Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Blueknight Energy Partners, L.P. | exhibit231ye2015.htm |

| EX-32.1 - EXHIBIT 32.1 - Blueknight Energy Partners, L.P. | exhibit321ye2015.htm |

| EX-31.2 - EXHIBIT 31.2 - Blueknight Energy Partners, L.P. | exhibit312ye2015.htm |

| EX-31.1 - EXHIBIT 31.1 - Blueknight Energy Partners, L.P. | exhibit311ye2015.htm |

| EX-21.1 - EXHIBIT 21.1 - Blueknight Energy Partners, L.P. | exhibit211ye2015.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to _________

Commission File Number 001-33503

BLUEKNIGHT ENERGY PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 20-8536826 (IRS Employer Identification No.) | |

201 NW 10th, Suite 200 Oklahoma City, Oklahoma 73103 (Address of principal executive offices, zip code) Registrant’s telephone number, including area code: (405) 278-6400 | ||

(Former name, former address and former fiscal year, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Units representing limited partner interests | Nasdaq Global Market | |

Series A Preferred Units representing limited partner interests | Nasdaq Global Market | |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer ý | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2015, the aggregate market value of the registrant’s common units held by non-affiliates of the registrant was approximately $143.5 million, based on $7.49 per common unit, the closing price of the common units as reported on the NASDAQ Global Market on such date.

As of March 3, 2016, there were 30,158,619 Series A Preferred Units and 33,198,339 common units outstanding.

Table of Contents | ||

Page | ||

Business. | ||

Risk Factors. | ||

Unresolved Staff Comments. | ||

Properties. | ||

Legal Proceedings. | ||

Mine Safety Disclosures. | ||

Market for Registrant’s Common Equity, Related Unitholder Matters and Issuer Purchases of Equity Securities. | ||

Selected Financial Data. | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations. | ||

Quantitative and Qualitative Disclosures about Market Risk. | ||

Financial Statements and Supplementary Data. | ||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | ||

Controls and Procedures. | ||

Directors, Executive Officers and Corporate Governance. | ||

Executive Compensation. | ||

Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters. | ||

Certain Relationships and Related Transactions, and Director Independence. | ||

Principal Accountant Fees and Services. | ||

Exhibits, Financial Statement Schedules. | ||

i

DEFINITIONS

We use the following terms in this report:

Barrel: One barrel of petroleum products equals 42 United States gallons.

Bpd: Barrels per day.

Common carrier pipeline: A pipeline engaged in the transportation of petroleum products as a public utility and common carrier for hire.

Condensate: A natural gas liquid with a low vapor pressure, mainly composed of propane, butane, pentane and heavier hydrocarbon fractions.

Feedstock: A raw material required for an industrial process such as petrochemical manufacturing.

Finished asphalt products: As used herein, the term refers to liquid asphalt cement sold directly to end users and to asphalt emulsions, asphalt cutbacks, polymer modified asphalt cement and related asphalt products processed using liquid asphalt cement. The term is also used to refer to various residual fuel oil products directly sold to end users.

Liquid asphalt cement: A dark brown to black cementitious material that is primarily produced by petroleum distillation. When crude oil is separated in distillation towers at a refinery, the heaviest hydrocarbons with the highest boiling points settle at the bottom. These tar-like fractions, called residuum, require relatively little additional processing to become products such as asphalt cement or residual fuel oil. Liquid asphalt cement is primarily used in the road construction and maintenance industry. Residual fuel oil is primarily used as a burner fuel in numerous industrial and commercial business applications. As used herein, the term refers to both liquid asphalt cement and residual fuel oils.

Midstream: The industry term for the components of the energy industry in between the production of oil and gas (upstream) and the distribution of refined and finished products (downstream).

PMAC: Polymer modified asphalt cement.

Preferred Units: Series A Preferred Units representing limited partnership interests in our partnership.

SemCorp: SemCorp refers to SemGroup Corporation and its predecessors (including SemGroup, L.P.), subsidiaries and affiliates (other than our General Partner and us during periods in which we were affiliated with SemGroup, L.P.).

Terminalling: The receipt of crude oil and petroleum products for storage into storage tanks and other appurtenant equipment, including pipelines, where the crude oil and petroleum products will be commingled with other products of similar quality; the storage of the crude oil and petroleum products; and the delivery of the crude oil and petroleum products as directed by a distributor into a truck, vessel or pipeline.

Throughput: The volume of product transported or passing through a pipeline, plant, terminal or other facility.

ii

PART I.

As used in this annual report, unless we indicate otherwise: (1) “Blueknight Energy Partners,” “our,” “we,” “us” and similar terms refer to Blueknight Energy Partners, L.P. , together with its subsidiaries, (2) our “General Partner” refers to Blueknight Energy Partners G.P., L.L.C., (3) “Vitol” refers to Vitol Holding B.V., its affiliates and subsidiaries (other than our General Partner and us) and (4) “Charlesbank” refers to Charlesbank Capital Partners, LLC, its affiliates and subsidiaries (other than our General Partner and us).

Forward Looking Statements

This report contains “forward-looking statements” within the meaning of the federal securities laws. Statements included in this annual report that are not historical facts (including any statements regarding plans and objectives of management for future operations or economic performance, or assumptions or forecasts related thereto) are forward-looking statements. These statements can be identified by the use of forward-looking terminology including “may,” “will,” “should,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “continue” or other similar words. These statements discuss future expectations, contain projections of results of operations or of financial condition, or state other “forward-looking” information. We and our representatives may from time to time make other oral or written statements that are also forward-looking statements.

Such forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those anticipated as of the date of this report. Although we believe that the expectations or assumptions reflected in these forward-looking statements are based on reasonable assumptions, no assurance can be given that these expectations will prove to be correct. Important factors that could cause our actual results to differ materially from the expectations reflected in these forward-looking statements include, among other things, those set forth in “Item 1A-Risk Factors,” included in this annual report, and those set forth from time to time in our filings with the Securities and Exchange Commission (“SEC”), which are available through the Investor Relations link at www.bkep.com and through the SEC’s Electronic Data Gathering and Retrieval System (“EDGAR”) at http://www.sec.gov.

All forward-looking statements included in this report are based on information available to us on the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this report.

Item 1. Business

Overview

We are a publicly traded master limited partnership with operations in twenty-four states. We provide integrated terminalling, storage, gathering and transportation services for companies engaged in the production, distribution and marketing of crude oil and liquid asphalt cement. We manage our operations through four operating segments: (i) asphalt terminalling services, (ii) crude oil terminalling and storage services, (iii) crude oil pipeline services, and (iv) crude oil trucking and producer field services.

