Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - AMERICAN VANGUARD CORP | d238269dex21.htm |

| EX-10.18 - EX-10.18 - AMERICAN VANGUARD CORP | d238269dex1018.htm |

| EX-31.2 - EX-31.2 - AMERICAN VANGUARD CORP | d238269dex312.htm |

| EX-32.1 - EX-32.1 - AMERICAN VANGUARD CORP | d238269dex321.htm |

| EX-23 - EX-23 - AMERICAN VANGUARD CORP | d238269dex23.htm |

| EX-31.1 - EX-31.1 - AMERICAN VANGUARD CORP | d238269dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Year Ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Transition Period From To

Commission file number 001-13795

AMERICAN VANGUARD CORPORATION

| Delaware | 95-2588080 | |

| (State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 4695 MacArthur Court, Newport Beach, California | 92660 | |

| (Address of principal executive offices) | (Zip Code) | |

(949) 260-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, $.10 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock of the registrant held by non-affiliates is $392.9 million. This figure is estimated as of June 30, 2015 at which date the closing price of the registrant’s Common Stock on the New York Stock Exchange was $13.80 per share. For purposes of this calculation, shares owned by executive officers, directors, and 5% stockholders known to the registrant have been deemed to be owned by affiliates. The number of shares of $.10 par value Common Stock outstanding as of June 30, 2015, was 29,167,289. The number of shares of $.10 par value Common Stock outstanding as of February 22, 2016 was 29,214,568.

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

December 31, 2015

i

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Unless otherwise indicated or the context otherwise requires, the terms “Company,” “we,” “us,” and “our” refer to American Vanguard Corporation and its consolidated subsidiaries (“AVD”).

Forward-looking statements in this report, including without limitation, statements relating to the Company’s plans, strategies, objectives, expectations, intentions, and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties. (Refer to Part I, Item 1A, Risk Factors and Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, included in this Annual Report.)

| ITEM 1 | BUSINESS |

AVD was incorporated under the laws of the State of Delaware in January 1969 and operates as a holding company. Unless the context otherwise requires, references to the “Company” or the “Registrant,” in this Annual Report refer to AVD. The Company conducts its business through its subsidiaries, AMVAC Chemical Corporation (“AMVAC”), GemChem, Inc. (“GemChem”), 2110 Davie Corporation (“DAVIE”), Quimica Amvac de Mexico S.A. de C.V. (“AMVAC M”), AMVAC Mexico Sociedad de Responsabilidad Limitada (“AMVAC M Srl”), AMVAC de Costa Rica Sociedad de Responsabilidad Limitada (“AMVAC CR Srl”), AMVAC Switzerland GmbH (“AMVAC S”), AMVAC do Brasil Representácoes Ltda (“AMVAC B”), AMVAC CV (“AMVAC CV”), AMVAC Netherlands BV (“AMVAC BV”) and Envance Technologies, LLC (“Envance”).

Based on similar economic and operational characteristics, the Company’s business is aggregated into one reportable segment. Refer to Part II, Item 7 for selective enterprise information.

AMVAC

AMVAC is a California corporation that traces its history from 1945 and is a specialty chemical manufacturer that develops and markets products for agricultural, commercial and consumer uses. It manufactures and formulates chemicals for crops, turf and ornamental plants, and human and animal health protection. These chemicals, which include insecticides, fungicides, herbicides, molluscicides, growth regulators, and soil fumigants, are marketed in liquid, powder, and granular forms. In prior years, AMVAC considered itself a distributor-formulator, but now AMVAC primarily manufactures, distributes, and formulates its own proprietary products or custom manufactures or formulates for others. AMVAC has historically expanded its business through both the acquisition of established chemistries (which it has revived in the marketplace) and the development and commercialization of new compounds through licensing arrangements. Below is a description of the Company’s acquisition/licensing activity over the past five years.

On October 26, 2015, AMVAC entered into a license and supply agreement with Badische Anilin-und Soda-Fabrik (“BASF”) under which BASF sold and AMVAC acquired certain assets relating to the imazaquin product line. Imazaquin is an herbicide that is used on soybeans and for certain non-crop applications.

On April 29, 2015 the registrant’s international subsidiary, AMVAC C.V., completed the acquisition of certain assets related to the bromacil herbicide product line from DuPont Crop Protection. The assets acquired included the Hyvar® and Krovar® trademarks, product registrations, product registration data, customer information, access to certain know-how, technical registrations and associated registration data in all markets outside of North America. Bromacil is a broad spectrum residual herbicide used on crops such as pineapples, citrus, agave and asparagus, and is marketed globally under the Hyvar® and Krovar® brands

On April 6, 2015 the registrant’s international subsidiary, AMVAC C.V., completed the acquisition of certain assets related to the Nemacur® insecticide/nematicide product line from Adama Agricultural Solutions Ltd (“Adama”). The assets acquired include trademarks, product registrations, associated registration data, and customer information that relate to the marketing and sale of this crop protection product in Europe. Nemacur is used to control soil insects and nematodes on many fruit and vegetable crops.

On March 25, 2013, AVD made an equity investment in TyraTech Inc. (“TyraTech”), a Delaware corporation that specializes in developing, marketing and selling pesticide products containing natural oils and other natural ingredients. As of December 31, 2015, the Company’s ownership position in TyraTech was approximately 15.11%.

On October 7, 2011, AMVAC completed the acquisition of the international rights to the cotton defoliant product tribufos (sold under the trade name Def ®) from Bayer CropScience AG (“BCS AG”). The acquired assets include registrations and data rights, rights relating to manufacturing and formulation know-how, inventories and the trademark Def.

1

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Def complements AMVAC’s existing cotton defoliant product Folex®, which it has marketed since 2002. This acquisition also complements the U.S. rights to Def that the Company purchased from BCS AG on July 21, 2010. Both Folex and Def are fast and effective cotton defoliants that facilitate the removal of leaves surrounding the cotton boll and, in combination with other products, function as a harvest aid.

Seasonality

The agricultural chemical industry, in general, is cyclical in nature. The demand for AMVAC’s products tends to be seasonal. Seasonal usage, however, does not necessarily follow calendar dates, but more closely follows varying growing seasonal patterns, weather conditions, geography, weather related pressure from pests and customer marketing programs.

Backlog

AMVAC does not believe that backlog is a significant factor in its business. AMVAC primarily sells its products on the basis of purchase orders, although from time to time it has entered into requirements contracts with certain customers.

Customers

The Company’s largest three customers accounted for 18%, 12% and 8% of the Company’s sales in 2015; 20%, 11% and 8% in 2014; and 17%, 13%, and 8% in 2013.

Distribution

AMVAC predominantly distributes its products domestically through national distribution companies and buying groups or co-operatives, that purchase AMVAC’s goods on a purchase order basis and, in turn, sell them to retailers/growers/end-users. The Company’s domestic and international distributors, agents, or customers typically have long-established relationships with retailers/end-users, far-reaching logistics and transportation capabilities and customer service expertise. The markets for AMVAC products vary by region, target crop, use and type of distribution channel. AMVAC’s customers are experts at addressing these markets. The Company manages its international sales through its Netherlands’ entity which has sales offices in Mexico or Costa Rica and, employed sales force executives or sales agents in other territories.

