Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | a201602268-kinvestorpresen.htm |

Investor Presentation March 2016

2 Forward-Looking Statements / Disclaimers The information contained in this presentation has been prepared to assist you in making your own evaluation of the company and does not purport to contain all of the information you may consider important. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but should not be relied upon as an accurate representation of future results. Certain statements, estimates and financial information contained in this presentation constitute forward-‐looking statements. Such forward- looking statements involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from the results implied or expressed in such forward-‐looking statements. While presented with numerical specificity, certain forward-looking statements are based (1) upon assumptions that are inherently subject to significant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including, without limitation, our ability to maintain adequate liquidity, realize the potential benefit of our net operating loss tax carryforwards, obtain sufficient debt and equity financings, capital costs, well production performance, operating costs, commodity pricing, differentials or crack spreads, realize the potential benefits of our supply and offtake agreements, assumptions inherent in a sum-of-the-parts valuation, realize the benefit of our investment in Laramie Energy Company, assumptions related to our investment in Laramie Energy Company, the potential uplift of an MLP, our ability to meet environmental and regulatory requirements without additional capital expenditures, our acquisition integration strategy, and our ability to complete the refinery turnaround and increase throughput and profitability, our ability to evaluate and pursue strategic and growth opportunities, our estimates of 2016 on-island sales volume, our estimates related to fourth quarter and full-year 2015 Adjusted EBITDA and certain other financial measures, and other known and unknown risks (all of which are difficult to predict and many of which are beyond the company's control) some of which are further discussed in the company’s periodic and other filings with the SEC and (2) upon assumptions with respect to future business decisions that are subject to change. There can be no assurance that the results implied or expressed in such forward-looking statements or the underlying assumptions will be realized and that actual results of operations or future events will not be materially different from the results implied or expressed in such forward-looking statements. Under no circumstances should the inclusion of the forward-looking statements be regarded as a representation, undertaking, warranty or prediction by the company or any other person with respect to the accuracy thereof or the accuracy of the underlying assumptions, or that the company will achieve or is likely to achieve any particular results. The forward-looking statements are made as of the date hereof and the company disclaims any intent or obligation to update publicly or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law. Recipients are cautioned that forward-looking statements are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. This presentation contains non-GAAP financial measures, such as Adjusted EBITDA and cash flows, including certain key statistics and estimates on slide twenty one. Please see the Appendix for the definitions and reconciliations of the non-GAAP financial measures that are based on reconcilable historical information.

Company Overview

4 Largest and Most Complex(1) Refiner in Niche Hawaii Market Crude capacity of 94,000 barrels per day 50% distillate yield configuration Flexibility to utilize a wide range of crude blends Our Business Platforms Integrated Network of Logistics Assets 5.4 million barrels of storage capacity with 27 miles of pipelines 2 barges delivering products to 8 refined product terminals and ocean vessels Difficult to replicate system of assets Distributor and Marketer of Refined Products Mid Pac acquisition significantly expanded distribution network Gasoline and diesel distributed through 128 serviced locations across Hawaii Wholesale and bulk provider on the islands Competitive Natural Gas Producer Below $1.2MM wells delivering average 1.8 BCFE EURs More than 2,000 economic drilling locations Production and acreage anticipated to double with recent acquisition In te gr at ed R efi n er an d Ma rk et e r ____________________ (1) As measured by Nelson Complexity rating. U p st re am

5 9/25/2013: Restart of Kapolei Refinery. Renamed Hawaii Independent Energy 9/1/2012: Delta Petroleum emerged from Chapter 11. Company is renamed Par Petroleum Piceance Energy dba Laramie Energy joint venture initiated Company Timeline 2012 Emerging as Par 2013 Building the Foundation 2014 Transitioning to Profitability 2016 12/31/2012: Closed acquisition of SEACOR Energy. Renamed Texadian Energy 6/17/2013: Agreed to purchase Kapolei Refinery from Tesoro 8/14/2014: Successfully completed $102MM common stock rights offering Strategic Transactions Financial Transactions 11/14/2013: HIE Retail entered into a credit agreement: $30MM term loan and $5MM revolver 4/1/2015: Closed acquisition of Mid Pac Petroleum $200MM PIPE, supply & exchange agreements, and $125MM ABL facility Mid Pac entered into a credit agreement: $50MM term loan and $5MM revolver 6/1/2015: Closed new supply & offtake agreement, including $125MM deferred payment capacity and $250MM inventory facility 9/22/2015: Laramie Energy entered into a joint venture with Wexpro Company for an 80 well drilling program 3/1/2016: Laramie Energy acquired 89 MMCFE/day of production and 71,000 net acres in the Piceance Basin for $157.5 MM 11/25/2015: Completed registered direct offering of approximately $74MM 12/17/2015: Successfully completed refinancing of retail credit facilities: $110MM term loan and $5MM revolver 2015 Growth Phase