Our Operations

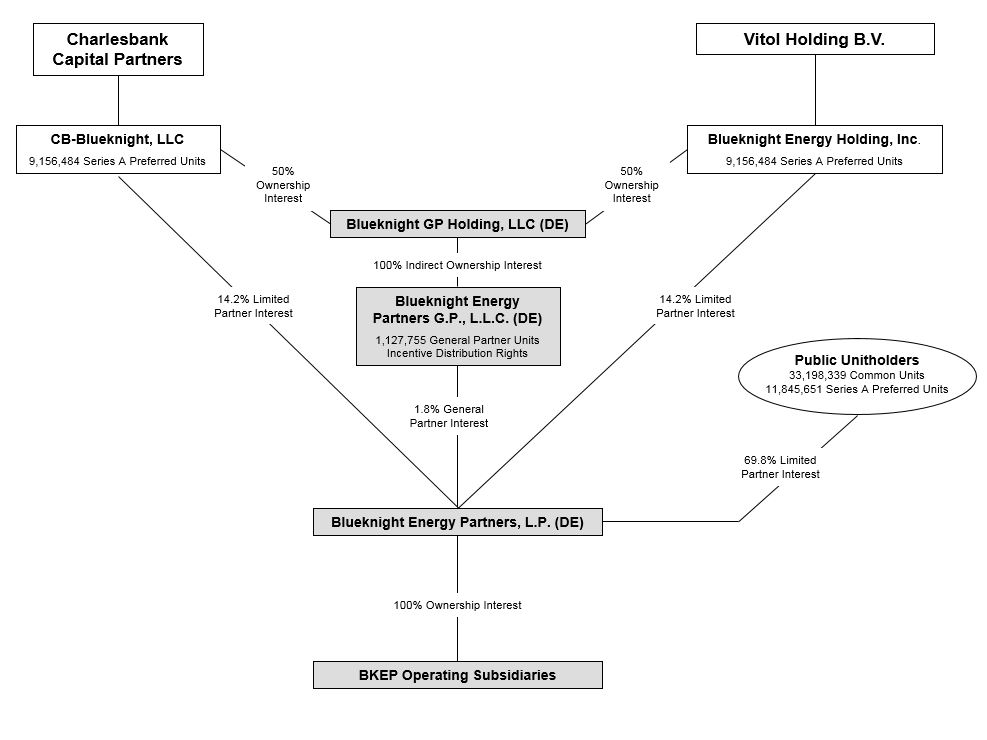

We were formed as a Delaware limited partnership in 2007 to own, operate and develop a diversified portfolio of complementary midstream energy assets. Our operating assets are owned by, and our operations are conducted through, our subsidiaries. Our General Partner has sole responsibility for conducting our business and for managing our operations. Our General Partner is jointly owned by Blueknight Energy Holding, Inc. (which is an affiliate of Vitol) and CB-Blueknight, LLC (which is an affiliate of Charlesbank). As such, Vitol and Charlesbank control our operations.

Our General Partner has no business or operations other than managing our business. In addition, outside of its investment in us, our General Partner owns no assets or property other than a minimal amount of cash, which has been distributed by us to our General Partner in respect of its interest in us. Our partnership agreement imposes no additional material liabilities upon our General Partner or obligations to contribute to us other than those liabilities and obligations imposed on general partners under the Delaware Revised Uniform Limited Partnership Act.

1

The following diagram depicts our organizational structure, including our relationship with our affiliates and subsidiaries, as of March 3, 2016:

Our Strengths and Strategies

Strategically placed assets. Our primary crude oil terminalling and storage facilities are located within the Cushing Interchange in Cushing, Oklahoma, one of the largest crude oil marketing hubs in the United States and the designated point of delivery specified in all New York Mercantile Exchange (“NYMEX”) crude oil futures contracts. We believe that the Cushing Interchange will continue to serve as one of the largest crude oil marketing hubs in the United States. In addition, we have approximately 985 miles of strategically positioned gathering and transportation pipelines in Oklahoma and Texas as well as 45 asphalt terminals located in 23 states that we believe are well positioned to provide services in the market areas they serve throughout the continental United States.

Growth opportunities. Vitol and Charlesbank have indicated that they intend to use us as a growth vehicle to pursue the acquisition and expansion of midstream energy businesses and assets. Vitol and Charlesbank may use a development company, in which we would have no interest, for pursuing projects that we may later have the opportunity to acquire. Further, we may be involved in additional midstream projects for Vitol or Charlesbank outside of any development company. We also cannot say with any certainty whether or not such a development company, or Vitol or Charlesbank, will develop any projects or, if they do, which, if any, of these future acquisition opportunities may be made available to us, or if we will choose to pursue any such opportunity. There are currently no such projects active.

Experienced management team. Our General Partner has an experienced and knowledgeable management team with extensive experience in the energy industry. We expect to directly benefit from this management team’s strengths, including significant relationships throughout the energy industry with producers, marketers and refiners of crude oil, and customers of our asphalt terminalling services.

2

Our relationship with Vitol and Charlesbank. Vitol and Charlesbank jointly own our General Partner and therefore control our operations. Vitol owns a diversified portfolio of midstream energy assets in the United States and internationally. Charlesbank is a middle-market private equity investment firm based in Boston and New York. These relationships may provide us with additional capital sources for future growth as well as increased opportunities to provide terminalling, storage, processing, gathering and transportation services. While these relationships may benefit us, they may also be a source of potential conflicts. Vitol and Charlesbank are not restricted from competing with us and both have ownership interests in other publicly traded midstream partnerships. Vitol and Charlesbank may acquire, construct or dispose of additional midstream or other assets in the future without any obligation to offer us the opportunity to purchase or construct those assets.

Industry Overview

Asphalt Industry

We provide asphalt terminalling services to marketers and distributors of liquid asphalt cement and asphalt-related products. Our business model begins with the unloading of product at one of our terminals and extends to the point of distribution to our customers. We do not take title to the product - we lease certain facilities for operation by our customers and at some facilities we process, blend and manufacture products to meet our customers’ specifications. Our terminal network consists of 45 facilities located coast-to-coast throughout the United States.

Liquid asphalt cement is one of the oldest engineering materials. Liquid asphalt cement’s adhesive and waterproofing properties have been used for building structures, waterproofing ships, mummification and numerous other applications.

Production of liquid asphalt cement begins with the refining of crude oil. Liquid asphalt cement is a dark brown to black cementitious material that is primarily produced by petroleum distillation. When crude oil is separated in distillation towers at a refinery, the heaviest hydrocarbons with the highest boiling points settle at the bottom. These tar-like fractions, called residuum, require relatively little additional processing to become products such as asphalt base or residual fuel oil. Liquid asphalt cement production typically represents only a small portion of the total product production in the crude oil refining process. The liquid asphalt cement produced by petroleum distillation can be sold by the refinery either directly into the wholesale and retail liquid asphalt cement markets or to a liquid asphalt cement marketer.

In its normal state, asphalt cement is too viscous a liquid to be used at ambient temperatures. For paving applications, asphalt cement can be heated (hot mix asphalt), diluted or cut back with petroleum solvents (cutback asphalts), or emulsified in a water base with emulsifying chemicals by a colloid mill (asphalt emulsions). Hot mix asphalt is produced by mixing hot asphalt cement and heated aggregate (stone, sand and/or gravel). The hot mix asphalt is loaded into trucks for transport to the paving site, where it is placed on the road surface by paving machines and compacted by rollers. Hot mix asphalt is used for new construction, reconstruction and for thin maintenance overlay on existing roads.

Asphalt emulsions and cutback asphalts are used for a variety of applications including spraying as a tack coat between an old pavement and a new hot mix asphalt overlay, cold mix pothole patching material, and preventive maintenance surface applications such as chip seals. Asphalt emulsions are also used for fog seal, slurry seal, scrub seal, sand seal and microsurfacing maintenance treatments, for warm mix emulsion/aggregate mixtures, base stabilization and both central plant and in-place recycling. Asphalt emulsions and cutback asphalts are generally sold directly to government agencies but are also sold to contractors.

The asphalt industry in the United States is characterized by a high degree of seasonality. Much of this seasonality is due to the impact that weather conditions have on road construction schedules, particularly in cold weather states. Refineries produce liquid asphalt cement year round, but the peak asphalt demand season is during the warm weather months when most of the road construction activity in the United States takes place. Liquid asphalt cement marketers and finished asphalt product producers with access to storage capacity possess the inherent advantage of being able to purchase supply from refineries on a year-round basis and then sell finished asphalt products in the peak summer demand season.

