Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Virtu KCG Holdings LLC | d135216d8k.htm |

KCG Holdings, Inc. (KCG) Bernstein Financials Summit March 10, 2016 Exhibit 99.1

Safe Harbor Certain statements contained herein and the documents incorporated by reference containing the words “believes,” “intends,” “expects,” “anticipates,” and words of similar meaning, may constitute forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” are not historical facts and are based on current expectations, estimates and projections about KCG's industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Any forward-looking statement contained herein speaks only as of the date on which it is made. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with: (i) the inability to manage trading strategy performance and sustain revenue and earnings growth; (ii) the sale of KCG Hotspot, including the receipt of additional payments that are subject to certain contingencies; (iii) changes in market structure, legislative, regulatory or financial reporting rules, including the increased focus by Congress, federal and state regulators, the SROs and the media on market structure issues, and in particular, the scrutiny of high frequency trading, alternative trading systems, market fragmentation, colocation, access to market data feeds, and remuneration arrangements such as payment for order flow and exchange fee structures; (iv) past or future changes to KCG's organizational structure and management; (v) KCG's ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by KCG's customers and potential customers; (vi) KCG's ability to keep up with technological changes; (vii) KCG's ability to effectively identify and manage market risk, operational and technology risk, cybersecurity risk, legal risk, liquidity risk, reputational risk, counterparty and credit risk, international risk, regulatory risk, and compliance risk; (viii) the cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings; (ix) the effects of increased competition and KCG's ability to maintain and expand market share; (x) the announced plan to relocate KCG’s global headquarters from Jersey City, NJ to New York, NY; and (xi) KCG’s ability to complete the sale or disposition of any or all of the assets or businesses that are classified as held for sale. The list above is not exhaustive. Because forward looking statements involve risks and uncertainties, the actual results and performance of KCG may materially differ from the results expressed or implied by such statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Unless otherwise required by law, KCG also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made herein. Readers should carefully review the risks and uncertainties disclosed in KCG’s reports with the U.S. Securities and Exchange Commission (“SEC”), including those detailed in “Risk Factors” in Part I, Item 1A of KCG's Annual Report on Form 10-K for the year ended December 31, 2015, “Legal Proceedings” in Part I, Item 3, under “Certain Factors Affecting Results of Operations” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, in “Quantitative and Qualitative Disclosures About Market Risk” in Part II, Item 7A, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. This information should be read in conjunction with KCG’s Consolidated Financial Statements and the Notes thereto contained in its Form 10-K, and in other reports or documents KCG files with, or furnishes to, the SEC from time to time. For additional disclosures, please see https://www.kcg.com/legal/global-disclosures.

A better model for the emerging competitive landscape – a pure-play, execution-only, technology-driven intermediary for banks, brokers and asset managers Categorized among a group of specialized firms emerging as alternatives to the global banks across disciplines Prospects for greater operational efficiencies and multiyear organic growth direct from core capabilities requiring minimal additional investment Demonstrated record of capital return with strong cash flow generation, the pending monetization of a portion of KCG’s 16.7% stake in BATS and receivables from asset sales Management target for a return on equity (ROE) of 10% in 2017 up from 4% in 2015 Currently trading at a discount to tangible book value of $14.90 per share at year-end 2015 KCG Investment Rationale See addendum for a reconciliation of GAAP to non-GAAP financial results.

KCG facilitates the efficient trading of liquid financial instruments across asset classes and regions A leading, independent global securities firm dedicated exclusively to trading Applies intellectual capital, trading models, technology and data to principal trading as a market maker and agency-based trading Delivers consistent, high-quality trade executions on behalf of clients that drive trading performance for retail and institutional investors Contributes to better price discovery, deeper liquidity, tighter spreads and lower costs for all market participants The KCG Model Market Making Agency Execution Trading Venues