6 Growth Opportunity Framework Tier 1 • Refining • Marketing • Midstream & downstream logistics Tier 2 • E&P with Laramie tie-in • Upstream logistics • Gathering systems • Gas processing • Chemical / process businesses Tier 3 • E&P w/o Laramie tie-in • Oilfield services • Power generation • Non-oil logistics Strategic Factors Existing Competencies NOL Refining System Integration MLP Qualifying Hawaii Laramie Target acquisitions that generate risk adjusted returns on capital and are accretive to sum of the parts valuation

Business Platform Overview

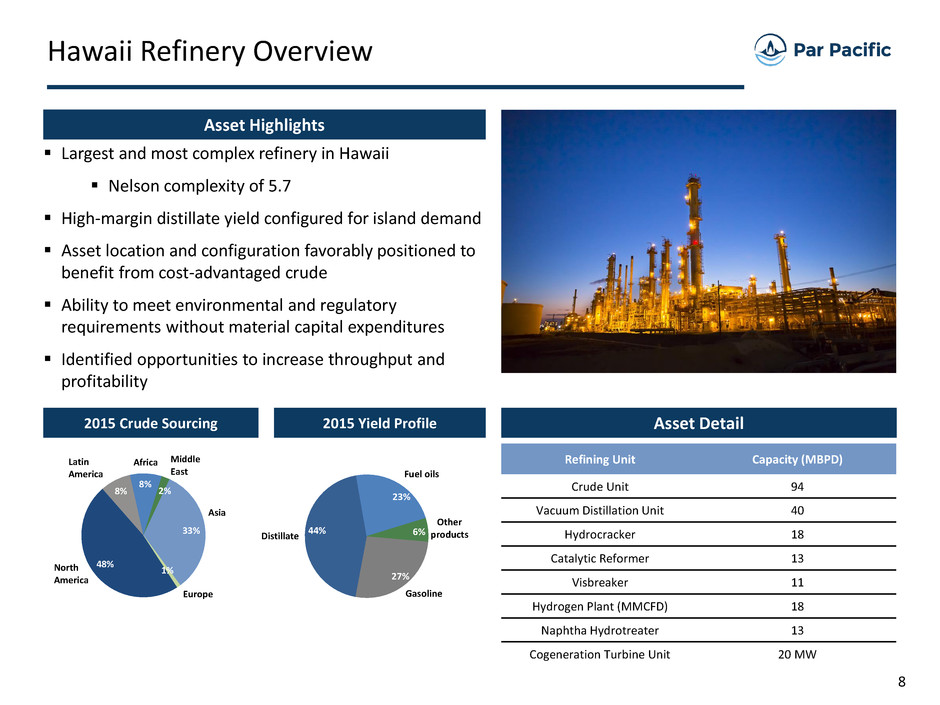

8 Refining Unit Capacity (MBPD) Crude Unit 94 Vacuum Distillation Unit 40 Hydrocracker 18 Catalytic Reformer 13 Visbreaker 11 Hydrogen Plant (MMCFD) 18 Naphtha Hydrotreater 13 Cogeneration Turbine Unit 20 MW Hawaii Refinery Overview Asset Highlights Largest and most complex refinery in Hawaii Nelson complexity of 5.7 High-margin distillate yield configured for island demand Asset location and configuration favorably positioned to benefit from cost-advantaged crude Ability to meet environmental and regulatory requirements without material capital expenditures Identified opportunities to increase throughput and profitability Asset Detail2015 Crude Sourcing 2015 Yield Profile Gasoline Distillate Fuel oils Other products44% 23% 6% 27% 48% 8% 8% 2% 33% 1%North America Latin America Africa Middle East Asia Europe

9 30,000 Bbls 185,000 Bbls 138,000 Bbls 135,000 Bbls 12,000 Bbls Hawaiian Assets MapAsset Highlights Logistics System Overview Integrated system enhances flexibility and profitability Difficult to replicate asset base Multiple advantages from Single Point Mooring Additional uptime from wind & sea conditions Increased safety and flexibility Enhanced distribution capability Potential uplift from MLP formation Latin America South America North America Middle East Africa Asia Logistics network represents a critical component of Par Pacific’s operations Asset Detail # of Terminals 8 Crude Storage Capacity (MMBbls) 2.4 Other Storage Capacity (MMBbls) 3.0 # of Barges 2 Miles of Pipeline 27 ____________________ (1) Figures represent offsite storage amounts. (1) Refinery Terminal Crude Inflows Crude Refined Products Outflows

10 $35,470 $38,909 33,000 34,000 35,000 36,000 37,000 38,000 39,000 40,000 2014 2015 49,484 50,283 49,000 49,500 50,000 50,500 2014 2015 Same Store Growth (FY2014 vs. FY2015)(1) Retail Network Overview Asset Highlights Extensive footprint across five islands Mid Pac acquisition significantly expanded scale and operating capabilities Anticipated continued volume growth from increasing retail and distribution network Several identified opportunities to enhance profitability through continued integration and asset optimization Fuel Volumes Merchandise Sales ____________________ (1) Same store comparison excludes Mid Pac. (2) Pro forma including Mid Pac. (gallons in thousands) Asset Details(2) Locations Total: 128 Retail Segment: 91 Annual Fuel Sales 115 million gallons Company Operated Convenience Stores 38 Fee-Owned Sites 22 ($ in thousands)

