Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Everyday Health, Inc. | t1600124_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Everyday Health, Inc. | t1600124_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Everyday Health, Inc. | t1600124_ex31-2.htm |

| EX-21.1 - EXHIBIT 21.1 - Everyday Health, Inc. | t1600124_ex21-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Everyday Health, Inc. | t1600124_ex32-2.htm |

| EX-23.1 - EXHIBIT 23.1 - Everyday Health, Inc. | t1600124_ex23-1.htm |

| EX-10.11 - EXHIBIT 10.11 - Everyday Health, Inc. | t1600124_ex10-11.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| Commission file number: 001-36371 |

Everyday

Health, Inc.

(Exact name of registrant as specified in its charter)

| Delaware

(State or other jurisdiction of incorporation or organization) |

80-0036062

(I.R.S. Employer Identification No.) | |

| 345

Hudson Street, 16th Floor New York, NY (Address of principal executive offices) |

10014 |

Registrant’s

telephone number, including area code: (646) 728-9500

Securities registered pursuant to Section 12(b) of the Act:

| Title of class | Name of each exchange on which registered | |

| Common Stock, $0.01 par value per share | New York Stock Exchange |

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |||

| Non-accelerated filer ¨ | (Do not check if smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $296.1 million as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing price on the New York Stock Exchange reported for such date. Excludes an aggregate of 8,757,881 shares of the registrant’s common stock held as of such date by officers, directors and stockholders that the registrant has concluded are or were affiliates of the registrant. Exclusion of such shares should not be construed to indicate that the holder of any such shares possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

There were 32,866,363 shares of the registrant’s common stock issued and outstanding as of March 4, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, in connection with the Registrant’s 2016 Annual Meeting of Stockholders.

EVERYDAY HEALTH, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

Except as otherwise indicated herein or as the context otherwise requires, references in this Annual Report on Form 10-K to “Everyday Health,” “the company,” “we,” “us,” “our” and similar references refer to Everyday Health, Inc. and, where appropriate, our subsidiaries. This report contains registered marks, trademarks and trade names of other companies. All other trademarks, registered marks and trade names appearing in this report are the property of their respective holders.

2

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions, including those relating to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “potential,” “intend” or “continue,” the negative of terms like these or other comparable terminology, and other words or terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are only predictions. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Any or all of our forward-looking statements in this document may turn out to be wrong. Actual events or results may differ materially. Our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties and other factors. We discuss many of these risks, uncertainties and other factors in this Annual Report on Form 10-K in greater detail under the heading “Item 1A—Risk Factors.” We caution investors that our business and financial performance are subject to substantial risks and uncertainties.

Mission

Everyday Health empowers and inspires consumers and healthcare professionals to make better health and wellness decisions.

Overview

We operate a leading digital marketing and communications platform for healthcare marketers that want to engage with consumers and healthcare professionals. Our platform combines premier content from leading brands, a large and engaged audience, and extensive data and analytics expertise to provide (i) a highly personalized content experience for our users and (ii) an efficient marketing channel for our diverse set of customers. We currently reach more than 50 million consumers and more than 700,000 U.S. physicians, which is more than two-thirds of all active U.S. physicians and more than triple the physician reach we had two years ago. During 2015, our customers included five of the top ten global advertisers in 2014, as compiled by Advertising Age, 24 of the top 25 global pharmaceutical companies ranked by 2014 revenue, and more than 350 hospitals across 30 states, including six of the top ten largest health systems in the U.S.

The Internet and mobile devices have become indispensable for both consumers seeking to take a more active role in managing their health and healthcare professionals striving to provide better care for their patients.

Consumers use our digital content, interactive tools and 14 mobile applications to manage a broad array of health and wellness needs on a daily basis, including medical conditions, pregnancy, diet and fitness. Since our inception, more than 70 million consumers have registered with us online and voluntarily provided us with valuable data, including demographic information and health-related interests. We augment our user profiles by collecting behavioral data through engagement with our properties and appending data from third-party sources. Our proprietary technology utilizes the data we collect to provide a highly-personalized experience for our consumers, including customized content, to drive better health outcomes and to connect users looking for support.

We enable healthcare professionals to make better decisions for their patients by providing them with the news, tools and information needed to stay abreast of industry, legislative and regulatory developments in major medical specialties. We provide a highly-tailored content experience to each healthcare professional based on the individual’s specific medical practice and interests. We partner with prominent healthcare professionals to provide expert commentary and perspectives on important medical developments and distribute our content through partnerships with premier medical associations. We also offer physicians the ability to satisfy their continuing medical education, or CME, requirements for maintenance of licensure and maintenance of certification through engagement with our content.

We derive almost all of our revenues from the sale of digital marketing and communications solutions that engage consumers and healthcare professionals. We have developed strong relationships with marketers across a variety of health and wellness categories, including pharmaceuticals, over-the-counter products, food, retail and lifestyle, as well as hospital systems and health insurance companies. We specialize in providing highly-customized, data-driven solutions that can precisely target niche health audiences, and which are designed to be effective on a desktop or mobile device. Our solutions allow our customers to promote their products and services in a highly targeted and measurable manner, influence purchase decisions and drive better health compliance. Our innovative programs, which utilize sophisticated campaign analytics to measure and maximize a marketer’s return on investment, or ROI, have been instrumental in significantly growing our revenue among our largest customers. We believe our customers view our data-driven marketing solutions as both superior to traditional media channels, which lack interactivity and the ability to measure and optimize ROI in real time, and superior to other online media channels, which lack the data or technology to target the desired audience or measure the effectiveness of the campaign.

Industry Dynamics

The U.S. healthcare industry is undergoing a profound transformation whereby consumers will likely be more directly engaged in managing their health and making health-related purchase decisions. At the same time, digital technology is providing new avenues for consumers to manage their health, healthcare professionals to stay informed and treat patients, marketers to reach and influence consumers and healthcare professionals, and health payers and providers to improve care and lower cost.

3

Growth in Digital Marketing

Marketers increasingly view digital marketing as providing significant advantages over traditional marketing channels through improved reach and more precise targeting for their campaigns, as well as the ability to maximize ROI in a more measurable and data-driven manner. We believe the benefits of digital marketing will continue to change the way advertisers plan and buy media and cause them to shift more of their budgets away from traditional media. According to published reports, digital advertising is projected to grow from 22.3% of all U.S. media advertising spend in 2012 to 37.3% in 2018, at which time digital advertising is projected to become the largest individual advertising medium.

Health and wellness advertisers are likewise expected to increase their digital marketing spending. According to published reports, digital media spending by the U.S. healthcare and pharmaceutical industry will more than double between 2012 and 2018.

Rising Importance of the Health Consumer

The Internet has fundamentally altered the consumer health market, as more consumers use digital media as a convenient resource for obtaining critical information, making health and lifestyle decisions and using decision-support tools. During 2015, on average, approximately 199 million unique visitors accessed health-related websites per month in the U.S., according to comScore.

