Attached files

| file | filename |

|---|---|

| 8-K - Virgin America Inc. | a8-kjpmorganaviationconfer.htm |

VIRGIN AMERICA MARCH 2016

DISCLAIMER 2 This presentation includes forward-looking statements that are subject to many risks and uncertainties. These forward-looking statements, such as our statements about our short-term and long-term growth strategies, can sometimes be identified by our use of terms such as “intend,” “expect,” “plan,” “estimate,” “future,” “strive” and similar words. Although we believe that the expectations reflected in our forward-looking statements are reasonable, those statements involve many risks and uncertainties that may cause our actual results to differ from what may be expressed or implied in our statements. Those risks are discussed in our annual report on Form 10-K, which is on file with the Securities and Exchange Commission (the “SEC), particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” No forward-looking statement is a guarantee of future results, and you should not place undue reliance on our forward-looking statements, which reflect our views as of the date of this presentation. We assume no obligation to update any forward-looking statement contained in this presentation, except as may be required by law. This presentation contains certain information that has not been presented in accordance with generally accepted accounting principles (“GAAP"). Reconciliations of such information to the most directly comparable GAAP financial measures are included in the Appendix to these slides and in our annual report on Form 10-K. This information should not be considered a substitute for any GAAP financial measures.

3 Premium travel experience combined with an award-winning brand Low cost carrier cost structure Established presence in key markets Significant market expansion opportunities Ancillary revenue opportunities contribute additional top-line growth Strong balance sheet to support long-term growth KEY INVESTMENT HIGHLIGHTS

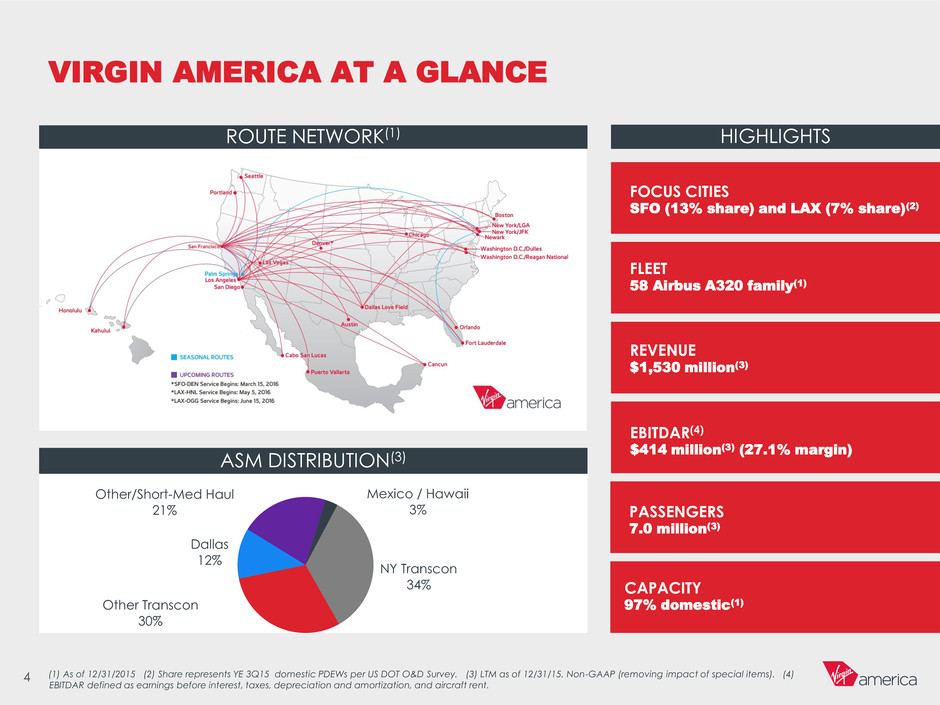

VIRGIN AMERICA AT A GLANCE 4 ROUTE NETWORK(1) HIGHLIGHTS (1) As of 12/31/2015 (2) Share represents YE 3Q15 domestic PDEWs per US DOT O&D Survey. (3) LTM as of 12/31/15. Non-GAAP (removing impact of special items). (4) EBITDAR defined as earnings before interest, taxes, depreciation and amortization, and aircraft rent. ASM DISTRIBUTION(3) FOCUS CITIES SFO (13% share) and LAX (7% share)(2) FLEET 58 Airbus A320 family(1) REVENUE $1,530 million(3) EBITDAR(4) $414 million(3) (27.1% margin) PASSENGERS 7.0 million(3) CAPACITY 97% domestic(1) NY Transcon 34% Other Transcon 30% Dallas 12% Other/Short-Med Haul 21% Mexico / Hawaii 3%

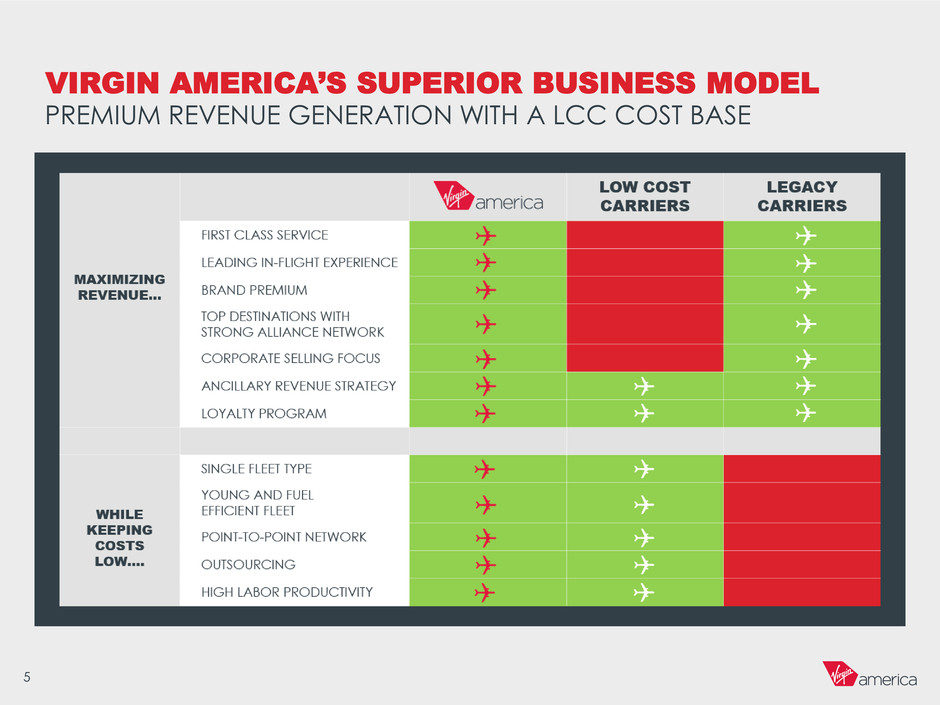

PREMIUM REVENUE GENERATION WITH A LCC COST BASE VIRGIN AMERICA’S SUPERIOR BUSINESS MODEL 5

A PREMIUM TRAVEL EXPERIENCE THAT IS CONSISTENT ACROSS THE ENTIRE FLEET FOR ALL DESTINATIONS 55” pitch, 165 degree recline Massaging chairs Distinctive meal service Spacious cabin Dedicated flight attendant and lavatory for 8 seats Free movies + premium TV Free live television In-seat power Access to paid WiFi Extra leg room with 38” pitch Free food and beverage Free movies + premium TV Priority boarding/security Dedicated overhead bin space Free live television In-seat power Access to paid WiFi Custom-designed Recaro seats 32” – 33” pitch Full in-flight entertainment Food and beverage on demand via seatback screen Free live television In-seat power Access to paid WiFi PREMIUM IN-FLIGHT EXPERIENCE 6 FIRST CLASS MAIN CABIN SELECT MAIN CABIN

