Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NAVISTAR INTERNATIONAL CORP | d155012dex991.htm |

| 8-K - 8-K - NAVISTAR INTERNATIONAL CORP | d155012d8k.htm |

Q1 2016 earnings presentation March 8, 2016 Exhibit 99.2

Safe Harbor Statement and Other Cautionary Notes Information provided and statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such forward-looking statements only speak as of the date of this presentation and the Company assumes no obligation to update the information included in this presentation. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a further description of these factors, see the risk factors set forth in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended October 31, 2015. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our results of operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events. The financial information herein contains audited and unaudited information and has been prepared by management in good faith and based on data currently available to the Company. Certain non-GAAP measures are used in this presentation to assist the reader in understanding our core manufacturing business. We believe this information is useful and relevant to assess and measure the performance of our core manufacturing business as it illustrates manufacturing performance. It also excludes financial services and other items that may not be related to the core manufacturing business or underlying results. Management often uses this information to assess and measure the underlying performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results. The non-GAAP numbers are reconciled to the most appropriate GAAP number in the appendix of this presentation.

Agenda Overview Troy Clarke Financial Results Walter Borst Summary Troy Clarke

1st QUARTER 2016 RESULTS Troy Clarke, President & CEO

Adjusted EBITDA up 43%, to $77 million, on lower revenue Ongoing cost management Progress towards 2016 operating and financial goals Q1 2016 Overview Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation.

Maintain FY2016 industry outlook of 350,000-380,000 trucks and buses Navistar’s market share improved throughout the quarter Improved order share Industry Outlook, Navistar Share

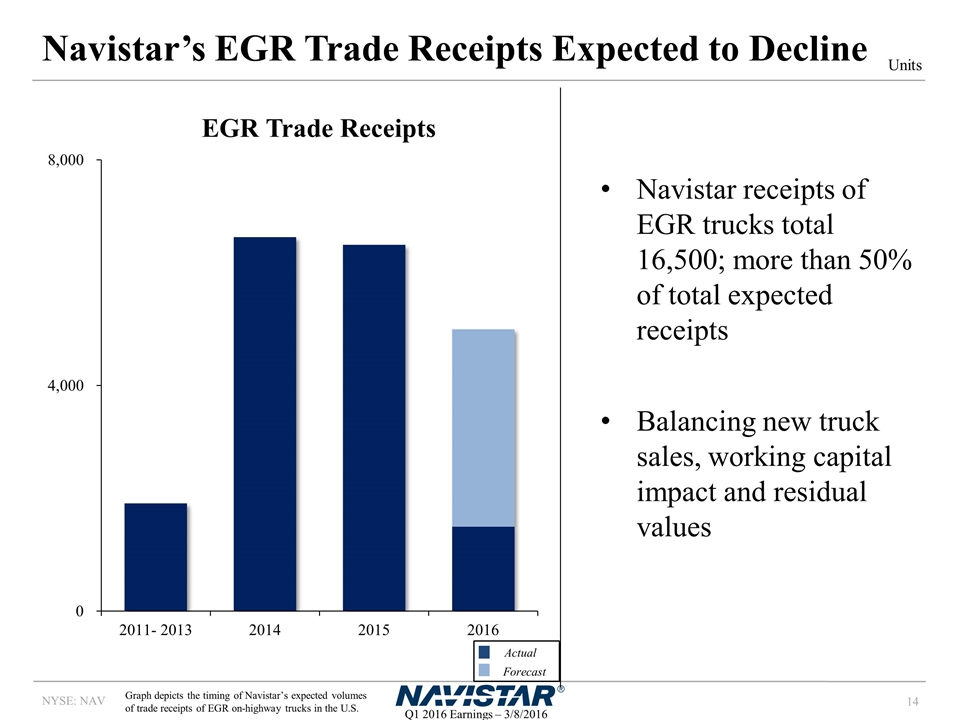

Used truck inventory increased in Q1 Reflects industry-wide oversupply and slowdown in Navistar used sales More than halfway through expected MaxxForce receipts Project 2016 and 2017 receipts will be lower than 2014 and 2015 Used Truck Inventory

Entire product line-up renewed by the end of 2018 Launched HX premium severe service trucks Announced Cummins ISL9 engine Uptime improvement Warranty expense at 2.6% of revenue(A) More than 180,000 OnCommand Connection subscribers First to market with Over-the-Air Reprogramming Investments to Drive Future Market Share (A) Excludes pre-existing warranty

FINANCIAL RESULTS Walter Borst, Executive Vice President & CFO

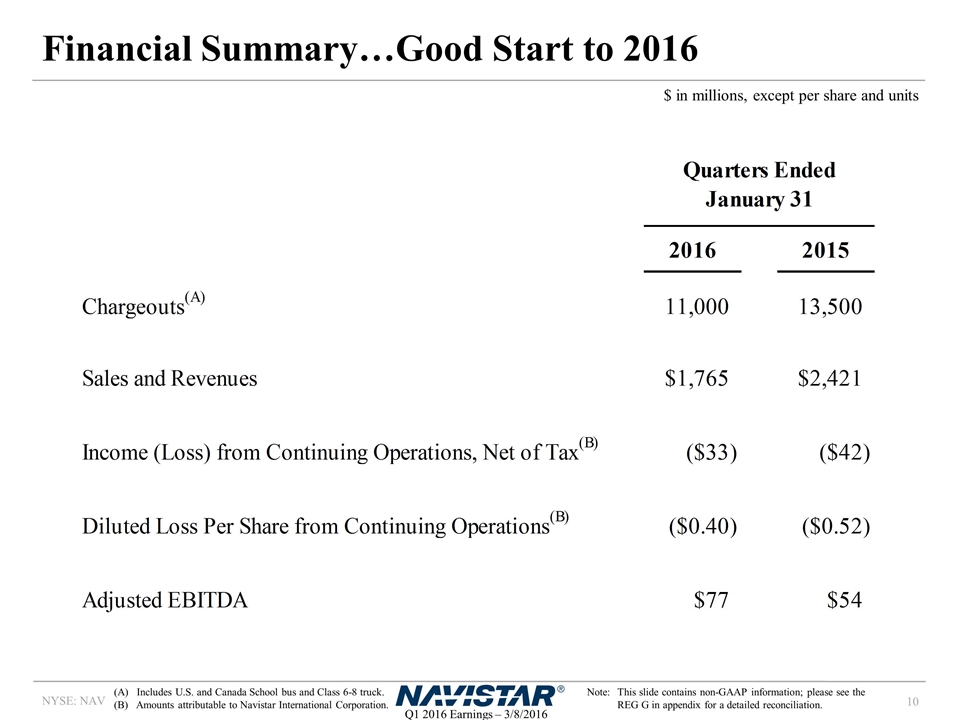

Financial Summary…Good Start to 2016 Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. (A) Includes U.S. and Canada School bus and Class 6-8 truck. (B) Amounts attributable to Navistar International Corporation. $ in millions, except per share and units Quarters Ended January 31 2016 2015 Chargeouts(A) 11,000 13,500 Sales and Revenues $1,765 $2,421 Income (Loss) from Continuing Operations, Net of Tax(B) $-33 $-42 Diluted Loss Per Share from Continuing Operations(B) $-0.4 $-0.52 Adjusted EBITDA $77 $54