11 Ongoing Refinery Optimization Opportunities Opportunity to meaningfully increase system volumes and enhance profitability Total Sales VolumeOn-Island Sales Volume Throughput Volume On-island demand is the primary constraint for refinery utilization Enhancing on-island sales improves margin from favorable market pricing and reduced cost of freight Ability to export products profitably in favorable market conditions Increased refinery throughput generates economies of scale (MBbl/d) (MBbl/d) (MBbl/d) 50 52 57 56 64 64 59 62 40 50 60 70 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 66 70 72 68 82 75 74 76 40 55 70 85 Q '14 Q2 '14 Q3 '14 Q4 '14 Q '15 Q2 '15 Q3 '15 Q4 '15 67 71 69 66 75 81 73 80 40 55 70 85 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15

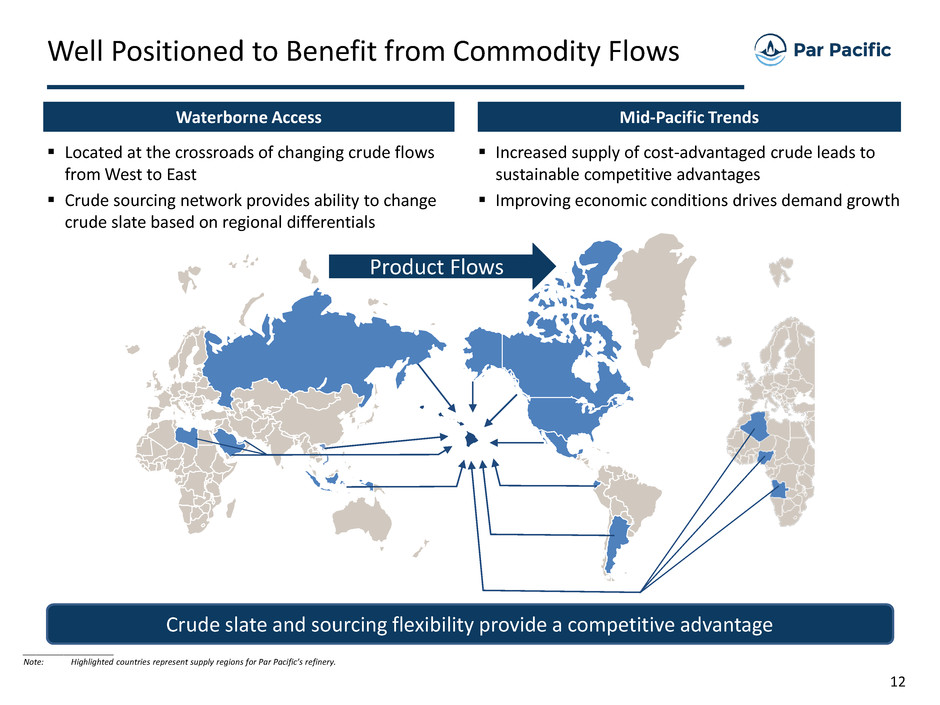

12 Well Positioned to Benefit from Commodity Flows Crude slate and sourcing flexibility provide a competitive advantage Located at the crossroads of changing crude flows from West to East Crude sourcing network provides ability to change crude slate based on regional differentials ____________________ Note: Highlighted countries represent supply regions for Par Pacific’s refinery. Waterborne Access Mid-Pacific Trends Increased supply of cost-advantaged crude leads to sustainable competitive advantages Improving economic conditions drives demand growth Product Flows

