Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex311.htm |

| EX-23.1 - EXHIBIT 23.1 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex231.htm |

| EX-31.2 - EXHIBIT 31.2 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex312.htm |

| EX-32.1 - EXHIBIT 32.1 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex321.htm |

| EX-10.37 - EXHIBIT 10.37 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex1037.htm |

| EX-10.36 - EXHIBIT 10.36 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex1036.htm |

| EX-10.34 - EXHIBIT 10.34 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex1034.htm |

| EX-10.35 - EXHIBIT 10.35 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex1035.htm |

| EX-10.38 - EXHIBIT 10.38 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex1038.htm |

| EX-10.39 - EXHIBIT 10.39 - SELLAS Life Sciences Group, Inc. | copyofgale-20151231xex1039.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K /A

Amendment No. 1

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-33958

_______________________________________________________

Galena Biopharma, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________

Delaware | 20-8099512 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583

(855) 855-4253

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Securities registered pursuant to Section 12(b) of the Exchange Act: | ||

Title of Each Class | Name of Exchange on Which Registered | |

Common Stock, $0.0001 Par Value per Share | The NASDAQ Capital Market | |

Securities registered pursuant to Section 12(b) of the Exchange Act: | ||

None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Yes þ No

Indicate by check mark whether the registrant has submitted electronically and posted on it corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for any such shorter time that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | ¨ | Accelerated filer | þ | |||

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ¨ Yes þ No

Based on the closing price of the Registrant's common stock as reported on the NASDAQ Capital Market, the aggregate market value of the Registrant's common stock held by non-affiliates on June 30, 2014 (the last business day of the Registrant's most recently completed second fiscal quarter) was approximately $275,097,000.

As of February 29, 2016, Galena Biopharma, Inc. had outstanding 181,746,561 shares of common stock, $0.0001 par value per share, exclusive of treasury shares.

EXPLANATORY NOTE

Galena Biopharma, Inc. is filing this Amendment No. 1 on Form 10-K/A ("Form 10-K/A") to its Annual Report on Form 10-K for the fiscal year ended December 31, 2015 as filed with the Securities and Exchange Commission on March 10, 2016 (the "Original Filing") solely to correct a typographical error in the content of Item 1A, "Risk Factors." The typographical error appears in the second full paragraph under the "Risks Relating to Our Former Commercial Operations" on page 19 of the Original Filing. In the fourth sentence of that paragraph the word "not" was inadvertently left out. The correct sentence is as follows: "We are not a target or subject of that investigation." Except for that correction, there have been no changes in any of the financial or other information contained in the report. For convenience, the entire Annual Report on Form 10-K, as amended, is being re-filed.

GALENA BIOPHARMA, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

Part No. | Item No. | Description | Page No. | ||

I | 1 | Business | |||

1A | Risk Factors | ||||

1B | Unresolved Staff Comments | ||||

2 | Properties | ||||

3 | Legal Proceedings | ||||

4 | Mine Safety Disclosures | ||||

II | 5 | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

6 | Selected Financial Data | ||||

7 | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||||

7A | Quantitative and Qualitative Disclosures About Market Risk | ||||

II | 8 | Financial Statements and Supplementary Data | |||

9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | ||||

9A | Controls and Procedures | ||||

9B | Other Information | ||||

III | 10 | Directors, Executive Officers and Corporate Governance | |||

11 | Executive Compensation | ||||

12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||||

13 | Certain Relationships and Related Transactions, and Director Independence | ||||

14 | Principal Accountant Fees and Services | ||||

Index to Exhibits | |||||

EX-10.34 | |||||

EX-10.35 | |||||

EX-10.36 | |||||

EX-10.37 | |||||

EX-10.38 | |||||

EX-10.39 | |||||

EX-23.1 | |||||

EX-31.1 | |||||

EX-31.2 | |||||

EX-32.1 | |||||

4

"SAFE HARBOR" STATEMENT

Some of the information contained in this annual report may include forward-looking statements that reflect our current views with respect to our development programs, business strategy, business plan, financial performance and other future events. These statements include forward-looking statements both with respect to us, specifically, and our industry, in general. We make these statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “estimate,” “may,” “should,” “anticipate,” “will” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws and otherwise.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. There are or will be important factors that could cause actual results to differ materially from those indicated in these statements. These factors include, but are not limited to, those factors set forth in the sections entitled “Business,” “Risk Factors,” “Legal Proceedings,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk” and “Controls and Procedures” in this annual report, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this annual report. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

If one or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this “Safe Harbor” Statement.

5

PART I

ITEM 1. BUSINESS

Overview

Galena Biopharma, Inc. (“we,” “us,” “our,” “Galena” or the “Company”) is a biopharmaceutical company committed to the development and commercialization of targeted oncology therapeutics that address major unmet medical needs. Galena’s development portfolio is focused primarily on addressing the rapidly growing patient populations of cancer survivors by harnessing the power of the immune system to prevent cancer recurrence. The Company’s pipeline consists of multiple mid- to late-stage clinical assets, including novel cancer immunotherapy programs led by NeuVax™ (nelipepimut-S), GALE-301 and GALE-302. NeuVax is currently in a pivotal, Phase 3 breast cancer clinical trial with several concurrent Phase 2 trials ongoing both as a single agent and in combination with other therapies. GALE-301 is in a Phase 2a clinical trial in ovarian and endometrial cancers and in a Phase 1b clinical trial given sequentially with GALE-302.

We are seeking to build value for shareholders through pursuit of the following objectives:

• | Develop novel cancer immunotherapies to address unmet medical needs through the use of peptide-based vaccines targeting well-established tumor antigens. One of our key strategies is to target the adjuvant setting in patients with higher risk of recurrence, who had their primary treatment for cancer and have no evidence of disease, and are more likely to benefit from treatment via immunotherapy. Our immunotherapy programs are currently targeting two key areas: secondary prevention intended to significantly decrease the risk of disease recurrence in breast, gastric, and ovarian cancers; and primary prevention intended to cease or delay ductal carcinoma in situ (DCIS) from becoming invasive breast cancer. |

• | Expand our development pipeline by enhancing the clinical and geographic footprint of our technologies. We intend to accomplish this through the initiation of new clinical trials and potentially through acquisition of additional oncology programs. |

• | Leverage partnerships and collaborations, as well as investigator-sponsored trial arrangements, to maximize the scope of potential clinical opportunities in a cost effective and efficient manner. |

• | Focus our resources on our valuable and expanding clinical development programs. On November 19, 2015 we sold our Abstral® (fentanyl) Sublingual Tablets product and related assets and on December 24, 2015 we sold Zuplenz (ondansetron) Oral Soluble Film product and related assets, and as of December 31, 2015, we ceased our commercial operations. |

6

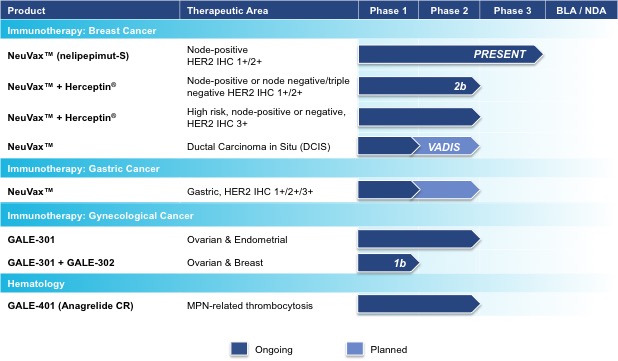

The chart below summarizes the current status of our clinical development pipeline:

Novel Cancer Immunotherapies

Our targeted cancer immunotherapy approach is currently based upon two key areas: preventing secondary recurrence of cancer, which is becoming increasingly important as the number of cancer survivors continues to grow; and, primary prevention intended to cease a condition known as ductal carcinoma in situ (DCIS) from becoming invasive breast cancer. Once a patient’s tumor becomes metastatic, the outcome is often fatal, making the prevention of recurrence a potentially critical component of overall patient care. Our programs primarily target patients in the adjuvant (after-surgery) setting who have relatively healthy immune systems, but may still have residual disease. Minimal residual disease, or single cancer cells (occult cancer cells) or micrometastasis, that are undetectable by current radiographic scanning technologies, can result in disease recurrence.

