Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - COMSovereign Holding Corp. | f10k2015ex32i_drone.htm |

| EX-31.1 - CERTIFICATION - COMSovereign Holding Corp. | f10k2015ex31i_drone.htm |

| EX-31.2 - CERTIFICATION - COMSovereign Holding Corp. | f10k2015ex31ii_drone.htm |

| EX-21 - LIST OF SUBSIDIARIES FILED AS AN EXHIBIT TO THIS ANNUAL REPORT ON FORM 10-K - COMSovereign Holding Corp. | f10k2015ex21_drone.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

Commission File No. 333-150332

DRONE AVIATION HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 46-5538504 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

11651 Central Parkway #118 Jacksonville FL |

32224 | |

| (Address of principal executive office) | (Zip Code) |

(904) 834-4400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Note: The Company is a voluntary filer but has filed all reports it would have been required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months if it was a mandatory filer.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2015, based on the closing sales price of the Common Stock as quoted on the OTCQX was $18,981.074.

As of March 4, 2016, there were 5,461,553 shares of registrant’s common stock outstanding.

TABLE OF CONTENTS

| PAGE | ||

| PART I | ||

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 6 |

| Item 1B. | Unresolved Staff Comments | 11 |

| Item 2. | Properties | 11 |

| Item 3. | Legal Proceedings | 11 |

| Item 4. | Mine Safety Disclosures | 11 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 12 |

| Item 6. | Selected Financial Data | 12 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 16 |

| Item 8. | Financial Statements and Supplementary Data | 16 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 16 |

| Item 9A. | Controls and Procedures | 16 |

| Item 9B. | Other Information | 17 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 18 |

| Item 11. | Executive Compensation | 21 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 25 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 26 |

| Item 14. | Principal Accounting Fees and Services | 26 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 27 |

| Signatures | 31 |

Cautionary Note Regarding Forward Looking Statements

This Annual Report on Form 10-K (the “Annual Report”) contains ‘‘forward-looking statements’’ that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are ‘‘forward-looking statements’’, including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as ‘‘may’’, ‘‘will’’, ‘‘should’’, ‘‘could’’, ‘‘would’’, ‘‘predicts’’, ‘‘potential’’, ‘‘continue’’, ‘‘expects’’, ‘‘anticipates’’, ‘‘future’’, ‘‘intends’’, ‘‘plans’’, ‘‘believes’’, ‘‘estimates’’ and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business. Furthermore, industry forecasts are likely to be inaccurate, especially over long periods of time. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation:

| ● | competition in the market for tethered drone based products; | |

| ● | our ability to develop brand awareness and industry reputation; | |

| ● | our ability to adapt to rapid evolution in technology and industry standards; | |

| ● | our ability to attract and retain management and skilled personnel; | |

| ● | our growth and marketing strategies; | |

| ● | anticipated trends in our business; | |

| ● | our future results of operations; | |

| ● | our lack of profitable operations in recent periods; | |

| ● | market conditions in the tethered drone industry; | |

| ● | the impact of government regulation; | |

| ● | emerging viable and sustainable markets for tethered drone products; | |

| ● | significant errors or security flaws in our products and services; | |

| ● | insufficient protection for our intellectual property; | |

| ● | Our ability to enforce our intellectual property; | |

| ● | claims of infringement on third party intellectual property; | |

| ● | pricing pressures in the tethered drone market; | |

| ● | our financial position, business strategy and other plans and objectives for future operations; | |

| ● | economic conditions in the U.S. and worldwide; and | |

| ● | the ability of our management team to execute its plans to meet its goals |

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings ‘‘Risk factors’’, ‘‘Management’s discussion and analysis of financial condition and results of operations’’, ‘‘Business’’ and elsewhere in this report.

PART I

Item 1. Business

Organization

We are a Nevada corporation formed on April 17, 2014, as a wholly-owned subsidiary of MacroSolve, Inc., an Oklahoma corporation (“MacroSolve”). Effective April 30, 2014, MacroSolve merged with and into our Company, with our Company as the surviving entity, for purposes of moving our state of incorporation from Oklahoma to Nevada (the “Redomestication”). Any references to “Drone Aviation,” “we,” “us,” “DAC”, or the “Company” or any similar references relating to periods before the Redomestication shall be construed as references to MacroSolve, being the previous parent company of Drone Aviation.

Upon consummation of a share exchange with Drone Aviation Corp. (“Drone”) on June 3, 2014 (the “Share Exchange”), Drone became our wholly-owned subsidiary and we began a new line of business in the tethered drone space. On March 26, 2015, we filed a Plan of Merger in the State of Nevada, pursuant to which Drone was merged into our Company which is the surviving corporation.

Our principal executive offices are located at 11651 Central Parkway #118, Jacksonville, FL 32224 and our phone number is (904) 834-4400.

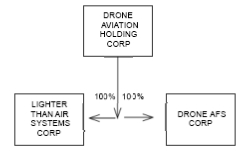

Corporate Structure

Our current corporate structure is set forth below:

Business Overview

We are focused on the business of the design, development, marketing and sale of lighter-than air (“LTA”) advanced aersostats, tethered drones, and land-based intelligence, surveillance and reconnaissance (“ISR”) solutions. We, through our wholly owned subsidiary, Lighter Than Air Systems Corp. (“LTAS”), which was acquired on June 3, 2014 upon consummation of a Share Exchange with Drone Aviation Corp., a wholly-owned subsidiary which was merged into Drone Aviation on March 26, 2015, are focused on the development of tethered aerostats known as the Winch Aerostat Small Platform (“WASP”) as well as certain other tethered drone products including the WATT electric tethered drone launched on March 2, 2015. The WATT is our first model of a new line of commercial-grade electric tethered drones designed to provide secure and reliable aerial monitoring for extended durations while being tethered to the ground via a high strength armored tether.

Products

We, through our wholly owned subsidiary, LTAS, are focused on the development of tethered aerostats known as the WASP and certain other tethered drone based products, including the recently announced WATT tethered drone. The tethered aerostat system is a lighter-than-air, compact aerostat platform either self-contained on a trailer that can be towed by a Military All-Terrain Vehicle, or MATV, or Mine Resistant Ambush Protected, or MRAP, or other standard vehicle, or it can operate from the bed of a pickup truck. It is designed to provide semi-persistent, mobile, real-time day/night high definition footage for intelligence, surveillance and reconnaissance (“ISR”), detection of improvised explosive devices (“IEDs”), border security and other governmental and civilian uses. The WASP is a mobile, tactical-sized aerostat capable of carrying a variety of payloads in support of military operations. All of our products can also be utilized for disaster response missions, by supporting two-way and cellular communications, and act as a repeater or provide wireless networking.

| 1 |

The aerostat systems have a tethered envelope filled with helium gas, either a stabilized ISR payload or communications payload, portable ground control station and a datalink between the ground station and the envelope. Hovering at up to 2,000 ft. above the ground, the systems provide surveillance and communications capabilities with relatively low acquisition and maintenance costs. The systems require an operational crew of a minimum of two personnel, relatively simple maintenance procedures and a quick retrieval and helium top-off for re-inflation.