The widespread adoption of mobile devices is further accelerating the usage of the Internet and other digital services to manage a healthy lifestyle. Mobile devices make health-related information easy to access anytime and anywhere, and an increasing number of mobile applications and digitally-connected devices are allowing consumers to directly manage and monitor their health in unprecedented ways. For example, consumers are using mobile technology to track caloric intake and fitness performance, seek information about medical symptoms and conditions, communicate with healthcare professionals, and measure vital signs.

Significant changes in the delivery and reimbursement of healthcare are going to substantially increase the number of healthcare consumers and their level of personal investment in healthcare spending. According to the U.S. Department of Health and Human Services, more than eight million new consumers selected an insurance plan through the Affordable Care Act’s health insurance marketplace in the first enrollment period. In addition, consumers are being forced to bear more of their healthcare costs as a result of the changes caused by the Affordable Care Act as well as payers seeking to link healthcare coverage to personal behavioral and health characteristics. As a result, more consumers will be incentivized to take a greater interest in the price of healthcare, understanding their treatment options and improving their overall health.

Challenges for the Pharmaceutical Industry

The pharmaceutical industry is facing a number of key challenges that we believe will dramatically increase the need for these companies to interact with consumers and physicians more directly through digital channels.

The research and development pipelines of large global pharmaceutical companies have significantly changed over the past decade. The patent terms of many of the mass-market medicines, the so-called blockbuster drugs, have expired or will expire in the next few years. In response, pharmaceutical companies have shifted their focus from blockbuster drugs to developing and commercializing profitable specialty products for smaller patient populations generally defined by chronic illness. According to published reports, specialty drugs are forecasted to be 50% of all U.S. drug expenditures in 2018, an increase from 20% in 2009. We believe it is difficult to reach smaller, discrete patient populations through traditional advertising channels and, as a result, pharmaceutical companies will increasingly utilize digital channels to better target consumers and physicians.

Moreover, pharmaceutical companies are increasingly changing their traditional sales model and replacing in-person interactions with technology and interactive services that facilitate direct interaction with physicians and consumers. The number of sales representatives employed by pharmaceutical and medical device companies marketing to physicians has declined dramatically in recent years. At the same time, sales representatives are also finding it more difficult to spend meaningful time with physicians as an increasing number of physicians have requested sales representatives refrain from contacting them for marketing purposes.

Healthcare Trends Impacting Physicians and Payers

The changing healthcare landscape is presenting new and complex challenges for physicians. Physicians are seeking ways to address growing administrative complexities, increasing reimbursement pressures, time constraints and a constantly changing regulatory environment. Under developing payment models, physicians are increasingly incentivized to improve their patients’ healthcare outcomes as opposed to being reimbursed solely based on services provided. Physicians are also overburdened with information and challenged with keeping current on medical developments and news. As a result, physicians are increasingly utilizing digital and mobile solutions to meet these challenges, improve practice efficiencies and patient care and keep current on medical developments and news. For example, physicians need access to relevant and reliable clinical information at the point-of-care to help make informed decisions. We believe that physicians will increasingly rely on the Internet and digital technologies to stay better informed on medical developments, provide better care for their patients and more efficiently manage their medical practices.

The changes in the payment models for healthcare costs are forcing payers, providers and employers to significantly alter the way they manage their businesses. For example, payers seeking to recruit new consumers, better manage their health outcomes and drive down overall healthcare costs will need to market health insurance products directly to consumers through the recently introduced healthcare exchanges. These payers will need a better understanding of who the consumer is, what they want and what they can afford, which are challenges that these entities have not historically addressed. Likewise, providers will seek to develop long-term relationships with consumers in order to retain them and improve their long-term health. Lastly, employers will need to more directly engage their employees in managing their health in order to lower the employers’ long-term healthcare costs and improve productivity.

4

The Everyday Health Solution

Our digital platform has three core components:

We attract a large and engaged audience of consumers and healthcare professionals to our premium health content across multiple channels, including the web, mobile devices, video and social media, and utilize our data and analytics expertise to deliver highly personalized user experiences. The combination of our audience, content and proprietary data assets also creates a unique health engagement platform that we monetize through effective marketing and engagement solutions that address the varied business needs of constituencies across the health and wellness landscape.

Solutions for Users

We believe that the depth, breadth and quality of our content, combined with our ability to provide a highly personalized digital experience, enables consumers to better manage their health and wellness needs and healthcare professionals to better serve their patients and manage their practices.

Premier Content and Tools

Our content is designed to provide consumers and healthcare professionals with access to the most trusted health and wellness content tailored to meet their daily needs. Our proprietary content is created by experienced health and medical writers, editors, videographers, designers and product specialists who create original articles and columns, videos, slideshows and interactive graphics for use across our properties. To supplement our original content, we partner with leading health experts, such as Dr. Sanjay Gupta, and medical associations, such as the American Heart Association, to provide users with access to trusted and reliable content across the health spectrum. We also partner with leading health brands, where we license the exclusive digital rights to their proprietary content and develop digital properties that we monetize either through subscriptions or advertising models.

Our consumer-focused properties include online content, interactive tools and applications designed to allow consumers to manage a broad array of health and wellness needs on a daily basis. Everyday Health, our flagship brand, is a broad-based health information portal that provides consumers with trusted and actionable health information intended to empower users to better manage their health and wellness. Expert commentary is an important component of the consumer experience on Everyday Health. For example, Dr. Sanjay Gupta, chief medical correspondent for CNN and contributor to “60 Minutes,” contributes real-life perspectives and advice on health and condition news aimed at consumers on www.EverydayHealth.com. Between 2013 and 2015, visits to Everyday Health have increased approximately 21% on a compounded annual basis.

We operate the digital properties for the What to Expect brand, the leading pregnancy and parenting media resource. Based on the best-selling pregnancy book, What to Expect When You’re Expecting, by author Heidi Murkoff, the What to Expect website and mobile applications contain content written by Ms. Murkoff on conception planning and pregnancy, as well as information on newborns and toddlers. We generated approximately three million registrations for our What to Expect properties in 2015, two million of which were pregnant women in the U.S., representing approximately half of the total number of U.S. births in 2015. More than 80% of What to Expect’s usage comes from mobile devices and the What to Expect mobile application is one of the top-ranked, customer-rated and downloaded applications on iOS (including iPhone, iPad and Apple Watch) and Android. Our licensing agreement for the digital rights to the What to Expect brand continues through 2024.

We also operate the Mayo Clinic Diet digital program, a subscription-based plan for weight loss, and ultimately better health, developed by the weight loss experts at Mayo Clinic. Based on the bestselling book by the same name, the Mayo Clinic Diet digital program provides a step-by-step program to jump-start quick weight loss, achieve a goal weight and maintain it for life.