Our therapies utilize an immunodominant peptide combined with the immune adjuvant, recombinant human granulocyte macrophage-colony stimulating factor (rhGM-CSF, Leukine), and work by harnessing the patient’s own immune system to seek out and attack any residual cancer cells. Using peptide immunogens has many potential clinical advantages, including a favorable safety profile, since these drugs may lack the toxicities typical of most cancer therapies. They also have the potential to evoke long-lasting protection through activation of the immune system and a convenient, intradermal mode of delivery. We are currently engaged in multiple clinical trials with NeuVax™ (nelipepimut-S), GALE-301, and GALE-302, targeting the prevention of recurrence in breast, gastric, endometrial and ovarian cancers.

7

NeuVax™ (nelipepimut-S)

NeuVax™ (nelipepimut-S), our lead product candidate, is a cancer immunotherapy targeting human epidermal growth factor receptor (HER2) expressing cancers. NeuVax is the immunodominant nonapeptide derived from the extracellular domain of the HER2 protein, a well-established and validated target for therapeutic intervention in breast and gastric carcinomas. The NeuVax vaccine is combined with GM-CSF for injection under the skin, or intradermal administration. Data has shown that an increased presence of circulating tumor cells (CTCs) may predict Disease Free Survival (DFS) and Overall Survival (OS)-suggesting a presence of of isolated micrometastases, not detectable clinically, but, over time, can lead to recurrence, most often in distant sites. After binding to the specific HLA molecules on antigen presenting cells, the nelipepimut-S sequence stimulates specific cytotoxic T lymphocyte (CTLs), causing significant clonal expansion. These activated CTLs recognize, neutralize and destroy, through cell lysis, HER2 expressing cancer cells, including occult cancer cells and micrometastatic foci. The nelipepimut immune response can also generate CTLs to other immunogenic peptides through inter- and intra-antigenic epitope spreading.

Breast Cancer: According to the National Cancer Institute, over 230,000 women in the U.S. are diagnosed with breast cancer annually. While improved diagnostics and targeted therapies have decreased breast cancer mortality in the U.S., metastatic breast cancer remains incurable. Approximately 75% to 80% of breast cancer patients have tissue test positive for some increased amount of the HER2 receptor, which is associated with disease progression and decreased survival. Only approximately 20% to 30% of all breast cancer patients-those with HER2 immunohistochemistry (IHC) 3+ disease, or IHC 2+ and fluorescence in situ hybridization (FISH) amplified-have a HER2 directed, approved treatment option available after their initial standard of care. This leaves the majority of breast cancer patients with low-to-intermediate HER2 expression (IHC 1+/2+) ineligible for therapy and without an effective targeted treatment option to prevent cancer recurrence.

We have multiple trials currently ongoing for NeuVax. For our pivotal, Phase 3 PRESENT (Prevention of Recurrence in Early-Stage, Node- Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) trial, NeuVax is targeting the 50,000-60,000 female breast cancer patients annually diagnosed in the U.S. who are at a higher risk of their breast cancer recurring, which we refer to as “disease recurrence,” after achieving “no evidence of disease” (NED) status, (or becoming a “survivor”) with standard-of-care therapy (surgery, chemotherapy, radiation). These high-risk patients have a particular molecular signature and disease status: HER2 IHC 1+/2+ (oncoprotein associated with aggressive tumor growth), node positive (disease present in the axillary lymph nodes prior to surgery), and are HLA A2 and/or A3 positive (human leukocyte antigen from A2/A3 patients who have the same loci of genes which represents approximately 65% of the population). Up to 25% of resectable, node-positive breast cancer patients, having no radiographic evidence of disease following surgery and adjuvant chemo/radiation therapy, are expected to relapse within three years following diagnosis. The prognosis upon recurrence is very poor. These cancer patients presumably still had isolated, undetected tumor CTCs that led to a recurrence of cancer in the breast (local recurrence) or in another location (metastatic disease). In addition to our Phase 3 trial, we currently have two additional Phase 2 breast cancer trials ongoing with NeuVax in combination with trastuzumab (Herceptin®; Genentech/Roche) targeting the prevention of recurrence in expanded indications.

We also recently announced our intent to initiate a Phase 2 trial with NeuVax as a single agent in patients with ductal carcinoma in situ (DCIS) in collaboration with the National Cancer Institute (NCI), potentially positioning NeuVax as a treatment for earlier stage disease. The trial will have an immunological endpoint evaluating NeuVax peptide-specific cytotoxic T lymphocyte (CTL; CD8+ T-cell) response in vaccinated patients. DCIS is defined by the NCI as a noninvasive condition in which abnormal cells are found in the lining of a breast duct, and is the most common type of breast cancer. The abnormal cells have not spread outside the duct to other tissues in the breast. In some cases, DCIS may become invasive cancer and spread to other tissues, and at this time, there are no established methods to identify lesions which could become invasive. Current treatment options for DCIS include breast- conserving surgery and radiation therapy with or without tamoxifen, breast-conserving surgery without radiation therapy, or total mastectomy with or without tamoxifen. According to the American Cancer Society, in 2015 there were an estimated 50,000 diagnoses of DCIS.

8

Gastric Cancer: Gastric cancer is the fourth leading cancer in the world and the second most common cause of death due to malignancy, accounting for 736,000 deaths (9.7% of the total) . Nearly 1 million new cases of gastric cancer and 0.7 million gastric cancer deaths are reported every year. Currently, gastric cancer is more common in Asia than in the United State of America (USA) or Europe. Notably, 42% of cases occur in China alone. The 5-year survival rate for patients undergoing surgical resection was reported to be only 27% in 1992 ( reference) .According to the NCI, gastric (stomach) cancer is a disease in which malignant (cancer) cells form in the lining of the stomach. Almost all gastric cancers are adenocarcinomas (cancers that begin in cells that make and release mucus and other fluids). Other types of gastric cancer are gastrointestinal carcinoid tumors, gastrointestinal stromal tumors, and lymphomas. Infection with bacteria called Helicobacter pylori (H. pylori) is a common cause of gastric cancer and age, diet, and stomach disease can affect the risk of developing gastric cancer. Gastric cancer is often diagnosed at an advanced stage because there are no early signs or symptoms. Gastric, or stomach cancer, is the second-most common cancer among males and third-most among females in Asia and worldwide with over 35,000 new cases a year in India, where an initial clinical trial of NeuVax will be run. Overexpression of the HER2 receptor occurs in approximately 20% of gastric and gastro-esophageal junction adenocarcinomas, predominantly those of the intestinal type. Overall, without regard to the stage of cancer, only approximately 28% of patients with stomach cancer live at least five years following diagnosis and new adjuvant treatments are needed to prevent disease recurrence.

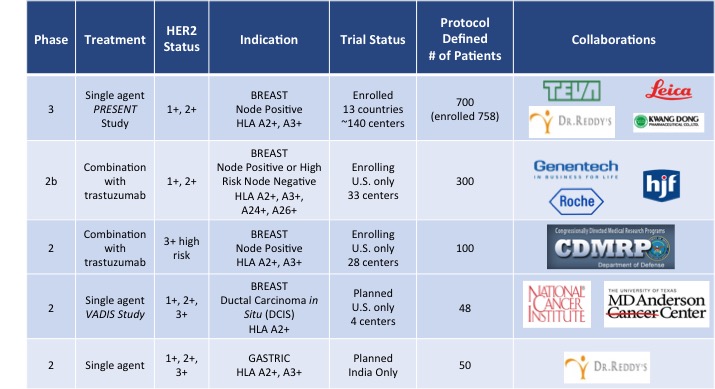

We currently have a number of ongoing or planned clinical trials designed to expand the clinical and geographical footprint of NeuVax:

• | Phase 3 Ongoing: Our Phase 3 PRESENT (Prevention of Recurrence in Early- Stage, Node-Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) study targeted enrollment of 700 HER2 1+/2+ patients who are HLA A2 or A3 positive under a Special Protocol Assessment (SPA) granted by the U.S. Food and Drug Administration (FDA). The multinational, multicenter, randomized, double-blinded PRESENT trial is ongoing in North America, Western and Eastern Europe, and Israel. The trial is fully enrolled with 758 patients. |

• | Phase 2b Ongoing: A randomized, multicenter, investigator-sponsored, 300 patient Phase 2b clinical trial is enrolling HER2 1+/2+ node-positive and high-risk node-negative breast cancer patients who are HLA A2, A3, A24 and/or A26 positive to study NeuVax in combination with trastuzumab in the adjuvant setting. This investigator sponsored trial (IST) is co-funded by Genentech/Roche (providing both trastuzumab and monetary support) and Galena (providing NeuVax and monetary support). |

• | Phase 2 Ongoing: An IST is also ongoing to study NeuVax in combination with trastuzumab. The study will enroll 100 node positive and negative HER2 IHC 3+ patients or HER2 gene-amplified breast cancer patients who are HLA A2 and/or HLA A3 positive and are determined to be at high-risk for recurrence. Partial funding for this trial comes from the Department of Defense (DoD) through the Congressionally Directed Medical Research Program via legislation known as the Defense Appropriations Act. The grant was awarded under a Breast Cancer Research Program with the Breakthrough Award given to the lead investigator for the trial. |

• | Phase 2 Planned: A clinical trial, entitled, VADIS: Phase 2 trial of the Nelipepimut-S Peptide VAccine in Women with DCIS of the Breast is planned to initiate in Q1 2016. The Phase 2 trial will be a single-blind, double arm, randomized, controlled trial in pre- or post-menopausal patients with DCIS who are HLA-A2 positive with HER2 expression of IHC 1+, 2+, or 3+. VADIS will be co-funded and run in collaboration with the National Cancer Institute (NCI). |

• | Phase 2 Planned: A Phase 2 clinical trial in patients with gastric cancer is expected to initiate in 2016. The trial will be run in India by our partner, Dr. Reddy’s Laboratories, Ltd., as part of our NeuVax commercialization agreement in that region with Dr. Reddy’s. |

9

GALE-301 and GALE-302

Our second immunotherapy franchise targets folate binding protein (FBP) receptor-alpha, a well-validated therapeutic target, which has been shown to be highly over-expressed (20-80 fold) in ovarian, endometrial and breast cancers. Current treatments after surgery for these diseases are principally with platinum based chemotherapeutic agents and patients suffer a high recurrence rate; and, most patients relapse with an extremely poor prognosis. Both GALE-301 (E39) and GALE-302 (E39’) are immunogenic peptides that can stimulate CTLs to recognize and destroy FBP-expressing cancer cells. GALE-301 consists of the FBP peptide E39 and is combined with GM-CSF, and is currently in a Phase 2a clinical trial for the prevention of recurrence in patients with ovarian and endometrial cancers. Although not powered for efficacy, promising preliminary results from the Phase 2a clinical trial of GALE-301 were presented in September 2015 at the European Cancer Congress. The results (i) demonstrated statistically significant data with the estimate for disease free survival at two years at 85.7% (1000 mcg dose group) vs. 33.6% for the control group (p < .02), (ii) showed that GALE-301 was well-tolerated with primarily Grade 1 and 2 toxicities, and (iii) elicited a strong in vivo immune response.

GALE-302 is an attenuated version of the E39 peptide and is currently in a Phase 1b randomized, single-center trial investigating a novel vaccination series using GALE-301 and GALE-302 to evaluate the immune response and monitor long-term immunity. In November 2015, we presented preliminary data at the Society for Immunotherapy of Cancer Conference on the primary vaccine series (PVS) from a randomized Phase 1b trial with GALE-301 and GALE-302 demonstrating that the in vivo immune response is enhanced with the use of the attenuated E39’ (GALE-302) after E39 (GALE-301). Both agents were shown to be immunogenic and well tolerated with no differences in toxicities between primary vaccine sequences.

Ovarian Cancer: According to the NCI Surveillance, Epidemiology, and End Results (SEER) Program, new cases of ovarian cancer occur at an annual rate of 12.1 per 100,000 women in the U.S., with an estimated 21,290 cases for 2015. Although ovarian cancer represents about 1.3% of all cancers, it represents about 2.4% of all cancer deaths, or an estimated 14,180 deaths in 2015. Approximately 1.3% of women will be diagnosed with ovarian cancer at some point during their lifetime (2010 - 2012 data). The prevalence of ovarian cancer in the U.S. is about 192,000 women, and the five-year survivorship for women with ovarian cancer is 45.6%. Due to the lack of specific symptoms, the majority of ovarian cancer patients are diagnosed at later stages of the disease, with an estimated 75% of women presenting with advanced-stage (III or IV) disease. These patients have their tumors routinely surgically debulked to minimal residual disease, and then are treated with platinum- and/or taxane-based chemotherapy. While many patients respond to this treatment regimen and become clinically free-of-disease, the majority of these patients will relapse. Depending upon their level of residual disease, the risk for recurrence after completion of primary therapy ranges from 60% to 85%. Unfortunately for these women, once the disease recurs, treatment options are limited and the disease is most likely incurable.

According to the NCI SEER Program, new cases of endometrial cancer occur at an annual rate of 25.1 per 100,000 women in the U.S., with an estimated 54,870 cases for 2015. Although endometrial cancer represents about 3.3% of all cancers, it represents about 1.7% of all cancer deaths, or an estimated 10,170 deaths in 2015. Approximately 2.8% of women will be diagnosed with endometrial cancer at some point during their lifetime (2010 - 2012 data). The prevalence of endometrial cancer in the U.S. is about 620,000 women, and the five-year survivorship for women with endometrial cancer is 81.7%.

Hematology

GALE-401 (anagrelide controlled release (CR))

GALE-401 contains the active ingredient anagrelide, an FDA-approved product, for the treatment of patients with myeloproliferative neoplasms (MPNs) to lower abnormally elevated platelet levels. The currently available immediate release (IR) version of anagrelide causes adverse events that are believed to be dose and plasma concentration dependent. These adverse events may limit the use of the IR version of the drug. Therefore, reducing the maximum concentration (Cmax) is hypothesized to reduce the side effects, but preserve efficacy, potentially allowing a broader use of the drug.

Multiple Phase 1 studies in 98 healthy subjects have shown GALE-401 reduces the Cmax of anagrelide following oral administration, appears to be well tolerated at the doses administered, and to be capable of reducing platelet levels. The Phase 1 program provided the desired PK/PD (pharmacokinetic/pharmacodynamic) profile to

10

enable the initiation of the ongoing Phase 2 proof-of-concept trial. The Phase 2, open label, single arm, proof-of-concept trial enrolled 18 patients in the United States for the treatment of thrombocytosis, or elevated platelet counts in patients with MPNs. Final Phase 2 safety and efficacy data were presented at the 57th American Society of Hematology Annual Meeting in December 2015. The study demonstrated that GALE-401 was well tolerated with primarily Grade 1 and 2 toxicities in 16 of the 18 subjects enrolled. The efficacy shown in the trial compares favorably to historical anagrelide immediate release (IR) response rates with the following platelet response: overall response rate (ORR) of 78% (14/18); complete response (CR) of 39% (7/18); partial response (PR) of 39% (7/18). Based on a regulatory meeting with the FDA, Galena believes a 505(b)(2) regulatory filing is an acceptable pathway for development and potential approval of GALE-401.

Myeloproliferative neoplasms: MPNs are a closely related group of hematological malignancies in which the bone marrow cells that produce the body’s blood cells develop and function abnormally. The main MPNs are Polycythemia Vera (PV), Essential Thrombocythemia (ET), Primary Myelofibrosis (PMF), and Chronic Myelogenous Leukemia (CML), all of which are associated with high platelet counts. The MPNs are progressive blood cancers that can strike anyone at any age and for which there is no known cure.

Alliance Partners in Therapeutic Areas

We are actively looking to leverage our technology platforms by seeking to work with pharmaceutical and biotechnology partners in a number of therapeutic areas in oncology. Our team has experience targeting products in multiple indications, and based on this experience, we believe we can expand the clinical utility of our current development candidates as well as discover more drug candidates by working with partners than we can develop with our own resources. We are seeking to work with partners in the discovery and development of drugs in a number of therapeutic areas and technology platforms.

11

Intellectual Property

Patents and other intellectual property rights are crucial to our success. It is our policy to protect our intellectual property rights through available means, including filing and prosecuting patent applications in the U.S. and other countries, protecting trade secrets, and utilizing regulatory protections such as data exclusivity. We also include restrictions regarding use and disclosure of our proprietary information in our contracts with third parties, and utilize customary confidentiality agreements with our employees, consultants, clinical investigators and scientific advisors to protect our confidential information and know-how. Together with our licensors, we also rely on trade secrets to protect our combined technology especially where we do not believe patent protection is appropriate or obtainable. It is our policy to operate without infringing on, or misappropriating, the proprietary rights of others. The following chart summarizes our intellectual property rights:

Drug Candidate | Indication | Scope | Estimated Exclusivity Period |

NeuVax™ (nelipepimut-S) | Breast cancer recurrence | Filed and pending or issued worldwide | 2028 |

NeuVax™ (nelipepimut-S) | Gastric | Filed and pending or issued worldwide | 2028 |

NeuVax™ (nelipepimut-S) | DCIS | Filed and pending or issued worldwide | 2028 |

NeuVax™ in combination with trastuzumab | Breast cancer | Filed and pending or issued worldwide | 2026 |

NeuVax™ in combination with other compounds | Breast cancer | Filed and pending or issued worldwide | 2037 |

GALE-301 & GALE-302 | Breast, ovarian and endometrial cancer | Filed and pending or issued worldwide | 2035 |

GALE-401 (Anagrelide Controlled Release) | Platelet Lowering | Filed and pending or issued worldwide | 2029 |

12

Out-License Agreements

Teva Pharmaceuticals

Effective December 3, 2012, we entered into a license and supply agreement with ABIC Marketing Limited, a subsidiary of Teva Pharmaceuticals (“ABIC”). Under the agreement, we granted ABIC exclusive rights to seek marketing approval in Israel for our NeuVax product candidate for the treatment of breast cancer following its approval by the FDA or the European Medicines Agency, and to market, sell and distribute NeuVax in Israel assuming such approval is obtained. ABIC’s rights also include a right of first refusal in Israel for all future indications for which NeuVax may be approved.

Under the license and supply agreement, ABIC will assume responsibility for regulatory registration of NeuVax in Israel, provide financial support for local development, and commercialize the product in the region in exchange for making royalty payments to us based on future sales of NeuVax. ABIC also agrees in the license and supply agreement to purchase all supplies of NeuVax from us at a price determined according to a specified formula.

Dr. Reddy’s Laboratories Ltd.

Effective January 14, 2014, we entered into a strategic development and commercialization partnership with Dr. Reddy’s Laboratories Ltd. (“Dr. Reddy’s”), under which we licensed commercial rights in India to Dr. Reddy’s for NeuVax in breast and gastric cancers. Under the agreement, Dr. Reddy’s will lead the Phase 2 development of NeuVax in India in gastric cancer, expanding the potential patient population addressable with NeuVax.

Kwang Dong Pharmaceutical Co., Ltd.

Effective April 30, 2009, we entered into a license agreement with Kwang Dong Pharmaceutical Co, Ltd (Kwang Dong). Under the agreement, we granted Kwang Dong exclusive rights to seek marketing approval in The Republic of Korea (South Korea) for our NeuVax product candidate for the treatment of breast cancer following its approval by the FDA or the European Medicines Agency, and to market, sell and distribute NeuVax in South Korea assuming such approval is obtained.

13

Recent Developments (in reverse chronological order)

Litigation Settlement

On February 4 and 16, 2016, the United States District Court for the District of Oregon granted preliminary approval of the settlements we had previously reported we had reached in In re Galena Biopharma, Inc. Derivative Litigation, Civil Action No. 3:14-cv-00382-SI and in In re Galena Biopharma, Inc. Securities Litigation, Civil Action No. 3:14-cv-00367-SI, respectively. The Court has set the final approval hearings for April 21, 2016 in In re Galena Biopharma, Inc. Derivative Litigation and June 23, 2016 in In re Galena Biopharma, Inc. Securities Litigation.

Announced a Notice of Allowance of a U.S. Patent for NeuVax

On February 8, 2016, we announced the United States Patent Office issued a Notice of Allowance for an additional U.S. patent application covering multiple uses of NeuVax™ (nelipepimut-S): inducing and maintaining an immune response to HER2 expressing tumor cells in patients in clinical remission with a tumor having a fluorescence in situ hybridization (FISH) rating of less than about 2.0 (FISH <2.0); inducing and sustaining a cytotoxic T-lymphocyte (CTL) response to HER2 in patients in clinical remission from a tumor with a FISH rating of less than about 2.0 (FISH < 2.0); reducing risk of cancer recurrence in patients in clinical remission from a tumor with a FISH rating of less than about 2.0 (FISH < 2.0); and preventing bone only recurrence of a HER2 expressing cancer. This patent will expand both the protection and the potential population of cancer patients NeuVax may address. Once issued, the patent will expire in 2028, not including any patent term extensions.

Presented Observational Study Data in Gastric Cancer Patients at the ASCO 2016 Gastrointestinal Cancers Symposium

On January 21, 2016, we presented data from an observational study in gastric cancer patients at the American Society of Clinical Oncology (ASCO) 2016 Gastrointestinal Cancers Symposium. The study was conducted by our partner, Dr. Reddy’s Laboratories Ltd, who will conduct a Phase 2 clinical trial of NeuVax in gastric cancer patients in India. The poster, entitled, “An observational study evaluating the expression of HER2 (1+, 2+, and 3+) with HLA A2+/A3+ in gastric adenocarcinoma patients” showed that approximately 25% of the patients met the projected clinical protocol population of all levels of expression of HER2 and HLA A2+ and/or A3+ as defined for the planned NeuVax Phase 2 clinical trial. Results indicate an acceptable potential for enrollment rate, given the high incidence of gastric cancer in this population, and will inform the screen failure rate in the planned Phase 2 clinical study.

Closed Two Public Offerings

On January 12, 2016, we closed the previously announced underwritten public offering of common stock and warrants. The net proceeds to us were approximately $20 million.

On March 18, 2015, we announced the closing of an underwritten public offering of common stock and warrants. The net proceeds to us were approximately $35.4 million.

Changes to our Board of Directors & Management Team

On December 24, 2015, we announced that Steven A. Kriegsman will be retiring as a Director of the Company when his current term expires the day prior to the June 2016 Annual Meeting of Stockholders. We also announced that we would conduct a search to replace Mr. Kriegsman’s position on the Board of Directors and add an additional board member.

On December 11, 2015, we announced the departure of our Chief Financial Officer (CFO), Mr. Ryan Dunlap, effective December 31, 2015, as he was unable to relocate to the Company’s headquarters in California. We have instituted a search for a new CFO.

14

On October 30, 2015, we announced the hiring of Bijan Nejadnik, M.D., as our Executive Vice President and Chief Medical Officer. Dr. Nejadnik will be responsible for managing all of Galena's clinical development programs. Dr. Nejadnik has more than 22 years of academic and industry experience, including twelve years with pharmaceutical and biotech companies including Jazz Pharmaceuticals, Johnson & Johnson, and Purdue Pharma. During his career, Dr. Nejadnik has successfully developed numerous biologics and small molecules, advancing these agents towards Biologics License Application (BLA) and New Drug Application (NDA) submissions.

Divestiture of Commercial Operations

On November 9, 2015, we announced the completion of a strategic review of the commercial business and operations. As a result of a strategic review, on November 19, 2015 we sold our Abstral® (fentanyl) Sublingual Tablets product and related assets; and, on December 24, 2015, we sold Zuplenz® (ondansetron) Oral Soluble Film product and related assets. On December 31, 2015 we ceased our commercial operations.

GALE 401 Final Phase 2 Clinical Trial Data Presented was presented at the 57th American Society of Hematology (ASH) Annual Meeting and Exposition

On December 8, 2015, we presented final data via a poster presentation entitled “Final results of anagrelide controlled-release (GALE-401) safety, efficacy and pharmacokinetics in subjects with myeloproliferative neoplasms (MPN)-related thrombocytosis.”. The Phase 2 study demonstrated GALE-401 is well tolerated and the efficacy compares favorably to historical anagrelide immediate release (IR) with reported platelet count best response rates of eleven (61.1%) complete responses (CR), four (22.2%) partial responses (PR), and an overall response rate (ORR) of 83.3%. The mean time to response ranged from 1 to 9 weeks with GALE-401, which compares favorably to historical anagrelide IR, where time to response ranged from 4 to 12 weeks. Fourteen of 18 subjects enrolled experienced a treatment related adverse event (AE); however, the vast majority of AEs were Grade 1/2 with no patients discontinuing therapy due to progression of disease. Nine patients remain on trial and the median time of response has not yet been reached.

GALE-302 Phase 1b Immunological Data Optimizing GALE-301 was presented at the Society for Immunotherapy of Cancer (SITC) 30th Anniversary Annual Meeting

On November 7, 2015 we presented the poster, entitled, “Preliminary report of a clinical trial supporting the sequential use of an attenuated E39 peptide (E39’) to optimize the immunologic response to the FBP (E39+GM-CSF) vaccine,” that compared three primary vaccine series (PVS) sequences of GALE-301 (E39) and GALE-302 (E39’) in ovarian and breast cancer patients to optimize the ex vivo immune responses, local reactions (LR), and delayed type hypersensitivity (DTH) reactions. The data demonstrated that the in vivo immune response is enhanced with the use of the attenuated E39’ (GALE-302) after E39 (GALE-301). The optimal vaccination sequence utilizing three inoculations of GALE-301 followed by three inoculations of GALE-302 produced the most prominent and statistically significant LR and DTH responses.

Collaboration with the National Cancer Institute on a Phase 2 clinical trial with NeuVax in Ductal Carcinoma in Situ Patients

On September 30, 2015, we announced a collaboration with the National Cancer Institute (NCI) to initiate a Phase 2 clinical trial with NeuVax in patients diagnosed with Ductal Carcinoma in Situ (DCIS). The trial will be entitled VADIS: Phase 2 trial of the Nelipepimut-S Peptide VAccine in Women with DCIS of the Breast. The University of Texas M.D. Anderson Cancer Center (MDACC) Phase I and II Chemoprevention Consortium will be the lead clinical trial site for this multi-center trial with Elizabeth Mittendorf, M.D., Ph.D. serving as the study Principal Investigator. The Consortium is funded through the Division of Cancer Prevention at NCI, which will provide financial and administrative support for the trial. We will provide NeuVax, as well as additional financial and administrative support. The single-blind, double arm, randomized, controlled trial is expected to initiate in the first half of 2016.

15

GALE-301 Positive Phase 2a Clinical Trial Data Presented at the European Cancer Congress 2015

On September 28, 2015 we announced the poster presentation of positive data from the GALE-301 Phase 2a portion of the Phase 1/2a clinical trial at the European Cancer Congress 2015, providing updated data for all ovarian and endometrial cancer patients who have received at least twelve months of treatment on the study. The poster was entitled, “Preliminary results of the phase I/IIa dose finding trial of a folate binding protein vaccine GALE-301 (E39) + GM-CSF in ovarian and endometrial cancer patients to prevent recurrence,” and as presented, the clinical recurrence rate based on all treatment cohorts was 41% in the Vaccine Group (VG) (n=29) versus 55% in the Control Group (CG) (n=22), p=0.41. However, in the 1000 mcg VG cohort (n=15), there have only been two clinical recurrences (13.3% versus 55% CG, p=0.02), and the two-year Disease Free Survival (DFS) estimate is 85.7% (1000 mcg patients) versus 33.6% (CG), p < 0.02, as compared by Kaplan-Meir and Log rank tests.

IDMC Provides Recommendation to Reduce Cardiac Monitoring in the NeuVax, Phase 3 PRESENT Clinical Trial

On August 24, 2015 we announced that the Independent Data Monitoring Committee (IDMC) for the NeuVax Phase 3, PRESENT clinical trial recommended that the Company can reduce the cardiac toxicity monitoring for patients in the study. Following its meeting in June 2015, the IDMC recommended routine cardiac monitoring could be reduced in the PRESENT trial and that such a reduction is justified and consistent with the pre-specified Cardiac Toxicity Monitoring Stopping Rules defined in the study protocol. The IDMC had no other suggestions and recommended the trial continue as planned.

Published an abstract on the Leica Biosystem’s Companion Diagnostic at the American Society of Clinical Oncology (ASCO) 2015 Annual Meeting

On May 27, 2015, we announced an abstract publication at the ASCO 2015 Annual Meeting related to our NeuVax Phase 3 PRESENT trial companion diagnostic in abstract #e11609, entitled, “Analytical Validation of BOND Oracle HER2 IHC System for Identifying Low to Intermediate HER2 Expressing Breast Cancer in NeuVax PRESENT Phase 3 Clinical Trial.” This data demonstrated a direct correlation between cell line receptor load, quantitative measure of HER2 protein, and IHC score. The ability to discriminate HER2 protein expression at the low and intermediate levels in breast cancer tumors will identify patients for new treatments in development such as NeuVax. Specifically, the validation of the Bond Oracle HER2 IHC System to distinguish lower levels of HER2+ expressions supports its use as a companion diagnostic.

NeuVax Phase 3, PRESENT Clinical Trial Over-Enrollment Completed

On April 14, 2015, we announced the completion of enrollment in the NeuVax™ Phase 3 PRESENT clinical trial. As anticipated, we over-enrolled the trial by 7.7% with a total of 758 patients now in the intent-to-treat (ITT) population. The protocol for the PRESENT trial called for 700 patients; and we expect this higher number of ITT patients will increase the confidence in both the timing and quality of the statistics and the final outcome of the trial. The primary endpoint is currently expected to be reached in 2018, after the last patient dosed reaches her 36th month of treatment, or a total of 141 events (recurrence or death) occur, whichever comes later.

Expanded Patient Population in NeuVax and Trastuzumab Combination Trial in HER2 1+/2+ patients to include HLA A24+ and/or HLA-A26+ patients

On March 26, 2015, we announced that human leukocyte antigen HLA-A24 and/or HLA-A26 positive women are now eligible for enrollment into the ongoing Phase 2b clinical trial with NeuVax in combination with trastuzumab. The trial evaluates node positive and high-risk node negative breast cancer patients with IHC HER2 1+/2+ expressing tumors who are disease-free after standard of care therapy.

Enrolled 700th Patient in NeuVax Phase 3 PRESENT Clinical Trial

On February 9, 2015, we announced enrollment of the 700th patient in the NeuVax Phase 3 PRESENT clinical trial, which is the patient enrollment target as defined by the PRESENT Phase 3 clinical trial protocol.

16

Competition

The biotechnology industry, including cancer immunotherapy vaccines and hematology therapies, is intensely competitive and involves a high degree of risk. Potential competitors in the U.S. and worldwide are numerous and include pharmaceutical and biotechnology companies, educational institutions and research foundations. We compete with many of these companies who have far greater experience, capital resources, research and technical resources, marketing experience, research and development staffs and facilities than us. Some of our competitors may develop and commercialize products that compete directly with those incorporating our technology, and they may introduce products to market earlier than our products or on a more cost effective basis. We may be unable to effectively develop our technology or any other applications on a cost effective basis or otherwise. In addition, our technology may be subject to competition from other technology or methods developed using techniques other than those developed by traditional biotechnology methods. Our competitors compete with us in recruiting and retaining qualified scientific and management personnel as well as in acquiring technologies complementary to our technology. We, and our collaborators, may face competition with respect to product efficacy and safety, ease of use and adaptability to various modes of administration, acceptance by physicians, the timing and scope of regulatory approvals, availability of resources, reimbursement coverage, price, and patent position including potentially dominant patent positions of others.

For patients with early stage breast cancer, adjuvant therapy is often given to prevent recurrence and increase the chance of long-term disease free survival. Adjuvant therapy for breast cancer can include chemotherapy, hormonal therapy, radiation therapy, or combinations thereof. In addition, the HER2 targeted drug trastuzumab (Herceptin®) may be given to patients with tumors with high expression of HER2 (IHC 3+), as well as other novel targets such as MUC1 which may be useful in treating breast cancer.

There are a number of cancer vaccines in development for breast cancer, including but not limited to Lapuleucel-T (Dendreon), AE-37 (Antigen Express), and Stimuvax (Merck KgA). While these development candidates are aimed at a number of different targets, and AE-37 has published data in the HER2 breast cancer patient population, there is no guarantee that any of the these compounds will not in the future be indicated for treatment of low-to-intermediate HER2 breast cancer patients and become directly competitive with NeuVax.

A number of chemotherapeutic agents have demonstrated activity in gynecological carcinomas (ovarian and endometrial), particularly platinum based regimens. New chemotherapy agents are being evaluated including trabectedin (Yondelis) and belotecan as well as targeted agents such as bevacizumab (Avastin) and pazopanib (Avotrient). Monoclonal antibodies are also being developed including farletuzumab and catumaxomab. The Company is not aware of any of these agents being evaluated in the adjuvant setting where GALE-301 is being considered for further development. TPIV200 (TapImmune) is in development targeting FBP in ovarian cancer.

For patients with myeloproliferative neoplasms (MPNs), current treatment options include Agrylin® (anagrelide hydrochloride) and its generic equivalents, hydorxyurea and interferon alpha. Agents currently being studied in patients with MPNs include investigational JAK2 inhibitors (e.g., LY2784544 (Eli Lily), momelotinib (Gilead Sciences) and pegylated interferon alfa-2a (Pegasys, Genentech/Roche)).

17

Government Regulation

The U.S. and other developed countries extensively regulate the preclinical and clinical testing, manufacturing, labeling, storage, record-keeping, advertising, promotion, export, marketing and distribution of drugs and biologic products. The FDA regulates pharmaceutical and biologic products under the Federal Food, Drug, and Cosmetic Act, the Public Health Service Act and other federal statutes and regulations.

To obtain approval of our future product candidates from the FDA, we must, among other requirements, submit data supporting safety and efficacy for the intended indication as well as detailed information on the manufacture and composition of the product candidate. In most cases, this will require extensive laboratory tests and preclinical and clinical trials. The collection of these data, as well as the preparation of applications for review by the FDA involve significant time and expense. The FDA may require post-marketing testing to monitor the safety and efficacy of approved products or place conditions on any product approvals that could restrict the therapeutic claims and commercial applications of these products. Regulatory authorities may withdraw product approvals if we fail to comply with regulatory standards and or the conditions of the regulatory approval at any time following initial marketing of our products.

The amount of time taken by the FDA for approval of an NDA or BLA will depend upon a number of factors, including whether the product candidate has received priority review or fast track designation, the quality of the submission and studies presented, and the workload at the FDA.

We anticipate that our products will be manufactured by our strategic partners, licensees or other third parties. Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is manufactured and will not approve the product unless the manufacturing facilities are in compliance with the FDA’s current good manufacturing practice (“cGMP”), which are regulations that govern the manufacture, holding and distribution of a product. Manufacturers of biologics also must comply with the FDA’s general biological product standards. Our manufacturers also will be subject to regulation under the Occupational Safety and Health Act, the Nuclear Energy and Radiation Control Act, the Toxic Substance Control Act and the Resource Conservation and Recovery Act and other applicable environmental statutes. Following approval, the FDA periodically inspects drug and biologic manufacturing facilities to ensure continued compliance with the good manufacturing practices regulations. Our manufacturers will have to continue to comply with those requirements. Failure to comply with these requirements subjects the manufacturer to possible legal or regulatory action, such as suspension of manufacturing or recall or seizure of product. Adverse patient experiences with the product must be reported to the FDA and could result in the imposition of marketing restrictions through labeling changes or market removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

The labeling, advertising, promotion, marketing and distribution of a drug or biologic product also must be in compliance with FDA and Federal Trade Commission requirements which include, among others, standards and regulations for off-label promotion, industry sponsored scientific and educational activities, promotional activities involving the internet, and direct-to-consumer advertising. In addition, we will be subject to various laws and regulations governing laboratory practices and the experimental use of animals. In each of these areas, as above, the FDA has broad regulatory and enforcement powers, including the ability to levy fines and civil penalties, suspend or delay issuance of product approvals, seize or recall products, and deny or withdraw approvals.

We will also be subject to a variety of regulations governing clinical trials and sales of our products outside the U.S. Whether or not FDA approval has been obtained, approval of a product candidate by the comparable regulatory authorities of foreign countries and regions must be obtained prior to the commencement of marketing the product in those countries. The approval process varies from one regulatory authority to another and the time may be longer or shorter than that required for FDA approval. In the European Union, Canada and Australia, regulatory requirements and approval processes are similar, in principle, to those in the U.S.

18

Financial Condition

We had cash and cash equivalents of approximately $38.2 million as of February 29, 2016. We believe that our existing cash and cash equivalents, funding available under our Lincoln Park Capital, LLC (LPC) purchase agreement and At Market Issuance Sales Agreements (ATM), should be sufficient to fund our operations for at least one year. This projection is based on our current planned operations, and subject to changes in our plans, uncertainties inherent in our business, and the need to seek to replenish our existing cash and cash equivalents sooner than we project and in greater amounts that we had projected.

On March 18, 2015, we announced the closing of our underwritten public offering of 24,358,974 shares of common stock and 12,179,487 warrants to purchase our common stock at an exercise price of $2.08. The underwriters also exercised their over-allotment option to purchase warrants to purchase an aggregate of 1,826,923 shares of our common stock. On April 10, 2015, the underwriters exercised their option to purchase an additional 3,653,846 shares of common stock providing us additional net proceeds of $5.4 million. The total net proceeds to us were approximately $40.8 million.

On January 12, 2016, we closed on our underwritten public offering of 19,772,727 shares of common stock and 11,863,636 warrants to purchase our common stock at an exercise price of $1.42. The underwriters also exercised their over-allotment option to purchase warrants to purchase an aggregate of 1,779,545 shares of our common stock. The total net proceeds to us were approximately $20.1 million.

In addition to the funds raised through underwritten public offerings, we maintain a purchase agreement with Lincoln Park Capital LLC (LPC) and At Market Issuance Sales Agreements (ATM) with future availability of $42.2 million and $15.4 million, respectively subject to certain terms and conditions. We used the LPC purchase agreement in the fourth quarter of 2014 and the first quarter of 2015 raising $8.5 million and $4.4 million, respectively, by issuing 5.2 million and 2.7 million shares of our common stock. In addition, we used the ATM in the fourth quarter of 2014 and the first quarter of 2015 raising $2.3 million by issuing 1.4 million shares of our common stock in both quarters. In light of our current stock price to continue to rely on sales of our common stock under the LPC purchase agreement, we will need to obtain certain revisions to the terms and conditions of the LPC purchase agreement. We may also continue to use the ATM, or other instruments, in order to fund our operations going forward.

We expect to continue to incur operating losses as we continue to advance our product candidates through the drug development and the regulatory process. In the absence of revenue, our potential sources of operational funding are proceeds from the sale of equity, funded research and development payments, debt financing arrangements, and payments received under partnership and collaborative agreements. There is no guarantee that any debt, additional equity or other funding will be available to us on acceptable terms, or at all. If we fail to obtain additional funding when needed, we would be forced to scale back, or terminate, our operations or to seek to merge with or to be acquired by another company.

19

Environmental Compliance

Our development programs involve the controlled use of potentially harmful biological materials as well as hazardous materials, chemicals and various radioactive compounds. We are subject to federal, state and local laws and regulations governing the use, storage, handling and disposal of these materials and specific waste products. We are also subject to numerous environmental, health and workplace safety laws and regulations. The cost of compliance with these laws and regulations could be significant and may adversely affect capital expenditures to the extent we are required to procure expensive capital equipment to meet regulatory requirements.

Human Resources

As of March 10, 2016, the Company had 22 full-time employees. None of our employees are represented by a labor union or covered by a collective bargaining agreement, nor have we experienced any work stoppages.

Corporate Information

Our principal executive offices are located at 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583, and our phone number is (855) 855-4253. Our website address is www.galenabiopharma.com. We do not incorporate the information on our website into this annual report, and you should not consider such information part of this annual report.

20

ITEM 1A. RISK FACTORS

Our business is subject to numerous risks. We caution you that the following important factors, among others, could cause our actual results to differ materially from those expressed in statements made by us or on our behalf in filings with the SEC, press releases or communications with investors and others. Any or all of our statements in this annual report and in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. The factors mentioned in the discussion below will be important in determining future results. Consequently, actual future results may vary materially from those anticipated in this annual report or our other public statements.

Risks Relating to Our Former Commercial Operations

We are subject to U.S. federal and state health care fraud and abuse and false claims laws and regulations, and we recently have been subpoenaed in connection with marketing and promotional practices related to Abstral. Prosecutions under such laws have increased in recent years and we may become subject to such prosecutions or related litigation under these laws. If we have not fully complied with such laws, we could face substantial penalties.

Our former commercial operations and development programs are subject to various U.S. federal and state fraud and abuse laws, including, without limitation, the federal False Claims Act, federal Anti-Kickback Statute, and the federal Sunshine Act.

A federal investigation of two of the high-prescribing physicians for Abstral has resulted in the criminal prosecution of the two physicians for alleged violations of the federal False Claims Act and other federal statutes. The criminal trial is set for some time in 2016. We have received a trial subpoena for documents in connection with that investigation and we have been in contact with the U.S. Attorney’s Office for the Southern District of Alabama, which is handling the criminal trial, and are cooperating in the production of documents. We are not a target or subject of that investigation. There also have been federal and state investigations of a company that has a product that competes with Abstral in the same therapeutic class, and we have learned that the FDA and other governmental agencies may be investigating our Abstral promotion practices. On December 16, 2015, we received a subpoena issued by the U.S. Attorney’s Office in District of New Jersey requesting the production of a broad range of documents pertaining to our marketing and promotional practices for Abstral. We have been in contact with the U.S. Attorney’s Office for the District of New Jersey and are cooperating in the production of the requested documents. We are unable to predict whether we could become subject to legal or administrative actions as a result of these matters, or the impact of such matters. If we are found to be in violation of the False Claims Act, Anti-Kickback Statute, Patient Protection and Affordable Care Act, or any other applicable state or any federal fraud and abuse laws, we may be subject to penalties, such as civil and criminal penalties, damages, fines, or an administrative action of exclusion from government health care reimbursement programs. We can make no assurances as to the time or resources that will need to be devoted to these matters or their outcome, or the impact, if any, that these matters or any resulting legal or administrative proceedings may have on our business or financial condition.

The federal False Claims Act prohibits persons from knowingly filing, or causing to be filed, a false claim to, or the knowing use of false statements to obtain payment from, the federal government. Qui tam suits filed under the False Claims Act can be brought by any individual on behalf of the government and such individuals, commonly known as “relators” or “whistleblowers,” may share in any amounts paid by the entity to the government in fines or settlement. The frequency of filing qui tam actions has increased significantly in recent years, causing greater numbers of health care companies to have to defend such qui tam actions and pay substantial sums to settle such actions.

21

The federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving, or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a federal health care program such as the Medicare and Medicaid programs. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal health care covered business, the statute has been violated. The Anti-Kickback Statute is broad, and despite a series of narrow safe harbors, prohibits many arrangements and practices that are lawful in businesses outside of the health care industry. Penalties for violations of the federal Anti-Kickback Statute include criminal penalties and civil and administrative sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal health care programs. An alleged violation of the Anti- Kickback Statute may be used as a predicate offense to establish liability pursuant to other federal laws and regulations such as the federal False Claims Act. Many states have also adopted laws similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for health care items or services reimbursed by any source, not only Medicare and Medicaid programs.

The federal Patient Protection and Affordable Care Act includes provisions expanding the ability of certain relators to bring actions that would have been dismissed under prior law. When an entity is determined to have violated the federal False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties for each separate false claim. The Deficit Reduction Act of 2005 encouraged states to enact or modify their state false claims acts to be at least as effective as the federal False Claims Act by granting states a portion of any federal Medicaid funds recovered through Medicaid-related actions. Most states have enacted state false claims laws, and many of those states included laws including qui tam provisions. The federal Patient Protection and Affordable Care Act includes provisions known as the Physician Payments Sunshine Act, which requires manufacturers of drugs, biologics, devices and medical supplies covered under Medicare and Medicaid to record any transfers of value to physicians and teaching hospitals and to report this data beginning in 2013 to the Centers for Medicare and Medicaid Services for subsequent public disclosures. Manufacturers must also disclose investment interests held by physicians and their family members. Failure to submit the required information may result in civil monetary penalties of up to $1 million per year for knowing violations and may result in liability under other federal laws or regulations. Similar reporting requirements have also been enacted on the state level in the U.S., and an increasing number of countries worldwide either have adopted or are considering similar laws requiring transparency of interactions with health care professionals. In addition, some states such as Massachusetts and Vermont imposed an outright ban on certain gifts to physicians. These laws could affect our product promotional activities by limiting the kinds of interactions we could have with hospitals, physicians or other potential purchasers or users of our system. Both the disclosure laws and gift bans also will impose administrative, cost and compliance burdens on us.

We face product liability exposure and, if successful claims are brought against us, we may incur substantial liability if our insurance coverage for those claims is inadequate.

The commercial sale of our products exposes us to possible product liability claims. This risk exists even if a product is approved for commercial sale by the FDA and manufactured in facilities licensed and regulated by the FDA. Our products are designed to affect important bodily functions and processes. Any side effects, manufacturing defects, misuse or abuse associated with our products could result in injury to a patient or even death. For example, because Abstral is designed to be self-administered by patients, it is possible that a patient could fail to follow instructions and as a result apply a dose in a manner that results in injury. In addition, Abstral is an opioid pain reliever that contains fentanyl, which is regulated as a “controlled substance” under the Controlled Substances Act of 1970 (the “CSA”) and could result in harm to patients relating to its potential for abuse. Product liability claims may be brought against us by consumers, health care providers, pharmaceutical companies or others selling or otherwise coming into contact with our products or generic versions of our products. If we cannot successfully defend ourselves against product liability claims we could incur substantial liabilities. Because we have sold Abstral and Zuplenz, regardless of merit or eventual outcome, product liability claims may result in:

•impairment of our business reputation;

•costs of related litigation;

•distraction of management’s attention from our primary business; or

•substantial monetary awards to patients or other claimants.

22

We have obtained product liability insurance coverage for commercial product sales with a $10 million per occurrence and a $10 million annual aggregate coverage limit. Our insurance coverage may not be sufficient to cover all of our product liability related expenses or losses and may not cover us for any expenses or losses we may suffer. Moreover, insurance coverage is becoming increasingly expensive and, in the future, we may not be able to maintain insurance coverage at a reasonable cost, in sufficient amounts or upon adequate terms to protect us against losses due to product liability. If we determine that it is prudent to increase our product liability coverage based on sales of our products, we may be unable to obtain this increased product liability insurance on commercially reasonable terms or at all. Large judgments have been awarded in class action or individual lawsuits based on drugs that had unanticipated side effects, including side effects that may be less severe than those of our products. A successful product liability claim or series of claims brought against us could cause our stock price to decline and, if judgments exceed our insurance coverage, could decrease our cash and have a material adverse effect on our business, results of operations, financial condition and prospects.

Our business involves the use of hazardous materials and we and our third-party manufacturers and suppliers must comply with environmental laws and regulations, which can be expensive and restrict how we do business.

Our third-party manufacturers and suppliers activities involve the controlled storage, use and disposal of hazardous materials. We and our manufacturers and suppliers are subject to laws and regulations governing the use, manufacture, storage, handling and disposal of these hazardous materials even after we sell or otherwise dispose of the products. In some cases, these hazardous materials and various wastes resulting from their use were stored at our contractors or manufacturers’ facilities pending use and disposal. We cannot completely eliminate the risk of contamination, which could cause injury to our employees and others, environmental damage resulting in costly clean-up and liabilities under applicable laws and regulations governing the use, storage, handling and disposal of these materials and specified waste products. Although we expect that the safety procedures utilized by our third-party contractors and manufacturers for handling and disposing of these materials will generally comply with the standards prescribed by these laws and regulations, we cannot guarantee that this will be the case or eliminate the risk of accidental contamination or injury from these materials. In such an event, we may be held liable for any resulting damages and such liability could exceed our resources. We do not currently carry biological or hazardous waste insurance coverage and our property and casualty and general liability insurance policies specifically exclude coverage for damages and fines arising from biological or hazardous waste exposure or contamination.

We will continue to be responsible for certain liabilities and obligations related to Abstral and Zuplenz, and if unknown liabilities were to arise it could have a material adverse effect on us.

Under our respective asset purchase agreements with Sentynl Therapeutics, Inc. and Midatech Pharma PLC, our future obligations under our former agreements with Orexo AB and MonoSol have been assumed by Sentynl and Midatech, respectively, except that we will continue to be responsible for chargebacks, rebates, patient assistance and certain other product distribution channel liabilities related to Abstral and Zuplenz for a specified period of time post-closing. We also will be responsible for any pre-closing liabilities and obligations related to Abstral and Zuplenz, including unknown liabilities, and have agreed in the respective asset purchase agreements to indemnify Sentynl and Midatech for any breach of our representations, warranties and covenants in the respective asset purchase agreements up to a certain agreed to amount. We cannot quantify these responsibilities to Sentanyl and Midatech, but if substantial unknown liabilities were to arise, it could have a material adverse effect on our financial condition.

23

Risks Relating to Our Development Programs

Our drug candidates may not receive regulatory approval or be successfully commercialized.

Before they can be marketed, our products in development must be approved by the FDA or similar foreign governmental agencies. The process for obtaining FDA approval is both time-consuming and costly, with no certainty of a successful outcome. Before obtaining regulatory approval for the sale of any drug candidate, we must conduct preclinical tests and clinical trials to demonstrate the safety and efficacy in humans of our product candidates. Although our drug candidates have exhibited no serious adverse events (“SAEs”) in the Phase 1 and 1/2 clinical trials, SAEs or other unexpected side effects may arise during further testing and development. A failure of any preclinical study or clinical trial can occur at any stage of testing. The results of preclinical and initial clinical testing of these products may not necessarily indicate the results that will be obtained from later or more extensive testing. It also is possible to suffer significant setbacks in advanced clinical trials, even after obtaining promising results in earlier trials.

Clinical trial designs that were discussed with the authorities prior to their commencement may not result in the success of the trials or subsequently may not be considered sufficient for approval. Thus, our special protocol assessment with the FDA for our PRESENT trial does not ensure success of the trial or guarantee regulatory approval of NeuVax for the treatment of breast cancer.

In 2009, we reached agreement with the FDA regarding the special protocol assessment, or SPA, for the design of our NeuVax Phase 3 PRESENT trial as an adjuvant treatment for patients with node positive, HER2 1+/2+ breast cancer. An SPA certifies the agreement with the FDA regarding the study endpoints, study design and statistical assumptions of the clinical trial. The SPA is documented as part of the administrative record, and is binding on the FDA and may not be changed unless we fail to follow the agreed upon protocol, data supporting the test are found to be false or incomplete, or the FDA determines that a substantial scientific issue essential to determining the safety or effectiveness of the drug was identified after the testing began. In June 2013, the FDA agreed to an amendment to the SPA to account for the use of a companion diagnostic. Even with an SPA, approval of an NDA or BLA is not guaranteed because a final determination that an agreed upon protocol satisfies a specific objective, such as the demonstration of efficacy, or supports an approval decision, will be based on a complete review of all the data submitted to the FDA. There is no assurance, therefore, that the NeuVax Phase 3 PRESENT trial will be successful or that NeuVax for the treatment of patients with node positive, HER2 1+ and/or 2+ breast cancer will be approved by the FDA.

A number of different factors could prevent us from obtaining regulatory approval or commercializing our product candidates on a timely basis, or at all.

We, the FDA or other applicable regulatory authorities, an Independent Data Monitoring Committee or “IDMC” governing our clinical trials, or an institutional review board, or “IRB,” which is an independent committee registered with and overseen by the U.S. Department of Health and Human Services, or “HHS,” that functions to approve, monitor and review biomedical and behavioral research involving humans, may suspend clinical trials of a drug candidate at any time for various reasons, including if we, or it, believe the subjects or patients participating in such trials are being exposed to unacceptable health risks. Among other reasons, adverse side effects of a drug candidate on subjects or patients in a clinical trial could result in the FDA or other regulatory authorities suspending or terminating the trial and refusing to approve a particular drug candidate for any or all indications of use.

Clinical trials of a new drug candidate require the enrollment of a sufficient number of patients, including patients who are suffering from the disease the drug candidate is intended to treat and who meet other eligibility criteria. Rates of patient enrollment are affected by many factors, and delays in patient enrollment can result in increased costs and longer development times than we expect at present. Patients who are enrolled at the outset of this standard of care also may eventually choose for personal reasons not to participate in the study. We also compete for eligible patients with other oncology trials underway from time to time, and we may experience delays in patient enrollment due to the dependency of other large trials underway in the same patient population.