Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________

FORM 10-K

______________________________________

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36460

______________________________________

SunEdison Semiconductor Limited

(Exact name of registrant as specified in its charter)

______________________________________

Singapore | N/A | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

11 Lorong 3 Toa Payoh, Singapore | 319579 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(65) 6681-9300

______________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered: | |

$0 Par Value Ordinary Shares | The NASDAQ Global Select Market | |

Securities Registered Pursuant to Section 12(g) of the Act:

None

(Title of Class)

______________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

1

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant's Ordinary Shares held by nonaffiliates of the registrant, based upon the closing price of such stock on June 30, 2015 of $17.27 as reported by the NASDAQ Global Select Market, and 31,225,254 shares outstanding on such date, was $539,260,137. The number of shares outstanding of the registrant's Ordinary Shares as of March 4, 2016, was 41,979,856 shares.

DOCUMENTS INCORPORATED BY REFERENCE

1. Portions of the registrant’s 2015 Annual Report to Stockholders (Part I, Part II, and Part IV)

2

Table of Contents

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

3

PART I

Item 1. Business

Overview

SunEdison Semiconductor Limited and subsidiaries ("SunEdison Semiconductor", "SSL", the "Company", "we", "us", and "our") is a global leader in the development, manufacture, and sale of silicon wafers to the semiconductor industry. Wafers are used as the base substrate for nearly all semiconductor devices, which in turn provide the foundation for the entire electronics industry. Our business was established in 1959 and was known during most of our history as MEMC Electronic Materials, Inc. ("MEMC"). We have developed a broad product portfolio, an extensive global manufacturing footprint, process technology expertise, and supply chain flexibility, while increasing our capital efficiency and maintaining a lean operating culture.

Throughout our over 55 years of operations, we have pioneered a number of semiconductor industry firsts, including the development of the dislocation-free Czochralski ("CZ") silicon crystal growth process and the chemical-mechanical planarization ("CMP") process, as well as the initial production and commercialization of 100mm and 200mm semiconductor wafers. We have been a leader in the development of advanced substrates such as epitaxial ("EPI") wafers and wafers for the silicon-on-insulator ("SOI") market, which enable advanced computing and communications applications.

We sell our products primarily to the major semiconductor manufacturers in the world, including integrated device manufacturers and pure-play semiconductor foundries, and to a lesser extent, leading companies that specialize in wafer customization. Our largest customers were Samsung (Samsung Electronics Co., Ltd. and related companies), Taiwan Semiconductor Manufacturing Company ("TSMC"), and STMicroelectronics during 2015. We operate facilities in major semiconductor manufacturing regions throughout the world, including Taiwan, Malaysia, South Korea, Italy, Japan, and the United States ("U.S."). We have chosen to locate our manufacturing facilities in regions that offer both low operating costs and close proximity to our customers to facilitate collaboration on product development activities and shorten product delivery times.

The Company historically consisted of the combined operations of certain entities formerly wholly-owned by SunEdison, Inc. (“SunEdison”). Following the completion of a series of transactions undertaken to transfer ownership of its semiconductor materials business (the "Formation Transactions"), SunEdison sold a minority interest in SunEdison Semiconductor through an initial public offering of our ordinary shares (the "IPO") and in a private placement to Samsung Electronics Co., Ltd. and Samsung Fine Chemicals Co., Ltd. (see Samsung Private Placements below), both of which closed on May 28, 2014, and resulted in the creation of SunEdison Semiconductor Limited (prior to the IPO, SunEdison Semiconductor Pte. Ltd.), a stand-alone public company. In a secondary offering which closed on January 20, 2015, SunEdison sold additional shares of the Company, resulting in SunEdison's minority ownership of the Company. A subsequent secondary public offering of 15,935,828 of our ordinary shares by SunEdison, Samsung Fine Chemicals Co., Ltd., and Samsung Electronics Co., Ltd. was closed on July 1, 2015. As of and after the closing of the secondary offering on July 1, 2015, in which SunEdison, Samsung Fine Chemicals Co., Ltd., and Samsung Electronics Co., Ltd. sold all of their shares in the Company, transactions with those entities are no longer considered related party transactions. See "Formation Transactions and Secondary Offerings" below.

Our principal executive offices are located at 11 Lorong 3 Toa Payoh, Singapore 319579, and our telephone number at that address is +65 6681-9300. Our principal executive offices in the U.S. are located at 501 Pearl Drive (City of O’Fallon), St. Peters, Missouri 63376, and our telephone number at that address is (636) 474-5000. Our website address is www.sunedisonsemi.com.

Formation Transactions

Initial Public Offering. We closed on an initial public offering of 7,200,000 ordinary shares, representing equity interests in the Company, at a price to the public of $13.00 per ordinary share on May 28, 2014. The Company received net proceeds of $85.9 million from the sale of the ordinary shares, after deducting underwriting discounts, commissions, structuring fees, and offering expenses of $7.7 million. Following the IPO, the underwriters exercised their over-allotment option to purchase an additional 1,080,000 ordinary shares at a price of $13.00 per ordinary share, providing additional net proceeds of $13.1 million, after deducting $0.9 million of underwriting discounts, commissions, and structuring fees.

1

Samsung Private Placements. Effective with the closing of the IPO, Samsung Fine Chemicals Co., Ltd. ("Samsung Fine Chemicals") and Samsung Electronics Co., Ltd. ("Samsung Electronics") (together, the "Samsung Purchasers") purchased $93.6 million and $31.5 million, respectively, of our ordinary shares in separate private placements at a price per share equal to the public offering price of $13.00 per ordinary share. Samsung Fine Chemicals is a joint venture partner of ours and SunEdison Products Singapore Pte. Ltd., a subsidiary of SunEdison, in SMP Ltd. ("SMP"). Samsung Electronics is one of our customers and was our joint venture partner in MEMC Korea Company, Ltd. ("MKC"). Samsung Fine Chemicals made an aggregate cash investment in us of $93.6 million and, in a non-cash transaction, Samsung Electronics transferred to us its remaining 20% interest in MKC as consideration for the issuance of the ordinary shares. We realized net proceeds from the Samsung Fine Chemicals investment in us of $87.3 million after deducting underwriting discounts, commissions, structuring fees, and offering expenses of $6.3 million. These share purchases closed concurrently with the IPO. As a result of obtaining the 20% interest in MKC, we redeemed the noncontrolling interest in this entity and MKC is now a wholly-owned subsidiary of the Company. There was no gain or loss recognized in connection with these transactions.

Investment in SMP. SunEdison acquired a 35% interest in SMP from Samsung Fine Chemicals Co., Ltd for a cash purchase price of 143.9 billion South Korean won ("KRW"), or $140.7 million, and contributed that interest in SMP to us as part of the Formation Transactions. SMP owns a polysilicon manufacturing facility which was recently completed and is in the initial stages of production. Our ownership interest decreased from 35.00% to 33.05% on June 12, 2015, from 33.05% to 30.51% on August 5, 2015, from 30.51% to 30.02% on October 6, 2015, and from 30.02% to 28.32% on February 5, 2016 as a result of capital calls by SMP in which we did not participate.

During the third quarter of 2015, we entered into a definitive agreement to sell approximately 30% of our SMP investment, representing approximately 9% of total SMP shares outstanding, for $35.0 million to SunEdison. We have received an advance payment of the $35.0 million, representing the purchase price, which is recorded as a deposit for investment distribution, within current liabilities, on our balance sheet. The sale closed in March 2016.

