Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANIXTER INTERNATIONAL INC | a8-kpresentationatmarch201.htm |

| EX-99.1 - EXHIBIT 99.1 - ANIXTER INTERNATIONAL INC | exhibit991anixtertopresent.htm |

Ted Dosch Executive Vice President and CFO 2016 Global High Yield & Leveraged Finance Conference March 2, 2016 Exhibit 99.2

© 2016 Anixter Inc. Safe Harbor Statement The statements in this presentation other than historical facts are forward-looking statements made in reliance upon the safe harbor of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of factors that could cause our actual results to differ materially from what is indicated here. These factors include but are not limited to general economic conditions, the level of customer demand particularly for capital projects in the markets we serve, changes in supplier sales strategies or financial viability, risks associated with the sale of nonconforming products and services, political, economic or currency risks related to foreign operations, inventory obsolescence, copper price fluctuations, customer viability, risks associated with accounts receivable, the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks and risks associated with integration of acquired companies. These uncertainties may cause our actual results to be materially different than those expressed in any forward looking statements. We do not undertake to update any forward looking statements. Please see our Securities and Exchange Commission (“SEC”) filings for more information. In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) above, this presentation includes certain financial measures computed using non-GAAP components as defined by the SEC. Specifically, net sales comparisons to the prior corresponding period, both worldwide and in relevant segments, are discussed in this presentation both on a GAAP basis and non-GAAP basis. We believe that by reporting non-GAAP organic growth, which adjusts for the impact of acquisitions (when applicable), foreign exchange fluctuations and copper prices, both management and investors are provided with meaningful supplemental sales information to understand and analyze our underlying trends and other aspects of our financial performance. Beginning in 2015, we calculate the year-over-year organic sales growth impact relating to the Tri-Ed and Power Solutions acquisitions by including the 2014 results with our results (on a "pro forma" basis) as we believe this represents the most accurate representation of organic growth, considering the nature of the companies we acquired and the synergistic revenues that have been achieved. From time to time, we may also exclude other items from reported financial results (e.g., impairment charges, inventory adjustments, restructuring charges, tax items, currency devaluations, etc.) so that both management and financial statement users can use these non-GAAP financial measures to better understand and evaluate our performance period over period and to analyze the underlying trends of our business. Non-GAAP financial measures provide insight into selected financial information and should be evaluated in the context in which they are presented. These non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. The non-GAAP financial measures should be considered in conjunction with the Condensed Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above. Unless otherwise stated, all numbers in this presentation reflect results from continuing operations. 2

© 2016 Anixter Inc. 2016 Global High Yield & Leveraged Finance Conference Table of Contents 1) Repositioned and Strengthened Business 2) Business Model Overview 3) Cash Flow and Capital Allocation Priorities 4) Driving Excellence in Execution 3

© 2016 Anixter Inc. Q3 2014 Q2 2015 Q3 2015 Resulting in more attractive end market exposure Repositioned and Strengthened Business Strategic Actions Transform the Business Closed 9/17/2014 Adj. EBITDA* $36M Purchase Price $420M A C Q U I S I T I O N S D I V E S T I T U R E Closed 10/5/2015 Adj. EBITDA** $79M Purchase Price $825M Closed 6/1/2015 2014 Adj. EBITDA $47M Sale Price $380M OEM Supply – Fasteners 4 *Tri-Ed Adjusted EBITDA for the trailing twelve months ended June 30, 2014 **HD Supply Power Solutions Adjusted EBITDA from HD Supply SEC filings

© 2016 Anixter Inc. Repositioned and Strengthened Business More Focused Mix with a New Segment Structure Previous Structure Changes Repositioned Segment Structure 2015 Sales Segment Name 2015 PF Sales Enterprise Cabling & Security Solutions $3.9 Network & Security Solutions $3.9 Electrical and Electronic Wire & Cable $1.9 +$0.4 Low voltage Electrical & Electronic Solutions $2.3 Power Solutions $0.4 +$0.9 High voltage Utility Power Solutions $1.5 Total $6.2 $7.7 ECS 62% W&C 38% 5 $ Billions Network & Security Solutions 51% Utility Power Solutions 19% Electrical & Electronic Solutions 30%

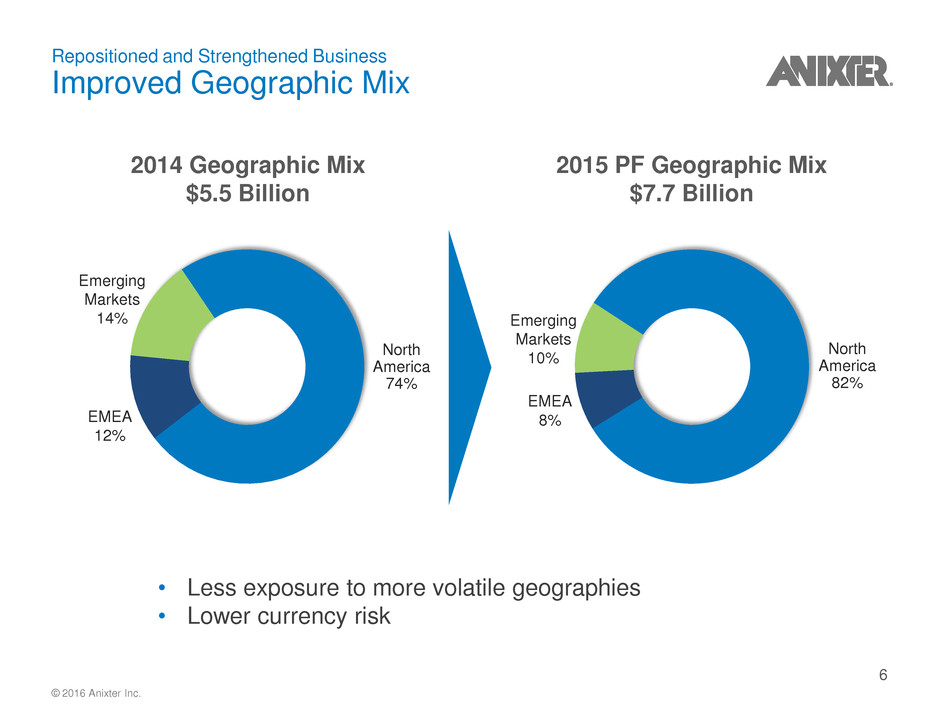

© 2016 Anixter Inc. • Less exposure to more volatile geographies • Lower currency risk Repositioned and Strengthened Business Improved Geographic Mix 2014 Geographic Mix $5.5 Billion 2015 PF Geographic Mix $7.7 Billion North America 74% EMEA 12% Emerging Markets 14% North America 82% Emerging Markets 10% EMEA 8% 6

© 2016 Anixter Inc. 24.8% 27.5% 2013 2014 PF Repositioned and Strengthened Business Strategic Actions Change Financial Profile, But Most Importantly Drive Increased ROTC 7 ROTC Tri-Ed and Power Solutions: Higher ROTC • Lower gross margin • Lower operating expense • Lower working capital Key Changes to Our Financial Profile Fasteners: Lower ROTC • Higher gross margin • Higher operating expense • Higher working capital +270 bps

© 2016 Anixter Inc. Enhanced geographic reach Increased customer penetration Leveraged purchasing scale IT and G&A savings Expanded service offerings Expanded product offerings Repositioned and Strengthened Business Strategic Actions Create Synergy and Accretion Opportunities Revenues Gross margin Operating expense 8 EBITDA Synergy Targets: • Tri-Ed: ~$15M by 2017 • Low voltage: ~$19M by 2018 • Utility: ~$6M by 2018 CUMULATIVE: ~$40M by 2018

© 2016 Anixter Inc. Business Model Overview Leading Positions in Attractive Businesses 9 Network & Security Solutions Electrical & Electronic Solutions Utility Power Solutions Leading Position Global #1 Global Top 3 North America #1 Large ~$55B TAM ~$450B TAM ~$31B TAM Growing 3 - 4% CAGR 2 - 3% CAGR ~4% CAGR Fragmented ~7% Share <1% Share <4% Share Diverse and Global END USERS Commercial, Data Center, Defense, Education, Electronics, Government, Healthcare, Industrial, Oil and Gas, Retail, Semi-conductor, Transportation, Utility CHANNELS Contractors, Integrators, EPCs $ Billions

© 2016 Anixter Inc. Business Model Overview Strong, Diverse and Global Suppliers and Customers 10 CUSTOMERS SUPPLIERS

© 2016 Anixter Inc. Business Model Overview Competitive Advantages and Barriers to Entry Key Differentiators • Global Capabilities with Local Presence • • Customized and Scalable Supply Chain Solutions • • Technical Expertise • Network & Security Solutions Electrical & Electronic Solutions Utility Power Solutions 11

© 2016 Anixter Inc. Business Model Overview Unmatched Global Capabilities 12 12 300+ WAREHOUSES/ BRANCHES 300+ CITIES

© 2016 Anixter Inc. • Unique, 4,000-square-foot facility designed to test security, data center and industrial communications solutions independent of our manufacturer partners • Proof of concept testing for customer security and communications requirements • Key product testing areas include: physical security, data infrastructure and industrial communications • Anixter IP Assured testing for data centers and IP security Business Model Overview Industry-Leading Technical Expertise 13 Infrastructure Solutions Lab Technology Support Services • Global engineering team focused on positioning Anixter as a technology leader trusted advisor in the following areas: – Data Center – Enterprise networks – Audio Visual – Physical security – Wireless • Partner with Anixter sales representatives and their customers to assist with: – Application consultation – Technology selection – Bill of material generation • Industry experts that hold technical certifications and participate in a variety of standards bodies Anixter provides unique and unparalleled technical support to customers

© 2016 Anixter Inc. 14 Business Model Overview Customized and Scalable Supply Chain Solutions: Connecting the Dots Sourcing Inventory Management Product Enhancement & Packaging Project Coordination Global Logistics

© 2016 Anixter Inc. Cash Flow and Capital Allocation Priorities Counter-Cyclical Free Cash Flow Provides Financial Flexibility Generate Strong Free Cash Flow Throughout the Economic Cycle 2015 sales growth includes the Power Solutions acquisition. On an organic basis, 2015 sales increased by 1.3%. Numbers prior to 2015 are not restated for the sale of our Fasteners business. 15

© 2016 Anixter Inc. Cash Flow and Capital Allocation Priorities Near Term Cash Flow Allocation Priority is to Return to Target Debt Levels *2015 Debt / Adjusted EBITDA includes 12 months of Power Solutions earnings on a pro forma basis Target range: 2.5 - 3.0x Target range: 45 - 50% 16

© 2016 Anixter Inc. $390.0 $155.2 $134.2 $173.0 $15.6 $350.0 $400.0 $41.1 $350.0 $0 $250 $500 $750 $1,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 5.50% Senior Notes due 2023 Undrawn European Facilities 5.125% Senior Notes due 2021 5.625% Senior Notes due 2019 Undrawn CAD Revolver CAD Term Loan Undrawn Inventory Revolver Undrawn A/R Revolver $600MM A/R Revolver *As of January 1, 2016, borrowing base on A/R Revolver is $546 million **Undrawn facilities are shown net of Letters of Credit that are backed by the respective revolvers and facilities 17 ($ in Millions) Cash Flow and Capital Allocation Priorities Debt Maturity Schedule

© 2016 Anixter Inc. Driving Excellence in Execution 18 Capitalize on all available growth levers Deliver $40M in cumulative run rate synergies by 2018 Achieve long term financial goals Execute on operational performance levers 1 2 3 4

© 2016 Anixter Inc. Driving Excellence in Execution Capitalize on Multiple Long Term Revenue Growth Opportunities • Security products • Low voltage electrical products • Industrial Communication and Control • Wireless • Professional audio/visual • Data and mobility usage • Physical security • Non-residential construction • Residential construction • Electrical grid infrastructure • Oil and gas headwinds • Deflationary pressures • One Anixter • Synergistic cross-selling • Multi-tenant data centers • Small and mid-sized customers • Digital marketing and eCommerce Core Market Growth Product Line & Service Offering Expansion Market Share Gains • Expansion of security and low voltage products into Canada, Mexico and EMEA • Expansion of utility products into Western Canada and Mexico Geographic Growth 19 Organic Growth Goals: 150 - 250 bps above market 4 - 6% CAGR

© 2016 Anixter Inc. Balance Sheet Discipline Driving Excellence in Execution Execute on Operational Performance Levers Profitable Sales Growth Cost Management • Innovative product offerings and expertise • Expanded supply chain services • Leverage synergy opportunities • Sourcing strategies: direct and indirect • Competitive cost structure mentality • Day-to-day cost management discipline • Rationalize footprint • Working capital initiatives • Capital management 20

© 2016 Anixter Inc. FY 15 FY 16 FY 17 FY 18 Driving Excellence in Execution Deliver $40 Million in Cumulative Run Rate EBITDA Synergies by 2018 Tri-Ed Low Voltage Utility $40M + $30M $17M $5M • Tri-Ed: $80 Million • Power Solutions: $200 Million Year 3 Run Rate Sales Synergy Goals 21

© 2016 Anixter Inc. In Summary Compelling Investor Value Proposition Results from our Compelling Customer Value Proposition 22 • Customer value proposition − Reduce cost, complexity and risk in our customers’ supply chains − Differentiators including: • Global capabilities with local presence • Customized and scalable supply chain solutions • Technical expertise • Investor value proposition − Leading positions in attractive businesses − Competitive advantage and barriers to entry − Globally scalable business model − Financial strength and capital efficiency − Visibility to growth, ability to deliver synergies