The WASP is a mobile, tactical-sized aerostat capable of carrying a variety of payloads in support of military operations helping troops in the field have a tactical edge while communicating over greater distances. The WASP leverages aerostat technology to elevate network payloads to an advantaged height to enable persistent network connectivity while reducing risk to units conducting missions.

In 2014, BAE systems procured two WASP systems which were delivered to the U.S. Space and Missile Defense Command (“SMDC”). The WASP Systems provided to the SMDC/Army Forces Strategic Command participated in the U.S. Army's Network Integration Evaluation (“NIE”) 14.1 where they were a “System Under Evaluation,” meaning that they were used to test other new systems. The two WASPs returned to NIE 14.2 which took place at Fort Bliss, TX and White Sands Missile Range, NM during April and May 2014, as a “Baseline System” following their successful mission at NIE 14.1. The NIE 14.2 exercises were intended to evaluate joint force network capabilities; improve unified land operations with communications nodes based on aircraft and unmanned aerial vehicles (UAVs); integrate networking technologies into the armored brigade combat team; develop ways to deliver, collect and process integrated, multi-source intelligence to front-line warfighters; and make field command posts more mobile and efficient. The NIE 14.2 exercises also involved beyond-line-of-sight communications; expeditionary signal brigade tropospheric scatter communications; network intrusion prevention; cellular communications; electromagnetic spectrum operation; condition based maintenance; and operational energy solutions.

In 2015, the U.S. Army-owned WASP tactical aerostats also successfully completed the DoD Enterprise Challenge 2015 (“EC15”), a program created to explore how various technologies could collect, send and retrieve data from the field through a secure, interconnected network of multiple agencies, partners and organizations, providing access to real-time data and video. During EC15, the WASP systems were used to capture and relay real-time, high definition video to various handheld devices, tablet computers and other deployed systems. In September 2015, the WASP systems also took part in the latest Army NIE exercise, NIE 16.1 which focused on new technologies assessments including coalition network capabilities, expeditionary command posts, operational energy capabilities, and manned/unmanned teaming (air and ground robotics). As a result of its performance, DAC will continue to support the U.S. Army-owned WASP systems for future exercises scheduled for 2016.

On March 2, 2015 we announced that we had officially launched WATT, our first model of a new line of commercial-grade electric tethered drones designed to provide secure and reliable aerial monitoring for extended durations while being tethered to the ground via a high strength armored tether. Our tethered electric drone product line consists of electrically powered drones connected to a ground-based software controlled winch via a safe and secure armored tether line. The concept of the tethered drone system is built on the strength of our years of developing tethered solutions for our aerostat products and combining that with the advantages of multi-rotor copters. The end result is a robust capability designed to be used in almost all weather environments and controlled with the push of a button. The initial tethered drone known as the WATT is being designed to take off, hover and land via remote control while being connected by a unique tether technology where all data, controls and endurance are built into the tether. The same components and systems that our military customers rely on in our launcher systems are being incorporated into the self-contained copter system in order to produce a heavier-than-air, tethered product offering. The WATT is a complete turnkey system that can be launched within minutes of unpacking from a standard case stored in a host vehicle. Once launched, WATT is designed to hover in a stationary position directly above its launch site at one of several preset altitudes of up to 300 ft. for up to 8 hours where a highly stabilized military-grade/broadcast quality HD video imager can provide a 360° live aerial monitoring feed directly through the tether to its host vehicle or to a network of mobile devices such as tablets or laptop computers. Compact and lightweight, the WATT system features the ability to draw power from both its host vehicle or independently provide up to 8 hours of operation through its own ground power equipment that is specially designed to be transported and deployed from commercial vehicles such as TV production trucks, first responder vehicles or even common agriculture/infrastructure equipment thanks to its standard 120v adapter.

Market

The market for our LTAS and tethered drones has grown significantly over the last several years following the recent proposed guidelines by the FAA for commercial drone use for which our tethered drone product line is designed to comply. The military has transformed into a smaller, more agile fighting force in need of a network of technologies to provide improved observation, communication and precision targeting of combat troop locations, which are often embedded in dense population centers or dispersed in remote locations. Our products are intended to provide critical observation and communication capabilities serving the increased demand for ISR and communications, including real-time tactical reconnaissance, tracking, combat assessment and geographic data, while reducing the risks to our troops in theatre. Finally, in a highly constrained fiscal environment, we believe the typically lower acquisition and use/maintenance costs of LTA aerostats and tethered drones make them more appealing when compared to their heavier than air manned or larger LTA unmanned system alternatives.

| 2 |

The markets for our systems on a stand-alone basis and/or combined with other payloads relates to the following applications, among others:

Governmental Markets:

| ● | International, Federal, state and local governments as well as U.S. and foreign government agencies, including U.S. Department of Defense (DoD), U.S. Drug Enforcement Agency (DEA), U.S. Homeland Security, Customs and Border Patrol, Environmental Protection Agency (EPA), U.S. Department of State, Federal Emergency Management Agency (FEMA), U.S. and state Departments of Transportation, Penitentiaries, and Police forces; | |

| ● | Military, including U.S. Army Space and Missile Defense Agency (SMDC) and U.S. Air Force installations; | |

| ● | Intelligence, reconnaissance and surveillance (ISR), including Joint Improvised Explosive Device Defeat Organization (JIEDDO); | |

| ● | Border security monitoring, including U.S. Homeland Security, to deter and detect illegal entry; | |

| ● | Drug enforcement along U.S. borders; | |

| ● | Monitoring environmental pollution and sampling air emissions; and | |

| ● | Vehicle Traffic monitoring, including aerial speed enforcement by state and local law enforcement agencies. |

Commercial Markets:

| ● | TV and Media Production Mobile communications systems, expanding on-site reporting capabilities to include aerial videography and photography; | |

| ● | Agriculture monitoring, including monitoring crop health, field monitoring to reduce costs and increase yields; | |

| ● | Security for large events, including crowd management; | |

| ● | Natural disaster instant infrastructure to support first responders; | |

| ● | Oil pipeline monitoring and exploration; and | |

| ● | Atmospheric and climate research. |

Distribution

We sell our products directly to end customers. In addition, our products are included in the GSA Schedule, which allows government customers to directly negotiate and acquire products and services from commercially-listed suppliers.

