Attached files

| file | filename |

|---|---|

| EX-21 - SUBSIDIARIES - ATRION CORP | atri_ex21.htm |

| EX-23 - CONSENT - ATRION CORP | atri_ex23.htm |

| EX-31.1 - CERTIFICATION - ATRION CORP | atri_ex311.htm |

| EX-32.1 - CERTIFICATION - ATRION CORP | atri_ex321.htm |

| EX-31.2 - CERTIFICATION - ATRION CORP | atri_ex312.htm |

| EX-32.2 - CERTIFICATION - ATRION CORP | atri_ex322.htm |

| 10-K - ANNUAL REPORT - ATRION CORP | atri_10k.htm |

Exhibit 13.1

|

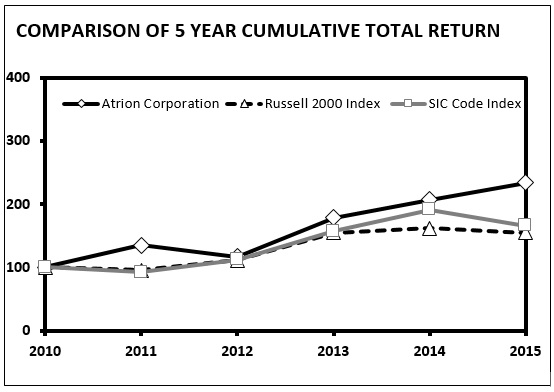

Company/Index

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

||||||||||||||||||

|

Atrion Corporation

|

$ | 100.00 | $ | 135.13 | $ | 116.97 | $ | 178.64 | $ | 206.84 | $ | 233.94 | ||||||||||||

|

Russell 2000 Index

|

$ | 100.00 | $ | 95.82 | $ | 111.49 | $ | 154.78 | $ | 162.35 | $ | 155.18 | ||||||||||||

|

SIC Code Index

|

$ | 100.00 | $ | 92.73 | $ | 111.94 | $ | 157.36 | $ | 191.14 | $ | 165.69 | ||||||||||||

The graph set forth above compares the total cumulative return for the five-year period ended December 31, 2015 on the Company's common stock, the Russell 2000 Index and SIC Code 3841 Index--Surgical and Medical Instruments (compiled by Zacks Investment Research, Inc.), assuming $100 was invested on December 31, 2010 in our common stock, the Russell 2000 Index and the SIC Code Index and dividends were reinvested.