Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR SLIDES MARCH 2016 - Sprague Resources LP | form8-kinvestorslidesmarch.htm |

1 Sprague Resources LP Investor Update March 10, 2016

2 Safe Harbor Forward-Looking Statements / Non-GAAP Measures Some of the statements in this presentation may contain forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “will,” “project,” “budget,” “potential,” or “continue,” and similar references to future periods. However, the absence of these words does not mean that a statement is not forward looking. Descriptions of our objectives, goals, plans, projections, estimates, anticipated capital expenditures, cost savings, strategy for customer retention and strategy for risk management and other statements of future events or conditions are also forward looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Our actual future results and financial condition may differ materially from those indicated in the forward-looking statements. These forward-looking statements involve risks and uncertainties and other factors that are difficult to predict and many of which are beyond management’s control. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, but are not limited to, increased competition for our products or services; changes in supply or demand for our products; changes in operating conditions and costs; changes in the level of environmental remediation spending; potential equipment malfunction; potential labor issues; the legislative or regulatory environment; terminal construction repair/delays; nonperformance by major customers or suppliers; and political, economic and capital market conditions, including the impact of potential terrorist acts and international hostilities. For a more detailed description of these and other risks and uncertainties, please see the “Risk Factors” section in our most recent Annual Report on Form 10-K and/or most recent 10-Q, for 8-K and other items filed with the U.S. Securities and Exchange Commission and also available in the “Investor Relations” section of our website www.spragueenergy.com. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. In this presentation we refer to certain financial measures not prepared in accordance with generally accepted accounting principles, or GAAP, including adjusted gross margin and adjusted EBITDA. For a description of how we define these non-GAAP financial measures see “Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations – How Management Evaluates Our Results of Operations.” in Sprague’s current Quarterly Report on Form 10-Q and/or most recent 10-K available in the “Investor Relations” section of our website www.spragueenergy.com.

3 Sprague Overview Sprague was founded in 1870 and has grown to become one of the largest suppliers of energy and materials handling services to commercial and industrial customers in the northeast United States and Quebec today Sprague’s business is diverse and unique in the MLP space – • Control 19 waterborne terminals with 14.2 million barrels of refined product storage, annually marketing more than 1.6 billion gallons • Market natural gas in 13 states, supplying more than 56 Bcf of gas annually • Handle more than 2.6 million short tons and 266 million gallons annually of third-party bulk and liquid materials across our docks in 14 terminals Sprague intends to deliver increasing distributions to investors by growing distributable cash flow per unit through four primary business strategies: • Making accretive terminal and marketing/distribution business acquisitions • Achieving organic growth in existing business segments • Limiting exposure to commodity price volatility and credit risk • Maintaining operational excellence with safe, cost-effective operations and environmental stewardship

4 Key Considerations Outstanding operating performance has resulted in 2.1x coverage on TTM basis(1) Naturally de-levering balance sheet, low “permanent leverage” and ample liquidity Ability to finance near term acquisition and capex growth without additional equity Supply teams are experts in unique Northeast logistical challenges Product and service innovations generate incremental margins Long history of safe, cost-effective operations and environmental stewardship Materials Handling business is 100% fee-based, with multi-year contracts More than 50% of Refined Product sales are made under contract with customers Natural Gas contract base margins can be enhanced by optimization activities Strong track record of successful acquisitions Recent acquisitions offer opportunity to leverage legacy skills and investments Executing on organic growth projects at compelling effective multiples Terminaling, Logistics and Marketing Expertise Contract-Based Income with Upside Potential Financial Strength Visible Growth Prospects (1) As of December 31, 2015

5 Investing to Drive Growth 2010 to Present Sprague’s History of Growth • Acquired leading transportation fuels supplier in NYC metro area and expanded into delivered fuels business • Invested in capabilities to offer material handling services in paper/forest products industry • First supplier to offer biodiesel products in the Northeast • Additional natural gas acquisitions propelled down-market expansion to smaller commercial customers • Purchase of Kildair terminal on St. Lawrence river terminal expands footprint into Canada • Transitioned product offering to residual fuel oils, modifying coal terminals to handle new liquids • Maintained reputation as leading industrial energy supplier through multi-source Btu product offering • Sprague family sold business to Royal Dutch Shell in 1970 • Axel Johnson Inc. purchased Sprague in 1972 • Expanded into distillate fuels and serving wholesale segment • Offered customers access to gasoline • Entered natural gas marketing business, once again serving industrial account base with new Btu source • Leveraged refined product terminals for new materials handling business in coal, gypsum, and road salt • Expanded materials handling business to include liquids such as asphalt • Founded in Boston in 1870 by CH Sprague • Major coal supplier into the Northeast US, helping to fuel America’s industrial revolution • Fleet of steamship vessels allowed worldwide coal procurement and distribution network • Coal supplier to US Fleet in WWI and WWII Fueling America’s Growth 1870 to 1950 Evolving to Meet New Fuel Needs 1950 to 1985 Expanding the Product Offering 1985 to 2000 New Geographies and Capabilities 2000 to 2010 • Refined products growth powered by expanded third-party terminal presence and investments in Real- Time® pricing platform • Geographical footprint expands with key terminal purchase in Bronx, solidifying supply capability to NYC region • Natural gas acquisitions allow Sprague to serve smaller volume commercial accounts across a wider footprint • Initial Public Offering in late 2013