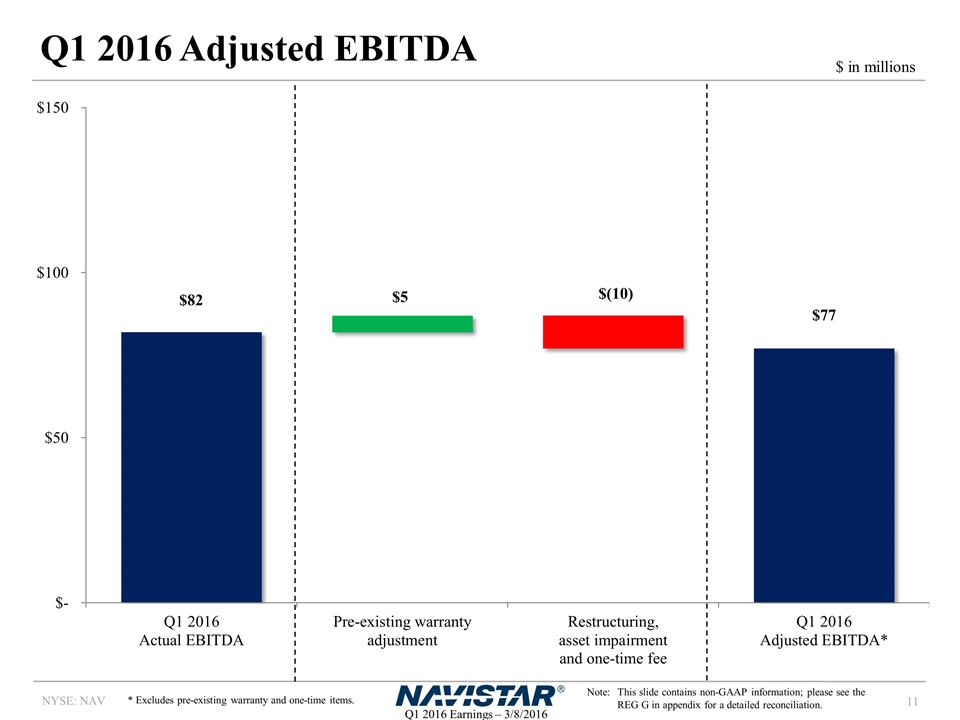

Q1 2016 Adjusted EBITDA $ in millions Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. * Excludes pre-existing warranty and one-time items.

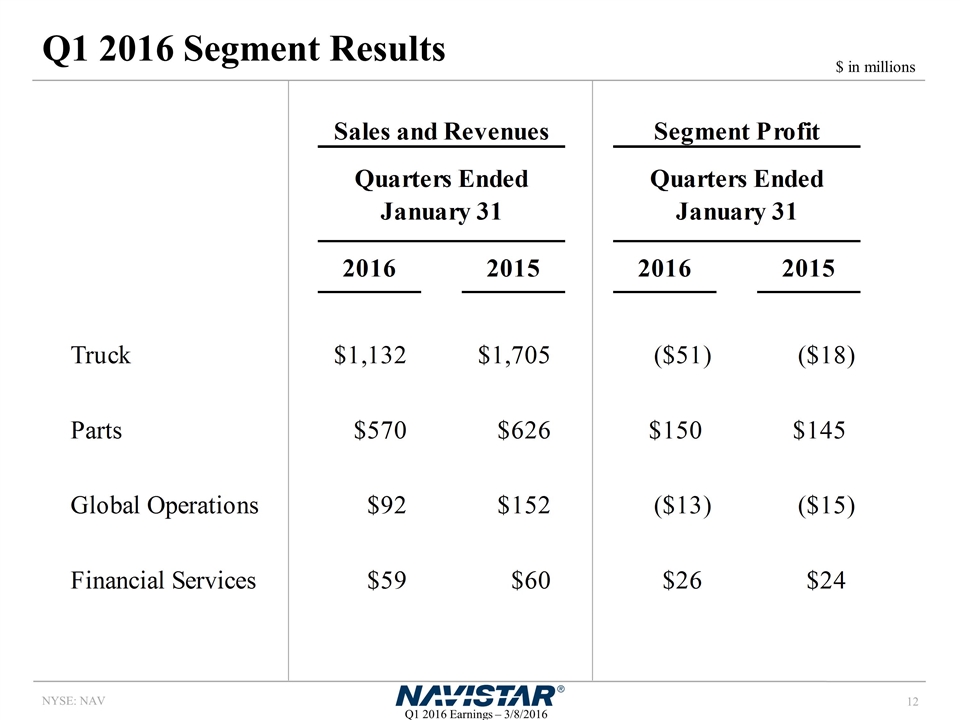

Q1 2016 Segment Results $ in millions Sales and Revenues Segment Profit Quarters Ended January 31 Quarters Ended January 31 2016 2015 2016 2015 Truck $1,132 $1,705 $-51 $-18 Parts $570 $626 $150 $145 Global Operations $92 $152 $-13 $-15 Financial Services $59 $60 $26 $24

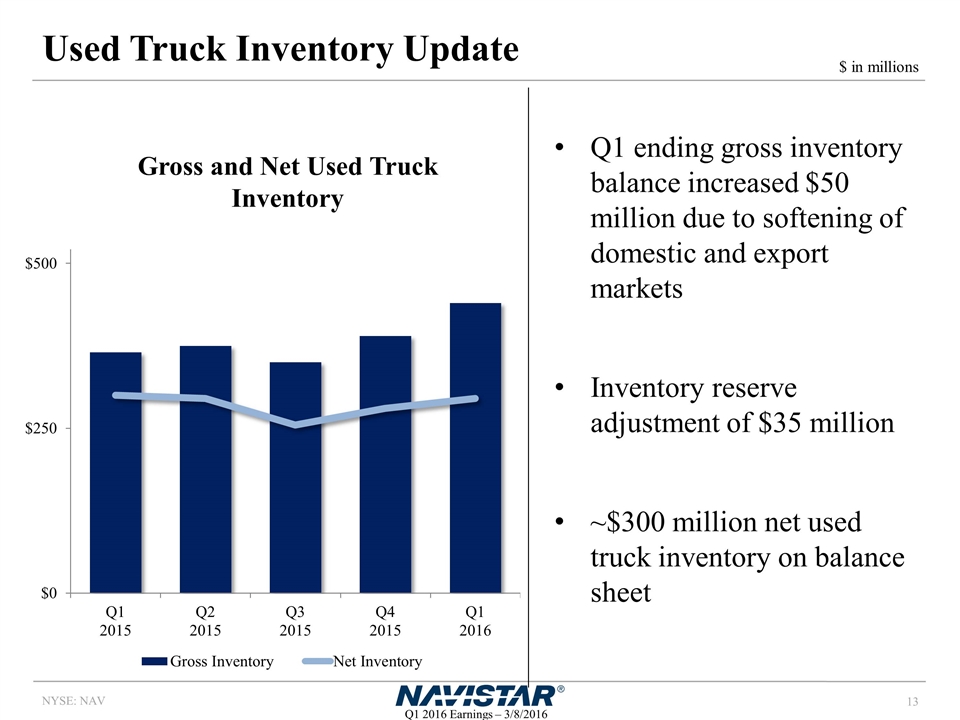

Used Truck Inventory Update Q1 ending gross inventory balance increased $50 million due to softening of domestic and export markets Inventory reserve adjustment of $35 million ~$300 million net used truck inventory on balance sheet Gross and Net Used Truck Inventory $ in millions

Navistar’s EGR Trade Receipts Expected to Decline Navistar receipts of EGR trucks total 16,500; more than 50% of total expected receipts Balancing new truck sales, working capital impact and residual values EGR Trade Receipts Actual Forecast Units Graph depicts the timing of Navistar’s expected volumes of trade receipts of EGR on-highway trucks in the U.S.