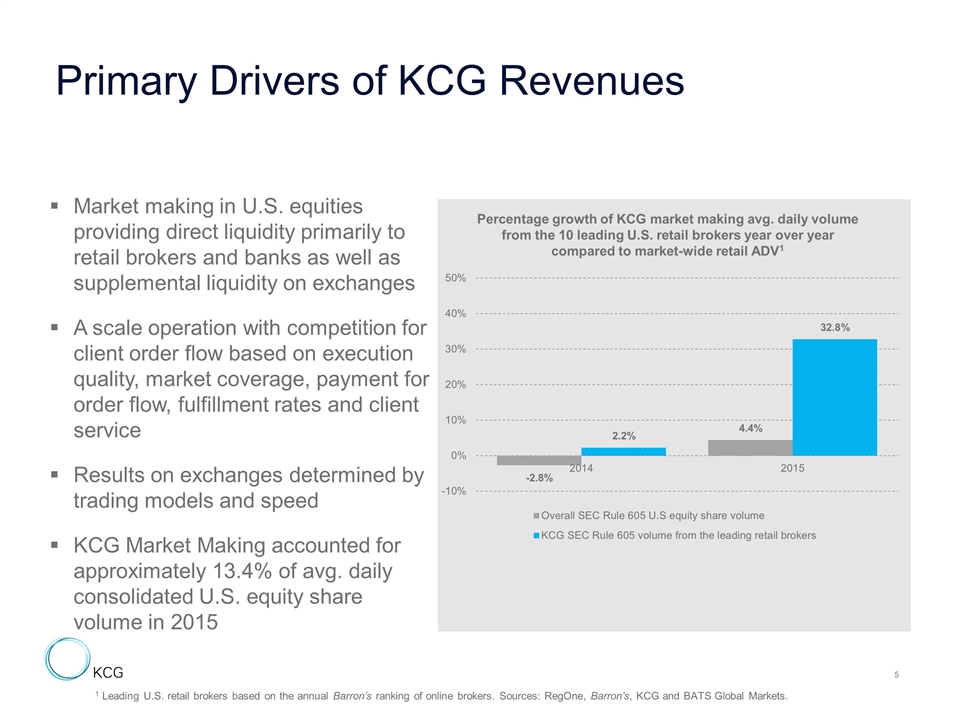

Market making in U.S. equities providing direct liquidity primarily to retail brokers and banks as well as supplemental liquidity on exchanges A scale operation with competition for client order flow based on execution quality, market coverage, payment for order flow, fulfillment rates and client service Results on exchanges determined by trading models and speed KCG Market Making accounted for approximately 13.4% of avg. daily consolidated U.S. equity share volume in 2015 1 Leading U.S. retail brokers based on the annual Barron’s ranking of online brokers. Sources: RegOne, Barron’s, KCG and BATS Global Markets. Primary Drivers of KCG Revenues Percentage growth of KCG market making avg. daily volume from the 10 leading U.S. retail brokers year over year compared to market-wide retail ADV1

