Attached files

| file | filename |

|---|---|

| 10-K - 10-K - REGENXBIO Inc. | rgnx-10k_20151231.htm |

| EX-10.32 - EX-10.32 - REGENXBIO Inc. | rgnx-ex1032_225.htm |

| EX-10.33 - EX-10.33 - REGENXBIO Inc. | rgnx-ex1033_227.htm |

| EX-31.1 - EX-31.1 - REGENXBIO Inc. | rgnx-ex311_223.htm |

| EX-23.1 - EX-23.1 - REGENXBIO Inc. | rgnx-ex231_224.htm |

| EX-10.34 - EX-10.34 - REGENXBIO Inc. | rgnx-ex1034_732.htm |

| EX-31.2 - EX-31.2 - REGENXBIO Inc. | rgnx-ex312_222.htm |

| EX-32.1 - EX-32.1 - REGENXBIO Inc. | rgnx-ex321_221.htm |

Exhibit 10.31

FIRST AMENDMENT TO LEASE

THIS FIRST AMENDMENT TO LEASE (this “Amendment”) is entered into as of this 30th day of September, 2015 (the “Amendment Execution Date”), by and between BMR-MEDICAL CENTER DRIVE LLC, a Delaware limited liability company (“Landlord”), and REGENXBIO INC., a Delaware corporation (“Tenant”).

RECITALS

A. WHEREAS, Landlord owns certain real property (the “Property”) and the improvements on the Property located at 9704, 9708, 9712 and 9714 Medical Center Drive, Rockville, Maryland, including the buildings located thereon;

B. Landlord and Tenant are parties to that certain Lease dated as of March 6, 2015, as affected by that certain Acknowledgement of Term Commencement Date and Term Expiration Date dated as of April 17, 2015 (the “Acknowledgement”), given by Tenant in favor of Landlord (collectively, as the same may have been amended, supplemented or modified from time to time, the “Existing Lease”), whereby Tenant leases certain premises consisting of approximately ten thousand eight hundred thirty-three (10,833) square feet of Rentable Area (the “9712 Premises”) from Landlord in the building at 9712 Medical Center Drive, Rockville, Maryland (the “9712 Building”);

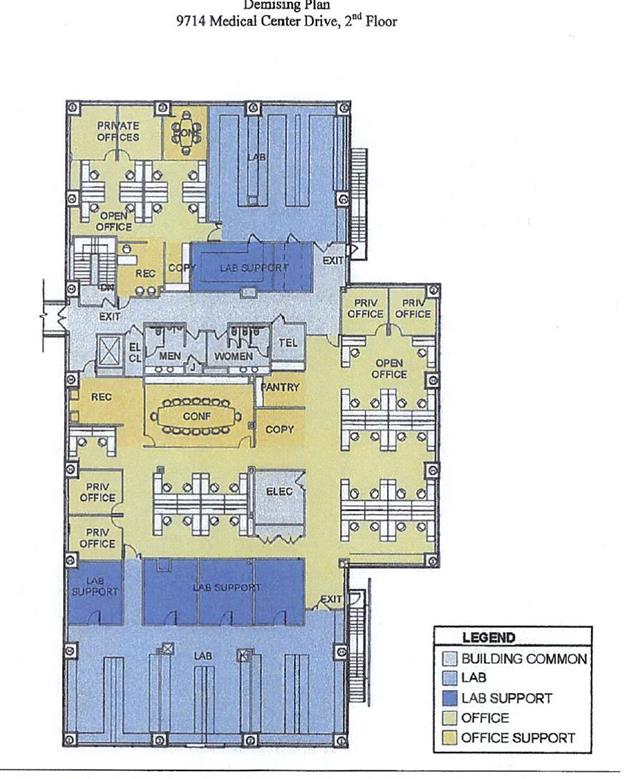

C. WHEREAS, Landlord desires to lease to Tenant, and Tenant desires to lease from Landlord, additional premises consisting of approximately nineteen thousand fifty-six (19,056) square feet of Rentable Area (the “9714 Premises) on the second floor of the building at 9714 Medical Center Drive in Rockville, Maryland (the “9714 Building”), as depicted on Exhibit A-1 attached hereto; and

D. WHEREAS, Landlord and Tenant desire to modify and amend the Existing Lease only in the respects and on the conditions hereinafter stated.

AGREEMENT

NOW, THEREFORE, Landlord and Tenant, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, agree as follows:

1. Definitions. For purposes of this Amendment, capitalized terms shall have the meanings ascribed to them in the Existing Lease unless otherwise defined herein. The Existing Lease, as amended by this Amendment, is referred to collectively herein as the “Lease.” From and after the date hereof, the term “Lease,” as used in the Existing Lease, shall mean the Existing Lease, as amended by this Amendment.

2. Term of 9712 Premises. The parties wish to correct the Term Expiration Date noted in the Acknowledgement. In accordance with Section 3 of the Existing Lease, the Term Expiration Date for the 9712 Premises shall be October 31, 2020 (and Base Rent with respect to the 9712 Premises for the period from October 17, 2020 through October 31, 2020 shall be paid in accordance with Section 3 of the Existing Lease).

3. Lease of 9714 Premises. Effective on the Amendment Execution Date, Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the 9714 Premises, for use by Tenant in accordance with the 9714 Permitted Use (as defined in Section 5 below) and no other uses. From and after the Amendment Execution Date, the term “Premises,” as used in the Lease, shall mean the 9712 Premises and/or the 9714 Premises, Exhibit A to the Existing Lease shall be supplemented with the addition of Exhibit A-1 to this

Amendment and the term “Building” shall mean, individually and collectively, as the context dictates, the 9712 Building and/or the 9714 Building. All provisions of the Lease applicable to the “Premises” shall be applicable to both the 9712 Premises and the 9714 Premises, except to the extent specifically set forth herein.

4. Rentable Area and Pro Rata Share. The chart in Section 2.2 of the Existing Lease is hereby deleted in its entirety and replaced with the following:

|

Definition or Provision |

Means the Following (As of the Amendment Execution Date) |

|

Approximate Rentable Area of 9712 Premises |

10,833 square feet |

|

Approximate Rentable Area of 9714 Premises |

19,056 square feet |

|

Approximate Rentable Area of 9712 Building |

22,907 square feet |

|

Approximate Rentable Area of 9714 Building |

35,375 square feet |

|

Approximate Rentable Area of South Campus |

92,125 square feet |

|

Approximate Rentable Area of Project |

214,725 square feet |

|

Tenant’s Pro Rata Share of 9712 Building |

47.29% |

|

Tenant’s Pro Rata Share of 9714 Building |

53.87% |

|

Tenant’s Pro Rata Share of South Campus for 9712 Premises |

11.76% |

|

Tenant’s Pro Rata Share of South Campus for 9714 Premises |

20.68% |

|

Tenant’s Pro Rata Share of Project for 9712 Premises |

5.05% |

|

Tenant’s Pro Rata Share of Project for 9714 Premises |

8.87% |

5. 9714 Permitted Use. The Permitted Use under Section 2.7 of the Existing Lease shall apply solely to the 9712 Premises. The Permitted Use for the 9714 Premises shall be office and laboratory use in conformity with all Applicable Laws. The term “Permitted Use” as used in the Lease shall mean, individually and collectively, as the context dictates, the Permitted Use for the 9712 Building and/or the 9714 Building and all provisions of the Lease applicable to the “Permitted Use” shall be applicable to both the 9712 Premises and the 9714 Premises, except to the extent otherwise specifically set forth herein.

