Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XO GROUP INC. | v433387_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - XO GROUP INC. | v433387_ex99-1.htm |

Exhibit 99.2

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 1 Investor Relations Presentation March 3, 2016

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 2 This presentation may contain projections or other forward - looking statements regarding future events or our future financial pe rformance or estimates regarding third parties. These statements are only estimates or predictions and reflect our current beliefs and exp ect ations. Actual events or results may differ materially from those contained in the estimates, projections or forward - looking statements. It is routine for internal projections and expectations to change as the quarter progresses, and therefore it should be clearly understood that the inte rna l projections and beliefs upon which we base our expectations may change prior to the end of the quarter. Although these expectations may chang e, we will not necessarily inform you if they do. Our policy is to provide expectations not more than once per quarter, and not to update th at information until the next quarter. Some of the factors that could cause actual results to differ materially from the forward - looking statements c ontained herein include, without limitation, ( i ) our operating results may fluctuate, are difficult to predict and could fall below expectations , (ii) our transactions business is dependent on third party participants, whose lack of performance could adversely affect our results of operations , (iii) our ongoing investment in new businesses and new products, services, and technologies is inherently risky, and could disrupt our ongoing bus iness and/or fail to generate the results we are expecting , (iv) we may be unable to develop solutions that generate revenue from advertising and other services delivered to mobile phones and wireless devices , (v) our businesses could be negatively affected by changes in Internet search engine algorithms , (vi) intense competition in our markets may adversely affect revenue and results of operations , (vii) we may be subject to legal liability associated with providing online services or content , (viii) fraudulent or unlawful activities on our marketplace could harm our business and consumer confidence in our marketplace , (ix) we are subject to payments - related risks , (x) we cannot assure you that our publications will be profitable , and (xi) other factors detailed in documents we file from time to time with the Securities and Exchange Commission. Forward - looking statements in this release are made pursuant to the safe harbor provisions contained in the Private Securities Litiga tio n Reform Act of 1995. This presentation includes certain "Non - GAAP financial information." A reconciliation of such information the most directly comparable GAAP data can be found at the end of this presentation. SAFE HARBOR

© 2015 XO GROUP INC. ALL RIGHTS RESERVED. 3 ATTRACTIVE FINANCIAL PROFILE LEADER IN LARGE MARKET • #1 online wedding property; growing baby property • Replenishing audience in an attractive demographic • Strong multi - platform brand built over 19 years • Diversified revenue streams • ~80% of the executive management team assembled over the past 2.5 years - ~50 % of the broader leadership team assembled over the past 2.5 years • Revamped business operations • Upgraded user products and underlying technology • Expanding market opportunity with new offerings • Balanced capital allocation while transforming business • New double digit revenue growth target model - CAGR 2010 – 2015 5 % • New adjusted EBITDA margin target of 20%+ - While investing in the company, delivered adjusted EBITDA margin of 19% from 2014 - 2015 STRATEGIC TRANSFORMATION UNDERWAY INVESTMENT OPPORTUNITY

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 4 Our mission is to help people navigate and truly enjoy life’s biggest moments, TOGETHER. Our family of multi - platform brands guide couples through transformative lifestages , from getting married, to moving in together and having a baby.

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 5 XO GROUP AT A GLANCE 2015 Total Revenue $142M and Respective % of Revenue 2015 Revenue (1%) y/y 2015 Revenue excluding Merchandise +10% y/y $29M 2015 Adj. EBITDA 660 Employees ** $ 89M Cash & Cash Equivalents** * Includes revenue earned from GigMasters.com and other ancillary brands and sites; **as of December 31, 2015 The Nest: 1% The Bump: 10% The Knot:* 89% Local Online: 47% National Online: 2 5 % Publishing + Other: 1 7 % Transactions: 1 0 % Merchandise (exited Q1 2015): 1% Full Year 2015 Revenue by Brand

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 6 2013 - 2015: STRATEGIC TRANSFORMATION UNDERWAY Focus, Leadership, Product & Operational Excellence Revamped executive & leadership team Evaluated & took decisive action on non - core assets [disposed of Ijie (The Knot China) & Merchandise operations] Greatly improved our product and technology Made capital allocation a priority and set target financial model