6 Sprague Acquisition History 2001 2003 2005 2007 2009 2011 Mt. Vernon, NY $1.1 mm New Bedford, MA $12.1 mm Portland, ME $5.8 mm Sprague has invested more than $445 million in acquisition growth since 2000 primarily through non-auction processes that leverage its network of relationships Everett, MA $0.7mm RAD Energy $23.6 mm Searsport, ME (expansion) $0.5 mm Houston Energy Services $6.7 mm Refined Products Natural Gas Materials Handling Kildair (expansion) $4.7 mm 2013 Bridgeport, CT $20.7 mm Kildair (50%) $71.9 mm Kildair (50%) $27.5 mm Albany, NY (expansion) $3.4 mm 2015 Metromedia Energy $22.0 mm Bronx, NY and Castle Oil $56.0 mm Hess Commercial Fuels $0 Kildair (dropdown) $175 mm Note: Sprague signed long term operating leases for control of key refined products terminal positions in the Providence, RI and New Haven, CT markets in April and July of 2014 Santa Buckley NG $17.5 mm

7 Refined Products Business Exploration / Production Refining Transportation Storage Commercial / Industrial Example Customers • Jobbers/Distributors • Municipalities • Manufacturers • Industrial Users • Transit Authorities • Property Managers Wholesale Activities Sprague purchases, transports, stores and markets distillates, unbranded gasoline, residual fuel oil and asphalt to wholesalers, resellers and commercial customers. Of our total volume sold in 2015, distillate sales accounted for 72%, gasoline accounted for 13% and residual fuel oil and asphalt accounted for approximately 15%.

8 Natural Gas Business • Power Generation • Manufacturing • Retail • Education • Government • Commercial Real Estate • Health Care Exploration / Production Processing Transportation Storage Local Distribution (Utility) Example Customers • Schedules delivery on major pipelines • Delivers gas to utilities and/or customers directly • Bills customers for supply • Provides value-added products and services Activities Sprague sells natural gas and related delivery services to industrial, commercial, institutional and government customers.

9 Materials Handling Business Offload Wood Pulp Offload Windmill Components Store Asphalt Rail, Truck, Ship Store Newsprint Source New England, Canada Source South America, Europe, Asia, Canada Customers Domestic Paper Mills Transport Ship Transport Export to Final Destination Load Crude Oil Load Gypsum Transport Activity Examples INBOUND OUTBOUND Sprague utilizes its waterfront terminal network to offload, store and prepare for delivery a wide variety of liquid, bulk and break bulk materials on long-term, predominantly fee-based contracts.

10 Heating Oil Diesel Fuel Residual Fuel and Asphalt Gasoline Other Distillates Adjusted Gross Margin for Year Ended 2015: $276 million Refined Products Volume by Product Segment: 2015 Materials Handled by Category: 2015 Refined Products 62% Natural Gas 18% Materials Handling 17% Earnings Diversity Other 3% Liquid Bulk: - Crude oil - Refined products - Asphalt - Clay slurry Dry Bulk: - Salt - Petroleum coke - Gypsum - Coal Break Bulk: - Wood pulp - Paper Heavy Lift: - Windmill components - Generators

11 Refined Products Advantages • One of the largest independent wholesale distributors of refined products in the Northeast US and Canada • Access to marine, rail and truck supply sources • Multiple storage tanks and automated truck loading equipment, blending and fuel additive injection systems capable of producing specialized fuel and asphalt • Long history of safe, cost-effective operations and environmental stewardship Asset Network Marketing Strength • Logistics and supply expertise keep terminals supplied in the most adverse conditions, earning reputation for reliability • Diverse product mix of heating oil, diesel fuel, unbranded gasoline, residual fuel oil, asphalt, kerosene, jet fuel and biofuels • Broad customer portfolio of wholesalers, distributors, federal and state agencies, municipalities, regional transit authorities, industrial companies, real estate managers, educational institutions and marine fuel consumers • Sprague Real-Time® pricing platform generating high percentage of contracted customer sales • Customized fuel management services including onsite bulk fuel supply construction and fleet card payment capabilities • Convenient access to customer service personnel, sales representatives and online account information $0.0779 $0.0619 $0.0779 $0.0876 $0.1012 $0.00 $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 2011 2012 2013 2014 2015 Refined Products Adjusted Unit Margin ($/gallon) Representative “Throughput Model” Margin (1) Sprague’s large and strategically located physical system supports a marketing business model built on supply and logistics expertise, coupled with product and service innovations, which we believe generates superior returns on the asset base over time as compared to a traditional throughput model (1) Source: Sprague