6. 9714 Premises Term. The provisions of Sections 2.4, 2.5 and 3 of the Existing Lease shall apply solely to the 9712 Premises. The Term of the Lease for the 9714 Premises (the “9714 Premises Term”) shall commence on the 9714 Term Commencement Date (as defined in Section 7(b) of this Amendment) and end on the day before the date that is sixty (60) months after the actual 9714 Term Commencement Date (the “9714 Term Expiration Date”), provided that if the actual 9714 Term Commencement Date is not the first day of a calendar month, the 9714 Premises Term and the 9714 Term Expiration Date shall be extended to the last day of the calendar month in which the 9714 Term Expiration Date would otherwise occur (and Base Rent for the 9714 Premises for such extension period shall be payable at the rate in effect during the month immediately preceding such extension period). The 9714 Premises Term shall be subject to earlier termination of the Lease as provided in the Lease and to extension pursuant to the Options (as defined in the Existing Lease and modified in Section 15 below). The term “Term Expiration Date” as used in the Lease shall mean, individually and collectively, as the context dictates, the Term Expiration Date for the 9712 Premises and/or the 9714 Term Expiration Date and all provisions of the Lease applicable to the “Term Expiration Date” shall be applicable to both the 9712 Premises and the 9714 Premises, except to the extent otherwise specifically set forth herein.

2

(a) The provisions of Article 4 and Exhibit B of the Existing Lease shall apply solely to the 9712 Premises. With respect to the 9714 Premises, Landlord shall use commercially reasonable efforts to tender possession of the 9714 Premises to Tenant on March 1, 2016 (the “Estimated 9714 Term Commencement Date”), broom-clean and free and clear of debris and any other tenancies, occupants and their personal property, furniture, fixtures and equipment, and with the work required of Landlord described in the 9714 Approved Plans (as defined below) (the “9714 Tenant Improvements”) Substantially Complete (collectively the “Delivery Condition”). Tenant agrees that in the event possession of the 9714 Premises is not delivered to Tenant in the Delivery Condition on or before the Estimated 9714 Term Commencement Date for any reason, then (i) neither this Amendment nor the Lease shall be void or voidable, (ii) Landlord shall not be liable to Tenant for any loss or damage resulting therefrom, (iii) the 9714 Term Expiration Date shall be extended accordingly and (iv) Tenant shall not be responsible for the payment of any Base Rent for the 9714 Premises until the 9714 Term Commencement Date as described in Section 7(b) of this Amendment actually occurs. For purposes of this Amendment, the term “Substantially Complete” or “Substantial Completion” means that (A) the 9714 Tenant Improvements are substantially complete in accordance with the 9714 Approved Plans and this Amendment, as certified by Landlord’s architect, except for minor punch list items, the existence, completion or correction of which will not materially interfere with Tenant’s use and occupancy of the 9714 Premises for the Permitted Use therefor, and (B) a certificate of occupancy for the 9714 Premises has been issued by the applicable Governmental Authority. Notwithstanding anything in the Lease to the contrary, Landlord’s obligation to timely achieve Substantial Completion shall be subject to extension on a day-for-day basis as a result of Force Majeure (as defined in the Existing Lease). Notwithstanding the foregoing, if due to any reason other than a holdover by the then-existing occupants of the 9714 Premises or Force Majeure, the 9714 Term Commencement Date does not occur within forty-five (45) days after the Estimated 9714 Term Commencement Date (the “Outside Possession Date”), then, commencing on the 9714 Term Commencement Date, Tenant shall be entitled to receive one (1) day of Base Rent abatement for the 9714 Premises for each day beyond the Outside Possession Date that the 9714 Term Commencement Date fails to occur.

(b) The “9714 Term Commencement Date” shall be the later of (i) the Estimated 9714 Term Commencement Date, and (ii) the date on which Landlord delivers possession of the 9714 Premises to Tenant in the Delivery Condition (as defined in Section 7(a) above). If such delivery of possession is delayed by action of Tenant, then the 9714 Term Commencement Date shall be the date that the 9714 Term Commencement Date would have occurred but for such delay. The date upon which the Term for the 9714 Premises actually commences shall be the “9714 Term Commencement Date.” Tenant shall execute and deliver to Landlord written acknowledgement of the 9714 Term Commencement Date within ten (10) days after the occurrence of the 9714 Term Commencement Date in the form attached as Exhibit C to this Amendment. Failure to execute and deliver such acknowledgement, however, shall not affect the 9714 Term Commencement Date or Landlord’s or Tenant’s liability under the Lease. Failure by Tenant to obtain validation by any medical review board or other similar governmental licensing of the 9714 Premises required for the Permitted Use of the 9714 Premises by Tenant shall not serve to extend the 9714 Term Commencement Date. For clarification purposes, the phrase “other similar governmental licensing” as used in the preceding sentence shall not apply to Landlord’s obligation to obtain a certificate of occupancy for the 9714 Premises as a condition precedent to the 9714 Tenant Improvements being deemed Substantially Complete.

(c) Landlord shall cause the 9714 Tenant Improvements to be constructed in the 9714 Premises at a cost to Landlord not to exceed (i) Two Hundred Eighty-Five Thousand Eight Hundred Forty and 00/100 Dollars ($285,840.00) (based upon Fifteen and 00/100 Dollars ($15.00) per square foot of Rentable Area of the 9714 Premises (the “9714 Base TI Allowance”), plus (ii) if requested by Tenant by a letter in the form attached