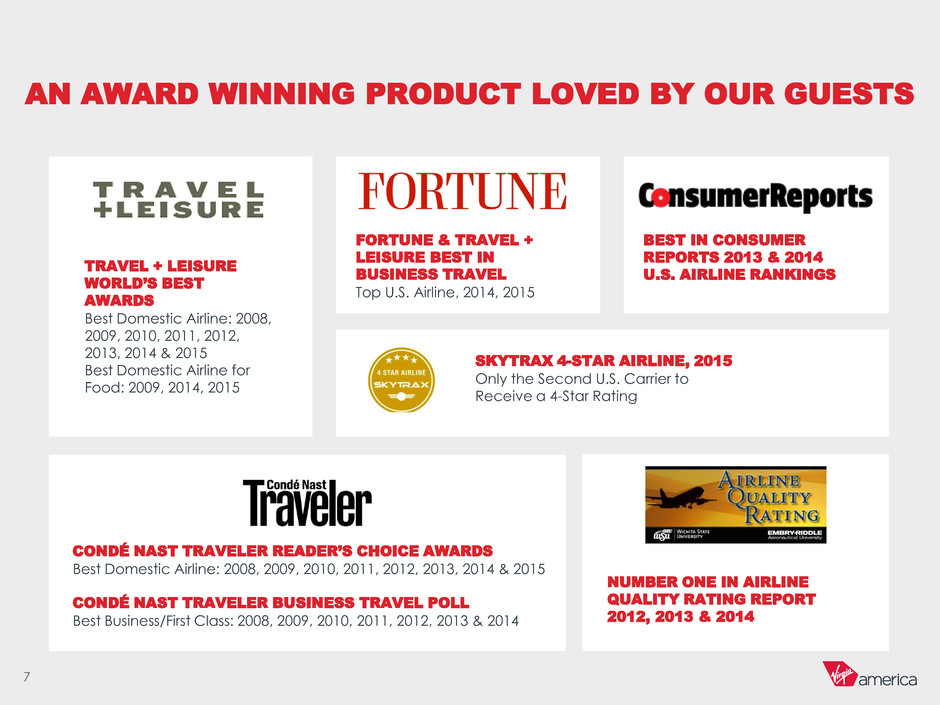

AN AWARD WINNING PRODUCT LOVED BY OUR GUESTS 7 CONDÉ NAST TRAVELER READER’S CHOICE AWARDS Best Domestic Airline: 2008, 2009, 2010, 2011, 2012, 2013, 2014 & 2015 CONDÉ NAST TRAVELER BUSINESS TRAVEL POLL Best Business/First Class: 2008, 2009, 2010, 2011, 2012, 2013 & 2014 BEST IN CONSUMER REPORTS 2013 & 2014 U.S. AIRLINE RANKINGS FORTUNE & TRAVEL + LEISURE BEST IN BUSINESS TRAVEL Top U.S. Airline, 2014, 2015 TRAVEL + LEISURE WORLD’S BEST AWARDS Best Domestic Airline: 2008, 2009, 2010, 2011, 2012, 2013, 2014 & 2015 Best Domestic Airline for Food: 2009, 2014, 2015 SKYTRAX 4-STAR AIRLINE, 2015 Only the Second U.S. Carrier to Receive a 4-Star Rating NUMBER ONE IN AIRLINE QUALITY RATING REPORT 2012, 2013 & 2014

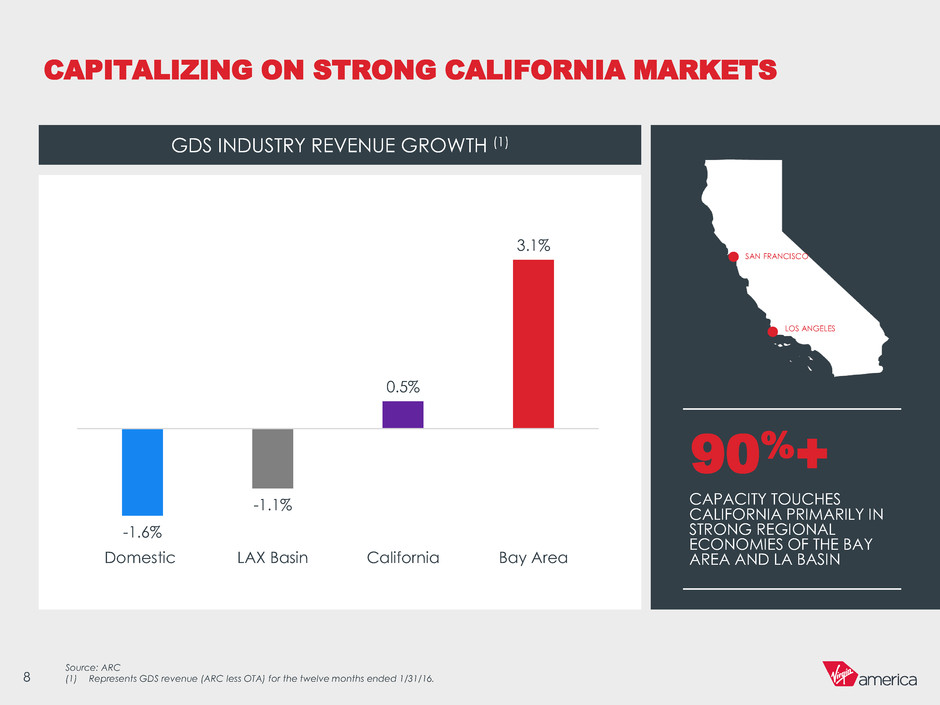

8 CAPITALIZING ON STRONG CALIFORNIA MARKETS Source: ARC (1) Represents GDS revenue (ARC less OTA) for the twelve months ended 1/31/16. GDS INDUSTRY REVENUE GROWTH (1) CAPACITY TOUCHES CALIFORNIA PRIMARILY IN STRONG REGIONAL ECONOMIES OF THE BAY AREA AND LA BASIN 90%+ SAN FRANCISCO LOS ANGELES -1.6% -1.1% 0.5% 3.1% Domestic LAX Basin California Bay Area

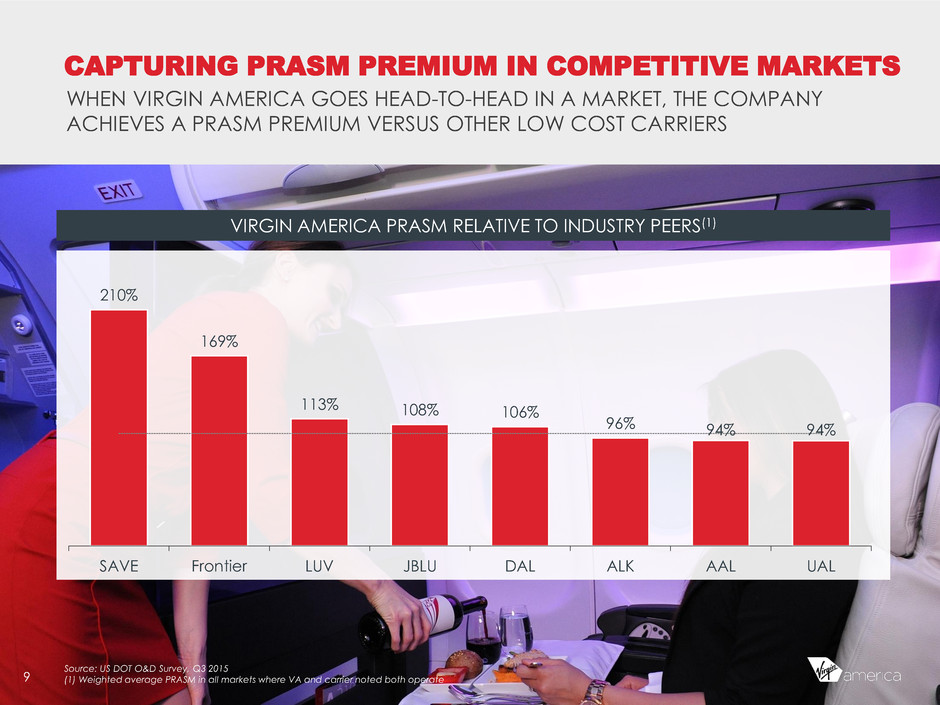

CAPTURING PRASM PREMIUM IN COMPETITIVE MARKETS 9 WHEN VIRGIN AMERICA GOES HEAD-TO-HEAD IN A MARKET, THE COMPANY ACHIEVES A PRASM PREMIUM VERSUS OTHER LOW COST CARRIERS VIRGIN AMERICA PRASM RELATIVE TO INDUSTRY PEERS(1) Source: US DOT O&D Survey, Q3 2015 (1) Weighted average PRASM in all markets where VA and carrier noted both operate 210% 169% 113% 108% 106% 96% 94% 94% SAVE Frontier LUV JBLU DAL ALK AAL UAL

