Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION PURSUANT TO - Novagen Ingenium Inc. | nova10k123114ex32_1.htm |

| EX-31.1 - CERTIFICATION - Novagen Ingenium Inc. | nova10k123114ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _____________

Commission file # 333-149617

NOVAGEN INGENIUM INC

(Exact Name of Registrant as Specified in its Charter)

| Nevada | 98-0471927 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification number) | |

| 1846 E. Innovation Park Drive, Oro Valley, Arizona | 85755 | |

(Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number: 310-994-7988

Securities registered under Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company in Rule 12b-2 of the Act (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $711,140.

As of March 9, 2016 the Registrant had 48,510,901 shares of its Common Stock outstanding.

FORWARD LOOKING STATEMENTS

Certain statements made in this Annual Report are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements made in this Report are based on current expectations that involve numerous risks and uncertainties. The Company’s plans and objectives are based, in part, on assumptions involving the growth and expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes that its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance that the forward-looking statements made in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements made in this Report, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

As used herein, the terms “we”, “us”, “our” and “the Company” refer to Novagen Ingenium Inc and the term “Novagen Group” refers to the Company and its five wholly-owned subsidiaries, unless the context indicates otherwise.

PART I

Item 1. Business

Overview

Novagen Ingenium Inc. (referred to herein collectively with its subsidiaries as “Novagen” and the “Company”), was incorporated in the State of Nevada, U.S.A., on June 22, 2005 under the name of Pickford Minerals, Inc. Since then, the Company has changed its name to Novagen Solar, Inc., and formed or acquired various subsidiaries which are in the business of designing, manufacturing and distributing V-Twin engines, custom motorcycles and related urban clothing under the Renegade brand. Renegade operates from leased premises situated at Helensvale, Queensland for use as a workshop, prototype machine shop and engine assembly shop. In late 2013, Renegade abandoned its custom motorcycle business and now concentrates on development of the Renegade V-Twin engine line as its core business.

On April 15, 2013, the Company filed Articles of Merger with the Nevada Secretary of State in order to merge with Novagen Ingenium Inc. (the "Subsidiary"), a wholly-owned subsidiary of the Company that was incorporated on April 2, 2013 under the laws of the State of Nevada (the "Merger"). Effective April 30, 2013, the Subsidiary merged with and into the Company, with the Company being the surviving entity. As a result of the Merger, effective April 30, 2013, the Articles of Incorporation of the Company were amended to change the name of the Registrant to Novagen Ingenium, Inc.

Engine Development

The reciprocating internal combustion engine has been in commercial operation for more than a century with many advances in technical operation resulting in numerous differentiated designs, including two stroke, four stroke, rotary, turbine, radial, in-line, v block, boxer, side valve and overhead engines. Over the past century, in-line and V-block engines have become the dominant configurations in non-aircraft commercial applications. Novagen intends to develop engines based on innovative designs and technology that can be powered by gasoline, diesoline, biofuels, liquid petroleum gas, steam, permanent magnets and other alternative energy sources.

The Renegade Engine

Prohibitive production costs have limited sales of the Renegade engine to 60 units since Renegade commenced operations on April 12, 2011. Our management intends to combine elements of the Renegade engine with our own engine products, materials and technologies, to produce engines that can be commissioned into industry, aerospace, marine and automotive applications. Novagen plans to utilize economies of scale not formerly available to Renegade to reduce production costs, and achieve profitability within the next 12 months. There is no assurance that we will succeed in developing an engine, or that if we do, that we will ever be able to commercialize it profitably.

The Novagen Y Engine

The Novagen Y Engine (patent pending) under development is a new design engine configuration that utilizes opposing pistons and three angled cylinders with 180º crank journals. On October 14, 2012, the Company filed for patent protection of the Novagen Y-Engine with the United States Patent and Trade Mark Office. On November 2, 2012, the Company filed an updated patent application and is currently preparing the utility patent application.

Products and Services

We sell our motor cycle products through our shop front and workshop facilities. Renegade had a number of independent dealers prior to the acquisition by Novagen and these dealers will be contacted to negotiate ongoing involvement in a new dealer network to be established in the near future. Motor cycle products sold by Renegade includes the sales and service of Renegade V-Twin engines, custom motorcycle design manufacture and sales, motorcycle engineering services and spare part sales. Through our shop front and workshop facility at Helensvale, we have established and serviced a growing customer base of motorcycle owners and enthusiasts.

| 1 |

Design and Development

We believe the combination of established products being delivered to market as original equipment manufacturers and the design and development of new engine technology places the company in a

We are committed to a substantial ongoing design and development program to:

| • | create and capture new engine intellectual technology; |

| • | develop, produce and improve line items such as Renegade V-Twin engines. |

Sales and Marketing

We will conduct ongoing marketing activities to promote Novagen and Renegade brands to our customer base and to the general public. Our marketing and promotional efforts will include attending motorcycle trade shows, obtaining publication of articles on our company and its products in industry magazines and other publications available to the general public.

Manufacturing and Suppliers

Our manufacturing operations consist of in-house production of components, parts and custom modifications. Supply of other components, materials and parts are sourced via standard commercial trading terms.

Competition

Engine technology design and development is highly competitive, and our competitors have substantially greater financial, personnel, development, marketing and other resources than us. Our main competitor is Ecomotors International, Inc. which is in an advanced development stage of an opposing piston engine. Other significant competitors range from back yard garage inventors to established market leading engine companies.

The V-Twin motorcycle engine market is highly competitive, and our competitors have substantially greater financial, personnel, development, marketing and other resources than us. Our main competitor is S&S Cycle, Inc. which dominates the after-market V-Twin engine market. Other short run V-Twin after-market engine manufacturers pose direct competition to us. We believe product placement in the original equipment manufacturer contracted supply and joint venture vehicle manufacturing industry will directly impact the future demand for after- market V-Twin motorcycle engines. We cannot assure anyone that we will be able to compete against current or future competitors. Competition faced by us may harm our operations, business and financial position.

Intellectual Property

The proprietary nature of, and protection for, our products, materials, processes and know-how are important to our business. We will seek patent protection in the United States and internationally for our intellectual property where available and when appropriate. In addition, we rely on trade secrets, know-how and continuing innovation to develop and maintain our competitive position.

On October 14, 2012, we filed for patent protection of the Novagen Y-Engine with the United States Patent and Trade Mark Office. On November 2, 2012, we filed an updated patent application and are currently preparing the utility patent application.

Our wholly owned subsidiary, Renegade Engine Company Pty Ltd., holds a registered trademark for the Renegade logo and the Renegade trade name in connection with motorcycles and motorcycle products.

| 2 |

Regulations

Our operations are subject to a variety of national, federal, regional and local laws, rules and regulations relating to worker safety and the use, storage, discharge and disposal of environmentally sensitive materials.