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 7 MIKE STEIB Chief Executive Officer Google Inc. NBC Universal McKinsey GILLIAN MUNSON Chief Financial Officer Allen & Co. Symbol Technologies Morgan Stanley KRISTIN SAVILIA President , Local Marketplace Linens ’n Things Macy’s NIC DI I ORIO Chief Technology Officer City 24/7 LLC Interpublic Group of Companies (IPG) BRENT TWORETZKY EVP , Product KATHY WU BRADY EVP , E - Commerce, Registry, and Guest Services DHANUSHA SIVAJEE EVP , Marketing JENNIFER GARRETT EVP , National Enterprise Viacom Inc. Mayer Brown AOL Brand Group Bloomberg Mobile HBO Vente - Privee USA AOL NBC Universal Udacity Chegg WebMD MICHELLE DVORKIN EVP , Human Resources AppNexus Lot18 AOL LEADERSHIP TEAM

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 8 -10% 0% 10% 20% 2012 2013 2014 2015 Year - Over - Year Growth Rates Revenue Non-GAAP Opex In the midst of investment cycle: operating expenses to grow at higher rates than revenue growth rates [2013 - 2014] Acqui - hired two award winning mobile development teams (~$1M) [2014] Acquired (~$5M) [Q3 2015] Invested in & vendor services company ($2.5M) [Oct. 2015] Acquired (~$6M*) INTERNAL INVESTMENTS STRATEGIC ACQUISITIONS & INVESTMENTS OPPORTUNISTIC STOCK BUYBACKS $20M authorization Repurchased $1.6M during 2014 Repurchased $8.8 million during 2015 CAPITAL ALLOCATION PRIORITIES * For the remaining 72% of GigMasters that XO Group did not own. The total acquisition price for GigMasters is $8.5 million in cash for complete ownership of the company.

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 9 BRIDES ARE OBSESSED WITH What do brides love more than planning their wedding ? Planning with The Knot. Featuring XO Employee Lindsey Perdeck , Wedding Date: December 17, 2016

© 2015 XO GROUP INC. ALL RIGHTS RESERVED. 10 $14,006 $4,711 $4,350 $2,141 $1,973 $4,032 WEDDING MARKET 1 United States Census Bureau American Community Survey and The 2014 The Knot Market Intelligence’s Annual Real Weddings Survey 2 2014 Real Weddings Study Avg. Cost Of A Wedding 1 ~$30K Includes engagement ring, but does not include honeymoon Local Wedding Vendors ~300K Annual Weddings Per Year ~1.8M Avg. Number Of Guests Per Wedding 136 Wedding Industry Market Size $70B+ Includes day - of wedding vendors, jewelry, registry, honeymoon and other categories Event/Wedding Planner Venue Band/ DJ Photo/ Video Florist Avg. $ Spent In 2014 [ Top 5 Wedding Verticals] 2 Multiple Verticals

© 2015 XO GROUP INC. ALL RIGHTS RESERVED. 11 THE KNOT: #1 IN WEDDINGS Unique Visitor Source: comScore Multi Platform 0 0.6 0.7 1.9 2.2 4.2 9.8 Zola / Loverly / Appy Couple Martha Stewart Weddings MyWedding Brides.com Wedding Bee Wedding Wire Network The Knot Wedding Network [+46%] [(10%)] [+46%] [(16%)] [+52%] 9.7 [+63%] Does not meet minimum reporting requirements Unique Visitors Monthly Average ( I n M illions ) With Year - Over - Year % Growth [12 months ended December 31, 2015]

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 12 IN ADDITION TO MAXIMIZING OUR MEDIA OPPORTUNITY, WE HAVE A LONG - TERM AMBITION TO UNLOCK A SIGNIFICANT MARKET OPPORTUNITY WITH TRANSACTIONS. Advertising Market Transactions + Advertising * image is not intended reflect revenue projections or scale 2015 Online Advertising Revenue Growth: + 14% Y/Y 2015 Transaction Revenue Growth: + 42% Y/Y

