Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-18516

ARTESIAN RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

51-0002090

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification Number)

|

664 Churchmans Road, Newark, Delaware 19702

Address of principal executive offices

(302) 453 – 6900

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Class A Non-Voting Common Stock

|

|

|

|

|

Name of each exchange on which registered

|

The NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

☐

|

Yes

|

☑

|

No

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

☐

|

Yes

|

☑

|

No

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

☑

|

Yes

|

☐

|

No

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

☑

|

Yes

|

☐

|

No

|

|

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12(b)-2 of the Exchange Act.:

|

Large Accelerated Filer ☐

|

Accelerated Filer ☑

|

Non-Accelerated Filer ☐

|

Smaller Reporting Company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

|

☐

|

Yes

|

☑

|

No

|

|

The aggregate market value of the Class A Non-Voting Common Stock and Class B Common Stock held by non-affiliates of the registrant at June 30, 2015 was $164,631,000 and $6,575,000, respectively. The aggregate market value of Class A Non-Voting Common Stock was computed by reference to the closing price of such class as reported on the Nasdaq Global Market on June 30, 2015, which trade date was June 30, 2015. The aggregate market value of Class B Common Stock was computed by reference to the last reported trade of such class as reported on the OTC Bulletin Board as of June 30, 2015, which trade date was June 29, 2015.

As of March 4, 2016, 8,184,067 shares of Class A Non-Voting Common Stock and 881,452 shares of Class B Common Stock were outstanding.

ARTESIAN RESOURCES CORPORATION

|

FORWARD LOOKING STATEMENTS

|

|

|

|

|

|

|

|

|

4-8

|

|

|

9-10

|

|

|

11

|

|

|

11

|

|

|

11

|

|

|

11

|

|

|

|

|

|

12

|

|

|

13

|

|

|

14-22

|

|

|

22

|

|

|

23-47

|

|

|

48

|

|

|

48

|

|

|

48

|

|

|

|

|

|

50-53

|

|

|

54-57

|

|

|

58

|

|

|

59

|

|

|

60

|

|

|

61

|

|

|

|

|

|

|

|

|

64

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this Annual Report on Form 10-K which express our "belief," "anticipation" or "expectation," as well as other statements which are not historical fact, are forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act and the Private Securities Litigation Reform Act of 1995. Statements regarding our goals, priorities, growth and expansion plans and expectation for our water and wastewater subsidiaries and non-regulated subsidiaries, customer base growth opportunities in Delaware and Cecil County, Maryland, our belief regarding our capacity to provide water services for the foreseeable future to our customers, our belief relating to our compliance and the cost to achieve compliance with relevant governmental regulations, our expectation of the timing of decisions by regulatory authorities, the impact of weather on our operations and the execution of our strategic initiatives, our expectation of the timing for construction on new projects, our belief regarding our reliance on outside engineering firms, our expectation relating to the adoption of recent accounting pronouncements, contract operations opportunities, legal proceedings, our properties, deferred tax assets, adequacy of our available sources of financing, the expected recovery of expenses related to our long-term debt, our expectation to be in compliance with financial covenants in our debt instruments, our ability to refinance our debt as it comes due, the timing and terms of renewals of our lines of credit, plans to increase our wastewater treatment operations, engineering services and other revenue streams less affected by weather, expected future contributions to our postretirement benefit plan, anticipated growth in our non-regulated division, the impact of recent acquisitions on our ability to expand and foster relationships, anticipated investments in certain of our facilities and systems and the sources of funding for such investments, sufficiency of internally generated funds and credit facilities to provide working capital and our liquidity needs are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and involve risks and uncertainties that could cause actual results to differ materially from those projected. Words such as "expects", "anticipates", "intends", "plans", "believes", "seeks", "estimates", "projects", "forecasts", "may", "should", variations of such words and similar expressions are intended to identify such forward-looking statements. Certain factors as discussed under Item 1A -Risk Factors, such as changes in weather, changes in our contractual obligations, changes in government policies, the timing and results of our rate requests, changes in economic and market conditions generally, and other matters could cause results to differ materially from those in the forward-looking statements. While the Company may elect to update forward-looking statements, we specifically disclaim any obligation to do so and you should not rely on any forward-looking statement as representation of the Company's views as of any date subsequent to the date of the filing of this Annual Report on Form 10-K.

General Information

Artesian Resources Corporation, a Delaware Corporation incorporated in Delaware in 1927, operates as the holding company of eight wholly-owned subsidiaries offering water, wastewater and other services on the Delmarva Peninsula. The Company's principal executive offices are located at 664 Churchmans Road, Newark, Delaware 19702. Our principal subsidiary, Artesian Water Company, Inc., is the oldest and largest investor-owned public water utility on the Delmarva Peninsula, and has been providing superior water service since 1905. We distribute and sell water, including water for public and private fire protection, to residential, commercial, industrial, municipal and utility customers throughout the states of Delaware, Maryland and Pennsylvania. We provide wastewater services to customers in Delaware. In addition, we provide contract water and wastewater operations, and water and sewer Service Line Protection Plans. Our Class A Non-Voting Common Stock is listed on the NASDAQ Global Select Market and trades under the symbol "ARTNA."

Artesian Resources Corporation, or Artesian Resources, operates as the parent holding company of five regulated public utilities: Artesian Water Company, Inc., or Artesian Water, Artesian Water Pennsylvania, Inc., or Artesian Water Pennsylvania, Artesian Water Maryland, Inc., or Artesian Water Maryland, Artesian Wastewater Management, Inc., or Artesian Wastewater, Artesian Wastewater Maryland, Inc., or Artesian Wastewater Maryland, and three non-regulated subsidiaries: Artesian Utility Development, Inc., or Artesian Utility, Artesian Development Corporation, or Artesian Development, and Artesian Consulting Engineers, Inc., or Artesian Consulting Engineers. The terms "we," "our" and the "Company" as used herein refer to Artesian Resources and its subsidiaries. The business activity conducted by each of our subsidiaries is discussed below under separate headings.

Our Market

Our current market area is the Delmarva Peninsula. Our largest service area is in the State of Delaware, which had an estimated population of approximately 946,000 at July 1, 2015. According to the US Census Bureau, Delaware's population increased an estimated 5.4% from 2010 to 2015, as compared to the nationwide growth rate of approximately 4.1%. Substantial portions of Delaware, particularly outside of New Castle County, are not served by a public water or wastewater system and represent potential opportunities for Artesian Water and Artesian Wastewater to obtain new exclusive franchised service areas. We continue to focus resources on developing and serving existing service territories and obtaining new territories throughout the State.

We have interconnection agreements for the sale of water with the towns of Elkton and Chesapeake City, Maryland. The Town of Elkton is required to take a minimum of 250,000 gallons per day of water through the interconnection and may take a maximum of 1.5 million gallons per day, or mgd.

We hold Certificates of Public Convenience and Necessity, or CPCNs, for approximately 282 square miles of exclusive water service territory and approximately 25 square miles of wastewater service territory, most of which is in Delaware and some in Maryland and Pennsylvania. Our largest connected regional water system, consisting of approximately 141 square miles and 74,000 customers, is located in northern New Castle County and portions of southern New Castle County, Delaware. A significant portion of our exclusive service territory in Delaware remains undeveloped, and if and when development occurs and there is population growth in these areas, along with the anticipated population growth in Maryland, we will increase our customer base by providing water and/or wastewater service to the newly developed areas and new customers.