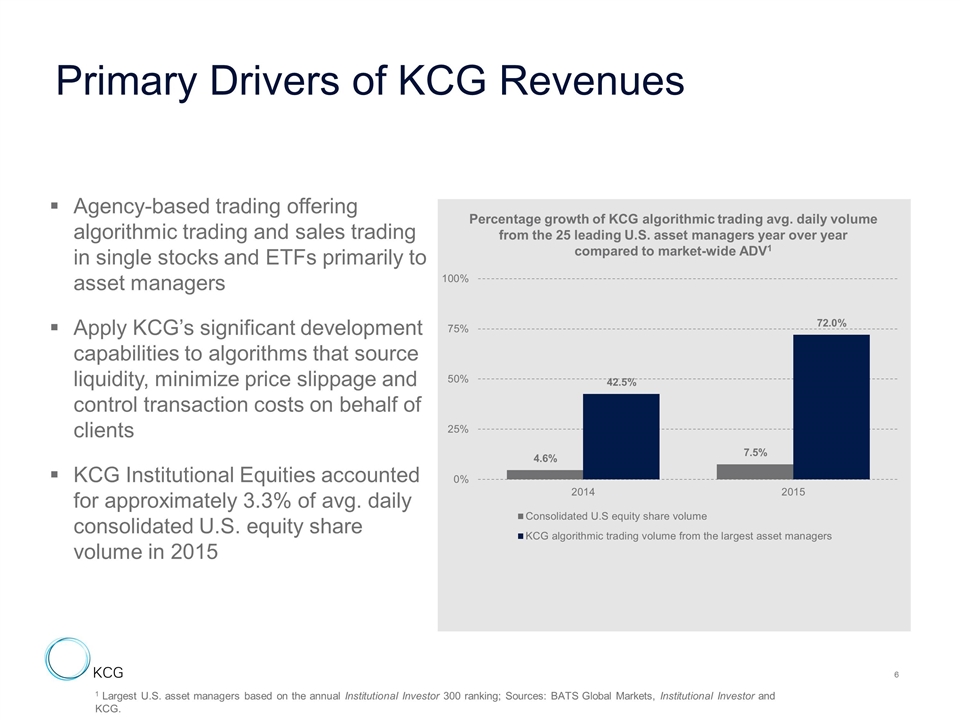

Agency-based trading offering algorithmic trading and sales trading in single stocks and ETFs primarily to asset managers Apply KCG’s significant development capabilities to algorithms that source liquidity, minimize price slippage and control transaction costs on behalf of clients KCG Institutional Equities accounted for approximately 3.3% of avg. daily consolidated U.S. equity share volume in 2015 1 Largest U.S. asset managers based on the annual Institutional Investor 300 ranking; Sources: BATS Global Markets, Institutional Investor and KCG. Primary Drivers of KCG Revenues Percentage growth of KCG algorithmic trading avg. daily volume from the 25 leading U.S. asset managers year over year compared to market-wide ADV1