3

as Exhibit D hereto executed by an authorized officer of Tenant, up to Six Hundred Sixty-Six Thousand Nine Hundred Sixty and 00/100 Dollars ($666,960.00) (based upon Thirty-Five and 00/100 Dollars ($35.00) per square foot of Rentable Area of the 9714 Premises) (the “9714 Additional TI Allowance”), for a total of up to Nine Hundred Fifty-Two Thousand Eight Hundred and 00/100 Dollars ($952,800.00) (based upon Fifty Dollars ($50.00) per square foot of Rentable Area of the 9714 Premises). The 9714 Base TI Allowance, together with the 9714 Additional TI Allowance (if and to the extent properly requested by Tenant pursuant to this Section), shall be referred to herein as the “9714 TI Allowance.” The 9714 TI Allowance may be applied to the following costs in connection with the 9714 Tenant Improvements: (A) construction, (B) project review and supervision fee to Landlord (which fee shall equal three percent (3%) of the cost of the 9714 Tenant Improvements, including the 9714 Base TI Allowance and, if used by Tenant, the 9714 Additional TI Allowance), (C) commissioning of mechanical, electrical and plumbing systems serving the 9714 Premises by a licensed, qualified commissioning agent hired by Landlord, and review of such party’s commissioning report by a licensed, qualified commissioning agent hired by Landlord, (D) space planning, architect, engineering and other related professional or consulting services performed by third parties unaffiliated with Tenant, (E) building permits and other taxes, fees, charges and levies by Governmental Authorities for permits or for inspections, and (F) costs and expenses for labor, materials, equipment and fixtures. In no event shall the 9714 TI Allowance be used for (V) the cost of work that is not authorized by the 9714 Approved Plans or otherwise approved in writing by Landlord, (W) payments to Tenant or any affiliates of Tenant, (X) the purchase of any furniture, personal property or other non-building system equipment, (Y) costs resulting from any default by Tenant of its obligations under the Lease or (Z) costs that are recoverable by Tenant from a third party (e.g., insurers, warrantors, or tortfeasors).

(d) Tenant shall have until March 31, 2017 (the “9714 TI Allowance Deadline”) to expend the unused portion of the 9714 TI Allowance, after which date Landlord’s obligation to fund such costs shall expire, provided, however, that the 9714 TI Allowance Deadline shall be extended by one (1) day for each day beyond the Estimated 9714 Term Commencement Date that Substantial Completion of the 9714 Tenant Improvements is delayed as a direct result of Force Majeure or delay caused by Landlord. Monthly Base Rent for the 9714 Premises shall be increased to include the amount of the 9714 Additional TI Allowance requested by Tenant and disbursed by Landlord (the “Actual 9714 Additional TI Allowance Amount”) in accordance with this Amendment, amortized over the initial 9714 Premises Term at a rate of eight percent (8%) annually, as if the Actual 9714 Additional TI Allowance Amount had been loaned to Tenant as of the 9714 Term Commencement Date (subject to adjustment as provided below) and repaid in equal monthly installments. The amount by which monthly Base Rent with respect to the 9714 Premises shall be increased shall be determined (and Base Rent shall be increased accordingly) as of the 9714 Term Commencement Date (with Landlord to provide Tenant an accounting of the same) and, if such determination does not reflect use by Tenant of all of the 9714 Additional TI Allowance requested by Tenant, the Actual 9714 Additional TI Allowance Amount shall be determined again as of the TI Deadline (with Landlord to provide Tenant with a reasonably detailed accounting of the same), with Tenant paying (on the next succeeding date that Base Rent is due under the Lease which is at least thirty (30) days after Tenant receives such accounting (the “TI True-Up Date”)), any underpayment of the further adjusted Base Rent for the 9714 Premises for the period beginning on the 9714 Term Commencement Date and ending on the TI True-Up Date.

(e) To the extent that the total projected cost of the 9714 Tenant Improvements (as reasonably projected and evidenced by Landlord via a reasonably detailed written calculation provided to Tenant) exceeds the 9714 TI Allowance (such excess, the “Excess 9714 TI Costs”), Tenant shall pay the costs of the 9714 Tenant Improvements on a pari passu basis with Landlord as such costs are paid, in the proportion of Excess 9714 TI Costs payable by Tenant to the 9714 Base TI Allowance (and, if properly requested by Tenant pursuant to this Amendment, the 9714 Additional TI Allowance) payable by Landlord. Landlord shall not be obligated

4

to expend any portion of the 9714 Additional TI Allowance until Landlord shall have received from Tenant a letter in the form attached as Exhibit D hereto executed by an authorized officer of Tenant. In no event shall any unused 9714 TI Allowance entitle Tenant to a credit against Rent payable under the Lease.

(f) Landlord designates, as Landlord’s authorized representative (“Landlord’s Authorized Representative”), (i) Tim Stoll as the person authorized to initial plans, drawings, approvals and to sign change orders pursuant to this Amendment, and (ii) an officer of Landlord as the person authorized to sign any amendments to the Lease. Tenant shall not be obligated to respond to or act upon any such item until such item has been initialed or signed (as applicable) by the appropriate Landlord’s Authorized Representative. Landlord may change either Landlord’s Authorized Representative upon one (1) business day’s prior written notice to Tenant.

(g) Tenant designates Vittal Vasista (“Tenant’s Authorized Representative”) as the person authorized to initial and sign all plans, drawings, change orders and approvals pursuant to this Amendment. Landlord shall not be obligated to respond to or act upon any such item until such item has been initialed or signed (as applicable) by Tenant’s Authorized Representative. Tenant may change Tenant’s Authorized Representative upon one (1) business day’s prior written notice to Landlord.

(h) The schedule for design and development of the 9714 Tenant Improvements, including the time periods for preparation and review of construction documents, approvals and performance, shall be in accordance with a schedule to be prepared by Landlord and reasonably approved by Tenant (the “9714 Schedule”). The 9714 Schedule shall be subject to adjustment as mutually agreed upon in writing by the parties, acting reasonably. Except as otherwise expressly provided in this Amendment, Tenant shall respond to all written requests for consents, approvals or directions made by Landlord pursuant to this Amendment and in accordance with Sections 2.10 and 39 of the Lease as amended hereby within five (5) business days following Tenant’s receipt of such request. Tenant’s failure to respond within such five (5) business day period shall be deemed approval by Tenant.

(i) Subject to the provisions of this Section 7(i), the architect, engineering consultants, design team, general contractor and subcontractors responsible for the construction of the 9714 Tenant Improvements shall be selected by Landlord and shall be qualified and licensed in the applicable jurisdiction(s). Promptly after Landlord and Tenant have approved the 9714 Construction Plans (as defined and provided in Section 7(k) below), Landlord shall promptly solicit bids to perform the 9714 Tenant Improvements from at least (2) qualified and licensed general contractors selected by Landlord and shall provide copies of such bids to Tenant. Landlord shall take into consideration the lowest price, as well as qualifications and experience, in selecting Landlord’s contractor, and shall endeavor to select the contractor with the lowest bid (although Landlord shall not be obligated to select the contractor with the lowest bid if Landlord determines that such contractor or such contractor’s team could cause labor disharmony or that such contractor’s or contractor’s team’s qualifications or experience performing comparable tenant improvement projects in similar buildings is not sufficient). All 9714 Tenant Improvements shall be performed by Landlord’s contractor, at Tenant’s sole cost and expense (subject to Landlord’s obligations with respect to any portion of the 9714 TI Allowance) and in accordance, in all material respects, with the 9714 Approved Plans and this Amendment. All materials and equipment furnished by Landlord or its contractors as the 9714 Tenant Improvements shall be new and in accordance with the 9714 Approved Plans and the 9714 Tenant Improvements shall be performed in a first-class, workmanlike manner.

