Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - EMC CORP | exhibit311-certificationof.htm |

| EX-31.2 - EXHIBIT 31.2 CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER - EMC CORP | exhibit312-certificationof.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A | ||||

Amendment No. 1 | ||||

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-9853

EMC CORPORATION

(Exact name of registrant as specified in its charter)

Massachusetts | 04-2680009 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

176 South Street Hopkinton, Massachusetts | 01748 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (508) 435-1000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of voting stock held by non-affiliates of the registrant was $50,627,600,803 based upon the closing price on the New York Stock Exchange on the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2015).

The number of shares of the registrant’s Common Stock, par value $.01 per share, outstanding as of January 29, 2016 was 1,947,047,380.

DOCUMENTS INCORPORATED BY REFERENCE

Information required in response to Part III of Form 10-K (Items 10, 13 and 14) is hereby incorporated by reference to the specified portions of the registrant’s Proxy Statement for the 2016 Annual Meeting of Shareholders.

EXPLANATORY NOTE

This Amendment No. 1 (“Amendment”) to the Annual Report on Form 10-K of EMC Corporation (“EMC” or the “Company”) for the fiscal year ended December 31, 2015, as filed with the Securities and Exchange Commission (“SEC”) on February 25, 2016 (the “Original Form 10-K”), is being filed for the purpose of amending Items 11 and 12 of Part III. This information was previously omitted from the Original Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits such information to be incorporated in a Form 10-K by reference to a definitive proxy statement if such proxy statement is filed no later than 120 days after our fiscal year end.

As previously reported, on October 12, 2015, EMC and Denali Holding Inc. (“Denali”), the parent company of Dell Inc., signed a definitive agreement under which Denali will acquire EMC. In connection with the issuance of Class V Common Stock of Denali in the proposed transaction, Denali has filed with the SEC a Registration Statement on Form S-4 (File No. 333-208524) that includes a preliminary proxy statement/prospectus regarding the proposed transaction and EMC has filed a preliminary proxy statement on Schedule 14A in connection with a special meeting of its shareholders to seek shareholder approval of the proposed transaction. In connection with the proposed transaction, EMC is filing this Amendment to provide certain information regarding EMC required to be incorporated by reference into Denali’s registration statement. In accordance with General Instruction G(3) to Form 10-K, the remaining information required by Part III (Items 10, 13 and 14) of the Original Form 10-K will continue to be incorporated by reference to the specified portions of EMC’s Proxy Statement for the 2016 Annual Meeting of Shareholders, which will be filed prior to 120 days after EMC’s fiscal year end.

As required by the rules of the SEC, this Amendment sets forth an amended “Item 15. Exhibits and Financial Statement Schedules” in its entirety and includes the new certifications from the Company's chief executive officer and chief financial officer. Because no financial statements or financial information have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as otherwise stated herein, no other information contained in the Original Form 10-K has been updated by this Amendment. This Amendment should be read in conjunction with our periodic filings made with the SEC, subsequent to the date of the Original Form 10-K.

2

ITEM 11. | EXECUTIVE COMPENSATION |

Compensation Committee Interlocks and Insider Participation: None of the Leadership and Compensation Committee (the “Compensation Committee”) members has ever been an officer or employee of EMC. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has an executive officer serving as a member of our Board or Compensation Committee.

LEADERSHIP AND COMPENSATION COMMITTEE REPORT |

The Leadership and Compensation Committee of EMC has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Leadership and Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Amendment No. 1 to the Annual Report on Form 10-K for the year ended December 31, 2015 of EMC.

LEADERSHIP AND COMPENSATION COMMITTEE

Randolph L. Cowen, Chair

William D. Green

Paul Sagan

COMPENSATION DISCUSSION AND ANALYSIS |

Executive Summary |

Pay-for-Performance Philosophy |

In keeping with our results-driven culture, the Compensation Committee expects our executives to deliver superior performance in a sustained fashion. As a result, a substantial portion of our executives’ overall compensation is tied to Company performance, with a significant majority of compensation awarded in the form of equity. The Compensation Committee links compensation to the achievement of challenging short- and long-term strategic, operational and financial goals that will drive EMC to achieve profitable revenue growth and market share gains, while investing in the business to further expand the global market opportunity for our product, services and solutions portfolio. In designing our executive compensation program, the Compensation Committee focuses on promoting our business strategy and aligning the interests of our executives with those of EMC shareholders.

Business Strategy |

The evolution of the IT marketplace, accelerated by the adoption of mobile devices, cloud computing, Big Data and social networking, continues to have a profound impact on enterprises and the way people work and live. EMC’s strategy is to enable enterprises to modernize their client/server-based infrastructures and applications while helping them to build new infrastructures and applications that take advantage of next generation opportunities in the cloud/mobile era of computing.

EMC is executing this strategy through our federation business model, which includes the following businesses: EMC Information Infrastructure, VMware Virtual Infrastructure, Pivotal and Virtustream (the “federation”). Together, our businesses enable customers to achieve their digital enterprise aspirations through business and IT transformation via trusted hybrid cloud, modern application development, Big Data and cybersecurity solutions.

Under this model, our businesses are strategically aligned to provide benefits for customers and partners, while each independent business operates freely to build its own ecosystem. This offers customers the ability to choose from a selection of the very best technology solutions, free from vendor lock-in. We believe this model creates a competitive advantage by ensuring tight integration of solutions for customers who prefer an integrated solution, and at the same time by allowing us to provide the best-of-breed offerings on a standalone basis for customers who prefer maximum flexibility in vendor and deployment options.

3

EMC stands at the forefront of the IT industry with a leading portfolio of products, services and solutions that provide a strong position from which to compete in the client/server-based platform of IT, which will continue to support the majority of enterprise workloads for several years to come; leading-edge technologies and products for the new cloud/mobile platform of IT; and powerful capabilities to help enterprises bridge the two.

Pending Merger with Dell |

References to the “Merger” in this Compensation Discussion and Analysis refer to the proposed merger of Universal Acquisition Co., a subsidiary of Denali Holding Inc., with and into EMC in connection with the proposed transaction contemplated by that certain merger agreement among Denali Holding Inc., Dell Inc., Universal Acquisition Co., and EMC, as more fully described Denali Holding Inc.’s Registration Statement on Form S-4 (File No. 333-208524) that includes a preliminary proxy statement/prospectus regarding the proposed transaction. Completion of the Merger is conditioned on approval of EMC’s shareholders, receipt of certain governmental approvals and the satisfaction of other conditions. For more information on the pending Merger, please read the proxy statement/prospectus and any other documents relating to the transaction filed or to be filed with the SEC.

2015 Business Results |

In 2015, we achieved the following revenue, profit and free cash flow:

2015 ($) | |

Revenue | 24.70 billion |

Non-GAAP Earnings Per Share (“EPS”)* | 1.82 |

Free Cash Flow* | 3.92 billion |

* | A reconciliation of our GAAP to non-GAAP results can be found in Exhibit A to this Item 11. |

Please see “Management’s Discussion and Analysis” in the Original Form 10-K for a more detailed description of our fiscal year 2015 financial results.

2015 Executive Compensation Program |

The Compensation Committee approved an executive compensation program for 2015 that implemented our pay-for-performance philosophy.

The primary elements of our executive compensation program are base salary, cash bonuses and equity incentives. In designing the cash bonus and equity incentive plans, the Compensation Committee predominantly used consolidated financial metrics as performance goals to drive the successful execution of the federation strategy.