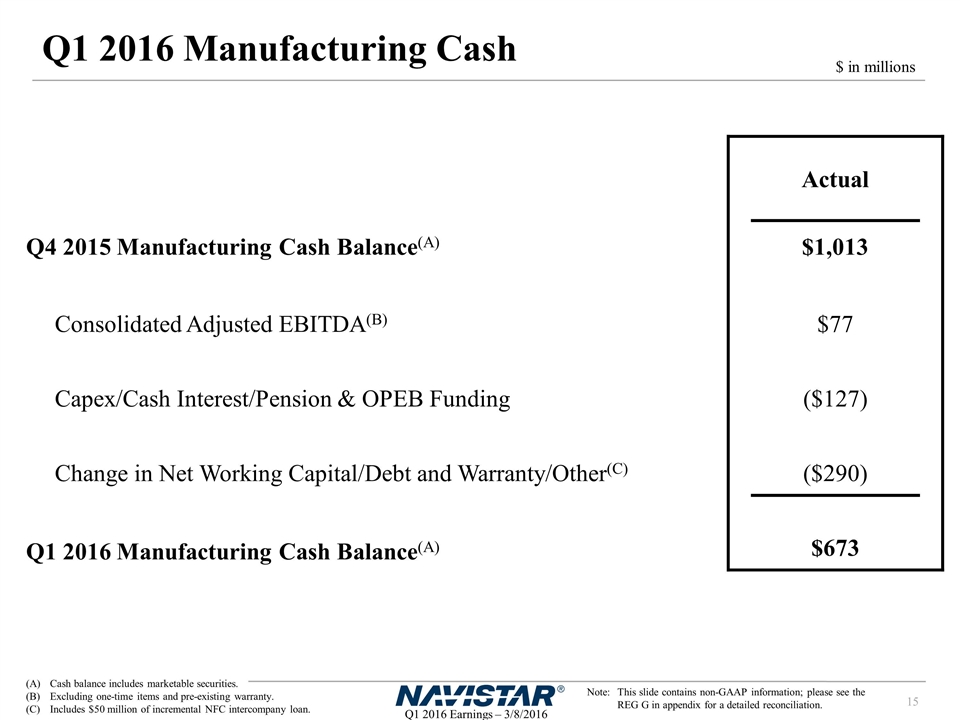

Q1 2016 Manufacturing Cash $ in millions Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. Cash balance includes marketable securities. Excluding one-time items and pre-existing warranty. Includes $50 million of incremental NFC intercompany loan. Actual Q4 2015 Manufacturing Cash Balance(A) $1,013 Consolidated Adjusted EBITDA(B) $77 Capex/Cash Interest/Pension & OPEB Funding ($127) Change in Net Working Capital/Debt and Warranty/Other(C) ($290) Q1 2016 Manufacturing Cash Balance(A) $673

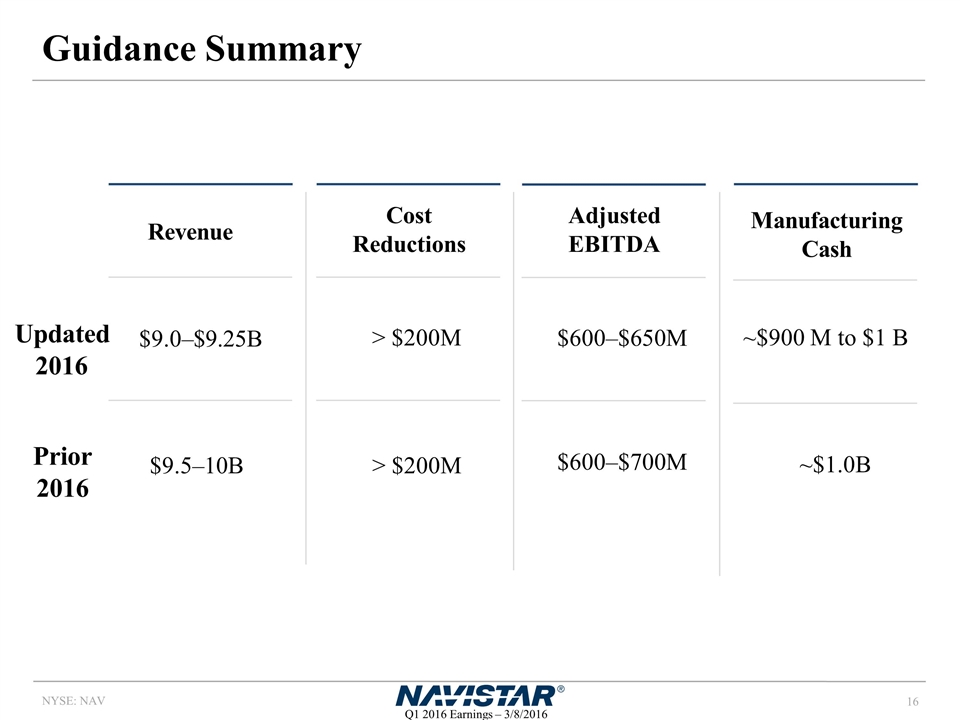

Guidance Summary Cost Reductions Adjusted EBITDA $9.0–$9.25B Updated 2016 $600–$650M > $200M ~$900 M to $1 B Revenue Manufacturing Cash $9.5–10B $600–$700M > $200M ~$1.0B Prior 2016

Summary Troy Clarke, President & CEO

Summary Demonstrated ability to… Manage and optimize costs Bring exciting products to market Improve Parts business Strengthen our dealer network Well-positioned to achieve 2016 full-year profitability and positive manufacturing free cash flow

Appendix

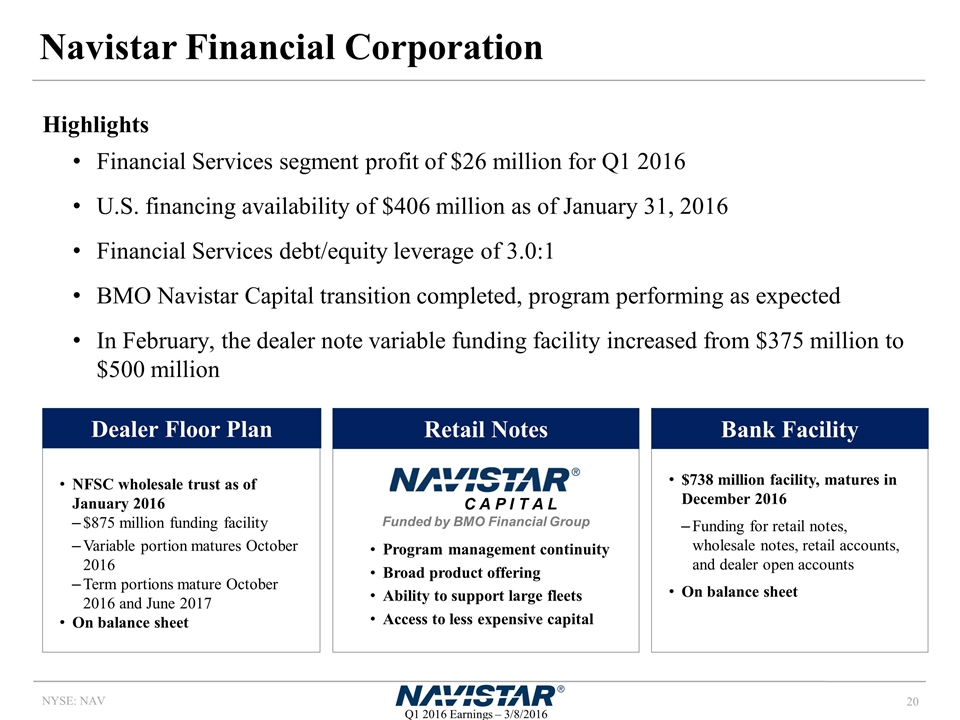

Navistar Financial Corporation Highlights Financial Services segment profit of $26 million for Q1 2016 U.S. financing availability of $406 million as of January 31, 2016 Financial Services debt/equity leverage of 3.0:1 BMO Navistar Capital transition completed, program performing as expected In February, the dealer note variable funding facility increased from $375 million to $500 million Retail Notes Bank Facility Dealer Floor Plan $738 million facility, matures in December 2016 Funding for retail notes, wholesale notes, retail accounts, and dealer open accounts On balance sheet NFSC wholesale trust as of January 2016 $875 million funding facility Variable portion matures October 2016 Term portions mature October 2016 and June 2017 On balance sheet Program management continuity Broad product offering Ability to support large fleets Access to less expensive capital C A P I T A L Funded by BMO Financial Group