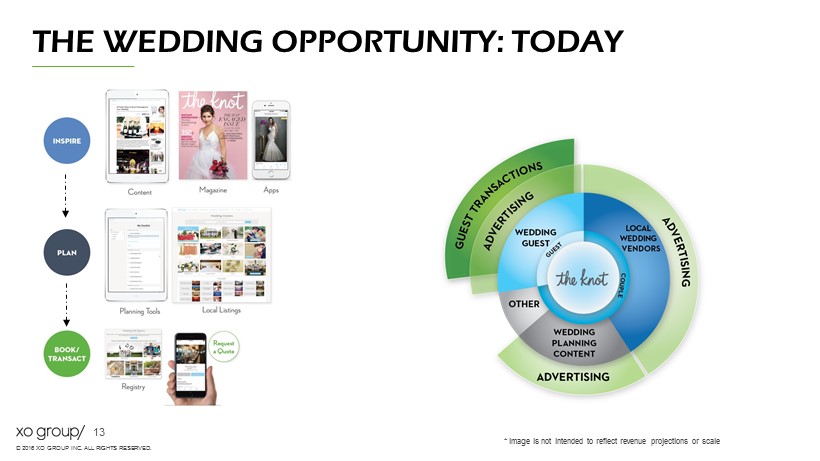

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 13 THE WEDDING OPPORTUNITY: TODAY * image is not intended to reflect revenue projections or scale

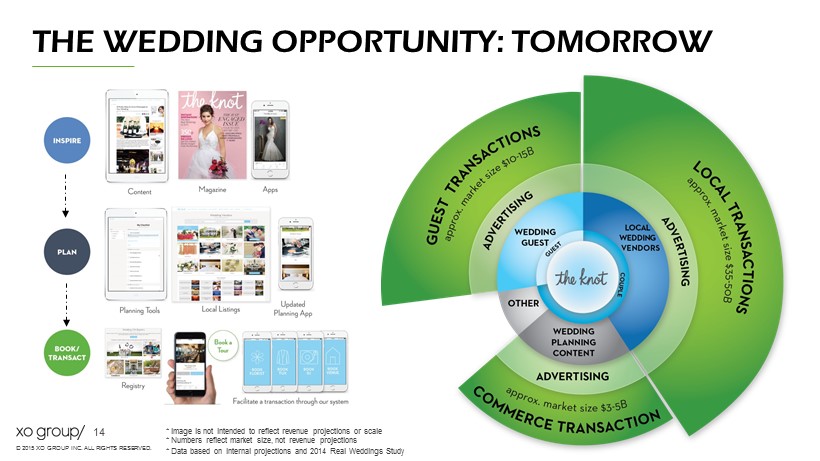

© 2015 XO GROUP INC. ALL RIGHTS RESERVED. 14 THE WEDDING OPPORTUNITY: TOMORROW * image is not intended to reflect revenue projections or scale * Numbers reflect market size, not revenue projections * Data based on internal projections and 2014 Real Weddings Study

© 2015 XO GROUP INC. ALL RIGHTS RESERVED. 15 OUR 2015 PROGRESS The cost of love. * image is not intended to reflect revenue projections or scale * Numbers reflect market size, not revenue projections * Data based on internal projections and 2014 Real Weddings Study * Leads data as of December 31, 2015

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 16 Fresh ideas and a supportive community help our parents celebrate the joys of parenthood. PARENTS CAN’T LIVE WITHOUT Featuring XO Employee Vanessa Velazquez Due Date: March 7, 2016

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 17 THE BUMP: GROWING BABY PLATFORM Unique Visitor Source: comScore Multi Platform; *NCHS National Vital Health Statistics Reports and USDA report - expenditures on children **12 months ended December 31, 2015 h *** Numbers reflect market size, not revenue projections ended as of September 30, 2015 10% of REVENUE Growing mobile user - base dramatically expands editorial and advertisers’ reach with innovative products, services and expert advice

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 18 The cost of love. $MM 2008 - 2013 FY 2014 FY 2015 Target Model Net Revenue Y/Y Growth 5% CAGR 7% (1%)* Double digit growth Gross Margin % 80% avg. 85% 93% 90 - 95% Adj. EBITDA Margin % 18% avg. 17% 21% At least 20% FINANCIAL MODEL *2015 Revenue Excluding Merchandise Operations, + 10 % Y/Y

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 19 Summary Income Statement ($M) 3 months ended 12/31/15 3 months ended 12/31/14 Revenue $38.1 $37.1 Gross Profit $35.3 $31.2 Margin 92.7% 84.3% *Adjusted EBITDA $7.9 $5.8 Net Income ($2.2) ($4.0) Earnings per Diluted Share ($0.09) ($0.16) *Non - GAAP Earnings per Diluted Share $0.11 $0.06 Q4 UPDATE • Total revenue increased 3% year - over - year • Total revenue excluding exited Merchandise operations increased 12% year - over - year • Transaction revenue increased 73% year - over - year; 60% of the increase was driven by registry services • Non - GAAP operating expenses increased 7% year - over - year • Adjusted EBITDA increased 2.9% year - over - year; 21% Adj. EBITDA Margin • $ 88.5 million in cash • Used $6.1 million in cash during the fourth quarter to acquire the remaining interest of GigMasters *Non - GAAP, please see reconciliation at the end of this presentation Summary Balance Sheet ($M) 12/31/15 12/31/14 Cash and cash equivalents $88.5 $90.0 Other current assets 25.8 23.5 Total Assets 196.7 193.6 Debt --- --- Current Liabilities 30.8 28.7 Total Liabilities 37.3 35.7 Total Liabilities and Stockholders’ Equity $196.7 $193.6