Other than the filing of patent applications with the respective governmental bodies, we are not aware of any approval of our engine and engineering services, materials or processes that may be required from government authorities at this stage in our development. However, once a product is ready to be commercialized, the governmental approval and regulatory process may become substantial.

We believe that we are in compliance in all material respects with all laws, rules, regulations and requirements that affect our business. Further, we believe that compliance with such laws, rules, regulations and requirements does not impose a material impediment on our ability to conduct business.

Facilities

Our principal facilities are located in Queensland, Australia, where we lease approximately 3,300 square feet of commercial space and 2,500 square feet of office space through our subsidiary, Novagen Pty Ltd. The lease is currently on a month-to-month basis.

Employees

The Company does not have any employees other than our officers and directors.

Item 1A. Risk Factors

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 1B. Unresolved Staff Comments

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 2. Properties

We do not presently own or have an interest in any real property.

Item 3. Legal Proceedings

Neither the Company nor any of its officers or directors is a party to any material legal proceeding or litigation and such persons know of no material legal proceeding or contemplated or threatened litigation. There are no judgments against the Company or its officers or directors. None of our officers or directors have been convicted of a felony or misdemeanour relating to securities or performance in corporate office.

| 3 |

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our shares trade under the symbol “NOVZ” on the OTCBB and the OTCQB. Very limited trading activity with our common stock has occurred during the past two years and the subsequent interim period; therefore, only limited historical price information is available. The following table sets forth the high and low bid prices of our common stock for the last two fiscal years, as reported by OTC Markets Group Inc. and represents inter dealer quotations, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

| Quarter Ended | High | Low | ||||||||

| December 31, 2014 | $ | 0.060 | $ | .030 | ||||||

| September 30, 2014 | 0.060 | 0.040 | ||||||||

| June 30, 2014 | 0.058 | 0.038 | ||||||||

| March 31, 2014 | 0.070 | 0.033 | ||||||||

| December 31, 2013 | 0.070 | 0.032 | ||||||||

| September 30, 2013 | 0.050 | 0.031 | ||||||||

| June 30, 2013 | 0.220 | 0.031 | ||||||||

| March 31, 2013 | 0.540 | 0.018 | ||||||||

Unregistered Sales of Equity Securities and Use of Proceeds

On June 24, 2013, the Company issued 2,000,000 shares of its common stock to related-party creditors in order to convert two promissory notes with an aggregate carrying value of $92,300 at the date of conversion (AU$100,000). The issuance of our common stock was exempt from registration under Regulation S promulgated under the Securities Act of 1933, as amended.

Holders

On March 9, 2016, we had 52 registered holders of our common stock and 48,510,901 shares of common stock issued and outstanding. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of shares of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

Dividend Policy

We have not declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Convertible Securities

At December 31, 2014, we had four convertible debt instrument outstanding, the principal of which can be converted into a maximum of 2,400,000 shares of common stock. As of December 31, 2014, none of the debt had been converted into common stock.

| 4 |

Penny Stock Regulation

Our shares must comply with the Penny Stock Reform Act of 1990, which may potentially decrease our shareholders’ ability to easily transfer their shares. Broker-dealer practices in connection with transactions in "penny stocks" are regulated. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that must comply with the penny stock rules. Since our shares must comply with such penny stock rules, our shareholders will in all likelihood find it more difficult to sell their securities.

Item 6. Selected Financial Data

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our plan of operation should be read in conjunction with the financial statements and the related notes. This discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Our actual results and the timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of certain factors.

Overview

Our business is in the early stages of development. We have not earned any significant revenues since inception. Our currently available capital and cash flow has been generated through share subscriptions and loans from management and non-affiliated third parties and it is management’s intention that this will continue together with increases in revenue.

Our ultimate success will depend upon our ability to raise capital, including joint venture projects and debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other derivative securities, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, both generally and specifically in the engine industry, and the fact that we have not been profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenue from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

As a result of the foregoing, our auditors have expressed doubt about our ability to continue as a going concern in our financial statements for the year ended December 31, 2014.

| 5 |

Results of Operations

We recorded a net comprehensive loss of $531,235 for the twelve months ended December 31, 2014, compared with a net comprehensive loss of $420,049 for the twelve months ended December 31, 2013 for the reasons enumerated in the following paragraphs.

Overall revenue volumes were down from the 2013 amount of $26,890 to $22,883 for 2014. Costs of revenues were also down from $28,176 in 2013 to $27,205 in 2014.

Total general and administrative expenses were slightly up from $269,283 in 2013 to $273,414 in 2014.

Depreciation expense was zero for the year ended December 31, 2014 because of our impairment of our property, plant and equipment (see Note 3 to the financial statements) versus $11,547 in 2013.

Interest expense (net of interest income) decreased significantly during 2014 (from $91,898 in 2013 to $58,343 in 2014). During 2013, we included $51,273 of interest expense resulting from the beneficial conversion feature issued during that year. If we remove that amount from interest expense for 2013, we have $40,674 in 2013 interest expense. This represents an actual increase in interest expense for 2014,commensurate with higher interest-bearing debt levels.

In 2013, we had $114,954 of costs related to the disposition of our operating subsidiary Novagen Pty Ltd. In Australia. We had no such costs in 2014.

Liquidity and Capital Reserves

Our financial statements have been prepared on a going concern basis that contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

At December 31, 2014 our total liabilities amounted to $1,081,961 compared with $796,150 at December 31, 2013. Cash used in operations for the years ended December 31, 2014 and 2013 were $287,505 and $330,058, respectively. Cash flows provided from financing activities were $256,932 and $260,015, respectively for those periods.

Item 7a. Quantitative and Qualitative Disclosures about Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| 6 |

Item 8. Financial Statements

FINANCIAL STATEMENTS

NOVAGEN INGENIUM, INC.

CONTENTS

| Report of Independent Registered Public Accounting Firm | F-2 | |||

| CONSOLIDATED FINANCIAL STATEMENTS | ||||

| Consolidated Balance Sheets as of December 31, 2014 and 2013 | F-3 | |||

| Consolidated Statements of Operations for the for the years ended December 31, 2014 and 2013 | F-4 | |||

| Consolidated Statement of Changes in Stockholders’ Deficit for the years ended December 31, 2014 and 2013 | F-5 | |||

| Consolidated Statement of Cash Flows for the years ended December 31, 2014 and 2013 | F-6 |

| F - 1 |

Report of Independent Public Accounting Firm

To the Board of Directors

Novagen Ingenium Inc.

Oro Valley, Arizona

We have audited the accompanying consolidated balance sheets of Novagen Ingenium Inc. and its subsidiaries (collectively, the “Company”) as of December 31, 2014 and 2013 and the related consolidated statements of operations, stockholders' deficit and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Novagen Ingenium, Inc. as of December 31, 2014 and 2013 and the consolidated results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has suffered losses from operations and has a working capital deficit. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regards to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

March 10, 2016

| F - 2 |

NOVAGEN INGENIUM INC.

CONSOLIDATED BALANCE SHEETS

| December 31, | ||||||||

| 2014 | 2013 | |||||||

| ASSETS | ||||||||

| Cash and equivalents | $ | 4,334 | $ | 327 | ||||

| Accounts receivable, net | 3,423 | |||||||

| Other current assets | 27 | |||||||

| Total current assets | 7,757 | 354 | ||||||

| Property and equipment, net | — | 227,038 | ||||||

| Other non-current assets | — | 18,085 | ||||||

| Total non-current assets | — | 245,123 | ||||||

| TOTAL ASSETS | $ | 7,757 | $ | 245,477 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Accounts payable and accrued liabilities | $ | 250,354 | $ | 159,562 | ||||

| Notes payable | 532,176 | 338,481 | ||||||

| Notes payable, related parties | 223,184 | 215,167 | ||||||

| Deferred income | 76,247 | 82,940 | ||||||

| Total current liabilities | 1,081,961 | 796,150 | ||||||

| TOTAL LIABILITIES | 1,081,961 | 796,150 | ||||||

| STOCKHOLDERS' DEFICIT | ||||||||

| Preferred stock, $0.0001 par value, 50,000,000 shares authorized; no shares issued and outstanding | — | — | ||||||

| Common stock, $0.0001 par value; 100 million shares authorized, 48,510,901 shares issued and outstanding at December 31, 2014 and 2013 | 4,852 | 4,852 | ||||||

| Additional paid in capital | 1,617,115 | 1,609,411 | ||||||

| Accumulated other comprehensive gain (loss) | 99,266 | 64,686 | ||||||

| Common stock payable | 17,550 | 17,550 | ||||||

| Accumulated deficit | (2,812,987 | ) | (2,247,172 | ) | ||||

| TOTAL STOCKHOLDERS' DEFICIT | (1,074,204 | ) | (550,673 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 7,757 | $ | 245,477 | ||||

The accompanying notes are an integral part of these consolidated financial statements

| F - 3 |

NOVAGEN INGENIUM INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE LOSS

| Year Ended December 31, | ||||||||

| 2014 | 2013 | |||||||

| REVENUES | ||||||||

| Sales | $ | 22,883 | $ | 26,890 | ||||

| Cost of revenues | 27,205 | 28,176 | ||||||

| Gross margin | (4,322 | ) | (1,286 | ) | ||||

| OPERATING EXPENSES | ||||||||

| General and administrative expenses | 273,414 | 269,283 | ||||||

| Depreciation, depletion and amortization | — | 11,547 | ||||||

| Asset impairments | 229,736 | |||||||

| Total operating expenses | 503,150 | 280,830 | ||||||

| Loss from operations | (507,472 | ) | (282,116 | ) | ||||

| OTHER INCOME/(EXPENSE) | ||||||||

| Interest income | 16 | 49 | ||||||

| Interest expense | (58,359 | ) | (91,947 | ) | ||||

| Total other expense | (58,343 | ) | (91,898 | ) | ||||

| Net loss from continuing operations | (565,815 | ) | (374,014 | ) | ||||

| Discontinued operations | — | (114,954 | ) | |||||

| Net loss | $ | (565,815 | ) | $ | (488,968 | ) | ||

| OTHER COMPREHENSIVE LOSS | ||||||||

| Currency translation | 34,580 | 68,919 | ||||||

| Net comprehensive loss | $ | (531,235 | ) | $ | (420,049 | ) | ||

| Net loss per share | $ | (0.01 | ) | $ | (0.01 | ) | ||

| From continuing operations | $ | (0.01 | ) | $ | (0.01 | ) | ||

| From discontinued operations | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weighted average number of shares outstanding, basic and fully diluted | 48,510,901 | 47,551,997 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

| F - 4 |

NOVAGEN INGENIUM, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Other | Common | Total | |||||||||||||||||||||||||

| Par | Paid in | Comprehensive | Stock | Accumulated | Stockholder | |||||||||||||||||||||||

| Shares | Value | Capital | Gain/ (Loss) | Payable | Deficit | Equity | ||||||||||||||||||||||

| Balance, December 31, 2012 | 46,510,901 | $ | 4,652 | $ | 1,199,494 | $ | (4,233 | ) | $ | — | $ | (1,758,204 | ) | $ | (558,291 | ) | ||||||||||||

| Shares issued for conversion of debt | 2,000,000 | 200 | 93,894 | 94,094 | ||||||||||||||||||||||||

| Beneficial conversion feature of promissory note | 51,273 | 51,273 | ||||||||||||||||||||||||||

| Gain on sale of subsidiary to related party | 264,750 | 264,750 | ||||||||||||||||||||||||||

| Unrealized currency gains / (losses) | 68,919 | 68,919 | ||||||||||||||||||||||||||

| Shares promised on connection with asset purchase | 17,550 | 17,550 | ||||||||||||||||||||||||||

| Net loss | (488,968 | ) | (488,968 | ) | ||||||||||||||||||||||||

| Balance, December 31, 2013 | 48,510,901 | 4,852 | 1,609,411 | 64,686 | 17,550 | (2,247,172 | ) | (550,673 | ) | |||||||||||||||||||

| Imputed interest | 7,704 | 7,704 | ||||||||||||||||||||||||||

| Unrealized currency gains / (losses) | 34,580 | 17,327 | ||||||||||||||||||||||||||

| Net loss | (565,815 | ) | (565,815 | ) | ||||||||||||||||||||||||

| Balance, December 31, 2014 | 48,510,901 | $ | 4,852 | $ | 1,617,115 | $ | 99,266 | $ | 17,550 | $ | (2,812,987 | ) | $ | (1,074,204 | ) | |||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

| F - 5 |

NOVAGEN INGENIUM INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Year Ended December 31, | ||||||||

| 2014 | 2013 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (565,815 | ) | $ | (488,968 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Beneficial conversion feature of promissory note | — | 51,273 | ||||||

| Depreciation | — | 11,547 | ||||||

| Asset impairment | 229,736 | — | ||||||

| Imputed interest | 7,704 | — | ||||||

| Change in operating assets and liabilities: | ||||||||

| Accounts receivable | (3,767 | ) | 7,995 | |||||

| Accrued interest | 30,483 | — | ||||||

| Prepaid expenses and other current assets | — | 13,029 | ||||||

| Deferred revenue | — | 22,968 | ||||||

| Accounts payable and accrued expenses | 14,154 | 52,098 | ||||||

| Net cash provided by / (used in) operations | (287,505 | ) | (330,058 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from notes payable | 243,309 | 130,872 | ||||||

| Proceeds from related-party notes payable | 138,889 | 153,859 | ||||||

| Payments on related-party notes payable | (125,266 | ) | (24,716 | ) | ||||

| Net cash provided by/(used in) financing activities | 256,932 | 260,015 | ||||||

| Foreign exchange effect | 34,850 | 68,919 | ||||||

| Net change in cash and equivalents | 4,007 | (1,124 | ) | |||||

| Cash and equivalents, beginning of period | 327 | 1,451 | ||||||

| Cash and equivalents, end of period | $ | 4,334 | $ | 327 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | ||||||||

| Cash paid for interest | $ | 10,312 | $ | 10,852 | ||||

| Cash paid for income taxes | $ | — | $ | — | ||||

| SUPPLEMENTAL DISCLOSURES OF NON-CASH FINANCING ACTIVITIES | ||||||||

| Debt conversions | $ | — | $ | 94,094 | ||||

| Shares Issued for property, plant and equipment | $ | — | $ | 17,550 | ||||

| Sale of subsidiary to related party | $ | — | $ | 264,750 | ||||

| Debt issued for property, plant and equipment | $ | — | $ | 239,563 | ||||

| Implied Australian General Services Tax | $ | — | $ | 18,085 | ||||

| Debt discount | $ | — | $ | 51,273 | ||||

| Reclassification of notes payable to related-party | $ | 112,697 | $ | — | ||||

| F - 6 |

NOVAGEN INGENIUM INC.

Notes to Consolidated Financial Statements

Note 1. Organization and Description of Business

Novagen Ingenium Inc. (referred to herein collectively with its subsidiaries as “Novagen” and the “Company”), was incorporated in the State of Nevada, U.S.A., on June 22, 2005 under the name of Pickford Minerals, Inc. The Company’s fiscal year end is December 31. On May 12, 2009, the Company changed its name to Novagen Solar Inc. The Company was originally engaged in the exploration of mineral deposits in Labrador, Newfoundland, but was unable to implement its exploration program. In April 2009, the Company began to pursue business opportunities relating to photovoltaic solar energy.

On December 7, 2011, there was a change in control of the Company when Twenty Second Trust, a trust organized under the laws of the State of Queensland, Australia acquired control of the Company by purchasing 67% of the issued and outstanding shares of the Company’s common stock from shareholders of the Company. Following the change in control, the board of directors determined that the Company should expand its business to include the development of environmentally sustainable energy solutions through innovative and eco-friendly products and technologies.

On January 3, 2012, the Company formed Novagen Pty Ltd under the laws of Australia, as a wholly owned operating subsidiary. On January 17, 2012, the Company formed Novagen Productions Pty Ltd. under the laws of Australia, as a wholly owned operating subsidiary. On March 2, 2012, the Company formed Novagen Finance Pty Ltd under the laws of Australia, as a wholly owned non-operating subsidiary.

On June 25, 2012 the Company acquired Renegade Streetwear Pty Ltd. (“Renegade”), under the laws of Australia as a wholly owned operating subsidiary. Prior to the acquisition of Renegade Streetwear Pty Ltd the Company was a shell company. After acquiring Renegade, the Company’s name was changed to Renegade Engine Company, Pty Ltd. At the time of the acquisition, Renegade was in the business of designing, manufacturing and distributing V-Twin engines, custom motorcycles and related urban clothing under the Renegade brand. Renegade operates from leased premises situated at Helensvale, Queensland for use as a workshop, prototype machine shop and engine assembly shop. In late 2013, Renegade abandoned its custom motorcycle business and now concentrates on development of the Renegade V-Twin engine line as its core business.

On September 27, 2012, the Company acquired all the issued and outstanding shares of Y Engine Developments Pty Ltd, a development stage Australian company (hereunder “Y Engine Developments”), from Michael Nugent, who is also the President and a director of the Company. The Company issued one common share to Mr. Nugent as the total aggregate consideration for Y Engine Developments.

On April 15, 2013, the Company filed Articles of Merger with the Nevada Secretary of State in order to merge with Novagen Ingenium Inc. (the "Subsidiary"), a wholly-owned subsidiary of the Company that was incorporated on April 2, 2013 under the laws of the State of Nevada (the "Merger"). Effective April 30, 2013, the Subsidiary merged with and into the Company, with the Company being the surviving entity. As a result of the Merger, effective April 30, 2013, the Articles of Incorporation of the Company were amended to change the name of the Registrant to Novagen Ingenium Inc.

Summary of Significant Accounting Policies

The financial statements of the Company have been prepared in accordance with the generally accepted accounting principles in the United States of America. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates that have been made using careful judgment. The financial statements have, in management’s opinion been properly prepared within reasonable limits of materiality and within the framework of the significant accounting policies summarized below:

| F - 7 |

Accounting Method

The Company’s financial statements are prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America and reported in US Dollars.

Revenue Recognition

Revenue from the sale of goods is recognised by the company in accordance with Accounting Standards Codification “(ASC”) 605, when all the following conditions have been satisfied:

| 1. | persuasive evidence of an arrangement exists; |

| 2. | product delivery has occurred; |

| 3. | title and risk of loss has transferred to the buyer; |

| 4. | sales price to the customer is fixed and determinable and; |

| 5. | collectability is assured. |

Cash received prior to the revenue recognition criteria above being met is recorded as deferred revenue until all criteria have been met.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses for the reporting period. The Company reviews its estimates on an ongoing basis. The estimates were based on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances. Actual results could differ from these estimates. The Company believes the judgments and estimates required in its accounting policies to be critical in the preparation of the Company’s financial statements.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid investments and short-term debt instruments with original maturities of three months or less to be cash equivalents.

Property and Equipment

The Company has property and equipment that was being depreciated over the period between two to ten years. At January 1, 2014, we impaired all of our property, plant and equipment (see Note 3).

Inventories

Inventories are measured at the lower of cost and net realizable value. The cost of manufactured products includes direct materials, direct labor and an appropriate portion of variable and fixed overheads. Overheads are applied on the basis of normal operating capacity. Costs are assigned on the basis of weighted average costs.

Concentration of Credit Risk

The Company places its cash and cash equivalents with high credit quality financial institutions in uninsured accounts.

| F - 8 |

Consolidation Policy

In January, March, June and September 2012, the Company incorporated three subsidiaries and acquired two wholly-owned subsidiaries, and as such, the consolidated financial statements include the accounts of Novagen Ingenium Inc. and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated upon consolidation.

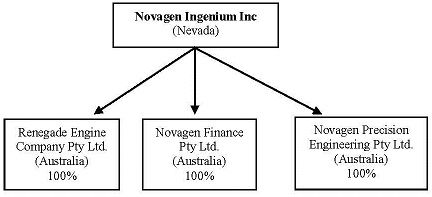

Our Corporate Structure

All of our business operations are conducted through our Australian subsidiaries. The chart below presents our corporate structure.

Reclassifications

Certain financial statement amounts for the prior period have been reclassified to conform to the current period presentation. These reclassifications had no effect on the net loss or accumulated deficit as previously reported.

Foreign Currency Translations

Novagen maintains its accounting records in US Dollars. The Company’s subsidiaries are located and operating outside of the United States of America. They maintain their accounting records in Australian Dollars. For reporting purposes the Company reports its financial information in US Dollars.

Transactions in a currency other than the functional currency are measured in the respective functional currencies of the Company and its subsidiaries and are recorded on initial recognition in the functional currencies at exchange rates approximating those ruling at the transaction dates. Exchange gains and losses are recorded in the statements of income and comprehensive income.

Assets and liabilities of the Company and its subsidiaries are translated into the U.S. dollars at exchange rates at the balance sheet date, equity accounts are translated at historical exchange rate and revenues and expenses are translated by using the average exchange rates. Translation adjustments are reported as cumulative translation adjustments and are shown as a separate component of other comprehensive income in the statements of stockholders’ equity.

The following table provides the exchange rates used to translate the balances in the accounts from Australian Dollars to US Dollars:

| Australian Dollar / US Dollar | ||||||||

| Item | Rate Used | 2014 | 2013 | |||||

| Assets and liabilities | Year-end | 0.8156 | 0.8906 | |||||

| Revenues and expenses | Average | 0.9022 | 0.9670 | |||||

| F - 9 |

Fair Value of Financial Instruments

The Company's financial instruments as defined by Accounting Standards Codification (“ASC”) 825, "Disclosures about Fair Value of Financial Instruments," include accounts payable and accrued liabilities and notes payable. Fair values were assumed to approximate carrying value for these financial instruments, except where noted. Management is of the opinion that the Company is not exposed to significant interest or credit risks arising from these financial instruments. The Company is operating outside the United States of America and has significant exposure to foreign currency risk due to the fluctuation of currency in which the Company operates and U.S. dollars.

Long-lived assets impairment

Long-lived assets of the Company are reviewed for impairment whenever events or circumstances indicate that the carrying amount of assets may not be recoverable, pursuant to guidance established in ASC 360, Accounting for the Impairment or Disposal of Long-Lived Assets.

Management considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations (undiscounted and without interest charges). If impairment is deemed to exist, the assets will be written down to fair value. Fair value is generally determined using a discounted cash flow analysis.

Stock-Based Compensation

The Company adopted ASC 718, "Share-Based Payment", to account for its stock options and similar equity instruments issued. Accordingly, compensation costs attributable to stock options or similar equity instruments granted are measured at the fair value at the grant date, and expensed over the expected vesting period. ASC 718 requires excess tax benefits be reported as a financing cash inflow rather than as a reduction of taxes paid. The Successor Company did not grant any stock options during 2013 or 2014.

Comprehensive Income

The Company adopted ASC 220, "Reporting Comprehensive Income", which establishes standards for reporting and display of comprehensive income, its components and accumulated balances. The Company is disclosing this information on its Statement of Stockholders' Equity and its Statements of Operations and Comprehensive Income. The Company’s comprehensive income consists of net earnings for the period and currency translation adjustments.

Income Taxes

The Company has adopted ASC 740, "Accounting for Income Taxes", which requires the Company to recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company’s financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the temporary differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse.

Basic and Diluted Loss Per Share

In accordance with ASC 260 – “Earnings Per Share”, the basic loss per common share is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding. Diluted loss per common share is computed similar to basic loss per common share except that the denominator is increased to include the number of additional common shares that would be outstanding if the potential common shares had been issued and if the additional common shares were dilutive. At December 31, 2014 and 2013, the basic loss per share was equal to diluted loss per share as there were no dilutive instruments.

| F - 10 |

Business Combinations

ASC 805 applies the acquisition method of accounting for business combinations established in ASC 805 to all acquisitions where the acquirer gains a controlling interest, regardless of whether consideration was exchanged. ASC 805 establishes principles and requirements for how the acquirer: a) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree; b) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and c) determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination.

Recently Adopted and Recently Enacted Accounting Pronouncements

Recent accounting pronouncements issued by the FASB (including its EITF), the AICPA, and the SEC did not or are not believed by management to have a material impact on the Company's present or future financial statements.

Note 2. Going Concern

The Company has an accumulated deficit of $2,812,987 at December 31, 2014, and does not have the resources at this time to repay its credit and debt obligations, make any payments in the form of dividends to its shareholders or fully implement its business plan. Without additional capital, the Company will not be able to remain in business.

These factors raise substantial doubt about the Company’s ability to continue as a going concern.

In addition to operational expenses, as the Company executes its business plan, it is incurring expenses related to complying with its public reporting requirements. In order to finance these expenditures, the Company has raised capital in the form of debt, which will have to be repaid, as discussed in detail below.

The Company has depended on loans from private investors and related parties for much of its operating capital. The Company will need to raise capital or have positive cash flows from operations in the next twelve months in order to remain in business.

Management anticipates that significant dilution will occur as a result of any future sales of the Company’s common stock and this will reduce the value of its outstanding shares. The Company cannot project the future level of dilution that will be experienced by investors as a result of its future financings, but it will significantly affect the value of its shares.

The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the possible inability of the Company to continue as a going concern.

Note 3. Property and Equipment

The Company has property and equipment being depreciated over five years. Depreciation on property and equipment is provided on a straight line basis over their expected useful lives.

On October 11, 2013, the Company acquired certain plant and equipment in exchange for a promissory note in the amount of AU$270,000 (approximately US$239,563) plus 270,000 shares of the Company common stock. An independent valuation of the fair value of the equipment was performed in Australia and determined that its fair value, before considering the Australian Goods and Services Tax (“GST”), was AU$203,060 (or approximately US$180,169). 10% of the amount was considered to be GST tax and not allocated to the purchase price, but held as future input GST payments. We valued the shares promised as consideration at their fair values on the date of the acquisition and added US$17,550 to the total amount of consideration given. Therefore, the total amount of consideration given, including the promissory note and promised stock, was US$257,113 and US$18,085 was allocated to input GST to be applied against future tax payments.

| F - 11 |

Because the asset purchase in 2013 failed to produce positive cash flows for 2013 or 2014, management elected to impair 100% of the carrying value of the property plant and equipment. At December 31, 2013, property, plant and equipment historical cost, accumulated depreciation and net carrying values were $237,118, $10,080 and $227,038, respectively. We charged asset impairments with $229,736. The difference between the impairment value in 2014 and the net carrying value at December 31, 2013 was due to exchange rate differences.

Depreciation expense was $11,547 for the year ended December 31, 2013.

Note 4. Notes Payable

Borrowings from related parties

Prior to December 31, 2013, the Company issued four promissory notes payable to related parties: Rubyden Pty Ltd., Jennifer Mewett Pty Ltd., Loadstone Motor Corporation Pty Ltd. and Micheal Nugent, respectively. All the related party notes are unsecured, payable on demand, and accrue interest at the rate of 5% per annum on un-matured amounts and 10% on matured, unpaid amounts.

During the year ended December 31, 2013, the Company borrowed an additional $153,859 from related parties, made principal payments of $24,716 and converted the above-mentioned Rubyden and Jennifer Mewett debt of AU$100,000 (about US$94,094 at the time of conversion). In addition, $194,700 (AU$219,437) was extinguished upon the sale of Novagen Pty Ltd. to a related party.

We ended 2013 and began 2014 with $103,842 (AU$116,597) of related-party debt.

During the year ended December 31, 2014, we received $138,889 (AU$154,125) in loan proceeds, made principal payments of $125,266 (AU$139,008) and adopted $112,697 (AU$125,060) in related-party debt from the third-party notes payable section when several of our creditors joined our board of directors.

In addition, we reduced the US Dollar equivalent of our Australian related-party debts from $244,421 to 223,184 due to changes in exchange rates from the strengthening US Dollar.

Borrowings from third parties

During the year ended December 31, 2013, we borrowed $130,872 from unrelated parties, and extinguished $24,400 (AU$27,500) upon the sale of Novagen Pty Ltd to a related party.

We began 2014 with $449,806 (AU$505,060) in amounts owed to third parties for borrowings.

During the year ended December 31, 2014, we borrowed an additional $243,309 (AU$270,000), (“the 2014 Third-Party Borrowings”), made no principal payments on these debts, and transferred $112,697 (AU$125,060) to the related-party section of the financial statements when certain creditors became related parties by joining our board of directors. We also reduced the recorded debt in US Dollars from $580,418 to $532,176 due to changes in exchange rates from the strengthening US Dollar.

Of the 2014 Third-Party Borrowings:

On April 24, 2014, we borrowed US$18,023 (AU$20,000) from an unrelated party. The debt is not evidenced by a promissory note.

We issued a promissory note on September 22, 2014 for $18,023 (AU$20,000) which is callable by the maker at any time, and which bears interest at 5% (10% on matured, unpaid amounts). The note may be converted at any time at AU$0.25 per share (which, at December 31, 2014, was equal to about US$0.204). We paid no interest or principal on this note during 2014, but accrued interest of $247 (AU$274).

| F - 12 |

We issued an additional promissory note on September 22, 2014 for $27,034 (AU$30,000) which is callable by the maker at any time, and which bears interest at 5% (10% on matured, unpaid amounts). The note may be converted at any time at AU$0.25 per share (which, at December 31, 2014, was equal to about US$0.204). We paid no interest or principal on this note during 2014, but accrued interest of $385 (AU$427)..

On November 24, 2014, we issued a promissory note in the amount of $180,229 (AU$200,000). The note is callable by the maker at any time, bears interest at 4.5%, and is convertible into 2,000,000 shares of common stock. We paid no interest or principal on this note during 2014, but accrued interest of $2,877 (AU$3,193).

The Company evaluated the terms of the above third-party notes in accordance with ASC Topic No. 815 – 40, Derivatives and Hedging - Contracts in Entity’s Own Stock and determined that the underlying common stock is indexed to the Company’s common stock. We determined that the conversion features did not meet the definition of a liability and therefore did not bifurcate the conversion feature and account for it as a separate derivative liability. The Company further analyzed the convertible debts for a beneficial conversion feature under ASC 470-20 on the date of the notes and determined that no beneficial conversion feature exists.

On third-party borrowings in total, we accrued $32,822 (AU$36,422) and paid $15,615 (AU$17,328) in interest and transferred $112,697 (AU$125,060) of principal and $14,104 (AU$15,651) of interest to the related-party section when certain creditors joined our board of directors.

In addition to the convertible promissory notes issued to creditors during 2014, one promissory note from before 2014 for AU$50,000 (US$45,057) can be converted into common stock at the rate of AU$0.10.

Note 5. Capital Stock

Preferred stock

The Company has 50,000,000 shares of preferred stock authorized and none issued.

Common stock

The Company has 100,000,000 shares of common stock authorized.

During the year ended December 31, 2013, we issued 1 million shares each to Rubyden Pty Ltd., and Jennifer Mewett Pty Ltd. to convert their debt balances to equity. We valued the shares at their grant date fair value of $94,094.

During the year ended December 31, 2014, we issued no additional common shares and had 48,510,901 shares issued and outstanding at December 31, 2014.

Note 6. Related Party Transactions

During the year ended December 31, 2013, we had net borrowings of $41,617 (AU$43,038) from the 22nd Trust, an entity for whom the Trustee is the wife of our Chief Executive Officer, Micheal Nugent, and extinguishment of the 22nd Trust’s debt of $115,496 (AU$119,437) upon the sale of Novagen Pty Ltd. to a related party.

During the year ended December 31, 2013, we had net borrowings from related parties other than the 22nd Trust of $87,526 (AU$98,626), debt converted into common stock of $94,094 (AU$100,000), and extinguished $96,700 (AU$100,000) of related-party debt when we sold Novagen Pty Ltd. to a related party.

During the year ended December 31, 2014, we received $138,889 (AU$154,125) in loan proceeds, made principal payments of $125,266 (AU$139,008) and adopted $112,697 (AU$125,060) in related-party debt from the third-party notes payable section when several of our creditors joined our board of directors.

| F - 13 |

In addition, we reduced the US Dollar equivalent of our Australian related-party debts from $244,421 to 223,184 due to changes in exchange rates from the strengthening US Dollar.

At December 31, 2014, since-inception cumulative net interest and principal payments to the Twenty-Second Trust exceeded borrowings from, and interest accruals to, the Twenty Second Trust by $14,259 (AU$15,823) and $103 (AU$114), respectively. At December 31, 2014, we fully reserved these amounts and included them in compensation expense.

Note 7. Business Combinations and Dispositions

Sale of Novagen Pty Ltd.

On July 1, 2013, we sold our subsidiary, Novagen Pty Ltd. to a related party for AU$100 (about US$92). The effect on the financial statements was to reduce assets by US$51,394, reduce liabilities by US$307,900, reduce stockholders’ equity by $22,700, increase the foreign exchange effect by $14,456, and to record a gain of $264,750 on the sale as follows:

| Financial Statement Item | Financial Effect | |||

| Assets | ||||

| Cash and equivalents | $ | (3,365 | ) | |

| Other current assets | (6 | ) | ||

| Investments | (16,747 | ) | ||

| Property, plant and equipment | (35,946 | ) | ||

| Accumulated depreciation | 6,981 | |||

| Intangible assets | (2,309 | ) | ||

| Total assets | (51,394 | ) | ||

| Liabilities | ||||

| Accounts payable and accrued liabilities | 42,432 | |||

| Notes payable | 25,383 | |||

| Notes payable, related parties | 240,085 | |||

| Deferred income | — | |||

| Total current liabilities | 307,900 | |||

| Stockholders' Deficit | ||||

| Additional paid in capital | 6,745 | |||

| Accumulated loss | 15,955 | |||

| Total stockholders' deficit | 22,700 | |||

| Foreign exchange effect | (14,456 | ) | ||

| Gain on sale of Novagen Pty Ltd to related party | $ | 264,750 | ||

Because the sale was to a related party, we included the gain in Additional Paid in Capital.

Acquisition of assets from Misal Technologies Pty Ltd.

On March 7, 2013, the Company entered into a written agreement to acquire certain assets, including an aircraft computerized hydraulic test station and associated intellectual property, from Misal Technologies Pty Ltd. of Victoria, Australia. Under the terms and subject to the conditions set forth in the agreement, Novagen was to pay a cash purchase price of AU$2,000,000 (USD$2,046,706) for the assets.

This acquisition has not closed and is still pending.

| F - 14 |

Note 8. Income Taxes

At December 31, 2014 and 2013, the Company had deferred tax assets of approximately $815,000 and $529,000, respectively, principally arising from net operating loss carryforwards for income tax purposes. As our management cannot determine that it is more likely than not that we will realize the benefit of the deferred tax asset, a valuation allowance equal to the deferred tax asset has been established at December 31, 2014 and 2013. The significant component of the deferred tax asset at December 31, 2014 and 2013 was as follows:

| December 31, | ||||||||

| 2014 | 2013 | |||||||

| Deferred tax asset at 30% | $ | 698,396 | $ | 529,000 | ||||

| Valuation allowance | (698,396 | ) | (529,000 | ) | ||||

| Net deferred tax asset | $ | — | $ | — | ||||

At December 31, 2014 and 2013, the Company had net operating loss carry forwards of approximately $2,328,000 and $1,762,000, respectively, which will begin to expire in the year 2026.

Note 9. Subsequent Events

On March 25, 2015, the Renegade Engine Company Pty Ltd., (“Renegade”), a wholly owned subsidiary, transferred all trade names and trademarks to Novagen Precision Engineering Pty Ltd., (“Novagen Precision”), another wholly-owned subsidiary. Subsequently, we changed the name of Renegade R Urban Streetware Pty Ltd. (“R Urban”) and sold R Urban to a related party on March 26, 2015.

We have evaluated subsequent events through the date of this report.

| F - 15 |

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

In connection with the preparation of this annual report on Form 10-K, an evaluation was carried out by our management, with the participation of the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (“Exchange Act”)) as of December 31, 2014. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC rules and forms and that such information is accumulated and communicated to management, including the Chief Executive Officer and the Chief Financial Officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company’s management concluded, as of the end of the period covered by this report, that the Company’s disclosure controls and procedures were not effective. Management intends to improve the adequacy of its disclosure controls and procedures during the course of 2015, subject to available resources.

Management’s Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and Rule 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the Company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the Company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The Company’s internal control over financial reporting includes those policies and procedures that:

| • | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company’s assets; |

| • | provide reasonable assurance that transactions are recorded as necessary to permit preparation of the financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of management and the board of directors; and |

| • | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements. |

The Company’s management conducted an assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). As a result of this assessment, management identified a material weakness in internal control over financial reporting.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

The material weakness identified is described below.

| 7 |

Procedures for Control Evaluation. Management has not established with appropriate rigor the procedures for evaluating internal controls over financial reporting. Due to limited resources and lack of segregation of duties, documentation of the limited control structure has not been accomplished.

Lack of Audit Committee. To date, the Company has not established an Audit Committee. It is management’s view that such a committee, including a financial expert, is an utmost important entity level control over the financial reporting process.

Insufficient Documentation of Review Procedures. We employ policies and procedures for reconciliation of the financial statements and note disclosures, however, these processes are not appropriately documented. The Company has only one individual responsible for the preparation of the financial records.

Insufficient Information Technology Procedures. Management has not established methodical and consistent data back-up procedures to ensure loss of data will not occur.

As a result of the material weaknesses in internal control over financial reporting described above, the Company’s management has concluded that, as of December 31, 2014, the Company’s internal control over financial reporting was not effective based on the criteria in Internal Control – Integrated Framework issued by COSO.

This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. We were not required to have, nor have we, engaged our independent registered public accounting firm to perform an audit of internal control over financial reporting pursuant to the rules of the Securities and Exchange Commission that permit us to provide only management’s report in this annual report.

Changes in Internal Control Over Financial Reporting

As of the end of the period covered by this report, there have been no changes in internal control over financial reporting (as defined in Rule 13a-15(f) of the Exchange Act) during the year ended December 31, 2012, that materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

CEO and CFO Certifications

Appearing immediately following the Signatures section of this report there are Certifications of our CEO and CFO. The Certifications are required in accordance with Section 302 of the Sarbanes-Oxley Act of 2002 (the Section 302 Certifications). This Item of this report is the information concerning the Evaluation referred to in the Section 302 Certifications and this information should be read in conjunction with the Section 302 Certifications for a more complete understanding of the topics presented.

| 8 |

PART III

Item 10. Directors, Executive Officers, Promoters and Control Persons; Compliance With Section 16(A) of the Exchange Act

The following sets forth our directors, executive officers, promoters and control persons, their ages, and all offices and positions held. Directors are elected for a period of one year and thereafter serve until the stockholders duly elect their successor. Officers and other employees serve at the will of our board of directors.

Name |

Position |

Age | Term Period Served as Director/Officer | |||||

| Micheal P. Nugent | CEO, President and a director | 52 | 2011 to present | |||||

| Noel Charles Mewett | Director | 65 | 2013 to present | |||||

| Garry Kinnaird | Director | 61 | 2013 to present | |||||

| Dr. Jon N. Leonard | Director | 75 | Appointed March 8, 2015 | |||||

| Kenneth R. Grohs | Director | 64 | Appointed March 8, 2015 | |||||

| Sonny Nugent | Director | 28 | Appointed March 8, 2015 | |||||

Micheal Nugent

Micheal P. Nugent has held senior executive positions and directorships with public and private companies in the United States and Australia since 1995. He is a certified diesel fitter in Australia. Mr. Nugent’s technical and corporate experience is expected to assist the Company with its efforts to implement profitable operations.

During the past five years, Mr. Nugent has held the following positions:

| Position(s) Held | From | To | Employer | Business Operations | ||||||||

| CEO | 2011 | 2014 | Loadstone Motor Corporation Pty Ltd. | engine development and manufacture | ||||||||

| director, CEO | 2009 | Present | Tautachrome, Inc. | Computer technology | ||||||||

| director, CEO | 2008 | 2013 | Nugent Aerospace, Inc. | non-operating | ||||||||

| director, CEO | 2008 | 2013 | Fire From Ice, Inc. | non-operating | ||||||||

| CEO | 2006 | 2014 | Adbax Truckside Management Pty Ltd. | transport industry service provider | ||||||||

| CEO | 2003 | 2013 | Cycclone Magnetic Engines, Inc. | engine development | ||||||||

| director | 2001 | 2013 | Roadships Australia Pty Ltd. | transportation logistics | ||||||||

| director | 2001 | 2013 | Bronzelink Pty Ltd. | holding company |

Noel Charles Mewett

Noel Charles Mewett has 40 years of business experience, having owned and operated numerous highly successful and profitable businesses in diverse market sectors. He holds a bachelor’s degree in sales and marketing from Melbourne University in Melbourne, Australia, and has also studied architecture at Melbourne University.

| 9 |

During the past five years, Mr. Mewett has held the following positions:

| Position(s) Held | From | To | Employer | Business Operations | ||||||||

| director/owner | 2002 | 2010 | Goldsite Pty Ltd | Retirement Village | ||||||||

| director/builder | 2005 | 2013 | Mewett Developments Pty Ltd | Construction | ||||||||

| director | 2006 | 2007 | Seachange Lifestyle Communities Pty Ltd | Retirement Village | ||||||||

| director | 2007 | 2013 | Savannah Lifestyle Resorts Pty Ltd | Retirement Village | ||||||||

| director | 2011 | 2013 | Riverstone Resources Pty Ltd | Gold Mining | ||||||||

| director/owner | 2010 | 2013 | Mewett Business Group Pty Ltd | Hospitality | ||||||||

| director/owner | 2012 | 2013 | More Concepts, Hong Kong | Int. Debit Card |

Garry W. Kinnaird

Garry W. Kinnaird is a Certified Financial Planner in Australia and a Justice of the Peace for the State of Queensland, Australia. He brings 32 years of financial and business experience to Novagen.

During the past five years, Mr. Kinnaird has held the following positions:

| Position(s) Held | From | To | Employer | Business Operations | ||||||||

| Senior Planner | 1980 | 2012 | AMP Ltd. | financial planning | ||||||||

| Senior Partner | 2004 | 2012 | Advice First Pty Ltd. | financial planning | ||||||||

| Director/Secretary | 1986 | 2012 | GK Financial Group Pty Ltd. | financial planning | ||||||||

| Director/Secretary | 1990 | Present | Silverbow Pty Ltd. | trustee of an investment trust | ||||||||

| Director | 2001 | Present | F & A Management No. 113 Pty Ltd. | trustee of a real estate trust |

Dr. Jon N. Leonard

Since September 2002, Dr. Leonard has been the Chief Executive Officer of and Chairman of the Board for Click Evidence, Inc., an Arizona corporation engaged in the development of smartphone imaging applications. From September 2002 through to May 2012, Dr. Leonard was variously employed by Raytheon Missile Systems Company as Senior Director of Programs, Advance Programs, and as Director, Counter Terrorism Technology.

Mr. Leonard holds a Ph.D. in Mathematics from the University of Arizona, a M.Sc. in Aerospace Engineering from U.C.L.A. and a B.A. in Physics from the University of Arizona.

Kenneth R. Grohs

Since 1983, Mr. Grohs has served as a Director and Senior Design Engineer of Goldenrod Pty Ltd., an Australian company engaged in the business of providing consulting structural engineering services primarily with respect to structural design and supervision of multi-story units, large to medium industrial complexes and domestic structures.

Mr. Grohs holds a Diploma of Civil Engineering from the Gippsland Institute of Advanced Education. He is a member of the Institution of Engineers, Australia, as well as the Board of Professional Engineers of Queensland.

Sonny Nugent

Sonny Nugent has been a director of Renegade Engine Company Pty Ltd., a wholly-owned subsidiary of the Registrant, since 2012. Since 2014, he has also held directorships with Novagen Finance Pty Ltd. and Novagen Precision Engineering Pty Ltd, each a wholly-owned subsidiary of the Registrant. Since 2013, Mr. Nugent has been a director of Fire From Ice Films Pty Ltd., an Australian film production company. From 2011 to 2012, Mr. Nugent was employed as a foreman by BC Platinum Construction Pty Ltd., an Australian construction company.

Sonny Nugent is the son of Micheal Nugent and Tamara Nugent. Micheal Nugent is the President, Chief Executive Officer, Chief Financial Officer and a director of the Registrant. Tamara Nugent is the sole trustee for Twenty Second Trust, the controlling shareholder of the Registrant. Sonny Nugent is a beneficiary of Twenty Second Trust.

| 10 |

Family Relationships:

There is no family relationship among any of our executive officers and directors other than that enumerated above between Sonny Nugent and Micheal Nugent.

Involvement in Certain Legal Proceedings

Except as noted herein or below, during the last ten years none of our directors or officers have:

| (1) | had any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| (2) | been convicted in a criminal proceeding or subject to a pending criminal proceeding; |

| (3) | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| (4) | been found by a court of competent jurisdiction in a civil action, the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Committees of the Board

All proceedings of our board of directors for the fiscal year ended December 31, 2014 were conducted by resolutions consented to in writing by our board of directors and filed with the minutes of the proceedings of our board of directors. Novagen does not have nominating, compensation or audit committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes that the functions of such committees can be adequately performed by the board of directors.

Novagen does not have any defined policy or procedure requirements for stockholders to submit recommendations or nominations for directors. The board of directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our company does not currently have any specific or minimum criteria for the election of nominees to the board of directors and we do not have any specific process or procedure for evaluating such nominees. The board of directors will assess all candidates, whether submitted by management or stockholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our board of directors may do so by directing a written request addressed to our President, Micheal Nugent, at the address appearing on the first page of this Report.

Audit Committee Financial Expert

We do not have a standing audit committee. Our directors perform the functions usually designated to an audit committee. All of our board members are also executive officers of the Company and therefore our board of directors has determined that we do not have a board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the NASD Rules.