Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ENTERPRISE FINANCIAL SERVICES CORP | a2015-128kinvestorpresenta.htm |

ENTERPRISE FINANCIAL SERVICES CORP FOURTH QUARTER 2015 INVESTOR PRESENTATION

1 Some of the information in this report contains “forward-looking statements” within the meaning of and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified with use of terms such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “could,” “continue” and the negative of these terms and similar words, although some forward-looking statements are expressed differently. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to a number of factors, including, but not limited to: credit risk; changes in the appraised valuation of real estate securing impaired loans; outcomes of litigation and other contingencies; exposure to general and local economic conditions; risks associated with rapid increases or decreases in prevailing interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in regulatory requirements; changes in accounting regulation or standards applicable to banks; and other risks discussed under the caption “Risk Factors” of our most recently filed Form 10-K and in Part II, 1A of our most recently filed Form 10-Q, all of which could cause the Company’s actual results to differ from those set forth in the forward-looking statements. Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis and expectations only as of the date of such statements. Forward-looking statements speak only as of the date they are made, and the Company does not intend, and undertakes no obligation, to publicly revise or update forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise, except as required by federal securities law. You should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file from time to time with the Securities and Exchange Commission which are available on our website at www.enterprisebank.com. FORWARD-LOOKING STATEMENT

2 COMPANY SNAPSHOT FDIC Data ENTERPRISE BANK $3.6 Billion IN TOTAL ASSETS ENTERPRISE TRUST $1.5 Billion IN ASSETS UNDER ADMINISTRATION CONCENTRATED ON PRIVATE BUSINESSES AND OWNER FAMILIES RELATIONSHIP DRIVEN ATTRACT TOP TALENT IN MARKETS PRODUCT BREADTH • BANKING • TRUST & WEALTH MANAGEMENT • TREASURY MANAGEMENT PROVEN ABILITY TO GROW COMMERCIAL AND INDUSTRIAL “C&I” LOANS STRONG BALANCE SHEET WITH ATTRACTIVE RISK PROFILE FOCUSED BUSINESS MODEL: Operates in MSAs St. Louis Kansas City Phoenix

3 DIFFERENTIATED BUSINESS MODEL: BUILT FOR QUALITY EARNINGS GROWTH FOCUSED AND WELL-DEFINED STRATEGY AIMED AT BUSINESS OWNERS, EXECUTIVES AND PROFESSIONALS TARGETED ARRAY OF BANKING AND WEALTH MANAGEMENT SERVICES TO MEET OUR CLIENTS’ NEEDS EXPERIENCED BANKERS AND ADVISORS Enterprise Bank Financial & Estate Planning Tax Credit Brokerage Business & Succession Planning Trust Administration Enterprise Trust Investment Management Enterprise University Treasury Management Personal & Private Banking Commercial & Business Banking PRIVATE BUSINESSES & OWNER FAMILIES Mortgage Banking

4 EU is a Continuing Series of More than 30 High-Impact Workshops for Business Owners DESIGNED TO HELP MANAGEMENT TEAMS GROW THEIR BUSINESSES EU IS OFFERED SEMI-ANNUALLY TO ENTERPRISE CLIENTS AND PROSPECTS ALIKE ENTERPRISE UNIVERSITY: A KEY BRAND DIFFERENTIATOR EU is Unique and Highly Valued; A Clear Differentiator MORE THAN 15,000 PARTICIPANTS TO DATE BUILT TO ENHANCE THE SALES PROCESS, SET THE BANK APART FROM COMPETITORS CREATES “RAVING FANS” FOR ENTERPRISE

5 6th RANKED IN DEPOSIT SHARE1, LARGEST PUBLICLY HELD BANK BASED IN ST. LOUIS2 STRONG TRACK RECORD OF SUCCESS IN ST. LOUIS 1 6/30/15 FDIC data 2 Excludes Bank Unit of Stifel Nicolaus 3 Excludes specialized lending products $1.5 BILLION WEALTH MANAGEMENT BUSINESS $1.43 BILLION IN LOANS $1.5 BILLION IN DEPOSITS CONSISTENT ABILITY TO PRODUCE LOAN GROWTH – 6% CAGR3 in C&I Loans OVER PAST FIVE YEARS ATTRACTING Top Level BANKERS

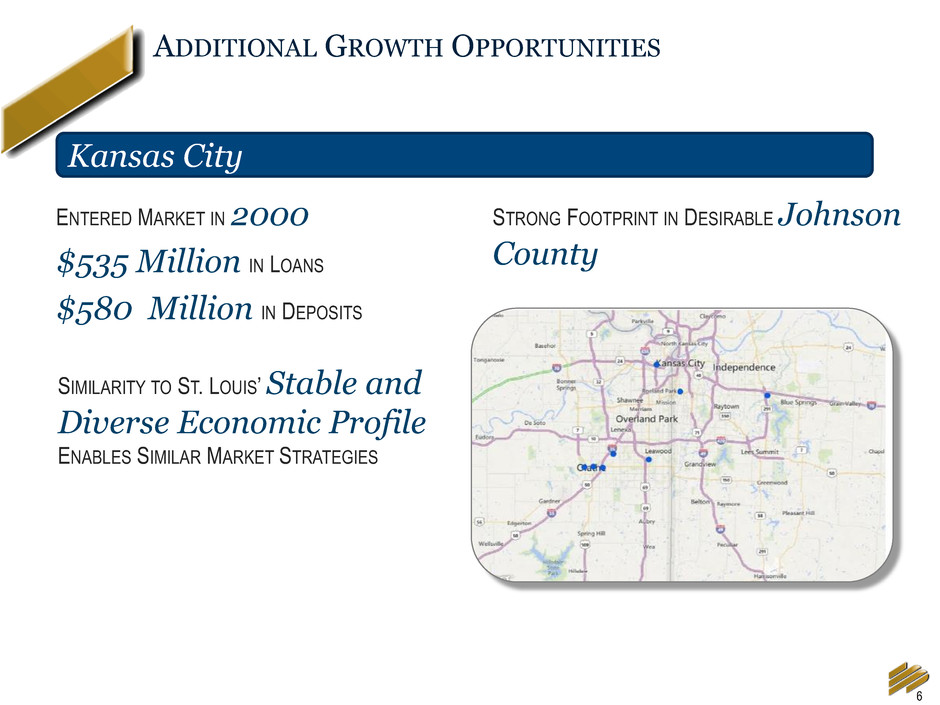

6 ENTERED MARKET IN 2000 $535 Million IN LOANS $580 Million IN DEPOSITS ADDITIONAL GROWTH OPPORTUNITIES STRONG FOOTPRINT IN DESIRABLE Johnson County SIMILARITY TO ST. LOUIS’ Stable and Diverse Economic Profile ENABLES SIMILAR MARKET STRATEGIES Kansas City

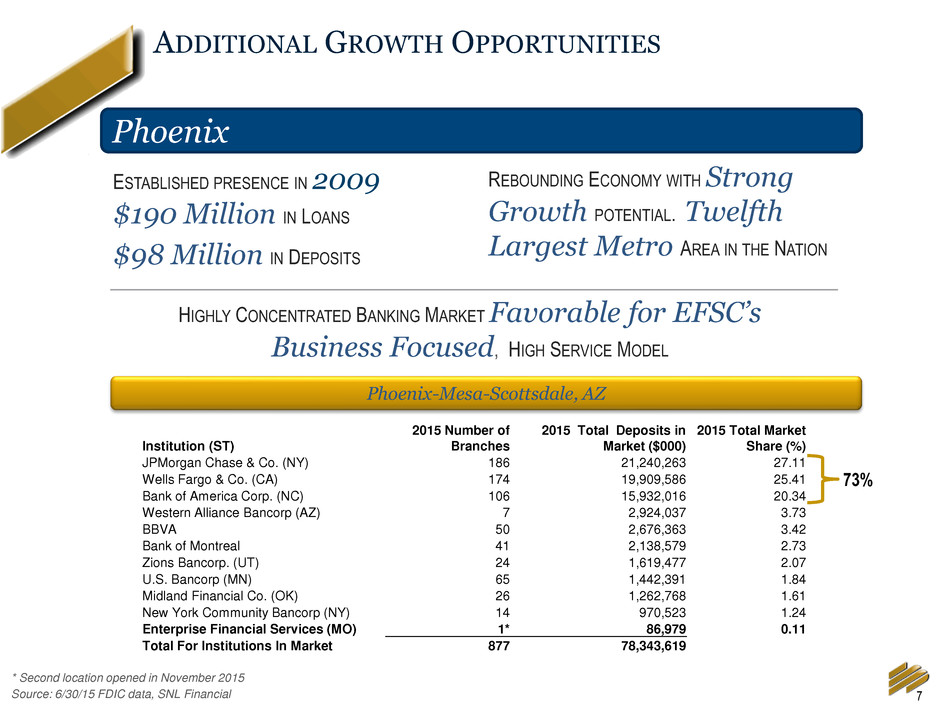

7 ADDITIONAL GROWTH OPPORTUNITIES Source: 6/30/15 FDIC data, SNL Financial ESTABLISHED PRESENCE IN 2009 $190 Million IN LOANS $98 Million IN DEPOSITS Phoenix-Mesa-Scottsdale, AZ REBOUNDING ECONOMY WITH Strong Growth POTENTIAL. Twelfth Largest Metro AREA IN THE NATION HIGHLY CONCENTRATED BANKING MARKET Favorable for EFSC’s Business Focused, HIGH SERVICE MODEL Phoenix 73% Institution (ST) 2015 Number of Branches 2015 Total Deposits in Market ($000) 2015 Total Market Share (%) JPMorgan Chase & Co. (NY) 186 21,240,263 27.11 Wells Fargo & Co. (CA) 174 19,909,586 25.41 Bank of America Corp. (NC) 106 15,932,016 20.34 Western Alliance Bancorp (AZ) 7 2,924,037 3.73 BBVA 50 2,676,363 3.42 Bank of Montreal 41 2,138,579 2.73 Zions Bancorp. (UT) 24 1,619,477 2.07 U.S. Bancorp (MN) 65 1,442,391 1.84 Midland Financial Co. (OK) 26 1,262,768 1.61 New York Community Bancorp (NY) 14 970,523 1.24 Enterprise Financial Services (MO) 1* 86,979 0.11 Total For Institutions In Market 877 78,343,619 * Second location opened in November 2015