12 Refined Products Terminal Network (1) Does not include ~2.0 million barrels of storage capacity (45 storage tanks) currently out of service and not necessary for current operations 2015 Storage Metrics Storage Tanks: 209 Tank Capacity (1): 14.2 MMbbl 2015 Marketing Metrics ~ Volume: 40 million barrels ~ Customers 3,200

13 Refined Products Growth Castle Oil asset purchase completed December 8, 2014 • 907,000 barrel waterfront terminal asset in Bronx, NY established permanent Sprague position inside New York City • Leveraged Sprague’s existing marketing presence, supply and logistics capabilities and back office systems • Cash purchase plus minimal common unit issuance to seller, immediately accretive to unitholders Kildair “dropdown” completed December 9, 2014 • 3.3 million barrel terminal asset located on St. Lawrence Seaway expanded Sprague network into Canada • Cash purchase plus minimal common unit issuance to GP seller, immediately accretive to unitholders Acquisition Growth – leveraging existing expertise and customer service systems Organic Growth – expanding the range of products and services provided Bronx terminal • $3 million capital expansion investment to upgrade and automate rack system, increasing variety of products marketed Kildair terminal • $4.5 million capital expansion investment to convert 420,000 barrels of out of service heavy oil tankage to light oil service Albany terminal • $0.3 million capital expansion investment to return 128,000 barrels of storage to service to address 500 ppm heating oil market in adjacent states

14 $0.45 $0.54 $0.78 $1.02 $0.90 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2011 2012 2013 2014 2015 Natural Gas Advantages • Sizeable market presence of approximately 15,000 commercial and industrial service locations throughout the Northeast and Mid-Atlantic states • Diverse portfolio of industrial customers in the pulp and paper, chemical, pharmaceutical and metal sectors. Commercial customer examples include hospitals, universities, municipalities, government agencies, apartment buildings and retail stores of varying size • Wide range of pricing options available to meet various customer budget and payment needs, unlike utility providers • Convenient access to customer service personnel, sales representatives and online account information • Dual-fuel capabilities (gas or oil) during periods of price arbitrage or supply dislocations • Electricity brokerage platform rounds out the customer offering to include liquid fuel, natural gas and power supply Marketing Strength Supply and Scheduling Expertise • All gas supply and scheduling to customer is coordinated by Sprague employees with deep local market knowledge • Portfolio of supply contracts, pipeline transportation capacity leases, storage leases and other physical delivery services over various terms on all major pipeline systems into Sprague’s footprint provide guaranteed supply for customers • Supply portfolio flexibility and diversity offers arbitrage opportunities for margin expansion above base contract levels Sprague believes a marketing model built on supply and logistics expertise, coupled with product and service innovations, generate superior returns on the asset base over time as compared to wholesale supply services Natural Gas Adjusted Unit Margin ($/MMBtu) Representative Wholesale Supply Services Margin (1) (1) Source: Sprague

15 Natural Gas Service Area 2015 Supply Metrics Pipelines: 21 States/Utilities: 13/42 2015 Marketing Metrics ~ MMBtus: 56,900,000 ~ Customer Locations: 14,000 Sprague transportation rights:

16 Natural Gas Growth Metromedia Energy asset purchase completed October 1, 2014 • 15 Bcf of annual natural gas supply to additional 10,000 commercial, industrial and municipal accounts • Expansion of natural gas service area to Maryland, Virginia and the District of Columbia with increased density in Boston/New York/Washington corridor • Included power brokerage business serving more than 7,000 commercial and industrial customers • Leveraged Sprague’s existing marketing presence, gas supply and logistics capabilities and back office systems. Larger pool of account demand offered additional opportunities to optimize gas pathways to customer burner tips and earn incremental margin • Cash purchase, immediately accretive to unitholders Santa Buckley Energy natural gas asset purchase completed February 1, 2016 (see next slide for details) Metromedia Energy and Santa Buckley Energy natural gas asset purchases • Strengthened strategic focus on serving smaller volume commercial and industrial segment • Expanded Sprague’s product portfolio to include assisting customers with electricity procurement Acquisition Growth – leveraging existing expertise and customer service systems Organic Growth – expanding the range of products and services provided