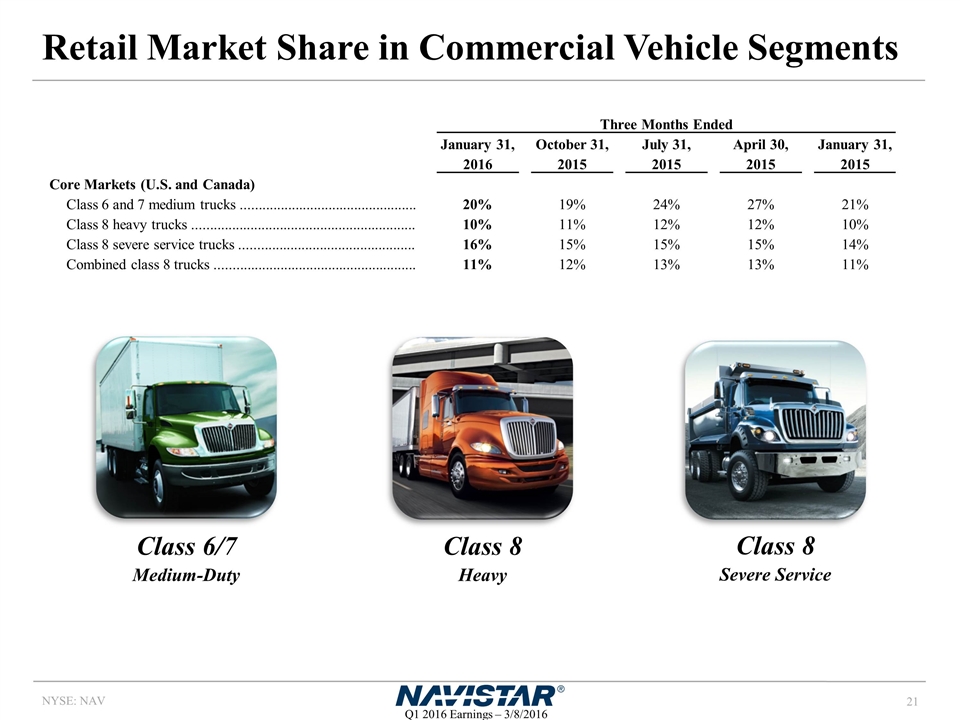

Retail Market Share in Commercial Vehicle Segments Class 6/7 Medium-Duty Class 8 Severe Service Class 8 Heavy Three Months Ended January 31, October 31, July 31, April 30, January 31, 2016 2015 2015 2015 2015 Core Markets (U.S. and Canada) Class 6 and 7 medium trucks ................................................ 20% 19% 24% 27% 21% Class 8 heavy trucks ............................................................. 10% 11% 12% 12% 10% Class 8 severe service trucks ................................................ 16% 15% 15% 15% 14% Combined class 8 trucks ....................................................... 11% 12% 13% 13% 11%

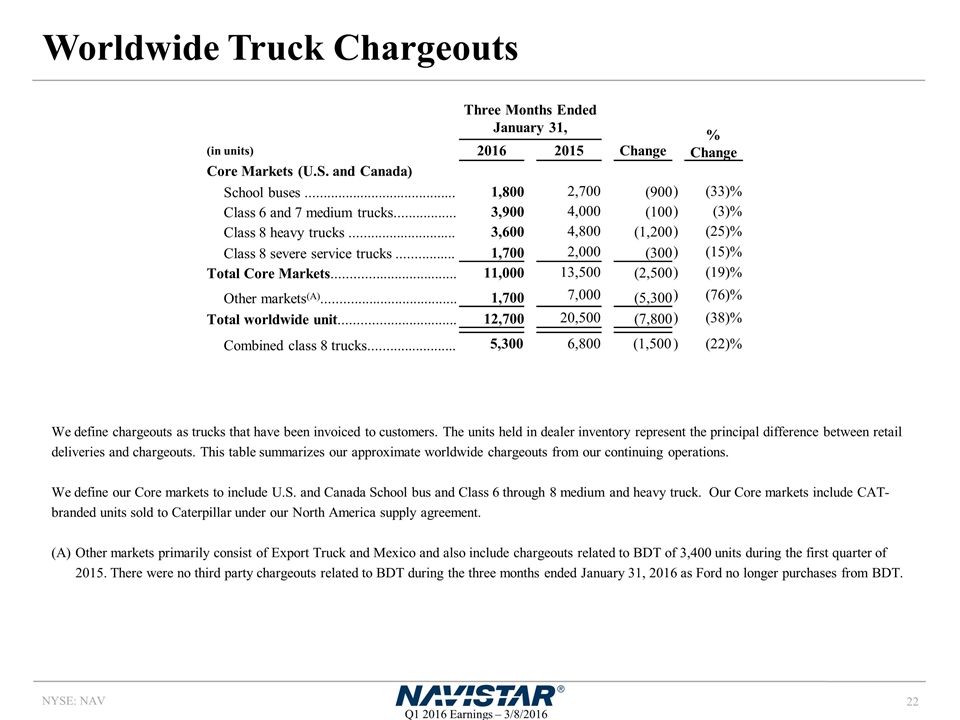

Worldwide Truck Chargeouts We define chargeouts as trucks that have been invoiced to customers. The units held in dealer inventory represent the principal difference between retail deliveries and chargeouts. This table summarizes our approximate worldwide chargeouts from our continuing operations. We define our Core markets to include U.S. and Canada School bus and Class 6 through 8 medium and heavy truck. Our Core markets include CAT-branded units sold to Caterpillar under our North America supply agreement. Other markets primarily consist of Export Truck and Mexico and also include chargeouts related to BDT of 3,400 units during the first quarter of 2015. There were no third party chargeouts related to BDT during the three months ended January 31, 2016 as Ford no longer purchases from BDT. Three Months Ended January 31, % Change (in units) 2016 2015 Change Core Markets (U.S. and Canada) School buses ......................................... 1,800 2,700 (900 ) (33)% Class 6 and 7 medium trucks................. 3,900 4,000 (100 ) (3)% Class 8 heavy trucks ............................. 3,600 4,800 (1,200 ) (25)% Class 8 severe service trucks ................ 1,700 2,000 (300 ) (15)% Total Core Markets.................................. 11,000 13,500 (2,500 ) (19)% Other markets(A)..................................... 1,700 7,000 (5,300 ) (76)% Total worldwide unit................................ 12,700 20,500 (7,800 ) (38)% Combined class 8 trucks........................ 5,300 6,800 (1,500 ) (22)%