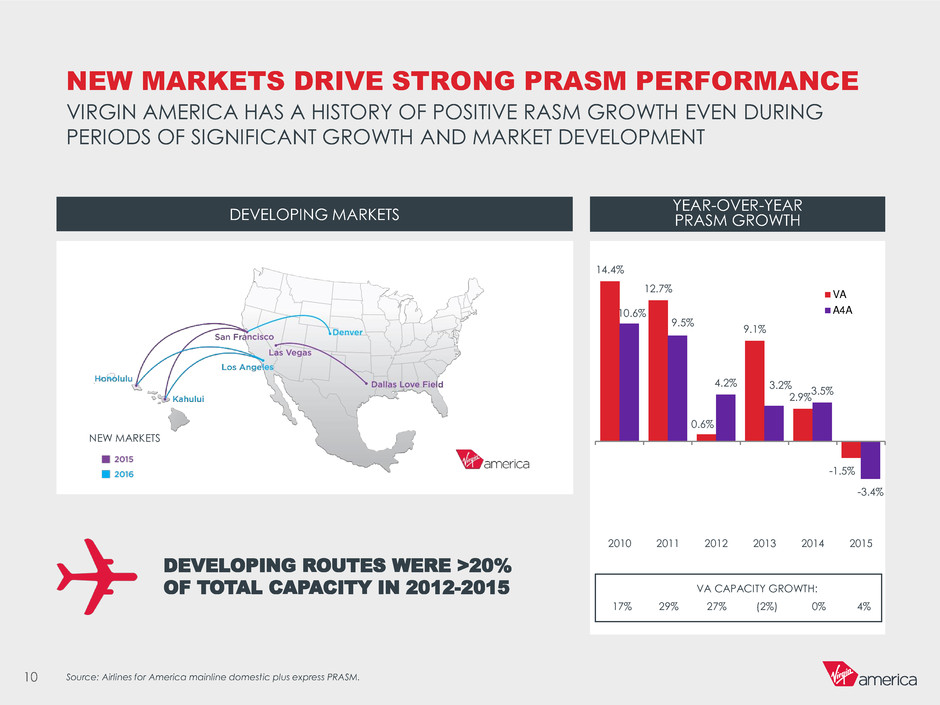

NEW MARKETS DRIVE STRONG PRASM PERFORMANCE 10 VIRGIN AMERICA HAS A HISTORY OF POSITIVE RASM GROWTH EVEN DURING PERIODS OF SIGNIFICANT GROWTH AND MARKET DEVELOPMENT DEVELOPING MARKETS Source: Airlines for America mainline domestic plus express PRASM. YEAR-OVER-YEAR PRASM GROWTH DEVELOPING ROUTES WERE >20% OF TOTAL CAPACITY IN 2012-2015 17% VA CAPACITY GROWTH: 29% 27% (2%) 0% 4% 14.4% 12.7% 0.6% 9.1% 2.9% -1.5% 10.6% 9.5% 4.2% 3.2% 3.5% -3.4% 2010 2011 2012 2013 2014 2015 VA A4A NEW MARKETS

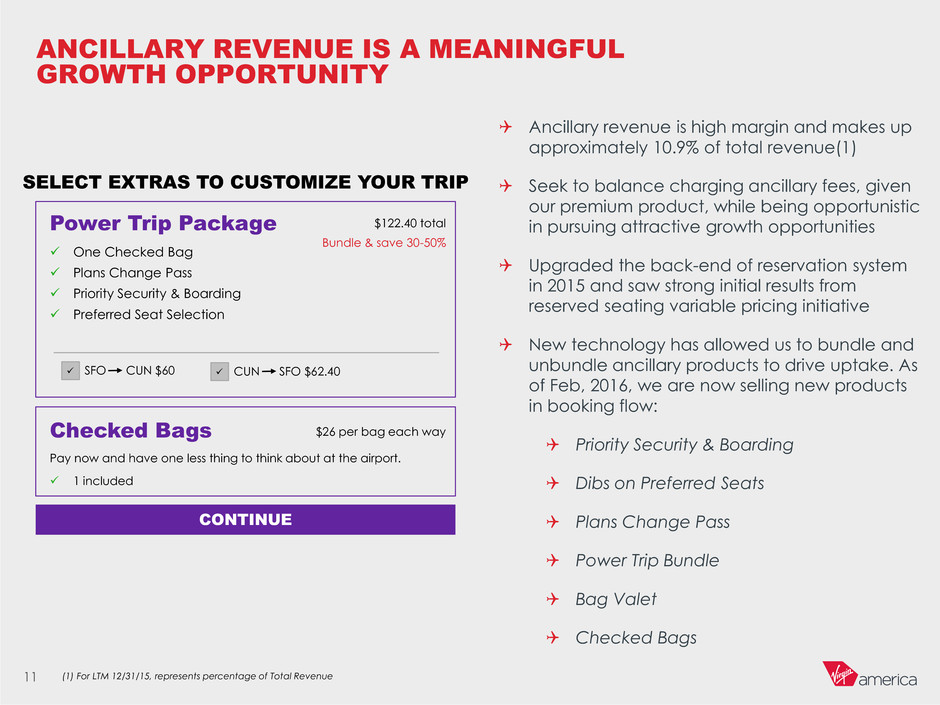

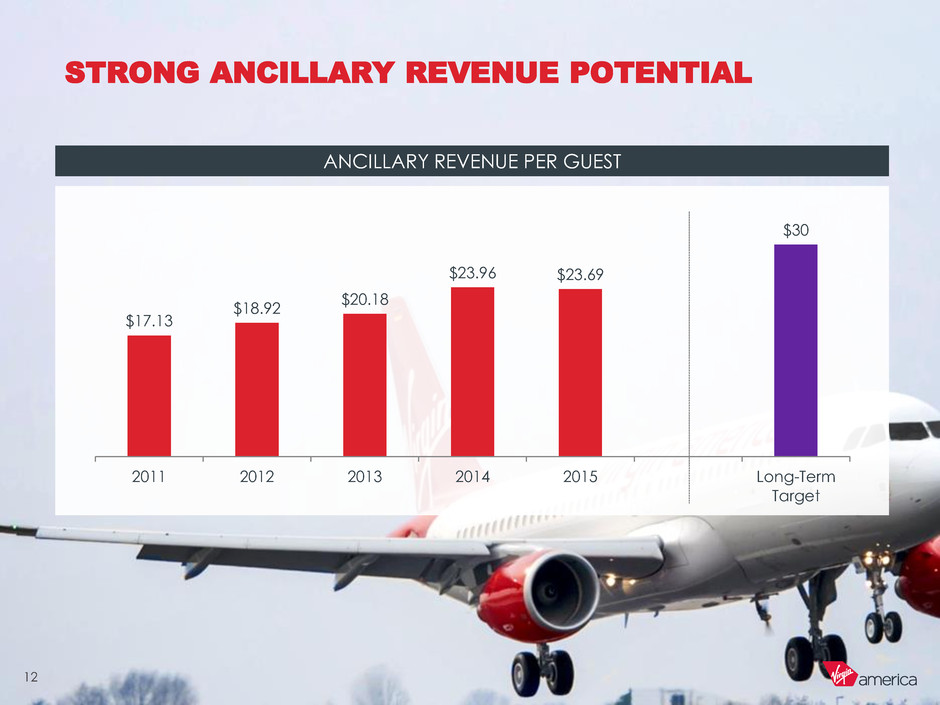

ANCILLARY REVENUE IS A MEANINGFUL GROWTH OPPORTUNITY 11 Ancillary revenue is high margin and makes up approximately 10.9% of total revenue(1) Seek to balance charging ancillary fees, given our premium product, while being opportunistic in pursuing attractive growth opportunities Upgraded the back-end of reservation system in 2015 and saw strong initial results from reserved seating variable pricing initiative New technology has allowed us to bundle and unbundle ancillary products to drive uptake. As of Feb, 2016, we are now selling new products in booking flow: Priority Security & Boarding Dibs on Preferred Seats Plans Change Pass Power Trip Bundle Bag Valet Checked Bags (1) For LTM 12/31/15, represents percentage of Total Revenue Power Trip Package One Checked Bag Plans Change Pass Priority Security & Boarding Preferred Seat Selection SFO CUN $60 CUN SFO $62.40 $122.40 total Bundle & save 30-50% SELECT EXTRAS TO CUSTOMIZE YOUR TRIP Checked Bags Pay now and have one less thing to think about at the airport. 1 included $26 per bag each way CONTINUE

STRONG ANCILLARY REVENUE POTENTIAL 12 ANCILLARY REVENUE PER GUEST $17.13 $18.92 $20.18 $23.96 $23.69 $30 2011 2012 2013 2014 2015 Long-Term Target