17 Santa Buckley Energy Natural Gas Division Transaction Terms • On 2/1/2016, Sprague Resources LP (NYSE: SRLP) announced that its operating subsidiaries, Sprague Operating Resources LLC and Sprague Energy Solutions Inc., had finalized the purchase of certain natural gas business assets of Santa Buckley Energy, Inc. located in Bridgeport, Connecticut • $17.5 million total cash purchase price excluding consideration for working capital assets and liabilities, funded with cash on hand and credit facility borrowings • Immediately accretive to unitholders Asset overview • Santa Buckley Energy’s natural gas business consists of supply agreements to approximately 1,000 commercial and industrial customers across four states within Sprague’s current footprint (CT, RI, MA, NH) • Acquired portfolio of business represents approximately 10 Bcf of annual natural gas demand • Electricity brokerage offering included, adding to Sprague’s existing brokerage business • Customers are primarily supplied through two New England pipeline systems familiar to Sprague (AGT & TGP) • Capitalizes on Sprague’s gas supply and scheduling expertise, offering opportunities for improved economics and margin uplift through optimization • Historical average annual adjusted EBITDA run rate of $3.5 million • Purchase financed through existing acquisition facility utilizing liquidity. Sprague has naturally de-levered its balance sheet in 2015 by paying down acquisition facility with excess cash flows from operations

18 Sprague Natural Gas Service Area including Santa Buckley Key transaction considerations • Purchase continues to build scale for Sprague’s commercial and industrial account base in existing New England footprint • Transaction leverages Sprague’s marketing, supply and back office investments • All natural gas supply will now be coordinated through Sprague, not outsourced to a 3rd party, allowing for supply cost improvement • Increased scale in electricity brokerage platform • Natural gas book of business may include customers with dual-fuel capabilities and offer a liquid fuel sales opportunity as well Acquired Portfolio Statistics • 1,000 customers • 10 Bcf of annual gas demand • 16 LDC’s across four states (CT, RI, MA, NH)

19 $28.4 $32.3 $28.4 $37.8 $45.6 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 2011 2012 2013 2014 2015 Materials Handling Advantages Sprague’s materials handling business has produced steady fee-based cash flows backed by long term contracts, leveraging existing refined products terminals and workforce Materials Handling Adjusted Gross Margin ($ in millions) • Network of waterfront terminals from New York to New England and Quebec, offering customers unparalleled import/export access to the densely populated Northeast corridor, Great Lakes and St. Lawrence Seaway • Liquid storage capacity for crude oil, refined products, asphalt and other industrial liquids. Outdoor laydown space (pad storage) for bulk aggregates and large construction project cargo. Indoor warehouse capacity for break bulk materials • Intermodal access to terminals by ocean vessels, rail and truck. Crude handling capability via direct access to CN railroad Premier Asset Locations Leveraged Workforce and Capabilities • Ten terminals capable of handling both liquid petroleum products in service to the refined products business as well as providing third-party materials handling services • Diverse set of services offered including ship handling, crane operations, pile building, warehousing, scaling and potential transportation to the final customer • Long history of safe, cost-effective operations and environmental stewardship

20 Liquid Finger Dock Rail Transfer Pad Nacelles Road Salt Pads Clay Slurry Rail connection to CP, CMQ and Pan Am Liquid Finger Dock Dry Bulk Dock Food Grade Warehouses Available for Development Blades Hopper Coal / Petcoke Third Party Tanks Third Party Tanks Storage for Sprague or Third-Party Use Summary Specifications Tank Shell Capacity 17 Tanks 1,140,000 Bbls Dry Bulk Storage 90,000 ft2 Covered 857,000 ft2 Bulk Pad Total Acreage 157 Acres Unloading Blades Terminal Example - Searsport, Maine

21 Materials Handling Business 2015 Storage Metrics Storage Tanks: 209 Tank Capacity (1): 14.2 MMbbl 25 Pads: 1,647,000 ft2 9 Warehouses: 305,000 ft2