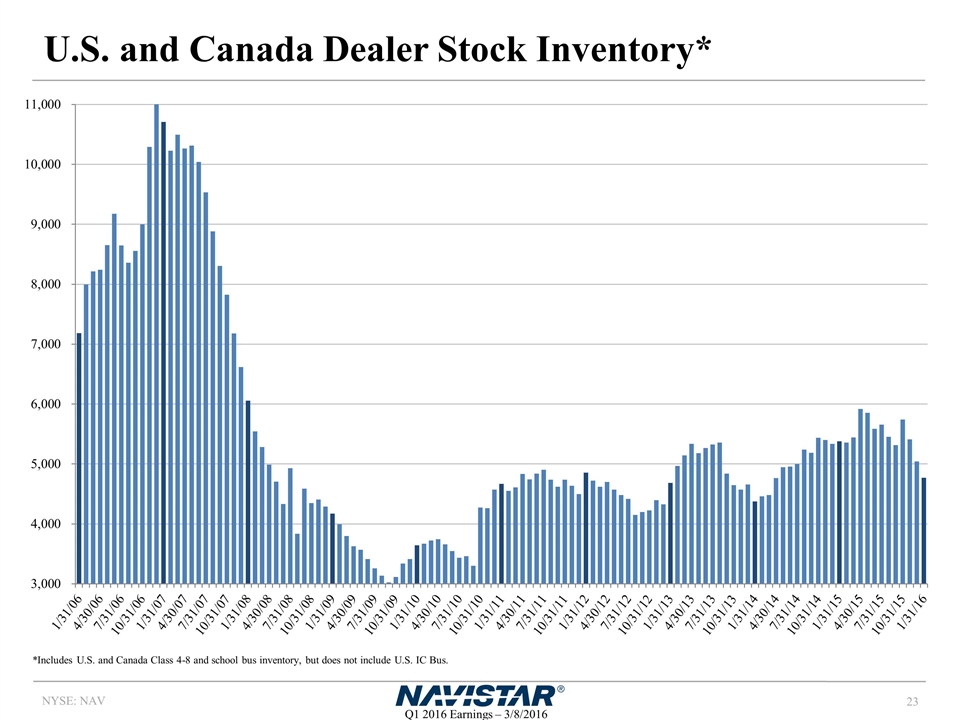

U.S. and Canada Dealer Stock Inventory* *Includes U.S. and Canada Class 4-8 and school bus inventory, but does not include U.S. IC Bus.

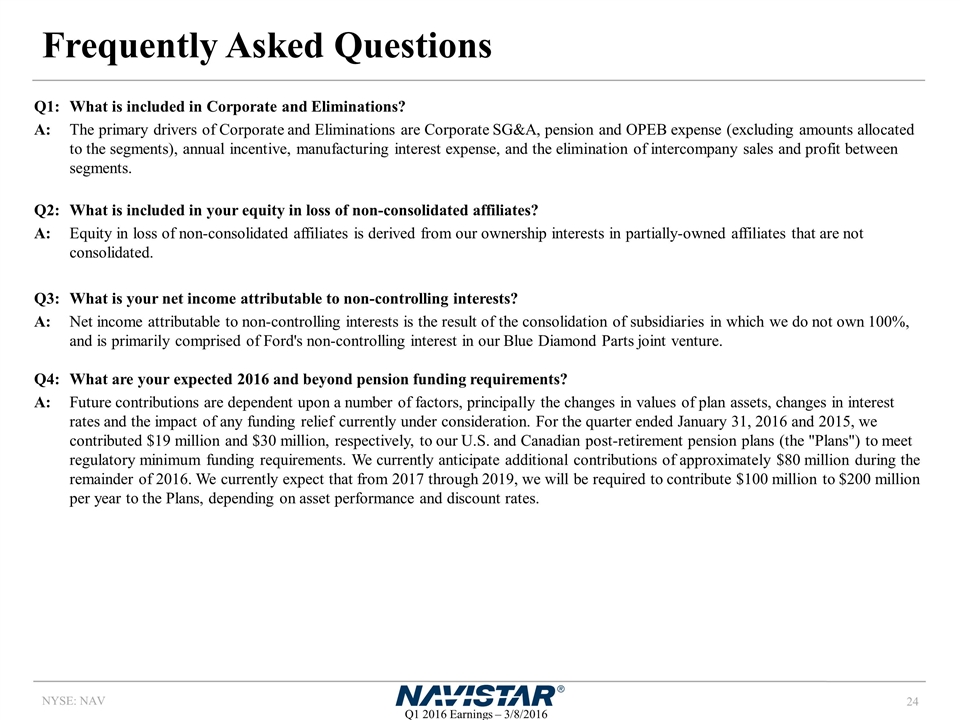

Frequently Asked Questions Q1: What is included in Corporate and Eliminations? A:The primary drivers of Corporate and Eliminations are Corporate SG&A, pension and OPEB expense (excluding amounts allocated to the segments), annual incentive, manufacturing interest expense, and the elimination of intercompany sales and profit between segments. Q2: What is included in your equity in loss of non-consolidated affiliates? A:Equity in loss of non-consolidated affiliates is derived from our ownership interests in partially-owned affiliates that are not consolidated. Q3: What is your net income attributable to non-controlling interests? A:Net income attributable to non-controlling interests is the result of the consolidation of subsidiaries in which we do not own 100%, and is primarily comprised of Ford's non-controlling interest in our Blue Diamond Parts joint venture. Q4:What are your expected 2016 and beyond pension funding requirements? A:Future contributions are dependent upon a number of factors, principally the changes in values of plan assets, changes in interest rates and the impact of any funding relief currently under consideration. For the quarter ended January 31, 2016 and 2015, we contributed $19 million and $30 million, respectively, to our U.S. and Canadian post-retirement pension plans (the "Plans") to meet regulatory minimum funding requirements. We currently anticipate additional contributions of approximately $80 million during the remainder of 2016. We currently expect that from 2017 through 2019, we will be required to contribute $100 million to $200 million per year to the Plans, depending on asset performance and discount rates.