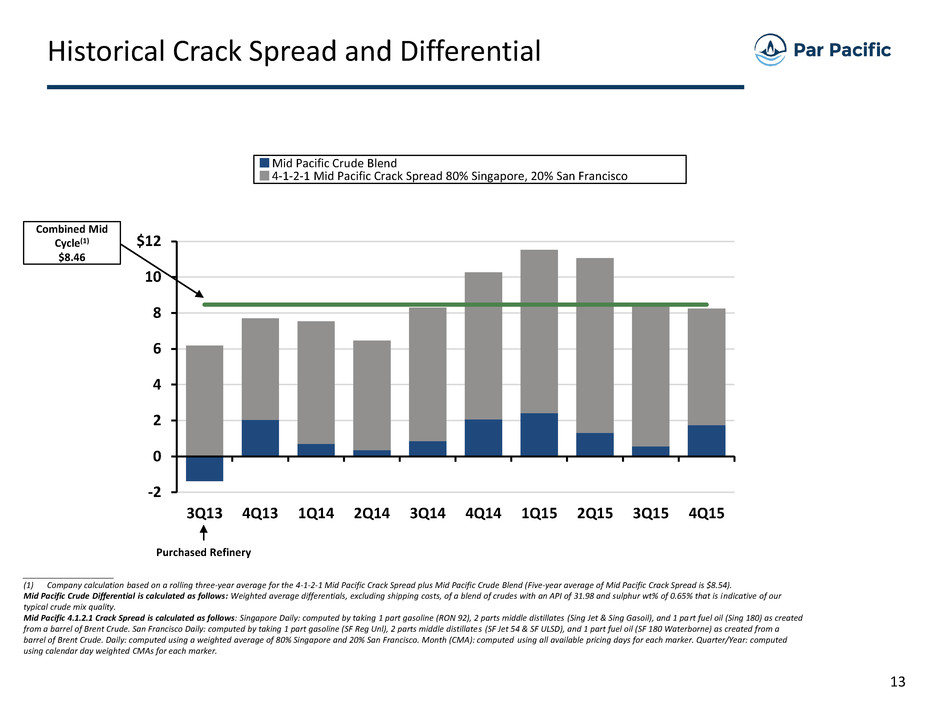

13 -2 0 2 4 6 8 10 $12 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 Historical Crack Spread and Differential Mid Pacific Crude Blend 4-1-2-1 Mid Pacific Crack Spread 80% Singapore, 20% San Francisco ____________________ (1) Company calculation based on a rolling three-year average for the 4-1-2-1 Mid Pacific Crack Spread plus Mid Pacific Crude Blend (Five-year average of Mid Pacific Crack Spread is $8.54). Mid Pacific Crude Differential is calculated as follows: Weighted average differentials, excluding shipping costs, of a blend of crudes with an API of 31.98 and sulphur wt% of 0.65% that is indicative of our typical crude mix quality. Mid Pacific 4.1.2.1 Crack Spread is calculated as follows: Singapore Daily: computed by taking 1 part gasoline (RON 92), 2 parts middle distillates (Sing Jet & Sing Gasoil), and 1 part fuel oil (Sing 180) as created from a barrel of Brent Crude. San Francisco Daily: computed by taking 1 part gasoline (SF Reg Unl), 2 parts middle distillates (SF Jet 54 & SF ULSD), and 1 part fuel oil (SF 180 Waterborne) as created from a barrel of Brent Crude. Daily: computed using a weighted average of 80% Singapore and 20% San Francisco. Month (CMA): computed using all available pricing days for each marker. Quarter/Year: computed using calendar day weighted CMAs for each marker. Purchased Refinery Combined Mid Cycle(1) $8.46

14 Leader in Niche Hawaiian Market Air Travel(2) ____________________ (1) Source: DBEDT; EIA, including military demand per Par Pacific estimates, assuming Par Pacific throughput at 75MBD. (2) Source: Number of visitors per DBEDT. Refined Product Demand(1) Par Refinery Yield 20152014 Shortage of available distillate capacity in Hawaii Ability to reconfigure yield based on product demand Air travel projected to continue to grow Fuel oil utilized for ~70% of electricity generation (In Thousands) Hawaii Petroleum Use(1) Petroleum- Fired Coal-Fired Other Renewables 69% 17% 14% Electricity Production Commercial Aviation Marine Transport Military Use Other 28% 28% 27% 6% 8% 3% Ground Transportation 7,500 7,750 8,000 8,250 8,500 8,750 9,000 2013 2014 2015E 2016E 2017E 2018E MBbl/d 60 59 72 50 0 8 16 24 32 40 48 56 64 72 80 Other Products Distillate Total Production Total Demand Gasoline Distillate Fuel oils Other products44% 23% 6% 27% Distillates Gasoline Fuel oils Other products 38% 25% 33% 4%

15 Experienced management team that has drilled over 300 wells in the basin with a 99% success rate Drilling and completion (“D&C”) costs reduced from $1.8MM to approximately $1MM Closed acquisition of additional Piceance Basin assets March 1, 2016 JV agreement with Wexpro further improves economics Over 8,000 Mesaverde drilling locations aross 126,000 net acres Strong hedge position with approximately 90% of projected existing production hedged at $2.34/MMBTU Asset Highlights Laramie Energy Overview Commodity Pricing Sensitivities(1) Production Profile(2) Keys To Long Term Value Realization ____________________ (1) Represents high Net Revenue Interest Pad, $1.1 MM D&C costs, 1.8 Bcfe gross EUR type-curve without the benefit of Wexpro Joint Development Agreement. Assumes $40.00 / bbl WTI price and NGL realizations between 27-39% of WTI over the life of the well. Ethane rejection beginning in 2017. (2) Figures for 100% of Laramie Energy. Proforma for acquisition. Assumes modest completion activity of $10-20MM in second half of 2016. Vast majority of 126,000 net acre position is held by production Minimal volume commitments on gathering, compression, processing or treating systems Minimal firm transportation and takeaway capacity commitments Realized lower operating costs through recent infrastructure investments (water handling, compression, gathering) Capital deployment decisions are based on marginal economics vs. sunk costs Cost reductions through integration of acquired assets (MMcfe/d)