22 Materials Handling Growth Castle Oil asset purchase completed December 8, 2014 • Deepwater terminal asset in Bronx, NY provided direct access to New York City’s materials handling requirements • Asset and workforce supports both refined products and materials handling businesses • Cash purchase plus minimal common unit issuance to seller, immediately accretive to unitholders • Existing asphalt materials handling contract, space available for additional laydown space if needed Kildair “dropdown” completed December 9, 2014 • St. Lawrence Seaway terminal expanded Sprague network into Canada • Asset and workforce supports both refined products and materials handling businesses • Cash purchase plus minimal common unit issuance to GP seller, immediately accretive to unitholders • $30 million expansion capital project to support long-term crude handling and storage contract for customer Searsport terminal • Q3 2015 Searsport introduces bulk handling services for new scrap metal export customer • $900,000 Searsport investment in 2015 to upgrade and expand storage for increased windmill handling capabilities River Road terminal • $800,000 planned River Road investment to upgrade dock capabilities in 2016 Acquisition Growth – leveraging existing expertise and customer service systems Organic Growth – expanding the range of products and services provided

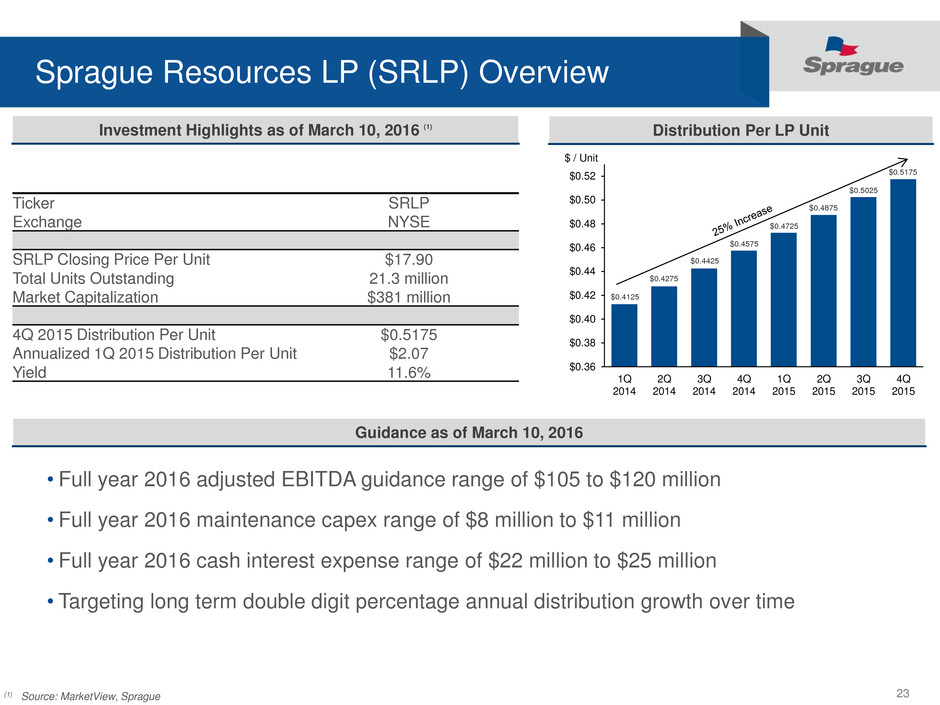

23 Sprague Resources LP (SRLP) Overview Distribution Per LP Unit Investment Highlights as of March 10, 2016 (1) Ticker SRLP Exchange NYSE SRLP Closing Price Per Unit $17.90 Total Units Outstanding 21.3 million Market Capitalization $381 million 4Q 2015 Distribution Per Unit $0.5175 Annualized 1Q 2015 Distribution Per Unit $2.07 Yield 11.6% • Full year 2016 adjusted EBITDA guidance range of $105 to $120 million • Full year 2016 maintenance capex range of $8 million to $11 million • Full year 2016 cash interest expense range of $22 million to $25 million • Targeting long term double digit percentage annual distribution growth over time Guidance as of March 10, 2016 $0.36 $0.38 $0.40 $0.42 $0.44 $0.46 $0.48 $0.50 $0.52 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 $ / Unit $0.4275 $0.4425 $0.4575 $0.4725 $0.4875 $0.5025 $0.4125 $0.5175 (1) Source: MarketView, Sprague

24 Financial Strengths Outstanding operating performance has resulted in 2.1x coverage on TTM basis(1) Seven consecutive quarterly distribution increases Maintained double-digit distribution growth guidance as of March 10, 2016 Permanent leverage ratio of 2.5x(2), well below facility covenants Excess cash flows used to pay down debt and naturally de-lever balance sheet Supportive credit facility with ample liquidity available to fund meaningful growth Ability to finance near term acquisition and capex growth without additional equity Organic capex projects typically funded with internal operating cash flows Business success not dependent on outright energy price levels Product slate continues to evolve to meet customer’s energy requirements Lower commodity prices decrease W/C requirements and interest expense Low Leverage Strong Coverage Business Model Room to Fund Growth Organically (1) As of December 31, 2015 (2) Acquisition facility debt as of December 31, 2015 divided by TTM Adjusted EBITDA