Below is a summary of the Named Executive Officers’ 2014 and 2015 compensation as set forth in the Summary Compensation Table:

Name | Year | Salary ($) | Cash Incentive Compensation ($) | Equity Awards ($) | All Other Compensation ($) | Total ($) |

Joseph M. Tucci | 2015 | 1,000,000 | 1,144,422 | 7,942,324 | 320,964 | 10,407,710 |

2014 | 1,000,000 | 1,307,021 | 8,415,112 | 481,186 | 11,203,318 | |

Zane C. Rowe | 2015 | 750,000 | 600,741 | 4,963,999 | 195,373 | 6,510,113 |

2014 | 167,308 | 174,686 | 6,000,019 | 54,350 | 6,696,362* | |

David I. Goulden | 2015 | 850,000 | 954,415 | 7,942,324 | 103,051 | 9,849,790 |

2014 | 850,000 | 1,075,513 | 8,415,112 | 190,632 | 10,531,257 | |

Jeremy Burton | 2015 | 800,000 | 665,940 | 6,964,012 | 86,626 | 8,516,578 |

2014 | 768,750 | 717,035 | 5,259,464 | 158,236 | 6,903,485 | |

Howard D. Elias | 2015 | 781,923 | 665,940 | 6,964,012 | 84,644 | 8,496,519 |

2014 | 750,000 | 746,183 | 5,259,464 | 178,839 | 6,934,486 | |

* | Also includes a $300,000 sign-on bonus that Mr. Rowe received in 2014. |

4

For more information, please see the Summary Compensation Table, and the accompanying compensation tables, beginning on page 21 of this Amendment.

2015 Cash Bonuses |

For the cash bonus plans, the Compensation Committee approved challenging revenue, profitability and cash flow goals, as well as qualitative goals to complete strategic and operational priorities, because they believe that solid performance in these areas leads to long-term shareholder value.

Based on EMC’s financial performance in 2015, the Named Executive Officers achieved approximately 91.9%, 94.7% and 91.1%, respectively, of the non-GAAP EPS, revenue and free cash flow targets established by the Compensation Committee for the 2015 Corporate Incentive Plan. In addition, the Named Executive Officers achieved between 71% and 86% of their respective strategic and operational priorities established by the Compensation Committee for the 2015 Executive Management By Objectives Plan (the “Executive MBO”).

Since our 2015 revenue, EPS and free cash flow results fell below the applicable plan targets and the Named Executive Officers failed to achieve all of their respective strategic and operational goals, the Named Executive Officers’ cash bonuses were paid at less than target, in the amounts set forth below:

Name | Corporate Incentive Plan | Executive MBO | ||

Target ($) | Actual ($) | Target ($) | Actual ($) | |

Joseph M. Tucci | 1,080,000 | 888,840 | 360,000 | 255,582 |

Zane C. Rowe | 562,500 | 462,938 | 187,500 | 137,803 |

David I. Goulden | 862,500 | 709,838 | 287,500 | 244,577 |

Jeremy Burton | 600,000 | 493,800 | 200,000 | 172,140 |

Howard D. Elias | 600,000 | 493,800 | 200,000 | 172,140 |

2015 Equity Incentive Awards |

For 2015, the Compensation Committee granted our Named Executive Officers a mix of performance stock unit awards and time-based stock unit awards, as described below. The number of performance-based and time-based stock unit awards granted to the Named Executive Officers is set forth below:

Name | February 2015 Performance Awards (#) | February 2015 Time-Based Awards (#) | July 2015 Time-Based Awards (#) |

Joseph M. Tucci | 176,212 | 117,475 | 0 |

Zane C. Rowe | 110,134 | 73,422 | 0 |

David I. Goulden | 176,212 | 117,475 | 0 |

Jeremy Burton | 110,134 | 73,422 | 74,963 |

Howard D. Elias | 110,134 | 73,422 | 74,963 |

Subject to accelerated vesting upon the earlier consummation of the Merger, these performance stock units will vest in 2018 only if the Company achieves specific three-year cumulative non-GAAP EPS, revenue and relative TSR metrics. We refer to these three-year performance awards as the “2015 LTIP stock units.”

In addition, recognizing that a very large portion of our executives’ compensation is at risk, the Compensation Committee granted our Named Executive Officers these time-based stock units to promote retention. Subject to accelerated vesting upon the earlier consummation of the Merger, the time-based stock units vest over a two- or three-year period, subject to the executive’s continued employment with EMC.

For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

5

2012 Long-Term Incentive Plan Awards |

In August 2012, the Compensation Committee granted three-year performance-based restricted stock units to select members of EMC’s senior management team. We refer to these grants as the “2012 LTIP stock units.”

Since the 2012 LTIP stock unit awards were incremental to the participating executives’ annual compensation, the Compensation Committee set a rigorous three-year cumulative revenue target of $79.2 billion for fiscal years 2013 through 2015, with a minimum threshold of $72.0 billion.

Our actual three-year cumulative revenue was $72.37 billion. In accordance with plan design, 62.6% of the 2012 LTIP stock units became eligible to vest in two equal installments, the first of which vested in February 2016. Subject to accelerated vesting upon the earlier consummation of the Merger, the second installment will vest in February 2017, subject to the executive’s continued employment. The remaining 37.4% of the 2012 LTIP stock units did not vest and were forfeited.

For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

Other Compensation Practices |

Highlights of our executive compensation program also include:

What We Do ü Pay-for-performance ü Require significant stock ownership by executives and directors ü Maintain “double trigger” change in control agreements ü Maintain a clawback policy applicable to all employees for cash and equity incentive compensation ü Compensation Committee oversees risks associated with compensation policies and practices ü Compensation Committee retains an independent compensation consultant ü CEO succession planning | What We Do Not Do û No hedging or pledging of Company stock û No excessive perquisites for executives û No pension or SERP benefits for executives û No discounted stock options û No option repricings without shareholder approval û No dividend equivalents paid unless equity awards vest û No excise tax gross-ups |

The Compensation Committee believes that the actions and policies described above clearly demonstrate the Company’s commitment to and consistent execution of an effective pay-for-performance executive compensation program.

Named Executive Officers |

The executive officers who appear in the Summary Compensation Table for 2015 are referred to collectively in this Amendment as the “Named Executive Officers,” and they are:

Name | Title |

Joseph M. Tucci | Chairman and Chief Executive Officer |

Zane C. Rowe | Former Executive Vice President and Chief Financial Officer |

David I. Goulden | Chief Executive Officer, EMC Information Infrastructure |

Jeremy Burton | President, Products and Marketing |

Howard D. Elias | President and Chief Operating Officer, Global Enterprise Services |

Mr. Rowe served as Chief Financial Officer of EMC until March 1, 2016, at which time he became Chief Financial Officer of VMware. Denis G. Cashman was appointed Chief Financial Officer of EMC, effective March 1, 2016.

6

EMC’s Executive Compensation Program |

The primary elements of EMC’s executive compensation program are base salary, cash bonuses and equity incentives.

When designing the executive compensation program, the Compensation Committee gives significant weight to cash bonuses and equity incentives, which reflects the Compensation Committee’s belief that a large portion of executive compensation should be performance-based. This compensation is performance-based since payment and/or vesting are tied to the achievement of individual and/or corporate performance goals. In addition, with respect to the equity awards, the value ultimately realized by the recipient fluctuates with the price of our common stock. The Compensation Committee believes that equity incentives are particularly significant because they drive the achievement of EMC’s long-term operational and strategic goals and align the executives’ interests with those of EMC shareholders, while the cash bonuses drive the achievement of shorter-term performance goals. In designing our cash bonus and equity incentive programs for 2015, the Compensation Committee predominantly used consolidated financial metrics as performance goals to drive the successful execution of the federation strategy.

