Attached files

| file | filename |

|---|---|

| 8-K - CORENERGY INFRASTRUCTURE TRUST INC 8-K 3-3-2016 - CorEnergy Infrastructure Trust, Inc. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - CorEnergy Infrastructure Trust, Inc. | ex99_1.htm |

Exhibit 99.2

LISTED CORR NYSE Capital Link Master Limited PartnershipInvesting ForumJeff Fulmer, Senior Vice PresidentMarch 3, 2016

This presentation contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although CorEnergy believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in CorEnergy’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required by law, CorEnergy does not assume a duty to update any forward-looking statement. In particular, any distribution paid in the future to our stockholders will depend on the actual performance of CorEnergy, its costs of leverage and other operating expenses and will be subject to the approval of CorEnergy’s Board of Directors and compliance with leverage covenants. Disclaimer

Direct Access to Energy Infrastructure Own infrastructure assets critical to tenant / customer operationsEnter into long-term leases with predictable base rents having inflationary protectionCollect rents that have priority, and are reflected as necessary tenant / customer operating expenseDeliver total returns of 8-10% on assets derived from base rents, participating rents and new acquisitions REIT Strategy 1099 infrastructure access for institutional, tax exempt and non-US investors (no K-1, UBTI or ECI)REITs are not investment companies, but are eligible to be owned by investment companies REIT Structure SUITABILITY

Broadened Investor Suitability CORR MLPsMarket Cap: ~$390 Bn1,4 1) “The Research Magazine Guide to Master Limited Partnerships 2015”, July 20152) Bloomberg Data, February 20163) REIT.com “REIT Industry Financial Snapshot”, January 2016, includes only equity REITs4) U.S. Capital Advisors “USCA Weekly MLP Update”, February 29, 2016 Retail & Insider Institutional REITsMarket Cap: ~$851 Bn1,3 2

Diversification Across the Energy Value Chain UPSTREAM MIDSTREAM DOWNSTREAM SWD facilities Portland Terminal Pinedale LGS Omega Pipeline MoGas Pipeline Grand Isle Gathering System

GIGS terminal Portland Terminal: MLP as Tenant 39-acre terminal to receive, store and deliver heavy and refined petroleum products84 tanks with 1.5 million barrels of storage capacity; loading for ships, rail and trucksTriple net operating lease with Arc Terminals; 15-year initial term, 5-year renewals Acquired for $40 million and financed $10 million in expansion projects

MoGas Interstate Pipeline: LDCs as Tenants GIGS terminal 263-mile pipeline connecting natural gas supplies to Missouri utilitiesCritical pipeline with 97% of revenues from firm transportation contractsHeld as taxable company; subject to intercompany mortgage$125 million financed through issuance of new equity and preferred

Priority and Magnitude of CORR Rent "A termination of the Pinedale Lease Agreement would significantly disrupt our ability to produce oil and gas from Pinedale field which would have a material adverse effect on our business, financial condition, results of operations, and cash flows.“2 Interest is single largest cash expense for tenants Includes CorEnergy Lease Payments 1) Portion attributable to CORR Rent2) Ultra Petroleum 2015 Form 10-K3) Excluding gains, losses and impairmentsSources: UPL and EXXI Filings

Recurring and Sustained Performance Diversification of asset and revenue sources enhances dividend stabilityLong-term contracted revenues with potential escalatorsDividend growth target: 3-5% annually including acquisitions and new projects~1.5x coverage ratio of AFFO to dividend allows for debt repayment and capital reinvestments Asset Growth Drives Dividend Growth (2) Exit dividend for each fiscal period, annualized, adjusted for reverse stock split Dividends Per Share2 Total Assets H1

Adequate Liquidity for Anticipated Needs Capitalization Preferred to Total Equity Ratio: Adjusted ratio of 13%, below our 33% target Financing Ratios Remain Well Below Targets Total Debt to Total Capitalization Ratio: Adjusted ratio of ~34%, within our target range of 25-50% Three Publicly Traded Financial Instruments 7% Convertible Notes7 3/8% Preferred Series A Common Shares

Concluding Remarks Direct access to critical energy infrastructure for institutional, retail, tax exempt, and non-US investorsLong-term leases with predictable base rents, adjusted annually for inflationRent payments to CORR have high priority and are usually reflected as “field-level” operating expensesManagement team with deep experience in the energy industryA record of dividend growth and a “pipeline” of opportunities

For more information please visit our website at corenergy.corridortrust.comOr contact Investor Relations directly at: 877-699-CORRinfo@corridortrust.com

Appendix

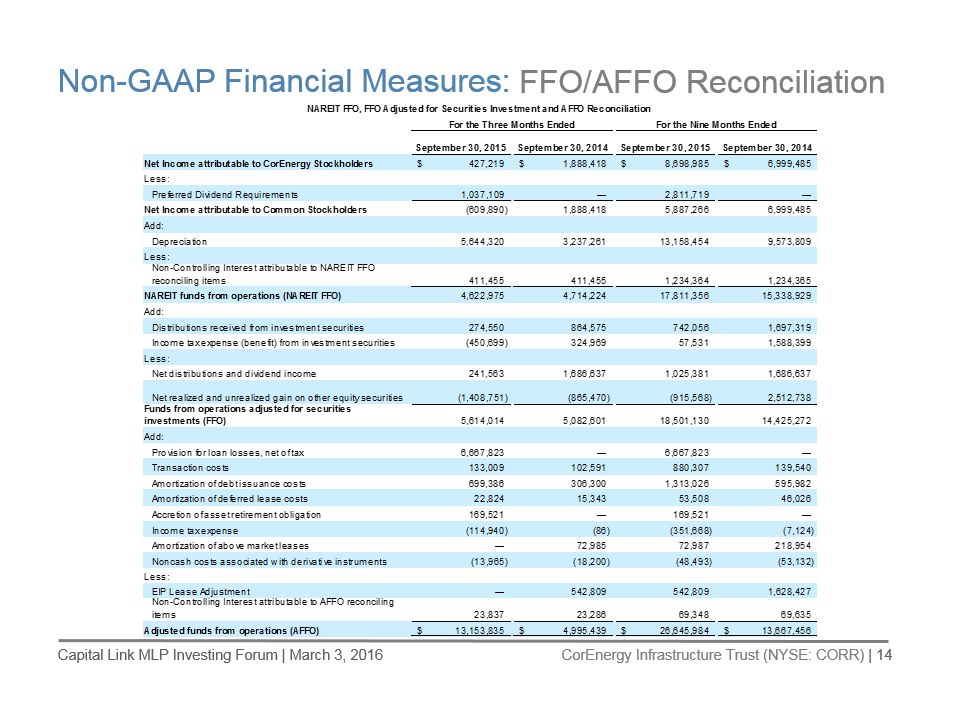

Non-GAAP Financial Measures: FFO/AFFO Reconciliation

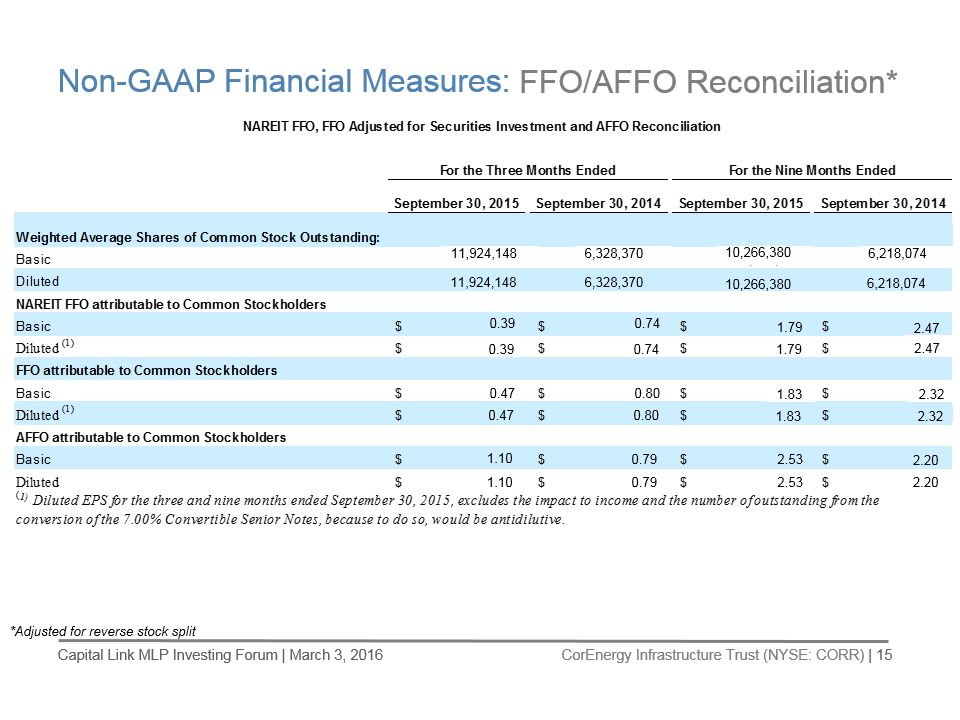

Non-GAAP Financial Measures: FFO/AFFO Reconciliation* 1.10 11,924,148 1.10 0.47 0.39 0.47 0.39 *Adjusted for reverse stock split 0.74 0.74 1.79 1.79 0.80 0.80 0.79 0.79 11,924,148 6,328,370 10,266,380 6,218,074 6,328,370 10,266,380 6,218,074 1.83 1.83 2.53 2.53 2.20 2.20 2.32 2.32 2.47 2.47

Non-GAAP Financial Measures: Contribution Margin1

Non-GAAP Financial Measures: Contribution Margin1 (1) Equals Total Lease Revenue, Security Distributions, Financing Revenue and Operating Results in the MD&A of Forms 10-K and 10-Q. Reconciliation on slides 15-16.

Non-GAAP Financial Measures: Fixed-Charges Coverage