Crude Oil Industry

We provide crude oil gathering, marketing, transportation, storage and terminalling services to producers, marketers and refiners of crude oil products. The market we serve, which begins at the source of production and extends to the point of distribution to the end user customer, is commonly referred to as the “midstream” market. Our crude oil operations are located primarily in Oklahoma, Kansas and Texas, where there are extensive crude oil production operations in place and our assets extend from gathering systems and trucking networks in and around producing fields to transportation pipelines carrying crude

3

oil to logistics hubs, such as the Cushing Interchange, where we have terminalling and storage facilities that aid our customers in managing their crude oil.

Gathering, marketing and transportation. Pipeline transportation is generally considered the lowest cost and safest method for shipping crude oil and refined petroleum products to other locations. Crude oil pipelines transport oil from the wellhead to logistics hubs and/or refineries. Logistics hubs like the Cushing Interchange provide storage and connections to other pipeline systems and modes of transportation, such as tankers, railroads and trucks. Vessels and railroads provide additional transportation capabilities for shipping crude oil between gathering storage systems, pipelines, terminals and storage centers and end-users. Vessel transportation is typically a cost-efficient mode of transportation that allows for the ability to transport large volumes of crude oil over long distances.

Trucking complements pipeline gathering systems by gathering crude oil from operators at remote wellhead locations not served by pipeline gathering systems. These trucks can also be used to transport crude oil to aggregation points and storage facilities, which are generally located along pipeline gathering and transportation systems. Trucking is generally limited to low volume, short haul movements where other alternatives to pipeline transportation are often unavailable. Trucking costs escalate sharply with distance, making trucking the most expensive mode of crude oil transportation. Despite being small in terms of both volume per shipment and distance, trucking is an essential component of the oil distribution system.

Terminalling and storage. Terminalling and storage facilities complement the crude oil pipeline gathering and transportation systems. Terminals are facilities where crude oil is transferred to or from a storage facility or transportation system, such as a gathering pipeline, to another transportation system, such as trucks or another pipeline. Terminals play a key role in moving crude oil to end-users such as refineries by providing storage and inventory management and distribution.

Storage and terminalling assets generate revenues through a combination of storage and throughput charges to third parties. Storage fees are generated when tank capacity is provided to third parties. Terminalling services fees, also referred to as throughput services fees, are generated when a terminal receives crude oil from a shipper and redelivers it to another shipper. Both storage and terminalling services fees are earned from refiners and gatherers that need segregated storage for refining feedstocks, pipeline operators, refiners or traders that need segregated storage, traders who make or take delivery under NYMEX contracts and producers and marketers that seek to increase their marketing alternatives.

Overview of the Cushing Interchange. The Cushing Interchange, located in Cushing, Oklahoma, is one of the largest crude oil marketing hubs in the United States and the designated point of delivery specified in NYMEX crude oil futures contracts. As the NYMEX delivery point and a cash market hub, the Cushing Interchange serves as the primary source of refinery feedstock for Midwest refiners and plays an integral role in establishing and maintaining markets for many varieties of foreign and domestic crude oil. The following table lists certain of the entities with incoming pipelines connected to the Cushing Interchange, the proprietary terminals within the complex and outgoing pipelines from the Cushing Interchange for delivery throughout the United States:

Incoming Pipelines to Cushing Interchange | Cushing Interchange Terminals | Outgoing Pipelines from Cushing Interchange |

Blueknight Energy Partners, L.P. BP p.l.c. Enterprise Products Partners L.P. Sunoco Logistics Partners, L.P. Plains All American Pipeline, L.P. Enbridge Energy Partners, L.P. Rose Rock Midstream, L.P. Basin Pipeline System TransCanada Corp. White Cliffs Pipeline, LLC | Blueknight Energy Partners, L.P. Enterprise Products Partners L.P. Enbridge Energy Partners, L.P. Plains All American Pipeline, L.P. ConocoPhillips Rose Rock Midstream, L.P. Magellan Midstream Partners, L.P. Deeprock Energy Resources LLC Kinder Morgan, Inc. Gavilon, LLC NGL Energy Partners, L.P. | Blueknight Energy Partners, L.P. BP p.l.c. ConocoPhillips Sunoco Logistics Partners, L.P. Enbridge Energy Partners, L.P. Osage Pipeline Company, LLC Plains All American Pipeline, L.P. Magellan Midstream Partners, L.P. Centurion Pipeline L.P. Seaway Crude Pipeline Company LLC Gavilon, LLC |

With our pipeline and terminalling infrastructure, we have the ability to receive and/or deliver, directly or indirectly, to all pipelines and terminals within the Cushing Interchange.

4

Residual Fuel Oil Industry

Like asphalt cement, residual fuel oil is another by-product of the crude oil distillation process. Residual fuel oil is primarily used as a burner fuel in numerous industrial and commercial applications including the utility industry, the shipping and paper industry, steel mills, tire manufacturing, and food processors.

The residual fuel oil industry in the United States is characterized by a high degree of seasonality with much of the seasonality driven by the impact of weather on the need to produce power for heating and cooling applications. The residual fuel oil market is largely a commodity market with price functioning as the primary decision-making criterion. However, many customers have unique product specifications driven by their particular business applications that require the blending of various components to meet those specifications.

Residual fuel oil is purchased from a variety of refiners by our customers and transported to our terminalling and storage facilities via numerous transportation methods including rail tank car, barge, ship and truck. Some of our customers use our asphalt assets to service their residual fuel oil business.

Asphalt Terminalling Services

With approximately 8.2 million barrels of total asphalt product and residual fuel oil storage capacity, we are able to provide our customers the ability to effectively manage their asphalt product storage and processing and marketing activities. As of March 3, 2016, we have 45 terminals located in 23 states and as such are well-positioned to provide asphalt terminalling services in the market areas they serve throughout the continental United States.

We serve the asphalt industry by providing our customers access to their market areas through a combination of the leasing of certain of our asphalt facilities and the provision of storage and processing services at other of our asphalt and residual fuel oil facilities. We generate revenues by charging a fee for the lease of a facility or for services provided as asphalt products are terminalled, stored and/or processed in our facilities.

In addition, as of December 31, 2015, we have leases and storage agreements with third party customers relating to all of our asphalt facilities. The majority of the leases and storage agreements related to these facilities have terms that expire between the end of 2016 and the end of 2018. We operate the asphalt facilities that are contracted by storage, throughput and handling agreements while our contract counterparties operate the asphalt facilities that are subject to the lease agreements.

At facilities where we have storage contracts, we receive, store and/or process our customer’s asphalt products until we deliver these products to our customers or other third parties. Our asphalt assets include the logistics assets, such as docks and rail spurs and the piping and pumping equipment necessary to facilitate the unloading of liquid asphalt cement into our terminalling and storage facilities, as well as the processing and manufacturing equipment required for the processing of asphalt emulsions, asphalt cutbacks, polymer modified asphalt cement and other related finished asphalt products. After initial unloading, the liquid asphalt cement is moved via heat-traced pipe into storage tanks. These tanks are insulated and contain heating elements that allow the asphalt cement to be stored in a heated state. The asphalt cement can then be directly sold by our customers to end users or used as a raw material for the processing of asphalt emulsions, asphalt cutbacks, polymer modified asphalt cement and related finished asphalt products that we process in accordance with the formulations and specifications provided by our customers. Depending on the product, the processing of asphalt entails combining asphalt cement and various other products such as emulsifying chemicals and polymers to achieve the desired specification and application requirements.

At leased facilities, our customers conduct the operations at the asphalt facility, including the storage and processing of asphalt products, and we collect a monthly rental fee relating to the lease of such facility. Generally, under the terms of these leases, (i) title to the asphalt, raw materials or finished asphalt products received, unloaded, stored or otherwise handled at such asphalt facility is in the name of the lessee, (ii) the lessee is responsible for complying with environmental, health, safety, transportation and security laws, (iii) the lessee is required to obtain and maintain necessary permits, licenses, plans, approvals or other such authorizations and is responsible for insuring such asphalt facility, and (iv) most routine maintenance and repair of such asphalt facility is the responsibility of the lessee.

We do not take title to, or marketing responsibility for, the liquid asphalt product that we terminal, store and/or process. As a result, our asphalt operations have minimal direct exposure to changes in commodity prices, but the volumes of liquid asphalt cement we receive, store and/or process are indirectly affected by commodity prices.

5

The following table provides an overview of our asphalt facilities as of December 31, 2015:

Location | Number of Facilities(2) | Total Tankage (in thousands of Bbls)(1) |

Arkansas | 1 | 21 |

California | 1 | 66 |

Colorado | 4 | 401 |

Georgia | 1 | 38 |

Idaho | 1 | 285 |

Illinois | 2 | 232 |

Indiana | 1 | 156 |

Kansas | 4 | 492 |

Missouri | 3 | 643 |

Montana | 1 | 123 |

Nebraska | 1 | 292 |

New Jersey | 1 | 459 |

Nevada | 1 | 280 |

Ohio | 1 | 38 |

Oklahoma | 6 | 904 |

Pennsylvania | 1 | 59 |

Tennessee | 3 | 470 |

Texas | 3 | 779 |

Utah | 2 | 300 |

Virginia | 1 | 547 |

Washington | 3 | 470 |

Wyoming | 1 | 219 |

Total | 43 | 7,274 |

_______________

(1) Total tankage refers to the approximate total capacity of all tanks.

(2) | This table does not include two facilities acquired in February 2016. These facilities are located in North Carolina and Virginia and have combined tankage of 885,000 bbls. |

Our asphalt assets range in age from one year to over fifty years, and we expect that our storage tanks and related assets will have an average remaining life in excess of 20 years.

Significant Customers. Ergon Asphalt & Emulsions, Heartland Asphalt Materials, Inc., Suncor Energy USA, Axeon Marketing, LLC and Western States Asphalt, Inc. each accounted for at least 10% but not more than 25% of asphalt terminalling services revenue in 2015. The loss of any of these customers could have a material adverse effect on our business, cash flows and results of operations. No other customer accounted for more than 10% of our asphalt terminalling services revenue during 2015.

Crude Oil Terminalling and Storage Services

With approximately 7.4 million barrels of above-ground crude oil terminalling facilities and storage tanks, we are able to provide our customers the ability to effectively manage their crude oil inventories and enhance flexibility in their marketing and operating activities. Our crude oil terminalling and storage assets are located throughout our core operating areas with the majority of our crude oil terminalling and storage strategically located at the Cushing Interchange.

Our crude oil terminals and storage assets receive crude oil products from pipelines, including those owned by us, and distribute these products to interstate common carrier pipelines and regional independent refiners, among other third parties. Our crude oil terminals derive most of their revenues from terminalling services fees charged to customers.

6

The table below sets forth the total average barrels stored at and delivered out of our Cushing terminal in each of the periods presented and the total storage capacity at our Cushing terminal and at our other terminals at the end of such periods:

For the year ended December 31, | ||||

2014 | 2015 | |||

(in thousands) | ||||

Average crude oil barrels stored per month at our Cushing terminal | 1,724 | 5,322 | ||

Average crude oil delivered (Bpd) to our Cushing terminal | 77 | 117 | ||

Total storage capacity at our Cushing terminal (barrels at end of period) | 6,600 | 6,600 | ||

Total other storage capacity (barrels at end of period) | 1,091 | 824 | ||

The following table outlines the location of our crude oil terminals and their storage capacities and number of tanks as of December 31, 2015:

Location | Storage Capacity (thousands of barrels) | Number of Tanks | ||

Cushing, Oklahoma | 6,600 | 34 | ||

Longview, Texas | 238 | 4 | ||

Other(1) | 586 | 194 | ||

Total | 7,424 | 232 | ||

_______________

(1) Consists of miscellaneous storage tanks located at various points along our pipeline and gathering systems.

Cushing Terminal. One of our principal assets is our Cushing terminal, which is located within the Cushing Interchange in Cushing, Oklahoma. Currently, we own and operate 34 crude oil storage tanks with approximately 6.6 million barrels of storage capacity at this location. We own approximately 50 additional acres of land within the Cushing Interchange that is available for future expansion.

Our Cushing terminal was constructed over the last 50 years and has an expected remaining life of at least 20 years. Over 90% of our total storage capacity in our Cushing terminal has been built since 2002. We estimate that our storage tanks have a weighted average age of twelve years.

The design and construction specifications of our storage tanks meet or exceed the minimums established by the American Petroleum Institute, (“API”). Our storage tanks also undergo regular maintenance inspection programs that are more stringent than established governmental guidelines. We believe that these design specifications and inspection programs will result in lower future maintenance capital costs to us.

A key attribute of our Cushing terminal is that through our pipeline interface, we have access and connectivity to almost all of the terminals located within the Cushing Interchange. This connectivity is a key attribute of our Cushing terminal because it provides us the ability to deliver to virtually any customer within the Cushing Interchange.

Our Cushing terminal can receive crude oil from our Mid-Continent system as well as other terminals owned by Magellan Midstream Partners, Enterprise Products Partners, Sunoco Logistics Partners, Plains All American Pipeline, L.P., Seaway Crude Pipeline Company, LLC, Enbridge Energy Partners, Rose Rock Midstream Partners, Deeprock Energy Resources, LLC and two truck stations. Our Cushing terminal’s pipeline connections to major markets in the Mid-Continent region provide our customers with marketing flexibility. Our Cushing terminal can deliver crude oil via pipeline and, in the aggregate, is capable of receiving and/or delivering approximately 350,000 Bpd of crude oil.

Longview Terminal. We own and operate the Longview terminal, located in Longview, Texas, consisting of four tanks with a total storage capacity of 238,000 barrels. We use our Longview terminal in connection with our East Texas system. A number of other potential customers have access to the Longview terminal. The Longview terminal was constructed beginning in the 1940s, and we believe it has a remaining life of at least 20 years.

Significant Customers. For the year ended December 31, 2015, Vitol accounted for at least 45% but not more than 50% of our total crude oil terminalling and storage revenue, and MV Purchasing, LLC and Sunoco Partners Marketing & Terminals, L.P. each accounted for at least 10% but not more than 20% of our total crude oil terminalling and storage revenue. The loss of any of these customers could have a material adverse effect on our business, cash flows and results of operations. No other

7

customer accounted for more than 10% of our crude oil terminalling and storage revenue during 2015. As of March 2016, we provide crude oil terminalling and storage services to Vitol under agreements with aggregate storage capacity of 2.2 million barrels expiring in May 2017. For more information regarding the Vitol storage agreements, please see “Item 13-Certain Relationships and Related Party Transactions, and Director Independence-Agreements with Vitol.”

Crude Oil Pipeline Services

We own and operate a crude oil transportation system in the Mid-Continent region of the United States with a combined length of approximately 515 miles and a 220 mile tariff-regulated crude oil gathering and transportation pipeline in the Longview, Texas area. In addition, we own and operate the Eagle North system in the Mid-Continent region of the United States with a length of approximately 250 miles.

System | Asset Type | Approximate Length (miles) | Average Throughput for Year Ended December 31, 2014 (Bpd) | Average Throughput for Year Ended December 31, 2015 (Bpd) | Pipe Diameter Range |

Mid-Continent | Gathering and transportation pipelines | 515 | 20,397 | 23,706 | 4” to 20” |

East Texas | Gathering and transportation pipelines | 220 | 17,521 | 15,645 | 6” to 8” |

Eagle North | Transportation pipeline | 250 | 13,370 | 12,289 | 6” to 8” |

Mid-Continent System. Our Mid-Continent transportation system provides access to our Cushing terminal and other storage facilities. The Oklahoma portion of our Mid-Continent system consists of approximately 515 miles of various sized pipeline, of which approximately 115 miles is currently idle. Crude oil delivered into the Oklahoma portion of our Mid-Continent system is transported to our Cushing terminal or delivered to local area refiners. The Mid-Continent system includes an approximately 75-mile gathering and transportation system in southern Oklahoma acquired in November 2015, on which we market approximately 35,000 barrels of crude oil per month. The marketed barrels are delivered to a single customer in southern Oklahoma. The Mid-Continent system also includes a 35-mile gathering and transportation system in the Texas Panhandle near Dumas, Texas. Crude oil collected through the Texas Panhandle portion of our Mid-Continent system is transported by pipeline to a station where it is then delivered to market via tanker truck. For the years ended December 31, 2014 and 2015, this system delivered an average of approximately 20,397 Bpd and 23,706 Bpd of crude oil, respectively. The Mid-Continent system was constructed in various stages beginning in the 1940s, and we believe it has a remaining life of at least 20 years. In December 2015 we recorded a $1.4 million impairment expense to write a portion of the Mid-Continent system down to its estimated fair value.

East Texas System. Our East Texas system consists of approximately 220 miles of tariff-regulated crude oil gathering pipeline, of which approximately 135 miles is comprised of currently idle, inactive gathering lines. The East Texas portion of this system delivers to crude oil terminalling, refinery and storage facilities at various delivery points in the East Texas region. For the years ended December 31, 2014 and 2015, our East Texas system gathered an average of approximately 17,521 Bpd and 15,645 Bpd, respectively. Shippers on the East Texas system include Eastex Crude Co, Enbridge Energy Marketing LLC, XTO Energy Inc., Vitol, Delek Refining Ltd, Texas Gathering Company LLC, Plains All American, L.P. and Sunoco Logistics Partners L.P. The East Texas system was constructed in various stages beginning in the 1940s and we believe it has a remaining life of at least 20 years. In December 2015 we recorded a $12.6 million impairment expense to write this system down to its estimated fair value.

Eagle North System. Our Eagle North system is comprised of a 250-mile, 8-inch pipeline, of which approximately 55 miles is currently idle, that originates in Cushing, Oklahoma and terminates in Ardmore, Oklahoma.

Significant Customers. For the year ended December 31, 2015, Vitol accounted for at least 30% but not more than 35% of our total crude oil pipeline services revenue, and XTO Energy, Inc. and Valero Marketing & Supply Co. each accounted for at least 10% but not more than 25% of crude oil pipeline services revenue in 2015. The loss of any of these customers could have a material adverse effect on our business, cash flows and results of operations. No other customer accounted for more than 10% of our crude oil pipeline services revenue during 2015.

Crude Oil Trucking and Producer Field Services

We provide two types of trucking services: crude oil trucking and producer field services.

8

Crude Oil Trucking Services. To complement our pipeline gathering, marketing and transportation business, we use our approximately 152 owned or leased tanker trucks, which have an average tank size of approximately 200 barrels, to move crude oil to aggregation points, pipeline injection stations and storage facilities. Our tanker trucks moved an average of 64,000 Bpd and 51,000 Bpd, respectively, for the years ended December 31, 2014 and 2015 from wellhead locations not served by pipeline gathering systems to aggregation points and storage facilities. The following table outlines the distribution of our trucking assets among our operating areas as of March 3, 2016:

Location | Number of Trucks | |

Oklahoma | 108 | |

Kansas | 33 | |

Texas | 11 | |

Total | 152 | |

During the second half of 2015, our West Texas operating margins and transported volumes were negatively impacted by increased competition from transporters moving equipment from crude oil shale areas to West Texas, where crude oil volumes have remained fairly steady, and producers and marketers quickly pipe-connecting barrels for transport. As a result, we decided to cease trucking barrels in West Texas and refocus our efforts on transporting barrels around our owned crude oil pipelines and storage assets in Oklahoma and Kansas. Due to this change we recognized a $1.6 million restructuring expense in December 2015, comprised of employee severance costs and the recognition of future lease expense on idled equipment as of December 31, 2015. The severance costs were paid in the first quarter of 2016 and the lease payments will be made over the remaining lease terms, which extend through July 2019. See Note 6 to our Consolidated Financial Statements for additional detail regarding this restructuring expense. Additionally, in December 2015 we recorded a $0.5 million impairment expense to write the assets related to our West Texas trucking stations down to their estimated fair value.

Producer Field Services. We provide various producer field services for companies such as Pioneer Natural Resources Co., Parallel Energy, L.P., Regency Gas Services, LLC, DCP Midstream, LLC and ConocoPhillips Co. These services may include gathering condensates by way of bobtail trucks for natural gas companies to hauling produced water to disposal wells, providing hot and cold fresh water, chemical and down hole well treating, wet oil clean up, and building and maintaining separation facilities. We provide these services at contracted hourly rates. Our producer service fleet consists of approximately 90 trucks in a number of different sizes.

Significant Customers. For the year ended December 31, 2015, Vitol accounted for at least 40% but not more than 45% of our total crude oil trucking and producer field services revenue, and MV Purchasing, LLC and Devon Energy Production Co. each accounted for at least 10% but not more than 25% of crude oil trucking and producer field services revenue in 2015. The loss of any of these customers could have a material adverse effect on our business, cash flows and results of operations. No other customer accounted for more than 10% of our crude oil trucking and producer field services revenue during 2015.

Competition

We are subject to competition from other crude oil gathering, pipeline transportation, terminalling and storage operations, and trucking operations that may be able to supply our customers with the same or comparable services on a more competitive basis. We compete with national, regional and local liquid asphalt cement storage and processing companies, and gathering, storage and pipeline companies, including the major integrated oil companies, of widely varying sizes, financial resources and experience.