Competition

In its many marketplaces, AMVAC faces competition from both domestic and foreign manufacturers. Many of our competitors are larger and have substantially greater financial and technical resources than AMVAC. AMVAC’s ability to compete depends on its ability to develop additional applications for its current products and expand its product lines and customer base. AMVAC competes principally on the basis of the quality and efficacy of its products, price and the technical service and support given to its customers.

Generally, the treatment against pests of any kind is broad in scope, there being more than one way or one product for treatment, eradication, or suppression. In some cases, AMVAC has attempted to position itself in smaller niche markets which are no longer addressed by larger companies. In other cases, for example in the Midwestern corn market, the Company competes directly with larger competitors.

Manufacturing

Through its four domestic manufacturing facilities (see Item 2, Properties), AMVAC synthesizes many of the technical grade active ingredients that are in its end-use products. Further, AMVAC formulates and packages the majority of its end-use products at its own facilities or at the facilities of third-party formulators.

Raw Materials

AMVAC utilizes numerous companies to supply the various raw materials and components used in manufacturing its products. Many of these materials are readily available from domestic sources. In those instances where there is a single source of supply or where the source is not domestic, AMVAC seeks to secure its supply by either long-term (multi-year) arrangements or purchasing on long lead times from its suppliers. AMVAC believes that it is considered to be a valued customer to such sole-source suppliers.

2

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Intellectual Property

AMVAC’s proprietary product formulations are protected, to the extent possible, as trade secrets and, to a lesser extent, by patents. Certain of the Company’s closed delivery systems are patented and AMVAC has made applications for related inventions to expand its equipment portfolio, particularly with respect to its Smart Integrated Multi-Product Precision Application System, (“SIMPAS”) technology. Further, AMVAC’s trademarks bring value to its products in both domestic and foreign markets. AMVAC considers that, in the aggregate, its trademarks, licenses, and patents constitute a valuable asset. While it does not regard its business as being materially dependent upon any single trademark, license, or patent, it believes that its developmental equipment technology may bring significant value in future years.

EPA Registrations

AMVAC’s products also receive protection afforded by the terms of the Federal Insecticide, Fungicide and Rodenticide Act (“FIFRA”) legislation. The legislation makes it unlawful to sell any pesticide in the United States, unless such pesticide has first been registered by the United States Environmental Protection Agency (“U.S. EPA”). Substantially all of AMVAC’s products are subject to U.S. EPA registration and periodic re-registration requirements and are registered in accordance with FIFRA. This registration by U.S. EPA is based, among other things, on data demonstrating that the product will not cause unreasonable adverse effects on human health or the environment, when it is used according to approved label directions. In addition, each state, requires a specific registration before any of AMVAC’s products can be marketed or used in that state. State registrations are predominantly renewed annually with a smaller number of registrations that are renewed on a multiple year basis. Foreign jurisdictions typically have similar registration requirements by statute. The U.S. EPA, state, and foreign agencies have required, and may require in the future, that certain scientific data requirements be performed on registered products sold by AMVAC. AMVAC, on its own behalf and in joint efforts with other registrants, has furnished, and is currently furnishing, certain required data relative to specific products.

Under FIFRA, the federal government requires registrants to submit a wide range of scientific data to support U.S. registrations. This requirement results in operating expenses in such areas as regulatory compliance with U.S. EPA and other such bodies in the markets in which the Company sells its products, and the production of new products or new formulations of existing products. AMVAC expensed $9,831, $14,084, and $16,526 during 2015, 2014 and 2013 respectively, on these activities.

| 2015 | 2014 | 2013 | ||||||||||

| Registration |

$ | 6,375 | $ | 9,188 | $ | 11,556 | ||||||

| Product Development |

3,456 | 4,896 | 4,970 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 9,831 | $ | 14,084 | $ | 16,526 | |||||||

|

|

|

|

|

|

|

|||||||

3

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Environmental

During 2015, AMVAC continued activities to address environmental issues associated with its facility in Commerce, CA. (the “Facility”). An outline of the history of those activities follows.

In 1995, the California Department of Toxic Substances Control (“DTSC”) conducted a Resource Conservation and Recovery Act (“RCRA”) Facility Assessment (“RFA”) of those facilities having hazardous waste storage permits. In March 1997, the RFA culminated in DTSC accepting the Facility into its Expedited Remedial Action Program. Under this program, the Facility was required to conduct an environmental investigation and health risk assessment. Depending on the findings of these investigations, the Facility might also be required to develop and implement remedial measures to address any historical environmental impairment.

This activity then took two paths: first, the RCRA permit closure and second, the larger site characterization.

With respect to the RCRA permit closure, in 1998, AMVAC began the formal process to close its hazardous waste permit at the Facility (which had allowed AMVAC to store hazardous waste longer than 90 days) as required by federal regulations. Formal regulatory closure actions began in 2005 and were completed in 2008, as evidenced by DTSC’s October 1, 2008 acknowledgement of AMVAC’s Closure Certification Report.

With respect to the larger site characterization, soil and groundwater characterization activities began in December 2002 in accordance with the Site Investigation Plan that was approved by DTSC. Additional activities were conducted from 2003 to 2014, with oversight provided by DTSC. Additional review of groundwater and soil data is being conducted in response to federally-mandated initiatives of similarly affected sites. Risk assessment activities have been concluded. The Company submitted a draft remedial action plan to DTSC in February 2015, received formal DTSC comments in January 2016, and will submit a revised remedial action plan in early 2016. Until the remedial action plan has been submitted and comments are received from DTSC, it is uncertain whether the cost associated with further investigation and potential remediation activities will have a material impact on the Company’s consolidated financial statements or its results of operations. Thus, the Company is unable to determine what sort of remediation is probable, nor can the cost of remediation be reasonably estimated (the scope can vary depending upon the risk assessment and many other factors). Accordingly, the Company has not recorded a loss contingency with respect thereto.

AMVAC is subject to numerous federal and state laws and governmental regulations concerning environmental matters and employee health and safety at its four manufacturing facilities. The Company continually adapts its manufacturing process to the environmental control standards of the various regulatory agencies. The U.S. EPA and other federal and state agencies have the authority to promulgate regulations that could have an impact on the Company’s operations.

AMVAC expends substantial funds to minimize the discharge of materials in the environment and to comply with the governmental regulations relating to protection of the environment. Wherever feasible, AMVAC recovers and recycles raw materials and increases product yield in order to partially offset increasing pollution abatement costs.

The Company is committed to a long-term environmental protection program that reduces emissions of hazardous materials into the environment, as well as to the remediation of identified existing environmental concerns.

Employees

As of December 31, 2015, the Company employed 347 employees. The Company employed 382 employees as of December 31, 2014 and 499 employees as of December 31, 2013. From time to time, due to the seasonality of its business, AMVAC uses temporary contract personnel to perform certain duties primarily related to packaging of its products. None of the Company’s employees are subject to a collective bargaining agreement. The Company believes it maintains positive relations with its employees.

4

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Domestic operations

AMVAC is a California corporation that was incorporated under the name of Durham Chemical in August 1945. The name of the corporation was subsequently changed to AMVAC in January 1973. As the Company’s main operating subsidiary, AMVAC owns and/or operates the Company’s domestic manufacturing facilities and is also the parent company (owns 99%) of AMVAC CV. AMVAC manufactures, formulates, packages and sells its products in the USA and is a wholly owned subsidiary of AVD.

