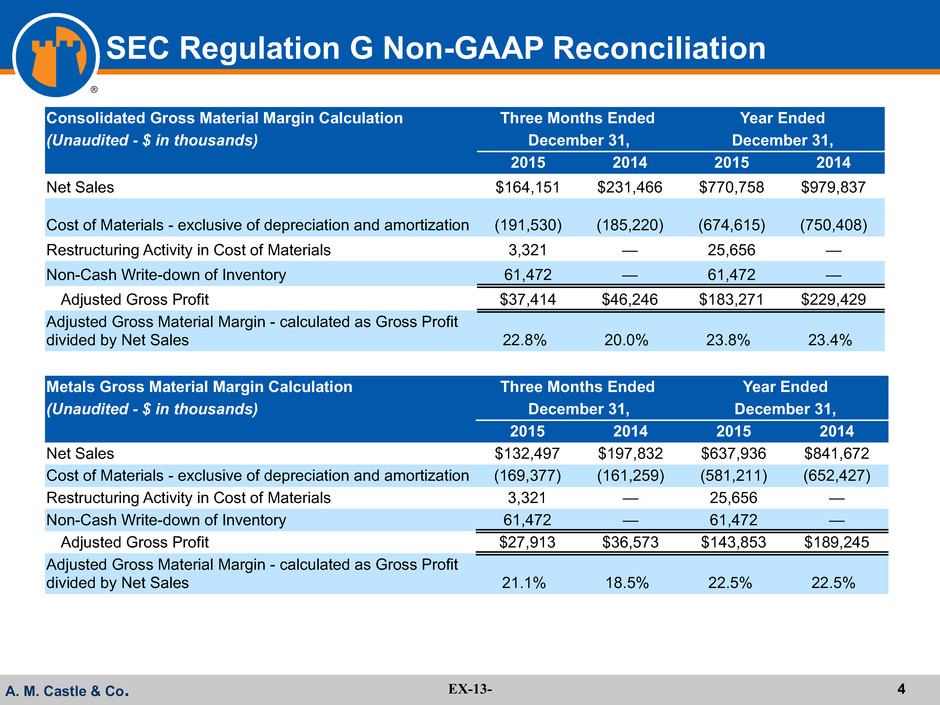

A. M. Castle & Co. ® SEC Regulation G Non-GAAP Reconciliation Consolidated Gross Material Margin Calculation Three Months Ended Year Ended (Unaudited - $ in thousands) December 31, December 31, 2015 2014 2015 2014 Net Sales $164,151 $231,466 $770,758 $979,837 Cost of Materials - exclusive of depreciation and amortization (191,530) (185,220) (674,615) (750,408) Restructuring Activity in Cost of Materials 3,321 — 25,656 — Non-Cash Write-down of Inventory 61,472 — 61,472 — Adjusted Gross Profit $37,414 $46,246 $183,271 $229,429 Adjusted Gross Material Margin - calculated as Gross Profit divided by Net Sales 22.8% 20.0% 23.8% 23.4% EX-13- 4 Metals Gross Material Margin Calculation Three Months Ended Year Ended (Unaudited - $ in thousands) December 31, December 31, 2015 2014 2015 2014 Net Sales $132,497 $197,832 $637,936 $841,672 Cost of Materials - exclusive of depreciation and amortization (169,377) (161,259) (581,211) (652,427) Restructuring Activity in Cost of Materials 3,321 — 25,656 — Non-Cash Write-down of Inventory 61,472 — 61,472 — Adjusted Gross Profit $27,913 $36,573 $143,853 $189,245 Adjusted Gross Material Margin - calculated as Gross Profit divided by Net Sales 21.1% 18.5% 22.5% 22.5%