© 2015 XO GROUP INC. ALL RIGHTS RESERVED. 20 ATTRACTIVE FINANCIAL PROFILE LEADER IN LARGE MARKET • #1 online wedding property; growing baby property • Replenishing audience in an attractive demographic • Strong multi - platform brand built over 19 years • Diversified revenue streams • ~80% of the executive management team assembled over the past 2.5 years - ~50 % of the broader leadership team assembled over the past 2.5 years • Revamped business operations • Upgraded user products and underlying technology • Expanding market opportunity with new offerings • Balanced capital allocation while transforming business • New double digit revenue growth target model - CAGR 2010 – 2015 5 % • New adjusted EBITDA margin target of 20%+ - While investing in the company, delivered adjusted EBITDA margin of 19% from 2014 - 2015 STRATEGIC TRANSFORMATION UNDERWAY INVESTMENT OPPORTUNITY

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 21 Questions? Contact ir@xogrp.com

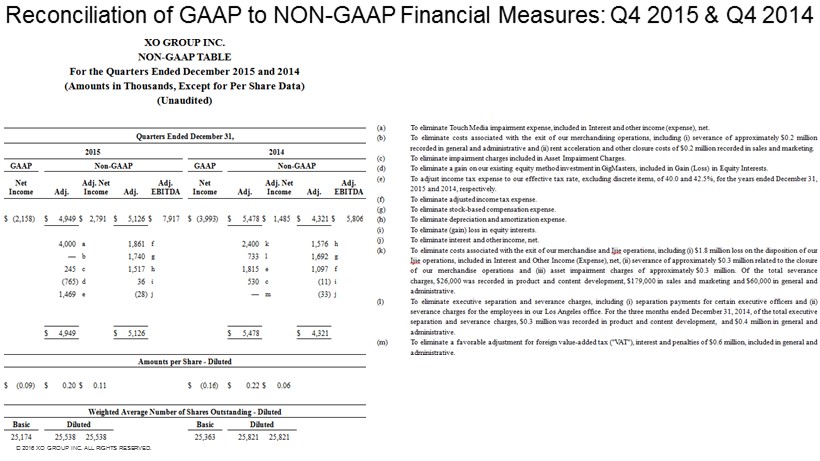

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 22 Reconciliation of GAAP to NON - GAAP Financial Measures: Q4 2015 & Q4 2014

© 2016 XO GROUP INC. ALL RIGHTS RESERVED. 23 Reconciliation of GAAP to NON - GAAP Financial Measures: 2015 & 2014

24 © 2016 XO GROUP INC. ALL RIGHTS RESERVED. Reconciliation of GAAP to NON - GAAP Financial Measures: Operating Expenses Q4, 2015 & 2014

25 © 2016 XO GROUP INC. ALL RIGHTS RESERVED. Reconciliation of GAAP to NON - GAAP Financial Measures: Operating Expenses Full Year, 2015 & 2014

26 © 2016 XO GROUP INC. ALL RIGHTS RESERVED. Supplemental Data (Unaudited) – TheKnot.com Local Advertising Metrics Q4 2015 Q3 2015 Q2 2015 Q1 2015 Q4 2014 Q3 2014 Q2 2014 Q1 2014 Vendor Count (b) 24,340 24,117 23,790 23,338 22,694 22,281 21,886 21,677 Retention Rate (c) 73.8% 74.9% 76.4% 78.9% 78.3% 77.2% 74.8% 73.0% Avg. Revenue/Vendor (b) $2,628 $2,582 $2,547 $2,519 $2,527 $2,517 $2,516 $2,497 Vendor Count at the end of the respective period 25,106 25,034 24,619 25,182 24,764 24,304 23,682 23,064 (a) Previously disclosed as Profile Count (b) Calculated on a trailing twelve - month basis. (c) Calculated on a trailing twelve - month basis. Previously disclosed as churn rate. Retention rate calculated as one less churn rate.