8 CROSS-SELLING AND BUSINESS BANKING INITIATIVES COMPLEMENT PRIMARY COMMERCIAL STRATEGY HIGH Client Satisfaction PAVES WAY FOR ADD-ON PRODUCT SALES TREASURY MANAGEMENT Product Implementations Rose 30% FROM 2014; CROSS-SELLS ACCOUNTED FOR 40% OF OVERALL IMPLEMENTATIONS IN 2015 Business Banking Initiative TARGETING $1-10 MILLION REVENUE BUSINESSES, Produced 62% Increase IN BUSINESS BANKING RELATIONSHIPS IN 2015; AVERAGE CROSS-SELL RATIO 4.7, 20% Higher THAN PRIOR YEAR BRANCH ORGANIZATION MOBILIZED TO Cross-Sell Personal Banking Services TO COMMERCIAL AND BUSINESS BANKING CLIENTS ESTABLISHED Distinct Sales and Relationship Management Models TO EFFICIENTLY PENETRATE AND SERVICE THE MARKET

9 HISTORY OF STRONG C&I GROWTH $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2010 2011 2012 2013 2014 2015 $594 In millions $763 $963 $1,042 $1,264 $1,484

10 Tax Credit Programs. $137 MILLION IN LOANS OUTSTANDING RELATED TO FEDERAL NEW MARKETS, HISTORIC AND MISSOURI AFFORDABLE HOUSING TAX CREDITS. $183 MILLION IN FEDERAL & STATE NEW MARKETS TAX CREDITS AWARDED TO DATE. Enterprise Value Lending. $350 MILLION IN M&A RELATED LOANS OUTSTANDING, PARTNERING WITH PE AND VC FIRMS Life Insurance Premium Financing. $265 MILLION IN LOANS OUTSTANDING RELATED TO HIGH NET WORTH ESTATE PLANNING FOCUSED LOAN GROWTH STRATEGIES 5.0% 12.7% 9.6% Total Portfolio Loans SPECIALIZED MARKET SEGMENTS HAVE GROWN TO 27% OF TOTAL PORTFOLIO LOANS, OFFERING COMPETITIVE ADVANTAGES, RISK ADJUSTED PRICING AND FEE INCOME OPPORTUNITIES. EXPECTATIONS FOR FUTURE GROWTH INCLUDE CONTINUED FOCUS IN THESE SPECIALIZED MARKET SEGMENTS.

11 DRIVERS OF LOAN GROWTH Enterprise Value Lending 43.0% Life Insurance Premium Finance 14.0% General Commercial & Industrial 14.0% Commercial/ Construction RE 15.0% Residential RE 3.5% Consumer & Other 10.5% ENTERPRISE VALUE LENDING LIFE INSURANCE PREMIUM FINANCE GENERAL COMMERCIAL & INDUSTRIAL COMMERCIAL/CONSTRUCTION RE RESIDENTIAL RE CONSUMER & OTHER $317 MILLION Dec 31, 2014 – Dec 31, 2015

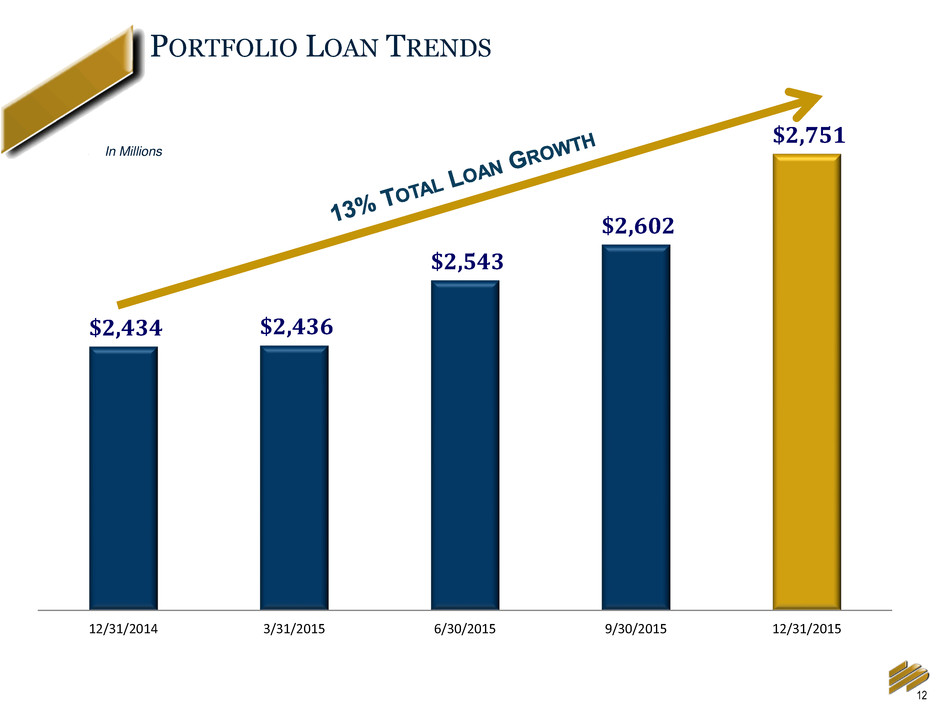

12 PORTFOLIO LOAN TRENDS $2,434 $2,436 $2,543 $2,602 $2,751 12/31/2014 3/31/2015 6/30/2015 9/30/2015 12/31/2015 In Millions

13 26% 41% 13% 20% ATTRACTIVE DEPOSIT MIX CD Interest Bearing Transaction Accts DDA MMA & Savings DEC 31, 2015 $2,785MM Significant DDA COMPOSITION Declining COST OF DEPOSITS IMPROVING Core Funding 80% OF Core Deposits ARE COMMERCIAL CUSTOMERS $2,492 $2,675 $2,692 $2,814 $2,785 25.8% 25.5% 24.5% 24.6% 25.8% -30.0% -5.0% 20.0% Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Deposits DDA % Cost of Deposits 0.36% 12% DEPOSIT GROWTH DURING 2015

14 CONTINUED GROWTH IN CORE EPS DRIVE NET INTEREST INCOME GROWTH IN DOLLARS WITH FAVORABLE LOAN GROWTH TRENDS DEFEND NET INTEREST MARGIN MAINTAIN HIGH QUALITY CREDIT PROFILE ACHIEVE FURTHER IMPROVEMENT IN OPERATING LEVERAGE ENHANCE DEPOSIT LEVELS TO SUPPORT GROWTH FINANCIAL PRIORITIES 48% 12% 5 bps 58 bps NPLs/Loans 7% 12% Q4 2015 Compared to Q4 2014

15 POSITIVE MOMENTUM IN CORE* EARNINGS PER SHARE $0.33 $0.35 $0.38 $0.44 $0.49 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation 48% CORE EPS GROWTH FROM Q4 2014 TO Q4 2015

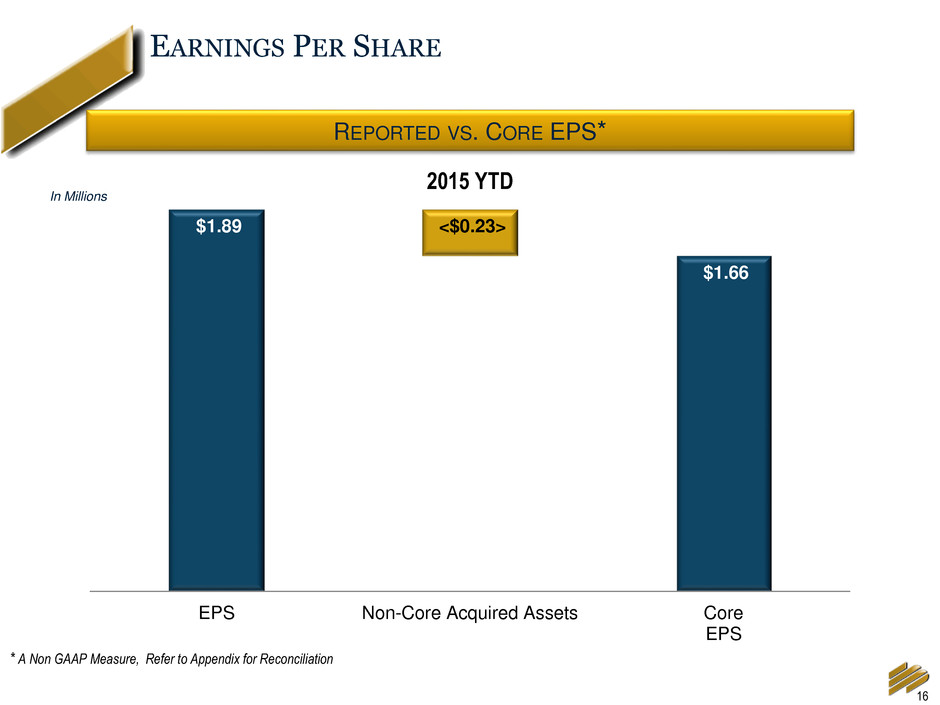

16 EARNINGS PER SHARE $22,387 $1.89 <$0.23> $1.66 EPS Non-Core Acquired Assets Core EPS In Millions * A Non GAAP Measure, Refer to Appendix for Reconciliation REPORTED VS. CORE EPS* 2015 YTD

17 FULL YEAR EARNINGS PER SHARE TREND $1.29 $0.29 < $0.01> $0.03 $0.06 $1.66 2014 YTD Net Interest Income Portfolio Loan Loss Provision Non Interest Income Non Interest Expense 2015 YTD In Millions CHANGES IN CORE EPS* Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

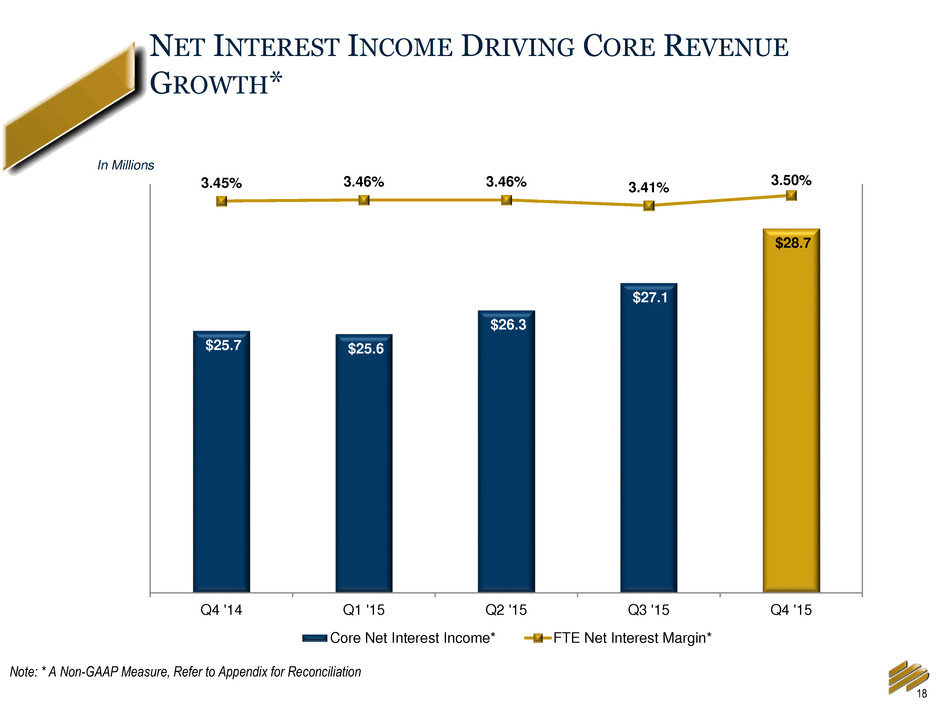

18 NET INTEREST INCOME DRIVING CORE REVENUE GROWTH* In Millions Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation $25.7 $25.6 $26.3 $27.1 $28.7 3.45% 3.46% 3.46% 3.41% 3.50% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% $18.0 $19.0 $20.0 $21.0 $22.0 $23.0 $24.0 $25.0 $26.0 $27.0 $28.0 $29.0 $30.0 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Core Net Interest Income* FTE Net Interest Margin*

19 CREDIT TRENDS FOR PORTFOLIO LOANS 10 bps 25 bps 11 bps 2 bps -10 bps Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Net Charge-offs (1) 2014 NCO = 7 bps (1) Portfolio loans only, excludes PCI (Purchased Credit Impaired) loans $2.0 $1.6 $2.2 $0.6 $0.5 $- $0.6 $1.2 $1.8 $2.4 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Provision for Portfolio Loans Q4 2015 EFSC PEER(2) NPA’S/ASSETS = 0.48% 0.74% NPL’S/LOANS = 0.33% 0.71% ALLL/NPL’S = 368% 160% ALLL/LOANS = 1.22% 1.16% (2) Peer data as of 9/30/2015 (source: SNL Financial) In Millions 2015 NCO = 6 bps $139.0 $1.6 $107.0 $59.6 $148.6 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Portfolio Loan Growth In Millions Net Charge-offs (1)

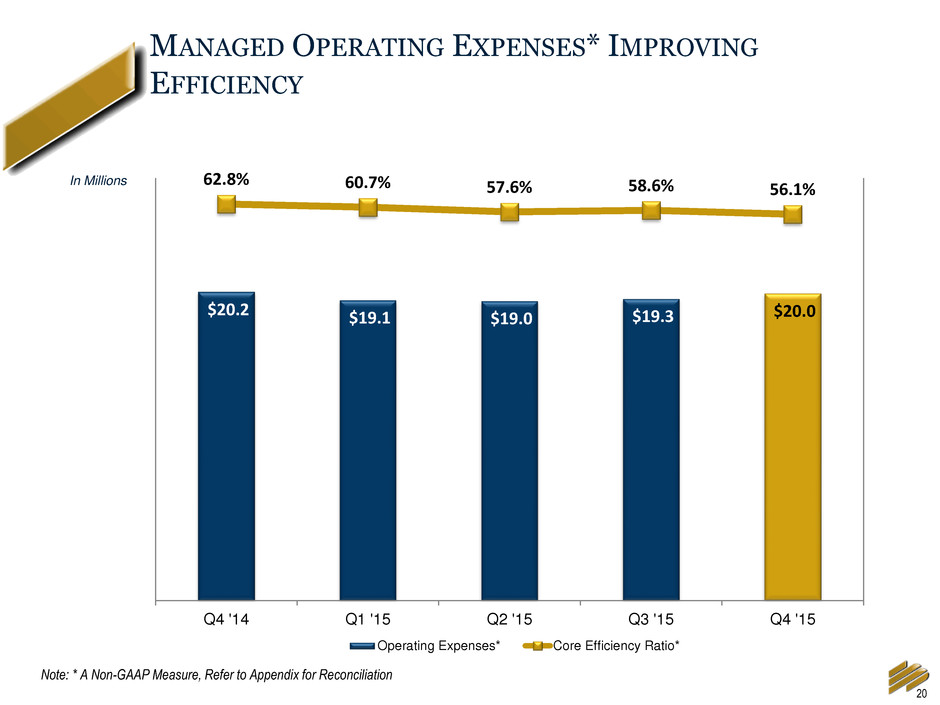

20 MANAGED OPERATING EXPENSES* IMPROVING EFFICIENCY In Millions Note: * A Non-GAAP Measure, Refer to Appendix for Reconciliation $20.2 $19.1 $19.0 $19.3 $20.0 62.8% 60.7% 57.6% 58.6% 56.1% -20 -5 10 25 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Operating Expenses* Core Efficiency Ratio*

21 FIRST QUARTER 2016 DIVIDEND INCREASED 13% TO $0.09 PER COMMON SHARE 4TH CONSECUTIVE INCREASE 2,000,000 SHARE COMMON STOCK REPURCHASE PLAN INSTITUTED ~ 10% OF EFSC OUTSTANDING SHARES NO SPECIFIED END DATE DISCIPLINED, PATIENT APPROACH BASED ON MARKET CONDITIONS SUFFICIENT CAPITAL TO SUPPORT GROWTH PLANS STRONG CAPITAL LEVELS FACILITATE GROWTH AND RETURNS 5.15% 4.99% 6.02% 7.78% 8.69% 9.01% 8.94% 8.90% 8.88% TANGIBLE COMMON EQUITY/TANGIBLE ASSETS

22 HIGHLY FOCUSED, Proven BUSINESS MODEL STRONG TRACK RECORD OF Commercial Loan Growth DIFFERENTIATED COMPETITIVE Lending Expertise Replicating ST. LOUIS MODEL IN Kansas City AND Phoenix DEMONSTRATED PROGRESS TOWARD INCREASED RETURNS AND Enhancing Shareholder Value 190% 91% EFSC Index 5-Year Total Shareholder Return Note: Index = SNL U.S. Bank $1B - $5B, as of 12/31/2015 Source: SNL ENTERPRISE FINANCIAL

23 APPENDIX 4Q 2015 INVESTOR PRESENTATION

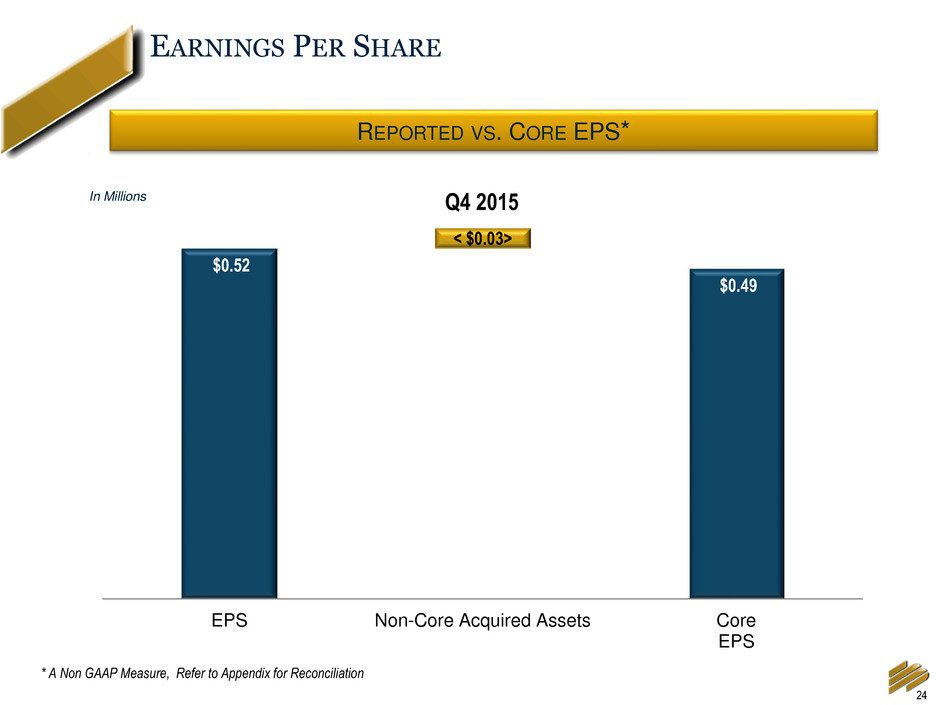

24 EARNINGS PER SHARE $22,387 $0.52 < $0.03> $0.49 EPS Non-Core Acquired Assets Core EPS In Millions * A Non GAAP Measure, Refer to Appendix for Reconciliation REPORTED VS. CORE EPS* Q4 2015

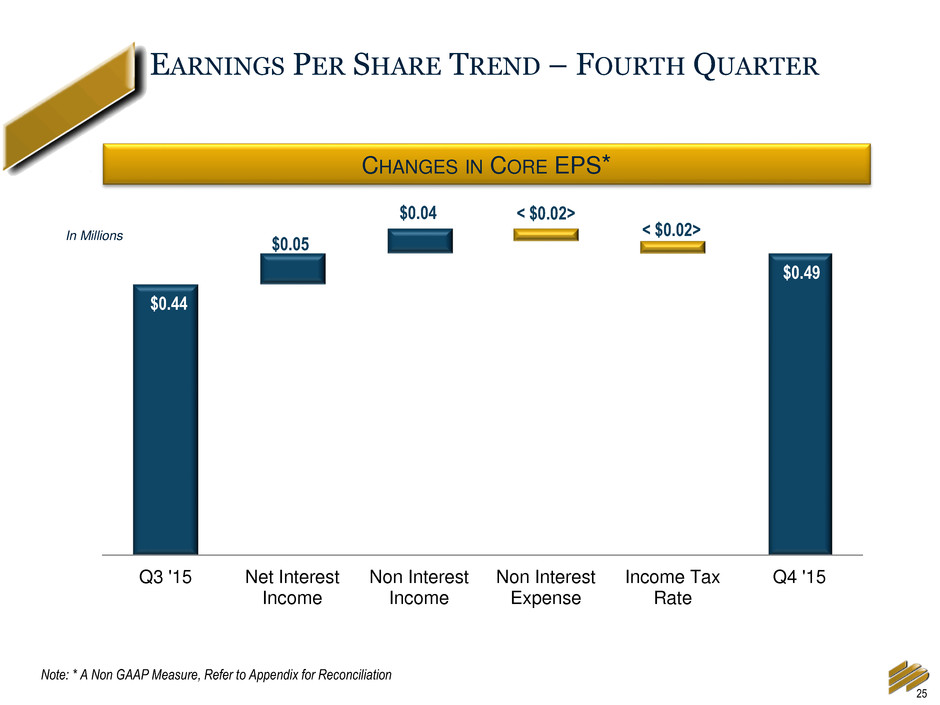

25 EARNINGS PER SHARE TREND – FOURTH QUARTER $0.44 $0.05 $0.04 < $0.02> < $0.02> $0.49 Q3 '15 Net Interest Income Non Interest Income Non Interest Expense Income Tax Rate Q4 '15 In Millions CHANGES IN CORE EPS* Note: * A Non GAAP Measure, Refer to Appendix for Reconciliation

26 BALANCE SHEET POSITIONED FOR GROWTH Modest Asset Sensitivity (200 BPS RATE SHOCK INCREASES NII BY 4.1%) 62% FLOATING RATE LOANS, WITH THREE-YEAR AVERAGE DURATION High-quality, Cash-flowing SECURITIES PORTFOLIO WITH FOUR YEAR AVERAGE DURATION 26% DDA TO TOTAL DEPOSITS 8.9% Tangible Common Equity/Tangible ASSETS

27 SIGNIFICANT EARNINGS CONTRIBUTION (PRE-TAX) Significant CONTRIBUTION TO FUTURE EARNINGS WITH ESTIMATED FUTURE ACCRETABLE YIELD OF $25 Million SUCCESSFUL FDIC-ASSISTED ACQUISITION STRATEGY SUCCESSFULLY ENTERED INTO AGREEMENT TO TERMINATE ALL EXISTING LOSS SHARE AGREEMENTS WITH THE FDIC IN DECEMBER 2015 2013 2014 2015 $15,459 $10,860 $11,680 Dollars in Thousands Accretable yield estimate as of 12/31/15 COMPLETED 4 FDIC- Assisted TRANSACTIONS SINCE DECEMBER 2009 CONTRIBUTED $55 Million IN Net Earnings SINCE ACQUISITION $117 Million OF CONTRACTUAL CASH FLOWS WITH $65 Million CARRYING VALUE

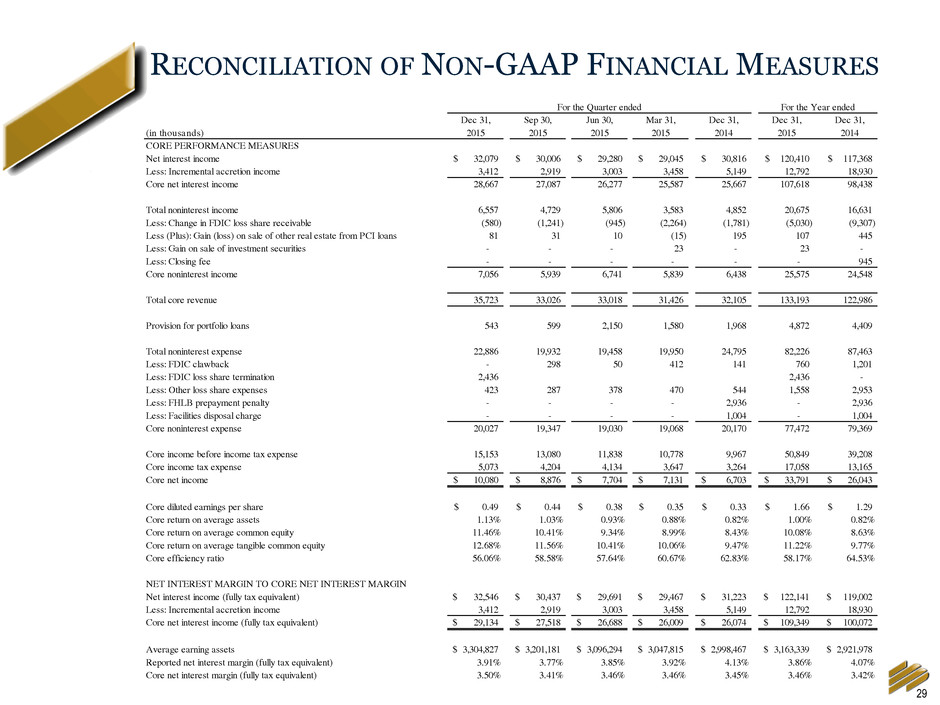

28 USE OF NON-GAAP FINANCIAL MEASURES The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as Core net income margin and other Core performance measures, in this presentation that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The Company considers its Core performance measures presented in presentation as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of PCI loans and related income and expenses, the impact of nonrecurring items, and the Company's operating performance on an ongoing basis. Core performance measures include contractual interest on PCI loans but exclude incremental accretion on these loans. Core performance measures also exclude the Change in FDIC receivable, Gain or loss of other real estate from PCI loans and expenses directly related to the PCI loans and other assets formerly covered under FDIC loss share agreements. Core performance measures also exclude certain other income and expense items the Company believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis. The attached tables contain a reconciliation of these Core performance measures to the GAAP measures. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the tables below, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measure for the periods indicated. Peer group data consists of banks with total assets from $1-$10 billion with commercial loans greater than 20% and consumer loans less than 20%.

29 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Dec 31, Sep 30, Jun 30, Mar 31, Dec 31, Dec 31, Dec 31, (in thousands) 2015 2015 2015 2015 2014 2015 2014 CORE PERFORMANCE MEASURES Net interest income 32,079$ 30,006$ 29,280$ 29,045$ 30,816$ 120,410$ 117,368$ Less: Incremental accretion income 3,412 2,919 3,003 3,458 5,149 12,792 18,930 Core net interest income 28,667 27,087 26,277 25,587 25,667 107,618 98,438 Total noninterest income 6,557 4,729 5,806 3,583 4,852 20,675 16,631 Less: Change in FDIC loss share receivable (580) (1,241) (945) (2,264) (1,781) (5,030) (9,307) Less (Plus): Gain (loss) on sale of other real estate from PCI loans 81 31 10 (15) 195 107 445 Less: Gain on sale of investment securities - - - 23 - 23 - Less: Closing fee - - - - - - 945 Core noninterest income 7,056 5,939 6,741 5,839 6,438 25,575 24,548 Total core revenue 35,723 33,026 33,018 31,426 32,105 133,193 122,986 Provision for portfolio loans 543 599 2,150 1,580 1,968 4,872 4,409 Total noninterest expense 22,886 19,932 19,458 19,950 24,795 82,226 87,463 Less: FDIC clawback - 298 50 412 141 760 1,201 Less: FDIC loss share termination 2,436 2,436 - Less: Other loss share expenses 423 287 378 470 544 1,558 2,953 Less: FHLB prepayment penalty - - - - 2,936 - 2,936 Less: Facilities disposal charge - - - - 1,004 - 1,004 Core noninterest expense 20,027 19,347 19,030 19,068 20,170 77,472 79,369 Core income before income tax expense 15,153 13,080 11,838 10,778 9,967 50,849 39,208 Core income tax expense 5,073 4,204 4,134 3,647 3,264 17,058 13,165 Core net income 10,080$ 8,876$ 7,704$ 7,131$ 6,703$ 33,791$ 26,043$ Core diluted earnings per share 0.49$ 0.44$ 0.38$ 0.35$ 0.33$ 1.66$ 1.29$ Core return on average assets 1.13% 1.03% 0.93% 0.88% 0.82% 1.00% 0.82% Core return on average common equity 11.46% 10.41% 9.34% 8.99% 8.43% 10.08% 8.63% Core return on average tangible common equity 12.68% 11.56% 10.41% 10.06% 9.47% 11.22% 9.77% Core efficiency ratio 56.06% 58.58% 57.64% 60.67% 62.83% 58.17% 64.53% NET INTEREST MARGIN TO CORE NET INTEREST MARGIN Net interest income (fully tax equivalent) 32,546$ 30,437$ 29,691$ 29,467$ 31,223$ 122,141$ 119,002$ Less: Incremental accretion income 3,412 2,919 3,003 3,458 5,149 12,792 18,930 Core net interest income (fully tax equivalent) 29,134$ 27,518$ 26,688$ 26,009$ 26,074$ 109,349$ 100,072$ Average earning assets 3,304,827$ 3,201,181$ 3,096,294$ 3,047,815$ 2,998,467$ 3,163,339$ 2,921,978$ Reported net interest margin (fully tax equivalent) 3.91% 3.77% 3.85% 3.92% 4.13% 3.86% 4.07% Core net interest margin (fully tax equivalent) 3.50% 3.41% 3.46% 3.46% 3.45% 3.46% 3.42% For the Quarter ended For the Year ended