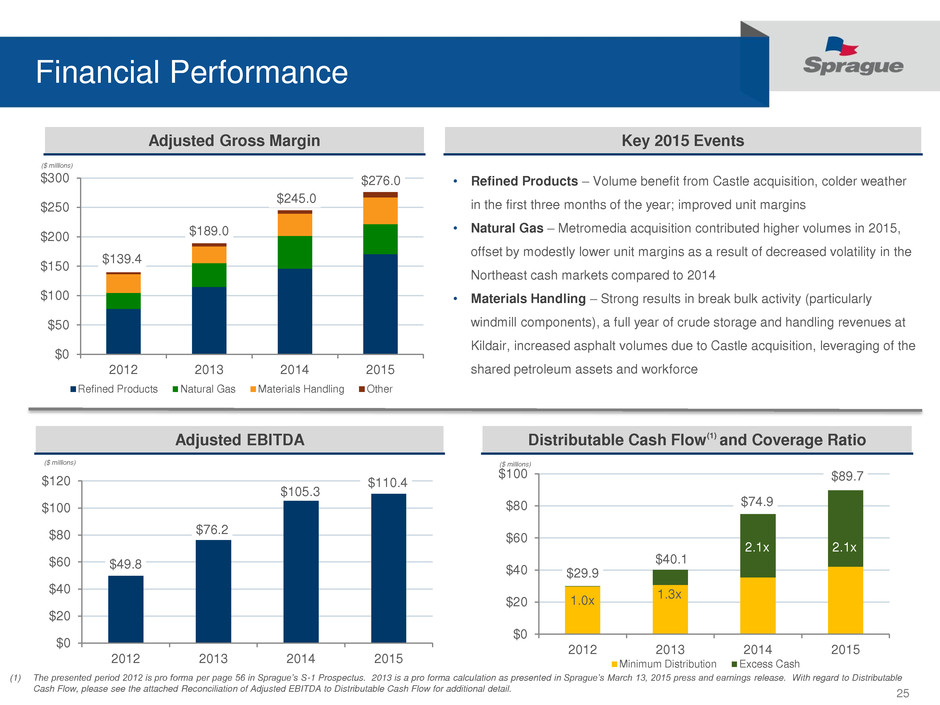

25 $29.9 $40.1 $74.9 $89.7 $0 $20 $40 $60 $80 $100 2012 2013 2014 2015 Minimum Distribution Excess Cash Financial Performance Adjusted EBITDA • Refined Products – Volume benefit from Castle acquisition, colder weather in the first three months of the year; improved unit margins • Natural Gas – Metromedia acquisition contributed higher volumes in 2015, offset by modestly lower unit margins as a result of decreased volatility in the Northeast cash markets compared to 2014 • Materials Handling – Strong results in break bulk activity (particularly windmill components), a full year of crude storage and handling revenues at Kildair, increased asphalt volumes due to Castle acquisition, leveraging of the shared petroleum assets and workforce Adjusted Gross Margin Key 2015 Events Distributable Cash Flow(1) and Coverage Ratio (1) The presented period 2012 is pro forma per page 56 in Sprague’s S-1 Prospectus. 2013 is a pro forma calculation as presented in Sprague’s March 13, 2015 press and earnings release. With regard to Distributable Cash Flow, please see the attached Reconciliation of Adjusted EBITDA to Distributable Cash Flow for additional detail. $139.4 $189.0 $245.0 $276.0 $0 $50 $100 $150 $200 $250 $300 2012 2013 2014 2015 Refined Products Natural Gas Materials Handling Other ($ millions) $49.8 $76.2 $105.3 $110.4 $0 $20 $40 $60 $80 $100 $120 2012 2013 2014 2015 ($ millions) ($ millions) 1.0x 1.3x 2.1x 2.1x

26 Sprague Consolidated Balance Sheet As of December 31, 2015 (In thousands) 12/31/15 12/31/14 Assets Current assets: Cash and cash equivalents $ 30,974 $ 4,080 Accounts receivable, net 160,848 289,424 Inventories 241,320 390,555 Fair value of derivative assets 157,714 229,890 Other current assets 57,006 53,311 Total current assets 647,862 967,260 Property, plant, and equipment, net 250,909 250,126 Intangibles and other assets, net 38,273 59,166 Goodwill, net 63,288 63,288 Total assets $ 1,000,332 $ 1,339,840 12/31/15 12/31/14 Liabilities and unitholders’ equity Current liabilities: Accounts payable and accrued liabilities $ 139,227 $ 262,425 Fair value of derivative liabilities 37,178 89,176 Due to General Partner and affiliate 14,021 15,340 Current portion of long-term debt 333,916 398,527 Total current liabilities 524,342 765,468 Long-term debt 287,184 423,780 Other liabilities 31,321 34,698 Total liabilities 842,847 1,223,946 Unitholders’ equity 157,485 115,894 Total liabilities and unitholders’ equity $ 1,000,332 $ 1,339,840