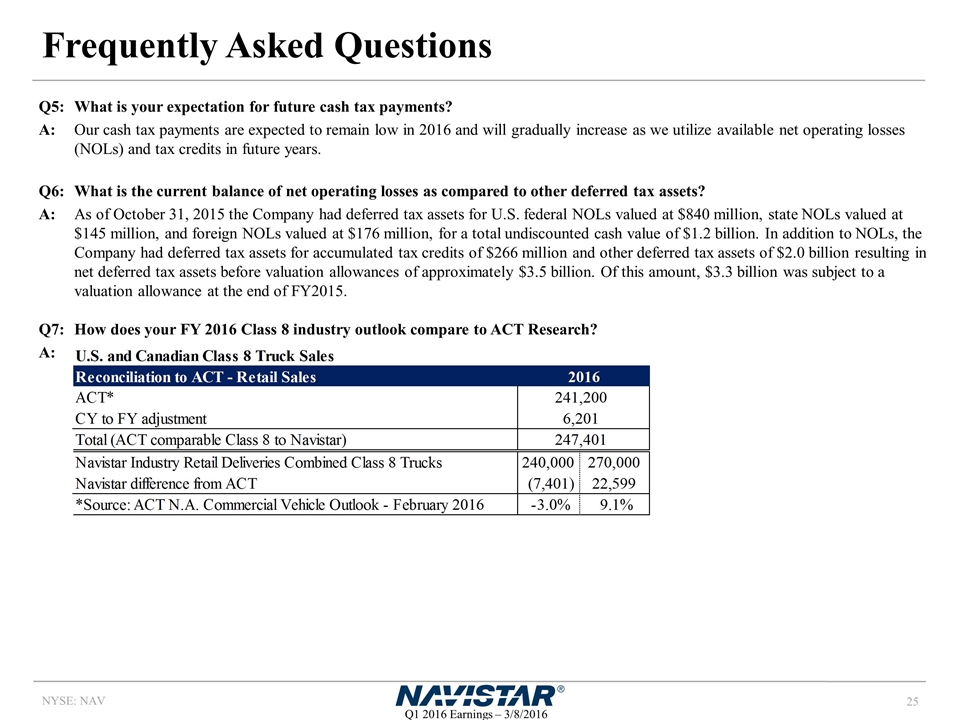

Frequently Asked Questions Q5:What is your expectation for future cash tax payments? A:Our cash tax payments are expected to remain low in 2016 and will gradually increase as we utilize available net operating losses (NOLs) and tax credits in future years. Q6:What is the current balance of net operating losses as compared to other deferred tax assets? A: As of October 31, 2015 the Company had deferred tax assets for U.S. federal NOLs valued at $840 million, state NOLs valued at $145 million, and foreign NOLs valued at $176 million, for a total undiscounted cash value of $1.2 billion. In addition to NOLs, the Company had deferred tax assets for accumulated tax credits of $266 million and other deferred tax assets of $2.0 billion resulting in net deferred tax assets before valuation allowances of approximately $3.5 billion. Of this amount, $3.3 billion was subject to a valuation allowance at the end of FY2015. Q7:How does your FY 2016 Class 8 industry outlook compare to ACT Research? A: U.S. and Canadian Class 8 Truck Sales Reconciliation to ACT - Retail Sales 2016 2016 2016 2016CY 2015CY 2014CY ACT* 241200 244500 244500 ,244,500 ,288,000 ,253,129 CY to FY adjustment 6201 9324 9324 Total (ACT comparable Class 8 to Navistar) 247401 253824 253824 Navistar Industry Retail Deliveries Combined Class 8 Trucks 240000 270000 240000 270000 240000 270000 Navistar difference from ACT -7401 22599 -13824 16176 -13824 16176 *Source: ACT N.A. Commercial Vehicle Outlook - February 2016 -0.03 9.0999999999999998 -5.4% 6.4% -5.4% 6.4%

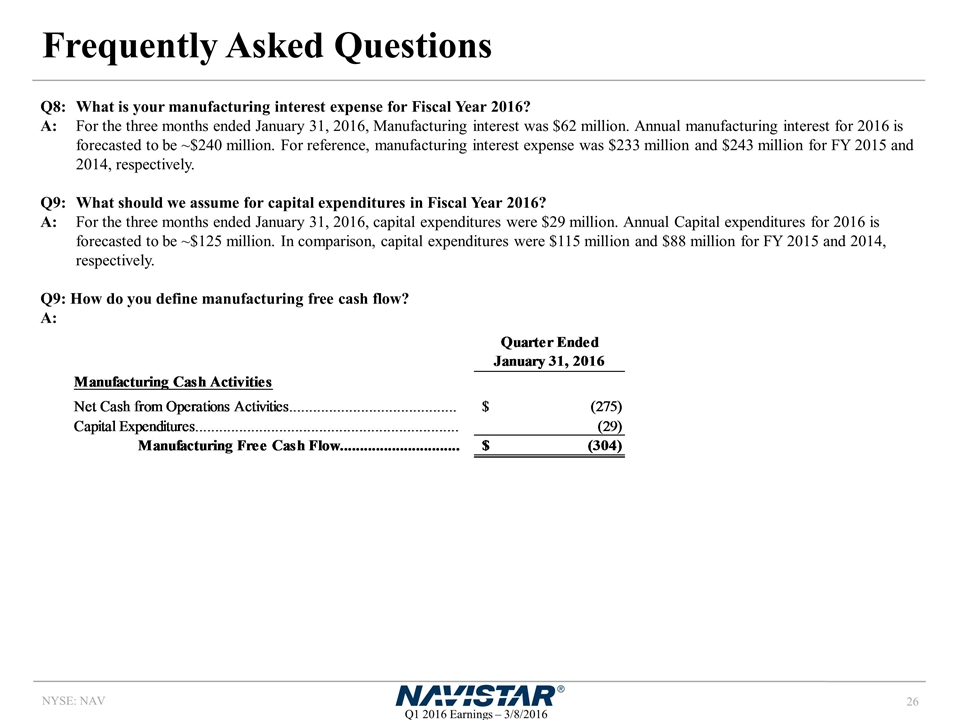

Frequently Asked Questions Q8: What is your manufacturing interest expense for Fiscal Year 2016? A: For the three months ended January 31, 2016, Manufacturing interest was $62 million. Annual manufacturing interest for 2016 is forecasted to be ~$240 million. For reference, manufacturing interest expense was $233 million and $243 million for FY 2015 and 2014, respectively. Q9:What should we assume for capital expenditures in Fiscal Year 2016? A: For the three months ended January 31, 2016, capital expenditures were $29 million. Annual Capital expenditures for 2016 is forecasted to be ~$125 million. In comparison, capital expenditures were $115 million and $88 million for FY 2015 and 2014, respectively. Q9: How do you define manufacturing free cash flow? A: Quarter Ended January 31, 2016 Manufacturing Cash Activities Net Cash from Operations Activities $-,275 Capital Expenditures -29 Manufacturing Free Cash Flow $-,304