(j) Landlord shall prepare and submit to Tenant for approval in accordance with Sections 2.10 and 39 of the Lease as amended hereby, schematics covering the 9714 Tenant Improvements prepared in

5

conformity with the applicable provisions of this Amendment (the “9714 Draft Schematic Plans”). The 9714 Draft Schematic Plans shall contain sufficient information and detail to accurately describe the proposed design to Tenant. Tenant shall notify Landlord in writing within five (5) business days after receipt of the 9714 Draft Schematic Plans whether Tenant approves or objects to the 9714 Draft Schematic Plans and of the manner, if any, in which the 9714 Draft Schematic Plans are unacceptable. Tenant’s failure to respond within such five (5) business day period shall be deemed approval by Tenant. If Tenant objects to the 9714 Draft Schematic Plans, then Landlord shall revise the 9714 Draft Schematic Plans and cause Tenant’s objections to be remedied in the revised 9714 Draft Schematic Plans. Landlord shall then resubmit the revised 9714 Draft Schematic Plans to Tenant for approval, such approval not to be unreasonably withheld, conditioned or delayed. Tenant’s approval of or objection to revised 9714 Draft Schematic Plans and Landlord’s correction of the same shall be in accordance with this Section 7(j) until Tenant has approved the 9714 Draft Schematic Plans in writing or been deemed to have approved them. The iteration of the 9714 Draft Schematic Plans that is approved or deemed approved by Tenant without objection shall be referred to herein as the “9714 Approved Schematic Plans.” In the event that 9714 Draft Schematic Plans are not approved by Tenant in accordance with this Section 7(j) prior to November 1, 2015, provided that Landlord submits to Tenant for approval by October 15, 2015 in accordance with this Section 7(j) a revised set of 9714 Draft Schematic Plans, then, notwithstanding anything in this Amendment to the contrary, Landlord shall be entitled to a day-for-day delay in the Estimated 9714 Term Commencement Date for every day after such November 1, 2015 date until 9714 Draft Schematic Plans are approved by Tenant in accordance with this Section 7(j).

(k) Commencing promptly after the Amendment Execution Date, Landlord shall cause its architect and engineer to prepare final plans and specifications for the 9714 Tenant Improvements that (i) are consistent with and are logical evolutions of the 9714 Approved Schematic Plans and (ii) incorporate any other Tenant-requested (and Landlord-approved) Changes (as defined below). As soon as such final plans and specifications (“9714 Construction Plans”) are completed, Landlord shall deliver the same to Tenant for Tenant’s approval in accordance with Sections 2.10 and 39 of the Lease as amended hereby, which approval shall not be unreasonably withheld, conditioned or delayed (provided that Tenant may only disapprove the 9714 Construction Plans if they (A) are not consistent with and logical evolutions of the 9714 Approved Schematic Plans, (B) do not incorporate any Tenant-requested (and Landlord-approved) Change, or (C) reflect a violation of Applicable Law or design defect). Such 9714 Construction Plans shall be approved or disapproved by Tenant in accordance with this Section 7(k) within five (5) business days after delivery to Tenant. Tenant’s failure to respond within such five (5) business day period shall be deemed approval by Tenant. If the 9714 Construction Plans are disapproved by Tenant for one of the reasons set forth in subsections (A), (B) or (C) of this Section 7(k), then Tenant shall notify Landlord in writing of such objections to such 9714 Construction Plans, and the parties shall confer and negotiate in good faith to reach agreement on the 9714 Construction Plans. Landlord shall then resubmit the revised 9714 Construction Plans to Tenant for approval, such approval not to be unreasonably withheld, conditioned or delayed. Tenant’s approval of or objection to revised 9714 Construction Plans and Landlord’s correction of the same shall be in accordance with this Section 7(k) until Tenant has approved the 9714 Construction Plans in writing or been deemed to have approved them in accordance with this Section 7(k). Promptly after the 9714 Construction Plans are approved (or deemed approved) by Landlord and Tenant in accordance with this Section 7(k), two (2) copies of such 9714 Construction Plans shall be initialed and dated by Landlord and Tenant, and Landlord shall promptly submit such 9714 Construction Plans to all appropriate Governmental Authorities for approval. The 9714 Construction Plans so approved, and all change orders specifically permitted by this Amendment, are referred to herein as the “9714 Approved Plans.”

6

(l) Any changes to the 9714 Approved Plans (each, a “Change”) shall be requested and instituted in accordance with the provisions of this Section 7(l) and shall be subject to the written approval of the non-requesting party in accordance with this Amendment.

(i) Either Landlord or Tenant may request Changes after Tenant approves the 9714 Approved Plans by notifying the other party thereof in writing in substantially the same form as the AIA standard change order form (a “Change Request”), which Change Request shall detail the nature and extent of any requested Changes, including (i) the Change, (ii) the party required to perform the Change and (iii) any modification of the 9714 Approved Plans and the 9714 Schedule, as applicable, necessitated by the Change. If the nature of a Change requires revisions to the 9714 Approved Plans, then the requesting party shall be solely responsible for the cost and expense of such revisions and any increases in the cost of the 9714 Tenant Improvements as a result of such Change. Change Requests shall be signed by the requesting party’s Authorized Representative.

(ii) All Change Requests shall be subject to the other party’s prior written approval, which approval shall not be unreasonably withheld, conditioned or delayed. The non-requesting party shall have five (5) business days after receipt of a Change Request in accordance with Sections 2.10 and 39 of the Lease as amended hereby to notify the requesting party in writing of the non-requesting party’s decision either to approve or object to the Change Request. The non-requesting party’s failure to respond within such five (5) business day period shall be deemed approval by the non-requesting party.

(m) Notwithstanding anything to the contrary set forth elsewhere in this Amendment, Landlord shall not have any obligation to expend any portion of the 9714 TI Allowance until Landlord and Tenant shall have approved in writing the budget for the 9714 Tenant Improvements (the “9714 Approved Budget”). Landlord shall provide the proposed 9714 Approved Budget to Tenant in accordance with Sections 2.10 and 39 of the Lease as amended hereby concurrently with its approval of the bid and selection of the contractor for the performance of the 9714 Tenant Improvements pursuant to Section 7(i) hereof. If prior to approval of the 9714 Approved Budget, Tenant shall direct Landlord in writing to commence construction of the 9714 Tenant Improvements, then Tenant shall be responsible to pay all of the costs and expenses incurred in connection with the 9714 Tenant Improvements as they become due until such time as the 9714 Approved Budget is approved at which time the other applicable provisions of this Section 7 shall apply to all such costs and expenses both theretofore and thereafter incurred; provided, however that Landlord shall have no obligation to commence the 9714 Tenant Improvements prior to approval of the 9714 Approved Budget unless and until Tenant delivers such written direction to Landlord to commence construction, and the Estimated 9714 Term Commencement Date shall be extended by one (1) day for every day beyond November 1, 2015 that Tenant has neither delivered such written direction to Landlord nor approved the 9714 Approved Budget.