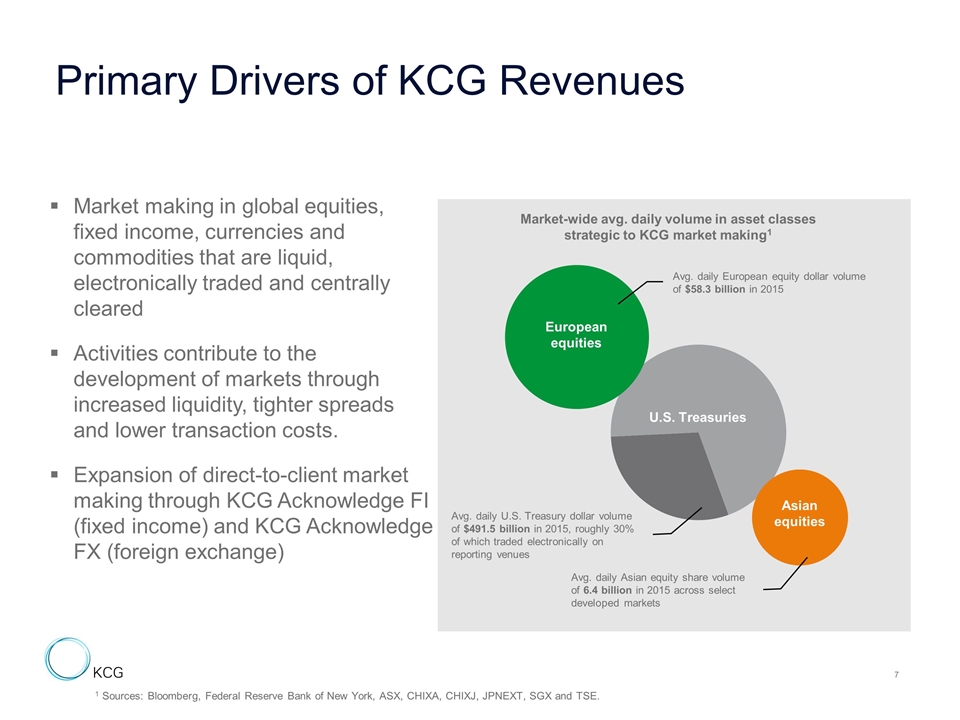

Market making in global equities, fixed income, currencies and commodities that are liquid, electronically traded and centrally cleared Activities contribute to the development of markets through increased liquidity, tighter spreads and lower transaction costs. Expansion of direct-to-client market making through KCG Acknowledge FI (fixed income) and KCG Acknowledge FX (foreign exchange) 1 Sources: Bloomberg, Federal Reserve Bank of New York, ASX, CHIXA, CHIXJ, JPNEXT, SGX and TSE. Primary Drivers of KCG Revenues Market-wide avg. daily volume in asset classes strategic to KCG market making1 U.S. Treasuries European equities Avg. daily European equity dollar volume of $58.3 billion in 2015 Asian equities Avg. daily U.S. Treasury dollar volume of $491.5 billion in 2015, roughly 30% of which traded electronically on reporting venues Avg. daily Asian equity share volume of 6.4 billion in 2015 across select developed markets

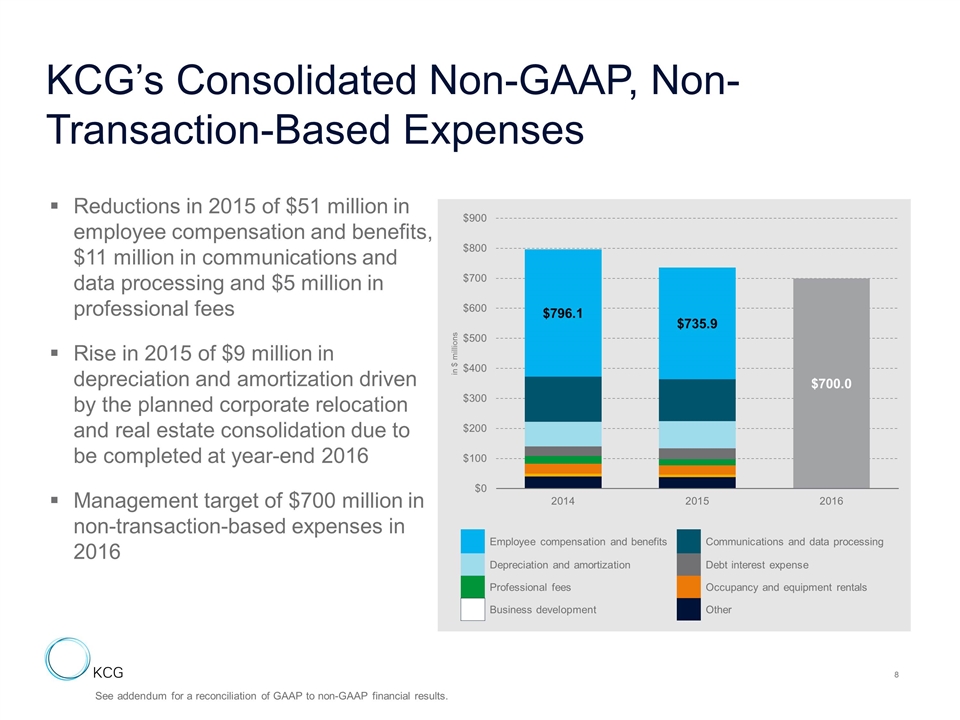

KCG’s Consolidated Non-GAAP, Non-Transaction-Based Expenses Reductions in 2015 of $51 million in employee compensation and benefits, $11 million in communications and data processing and $5 million in professional fees Rise in 2015 of $9 million in depreciation and amortization driven by the planned corporate relocation and real estate consolidation due to be completed at year-end 2016 Management target of $700 million in non-transaction-based expenses in 2016 Employee compensation and benefits Communications and data processing Depreciation and amortization Debt interest expense Professional fees Occupancy and equipment rentals Business development Other See addendum for a reconciliation of GAAP to non-GAAP financial results.