Senior Secured Credit Facility. The Company and its direct subsidiary, SunEdison Semiconductor B.V. ("SSBV" or the "Borrower"), entered into a credit agreement on May 27, 2014 and subsequently amended on December 29, 2015 as discussed below ("Amendment of and Prepayment under Credit Agreement"), with Goldman Sachs Bank USA, as administrative agent, sole lead arranger, and sole syndication agent, and, together with Macquarie Capital (USA) Inc., as joint bookrunners, Citibank, N.A., as letter of credit issuer, and the lender parties thereto (the "Credit Facility"). The Credit Facility provided for: (i) a senior secured term loan facility in an aggregate principal amount up to $210.0 million (the “Term Facility”), and (ii) a senior secured revolving credit facility in an aggregate principal amount up to $50.0 million (the “Revolving Facility”). Under the Revolving Facility, the Borrower may obtain (i) letters of credit and bankers’ acceptances in an aggregate stated amount up to $15.0 million, and (ii) swing line loans in an aggregate principal amount up to $15.0 million. The Term Facility has a five-year term, ending May 27, 2019, and the Revolving Facility has a three-year term, ending May 27, 2017. The full amount of the Term Facility was drawn on May 27, 2014. As of December 31, 2015, no amounts were outstanding under the Revolving Facility, but $4.3 million of third party letters of credit were outstanding, which reduced the available borrowing capacity by a like amount. The original principal amount of the Term Facility must be repaid in quarterly installments of $525,000 beginning September 30, 2014 with the remaining balance paid at maturity. The principal amount repayment schedule was adjusted proportionately after the prepayment discussed below.

The Term Facility was issued at a discount of 1.00%, or $2.1 million, which will be amortized as an increase in interest expense over the term of the Term Facility.

The Borrower’s obligations under the Credit Facility are guaranteed by the Company and certain of its direct and indirect subsidiaries. The Borrower’s obligations and the guaranty obligations of the Company and its subsidiaries are secured by first-priority liens on and security interests in certain present and future assets of the Company, the Borrower, and the subsidiary guarantors, including pledges of the capital stock of certain of the Company’s subsidiaries.

Borrowings under the Credit Facility bear interest (i) at a base rate plus 4.50% per annum or (ii) at a reserve-adjusted eurocurrency rate plus 5.50% per annum. The minimum eurocurrency base rate for the Term Facility shall at no time be less than 1.00% per annum. Interest will be paid quarterly in arrears, and at the maturity date of each facility for loans bearing interest with reference to the base rate. Interest will be paid on the last day of selected interest periods (which will be one, three and six months), and at the maturity date of each facility for loans bearing interest with reference to the reserve-adjusted eurocurrency rate (and at the end of every three months, in the case of any interest period longer than three months). A fee equal to 5.50% per annum will be payable by the Borrower, quarterly in arrears, in respect of the daily amount available to be drawn under outstanding letters of credit and bankers’ acceptances.

2

The Credit Facility contains customary representations, covenants, and events of default typical for credit arrangements of comparable size, including our maintenance of a consolidated leverage ratio of not greater than 2.5 to 1.0 for the quarters ending after September 30, 2015. The Credit Facility also contains customary material adverse effects and cross-default clauses. The cross-default clause is applicable to defaults on other indebtedness in excess of $30.0 million. We were in compliance with all covenants of the Credit Facility as of December 31, 2015.

2015 Events

Secondary Offerings and Separation from SunEdison and Samsung

On January 20, 2015, a secondary public offering of 17,250,000 of our ordinary shares by SunEdison, Samsung Fine Chemicals Co., Ltd., and Samsung Electronics Co., Ltd. was closed. We did not receive any of the proceeds from the sale of our ordinary shares in this offering. As a result of this offering, our former parent company, SunEdison, ceased to own more than 50% of our outstanding ordinary shares.

A subsequent secondary public offering of 15,935,828 of our ordinary shares by SunEdison, Samsung Fine Chemicals Co., Ltd., and Samsung Electronics Co., Ltd. was closed on July 1, 2015. We did not receive any of the proceeds from the sale of our ordinary shares in this offering. In this offering, SunEdison, Samsung Fine Chemicals Co., Ltd., and Samsung Electronics Co., Ltd. sold all remaining shares of the Company that they held. As of and after the closing of the secondary offering on July 1, 2015, transactions with SunEdison, Samsung Fine Chemicals Co., Ltd., and Samsung Electronics Co., Ltd. are no longer considered related party transactions.

MKC Financing

Effective December 30, 2015, MKC entered into term loan agreements for an aggregate principal amount of KRW 50 billion with three banks as follows (the "MKC Financing"): (i) Shinhan Bank - term loan with a principal amount of KRW 20 billion at an interest rate equal to the average 91-day CD rate plus 2.10% (the “Shinhan Term Loan”), (ii) Hana Bank - term loan with a principal amount of KRW 20 billion at an interest rate equal to the average 91-day CD rate plus 2.13% (the “Hana Term Loan”), and (iii) Korea Development Bank - term loan with a principal amount of KRW 10 billion at an interest rate of the average 91-day CD rate plus 2.18% (the “KDB Term Loan” and, together with the Shinhan Term Loan and the Hana Term Loan, collectively, the “Korean Term Loans”). As of December 31, 2015, KRW 5 billion of the KDB Term Loan remained unfunded and was funded in January 2016.

Each of the Korean Term Loans has a term of 36 months and is secured by a mortgage of MKC’s real property and equipment. In addition, the Hana Term Loan is secured by a pledge of MKC funds on deposit at Hana Bank in the amount of KRW 3.1 billion. The proceeds of the Korean Term Loans were used to make a prepayment of the outstanding principal of the Term Facility, as outlined below.

Shinhan Bank, Hana Bank, and Korea Development Bank, and their respective affiliates, in certain instances have performed, and may in the future perform, various commercial banking, investment banking and other financial advisory services for the Company and its affiliates for which they have received, or will receive, customary fees and expenses.

Amendment of and Prepayment under Credit Agreement

Concurrent with the MKC Financing, the Company and SSBV, entered into the First Amendment to Credit Agreement (the “First Amendment”), by and among the Borrower, the Company, the other guarantors party thereto, the lenders party thereto and Goldman Sachs Bank USA, as administrative agent (in such capacity, the “Administrative Agent”), thereby amending the Credit Agreement, dated as of May 27, 2014 (as amended, the "Credit Agreement"). On December 29, 2015, the Company and the Borrower executed and delivered the First Amendment, which is dated as of December 22, 2015 and, pursuant to its terms, became effective on December 29, 2015.

The First Amendment provides, in part, for the termination, release and discharge of all the obligations of MKC (a subsidiary of the Borrower and formerly a guarantor under the Credit Facility) under the Credit Facility and other loan documents and the release of the Administrative Agent’s liens on MKC’s assets and the equity interests in MKC. In connection with such release, certain covenants were added to the Credit Facility with respect to MKC, including (i) a requirement that the Borrower cause MKC to utilize a portion of any cash available for distribution to pay an annual dividend to the Borrower or one of our other subsidiaries, (ii) limits on our rights to make future investments in MKC, as well as our ability to settle historical trade balances, and to maintain future intercompany trade balances owed between MKC and the Company and its other subsidiaries, and (iii) restrictions on MKC’s incurrence of future indebtedness.