(n) This Section 7 shall not apply to improvements performed in any additional premises added to the Premises at any time or from time to time after the Amendment Execution Date, whether by any options under the Lease or otherwise; or to any portion of the Premises or any additions to the Premises in the event of a renewal or extension of the original Term, whether by any options under the Lease or otherwise.

8. Condition of 9714 Premises. Tenant acknowledges that (a) it is fully familiar with the condition of the 9714 Premises and, notwithstanding anything contained in the Lease to the contrary, agrees to take the same in its condition “as is” as of the 9714 Term Commencement Date, and (b) Landlord shall have no obligation to alter, repair or otherwise prepare the 9714 Premises for Tenant’s occupancy or to pay for any improvements to the 9714 Building, except in either case as may be expressly provided in the Lease or Section 7 above.

7

9. 9714 Base Rent. The provisions of Section 2.3 and 7.1 of the Existing Lease shall apply solely to the 9712 Premises. With respect to the 9714 Premises, Tenant shall pay to Landlord as Base Rent for the 9714 Premises, commencing on the 9714 Term Commencement Date, the monthly installments of Base Rent for the 9714 Premises set forth below, in advance on the first day of each and every calendar month during the 9714 Premises Term:

|

Dates |

Square Feet of Rentable Area |

Base Rent per Square Foot of Rentable Area |

Monthly Base Rent* |

Annual Base Rent* |

|

9714 Lease Year 1 |

19,056 |

$26.00 annually |

$41,288.00 |

$495,456.00 |

|

9714 Lease Year 2 |

19,056 |

$26.78 annually |

$42,526.64 |

$510,319.68 |

|

9714 Lease Year 3 |

19,056 |

$27.58 annually |

$43,797.04 |

$525,564.48 |

|

9714 Lease Year 4 |

19,056 |

$28.41 annually |

$45,115.08 |

$541,380.96 |

|

9714 Lease Year 5 |

19,056 |

$29.26 annually |

$46,464.88 |

$557,578.56 |

* prorated for any partial period

As used herein, “9714 Lease Year” shall mean the 12-month period commencing on the 9714 Term Commencement Date and each subsequent 12-month period (or portion thereof) during the 9714 Premises Term, provided that if the actual 9714 Term Commencement Date is not the first day of a calendar month, the 9714 Premises Term and the 9714 Term Expiration Date shall be extended to the last day of the calendar month in which the 9714 Term Expiration Date would otherwise occur (and Base Rent for the 9714 Premises for such extension period shall be payable at the rate in effect during the month immediately preceding such extension period).

10. 9714 Additional Rent.

(a) The provisions of Section 7.2 of the Existing Lease shall apply solely to the 9712 Premises. With respect to the 9714 Premises, in addition to Base Rent for the 9714 Premises, Tenant shall pay to Landlord as Additional Rent for the 9714 Premises at times hereinafter specified in this Amendment (i) Tenant’s 9714 Adjusted Share (as defined below) of Operating Expenses (as defined in the Existing Lease) for (A) the 9714 Building, (B) the South Campus for the 9714 Premises and (c) the Project for the 9714 Premises, (ii) the Property Management Fee (as defined in the Existing Lease) and (iii) any other amounts that Tenant assumes or agrees to pay under the provisions of the Lease that are owed to Landlord, including any and all other sums that may become due by reason of any default of Tenant or failure on Tenant’s part to comply with the agreements, terms, covenants and conditions of the Lease to be performed by Tenant, after notice and the lapse of any applicable cure periods. To the extent that Tenant uses more than Tenant’s Pro Rata Share of any item of Operating Expenses related to the 9714 Premises, Tenant shall pay Landlord for such excess in addition to Tenant’s obligation to pay Tenant’s Pro Rata Share of Operating Expenses (such excess, together with Tenant’s Pro Rata Share, “Tenant’s 9714 Adjusted Share”).

(b) The provisions of the first paragraph of Section 9.2 and Section 9.2(y) of the Existing Lease shall apply solely to the 9712 Premises. With respect to the 9714 Premises, Tenant shall pay to Landlord on the first day of each calendar month of the Term, as Additional Rent, commencing on the 9714 Term Commencement Date, (i) the Property Management Fee and (ii) Landlord’s good faith estimate of Tenant’s 9714 Adjusted Share of Operating Expenses with respect to the 9714 Building, the South Campus for the 9714 Premises and the Project for the 9714 Premises for such month.

8

(c) The provisions of Section 9.4 and 9.5 of the Existing Lease shall apply solely to the 9712 Premises. Tenant shall not be responsible for Operating Expenses with respect to the 9714 Premises with respect to any time period prior to the 9714 Term Commencement Date; provided, however, that if Landlord shall permit Tenant possession of the 9714 Premises prior to the 9714 Term Commencement Date, Tenant shall be responsible for Operating Expenses from such earlier date of possession (the 9714 Term Commencement Date or such earlier date, as applicable, the “Expense Trigger Date”); and provided, further, that Landlord may annualize certain Operating Expenses incurred prior to the Expense Trigger Date over the course of the budgeted year during which the Expense Trigger Date occurs, and Tenant shall be responsible for the annualized portion of such Operating Expenses corresponding to the number of days during such year, commencing with the Expense Trigger Date, for which Tenant is otherwise liable for Operating Expenses with respect to the 9714 Premises pursuant to the Lease. Tenant’s responsibility for Tenant’s Adjusted Share of Operating Expenses with respect to the 9714 Premises shall continue to the latest of (i) the date of termination of the Lease with respect to the 9714 Premises, (ii) the date Tenant has fully vacated the 9714 Premises and (c) if termination of the Lease is due to a default by Tenant, the date of rental commencement of a replacement tenant. Operating Expenses for the calendar year in which Tenant’s obligation to share therein commences and for the calendar year in which such obligation ceases shall be prorated on a basis reasonably determined by Landlord. Expenses such as taxes, assessments and insurance premiums that are incurred for an extended time period shall be prorated based upon the time periods to which they apply so that the amounts attributed to the 9714 Premises relate in a reasonable manner to the time period wherein Tenant has an obligation to share in Operating Expenses.