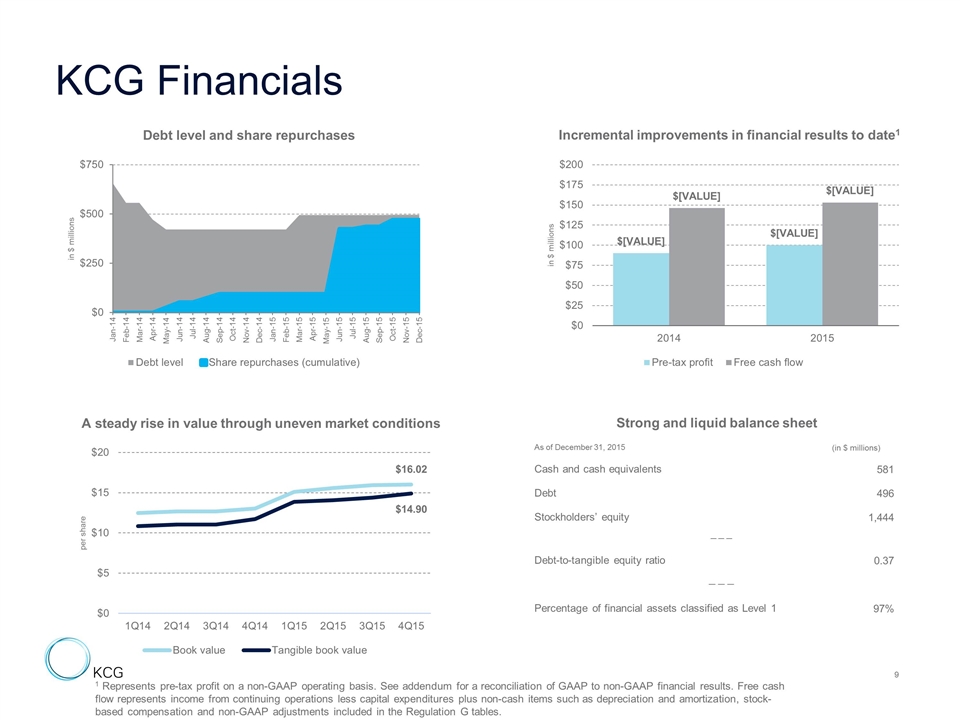

KCG Financials Debt level and share repurchases Incremental improvements in financial results to date1 A steady rise in value through uneven market conditions As of December 31, 2015 (in $ millions) Cash and cash equivalents 581 Debt 496 Stockholders’ equity 1,444 ─ ─ ─ Debt-to-tangible equity ratio 0.37 ─ ─ ─ Percentage of financial assets classified as Level 1 97% Strong and liquid balance sheet 1 Represents pre-tax profit on a non-GAAP operating basis. See addendum for a reconciliation of GAAP to non-GAAP financial results. Free cash flow represents income from continuing operations less capital expenditures plus non-cash items such as depreciation and amortization, stock-based compensation and non-GAAP adjustments included in the Regulation G tables.