With respect to our crude oil gathering and transportation services, these competitors include Enterprise Products Partners L.P., Plains All American Pipeline, L.P., Magellan Midstream Partners, L.P., Sunoco Logistics Partners L.P. and Rose Rock Midstream Partners, L.P., among others. With respect to our crude oil storage and terminalling services, these competitors include Magellan Midstream Partners, L.P., Enbridge Energy Partners, L.P., Plains All American Pipeline, L.P. and Rose Rock Midstream Partners, L.P., among others. Several of our competitors conduct portions of their operations through publicly traded partnerships with structures similar to ours, including Plains All American Pipeline, L.P., Enterprise Products Partners L.P., Sunoco Logistics Partners L.P., Magellan Midstream Partners, L.P. and Rose Rock Midstream Partners, L.P. Our ability to compete could be harmed by factors we cannot control, including:

• | the perception that another company can provide better service; |

• | the availability of crude oil alternative supply points, or crude oil supply points located closer to the operations of our customers; and/or |

9

• | a decision by our competitors to acquire or construct crude oil midstream assets and provide gathering, transportation, terminalling or storage services in geographic areas, or to customers, served by our assets and services. |

The asphalt industry is highly fragmented and regional in nature. Participants range in size from major oil companies to small family-owned businesses. Participants in the asphalt business include refiners such as BP p.l.c., Flint Hills Resources, L.P., CHS, Inc., Exxon Mobil Corporation, ConocoPhillips Co., NuStar Energy L.P., Ergon, Inc., Marathon Petroleum Company LLC, Alon USA LP, Suncor Energy Inc. and Valero Energy Corporation; resellers such as NuStar Energy L.P., Idaho Asphalt Supply, Inc. and Asphalt Materials, Inc.; and large road construction firms such as Old Castle Materials, Inc. and Colas SA. We compete for asphalt terminalling services with the national, regional and local industry participants as well as liquid asphalt cement terminalling and storage companies including the major integrated oil companies and a variety of others, such as KinderMorgan Inc., International-Matex Tank Terminals and Houston Fuel Oil Terminal Company.

If we are unable to compete effectively with services offered by other midstream enterprises, our financial results and ability to make distributions to our unitholders may be adversely affected. Additionally, we also compete with national, regional and local companies for asset acquisitions and expansion opportunities. Some of these competitors are substantially larger than us and have greater financial resources and lower costs of capital than we do.

Pipeline Regulation

Currently, we have tariff rates that are regulated by the Texas Railroad Commission. We do not currently offer interstate transportation service regulated by the Federal Energy Regulatory Commission (“FERC”) with the exception of two short interstate segments where the sole shipper is our affiliate. Our interstate pipeline segments are subject to regulatory enforcement by the Pipeline Hazardous Materials Safety Administration.

Gathering and Intrastate Pipeline Regulation. All intrastate pipelines in the state of Texas are regulated by the Texas Railroad Commission and intrastate pipelines in the state of Oklahoma are regulated by the Oklahoma Corporation Commission. In the states in which we operate, regulation of crude gathering facilities and intrastate crude pipeline facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and complaint-based rate regulation. For example, our intrastate crude pipeline facilities in Texas must have a tariff on file and charge just and reasonable rates for service, which must be provided on a non-discriminatory basis.

Pipeline Safety. Our pipelines are subject to state and federal laws and regulations governing design, construction, operation and maintenance of the lines; qualifications of pipeline personnel; public awareness; emergency response and other aspects of pipeline safety. These laws and regulations are subject to change, resulting in potentially more stringent requirements and increased costs. Applicable pipeline safety regulations establish minimum safety requirements and, for pipelines that pose a greater risk to populated areas or environmentally sensitive areas, impose a more rigorous requirement for the implementation of pipeline integrity management programs for our pipelines. On January 3, 2012, President Obama signed the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011. That legislation increased the maximum civil penalties for pipeline safety administrative enforcement actions; required the DOT to study and report on the expansion of integrity management requirements, the sufficiency of existing gathering line regulations to ensure safety and the feasibility of leak detection systems for hazardous liquid pipelines; required pipeline operators to verify their records on maximum allowable operating pressure; and imposed new emergency response and incident notification requirements. In 2015 several amendments were issued. These amendments added additional construction inspection requirements, clarified integrity management rules, and updated federally incorporated standards. The states in which we operate pipelines incorporate into their state rules those federal safety standards for hazardous liquids pipelines contained in Title 49, Part 195 of the Federal Code of Regulations. As a result, the issuance of any new pipeline safety regulations, including additional requirements for integrity management, is likely to increase the operating costs of our pipelines subject to such new requirements, and such future costs may be material.

Trucking Regulation. We operate a fleet of trucks to transport crude oil and oilfield materials as a private, contract and common carrier. We are licensed to perform both intrastate and interstate motor carrier services. As a motor carrier, we are subject to certain safety regulations issued by the DOT. The trucking regulations cover, among other things, driver operations, maintaining log books, truck manifest preparations, the placement of safety placards on the trucks and trailer vehicles, drug and alcohol testing, safety of operation and equipment and many other aspects of truck operations. We are also subject to requirements of the federal Occupational Safety and Health Act, as amended (“OSHA”), with respect to our trucking operations.

10

Environmental, Health and Safety Risks

General. Our midstream crude oil gathering, transportation, terminalling and storage operations, and our asphalt assets, are subject to stringent federal, state and local laws and regulations relating to the discharge of materials into the environment or otherwise relating to protection of the environment. As with the midstream and liquid asphalt cement industries generally, compliance with current and anticipated environmental laws and regulations increases our overall cost of business, including our capital costs to construct, maintain and upgrade equipment and facilities. Failure to comply with these laws and regulations may result in the assessment of significant administrative, civil and criminal penalties, the imposition of investigatory and remedial liabilities, and issuance of injunctions that may restrict or prohibit some or all of our operations. We believe that our operations are in substantial compliance with applicable laws and regulations. However, environmental laws and regulations are subject to change, resulting in potentially more stringent requirements, and we cannot provide any assurance that the cost of compliance with current and future laws and regulations will not have a material effect on our results of operations or earnings.

Risks of accidental releases into the environment are inherent in the nature of both our midstream and liquid asphalt cement operations, such as leaks or spills of petroleum products or hazardous materials from our pipelines, trucks, terminals and storage facilities. A discharge of petroleum products or hazardous materials into the environment could, to the extent such event is not covered by insurance, subject us to substantial expense, including costs related to environmental clean-up or restoration, compliance with applicable laws and regulations, and any personal injury, natural resource or property damage claims made by neighboring landowners and other third parties.

The following is a summary of the more significant current environmental, health and safety laws and regulations to which our business operations are subject and for which compliance may require material capital expenditures or have a material adverse impact on our results of operations, financial position and cash flows.

Water. The federal Clean Water Act and analogous state and local laws impose restrictions and strict controls regarding the discharge of pollutants into waters of the United States and state waters. We note that the term “waters of the United States” is already broadly construed, and the United States Environmental Protection Agency (“EPA”) and U.S. Army Corps of Engineers recently adopted a rule to clarify the meaning of the term “waters of the United States.” Many interested parties believe that the rule expands federal jurisdiction under the Clean Water Act. The effectiveness of the new rule has been stayed pending ongoing judicial challenges. Permits must be obtained to discharge pollutants into these waters. The Clean Water Act and analogous laws provide significant penalties for unauthorized discharges and impose substantial potential liabilities for cleaning up spills and leaks into water. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions. We believe that we are in substantial compliance with any such applicable state requirements.

The federal Oil Pollution Act, as amended (“OPA”), was enacted in 1990 and amended provisions of the Federal Water Pollution Control Act of 1972, the Clean Water Act, and other statutes as they pertain to prevention and response to oil spills. The OPA, and analogous state and local laws, subject owners of facilities used for storing, handling or transporting oil, including trucks and pipelines, to strict, joint and potentially unlimited liability for containment and removal costs, natural resource damages and certain other consequences of an oil spill, where such spill is into navigable waters, along shorelines or in the exclusive economic zone of the United States. The OPA, the Clean Water Act and other analogous laws also impose certain spill prevention, control and countermeasure requirements, such as the preparation of detailed oil spill emergency response plans and the construction of dikes and other containment structures to prevent contamination of navigable or other waters in the event of an oil overflow, rupture or leak. We believe that we are in substantial compliance with applicable OPA and analogous state and local requirements.