11. Utilities and Services for the 9714 Premises. The provisions of Article 16 of the Existing Lease shall apply solely to the 9712 Premises. With respect to the 9714 Premises:

(a) Tenant shall pay for all water (including the cost to service, repair and replace reverse osmosis, de-ionized and other treated water), gas, heat, light, power, telephone, internet service, cable television, other telecommunications and other utilities supplied to the 9714 Premises, together with any fees, surcharges and taxes thereon. If any such utility is not separately metered to Tenant, Tenant shall pay Tenant’s Adjusted Share of all charges of such utility jointly metered with all other premises in the 9714 Building as Additional Rent or, in the alternative, Landlord may, at its option, directly meter the usage of such utilities by Tenant provided that, if the decision to direct meter the usage of such utilities is due to the overconsumption of such utilities by Tenant, then the cost of purchasing, installing and monitoring such metering equipment shall be paid by Tenant as Additional Rent, and otherwise such cost shall be paid by Landlord. Landlord may base its bills for utilities on reasonable estimates; provided that Landlord adjusts such billings promptly thereafter or as part of the next Landlord’s Statement to reflect the actual cost of providing utilities to the 9714 Premises. To the extent that Tenant uses more than Tenant’s Pro Rata Share of any utilities, then Tenant shall pay Landlord for Tenant’s Adjusted Share of such utilities to reflect such excess. In the event that the 9714 Building, South Campus or Project is less than fully occupied during a calendar year, Tenant acknowledges that Landlord may extrapolate utility usage that varies depending on the occupancy of the 9714 Building, South Campus or Project (as applicable) to equal Landlord’s reasonable estimate of what such utility usage would have been had the 9714 Building, South Campus or Project, as applicable, been ninety-five percent (95%) occupied during such calendar year; provided, however, that Landlord shall not recover more than one hundred percent (100%) of the cost of such utilities. Tenant shall not be liable for the cost of utilities supplied to the 9714 Premises attributable to the time period prior to the 9714 Term Commencement Date; provided, however, that, if Landlord shall permit Tenant possession of the 9714 Premises prior to the 9714 Term Commencement Date and Tenant uses the 9714 Premises for any purpose other than for the placement of its cabling, equipment, furniture and personal property therein, then Tenant shall be responsible for the cost of utilities supplied to the 9714 Premises from such earlier date of possession. In any event, if Landlord permits Tenant any early access to the

9

9714 Premises, then Tenant shall exercise such right of early access in a manner that does not interfere with the construction of the 9714 Tenant Improvements in the 9714 Premises.

(b) Landlord shall not be liable for, nor shall any eviction of Tenant result from, the failure to furnish any utility or service to the 9714 Premises, whether or not such failure is caused by Force Majeure (as defined in the Existing Lease) or Severe Weather Conditions (as defined in the Existing Lease), provided, however, that the provisions of Section 16.2 of the Existing Lease shall apply to any Material Services Failure (as defined in the Existing Lease) to the 9714 Premises.

(c) Tenant shall pay for, prior to delinquency of payment therefor, any utilities and services that may be furnished to the 9714 Premises during or, if Tenant occupies the 9714 Premises after the expiration or earlier termination of the Term, after the Term, beyond those utilities provided by Landlord, including telephone, internet service, cable television and other telecommunications, together with any fees, surcharges and taxes thereon. Upon Landlord’s demand, utilities and services provided to the 9714 Premises that are separately metered shall be paid by Tenant directly to the supplier of such utilities or services.

(d) Tenant shall not, without Landlord’s prior written consent, use any device in the 9714 Premises (including data processing machines) that will in any way (i) increase the amount of ventilation, air exchange, gas, steam, electricity or water required or consumed in the 9714 Premises based upon Tenant’s Pro Rata Share of the 9714 Building or Project (as applicable) beyond the existing capacity of the 9714 Building or the Project usually furnished or supplied for the Permitted Use or (ii) exceed Tenant’s Pro Rata Share of the 9714 Building’s or Project’s (as applicable) capacity to provide such utilities or services.

(e) If Tenant shall require utilities or services in excess of those usually furnished or supplied for tenants in similar spaces in the 9714 Building or the Project by reason of Tenant’s equipment or extended hours of business operations, then Tenant shall first procure Landlord’s consent for the use thereof, which consent Landlord may condition upon the availability of such excess utilities or services, and Tenant shall pay as Additional Rent an amount equal to the cost of providing such excess utilities and services.

(f) Landlord shall provide water in Common Area for lavatory and landscaping purposes only, which water shall be from the local municipal or similar source; provided, however, that if Landlord reasonably determines that Tenant requires, uses or consumes water provided to the Common Area for any purpose other than ordinary lavatory purposes, and such additional requirement, use or consumption is not promptly discontinued after written demand from Landlord, Landlord may install a Tenant Water Meter (as defined in the Existing Lease) and thereby measure Tenant’s water consumption for all purposes. Tenant shall pay Landlord for the costs of any Tenant Water Meter and the installation and maintenance thereof during the Term. If Landlord installs a Tenant Water Meter, Tenant shall pay for water consumed, as shown on such meter, as and when bills are rendered. If Tenant fails to timely make such payments, Landlord may pay such charges and collect the same from Tenant. Any such costs or expenses incurred or payments made by Landlord for any of the reasons or purposes stated in this Section shall be deemed to be Additional Rent payable by Tenant and collectible by Landlord as such.

(g) Landlord reserves the right to stop service of the elevator, plumbing, ventilation, air conditioning and utility systems, when Landlord reasonably deems necessary, due to accident, emergency or the need to make repairs, alterations or improvements, until such repairs, alterations or improvements shall have been completed, and except as provided in Section 11(b) above, Landlord shall further have no responsibility or liability for failure to supply elevator facilities, plumbing, ventilation, air conditioning or utility service when prevented from doing so by Force Majeure or, to the extent permitted by Applicable Laws, Landlord’s negligence. Without limiting the foregoing, it is expressly understood and agreed that any covenants on

10

Landlord’s part to furnish any service pursuant to any of the terms, covenants, conditions, provisions or agreements of this Lease, or to perform any act or thing for the benefit of Tenant, shall not be deemed breached if Landlord is unable to furnish or perform the same by virtue of Force Majeure or, to the extent permitted by Applicable Laws, Landlord’s negligence.

(h) For the 9714 Premises, Landlord shall (i) maintain and operate the HVAC systems (excluding any Tenant-installed supplemental units exclusively serving the 9714 Premises) used for the Permitted Use only (“Base HVAC”) and (ii) subject to Subsection 11(h)(i), furnish Base HVAC as reasonably required (except as this Amendment otherwise provides) for reasonably comfortable occupancy of the 9714 Premises twenty-four (24) hours a day, every day during the 9714 Premises Term, subject to casualty, eminent domain or as otherwise specified in this Section. Tenant’s HVAC usage for the 9714 Premises shall be separately metered. Tenant may deliver written notice to Landlord from time to time stating the specific temperature to which Tenant desires the HVAC system for the 9714 Premises to be set during specific hours on specific days (“HVAC Checkpoints”), and Landlord shall program the HVAC system to reflect Tenant’s desired HVAC Checkpoints. Notwithstanding anything to the contrary in this Section (but subject to Section 11(b) above), Landlord shall have no liability, and Tenant shall have no right or remedy, on account of any interruption or impairment in Base HVAC services; provided that Landlord diligently endeavors to cure any such interruption or impairment.