As our growth strategy has evolved to focus primarily on proprietary content and providing marketing and communications solutions to our expanding customer base, we have placed less emphasis on operating consumer subscription properties. For example, our digital licensing agreement with South Beach Diet recently expired and our digital licensing agreement with Jillian Michaels will expire in the second quarter of 2016.

5

The table below outlines the key content offerings we provide consumers:

| Content Offering | Description | |

| Everyday Health/Healthy Living Content | Original daily and weekly content, which is medically reviewed where appropriate, that offers information, advice and inspiration for those seeking to live healthier lives or who face medical challenges. Content includes relevant, consumer-focused coverage of research published in peer-reviewed medical journals or presented at major medical conferences. | |

| Health Condition and Drug Encyclopedia | Wellness and prevention information and advice from leading fitness experts, as well as condition definitions, symptom lists, common treatments and drug information from healthcare authorities. | |

| Health News | Coverage of major public health, regulatory and consumer health stories designed to separate fact from fiction and offer actionable messages to health and condition audiences. | |

| Original Video | Health videos that focus on people living active, healthy lives, as well as those coping with chronic conditions. Programming that offers expert insight into emerging health trends and important research. | |

| Interactive Slideshows and Graphics | Original health content presented in high-impact graphical formats, including sequenced photo galleries where consumers may explore wellness trends, health conditions or medical news. | |

| Expert and Patient Perspective | Columns and Q&As by leading experts and patient advocates that provide explanation and perspective on condition and wellness topics, including heart disease, depression, psoriasis, multiple sclerosis and cancer, as well as nutrition, weight loss, fitness and longevity. | |

| Health Assessments | Quizzes and algorithmic-based intake exams designed to help users assess their risk of developing particular conditions, or the likelihood that they need to seek health care for particular symptoms. | |

| Community | Forums where consumers can share health goals and experiences. | |

| Healthy Recipes | Thousands of recipes across a variety of categories, including low fat, diabetes friendly, low carb, low calorie, low sodium and gluten free. |

For healthcare professionals, we provide premier digital content that enables healthcare professionals to stay abreast of clinical, industry, legislative and regulatory developments across all major medical specialties. Our flagship professional property, MedPage Today, includes a dedicated team of 30 journalists, including editors, reporters and videographers, and provides relevant clinical news based on research findings published in peer-reviewed medical journals as well as research reported at numerous medical conferences around the world. MedPage Today delivers breaking medical news in 34 medical specialties and major public policy developments at the state and federal levels seven days a week. MedPage Today coordinates with approximately 4,000 leading researchers and clinicians, as well as more than 300 academic medical centers, to aid in gathering in-depth information for articles. MedPage Today’s excellence has been recognized with awards from the American Society of Healthcare Business Editors, the National Institute for Healthcare Management, the eHealthcare Leadership Awards, the Medical Marketing and Media Awards, and the Web Health Awards. Additionally, MedPage Today was named as a finalist for the Jesse M. Neal Awards and the Gerald M. Loeb Award.

During 2015, more than 300 million customized e-newsletters and alerts were sent to our audience of more than 700,000 U.S. physicians. In 2015, we issued more than 380,000 certificates to users who earned CME credit by reading MedPage Today articles. We have designed our content offerings to be utilized by healthcare professionals at the point-of-care. Approximately 68% of the visits to MedPage Today occurred during the practice hours of 8 a.m. through 6 p.m.

The table below outlines the key content offerings we provide healthcare professionals:

| Content Offering | Description | |

| Breaking Medical News | Breaking medical news covering 34 specialties and major public policy developments at the state and federal levels seven days a week. Clinical content is reviewed and approved by a team of physicians under the direction of our chief medical reviewer. | |

| Conference Coverage | Relevant clinical news based on research reported at numerous medical conferences around the world, producing approximately 5,500 articles and 800 videos in 2015. | |

| Point-of-Care | Critical practice information at the point-of-care, including comprehensive reference information and regulatory alerts and announcements. | |

| Continuing Medical Education | Physicians and other healthcare professionals can receive CME credits to support their professional development at no cost through more than 3,000 CME-accredited news articles certified through Projects in Knowledge, as well as by participating in educational activities hosted by MedPage Today and our academic partners. | |

| Expert Commentary | Commentary and opinion pieces from leading physicians, government officials and policy experts, including Dr. Sanjay Gupta, Kevin Pho, MD, Tim Johnson, MD, and David Nash, MD. | |

| Interactive Tools | Healthcare professionals can gauge colleagues’ opinions by participating in a weekly survey linked to major news stories or evidence-based diagnostic quizzes. |

Personalized Experiences

Our sophisticated data and analytics technology and expertise allow us to personalize the content experience for our consumers and healthcare professionals. The data we gather from each incremental engagement with our properties by a user, whether or not registered, enhances our ability to personalize content we deliver to our users. We believe our data-driven approach to delivering a more personalized user experience is a key differentiator between us and our competitors.

6

Since our inception, more than 70 million consumers have registered with us and voluntarily provided us with valuable data, including demographic information and health-related interests. We have separately developed millions of anonymous health consumer profiles that have been used to personalize content for our unregistered consumers. We utilize this information, as well as proprietary predictive modeling, to provide consumers with highly-customized content and tailored programs linked to the individual’s health profile and to connect users looking for support or to engage others that are facing similar health issues. Providing personalized content and experiences across the health spectrum – whether it is for someone coping with a serious disease, managing a chronic condition or seeking to achieve their diet or fitness goals – leads to better health outcomes for consumers and creates a highly-engaged and loyal audience that will rely on our content and tools to manage future health concerns. In 2015, consumers spent over one million hours in our online patient education centers that focus on specific health conditions. During 2015, we also distributed over 200 million opt-in newsletters per month with content specifically tailored to the consumers’ individual health interests.

We also offer a variety of tools and applications that address specific consumer needs, including weight loss, exercise, pregnancy, diet and nutrition and managing medical conditions such as diabetes. For example, consumers can create personalized pregnancy calendars, calorie counters, meal plans and drug alerts. During 2015, approximately 1.7 million consumers utilized our various diet and fitness tools, including our My Calorie Counter property, which provides a suite of calorie and nutrition tools that provide consumers with the ability to easily track food and nutrient intake and calorie burn based on a large database of commonly consumed foods. During 2015, more than two million consumers used the What to Expect mobile application for a customized pregnancy calendar and management tool.