Competition

We believe that the principal competitive factors in the markets for the LTAS aerostat systems include product performance, features, acquisition cost, lifetime operating cost, including maintenance and support, ease of use, integration with existing equipment, size, mobility, quality, reliability, customer support, brand and reputation.

We believe the current market competitors to the WASP aerostat systems include a large number of not only small “mom and pop” tethered aerostat and balloon companies but large defense contractors, among them: TCOM, Raytheon, Lockheed Martin, ISL, ILC Dover, Compass Systems, Raven Aerostar and American Blimp Corporation. We believe there are numerous "hobbycraft" drone companies such as DJI and Parrot offering hobby grade free flying drones for pleasure use, as well as many larger drone manufactures such as Northrup Grumman and Boeing, offering military grade free flying drones to the U.S. Government. There are very few commercial grade tethered drone competitors for our tethered drone systems which remain tethered to the ground via a high strength armored tether, but among them are Elistair located in Lyon, France and Cyphy Works Inc. located in Danvers, MA.

Many of our LTA competitors have received considerable funding from government or government-related sources to develop and build LTA aerostats. Most of these organizations and many of our other competitors have greater financial, technical, manufacturing, marketing and sales resources and capabilities than we do. We anticipate increasing competition as a result of defense industry consolidation, which has enabled companies to enhance their competitive position and ability to compete against us. In addition, other companies may introduce competing aerostats or solutions based on alternative technologies that may adversely affect our competitive position. As a result, our products may become less or non-competitive or obsolete.

Technology, Research and Development

We conduct the development, commercialization and construction of the WATT tethered drone and WASP aerostat systems in-house.

| 3 |

Our research and development efforts are largely focused on the tethered drone systems and aerostat systems. We have developed a “non-military spec” aerostat system for use in more commercial or governmental applications that does not require the level of durability and ruggedness of the current militarized model and we continue to work on different models with different payloads for various applications.

The concept of the WATT system is built on the strength of our years of developing tethered solutions for our aerostat products combined with the advantages of rotor copters. The end result is a robust capability that is designed to be utilized in almost all weather environments and controlled with the push of a button. The DAC tethered drone is designed to take off, hover and land via remote control all while being connected by a unique tether technology where all data, controls and endurance are built into the tether. The same components and systems that our military customers rely on from our launcher systems are incorporated into the self-contained DAC tethered drone system in order to produce a unique heavier than air, tethered product offering.

For the year ended December 31, 2015, we spent $744,452, and for the year ended December 31, 2014, we spent $142,011 on research and development activities.

Partners

We are party to several agreements with partners and distributors to assist us with the marketing and sales of various products, as we currently have limited in-house sales capabilities. Current relationships include:

| ● | A sales and distribution partnership with U.S. government prime contractor ADS Inc. | |

| ● | Signed in March 2015, a 3 year sales, marketing and integration partnership with L3 for a “L3-Branded” WASP targeting prime contract customers. |

Intellectual Property

We review each of our intellectual properties and make a determination as to the best means to protect such property, by trademark, by copyright, by patent, by trade secret, or otherwise. We believe that we have taken appropriate steps to protect our intellectual properties, based on our evaluation of the factors unique to each such property, but cannot guarantee that this is the case. The United States Patent and Trademark Office issued U.S. Patent No. 7,822,816 to MacroSolve. The patent covers certain mobile information collection systems across all wireless networks, smart phones, tablets, and rugged mobile devices, regardless of carrier and manufacturer. In September 2011, MacroSolve filed a continuation of U.S. Patent No. 7,822,816 which is assigned number 12/910,706. On March 7, 2014, the United States Patent and Trademark Office (“USPTO”) sent MacroSolve an office action related to an ex parte reexamination of the ‘816 patent which rejected all the claims in the patent. As a result of the office action, the ‘816 patent was deemed unlikely to produce future revenues.

On September 18 and 19, 2014, we filed provisional patent application numbers “62/052,289” and “62/052,946” entitled “Tethered Portable Aerial Media broadcast System” based on the tethered drone system. On September 18, 2015, we filed a utility patent application claiming a priority date of the two provisional patent applications and having application Serial Number “14858467” entitled “Apparatus and Methods for Tethered Aerial Platform and System”. On July 7, 2015 we filed a provisional patent application number “62/189,341” entitled “Apparatus, Methods and System for Tethered Aerial Platform”. Our success and ability to compete depends in part on our ability to develop and maintain our intellectual property and proprietary technology and to operate without infringing on the proprietary rights of others. As we continue the development of the tethered drone and aerostat systems, we expect that we will rely on patents, trade secrets, copyrights, trademarks, non-disclosure agreements and other contractual provisions. We have also registered the trademark Blimp in a Box. In certain cases, when appropriate, we opt to protect our intellectual property through trade secrets as opposed to filing for patent protection in order to preserve confidentiality. All of our employees are subject to non-disclosure agreements and other contractual provisions to establish and maintain our proprietary rights.

Dependence on a Few Customers and Regulatory Matters

We believe there is a large, growing market for our commercial tethered drones internationally as well as in the U.S. With the recent proposed guidelines for commercial drone use in the U.S. by the FAA, we anticipate a growing U.S. market for commercial drone applications that our tethered drones can serve. Until the FAA officially adopts and publishes these guidelines, we are restricted to operating our tethered drones in the National Air Space (NAS) under either FAA granted exemptions or Certificate of Authorizations. We are currently engaged with commercial and research organizations in order to determine how our tethered drones can be operated under FAA exemptions or COA's until the FAA formally adopts a policy for commercial drone use in the NAS. We are currently evaluating various international markets where the FAA does not control the airspace where our tethered drones can potentially be operated by potential customers. We anticipate that the majority of our LTA based revenue at least in the foreseeable future will come from U.S. government and government-related entities, including both the DoD and other departments and agencies. Government programs that we may seek to participate in must compete with other programs for consideration during Congress’s budget and appropriations hearings, and may be affected by changes not only in political power and appointments but also general economic conditions and other factors beyond our control. Reductions, extensions or terminations in a program that we are seeking to participate in or overall defense spending could adversely affect our ability to generate revenues and realize any profits. We cannot predict whether potential changes in security, defense and intelligence priorities will afford opportunities for our business in terms of research and development or product contracts, but any reduction in government spending on such programs could negatively impact our ability to generate revenues.