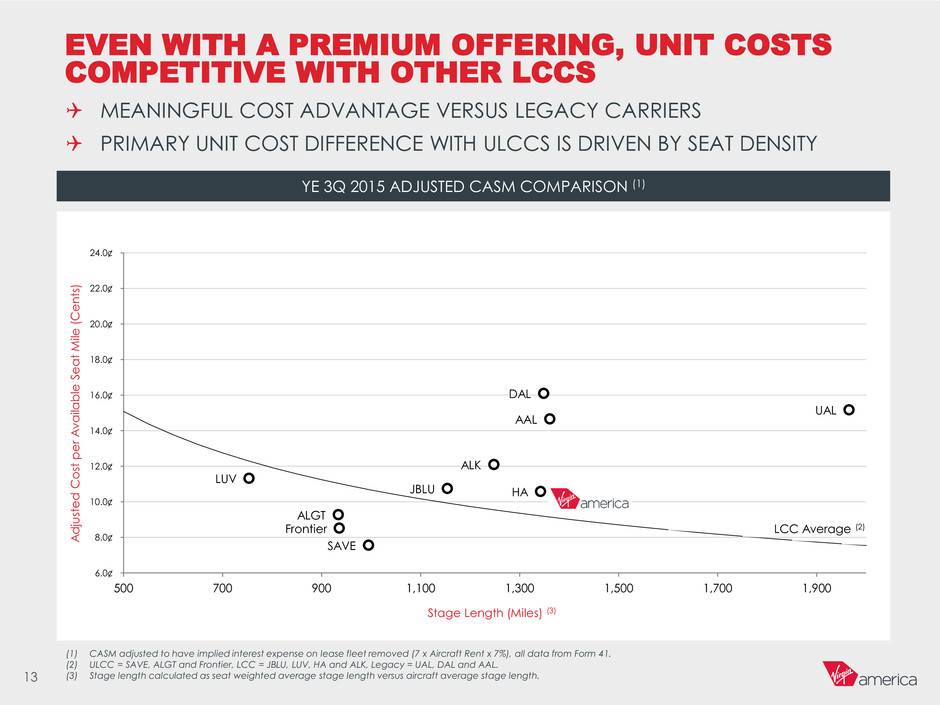

EVEN WITH A PREMIUM OFFERING, UNIT COSTS COMPETITIVE WITH OTHER LCCS 13 YE 3Q 2015 ADJUSTED CASM COMPARISON (1) MEANINGFUL COST ADVANTAGE VERSUS LEGACY CARRIERS PRIMARY UNIT COST DIFFERENCE WITH ULCCS IS DRIVEN BY SEAT DENSITY (1) CASM adjusted to have implied interest expense on lease fleet removed (7 x Aircraft Rent x 7%), all data from Form 41. (2) ULCC = SAVE, ALGT and Frontier, LCC = JBLU, LUV, HA and ALK, Legacy = UAL, DAL and AAL. (3) Stage length calculated as seat weighted average stage length versus aircraft average stage length. AAL ALK JBLU DAL Frontier ALGT SAVE UAL VA LUV HA 6.0¢ 8.0¢ 10.0¢ 12.0¢ 14.0¢ 16.0¢ 18.0¢ 20.0¢ 22.0¢ 24.0¢ 500 700 900 1,100 1,300 1,500 1,700 1,900 A d ju st e d Cos t p e r A v a ila ble S e a t M ile ( C e n ts ) Stage Length (Miles) (3) LCC Average (2)

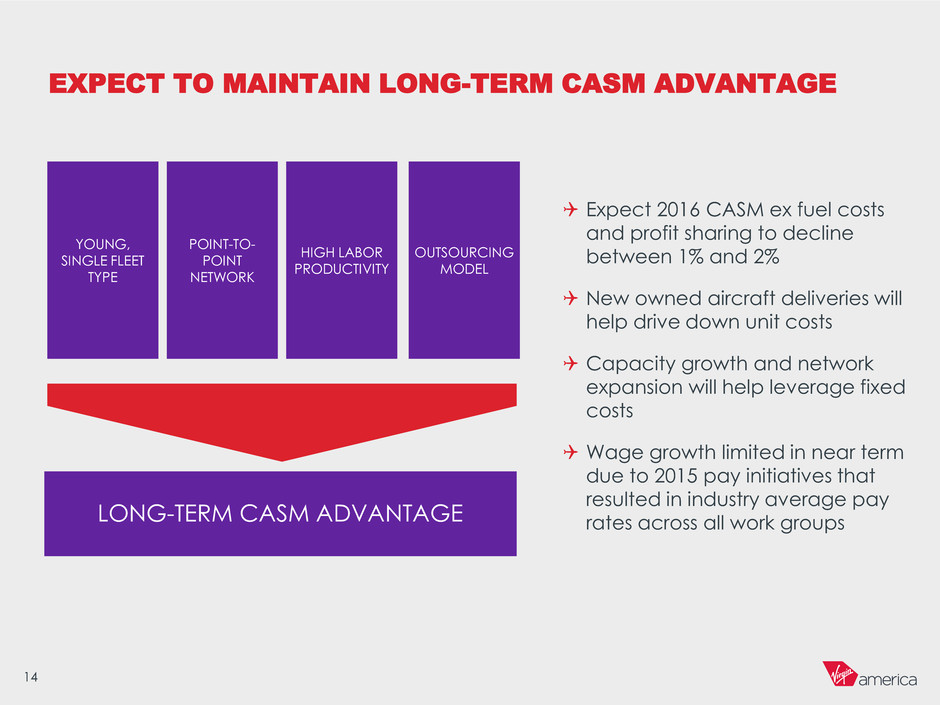

EXPECT TO MAINTAIN LONG-TERM CASM ADVANTAGE 14 Expect 2016 CASM ex fuel costs and profit sharing to decline between 1% and 2% New owned aircraft deliveries will help drive down unit costs Capacity growth and network expansion will help leverage fixed costs Wage growth limited in near term due to 2015 pay initiatives that resulted in industry average pay rates across all work groups YOUNG, SINGLE FLEET TYPE POINT-TO- POINT NETWORK HIGH LABOR PRODUCTIVITY LONG-TERM CASM ADVANTAGE OUTSOURCING MODEL

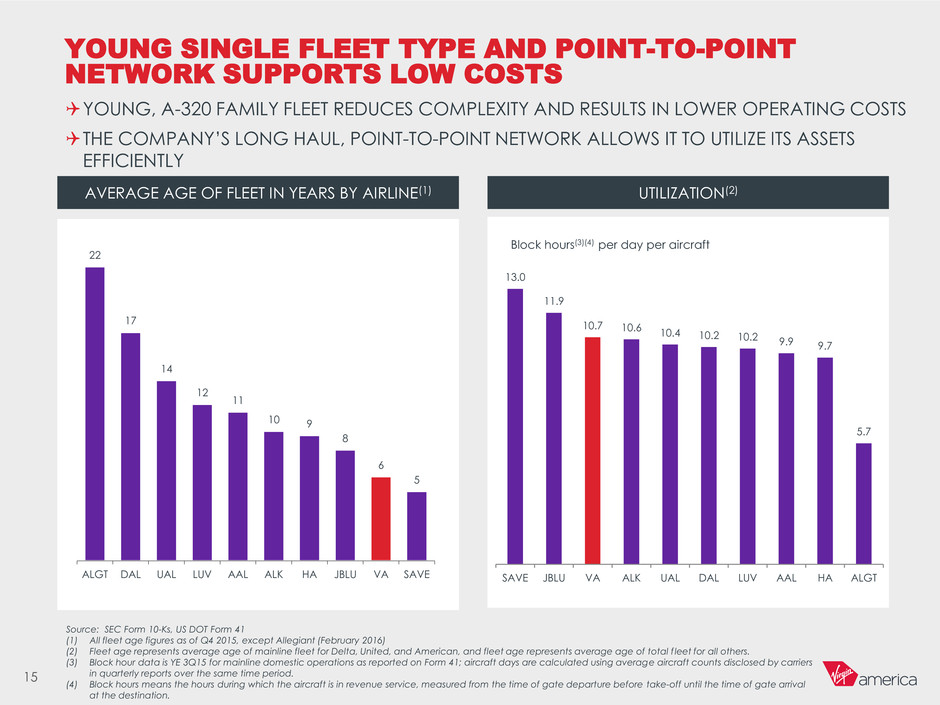

YOUNG SINGLE FLEET TYPE AND POINT-TO-POINT NETWORK SUPPORTS LOW COSTS 15 AVERAGE AGE OF FLEET IN YEARS BY AIRLINE(1) Source: SEC Form 10-Ks, US DOT Form 41 (1) All fleet age figures as of Q4 2015, except Allegiant (February 2016) (2) Fleet age represents average age of mainline fleet for Delta, United, and American, and fleet age represents average age of total f leet for all others. (3) Block hour data is YE 3Q15 for mainline domestic operations as reported on Form 41; aircraft days are calculated using average aircraft counts disclosed by carriers in quarterly reports over the same time period. (4) Block hours means the hours during which the aircraft is in revenue service, measured from the time of gate departure before take-off until the time of gate arrival at the destination. UTILIZATION(2) Block hours(3)(4) per day per aircraft YOUNG, A-320 FAMILY FLEET REDUCES COMPLEXITY AND RESULTS IN LOWER OPERATING COSTS THE COMPANY’S LONG HAUL, POINT-TO-POINT NETWORK ALLOWS IT TO UTILIZE ITS ASSETS EFFICIENTLY 22 17 14 12 11 10 9 8 6 5 ALGT DAL UAL LUV AAL ALK HA JBLU VA SAVE 13.0 11.9 10.7 10.6 10.4 10.2 10.2 9.9 9.7 5.7 SAVE JBLU VA ALK UAL DAL LUV AAL HA ALGT