The table below outlines our key tools for consumers that provide customized programs or tailored advice:

| Content Offering | Description | |

| The Symptom Checker | Symptom triage tool featuring a board certified emergency room physician who through a series of recorded video segments questions users about their medical history and symptoms and provides care recommendations and action plans. | |

| The Pregnancy Tracker | Health tool that provides day-by-day and week-by-week information on fetal development and changes to the woman’s body as the pregnancy progresses. | |

| Due Date Calculator | Newly-pregnant women can calculate their expected due date based on the information provided. The tool directs users to personalized What to Expect content and services based on the due date. | |

| Tests and Screenings | This in-app tool empowers moms-to-be with a forward-looking view of key medical tests and screenings during pregnancy. This tool includes timely notifications and trusted, expert content about when each test occurs, what can be expected at each test appointment, and the importance of each test to her and her baby’s health. | |

| My Calorie Counter | www.My-Calorie-Counter.com and the related mobile application contain a suite of calorie and nutrition tools that provide consumers with the ability to easily track food and nutrient intake and calorie burn based on a large database of commonly consumed foods. | |

| BMI Calculator | The body mass index (BMI) is a quick and easy way for a user to see if his or her weight is within the normal or average range for his or her height. | |

| Diabetes in Check | This type-2 diabetes management mobile application features a wide range of tools, including diabetes coaching designed by a certified diabetes educator, trackers for blood glucose and medication, reminders, and tools for healthy eating, such as a food tracker with a barcode scanner and a recipe database. | |

| The Meal Planner | Health tool that produces healthy menu recommendations, including nutrient and calorie information, based on user food preferences and dietary restrictions. |

We also provide a highly-personalized experience for healthcare professionals. Healthcare professionals can select specific content areas they are interested in, whether focused on medical or surgical specialties or practice management issues. We offer in-depth content for 34 different medical specialties and numerous conferences around the world, including emails linked to specific practice areas and a healthcare professional’s prior engagement with our content. Healthcare professionals also have the opportunity to participate in market research focused on their area of expertise, earn CME credits and enable physicians to request online samples to be used in their medical practice. Furthermore, healthcare professionals may connect with colleagues in various formats, including peer-to-peer interviews and roundtables. As with our consumers, we believe that our focus on personalization has been critical in fostering a highly engaged audience of healthcare professionals.

Multi-Platform Approach

We design our health content for consumers and healthcare professionals to be accessible anytime and anywhere and to be distributed across multiple platforms, especially mobile. During 2015, our mobile traffic accounted for approximately 75% of our total traffic to operated properties. In addition, we currently offer 16 mobile applications, which have generated more than 21 million downloads.

We offer 14 consumer mobile applications that are available for use on the iPhone, iPad, Android and Android Tablet. Our consumer mobile applications provide a broad array of features, including customized exercise programs, tailored meal recommendations, video tutorials and tools to track daily performance against goals, which enable our consumers to manage their health and wellness needs throughout the day. In addition, we actively utilize video, online communities and social media channels to engage our consumers in new ways and to promote our content more broadly. Our vibrant digital communities are designed for users to engage directly with each other on specific health conditions or health journeys such as pregnancy. For example, during 2015, our users posted a message to our community forums on our What to Expect property every three seconds on average.

Healthcare professionals can also access our high-quality content through various platforms. Our MedPage Today mobile application, which is available for both Apple and Android platforms, includes breaking medical news, comprehensive reference information and regulatory alerts and announcements. We also distribute our content through partnerships with premier medical associations, including the American College of Cardiology, the American Society of Clinical Oncology, the American Association of Clinical Endocrinologists, the American Medical Students Association, and the American College of Rheumatology. We syndicate our content to numerous hospitals across the U.S. These affiliations and syndication arrangements have contributed to the significant growth in our audience and engagement with our content. MedPage Today’s reach among U.S. physicians has increased from approximately 600,000 in 2014 to more than 700,000 in 2015. Between 2013 and 2015, visits by healthcare professionals to MedPage Today increased approximately 17% on a compounded annual basis.

7

Solutions for Customers

We believe the combination of our premier content, large user base and data and technology expertise provides a unique platform for a wide range of health-focused entities to fulfill their key strategic marketing and communications needs by effectively engaging with their target audience. We have built deep relationships with many leading pharmaceutical, over-the-counter, retail, food and lifestyle marketers, as well as health payers and providers, that view us as a strategic and trusted partner for complex digital initiatives that target specific population sets with customized engagement solutions. For example, during 2015, our customers included five of the top ten global advertisers in 2014, as compiled by Advertising Age, and 24 of the top 25 global pharmaceutical companies ranked by 2014 revenue. We also service more than 350 hospitals across 30 states, including six of the top ten largest health systems in the U.S. Our customers are all focused on the following four elements when implementing their marketing and communications campaigns:

| · | identifying their target audience; |

| · | efficiently and effectively reaching this target audience; |

| · | engaging this target audience to achieve a specific marketing and/or communications objective; and |

| · | measuring the performance of their marketing and/or communications initiatives. |

Our premier content has generated a large and highly-engaged audience across the health spectrum. We have collected a large amount of data about our audience over the years from a variety of sources. Since inception, more than 70 million consumers have registered with us, voluntarily providing us with important demographic information and data relating to specific health interests and conditions. Our registration information is supplemented with data aggregated from millions of anonymous health consumer profiles we have built since our inception, data collected from our users’ interactions with one or more of our properties and with other websites through the use of cookies and similar tracking technologies, and data obtained from third-party sources.

This database of information about our audience has allowed us to create customized offerings that enable our customers to effectively target their desired audience through highly immersive interactive and multi-platform campaigns. Our solutions include, among others:

| · | traditional media solutions, such as banner advertisements and e-mail newsletters; |

| · | interactive brand sponsorships, which consist of sponsored custom-created marketing programs; |

| · | customer acquisition, or lead generation, campaigns designed to deliver qualified users through the registration process; and |

| · | a SaaS-based platform for hospital systems to engage with consumers and healthcare professionals. |

Given the size and scope of our content and audience assets, marketers have significant flexibility to undertake multiple marketing and communications strategies through a single platform directed at specific geographic areas or niche demographic groups, health interests, issues or user communities. For example, for a pharmaceutical customer with a multiple sclerosis drug, we have implemented a multi-faceted campaign to deliver highly-targeted and engaging messaging to their target audience. This campaign included, among other things: (i) utilizing interactive brand sponsorships promoting multiple sclerosis content across our properties; (ii) targeting the relevant audience across television and digital video assets; and (iii) using our database to target their desired audience beyond our properties and across the web.

In addition to offering a wide range of solutions for our diverse customer base, we also utilize a variety of revenue models with our customers, depending on the specific needs and profile of the customer. For example, we may price our services on (i) a fixed fee basis; (ii) a cost-per-impression (CPM) or cost-per-visitor (CPV) basis; (iii) the return-on-investment (ROI) we deliver from a specific campaign; or (iv) a SaaS licensing fee. An increasing number of our marketing programs provide for revenues to us based entirely upon the ROI we deliver for our customers, such as the increase in prescription activity for a pharmaceutical product.

