Attached files

| file | filename |

|---|---|

| EX-21.1 - LISTING OF SUBSIDIARIES - ERICKSON INC. | eac-20151231xexx211.htm |

| EX-32.1 - CERTIFICATIONS OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER - ERICKSON INC. | eac-20151231xexx321.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM GRANT THORNTON LLP - ERICKSON INC. | eac-20151231xexx231.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - ERICKSON INC. | eac-20151231xexx312.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - ERICKSON INC. | eac-20151231xexx311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

_________________________

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2015 | |

OR | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________. | |

Commission File Number 001-35482

_________________________

ERICKSON INCORPORATED

(Exact name of registrant as specified in its charter)

_________________________

Delaware | 93-1307561 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

5550 SW Macadam Avenue, Suite 200, Portland, Oregon | 97239 | |

(Address of principal executive offices) | (Zip Code) | |

(503) 505-5800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.0001 par value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: N/A

(Title of each class)

_________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K ((§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | ||||

Non-accelerated filer | ý (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 30, 2015, the aggregate market value of voting common stock held by non-affiliates of the Registrant was approximately $27,050,053. For purposes of this calculation, executive officers, directors and entities deemed controlled by a director are considered affiliates.

On March 4, 2016, 13,895,421 shares of common stock, par value $0.0001, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

The registrant has incorporated by reference into Part III, Items 10 through 14, of this Annual Report on Form 10-K, portions of its definitive proxy statement to be filed pursuant to Regulation 14A for the Annual Meeting of Shareholders scheduled to be held on June 8, 2016.

2

ERICKSON INCORPORATED

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

3

DEFINITIONS

The abbreviations or acronyms defined below are used throughout this Form 10-K:

Abbreviation or Acronym | Definition | |

Air Amazonia | Air Amazonia Serviços Aeronauticos Ltda. | |

ANAC | Agência Nacional de Aviação Civil | |

CARB | Commercial Airlift Review Board | |

CPH | Cost per hour | |

DER | Designated Engineering Representatives | |

DoD | United States Department of Defense | |

DOJ | United States Department of Justice | |

DOT | United States Department of Transportation | |

EAR | Export Administration Regulations | |

EHI | Erickson Helicopters, Inc. (formerly “Evergreen Helicopters, Inc.”) | |

FAA | Federal Aviation Administration | |

FCPA | Foreign Corrupt Practices Act | |

FSC | Forest Stewardship Council | |

HRT | HRT Participacoes em Petroleo S.A. | |

ITAR | International Traffic in Arms Regulations | |

LCLA | Low cost/low altitude | |

MRO | Maintenance, repair and overhaul | |

OFAC | United States Department of the Treasury’s Office of Foreign Assets Control | |

OSHA | Occupational Safety and Health Administration | |

RII | Required Inspection Item | |

RTS | Return to Service | |

SEC | United Stated Securities and Exchange Commission | |

SHARP | Occupational Safety and Health Administration’s Safety and Health Achievement Recognition Program | |

STC’d | Supplemental Type Certificated | |

STOL | Short takeoff and landing | |

4

PART I

ITEM 1. | BUSINESS. |

Certain statements contained in this Item 1 may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those reflected in any forward-looking statements, as discussed more fully in Part I, “Item 1A. Risk Factors.”

General

Established in 1971, Erickson Incorporated is a global provider of aviation services to both commercial and governmental entities in 21 countries on six continents. We own and operate a diverse fleet of aircraft and provide a broad range of aerial services, including critical supply and logistics for deployed military forces, humanitarian relief, firefighting, timber harvesting, infrastructure construction, and crewing. We also maintain a vertically-integrated manufacturing capability for the Aircrane and related components, and maintenance, repair, and overhaul services for the Aircrane and other aircraft. We operate as three distinct segments consisting of Commercial Aviation Services, Global Defense and Security, and Manufacturing and Maintenance, Repair and Overhaul (“MRO”), with revenues and costs related to its business activities maintained and analyzed based on the type of customer served and services provided.

In May 2013, we acquired Evergreen Helicopters, Inc. for $298 million, which contributed a fleet of 65 aircraft of varying rotary-wing and fixed-wing types providing aerial services primarily for the United States (“U.S.”) Military in support of overseas operations. And, in September 2013, we acquired Air Amazonia Serviços Aeronauticos Ltda. (“Air Amazonia”) and certain related assets for $26 million, which contributed a fleet of six aircraft and repair station certification in Brazil.

As of December 31, 2015, we had 819 employees, of which approximately 364 are located in Oregon, primarily at our Southern Oregon facilities and Portland headquarters. We employ approximately 367 pilots and deployment personnel, including pilots and maintenance personnel, on-site globally where our aircraft are deployed. In the U.S., none of our employees are represented by a labor union. In Italy, 2 pilots are covered by statutory employment protections. And, in Brazil, all of our 20 employees are covered by statutory employment protections under Brazilian labor law.

We are a corporation organized under the laws of the State of Delaware in 2000. We are headquartered at 5550 SW Macadam Avenue, Suite 200, Portland Oregon, and our phone number is (503) 505-5800. We file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the “SEC”). Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available and may be assessed free of charge through the Investors section of the Company’s website at http://ericksoninc.com as soon as reasonable practicable after the reports are electronically filed with, or furnished to, the SEC. It is not intended that the Company’s website and the information contained therein or connected thereto be incorporated into this Annual Report of Form 10-K. Information may also be obtained vis the SEC website at sec.gov.

Aircraft Fleet and Aviation Services

We operate a diverse fleet of light, medium, and heavy rotor-wing and fixed-wing aircraft, including the world’s largest fleet of Aircranes. In providing aerial solutions to our customers, we typically lease our aviation services for specific missions, with customers generally paying for the aircraft, maintenance, and crewing services, and in many cases, fuel to operate the aircraft. Our crews consist of two to four pilots per aircraft who are capable of flying daily missions of up to 24 hours. Missions are generally highly specialized and require pilots, mechanics, technicians, and support crews with extensive experience in aviation operations and in specific mission training.

The Aircrane is a versatile and powerful heavy-lift helicopter that we manufacture in-house. With two models, the S-64E and S-64F, and a lift capacity of up to 25,000 pounds, the Aircrane is the only commercial aircraft built specifically as a flying crane, without a fuselage for internal loads. The Aircrane is unique in that it is a commercial heavy-lift helicopter with a rear load-facing cockpit, combining an unobstructed view and complete aircraft control for precision lift and load placement capabilities. In certain circumstances, our in-house engineers have designed custom modifications to the Aircrane to meet certain industry-specific needs, like our “heli-harvester” hydraulic logging grapple, a 2,650-gallon water tank and snorkel for aerial firefighting, an anti-rotation device and hoist for construction, and composite main rotor blades designed to improve performance. We own the Type and Production Certificates for the Aircrane, granting us exclusive design, manufacturing and

5

related rights for the aircraft and original equipment manufacturer (“OEM”) components, and the Type Certificate for the engine type used in the Aircrane.

Periodically, our aircraft are removed from service and undergo heavy maintenance activities, including inspections and repairs of the airframe and related parts as required. The actual time between heavy maintenance depends on many factors, including hours of operation, calendar time and nature of use. Heavy maintenance can require several months to complete, during which time the aircraft is unavailable for aerial services. As a result of maintenance, aircraft are out-of-service from time-to-time. Throughout the course of any given year, the composition of our fleet may change to meet the needs of our business. As needed, we may remove aircraft from service for maintenance or to sell, or add aircraft to the fleet either through our own manufacturing facility or through a purchase or lease.