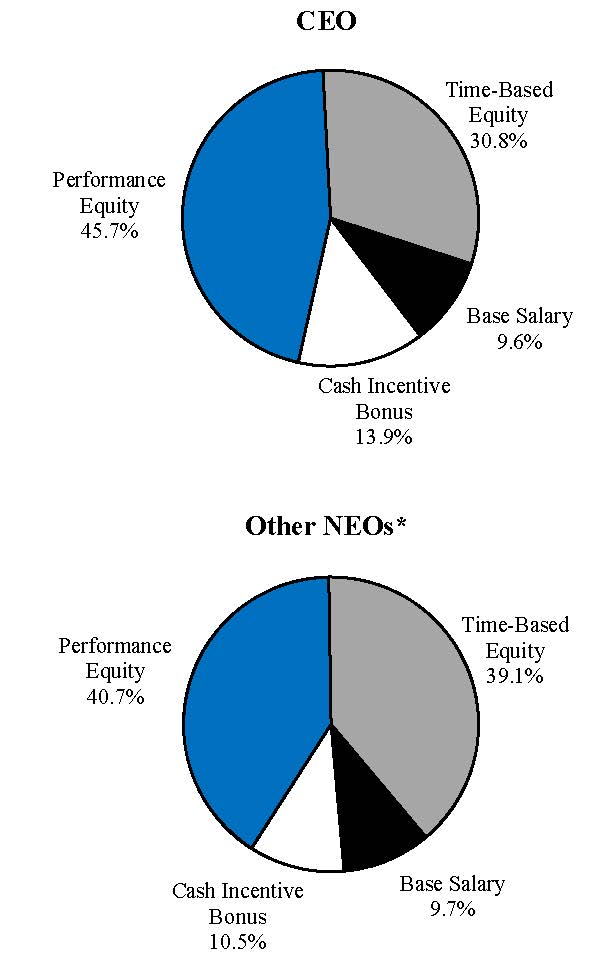

Set forth below is a summary of the relative weights given to each component of the 2015 compensation opportunities for Mr. Tucci and the other Named Executive Officers.

______________________

* | Reflects average compensation. |

For purposes of determining the percentages shown above for the annual compensation opportunities of the Named Executive Officers, the base salaries and cash bonus targets are calculated on an annualized basis. In addition, it is assumed that cash bonuses are earned at target levels and restricted stock units have a value equal to the underlying value of the stock on the date the grant was approved. Since incentive compensation has both upside opportunities and downside risk, these percentages may not reflect the actual amounts realized.

Base Salary |

We use base salary to compensate our employees, including the Named Executive Officers, for performing their day-to-day responsibilities. In general, the base salary of each of the Named Executive Officers is determined by evaluating the executive officer’s responsibilities, experience and impact on EMC’s results and the salaries paid to similarly situated executives

7

internally and externally. After consideration of the foregoing factors, Mr. Elias’ base salary was increased in May 2015. The Compensation Committee did not approve any other changes to the base salaries of our Named Executive Officers for 2015.

The Named Executive Officers’ 2015 annual base salaries are set forth below:

Name | 2015 ($) |

Joseph M. Tucci* | 1,000,000 |

Zane C. Rowe | 750,000 |

David I. Goulden | 850,000 |

Jeremy Burton | 800,000 |

Howard D. Elias** | 800,000 |

* | Mr. Tucci’s annual base salary has not increased since 2001. |

** | As described above, Mr. Elias’ annual base salary increased from $750,000 to $800,000 in May 2015. |

Cash Bonus Plans |

In 2015, more than 95% of our employees, including the Named Executive Officers, participated in our cash bonus plans under which the payment of bonuses is contingent upon the achievement of pre-determined performance goals. Our cash bonus plans are designed to motivate our employees to achieve specified corporate, business unit, individual, strategic, operational and financial performance goals.

Each year, the Compensation Committee approves each Named Executive Officer’s cash bonus opportunity. In determining the cash bonus opportunity, the Compensation Committee considers a number of factors, including EMC’s performance, the individual’s performance and the performance of the business unit or function for which the individual is responsible, the individual’s contribution to the execution of the federation strategy, the individual’s experience, similar compensation opportunities that may be payable to similarly situated executives internally and externally, changes in the competitive marketplace and the economy, and the other elements of compensation payable by EMC to the individual. After consideration of the foregoing factors, the Compensation Committee did not make any changes to the annual target cash bonus opportunities of our Named Executive Officers for 2015.

The Named Executive Officers’ 2015 total annual target cash bonus opportunities are set forth below:

Name | 2015 ($) |

Joseph M. Tucci* | 1,440,000 |

Zane C. Rowe | 750,000 |

David I. Goulden | 1,150,000 |

Jeremy Burton | 800,000 |

Howard D. Elias | 800,000 |

* | Mr. Tucci’s total annual target cash bonus opportunity has not increased since 2001. |

2015 Cash Bonus Plans |

For 2015, the Compensation Committee approved two cash bonus plans in which the Named Executive Officers were eligible to participate: the Corporate Incentive Plan and the Executive MBO. The Corporate Incentive Plan is intended to incent the achievement of financial metrics for the Company that are aligned with the annual operating plan set by the Board. The Executive MBO is intended to incent the achievement of strategic and operational goals.

The Compensation Committee determined that the vast majority (75%) of the cash bonus opportunity for the Named Executive Officers should be allocated to the Corporate Incentive Plan since they have responsibility for, and a significant impact on, EMC’s overall corporate performance and achievement of long-term objectives, and the remaining portion (25%) of their respective cash bonus opportunity should be allocated to the Executive MBO to focus on the achievement of specific strategic and operational goals.

8

2015 Corporate Incentive Plan |

The 2015 Corporate Incentive Plan is an annual incentive plan under which EMC executives, including our Named Executive Officers, were eligible to receive cash bonuses contingent upon EMC’s attainment of EPS, revenue and free cash flow targets, with 50% of the opportunity based on EPS, 30% based on revenue and 20% based on free cash flow. The Compensation Committee selected these financial metrics because in its judgment they represent the primary metrics on which the Named Executive Officers should focus to drive EMC’s strategic plan and shareholder value. EPS was given the greatest weighting under the 2015 Corporate Incentive Plan to emphasize profitable growth and because the Compensation Committee believes that increases in EPS will lead to greater long-term shareholder value. EPS and free cash flow are calculated on a non-GAAP basis. EMC’s management uses these non-GAAP financial measures in their financial and operating decision-making because management believes they reflect EMC’s ongoing business in a manner that allows meaningful period-to-period comparisons.

Plan participants were provided with the opportunity to earn up to 40% of their annual target bonus on the achievement of both EPS and revenue targets set by the Compensation Committee for the first half of 2015. The opportunity to receive a first-half payment was provided to incent strong revenue growth and profitability during the first half of the year. The plan design provided no payment for the free cash flow component for the first half of 2015 because the Compensation Committee determined that it would not be appropriate to assess whether a full year free cash flow target would be achieved after only six months given the large number of factors that could impact free cash flow in the second half of the year.

The 2015 Corporate Incentive Plan funds at 100% of target upon the achievement of the performance target for each of the three metrics. Although, generally, participants were not entitled to a bonus unless the performance threshold for each metric was achieved, the Compensation Committee had discretion under the plan to award up to 50% of the annual target opportunity for performance below that threshold. In addition, the plan provided that the Compensation Committee could exercise negative discretion to reduce payments. The maximum bonus opportunity under the plan was equal to 200% of a participant’s target bonus opportunity.