Pharmaceutical companies represent our largest customer segment. Our acquisitions of DoctorDirectory in November 2014 and Cambridge BioMarketing in March 2015 have significantly expanded our revenue opportunity and the range of services we can provide to these pharmaceutical customers. The DoctorDirectory acquisition enhanced our ability to offer innovative multi-platform solutions that target healthcare professionals not being covered by a pharmaceutical sales representative, while the Cambridge BioMarketing acquisition enhanced our strategic launch and marketing solutions for pharmaceutical brands focused on orphan and rare diseases. As a result, we are now able to offer solutions to our pharmaceutical customers across their product portfolio, whether orphan, specialty or mass-market, and across the product lifecycle, whether pre-launch, during the patent exclusivity period or post-patent exclusivity.

An important area of focus for us is providing solutions for orphan and rare diseases. The orphan and rare disease market is estimated to grow from $90 billion in 2013 to $176 billion by 2020, accounting for approximately 19% of all branded-drug sales by 2020, up from approximately 9% in 2006. Approximately 47% of the new molecule drug approvals by the FDA in 2015 were for orphan or rare diseases. Through Cambridge BioMarketing, we are able to provide pharmaceutical brands focused on orphan and rare diseases with a compelling marketing solution from pre-launch to launch to post-launch. Our solution includes preparing the brand’s internal communications and global marketing tools, increasing market awareness of the disease and patient identification, advising the brand on critical launch issues, navigating the FDA approval process, launching the product on a global scale, and conducting post-launch audience outreach to patients and healthcare professionals to support continued brand growth.

Another important area of focus for us is leveraging our content, audience and data assets to provide solutions for health insurers and hospital systems that are increasingly seeking to engage directly with consumers and healthcare professionals with targeted marketing campaigns. By virtue of our acquisition of Tea Leaves in August 2015, our core offering for hospital facilities and systems is a SaaS-based marketing and analytics platform used to reach and engage both consumers and physicians. Our platform enables a hospital to better drive its growth strategy and generate profitable revenue by identifying high value customers and engaging in segmented and targeted marketing campaigns using proprietary and third-party data, such as payer distribution, medical history, health claims data, purchase history and behavioral data. Hospital systems can use our sophisticated software platform to recruit new patients and physicians, retain existing patients and physicians, influence where physicians refer their patients and control costs.

Our health insurance clients can leverage our platform to recruit consumers and better manage medical conditions and daily health across areas such as nutrition, stress, physical activity and weight loss. Our core offering for health payers is our Maternity Outcomes Management (MOM) program, which leverages our What to Expect property and connects pregnant women with their insurance carrier’s risk management programs earlier in their pregnancies, which allows payers to identify risk factors earlier and introduce meaningful interventions, if necessary, so as to ensure safer and healthier pregnancies. According to the Centers for Disease Control and Prevention, pregnancy complications represent a $26 billion annual cost burden to the U.S. healthcare system.

8

We supplement the information we collect about our audience by partnering with third parties to expand our reach and increase the diversity of our audience. For example, through our relationship with the Mayo Clinic, we manage and sell advertising opportunities on MayoClinic.org. Additionally, we utilize our data expertise, including our advertising buying platform, to enable marketers to efficiently reach our audience and their look-alikes on third-party websites, mobile devices, social channels and video outlets and more effectively optimize their marketing spend.

We believe a key differentiator of our business is our ability to use our extensive data assets to provide customers across our customer base with more significant and measurable ROI relative to offline and other digital channels. Our proprietary technology (i) optimizes the relevancy of marketing campaigns placed across our properties and outside of our properties to deliver marketing messages that users are most likely to engage with and (ii) tracks and measures the effectiveness of our customers’ marketing campaigns. For example, we are able to attribute revenue to specific marketing spend, gain visibility into the lifetime performance of users and ultimately assess and improve a campaign’s ROI. Our technology allows us to adjust the campaign in real-time to improve its efficacy. Furthermore, we provide our customers with detailed post-campaign reporting that allows them to measure and evaluate the effectiveness of their campaigns.

Many of our large marketing and engagement campaigns also include specific ROI goals which we are able to effectively measure due to our large opt-in registration database. By partnering with industry-leading data companies, such as IMS and Crossix, that anonymously match a user’s online campaign exposure to their offline purchase decisions, we can further provide a demonstrable and third-party verified ROI measurement that reflects sales impact. As noted above, we also conduct certain marketing campaigns that provide for revenues to us based entirely upon the ROI we deliver for our customers, such as the increase in prescription activity for a pharmaceutical product. For example, we created an ROI-based marketing campaign for a pharmaceutical customer seeking deeper connections with a limited number of high-value medical specialists who wrote the majority of the prescriptions for their rheumatoid arthritis drug. We utilized an integrated suite of promotional tactics, including online advertising, e-mail and direct mail marketing services, which resulted in an increase of approximately 9% in prescriptions from the targeted physicians as compared to a control test group, generating more than $31 million in incremental revenue since the campaign launched in 2014. Likewise, our platform for hospital clients can incorporate the hospital’s internal data, including medical and financial records, allowing us to effectively measure the specific ROI for marketing campaigns that we implement on the hospital’s behalf.

We sell our marketing and communications solutions primarily through our direct sales force. As a result of the growth in our business and the diversification of our solutions for customers, our sales personnel now specialize in selling distinct product sets. Specifically, we have dedicated sales personnel selling solutions that target consumers and a distinct sales group for solutions targeting healthcare professionals, as well as a third group selling our SaaS and media solutions targeting hospital systems and health insurance companies. Our sales representatives, consisting of more than 100 employees, are located in New York City, Asheville, North Carolina, Cambridge, Massachusetts, Chicago, Illinois and other areas throughout the U.S.

Technology

Our technology infrastructure provides for continuous availability of our content offerings and customer solutions. Currently, our websites are hosted on infrastructure located in a third-party data center located in Carlstadt, New Jersey with a back-up data center located in Scottsdale, Arizona. The infrastructure of our Tea Leaves software platform for hospital systems is currently located in Atlanta, Georgia and will be moved to Alpharetta, Georgia in 2016. Our operations are dependent in part on our ability, and the ability of our hosting providers, to maintain our computer and telecommunications systems in effective working order and to protect our systems against damage from fire, theft, natural disaster, power loss, telecommunications failure, hacker attacks, computer viruses and other events beyond our control. We back up our data using a combination of a secondary data center, electronic vaulting and tape storage to offsite storage facilities on a daily basis. We also operate intrusion detection systems and perform regular log reviews for malicious activity. We operate our database in a multi-node platform using a technology designed to support large data sets and transaction volumes. Our technology allows us to aggregate, store and process large amounts of data while maintaining high application availability and responsiveness.

Our systems are designed to have no single point of failure, other than the data center itself, and have redundancy at the network, power, firewall, load balancer, application server, database and storage levels. We maintain operational flexibility, which allows us to allocate resources to or from applications based on demand. We continually add and refine functionality for our properties, ensuring that each modification is carefully tested and deployed before being moved into production by following a strict change management process. We have access to bandwidth on demand and additional physical capacity in each of our data centers to react to increased volume on our websites. We monitor systems continuously using automated tools and services. Emergency response teams provide full time coverage to respond to any issues affecting user functionality or performance.

We employ several layers of security, including encryption, secure transmission protocols and strict access controls, to ensure privacy, integrity and availability of our data. We utilize additional levels of security for e-commerce transactions, specifically when credit-card processing is required, including background checks of relevant employees and regular third-party security scans.

The key components of our software have primarily been designed, developed and deployed by our internal technology group. However, we also license database management software, outsource video delivery for our properties and otherwise use external sources for technological purposes when appropriate. We select external technology partners according to stability, reputation, performance and proven service levels.

Competition

We face competition for consumers, healthcare professionals and customers from a variety of online and offline companies, government agencies and other organizations that provide content, tools and applications to consumers and healthcare professionals interested in health-related information. Our ability to compete successfully against these entities depends on many factors, including:

| · | the brand recognition of Everyday Health and our other properties; |

| · | the quality, timeliness and reliability of our offerings; |

| · | the effectiveness of our sales and marketing efforts; and |

| · | our ability to keep pace with technological advances and trends. |

We face competition from the following:

| · | websites, mobile applications and other products and services that provide online consumer health and wellness information, such as www.webmd.com, or information directed at healthcare professionals, such as www.medscape.com (owned by WebMD); |

| · | general interest consumer websites or search engines that offer specialized health sub-channels or functions, such as www.yahoo.com and www.google.com, and other high-traffic websites that include both health-related and non-health-related content and services, including social media websites, such as www.facebook.com; |

| · | non-profit and governmental websites that provide consumer health information, such as www.fda.gov, www.cdc.gov and www.health.nih.gov; |

| · | advertising agencies that market digital products and services directly to customers; |

9

| · | software solutions for hospital systems to engage with consumers and/or healthcare professionals, such as Advisory Board Company and eVariant; and |

| · | advertising technology companies that aggregate traffic from multiple online websites or directly target health-related consumers. |

We also face competition from a number of companies that provide consumer and professional health-oriented content through traditional offline media. These competitors include magazine and book publishers, medical content publishers and distributors of television and video programming.

Intellectual Property

We currently own approximately 60 registered trademarks around the world, including Everyday Health and MedPage Today. In addition, we own two U.S. patents. Our success depends upon our ability to protect our core technology and intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including trade secrets, trademarks, copyrights and patents, as well as contractual restrictions. We enter into confidentiality and proprietary rights agreements with our employees, consultants and business partners, and we control access to and distribution of our proprietary information. In addition, we have registered various domain names, including www.EverydayHealth.com, www.MedPageToday.com and www.TeaLeavesHealth.com, which are critical to the operation of our business and our properties. However, not all of our intellectual property is protected by registered copyrights or other registered intellectual property or statutory rights. For example, some of our content is protected by user agreements that limit access to and use of such content.

In addition to the technology and intellectual property that we own, we also license key health-related content and tools from third parties that we distribute on the properties that we operate. We also license data, software and technology products that are important to our ability to manage and deliver content and market and sell our products and services.

Our ability to operate some of our properties is governed by licensing agreements with the owners of the offline brands and associated content, including Heidi Murkoff, author of the best-selling book What to Expect When You’re Expecting. These licensing agreements provide us with the exclusive rights, subject to limited exceptions, to use and market the brand and associated content online, as well as to determine the precise methods for monetizing the content online. In exchange for these rights, our partners receive specified royalties based on the revenues generated from our operation of the applicable website and related services, such as e-mail newsletters and product sales. We may also create new content in conjunction with these partners. However, pursuant to our agreements with these partners, we may not own the intellectual property rights to this new content or any related user-generated content.

Industry Standards and Government Regulation

This section describes the key laws, regulations and industry standards that affect our business. Some of the aspects described below, such as those surrounding consumer protection, affect us directly. Other aspects do not apply to us directly, but may have a significant effect on the way our partners and customers can operate.

Consumer Protection

Our business is subject to federal and state consumer protection laws that regulate unfair and deceptive practices. The laws that most directly affect our business are those related to the use and protection of consumer information and those related to advertising and marketing.

Privacy

Our collection, storage and sharing of information regarding consumers, including visitors to our properties, is governed by various U.S. federal and state laws, regulations and standards. Enforcement by regulators, including the Federal Trade Commission, or the FTC, requires us to provide consumers with notice, choice, security and access with respect to such information.

Behavioral Advertising

New laws and regulations may be adopted in the U.S. and internationally, or existing laws and regulations may be interpreted in new ways that would affect our business, particularly with regard to collection or use of data to target advertisements to consumers. A number of U.S. states have proposed bills that contain provisions that would regulate how companies can use cookies and other tracking technologies to collect and use information about individuals and their behaviors.

We participate in the Digital Advertising Alliance, or DAA, self-regulatory program under which we provide consumers with notice about our use of cookies and our collection and use of data in connection with the delivery of targeted advertising. In July 2015, the World Wide Web Consortium published tentative standards for developing a “Do Not Track” program to allow users to opt-out of having companies collect information about their online actions. In addition, the DAA and The National Telecommunication and Information Association have developed principles and guidelines for providing users disclosures regarding the use of consumer data on mobile platforms.

Consumers can currently opt out of the placement or use of our cookies for online targeted advertising purposes by either deleting or disabling cookies on their browsers, visiting websites that allow consumers to place an opt-out cookie on their browsers, or by downloading browser plug-ins and other tools that can be set to identify cookies and other tracking technologies and/or block the delivery of online advertisements on websites and applications. In addition, the default settings of consumer devices and software, including web browsers, may be set to prevent the placement of cookies unless the consumer actively elects to allow them.

10

Data Protection Regulation

Many states have passed laws regulating the actions that a business must take if it experiences a data breach. Compromised companies must promptly disclose breaches to customers. Congress has also contemplated similar federal legislation relating to data breaches and the Health Information for Economic and Clinical Health Act of 2009, or HITECH, requires breaches of certain unsecured, individually identifiable health information to be reported. In the past, the FTC has prosecuted some data breach cases as unfair and deceptive acts or practices under the Federal Trade Commission Act. We intend to continue to protect all consumer data and to comply with all applicable laws regarding the protection of customer data.

CAN-SPAM Act

The CAN-SPAM Act regulates commercial e-mails, provides a right on the part of the recipient to request the sender to stop sending messages, and establishes penalties for the sending of e-mail messages that are intended to deceive the recipient as to source or content. Recipients must be furnished with an electronic method of informing the sender of the recipient’s decision to not receive further commercial e-mails. We are applying the CAN-SPAM requirements to our e-mail communications, and believe that our practices comply with the requirements of the CAN-SPAM Act. In addition, actions could be brought against us under various state spam laws, which are not entirely preempted by CAN-SPAM.