Our fleet includes the heavy-lift rotor wing Aircrane, as well as medium-/light-lift rotor wing and fixed wing aircraft as follows:

As of December 31, | ||||||||

2015 | 2014 | 2013 | ||||||

Summary of owned and leased aircraft: | ||||||||

Owned | 47 | 54 | 56 | |||||

Leased | 27 | 32 | 34 | |||||

Total aircraft in fleet, including aircraft held for sale | 74 | 86 | 90 | |||||

Type and model of aircraft in fleet: | ||||||||

Rotor wing: | ||||||||

Heavy lift | 20 | 20 | 20 | |||||

Medium lift | 36 | 41 | 41 | |||||

Light lift | 11 | 13 | 16 | |||||

Fixed wing | 7 | 12 | 13 | |||||

Total aircraft in fleet, including aircraft held for sale | 74 | 86 | 90 | |||||

Less: | ||||||||

Aircraft held for sale | 15 | — | — | |||||

Total aircraft in fleet | 59 | 86 | 90 | |||||

Aircraft deployed outside of North America | 33 | 41 | 50 | |||||

Although the global deployment of the Company’s aircraft and crews helps limit the effects of seasonality, historically the demand for the Company’s services are generally reduced in winter or monsoon seasons, January through April, with peak season from June through October.

During the years ended December 31, 2015, 2014 and 2013, we had two customers, Fluor Government Group and the U.S. Forest Service, each representing 13% to 18% of our revenues, with no other customer representing more than 10%. Additionally, during the year ended December 31, 2015, 36% of our revenues was generated in the U.S., compared with 30% in 2014 and 34% in 2013.

Financial information for each of our reportable segments, Commercial Aviation Services, Global Defense and Security, and Manufacturing and MRO, is included in the notes to our consolidated financial statements included in Item. 8—“Financial Statements and Supplementary Data.”

Commercial Aviation Services. Our Commercial Aviation Services revenue is primarily derived from contract arrangements with customers on a global basis, including North America, Europe, Australia, and South America, who use our services for the following:

• | Firefighting. Our aerial firefighting services are provided to customers including federal, state, local and international government and commercial entities. Under our typical firefighting contracts, aircraft are deployed to locations prone to seasonal fires, where they remain on standby throughout the fire season. Because of the inverse timing of fire seasons in the Northern and Southern Hemispheres, we are able to provide firefighting services on year-round basis by moving aircraft from one hemisphere to another. |

6

• | Timber Harvesting. Our aerial timber harvesting services are primarily provided to commercial entities, whereby timber is vertically lifted and transported with our proprietary hydraulic grapple, minimizing the need for road development and large support crews on the ground. Aerial timber harvesting is often used to harvest high-value timber to be used in high-grade products such as furniture and flooring. It can also be a strategy for reaching timber located in challenging terrain, where building access roads is cost-prohibitive or logistically impossible. |

• | Infrastructure Construction. Our aerial infrastructure construction services are provided to commercial entities within the construction, energy transmission, and energy generation industries, and also include international governments. Heavy-lift helicopters, such as the Aircrane, are used in a variety of infrastructure construction projects such as transmission and utility grid construction, wind turbine construction, and HVAC unit placement, allowing utilities and construction services firms to install infrastructure in remote or hard-to-access locations. |

• | Oil and Gas. Our aerial oil and gas services are provided to commercial entities in the exploration of such resources, as well as their production process. We provide passenger and cargo transport in austere and remote locations with difficult operating challenges, including the transport of drilling supplies and production rig equipment with surveyors and geologists deep into the jungle or carrying personnel and supplies to remote drill platforms. |

We provide such services pursuant to a variety of contractual arrangements, including: (i) a daily standby fee for the contract period with an additional rate for hours flown; (ii) exclusive use contracts whereby we are obligated to provide, and our customer is obligated to take and pay for, the use of our services which is charged on a per-day basis for availability and on a per-hour basis for actual aircraft use; (iii) call when needed contracts whereby we may elect to provide services if such customer requests and we only charge for actual aircraft use; and (iv) an hourly rate structure or on a per cubic meter of timber delivered basis. Contract terms can range from a single lift to several years in duration.

This market is fragmented with competition coming primarily from smaller regional operators and we generally compete on capability of the aircraft, price, safety record, and accident prevention and training. Such aviation services to commercial entities is highly competitive and requires specialized and unique aircraft capable of performing precision and heavy load lifts and a highly skilled workforce to deliver such services.

During the years ended December 31, 2015, 2014 and 2013, approximately 58%, 62% and 59%, respectively, of our Commercial Aviation Services revenues were derived from operations outside of the U.S.

Global Defense and Security. Our Global Defense and Security revenue is primarily derived from contract arrangements with domestic and foreign governmental entities who use our services for the transport of personnel and cargo, as well as maintenance, logistics and training all in connection with their defense and security programs. The majority of such services are performed outside of the U.S. in hostile areas.

We have the capability of deploying aircraft to support external load operations, passenger and cargo transportation, combination loads, low cost/low altitude (“LCLA”) airdrops, short takeoff and landing (“STOL”), the transportation of persons by air to a place where they can receive medical care (“MEDEVAC”), and the evacuation of casualties by air (“CASEVAC”). Our aircraft can be equipped with Supplemental Type Certificated (“STC’d”) Night Vision Goggles, Ballistic Protection, and roller systems.

We generally charge a daily standby fee for the contract period with an additional rate for hours flown, with some contracts including a minimum number of hours to be flown before the hourly rate is charged. Contract terms range from 2 months to 5 years, with the majority being multi-year arrangements.

In order to transport any DoD passengers or cargo in a civilian aircraft, the operator must undergo a set of audits to become certified, with follow-up inspections thereafter. To compete, companies must have a variety of operational specifications approved by both the FAA and CARB, resulting in a significant barrier to entry into the market.

During the years ended December 31, 2015, 2014 and 2013, approximately 97%, 99% and 97%, respectively, of our Global Defense and Security revenues were derived from either prime or sub contracts for the DoD, with approximately 93%, 88%, and 91%, respectively, related to operations outside of the U.S.

Manufacturing and MRO. Our Manufacturing and MRO revenue is primarily derived from customers who own or operate Aircranes, or the military version CH-54s, and other legacy aircraft platforms, which generally consist of older aircraft no longer in production by the original equipment manufacturer such as the Bell 214 helicopter. It includes the sale of aircraft

7

components and MRO services for these helicopters globally. Such revenue also includes revenue from the sale of any aircraft.

We have extensive capabilities in new parts production of airframes, aircraft systems, and avionics components for a wide variety of rotary aircraft. Our manufacturing operations can fabricate hard-to-locate parts, or even reverse engineer and reproduce parts that may no longer be available from traditional sources. We manufacture new aircraft components on a contract basis for key original equipment manufacturers of helicopters, as well as provide a wide array of MRO services to helicopter operators globally. These services include the disassembly, cleaning, inspection, repair, and reassembly of airframes, engines, components, and accessories, as well as the testing of complete engines and components to FAA standards, as well as reciprocating international agencies. We provide these services out of our AS9100-certified facilities in Southern Oregon, which we complement with field support. We are able to remanufacture an Aircrane to new specifications in approximately 8 to 12 months, depending on specifications and complexity.

To provide Manufacturing and MRO services, as well as to support the maintenance and repair services of our aircraft fleet, we carry a significant amount of aircraft support parts, many of which are no longer in production. Many of these items are parts that have been removed from aircraft, refurbished according to manufacturers and FAA specifications, and returned to aircraft support parts for use on our aircraft fleet or for sale to other helicopter owners or operators.