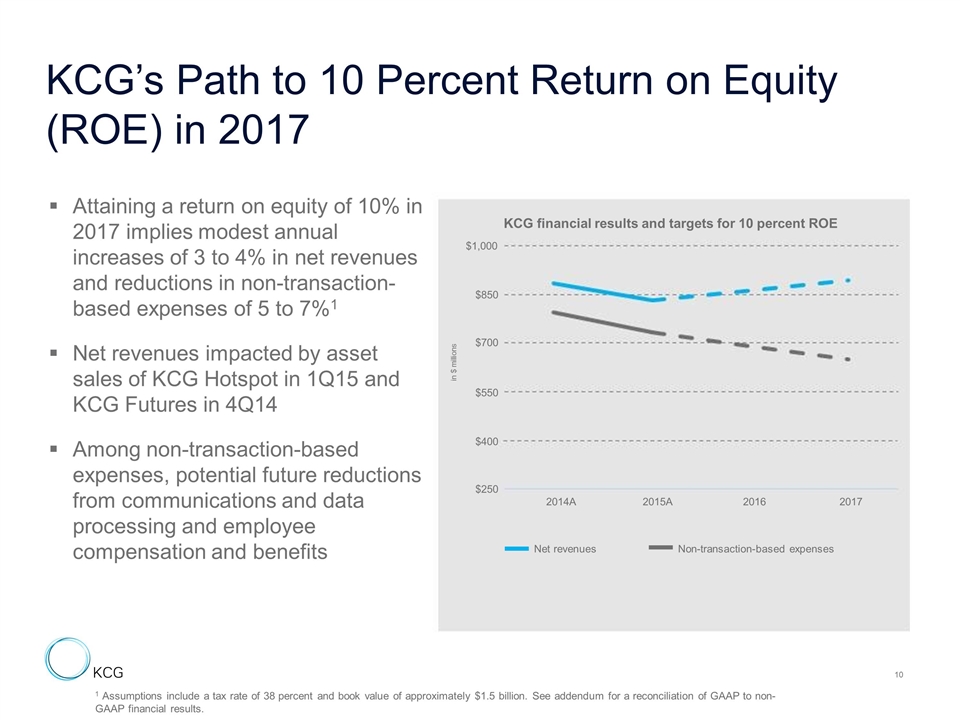

KCG’s Path to 10 Percent Return on Equity (ROE) in 2017 Attaining a return on equity of 10% in 2017 implies modest annual increases of 3 to 4% in net revenues and reductions in non-transaction-based expenses of 5 to 7%1 Net revenues impacted by asset sales of KCG Hotspot in 1Q15 and KCG Futures in 4Q14 Among non-transaction-based expenses, potential future reductions from communications and data processing and employee compensation and benefits 1 Assumptions include a tax rate of 38 percent and book value of approximately $1.5 billion. See addendum for a reconciliation of GAAP to non-GAAP financial results. Net revenues Non-transaction-based expenses $250 $400 $550 $700 $850 $1,000 2014A 2015A 2016 2017 in $ millions KCG financial results and targets for 10 percent ROE