16 Backlog in excess of 64 drilled, uncompleted wells as of year end Deliver reduced D&C costs and lease operating expense (“LOE”) through water handling infrastructure investment Continue to innovate and drive efficiencies in capital and operating cost profile 2016 Plan Summary Laramie Energy 2016 Development Program Laramie Existing Portfolio (2) ____________________ (1) Assumes 21 well pad with full allocation of infrastructure, facilities and mobilization costs. (2) Assumes $3.00 / MMBTU CIG price, $50 / BBL WTI and range of 25-35% of WTI for NGL realizations. Also based on 1.8 BCFE type curve and approximately $1.15 MM D&C costs per well. Excludes acquisition inventory drilling locations. (2) Driving down the D&C Cost Profile (1) Reduce capital requirements per well by 8% from prior estimates Sandless fracs are large driver in reduced costs and delivering encouraging results 55 437 497 840 359 988 0 400 800 1,200 1,600 2,000 2,400 2,800 3,200 0 200 400 600 800 1,000 1,200 1,400 1,600 30% - 35% 25% - 30% 20% - 25% 15% - 20% 10% - 15% 0% - 10% Cu m ul ati ve Lo catio ns Lo ca tio ns Rate of Return Range Lower LOE’s to Laramie historical levels Acquired properties average $0.73/Mcfe during 2015 Laramie LOE average $0.56/Mcfe during 2015 Additional volume provides scale to further reduce costs Adding modest G&A of $2 - $4MM while growing production base by 80+ MMcfe/day Scale produces leverage to reduce gathering, processing and treating costs Improving market netbacks on gas and NGLs by leveraging PARR commercial platform Acquisition Integration Strategy ($s in millions) D&C Capital Trends Historical (2010-2015) D&C AFE September 2015 D&C AFE December 2015 D&C AFE Pre-Water Facility Post-Water Facility High-End Low-End High-End Low-End Drill & Case 0.75$ 0.75$ 0.53$ 0.48$ 0.51$ 0.43$ Complete 1. 5$ 0.85$ 0.69$ 0.64$ 0.64$ 0.57$ Total 1.80$ 1.60$ 1.22$ 1.12$ 1.15$ 1.00$ Frac Water Volumes ( bbls / stage) 17,500 17,500 10,000 10,000 Number of Stages 6 6 10 10

Financial Overview

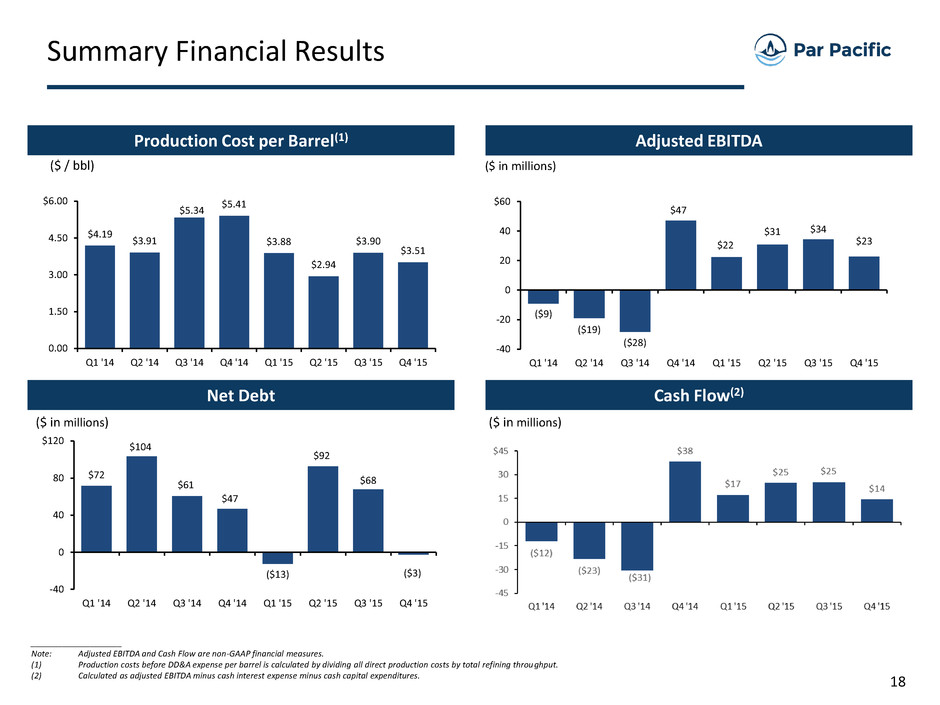

18 Adjusted EBITDA Net Debt Production Cost per Barrel(1) ($ in millions) ($ in millions) ____________________ Note: Adjusted EBITDA and Cash Flow are non-GAAP financial measures. (1) Production costs before DD&A expense per barrel is calculated by dividing all direct production costs by total refining throughput. (2) Calculated as adjusted EBITDA minus cash interest expense minus cash capital expenditures. Summary Financial Results Cash Flow(2) ($ / bbl) ($ in millions) $4.19 $3.91 $5.34 $5.41 $3.88 $2.94 $3.90 $3.51 0.00 1.50 3.00 4.50 $6.00 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 $72 $104 $61 $47 ($13) $92 $68 ($3) -40 0 40 80 $120 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 ($9) ($19) ($28) $47 $22 $31 $34 $23 -40 -20 0 20 40 $60 Q1 '14 2 ' 3 4 4 4 1 '15 Q2 '15 Q3 '15 Q4 '15