Subsidiaries

Artesian Water

Artesian Water, our principal subsidiary, is the oldest and largest public water utility in the State of Delaware and has been providing water service within the state since 1905. Artesian Water distributes and sells water to residential, commercial, industrial, governmental, municipal and utility customers throughout the State of Delaware. In addition, Artesian Water provides services to other water utilities, including operations and billing functions, and also has contract operation agreements with private and municipal water providers. We also provide water for public and private fire protection to customers in our service territories.

Artesian Water Maryland

Artesian Water Maryland began operations in August 2007. Artesian Water Maryland distributes and sells water to residential, commercial, industrial and municipal customers in Cecil County, Maryland.

Artesian Water Pennsylvania

Artesian Water Pennsylvania began operations upon receiving recognition as a regulated public water utility by the Pennsylvania Public Utility Commission, or PAPUC, in 2002. It provides water service to a residential community in Chester County. Artesian Water Pennsylvania filed an application with the PAPUC to increase our service area in Pennsylvania, which was approved and a related order was entered on February 4, 2005. This application involved specific developments, in which we expect modest future growth.

Artesian Wastewater

Artesian Wastewater is a regulated entity that owns wastewater collection and treatment infrastructure and provides wastewater services to customers in Delaware as a regulated public wastewater service company. As of December 31, 2015, Artesian Wastewater owned and operated four wastewater treatment facilities, which are capable of treating approximately 730,000 gallons per day and can be expanded to treat approximately 1.6 mgd.

Artesian Wastewater Maryland

Artesian Wastewater Maryland is a regulated wastewater entity in the State of Maryland and was incorporated on June 3, 2008. Artesian Wastewater Maryland is able to provide public wastewater services to customers in the State of Maryland. It is currently not providing wastewater services in Maryland.

Artesian Utility

Artesian Utility was formed in 1996. It designs and builds water and wastewater infrastructure and provides contract water and wastewater services on the Delmarva Peninsula. Artesian Utility also evaluates land parcels, provides recommendations to developers on the size of water or wastewater facilities and the type of technology that should be used for treatment at such facilities, and operates water and wastewater facilities in Delaware for municipal and governmental organizations. Artesian Utility also contracts with developers for design and construction of wastewater facilities within the Delmarva Peninsula, using a number of different technologies for treatment of wastewater at each facility. In addition, as further discussed below, effective April 2012, Artesian Utility operates the Water Service Line Protection Plan, or WSLP Plan, and the Sewer Service Line Protection Plan, or SSLP Plan. In November 2015, a third plan was added, the Internal Service Line Protection, or ISLP Plan.

We currently operate wastewater treatment facilities for the town of Middletown, Delaware, in southern New Castle County, or Middletown, under a 20-year contract that expires in July 2022. The facilities include two wastewater treatment stations with capacities of up to approximately 2.5 mgd and 250,000 gallons per day, respectively. We also operate a wastewater disposal facility in Middletown in order to support the 2.5 mgd wastewater facility. One of the wastewater treatment facilities in Middletown now provides reclaimed wastewater for use in spray irrigation on public and agricultural lands in the area.

Artesian Utility has operated the WSLP Plan and the SSLP Plan since 2012. Artesian Resources initiated the WSLP Plan in March 2005. The WSLP Plan covers all parts, material and labor required to repair or replace participating customers' leaking water service lines up to an annual limit. The WSLP Plan was expanded in the second quarter of 2008 to include maintenance or repair to customers' sewer lines. The SSLP Plan covers all parts, material and labor required to repair or replace participating customers' leaking or clogged sewer lines up to an annual limit. Also, in the second quarter of 2010, the WSLP Plan and SSLP Plan were extended to include non-utility customers of Artesian Resources. The ISLP Plan was introduced in November 2015 to further enhance available coverage to include water and wastewater lines within the residence. As of December 31, 2015, approximately 19,300, or 25.1%, of our eligible water customers signed up for the WSLP Plan, approximately 14,700, or 19.1%, of our eligible customers signed up for the SSLP Plan and approximately 1,200 non-customer participants signed up for either the WSLP Plan or SSLP Plan. Approximately 800 customers signed up under the ISLP Plan in the first two months it was offered.

Artesian Development

Artesian Development is a real estate holding company that owns properties, including land zoned for office buildings, a water treatment plant and wastewater facility, as well as property for current operations, including an office facility in Sussex County, Delaware. The facility consists of approximately 10,000 square feet of office space along with nearly 10,000 square feet of warehouse space. This facility allows all of our Sussex County, Delaware operations to be housed in one central location.

Artesian Consulting Engineers

Artesian Consulting Engineers no longer offers development and architectural services to outside third parties. Artesian will continue to provide design and engineering contract services through our Artesian Utility subsidiary.

Regulatory Matters

Overview

Our water and wastewater utility operations are subject to regulation by their respective state regulatory commissions, which have broad administrative power and authority to regulate rates charged for service, determine franchise areas and conditions of service, approve acquisitions, authorize the issuance of securities and other matters. The profitability of our utility operations is influenced, to a great extent, by the timeliness and adequacy of regulatory relief we are granted by the respective regulatory commissions or authorities in the states in which we operate.

We are subject to regulation by the following state regulatory commissions:

· The Delaware Public Service Commission, or DEPSC, regulates both Artesian Water and Artesian Wastewater.

· The Maryland Public Service Commission, or MDPSC, regulates both Artesian Water Maryland and Artesian Wastewater Maryland.

· The Pennsylvania Public Utility Commission, or PAPUC, regulates Artesian Water Pennsylvania.

Our water and wastewater utility operations are also subject to regulation under the federal Safe Drinking Water Act of 1974, or Safe Drinking Water Act, the Clean Water Act of 1972, or the Clean Water Act, and related state laws, and under federal and state regulations issued under these laws. These laws and regulations establish criteria and standards for drinking water and for wastewater discharges. Capital expenditures and operating costs required as a result of water quality standards and environmental requirements have been traditionally recognized by state regulatory commissions as appropriate for inclusion in establishing rates.

Water and Wastewater Rates

Our regulated utilities periodically seek rate increases to cover the cost of increased operating expenses, increased financing expenses due to additional investments in utility plant and other costs of doing business. In Delaware, utilities are permitted by law to place rates into effect, under bond, on a temporary basis pending completion of a rate increase proceeding. The first temporary increase may be up to the lesser of $2.5 million on an annual basis or 15% of gross water sales. Should the rate case not be completed within seven months, by law, the utility may put the entire requested rate relief, up to 15% of gross water sales, in effect under bond until a final resolution is ordered and placed into effect. If any such rates are found to be in excess of rates the DEPSC finds to be appropriate, the utility must refund customers the portion found to be in excess with interest. The timing of our rate increase requests are therefore dependent upon the estimated cost of the administrative process in relation to the investments and expenses that we hope to recover through the rate increase. We can provide no assurances that rate increase requests will be approved by applicable regulatory agencies and, if approved, we cannot guarantee that these rate increases will be granted in a timely or sufficient manner to cover the investments and expenses for which we initially sought the rate increase.