GemChem is a California corporation that was incorporated in 1991 and was subsequently purchased by the Company in 1994. GemChem sells into the pharmaceutical, cosmetic and nutritional markets, in addition to purchasing key raw materials for the Company. GemChem is a wholly owned subsidiary of AVD.

DAVIE owns real estate for corporate use only. See also Part I, Item 2 of this Annual Report. DAVIE is a wholly owned subsidiary of AVD.

On November 30, 2012, AMVAC and TyraTech formed a Delaware limited liability company, Envance, in which the Company owned 60% and TyraTech held 40% of the equity interest. Subsequently, on April 1, 2015, the Company entered into an agreement with TyraTech to change its ownership from 60% to 87%. Envance has the rights to develop and commercialize pesticide products and technologies made from natural oils in global consumer, commercial, professional, crop protection and seed treatment markets and has begun bringing products to market. Envance is headquartered in TyraTech’s facility in Research Triangle Park, North Carolina.

International operations

In July 2012, the Company formed AMVAC C.V., which is incorporated in the Netherlands, for the purpose of managing foreign sales on behalf of the Company. AMVAC C.V. is owned jointly by AMVAC as the general partner, and AVD International, LLC (also formed in July 2012 as a wholly owned subsidiary of AMVAC), as the limited partner, and is therefore a wholly owned subsidiary of AMVAC.

AMVAC BV is a registered Dutch private limited liability company that was formed in July 2012. AMVAC BV is located in the Netherlands and is wholly owned by AMVAC C.V. During 2015, the international business sold the Company’s products in 54 countries, as compared to 57 countries in 2014.

The Company opened an office in 2008 in Costa Rica, to conduct business in Costa Rica and other countries in Central America. The office is operated by AMVAC CR Srl and markets chemical products for agricultural and commercial uses.

The Company opened an office in Basel, Switzerland in 2006. The office is operated by AMVAC S. The Company formed the new subsidiary to expand its resources dedicated to business development opportunities to maintain the Company’s registrations in that country. Also in 2006, the Company formed a Brazilian entity which operates as AMVAC B. It functions primarily to maintain the Company’s registrations in that country.

The Company opened an office in 1998 in Mexico to conduct business primarily in Mexico. The office is operated by AMVAC M Srl and markets chemical products for agricultural and commercial uses. In November 2013, a Mexican entity, AMVAC M Srl, was incorporated to conduct business in Mexico; this entity is part of the new international business structure and is a wholly owned subsidiary of AMVAC BV.

The Company classifies as export sales all products bearing foreign labeling shipped to a foreign destination.

| 2015 | 2014 | 2013 | ||||||||||

| Export sales |

$ | 77,295 | $ | 73,706 | $ | 69,772 | ||||||

| Percentage of net sales |

26.7 | % | 24.7 | % | 18.3 | % | ||||||

5

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Risk Management

The Company regularly monitors matters, whether insurable or not, that could pose material risk to its operations, financial performance or the safety of its employees and neighbors. The Risk Committee of the Board of Directors (“Board”) was formed in 2010, consists of three members of the Board and meets regularly. In fact, all members of the Board attend Risk Committee meetings. Working with senior management, the committee continuously evaluates the Company’s risk profile, identifies mitigation measures and ensures that the Company is prudently managing these risks. In support of the Risk Committee, senior management has appointed a risk manager and designated several senior executives to lead teams focused on addressing each of several of the most material risks facing the Company; these groups perform analysis with the benefit of operational knowledge. The top risks identified by management and being addressed by risk teams (in no particular order) include: adverse political and regulatory climate; managing high levels of inventory and associated reduced levels of manufacturing activity; succession planning and bench strength; maintaining a competitive edge in the marketplace; the possibility of an environmental event; undervaluation of the Company; availability of acquisition and licensing targets and cyber terrorism. Over the course of 2015, the Company continued to implement its enterprise risk management program, which extends to all areas of potential risk and is a permanent feature in the Company’s operation. In addition, the Company continually evaluates insurance levels for product liability, property damage and other potential areas of risk. Management believes its facilities and equipment are adequately insured against loss from usual business risks.

Available Information

The Company makes available free of charge (through its website, www.american-vanguard.com), its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission (“SEC”). Such reports are also available free of charge on the SEC website, www.sec.gov. Also available free of charge on the Company’s website are the Company’s Audit Committee, Compensation Committee, Finance Committee and Nominating and Corporate Governance Committee Charters, the Company’s Corporate Governance Guidelines, the Company’s Code of Conduct and Ethics, the Company’s Employee Complaint Procedures for Accounting and Auditing Matters and the Company’s policy on Stockholder Nomination and Communication. The Company’s Internet website and the information contained therein or incorporated therein are not intended to be incorporated into this Annual Report on Form 10-K.

| ITEM 1A. | RISK FACTORS |

The regulatory climate has grown increasingly challenging to the Company’s interests both domestically and internationally—Various agencies within the U.S. (both federal and state) and foreign governments continue to exercise increased scrutiny in permitting continued uses (or the expansion of such uses) of older chemistries, including many of the Company’s products and, in some cases, have initiated or entertained challenges to these uses. The challenge of the regulatory climate is even more pronounced in certain other geographical regions where the Company faces resistance to the continued use of certain of its products. There is no guarantee that this climate will change in the near term or that the Company will be able to maintain or expand the uses of many of its products in the face of these regulatory challenges.

U.S. EPA has proposed further limitations on the continued registration of organophosphates—On September 25, 2015 the U.S. EPA published in the Federal Register draft human health risk assessments for four of the Company’s organophosphate (“OP”) compounds (marketed under the names Bidrin, Counter, Folex and Mocap) in which it recommends the application of a 10X safety factor under the FQPA (Food Quality Protection Act) in light of the alleged possibility of neurodevelopmental harm to women and children based on epidemiological data. The agency is seeking public comment on these risk assessments and has indicated its current intention to apply this safety factor to all registered OPs, as they come up for review or renewal. There are at least 10 other companies that have OP products which are sold (and used) in the U.S. The Company, like many in our industry, believes that the basis for applying this safety factor is unsound and that there is no causal link between the perceived harm and the use of its products. Accordingly, the Company intends to take all action necessary to defend its registrations. It is expected we will be joined in this effort by other companies who are similarly concerned about the potential impact of U.S. EPA’s action. Further, there is no guarantee that the Company’s actions will alter the course that U.S. EPA has proposed and, if the agency’s position becomes final, some uses of the company’s OP products could be limited or cancelled. Such action could have a material adverse effect upon the Company’s financial performance in future reporting periods.

6

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Use of the Company’s products is subject to continuing challenges from activist groups—Use of agrochemical products, including the Company’s products is regularly challenged by activist groups in many jurisdictions under a multitude of federal and state statutes, including FIFRA, the Food Quality Protection Act, Endangered Species Act, and the Clean Water Act, to name a few. These challenges typically take the form of lawsuits or administrative proceedings against the U.S. EPA and/or other federal or state agencies, the filing of amicus briefs in pending actions, the introduction of legislation that is inimical to the Company’s interests, and/or adverse comments made in response to public comment invited by U.S. EPA in the course of registration, re-registration or label expansion. It is possible that one or more of these challenges could succeed, resulting in a material adverse effect upon one or more of the Company’s products.