19 Capitalization and Maturity Profile ($ in millions) Capitalization Maturity Profile $60 $11 $11 $11 $11 $11 $55 $5 0 10 20 30 40 50 60 70 80 2016 2017 2018 2019 2020 Thereafter Par Term Loan Retail Term Loan Retail Revolver (undrawn) $71 $48 $16 ($ in millions) Cash & Cash Equivalents Debt: Par Term Loan Retail Term Loan Retail Revolver Deferred Financing Costs Total Debt Equity: Book Value of Equity Tot l Shareholders Equity Total C pitalization Credit Statistics: Total Debt / Capitalization Total Debt / 2015 Adjusted EBITDA Total Net Debt / Capitalization Total Net Debt / 2015 Adjusted EBITDA (1%) (0.0x) As of 12/31/2015 $168 60 110 (5) 0 $165 $341 $34 $506 33% 1.5x ____________________ (1) Previously reported as an asset. Now reported as a reduction of debt due to a change in GAAP. (1)

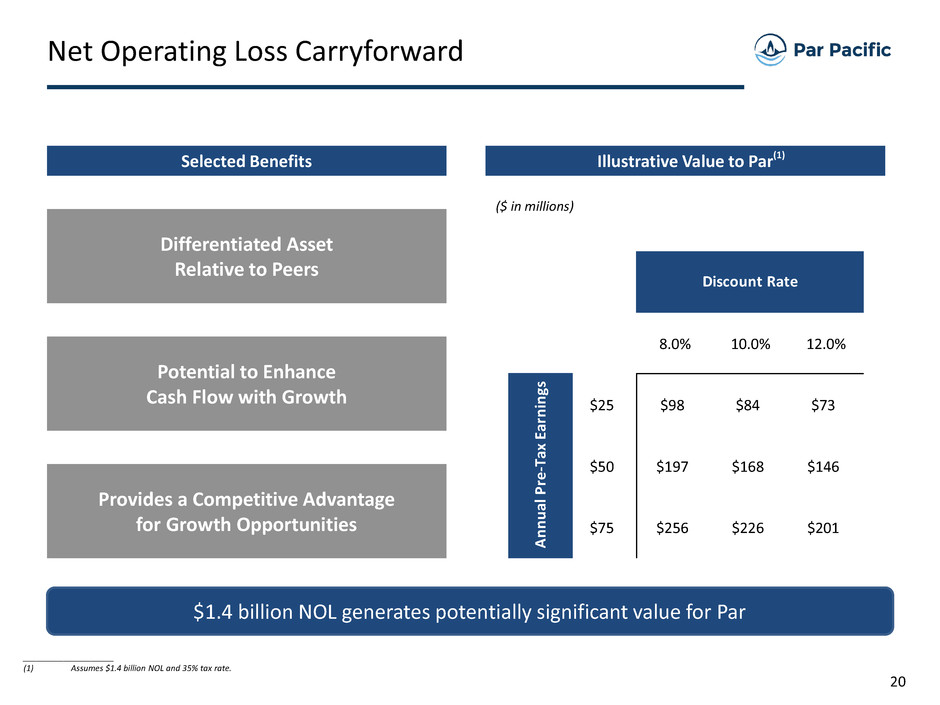

20 Net Operating Loss Carryforward Differentiated Asset Relative to Peers Potential to Enhance Cash Flow with Growth Provides a Competitive Advantage for Growth Opportunities $1.4 billion NOL generates potentially significant value for Par Selected Benefits Illustrative Value to Par ($ in millions) 8.0% 10.0% 12.0% $25 $98 $84 $73 $50 $197 $168 $146 $75 $256 $226 $201 Discount Rate A nn ua l P re -T ax E ar ni ng s (1) ____________________ (1) Assumes $1.4 billion NOL and 35% tax rate.

21 Par Pacific Summary Refining – Largest & most complex refinery in Hawaii with distillate focused yield Logistics – Integrated and difficult to replicate asset base, resulting in stable consistent value Retail – Competitive position within a strong niche market, delivering robust on-island sales volumes and margins North American Logistics – Opportunistic crude purchase capabilities of lower priced crudes Laramie – low cost gas producer with deep inventory of drilling locations and minimal contractual obligations Key Highlights Enterprise ValueKey Statistics ____________________ (1) Represents Par Pacific’s share of Laramie Energy as of 12/31/2015 proforma for the investment used to close the acquisition on 3/1/2016. (2) Represents Par Pacific’s 32.4% share of Laramie Energy. Calculated as 32.4% of midpoint 2016E exit production. (3) Represents Par Pacific’s 42.4% share of Laramie Energy. Calculated based on midpoint of 2016E production. (4) 41,009,924 shares of common stock outstanding as of 12/31/2015. NOL Gross Balance Net Op rating Loss (NOL) Carryforwards $1,400 ($ in millions, except per share data) Refining Logistics Retail Corporate & Others Total Adjusted EBITDA Adjusted EBITDA FY'15 (49) 33 $29 $97 $110 Investment Book Valu (1) 2015 Production (MMcfe/d) (2) 2016E Production (MMcfe/d) (3) Laramie Energy (Par Pacific investment) $131 18 57 Share Price Shares Outstanding (4) Market Capitalization Debt Cash Cash Earmarked for Laramie Investment Net Debt Total Enterprise Value As of COB $23.62 41 $968 2/26/2016 165 55 52 $916 (168)