27 $0 $200 $400 $600 $800 $1,000 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Acquisition Line Working Capital Facility (in millions) Debt Liquidity Acquisition Facility $283 $117 Credit Facility, Liquidity and Leverage • $1.12 billion Working Capital facilities (includes $120 million multicurrency Working Capital facility) • $550 million Acquisition facility • Accordions: • Combined Working Capital facilities - $200 million • Acquisition facility - $200 million • Maximum size is $2.2 billion (including optional contango facility of $125 million) • Significant capacity and liquidity to finance our ongoing business requirements and growth • JPMorgan Chase is Administrative Agent (Syndicate of 24 Diverse Lenders) (in millions) Debt Liquidity Working Capital Facility $333 $187 Total Facility Size - $1.67 billion (Committed 5 years, expiring December 2019) Debt and Liquidity as of December 31, 2015 D e b t 3.0x 2.7x 2.7x Permanent Leverage Ratio(1) 2.8x $815 $728 $541 $555 (1) Acquisition facility debt as of December 31, 2015 divided by TTM Adjusted EBITDA $616 2.5x

28 Q4 and FY 2015 Selected Metrics Three Months Ended December 31, Twelve Months Ended December 31, 2015 2014 (1) 2015 2014 (1) (unaudited) (unaudited) ($ and volumes in thousands) Volumes: Refined products (gallons) 381,066 475,398 1,684,158 1,668,240 Natural gas (MMBtus) 14,147 16,166 56,894 54,430 Materials handling (short tons) 807 703 2,666 2,663 Materials handling (gallons) 79,296 96,474 266,280 309,834 Net Sales: Refined products $ 564,523 $ 1,076,410 $ 3,063,858 $ 4,650,871 Natural gas 81,648 104,926 347,453 359,984 Materials handling 11,665 10,908 45,570 37,776 Other operations 5,955 5,750 25,033 21,131 Total net sales $ 663,791 $ 1,197,994 $ 3,481,914 $ 5,069,762 Adjusted Gross Margin: Refined products $ 46,347 $ 44,153 $ 170,448 $ 146,021 Natural gas 10,448 12,922 51,004 55,536 Materials handling 11,665 10,925 45,564 37,811 Other operations 2,338 1,660 8,986 5,599 Total adjusted gross margin $ 70,798 $ 69,660 $ 276,002 $ 244,967 Calculation of Adjusted Gross Margin: (2) Total net sales $ 663,791 $ 1,197,994 $ 3,481,914 $ 5,069,762 Cost of products sold (exclusive of depreciation and amortization) (583,955 ) (1,076,155 ) (3,188,924 ) (4,755,031 ) Add: unrealized (gain) loss on inventory (3,023 ) 241 2,079 (11,070 ) Add: unrealized loss on prepaid forward contracts 380 — 2,628 — Add: unrealized gain on natural gas transportation contracts (6,395 ) (52,420 ) (21,695 ) (58,694 ) Total adjusted gross margin $ 70,798 $ 69,660 $ 276,002 $ 244,967 1) On December 9, 2014, the Partnership acquired all of the equity interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC. As the acquisition of Kildair by the Partnership represents a transfer of entities under common control, the Consolidated Financial Statements for the three and twelve months ended December 31, 2014, and related information presented herein have been recast by including the historical financial results of Kildair for all periods that were under common control. 2) Adjusted gross margin is defined as net sales less cost of products sold (exclusive of depreciation and amortization) increased by unrealized hedging losses and decreased by unrealized hedging gains, in each case with respect to refined products and natural gas inventory, prepaid forward contracts and natural gas transportation contracts.