3

In connection with the First Amendment, the Borrower made a $40 million prepayment of the outstanding principal under the Term Facility (the “Prepayment”) and, in accordance with the term of the Credit Agreement also paid a 1% call premium with the proceeds of the MKC Financing. The Prepayment was completed by the Borrower on December 30, 2015. The Borrower will be obligated to make two additional prepayments, each in an amount of $5 million, on the dates that are 10 months and 13 months after the effective date of the First Amendment (October 31, 2016 and January 31, 2017, respectively). Also, as part of the First Amendment, the lenders’ aggregate commitment under the Borrower’s Revolving Facility was reduced from $50 million to $40 million.

2015 Ipoh Plan

On July 30, 2015, the Board of Directors of the Company authorized the closure of our Ipoh, Malaysia facility ("2015 Ipoh Plan"), which produces 200 millimeter ("mm") semiconductor wafers. This action is being taken to consolidate the Company’s manufacturing footprint and is consistent with our continued efforts to improve operational efficiencies, maximize capacity utilization across the Company's geographic platforms, and lower costs. The consolidation will include the transitioning of 200mm wafering activities from our Ipoh facility to Novara, Italy and other operating facilities. This action will affect approximately 650 employees at the Ipoh facility and will be largely complete by the end of 2016.

The decision to close the Ipoh facility triggered an interim impairment analysis, resulting in the recording of $56.7 million of long-lived asset impairment charges. Restructuring charges relating to the 2015 Ipoh Plan were recorded in the amount of $3.1 million.

Products and Applications

Our wafers are used as the base substrate for the manufacture of various types of semiconductor devices, including microprocessors, memory, analog, mixed-signal and radio frequency ("RF") integrated circuits, discrete, application specific integrated circuits, microelectromechanical systems ("MEMS"), and image sensors. These semiconductor devices are used in computers, smart phones, tablets and other mobile electronic devices, automobiles, and other consumer and industrial products. We have approximately 1,965 products in our portfolio. We offer wafers with a wide variety of features and in varying sizes, flatness characteristics, crystal properties, and electrical properties to satisfy numerous product specifications required by our customers. Our wafers range in size from 150mm to 300mm. We will continue to monitor the development of the 450mm wafer market and, if circumstances warrant, we will adjust our development and production capabilities.

4

The chart below summarizes our products, the diameters in which we offer each product, and the principal applications for each product.

Wafer Diameter (millimeters) | ||||||||

Products | 150 | 200 | 300 | Principal Applications | ||||

Polished Wafers: | ||||||||

Low Resistivity | ü | ü | ü | Power devices | ||||

High Resistivity | ü | ü | RF devices, Power devices | |||||

Standard (Prime/Test) | ü | ü | ü | Memory, Logic, Analog | ||||

Low COP Prime | ü | ü | ü | Logic, Analog | ||||

Annealed | ü | ü | Logic, Analog | |||||

Perfect Silicon | ü | ü | Memory | |||||

MDZ | ü | ü | ü | Logic, Analog | ||||

OPTIA Perfect Silicon +MDZ | ü | ü | Memory, Logic, Analog | |||||

EPI Wafers: | ||||||||

Standard CMOS/AEGISTM | ü | ü | ü | Logic, Image sensors, Memory | ||||

Power Discrete | ü | ü | Power devices | |||||

Custom | ü | ü | ü | Various applications | ||||

SOI Wafers: | ||||||||

Power | ü | ü | Power devices, MEMS | |||||

FD/Perfect | ü | Logic | ||||||

RF/Charge Trap Layer | ü | ü | RF devices | |||||

Depending on market conditions, we also sell intermediate products such as TCS gas, ingots, and scrap wafers to semiconductor device and equipment makers. These sales have not been material to our results of operations since December 2011.

Polished Wafers

Our polished wafers are used in a wide range of applications, including memory, analog, RF devices, digital signal processors ("DSPs"), and power devices. Our polished wafer is a polished, highly-refined, pure wafer with an ultra-flat and ultra-clean surface. We manufacture the vast majority of our polished wafers with a sophisticated chemical-mechanical polishing process that removes defects and leaves an extremely smooth surface. Wafer flatness and cleanliness requirements, along with crystal perfection, have become increasingly important as semiconductor devices become more complex and transistors decrease in size.

Our OPTIA™ wafer is a 100% defect-free crystalline structure based on our technologies and processes, including MDZ®. Our MDZ® product feature can increase our customers’ yields by drawing impurities away from the surface of the wafer during device processing in a manner that is efficient and reliable, with results that are reproducible. We believe the OPTIA™ wafer is one of the most technologically advanced polished wafers available today. Our annealed wafer is a polished wafer with near surface crystalline defects dissolved during a high-temperature thermal treatment.

We also supply test/monitor wafers to our customers for their use in testing semiconductor fabrication lines and processes. Although test/monitor wafers are substantially the same as polished wafers with respect to cleanliness, and in some cases flatness, other specifications are generally less rigorous.

EPI Wafers

5

EPI wafers increase the reliability and decrease the power consumption of semiconductor devices and therefore are increasingly used in mobile device and cloud infrastructure applications. Our EPI wafers consist of a thin silicon layer grown on the polished surface of the wafer. Typically, the epitaxial layer has different electrical properties from the underlying wafer. This provides our customers with better isolation between circuit elements than a polished wafer and the ability to tailor the wafer to the specific demands of the device. This improved isolation allows for increased reliability of the finished semiconductor device and greater efficiencies during the semiconductor manufacturing process, which ultimately allows for more complex semiconductor devices.

We designed our AEGIS™ product for certain specialized applications requiring high resistivity EPI wafers. The AEGIS™ wafer includes a thin epitaxial layer grown on a standard starting wafer, which eliminates harmful defects on the surface of the wafer, thereby allowing device manufacturers to increase yields and improve process reliability.

SOI Wafers

SOI wafers improve switching speeds and enhance the performance of RF devices such as power amplifiers, switches, and sensors. Our SOI wafers have three layers: a thin surface layer of silicon where the transistors are formed, an underlying layer of insulating material, and a support, or “handle”, bulk semiconductor wafer. Transistors built within the top silicon layer typically switch signals faster, run at lower voltages, and are much less vulnerable to signal noise from background cosmic ray particles. Each transistor is isolated from its neighbor by a complete layer of silicon dioxide. References to SOI throughout this document refer to the thin layer transfer SOI technology, which is a sub-segment of the overall SOI market in which we participate.

Customers and Customer Concentration

We sell our products primarily to the major semiconductor manufacturers in the world, including integrated device manufacturers and pure-play semiconductor foundries, and to a lesser extent, leading companies that specialize in wafer customization. We service our customers through our 13 global locations, including manufacturing plants and sales and services offices. Our top 10 customers by net sales for 2015, set forth in alphabetical order, were: Global Foundries, Infineon Technologies, Intel Corporation, Micron Technology, NXP Semiconductors, Samsung, STMicroelectronics, Texas Instruments, TSMC, and United Microelectronics Corporation. We have had relationships with all of our top 10 customers for more than 10 years. In 2015, Samsung, TSMC, and STMicroelectronics accounted for approximately 21%, 14%, and 11%, respectively, of our net sales to non-affiliates. No other customer accounted for more than 10% of our net sales to non-affiliates during 2015.