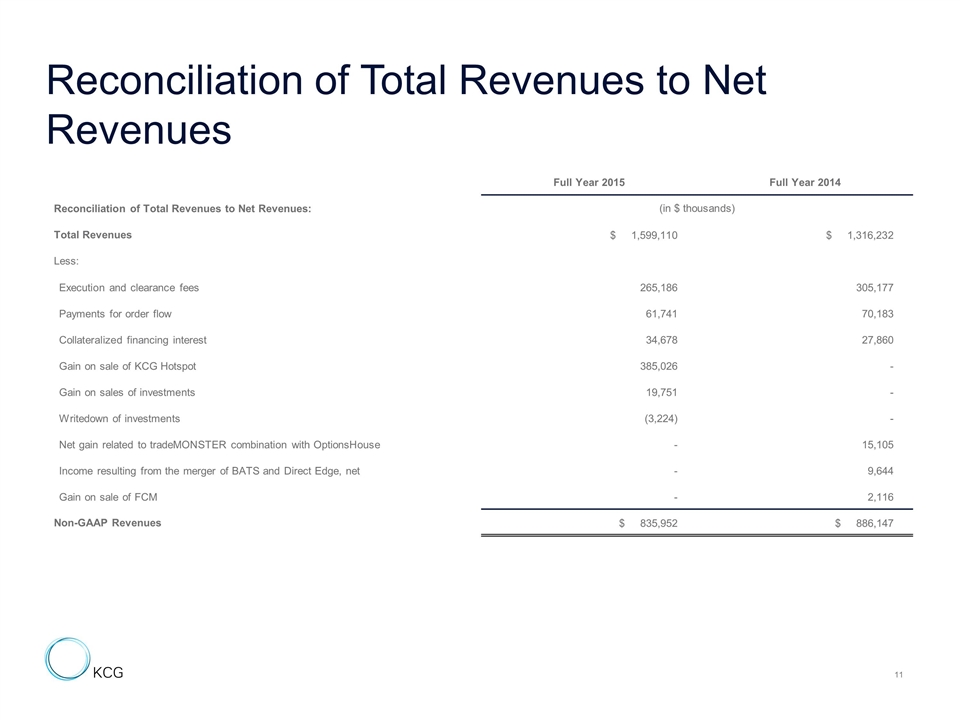

Reconciliation of Total Revenues to Net Revenues Full Year 2015 Full Year 2014 Reconciliation of Total Revenues to Net Revenues: (in $ thousands) Total Revenues $ 1,599,110 $ 1,316,232 Less: Execution and clearance fees 265,186 305,177 Payments for order flow 61,741 70,183 Collateralized financing interest 34,678 27,860 Gain on sale of KCG Hotspot 385,026 - Gain on sales of investments 19,751 - Writedown of investments (3,224) - Net gain related to tradeMONSTER combination with OptionsHouse - 15,105 Income resulting from the merger of BATS and Direct Edge, net - 9,644 Gain on sale of FCM - 2,116 Non-GAAP Revenues $ 835,952 $ 886,147 11