22 • Flexible Capital Structure • Conservative Access to Liquidity • Profitability Throughout Cycles • Utilize Capital Markets Opportunistically Conservative Capital Structure Minimal near-term maturities enhances flexibility Low financial leverage positions Par Pacific for future growth opportunities Efficient Commodity Financing Substantially reduces working capital requirements Commodity financing enhances crude sourcing optionality Favorable terms increase financial flexibility Well Capitalized Demonstrated capability to access public and private capital markets Maintain access to comfortable levels of liquidity to support operations Profitability Throughout Cycles Utilize hedging to minimize impact of commodity price fluctuations Continued operations optimization focusing on reliability, yields, energy use, and sustainable costs to enhance profitability NOL enhances cash flow from operations Financial Strategy

23 Constructive Market Environment Experienced Management Team and Board Significant Financial Flexibility Identified Growth Opportunities High Quality Asset Base in Niche Market Summary

24 Contact Information Par Pacific Holdings, Inc. (NYSE MKT: PARR) 800 Gessner Road, Suite 875 Houston, TX 77024 (281) 899-4800 www.parpacific.com Christine Thorp Director, Investor Relations cthorp@parpacific.com (832) 916-3396

Appendix

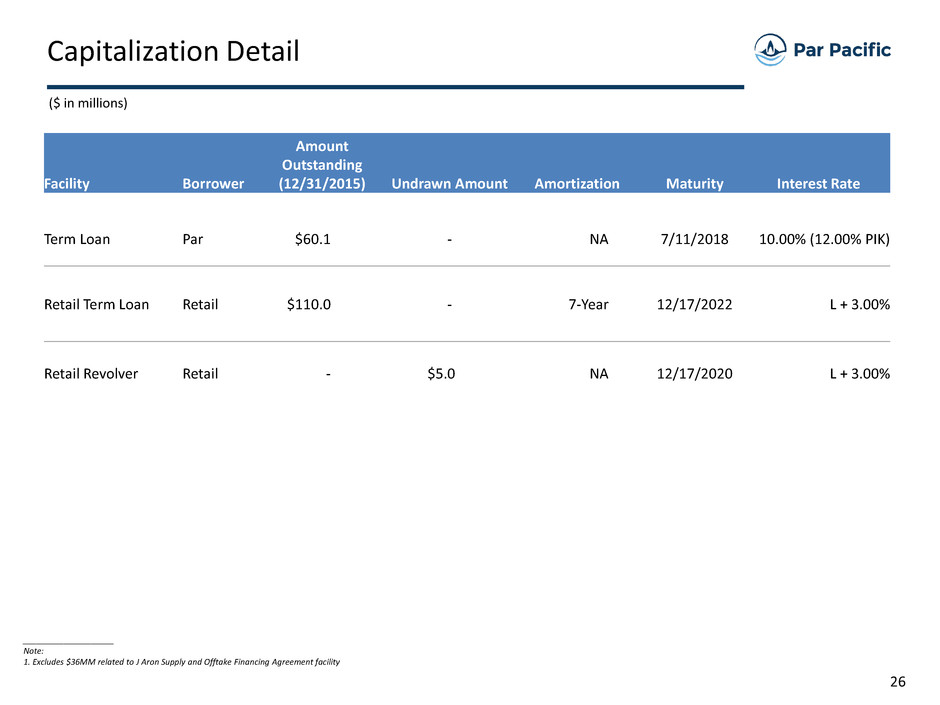

26 Capitalization Detail ____________________ Note: 1. Excludes $36MM related to J Aron Supply and Offtake Financing Agreement facility ($ in millions) Facility Borrower Amount Outstanding (12/31/2015) Undrawn Amount Amortization Maturity Interest Rate Term Loan Par $60.1 - NA 7/11/2018 10.00% (12.00% PIK) Retail Term Loan Retail $110.0 - 7-Year 12/17/2022 L + 3.00% Retail Revolver Retail - $5.0 NA 12/17/2020 L + 3.00%