We have registered as a contractor with the U.S. Government and are required to comply with and will be affected by laws and regulations relating to the award, administration and performance of U.S. contracts. Government contract laws and regulations affect how we will do business with customers, and in some instances, will impose added costs on our business. A violation of specific laws and regulations could result in the imposition of fines and penalties, the termination of any then existing contracts or the inability to bid on future contracts.

| 4 |

Since our LTA systems are tethered to the ground they are required to comply with regulations enforced by the FAA, which currently does not allow any commercial untethered flights by free flying drones in commercial airspace in the U.S. without prior FAA clearance certifications or an FAA Certificate of Waiver or Authorization (COA) that are difficult and time-consuming to obtain.

International sales of our products may also be subject to U.S. laws, regulations and policies like the United States Department of State restrictions on the transfer of technology, International Traffic in Arms Regulations (ITAR) and other export laws and regulations and may be subject to first obtaining licenses, clearances or authorizations from various regulatory entities. This may limit our ability to sell our products abroad and the failure to comply with any of these regulations could adversely affect our ability to conduct business and generate revenues as well as increase our operating costs. Our products may also be subject to regulation by the National Telecommunications and Information Administration and the Federal Communications Commission, which regulate wireless communications.

Sources and Availability of Components

Certain materials and equipment for our products are custom made for those products and are available only from either a single or limited number of suppliers. Failure of a supplier could cause delays in delivery of the products if another supplier cannot promptly be found or if the quality of such replacement supplier’s components is inferior or unacceptable.

Employees

We have four full-time employees and two part-time consultants that comprise our executive management and accounting team. LTAS has five full-time and fourteen part-time employees. We have no labor union contracts and believe relations with our employees are satisfactory.

Recent Developments

| ☐ | On February 2, 2016, we announced a follow-up order from the United States Environmental Protection Agency (EPA) for an aerostat and related airborne equipment and operator training. |

| ☐ | On January 25, 2015, we announced a partnership for sales, operating, training and support of the WATT-200 tethered drone with Measure UAS, Inc. Measure has been granted a 333 exemption by the Federal Aviation Administration (FAA) to operate the WATT-200 for their Drone as a Service operations. |

| ☐ | On January 11, 2016 we announced a joint sales partnership with Skyfire Consulting, a drone services and consulting company serving first responders nationwide. The companies presented the WATT line of tethered drones at the annual Fire-Rescue East 2016 Conference in Daytona Beach, Florida in January 2016. |

| ☐ | On January 6, 2016 our common stock commenced trading on the OTCQX Market. |

| ☐ | On July 20, 2015, we closed an asset purchase agreement for the purchase of substantially all the assets of Adaptive Flight, Inc., (“AFI”). The Asset Purchase Agreement was entered into by and among the Company, AFI, the shareholders of AFI, and Drone AFS Corp., a Nevada corporation formed by the Company for the purpose of effecting the asset purchase. AFI was in the business of designing and developing flight control systems for unmanned aerial vehicles. Among the assets we acquired are commercial software licenses for the “GUST” (Georgia Tech UAV Simulation Tool) autopilot system, and other transferable licenses which include flight simulation and fault tolerant flight control algorithms. |

| ☐ | In July, 2015, the U.S. Army-owned WASP tactical aerostats successfully completed the DoD Enterprise Challenge 2015 (“EC15”) providing real-time situational awareness to participating ground forces and personnel. As a result of its performance, DAC will continue to support the U.S. Army-owned WASP systems for future exercises scheduled for 2016. The Enterprise Challenge program was created to explore how various technologies could collect, send and retrieve data from the field through a secure, interconnected network of multiple agencies, partners and organizations, providing access to real-time data and video. The WASP systems were used to capture and relay real-time, high definition video to various handheld devices, tablet computers and other deployed systems. |

| ☐ | We provided two WASP systems and six aerostats in 2013 to BAE Systems to support the U.S. Army Space and Missile Defense Command (SMDC). We delivered self-contained, compact, trailer-mounted aerostat launcher system and aerostats, which are undergoing testing and evaluation for various mission profiles to support and enhance critical communications for the Army. In 2015 we were contracted for parts and services related to enhancing and supporting these two WASP systems owned and operated by the SMDC. The upgrades and services were designed to expand the payload weight capability of the WASP systems in order to integrate specialized wireless electronics, advanced optics and a communication package provided by L-3 Communications Systems-West. In June 2015, we formed a working group with L-3 CS-West to form a technical integration plan of their technology into the WASP and jointly market the integrated solutions. The group will focus on upgrading the WASP system through the integration of electro-optical and infrared (EO/IR) imaging tactical surveillance system coupled to an L-3 CS-West communications package, which will provide secure high-definition video imagery to ground-based devices such as L-3’s Remote Operations Video Enhanced Receiver (ROVER). |

| ☐ | In August 2015, we provided the Unites States Environmental Protection Agency (EPA) with customized winch systems and related equipment for use at the Agency’s National Risk Management Research Laboratory (NRMRL) as part of the EQA’s on-going emission sampling program utilizing tethered aerostats. |

| ☐ | In October 2015, we provided two customized WASP systems to specialized defense contractor Troll Systems, jointly working with Troll to integrate the L-3 Wescam MX-10 advanced optical sensor system into the WASP platform for an international customer. |

| 5 |

Item 1A. Risk Factors

Investors should carefully consider the risks described below as well as other information provided in this document, including information in the section of this document entitled “Information Regarding Forward Looking Statements.” The Company’s business, financial condition or results of operations could be materially adversely affected, the value of the Company’s common stock could decline and investors may lose all or part of their investment as a result of these risks.

Risks Related to Our Business and Industry

Product development is a long, expensive and uncertain process.

The development of LTAS aerostats and tethered drones ISR systems is a costly, complex and time-consuming process, and the investment in product development often involves a long wait until a return, if any, is achieved on such investment. We continue to make significant investments in research and development relating to our aerostats ISR systems, and tethered powered drones. Investments in new technology and processes are inherently speculative. Technical obstacles and challenges we encounter in our research and development process may result in delays in or abandonment of product commercialization, may substantially increase the costs of development, and may negatively affect our results of operations.

Successful technical development of our products does not guarantee successful commercialization.