29 Q4 and FY 2015 Adjusted EBITDA Reconciliation Three Months Ended December 31, Twelve Months Ended December 31, 2015 2014 (1) 2015 2014 (1) ($ in thousands, except unit and per unit amounts) Statement of Operations Data: Net sales $ 663,791 $ 1,197,994 $ 3,481,914 $ 5,069,762 Operating costs and expenses: Cost of products sold (exclusive of depreciation and amortization) 583,955 1,076,155 3,188,924 4,755,031 Operating expenses 17,074 16,395 71,468 62,993 Selling, general and administrative 23,210 22,963 94,403 76,420 Depreciation and amortization 4,977 5,167 20,342 17,625 Total operating costs and expenses 629,216 1,120,680 3,375,137 4,912,069 Operating income 34,575 77,314 106,777 157,693 Other (expense) income (216 ) (288 ) 298 (288 ) Interest income 89 169 456 569 Interest expense (6,743 ) (8,104 ) (27,367 ) (29,651 ) Income before income taxes 27,705 69,091 80,164 128,323 Income tax (benefit) provision 674 (3,503 ) (1,816 ) (5,509 ) Net income 28,379 65,588 78,348 122,814 Add/(deduct): Income attributable to Kildair — (1,977 ) — (4,080 ) Incentive distributions declared (167 ) — (321 ) — Limited partners’ interest in net income $ 28,212 $ 63,611 $ 78,027 $ 118,734 Net income per limited partner unit: Common - basic $ 1.34 $ 3.13 $ 3.71 $ 5.88 Common - diluted $ 1.32 $ 3.07 $ 3.65 $ 5.84 Subordinated - basic and diluted $ 1.34 $ 3.13 $ 3.71 $ 5.88 Units used to compute net income per limited partner unit: Common – basic 11,007,220 10,271,010 10,975,941 10,131,928 Common - diluted 11,187,570 10,453,910 11,141,333 10,195,566 Subordinated - basic and diluted 10,071,970 10,071,970 10,071,970 10,071,970 Reconciliation of net income to adjusted EBITDA: Net income $ 28,379 $ 65,588 $ 78,348 $ 122,814 Add/(deduct): Interest expense, net 6,654 7,935 26,911 29,082 Tax (benefit) provision (674 ) 3,503 1,816 5,509 Depreciation and amortization 4,977 5,167 20,342 17,625 EBITDA (2) $ 39,336 $ 82,193 $ 127,417 $ 175,030 Add: unrealized (gain) loss on inventory (3,023 ) 241 2,079 (11,070 ) Add: unrealized loss on prepaid forward contracts 380 — 2,628 — Add: unrealized gain on natural gas transportation contracts (6,395 ) (52,420 ) (21,695 ) (58,694 ) Adjusted EBITDA (3) $ 30,298 $ 30,014 $ 110,429 $ 105,266 1) On December 9, 2014, the Partnership acquired all of the equity interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC. As the acquisition of Kildair by the Partnership represents a transfer of entities under common control, the Consolidated Financial Statements for the three and twelve months ended December 31, 2014, and related information presented herein have been recast by including the historical financial results of Kildair for all periods that were under common control. 2) EBITDA represents net income before interest, income taxes, depreciation and amortization. 3) Adjusted EBITDA represents EBITDA increased by unrealized hedging losses and decreased by unrealized hedging gains, in each case with respect to refined products and natural gas inventory, prepaid forward contracts and natural gas transportation contracts.

30 Q3 and FY 2015 Distributable Cash Flow Reconciliation Three Months Ended December 31, Twelve Months Ended December 31, 2015 2014 (1) 2015 2014 (1) (unaudited) (unaudited) (unaudited) (unaudited) ($ in thousands) Reconciliation of adjusted EBITDA to distributable cash flow: Adjusted EBITDA (2) $ 30,298 $ 30,014 $ 110,429 $ 105,266 Add/(deduct): Cash interest expense, net (5,771 ) (6,687 ) (23,359 ) (24,265 ) Cash taxes 49 (1,350 ) (1,668 ) (3,042 ) Maintenance capital expenditures (1,689 ) (4,231 ) (8,855 ) (8,290 ) Elimination of expense relating to incentive compensation and directors fees expected to be paid in common units 3,206 2,915 8,437 8,182 Other 1,866 4,711 4,701 6,102 Eliminate the effects of Kildair (3) — (4,206 ) — (9,056 ) Distributable cash flow $ 27,959 $ 21,166 $ 89,685 $ 74,897 1) On December 9, 2014, the Partnership acquired all of the equity interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC. As the acquisition of Kildair by the Partnership represents a transfer of entities under common control, the Consolidated Financial Statements for the three and twelve months ended December 31, 2014, and related information presented herein have been recast by including the historical financial results of Kildair for all periods that were under common control. 2) Adjusted EBITDA represents EBITDA increased by unrealized hedging losses and decreased by unrealized hedging gains, in each case with respect to refined products and natural gas inventory, prepaid forward contracts and natural gas transportation contracts. 3) To report distributable cash flow excluding Kildair for the periods that were under common control and prior to the Kildair acquisition on December 9, 2014.