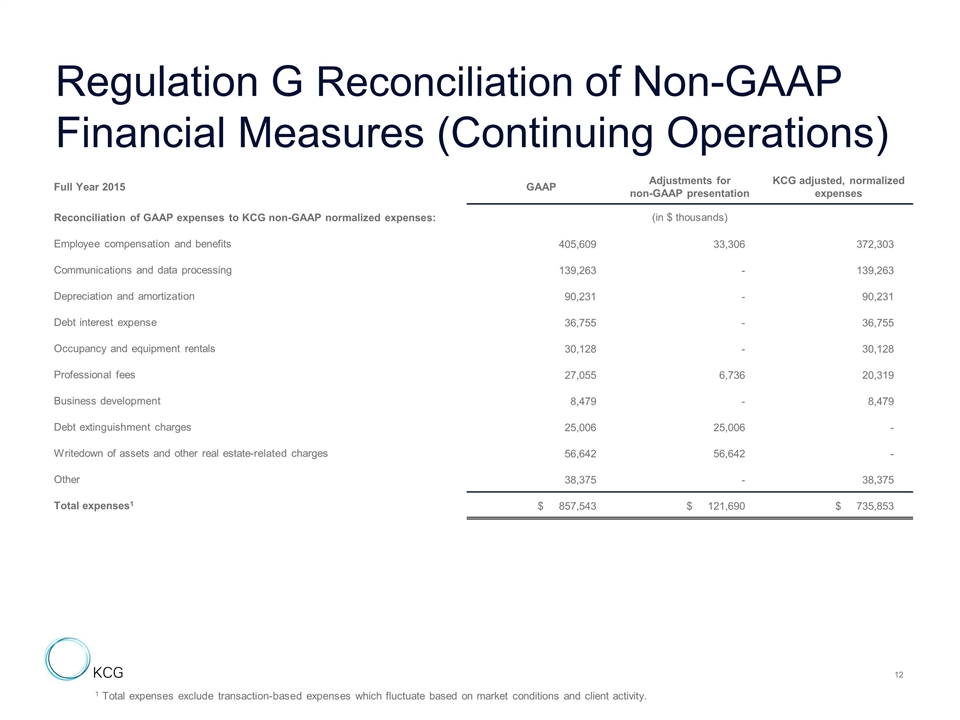

Regulation G Reconciliation of Non-GAAP Financial Measures (Continuing Operations) Full Year 2015 GAAP Adjustments for non-GAAP presentation KCG adjusted, normalized expenses Reconciliation of GAAP expenses to KCG non-GAAP normalized expenses: (in $ thousands) Employee compensation and benefits 405,609 33,306 372,303 Communications and data processing 139,263 - 139,263 Depreciation and amortization 90,231 - 90,231 Debt interest expense 36,755 - 36,755 Occupancy and equipment rentals 30,128 - 30,128 Professional fees 27,055 6,736 20,319 Business development 8,479 - 8,479 Debt extinguishment charges 25,006 25,006 - Writedown of assets and other real estate-related charges 56,642 56,642 - Other 38,375 - 38,375 Total expenses1 $ 857,543 $ 121,690 $ 735,853 1 Total expenses exclude transaction-based expenses which fluctuate based on market conditions and client activity. 12

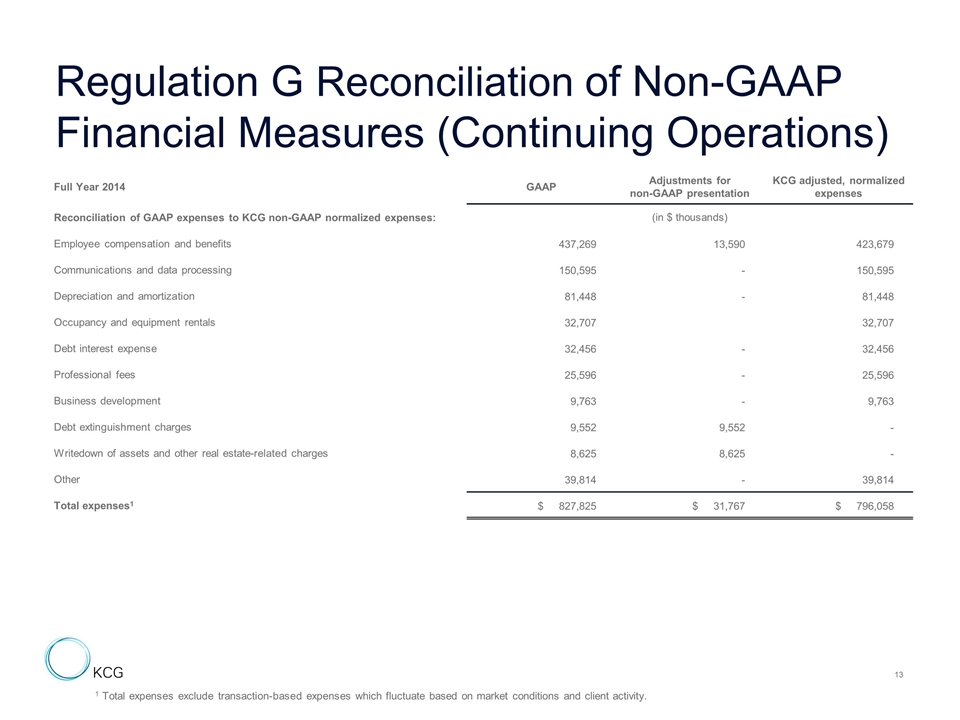

Regulation G Reconciliation of Non-GAAP Financial Measures (Continuing Operations) Full Year 2014 GAAP Adjustments for non-GAAP presentation KCG adjusted, normalized expenses Reconciliation of GAAP expenses to KCG non-GAAP normalized expenses: (in $ thousands) Employee compensation and benefits 437,269 13,590 423,679 Communications and data processing 150,595 - 150,595 Depreciation and amortization 81,448 - 81,448 Occupancy and equipment rentals 32,707 32,707 Debt interest expense 32,456 - 32,456 Professional fees 25,596 - 25,596 Business development 9,763 - 9,763 Debt extinguishment charges 9,552 9,552 - Writedown of assets and other real estate-related charges 8,625 8,625 - Other 39,814 - 39,814 Total expenses1 $ 827,825 $ 31,767 $ 796,058 1 Total expenses exclude transaction-based expenses which fluctuate based on market conditions and client activity. 13