(i) For any utilities serving the 9714 Premises for which Tenant is billed directly by such utility provider, Tenant agrees to furnish to Landlord, within thirty (30) days after Landlord’s request, (a) any invoices or statements for such utilities, (b) any other utility usage information reasonably requested by Landlord, and (c) within thirty (30) days after each calendar year during the 9714 Premises Term, authorization to allow Landlord to access Tenant’s usage information reasonably available and reasonably necessary for Landlord to complete an ENERGY STAR® Statement of Performance (or similar comprehensive utility usage report (e.g., related to Labs 21), if requested by Landlord) and any other information reasonably requested by Landlord for the immediately preceding year; and Tenant shall comply with any other energy usage or consumption requirements required by Applicable Laws. Tenant shall retain records of utility usage at the 9714 Premises, including invoices and statements from the utility provider, for at least sixty (60) months, or such other period of time as may be requested by Landlord. Tenant acknowledges that any utility information for the 9714 Premises, the 9714 Building and the Project may be shared with third parties, including Landlord’s consultants and Governmental Authorities. In addition to the foregoing, Tenant shall comply with all Applicable Laws related to the disclosure and tracking of energy consumption at the 9714 Premises. The provisions of this Section shall survive the expiration or earlier termination of the Lease.

12. 9714 Premises Repairs and Maintenance. The provisions of Section 18.1 of the Existing Lease shall apply solely to the 9712 Premises. With respect to the 9714 Premises, Landlord shall repair and maintain the structural and exterior portions and Common Area of the 9714 Building and the Project, including roofing and covering materials; foundations (excluding any architectural slabs, but including any structural slabs); exterior walls; plumbing; fire sprinkler systems (if any); HVAC systems; elevators; and electrical systems installed or furnished by Landlord.

13. Security Deposit. Landlord currently holds Twenty-Three Thousand Nine Hundred Twenty-Two and 88/100 Dollars ($23,922.88) as the Security Deposit under the Existing Lease. Tenant shall deposit with Landlord on or before the Amendment Execution Date an additional sum of Eighty-Two Thousand Five Hundred Seventy-Six and 00/100 Dollars ($82,576.00), for a total Security Deposit of One Hundred Six Thousand Four Hundred Ninety-Eight and 88/100 Dollars ($106,498.88).

11

14. 9714 Parking. Parking for both the 9712 Premises and the 9714 Premises shall be as set forth in Section 13.3 of the Existing Lease. As of the Amendment Execution Date, Tenant’s Pro Rata Share of the parking facilities serving the Project is equal to 2.6 parking spaces per one thousand (1,000) square feet of Rentable Area.

15. Options to Extend the Term. The Options to extend the Term set forth in Article 42 of the Existing Lease shall apply to the entire Premises (including the 9714 Premises); provided, however, that (a) the time period for exercise and length of the first Option shall be calculated based upon the expiration of the Term of the Lease for the 9712 Premises (i.e., October 31, 2020) and (b) the 9714 Premises Term would only be extended to the extent necessary to make it coterminous with the Term of the Lease for the 9712 Premises as extended pursuant to such Option (i.e., the Term with respect to the first Option for both the 9712 Premises and the 9714 Premises would be extended until October 31, 2023).

16. Right of First Refusal. The first (1st) sentence of Article 43 of the Existing Lease is hereby amended and restated in its entirety as follows:

Commencing upon the Amendment Execution Date (as defined in the First Amendment to this Lease), but subject to any other parties’ pre-existing rights existing on such Amendment Execution Date with respect to Available ROFR Premises (as defined below) (including, without limitation, any such rights granted to GlycoMimetics, Inc.), Tenant shall have a right of first refusal (“ROFR”) as to any rentable premises on the first (1st) floor of the building located at 9714 Medical Center Drive, Rockville, Maryland, for which Landlord is seeking a tenant (“Available ROFR Premises”); provided, however, that in no event shall Landlord be required to lease any Available ROFR Premises to Tenant for any period past the date on which this Lease expires or is terminated pursuant to its terms.

17. Broker. Tenant represents and warrants that it has not dealt with any broker or agent in the negotiation for or the obtaining of this Amendment, other than Sheer Partners (“Broker”), and agrees to reimburse, indemnify, save, defend (at Landlord’s option and with counsel reasonably acceptable to Landlord, at Tenant’s sole cost and expense) and hold harmless the Landlord Indemnitees (as defined in the Lease) for, from and against any and all cost or liability for compensation claimed by any such broker or agent, other than Broker, employed or engaged by Tenant or claiming to have been employed or engaged by Tenant. Broker is entitled to a leasing commission in connection with the making of this Amendment, and Landlord shall pay such commission to Broker pursuant to a separate agreement between Landlord and Broker. Landlord represents and warrants that it has had no dealings with any real estate broker or agent in connection with the negotiation of this Amendment other than Broker and agrees to reimburse, indemnify, save, defend (at Tenant’s option and with counsel reasonably acceptable to Tenant, at Landlord’s sole cost and expense) and hold Tenant harmless for, from and against any and all cost or liability for compensation claimed by any broker or agent, other than Broker, employed or engaged by Landlord or claiming to have been employed or engaged by Landlord.

18. No Default. Landlord and Tenant each represents, warrants and covenants to the other that, to the best of its knowledge, Landlord and Tenant are not in default of any of their respective obligations under the Existing Lease and no event has occurred that, with the passage of time or the giving of notice (or both) would constitute a default by either Landlord or Tenant thereunder.

12

19. Notices. The address for notices to Tenant set forth in Section 2.10 of the Existing Lease and the address for invoices to Tenant set forth in Section 2.11 of the Existing Lease are both hereby deleted in their entirety and replaced respectively with the following:

Address for Notices to Tenant:

REGENXBIO Inc.

9712 Medical Center Drive, Suite 100

Rockville, MD 20850

Attn: General Counsel

With copies by email to:

Sberl@regenxbio.com

and to:

Vvasista@regenxbio.com

Address for Invoices to Tenant:

REGENXBIO Inc.

9712 Medical Center Drive, Suite 100

Rockville, MD 20850

Attn: Chief Financial Officer

20. Effect of Amendment. Except as modified by this Amendment, the Existing Lease and all the covenants, agreements, terms, provisions and conditions thereof shall remain in full force and effect and are hereby ratified and affirmed. In the event of any conflict between the terms contained in this Amendment and the Existing Lease, the terms herein contained shall supersede and control the obligations and liabilities of the parties.

21. Successors and Assigns. Each of the covenants, conditions and agreements contained in this Amendment shall inure to the benefit of and shall apply to and be binding upon the parties hereto and their respective heirs, legatees, devisees, executors, administrators and permitted successors and assigns and sublessees. Nothing in this section shall in any way alter the provisions of the Lease restricting assignment or subletting.