Sales and Marketing

We market our semiconductor wafers primarily through a direct sales force. We have customer service and support centers strategically located across the globe, including in China, France, Germany, Italy, Japan, Malaysia, Singapore, South Korea, Taiwan, and the U.S. A key element of our sales and marketing strategy is establishing and maintaining close relationships with our customers, which we accomplish using multi-functional teams of technical, sales and marketing, and manufacturing personnel, including over 30 dedicated field application engineers. Our multi-functional teams work closely with our customers to optimize our products for our customers’ current and future production processes, requirements, and specifications. We closely monitor changing customer needs and target our research and development and manufacturing to produce wafers adapted to each customer’s specific needs.

Sales to our customers are generally governed by purchase orders or, in certain cases, agreements with terms of one year or less that include pricing terms and estimated quantity requirements. Our customer agreements generally do not require that a customer purchase a minimum quantity of wafers.

We sell semiconductor wafers to certain customers under consignment arrangements. These consignment arrangements generally require us to maintain a certain quantity of wafers in inventory at the customer’s facility or at a storage facility designated by the customer. We ship the wafers to the storage facility, but do not charge the customer or recognize sales for those wafers until title passes to the customer under these arrangements. We had $15.8 million and $20.1 million of inventory held on consignment as of December 31, 2015 and 2014, respectively.

Research and Development

6

The semiconductor wafer market is characterized by continuous technological development and product innovation. Our research and development ("R&D") organization consists of over 92 engineers, of whom approximately 52 have PhDs. Our R&D model combines engineering innovation with specific commercialization strategies and seeks to align our technology innovation efforts with our customers’ requirements for new and evolving applications. We accomplish this through a deep understanding of our customers’ current and future technology requirements, and by targeting our R&D efforts at developing products to meet those technology requirements. Our field application engineering team collaborates with our account managers and serves as the key technical interface between us and our customers. Members of this team are assigned to key customers worldwide and lead the introduction and qualification of new products, collaborate with our customers in the development of new technical solutions, and support the resolution of any product-related issues.

We devote a significant portion of our R&D resources to enhancing our position in the crystal technology area. In conjunction with these efforts, we are developing wafer technologies to meet advanced flatness and particle specifications of our customers. We are also continuing to focus on the development of advanced substrates such as EPI and SOI wafers, and manufacturing cost reductions.

We continue to invest in R&D associated with larger wafer sizes in addition to our focus on advancements in wafer material properties. We produced our first 300mm wafer in 1991 and are continuing to enhance our 300mm technology program. We produced our first 450mm wafer in 2009, but to date have produced only minimal quantities of mechanical wafers at this size due to limited market demand for 450mm wafers. We also continue to focus on process design advancements to drive cost reductions and productivity improvements.

We entered into joint development arrangements with SunEdison in connection with the IPO pursuant to which we and SunEdison will collaborate on future R&D activities with respect to the intellectual property to be licensed between us, as well as projects related thereto. See “Certain Relationships and Related Party Transactions, and Director Independence" for additional information on these arrangements.

Manufacturing

We have established a global manufacturing network consisting of eight facilities located in Taiwan, Malaysia, South Korea, Italy, Japan, and the U.S. to meet our customers' needs worldwide. We commenced a plan to consolidate our wafering manufacturing footprint on July 30, 2015 by announcing the closure of our Ipoh operations by the end of 2016 and the transitioning of Ipoh's 200mm wafering activities from our Ipoh facility to Novara, Italy and other operating facilities. We have located our manufacturing facilities in regions that offer both low operating costs and highly educated work forces in close proximity to our customers. This “local” presence enables us to facilitate collaboration with our customers on product development activities and shorten product delivery and response times.

We have installed uniform tools and processes across our manufacturing facilities in order to facilitate the transfer of manufacturing between sites. While customers generally require that they “qualify” each facility at which we manufacture wafers for them, a process that typically takes three to six months but which can take up to one year for certain products, in many cases multiple sites are qualified for a particular product to allow manufacturing flexibility. In addition, multiple qualifications permit us to quickly shift production between facilities in the event of a natural disaster or other occurrence affecting one of our facilities, enabling uninterrupted delivery of products to our customers. Production at our Japanese facility, for example, was disrupted as a result of the March 2011 earthquake and tsunami, but we were able to shift production of our 200mm wafers quickly to other facilities that had been, or were already in the process of being, qualified, enabling us to continue delivering those wafers to customers in a timely manner.

Our wafer manufacturing process begins with high purity polysilicon. The polysilicon is melted in a quartz crucible along with small amounts of electrically active elements such as arsenic, boron, phosphorous, or antimony. We then lower a silicon seed crystal into the melt and slowly extract it from the melt. The resultant body of silicon is called an ingot. The temperature of the melt, speed of extraction, and rotation of the crucible govern the size of the ingot, while the concentration of the electrically active element in the melt governs the electrical properties of the wafers to be made from the ingot. This is a complex, proprietary process requiring many control features on the crystal-growing equipment.

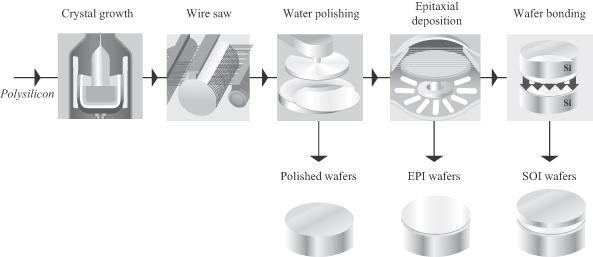

Once the crystal ingot is grown, we grind the ingots to the specified size and slice them into thin wafers. Next, we prepare the wafers for surface polishing with a multi-step process using precision wafer planarization machines, edge contour machines, and chemical etchers. Final polishing and cleaning processes give the wafers the clean and ultraflat mirror-polished surfaces required for the fabrication of semiconductor devices. We further process some of our products into EPI wafers by utilizing a chemical vapor deposition process to deposit a single crystal silicon layer on the polished surface. Additional wafer customization can be made through our SOI process, which creates an oxide isolated silicon layer on a base substrate. We believe we are one of only two fully integrated SOI manufacturers.

The graphic below illustrates key steps in the manufacturing process for our semiconductor wafers:

7

Raw Materials

The principal raw material used in our manufacturing process is polysilicon. We have historically obtained our requirements for polysilicon primarily from SunEdison’s facility in Pasadena, Texas, as well as from other external polysilicon suppliers. On June 23, 2015, SunEdison Semiconductor Limited and SunEdison, Inc. entered into a letter agreement regarding granular polysilicon supply matters (the “Agreement”). The Agreement provides for a long-term supply by SunEdison of the Company’s granular semiconductor grade polysilicon needs. The Agreement provides for a fixed price per kilogram of granular polysilicon supplied for each year over the 10.5-year period of the Agreement, and allows us to obtain the polysilicon from any SunEdison subsidiary.

On February 18, 2016, Sunedison announced it will be closing the currently-idled Pasadena facility. We believe polysilicon production at Pasadena has stopped and will not be restarted. Over the past several months, the Company has been working on several initiatives to improve contingency planning for polysilicon supply. These initiatives include:

• | Building significant polysilicon inventory from the Pasadena facility; |

• | Negotiating backup supply agreements for polysilicon from additional suppliers at acceptable prices; and |

• | Supporting the early stages of the production ramp at SMP, and starting customer qualifications. |

We believe these improvements will be sufficient to meet all of our polysilicon requirements.

Competition

The market for semiconductor wafers is highly competitive. We compete globally and face competition from established manufacturers. Our major worldwide competitors are Shin-Etsu Handotai, SUMCO Corporation, Siltronic AG, and LG Siltron. The key competitive factors in the semiconductor wafer market are product quality, consistency, price, technical innovation, customer service, and product availability. We emphasize our technology and product innovation, customer service, and consistency in delivering high quality wafers that meet our customers' evolving requirements. Some of our competitors are larger than us, which may enable them to produce wafers at a lower per unit cost due to economies of scale, and have greater influence than us on market prices. We also believe certain of our competitors may experience competitive advantages in their home markets, where customers are willing to pay a premium for wafers from a domestic manufacturer. Furthermore, our larger competitors have a majority of their manufacturing operations in Japan and have benefited from the depreciation of the Japanese yen.

Proprietary Information and Intellectual Property

8

We believe that the success of our business depends in part on our proprietary technology, information, and processes. We protect our intellectual property rights based on patents and trade secrets. We had 235 U.S. patents and 170 non-U.S. patents as of December 31, 2015. Additionally, as of December 31, 2015, we had 72 pending U.S. patent applications and approximately 145 pending non-U.S. patent applications. The number of patents granted to us and the number of patents we had pending as of December 31, 2015 were as follows:

Number of Patents Granted | Number of Patents Pending | |||||

Polysilicon | 19 | 27 | ||||

Crystal | 151 | 39 | ||||

Wafering | 135 | 54 | ||||

EPI | 73 | 15 | ||||

SOI | 27 | 82 | ||||

Total | 405 | 217 | ||||

The table below sets forth the approximate number of our current U.S. and non-U.S. patents that are scheduled to expire in the referenced periods:

Number of Patents Scheduled to Expire | ||||||

During the Years Ended December 31, | U.S. | Non-U.S. | ||||

2016-2020 | 114 | 66 | ||||

2021-2025 | 46 | 55 | ||||

2026-2030 | 36 | 38 | ||||

2031 and thereafter | 39 | 11 | ||||

Total | 235 | 170 | ||||

While we consider our patents to be valuable assets, we do not believe that the success of our business is dependent upon any single patent or group of related patents. In addition, we do not believe that the loss or expiration of any single patent or group of related patents would materially affect our overall operations.

Certain intellectual property assets, including patents, were transferred to us in connection with the Formation Transactions based on the subject matter of the assets, in particular, intellectual property assets in respect of processes, product, and apparatus that are used in to the production of semiconductor wafers. SunEdison retained intellectual property assets that are primarily related to the production of solar wafers. Other intellectual property is owned by either us or SunEdison based on the asset’s primary application in situations where the subject matter of particular intellectual property significantly overlaps between our business and SunEdison's business.

We entered into intellectual property licensing agreements with SunEdison in connection with the Formation Transactions, pursuant to which certain intellectual property used in both our business and that of SunEdison is subject to cross-licensing arrangements. See “Certain Relationships and Related Party Transactions-Intellectual Property Licensing Agreements,” below for a summary of the material terms of these agreements.

We have agreed to indemnify some of our customers against claims of infringement of the intellectual property rights of others in our sales contracts with these customers. Historically, we have not paid any claims under these indemnification obligations, and we do not have any pending indemnification claims against us.

Environmental Matters

Our operations and facilities are subject to U.S. and non-U.S. laws and regulations governing the protection of the environment and our employees, including those governing air emissions, water discharges, the management and disposal of hazardous substances and wastes, and the cleanup of contaminated sites. We could incur substantial costs, including cleanup costs, fines or civil or criminal sanctions, or third party property damage or personal injury claims, in the event of violations or liabilities under these laws and regulations, or non-compliance with the environmental permits required at our facilities. Potentially significant expenditures could be required in order to comply with environmental laws that may be adopted or imposed in the future. In addition, we could be liable for violation of environmental laws or regulations or clean up costs at former facilities. We are not aware of any threatened or pending material environmental investigations, lawsuits or claims involving us, our operations, or our current or former facilities.

9

Groundwater and/or soil contamination has been detected at our facility in St. Peters, Missouri and our former facility in Merano, Italy. We believe we are taking all necessary remedial steps at these two facilities and continue to monitor two other facilities previously remediated. We do not expect the costs of the ongoing monitoring at those sites to be material. In connection with our decision to indefinitely close the Merano, Italy polysilicon and chlorosilanes facilities, during 2013 we recorded an additional $3.4 million of environmental cleanup cost to reflect remediation activities that are expected to be required to be undertaken there. In December 2014, we closed on the sale of the Merano, Italy polysilicon facility and the related chlorosilanes facility. The buyer has assumed the environmental liabilities pertaining to the facilities that were sold. In August 2015, we made a decision to close our Ipoh, Malaysia facility, but do not expect to incur significant environment charges in relation to the Ipoh closure. We believe we have adequately accrued all estimated required expenses with respect to the Merano, Italy facilities as of December 31, 2015. However, actual future expenses could differ from our estimates. Additionally, if we decide to close any of our other facilities in the future, we could be subject to additional costs related to cleanup and/or remediation at that site in connection with closing the facility. Compliance with foreign, federal, state, and local provisions which have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had a material effect on our business, financial condition, or results of operations as of December 31, 2015, and we do not currently expect any known conditions to have a material impact on our business in the future.

Employees

We had approximately 4,400 employees as of December 31, 2015, nearly 1,400 of whom were unionized at our manufacturing facilities in: St. Peters, Missouri; Merano, Italy; Novara, Italy; Utsunomiya, Japan; and Cheonan, South Korea. Local law in various countries also requires our participation in works councils. We have not experienced any material work stoppages at any of our facilities due to labor union activities in recent years. We believe our relations with our employees are good.

Geographic Information

Information regarding our foreign and domestic operations is contained in Note 17, Notes to Consolidated Financial Statements, included in our 2015 Annual Report, which information is incorporated herein by reference.

Available Information

We make available free of charge through our website (http://www.sunedisonsemi.com) the reports that we file with the Securities and Exchange Commission ("SEC"), including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains an internet site containing these reports and proxy and information statements at http://www.sec.gov. Any materials we file can be read and copied online at that site or at the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549, on official business days between the hours of 10:00 am and 3:00 pm. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

Item 1A. Risk Factors

RISK FACTORS

Risks Related to Our Business

We face intense competition in the industry in which we operate, including from competitors that have a greater market share than we do, and have cost advantages due to scale and the weakened Japanese yen, which could materially adversely affect our business, financial condition, and results of operations.

10

We face intense competition in the semiconductor wafer industry from established manufacturers throughout the world, including Shin-Etsu Handotai, SUMCO Corporation, Siltronic AG, and LG Siltron. Some of our competitors have greater financial, technical, engineering, and manufacturing resources than we do, enabling them to develop products that currently, and may in the future, compete favorably against our products in terms of design, quality, and performance. Our larger competitors may also be able to produce wafers at a lower per unit cost due to economies of scale and have greater influence than we do on market prices. In addition, certain of our competitors may have a perceived advantage in the market with respect to the quality of their products. We expect that all of our competitors will continue to improve the design and performance of their products and introduce new products with competitive price and performance characteristics. Furthermore, our larger competitors have a majority of their manufacturing operations in Japan and are benefiting from the weakened Japanese yen, which could potentially depreciate further in the future. Our failure to compete effectively would have a material adverse effect on our business, financial condition, and results of operations.

Our business depends on conditions in the semiconductor device industry. When that industry experiences a cyclical downturn, our sales are likely to decrease and we could be forced to reduce our prices without being able to reduce costs, including fixed costs, all of which could materially adversely affect our business, financial condition, and results of operations.

Our business depends in large part upon the market demand for our customers’ semiconductor devices that are utilized in electronics applications. The semiconductor device industry is subject to cyclical and volatile fluctuations in supply and demand and has experienced significant downturns in the past. These downturns often occur in connection with declines in general economic conditions. If the current market softness continues, or the semiconductor device industry continues to experience frequent downturns, we will face pressure to reduce our prices, which may require us to further rationalize capacity and attempt to reduce our fixed costs. If we are unable to reduce our costs sufficiently to offset reductions in prices and sales volumes, our business, financial condition, and results of operations will be materially adversely affected.

Average selling prices for semiconductor wafers have been volatile and generally declining in recent years. If we are unable to reduce our manufacturing costs and operating expenses in response to decreased prices, we may not be able to compete effectively.

Average selling prices for semiconductor wafers have been volatile and generally declining in recent years. Additionally, consolidation within the semiconductor industry has increased the pricing power of our customers over time, resulting in downward pressure on wafer average selling prices. When average selling prices decline, our net sales and gross profit also decline unless we are able to reduce the cost to manufacture our products or sell more products. If we are not able to reduce our manufacturing costs and leverage our operating expenses sufficiently to offset any future price erosion, or if we are unable to offset price erosion by increasing our sales and expanding our market share, our business, financial condition, and results of operations could be materially and adversely affected.

Our dependence on a limited number of suppliers for polysilicon and other raw materials, equipment, and supplies could harm our production output and increase our costs, which could have a material adverse effect on our business, financial condition, and results of operations.

Our ability to meet our customers’ demand for our products depends upon obtaining adequate supplies of quality raw materials on a timely basis. We obtain several raw materials, equipment, and supplies from sole suppliers. Additionally, we have historically obtained our requirements for polysilicon primarily from SunEdison’s Pasadena, Texas facility. On June 23, 2015, SunEdison Semiconductor Limited and SunEdison, Inc. entered into a letter agreement regarding granular polysilicon supply matters (the “Agreement”). The Agreement provides for a long-term supply by SunEdison of the Company’s granular semiconductor grade polysilicon needs. The Agreement provides for a fixed price per kilogram of granular polysilicon supplied for each year over the 10.5-year period of the Agreement, and allows us to obtain the polysilicon from any SunEdison subsidiary, including polysilicon sourced from SMP.

On February 18, 2016, Sunedison announced it will be closing the currently-idled Pasadena facility. We believe polysilicon production at Pasadena has stopped and will not be restarted. Although the Company has been working on several initiatives to improve contingency planning for polysilicon supply, there can be no assurance that we will achieve complete independence from the supply constraints.

As our existing inventory continues to deplete, we will increasingly be required to use other suppliers, at least until SMP is qualified to manufacture electronics-grade granular polysilicon. This could result in manufacturing delays, increased raw materials cost, decreased manufacturing yields, and further investments in equipment. In addition, we are at risk that polysilicon suppliers not used by the Company, including SMP, may prove unable to become qualified as suppliers. Any of these events could have a material adverse effect on our business, financial condition, and results of operations.

11

Occasionally we have experienced limited supplies of certain other raw materials, equipment, and supplies and may experience shortages in the future. A prolonged inability to obtain raw materials, equipment, or supplies, or increases in prices resulting from shortages of these materials, could have a material adverse effect on our business, financial condition, and results of operations.

We may never realize the expected benefits from our ownership in SMP, and the SMP facility may require additional capital investments.

As of December 31, 2015, we have a 30.02% ownership interest in SMP recorded at $121.6 million.

SMP was established to construct and operate a polysilicon manufacturing facility for the benefit of the joint venture partners of SMP. Construction of the SMP polysilicon manufacturing facility was recently completed. The facility is in the initial stages of polysilicon production, but has not reached full commercial capabilities at this time. We are, therefore, not yet purchasing polysilicon in bulk from the facility. Commencement of commercial operations at the facility could be delayed for a variety of reasons, including weather, natural disasters, labor shortages or strikes, or other factors beyond our control.

Furthermore, we may not realize all of the expected benefits of the SMP manufacturing facility and our investment in SMP for the following reasons, among other things:

• | the facility may never achieve the commercial capabilities to produce electronic grade polysilicon, |

• | the facility may operate less efficiently than we expect or may not become commercially viable at all, including for reasons beyond our control, |

• | we may become involved in disputes with our joint venture partners regarding additional capital investments or operations, such as how to best deploy assets, and such disagreements could disrupt or halt the operations of the facility or negatively impact the facility's efficiency, |

• | the facility may not receive appropriate regulatory approvals to manufacture electronic grade polysilicon or such approvals may be delayed, |

• | general political and economic uncertainty could impact operations at the facility, as could multiple regulatory requirements that are subject to change, any future implementation of trade protection measures and import or export licensing requirements between the U.S. and South Korea, labor regulations or work stoppages, fluctuations in currency exchange rates, and compliance with U.S. regulations that apply to international operations, including trade laws and the U.S. Foreign Corrupt Practices Act, |

• | we may be requested to make unexpected and substantial additional capital investments in SMP, and |

• | operations at the facility may be disrupted by natural disasters, equipment failures, or environmental factors. |

Any of these, or other actions or factors, could adversely affect our supply of polysilicon from SMP or our ability to otherwise realize any return on our investment in the joint venture, which could have a material adverse effect on our business, financial condition, and results of operations.

We are exploring and evaluating potential strategic alternatives and there can be no assurance that we will be successful in identifying or completing any strategic alternative, that any such strategic alternative will result in additional value for our shareholders or that the process will not have an adverse impact on our business.

12

On February 18, 2016, we announced that our board of directors has authorized a process to explore possible strategic alternatives following receipt of unsolicited preliminary indications of interest in the Company. A strategic alternative may include, but is not limited to, a sale of our company, a merger with another party, a sale of some or all of our assets or another strategic transaction. There can be no assurance that the exploration of strategic alternatives will result in the identification or consummation of any transaction. Our board of directors may also determine that our most effective strategy is to continue to effectuate our current business plan. The process of exploring strategic alternatives may be time consuming and disruptive to our business operations and, if we are unable to effectively manage the process, our business, financial condition and results of operations could be adversely affected. We could incur substantial expenses associated with identifying and evaluating potential strategic alternatives. No decision has been made with respect to any transaction and we cannot assure you that we will be able to identify and undertake any transaction that allows our shareholders to realize an increase in the value of their ordinary shares or provide any guidance on the timing of such action, if any. We also cannot assure you that any potential transaction or other strategic alternative, if identified, evaluated and consummated, will provide greater value to our shareholders than that reflected in the current price of our ordinary shares. Any potential transaction would be dependent upon a number of factors that may be beyond our control, including, but not limited to, market conditions, industry trends, the interest of third parties in our business and the availability of financing to potential buyers on reasonable terms. We do not intend to comment regarding the evaluation of strategic alternatives until such time as the board of directors has determined the outcome of the process or otherwise has deemed that disclosure is appropriate or required by applicable law. As a consequence, perceived uncertainties related to our future may result in the loss of potential business opportunities and volatility in the market price of our ordinary shares and may make it more difficult for us to attract and retain qualified personnel and business partners.

If we fail to meet changing customer demands or achieve market acceptance and quality control for new products, we may lose customers and our sales could suffer.

The industry in which we operate changes rapidly. Changes in our customers’ requirements means that we must adapt to new and more demanding technologies, product specifications and sizes, as well as manufacturing processes. Our ability to remain competitive depends upon our ability to continue to differentiate our products based on size, flatness, reduced defects, crystal properties, and electrical characteristics, and develop technologically advanced products and processes. Although we expect to continue to make significant investments in R&D, we cannot ensure that we will be able to successfully introduce, market, and cost-effectively manufacture new products, or that we will be able to develop new or enhanced products and processes that satisfy our customers’ needs. If we are unable to adapt to changing customer demands, or if new products that we develop, such as SOI, do not achieve market acceptance, perform to customer’s specifications due to quality issues, or achieve profitability, our business, financial condition, and results of operations will be materially and adversely affected.

A significant reduction in, or loss of, purchases by any of our top customers could materially adversely affect our business, financial condition, and results of operations.

Three customers accounted for approximately 21%, 14%, and 11%, respectively, of our net sales to non-affiliates in 2015 and our top 10 customers accounted for approximately 71% of our net sales to non-affiliates in 2015. Sales to our customers are generally governed by purchase orders or, in certain cases, short-term agreements that include pricing terms and estimated quantity requirements. We do not generally have long-term agreements with our customers, and our customers are not obligated to purchase a minimum quantity of wafers from us. We are exposed to the risk of lower sales if our customers reduce their demand for our products as a result of cyclical fluctuations or competitive factors. Our business, financial condition, and results of operations could materially suffer if we experience a significant reduction in, or loss of, purchases by any of our top customers.

Our manufacturing processes are highly complex and potentially vulnerable to impurities, disruptions, or inefficient implementation of production changes that can significantly increase our costs and delay product shipments to our customers.

Our manufacturing processes are highly complex, require advanced and increasingly costly equipment, and are continuously being modified or maintained in an effort to improve yields and product performance. Impurities or other difficulties in the manufacturing process can lower yields, interrupt production, result in losses of products in process, and harm our reputation. Additionally, as system complexity and production changes have increased, manufacturing tolerances have been reduced and requirements for precision have become even more demanding. We have from time to time experienced bottlenecks and production difficulties that have caused delivery delays and quality control problems. We cannot ensure that we will not experience bottlenecks or production or transition difficulties in the future. Such incidents, if they occur, could have a material adverse effect on our business, financial condition, and results of operations.

If we are not able to match our manufacturing capacity and output to the demand for our products, our business, financial condition, and results of operations could be materially adversely affected.

13

The cyclicality and volatility of the semiconductor industry make it difficult to predict future developments in the markets we serve, making it difficult to estimate future requirements for manufacturing capacity. We may experience a shortage of capacity and an increase in lead times for delivery of our products to our customers, or an inability to deliver the required number of products during periods of high demand for our products. When our manufacturing facilities are operating at high capacity, we may also experience disruptions, problems or inefficiencies in our manufacturing processes due to overutilization, potentially resulting in the loss of sales and damage to our relationships with customers. Additionally, increases in our manufacturing capacity based on anticipated growth in demand for our products may exceed demand requirements, leading to overcapacity and excessive fixed costs. Lower than expected demand for our products may also lead to excessive inventory, which could result in write-offs of inventory and losses on products. Past overcapacity for certain products or technologies and cost optimization have led us to close or shutter manufacturing facilities and, as a result, to incur impairment and restructuring charges and other related closure costs. For example, on July 30, 2015, the Board of Directors of the Company authorized the closure of our Ipoh, Malaysia facility, which produces 200mm semiconductor wafers. This action to consolidate our Ipoh operations includes the transitioning of 200mm wafering activities from our Ipoh facility to Novara, Italy and other operating facilities. Failure to effectively transition these wafering activities and future capacity imbalances could have a material adverse effect on our business, financial condition, or results of operations.

Because our customers generally require that they qualify a facility before we can begin manufacturing products for them at that facility, we may not be able to quickly transfer production of specific products from one of our manufacturing facilities to another in the event of an interruption or lack of capacity at any of our facilities, which could result in lost sales and damage to customer relationships.

It typically takes three to six months for our customers to qualify one of our manufacturing facilities to produce a specific product, but it can take up to one year depending upon a customer’s requirements. While in many cases multiple sites are qualified for a particular product to allow flexibility, an interruption of operations or lack of available capacity at any of our manufacturing facilities could result in delays in, or cancellations of, shipments of products in the event only one facility is qualified to manufacture such products. A number of factors could cause interruptions or lack of capacity at a facility, including extreme weather conditions such as hurricanes, earthquakes, equipment and power failures, shortages of raw materials or supplies, and transportation complications. We have experienced interruptions of our manufacturing operations due to some of these events in the past and could have such interruptions again in the future. If we experience an interruption or lack of capacity at any of our manufacturing facilities for any reason, it could result in lost sales and damage to customer relationships, which could materially and adversely affect our business, financial condition, and results of operations.

Our business may be harmed if we fail to properly protect our intellectual property or infringe on the intellectual property rights of third parties.

We believe that the success of our business depends, in part, on our proprietary technology, information, processes and know-how, and on our ability to operate without infringing on the proprietary rights of third parties. We seek to protect our intellectual property rights based on trade secrets and patents as part of our ongoing R&D and manufacturing activities. We cannot be certain, however, that we have adequately protected or will be able to adequately protect our technology, that our competitors will not be able to utilize our existing technology or develop similar technology independently, that the claims allowed with respect to any patents held by us will be broad enough to protect our technology, or that foreign intellectual property laws will adequately protect our intellectual property rights.

Any future litigation to enforce patents issued to us, to protect trade secrets or know-how possessed by us, or to defend ourselves or indemnify others against claimed infringement of the rights of others, could have a material adverse effect on our business, financial condition, and results of operations. Occasionally, we receive notices from other companies that allege we may be infringing certain of their patents or other rights. If we are unable to resolve these matters satisfactorily, or to obtain licenses on acceptable terms, we may face litigation. Regardless of the validity or successful outcome of any future claims, we may need to expend significant time and expense to protect our intellectual property rights or to defend against claims of infringement by third parties. If we lose any such litigation where we are alleged to infringe the rights of others, we may be required to pay substantial damages, seek licenses from others, or change or stop manufacturing or selling some of our products. Any of these outcomes could have a material adverse effect on our business, financial condition, and results of operations.

Occasionally, we may become involved in other litigation and regulatory proceedings, which could require significant attention from our management and result in significant expense to us and disruptions in our business.

14

Adding to litigation related to our intellectual property rights, we have in the past, and may in the future, be named as a defendant from time to time in other lawsuits and regulatory actions relating to our business, such as commercial contract claims, employment claims, and tax examinations, some of which may claim significant damages or cause us reputational harm. Due to the inherent uncertainties of litigation and regulatory proceedings, we cannot accurately predict the ultimate outcome of any such proceeding. An unfavorable outcome could have a material adverse impact on our business, financial condition, and results of operations, or limit our ability to engage in certain of our business activities. Additionally, regardless of the outcome of any litigation or regulatory proceeding, such proceedings are often expensive, time-consuming, disruptive to normal business operations, and require significant attention from our management.

SSL is incorporated outside of the U.S. and a substantial portion of our operations and sales are outside of the U.S. We are, therefore, subject to the risks of doing business internationally, including periodic economic downturns and political instability, which may adversely affect our sales and cost of doing business in those regions of the world.

Global economic downturns have affected our results of operations in the past and could affect our results of operations in the future. In addition, other factors relating to the operation of our business outside of the U.S. may have a material adverse effect on our business, financial condition, and results of operations in the future, including:

• | fluctuations in currency exchange rates, |

• | the imposition of governmental controls or changes in government regulations, including tax regulations, |

• | difficulties in enforcing our intellectual property rights, |

• | export license requirements, |

• | restrictions on the export of technology, |

• | compliance with U.S. and Singapore laws, as well as applicable laws governing our international operations, including the Foreign Corrupt Practices Act and export control laws, |

• | difficulties in achieving headcount reductions due to unionized labor and works councils, |

• | restrictions on the transfer of funds and assets between jurisdictions, |

• | geopolitical instability, and |

• | trade restrictions, import/export duties, and changes in tariffs. |

We may seek to expand our presence in certain foreign markets or enter emerging markets in the future. Evaluating or entering into an emerging market may require considerable management time, as well as start-up expenses for market development, before any significant sales and earnings are generated. Operations in new foreign markets may achieve low margins or may be unprofitable, and expansion in existing markets may be affected by local political, economic, and market conditions. Our success will depend, in part, on our ability to anticipate and effectively manage these and the other risks noted above as we continue to operate our business globally. The impact of any one or more of these factors could materially adversely affect our business, financial condition, and results of operations.

We may incur additional tax expense or become subject to additional tax exposure, which could adversely affect our business, financial condition, and results of operations.

We are subject to income taxes in Singapore, the United States, and several other foreign jurisdictions. Our tax liabilities are dependent upon the distribution of income among these different jurisdictions. Our provision for income taxes and related tax payments in the future could be adversely affected by numerous factors, including, but not limited to, income before taxes being lower than anticipated in countries with lower statutory tax rates and higher than anticipated in countries with higher statutory tax rates, changes in the valuation of deferred tax assets and liabilities, and changes in tax laws and regulations. We are also subject to the examination of our income tax returns by the tax authorities of every jurisdiction in which we operate. The results of audits and examinations of previously filed tax returns and continuing assessments of our tax exposures may have an adverse effect on the Company’s provision for income taxes and related tax payments.

Additionally, our subsidiary in Taiwan operates under a tax holiday, which lowers our effective income tax rate in that jurisdiction. This tax holiday requires us to meet certain minimum employment and investment criteria or thresholds in Taiwan. We cannot ensure that we will be able to continue to meet these criteria or thresholds, or realize any net tax benefits from this tax holiday in the future. If our tax holiday is terminated, our business, financial condition, and results of operations could be adversely affected.

We are subject to periodic fluctuations in currency exchange rates which could cause our financial results, which are reported in U.S. dollars, to vary significantly from period to period.

15

Net sales to non-affiliates generated from outside of the U.S., which represented approximately 84%, 85%, and 86% of our net sales to non-affiliates for the years ended December 31, 2015, 2014, and 2013 respectively, expose us to currency exchange rate fluctuations. Our risk exposure from these sales is primarily related to the Japanese yen, the new Taiwan dollar, South Korean won, euro, and Malaysian ringgit. Because the majority of our sales are denominated in the U.S. dollar, if one or more competitors sells to our customers in a different currency than the U.S. dollar, we are subject to the risk that the competitors’ products will be relatively less expensive than our products due to exchange rate effects. In addition, a substantial portion of manufacturing and operating costs at our non-U.S. facilities are incurred in currencies other than the U.S. dollar, principally the Japanese yen, New Taiwan dollar, South Korean won, euro, and Malaysian ringgit. Unfavorable exchange rate fluctuations in any or all of these currencies may adversely affect the cost of our products and/or related operating expenses.

Our results of operations are also impacted by currency exchange rate fluctuations to the extent that we are unable to match net sales made in non-U.S. currencies with expenses incurred in the same currency. Where we have significantly more expenses than net sales generated in a non-U.S. currency, for example, our profit from operations in that location would be adversely affected in the event that the U.S. dollar depreciates against that currency. We have established transaction-based hedging programs to protect against reductions in value and volatility of future cash flows caused by changes in currency exchange rates. Our hedging programs reduce, but do not always eliminate, the impact of currency exchange rate movements. We recognized net currency exchange income totaling $7.2 million, $3.4 million, and $3.7 million for the years ended December 31, 2015, 2014, and 2013, respectively. Currency exchange risks inherent in doing business outside the U.S. could have a material adverse effect on our business, financial condition, and results of operations.

Our financial statements are presented in U.S. dollars. As a result, we must translate the assets, liabilities, net sales, and expenses of a substantial portion of our non-U.S. operations into U.S. dollars at applicable exchange rates. Consequently, increases or decreases in the value of the U.S. dollar may affect the value of these items with respect to our non-U.S. dollar businesses in our financial statements, even if their value has not changed in their local currency. These translations could significantly affect the comparability of our results between financial periods or result in significant changes to the carrying value of our assets, liabilities, and equity.

Our ability to operate our business effectively could be impaired if we fail to attract and retain key personnel.

Our ability to operate our business and implement our strategies effectively depends, in part, on the efforts of our executive officers and other key employees. Our management team has significant industry experience and would be difficult to replace. These individuals possess sales, marketing, engineering, manufacturing, financial, and administrative skills that are critical to the operation of our business. In addition, the market for engineers and other individuals with the required technical expertise to succeed in our business is highly competitive, and we may be unable to attract and retain qualified personnel to replace or succeed key employees should the need arise. The loss of the services of any of our key employees, or the failure to attract or retain other qualified personnel, could have a material adverse effect on our business, financial condition, and results of operations.

We have in the past, and may in the future, implement initiatives designed to rationalize our use of resources, optimize those resources for the most attractive market opportunities, and manage our production capacity to meet demand efficiently. We may fail to realize the full benefits of, and could incur significant costs relating to, any such initiatives, which could materially adversely affect our business, financial condition, and results of operations.

We have implemented several initiatives since 2011 designed to rationalize our use of resources, optimize those resources for the most attractive market opportunities, and manage our production capacity to meet demand efficiently. During the fourth quarter of 2011, SunEdison committed to a series of actions to reduce its global workforce, right-size its production capacity, and accelerate operating cost reductions (the "2011 Global Plan"). In connection with that plan, we reduced our workforce by approximately 11% and shuttered our Merano, Italy polysilicon facility. Primarily as a result of these actions, we incurred restructuring charges of $284.5 million and long-lived asset impairment charges of $234.7 million in 2011, $33.6 million of non-cash impairment charges in 2013, and $57.3 million of non-cash impairment charges in 2014.

On February 7, 2014, we commenced a plan to consolidate our crystal operations. The consolidation included transitioning small diameter crystal activities from our St. Peters, Missouri facility to other crystal facilities in South Korea, Taiwan, and Italy. Restructuring charges of $3.9 million and long-lived asset impairment charges of $2.1 million were recorded for the year ended December 31, 2014 in connection with the plan to consolidate our crystal operations.