On April 11, 2014, Artesian Water filed a request with the DEPSC to implement new rates to meet a requested increase in revenue of 15.90%, or approximately $10.0 million, on an annualized basis. The actual effective requested increase was 12.58%, since, in accordance with applicable law, Artesian Water had been permitted to recover specific investments made in infrastructure through the assessment of a cumulative 3.32% Distribution System Improvement Charge, or DSIC. The DSIC rate of 3.32% was set to zero when the first step of temporary rates designed to generate an increase of 3.98%, or $2.5 million, on an annual basis, was placed into effect on June 10, 2014. A second step of temporary rates designed to generate an increase of 7.17%, or $4.5 million, on an annualized basis, was placed into effect on November 13, 2014. A portion of the second step of temporary increases was held in reserve until a final decision was determined by the DEPSC and was not reflected in income. On August 18, 2015, the DEPSC made a preliminary ruling in response to Artesian Water's April 11, 2014 request. The preliminary ruling recommended a permanent rate increase in revenue of approximately $6.0 million, or 9.5%, on an annualized basis, which is an incremental increase for customers of approximately 6.2% above the DSIC rate previously in effect. On October 6, 2015, a DEPSC order was issued concurring with the preliminary ruling issued on August 18, 2015. On January 19, 2016, the final DEPSC order was issued related to the permanent rate increase and concurred with the October 6, 2015 order. Since the permanent rate increase was less than amounts collected under previously approved temporary increases in rates, Artesian Water was required to refund a portion of the temporary rate increases to its customers. The refund, plus interest, at the average prime rate, for the overpayment from customers was applied to current and future customer bills in October 2015. Since the final rate award was at a level not less than the amount previously reported as income, there was no material impact upon previously reported water sales revenue. The new rates are designed to allow recovery of capital investments made by Artesian Water and to cover increased costs of operations, including water quality testing, chemicals and electricity for water treatment, taxes, labor and benefits. Prior to the 2014 filing, Artesian Water's last request to implement new rates was filed in April 2011.

On January 18, 2013, Artesian Wastewater filed an application with the DEPSC to revise its rates and charges for wastewater services concerning territories located in Kent and Sussex County, Delaware. Artesian Wastewater requested authorization to implement proposed rates for wastewater services to meet a requested increase in revenue of approximately $343,000, or 34.8%, on an annualized basis. The new rates were designed to support Artesian Wastewater's ongoing capital improvement program and to cover increased costs of operations. On August 6, 2013, Artesian Wastewater, the Staff of the DEPSC and the Division of the Public Advocate entered into an agreement to settle Artesian Wastewater's application for an increase in rates. On October 8, 2013, the DEPSC approved the settlement agreement authorizing a two-step increase in rates, with the first step effective upon approval of the settlement and the second step effective in September 2014. The second increase in rates was fully implemented as of September 30, 2014. Based on the number of households at the time of the settlement, the new rates were estimated to provide Artesian Wastewater approximately $174,000 in additional annual revenue. The settlement also authorized a return on equity of 10%.

Service Territory Expansion

In Delaware, a Certificate of Public Convenience and Necessity, or CPCN, grants a water or wastewater company the exclusive right to serve all existing and new customers within a designated area. The DEPSC has the authority to issue and revoke these CPCNs. In this Form 10-K, we may refer to CPCNs as "franchises" or "service territories."

For a water company, the DEPSC may grant a CPCN under circumstances where there has been a determination that the water in the proposed service area does not meet the regulations governing drinking water standards of the State Division of Public Health for human consumption or where the supply is insufficient to meet the projected demand. For a wastewater company, the DEPSC has jurisdiction over non-governmental wastewater utilities having fifty or more customers in the aggregate. A CPCN for water and wastewater utilities shall be granted by the DEPSC to applicants in possession of one of the following:

Øa signed service agreement with the developer of a proposed subdivision or development, which subdivision or development has been duly approved by the respective county government;

Øa petition requesting such service signed by a majority of the landowners of the proposed territory to be served; or

Øa duly certified copy of a resolution from the governing body of a county or municipality requesting the applicant to provide service to the proposed territory to be served.

CPCNs are not transferable. A water or wastewater utility that has a CPCN must obtain the approval of the DEPSC to abandon a service territory. Once a CPCN is granted to a water or wastewater utility, it may not be suspended or terminated unless the DEPSC determines in accordance with its rules and regulations that good cause exists for any such suspension or termination. Although Artesian has been granted an exclusive franchise for each of its existing water and wastewater systems, its ability to expand service areas can be affected by the DEPSC awarding franchises to other regulated water or wastewater utilities with whom we compete for such franchises.

In Maryland, the Company must obtain approval from the appropriate local government authority for the ability to serve a particular area and also ensure that the acquired area is in the county's master water and sewer plan. The authority to exercise a franchise must then be obtained from the MDPSC. Utilities that seek to develop a franchise by constructing new facilities must obtain appropriate approvals from the Maryland Department of the Environment, the local government and the MDPSC. The utility must also obtain approval for soil and erosion plans and easement agreements from appropriate parties.

Other Regulatory Matters

Delaware law permits water utilities to put into effect, on a semi-annual basis, increases related to specific types of distribution system improvements through a Distribution System Improvement Charge, or DSIC. This charge may be implemented by water utilities between general rate increase applications that normally recognize changes in a water utility's overall financial position. The DSIC approval process is less costly when compared to the approval process for general rate increase requests. The DSIC rate applied between base rate filings is capped at 7.5% of the amount billed to customers under otherwise applicable rates and charges, and the DSIC rate increase applied cannot exceed 5% within any 12-month period. On December 17, 2013, the DEPSC approved Artesian Water's application to collect a cumulative DSIC rate of 3.32%, effective January 1, 2014, subject to audit at a later date. This rate was based on approximately $12.9 million in eligible plant improvements since September 30, 2011. The DSIC rate of 3.32% was set to zero when the first step of temporary rates designed to generate an increase of 3.98%, or $2.5 million on an annual basis, was placed into effect on June 10, 2014. In November 2014, Artesian Water filed an application with the DEPSC for approval to collect a DSIC rate of 0.34% effective January 1, 2015. This rate was based on approximately $1.3 million in eligible plant improvements since September 30, 2014. On December 16, 2014, the DEPSC approved the DSIC effective January 1, 2015, subject to audit at a later date. In May 2015, Artesian Water filed an application with the DEPSC for approval to collect a cumulative DSIC rate of 1.15% effective July 1, 2015. This rate was based on approximately $4.6 million in eligible plant improvements through April 30, 2015. On June 16, 2015 the DEPSC approved the DSIC effective July 1, 2015, subject to audit at a later date. On November 24, 2015, Artesian Water filed an application with the DEPSC for approval to collect a cumulative DSIC rate of 1.57%. This rate was based on approximately $7.0 million in eligible plant improvements through October 31, 2015. On December 15, 2015, the DEPSC approved the DSIC effective January 1, 2016, subject to audit at a later date.

Environmental Regulation

Our water and wastewater operations are subject to federal, state, and local requirements relating to environmental protection. The United States Environmental Protection Agency, or the EPA, the Delaware Department of Natural Resources and Environmental Control, or DNREC, and the Delaware Division of Public Health or the DPH, regulate the water quality of our treatment and distribution systems in Delaware, as do the EPA and the Maryland Department of the Environment, or MDE, with respect to our operations in Maryland. Chester Water Authority, which supplies water to Artesian Water through interconnections in northern New Castle County, is regulated by the Pennsylvania Department of Environmental Protection, as well as the EPA. We believe that we are in material compliance with all current federal, state and local water quality standards, including regulations under the federal Safe Drinking Water Act. However, if new water quality regulations are too costly, or if we fail to comply with such regulations, it could have a material adverse effect on our financial condition and results of operations.

The water industry is capital intensive, with the highest capital investment in plant and equipment per dollar of revenue among all utilities. Increasingly stringent drinking water regulations to meet the requirements of the Safe Drinking Water Act have required the water industry to invest in more advanced treatment systems and processes, which require a heightened level of expertise. Significant enhancements were made to existing facilities to effectively treat and remove compounds as required by government agencies, such as ultra violet oxidation treatment, ceramic membrane filtration and carbon filtration. We are currently in full compliance with the requirements of the Safe Drinking Water Act. Even though our water utility was founded in 1905, the majority of our investment in infrastructure occurred in the last 40 years.

Under Delaware state laws and regulations, we are required to file applications with DNREC for water allocation permits for each of our operating wells pumping greater than 50,000 gallons per day. For any wells in the Delaware River Basin, we must also file allocation permits with the Delaware River Basin Commission, or DRBC. We have 119 operating and 60 observation and monitoring wells in our Delaware systems. At December 31, 2015, we had allocation permits for 100 wells, permit applications pending for 3 wells, and 16 wells that do not require a permit.

Our access to aquifers within our service territory is not exclusive. Water allocation permits control the amount of water that can be drawn from water resources and are granted with specific restrictions on water level draw down limits, annual, monthly and daily pumpage limits, and well field allocation pumpage limits. We are also subject to water allocation regulations that control the amount of water that we can draw from water sources. As a result, if new or more restrictive water allocation regulations are imposed, they could have an adverse effect on our ability to supply the demands of our customers, and in turn, our water supply revenues and results of operations. Our ability to supply the demands of our customers historically has not been affected by private usage of the aquifers by landowners or the limits imposed by the state of Delaware. Because of the extensive regulatory requirements relating to the withdrawal of any significant amounts of water from the aquifers, we believe that third party usage of the aquifers within our service territory will not interfere with our ability to meet the present and future demands of our customers.

As required by the Safe Drinking Water Act, the EPA has established maximum contaminant levels for various substances found in drinking water to ensure that the water is safe for human consumption. These limits are known as Maximum Contaminant Levels and Maximum Residual Disinfection Levels. The EPA also regulates how often public water systems monitor their water for contaminants and report the monitoring results to the individual state agencies or the EPA. Generally, the larger the population served by a water system, the more frequent the monitoring and reporting requirements. The Safe Drinking Water Act applies to all 50 states.

DPH has set maximum contaminant levels for certain substances that are more restrictive than the maximum contaminant levels set by the EPA. The DPH is the EPA's agent for enforcing the Safe Drinking Water Act in Delaware and, in that capacity, monitors the activities of Artesian Water and reviews the results of water quality tests performed by Artesian Water for adherence to applicable regulations. Artesian Water is also subject to other laws regulating substances and contaminants in water, including rules for volatile organic compounds and the Total Coliform Rule.

A normal by-product of our iron removal treatment facilities is a solid consisting of the iron removed from untreated groundwater plus residue from chemicals used in the treatment process. The solids produced at our facilities are either disposed directly into approved wastewater facilities or removed from our facilities by a licensed third party vendor. A normal by-product of our carbon absorption filtration process is exhausted carbon media, which is disposed of by the contractor providing the media replacement. Management believes that compliance with existing federal, state or local laws and regulations regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has no material effect upon the business and affairs of the Company, but there is no assurance that such compliance will continue to not have a material effect in the future.

The MDE ensures that water quality and quantity at all public water systems in Maryland meet the needs of the public and are in compliance with federal and state regulations. The MDE also ensures that public drinking water systems provide safe and adequate water to all current and future users in Maryland, and that appropriate usage, planning, and conservation policies are implemented for Maryland's water resources. The MDE oversees the development of Source Water Assessments for water supplies, and issues water appropriation permits for public drinking water systems. In order to appropriate water for municipal, commercial, industrial or other non-domestic uses, a Water Appropriation Permit must be obtained. Issuance of the permit involves evaluating the needs of the user and the potential impact of the withdrawal on neighboring users and the water source in order to maximize beneficial use of the water of the State of Maryland. Permits for large appropriations often involve conducting pump tests to measure adequacy of an aquifer and safe yield of a well, or reviewing stream flow records to determine the adequacy of a surface water source. Regulations were finalized in 1999 that require all new community water systems to have sufficient technical, managerial and financial capacity to provide safe drinking water to their consumers prior to being issued a Construction Permit. Also, in 2007, capacity management guidance was finalized. Capacity limiting factors can include, source capacity, treatment capacity and appropriation permit quantity. The quantity of water withdrawn from the Port Deposit surface water intake is allocated by the Susquehanna River Basin Commission, or SRBC, and MDE. We have 12 operating wells and one surface water in-take in our Maryland systems.

The Clean Water Act has established the foundation for wastewater discharge control in the United States. The Clean Water Act established a control program for ensuring that communities have clean water by regulating the release of contaminants into waterways. Permits that limit the amounts of pollutants discharged are required of all wastewater dischargers under the National Pollutant Discharge Elimination System permit program. The Clean Water Act also requires that wastewater treatment plant discharges meet a minimum of secondary treatment. The secondary treatment process can remove up to 90% of the organic matter in wastewater. We operate environmentally friendly wastewater systems that meet all requirements of federal, state and local standards.

Sources of Water

We derive about 95% of our self-supplied groundwater from wells that pump groundwater from aquifers and other formations located in the Atlantic Coastal Plain. The remaining 5% of our groundwater supply comes from wells in the Piedmont Province. We use a variety of treatment methods, including aeration, pH adjustment, chlorination, fluoridation, ultra violet oxidation, arsenic removal, nitrate removal, radium removal, iron removal, and carbon absorption to meet federal, state and local water quality standards. Additionally, a corrosion inhibitor is added to all of our self-supplied groundwater and most of the supply from interconnections. We have 57 different water treatment facilities in our Delaware systems. We have 8 separate water treatment facilities in our Maryland systems. All water supplies that we purchase from neighboring utilities are potable. Based on our experience, we believe that the costs of treating groundwater are significantly lower than those of treating surface water.