22. Miscellaneous. This Amendment becomes effective only upon execution and delivery hereof by Landlord and Tenant. The captions of the sections, subsections, paragraphs and subparagraphs in this Amendment are inserted and included solely for convenience and shall not be considered or given any effect in construing the provisions hereof. All exhibits hereto are incorporated herein by reference. Submission of this instrument for examination or signature by Tenant does not constitute a reservation of or option for a lease, and shall not be effective as a lease, lease amendment or otherwise until execution by and delivery to both Landlord and Tenant.

23. Authority. Landlord and Tenant each guarantees, warrants and represents that the individual or individuals signing this Amendment have the power, authority and legal capacity to sign this Amendment on

13

behalf of and to bind all entities, corporations, partnerships, limited liability companies, joint venturers or other organizations and entities on whose behalf such individual or individuals have signed.

24. Counterparts; Facsimile and PDF Signatures. This Amendment may be executed in one or more counterparts, each of which, when taken together, shall constitute one and the same document. A facsimile or portable document format (PDF) signature on this Amendment shall be equivalent to, and have the same force and effect as, an original signature.

25. Entire Agreement. The terms of the Lease are intended by the parties as a final, complete and exclusive expression of their agreement with respect to the terms that are included therein, and may not be contradicted or supplemented by evidence of any other prior or contemporaneous agreement.

26. Savings Clause. Any provision of this Amendment that shall prove to be invalid, void or illegal shall in no way affect, impair or invalidate any other provision hereof, and all other provisions of this Amendment shall remain in full force and effect and shall be interpreted as if the invalid, void or illegal provision did not exist.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

14

IN WITNESS WHEREOF, Landlord and Tenant have executed this Amendment as of the date and year first above written.

LANDLORD:

|

BMR-MEDICAL CENTER DRIVE LLC, |

||

|

a Delaware limited liability company |

||

|

|

|

|

|

By: |

|

/s/ Kevin M. Simonsen |

|

Name: |

|

Kevin M. Simonsen |

|

Title: |

|

Sr. VP, Real Estate Legal |

TENANT:

|

REGENXBIO INC., |

||

|

a Delaware corporation |

||

|

|

|

|

|

By: |

|

/s/ Kenneth Mills |

|

Name: |

|

Kenneth Mills |

|

Title: |

|

President and CEO |

9714 PREMISES

A-1-1

[INTENTIONALLY DELETED]

B-2

ACKNOWLEDGEMENT OF 9714 TERM COMMENCEMENT DATE

AND 9714 TERM EXPIRATION DATE

This acknowledgement of 9714 TERM commencement date and 9714 TERM EXPIRATION DATE is entered into as of [_______], 20[__], with reference to that certain Lease dated as of March 6, 2015 (the “Original Lease”), as amended by that certain First Amendment to Lease dated as of September____, 2015, (the “First Amendment” and together with the Original Lease, and as the same may have been further amended, amended and restated, supplemented or modified from time to time, the “Lease”), by REGENXBIO INC., a Delaware corporation (“Tenant”), in favor of BMR-MEDICAL CENTER DRIVE LLC, a Delaware limited liability company (“Landlord”). All capitalized terms used herein without definition shall have the meanings ascribed to them in the Lease.

Tenant hereby confirms the following:

1. Tenant accepted possession of the 9714 Premises for use in accordance with the Permitted Use for the 9714 Premises on [_______], 20[__]. Tenant first occupied the 9714 Premises for the Permitted Use on [_______], 20[__].

2. To Tenant’s knowledge, the 9714 Premises are in good order, condition and repair.

3. The 9714 Tenant Improvements are Substantially Complete.

4. To Tenant’s knowledge, all conditions of the Lease to be performed by Landlord as a condition to the full effectiveness of the Lease have been satisfied, and Landlord has fulfilled all of its duties in the nature of inducements offered to Tenant to lease the 9714 Premises.

5. In accordance with the provisions of Section 6 of the First Amendment, the 9714 Term Commencement Date is [_______], 20[__], and, unless the Lease is terminated prior to the 9714 Term Expiration Date pursuant to its terms, the 9714 Term Expiration Date shall be [_______], 20[__].

6. The Lease is in full force and effect, and the same represents the entire agreement between Landlord and Tenant concerning the 9714 Premises[, except [_______]].

7. To Tenant’s knowledge, Tenant has no existing defenses against the enforcement of the Lease by Landlord, and, to Tenant’s knowledge, there exist no offsets or credits against Rent owed or to be owed by Tenant.

C-1

8. The obligation to pay Rent is presently in effect and all Rent obligations on the part of Tenant under the Lease with respect to the 9714 Premises commenced to accrue on [_______], 20[__], with Base Rent for the 9714 Premises payable on the dates and amounts set forth in the chart below:

|

Dates |

Approximate Square Feet of Rentable Area |

Base Rent per Square Foot of Rentable Area |

Monthly Base Rent* |

Annual Base Rent* |

|

[__]/[__]/[__]- [__]/[__]/[__] |

[ ] |

$[_______] annually |

[ ] |

[ ] |

* prorated for any partial period

9. The undersigned Tenant has not made any prior assignment, transfer, hypothecation or pledge of the Lease or of the rents thereunder or sublease of the Premises or any portion thereof.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

C-2

IN WITNESS WHEREOF, Tenant has executed this Acknowledgment of 9714 Term Commencement Date and 9714 Term Expiration Date as of the date first written above.

TENANT:

REGENXBIO INC.,

a Delaware corporation

|

By: |

|

|

|

Name: |

|

|

|

Title: |

|

|

C-3

FORM OF 9714 ADDITIONAL TI ALLOWANCE LETTER

[TENANT LETTERHEAD]

BMR-Medical Center Drive LLC

17190 Bernardo Center Drive

San Diego, California 92128

Attn: Real Estate Legal Department

[Date]

Re: 9714 Additional TI Allowance

To Whom It May Concern:

This letter concerns that certain Lease dated as of March 6, 2015 (the “Original Lease”), as amended by that certain First Amendment to Lease dated as of September ______, 2015, (the “First Amendment” and together with the Original Lease, and as the same may have been further amended, amended and restated, supplemented or modified from time to time, the “Lease”), between BMR-MEDICAL CENTER DRIVE LLC, a Delaware limited liability company (“Landlord”) and REGENXBIO INC., a Delaware corporation (“Tenant”). Capitalized terms not otherwise defined herein shall have the meanings given them in the Lease.

Tenant hereby notifies Landlord that it wishes to exercise its right to utilize the 9714 Additional TI Allowance pursuant to Section 6(e) of the First Amendment in the amount of $_______________.

If you have any questions, please do not hesitate to call [_______] at ([___]) [___]-[____].

Sincerely,

[Name]

[Title of Authorized Signatory]

|

cc: |

Greg Lubushkin |

Karen Sztraicher

John Bonanno

Kevin Simonsen

D-1