COPPA

The Children’s Online Privacy Protection Act, or COPPA, applies to operators of commercial websites and online services, including mobile applications, directed to U.S. children under the age of 13 that collect personal information from children, and to operators of general audience websites with actual knowledge that they are collecting information from U.S. children under the age of 13. In April 2013, the FTC updated its COPPA regulations to specify that the law applies to using cookies for behavioral targeting, device IDs, location data, video and photos for children under 13. Our websites and mobile applications are not directed at children under the age of 13. We believe that we are in compliance with COPPA.

Marketing

The marketing of our services and some of the marketing services we provide to our customers are subject to federal and state consumer protection laws that regulate unfair and deceptive practices. For example, in October 2009, the FTC published Guides Concerning the Use of Endorsements and Testimonials in Advertising and the FTC provided further guidance on the use of endorsements in June 2015. The FTC has indicated that “material connections,” such as payments or free products, between advertisers and endorsers, such as celebrities and bloggers, must be disclosed. In addition, advertisements that feature a consumer and convey his or her experience with a product or service as typical when that is not the case are required to clearly disclose the results that consumers can generally expect to receive from the advertised product or service. In March 2013, the FTC released updated guidance for mobile and online advertisers, known as the Dot Com Disclosures, to explain how to make required disclosures clear and conspicuous in online and mobile advertising to avoid deception. In December 2015, the FTC issued an Enforcement Policy Statement on Deceptively Formatted Advertisement that addressed how disclosures should be made for certain native advertising and sponsored content.

Regulation of Contests and Sweepstakes

In order to promote our properties and advertisers, we conduct contests and sweepstakes. Many states have prize, gift or sweepstakes statutes that apply to these promotions. We strive to comply with all applicable laws and regulations when we run these promotions.

Healthcare-Related Regulation

Regulation of Drug and Medical Device Advertising and Promotion

Information on our properties that promotes the use of pharmaceutical products or medical devices is subject to U.S. Food and Drug Administration, or FDA, and FTC requirements, and information regarding other products and services is subject to FTC requirements. The Federal Food, Drug, and Cosmetic Act, or FDC Act, requires that prescription drugs, including biological products, be approved by the FDA prior to marketing. The FDA allows for exchange of scientific information prior to approval, provided it is non-promotional in nature and does not draw explicit or implied conclusions regarding the ultimate safety or effectiveness of the unapproved drug. Upon approval, prescription drugs may be promoted and advertised only for uses reviewed and approved by the FDA. In addition, the labeling and advertising can be neither false nor misleading, and must present all material information, including potential risks, in a clear, conspicuous and neutral manner. There are also requirements for specified information to be part of labeling and advertising. Labeling and advertising that violate these legal standards are subject to FDA enforcement action and the FDA may impose administrative, civil and criminal sanctions for violations of the FDC Act or FDA regulations. State attorneys general have similar investigative tools and sanctions available to them.

The FDA also regulates the safety, effectiveness, and labeling of over-the-counter, or OTC, drugs under the FDC Act either through specific product approvals or through regulations that define approved claims for specific categories of such products. The FTC regulates the advertising of OTC drugs under the section of the Federal Trade Commission Act that prohibits unfair or deceptive trade practices. The FDA and FTC regulatory framework requires that OTC drugs be labeled in accordance with FDA approvals or regulations and promoted in a manner that is truthful, adequately substantiated, and consistent with the labeled uses. OTC drugs that do not meet these requirements are subject to FDA or FTC enforcement action depending on the nature of the violation. In addition, state attorneys general may bring enforcement actions for alleged unfair or deceptive advertising.

11

Companies may now advertise prescription drugs to consumers in any medium, provided that they satisfy FDA requirements. However, legislators, physician groups and others have called for restrictions on advertising of prescription drugs to consumers and increased FDA enforcement. Congress and the FDA have shown interest in these issues, as well. In January 2014, the FDA issued draft guidance entitled Fulfilling Regulatory Requirements for Postmarketing Submissions of Interactive Promotional Media for Prescription Human and Animal Drugs and Biologics, which indicated pharmaceutical and medical device companies may be responsible for content on third-party websites over which the company has influence or control. Companies may also be responsible for content created by an employee or agent acting on the company’s behalf. The draft guidance counseled that companies should submit to the FDA listings for all websites for which the company is responsible or actively participates. In June 2014, the FDA released draft guidance entitled Correcting Independent Third-Party Misinformation About Prescription Drugs and Medical Devices, which outlined circumstances when companies may be responsible for correcting misinformation that was created or distributed by third parties. That same month, the FDA provided additional draft guidance entitled Internet/Social Media Platforms with Character Space Limitations—Presenting Risk and Benefit Information for Prescription Drugs and Medical Devices and Internet/Social Media Platforms, which stated promotions in social media channels must adhere to the same fair balance requirements applicable to traditional media.

Industry trade groups, such as the Pharmaceuticals Research and Manufacturers of America, or PhRMA, have implemented voluntary guidelines for DTC advertising in response to public concerns. The PhRMA Guiding Principles for Direct to Consumer Advertisement of Prescription Medicines address various aspects of DTC advertising, including: balancing presentation of benefits and risks; the timing of DTC campaigns, including allowing for a period for education of healthcare professionals prior to launching a branded DTC campaign; use of healthcare professionals and celebrities in DTC advertisements; and timing and placement of advertisements with adult-oriented content.

HIPAA Privacy Standards and Security Standards

The Privacy Standards and Security Standards under the Health Insurance Portability and Accountability Act of 1996, or HIPAA, establish a set of basic national privacy and security standards for the protection of certain individually identifiable health information by health plans, healthcare clearinghouses and healthcare providers, referred to as covered entities, and the business associates with whom such covered entities contract for services. HITECH makes certain of HIPAA’s privacy and security standards also directly applicable to covered entities’ business associates. As a result, business associates are now subject to significant civil and criminal penalties for failure to comply with applicable privacy and security rule requirements. HIPAA directly applies to covered entities such as Tea Leaves’ hospital clients. Since these clients disclose protected health information to Tea Leaves that it uses to provide certain services to them, Tea Leaves is a business associate of those clients. Moreover, HITECH creates a new requirement to report certain breaches of unsecured, individually identifiable health information and imposes penalties on entities that fail to do so. Additionally, certain states have adopted comparable privacy and security laws and regulations, some of which may be more stringent than HIPAA.

Licensed Professional Regulation

The practice of most healthcare professions requires licensing under applicable state law. In addition, the laws in some states prohibit business entities from practicing medicine. Similar state prohibitions may exist with respect to other licensed professions. We do not believe that we engage in the practice of medicine or any other licensed healthcare profession, and we have attempted to structure our websites, tools, partner relationships and other operations to avoid violating these state licensing and professional practice laws. We do not believe that we provide professional medical advice, diagnosis, treatment, or other advice that is tailored in such a way as to implicate state licensing or professional practice laws. We employ and contract with physicians, nutritionists and fitness instructors who provide only medical, nutrition and fitness information to consumers.

Anti-Kickback Laws

There are federal and state laws that govern patient referrals, physician financial relationships and inducements to healthcare providers and patients. The federal healthcare program’s anti-kickback law prohibits any person or entity from offering, paying, soliciting or receiving anything of value, directly or indirectly, for the referral of patients covered by Medicare, Medicaid and other federal healthcare programs. Many states also have similar anti-kickback laws that are not necessarily limited to items or services for which payment is made by a federal healthcare program. In 2002, the Office of the Inspector General of the U.S. Department of Health and Human Services, the federal government agency responsible for interpreting the federal anti-kickback law, issued an advisory opinion that concluded that the sale of advertising and sponsorships to healthcare providers and vendors by web-based information services implicates the federal anti-kickback law. However, the advisory opinion suggests that enforcement action will not result if the fees paid represent fair market value for the advertising or sponsorship arrangements, the fees do not vary based on the volume or value of business generated by the advertising, and the advertising and sponsorship relationships are clearly identified as such to users. We carefully review our practices to ensure that we comply with all applicable laws.

Employees

As of December 31, 2015, we had approximately 700 employees. None of our employees is represented by a labor union or is subject to a collective bargaining agreement. We have not experienced an employment-related work stoppage and consider relations with our employees to be good.

Information about Segment and Geographic Revenue

Information about segment and geographic revenue is set forth in Note 2 of the notes to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

Corporate History

We were incorporated in Delaware in January 2002 as Agora Media Inc. We changed our name to Waterfront Media Inc. in January 2004. In January 2010, to better align our corporate identity with the Everyday Health brand, we changed our name to Everyday Health, Inc.

12

Our principal executive office is located at 345 Hudson Street, 16th Floor, New York, NY 10014, and our telephone number is (646) 728-9500.

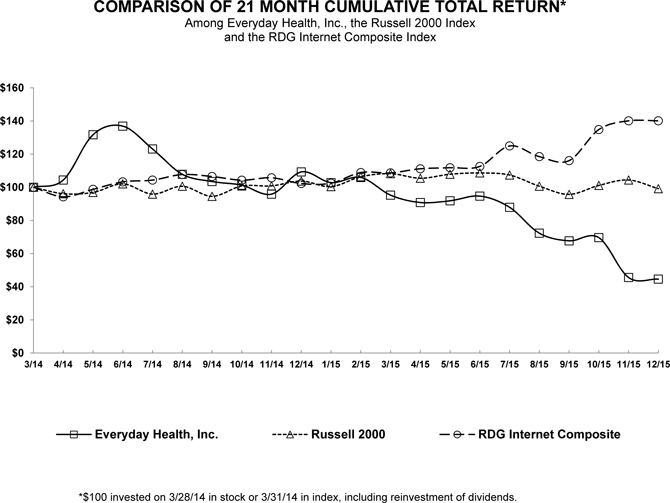

We completed our initial public offering in March 2014 and our common stock is listed on the New York Stock Exchange under the symbol “EVDY.”

The names Everyday Health, MedPage Today, Tea Leaves Health, Cambridge BioMarketing and DoctorDirectory and our logos are trademarks, service marks or trade names owned by us. All other trademarks, service marks or trade names appearing in this Annual Report on Form 10-K are owned by their respective holders.

Available Information

Our website is located at www.EverydayHealth.com, and our investor relations website is located at http://ir.everydayhealth.com/. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available, free of charge, on our investor relations website as soon as reasonably practicable after we file such material electronically with or furnish it to the Securities and Exchange Commission, or the SEC. The SEC also maintains a website that contains our SEC filings. The address of the website is www.sec.gov. Further, a copy of this Annual Report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The information on, or that can be accessed through, any Everyday Health property is not incorporated by reference into this Annual Report on Form 10-K and inclusion of the website addresses of our properties in this Annual Report on Form 10-K are inactive textual references only.

13

You should carefully consider the following risk factors, in addition to the other information contained in this Annual Report on Form 10-K and the information incorporated by reference herein. If any of the events described in the following risk factors occurs, our business, operating results and financial condition could be seriously harmed.

This Annual Report on Form 10-K also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of factors that are described below and elsewhere in this Annual Report on Form 10-K.

Risks Related to Our Business

We have incurred significant losses since our inception and expect to incur losses in the future.

We have accumulated significant losses since our inception. As of December 31, 2015, our accumulated deficit was $130.7 million. We expect to continue to incur significant operating expenses and, as a result, we will need to generate significant revenues to achieve or sustain profitability. We may not be able to achieve or sustain profitability on a quarterly or annual basis in the future.

If we are unable to provide content and services that attract users to Everyday Health properties on a consistent basis, our advertising and sponsorship revenues could be reduced.

Our users, including consumers and healthcare professionals, have numerous other online and offline sources of health and wellness related information and product offerings. Our ability to compete for user traffic depends upon our ability to provide compelling and trusted health and wellness content, tools, mobile applications and other services that meet the needs of a variety of types of users. Our ability to do so depends, in turn, on:

| · | our ability to develop innovative tools and mobile applications, as well as implement new and updated features and services for existing tools and applications; |

| · | our ability to hire and retain qualified authors, journalists and independent writers; |

| · | our ability to license quality content from third parties; and |

| · | our ability to monitor and respond to increases and decreases in user interest in specific topics. |

If users do not perceive our content, mobile applications and tools to be useful, reliable and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their visits to our properties. We cannot assure you that we will be able to continue to develop or acquire needed content, applications and tools at a reasonable cost or on a timely basis. The revenue opportunities generated from these efforts may fail to justify the amounts spent.

If we are unable to prove that our advertising and sponsorship solutions provide an attractive return on investment for our customers, our financial results could be harmed.

We derive a significant majority of our revenues from the sale of digital advertising and sponsorship solutions. Our ability to grow our advertising and sponsorship revenues will be dependent on our ability to demonstrate to marketers that their marketing campaigns with us provide a meaningful ROI relative to offline and other online opportunities. In fact, certain of our marketing campaigns are designed such that the revenues we receive are based entirely upon the ROI we deliver for our customers. We have invested significant resources in developing our research, analytics and campaign effectiveness capabilities and expect to continue to do so in the future. Our ability, however, to demonstrate the value of advertising and sponsorship on Everyday Health properties will depend, in part, on the sophistication of our analytics and measurement capabilities, the actions taken by our competitors to enhance their offerings, whether we meet the ROI expectations of our customers and a number of other factors. If we are unable to maintain sophisticated marketing and communications solutions that provide value to our customers or demonstrate our ability to provide value to our customers, our financial results will be harmed.

14

Our failure to attract and retain users in a cost-effective manner could compromise our ability to grow our revenues and become profitable.