To supplement our groundwater supply, we purchase treated surface water through interconnections only in the northern service area of our New Castle County, Delaware system. The treated surface water is blended with our groundwater supply for distribution to our customers. Nearly 85% of the overall 7.6 billion gallons of water we distributed in all of our Delaware systems during 2015 came from our groundwater wells, while the remaining 15% came from interconnections with other utilities and municipalities. The majority of the 0.1 billion gallons of water we distributed in all of our Maryland systems during 2015 came from our groundwater wells, while a portion came from treated surface water. In Delaware in 2015, we pumped an average of 17.9 mgd from our groundwater wells and obtained an average of approximately 3.1 mgd from interconnections. We have one water treatment facility that treats surface water from the Susquehanna River, located in Cecil County, Maryland. Our peak water supply capacity currently is approximately 55.0 mgd in Delaware and approximately 2.0 mgd in Maryland. We believe that we have in place sufficient capacity to provide water service for the foreseeable future to all existing and new customers in all of our service territories.

Interconnections and Storage

Most of our New Castle County, Delaware water system is interconnected. In the remainder of the State of Delaware, we have several satellite systems that have not yet been connected by transmission and distribution facilities. We intend to join these systems into larger integrated regional systems through the construction of a transmission and distribution network as development continues and our expansion efforts provide us with contiguous exclusive service territories.

In Delaware, we have 23 interconnections with 2 neighboring water utilities and 7 municipalities that provide us with the ability to purchase or sell water. An interconnection agreement with the Chester Water Authority has a "take or pay" clause requiring us to purchase 1.095 billion gallons annually. During the fiscal year ended December 31, 2015, we used the minimum draw under this agreement. The Chester Water Authority agreement, which expires December 31, 2021, provides for the right to extend the term of this agreement through and including December 31, 2047, at our option, subject to the approval of the Susquehanna River Basin Commission. All of the interconnections provide Artesian Water the ability to sell water to neighboring water utilities or municipalities. In Maryland, we have one interconnection that connects the Artesian Water system in Delaware to the Meadowview System, one interconnection with a neighboring utility, and three interconnections with the Town of Elkton. The interconnection with the Artesian Water Delaware system is capable of providing up to 3.0 mgd of water to our Maryland systems, of which 1.5 mgd is available to the Town of Elkton per our agreement with the Town. In March 2013, the interconnection to the Town of Chesapeake City was completed. The Town of Chesapeake City placed in service an interconnection and 1.57 miles of new water main to provide water to the Town of Chesapeake City from the Artesian Water Delaware system on Chesapeake City Road. The interconnection is currently the town's sole source of water supply, averaging approximately 83,000 gallons per day. The Chesapeake City Road plant is capable of producing up to 3 mgd and is part of a regional system with a production capacity of up to 28 mgd.

As of December 31, 2015, we were serving customers through approximately 1,218 miles of transmission and distribution mains. Mains range in diameter from two inches to twenty-four inches, and most of the mains are made of ductile iron or cast iron. We supply public fire protection service through approximately 5,942 hydrants installed throughout our service territories.

We have 29 storage tanks in Delaware, most of which are elevated, providing total system storage of 42 million gallons. We have developed and are using an Aquifer Storage and Recovery, or ASR, system in New Castle County, Delaware. Our ASR system provides approximately 130 million gallons of storage capacity, which can be withdrawn at an average rate of approximately 1 mgd. At some locations, we rely on hydropneumatic tanks to maintain adequate system pressures. Where possible, we combine our smaller satellite systems with systems having elevated storage facilities. In Cecil County, Maryland we have 7 storage tanks capable of storing approximately 2.4 million gallons.

Additional General Information

Seasonality

Substantially all of our water customers are metered, which allows us to measure and bill for our customers' water consumption. Demand for water during the warmer months is generally greater than during cooler months primarily due to additional customer requirements for water in connection with cooling systems, swimming pools, irrigation systems and other outside water use. Throughout the year, and particularly during typically warmer months, demand for water will vary with temperature and rainfall. In the event that temperatures during the typically warmer months are cooler than expected, or there is more rainfall than expected, the demand for water may decrease and our revenues may be adversely affected.

Competition

Our business in our franchised service areas is substantially free from direct competition with other public utilities, municipalities and other entities. However, our ability to provide additional water and wastewater services is subject to competition from other public utilities, municipalities and other entities. Even though our regulated utilities have been granted an exclusive franchise for each of our existing community water and wastewater systems, our ability to expand service areas can be affected by the DEPSC, the MDPSC or the PAPUC, awarding franchises to other regulated water or wastewater utilities with whom we compete for such franchises.

Employees

The Company has no collective bargaining agreements with any of its employees, and its work force is not union organized or union represented. As of December 31, 2015, we employed 231 full-time employees. Of these employees, 52 were officers and managers; 119 were employed as operations personnel, including engineers, technicians, draftsman, maintenance and repair persons, meter readers and utility personnel; and 28 were employed in accounting, budgeting, information systems, human resources, customer relations and public relations. The remaining 32 employees were administrative personnel. We believe that our employee relations are good.

Available Information

We are a Delaware corporation with our principal executive offices located at 664 Churchmans Road, Newark, Delaware, 19702. Our telephone number is (302) 453-6900 and our website address is www.artesianresources.com. We make available free of charge through our website our Code of Ethics, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K our Corporate Governance Guidelines, our Board Committee Charter and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission, or the SEC. We include our website address in this Annual Report on Form 10-K only as an inactive textual reference and do not intend it to be an active link to our website. Information contained on our website shall not be deemed incorporated into, or to be a part of, this report.

We file our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Exchange Act electronically with the SEC. The public may read or copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC, 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

We are exposed to a variety of risks and uncertainties. Most are general risks and uncertainties applicable to all water utility companies. We describe below some of the specific known risk factors that could negatively affect our business, financial condition or results of operations. If one or more of these risks or uncertainties materialize, actual results may vary materially from our projections. All forward-looking statements made by us in this Annual Report to the SEC on Form 10-K, in our Annual Report to Shareholders and in our subsequently filed quarterly and current reports to the SEC, as well as in our press releases and other public communications, are qualified by the risks described below.

Our operating revenue is primarily from water sales. The rates that we charge our customers are subject to the regulations of the Public Service Commissions in the states in which we operate. Additionally, our business requires significant capital expenditures on an annual basis and these expenditures are made for additions and replacement of property. If a Public Service Commission disapproves or is unable to timely approve our requests for rate increases or approves rate increases that are inadequate to cover our investments or increased costs, our profitability may suffer.

We file rate increase requests, from time to time, to recover our investments in utility plant and expenses. Once a rate increase petition is filed with a Public Service Commission, the ensuing administrative and hearing process may be lengthy and costly. We can provide no assurances that any future rate increase request will be approved by the DEPSC, MDPSC or PAPUC, and if approved, we cannot guarantee that these rate increases will be granted in a timely manner and/or will be sufficient in amount to cover the investments and expenses for which we initially sought the rate increase. To the extent we are able to pass through such costs to customers and a state public service commission subsequently determines that such costs should not have been paid by customers, we may be required to refund such costs, with interest, to customers. Any such costs not recovered through rates, or any such refund, could adversely affect our results of operations, financial position or cash flows.

We rely on governmental approvals in the States of Delaware, Maryland and Pennsylvania for applicable water allocation, water appropriation and water capacity permits related to additional systems that will assist in the operation of our water business. In addition, we rely on governmental approvals in the States of Delaware and Maryland for applicable wastewater collection, treatment and disposal permits that will assist in the operation of our wastewater business.

Our water and wastewater services are governed by various federal and state governmental agencies. Pursuant to these regulations, we are required to obtain various permits for any additional systems to assist in our operations. If any of those permit approvals are not received timely or at all, the Company may risk the loss of economic opportunity and its ability to create additional systems for the effective operation of our water business in the States of Delaware, Maryland and Pennsylvania or our wastewater business in the States of Delaware and Maryland. We can provide no assurances that we will receive all necessary permits to create additional systems to assist in the operation of our water or wastewater business.

Our business is subject to seasonal fluctuations, which could affect demand for our water service and our revenues.

Demand for water during warmer months is generally greater than during cooler months primarily due to additional customer requirements in irrigation systems, swimming pools, cooling systems and other outside water use. In the event that temperatures during typically warmer months are cooler than normal, or rainfall is more than normal, the demand for our water may decrease and adversely affect our revenues.

Drought conditions and government imposed water use restrictions may impact our ability to serve our current and future customers, and may impact our customers' use of our water, which may adversely affect our financial condition and results of operations.

We believe that we have in place sufficient capacity to provide water service for the foreseeable future to all existing and new customers in all of our service territories. However, severe drought conditions could interfere with our sources of water supply and could adversely affect our ability to supply water in sufficient quantities to our existing and future customers. This may adversely affect our revenues and earnings. Moreover, governmental restrictions on water usage during drought conditions may result in a decreased demand for water, which may adversely affect our revenue and earnings.

Our operating costs could be significantly increased if new or stricter regulatory standards are imposed by federal and state environmental agencies.

Our water and wastewater services are governed by various federal and state environmental protection and health and safety laws and regulations, including the federal Safe Drinking Water Act, the Clean Water Act and similar state laws. These federal and state regulations are issued by the United States Environmental Protection Agency and state environmental regulatory agencies. Pursuant to these laws, we are required to obtain various water allocation permits and environmental permits for our operations. The water allocation permits control the amount of water that can be drawn from water resources. New or stricter water allocation regulations can adversely affect our ability to meet the demands of our customers. While we have budgeted for future capital and operating expenditures to maintain compliance with these laws and our permits, it is possible that new or stricter standards would be imposed that will raise our operating costs. Thus, we can provide no assurances that our costs of complying with, or discharging liability under current and future environmental and health and safety laws will not adversely affect our business, results of operations or financial condition.

We are subject to risks associated with the collection, treatment and disposal of wastewater.

Wastewater collection, treatment and disposal involve various unique risks. If collection or treatment systems fail, overflow, or do not operate properly, untreated wastewater or other contaminants could spill onto nearby properties or into nearby streams and rivers, causing damage to persons or property, injury to aquatic life and economic damages, which may not be recoverable in fees. This risk is most acute during periods of substantial rainfall or flooding, which are common causes of sewer overflow and system failure. Liabilities resulting from such damages and injuries could materially and adversely affect the Company's results of operations and financial condition.

Turnover in our management team could have an adverse impact on our business or the financial market's perception of our ability to continue to grow.

Our success depends significantly on the continued contribution of our management team both individually and collectively. The loss of the services of any member of our management team or the inability to hire and retain experienced management personnel could harm our operating results.

We face competition from other water and wastewater utilities for the acquisition of new exclusive service territories.

Water and wastewater utilities competitively pursue the right to exclusively serve territories in Delaware and Maryland by entering into agreements with landowners, developers or municipalities and, under current law, then applying to the DEPSC or the MDPSC for a CPCN, which grants a water or wastewater utility the exclusive right to serve all existing and new customers of a water or wastewater utility within a designated area. Typically, water and wastewater utilities enter into agreements with developers who have approval from county governments with respect to proposed subdivisions or developments. Once a CPCN is granted to a water or wastewater utility, generally it may not be suspended or terminated unless the DEPSC or MDPSC determines in accordance with its rules and regulations that good cause exists for any such suspension or termination. Therefore, we face competition from other water and wastewater utilities as we pursue the right to exclusively serve territories. If we are unable to enter into agreements with landowners, developers or municipalities and secure CPCNs for the right to exclusively serve territories in Delaware or Maryland, our ability to expand may be significantly impeded.

We depend on the availability of capital for expansion, construction and maintenance. Weaknesses in capital and credit markets may limit our access to capital.

Our ability to continue our expansion efforts and fund our utility construction and maintenance program depends on the availability of adequate capital. There is no guarantee that we will be able to obtain sufficient capital in the future on favorable terms and conditions for expansion, construction and maintenance. In the event our lines of credit are not extended or we are unable to refinance our first mortgage bonds when due and the borrowings are called for payment, we will have to seek alternative financing sources, although there can be no assurance that these alternative financing sources will be available on terms acceptable to us. In the event we are unable to obtain sufficient capital, our expansion efforts could be curtailed, which may affect our growth and may affect our future results of operations.

General economic conditions may materially and adversely affect our financial condition and results of operations.

The effects of adverse U.S. economic conditions may lead to a number of impacts on our business that may materially and adversely affect our financial condition and results of operations. Such impacts may include a reduction in discretionary and recreational water use by our residential water customers, particularly during the summer months; a decline in usage by industrial and commercial customers as a result of decreased business activity and commerce in our customers' businesses; an increased incidence of customers' inability, bankruptcy or delay in paying their bills which may lead to higher bad debt expense and reduced cash flow; and a lower natural customer growth rate may result as compared to what had been experienced before the economic downturn due to a decline in new housing starts and a possible slight decline in the number of active customers due to housing vacancies or abandonments.

Any future acquisitions we undertake or other actions to further grow our water and wastewater business may involve risks.

An element of our growth strategy is the acquisition and integration of water and wastewater systems in order to broaden our current service areas, and move into new ones. It is our intent, when practical, to integrate any businesses we acquire with our existing operations. The negotiation of potential acquisitions as well as the integration of acquired businesses could require us to incur significant costs and cause diversion of our management's time and resources. We may not be successful in the future in identifying businesses that meet our acquisition criteria. The failure to identify such businesses may limit the rate of our growth. In addition, future acquisitions or expansion of our service areas by us could result in:

ØDilutive issuance of our equity securities;

ØIncurrence of debt and contingent liabilities;

ØDifficulties in integrating the operations and personnel of the acquired businesses;

ØDiversion of our management's attention from ongoing business concerns;

ØFailure to have effective internal control over financial reporting;

ØOverload of human resources; and

ØOther acquisition-related expense

Some or all of these items could have a material adverse effect on our business and our ability to finance our business and comply with regulatory requirements. The businesses we acquire in the future may not achieve sales and profitability that would justify our investment.

We also may experience risks relating to the challenges and costs of closing a transaction and the risk that an announced transaction may not close. Completion of certain acquisition transactions are conditioned upon, among other things, the receipt of approvals, including from the certain state public utilities commissions. Failure to complete a pending transaction would prevent us from realizing the anticipated benefits. We would also remain liable for significant transaction costs, including legal and accounting fees, whether or not the transaction is completed.