The majority of our contracts for manufacturing and MRO services are fixed priced, based on specifications of services to be provided or parts to be delivered. In addition, we offer “Cost per Hour” (“CPH”) contracts, in which we provide a full suite of parts and services (e.g., replacement parts, spare parts replenishment, scheduled and unscheduled engine maintenance) for a customer’s Aircrane at a fixed hourly rate. We also offer similar operations and services on engines and other components for owners of other aircraft platforms.

This market is fragmented with competition coming primarily from smaller regional entities. We generally compete on capability of the MRO facilities and personnel, as well as price. The providing of such MRO services is highly competitive and requires requisite facilities, access to aircraft supply parts, or the ability to manufacture in-house, and a highly skilled workforce to deliver such services.

During the years ended December 31, 2015, 2014 and 2013, Manufacturing and MRO revenues were $31.5 million, $15.3 million and $12.7 million, respectively, and represented 11% of revenues in 2015, compared with 4% in 2014 and 2013. We sold seven aircraft totaling $7.5 million in 2015, with four aircraft sold in 2014 totaling $2.8 million and none in 2013.

Backlog. Backlog represents the amount of revenue that we expect to derive from signed contracts, including oral contracts that have been subsequently memorialized in writing, or customer extension options. Our backlog consists of contracts with a duration of six months or more. For contracts that include both a daily and an hourly rate component, only the daily component of revenue is included in backlog and an estimate of the expected hourly revenue is not included. For contracts that include a guaranteed number of hours, the value of the guaranteed hours is included in backlog. For CPH contracts, which depend on hours flown by our customers, we calculate the contribution to backlog based on contracted minimum hours. When a binding aircraft sale contract has been signed with a customer, the purchase price of the aircraft not included in current revenues is included in backlog. When we sign a contract giving a potential purchaser an option to purchase an aircraft which only becomes binding on a non-refundable payment of a material option fee, we do not include the purchase price of the aircraft in backlog until the non-refundable payment has been made and the contract is a binding purchase contract.

As of February 16, 2016, our backlog was $228.4 million, of which $114.2 million was attributable to signed contracts and $114.2 million was attributable to anticipated exercises of customer extension options. We had total backlog of $325.4 million, of which $159.7 million was attributable to signed contracts and $165.7 million was attributable to anticipated exercises of customer extension options as of December 31, 2014. A material portion of our contracts are subject to a cancellation notice period of 90 days or less.

Research and Development. We dedicate resources to improving our aircraft’s performance and developing new applications and products. During 2015, 2014 and 2013, we incurred $2.7 million, $3.8 million and $4.0 million, respectively on research and development activities. We have recently completed fabrication of composite main rotor blades, of which testing is expected to begin in the second quarter of 2016, and commercial production by the fourth quarter of 2016. We plan to extend such research and development efforts to other legacy aircraft models.

Intellectual Property. Our core technologies are protected through a combination of intellectual property rights, including ownership of S-64 Type and Production Certificates, trade secrets, patents, copyrights, and trademarks, as well as through contractual restrictions. We enter into confidentiality and inventions assignment agreements with our designers, engineers, consultants, and business partners, and we control access to and distribution of our proprietary information.

8

Regulation

All aspects of our business are heavily regulated under federal, state, local, and foreign laws and regulations. These laws and regulations may require us to maintain and comply with a wide variety of certificates, permits, licenses, noise abatement standards, and other requirements. These regulatory agencies have the authority to modify, amend, suspend, or revoke the certificates, permits, and licenses granted to us for failure to comply with provisions of law or applicable regulations, and may impose civil or criminal penalties for violations of applicable rules and regulations.

FAA and Comparable Agencies. We operate under Federal Aviation Administration (“FAA”) Part 135, U.S. Air Carrier, Part 133, Rotorcraft External-Load Operations, and Part 144, Repair Stations. Our aerial operations, aircraft manufacturing, and MRO activities are subject to complex aviation and transportation laws and regulations under which the U.S. Department of Transportation (“DOT”), principally through the FAA, exercises regulatory authority over certificate holders and persons that operate, manufacture, or repair aircraft. We are also subject to comparable regulation in several foreign countries with respect to our operations in those countries.

The FAA and comparable foreign agencies have jurisdiction over many aspects of our business, including:

• | The issuance of type certificates for the Aircrane and Aircrane engines; |

• | Approval of major modifications to the Aircrane or its systems; |

• | Approval of Aircrane accessories used in our operations, such as our sea snorkel and our anti-rotation device and hoist; |

• | Promulgation and enforcement of rules governing the operation of aircraft generally and in connection with specific missions; |

• | Promulgation and enforcement of rules governing the manufacture and repair of aircraft, aircraft systems, and aircraft components; and |

• | Promulgation and enforcement of rules governing the qualification, training, and currency of pilots, flight crew, and repair and maintenance personnel. |

The FAA and comparable foreign authorities actively monitor compliance with these rules and conduct regular inspections and audits of our operations and facilities. A serious violation of any of these rules could result in the imposition of fines or penalties, the revocation of our type certificate or the suspension or revocation of our operating licenses. The aviation regulation agencies in various jurisdictions sometimes work in concert to avoid duplication of regulatory effort, but each agency has authority to impose and enforce its own regulations and conduct its own inspections with respect to operations within its jurisdiction.

U.S. federal laws require that at least 75% of the voting securities of a domestic air carrier be owned or controlled by citizens of the U.S., and that its president and at least two-thirds of its directors and managing officers be U.S. citizens. Our CEO and at least two-thirds of our directors and managing officers are U.S. citizens, and our certificate of incorporation and bylaws restrict voting of shares of our capital stock by non-U.S. citizens. Our bylaws provide that no shares of our capital stock may be voted by or at the direction of non-U.S. citizens unless such shares are registered on a separate stock record, which we refer to as the foreign stock record. Our bylaws further provide that the voting rights of the shares registered on the foreign stock record in the name of each foreign stockholder will be proportionally reduced so that the voting rights of the amount so registered are reduced if the amount registered would exceed the foreign ownership restrictions imposed by federal law.

The Commercial Airlift Review Board (“CARB”) regulates civilian air carriers transporting passengers for the U.S. Department of Defense (“DoD”), which includes the U.S. Army, U.S. Navy, Air Force, Marines, and Special Operations units. CARB authorization allows the DoD to utilize approved civilian air carriers to provide mission-critical support service. We hold CARB authorization to operate both rotor and fixed wing aircraft for the DoD.

Environmental Regulations. We are subject to stringent federal, state, local, and foreign environmental laws and regulations concerning, among other things, water discharges, air emissions, hazardous material and waste management, and environmental cleanup.

Other Regulations. Our operations in non-U.S. jurisdictions are subject to local governmental regulations that may limit foreign ownership of aviation companies. Because of these local regulations, we conduct some of our operations through entities in which local citizens own a majority interest and we hold a minority interest, or through local agents. We retain independent representatives in specific countries on a commission basis, and our independent representatives operate under

9

contracts in which they pledge to act in full compliance with the Foreign Corrupt Practices Act (“FCPA”) and other applicable legislation.

Our operations are subject to U.S. export control laws and regulations that regulate the import, export, and re-export of products, technologies, and services. This includes economic sanctions and anti-boycott laws that together serve to protect and promote national security, economic stability, and human rights. We also comply with applicable trade control laws of the countries in which we operate.

Our operations are also subject to the oversight of the Occupational Safety and Health Administration (“OSHA”) concerning employee safety and health matters.

