Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Triumph Bancorp, Inc. | d153525dex991.htm |

| EX-2.1 - EX-2.1 - Triumph Bancorp, Inc. | d153525dex21.htm |

| 8-K - FORM 8-K - Triumph Bancorp, Inc. | d153525d8k.htm |

ACQUISITION OF COLOEAST BANKSHARES, INC. March 7, 2016 Exhibit 99.2 |

DISCLAIMER FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions,

forecasts, objectives, assumptions or future events or

performance are not historical facts and may be forward-looking. You

can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,”

“intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words

or phrases that are predictions of or indicate future events or trends

and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely

on them as predictions of future events. Forward-looking

statements depend on assumptions, data or methods that may be incorrect

or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual

results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the possibility that the expected benefits related to the

proposed transaction may not materialize as expected; the proposed transaction not being timely completed, if completed at all; prior to the completion of the proposed transaction, ColoEast

Bankshares’ business experiencing disruptions due to

transaction-related uncertainty or other factors making it more

difficult to maintain relationships with employees, customers, other business partners or governmental entities, difficulty retaining key employees, and the parties being unable to successfully implement integration strategies or to achieve expected

synergies and operating efficiencies within the expected

time-frames or at all; our limited operating history as an

integrated company; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market area; our ability to mitigate our risk exposures; our ability to maintain our historical

earnings trends; risks related to the integration of acquired businesses and any future acquisitions; changes in management personnel; interest rate risk; concentration of our factoring

services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs;

time and effort necessary to resolve nonperforming assets;

inaccuracy of the assumptions and estimates we make in establishing

reserves for probable loan losses and other estimates; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, and other intangible assets or deferred tax

assets; risks related to our asset management business; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and

non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the obligations associated with being a public company; the accuracy

of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network

security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in

federal tax law or policy; the impact of recent and future

legislative and regulatory changes, including changes in banking,

securities and tax laws and regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and their application by our regulators; governmental monetary and fiscal policies; changes in the

scope and cost of the Federal Deposit Insurance Corporation

insurance and other coverages; failure to receive regulatory approval

for future acquisitions; increases in our capital requirements; and risk retention requirements under the Dodd- Frank Act. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All

forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular

forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on

which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the

occurrence of unanticipated events or circumstances,

except as required by applicable law. For a discussion of such

risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and the forward-looking statement disclosure contained in our Annual Report on Form 10-K,

filed with the Securities and Exchange Commission on February 26, 2016. Unless otherwise referenced, all data presented is as of 12/31/2015. |

PAGE 3 TRANSACTION SUMMARY • Structure – Transaction value $69-$70 million, depending on NPA levels – 100% cash consideration – $11.9 million of TruPS to be assumed by Triumph, $19.6 million of other debt, preferred and accrued obligations to be retired at or before closing (details on p.9) • Closing conditions – Minimum $60.5 million common equity less preferred dividends – Maximum $9.3 million NPAs (nonaccrual + OREO) – ColoEast shareholder approval, customary regulatory approvals • Expected timeline – Target close Q3 2016; intent is to merge banks at close – Target core system conversion in Q4 2016 |

PAGE 4 TRANSACTION RATIONALE • Execution on our strategy – Deploys excess capital to expand community banking platform and support future commercial finance growth • Consistent with our criteria – An attractive deposit franchise for a reasonable price – Projected to be accretive to earnings, < 3.5 year recovery

of TBV dilution •

Substantial growth potential

– Attractive Colorado markets along northern and southern Front Range – Revenue synergies from implementing our operating model – Additional regional base for M&A activity • We’ve done this before – Leverages our experience integrating and managing an out-of-market community bank franchise |

PAGE 5 CONSISTENT WITH OUR CRITERIA • Meaningful size – $759 million in assets with potential for growth • Strong deposit franchise – 30 bps cost of deposits, 68% deposits trans/MMDA/savings (ex time) • Significant funding capacity – 68% loan to deposit ratio • Opportunity to capture substantial efficiencies – $2.5 million OREO expenses rolling off, $5 million projected synergies • Reasonably priced 1 – 1.30x TBV at YE 2015, 31.6x 2015 earnings – 1.40x TBV less preferred dividends 2 at YE 2015, 16.1x run rate earnings 3 – ~