We are subject to, and could be further subject to, governmental investigations or actions by other third parties.

We are subject to various federal and state laws, including environmental laws, violations of which can involve civil or criminal sanctions.

Our operations from time to time could be parties to or targets of lawsuits, claims, investigations and proceedings, including system failure, injury, contract, environmental, health and safety and employment matters, which are handled and defended in the ordinary course of business. The results of any future litigation or settlement of such lawsuits and claims are inherently unpredictable, but such outcomes could also materially and adversely affect our business, financial position and results of operations.

We are dependent on the continuous and reliable operation of our information technology systems.

We rely on our information technology systems to manage our operation of our business. Specifically with respect to customer service and billing, managing construction projects, managing our financial records, tracking assets, remotely monitoring some of our treatment, storage and pumping facilities and managing human resources, inventory and accounts receivable collections. Such systems require periodic modifications, upgrades and or replacement that subject us to inherent costs and risks, including substantial capital expenditures, additional administration and operating expenses, and other risks and costs of delays in transitioning to new systems or of integrating new systems into our current systems. Our computer and communications systems and operations could be damaged or interrupted by natural disasters, telecommunications failures or acts of war or terrorism or similar events or disruptions. A loss of these systems or major problems with the operation of these systems could affect our operations and have a material adverse effect on our results of operations.

There have been an increasing number of cyber-attacks on companies around the world, which have caused operational failures or compromised sensitive corporate or customer data. These attacks have occurred over the internet, through malware, viruses or attachments to e-mails or through persons inside the organization or with access to systems inside the organization. We have implemented security measures and will continue to devote resources to address any security vulnerabilities in an effort to prevent cyber-attacks. Despite our efforts, a cyber-attack, if it occurred, could cause water or wastewater system problems, disrupt service to our customers, compromise important data or systems or result in an unintended release of customer information. We feel we have adequate cyber-security insurance coverage to mitigate the cost of any such cyber-attack, however, a possible cyber-attack could affect our operations and have a material adverse effect on our results of operations.

Contamination of our water supply may result in disruption in our services and could lead to litigation that may adversely affect our business, operating results and financial condition.

Our water supplies are subject to contamination from naturally-occurring compounds as well as pollution resulting from man-made sources. Even though we monitor the quality of water on an on-going basis, any possible contamination due to factors beyond our control could interrupt the use of our water supply until we are able to substitute it from an uncontaminated water source. Additionally, treating the contaminated water source could involve significant costs and could adversely affect our business. We could also be held liable for consequences arising out of human or environmental exposure to hazardous substances, if found, in our water supply. This could adversely affect our business, results of operations and financial condition.

Potential terrorist attacks may disrupt our operations and adversely affect our business, operating results and financial condition.

We have taken steps to increase security measures at our facilities and heighten employee awareness of threats to our water supply. We also have tightened our security measures regarding delivery and handling of certain chemicals used in our business. We have and will continue to bear any increase in costs, most of which have been recoverable under state regulatory policies, for security precautions to protect our facilities, operations and supplies. While the costs of increases in security, including capital expenditures, may be significant, we expect these costs to continue to be recoverable in water and wastewater rates. Despite our security measures, we may not be in a position to control the outcome of terrorist events, or other attacks on our water systems, should they occur.

None.

Our corporate headquarters are located at 664 Churchmans Road, Newark, Delaware and are owned by Artesian Water.

Artesian Development owns approximately 6 acres of land in New Castle County, Delaware zoned for office development and two nine-acre parcels of land in Sussex County, Delaware for water and wastewater treatment facilities and elevated water storage. Artesian Development also owns an office facility located in Sussex County, Delaware. The facility consists of approximately 10,000 square feet of office space along with approximately 10,000 square feet of warehouse space.

Artesian Water owns land, rights-of-way, easements, transmission and distribution mains, pump facilities, treatment plants, storage tanks, meters, vehicles and related equipment and facilities throughout Delaware, of which the majority are used for utility operations. Artesian Water Pennsylvania owns transmission and distribution mains. Artesian Water Maryland owns land, transmission and distribution mains, pump facilities and storage tanks. Artesian Wastewater owns land, rights-of-way, easements, treatment and disposal plants, collection mains and lift stations. Artesian Wastewater owns a 75-acre parcel of land in Sussex County, Delaware for the operation of the wastewater facility known as the Northern Sussex Regional Water Recharge Complex. The following table indicates our utility plant as of December 31, 2015.

|

Utility plant comprises:

|

||||||||

|

In thousands

|

||||||||

|

|

Estimated Useful Life

(In Years)

|

December 31, 2015

|

||||||

|

Utility plant at original cost

|

||||||||

|

Utility plant in service-Water

|

||||||||

|

Intangible plant

|

---

|

$

|

140

|

|||||

|

Source of supply plant

|

45-85

|

19,313

|

||||||

|

Pumping and water treatment plant

|

8-62

|

77,221

|

||||||

|

Transmission and distribution plant

|

||||||||

|

Mains

|

81

|

224,104

|

||||||

|

Services

|

39

|

36,060

|

||||||

|

Storage tanks

|

76

|

23,992

|

||||||

|

Meters

|

26

|

24,150

|

||||||

|

Hydrants

|

60

|

12,037

|

||||||

|

General plant

|

3-31

|

52,434

|

||||||

|

|

||||||||

|

Utility plant in service-Wastewater

|

||||||||

|

Treatment and disposal plant

|

35-62

|

14,012

|

||||||

|

Collection mains and lift stations

|

81

|

7,833

|

||||||

|

General plant

|

3-31

|

906

|

||||||

|

|

||||||||

|

Property held for future use

|

---

|

14,345

|

||||||

|

Construction work in progress

|

---

|

3,809

|

||||||

|

|

510,356

|

|||||||

|

Less – accumulated depreciation

|

104,750

|

|||||||

|

|

$

|

405,606

|

||||||

Substantially all of Artesian Water's utility plant, except the utility plant in the town of Townsend, Delaware, is pledged as security for First Mortgage Securities. As of December 31, 2015, no other utility plant has been pledged as security for loans.

We believe that our properties are generally maintained in good condition and in accordance with current standards of good water and wastewater works industry practice. We believe that all of our existing facilities adequately meet current necessary production capacities and current levels of utilization.

On September 30, 2014, the United States District Court for the Eastern District of Pennsylvania, or the Court, issued an Order regarding the complaint filed on December 22, 2010 by Artesian Water, against Chester Water Authority, or CWA. The complaint claimed breach of contract, unjust enrichment, and requested declaratory judgment in relation to an interconnection agreement with CWA to supply bulk water supplies to Artesian Water.

According to the Order of the Court, Artesian Water was required to pay CWA amounts withheld related to CWA rate increases from 2008, 2009, and 2010 totaling approximately $3.1 million. The $3.1 million withheld from Artesian Water's previous payments to CWA were accrued by Artesian Water when originally invoiced by CWA and were paid by Artesian Water to CWA in October 2014. In addition, CWA requested approximately $0.4 million in prejudgment and post judgment interest related to amounts withheld, which was accrued by Artesian Water as of December 31, 2014 and subsequently paid in January 2015. This amount was calculated at 6% per annum on outstanding amounts withheld.