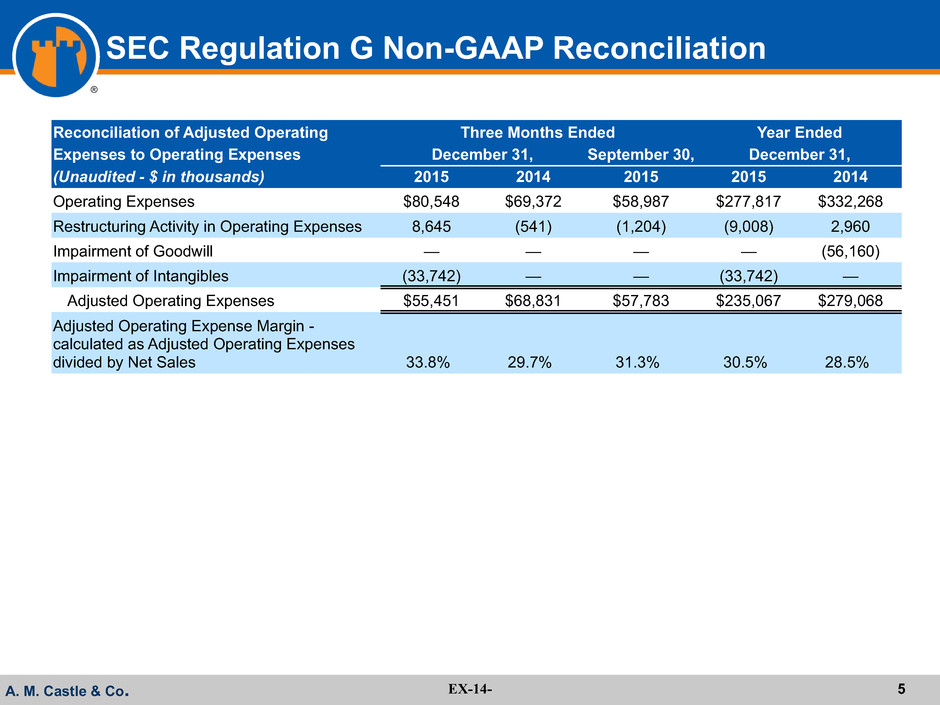

A. M. Castle & Co. ® SEC Regulation G Non-GAAP Reconciliation Reconciliation of Adjusted Operating Three Months Ended Year Ended Expenses to Operating Expenses December 31, September 30, December 31, (Unaudited - $ in thousands) 2015 2014 2015 2015 2014 Operating Expenses $80,548 $69,372 $58,987 $277,817 $332,268 Restructuring Activity in Operating Expenses 8,645 (541) (1,204) (9,008) 2,960 Impairment of Goodwill — — — — (56,160) Impairment of Intangibles (33,742) — — (33,742) — Adjusted Operating Expenses $55,451 $68,831 $57,783 $235,067 $279,068 Adjusted Operating Expense Margin - calculated as Adjusted Operating Expenses divided by Net Sales 33.8% 29.7% 31.3% 30.5% 28.5% EX-14- 5

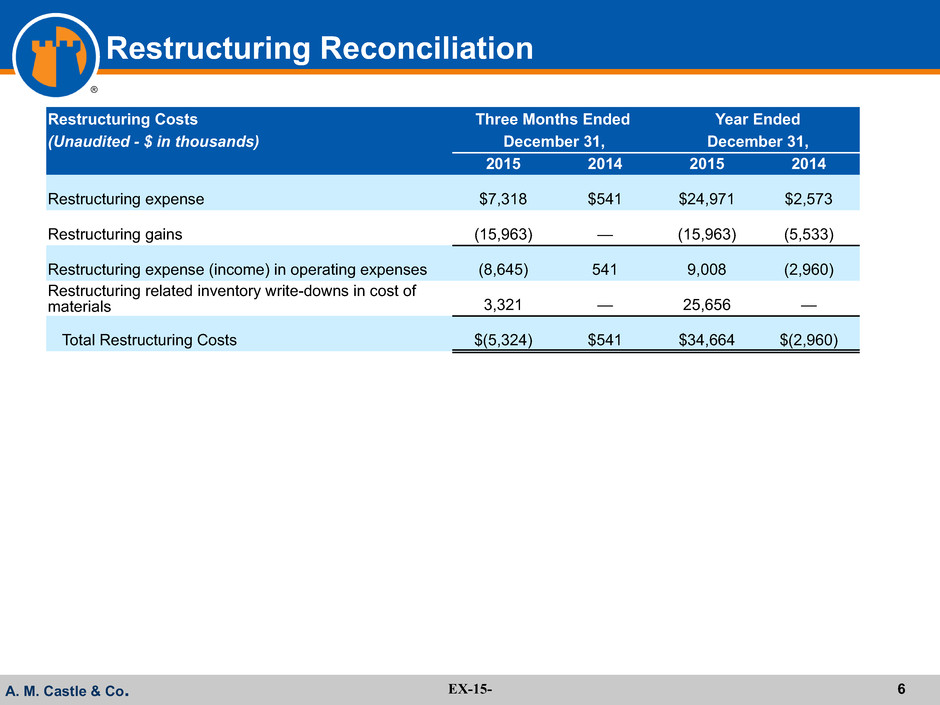

A. M. Castle & Co. ® Restructuring Reconciliation Restructuring Costs Three Months Ended Year Ended (Unaudited - $ in thousands) December 31, December 31, 2015 2014 2015 2014 Restructuring expense $7,318 $541 $24,971 $2,573 Restructuring gains (15,963) — (15,963) (5,533) Restructuring expense (income) in operating expenses (8,645) 541 9,008 (2,960) Restructuring related inventory write-downs in cost of materials 3,321 — 25,656 — Total Restructuring Costs $(5,324) $541 $34,664 $(2,960) EX-15- 6

A.M. Castle & Co. ® A. M. Castle & Co. NYSE: CAS Thank You EX-16- 7