26% accretive to 2017E earnings 4 ,

< 3.5 year recovery of TBV dilution

(1) Assumes consideration of $69 million based on maximum NPAs of $9.3 million at close (2) Unpaid dividends on TARP preferred of $3.8 million are not recorded on GAAP balance sheet (3) Annualized consolidated net income of $4.280 million based on $970k in Q3 2015 and $1.169 million in Q4 2015

(4) Projected accretion based on median analyst EPS estimates per SNL |

PAGE 6 OVERVIEW OF COLOEAST BANKSHARES, INC. • Based in Lamar, Colorado; 16 branches, 1 LPO in Colorado, 2 branches in western Kansas • $759 million in assets, $453 million in loans yielding 5.6% • $664 million in deposits with cost of 30 bps • $15 million (2.0% assets) in NPAs (nonaccrual + OREO), projected $9.3 million or less at close • Resumed loan growth and enhanced profitability in last 2 quarters of 2015 • Holding company’s written enforcement action with Federal Reserve terminated February 29 |

PAGE 7 OVERVIEW OF COLOEAST BANKSHARES, INC. |

PAGE 8 PRICING AND FINANCIAL IMPACT • Valuation multiples 1 – 1.30x current TBV at YE 2015 – 1.40x current TBV at YE 2015 less preferred dividends 2 – 31.6x 2015 earnings (includes $2.5 million OREO expenses rolling off) – 16.1x run rate earnings (Q3-Q4 2015 annualized) 3 • Projected earnings accretion 4 – 2016: $0.10 / share or 9.7% (cost synergies ~20% phased

in) –

2017: $0.35 / share or 26.1% (cost synergies ~95% phased in) • TBV dilution – Approximately (10.5)% with < 3.5 year earn back (crossover method) • Projected pro forma capitalization – 9% TCE / TA at close – Pro forma capital ratios to remain well capitalized (1) Assumes consideration of $69 million based on maximum NPAs of $9.3 million at close

(2) Unpaid dividends on TARP preferred of $3.8 million are not recorded on GAAP balance sheet

(3) Annualized consolidated net income of $4.280 million based on $970k in Q3 2015 and $1.169 million in Q4 2015 (4) Projected accretion based on median analyst EPS estimates per SNL |

PAGE 9 TRANSACTION ASSUMPTIONS • Holding company obligations as of 12/31/15 – Preferred (TARP): $10.5 million principal plus $3.8 million in unpaid dividends to be retired – TruPS: $11.9 million principal to be assumed, $1.1 million in accrued interest to be paid current if in deferral at closing – Subordinated debentures: $2.8 million principal to be retired, $0.4 million in accrued interest to be paid current if in deferral at closing – Senior debt: $880,000 principal plus $36,000 interest to be retired • Projected fair value marks – ~ 3% on loans + OREO (gross of ALLL) • Projected cost savings – $2.5 million OREO losses & expenses incurred in 2015 rolling off – $5.0 million additional synergies phased in over 4 quarters • Revenue synergies (loans, deposits & fees) not modeled |