ITEM 1A. RISK FACTORS.

Our business is subject to numerous risks and uncertainties. You should carefully consider the following risk factors and all other information contained in this annual report on Form 10-K and the reports we file with the SEC from time to time. Any of these risks could harm our business, results of operations, financial condition and prospects. In addition, risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, results of operations, financial condition and prospects.

Risks Relating to our Indebtedness

Our substantial indebtedness and significant debt service obligations could adversely affect our financial condition and impair our ability to grow and operate our business.

We have a substantial amount of debt and have significant debt service obligations. As of December 31, 2015, the principal amount of our total indebtedness was approximately $479.1 million, and secured by liens on substantially all of our existing and future assets.

The existence and terms of our indebtedness could adversely affect our financial condition by:

• | making it more difficult for us to satisfy our obligations with respect to our indebtedness; |

• | increasing our vulnerability to generally adverse economic and industry conditions; |

• | limiting our ability to fund future working capital, capital expenditures, research and development and other general corporate requirements; |

• | requiring us to dedicate a substantial portion of our cash flow from operations to service payments on our debt; |

• | limiting our flexibility to react to changes in our business and the industry in which we operate; |

• | placing us at a competitive disadvantage to any of our competitors that have less debt; |

• | limiting our ability to borrow additional funds; and |

• | requiring us to comply with financial and other restrictive covenants. |

Our failure to comply with the covenants contained in our credit facility could result in an event of default, which could materially and adversely affect our operating results and our financial condition.

Our ability to draw down borrowings under our credit facility depends in part on our compliance with financial covenants contained in the facility. An inability to draw down on our credit facility could have a material adverse effect on our ability to make capital expenditures, on our results of operations and on our liquidity. Further, failure to maintain the financial ratios required under our credit facility would constitute an event of default, allowing the lenders under our credit facility to declare the entire balance of any and all sums payable under the credit facility immediately due and payable. If a payment default or acceleration were to occur under our credit facility, holders of our $355 million principal amount of 8.25% Second Priority Senior Secured Promissory Notes due 2020 (“2020 Senior Notes”) would be permitted to accelerate the maturity of the 2020 Senior Notes.

We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to meet our debt service obligations and seek any potential refinancing of our indebtedness depends upon our ability to generate sufficient cash from our operations, financings or asset sales, which are subject to general economic conditions, industry cycles, seasonality and other factors, some of which may be beyond our control. If our cash flows and capital

10

resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and may have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness, selling our assets, reducing or delaying capital investments or seeking to raise additional capital. Our ability to restructure or refinance our indebtedness will depend on the conditions of the capital markets and our financial condition at such time. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments may also restrict us from adopting some of these alternatives. If we cannot make scheduled payments on our debt, we will be in default under our credit facilities and the lenders under our 2020 Senior Notes and credit facility could declare all outstanding principal and interest to be due and payable and we could be forced into bankruptcy or liquidation.

Our ability to obtain adequate financing or raise capital in the future may be limited.

We depend, in part, upon borrowings under our credit facilities to fund our operations and contractual commitments. If we were called upon to fund all outstanding commitments, we may not have sufficient funds to do so. A number of factors could cause us to incur increased borrowing costs and to have greater difficulty accessing public and private markets for debt. These factors include general economic conditions, disruptions or declines in the global capital markets, and our financial performance, outlook, or credit ratings. Additionally, our suppliers may require us to pay cash in advance or obtain letters of credit as a condition to selling us their products and services. If we cannot access financing when needed, and on acceptable terms, we may be unable to continue to fund our capital requirements or contractual commitments, which would have an adverse effect on our business, financial condition and results of operations.

Risks Relating to our Business

The aviation services business is highly competitive.

Each of our segments faces significant competition. We compete for most of our work with other helicopter operators and, for some operations, with fixed-wing operators and ground-based alternatives. Many of our contracts are awarded after competitive bidding, and competition for those contracts is generally intense. We have several major competitors and numerous small competitors operating in our aerial services markets. Our competitors may at times undercut our prices or could develop the capability to manufacture products or provide services similar to products that we manufacture or services that we provide. We may not be able to compete successfully against our current or future competitors and the competitive pressures we face may result in reduced revenues and market share. If we are unable to adjust our costs relative to our pricing, our profitability will suffer. In addition, some of our competitors may have greater financial and other resources than we do, and may therefore be able to react to market conditions and compete more effectively than we do.

We depend on a small number of large customers for a significant portion of our revenues.

We derive a significant amount of our revenue from a small number of major customers. Several of our largest customers are governmental agencies or entities that may be subject to budget or other financial constraints. In light of the ongoing European financial crisis, there are heightened risks associated with our future revenue attributable to services provided in the region, including Greece and Italy. Revenue derived from our firefighting contracts under which we are paid for hours flown is influenced by outside factors, such as seasonality and weather conditions, that may negatively impact our future revenue. Similarly, in light of anticipated troop withdrawals in Afghanistan, there is a heightened risk of a decline in our future revenue attributable to contracts in the region. Should we lose one of our major customers for any reason, we may be unable to identify new opportunities sufficient to avoid a reduction in revenues and our business and financial condition could suffer.

A significant portion of our Global Defense and Security revenue is derived from providing airlift services in Afghanistan.

Our Global Defense and Security business derives a significant portion of its revenue from providing airlift services in Afghanistan for the DoD. The U.S. government has been reducing military activities in Afghanistan and began calendar year 2015 with approximately 10,000 military personnel in Afghanistan. The U.S. government announced plans to reduce the number of troops in Afghanistan by approximately half before the end of calendar year 2016. Our Global Defense and Security revenue will likely continue to experience declines as troop reductions occur in Afghanistan. In addition, as a result of the already reduced level of flight activity in the Afghanistan region, we have seen increased pressure from our competitors in connection with new DoD contracts in other regions of the world where we operate, which we believe may negatively impact our pricing with respect to some of the new DoD contracts on which we bid.

11

Our operations involve significant risks, which may result in hazards that may not be covered by our insurance or may increase the cost of our insurance.

The operation of aircraft inherently involves a high degree of risk. Hazards such as aircraft accidents, mechanical failures, collisions, fire, and adverse weather may result in loss of life, serious injury to employees and other persons, damage to property, losses of equipment and revenues, revocation of necessary governmental approvals and suspension or reduction of operations. Our insurance and indemnification arrangements may not cover all potential losses and are subject to deductibles, retentions, coverage limits, and coverage exceptions and, as a result, severe casualty losses or the expropriation or confiscation of significant assets could materially and adversely affect our financial condition or results of operations.

If we fail to maintain our safety record, our ability to attract new customers and maintain our existing customers would be harmed.

A favorable safety record is one of the primary factors a customer reviews in selecting an aviation provider. If we fail to maintain our safety and reliability record, our ability to attract new customers and maintain our current customers will be materially and adversely affected. In addition, safety violations could lead to increased regulatory scrutiny; increase our insurance rates and expense, which is a significant operating cost; or increase the difficulty of maintaining our existing insurance coverage in the future, which would adversely affect our operations.

Factors beyond our control, including weather and seasonal fluctuations, may reduce aircraft flight hours, which would affect our revenues and operations.