The elements of the 2015 Corporate Incentive Plan are set forth below:

Performance Goal | Threshold (50% Payout) ($) | Target (100% Payout) ($) | Maximum (200% Payout) ($) | Component Weighting | Achievement/ Plan Payout ($) |

Non-GAAP EPS* | 1.58 | 1.98 | 2.06 | 50% | 1.82/80.7% |

Revenue (billions) | 20.874 | 26.093 | 26.771 | 30% | 24.704/87.3% |

Non-GAAP free cash flow (billions)* | 3.440 | 4.300 | 4.474 | 20% | 3.917/78.7% |

* | For purposes of calculating achievement of the EPS target, amounts relating to stock-based compensation expense, intangible asset amortization, restructuring charges, acquisition and other related charges, a fair value adjustment on assets held for sale, VMware litigation and other contingencies, a VMware GSA settlement charge, special tax items and merger-related costs were excluded. For purposes of calculating achievement of the free cash flow target, free cash flow was defined as net cash provided by operating activities less additions to property, plant and equipment and capitalized software development costs. A reconciliation of our GAAP to non-GAAP results can be found in Exhibit A to this Item 11. |

We did not achieve 100% of the EPS, revenue or free cash flow targets under the 2015 Corporate Incentive Plan, and each participant’s bonus was paid at only 82.3% of target. The annual target bonus opportunities and actual payouts to the Named Executive Officers under the 2015 Corporate Incentive Plan are set forth below:

Name | Corporate Incentive Plan | |

Target ($) | Actual ($) | |

Joseph M. Tucci | 1,080,000 | 888,840 |

Zane C. Rowe | 562,500 | 462,938 |

David I. Goulden | 862,500 | 709,838 |

Jeremy Burton | 600,000 | 493,800 |

Howard D. Elias | 600,000 | 493,800 |

9

2015 Executive MBO |

In 2015, members of our executive leadership team were eligible to receive semi-annual cash bonuses contingent upon achievement of a number of shared and individual semi-annual performance goals under the Executive MBO. The primary purpose of the Executive MBO is to focus our executive leadership team on the completion of strategic and operational priorities, thereby leading to greater long-term shareholder value.

The Compensation Committee assigned shared goals to the executive leadership team, including the Named Executive Officers, with a significant majority of the payments tied to the achievement of these shared goals. In addition, the participating executives were assigned individual goals, with a small portion of the payments tied to achievement of the individual goals. The Compensation Committee assigned individual goals to Messrs. Tucci and Rowe, Mr. Tucci assigned individual goals to Mr. Goulden, and Messrs. Tucci and Goulden assigned individual goals to Messrs. Burton and Elias. Each of the shared goals and individual goals were specific and measurable. At the close of each half of 2015, the Compensation Committee or Messrs. Tucci and Goulden, as applicable, determined whether the applicable semi-annual goals had been achieved.

A general description of the shared and individual goals assigned to the Named Executive Officers under the Executive MBO in 2015 is set forth below:

First-Half Shared Goals

Executive Officers | Description |

All Named Executive Officers | l Drive federation messaging and further development of strategic priorities l Strengthen converged infrastructure strategy within federation l Execute on new solutions-focused value-based sales approach l Implement 3rd platform storage and infrastructure business initiatives l Focus on talent management and succession planning |

Second-Half Shared Goals

Executive Officers | Description |

Joseph M. Tucci Zane C. Rowe | l Enhance market perception of federation strategy l Execute on go-to-market initiatives for the federation l Develop a cost reduction plan for federation l Continue development of cloud services business strategy |

David I. Goulden Jeremy Burton Howard D. Elias | l Reorganize EMC Information Infrastructure business segments l Develop new EMC Information Infrastructure go-to-market strategy l Develop a cost reduction plan for EMC Information Infrastructure l Focus on talent management to support reorganized business segments |

In addition to the first-half shared goals described above, the Compensation Committee assigned the Named Executive Officers certain first-half financial goals under the Executive MBO that were aligned to EMC’s 2015 operating plan. The Compensation Committee assigned Messrs. Tucci and Rowe first-half financial goals related to EMC’s consolidated revenue and non-GAAP EPS results, as the Compensation Committee determined that Messrs. Tucci and Rowe are most responsible for the overall federation strategy. Messrs. Goulden, Burton and Elias had first-half financial goals based on revenue and operating income results for the EMC Information Infrastructure business, as the Compensation Committee determined that those executives should have an additional incentive to focus on the EMC Information Infrastructure business.

EMC achieved the following results against those targets:

Joseph M. Tucci and Zane C. Rowe | David I. Goulden, Jeremy Burton and Howard D. Elias | ||||||

EMC Consolidated | EMC Information Infrastructure | ||||||

Revenue (billions) | Non-GAAP EPS* | Revenue (billions) | Operating Income** (billions) | ||||

Target ($) | Actual ($) | Target ($) | Actual ($) | Target ($) | Actual ($) | Target ($) | Actual ($) |

11.972 | 11.610 | 0.73 | 0.74 | 8.763 | 8.470 | 1.299 | 1.268 |

* | For purposes of calculating achievement of the EPS target, amounts relating to stock-based compensation expense, intangible asset amortization, restructuring charges, acquisition and other related charges, the R&D tax credit for 2015, a fair value adjustment on assets held for sale, a VMware GSA settlement charge and VMware litigation and other contingencies were excluded. A reconciliation of our GAAP to non-GAAP results can be found in Exhibit A to this Item 11. |

10

** | For purposes of calculating achievement of the EMC Information Infrastructure operating income target, amounts relating to corporate reconciling items, VMware operating income and Pivotal operating expense were excluded. A reconciliation of EMC consolidated operating income to EMC Information Infrastructure operating income can be found in Exhibit A to this Item 11. |

The Named Executive Officers were not assigned second-half financial goals under the Executive MBO because the Compensation Committee determined that the Named Executive Officers were adequately incented to drive financial performance through their participation in other cash and equity incentive plans.

Individual Goals

Executive Officer | Description |

Joseph M. Tucci | l Continue development of long-term strategy for federation l Optimize alignment and cooperation among federation companies l Drive key Pivotal business initiatives l Focus on CEO succession planning |

Zane C. Rowe | l Continue development of long-term strategy for federation l Optimize alignment and cooperation among federation companies l Focus on federation capital structure and allocation l Strengthen investor relations program l Sponsor new customer accounts |

David I. Goulden | l Harmonize and coordinate strategic business initiatives l Lead go-to-market strategy for new EMC Information Infrastructure business segments l Execute on talent management initiatives l Focus on customer accounts |

Jeremy Burton | l Drive product launches and related initiatives l Continue development of go-forward product strategy |

Howard D. Elias | l Drive supply chain integration efforts l Execute on talent management initiatives |

Although achievement of the Executive MBO goals for each of the Named Executive Officers required significant effort, the Compensation Committee expected that the goals would be attainable by the Named Executive Officers and, historically, a significant percentage of the Executive MBO goals from year to year have been achieved.

Overall, in 2015, the Named Executive Officers’ achievement of their respective goals ranged from 71% to 86%. The annual target bonus opportunities and actual payouts to the Named Executive Officers under the 2015 Executive MBO are set forth below:

Name | Executive MBO | |

Target ($) | Actual ($) | |

Joseph M. Tucci | 360,000 | 255,582 |

Zane C. Rowe | 187,500 | 137,803 |

David I. Goulden | 287,500 | 244,577 |

Jeremy Burton | 200,000 | 172,140 |

Howard D. Elias | 200,000 | 172,140 |

Equity Incentives |

EMC believes strongly that equity awards align the interests of our employees with those of our shareholders. EMC grants equity incentive awards:

• | to motivate our employees, including the Named Executive Officers, to achieve EMC’s financial and strategic goals; |

• | to tie a portion of the compensation of our employees, including the Named Executive Officers, to the value of our common stock; and |

• | to promote retention through the use of multi-year vesting schedules. |

Under the Amended and Restated 2003 Stock Plan (the “2003 Stock Plan”), EMC grants equity awards with performance-based and/or time-based vesting conditions to provide employees with a mixed equity portfolio and to increase employee retention. In establishing criteria for equity awards to be granted to the Named Executive Officers, the number of shares subject

11

to those awards and the terms and conditions of those awards, the Compensation Committee takes into account the duties and responsibilities of the individual, individual performance, previous equity awards made to such individual and the value of those awards, and awards made to similarly situated executives internally and externally.