Periodically, we are involved in other proceedings or litigation arising in the ordinary course of business. We do not believe that the ultimate resolution of these matters will materially affect our business, financial position or results of operations. However, we cannot assure that we will prevail in any litigation and, regardless of the outcome, may incur significant litigation expense and may have significant diversion of management attention.

The information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K (17 CFR 229.104) is not applicable to our Company.

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information for the Company's Common Equity

Artesian Resources' Class A Non-Voting Common Stock, or Class A Stock, is listed on NASDAQ Global Select Market and trades under the symbol "ARTNA." On March 4, 2016, the last closing sale price as reported by the NASDAQ Global Select Market was $27.68 per share. On March 4, 2016 there were 716 holders of record of the Class A Stock. The following table sets forth, for the periods indicated, the high and low closing sale prices for the Class A Stock as reported by NASDAQ Global Select Market and the cash dividends declared per share.

CLASS A NON-VOTING COMMON STOCK

|

|

High

|

Low

|

Dividend Per Share

|

|||||||||

|

2015

|

||||||||||||

|

First Quarter

|

$

|

22.72

|

$

|

20.00

|

$

|

0.2151

|

||||||

|

Second Quarter

|

22.16

|

20.70

|

0.2183

|

|||||||||

|

Third Quarter

|

24.14

|

21.32

|

0.2183

|

|||||||||

|

Fourth Quarter

|

29.11

|

24.14

|

0.2216

|

|||||||||

|

|

||||||||||||

|

2014

|

||||||||||||

|

First Quarter

|

$

|

23.70

|

$

|

21.61

|

$

|

0.2088

|

||||||

|

Second Quarter

|

22.68

|

21.11

|

0.2119

|

|||||||||

|

Third Quarter

|

22.70

|

20.14

|

0.2119

|

|||||||||

|

Fourth Quarter

|

22.80

|

19.87

|

0.2151

|

|||||||||

Our Class B Voting Stock, or Class B Stock, is quoted on the OTC Bulletin Board under the symbol "ARTNB." There has been a limited and sporadic public trading market for the Class B Stock. As of March 4, 2016, the last reported trade of the Class B Stock on the OTC Bulletin Board was at a price of $29.00 per share on January 29, 2016. As of March 4, 2016, we had 161 holders of record of the Class B Stock. The Class B shares are paid the same dividend as the Class A shares noted in the table above.

Recent Sales of Unregistered Securities

During the quarter ended December 31, 2015, we did not issue any unregistered shares of our Class A or Class B Stock.

Equity Compensation Plan Information

The following table provides information on the shares of our Class A Stock that may be issued upon exercise of outstanding stock options as of December 31, 2015 under the Company's stockholder approved stock plans.

|

Equity Compensation Plan Information

|

||||||||||||

|

Plan category

|

Number of securities to be issued upon exercise of outstanding options (a)

|

Weighted-average exercise price of outstanding options

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|||||||||

|

|

||||||||||||

|

Equity compensation plans approved by security holders

|

270,000

|

$

|

19.34

|

326,500

|

||||||||

|

|

||||||||||||

|

Equity compensation plans not approved by security holders

|

---

|

---

|

---

|

|||||||||

|

|

||||||||||||

|

Total

|

270,000

|

326,500

|

||||||||||

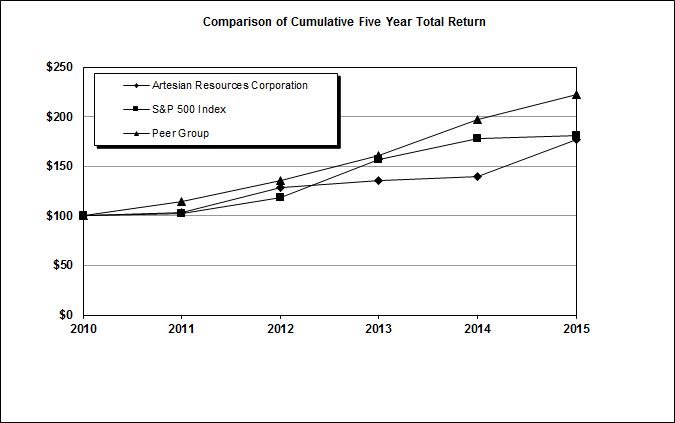

The following graph compares the percentage change in cumulative shareholder return on the Company's Class A Stock with the Standard & Poor's 500 Stock Index and a Peer Group of water utility companies having similar market capitalizations. The graph covers the period from December 2010 (assuming a $100 investment on December 31, 2010, and the reinvestment of any dividends) through December 2015:

|

|

|

INDEXED RETURNS

|

||||||||||

|

|

Base Period

|

Years Ending December 31

|

||||||||||

|

Company Name / Index

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||

|

Artesian Resources Corporation

|

|

100

|

|

103.42

|

128.12

|

135.97

|

139.14

|

177.28

|

||||

|

S&P 500 Index

|

|

100

|

|

102.11

|

118.45

|

156.82

|

178.29

|

180.75

|

||||

|

Peer Group

|

|

100

|

|

113.98

|

135.77

|

160.59

|

197.20

|

222.35

|

||||

The Peer Group includes American States Water Company, American Water Works Company, Inc., Aqua America, Inc., California Water Service Group, Connecticut Water Service, Inc., Middlesex Water Company, SJW Corporation and York Water Company.

The selected statement of operations and balance sheet data shown below were derived from our consolidated financial statements. The consolidated statement of operations data for the years ended December 31, 2015, 2014 and 2013 and the consolidated balance sheet data as of December 31, 2015 and 2014 have been derived from our audited financial statements included elsewhere in this Annual Report on Form 10-K. The consolidated statement of operations data for the years ended December 31, 2012 and 2011 and the consolidated balance sheet data as of December 31, 2013, 2012 and 2011 have been derived from audited consolidated financial statements which are not included in this Annual Report on Form 10-K. You should read this selected financial data together with our consolidated financial statements and related notes, as well as the discussion under the caption "Management's Discussion and Analysis of Financial Condition and Results of Operations."

|

In thousands, except per share and operating data

|

2015

|

2014

|

2013

|

2012

|

2011

|

|||||||||||||||

|

|

||||||||||||||||||||

|

STATEMENT OF OPERATIONS DATA

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Operating revenues

|

||||||||||||||||||||

|

Water sales

|

$

|

68,932

|

$

|

64,667

|

$

|

61,846

|

$

|

63,607

|

$

|

57,564

|

||||||||||

|

Other utility operating revenue

|

3,694

|

3,648

|

3,253

|

3,169

|

3,302

|

|||||||||||||||

|

Non-utility operating revenue

|

4,398

|

4,150

|

3,974

|

3,787

|

4,204

|

|||||||||||||||

|

Total operating revenues

|

$

|

77,024

|

$

|

72,465

|

$

|

69,073

|

$

|

70,563

|

$

|

65,070

|

||||||||||

|

|

||||||||||||||||||||

|