A significant portion of our operating revenue is dependent on actual flight hours, and a substantial portion of our direct costs are fixed. Flight hours could be negatively impacted by factors beyond our control and fluctuate depending on cyclical weather-related and seasonal limitations, which would affect our revenues and operations. In addition, generally our aircraft are not currently equipped to fly at night, reinforcing the seasonality of our business with more activity in the Northern Hemisphere during the summer months and less activity during the winter months. Poor visibility, high winds, and heavy precipitation can restrict the operation of helicopters and significantly reduce our flight hours. Reduced flight hours can have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Some of our arrangements with customers are short-term, ad hoc, or “call when needed” and may not be renewed.

We generate a portion of our revenues from arrangements with customers with terms of less than six months, ad hoc arrangements, and “call when needed” contracts. There is a risk that customers may not continue to seek the same level of services from us as they have in the past or that they will not renew these arrangements or terminate them at short notice. Under “call when needed” contracts, we pre-negotiate rates for providing services that customers may request that we perform (but which we are not typically obligated to perform) depending on their needs. The rates we charge for these contingent services are higher than the rates under stand-by arrangements, and we attempt to schedule our aircraft to maximize our revenue from these types of contracts. The ultimate value we derive from such contracts is subject to factors beyond our control, such as the severity and duration of fire seasons. In the past, several of our larger contracts have not been renewed for reasons unrelated to our performance, such as the financial condition of our customers or their decision to internalize the services we provided to them. If we are unable to retain or replace customers experiencing similar circumstances, our business and financial condition could suffer.

Foreign, domestic, federal, state and local government spending and mission priorities may change in a manner that materially and adversely affects our future revenues and limits our growth prospects.

Our business depends upon continued government expenditures on programs that we support. These expenditures have not remained constant over time. Current foreign and domestic government spending levels on programs that we support may not be sustainable as a result of changes in government leadership, policies, or priorities. These or other factors could cause government agencies and departments to reduce their purchases under contracts, exercise their right to terminate contracts, or not exercise options to renew contracts, any of which could cause us to lose revenue. A significant decline in overall government spending or a shift in expenditures away from agencies or programs that we support could cause a material decline in our revenues and harm our financial results.

We depend on a small number of manufacturers for some of our aircraft components.

We rely on more than 200 supplier business units or locations for significant or critical components. A small number of manufacturers make some of the key components for our aircraft, and in some instances there is only a single manufacturer,

12

although other manufacturers could be used if necessary for all of our components. If these manufacturers experience production delays, or if the cost of components increases, our operations could suffer. If a manufacturer ceases production of a required component, we could incur significant costs in purchasing the right to manufacture those components or in developing and certifying a suitable replacement, and in manufacturing those components.

Our failure to develop new technologies, and to adequately protect our intellectual property rights, could adversely affect our operations.

Our ability to grow depends in part on our development of new products or applications. Competitors may develop similar applications for their aircraft, which would increase our competition in providing aerial services. Not all of our products and applications have been, or may be, patented or otherwise legally protected. We rely upon intellectual property law, trade secret protection, and confidentiality and license agreements with our employees, clients, consultants, partners, and others to protect our new and existing intellectual property rights. If we are not able to adequately protect the inventions and intellectual property we have developed, in the U.S. and in foreign countries, or if any of our trade secrets, know-how, or other technologies were to be disclosed to or independently developed by a competitor, our business, financial condition, and results of operations could be materially adversely affected.

We are exposed to risks associated with operating internationally.

We purchase products from and supply products to businesses located outside of the U.S. We also have significant operations outside the U.S. A number of risks inherent in international operations could have a material adverse effect on our business, including:

• | currency fluctuations, which can reduce our revenues for transactions denominated in non-U.S. currency or make our services relatively more expensive if denominated in U.S. currency; |

• | difficulties in staffing and managing multi-national operations; |

• | civil disturbances, government or financial instability, nationalization and expropriation of private assets, and the imposition of taxes or other charges by government authorities; |

• | significant receivables from international customers; |

• | risks associated with transporting our aircraft, including risks associated with piracy and adverse weather; |

• | limitations on our ability to enforce legal rights and remedies; |

• | uncertainties regarding required approvals or legal structures necessary to operate aircraft or provide our products and services in a given jurisdiction; |

• | changes in regulatory structures or trade policies; |

• | tariff and tax regulations including permanent establishment determinations by foreign governments; |

• | compliance with all applicable export control laws and regulations of the U.S. and other countries; |

• | difficulties in obtaining export and import licenses; and |

• | the risk of government-financed competition. |

While we have adopted and will continue to adopt measures to reduce the potential impact of losses resulting from the risks of doing business internationally, we may not be successful and any measures we take may not be adequate or the regions in which we operate may not continue to be stable enough to allow us to operate profitably or at all.

We are subject to significant government regulation and may need to incur significant expenses to comply with new or more stringent governmental regulation.

The aerial services business is heavily regulated by the FAA in the U.S. and equivalent regulatory agencies in other countries. The FAA regulates the general operation of our aircraft, the process by which our aircraft are maintained, the components and systems that are installed in our aircraft, the qualification of our flight crews and maintenance personnel, and the specialized operations that we undertake. Our aircraft manufacturing and MRO operations are also subject to regulation by the FAA and other governmental authorities. The FAA regulates the design and manufacture of aircraft and aircraft systems and components. It also sets and enforces standards for the repair of aircraft, systems, and components and for the qualification of personnel performing these functions. Our operations in other countries are similarly regulated under equivalent local laws and regulations, which could change at any time. New and more stringent governmental regulations may be adopted in the future that, if enacted, may have an adverse impact on us. If any of our material licenses, certificates, authorizations, or approvals were revoked or suspended by the FAA or equivalent regulatory agencies in other countries, our results of operations and financial condition may be adversely affected.

13

Environmental regulation and legal proceedings could lead to significant costs and liability.

We are subject to a variety of laws and regulations, including environmental and health and safety regulations. Because our operations are inherently hazardous, compliance with these regulations is challenging and requires constant attention and focus. We are subject to federal, state, and foreign environmental laws and regulations concerning, among other things, water discharges, air emissions, hazardous material and waste management, and environmental cleanup. Environmental laws and regulations continue to evolve, and we may become subject to increasingly stringent environmental standards in the future, particularly under air quality and water quality laws and standards related to climate change issues, such as reporting greenhouse gas emissions. Our failure to comply with these regulations could subject us to fines and other penalties administered by the agencies responsible for environmental and safety compliance.

If we fail to comply with government procurement laws and regulations, we could lose business and be liable for various penalties or sanctions.

Some of our services are sold under U.S. or foreign government contracts or subcontracts, which typically require a competitive bid process. Government contracts generally are terminable at any time for the convenience of the government. From time to time, we are also subject to government inquiries and investigations of our business practices due to our participation in government programs. Violation of applicable government rules and regulations could result in civil liability, the cancellation or suspension of existing contracts, or the ineligibility for future contracts or subcontracts funded in whole or in part with federal funds, any of which could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Not being classified as a small business may adversely affect our ability to compete for some government contracts.

The North American Industry Classification Systems (“NAICS”) maintains industry and product specific codes that are utilized by the U.S. Small Business Administration as a basis for its size standards applicable to Federal government procurements. Businesses that meet the small business size standard for the relevant NAICS code are able to bid on small business set-aside contracts. Several of our contracts provide for differentiating factors in their award process which include small business status, performance records, safety records, and other factors. Several of these factors have been instrumental in us winning new work and continuing contracts. We do not currently qualify as a small business and it is possible that we may not be classified as a small business in the future. Not being classified as a small business may adversely impact our eligibility for special small business programs and limit our ability to partner with other business entities that seek to team with small business entities as may be required under a specific contract.

Product liability and product warranty risks could adversely affect our operating results.