27 Non-GAAP Financials Adjusted EBITDA Reconciliation and Cash Flow Data (1) (in thousands) (1) We believe the non-GAAP financial metrics used herein, including Adjusted EBITDA and Adjusted Net Income, are useful supplemental financial measures to assess, among other things: the financial performance of our assets without regard to financing methods, capital structure or historical cost basis; the ability of our assets to generate cash to pay interest on our indebtedness; our operational performance and return on invested capital as compared to other companies without regard to financing methods and capital structure; and the cash generating capability of our business. The non-GAPP financial metrics used herein should not be considered in isolation or as a substitute for financial measures prepared in accordance with GAAP. Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income (loss) ($14,568) ($24,677) ($39,456) $31,660 $462 $11,723 $14,740 (66,836) Adjustments to Net income (loss): Unrealized loss (gain) on derivatives (149) 191 - (698) 2,406 (1,980) 4,360 6,110 Lower of cost or net realizable value adjustment - 2,444 (2,179) 44 2,628 21,155 Acquisition and integration expense 2,851 2,419 3,856 2,561 1,061 470 280 195 Release of valuation allowance due to Mid Pac acquisition - - - - - (18,585) 295 1,531 Loss on termination of financing agreements 1,788 - 19,229 - 440 Change in value of common stock warrants (1,577) (140) (2,401) (315) 5,022 (3,313) 1,023 932 Change in value of contingent consideration (2,465) (2,297) (996) 2,909 4,929 9,495 4,255 (229) Loss on sale of assets, net - - 624 - - - - - Inventory valuation adjustment - - - - - - (13,390) (1,569) Impairment expense - - - - - - 9,639 - Adjusted Net Income (loss) ($15,908) ($24,504) ($38,373) $40,349 $11,701 $17,083 $23,830 ($38,271) Depreciation, depletion and amortization 3,061 3,290 3,918 4,628 3,251 5,005 4,596 7,066 Interest expense and financing costs, net 3,507 3,397 7,076 4,015 5,557 5,825 4,387 4,387 Equity losses from Laramie Energy, LLC 221 (760) (835) (1,475) 1,826 2,950 1,355 49,852 Income tax expense (benefit) 35 2 (150) (342) 65 (22) 174 (246) Adjusted EBITDA ($9,084) ($18,575) ($28,364) $47,175 $22,400 $30,841 $34,342 $22,788 Other cash flow data: Cash Interest (1,138) (889) (1,321) (1,178) (415) (809) (3,000) (1,870) Cash Capital Expenditures (2,018) (3,891) (817) (7,574) (4,747) (5,126) (5,984) (6,488) 2014 2015

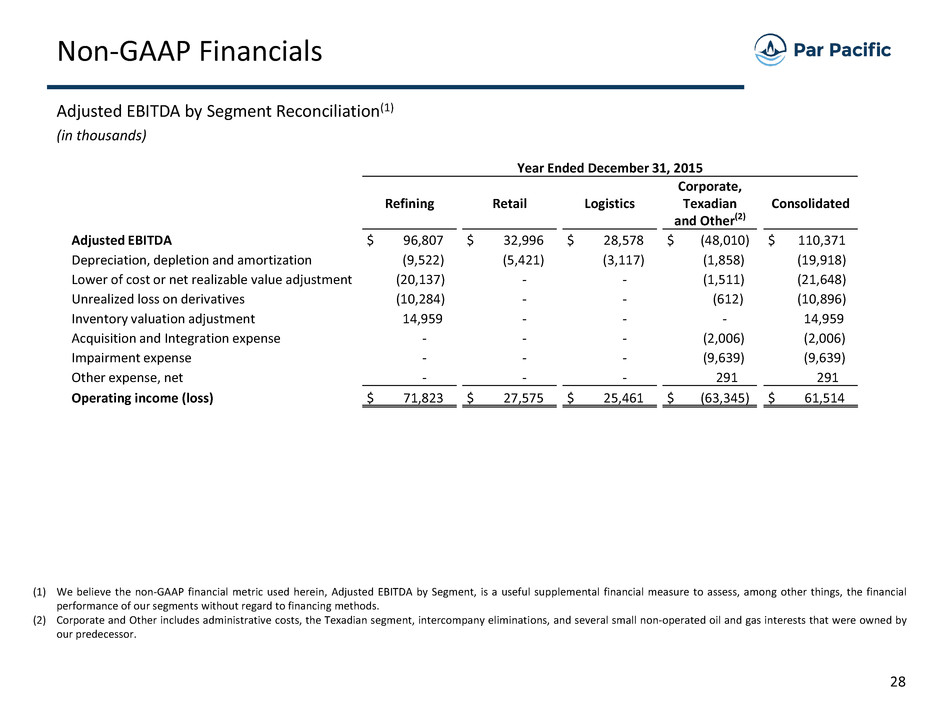

28 Non-GAAP Financials Adjusted EBITDA by Segment Reconciliation(1) (in thousands) (1) We believe the non-GAAP financial metric used herein, Adjusted EBITDA by Segment, is a useful supplemental financial measure to assess, among other things, the financial performance of our segments without regard to financing methods. (2) Corporate and Other includes administrative costs, the Texadian segment, intercompany eliminations, and several small non-operated oil and gas interests that were owned by our predecessor. Year Ended December 31, 2015 Refining Retail Logistics Corporate, Texadian and Other(2) Consolidated Adjusted EBITDA $ 96,807 $ 32,996 $ 28,578 $ (48,010) $ 110,371 Depreciation, depletion and amortization (9,522) (5,421) (3,117) (1,858) (19,918) Lower of cost or net realizable value adjustment (20,137) - - (1,511) (21,648) Unrealized loss on derivatives (10,284) - - (612) (10,896) Inventory valuation adjustment 14,959 - - - 14,959 Acquisition and Integration expense - - - (2,006) (2,006) Impairment expense - - - (9,639) (9,639) Other expense, net - - - 291 291 Operating income (loss) $ 71,823 $ 27,575 $ 25,461 $ (63,345) $ 61,514