Treatment of Equity Awards upon Consummation of the Merger |

With limited exceptions (discussed below), in connection with the consummation of the Merger, all outstanding EMC equity awards will become fully vested (with performance awards vesting at the target level of performance) and, where applicable, exercised, and each holder will become entitled to receive the merger consideration with respect to the shares of EMC common stock subject to each award (net of shares withheld for exercise price and tax withholding obligations) upon consummation of the Merger in the same manner as other EMC shareholders.

Pursuant to the terms of the merger agreement, individual award recipients may agree that the vesting of their outstanding equity awards may not fully accelerate in connection with the Merger, but no such agreements are in effect with any of the Named Executive Officers as of the date of this Amendment. In addition, EMC may grant equity awards prior to the consummation of the Merger, which, by their terms, may not fully accelerate in connection with the Merger, but no such awards have been made to any of the Named Executive Officers as of the date of this Amendment.

The discussion in this Compensation Discussion and Analysis with respect to the design and vesting terms of outstanding equity awards is subject to the vesting treatment described above upon consummation of the Merger.

2015 Equity Award Program |

In designing the equity program for our executive leadership team each year, the Compensation Committee considers marketplace trends in incentive plan design and feedback received from our shareholder engagement. In 2014, the Compensation Committee changed the design of the equity program for our executive leadership team to:

• | establish multi-year performance goals to incent long-term performance; and |

• | add a relative TSR metric to provide strong alignment with shareholder interests. |

For 2015, the Compensation Committee determined it was appropriate to continue with the 2014 plan design. Accordingly, the Compensation Committee granted our Named Executive Officers a mix of performance stock unit awards and time-based stock unit awards in 2015, as described below. The number of performance-based and time-based stock unit awards granted to the Named Executive Officers is set forth below:

Name | February 2015 Performance Awards* (#) | February 2015 Time-Based Awards (#) | July 2015 Time-Based Awards (#) |

Joseph M. Tucci | 176,212 | 117,475 | 0 |

Zane C. Rowe | 110,134 | 73,422 | 0 |

David I. Goulden | 176,212 | 117,475 | 0 |

Jeremy Burton | 110,134 | 73,422 | 74,963 |

Howard D. Elias | 110,134 | 73,422 | 74,963 |

* | Reflects target number of performance awards. |

2015 Performance Stock Units |

The performance stock units granted to the Named Executive Officers in February 2015 are designed to vest in 2018 only if the Company achieves specific three-year cumulative non-GAAP EPS, revenue and relative TSR metrics, subject to the treatment described above in the event of the earlier consummation of the Merger. We refer to these three-year performance awards as the “2015 LTIP stock units.”

As described below, the EPS, revenue and relative TSR goal components of the 2015 LTIP stock units are weighted 45%, 30% and 25%, respectively.

Each of the EPS and revenue components of the 2015 LTIP stock units are designed to vest if EMC achieves greater than the threshold level of the cumulative goal for such component over fiscal years 2015 through 2017. The Compensation

12

Committee selected EPS and revenue metrics because in its judgment they represent two of the most important metrics on which the Named Executive Officers should focus to drive EMC’s strategic plan and shareholder value. EPS was given the greatest weighting to emphasize profitable growth and because the Compensation Committee believes that increases in EPS over time will lead to greater long-term shareholder value. EPS is calculated on a non-GAAP basis.

The TSR component of the 2015 LTIP stock units is designed to vest if EMC achieves at least a threshold level of TSR over fiscal years 2015 through 2017 relative to the S&P 500 Technology Index. The Compensation Committee selected a relative TSR metric in recognition of evolving marketplace trends in incentive plan design and because the Compensation Committee believes that relative TSR is an important indicator of EMC’s performance compared to the industry, provides the executives added incentive to make EMC a market leader within the industry, and provides strong alignment with shareholder interests. For purposes of these awards, TSR will be determined by dividing the 20-day average market value of our common stock at the end of the performance period by the 20-day average market value at the beginning of the performance period, and EMC’s TSR will be compared to the TSR ranking of companies included in the S&P 500 Technology Index.

Subject to the treatment described above in the event of the earlier consummation of the Merger, the vesting and payouts of the 2015 LTIP stock units depend on the percentage of achievement of the applicable targets, as follows:

Performance Goal | Threshold* | Target | Maximum | |||

Performance | Payout | Performance | Payout | Performance | Payout | |

Non-GAAP EPS | 50% of target | -0- | 97% to 103% of target | 100% of target | 120% of target | 200% of target |

Revenue | 67% of target | -0- | 97% to 103% of target | 110% of target | ||

Relative TSR | 25th percentile | 50% of target | 50th percentile | 75th percentile | ||

* | For non-GAAP EPS and revenue performance in excess of the applicable threshold level set forth above, some portion of the stock units associated with the applicable performance metric will vest. |

As set forth in the table above, the Compensation Committee selected funding slopes and a range (or “collar”) for achieving EPS and revenue performance targets in recognition of the difficulty in setting long-term goals within a rapidly transforming IT market. In connection with selecting these design features, the Compensation Committee’s compensation consultant provided the Compensation Committee assistance in reviewing peer practices and market trends for incentive plan design and the probability of achieving target performance.

Subject to the treatment described above in the event of the earlier consummation of the Merger, if actual results fail to reach or exceed the threshold levels of performance for any of the EPS, revenue and/or relative TSR performance metrics set forth above, the number of 2015 LTIP stock units associated with that metric will be forfeited; conversely, if actual results exceed the target goals for any of the performance metrics, up to 200% of the target number of 2015 LTIP stock units associated with that metric may vest.

The Compensation Committee believes that the three-year cumulative EPS and revenue goals are rigorous and that EMC must demonstrate superior EPS and revenue growth to meet these goals. The EPS and revenue goals were set, in part, in consideration of historical trends in our product growth rates and margins, industry projections for our addressable market, input from leaders of our business units across the federation on long-term expectations, and capital allocation strategies. The actual level of achievement will depend on EMC’s performance through 2017, subject to the treatment described above in the event of the earlier consummation of the Merger. If the Merger is not consummated, EMC will provide retrospective disclosure regarding the three-year cumulative EPS and revenue targets in 2018.

For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

2015 Time-Based Restricted Stock Units |

Recognizing that a very large portion of our executives’ compensation is at risk, the Compensation Committee determined to grant time-based stock units to promote retention. Accordingly, in addition to the performance stock units described above, our Named Executive Officers were granted time-based stock units in February 2015. Subject to the treatment described above in the event of the earlier consummation of the Merger, the time-based stock units granted in February 2015 vest at the rate of

13

one-third per year on each of the first three anniversaries of the grant date, subject to the executive’s continued employment with EMC.

In July 2015, the Compensation Committee granted each of Messrs. Burton and Elias 74,963 time-based stock units. Subject to the treatment described above in the event of the earlier consummation of the Merger, these stock units vest at the rate of 50% per year on each of the first two anniversaries of the grant date, subject to the executive’s continued employment with EMC. The Compensation Committee determined that these awards were appropriate in recognition of their outstanding performance and after further consideration of the equity compensation opportunities that may be afforded to similarly situated executives internally and externally.

For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

Pre-2015 Performance-Based Awards |

2014 Performance Stock Units |

As more fully described in the Proxy Statement for our 2015 Annual Meeting of Shareholders, in February 2014, the Compensation Committee granted three-year performance-based restricted stock units to EMC’s executive leadership team, including the Named Executive Officers (other than Mr. Rowe, whose employment with EMC commenced in October 2014). We refer to these grants as the “2014 LTIP stock units.” The 2014 LTIP stock units have a similar plan design as the 2015 LTIP stock units described above, except the 2014 LTIP stock units will vest based on performance over fiscal years 2014 through 2016, subject to the treatment described above in the event of the earlier consummation of the Merger.

The Compensation Committee believes that the three-year cumulative EPS and revenue goals are rigorous and that EMC must demonstrate superior EPS and revenue growth to meet these goals. The actual level of achievement will depend on EMC’s performance through 2016, subject to the treatment described above in the event of the earlier consummation of the Merger. If the Merger is not consummated, EMC will provide retrospective disclosure regarding the three-year cumulative EPS and revenue targets in 2017.

For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

2012 Long-Term Incentive Plan Awards |

As more fully described in the Proxy Statement for our 2013 Annual Meeting of Shareholders, in August 2012, the Compensation Committee granted three-year performance-based restricted stock units to select members of EMC’s senior management team, including Mr. Burton. We refer to these grants as the “2012 LTIP stock units.”

The Compensation Committee set a three-year cumulative revenue target of $79.2 billion for fiscal years 2013 through 2015 to be eligible for 100% vesting of the 2012 LTIP stock units, with a lesser percentage of 2012 LTIP stock units becoming eligible to vest for revenue achievement below target, but at or above a threshold of $72.0 billion.

Since the 2012 LTIP stock unit awards were incremental to the participating executives’ annual compensation, the Compensation Committee set a rigorous cumulative revenue target to incent sustained growth. IT spending growth over the past three years was significantly slower than the Compensation Committee expected when the three-year cumulative revenue target was established in December 2012. However, our actual three-year cumulative revenue ($72.37 billion) was above the threshold level of achievement.

Accordingly, the Compensation Committee determined that 62.6% of the 2012 LTIP stock units for Mr. Burton will vest in two equal installments, the first of which vested in February 2016. Subject to the treatment described above in the event of the earlier consummation of the Merger, the second installment will vest in February 2017, subject to Mr. Burton’s continued employment with EMC. The remaining 37.4% of the 2012 LTIP stock units did not vest and were forfeited.

For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

14

Dividend Equivalents |

As previously disclosed, the Company commenced payment of a quarterly cash dividend to shareholders, with the first quarterly dividend paid in July 2013. Pursuant to the existing terms of the Company’s outstanding restricted stock unit and performance stock unit awards, holders of those awards are entitled to accrue dividend equivalent payments in respect of cash dividends paid to shareholders while those awards are outstanding. These dividend equivalents will be paid to the holders of outstanding restricted stock unit and performance stock unit awards as and only to the extent such awards are earned and become vested. Pursuant to SEC rules, since restricted stock unit and performance stock unit awards granted to the Named Executive Officers prior to July 2013 were granted at a time when the Company did not regularly pay cash dividends to shareholders, the value of any dividend equivalents accrued on those awards in 2015, whether or not paid, are disclosed in the Summary Compensation Table as “All Other Compensation” on page 21 of this Amendment.

Equity Grant Guidelines |

As is the case for all of our equity awards and in accordance with our equity grant guidelines, stock options are usually granted by the Compensation Committee at regularly scheduled meetings. The grant date for such awards is generally the date of the meeting (if a business day) or the next business day (if the meeting is not held on a business day), however, if the meeting is held during the “quiet period” preceding our earnings announcement, the grant date is generally the first business day that the “quiet period” ends. The exercise price for stock options is always the closing price of our common stock on the grant date.

Retirement and Deferred Compensation Benefits |

EMC does not provide the Named Executive Officers with a defined benefit pension plan, any supplemental executive retirement plans, or retiree health benefits. EMC employees, including the Named Executive Officers, may participate in a 401(k) plan. The 401(k) plan is provided to U.S. employees as a standard benefit offering, designed to assist employees with retirement savings in a tax-advantaged manner. The plan provides for a matching contribution of up to 6% of the employee’s compensation, with a maximum of $6,000 per year. The Company match vests pro rata over the participant’s first three years of service. EMC makes a matching contribution to the 401(k) plan to attract and retain employees and because it provides an additional incentive for employees to save for retirement.

EMC also maintains a nonqualified deferred compensation plan pursuant to which designated managerial or highly compensated employees, including the Named Executive Officers, may elect to defer the receipt of a portion of the base salaries and/or cash bonuses they would otherwise have received when earned. EMC does not make any matching or other contributions under this plan. The nonqualified deferred compensation plan was adopted in order to give participants the ability to defer receipt of certain income to a later date, which may be an attractive tax planning feature, the availability of which assists in the attraction and retention of executive talent. Participants’ account balances reflect gains and losses in the plan’s investment funds, which are substantially similar to the investment options available under the 401(k) plan. For more information on EMC’s deferred compensation plan, please see “Compensation of Executive Officers - Nonqualified Deferred Compensation” beginning on page 28 of this Amendment.

Perquisites |

The Named Executive Officers receive limited perquisites as described below. The perquisites we provide represent a small fraction of the total compensation of each Named Executive Officer. The value of the perquisites we provide are generally taxable to the Named Executive Officers and the incremental cost to EMC of providing these perquisites is reflected in the Summary Compensation Table.

Limited tax and financial planning services, executive physicals and temporary housing allowances are provided because the Compensation Committee believes they allow the Named Executive Officers to focus more of their time and attention on their employment, promote the well-being of the Named Executive Officers, and facilitate attracting top talent and geographic relocation, respectively.

Personal use of EMC-owned aircraft is limited to our Chief Executive Officer and, on rare occasions, other Named Executive Officers. Limited personal use of EMC-owned aircraft is permitted to reduce these executives’ travel time and to allow them to devote more time to work duties.

15

EMC does not provide tax gross-ups to our Named Executive Officers or any other executive officers for perquisites or personal expenses.

The Compensation Committee periodically reviews the perquisites that it provides, including the cost to EMC of providing such perquisites, and believes that the perquisites provided are reasonable and appropriate. For more information on perquisites provided to the Named Executive Officers, please see the “All Other Compensation Table” on page 22 of this Amendment.

Post-Termination Compensation |

In addition to retirement and deferred compensation benefits described above, EMC has arrangements with the Named Executive Officers that may provide them with compensation following termination of employment for the reasons discussed below.

Change in Control |

Change in Control Agreements |

Change in control agreements benefit a corporation in the event of a change in control or a potential change in control by promoting stability during a potentially uncertain period and allowing executives who are parties to such agreements to focus on continuing business operations and the success of a potential business combination rather than seeking alternative employment. The Board believes that it is in EMC’s best interest to have change in control agreements with the Named Executive Officers. EMC’s change in control agreements provide the executives with cash severance payments, equity award acceleration and certain other benefits in the event that their employment is terminated in connection with a change in control (which would include the Merger) or potential change in control (known as “double trigger” benefits), which payments and benefits are described in more detail under “Compensation of Executive Officers - Potential Payments upon Termination or Change in Control” beginning on page 28 of this Amendment. The change in control agreements provide these benefits only if there is both (i) a change in control (or potential change in control) of EMC and (ii) the executive’s employment is terminated by EMC (or any successor) without cause or if the executive terminates his or her employment for good reason, in each case within 24 months following a change in control (or during a potential change in control period). We refer to such a termination of employment as a “qualifying termination.”

No excise tax gross-up is provided for any severance or other benefits paid under EMC’s change in control agreements with the Named Executive Officers.

The determination of the appropriate level of payments and benefits to provide in the event of a qualifying termination involved the consideration of a number of factors. The Board considered that a Named Executive Officer, who is more likely to lose his or her job in connection with a change in control than other employees, may require more time than other employees in order to secure an appropriate new position and, unless that executive was provided with change in control benefits, may be motivated to start a job search early in connection with a change in control to the detriment of EMC. The Compensation Committee reviewed peer practices and market trends, and determined that the level of change in control benefits provided to the Named Executive Officers is consistent with the level provided to executive officers of other public companies of similar size to EMC. Based on these considerations, we believe that the terms of the agreements are reasonable and provide an incentive for our Named Executive Officers to remain with EMC. In addition, by not providing cash severance payments, accelerated vesting of certain equity awards or other benefits unless both a change in control (or potential change in control) has occurred and an executive has a qualifying termination, we believe that an acquiror will be better able to retain EMC’s management team following a change in control.

The Compensation Committee annually reviews the reasonableness and appropriateness of the terms and conditions of EMC’s change in control agreements and the benefits payable thereunder.

Certain Equity Awards |

The significant majority of the equity awards held by our executive leadership team, including the Named Executive Officers, are designed to provide for accelerated vesting on a double trigger basis in connection with a change in control and a qualifying termination, consistent with EMC’s change in control agreements described above. However, the 2014 LTIP stock units will vest in full upon consummation of a change in control, as described in more detail under “Compensation of Executive Officers - Potential Payments upon Termination or Change in Control” beginning on page 28 of this Amendment. In February

16

2015, the Compensation Committee changed the design of the long-term performance awards going forward to ensure that they would be treated in accordance with EMC’s change in control agreements described above. Accordingly, the 2015 LTIP stock units are designed to provide for accelerated vesting on a double trigger basis in connection with a change in control and a qualifying termination.

Notwithstanding the terms of the change in control agreements and equity awards described above to the contrary, with limited exceptions, vesting of all outstanding equity awards will accelerate in connection with the consummation of the Merger. For more information on the treatment of outstanding equity awards upon consummation of the Merger, please see “Treatment of Equity Awards upon Consummation of the Merger” on page 12 of this Amendment.

For more information on potential payments and benefits under the change in control agreements, please see “Compensation of Executive Officers - Potential Payments upon Termination or Change in Control” beginning on page 28 of this Amendment.

Other Arrangements |

Except in limited circumstances, EMC typically does not enter into employment agreements.

In 2012, the Company entered into an employment arrangement with Mr. Tucci under which he was entitled to severance benefits upon termination of employment, other than in connection with a change in control. In February 2015, the arrangement expired.

The Named Executive Officers are entitled to certain benefits upon a termination due to death, disability or retirement.

For more detail regarding these arrangements, please see “Compensation of Executive Officers - Potential Payments upon Termination or Change in Control” beginning on page 28 of this Amendment.

Tax Deductibility |

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation greater than $1 million paid for any fiscal year to the corporation’s chief executive officer and certain other executive officers as of the end of any fiscal year. However, performance-based compensation is not subject to the $1 million deduction limit if certain requirements are met. The Compensation Committee considered the impact of Section 162(m) when designing EMC’s cash bonus and equity programs and determined that EMC’s interests were best served by not restricting the Compensation Committee’s discretion and flexibility in designing the compensation programs, even if such programs may result in certain non-deductible compensation expenses. Notwithstanding our general philosophy of maintaining flexibility in designing our programs, all of the performance equity awards granted to the Named Executive Officers in 2015 are designed with the intention to qualify as performance-based compensation that is exempt from the deductibility limits imposed by Section 162(m). However, the application of Section 162(m) is complex and may change over time (with potentially retroactive effect) and, accordingly, there can be no guarantee that all compensation intended to qualify as performance-based compensation will so qualify.

17

Stock Ownership Guidelines |

To align the interests of our executive leadership team, including the Named Executive Officers, with those of our shareholders, we established stock ownership guidelines to ensure that they hold a significant equity interest in EMC. We have had stock ownership guidelines in place for many years.

In July 2015, the Compensation Committee revised the executive stock ownership guidelines to align more closely with prevailing market practice. The new stock ownership guidelines require each member of the executive leadership team to own a fixed number of shares, which is calculated based on a multiple of each executive’s annual base salary. While executives are accumulating shares to reach the applicable ownership guideline, they are required to hold at least 40% of the net shares they receive from stock option exercises or the vesting of restricted stock awards until the ownership guideline is met. The stock ownership guidelines for the Named Executive Officers currently in office are set forth below:

Name | Multiple of Base Salary | Stock Ownership Guideline |

Joseph M. Tucci | 10x | 374,532 |

David I. Goulden | 6x | 191,011 |

Jeremy Burton | 3x | 89,888 |

Howard D. Elias | 3x | 89,888 |

New executive leadership team members have five years to reach compliance with the guidelines. Unexercised stock options, unvested shares of restricted stock and unvested restricted stock units are not counted for purposes of determining whether these guidelines are met. The Compensation Committee periodically reviews the executives’ holdings for compliance with these guidelines. As of March 1, 2016, all of the Named Executive Officers currently in office are in compliance with these guidelines.

Internal Pay Equity |

Messrs. Tucci and Goulden are provided with a greater compensation opportunity than our other Named Executive Officers. As Chairman and Chief Executive Officer, Mr. Tucci has primary oversight for the overall corporate performance of the federation, including the continued evolution and development of our vision and strategic direction. As Chief Executive Officer, EMC Information Infrastructure, Mr. Goulden has primary oversight for the performance of the EMC Information Infrastructure business. In addition, Messrs. Tucci and Goulden are responsible for establishing EMC as a market leader with innovative products, services and solutions, expanding EMC’s position in the market, and maintaining and building relationships with customers, partners, suppliers, employees, shareholders and other stakeholders. In setting Messrs. Tucci’s and Goulden’s compensation levels, the Compensation Committee also considered their respective experience as proven leaders and the competitive market conditions for chief executive officers.

Hedging and Pledging Policies |

EMC policies do not permit any employees, including the Named Executive Officers, to “hedge” ownership of EMC securities. In addition, no director, executive officer, or any related person, including any Named Executive Officer, may pledge EMC securities.

Compensation Recovery Policies |

We have an incentive compensation clawback policy under which EMC will require reimbursement of any cash or equity incentive compensation paid where payment was predicated on financial results that were subject to a significant restatement and the individual engaged in fraud or willful misconduct that caused or partially caused the restatement. The policy applies to all EMC employees, including the Named Executive Officers. In addition, EMC’s equity plans contain provisions that allow EMC to cancel outstanding equity awards or “clawback” the value of awards recently realized if a Named Executive Officer or other senior employee engages in activity detrimental to EMC, such as failing to comply with EMC’s Key Employee Agreement, including the non‑competition and non-solicitation provisions, engaging in any activity that results in the employee’s termination for cause, or being convicted of a crime.

18

Role of Compensation Consultant |

Retention. The Compensation Committee is directly responsible for the appointment, compensation and oversight of its compensation consultant. In 2015, the Compensation Committee engaged Towers Watson to serve as its compensation consultant. Towers Watson works at the direction of the Compensation Committee and reports directly to the Compensation Committee.

Independence. The Compensation Committee has assessed the independence of Towers Watson by reviewing several factors, including (i) other services, if any, that Towers Watson provides to EMC, (ii) the significance of the fees paid to Towers Watson by the Compensation Committee as a percentage of the total revenues of Towers Watson, (iii) the policies and procedures of Towers Watson that are designed to prevent conflicts, (iv) any business or personal relationships between the Towers Watson professionals engaged to advise the Compensation Committee and the members of the Compensation Committee and/or EMC’s executive officers, and (v) ownership of our common stock by any of the Towers Watson professionals engaged to advise the Compensation Committee. After careful consideration, the Compensation Committee determined that Towers Watson’s service to the Compensation Committee does not raise any conflicts of interest.

Services. During 2015, Towers Watson assisted the Compensation Committee with several matters, including, among other things, performing pay-for-performance analyses, and reviewing executive compensation practices, trends and competitive practices, and change in control and other termination scenarios.

Pre-Approval Policy. The Compensation Committee has a policy that provides that its compensation consultant will only provide services to the Compensation Committee and will not provide any other services to EMC, unless such services are pre-approved by the Compensation Committee. For 2015, the Compensation Committee pre-approved all fees paid to Towers Watson. The following table summarizes the fees paid for services that Towers Watson provided to the Compensation Committee and the fees paid for services provided to EMC that were pre-approved by the Compensation Committee for each of the last two fiscal years.

Fees for services to Compensation Committee ($) | Fees for services to EMC ($) | Fees for other services* ($) | |

2015 | 155,157 | 0 | 40,752 |

2014 | 210,915 | 0 | 47,616 |

* | The amounts reflect the fees associated with EMC’s purchase from Towers Watson of global broad-based surveys. |

Willis Towers Watson. Effective January 4, 2016, Towers Watson merged with Willis Group Holdings plc (“Willis”) to form Willis Towers Watson plc. EMC management has historically engaged Willis to perform a variety of benefits consulting and brokerage services, and continues to engage Willis Towers Watson to perform these services. Following the merger of Towers Watson and Willis, the Compensation Committee again assessed the independence of the combined companies based on the factors described above and determined that Willis Towers Watson’s continued service to the Compensation Committee would not raise any conflicts of interest.

Compensation Peer Group |

The Compensation Committee, with the assistance of its compensation consultant, reviews compensation from published technology industry surveys and from EMC’s compensation peer group companies for purposes of comparing EMC’s executive compensation program with market practices and in order to inform the Compensation Committee’s decisions regarding EMC’s executive compensation program. The Compensation Committee does not target or benchmark compensation to any particular percentile of compensation paid by other companies, but rather considers comparator compensation as one factor in making its compensation decisions. Other factors include EMC’s performance and an individual’s contribution, experience and potential. After taking these factors into account, the Compensation Committee exercises its judgment in making compensation decisions. We believe that this approach gives EMC the flexibility to make compensation decisions based upon all of the facts and circumstances.

19

EMC’s 2015 compensation peer group consisted of the following 15 companies:

• Accenture plc | • eBay Inc. | • NetApp, Inc. |

• Adobe Systems Incorporated | • Hewlett-Packard Company | • Oracle Corporation |

• CA, Inc. | • Intel Corporation | • Seagate Technology |

• Cisco Systems, Inc. | • International Business Machines Corporation | • Symantec Corporation |

• Computer Sciences Corporation | • Microsoft Corporation | • Xerox Corporation |

To select the compensation peer group companies, we used the three-step process described below.

Step | Screen | Rationale |

1 | U.S.-based publicly traded and industry-related companies, including companies in the following industries: l Computer Hardware, Services, Software & Storage l Office Supplies & Equipment l Computer Communications l Semiconductors | l Privately-held or recently acquired companies are eliminated l Only publicly-traded U.S. companies are required to disclose information on executive compensation pay levels and practices l Companies headquartered outside the U.S. are eliminated due to potential differences in executive pay structure and levels |

2 | Revenue and market capitalization l .25X to 4X that of EMC’s revenue l .25X to 4X that of EMC’s market capitalization | l Companies not comparable in size to EMC are eliminated due to differences in pay levels |

3 | Business and talent overlap l Companies to which EMC business segments are aligned l Companies from which EMC recruits and to which it loses talent | l Companies with a low degree of business overlap are eliminated |

Consideration of 2015 Advisory Vote on Executive Compensation |

At our 2015 Annual Meeting of Shareholders, our shareholders expressed strong support for our executive compensation program, with over 92% of votes cast voting in favor of the proposal.

When designing our 2016 executive compensation program, the Compensation Committee considered, among other things: the 2015 “say-on-pay” voting results; evolving compensation practices; our financial and operational performance; and the pending Merger. After careful consideration, the 2015 “say on pay” voting results did not prompt the Compensation Committee to make changes to the design of our executive compensation program.

20

COMPENSATION OF EXECUTIVE OFFICERS |

Summary Compensation Table |

The table below summarizes the compensation information for the Named Executive Officers for the fiscal years ended December 31, 2013, 2014 and 2015.

The amounts shown in the Stock Awards and Option Awards columns reflect the grant date fair value of equity awards for 2015 and prior years, not the actual amounts paid to or that may be realized by the Named Executive Officers.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards1 ($) | Option Awards1 ($) | Non-Equity Incentive Plan Compensation2 ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation3 ($) | Total ($) |

Joseph M. Tucci Chairman and Chief Executive Officer | 2015 | 1,000,000 | 0 | 7,942,3244 | 0 | 1,144,4225 | 0 | 320,964 | 10,407,710 |

2014 | 1,000,000 | 0 | 8,415,112 | 0 | 1,307,021 | 0 | 481,186 | 11,203,318 | |

2013 | 1,000,000 | 0 | 9,426,404 | 650,417 | 1,260,058 | 0 | 309,079 | 12,645,957 | |

Zane C. Rowe Former Executive Vice President and Chief Financial Officer | 2015 | 750,000 | 0 | 4,963,9994 | 0 | 600,7416 | 0 | 195,373 | 6,510,113 |

2014 | 167,308 | 300,000 | 6,000,019 | 0 | 174,686 | 0 | 54,350 | 6,696,362 | |

David I. Goulden Chief Executive Officer, EMC Information Infrastructure | 2015 | 850,000 | 0 | 7,942,3244 | 0 | 954,4157 | 0 | 103,051 | 9,849,790 |

2014 | 850,000 | 0 | 8,415,112 | 0 | 1,075,513 | 0 | 190,632 | 10,531,257 | |

2013 | 850,000 | 0 | 6,122,900 | 330,759 | 1,006,296 | 0 | 122,621 | 8,432,576 | |

Jeremy Burton President, Products and Marketing | 2015 | 800,000 | 0 | 6,964,0128 | 0 | 665,9409 | 0 | 86,626 | 8,516,578 |

2014 | 768,750 | 0 | 5,259,464 | 0 | 717,035 | 0 | 158,236 | 6,903,485 | |

2013 | 675,000 | 0 | 3,926,573 | 191,107 | 590,652 | 0 | 92,886 | 5,476,218 | |

Howard D. Elias President and Chief Operating Officer, Global Enterprise Services | 2015 | 781,923 | 0 | 6,964,0128 | 0 | 665,9409 | 0 | 84,644 | 8,496,519 |

2014 | 750,000 | 0 | 5,259,464 | 0 | 746,183 | 0 | 178,839 | 6,934,486 | |

2013 | 750,000 | 0 | 4,209,625 | 235,209 | 700,032 | 0 | 136,194 | 6,031,061 | |