Air Emissions. Our operations are subject to the federal Clean Air Act (“CAA”), as amended, as well as to comparable state and local laws. We believe that our operations are in substantial compliance with these laws in those areas in which we operate. Amendments to the CAA enacted in 1990 imposed a federal operating permit requirement for major sources of air emissions. Our crude oil terminal located in Cushing, Oklahoma holds such a permit, which is referred to as a “Title V permit.” On April 17, 2012, the EPA approved final rules under the CAA that established new air emission controls for oil and natural gas production, pipelines and processing operations. These rules became effective on October 15, 2012. To respond to challenges made to the rules, the EPA revised certain aspects of the April 2012 rules and has indicated it may reconsider other aspects. The costs of compliance with any modified or newly issued rules cannot be predicted. The Obama administration also announced in January 2015 that other federal agencies, including the Bureau of Land Management, the Pipeline and Hazardous Materials Safety Administration (“PHMSA”), and the Department of Energy, will impose new or more stringent regulations on the oil and gas sector that are said to have the effect of reducing methane emissions. In August 2015, the EPA proposed a rule to set standards for methane and volatile organic compound emissions from new and modified sources in the oil

11

and gas sector, including transmission. A final rule is expected in 2016. Depending on whether such rules are promulgated and the applicability and restrictions in any promulgated rule, compliance with such rules could result in additional compliance costs for us and for others in our industry. In response to these and other regulatory developments, we may be required to incur certain capital expenditures in the next several years for air pollution control equipment and operational changes in connection with obtaining or maintaining permits and approvals and complying with applicable regulations addressing air emission related issues. Although we can provide no assurance, we believe future compliance with the CAA, as currently amended, will not have a material adverse effect on our financial condition, results of operations or cash flows.

Climate Change. Legislative and regulatory measures to address concerns that emissions of certain gases, commonly referred to as “greenhouse gases” (“GHGs”), may be contributing to warming of the Earth’s atmosphere are in various phases of discussions or implementation at the international, national, regional, and state levels. The oil and gas industry is a direct source of certain GHG emissions, namely carbon dioxide and methane, and future restrictions on such emissions could impact our future operations. In the United States, the U.S. Congress has considered, but to date has not enacted, federal legislation requiring GHG controls. In addition, the EPA has promulgated a series of rulemakings and other actions to regulate GHGs as pollutants under the CAA. In May 2010, EPA finalized the Prevention of Significant Deterioration and Title V GHG Tailoring Rule, which phased in federal new source review and Title V permitting requirements for certain affected stationary sources of GHG emissions, beginning January 2, 2011. On June 23, 2014, the United States Supreme Court ruled that portions of the EPA’s GHG regulatory program violated the Clean Air Act. Specifically, the Supreme Court determined that GHGs cannot independently trigger Prevention of Significant Deterioration (“PSD”) permitting requirements. However, the Court held that certain PSD permitting requirements may apply to GHG emissions if emissions of another regulated pollutant, like sulfur dioxide or particulate matter, trigger PSD permitting. Additionally, the Supreme Court held that the Tailoring Rule’s regulatory emissions thresholds violated the Clean Air Act, while suggesting that EPA could promulgate “de minimis” thresholds for GHGs. Further proceedings are ongoing in the United States Court of Appeals for the District of Columbia. These EPA rulemakings could affect our operations and ability to obtain air permits for new or modified facilities. Furthermore, in 2009, the EPA issued a “Mandatory Reporting of Greenhouse Gases” final rule, establishing a comprehensive scheme of regulations that require monitoring and reporting of GHG emissions on an annual basis by operators of stationary sources in the U.S. emitting more than established annual thresholds of carbon dioxide-equivalent GHG emissions. Monitoring obligations began in 2010 and the emissions reporting required took effect in 2011. The scope of the rule was subsequently expanded to cover additional petroleum and natural gas production, processing, and transmission sources that were not previously covered by the rule. Although this rule does not control GHG emission levels from any facilities, it has caused us to incur monitoring and reporting costs. In addition, efforts have been and continue to be made in the international community toward the adoption of international treaties or protocols. In 2015, the United States participated in the United Nations Conference on Climate Change, which led to the adoption of the Paris Agreement that will require countries to review and “represent a progression” in their intended nationally determined contributions, which set GHG emission reduction goals, every five years beginning in 2020.

Legislation and regulations relating to control or reporting of GHG emissions are also in various stages of discussions or implementation in many of the states in which we operate. Passage of climate change legislation or other federal or state legislative or regulatory initiatives that regulate or restrict GHG emissions in areas in which we conduct business could adversely affect the demand for our products and services, and depending on the particular program adopted could increase the costs of our operations, including costs to operate and maintain our facilities, install new emission controls on our facilities, acquire allowances to authorize our GHG emissions (e.g., from natural gas fired combustion units), pay any taxes related to our GHG emissions and/or administer and manage a GHG emissions program. At this time, it is not possible to accurately estimate how laws or regulations addressing GHG emissions would impact our business. Although we do not expect we would be impacted to a greater degree than other similarly situated midstream transporters of petroleum products, the greenhouse gas control programs could have an adverse effect on our cost of doing business and could reduce demand for the products we transport.

In addition to potential impacts on our business directly or indirectly resulting from climate-change legislation or regulations, our business also could be negatively affected by climate related physical changes or changes in weather patterns. Severe weather could result in damages to or loss of our physical assets, impact our ability to conduct operations and/or result in a disruption of our customer’s operations. These types of physical changes could also affect entities that provide goods and services to us and indirectly have an adverse affect on our business as a result of increases in costs or availability of goods and services. Changes of this nature could have a material adverse impact on our business.

Solid Waste Disposal and Environmental Remediation. The Comprehensive Environmental Response, Compensation, and Liability Act, as amended (“CERCLA”), also known as Superfund, as well as comparable state and local laws, impose liability without regard to fault or the legality of the original act, on certain classes of persons associated with the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site or sites where the release

12

occurred and companies that disposed of, or arranged for the disposal of, the hazardous substances found at the site. Under CERCLA, such persons may be subject to strict and, under certain circumstances, joint and several liability for cleanup costs, for damages to natural resources, and for the costs of certain health studies. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by releases of hazardous substances or other pollutants. We generate materials in the course of our operations that are regulated as hazardous substances. Beyond the federal statute, many states have enacted environmental response statutes that are analogous to CERCLA.

We generate wastes, including “hazardous wastes,” that are subject to the requirements of the federal Resource Conservation and Recovery Act, as amended (“RCRA”), as well as to comparable state and local laws. While normal costs of complying with these laws would not be expected to have a material adverse effect on our financial conditions, we could incur substantial expense in the future if the RCRA exclusion for certain oil and gas waste were eliminated. Should our oil and gas wastes become subject to RCRA, we would also become subject to more rigorous and costly disposal requirements, resulting in additional capital expenditures or operating expenses for us.

We currently own or lease properties where hazardous substances are being handled, transported or stored or have been handled, transported or stored for many years. Although we believe that operating and disposal practices that were standard in the midstream, field services and liquid asphalt cement industries at the time were utilized at properties leased or owned by us, historical releases of hazardous substances or associated generated wastes have occurred on or under the properties owned or leased by us, or on or under other locations where these wastes were taken for disposal. In addition, many of these properties have been operated in the past by third parties whose treatment and disposal or release of hazardous substances or associated generated wastes were not under our control. These properties and the materials disposed on them may be subject to CERCLA, RCRA and analogous state laws. Under such laws, we could be required to remove or remediate previously spilled hazardous materials or associated generated wastes (including wastes disposed of or released by other site occupants or by prior owners or operators), or to clean up contaminated property (including contaminated groundwater).

Contamination resulting from the release of hazardous substances or associated generated wastes is not unusual within the midstream and liquid asphalt cement industries. Other assets we have acquired or will acquire in the future may have environmental remediation liabilities for which we are not indemnified. In the future, we likely will experience releases of hazardous materials, including petroleum products, into the environment from our pipeline terminalling and storage operations, or discover releases that were previously unidentified. Although we maintain a program designed to prevent and, as applicable, to detect and address such releases promptly, damages and liabilities incurred due to environmental releases from our assets may substantially affect our business.

Regulation of Hydraulic Fracturing. A portion of our customers’ production is developed from unconventional sources, such as shales, that require hydraulic fracturing as part of the completion process. Hydraulic fracturing involves the injection of water, sand and chemicals under pressure into shale formations to stimulate crude oil and/or gas production. The practice of hydraulic fracturing has been subject to public scrutiny in recent years and various efforts to regulate, or in some cases prohibit, hydraulic fracturing have been, and are still being, pursued at the local, state and federal levels of government. For example, several states, including states in which we operate, have imposed disclosure requirements on hydraulic fracturing, and several local governments have prohibited or severely restricted hydraulic fracturing within their jurisdictions. Restrictions on hydraulic fracturing could adversely affect our operations by reducing the volumes of crude oil that we transport.

Endangered Species and Migratory Birds. The Endangered Species Act (“ESA”), restricts activities that may affect endangered or threatened species or their habitats. While some of our operations may be located in areas that are designated as habitats for endangered or threatened species, we believe that we are in substantial compliance with the ESA. However, the designation of previously unlisted endangered or threatened species could cause us to incur additional costs or become subject to operating restrictions or bans or limit future development in the affected areas. The Migratory Bird Treaty Act (“MBTA"), implements various treaties and conventions between the United States and certain other nations for the protection of migratory birds. Pursuant to the MBTA, the taking, killing or possessing of migratory birds is unlawful without a permit, thereby potentially requiring the implementation of operating restrictions or a temporary, seasonal, or permanent ban in affected areas. We believe that we are in substantial compliance with the MBTA.

OSHA. We are subject to the requirements of OSHA, as well as to comparable state and local laws that regulate the protection of worker health and safety. In addition, the OSHA hazard communication standard requires that certain information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We believe that our operations are in substantial compliance with OSHA requirements and industry standards, record keeping requirements and monitoring of occupational exposure to regulated substances.

13

Anti-Terrorism Measures. The federal Department of Homeland Security Appropriations Act of 2007 requires the Department of Homeland Security (“DHS”), to issue regulations establishing risk-based performance standards for the security of chemical and industrial facilities, including oil and gas facilities that are deemed to present “high levels of security risk.” The DHS issued an interim final rule in April 2007 known as the Chemical Facility Anti-Terrorism Standards (“CFATS”) regarding risk-based performance standards to be attained pursuant to the act and, on November 20, 2007, further issued an Appendix A to CFATS that establish chemicals of interest and their respective threshold quantities that will trigger compliance with these interim rules. We currently do not handle, use, store, or process any “Chemicals of Interest” (“COI”) listed in Appendix A above their respective threshold quantities, and are therefore not subject to requirements of CFATS. We will continue to monitor the CFATS for regulatory changes that could impact our operations in the future.

Operational Hazards and Insurance

Pipelines, terminals, storage tanks and similar facilities may experience damage as a result of an accident or natural disaster. These hazards can cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage and suspension of operations. We have maintained insurance of various types and varying levels of coverage that we consider adequate under the circumstances to cover our operations and properties, including coverage for pollution related events. However, such insurance does not cover every potential risk associated with operating pipelines, terminals and other facilities. Notwithstanding what we believe is a favorable claims history, the overall cost of the insurance program as well as the deductibles and overall retention levels that we maintain have increased. Through the utilization of deductibles and retentions we self insure the “working layer” of loss activity to create a more efficient and cost effective program. The working layer consists of high frequency/low severity losses that are best retained and managed in-house. As we continue to grow, we will continue to monitor our retentions as they relate to the overall cost and scope of our insurance program.

Employees

As of December 31, 2015, we employed approximately 480 persons. None of these employees are represented by labor unions or covered by any collective bargaining agreement. We believe that relations with these employees are satisfactory.

Financial Information about Segments

Information regarding our operating revenues, profit and loss and identifiable assets attributable to each of our segments is presented in Note 20 to our consolidated financial statements included in this annual report on Form 10-K.

Available Information

We provide public access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports filed with the SEC under the Securities and Exchange Act of 1934. These documents may be accessed free of charge on our website, www.bkep.com, as soon as is reasonably practicable after their filing with the SEC. Information contained on our website is not incorporated by reference in this report or any of our other filings. The filings are also available through the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room is available by calling 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov.

Item 1A. Risk Factors

Limited partner interests are inherently different from the capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in a similar business. You should carefully consider the following risk factors together with all of the other information included in this report. If any of the following risks were actually to occur, our business, financial condition, results of operations and cash flows could be materially adversely affected. In that case, we might not be able to pay distributions on our units, the trading price of our units could decline and our unitholders could lose all or part of their investment.

Risks Related to our Business

We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our General Partner, to enable us to make cash distributions to holders of our units at our current distribution rate.

14

In order to make cash distributions on our Preferred Units at the preference distribution rate of $0.17875 per unit per quarter, or $0.715 per unit per year, and on our common units at the minimum quarterly distribution of $0.11 per unit per quarter, or $0.44 per unit per year, we will require available cash of approximately $9.2 million per quarter, or $36.7 million per year. We may not have sufficient available cash from operating surplus each quarter to enable us to make cash distributions on our Preferred Units at the preference rate or on our common units at the minimum quarterly distribution rate. The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things, the risks described herein.

In addition, the actual amount of cash we will have available for distribution will depend on other factors, including:

• | the level of capital expenditures we make; |

• | the cost of acquisitions; |

• | our debt service requirements and other liabilities; |

• | fluctuations in our working capital needs; |

• | our ability to borrow funds and access capital markets; |

• | restrictions contained in our credit facility or other debt agreements; and |

• | the amount of cash reserves established by our General Partner. |

Our cash available for distributions to our unitholders could be negatively impacted if we are unable to extend existing storage contracts or enter into new storage contracts at our Cushing terminal.

We have a total of 6.6 million barrels of storage capacity at the Cushing terminal. Customer storage contracts for 2.8 million barrels of storage at this location are month-to-month or expire in 2016. We may not be able to extend, renegotiate or replace these contracts when they expire, and the terms of any renegotiated contracts may not be as favorable as the contracts they replace. In addition, to the degree that we operate outside of long-term contracts, our revenues can be significantly more volatile than would be the case with a pricing structure negotiated through a long-term storage contract. If we cannot successfully renew significant contracts or must renew them on less favorable terms, our revenues from these arrangements could decline which could have a material adverse effect on our financial condition, results of operations and cash flows.

We depend on certain key customers for a portion of our revenues and are exposed to credit risks of these customers. The loss of or material nonpayment or nonperformance by any of these key customers could adversely affect our cash flow and results of operations.