Even if we successfully complete the technical development for one or all of our product development programs, we may still fail to develop a commercially successful product for a number of reasons, including among others the following:

| ● | failure to obtain the required regulatory approvals for their use; | |

| ● | prohibitive production costs; | |

| ● | competing products; | |

| ● | lack of innovation of the product; | |

| ● | ineffective distribution and marketing; | |

| ● | lack of sufficient cooperation from our partners; and | |

| ● | demonstrations of the products not aligning with or meeting customer needs. |

Although we have sold our WASP aerostat systems and various other aerostat ISR systems and components, our success in the market for the products we develop will depend largely on our ability to prove our products’ capabilities. Upon demonstration, our aerostats, tethered drones ISR systems may not have the capabilities they were designed to have or that we believed they would have. Furthermore, even if we do successfully demonstrate our products’ capabilities, potential customers may be more comfortable doing business with a larger, more established, more proven company than us. Moreover, competing products may prevent us from gaining wide market acceptance of our products. We may not achieve significant revenue from new product investments for a number of years, if at all.

Our potential customers are likely to be government or government-related entities that are subject to appropriations by Congress and reduced funding for defense procurement and research and development programs would likely adversely impact our ability to generate revenues.

We anticipate that the majority of our revenue (for our aerostats and tethered drone sales) at least in the foreseeable future will come from U.S. government and government-related entities, including both the Department of Defense (“DoD”) and other departments and agencies. Government programs that we may seek to participate in and contracts for aerostats or tethered drones must compete with other programs for consideration during Congress’ budget and appropriations hearings, and may be affected by changes not only in political power and appointments but also general economic conditions and other factors beyond our control. Reductions, extensions or terminations in a program that we are seeking to participate in or overall defense or other spending could adversely affect our ability to generate revenues and realize any profits. We cannot predict whether potential changes in security, defense, communications and intelligence priorities will afford opportunities for our business in terms of research and development or product contracts, but any reduction in government spending on such programs could negatively impact our ability to generate revenues.

Some of our products may be subject to governmental regulations pertaining to exportation.

International sales of our products may be subject to U.S. laws, regulations and policies like the International Traffic in Arms Regulations (ITAR) and other export laws and regulations and may be subject to first obtaining licenses, clearances or authorizations from various regulatory entities. If we are not allowed to export our products or the clearance process is burdensome, our ability to generate revenue would be adversely affected. The failure to comply with any of these regulations could adversely affect our ability to conduct our business and generate revenues as well as increasing our operating costs.

| 6 |

We compete with companies that have significantly more resources than we have and already have received government contracts for the development of aerostats and tethered drones.

A number of our competitors have received considerable funding from government or government-related sources to develop various aerostats and tethered drones. Most of these organizations and many of our other competitors have greater financial, technical, manufacturing, marketing and sales resources and capabilities than we do. Our products will compete not only with other tethered aerostats, but also with heavier-than-air fixed wing aircraft, manned aircraft, communications satellites and balloons. We anticipate increasing competition as a result of defense industry consolidation, which has enabled companies to enhance their competitive position and ability to compete against us. In addition, other companies may introduce competing aerostats or solutions based on alternative technologies that may adversely affect our competitive position. As a result, our products may become less or non-competitive or obsolete. If we are not able to compete successfully against our current and future competitors, we may fail to generate revenues and our financial condition would be adversely affected.

We may pursue strategic transactions in the future, which could be difficult to implement, disrupt our business or change our business profile significantly.

We intend to consider potential strategic transactions, which could involve acquisitions of businesses or assets, joint ventures or investments in businesses, products or technologies that expand, complement or otherwise relate to our current or future business. We may also consider, from time to time, opportunities to engage in joint ventures or other business collaborations with third parties to address particular market segments. These activities create risks such as, among others,: (i) the need to integrate and manage the businesses and products acquired with our own business and products, (ii) additional demands on our resources, systems, procedures and controls, (iii) disruption of our ongoing business, and (iv) diversion of management’s attention from other business concerns. Moreover, these transactions could involve: (a) substantial investment of funds or financings by issuance of debt or equity securities; (b) substantial investment with respect to technology transfers and operational integration; and (c) the acquisition or disposition of product lines or businesses. Also, such activities could result in one-time charges and expenses and have the potential to either dilute the interests of existing shareholders or result in the issuance of, or assumption of debt. Such acquisitions, investments, joint ventures or other business collaborations may involve significant commitments of financial and other resources of our company. Any such activity may not be successful in generating revenue, income or other returns to us, and the resources committed to such activities will not be available to us for other purposes. Moreover, if we are unable to access capital markets on acceptable terms or at all, we may not be able to consummate acquisitions, or may have to do so on the basis of a less than optimal capital structure. Our inability: (i) to take advantage of growth opportunities for our business or for our products or (ii) to address risks associated with acquisitions or investments in businesses, may negatively affect our operating results. Additionally, any impairment of goodwill or other intangible assets acquired in an acquisition or in an investment, or charges to earnings associated with any acquisition or investment activity, may materially reduce our earnings. These future acquisitions or joint ventures may not result in their anticipated benefits and we may not be able to properly integrate acquired products, technologies or businesses, with our existing products and operations or combine personnel and cultures. Failure to do so could deprive us of the intended benefits of those acquisitions.

If we fail to protect our intellectual property rights, we could lose our ability to compete in the marketplace.

Our intellectual property and proprietary rights are important to our ability to remain competitive and for the success of our products and our business. Patent protection can be limited and not all intellectual property is or can be patented. We rely on a combination of patent, trademark, copyright, and trade secret laws as well as confidentiality agreements and procedures, non-competition agreements and other contractual provisions to protect our intellectual property, other proprietary rights and our brand. We have little protection when we must rely on trade secrets and nondisclosure agreements. Our intellectual property rights may be challenged, invalidated or circumvented by third parties. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge or other trade secrets by employees or competitors. Furthermore, our competitors may independently develop technologies and products that are substantially equivalent or superior to our technologies and/or products, which could result in decreased revenues. Moreover, the laws of foreign countries may not protect our intellectual property rights to the same extent as the laws of the U.S. Litigation may be necessary to enforce our intellectual property rights which could result in substantial costs to us and substantial diversion of management attention. If we do not adequately protect our intellectual property, our competitors could use it to enhance their products. Our inability to adequately protect our intellectual property rights could adversely affect our business and financial condition, and the value of our brand and other intangible assets.

Other companies may claim that we infringe their intellectual property, which could materially increase our costs and harm our ability to generate future revenue and profit.

We do not believe our product technologies infringe the proprietary rights of any third party, but claims of infringement are becoming increasingly common and third parties may assert infringement claims against us. It may be difficult or impossible to identify, prior to receipt of notice from a third party, the trade secrets, patent position or other intellectual property rights of a third party, either in the United States or in foreign jurisdictions. Any such assertion may result in litigation or may require us to obtain a license for the intellectual property rights of third parties. If we are required to obtain licenses to use any third party technology, we would have to pay royalties, which may significantly reduce any profit on our products. In addition, any such litigation could be expensive and disruptive to our ability to generate revenue or enter into new market opportunities. If any of our products are found to infringe other parties’ proprietary rights and we are unable to come to terms regarding a license with such parties, we may be forced to modify our products to make them non-infringing or to cease production of such products altogether.

| 7 |

The nature of our business involves significant risks and uncertainties that may not be covered by insurance or indemnity.

We develop and sell products where insurance or indemnification may not be available, including:

| ● | Designing and developing products using advanced and unproven technologies and aerostats and tethered drones in intelligence and homeland security applications that are intended to operate in high demand, high risk situations; and |

| ● | Designing and developing products to collect, distribute and analyze various types of information. |

Failure of certain of our products could result in loss of life or property damage. Certain products may raise questions with respect to issues of civil liberties, intellectual property, trespass, conversion and similar concepts, which may raise new legal issues. Indemnification to cover potential claims or liabilities resulting from a failure of technologies developed or deployed may be available in certain circumstances but not in others. We are not able to maintain insurance to protect against all operational risks and uncertainties. Substantial claims resulting from an accident, failure of our product, or liability arising from our products in excess of any indemnity or insurance coverage (or for which indemnity or insurance is not available or was not obtained) could harm our financial condition, cash flows, and operating results. Any accident, even if fully covered or insured, could negatively affect our reputation among our customers and the public, and make it more difficult for us to compete effectively.

If we are unable to recruit and retain key management, technical and sales personnel, our business would be negatively affected.

For our business to be successful, we need to attract and retain highly qualified technical, management and sales personnel. The failure to recruit additional key personnel when needed with specific qualifications and on acceptable terms or to retain good relationships with our partners might impede our ability to continue to develop, commercialize and sell our products. To the extent the demand for skilled personnel exceeds supply, we could experience higher labor, recruiting and training costs in order to attract and retain such employees. The loss of any members of our management team may also delay or impair achievement of our business objectives and result in business disruptions due to the time needed for their replacements to be recruited and become familiar with our business. We face competition for qualified personnel from other companies with significantly more resources available to them and thus may not be able to attract the level of personnel needed for our business to succeed.

Economic conditions in the U.S. and worldwide could adversely affect our revenues.

Our revenues and operating results depend on the overall demand for our technologies and services. If the U.S. and worldwide economies weaken, either alone or in tandem with other factors beyond our control (including war, political unrest, shifts in market demand for our services, actions by competitors, etc.), we may not be able to maintain or expand the growth of our revenue.

We have experienced losses which may continue and which may negatively impact our ability to achieve our business objectives.

We incurred a net loss of $8,975,862 for the year ended December 31, 2015 and we experienced negative cash flow from operations. We can provide no assurance that we can achieve profitability or sustain cash flow positive operations on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. Revenues and profits, if any, will depend upon various factors, including whether we will be able to continue expansion of our revenue. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

If we are unable to obtain additional funding when needed, our business operations will be harmed and if we do obtain additional financing our then existing shareholders may suffer substantial dilution.

Although we believe we not currently require additional funds to sustain our operations and institute our business plan, we have historically required additional funds to continue operations and may again in the future. We do not have any contracts or commitments for additional funding, and there can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all, if needed. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to conduct business operations. If we are unable to obtain additional financing to finance a revised growth plan, we will likely be required to curtail such plans or cease our business operations. Any additional equity financing may involve substantial dilution to our then existing shareholders.

If we fail to protect our intellectual property rights, our ability to pursue the development of our technologies and products would be negatively affected.

Our success will depend in part on our ability to obtain patents and maintain adequate protection of our technologies. Some foreign countries lack rules and methods for defending intellectual property rights and do not protect proprietary rights to the same extent as the United States. We have not filed for any patent protection rights outside the United States and many companies have had difficulty protecting their proprietary rights in these foreign countries. We may not be able to prevent misappropriation of our proprietary rights.

| 8 |

We are currently seeking patent protection for the WATT system. On September 18 and 19, 2014, we filed provisional patent application numbers “62/052,289” and “62/052,946” entitled “Tethered Portable Aerial Media broadcast System” based on the tethered drone system. On September 18, 2015, we filed a utility patent application claiming a priority date of the two provisional patent applications and having application Serial Number “14858467” entitled “Apparatus and Methods for Tethered Aerial Platform and System”. On July 7, 2015 we filed a provisional patent application number “62/189,341” entitled “Apparatus, Methods and System for Tethered Aerial Platform”. However, the patent process is subject to numerous risks and uncertainties, and there can be no assurance that we will be successful in protecting our technologies by obtaining and enforcing patents. These risks and uncertainties include the following: patents that may be issued or licensed may be challenged, invalidated, or circumvented, or otherwise may not provide any competitive advantage; our competitors, many of which have substantially greater resources than us and many of which have made significant investments in competing technologies, may seek, or may already have obtained, patents that will limit, interfere with, or eliminate our ability to make, use, and license our technologies either in the United States or in international markets; there may be significant pressure on the United States government and other international governmental bodies to limit the scope of patent protection both inside and outside the United States for technologies that prove successful as a matter of public policy regarding security concerns; countries other than the United States may have less restrictive patent laws than those upheld by United States courts, allowing foreign competitors the ability to exploit these laws to create, develop, and market competing products.

Moreover, any patents issued to us may not provide us with meaningful protection, or others may challenge, circumvent or narrow our patents. Third parties may also independently develop technologies similar to ours or design around any patents on our technologies.

In addition, the PTO and patent offices in other jurisdictions have often required that patent applications concerning software inventions be limited or narrowed substantially to cover only the specific innovations exemplified in the patent application, thereby limiting the scope of protection against competitive challenges. Thus, even if we or our licensors are able to obtain patents, the patents may be substantially narrower than anticipated.

Our success depends on our patents, patent applications that may be licensed exclusively to us and other patents to which we may obtain assignment or licenses. We may not be aware, however, of all patents, published applications or published literature that may affect our business either by blocking our ability to commercialize our products, by preventing the patentability of future products or services to us or our licensors, or by covering the same or similar technologies that may invalidate our patents, limit the scope of our future patent claims or adversely affect our ability to market our products and services.

In addition to patents, we rely on a combination of trade secrets, confidentiality, nondisclosure and other contractual provisions, and security measures to protect our confidential and proprietary information. These measures may not adequately protect our trade secrets or other proprietary information. If they do not adequately protect our rights, third parties could use our technology, and we could lose any competitive advantage we may have. In addition, others may independently develop similar proprietary information or techniques or otherwise gain access to our trade secrets, which could impair any competitive advantage we may have.