The distribution and sale of the Company’s products are subject to prior governmental approvals and thereafter ongoing governmental regulation—The Company’s products are subject to laws administered by federal, state and foreign governments, including regulations requiring registration, approval and labeling of its products. The labeling requirements restrict the use of, and type of, application for our products. More stringent restrictions could make our products less available, which would adversely affect our revenues and profitability. Substantially all of the Company’s products are subject to the U.S. EPA, and similar agencies in the jurisdictions in which we do business, registration and re-registration requirements, and are registered in accordance with FIFRA. Such registration requirements are based, among other things, on data demonstrating that the product will not cause unreasonable adverse effects on human health or the environment when used according to approved label directions. All states, where any of the Company’s products are used, also require registration before our products can be marketed or used in that state. Governmental regulatory authorities have required, and may require in the future, that certain scientific data requirements be performed on the Company’s products. The Company, on its behalf and also in joint efforts with other registrants, has and is currently furnishing certain required data relative to its products. There can be no assurance, however, that the U.S. EPA or similar agencies will not request that certain tests or studies be repeated or that more stringent legislation or requirements will not be imposed in the future. The Company can provide no assurance that any testing approvals or registrations will be granted on a timely basis, if at all, or that its resources will be adequate to meet the costs of regulatory compliance.

The manufacturing of the Company’s products is subject to governmental regulations—The Company currently owns and operates three manufacturing facilities in Los Angeles, California; Axis, Alabama; and Marsing, Idaho and owns and has manufacturing services provided in a fourth facility in Hannibal, Missouri (the “Facilities”). The Facilities operate under the terms and conditions imposed by state and local authorities. The manufacturing of key ingredients for certain of the Company’s products occurs at the Facilities. An inability to renew or maintain a license or permit, or a significant increase in the fees for such licenses or permits, could impede the Company’s manufacture of one or more of its products, and/or increase the cost of production; this, in turn, would materially and adversely affect the Company’s ability to provide its products in a timely and affordable manner.

The Company may be subject to environmental liabilities—While the Company expends substantial funds to minimize the discharge of materials into the environment and to comply with governmental regulations relating to protection of the environment and its workforce, federal and state authorities may nevertheless seek fines and penalties for any violation of the various laws and governmental regulations. In addition, while the Company continually adapts its manufacturing processes to the environmental control standards of regulatory authorities, it cannot completely eliminate the risk of accidental contamination or injury from hazardous or regulated materials. Further, these various governmental agencies could, among other things, impose liability on the Company for cleaning up the damage resulting from the release of pesticides and other agents into the environment, including with respect to subsurface environmental contamination at its Los Angeles-based manufacturing facility, which has been the subject of characterization, risk assessment and remediation planning for several years. In short, the Company may be held liable for significant damages or fines relating to any environmental contamination or injury, which could have a material adverse effect on the Company’s financial condition and results of operations.

The Company’s business may be adversely affected by cyclical and seasonal effects—Demand for the Company’s products tends to be seasonal. Seasonal usage follows varying agricultural seasonal patterns, weather conditions and weather related pressure from pests, and customer marketing programs and requirements. Weather patterns can have an impact on the Company’s operations. For example, the end user of its products may, because of weather patterns, delay or intermittently disrupt field work during the planting season, which may result in a reduction of the use of some products and therefore may reduce the Company’s revenues and profitability. In light of the possibility of adverse seasonal effects, there can be no assurance that the Company will maintain sales performance at historical levels in any particular region.

7

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

The Company’s financial performance may be disproportionately affected by the strength or weakness of specific markets—From 2010 through 2012, the Company enjoyed dramatic growth in its corn product lines sold primarily into the Midwestern United States. By 2013, those products accounted for approximately 38% of the Company’s total net sales. However, due to prolonged wet conditions in early 2013, excess inventory of corn crop inputs (including some of the Company’s products) accumulated in the distribution channel. This market condition continued to affect the company’s overall financial performance adversely for the full years of 2014 and 2015. Sales of the Company’s corn product lines represented 19% of the Company’s sales in both 2014 and 2015. There is no guarantee that Midwest crop market conditions will return to the pre-2014 historical level or that other conditions adversely affecting the market will not come about.

The Company is dependent upon certain sole source suppliers for certain of its raw materials and active ingredients— There are a limited number of suppliers of certain important raw materials used by the Company in many of its products. Certain of these raw materials are available solely from sources overseas or from single sources domestically. Further, in conjunction with the purchase and/or licensing of various product lines (including Impact® , Force®, and Scepter®), the Company has entered into multi-year supply arrangements under which such counterparties are the sole source of either active ingredients and/or formulated end-use product and, in some cases, the manufacturer has entered the market as a competitor. There is no guarantee that any or all of these sole source manufacturers will be willing or able to supply these products to the Company reliably, continuously and at the levels anticipated by the Company or required by the market. If these sources prove to be unreliable and the Company is not able to supplant or otherwise second source these suppliers, it is possible that the Company will not realize its projected sales, which, in turn, could adversely affect the Company’s results of operations.

To the extent that capacity utilization is not fully realized at its manufacturing facilities, the Company may experience lower profitability—The Company has pursued a business strategy of acquiring manufacturing facilities at a steep discount to their replacement value. These acquisitions have enabled the Company to be more independent of overseas manufacturers than some of our competitors. While the Company endeavors continuously to maximize utilization of these facilities, our success in these endeavors is dependent upon many factors beyond our control, including fluctuating market conditions, product life cycles, weather conditions, availability of raw materials and regulatory constraints, among other things. There can be no assurance that the Company will be able to maximize its utilization of capacity at its manufacturing facilities, particularly when, as is currently the case, inventory of goods manufactured by the Company are at higher-than-normal levels. There is no assurance that absorption of factory costs will improve to the point that will enable the Company to return to its historically higher levels of profitability.

The Company’s continued success depends, in part, upon a limited number of key employees—Within certain functions, the Company relies heavily on a small number of key employees to manage ongoing operations and to perform strategic planning. In some cases, there are no internal candidates who are qualified to succeed these key personnel in the short term. In the event that the Company was to lose one or more key employees, there is no guarantee that Company could replace them with people having comparable skills. Further, the loss of key personnel could adversely affect the operation of the business.

The Company faces competition in certain markets from new technologies, both genetic and chemical—The Company faces competition from larger companies that market new chemistries, genetically modified (“GMO”) seeds and other similar technologies (e.g., RNA interference) in certain of the crop protection sectors in which the Company competes, particularly that of corn. In fact, many growers that have chosen to use GMO seeds have reduced their use of the types of pesticides sold by the Company. There is no guarantee that the Company will maintain its market share or pricing levels in sectors that are subject to competition from companies that market these technologies.

The Company faces competition from generic competitors that source product from countries having lower cost structures—The Company continues to face competition from competitors throughout the globe that may enter the market through either offers to pay data compensation, or similar means in foreign jurisdictions, and then subsequently source material from countries having lower cost structures (typically India and China). These competitors typically tend to operate at thinner gross margins and, with low costs of goods, can drive pricing and profitability of subject product lines downward. There is no guarantee that the Company will maintain market share and pricing over generic competitors or that such competitors will not offer generic versions of the Company’s products in the future.

The Company’s key customers typically carry competing product lines and may be influenced by the Company’s larger competitors—A significant portion of the Company’s products are sold to national distributors in the United States,

8

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

which also carry product lines of competitors that are much larger than the Company. Typically, revenues from the sales of these competing product lines and related program incentives constitute a greater part of our distributors’ income than do revenues from sales and program incentives arising from the Company’s product lines. Further, these distributors are often under pressure to market competing product lines rather than the Company’s. In light of these facts, there is no assurance that such customers will continue to market our products aggressively or successfully or that the Company will be able to influence such customers to continue to purchase our products instead of those of our competitors.

Industry consolidation may threaten the Company’s position in various markets. The agchem industry continues to undergo significant consolidation. Many of the Company’s competitors have grown or are about to grow through mergers and acquisitions. As a result, these competitors will tend to realize greater economies of scale, more diverse portfolios and greater influence throughout the distribution channels. Consequently, the Company may find it more difficult to compete in many markets. While such merger activity may generate acquisition opportunities for the Company, there is no guarantee that the Company will benefit from such opportunities. Further, there is a risk that the Company’s future performance may be hindered by the growth of its competitors through consolidation.

The Company is dependent on a limited number of customers, which makes it vulnerable to the continued relationship with and financial health of those customers—In 2015, three customers accounted for 38% of the Company’s sales. The Company’s future prospects may depend on the continued business of such customers and on our continued status as a qualified supplier to such customers. The Company cannot guarantee that our current significant customers will continue to buy products from us at current levels. The loss of a key customer could have a material adverse effect on the Company’s financial condition and results of operations.

The carrying value of certain assets on the Company’s consolidated balance sheets may be subject to impairment depending upon market trends and other factors—The Company regularly reviews the carrying value of certain assets, including long-lived assets, inventory, fixed assets and intangibles. Depending upon the class of assets in question, the Company takes into account various factors including, among others, sales, trends, market conditions, cash flows, profit margins and the like. Based upon this analysis, where circumstances warrant the Company may leave such carrying values unchanged or adjust them as appropriate. There is no guarantee that these carrying values can be maintained indefinitely, and it is possible that one or more such assets could be subject to impairment which, in turn, could have an adverse impact upon the financial performance of the Company.

Reduced financial performance may limit the Company’s ability to borrow under its credit facility—The Company has historically grown net sales through both expansion of current product lines and acquisition of product lines from third parties. In order to finance acquisitions, where necessary, the Company has drawn upon its senior credit facility. However, the Company’s borrowing capacity under the senior credit facility depends, in part, upon its satisfaction of a negative covenant that sets a maximum ratio of borrowed debt to earnings (as measured over the trailing 12 month period). There is no guarantee that the Company will continue to generate earnings necessary to ensure that it has sufficient borrowing capacity to support future acquisitions or that the lender group will amend the senior credit facility to provide for such borrowing capacity.

Dependence on the Company’s banking relationship—The Company’s main bank is Bank of the West, a wholly-owned subsidiary of the French bank, BNP Paribas. Bank of the West has been the Company’s primary bank for more than 30 years. Bank of the West is the syndication manager for the Company’s loans and from time to time, acts as the counterparty on the Company’s derivative transactions. In addition to Bank of the West, the syndicated banks include Wells Fargo Bank, N.A., BMO Harris Financing, Inc., MUFG Union Bank, N.A., Agstar Financial Services PCA and Greenstone Farm Credit Services, ACA, FLCA. The Company reviews the creditworthiness of its banks on a quarterly basis via credit agencies and also has face-to-face meetings with senior management of the banks. Management believes that the Company has an excellent working relationship with Bank of the West and the other financial institutions in the Company’s lender group. In light of the uncertainties in global financial markets, there is no guarantee, however, that the Company’s lenders will be either willing or able to continue lending to the Company at such rates and in such amounts as may be necessary to meet the Company’s working capital needs.

The Company’s growth has been fueled in part by acquisition—Over the past few decades, the Company’s growth has been driven by acquisition and licensing of both established and developmental products from third parties. There is no guarantee that acquisition targets or licensing opportunities meeting the Company’s investment criteria will remain available or will be affordable. If such opportunities do not present themselves, then the Company may be unable to record consistent growth in future years.

9

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

| ITEM 2 | PROPERTIES |

AMVAC owns in fee the Facility constituting approximately 152,000 square feet of improved land in Commerce, California (“Commerce”) on which its West Coast manufacturing and some of its warehouse facilities and offices are located.

DAVIE owns in fee approximately 72,000 square feet of warehouse, office and laboratory space on approximately 118,000 square feet of land in Commerce, California, which is leased to AMVAC. In 2013, the Company made a significant investment in the Glenn A. Wintemute Research Center, which houses the Company’s primary research laboratory supporting synthesis, formulation and other new product endeavors.

On December 28, 2007, pursuant to the provisions of the definitive Sale and Purchase Agreement (the “Agreement”) dated as of November 27, 2006 between AMVAC and BASF, AMVAC purchased the global Counter product line. AMVAC purchased certain manufacturing assets relating to the production of Counter and Thimet and located at BASF’s multi-plant facility situated in Hannibal, Missouri (the “Hannibal Site”). Subject to the terms and conditions of the Agreement, AMVAC purchased certain buildings, manufacturing equipment, office equipment, fixtures, supplies, records, raw materials, intermediates and packaging constituting the “T/C Unit” of the Hannibal Site. The parties entered into a ground lease and a manufacturing and shared services agreement, under which BASF continues to supply various shared services to AMVAC for the Hannibal Site.

On March 7, 2008, AMVAC acquired from Bayer CropScience Limited Partnership, (“BCS LP”), a U.S. business of BCS, a facility (the “Marsing Facility”) located in Marsing, ID, which consists of approximately 17 acres of improved real property, 15 of which are owned by AMVAC and two of which AMVAC leases from the City of Marsing for a term of 25 years. The Marsing Facility is engaged in the blending of liquid and powder raw materials and the packaging of finished liquid, powder and pelletized products for sale into the US agricultural market. With this acquisition, AMVAC acquired the ability to formulate flowable materials. In connection with the acquisition, AMVAC and BCS LP agreed to enter into a master processor agreement under which AMVAC provides certain third party manufacturing services to BCS LP on an ongoing basis that continued into 2015. Following the termination of the master supply agreement, AMVAC and BCS LP have continued to trade on a normal commercial basis.

In 2001, AMVAC completed the acquisition of a manufacturing facility (the “Axis Facility”) from E.I. DuPont de Nemours and Company (“DuPont”). The Axis Facility is one of three such units located on DuPont’s 510 acre complex in Axis, Alabama. The acquisition consisted of a long-term ground lease of 25 acres and the purchase of all improvements thereon. The facility is a multi-purpose plant designed for synthesis of active ingredients and formulation and packaging of finished products.

The production areas of AMVAC’s facilities are designed to run on a continuous 24 hour per day basis. AMVAC regularly adds chemical processing equipment to enhance or expand its production capabilities. AMVAC believes its facilities are in good operating condition, are suitable and adequate for current needs, can be modified to accommodate future needs, have flexibility to change products, and can produce at greater rates as required. Facilities and equipment are insured against losses from fire as well as other usual business risks. The Company knows of no material defects in title to, or encumbrances on, any of its properties except that substantially all of the Company’s assets are pledged as collateral under the Company’s loan agreements with its primary lender group. For further information, refer to note 2 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Annual Report.

AMVAC owns approximately 42 acres of unimproved land in Texas for possible future expansion.

The Company leases approximately 23,800 square feet of office space located at 4695 MacArthur Court in Newport Beach, California. The premises serve as the Company’s corporate headquarters. On July 1, 2016, the leased office space will be reduced to 19,953 square feet and the term of the lease will be extended to expire June 30, 2021, under the terms of the sixth amendment to the lease dated as of September 28, 2015.

10

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

AMVAC BV’s, GemChem’s, AMVAC M’s, AMVAC M Srl’s, AMVAC CR Srl’s and AMVAC S’s facilities consist of administration and sales offices which are leased.

| ITEM 3 | LEGAL PROCEEDINGS |

A. DBCP Cases

Over the course of the past 30 years, AMVAC and/or the Company have been named or otherwise implicated in a number of lawsuits concerning injuries allegedly arising from either contamination of water supplies or personal exposure to 1, 2-dibromo-3-chloropropane (“DBCP®”). DBCP was manufactured by several chemical companies, including Dow Chemical Company, Shell Oil Company and AMVAC and was approved by the U.S. EPA to control nematodes. DBCP was also applied on banana farms in Latin America. The U.S. EPA suspended registrations of DBCP in October 1979, except for use on pineapples in Hawaii. The U.S. EPA suspension was partially based on 1977 studies by other manufacturers that indicated a possible link between male fertility and exposure to DBCP among their factory production workers involved with producing the product.

At present, there are three domestic lawsuits and approximately 85 Nicaraguan lawsuits filed by former banana workers in which AMVAC has been named as a party. Only two of the Nicaraguan actions have actually been served on AMVAC.

As described more fully below, activity in domestic cases during 2015 is as follows: in Hawaii, Patrickson, et. al. v. Dole Food Company, et. al which had been dismissed in 2011 (for expiration of the statute of limitations), remains on appeal; and Adams, from which co-defendant Dole was dismissed, is on appeal with respect to such dismissal and, at any rate, involves claims that pre-dated AMVAC’s sales into the relevant market. All but one matter that had been pending in Louisiana and Delaware have been dismissed (and affirmed on appeal) based upon the applicable statutes of limitation. The pending Delaware matter is more fully described below. With respect to Nicaraguan matters, there was no change in status during 2015.

Delaware Matter

On or about May 31, 2012, HendlerLaw, P.C., which represents plaintiffs in seven related matters that had been pending before the United States District Court for the Eastern District of Louisiana (the “Hendler-Louisiana Cases” referred to in the Company’s Form 10-K for the period ended December 31, 2011 as Aguilar et al., v. Dole Fruit Company, Inc., et al (U.S.D.C., E.D. of LA No. CV-01305-CJB-SS)), filed nine separate actions, eight with the United States District Court for the District of Delaware (USCD DE No. 1:12-CV-00696-RGA)) and one with the Superior Court of the State of Delaware (which, for purposes of this filing shall be referred to as Chaverri et al. v. Dole Food Company, Inc. et al., case no. N12C-06-017-JOH). Six of the eight Hendler – Delaware cases and Chaverri involve claims for personal injury allegedly arising from exposure to DBCP on behalf of 235 banana workers from Costa Rica, Ecuador and Panama. Dole subsequently brought a motion to dismiss these seven matters under the “first-to-file” theory of jurisdiction, specifically in light of the fact that they involved identical claims and claimants as those appearing in the Hendler – Louisiana cases. These Delaware matters have been consolidated into one matter (the “Hendler-Delaware Case”). On August 21, 2012, the U.S. District Court in the Hendler-Delaware case granted defendants’ motion to dismiss the actions with prejudice, finding that the same claimants and claims had been pending in the Hendler-Louisiana cases where they had been first filed.

In October 2012, the federal district court in Louisiana granted defendant’s motion for summary judgment and dismissed the Hendler-Louisiana Cases for plaintiffs’ failure to bring the action within the applicable statute of limitations. Plaintiffs appealed the dismissal of the Hendler-Louisiana cases and, on September 19, 2013, the Fifth Circuit Court of Appeal upheld the lower court’s decision, finding no reason to reverse the dismissal.

On October 16, 2013, Plaintiffs filed a notice of appeal in the Hendler-Delaware case. Oral argument was heard before the Third Circuit Court of Appeal on June 24, 2014 in connection with that appeal, and, on August 11, 2015, the Third Circuit upheld the lower court’s dismissal of the Hendler-Delaware case. However, plaintiffs petitioned for rehearing en banc, arguing that, despite the fact that the same plaintiffs had made the same claims before another court (namely, the Louisiana court in the Hendler-Louisiana cases), because the Louisiana court had not decided the case on the merits (but, rather, on the basis of the statute of limitations), the Delaware trial court lacked the power to dismiss the Hendler-Delaware case with prejudice. On September 22, 2015, the Third Circuit vacated its previous ruling (to uphold the lower court dismissal) and the appeal was reheard en banc on February 17, 2016. The Company expects that a decision will be issued in 9 to 12 months. The Company believes the Hendler-Delaware case has no merit and, further, that a loss is neither probable nor reasonably estimable; accordingly, it has not recorded a loss contingency.

11

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Hawaiian Matters

Patrickson, et. al. v. Dole Food Company, et al In October 1997, AMVAC was served with two complaints in which it was named as a defendant, filed in the Circuit Court, First Circuit, State of Hawai’i and in the Circuit Court of the Second Circuit, State of Hawai’i (two identical suits) entitled Patrickson, et. al. v. Dole Food Company, et. al (“Patrickson Case”) alleging damages sustained from injuries (including sterility) to banana workers caused by plaintiffs’ exposure to DBCP while applying the product in their native countries. Other named defendants include: Dole Food Company, Shell Oil Company and Dow Chemical Company. After several years of law and motion activity, the court granted judgment in favor of the defendants based upon the statute of limitations on July 28, 2010. On August 24, 2010, the plaintiffs filed a notice of appeal. On April 8, 2011, counsel for plaintiffs filed a pleading to withdraw and to substitute new counsel. On October 21, 2015, the Hawai’i Supreme Court granted the appeal and overturned the lower court decision, ruling that the State of Hawai’i now recognizes cross-jurisdictional tolling, that plaintiffs filed their complaint within the applicable statute of limitations and that the matter is to be remanded to the lower court for further adjudication. No discovery has taken place in this matter, and, at this stage in the proceedings, the Company does not believe that a loss is either probable or reasonably estimable and, accordingly, has not recorded a loss contingency for this matter.

Adams v. Dole Food Company et al On approximately November 23, 2007, AMVAC was served with a suit filed by two former Hawaiian pineapple workers (and their spouses), alleging that they had testicular cancer due to DBCP exposure: Adams v. Dole Food Company et al in the First Circuit for the State of Hawaii. Plaintiff alleges that they were exposed to DBCP between 1971 and 1975. AMVAC denies that any of its product could have been used at the times and locations alleged by these plaintiffs. Following the dismissal of Dole Food Company on the basis of the exclusive remedy of worker’s compensation benefits, plaintiffs appealed the dismissal. That appeal has been pending since 2012. Plaintiffs’ counsel petitioned the court for substitution of counsel, but was denied on November 14, 2012. There has been no activity in the case since that time, and there is no estimated date of opinion. The Company does not believe that a loss is either probable or reasonably estimable and has not recorded a loss contingency for this matter.

Nicaraguan Matters

A review of court filings in Chinandega, Nicaragua, has found 85 suits alleging personal injury allegedly due to exposure to DBCP and involving approximately 3,592 plaintiffs have been filed against AMVAC and other parties. Of these cases, only two – Flavio Apolinar Castillo et al. v. AMVAC Chemical Corporation et al., No. 535/04 and Luis Cristobal Martinez Suazo et al. v. AMVAC Chemical Corporation et al., No. 679/04 Castillo and Suazo, (which were filed in 2004 and involve 15 banana workers) have been served on AMVAC. All but one of the suits in Nicaragua have been filed pursuant to Special Law 364, an October 2000 Nicaraguan statute that contains substantive and procedural provisions that Nicaragua’s Attorney General previously expressed as unconstitutional. Each of the Nicaraguan plaintiffs’ claims $1,000 in compensatory damages and $5,000 in punitive damages. In all of these cases, AMVAC is a joint defendant with Dow Chemical Company and Dole Food Company, Inc. AMVAC contends that the Nicaragua courts do not have jurisdiction over it and that Public Law 364 violates international due process of law. AMVAC has objected to personal jurisdiction and demanded under Law 364 that the claims be litigated in the United States. In 2007, the court denied these objections, and AMVAC appealed the denial. It is not presently known as to how many of these plaintiffs actually claim exposure to DBCP at the time AMVAC’s product was allegedly used nor is there any verification of the claimed injuries. Further, to date, plaintiffs have not had success in enforcing Nicaraguan judgments against domestic companies before U.S. courts. With respect to these Nicaraguan matters, AMVAC intends to defend any claim vigorously. Furthermore, the Company does not believe that a loss is either probable or reasonably estimable and has not recorded a loss contingency for these matters.

B. Other Matters

U.S. EPA RCRA Matter On or about March 24, 2015, Region 4 of the U.S. EPA issued to registrant’s principal operating subsidiary, AMVAC, an Opportunity to Show Cause why U.S. EPA should not take formal action under Section 3008(a) of the Resource Conservation and Recovery Act (RCRA) for potential noncompliance arising from AMVAC’s importation, transportation and storage of used, depleted Lock‘N Load containers having residual amounts of its product Thimet. AMVAC believes that these containers were properly handled and stored under, among others, the applicable provisions of the FIFRA relating to recycling and disposal of depleted, refillable containers (and their contents). AMVAC responded to the substance of the show cause letter on April 10, 2015 and has engaged in multiple discussions with U.S. EPA on the matter. While violations of RCRA, if any, may carry civil penalties, it is too early in the matter to determine whether a loss is probable or reasonably estimable. Accordingly, registrant has not recorded a loss contingency on this matter.

U.S. EPA RMP Matter On October 28 2015, Region 4 of the U.S. EPA provided AMVAC with notice of potential violations under Section 112(r)(7) of the Clean Air Act relating to the Company’s risk management program (“RMP”) at the its Axis, Alabama manufacturing facility. The notice arose from an inspection of the subject facility conducted by a U.S. EPA consultant on August 6, 2014 and cited several potential violations relating largely to processes, documentation and

12

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

training. The potential violations could carry civil, administrative or criminal penalties under applicable law. The Company has investigated the matters cited in the notice, and has established a timeline for furnishing a formal response and otherwise meeting with the agency. At this stage, however, it is too early to determine whether a loss is probable or reasonably estimable. Accordingly, registrant has not recorded a loss contingency on this matter.

Galvan v. AMVAC In an action entitled Graciela Galvan v. AMVAC Chemical Corp. filed on April 7, 2014 with the Superior Court for the State of California for the County of Orange (No. 00716103CXC) plaintiff, a former employee, alleges violations of wages and hours requirements under the California Labor Code. The Company has completed the deposition of putative class representative and participated in mediation on the matter. The Company continues to believe that all of the claims are without merit and intends to defend the matter vigorously. Further, the Company does not believe that a loss is probable or reasonably estimable and has not recorded a loss contingency for the matter.

Navarro v. AMVAC On May 28, 2015, former employee, Silvano Navarro (who abandoned his position after electing not to take a leave of absence under FMLA) delivered a written claim to the Company in which he alleged that he was damaged due to discrimination for disability and a host of other labor and employment charges. Subsequently, the unemployment compensation board (in an unrelated proceeding) ruled against awarding Mr. Navarro unemployment compensation, finding that he had left his position of his own choice, that the Company had offered him a leave of absence and that, even after his departure, his managers tried to get him to return to work. The parties met in November 2015 to mediate the matter and discontinued the mediation in order to complete further internal investigation. The Company believes that a loss is probable and reasonably estimable and has recorded a loss contingency for the matter in an amount that is not material.

Schiemer Farms v. AMVAC On or about May 12, 2015, Farmers Supply Co-op, made a written claim against the Company for losses from the alleged failure of the Company’s soil fumigant, Vapam, to control weeds on an onion crop that was harvested in late 2014. The grower alleges a loss of yield in the amount of $1.2 million. The Company has been in informal discussion with claimant (which applied the product) and grower and does not believe that claimant is entitled to the relief that it seeks. The parties have been in settlement discussions for the past few months. Based upon its understanding of the facts at this stage, the Company believes that a loss is probable and reasonably estimable and has recorded a loss contingency for the matter in an amount that is not material.

Walker v. AMVAC On or about May 9, 2015, former consultant, Larry Walker, made a written claim against the Company for alleged breach of contract and patent infringement arising from the Company’s having obtained a patent (US PTO 8,921,270) for use of the compound ametryn as a standalone burndown herbicide on corn. Mr. Walker alleges, among other things, that he invented the claims set forth in that patent. The Company believes that Mr. Walker’s allegations have no merit and that its own scientists invented the patented method. At this stage, the Company does not believe that a loss is either probable or reasonably estimable and has not recorded a loss contingency for the matter.

| ITEM 4 | MINE SAFETY DISCLOSURES |

Not Applicable

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Effective March 6, 2006, the Company listed its $0.10 par value common stock (“Common Stock”) on the New York Stock Exchange under the ticker symbol AVD. From January 1998 through March 5, 2006, the Common Stock was listed on the American Stock Exchange under the ticker symbol AVD. The Company’s Common Stock traded on The NASDAQ Stock Market under the symbol AMGD from March 1987 through January 1998.

13

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

The following table sets forth the range of high and low sales prices as reported for the Company’s Common Stock for the calendar quarters indicated.

| High | Low | |||||||

| Calendar 2015 |

||||||||

| First quarter |

$ | 12.53 | $ | 9.73 | ||||

| Second quarter |

15.25 | 10.48 | ||||||

| Third quarter |

14.10 | 10.84 | ||||||

| Fourth quarter |

16.06 | 11.83 | ||||||

| Calendar 2014 |

||||||||

| First quarter |

$ | 24.54 | $ | 20.85 | ||||

| Second quarter |

22.20 | 12.41 | ||||||

| Third quarter |

13.96 | 10.93 | ||||||

| Fourth quarter |

13.27 | 9.50 | ||||||

Holders

As of February 17, 2016, the number of stockholders of the Company’s Common Stock was approximately 5,129, which includes beneficial owners with shares held in brokerage accounts under street name and nominees.

Dividends

The Company has issued a cash dividend in each of the last nineteen years dating back to 1996. Cash dividends issued during the past three years are summarized in the table below.

| Declaration Date |

Distribution Date | Record Date | Dividend Per Share |

Total Paid |

||||||||

| March 16, 2015 |

April 17, 2015 | April 3, 2015 | $ | 0.02 | $ | 572 | ||||||

|

|

|

|

|

|||||||||

| Total 2015 |

$ | 0.02 | $ | 572 | ||||||||

|

|

|

|

|

|||||||||

| December 11, 2014 |

January 9, 2015 | December 26, 2014 | $ | 0.02 | $ | 569 | ||||||

| September 19, 2014 |

October 22, 2014 | October 8, 2014 | 0.05 | 1,417 | ||||||||

| June 9, 2014 |

July 17, 2014 | July 3, 2014 | 0.05 | 1,420 | ||||||||

| March 10, 2014 |

April 18, 2014 | April 4, 2014 | 0.05 | 1,417 | ||||||||

|

|

|

|

|

|||||||||

| Total 2014 |

$ | 0.17 | $ | 4,823 | ||||||||

|

|

|

|

|

|||||||||

| December 18, 2013 |

January 10, 2014 | December 27, 2013 | $ | 0.05 | $ | 1,418 | ||||||

| September 9, 2013 |

October 18, 2013 | October 4, 2013 | 0.05 | 1,415 | ||||||||

| June 10, 2013 |

July 19, 2013 | July 5, 2013 | 0.05 | 1,413 | ||||||||

| March 11, 2013 |

April 19, 2013 | April 5, 2013 | 0.07 | 1,976 | ||||||||

|

|

|

|

|

|||||||||

| Total 2013 |

$ | 0.22 | $ | 6,222 | ||||||||

|

|

|

|

|

|||||||||

Purchases of Equity Securities by the Issuer

In June 2013, the Board of Directors authorized the Company to repurchase its common stock with the intent of offsetting dilution caused by incentive stock compensation. Shares repurchased during 2014 and 2013 are summarized in the table below.

| Purchased From |

Purchased To | Shares | Average Price | Total Cost |

||||||||||

| January 1, 2014 |

March 31, 2014 | 70,000 | 21.87 | 1,531 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Total 2014 |

$ | 21.87 | $ | 1,531 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| October 1, 2013 |

December 31, 2013 | 70,000 | 27.63 | 1,934 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Total 2013 |

$ | 27.63 | $ | 1,934 | ||||||||||

|

|

|

|

|

|

|

|||||||||

14

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

Securities Authorized for Issuance Under Equity Compensation Plans

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants, and rights (a) |

Weighted- average exercise price of outstanding options, warrants, rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) (c) 1 |

|||||||||

| Equity compensation plans approved by security holders |

725,255 | $ | 9.55 | 902,000 | ||||||||

|

|

|

|

|

|

|

|||||||

| Total |

725,255 | $ | 9.55 | 902,000 | ||||||||

|

|

|

|

|

|

|

|||||||

| 1 | These stocks remain authorized for future issuance under the Equity Incentive Plan of 1993, as amended (“the Plan”). However, under section 15 of the Plan, future issuances are not permitted after May 12, 2015. Accordingly, the Company intends to seek stockholders’ approval to extend the term of such plan in connection with its 2016 Annual Stockholders’ Meeting. |

15

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

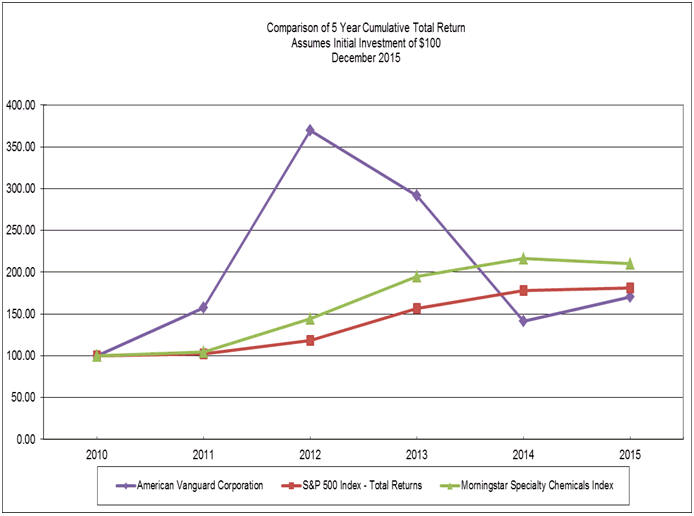

Stock Performance Graph

The following graph presents a comparison of the cumulative, five-year total return for the Company, the S&P 500 Stock Index, and a peer group (Specialty Chemical Industry). The graph assumes that the beginning values of the investments in the Company, the S&P 500 Stock Index, and the peer group of companies each was $100 on December 31, 2010. All calculations assume reinvestment of dividends. Returns over the indicated period should not be considered indicative of future returns.

16

Table of Contents

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

(Dollars in thousands, except per share data)

| ITEM 6 | SELECTED FINANCIAL DATA |

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Net sales |

$ | 289,382 | $ | 298,634 | $ | 381,021 | $ | 366,190 | $ | 301,080 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

$ | 111,902 | $ | 114,496 | $ | 171,347 | $ | 161,125 | $ | 123,068 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

$ | 11,524 | $ | 6,710 | $ | 55,735 | $ | 59,323 | $ | 39,226 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income tax expense and loss on equity investment |

$ | 8,962 | $ | 3,644 | $ | 53,834 | $ | 56,852 | $ | 35,223 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to American Vanguard |

$ | 6,591 | $ | 4,841 | $ | 34,449 | $ | 36,867 | $ | 22,068 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per common share |

$ | .23 | $ | .17 | $ | 1.22 | $ | 1.32 | $ | 0.80 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings per common share—assuming dilution |

$ | .23 | $ | .17 | $ | 1.19 | $ | 1.28 | $ | 0.79 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets(1) |

$ | 443,539 | $ | 472,321 | $ | 446,438 | $ | 399,563 | $ | 342,122 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Working capital |

$ | 160,549 | $ | 205,804 | $ | 139,007 | $ | 108,647 | $ | 104,713 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Long-term debt less current installments(1) |

$ | 68,321 | $ | 98,605 | $ | 50,671 | $ | 35,869 | $ | 51,481 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Stockholders’ equity |

$ | 268,395 | $ | 261,003 | $ | 257,795 | $ | 225,436 | $ | 187,072 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding—basic |

28,673 | 28,436 | 28,301 | 27,914 | 27,559 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding—assuming dilution |

29,237 | 28,912 | 28,899 | 28,756 | 27,875 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends per share of common stock |

$ | 0.02 | $ | 0.17 | $ | 0.22 | $ | 0.22 | $ | 0.08 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The selected consolidated financial data set forth above with respect to each of the calendar years in the five-year period ended December 31, 2015, have been derived from the Company’s consolidated financial statements and are qualified in their entirety by reference to the more detailed consolidated financial statements and the independent registered public accounting firm’s reports thereon, which are included elsewhere in this Report on Form 10-K for each of the three years in the period ended December 31, 2015. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

| (1) | In April 2015, The Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-03, Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. This ASU requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The Company adopted this new standard and retrospectively applied to the five-year period ended December 31, 2015. |

| ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

FORWARD-LOOKING STATEMENTS/RISK FACTORS: