Attached files

| file | filename |

|---|---|

| EX-3 - EX-3.2 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex32_358.htm |

| EX-3 - EX-3.3 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex33_357.htm |

| EX-3 - EX-3.4 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex34_529.htm |

| EX-21 - EX-21.1 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex211_62.htm |

| EX-23 - EX-23.1 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex231_57.htm |

| EX-31 - EX-31.1 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex311_58.htm |

| EX-31 - EX-31.2 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex312_59.htm |

| EX-32 - EX-32.1 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex321_60.htm |

| EX-32 - EX-32.2 - JONES FINANCIAL COMPANIES LLLP | ck0000815917-ex322_61.htm |

| 10-K - PDF COURTESY COPY - JONES FINANCIAL COMPANIES LLLP | 10K_2015_FINAL.pdf |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-16633

THE JONES FINANCIAL COMPANIES, L.L.L.P.

(Exact name of registrant as specified in its charter)

|

MISSOURI |

|

43-1450818 |

|

(State or other jurisdiction of |

|

(IRS Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

12555 Manchester Road |

|

|

|

Des Peres, Missouri |

|

63131 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code (314) 515-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

None |

|

None |

Securities registered pursuant to Section 12(g) of the Act:

Limited Partnership Interests

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

o |

|

Accelerated filer |

o |

|

Non-accelerated filer |

x |

(Do not check if a smaller reporting company) |

Smaller reporting company |

o |

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of February 26, 2016, 914,542 units of limited partnership interest (“Interests”) are outstanding, each representing $1,000 of limited partner capital. There is no public or private market for such Interests.

DOCUMENTS INCORPORATED BY REFERENCE

None

THE JONES FINANCIAL COMPANIES, L.L.L.P.

TABLE OF CONTENTS

|

|

|

|

|

Page |

|

PART I |

|

|

|

|

|

|

|

|

|

|

|

Item 1 |

|

|

3 |

|

|

Item 1A |

|

|

13 |

|

|

Item 1B |

|

|

27 |

|

|

Item 2 |

|

|

27 |

|

|

Item 3 |

|

|

27 |

|

|

Item 4 |

|

|

28 |

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

|

|

Item 5 |

|

|

29 |

|

|

Item 6 |

|

|

29 |

|

|

Item 7 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

30 |

|

Item 7A |

|

|

48 |

|

|

Item 8 |

|

|

49 |

|

|

Item 9 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

72 |

|

Item 9A |

|

|

72 |

|

|

Item 9B |

|

|

72 |

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

Item 10 |

|

|

73 |

|

|

Item 11 |

|

|

78 |

|

|

Item 12 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

80 |

|

Item 13 |

|

Certain Relationships and Related Transactions, and Director Independence |

|

81 |

|

Item 14 |

|

|

83 |

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

|

|

Item 15 |

|

|

84 |

|

|

|

|

|

85 |

2

PART I

The Jones Financial Companies, L.L.L.P. (“JFC”) is a registered limited liability limited partnership organized under the Missouri Revised Uniform Limited Partnership Act. Unless expressly stated, or the context otherwise requires, the terms “Registrant” and “Partnership” refer to JFC and all of its consolidated subsidiaries. The Partnership’s principal operating subsidiary, Edward D. Jones & Co., L.P. (“Edward Jones”), was organized in February 1941 and reorganized as a limited partnership in May 1969. JFC was organized in June 1987 and, along with Edward Jones, was reorganized in August 1987.

As of December 31, 2015, the Partnership operates in two geographic segments, the United States (“U.S.”) and Canada. Edward Jones is a registered broker-dealer in the U.S. and one of Edward Jones’ subsidiaries is a registered broker-dealer in Canada. JFC is the ultimate parent company of Edward Jones and is a holding company. Edward Jones primarily derives its revenue from the retail brokerage business through the distribution of mutual fund shares, fees related to assets held by and account services provided to its clients, including investment advisory services, the purchase or sale of listed and unlisted securities and insurance products, and principal transactions. Edward Jones conducts business in the U.S. and Canada with its clients, various brokers, dealers, clearing organizations, depositories and banks. For financial information related to segments for the years ended December 31, 2015, 2014 and 2013, see Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 8 – Financial Statements and Supplementary Data – Note 13 to the Consolidated Financial Statements.

3

PART I

|

Item 1. |

Business, continued |

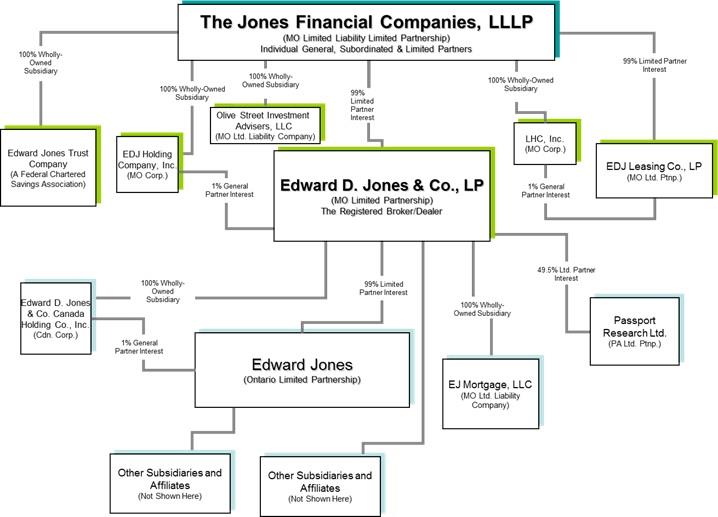

Organizational Structure.

At December 31, 2015, the Partnership was organized as follows:

For additional information about the Partnership’s other subsidiaries and affiliates, see Exhibit 21.1.

Branch Office Network. The Partnership primarily serves serious, long-term individual investors through its extensive network of branch offices. The Partnership's business model is designed to serve clients through personal relationships with financial advisors and branch office administrators ("BOA") located in the communities where its clients live and work. Financial advisors and BOAs provide tailored solutions and services to their clients while leveraging the resources of the Partnership's home office. The Partnership operated 12,482 branch offices as of December 31, 2015, primarily staffed by a single financial advisor and a BOA. Of this total, the Partnership operated 11,904 branch offices in the U.S. (located in all 50 states) and 578 branch offices in Canada.

4

PART I

|

Item 1. |

Business, continued |

Governance. Unlike a corporation, the Partnership is not governed by a board of directors and has no individuals who are designated as directors. Moreover, none of its securities are listed on a securities exchange and therefore the governance requirements that generally apply to many companies that file periodic reports with the U.S. Securities and Exchange Commission (“SEC”) do not apply to it. Under the terms of the Partnership’s Nineteenth Amended and Restated Agreement of Registered Limited Liability Limited Partnership, dated June 6, 2014, as amended (the “Partnership Agreement”), the Partnership’s Managing Partner has primary responsibility for administering the Partnership’s business, determining its policies and controlling its management. The Managing Partner also has the power to admit and dismiss general partners of JFC and to adjust the proportion of their respective interests in JFC. As of December 31, 2015, JFC was composed of 380 general partners, 19,873 limited partners and 362 subordinated limited partners. See Part III, Item 10 – Directors, Executive Officers and Corporate Governance for a description of the governance structure of the Partnership.

Revenues by Source. The following table sets forth the sources of the Partnership’s revenues for the past three years. Due to the interdependence of the activities and departments of the Partnership’s investment business and the inherently arbitrary assumptions required to allocate overhead, it is impractical to identify and specify expenses applicable to each aspect of the Partnership’s operations. Further information on revenue related to the Partnership’s segments is provided in Part II, Item 8 – Financial Statements and Supplementary Data – Note 13 to the Consolidated Financial Statements and Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

($ millions) |

|

2015 |

|

|

2014 |

|

|

2013 |

|

|||||||||||||||

|

Fee revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset-based fees |

|

$ |

3,399 |

|

|

|

51% |

|

|

$ |

3,089 |

|

|

|

49% |

|

|

$ |

2,523 |

|

|

|

44% |

|

|

Account and activity fees |

|

|

690 |

|

|

10% |

|

|

|

617 |

|

|

|

10% |

|

|

|

568 |

|

|

|

10% |

|

|

|

Total fee revenue |

|

|

4,089 |

|

|

61% |

|

|

|

3,706 |

|

|

|

59% |

|

|

|

3,091 |

|

|

|

54% |

|

|

|

Trade revenue |

|

|

2,425 |

|

|

|

36% |

|

|

|

2,460 |

|

|

|

38% |

|

|

|

2,439 |

|

|

|

43% |

|

|

Interest and dividends |

|

|

158 |

|

|

3% |

|

|

|

135 |

|

|

|

2% |

|

|

|

134 |

|

|

|

2% |

|

|

|

Other revenue |

|

|

22 |

|

|

0% |

|

|

|

32 |

|

|

|

1% |

|

|

|

52 |

|

|

|

1% |

|

|

|

Total revenue |

|

$ |

6,694 |

|

|

100% |

|

|

$ |

6,333 |

|

|

|

100% |

|

|

$ |

5,716 |

|

|

|

100% |

|

|

Asset-based Fees

The Partnership earns fees from investment advisory services offered in the U.S. through Edward Jones Advisory Solutions® (“Advisory Solutions”) and Edward Jones Managed Account Program® (“MAP”) and in Canada through Edward Jones Portfolio Program® (“Portfolio Program”) and Edward Jones Guided Portfolios® (“Guided Portfolios”). Advisory Solutions and MAP are both investment advisory programs created under the Investment Advisers Act of 1940. Portfolio Program and Guided Portfolios are not subject to this Act as services from these programs are only offered in Canada. In January 2016 the Partnership announced its intention to wind down the MAP program offered in the U.S. The Partnership stopped accepting new assets in the MAP program in January 2016 and intends to close the program by mid-2017. MAP represents less than 1% of asset-based fees revenue and the Partnership expects most of the client assets will be transferred to other programs which offer investment advisory services.

Through Advisory Solutions, financial advisors provide investment advisory services to clients for an annual fee based upon the average daily market value of their assets in the program. Clients can choose to invest in Advisory Solutions Fund Models, which invests in affiliated mutual funds, unaffiliated mutual funds, and exchange-traded funds or Advisory Solutions Unified Managed Account models, which also include separately managed allocations. When investing in Advisory Solutions, the client may elect either a research or a custom account model. If the client elects a research type model, the Partnership assumes full investment discretion on the account and the client assets will be invested in one of numerous different research models developed and managed by Edward Jones. If the client elects to build a custom model, the Partnership assumes limited investment discretion on the account and the investments are selected by the client and his or her financial advisor. The vast majority of client assets within Advisory Solutions are invested in research models.

5

PART I

|

Item 1. |

Business, continued |

In 2013, in order to accommodate the size and expected growth in investment advisory services offered through Advisory Solutions, as well as potentially lower client investment management expense, the Partnership formed the Bridge Builder Trust (the "Trust") to offer additional fund options for clients invested in Advisory Solutions. The Trust added seven sub-advised mutual funds to its series in 2015, bringing the total to eight sub-advised funds. At its discretion, the Trust may add additional funds in the future. Olive Street Investment Advisers, L.L.C. ("OLV"), a wholly-owned subsidiary of JFC and a Missouri limited liability company, is the investment adviser to the current sub-advised mutual funds. For each of the sub-advised mutual funds in the Trust, OLV has primary responsibility for setting the overall investment strategies of the mutual funds and selecting and managing sub-advisers, subject to the review and approval of the Trust's board of trustees. As of December 31, 2015, the Trust had client assets under management of $22.6 billion.

Through the MAP and Portfolio Program, financial advisors provide investment advisory services to clients by using independent investment managers and proprietary asset allocation models. Guided Portfolios is a non-discretionary, fee-based program with structured investment guidelines. Fees for these programs are based on the average value of client assets in the program.

The Partnership also earns revenue on clients’ assets through service fees and other revenues received under agreements with mutual fund and insurance companies. The fees generally range from 15 to 25 basis points (0.15% to 0.25%) of the value of the client assets held.

The Partnership earns revenue sharing from certain mutual fund and insurance companies. In most cases, this is additional compensation paid by investment advisers, insurance companies or distributors based on a percentage of average assets held by the Partnership’s clients.

In addition to the advisory programs mentioned above, the Partnership earns asset-based fees from the trust services and investment management services offered to its clients through Edward Jones Trust Company (“EJTC”), a wholly-owned subsidiary of JFC.

The Partnership is a 49.5% limited partner of Passport Research, Ltd. (“Passport Research”), the investment adviser for two money market funds made available to Edward Jones clients. Revenue from this source is primarily based on client assets in the funds. However, due to the low interest rate environment, the investment adviser voluntarily chose to reduce certain fees charged to the funds to a level that will maintain a positive client yield on funds. For further information on this reduction of fees, see Part II, Item 7A – Quantitative and Qualitative Disclosures About Market Risk. The Partnership has entered into a non-binding letter of intent to acquire the remaining 50.5% of Passport Research from Federated Investment Management Company ("Federated"), the general partner of Passport Research. The transaction is not expected to have a material impact on the Consolidated Financial Statements. Federated approved the transfer on February 18, 2016 and the transfer is expected to be completed in the fourth quarter of 2016, subject to customary regulatory and fund shareholder approvals.

Account and Activity Fees

Account and activity fees include shareholder accounting service fees, Individual Retirement Account (“IRA”) custodial service fees, and other product/service fees.

The Partnership charges fees to certain mutual fund companies for shareholder accounting services, including maintaining client account information and providing other administrative services for the mutual funds. The Partnership acts as the custodian for clients’ IRAs and the clients are charged an annual fee for this and other account services. Account and activity fees also include sales-based revenue sharing fees, insurance contract services, and fees earned through a co-branded credit card with a major credit card company.

Trade Revenue

Trade revenue consists of commissions, charges to clients for the purchase or sale of mutual fund shares, listed and unlisted equity securities and insurance products, principal transactions and investment banking. Trade revenue is impacted by trading volume, size of trades and market volatility.

6

PART I

|

Item 1. |

Business, continued |

Commissions – Mutual Funds. The Partnership distributes mutual fund shares in continuous offerings and new underwritings. As a dealer in mutual fund shares, the Partnership receives a dealer’s discount which generally ranges from 1% to 5% of the purchase price of the shares, depending on the terms of each fund’s prospectus and the amount of the purchase.

Commissions – Equities. The Partnership receives a commission when it acts as an agent for a client in the purchase or sale of listed and unlisted (over-the-counter) securities. The commission is based on the value of the securities purchased or sold.

Commissions – Insurance Products. The Partnership sells life insurance, long-term care insurance, disability insurance, fixed and variable annuities and other types of insurance products of unaffiliated insurance companies to its clients through its financial advisors who hold insurance sales licenses. As an agent for the insurance companies, the Partnership receives commissions on the premiums paid for the policies.

Principal Transactions. Revenue is earned from the Partnership's distribution of and participation in principal trading activities in municipal obligations, over-the-counter corporate obligations, certificates of deposit, unit investment trusts, and government obligations. The Partnership’s principal trading activities are conducted with other dealers where the Partnership acts as a dealer buying from and selling to its clients. In principal trading of securities, the Partnership exposes its capital to the risk of fluctuation in the fair value of its security positions. The Partnership maintains securities positions in inventory solely to support its business of buying securities from and selling securities to its retail clients and does not seek to profit by engaging in proprietary trading for its own account. The related unrealized gains and losses for these securities are recorded within trade revenue.

Revenue which was previously classified as investment banking was reclassified to principal transactions for all periods presented. Investment banking revenue is primarily derived from the Partnership’s distribution of unit investment trusts and participation in municipal obligations underwriting activities. Revenue also includes underwriting fee revenue related to underwriting and management fees as well as gross acquisition profit/loss and volume concession revenue, which is earned and collected from the issuer. The Partnership historically has not, and does not presently engage in other investment banking activities, such as assisting in mergers and acquisitions, arranging private placement of securities issues with institutions, or providing consulting and financial advisory services to entities.

As of December 31, 2015, the Partnership closed the negotiated municipal obligations underwriting portion of the investment banking business. The revenue and costs associated with the closure were immaterial.

Interest and Dividends

Interest and dividends revenue is earned on client margin (loan) account balances, cash and cash equivalents, cash and investments segregated under federal regulations, securities purchased under agreements to resell, partnership loans, inventory securities and investment securities. Loans secured by securities held in client margin accounts provide a source of income to the Partnership. The Partnership is permitted to use securities owned by margin clients having an aggregate market value of generally up to 140% of the debit balance in margin accounts as collateral for the borrowings. The Partnership may also use funds provided by free credit balances in client accounts to finance client margin account borrowings.

The Partnership’s interest income is impacted by the level of client margin account balances, cash and cash equivalents, cash and investments segregated under federal regulations, securities purchased under agreements to resell, partnership loans, inventory securities and investment securities and the interest rates earned on each.

Significant Revenue Source

As of December 31, 2015, the Partnership distributed mutual funds for approximately 70 mutual fund companies. One company, American Funds Distributors, Inc., represented 20% of the Partnership’s total revenue for the year ended December 31, 2015, which consisted of revenue from trades, asset-based fees and account and activity fees, which are described above. The revenue generated from this company relates to business conducted with the Partnership’s U.S. segment.

7

PART I

|

Item 1. |

Business, continued |

BUSINESS OPERATIONS

Research Department. The Partnership maintains a Research department to provide specific investment recommendations and market information for clients. The department supplements its own research with the services of independent research services. In addition, the Research department provides recommendations for asset allocation, portfolio rebalancing and investment selections for Advisory Solutions accounts.

Client Account Administration and Operations. The Partnership has an Operations division that is responsible for activities relating to client securities and the processing of transactions with other broker-dealers, exchanges and clearing organizations. These activities include receipt, identification and delivery of funds and securities, internal financial controls, accounting and personnel functions, office services, custody of client securities and handling of margin accounts. The Partnership processes virtually all of its own transactions.

To expedite the processing of orders, the Partnership’s branch offices are linked to the home office locations through an extensive communications network. Orders for securities are generally captured at the branch electronically, routed to the home office and forwarded to the appropriate market for execution. The Partnership’s processing following the execution of a security transaction is generally automated.

The volume of transactions the Partnership processes fluctuates considerably. The Partnership records such transactions and posts its books on a daily basis. The Partnership has a computerized branch office communication system which is principally utilized for entry of security orders, quotations, messages between offices, research of various client account information, and cash and security receipts functions. Home office personnel, including those in the Operations and Compliance divisions, monitor day-to-day operations to determine compliance with applicable laws, rules and regulations. Failure to keep current and accurate books and records can render the Partnership liable to disciplinary action by governmental and self-regulatory organizations (“SROs”).

The Partnership clears and settles virtually all of its listed and over-the-counter equities, municipal bond, corporate bond, mutual fund and annuity transactions for its U.S. broker-dealer through the National Securities Clearing Corporation (“NSCC”), Fixed Income Clearing Corporation (“FICC”) and Depository Trust Company (“DTC”), which are all subsidiaries of the Depository Trust and Clearing Corporation located in New York, New York.

In conjunction with clearing and settling transactions with NSCC, the Partnership holds client securities on deposit with DTC in lieu of maintaining physical custody of the certificates. The Partnership also uses a major bank for custody and settlement of U.S. treasury securities and Government National Mortgage Association), Federal National Mortgage Association and Federal Home Loan Mortgage Corporation issues.

The Canada broker-dealer handles the routing and settlement of client transactions. In addition, the Canada broker-dealer is a member of the Canadian Depository of Securities (“CDS”) and FundServ for clearing and settlement of transactions. CDS effects clearing of securities on the Canadian National Stock Exchange, Toronto Stock Exchange (“TSX”) and TSX Venture Exchange (“CDNX”). Client securities on deposit are also held with CDS and National Bank Correspondent Network.

The Partnership is substantially dependent upon the operational capacity and ability of NSCC, DTC, FICC, and CDS. Any serious delays in the processing of securities transactions encountered by these clearing and depository companies may result in delays of delivery of cash or securities to the Partnership’s clients.

Broadridge Financial Solutions, Inc. (“Broadridge”), along with its U.S. business, Securities Processing Solutions, U.S., and its international business, Securities Processing Solutions, International, provide automated data processing services for client account activity and related records for the Partnership in the U.S. and Canada, respectively. The Partnership does not employ its own floor brokers for transactions on exchanges. The Partnership has arrangements with other brokers to execute the Partnership’s transactions in return for a commission based on the size and type of trade. If, for any reason, any of the Partnership’s clearing, settling or executing agents were to fail, the Partnership and its clients would be subject to possible loss. To the extent that the Partnership would not be able to meet the obligations to the clients, such clients might experience delays in obtaining the protections afforded them.

8

PART I

|

Item 1. |

Business, continued |

The Canada broker-dealer has an agreement with Computershare Trust Company of Canada to act as trustee for cash balances held by clients in their retirement accounts. The Canada broker-dealer is the custodian for client securities and manages all related securities and cash processing, such as trades, dividends, corporate actions, client cash receipts and disbursements, client tax reporting and statements.

Employees. The Partnership’s financial advisors are employees (or general partners of the Partnership). As of December 31, 2015, the Partnership had approximately 41,000 full and part-time employees and general partners, including its 14,508 financial advisors. The Partnership’s financial advisors are generally compensated on a commission basis and may be entitled to bonus compensation based on their respective branch office profitability and the profitability of the Partnership. The Partnership pays bonuses to its non-financial advisor employees pursuant to a discretionary formula established by management based on the profitability of the Partnership.

Employees of the Partnership in the U.S. are bonded under a blanket policy. The Partnership has an aggregate annual coverage of $50,000,000 subject to deductibles. Employees of the Partnership in Canada are bonded under a blanket policy as required by the Investment Industry Regulation Organization of Canada (“IIROC”). The Partnership has an annual aggregate amount of coverage in Canada of C$50,000,000 with a per occurrence limit of C$25,000,000, subject to a deductible.

The Partnership maintains a comprehensive initial training program for prospective financial advisors which includes preparation for regulatory exams, concentrated instruction in the classroom and on-the-job training in a branch office. During the first phase, U.S. trainees study Series 7 and Series 66 examination materials and take the examinations. In Canada, financial advisors have the requisite examinations completed prior to being hired. After passing the requisite examinations, trainees complete a comprehensive training program in one of the Partnership’s home office training facilities, followed by on-the-job training in their respective markets in nearby branch locations. This training includes reviewing investments, compliance requirements, office procedures, and understanding client needs, as well as establishing a base of potential clients. To complete the initial comprehensive training program, the trainees return to a home office training facility for additional training. Later in their careers, the financial advisors attend additional training at home office. In addition, the Partnership offers periodic continuing training to its experienced financial advisors for the entirety of their careers. Training programs for the more experienced financial advisors continue to focus on meeting client needs and effective management of the branch office.

The Partnership considers its employee relations to be good and believes that its compensation and employee benefits, which include medical, life and disability insurance plans, and profit sharing and 401(k) plan, are competitive with those offered by other firms principally engaged in the securities business.

Competition. The Partnership is subject to intense competition in all phases of its business from other securities firms, many of which are substantially larger than the Partnership in terms of capital, brokerage volume and underwriting activities. In addition, the Partnership encounters competition from other organizations such as banks, insurance companies, and others offering financial services and advice. The Partnership also competes with a number of firms offering discount brokerage services, usually with lower levels of personalized service to individual clients. Further, the financial services industry continues to evolve technologically, with some firms now providing lower cost, computer-based "robo-advice" with limited or no personalized service to clients. Clients are able to transfer their business to competing organizations at any time. There is also intense competition among firms for financial advisors. The Partnership experiences continued efforts by competing firms to hire away its financial advisors, although the Partnership believes its rate of turnover of financial advisors is in line with comparable firms.

REGULATION

Broker-Dealer and Investment Adviser Regulation. The securities industry is subject to extensive federal and state laws, rules and regulations that cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of client funds and securities, client payment and margin requirements, capital structure of securities firms, record-keeping, and the conduct of directors, officers and employees.

9

PART I

|

Item 1. |

Business, continued |

The SEC is the U.S. agency responsible for the administration of the federal securities laws. Its mission is to protect investors, maintain fair, orderly and efficient markets, and facilitate capital formation. Edward Jones is registered as a broker-dealer with the SEC. Edward Jones is subject to periodic examinations by the SEC, review by a designated examining authority, and certain periodic and ad hoc reporting requirements of securities and customer funds. Much of the regulation of broker-dealers has been delegated to SROs, principally FINRA, by the SEC. FINRA adopts rules (which are subject to approval by the SEC) that govern the broker-dealer industry and conducts periodic examinations of Edward Jones’ operations.

Securities firms are also subject to regulation by state securities commissions and insurance regulators in those states in which they conduct business. Since Edward Jones is registered as a broker-dealer and sells insurance products in all 50 states, Puerto Rico, the U.S. Virgin Islands and the District of Columbia, Edward Jones is subject to state regulation in all of these states and territories.

The SEC, SROs and state authorities may conduct administrative proceedings which can result in censure, fine, suspension or expulsion of a broker-dealer, its officers or employees. Edward Jones has in the past been, and may in the future be, the subject of regulatory actions by various agencies that have the authority to regulate its activities (see Part I, Item 3 – Legal Proceedings for more information).

As an investment dealer in all provinces and territories of Canada, Edward Jones' Canada broker-dealer is subject to provincial, territorial and federal laws. All provinces and territorial jurisdictions have established securities administrators to fulfill the administration of securities laws. Edward Jones' Canada broker-dealer is also subject to the regulation of the Canada SRO, IIROC, which oversees the business conduct and financial affairs of its member firms, as well as all trading activity on debt and equity marketplaces in Canada. IIROC fulfills its regulatory obligations by implementing and enforcing rules regarding the proficiency, business and financial conduct of member firms and their registered employees, and marketplace integrity rules regarding trading activity on Canada debt and equity marketplaces.

In addition, Edward Jones, OLV and Passport Research are subject to the rules and regulations promulgated under the Investment Advisers Act of 1940 (“Investment Advisers Act”), which requires investment advisers to register with the SEC. Edward Jones, OLV and Passport Research are registered investment advisers. The rules and regulations promulgated under the Investment Advisers Act govern all aspects of the investment advisory business, including registration, trading practices, custody of client funds and securities, record-keeping, advertising and business conduct. Edward Jones, OLV and Passport Research are subject to periodic examinations by the SEC which is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act.

Pursuant to U.S. federal law, Edward Jones as a broker-dealer belongs to the Securities Investors Protection Corporation (“SIPC”). For clients in the U.S., SIPC provides $500,000 of coverage for missing cash and securities in a client's account, with a maximum of $250,000 for cash claims. Pursuant to IIROC requirements, the Canada broker-dealer belongs to the Canadian Investor Protection Fund (“CIPF”), a non-profit organization that provides investor protection for investment dealer insolvency. For clients in Canada, CIPF limits coverage to C$1,000,000 in total, which can be any combination of securities and cash.

The Partnership currently maintains additional protection for U.S. clients provided by Underwriters at Lloyd’s. The additional protection contract provided by Underwriters at Lloyd’s protects clients’ accounts in excess of the SIPC coverage subject to specified limits. This policy covers theft, misplacement, destruction, burglary, embezzlement or abstraction of cash and client securities up to an aggregate limit of $900,000,000 (with maximum cash coverage limited to $1,900,000 per client) for covered claims of all U.S. clients of Edward Jones. Market losses are not covered by SIPC or the additional protection. In addition, the Partnership has cash and investments segregated in special reserve bank accounts for the benefit for U.S. clients pursuant to the Customer Protection Rule 15c3-3 of the Securities Exchange Act of 1934, as amended (“Customer Protection Rule”).

10

PART I

|

Item 1. |

Business, continued |

Additional legislation, changes in rules promulgated by the SEC, the Department of Labor ("DOL") and SROs, and/or changes in the interpretation or enforcement of existing laws and rules, may directly affect the operations and profitability of broker-dealers and investment advisers. With the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), the SEC has been directed to study existing practices in the industry and granted discretionary rulemaking authority to establish, among other things, comparable standards of conduct for broker-dealers and investment advisers when providing personalized investment advice about securities to retail clients and such other clients as the SEC provides by rule. The SEC may engage in rulemaking or issue interpretive guidance concerning the standard of conduct for broker-dealers and investment advisers. FINRA or other regulatory authorities may also issue rules related to the Dodd–Frank Act. In addition, the DOL has published a proposed rule on the definition of the term "fiduciary" and exemptions related thereto in the context of the Employee Retirement Income Security Act. The Partnership cannot predict at this time what impact such rulemaking activities will have on the Partnership or its operations.

Trust Regulation of EJTC and Regulation of JFC as EJTC’s Parent. EJTC is a federally chartered savings and loan association that operates under a limited purpose “trust-only” charter, which generally restricts EJTC to acting solely in a trust or fiduciary capacity. EJTC and JFC are subject to supervision and regulation by the Office of the Comptroller of the Currency (“OCC”).

Uniform Net Capital Rule. As a result of its activities as a broker-dealer and a member firm of FINRA, Edward Jones is subject to the Uniform Net Capital Rule 15c3-1 of the Securities Exchange Act of 1934, as amended (“Uniform Net Capital Rule”) which is designed to measure the general financial integrity and liquidity of a broker-dealer and the minimum net capital deemed necessary to meet the broker-dealer’s continuing commitments to its clients. The Uniform Net Capital Rule provides for two methods of computing net capital and Edward Jones has adopted what is generally referred to as the alternative method. Minimum required net capital under the alternative method is equal to the greater of $250,000 or 2% of the aggregate debit items, as defined under the Customer Protection Rule. The Uniform Net Capital Rule prohibits withdrawal of equity capital whether by payment of dividends, repurchase of stock or other means, if net capital would thereafter be less than minimum requirements. Additionally, certain withdrawals require the approval of the SEC to the extent they exceed defined levels even though such withdrawals would not cause net capital to be less than 5% of aggregate debit items. In computing net capital, various adjustments are made to exclude assets which are not readily convertible into cash and to provide a conservative valuation of other assets, such as securities owned. Failure to maintain the required net capital may subject Edward Jones to suspension or expulsion by FINRA, the SEC and other regulatory bodies and/or exchanges and may ultimately require liquidation. Edward Jones has, at all times, been in compliance with the Uniform Net Capital Rule.

The Canada broker-dealer and EJTC are also required to maintain specified levels of regulatory capital. Each of these subsidiaries has, at all times, been in compliance with the applicable capital requirements in the jurisdictions in which it operates.

AVAILABLE INFORMATION

The Partnership files annual, quarterly, and current reports and other information with the SEC. The Partnership’s SEC filings are available to the public on the SEC’s website at www.sec.gov.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, and in particular Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements within the meaning of U.S. securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” and other expressions which predict or indicate future events and trends and which do not relate to historical matters. You should not rely on forward-looking statements, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Partnership. These risks, uncertainties and other factors may cause the actual results, performance or achievements of the Partnership to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

11

PART I

|

Item 1. |

Business, continued |

Some of the factors that might cause differences between forward-looking statements and actual events include, but are not limited to, the following: (1) general economic conditions, including an economic downturn or volatility in the U.S. and/or global securities markets; (2) regulatory actions; (3) changes in legislation or regulation, including new regulations under the Dodd-Frank Act and any rules promulgated by the DOL; (4) actions of competitors; (5) litigation; (6) the ability of clients, other broker-dealers, banks, depositories and clearing organizations to fulfill contractual obligations; (7) changes in interest rates; (8) changes in technology and other technology-related risks; (9) a fluctuation or decline in the fair value of securities; and (10) the risks discussed under Part I, Item 1A – Risk Factors. These forward-looking statements were based on information, plans, and estimates at the date of this report, and the Partnership does not undertake to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes.

12

PART I

The Partnership is subject to a number of risks potentially impacting its business, financial condition, results of operations and cash flows. In addition to the risks and uncertainties discussed elsewhere in this Annual Report on Form 10-K, or in the Partnership’s other filings with the SEC, the following are some important factors that could cause the Partnership’s actual results to differ materially from results experienced in the past or those projected in any forward-looking statement. The risks and uncertainties described below are not the only ones facing the Partnership. Additional risks and uncertainties not presently known to the Partnership or that the Partnership currently deems immaterial could also have a material adverse effect on the Partnership’s business and operations. If any of the matters included in the following risks were to occur, the Partnership’s business, financial condition, results of operations and cash flows could be materially adversely affected.

RISK RELATED TO THE PARTNERSHIP’S BUSINESS

Market Conditions — As a part of the securities industry, a downturn in the U.S. and/or global securities markets historically has, and in the future could have, a significant negative effect on revenues and could significantly reduce or eliminate profitability of the Partnership.

General political and economic conditions and events such as U.S. fiscal monetary policy, economic recession, natural disasters, terrorist attacks, war, changes in local economic and political conditions, regulatory changes or changes in the law, or interest rate or currency rate fluctuations could create a downturn in the U.S. and/or global securities markets. The securities industry, and therefore the Partnership, is highly dependent upon market prices and volumes which are highly unpredictable and volatile in nature. Events such as global recession, frozen credit markets, and institutional failures could make the capital markets increasingly volatile. Weakened global economic conditions and unsettled financial markets, among other things, could cause significant declines in the Partnership’s net revenues which would adversely impact its overall financial results.

As the Partnership’s composition of net revenue becomes more heavily weighted towards asset-based fee revenue, a decrease in the market value of assets can have a greater negative impact on the Partnership’s financial results than experienced in prior years, due to the fact that asset-based fees are earned on the value of the underlying client assets.

Market volatility could also cause clients to move their investments to lower margin products, or withdraw them, which could have an adverse impact on the profitability of the Partnership.

In addition, the Partnership could experience a material reduction in volume and lower securities prices in times of unfavorable economic conditions, which would result in lower trade revenue, decreased margins and losses in dealer inventory accounts and syndicate positions. This would have a material adverse impact on the profitability of the Partnership’s operations.

Furthermore, if the market were to experience a downturn or the economy were to enter into a recession, the Partnership would be subject to increased risk of its clients being unable to meet their commitments, such as margin obligations. If clients are unable to meet their margin obligations, the Partnership has an increased risk of losing money on margin transactions and incurring additional expenses defending or pursuing claims. Developments such as lower revenues and declining profit margins could reduce or eliminate the Partnership’s profitability.

13

PART I

|

Item 1A. |

Risk Factors, continued |

Legislative and Regulatory Initiatives — Proposed, potential and recently enacted federal and state legislation, rules and regulations could significantly impact the regulation and operation of the Partnership and its subsidiaries. In addition, such laws, rules and regulations may significantly alter or restrict the Partnership’s historic business practices, which could negatively affect its operating results.

The Partnership is subject to extensive regulation by federal and state regulatory agencies and by SROs. The Partnership operates in a regulatory environment that is subject to ongoing change and has seen significantly increased regulation in recent years. The Partnership may be adversely affected as a result of new or revised legislation or regulations, changes in federal, state or foreign tax laws and regulations, or by changes in the interpretation or enforcement of existing laws and regulations. The Partnership continues to monitor several regulatory initiatives and proposed, potential and enacted legislation and rules (“Legislative and Regulatory Initiatives”), including, but not limited to:

The Dodd-Frank Act. The Dodd-Frank Act, signed into law in July 2010, includes provisions that could potentially impact the Partnership’s operations. Since the passage of the Dodd-Frank Act, the Partnership has not been required to enact material changes to its operations. However, the Partnership continues to review and evaluate the provisions of the Dodd-Frank Act and the impending rules to determine what impact or potential impact they may have on the financial services industry, the Partnership and its operations. Among the numerous potentially impactful provisions in the Dodd-Frank Act are: (i) pursuant to Section 913 of the Dodd-Frank Act, the SEC staff issued a study recommending a universal fiduciary standard of care applicable to both broker-dealers and investment advisers when providing personalized investment advice about securities to retail clients, and such other clients as the SEC provides by rule; and (ii) pursuant to Section 914 of the Dodd-Frank Act, a new SRO to regulate investment advisers could be proposed. In addition, the Dodd-Frank Act contains new or enhanced regulations that could impact specific securities products offered by the Partnership to investors and specific securities transactions. Proposed rules related to all of these provisions have not yet been adopted by regulators. The Partnership cannot predict what impact any such rules, if adopted, would have on the Partnership.

Department of Labor Fiduciary Rule Proposal. In 2010, the DOL proposed a modification to a rule that would have impacted the Employee Retirement Income Security Act’s definition of “fiduciary” and potentially limited certain of Edward Jones’ business practices. In September 2011, the DOL announced that it was withdrawing the proposed rule and stated its intention to re-propose the rule in the future. On April 20, 2015, the DOL published in the Federal Register its proposed rule on the definition of the term "fiduciary" and exemptions related thereto. As proposed, the rule would impact qualified accounts, specifically, IRAs and other retirement accounts. The DOL held public hearings on the proposed rule in August 2015.

At this time, the DOL has not published a final rule and has publicly expressed there will be changes to the proposal in the final rule. As proposed, the rule would impact a significant portion of client assets under care. As proposed, the rule would have a material impact on the Partnership's results of operations. In addition, the Partnership is committing significant resources to be prepared for the opportunities and challenges that will arise as a result of the final rule. We are not able to predict how the final DOL rules may differ from the proposed rules. As such, the Partnership cannot predict at this time the full extent of any adverse impact on our operating results or the overall financial services industry.

Health Care Reform. The Patient Protection and Affordable Care Act, which was signed into law in March, 2010, amended and revised by the Health Care and Education and Reconciliation Act of 2010 (collectively referred to as the “Affordable Care Act”). The Affordable Care Act contains provisions that will be implemented over the next several years that may impact the Partnership. The Partnership is not yet able to determine the full potential financial impact of the Affordable Care Act.

Money Market Mutual Funds. The SEC adopted amendments to the rules that govern money market mutual funds in July 2014. The amendments preserve stable net asset value for certain retail funds and government funds. The amendments also impose, under certain circumstances, liquidity fees and redemption gates on non-government funds. The Partnership continues to evaluate the impact of these amendments on its operations and to consider the implementation of policies and procedures to address the amendments.

14

PART I

|

Item 1A. |

Risk Factors, continued |

These Legislative and Regulatory Initiatives may impact the manner in which the Partnership markets its products and services, manages its business and operations, and interacts with clients and regulators, any or all of which could materially impact the Partnership’s results of operations, financial condition, and liquidity. Regulatory changes or changes in the law could increase compliance costs which would adversely impact our profitability. However, the Partnership cannot presently predict when or if any of the proposed or potential Legislative and Regulatory Initiatives will be enacted or the impact that any Legislative and Regulatory Initiatives will have on the Partnership.

Competition — The Partnership is subject to intense competition for clients and personnel, and many of its competitors have greater resources.

All aspects of the Partnership’s business are highly competitive. The Partnership competes for clients and personnel directly with other securities firms and increasingly with other types of organizations and other businesses offering financial services, such as banks and insurance companies. Many of these organizations have substantially greater capital and additional resources, and some entities offer a wider range of financial services. Over the past several years, there has been significant consolidation of firms in the financial services industry, forcing the Partnership to compete with larger firms with greater capital and resources, brokerage volume and underwriting activities, and more competitive pricing. Also, the Partnership continues to compete with a number of firms offering discount brokerage services, usually with lower levels of personalized service to individual clients. Further, the financial services industry continues to evolve technologically, with some firms now providing lower cost, computer-based "robo-advice" with limited or no personalized service to clients. Clients are able to transfer their business to competing organizations at any time. The Partnership's continued ability to compete based on a business model designed to serve clients through personalized relationships with financial advisors and branch teams in order to provide tailored solutions may be impacted by the evolving financial services industry and client needs. If financial advisors do not meet client needs, the Partnership could lose clients, thereby reducing revenues and profitability. Further, the Partnership faces increased competition for clients from larger firms in its non-urban markets, and from a broad range of firms in the urban and suburban markets in which the Partnership competes.

Competition among financial services firms also exists for financial advisors and other personnel. The Partnership’s continued ability to expand its business and to compete effectively depends on the Partnership’s ability to attract qualified employees and to retain and motivate current employees. In addition, the Partnership's business is dependent on financial advisors' ability to attract and retain clients and assets. If the Partnership’s profitability decreases, then bonuses paid to financial advisors and other personnel, along with profit-sharing contributions, may be decreased or eliminated, increasing the risk that personnel could be hired away by competitors. In addition, during an extended downturn in the economy, there is increased risk the Partnership’s more successful financial advisors may leave because a significant portion of their compensation is variable based on the Partnership’s profitability.

The competitive pressure the Partnership experiences could have an adverse effect on its business, results of operations, financial condition and cash flow. For additional information, see Part I, Item 1 – Business – Business Operations – Competition.

Branch Office System — The Partnership’s system of maintaining branch offices primarily staffed by one financial advisor may expose the Partnership to risk of loss or liability from the activities of the financial advisors and to increases in rent related to increased real property values.

The vast majority of the Partnership’s branch offices are staffed by a single financial advisor and a branch office administrator. Branch offices do not have an onsite supervisor as would be found at broker-dealers with multi-broker branches. The Partnership’s primary supervisory activity is conducted from its home offices. Although this method of supervision is designed to comply with all applicable industry and regulatory requirements, it is possible that the Partnership is exposed to a risk of loss arising from alleged imprudent or illegal actions of its financial advisors. Furthermore, the Partnership may be exposed to further losses if additional time elapses before its supervisory personnel detect problem activity.

15

PART I

|

Item 1A. |

Risk Factors, continued |

The Partnership maintains personal financial and account information and other documents and instruments for its clients at its branch offices, both physically and in electronic format. Despite reasonable precautions, because the branch offices are relatively small and some are in remote locations, the security systems at these branch offices may not prevent theft of such information. If security of a branch is breached and personal financial and account information is stolen, the Partnership’s clients may suffer financial harm and the Partnership could suffer financial harm, reputational damage and regulatory issues.

In addition, the Partnership leases its branch office spaces and a material increase in the value of real property may increase the amount of rent paid, which will negatively impact the Partnership’s profitability.

Inability to Achieve Financial Advisor Growth Rate — If the Partnership is unable to fully achieve its goals for hiring financial advisors or the attrition rate of its financial advisors is higher than its expectations, the Partnership may not be able to meet its planned growth rates or maintain its current number of financial advisors.

Historically, during times of market volatility it is more difficult for the Partnership to attract qualified applicants for financial advisor positions. In addition, the Partnership relies heavily on referrals from its current financial advisors in recruiting new financial advisors. During times of market volatility, current financial advisors can be less effective in recruiting potential new financial advisors through referrals.

Regardless of the presence of market volatility, the Partnership has not historically been able to consistently meet its growth objectives. There can be no assurance that the Partnership will be able to grow at desired rates in future periods or maintain its current number of financial advisors.

A significant number of the Partnership’s financial advisors have been licensed as brokers for less than three years. As a result of their relative inexperience, many of these financial advisors have encountered or may encounter difficulties developing or expanding their businesses. Consequently, the Partnership has periodically experienced higher rates of attrition, particularly with respect to the less experienced financial advisors and especially during times of market volatility. The Partnership generally loses more than half of its financial advisors who have been licensed for less than three years. The Partnership may experience increased financial advisor attrition due to increased competition from other financial services companies and efforts by those firms to recruit its financial advisors. There can be no assurance that the attrition rates the Partnership has experienced in the past will not increase in the future.

Either the failure to achieve hiring goals or an attrition rate higher than anticipated may result in a decline in the revenue the Partnership receives from asset-based fees, commissions and other securities related revenues. The Partnership may not be able to either maintain its current number of financial advisors or achieve the level of net growth upon which its business model is based and its revenues and results of operations may be adversely impacted.

Increased Financial Advisor Compensation — Compensation paid to new financial advisors, as well as current financial advisors participating in a retirement transition plan, could negatively impact the Partnership’s profitability and capital if the increased compensation does not help retain financial advisors and clients.

In order to attract candidates to become financial advisors, the Partnership provides new financial advisors a minimum base compensation, as well as a bonus based on the amount of new assets gathered, during the first three years as a financial advisor. The intent is to attract a greater number of high quality recruits with an enhanced level of base compensation in order to meet the Partnership’s growth objectives and to serve more clients. If financial advisor base compensation does not result in a corresponding increase in the level of productivity and retention rate of these financial advisors, then this additional compensation could negatively impact the Partnership’s financial performance in future periods.

16

PART I

|

Item 1A. |

Risk Factors, continued |

Additionally, to better transition clients to a new financial advisor when their current financial advisor retires, as well as to retain quality financial advisors until retirement, the Partnership, in certain circumstances, offers individually tailored retirement transition plans to financial advisors. These retirement transition plans may offer increased financial consideration prior to and after retirement for financial advisors who provide client transition services in accordance with a retirement and transition employment agreement. If this increased financial consideration does not increase client asset retention or help to retain quality financial advisors until retirement, the additional financial consideration could negatively impact the Partnership’s profitability and capital in future periods. In addition, the Partnership expects that the retirement transition plans will result in higher financial advisor compensation expense in the future.

Litigation and Regulatory Investigations and Proceedings — As a securities firm, the Partnership is subject to litigation involving civil plaintiffs seeking substantial damages and regulatory investigations and proceedings, which have increased over time and are expected to continue to increase.

Many aspects of the Partnership’s business involve substantial litigation and regulatory risks. The Partnership is, from time to time, subject to examinations, informal inquiries and investigations by regulatory and other governmental agencies, as well as the SROs of which it is a member, including FINRA. Such matters have in the past, and could in the future, lead to formal actions, which may impact the Partnership’s business. In the ordinary course of business, the Partnership also is subject to arbitration claims, lawsuits and other significant litigation such as class action suits. Over time, there has been increasing litigation involving the securities industry, including class action suits that generally seek substantial damages.

The Partnership has incurred significant expenses to defend and/or settle claims in the past. In view of the inherent difficulty of predicting the outcome of such matters, particularly in cases in which claimants seek substantial or indeterminate damages or in actions which are at very preliminary stages, the Partnership cannot predict with certainty the eventual loss or range of loss related to such matters. Due to the uncertainty related to litigation and regulatory investigations and proceedings, the Partnership cannot determine if future litigation will have a material adverse effect on its consolidated financial condition. Such legal actions may be material to future operating results for a particular period or periods. See Part I, Item 3 – Legal Proceedings for more information regarding certain unresolved claims.

Reliance on Third Parties — The Partnership’s dependence on third-party organizations exposes the Partnership to disruption if their products and services are no longer offered or supported or develop defects.

The Partnership incurs obligations to its clients which are supported by obligations from firms within the industry, especially those firms with which the Partnership maintains relationships by which securities transactions are executed. The inability of an organization with which the Partnership does a large volume of business to promptly meet its obligations could result in substantial losses to the Partnership.

The Partnership is particularly dependent on Broadridge, which acts as the Partnership’s primary vendor for providing accounting and record-keeping for client accounts in both the U.S. and Canada. The Partnership’s communications and information systems are integrated with the information systems of Broadridge. There are relatively few alternative providers to Broadridge and although the Partnership has analyzed the feasibility of performing Broadridge’s functions internally, the Partnership may not be able to do it in a cost-effective manner or otherwise. The Partnership also utilizes the sub-accounting functionality of The Bank of New York Mellon Corporation (“BNY Mellon”) for mutual fund investments held by the Partnership’s clients. BNY Mellon’s sub-accounting technology solution enables the Partnership to provide fund shareholder accounting services to mutual funds. Consequently, any new computer systems or software packages implemented by these third parties which are not compatible with the Partnership’s systems, or any other interruption or the cessation of service by these third parties as a result of systems limitations or failures, could cause unanticipated disruptions in the Partnership’s business which may result in financial losses and/or disciplinary action by governmental agencies and/or SROs.

17

PART I

|

Item 1A. |

Risk Factors, continued |

Canada Operations — The Partnership has made, and intends to continue to make, substantial investments to support its Canada operations, which have not yet achieved profitability.

The Partnership commenced operations in Canada in 1994 and plans to continue to expand its branch system in Canada. Canada operations have operated at a substantial deficit from inception. The Partnership intends to make additional investments in its Canada operations to address short-term liquidity, capital, or expansion needs, which could be substantial.

There is no assurance Canada operations will ultimately become profitable. For further information on Canada operations, see Part II, Item 8 – Financial Statements and Supplementary Data – Note 13 to the Consolidated Financial Statements.

Capital Requirements; Uniform Net Capital and Customer Protection Rules — The Uniform Net Capital Rule imposes minimum net capital requirements and could limit the Partnership’s ability to engage in certain activities which are crucial to its business.

Adequacy of capital is vitally important to broker-dealers, and lack of sufficient capital may limit the Partnership’s ability to compete effectively. In particular, lack of sufficient capital or compliance with the Uniform Net Capital Rule may limit Edward Jones’ ability to commit to certain securities activities such as underwriting and trading, which require significant amounts of capital, its ability to expand margin account balances, as well as its commitment to new activities requiring an investment of capital. FINRA regulations and the Uniform Net Capital Rule may restrict Edward Jones’ ability to expand its business operations, including opening new branch offices or hiring additional financial advisors. Consequently, a significant operating loss or an extraordinary charge against net capital could adversely affect Edward Jones’ ability to expand or even maintain its present levels of business. In addition, pursuant to the Customer Protection Rule, the Partnership has cash and investments segregated in special reserve bank accounts for the benefit for U.S. clients. Increased regulations for the banking industry may impact the Partnership's ability to find institutions to place those segregated client funds.

In addition to the regulatory requirements applicable to Edward Jones, EJTC and the Canada broker-dealer are subject to regulatory capital requirements in the U.S. and in Canada. Failure by the Partnership to maintain the required net capital for any of its subsidiaries may subject it to disciplinary actions by the SEC, FINRA, IIROC, OCC or other regulatory bodies, which could ultimately require its liquidation. In the U.S., Edward Jones may be unable to expand its business and may be required to restrict its withdrawal of partnership capital in order to meet its net capital requirements.

Liquidity — The Partnership’s business in the securities industry requires that sufficient liquidity be available to maintain its business activities, and it may not always have access to sufficient funds.

Liquidity, or ready access to funds, is essential to the Partnership’s business. A tight credit market environment could have a negative impact on the Partnership’s ability to maintain sufficient liquidity to meet its working capital needs. Short-term and long-term financing are two sources of liquidity that could be affected by a tight credit market. In a tight credit market, lenders may reduce their lending to borrowers, including the Partnership. There is no assurance that financing will be available at attractive terms, or at all, in the future. A significant decrease in the Partnership’s access to funds could negatively affect its business and financial management in addition to its reputation in the industry. In addition, there is increased focus by regulators on the importance of effective liquidity risk management practices.

Many limited partners finance their Partnership capital contributions by obtaining personal bank loans. Any such bank loan agreement is between the limited partner and the bank. The Partnership performs certain administrative functions for the majority of limited partner bank loans, but does not guarantee limited partner bank loans, nor can limited partners pledge their Interests as collateral for the bank loans. Limited partners who finance all or a portion of their Interests with bank loans may be more likely to request the withdrawal of capital to repay such obligations should the Partnership experience a period of reduced earnings. Any withdrawals by limited partners are subject to the terms of the Partnership Agreement and would reduce the Partnership’s available liquidity and capital.

18

PART I

|

Item 1A. |

Risk Factors, continued |

The Partnership makes loans available to those general partners (other than members of the Executive Committee) who require financing for some or all of their Partnership capital contributions. Additionally, in limited circumstances, a general partner may withdraw from the Partnership and become a subordinated limited partner while he or she still has an outstanding partnership loan. Loans made by the Partnership to general partners are generally for a period of one year, but are expected to be renewed and bear interest at an interest rate defined in the loan documents. The Partnership has full recourse against any general partner that defaults on his or her Partnership loan obligations. However, there is no assurance that general partners will be able to repay the interest and/or the principal amount of their Partnership loans at or prior to maturity. If general partners are unable to repay the interest and/or the principal amount of their Partnership loans at or prior to maturity, the Partnership could be adversely impacted.

Upgrade of Technological Systems — The Partnership will engage in significant technology initiatives in the future which may be costly and could lead to disruptions.

From time to time, the Partnership has engaged in significant technology initiatives and expects to continue to do so in the future. Such initiatives are not only necessary to better meet the needs of the Partnership’s clients, but also to satisfy new industry standards and practices, better secure the transmission of clients’ information on the Partnership’s systems, and improve operational efficiency. With any major system replacement, there will be a period of education and adjustment for the branch and home office employees utilizing the system. Following any upgrade or replacement, if the Partnership’s systems or equipment do not operate properly, are disabled or fail to perform due to increased demand (which might occur during market upswings or downturns), or if a new system or system upgrade contains a major problem, the Partnership could experience unanticipated disruptions in service, including interrupted trading, slower response times, decreased client service and client satisfaction, and delays in the introduction of new products and services, any of which could result in financial losses, liability to clients, regulatory intervention or reputational damage. Further, the inability of the Partnership’s systems to accommodate a significant increase in volume of transactions also could constrain its ability to expand its business.

Interest Rate Environment — The Partnership’s profitability is impacted by a low interest rate environment.

A low interest rate environment adversely impacts the interest income the Partnership earns from clients’ margin loans, the investment of excess funds, and securities the Partnership owns, as well as the fees earned by the Partnership through its minority ownership in Passport Research, which is the investment adviser for two money market funds made available to the Partnership's clients. While a low interest rate environment positively impacts the Partnership’s expenses related to liabilities that finance certain assets, such as amounts payable to clients and other interest-bearing liabilities, its interest-bearing liabilities are less impacted by short-term interest rates compared to its interest earning assets, resulting in interest income being more sensitive to a low interest rate environment than interest expense.

Credit Risk — The Partnership is subject to credit risk due to the nature of the transactions it processes for its clients.

The Partnership is exposed to the risk that third parties who owe it money, securities or other assets will not meet their obligations. Many of the transactions in which the Partnership engages expose it to credit risk in the event of default by its counterparty or client, such as cash balances held at various major U.S. financial institutions, which typically exceed Federal Deposit Insurance Corporation (“FDIC”) insurance coverage limits. In addition, the Partnership’s credit risk may be increased when the collateral it holds cannot be realized or is liquidated at prices insufficient to recover the full amount of the obligation due to the Partnership. See Part III, Item 10 – Directors, Executive Officers and Corporate Governance, for more information about the Partnership’s credit risk.

19

PART I

|

Item 1A. |

Risk Factors, continued |

Lack of Capital Permanency — Because the Partnership’s capital is subject to mandatory redemption either upon the death or withdrawal request of a partner, the capital is not permanent and a significant mandatory redemption could lead to a substantial reduction in the Partnership’s capital, which could, in turn, have a material adverse effect on the Partnership’s business.

Under the terms of the Partnership Agreement, a partner’s capital is redeemed upon death. In addition, partners may request withdrawals from their capital accounts, subject to certain limitations on the timing of those withdrawals. Accordingly, the Partnership’s capital is not permanent and is dependent upon current and future partners to both maintain their existing capital and make additional capital contributions in the Partnership. Any withdrawal requests by general partners, subordinated limited partners or limited partners would reduce the Partnership’s available liquidity and capital. The Managing Partner may decline a withdrawal request if that withdrawal would result in the Partnership violating any agreement, such as a loan agreement, or any applicable laws, rules or regulations.