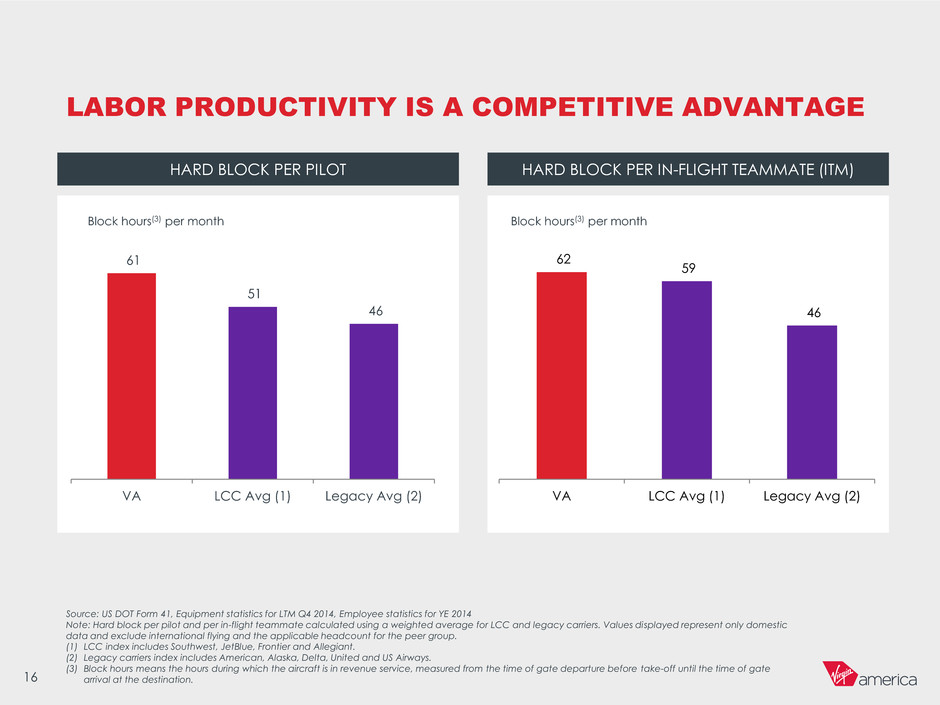

LABOR PRODUCTIVITY IS A COMPETITIVE ADVANTAGE 16 HARD BLOCK PER PILOT HARD BLOCK PER IN-FLIGHT TEAMMATE (ITM) Block hours(3) per monthBlock hours(3) per month Source: US DOT Form 41, Equipment statistics for LTM Q4 2014, Employee statistics for YE 2014 Note: Hard block per pilot and per in-flight teammate calculated using a weighted average for LCC and legacy carriers. Values displayed represent only domestic data and exclude international flying and the applicable headcount for the peer group. (1) LCC index includes Southwest, JetBlue, Frontier and Allegiant. (2) Legacy carriers index includes American, Alaska, Delta, United and US Airways. (3) Block hours means the hours during which the aircraft is in revenue service, measured from the time of gate departure before take-off until the time of gate arrival at the destination. 61 51 46 VA LCC Avg (1) Legacy Avg (2) 62 59 46 VA LCC Avg (1) Legacy Avg (2)

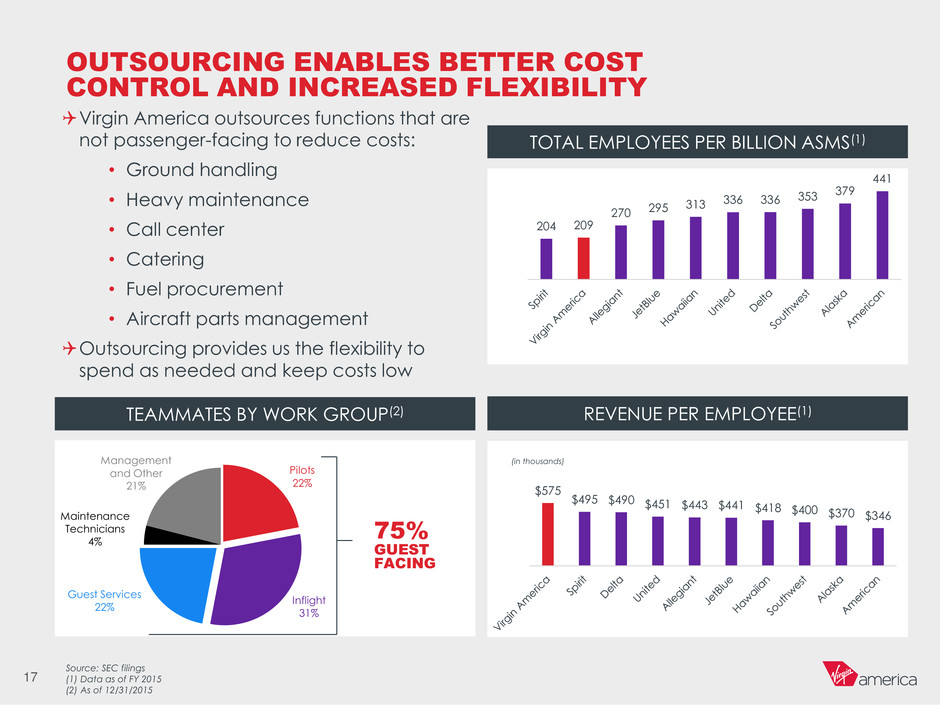

OUTSOURCING ENABLES BETTER COST CONTROL AND INCREASED FLEXIBILITY 17 Source: SEC filings (1) Data as of FY 2015 (2) As of 12/31/2015 TEAMMATES BY WORK GROUP(2) TOTAL EMPLOYEES PER BILLION ASMS(1) REVENUE PER EMPLOYEE(1) (in thousands) 75% GUEST FACING Virgin America outsources functions that are not passenger-facing to reduce costs: • Ground handling • Heavy maintenance • Call center • Catering • Fuel procurement • Aircraft parts management Outsourcing provides us the flexibility to spend as needed and keep costs low Pilots 22% Inflight 31% Guest Services 22% Maintenance Technicians 4% Management and Other 21% 204 209 270 295 313 336 336 353 379 441 $575 $495 $490 $451 $443 $441 $418 $400 $370 $346

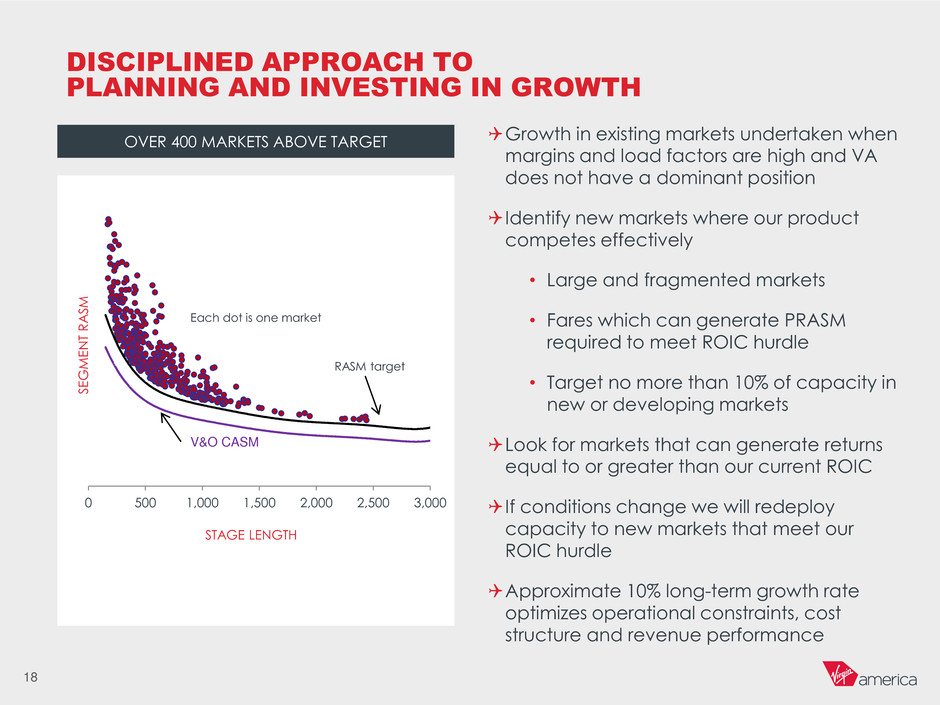

DISCIPLINED APPROACH TO PLANNING AND INVESTING IN GROWTH 18 OVER 400 MARKETS ABOVE TARGET Growth in existing markets undertaken when margins and load factors are high and VA does not have a dominant position Identify new markets where our product competes effectively • Large and fragmented markets • Fares which can generate PRASM required to meet ROIC hurdle • Target no more than 10% of capacity in new or developing markets Look for markets that can generate returns equal to or greater than our current ROIC If conditions change we will redeploy capacity to new markets that meet our ROIC hurdle Approximate 10% long-term growth rate optimizes operational constraints, cost structure and revenue performance Each dot is one market V&O CASM RASM target STAGE LENGTH SE G M E N T R A SM 0 500 1,000 1,500 2,000 2,500 3,000

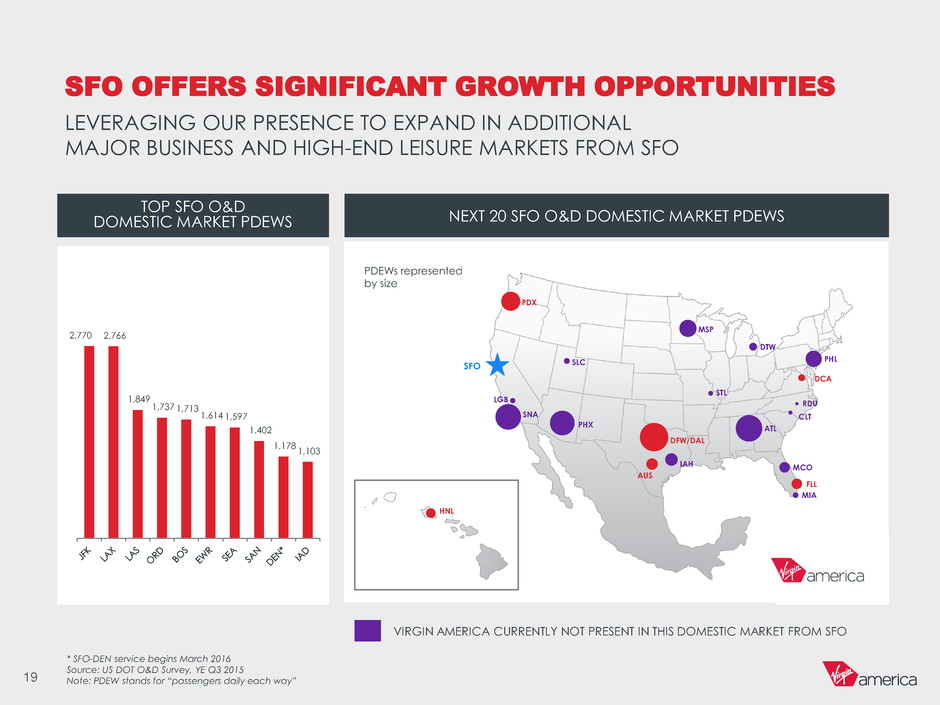

19 TOP SFO O&D DOMESTIC MARKET PDEWS NEXT 20 SFO O&D DOMESTIC MARKET PDEWS * SFO-DEN service begins March 2016 Source: US DOT O&D Survey, YE Q3 2015 Note: PDEW stands for “passengers daily each way” PDEWs represented by size SFO OFFERS SIGNIFICANT GROWTH OPPORTUNITIES LEVERAGING OUR PRESENCE TO EXPAND IN ADDITIONAL MAJOR BUSINESS AND HIGH-END LEISURE MARKETS FROM SFO VIRGIN AMERICA CURRENTLY NOT PRESENT IN THIS DOMESTIC MARKET FROM SFO 2,770 2,766 1,849 1,737 1,713 1,614 1,597 1,402 1,178 1,103 SFO PHL DTW ATL FLL MIA PHX PDX SLC SNA MSP DFW/DAL IAH AUS MCO DCA.STL . CLT . RDU.LGB HNL .

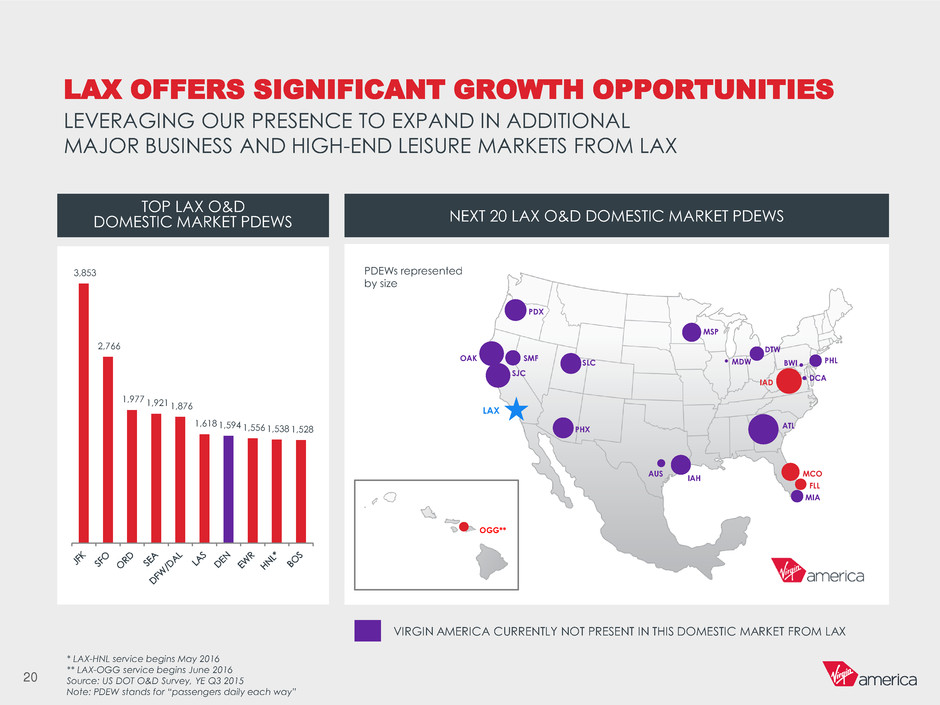

20 TOP LAX O&D DOMESTIC MARKET PDEWS NEXT 20 LAX O&D DOMESTIC MARKET PDEWS * LAX-HNL service begins May 2016 ** LAX-OGG service begins June 2016 Source: US DOT O&D Survey, YE Q3 2015 Note: PDEW stands for “passengers daily each way” LAX OFFERS SIGNIFICANT GROWTH OPPORTUNITIES LEVERAGING OUR PRESENCE TO EXPAND IN ADDITIONAL MAJOR BUSINESS AND HIGH-END LEISURE MARKETS FROM LAX VIRGIN AMERICA CURRENTLY NOT PRESENT IN THIS DOMESTIC MARKET FROM LAX PDEWs represented by size 3,853 2,766 1,977 1,921 1,876 1,618 1,594 1,556 1,538 1,528 LAX PDX . MDWSMFOAK SJC SLC PHX AUS MSP DTW PHLBWI IAD DCA MCO ATL IAH FLL OGG** MIA . .

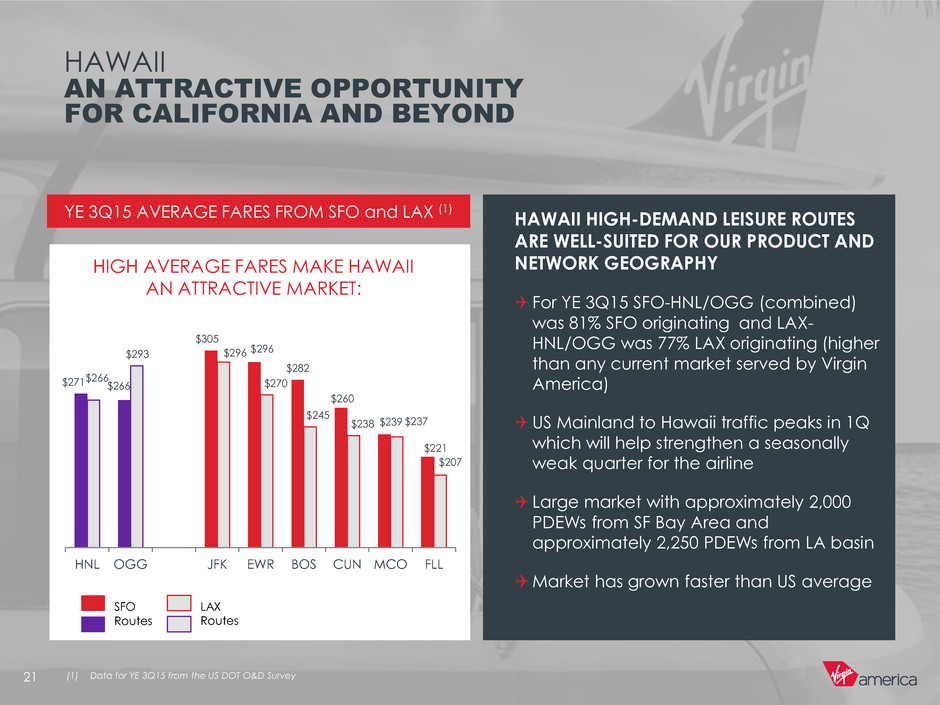

HAWAII AN ATTRACTIVE OPPORTUNITY FOR CALIFORNIA AND BEYOND 21 YE 3Q15 AVERAGE FARES FROM SFO and LAX (1) HAWAII HIGH-DEMAND LEISURE ROUTES ARE WELL-SUITED FOR OUR PRODUCT AND NETWORK GEOGRAPHY For YE 3Q15 SFO-HNL/OGG (combined) was 81% SFO originating and LAX- HNL/OGG was 77% LAX originating (higher than any current market served by Virgin America) US Mainland to Hawaii traffic peaks in 1Q which will help strengthen a seasonally weak quarter for the airline Large market with approximately 2,000 PDEWs from SF Bay Area and approximately 2,250 PDEWs from LA basin Market has grown faster than US average HIGH AVERAGE FARES MAKE HAWAII AN ATTRACTIVE MARKET: (1) Data for YE 3Q15 from the US DOT O&D Survey $271 $266 $305 $296 $282 $260 $239 $221 $266 $293 $296 $270 $245 $238 $237 $207 HNL OGG JFK EWR BOS CUN MCO FLL SFO Routes LAX Routes

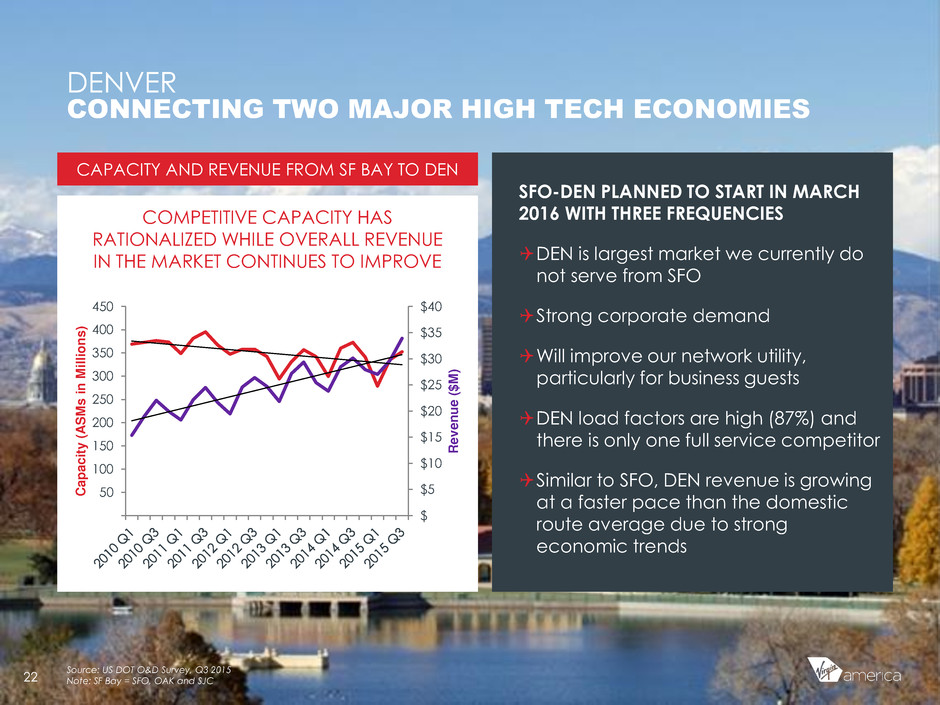

DENVER CONNECTING TWO MAJOR HIGH TECH ECONOMIES 22 CAPACITY AND REVENUE FROM SF BAY TO DEN SFO-DEN PLANNED TO START IN MARCH 2016 WITH THREE FREQUENCIES DEN is largest market we currently do not serve from SFO Strong corporate demand Will improve our network utility, particularly for business guests DEN load factors are high (87%) and there is only one full service competitor Similar to SFO, DEN revenue is growing at a faster pace than the domestic route average due to strong economic trends COMPETITIVE CAPACITY HAS RATIONALIZED WHILE OVERALL REVENUE IN THE MARKET CONTINUES TO IMPROVE Source: US DOT O&D Survey, Q3 2015 Note: SF Bay = SFO, OAK and SJC $ $5 $10 $15 $20 $25 $30 $35 $40 50 100 150 200 250 300 350 400 450 Re v en u e ($ M ) C a p a c it y ( A S M s i n M ill io n s )

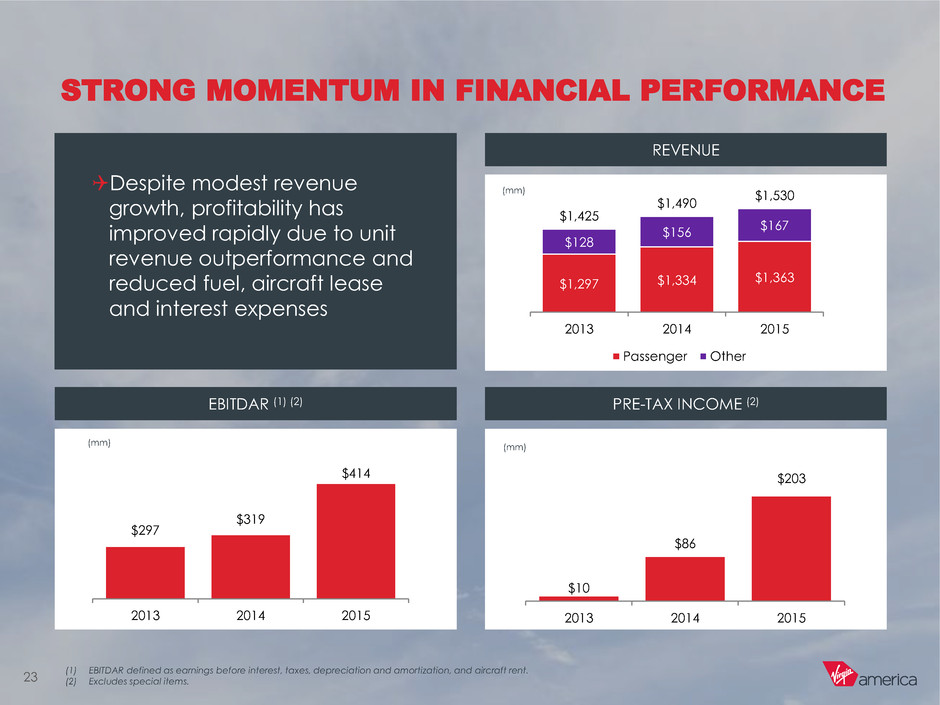

STRONG MOMENTUM IN FINANCIAL PERFORMANCE 23 EBITDAR (1) (2) PRE-TAX INCOME (2) REVENUE Despite modest revenue growth, profitability has improved rapidly due to unit revenue outperformance and reduced fuel, aircraft lease and interest expenses (mm) (mm)(mm) (1) EBITDAR defined as earnings before interest, taxes, depreciation and amortization, and aircraft rent. (2) Excludes special items. $1,297 $1,334 $1,363 $128 $156 $167 $1,425 $1,490 $1,530 2013 2014 2015 Passenger Other $297 $319 $414 2013 2014 2015 $10 $86 $203 2013 2014 2015

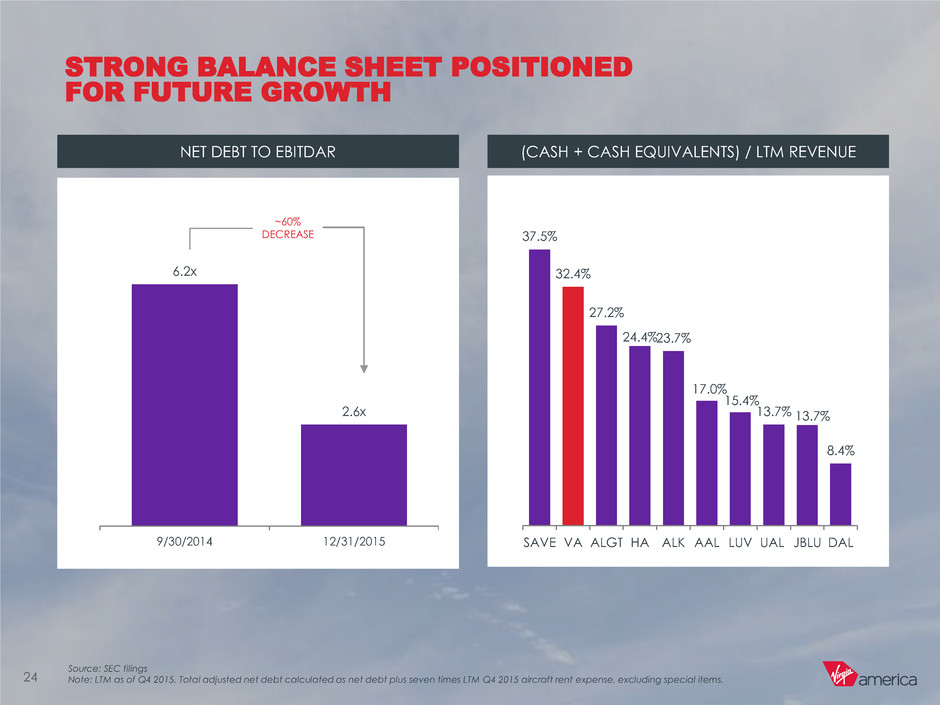

STRONG BALANCE SHEET POSITIONED FOR FUTURE GROWTH 24 NET DEBT TO EBITDAR Source: SEC filings Note: LTM as of Q4 2015. Total adjusted net debt calculated as net debt plus seven times LTM Q4 2015 aircraft rent expense, excluding special items. (CASH + CASH EQUIVALENTS) / LTM REVENUE 37.5% 32.4% 27.2% 24.4% 23.7% 17.0% 15.4% 13.7% 13.7% 8.4% SAVE VA ALGT HA ALK AAL LUV UAL JBLU DAL 6.2x 2.6x 9/30/2014 12/31/2015 ~60% DECREASE

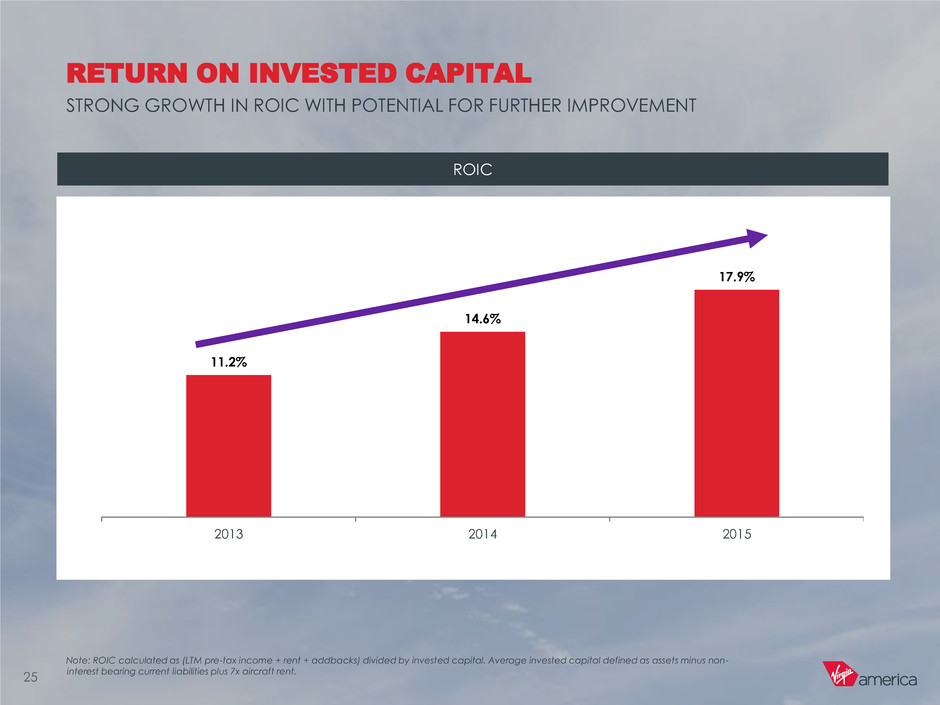

ROIC 11.2% 14.6% 17.9% 2013 2014 2015 25 RETURN ON INVESTED CAPITAL Note: ROIC calculated as (LTM pre-tax income + rent + addbacks) divided by invested capital. Average invested capital defined as assets minus non- interest bearing current liabilities plus 7x aircraft rent. STRONG GROWTH IN ROIC WITH POTENTIAL FOR FURTHER IMPROVEMENT

26 Premium travel experience combined with an award-winning brand Low cost carrier cost structure Established presence in key markets Significant market expansion opportunities Ancillary revenue opportunities contribute additional top-line growth Strong balance sheet to support long-term growth KEY INVESTMENT HIGHLIGHTS

APPENDIX

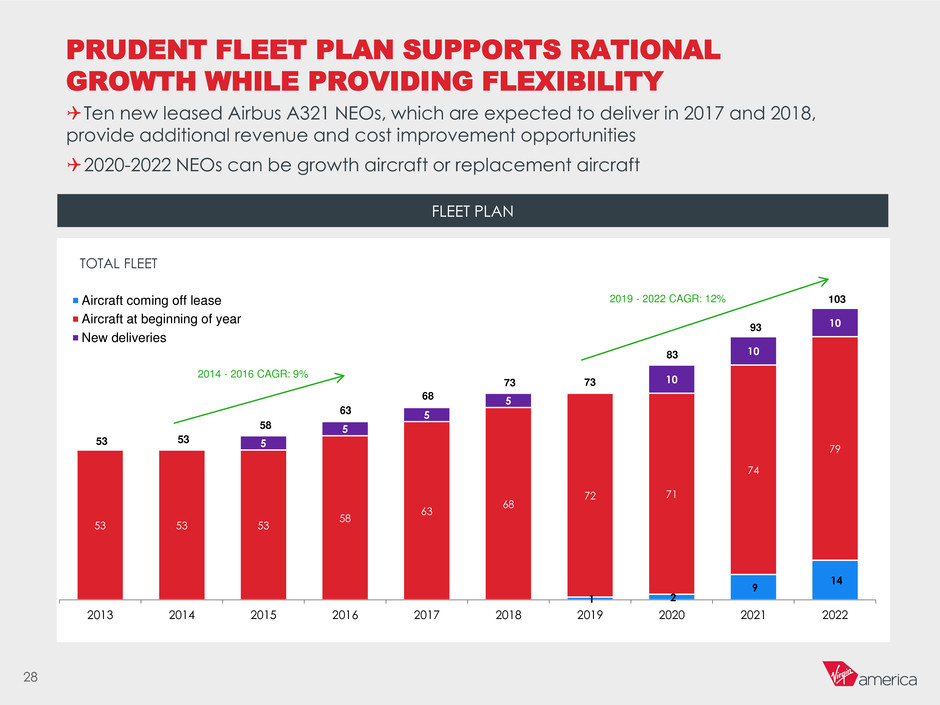

FLEET PLAN 28 PRUDENT FLEET PLAN SUPPORTS RATIONAL GROWTH WHILE PROVIDING FLEXIBILITY Ten new leased Airbus A321 NEOs, which are expected to deliver in 2017 and 2018, provide additional revenue and cost improvement opportunities 2020-2022 NEOs can be growth aircraft or replacement aircraft TOTAL FLEET 53 53 58 63 68 73 73 83 93 103 1 2 9 14 53 53 53 58 63 68 72 71 74 79 5 5 5 5 10 10 10 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Aircraft coming off lease Aircraft at beginning of year New deliveries 2014 - 2016 CAGR: 9% 2019 - 2022 CAGR: 12%

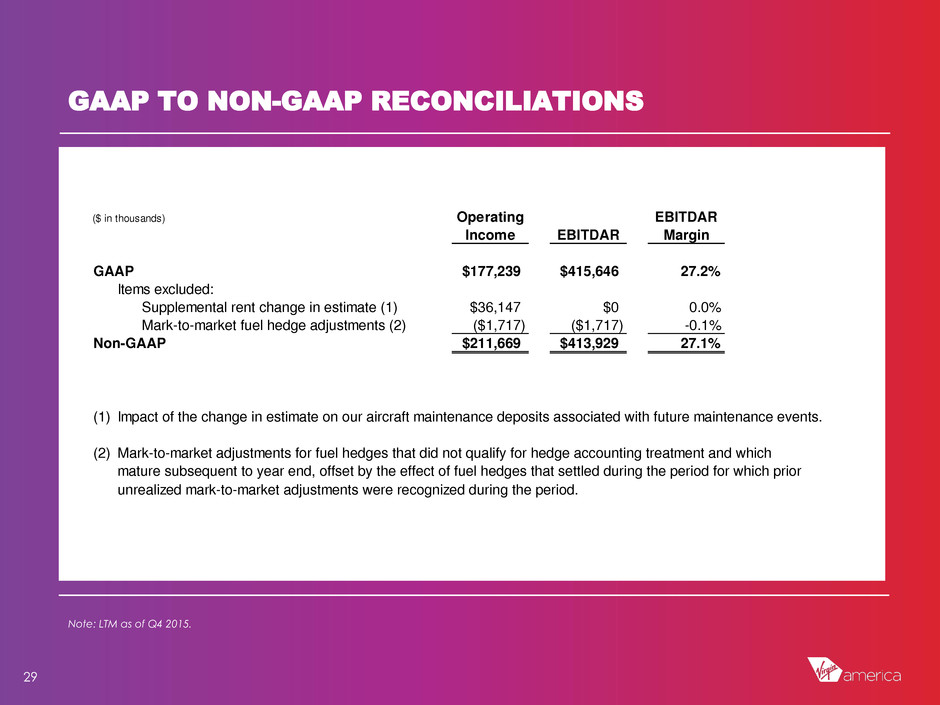

29 GAAP TO NON-GAAP RECONCILIATIONS Note: LTM as of Q4 2015. ($ in thousands) Operating EBITDAR Income EBITDAR Margin GAAP $177,239 $415,646 27.2% Items excluded: Supplemental rent change in estimate (1) $36,147 $0 0.0% Mark-to-market fuel hedge adjustments (2) ($1,717) ($1,717) -0.1% Non-GAAP $211,669 $413,929 27.1% (1) Impact of the change in estimate on our aircraft maintenance deposits associated with future maintenance events. (2) Mark-to-market adjustments for fuel hedges that did not qualify for hedge accounting treatment and which mature subsequent to year end, offset by the effect of fuel hedges that settled during the period for which prior unrealized mark-to-market adjustments were recognized during the period.