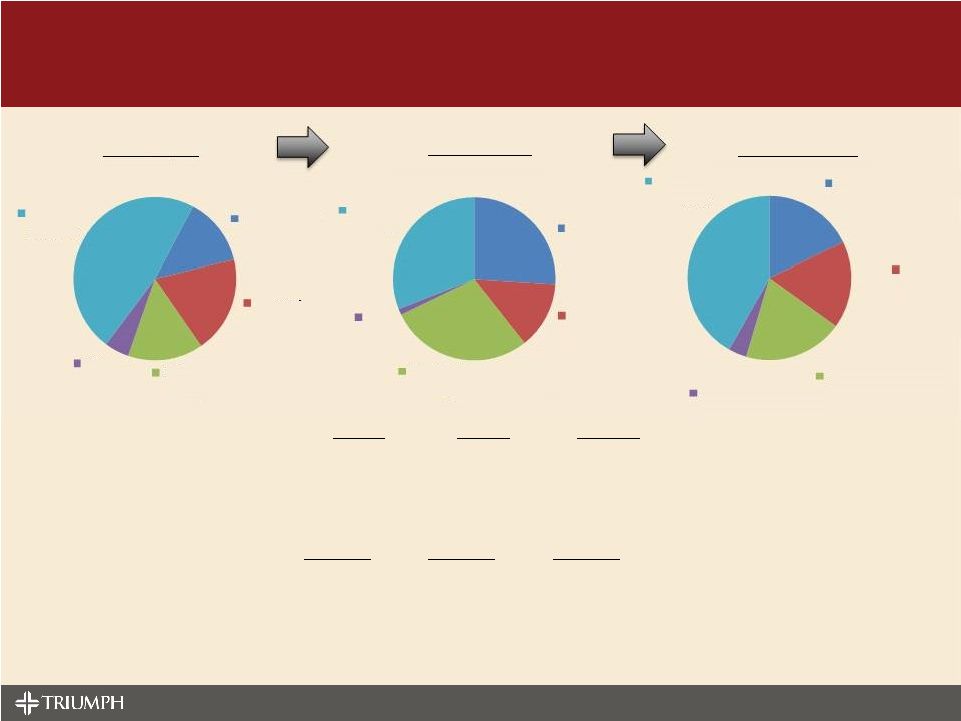

PAGE 10 PRO FORMA DEPOSIT COMPOSITION ColoEast Triumph Pro Forma Triumph ColoEast Pro Forma ($ in 000s) NIB Demand 168,264 $ 13.5% 172,705 $ 26.0% 340,969 $ 17.8% Interest Bearing Demand 238,833 19.1% 88,776 13.4% 327,609 17.1% MMDA & Savings 186,973 15.0% 188,774 28.4% 375,747 19.6% IRAs 60,971 4.9% 8,101 1.2% 69,072 3.6% Time Deposits 593,909 47.6% 205,640 31.0% 799,549 41.8% Total Deposits 1,248,950 $ 663,996 $ 1,912,946 $ Cost of Interest Bearing Deposits 0.67% 0.40% 0.58% Cost of Funds 0.64% 0.30% 0.52% NIB Demand Interest Bearing Demand MMDA & Savings IRAs Time Deposits NIB Demand Interest Bearing Demand MMDA & Savings IRAs Time Deposits NIB Demand Interest Bearing Demand MMDA & Savings IRAs Time Deposits (1) Source: SNL as of 12/31/15 |

PAGE 11 PRO FORMA LOAN COMPOSITION ColoEast Triumph Pro Forma Triumph ColoEast Pro Forma ($ in 000s) Factoring 215,088 $ 16.6% - $

0.0% 215,088 $ 12.3% RE Constr & Land Dev 43,876 3.4% 66,913 14.8% 110,789 6.3% RE Farmland 33,573 2.6% 103,008 22.7% 136,581 7.8% RE 1-4 Family 78,244 6.1% 37,324 8.2% 115,568 6.6% RE Comm'l Real Estate 291,819 22.6% 92,225 20.3% 384,044 22.0% Comm'l & Industrial 495,356 38.3% 145,318 32.1% 640,674 36.7% Consumer 13,050 1.0% 6,824 1.5% 19,874 1.1% Other Loans & Leases 120,879 9.4% 1,676 0.4% 122,555 7.0% Total Loans & Leases 1,291,885 $ 453,288 $ 1,745,173 $ Loan Yield 8.62% 5.55% 7.75% Net Interest Margin 6.49% 3.71% 5.58% RE Constr & Land Dev RE Farmland RE 1-4 Family RE Comm'l Real Estate Comm'l & Industrial Consumer Other Loans & Leases Commercial Finance 520,985 40% Community Banking 770,900 60% Commercial Finance 520,985 30% Community Banking 1,224,188 70% (1) Source: SNL as of 12/31/15 |