Patent protection and other intellectual property protection are crucial to the success of our business and prospects, and there is a substantial risk that such protections will prove inadequate.

Risks Relating to our Common Stock and its Market Value

The price of our common stock may be volatile.

The trading price of our common stock may be highly volatile and could be subject to fluctuations in response to a number of factors beyond our control. Some of these factors are:

| ● | dilution caused by our issuance of additional shares of common stock and other forms of equity securities, which we expect to make in connection with future capital financings to fund our operations and growth, to attract and retain valuable personnel and in connection with future strategic partnerships with other companies; | |

| ● | our results of operations and the performance of our competitors; | |

| ● | the public’s reaction to our press releases, our other public announcements and our filings with the Securities and Exchange Commission; | |

| ● | changes in earnings estimates or recommendations by research analysts who follow, or may follow, us or other companies in our industry; | |

| ● | changes in general economic conditions; | |

| ● | changes in the valuation of similarly situated companies, both in our industry and in other industries; | |

| ● | actions of our historical equity investors, including sales of common stock by our directors and executive officers; |

| 9 |

| ● | actions by institutional investors trading in our stock; | |

| ● | disruption of our operations; | |

| ● | any major change in our management team; | |

| ● | significant sales of our common stock; | |

| ● | other developments affecting us, our industry or our competitors; and | |

| ● | U.S. and international economic, legal and regulatory factors unrelated to our performance. |

These and other factors are largely beyond our control, and the impact of these risks, singly or in the aggregate, may result in material adverse changes to the market price of our common stock and/or our results of operations and financial condition.

There is a limited market for our common stock which may make it more difficult for you to dispose of your stock.

Our common stock is quoted on the OTCQX under the symbol “DRNE”. However, this is an unorganized, inter-dealer, over-the-counter market which provides significantly less liquidity than The NASDAQ Capital Market or other national securities exchanges. These factors may have an adverse impact on the trading and price of our common stock.

Sales of substantial amounts of our common stock in the public market could harm the market price of our common stock.

The sale of a substantial number of shares of our common stock by stockholders could adversely affect the market price of our shares. As of March 4, 2016, we had approximately 6,400 registered stockholders and many more beneficial holders, most of whom have held their shares for the required holding periods under Rule 144 promulgated pursuant to the Securities Act and thus hold freely tradable shares. The shares issued pursuant to conversions under our Series A, B, B-1, D, E, F and G Preferred Stock on November 20, 2015 and January 12, 2016 are either immediately freely tradable pursuant to Rule 144 promulgated pursuant to the Securities Act, or subject to a 180 day lock-up agreements. If such shares are sold, or if it is perceived they will be sold, the trading price of our common stock could decline. Because investors may be more reluctant to purchase shares of our common stock following substantial sales or issuances, the resale of these shares of common stock could impair our ability to raise capital in the near term.

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the Board of Directors may consider relevant.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| ● | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| ● | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| ● | obtain financial information and investment experience objectives of the person; and |

| ● | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

| 10 |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form:

| ● | sets forth the basis on which the broker or dealer made the suitability determination; and |

| ● | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit stockholders’ ability to buy and sell our stock and have an adverse effect on the market for our shares.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We maintain our mailing address at 11651 Central Parkway #118, Jacksonville, Florida 32224 which is also our primary physical location. Several of our management employees work remotely. We have entered into a 60 month operating lease for 5,533 square feet of office and manufacturing space at 11651 Central Parkway #118, Jacksonville, Florida 32224. The lease commenced February 1, 2015 and we took occupancy in June 2015. We also lease an executive office in Aventura, Florida for an executive on a month-to-month basis.

Item 3. Legal Proceedings.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. We are currently party to the following material legal proceedings:

MacroSolve, Inc. v Newegg Inc. (U.S.D.C. E.D. TX) case No. 6:12-cv-46-MSS-KNM

On January 30, 2012, MacroSolve, Inc. filed suit against Newegg, Inc. in the United States District Court Eastern District of Texas alleging infringement of one or more claims of United States Patent #7,822,816. On March 7, 2014, the United States Patent and Trademark Office (“USPTO”) sent MacroSolve, Inc. an office action related to an ex parte reexamination of the ‘816 patent, which rejected all the claims in the patent (the “USPTO Office Action”). As a result of the USPTO Office Action, on March 31, 2014, the Company dismissed its patent enforcement case against Newegg Inc. with prejudice. On April 6, 2015, the court denied the motion by Newegg for recovery of defendant legal fees of approximately $400,000 from the Company. On April 24, 2015, Newegg filed a Notice of Appeal with the United States Court of Appeals for the Federal Circuit. On August 19, 2015, the Company filed a Brief of Appellee MacroSolve, Inc. with the United States Court of Appeals for the Federal Circuit and on September 8, 2015, Newegg filed a Reply Brief. Oral arguments occurred on February 1, 2016. The Federal Circuit decision affirming the district court’s denial of fees came down on February 9, 2016 in the form of a Rule 36 (‘summary affirmance”) per curiam decision. Newegg has ninety days to file a petition for the U.S. Supreme Court to review. The Company has prevailed in this matter but should the case be accepted by the Supreme Court and the Company not prevail in that venue, the judgment would be borne by the former MacroSolve directors who sold their loans on April 17, 2014.

Item 4. Mine Safety Disclosures.

Not applicable.

| 11 |

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

The Company’s common stock has been quoted on the OTCQX under the ticker symbol “DRNE” since January 6, 2016, and previously was quoted on the OTCQB under the ticker symbol “DRNE” and the OTC Pink under the ticker symbol MCVE.

The following sets forth the range of the bid prices for our common stock for the quarters for the prior two fiscal years. Such prices represent inter-dealer quotations, do not represent actual transactions, and do not include retail mark-ups, markdowns or commissions. Such prices were determined from information provided by a majority of the market makers for the Company’s common stock.

| 2015 | 2014 | |||||||||||||||

| Sales Price | Sales Price | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| Quarter Ended | ||||||||||||||||

| March 31 | $ | 24.00 | $ | 9.20 | $ N/A | $ N/A | ||||||||||

| June 30 | 14.40 | 8.40 | 43.60 | $ | 26.00 | |||||||||||

| September 30 | 11.60 | 6.00 | 52.00 | $ | 14.80 | |||||||||||

| December 31 | 6.80 | 3.12 | 17.60 | $ | 6.00 | |||||||||||

Holders

As of March 4, 2016, there were 115 stockholders of record and approximately 6,400 beneficial holders of the Company’s common stock.