We manufacture, repair, and overhaul complex aircraft and critical parts for aircraft. Failure of our aircraft or parts could give rise to substantial product liability and other damage claims. We maintain insurance to address this risk, but our insurance coverage may not be adequate for some claims and there is no guarantee that insurance will continue to be available on terms acceptable to us, if at all. Additionally, aircraft and parts we manufacture for sale are subject to strict contractually established specifications using complex manufacturing processes. If we fail to meet the contractual requirements for a part, we may be subject to warranty costs to repair or replace the part itself and additional costs related to the investigation and inspection of non-complying parts. These costs are generally not insured.

Fuel shortages or fluctuations in the price of fuel could adversely affect our operations.

Our aerial operations depend on the use of jet fuel. Fuel costs have historically been subject to wide price fluctuations, and fuel availability is subject to shortage and is affected by demand for heating oil, gasoline, and other petroleum products. Fuel shortages and increases in the price of fuel, or decreases in the price of fuel when we have entered into hedging agreements, could adversely affect our operations.

We rely on information technology, and if we are unable to protect against service interruptions, data corruption, cyber-based attacks or network security breaches, our operations could be disrupted and our business could be negatively affected.

We rely on information technology networks and systems to process, transmit and store electronic and financial information; to coordinate our business across our global operation bases; and to communicate within our company and with customers, suppliers, partners and other third-parties. These information technology systems may be susceptible to damage, disruptions or shutdowns, hardware or software failures, power outages, computer viruses, cyber attacks, telecommunication failures, user errors or catastrophic events. If our information technology systems suffer severe damage, disruption or shutdown, and our

14

business continuity plans do not effectively resolve the issues in a timely manner, our operations could be disrupted and our business could be negatively affected. In addition, cyber attacks could lead to potential unauthorized access and disclosure of confidential information, and data loss and corruption.

Our business in countries with a history of corruption and transactions with foreign governments increases the compliance risks associated with our international activities.

Our international operations could expose us to trade and economic sanctions or other restrictions imposed by the U.S. or other governments or organizations. The U.S. Department of Justice and other federal agencies and authorities have a broad range of civil and criminal penalties at their disposal to impose against corporations and individuals for violations of trading sanctions laws, the FCPA, and other federal statutes. Under trading sanctions laws, the government may seek to impose modifications to business practices, including cessation of business activities in sanctioned countries, and modifications to compliance programs, which may increase compliance costs, and could subject us to fines, penalties and other sanctions.

Our failure to attract and retain qualified personnel could adversely affect us.

Our pilots and maintenance and manufacturing personnel are highly trained and qualified. Our ability to attract and retain qualified pilots, mechanics, and other highly trained personnel will be an important factor in determining our future success. Our aircraft, and the aerial services we provide, require pilots with high levels of flight experience. The market for these experienced and highly trained personnel is extremely competitive. Some of our pilots and mechanics are members of the U.S. military reserves and could be called to active duty. If significant numbers of such persons were called to active duty, it would reduce the supply of such workers, possibly curtailing our operations and likely increasing our labor costs. Because of our small size relative to many of our competitors, we may be unable to attract qualified personnel as easily as our competitors.

We have a significant stockholder whose interests may not coincide with other stockholders.

Entities affiliated with ZM Equity Partners, LLC owns a majority of our outstanding common stock, and one of our directors is a managing director of Centre Lane Partners, LLC, an affiliate of ZM Equity Partners, LLC. These stockholders could exert significant influence over all matters requiring stockholder approval, including the election of directors and the approval of significant corporate transactions. In addition, this concentration of ownership could delay or prevent a change in control of our company or make some transactions more difficult or impossible without the support of these stockholders. The interests of these stockholders may not always coincide with our interests as a company or the interests of other stockholders.

ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

ITEM 2. | PROPERTIES. |

Our headquarters are located in Portland, Oregon. We own or lease 340,758 square feet of building space (including offices, MRO facilities, warehouses, hangars and other operations facilities) primarily in Oregon and Alaska. We also lease 303,617 square feet of building space in various international locations, including in Canada, Brazil and Italy. Of the total owned or leased building space, 427,575 square feet is leased space. Additionally, we own a total of 48 acres of land in Oregon.

We believe our existing facilities, which are used by all operating segments, are in good operating condition and are suitable for the conduct of our business. We may improve, replace or reduce facilities as considered appropriate to meet the needs of our operations.

15

ITEM 3. | LEGAL PROCEEDINGS. |

Arizona Environmental Matter

In August 2012, EHI received a request for information from the State of Arizona and has been served various petitions regarding the Broadway-Pantano Site in Tucson, Arizona, which is comprised of two landfills at which the State of Arizona has been conducting soil and groundwater investigations and cleanups. According to these documents, the State has identified approximately 101 parties that are potentially responsible for the contamination. It is possible that the State or other liable parties may assert that EHI is liable for the alleged contamination at the site.

World Fuel Claim

In December 2013, World Fuel, a former fuel supplier of EIA and Evergreen Airlines (‘‘EA’’), filed suit in the Circuit Court of Yamhill County, Oregon against EIA, EA and other named parties claiming approximately $9.0 million of accounts payable due and owing to World Fuel for fuel purchases made by EIA and EA. EHI was a named party in the lawsuit since it was alleged that EHI signed a joint and several guaranty of payment in favor of World Fuel in 2012. In April 2014, we filed an answer, which included certain counterclaims against World Fuel and certain cross claims against Mr. Delford Smith. Although we are unable to predict the final outcome of the proceeding, we believe the allegations lack merit and intend to vigorously defend against them.

Stockholder Action

In August 2013, a stockholder class and derivative action was filed in the Court of Chancery for the State of Delaware against the Company, members of our board of directors, EAC Acquisition Corp., and entities affiliated with ZM Equity Partners, LLC and certain of their affiliates. The plaintiff asserted claims for breach of fiduciary duty and unjust enrichment in connection with the EHI acquisition and requested an award of unspecified monetary damages, disgorgement and restitution, certain other equitable relief, and an award of plaintiff’s costs and disbursements, including legal fees. Although we are unable to predict the final outcome of the proceeding, we believe the allegations lack merit and intend to vigorously defend against them.

ITEM 4. | MINE SAFETY DISCLOSURES. |

Not applicable.

16

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock began trading on the NASDAQ under the symbol “EAC” following our initial public offering in April 2012. Before then, there was no public market for our common stock. As of March 4, 2016, there were 10 holders of record of our common stock. A substantially greater number of holders of our stock are “street name” or beneficial holders, whose shares are held of record by banks, brokers, and other financial institutions. The following table sets forth, for the periods indicated, the highest and lowest sales prices of our common stock as reported on the NASDAQ:

High | Low | |||||||

2015 | ||||||||

Fourth Quarter | $ | 3.56 | $ | 1.84 | ||||

Third Quarter | 4.49 | 3.04 | ||||||

Second Quarter | 5.35 | 3.30 | ||||||

First Quarter | 8.75 | 4.22 | ||||||

2014 | ||||||||

Fourth Quarter | $ | 15.25 | $ | 7.88 | ||||

Third Quarter | 19.25 | 11.32 | ||||||

Second Quarter | 19.49 | 14.27 | ||||||

First Quarter | 21.94 | 18.02 | ||||||

We have never declared or paid, and do not anticipate declaring or paying, any cash dividends on our common stock. Instead, we currently anticipate that we will retain all of our future earnings, if any, to fund the operation and expansion of our business and to use as working capital and for other general corporate purposes. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects, and other factors our board of directors may deem relevant. Our existing credit facility limits our ability to declare and pay dividends.

Equity Compensation Plan Information

The following table provides information as of December 31, 2015 regarding shares of common stock that may be issued under our amended and restated 2012 Long-Term Incentive Plan (“2012 Plan”) and our CEO Plan and Stock Option Agreement:

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (1) | |||||||

Equity compensation plans approved by security holders | 165,000 | $ | 6.05 | 978,375 | ||||||

Equity compensation plans not approved by security holders | N/A | N/A | N/A | |||||||

Total | 165,000 | $ | 6.05 | 978,375 | ||||||

(1) | To the extent that any outstanding award under the 2012 Plan is canceled, expired, forfeited, surrendered, settled in cash, or otherwise terminated without delivery of shares to the participant, the shares retained by or returned to us will be available for future awards under the 2012 Plan. |

17

Stock Performance Graph

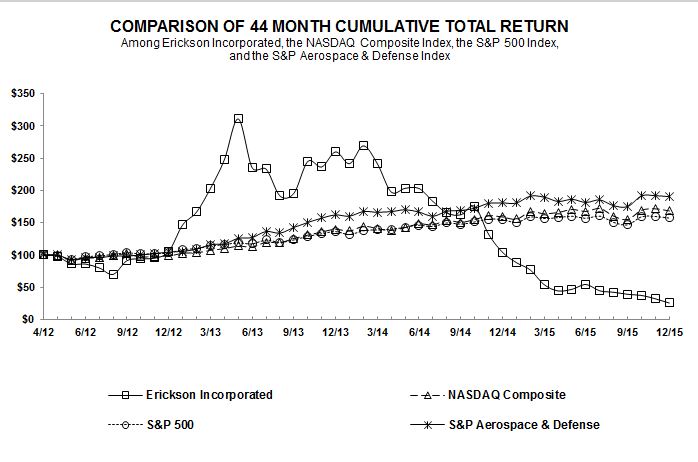

The following graph compares the cumulative total return on our common stock from April 10, 2012 (the date of our initial public offering) to December 31, 2015, with the cumulative total returns of the NASDAQ Composite Index, S&P 500 Index and S&P Aerospace and Defense Index from March 31, 2012 to December 31, 2015. The comparison assumes $100 was invested in shares of our common stock on April 10, 2012. The historical stock price performance shown on this graph is not necessarily indicative of future performance.

18

ITEM 6. | SELECTED FINANCIAL DATA. |

The following consolidated selected financial and other data should be read in conjunction with Item 7.—“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8.—“Financial Statements and Supplementary Data.”

As of December 31, | |||||||||||||||||||

2015 | 2014 | 2013 (1) | 2012 | 2011 | |||||||||||||||

(In thousands) | |||||||||||||||||||

Consolidated Balance Sheet Data: | |||||||||||||||||||

Cash and cash equivalents | $ | 2,129 | $ | 5,097 | $ | 1,881 | $ | 1,468 | $ | 268 | |||||||||

Aircraft, net, aircraft support parts and property, plant and equipment, net | 351,294 | 386,449 | 363,257 | 214,389 | 185,916 | ||||||||||||||

Total assets(2) | 601,653 | 693,220 | 710,435 | 248,024 | 224,783 | ||||||||||||||

Credit facility | 96,165 | 87,062 | 65,410 | 21,861 | 50,257 | ||||||||||||||

Total long-term debt(3) | 372,987 | 362,797 | 360,343 | 75,424 | 78,787 | ||||||||||||||

Working capital(4) | 8,562 | 17,840 | 3,357 | (73,125 | ) | (2,042 | ) | ||||||||||||

Total Erickson Incorporated shareholders’ equity (deficit) | 88,570 | 180,287 | 192,017 | 104,352 | (10,023 | ) | |||||||||||||

Years Ended December 31, | |||||||||||||||||||

2015 | 2014 | 2013 (1) | 2012 | 2011 | |||||||||||||||

(In thousands, except per share amounts) | |||||||||||||||||||

Consolidated Statement of Operations Data: | |||||||||||||||||||

Revenues, net | $ | 297,520 | $ | 346,609 | $ | 318,221 | $ | 180,824 | $ | 152,769 | |||||||||

Gross margin(5) | 15.9 | % | 23.3 | % | 29.6 | % | 33.1 | % | 28.4 | % | |||||||||

Operating income (loss) | $ | (54,799 | ) | $ | 22,330 | $ | 46,992 | $ | 33,433 | $ | 16,599 | ||||||||

Net income (loss)(6) | (86,632 | ) | (10,231 | ) | 9,866 | 15,636 | 16,260 | ||||||||||||

Net income (loss) attributable to Erickson Incorporated(6) | (86,713 | ) | (10,292 | ) | 9,657 | 15,230 | 15,870 | ||||||||||||

Net income (loss) attributable to Erickson Incorporated common shareholders(6) | (86,713 | ) | (10,292 | ) | 9,657 | 12,435 | 6,719 | ||||||||||||

Earnings (loss) per share—basic | (6.27 | ) | (0.75 | ) | 0.86 | 1.78 | 6,718.57 | ||||||||||||

Earnings (loss) per share—diluted | (6.27 | ) | (0.75 | ) | 0.82 | 1.78 | 6,718.57 | ||||||||||||

Consolidated Statement of Cash Flow Data: | |||||||||||||||||||

Net cash provided by (used in): | |||||||||||||||||||

Operating activities | $ | 21,168 | $ | 13,984 | $ | (24,792 | ) | $ | 28,158 | $ | (20,723 | ) | |||||||

Investing activities | (20,944 | ) | (30,120 | ) | (282,935 | ) | (21,492 | ) | (13,083 | ) | |||||||||

Financing activities | 1,331 | 21,494 | 307,888 | (5,446 | ) | 32,759 | |||||||||||||

Effect of foreign currency exchange rates on cash and cash equivalents | (4,523 | ) | (2,142 | ) | 252 | (20 | ) | (613 | ) | ||||||||||

Other Financial Data: | |||||||||||||||||||

EBITDA(7) | $ | (9,389 | ) | $ | 58,412 | $ | 76,347 | $ | 55,268 | $ | 45,283 | ||||||||

Adjusted EBITDA(7) | 58,703 | 83,753 | 90,881 | 56,913 | 42,083 | ||||||||||||||

Adjusted EBITDAR(7) | 75,700 | 103,951 | 104,886 | 56,913 | 42,083 | ||||||||||||||

(1) | Includes the financial information for EHI from May 2, 2013 forward and Air Amazonia from September 3, 2013 forward, the dates of acquisition. |

(2) | To conform with the 2015 presentation, debt issuance costs of $11.4 million in 2014 and $13.5 million in 2013 were reclassified from other noncurrent assets to credit facility and long-term debt, with $0.6 million in 2012 and $1.5 million in 2011 reclassified to credit facility. In addition, deferred tax assets of $0.9 million in 2014, $3.4 million in 2013, $8.2 million in 2012 and $7.6 million in 2011 were reclassified to deferred tax liabilities. |

19

(3) | To conform with the 2015 presentation, amounts outstanding under the credit facility are presented separately from long-term debt and debt issuance costs were reclassified from other noncurrent assets to long-term debt. |

(4) | To conform with the 2015 presentation, current deferred tax assets of $1.2 million in 2014, $3.7 million in 2013, $8.2 million in 2012, and $7.6 million in 2011 were reclassified to noncurrent deferred taxes. As of December 31, 2012, $71.2 million of debt outstanding under our credit facility is classified as a current liability due to the credit facility’s maturity date. |

(5) | To conform with the 2015 presentation, external commissions expense was reclassified from sales and marketing expense to cost of revenues as follows: $2.3 million in 2014; $1.9 million in 2013; $1.6 million in 2012; and $2.0 million in 2011. Accordingly, gross margin presented for such years do not agree with percents previously reported in our Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on March 10, 2015. |

(6) | For 2015, reflects impairment charges $49.8 million related to goodwill and $15.2 million related to other assets. For 2014, reflects impairment charge of $21.3 million related to goodwill. For 2013, reflects a $3.4 million loss on the sale of a note receivable from Evergreen International Aviation, Inc., the former parent of Evergreen Helicopters, Inc., which we acquired in May 2013. For 2011, reflects the reversal of $2.7 million of interest expense and an income tax benefit of $9.5 million related to the settlement of a tax matter. |

(7) | For the definition of such non-GAAP measurement, see “Non-GAAP Financial Measurements” in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, as well as an explanation as to why such measurement is important to us and a reconciliation to net income (loss) attributable to Erickson Incorporated as reported on our consolidated statements of operations. |

20

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand our business and operations. The following discussion and analysis should be read in conjunction with Item 6.—“Selected Financial Data and Item 8.—“Financial Statements and Supplementary Data.” Certain statements contained in this discussion may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those reflected in any forward-looking statements, as discussed more fully in Part I, “Item 1A. Risk Factors.”

OVERVIEW OF THE BUSINESS

Erickson Incorporated is a vertically integrated aerial services company engaged in the manufacture, maintenance and repair and the operation of aircraft in the U.S. and internationally. We generate revenues and cash flows from providing aerial and specialized manufacturing and maintenance services to commercial and governmental entities worldwide. Our vertically-integrated manufacturing capability provides unique manufacturing and MRO services for the Aircrane and other legacy aircraft platforms, related components, and aftermarket support.

The year ended December 31, 2015 was a challenging one for us, with a net loss of $86.7 million compared with a net loss of $10.3 million in 2014. The $76.4 million increase in our net loss was largely driven by a $28.6 million increase in the goodwill impairment charge recognized related to our Global Defense and Security segment, with $49.8 million recognized in 2015 and $21.3 million recognized in 2014, and the $15.2 million other asset impairment charge recognized in 2015 related to aircraft available for sale, of which we had none in 2014.

In addition, gross profit from our Global Defense and Security segment declined 72.4% primarily resulting from the reduction in scope of DoD activity in Afghanistan and the end of existing contracts in the Philippines and other locations, and our Commercial Aviation Services segment declined 32.6% primarily resulting from lower oil and gas services in Brazil coupled with lower firefighting services and timber harvesting activities. Partially offsetting these declines, was a 76.5% increase in our Manufacturing and MRO gross profit, as we had higher aircraft and related asset sales and we added a new legacy platform program, the Bell 214, which began in early 2015.

To provide aerial services to our customers, the aircraft we utilize are either owned or leased. Aircraft are subject to varying levels of required scheduled maintenance and inspections, which can be based on flight hours or lapse of time. As a result of planned or unplanned maintenance, aircraft are out-of-service from time-to-time. Throughout the course of any given year, we may remove aircraft from service for maintenance or to sell, or add aircraft to the fleet either through our own manufacturing facility or through a purchase or lease. Our aircraft utilization, which is calculated as the number of days on contract as a percentage of total available days, was as follows:

Years Ended December 31, | ||||||||

2015 | 2014 | 2013 | ||||||

Rotor Wing: | ||||||||

Heavy lift | 62.8 | % | 62.7 | % | 66.5 | % | ||

Medium and light lift | 24.1 | 45.5 | 46.0 | |||||

Fixed Wing | 24.3 | 33.0 | 50.0 | |||||

21

RESULTS OF OPERATIONS

The following table provides financial information to be considered in conjunction with management’s discussion and analysis of results of operations. Our consolidated statement of operations, and percentage of revenues, for the years presented are as follows (dollars in thousands):

Years Ended December 31, | ||||||||||||||||||||

2015 | 2014 | 2013 | ||||||||||||||||||

Revenues: | ||||||||||||||||||||

Commercial Aviation Services | $ | 160,885 | 54.1 | % | $ | 177,261 | 51.1 | % | $ | 179,955 | 56.6 | % | ||||||||

Global Defense and Security | 105,158 | 35.3 | 154,057 | 44.5 | 125,558 | 39.4 | ||||||||||||||

Manufacturing and MRO | 31,477 | 10.6 | 15,291 | 4.4 | 12,708 | 4.0 | ||||||||||||||

Total revenues | 297,520 | 100.0 | 346,609 | 100.0 | 318,221 | 100.0 | ||||||||||||||

Cost of revenues: | ||||||||||||||||||||

Commercial Aviation Services(1) | 129,018 | 80.2 | 129,978 | 73.3 | 122,991 | 68.3 | ||||||||||||||

Global Defense and Security(1) | 97,035 | 92.3 | 124,574 | 80.9 | 92,360 | 73.6 | ||||||||||||||

Manufacturing and MRO(1) | 24,192 | 76.9 | 11,163 | 73.0 | 8,680 | 68.3 | ||||||||||||||

Total cost of revenues | 250,245 | 84.1 | 265,715 | 76.7 | 224,031 | 70.4 | ||||||||||||||

Gross profit: | ||||||||||||||||||||

Commercial Aviation Services(1) | 31,867 | 19.8 | 47,283 | 26.7 | 56,964 | 31.7 | ||||||||||||||

Global Defense and Security(1) | 8,123 | 7.7 | 29,483 | 19.1 | 33,198 | 26.4 | ||||||||||||||

Manufacturing and MRO(1) | 7,285 | 23.1 | 4,128 | 27.0 | 4,028 | 31.7 | ||||||||||||||

Total gross profit | 47,275 | 15.9 | 80,894 | 23.3 | 94,190 | 29.6 | ||||||||||||||

Operating expenses: | ||||||||||||||||||||

General and administrative | 28,891 | 9.7 | 26,606 | 7.7 | 37,674 | 11.8 | ||||||||||||||

Research and development | 2,675 | 0.9 | 3,782 | 1.1 | 4,000 | 1.3 | ||||||||||||||

Selling and marketing | 5,449 | 1.8 | 6,904 | 2.0 | 5,524 | 1.7 | ||||||||||||||

Impairment of goodwill | 49,823 | 16.8 | 21,272 | 6.1 | — | — | ||||||||||||||

Impairment of other assets | 15,236 | 5.1 | — | — | — | — | ||||||||||||||

Total operating expenses | 102,074 | 34.3 | 58,564 | 16.9 | 47,198 | 14.8 | ||||||||||||||

Operating income (loss) | (54,799 | ) | (18.4 | ) | 22,330 | 6.4 | 46,992 | 14.8 | ||||||||||||

Interest expense, net | (37,073 | ) | (12.5 | ) | (35,800 | ) | (10.3 | ) | (25,175 | ) | (7.9 | ) | ||||||||

Other income (expense), net | 517 | 0.2 | (1,193 | ) | (0.3 | ) | (5,831 | ) | (1.9 | ) | ||||||||||

Net income (loss) before income taxes and noncontrolling interests | (91,355 | ) | (30.7 | ) | (14,663 | ) | (4.2 | ) | 15,986 | 5.0 | ||||||||||

Income tax expense (benefit) | (4,723 | ) | (1.6 | ) | (4,432 | ) | (1.3 | ) | 6,120 | 1.9 | ||||||||||