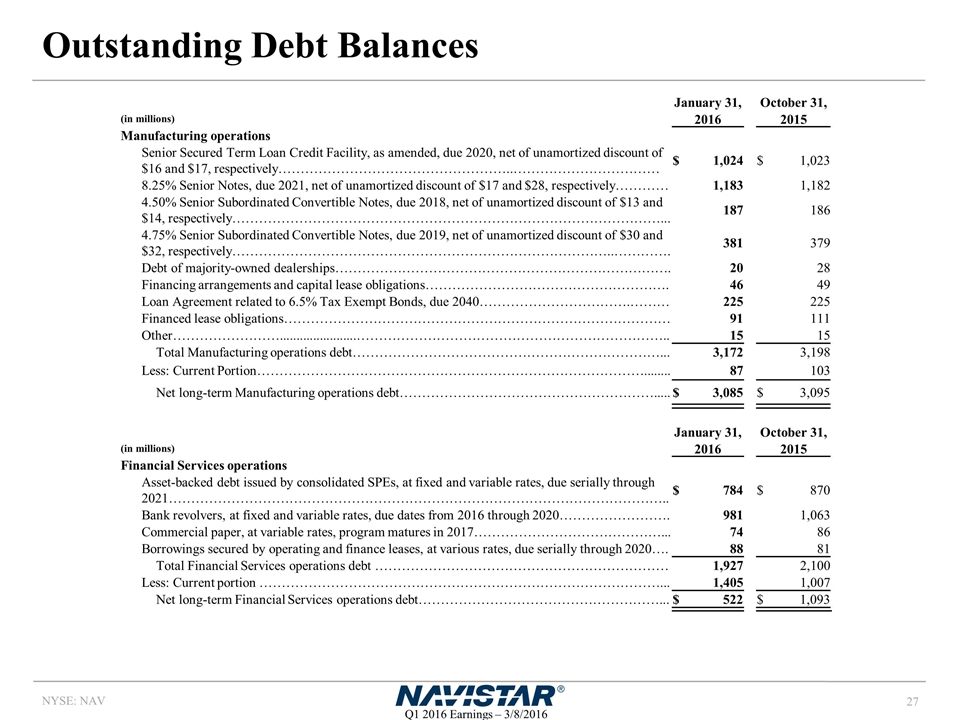

Outstanding Debt Balances January 31, October 31, (in millions) 2016 2015 Manufacturing operations Senior Secured Term Loan Credit Facility, as amended, due 2020, net of unamortized discount of $16 and $17, respectively……………………………………………..…………………………… $ 1,024 $ 1,023 8.25% Senior Notes, due 2021, net of unamortized discount of $17 and $28, respectively………… 1,183 1,182 4.50% Senior Subordinated Convertible Notes, due 2018, net of unamortized discount of $13 and $14, respectively……………………………………………………………………………………... 187 186 4.75% Senior Subordinated Convertible Notes, due 2019, net of unamortized discount of $30 and $32, respectively…………………………………………………………………………..…………. 381 379 Debt of majority-owned dealerships…………………………………………………………………. 20 28 Financing arrangements and capital lease obligations………………………………………………. 46 49 Loan Agreement related to 6.5% Tax Exempt Bonds, due 2040…………………………….……… 225 225 Financed lease obligations…………………………………………………………………………… 91 111 Other…………………….......................…………………………………………………………….. 15 15 Total Manufacturing operations debt……………………………………………………………... 3,172 3,198 Less: Current Portion……………………………………………………………………………........ 87 103 Net long-term Manufacturing operations debt…………………………………………………..... $ 3,085 $ 3,095 January 31, October 31, (in millions) 2016 2015 Financial Services operations Asset-backed debt issued by consolidated SPEs, at fixed and variable rates, due serially through 2021………………………………………………………………………………………………….. $ 784 $ 870 Bank revolvers, at fixed and variable rates, due dates from 2016 through 2020……………………. 981 1,063 Commercial paper, at variable rates, program matures in 2017……………………………………... 74 86 Borrowings secured by operating and finance leases, at various rates, due serially through 2020…. 88 81 Total Financial Services operations debt ………………………………………………………… 1,927 2,100 Less: Current portion ………………………………………………………………………………... 1,405 1,007 Net long-term Financial Services operations debt………………………………………………... $ 522 $ 1,093

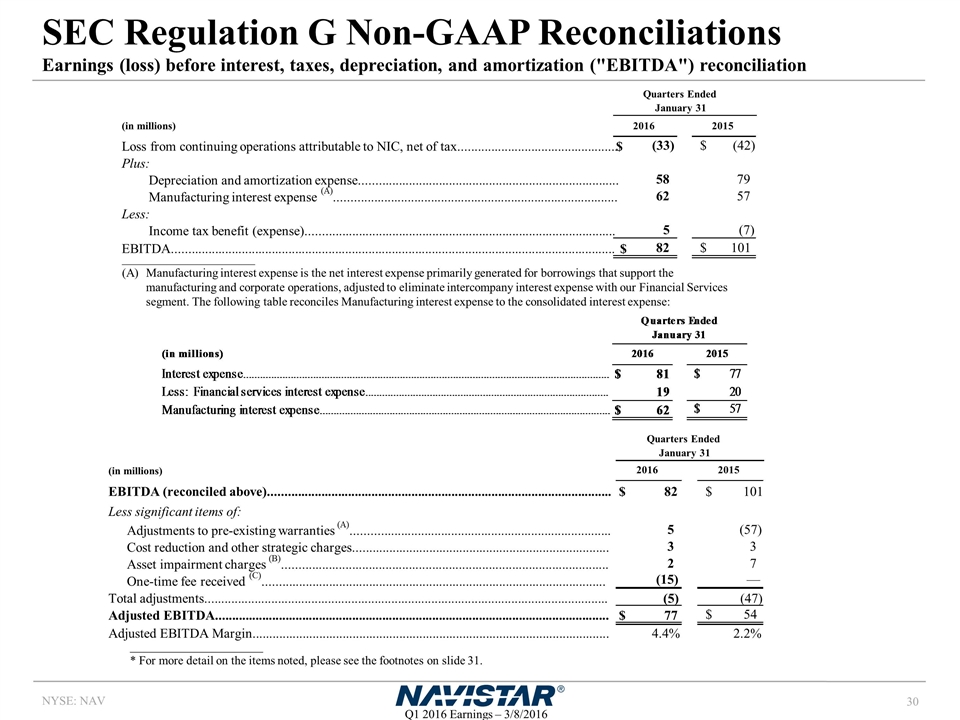

SEC Regulation G Non-GAAP Reconciliation SEC Regulation G Non-GAAP Reconciliation The financial measures presented below are unaudited and not in accordance with, or an alternative for, financial measures presented in accordance with U.S. generally accepted accounting principles ("GAAP"). The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP and are reconciled to the most appropriate GAAP number below Earnings (loss) Before Interest, Income Taxes, Depreciation, and Amortization (“EBITDA”): We define EBITDA as our consolidated net income (loss) from continuing operations attributable to Navistar International Corporation, net of tax, plus manufacturing interest expense, income taxes, and depreciation and amortization. We believe EBITDA provides meaningful information to the performance of our business and therefore we use it to supplement our GAAP reporting. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results.. Adjusted EBITDA: We believe that adjusted EBITDA, which excludes certain identified items that we do not consider to be part of our ongoing business, improves the comparability of year to year results, and is representative of our underlying performance. Management uses this information to assess and measure the performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance. Adjusted EBITDA margin: We define Adjusted EBITDA margin as a percentage of the Company's consolidated sales and revenues. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance. Manufacturing Cash, Cash Equivalents, and Marketable Securities: Manufacturing cash, cash equivalents, and marketable securities represents the Company’s consolidated cash, cash equivalents, and marketable securities excluding cash, cash equivalents, and marketable securities of our financial services operations. We include marketable securities with our cash and cash equivalents when assessing our liquidity position as our investments are highly liquid in nature. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of our ability to meet our operating requirements, capital expenditures, equity investments, and financial obligations. Structural costs consists of Selling, general and administrative expenses and Engineering and product development costs. Free Cash Flow consists of Net cash from operating activities and Capital Expenditures.

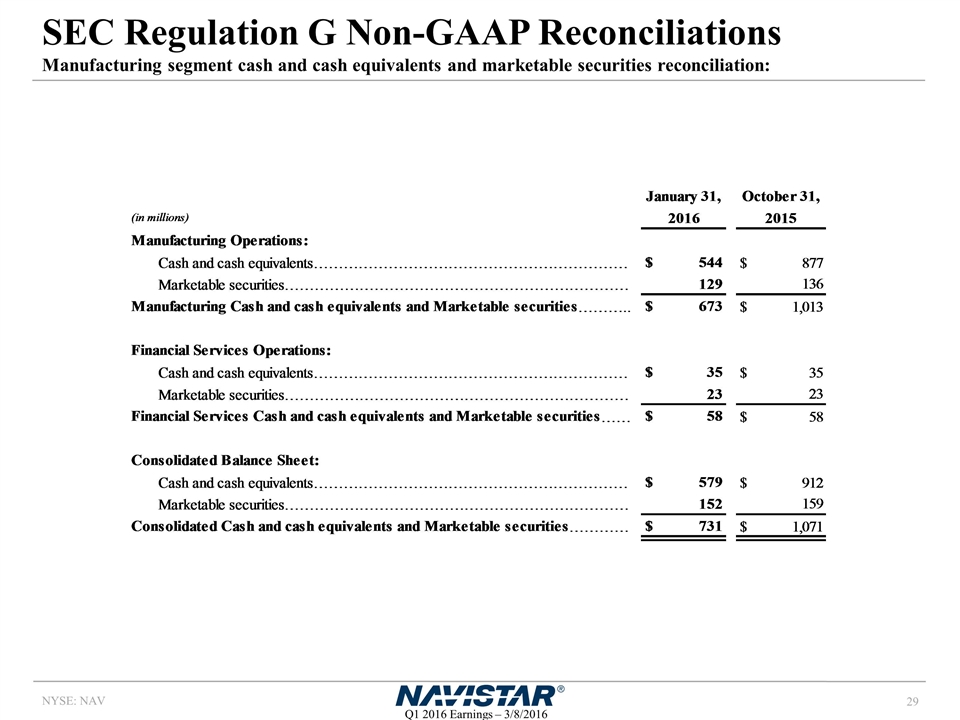

SEC Regulation G Non-GAAP Reconciliations Manufacturing segment cash and cash equivalents and marketable securities reconciliation: January 31, October 31, April 30, January 31, October 31, (in millions) 2016 2015 2015 2015 2014 Manufacturing Operations: Cash and cash equivalents……………………………………………………… $ 544 $ 877 $ 536 $ 583 $ 440 Marketable securities…………………………………………………………… 129 136 248 150 578 Manufacturing Cash and cash equivalents and Marketable securities……….. $ 673 $ 1,013 $ 784 $ 733 $ 1,018 Financial Services Operations: Cash and cash equivalents……………………………………………………… $ 35 $ 35 $ 47 $ 37 $ 57 Marketable securities…………………………………………………………… 23 23 25 25 27 Financial Services Cash and cash equivalents and Marketable securities…… $ 58 $ 58 $ 72 $ 62 $ 84 Consolidated Balance Sheet: Cash and cash equivalents……………………………………………………… $ 579 $ 912 $ 583 $ 620 $ 497 Marketable securities…………………………………………………………… 152 159 273 175 605 Consolidated Cash and cash equivalents and Marketable securities………… $ 731 $ 1,071 $ 856 $ 795 $ 1,102

SEC Regulation G Non-GAAP Reconciliations Earnings (loss) before interest, taxes, depreciation, and amortization ("EBITDA") reconciliation ______________________ (A) Manufacturing interest expense is the net interest expense primarily generated for borrowings that support the manufacturing and corporate operations, adjusted to eliminate intercompany interest expense with our Financial Services segment. The following table reconciles Manufacturing interest expense to the consolidated interest expense: ______________________ * For more detail on the items noted, please see the footnotes on slide 31. (in millions) Loss from continuing operations attributable to NIC, net of tax................................................ $ (33) $ (42) Plus: Depreciation and amortization expense.............................................................................. 58 79 Manufacturing interest expense (A)..................................................................................... 62 57 Less: Income tax benefit (expense)............................................................................................. 5 (7) EBITDA..................................................................................................................................... $ 82 $ 101 Quarters Ended January 31 2016 2015 (in millions) EBITDA (reconciled above)....................................................................................................... $ 82 $ 101 Less significant items of: Adjustments to pre-existing warranties (A).............................................................................. 5 (57) Cost reduction and other strategic charges............................................................................. 3 3 Asset impairment charges (B).................................................................................................. 2 7 One-time fee received (C)....................................................................................................... (15) — Total adjustments......................................................................................................................... (5) (47) Adjusted EBITDA...................................................................................................................... $ 77 $ 54 Adjusted EBITDA Margin........................................................................................................... 4.4% 2.2% Quarters Ended January 31 2016 2015 (in millions) 2014 Loss from continuing operations attributable to NIC, net of tax ………… $ -298 Plus: Depreciation and amortization expense ……………………………….. 99 Manufacturing interest expense(A) ………………………………….…. 57 Less: Income tax benefit (expense) …………………………………………… -23 EBITDA ………………………………………………………………………… $ $-,119 Quarters Ended January 31 (in millions) 2016 2015 2013 Interest expense $ 81 $ 77 $ 81 Less: Financial services interest expense 19 20 18 Manufacturing interest expense $ 62 $ 57 $ 63 (in millions) 2014 EBITDA (reconciled above) …......…………………………………… $-,119 Less significant items of: Adjustments to pre-existing warranties(A) ………………………...... 42 Restructuring charges(D) ………………………………...….………… 8 Asset impairment charges(C) ………...……………………………….. 151 Gain on settlement(E) ………………………………………………….. — Brazil truck business actions(F) …….....……………………………… — match below Total adjustments 201 Adjusted EBITDA …......………………………………………….....…… $82 (in millions) 2014 Expense (income): Adjustments to pre-existing warranties(A) $42 Accelerated depreciation(B) — Asset impairment charges(C) 151 Other restructuring charges and strategic initiatives(D) 8 Gain on settlement(E) — Brazil truck business actions(F) — Brazilian tax adjustments(G) 29 (A) (B) (C) (D) (E) (F) (G) The above items, except for the Brazilian tax adjustments, did not have a material impact on taxes due to the valuation allowances on our U.S. deferred tax assets, which was established in the fourth quarter of 2012.

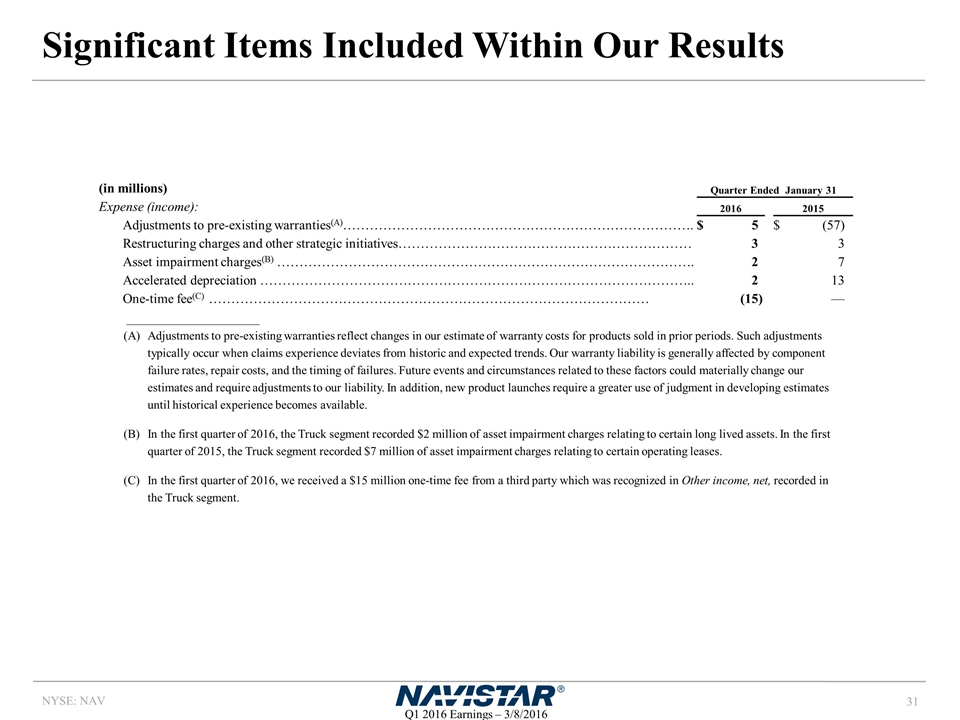

Significant Items Included Within Our Results Quarter Ended January 31 (in millions) Expense (income): 2016 2015 Adjustments to pre-existing warranties(A)……………………………………………………………………. $ 5 $ (57) Restructuring charges and other strategic initiatives………………………………………………………… 3 3 Asset impairment charges(B) …………………………………………………………………………………. 2 7 Accelerated depreciation …………………………………………………………………………………….. 2 13 One-time fee(C) ……………………………………………………………………………………… (15 ) — ______________________ Adjustments to pre-existing warranties reflect changes in our estimate of warranty costs for products sold in prior periods. Such adjustments typically occur when claims experience deviates from historic and expected trends. Our warranty liability is generally affected by component failure rates, repair costs, and the timing of failures. Future events and circumstances related to these factors could materially change our estimates and require adjustments to our liability. In addition, new product launches require a greater use of judgment in developing estimates until historical experience becomes available. In the first quarter of 2016, the Truck segment recorded $2 million of asset impairment charges relating to certain long lived assets. In the first quarter of 2015, the Truck segment recorded $7 million of asset impairment charges relating to certain operating leases. In the first quarter of 2016, we received a $15 million one-time fee from a third party which was recognized in Other income, net, recorded in the Truck segment.