Dividends

We have not declared any common stock dividends to date. We have no present intention of paying any cash dividends on our common stock in the foreseeable future, as we intend to use earnings, if any, to generate growth. The payment by us of dividends, if any, in the future, rests within the discretion of our Board of Directors and will depend, among other things, upon our earnings, our capital requirements and our financial condition, as well as other relevant factors. There are no material restrictions in our certificate of incorporation or bylaws that restrict us from declaring dividends.

Equity Compensation Plan Information

The following table provides information as of December 31, 2015, regarding our compensation plans under which equity securities are authorized for issuance:

| Plan category | Number of securities to be issued upon exercise of outstanding options | Weighted-average exercise price of outstanding options | Securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 120,000 | $ | 5.00 | 130,000 | ||||||||

| Equity compensation plans not approved by security holders | 287,500 | 6.63 | 0 | |||||||||

| Total | 407,500 | $ | 6.19 | 130,000 | ||||||||

Recent Sales of Unregistered Securities

The Company has previously disclosed all recent sales of unregistered securities on Current Reports on Form 8-K. There have been no recent sales of unregistered securities that have not been previously disclosed.

Item 6. Selected Financial Data.

Not required under Regulation S-K for “smaller reporting companies.”

| 12 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

The following discussion and analysis of financial condition and results of operations should be read in conjunction with our historical financial statements and the notes to those statements that appear elsewhere in this report. Certain statements in the discussion contain forward-looking statements based upon current expectations that involve risks and uncertainties, such as plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under “Item 1A. Risk Factors.” and elsewhere in this report.

Business Overview

For this information please see Part 1, Item 1 “Business.”

Results of Operations

Year Ended December 31, 2015 Compared to Year Ended December 31, 2014 (all references are to fiscal years).

Total Net Revenues: Total net revenues decreased approximately $386,000, or 45.0%, to approximately $472,000 in 2015 from approximately $858,000 for 2014. Sources of revenue in 2015 were derived primarily from small aerostat systems. Sources of revenue in 2014 included several large aerostat systems, cameras and accessories.

Cost of Revenues and Gross Profit: Cost of revenues for 2015 decreased approximately $392,000, or 58.1%, from approximately $675,000 in 2014 to approximately $283,000 in 2015, primarily consisting of materials, parts and labor associated with the sale of small aerostat systems. The resulting gross profit for 2015 of approximately $190,000 was a decrease of approximately $7,000, or 3.6% from the gross profit for 2014 of approximately $183,000 in line with the lower net revenue. Gross profit margins were 40% and 21% for 2015 and 2014, respectively. The cameras sold in 2014 were low margin which contributed to the lower gross profit margin in the prior year.

General and Administrative Expenses: General and administrative expenses increased by approximately $7,259,000, or 381%, to approximately $9,164,000 in 2015 from approximately $1,905,000 in 2014. The Company put an executive management team in place following the June 3, 2014 business combination and reverse merger discussed above which represents approximately $766,000 of the 2015 expenses. Management also received equity awards, including stock and options, valued at approximately $5,318,000 in non-cash expense. The Company incurred approximately $381,000 in financial advisory and investor relations expenses in 2015, including a placement agent warrant valued at $246,000 issued in association with the common stock sold in 2015. The Company paid its directors a total of $281,000, including $123,500 in non-cash equity. The Company established a Strategic Advisory Board in August 2014. The advisors were compensated with stock at the end of their first year of service and $213,000 non-cash pro-rata expense has been recorded in 2015. Legal expense was approximately $187,000 primarily related to the general corporate and securities matters, fundraising, and AFI asset acquisition. Research and development costs of approximately $744,000 were incurred in 2015, primarily related to the WATT tethered drone system. The Company invested approximately $210,000 in marketing and promotions, approximately $85,000 in occupancy costs, approximately $75,000 in accounting fees and approximately $136,000 in travel and related costs. The Company recorded $161,500 in expense related to the contingent liability associated with the possible issuance of additional stock in connection with the AFI asset acquisition.

Loss from Operations: Loss from operations for 2015 of approximately $8,974,000 was an increase of approximately $7,252,000 or (421) % over the loss from operations in 2014 of approximately $1,722,000, which resulted primarily due to the increase in G&A expenses of approximately $7,259,000.

Other Income and Expense: Total other expenses of approximately $2,000 in 2015 were approximately $399,000 or 99.6 % less than the total other expense of approximately $401,000 in 2014. This decrease is primarily due to a $351,000 non-cash expense for derivative accounting under ASC 815-15 “Derivative and Hedging” and $43,000 loss on sale of securities held for resale which occurred in 2014.

Net Loss: Net loss of approximately $8,976,000 in 2015 was approximately $6,852,000 or (322.7)% greater than the net loss in 2014 of approximately $2,123,000 primarily due to the factors previously discussed.

There was no provision for income taxes for the fiscal years ended 2015 and 2014 due to a valuation allowance of $1,434,996 and $497,501 recorded for the years ended December 31, 2015 and 2014 on the total tax provision, as we believed that it is more likely than not that the tax asset will not be utilized during the next year.

Liquidity and Capital Resources

As of December 31, 2015, the Company had total current assets of approximately $2,917,000 and total current liabilities of approximately $366,000 for working capital of approximately $2,551,000. As of December 31, 2015, the Company had cash and cash equivalents of approximately $2,660,000 and an accumulated deficit of approximately $11,139,000 since operations commenced in 2014.

| 13 |

Although there was a net loss of $8,975,862 in 2015, the Company's independent registered public accounting firm's audit report for the year ended December 31, 2015, included herein, did not contain a qualified opinion or an explanatory paragraph regarding the Company's ability to continue as a going concern. The accompanying financial statements have been prepared assuming that the Company continues as a going concern and contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The ability of the Company to continue as a going concern on a long-term basis will be dependent upon its ability to create and market innovative services and to sustain adequate working capital to finance its operations.

We have historically financed our operations through operating revenues and sales of equity securities to accredited investors. While we currently believe we have sufficient capital to continue our operations for the next 12 months, we may incur greater expenses than we currently anticipate. As a result, we could deplete our cash and working capital more rapidly than expected, which could result in our need to raise additional working capital through sale of equity securities or debt financing.

Sources and Uses of Cash

| Years Ended Dec 31, | ||||||||

| 2015 | 2014 | |||||||

| Cash flows (used in) operating activities | $ | (2,865,685 | ) | $ | (1,302,279 | ) | ||

| Cash flows (used in) provided by investing activities | (329,227 | ) | 1,529,098 | |||||

| Cash flows provided by financing activities | 4,484,750 | 1,143,077 | ||||||

| Net increase in cash and cash equivalents | $ | 1,289,838 | $ | 1,369,896 | ||||

Operating Activities: